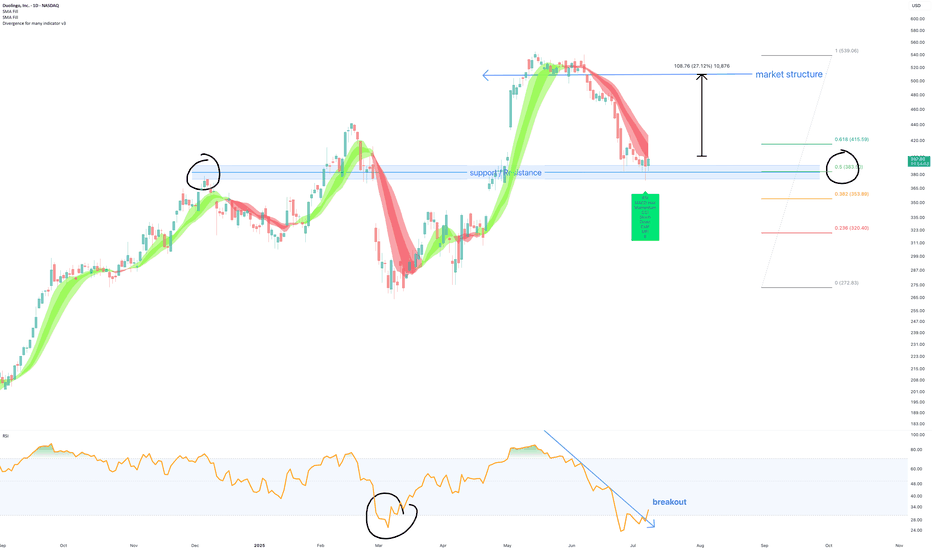

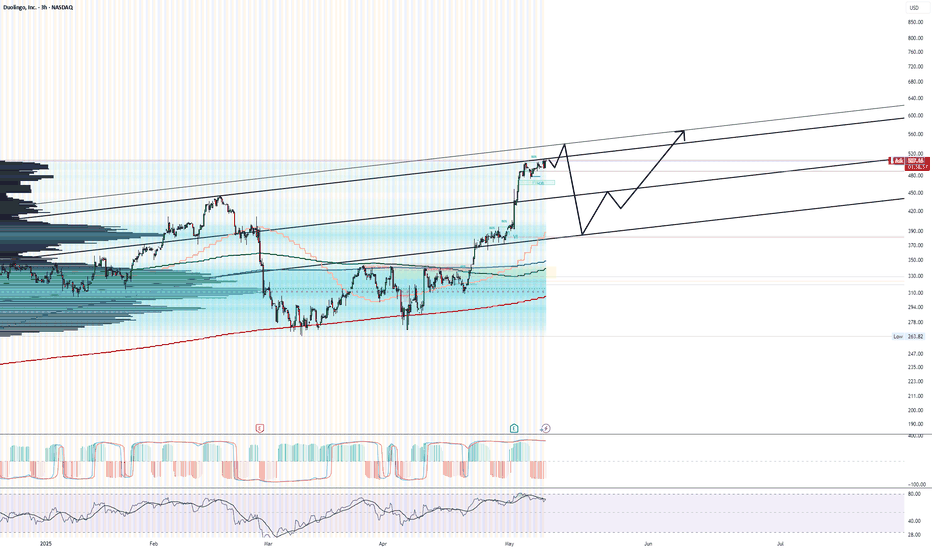

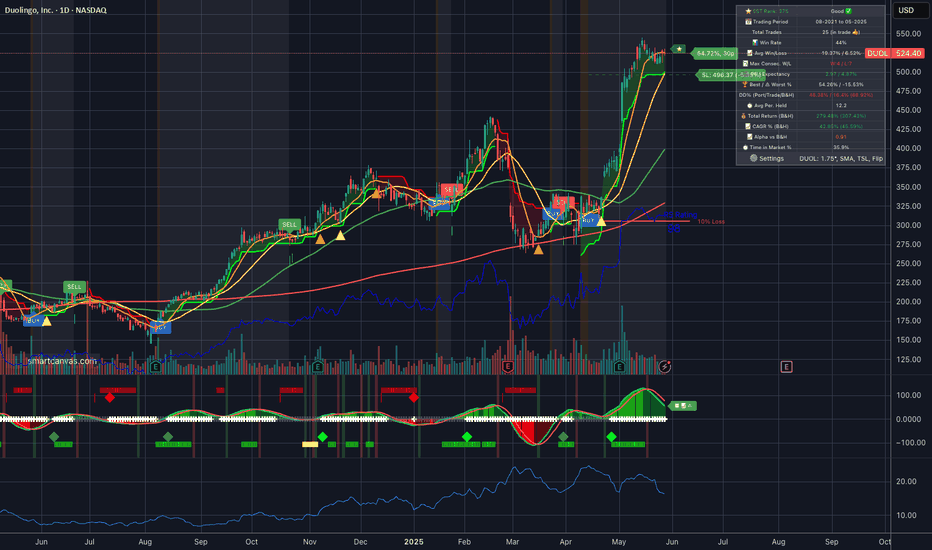

July 2025 - Duolingo trading opportunityGood news for Duolingo... The chart is now showing some promising signs that it might be ready to turn things around and head higher. Some simple clues why:

RSI resistance breakout:

The "RSI" indicator (bottom of chart) tells us strength is returning. A break of resistance that has been active ov

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

44.77 MXN

1.85 B MXN

15.60 B MXN

37.51 M

About Duolingo, Inc.

Sector

Industry

CEO

Luis von Ahn

Website

Headquarters

Pittsburgh

Founded

2011

FIGI

BBG01385HGR9

Duolingo, Inc. is a language-learning website and mobile application, which engages in the development of a free language learning website and crowd sourced text translation platform. It offers Duolingo for Schools, a free, web-based tool that aims to make it easier for teachers to use the Duolingo platform in a structured learning environment, and English Test, an online, on-demand assessment of English proficiency. The company was founded by Luis von Ahn and Severin Hacker in 2011 and is headquartered in Pittsburgh, PA.

Related stocks

Duolingo’s Language Learning Boom: A Profitable EdTech PlayDuolingo, the language-learning app that took the world by storm, has evolved from a free tool into a powerhouse since its 2021 IPO. With a market cap nearing $11 billion and its stock quadrupling in value, the company stands out as a rare profitable player in the edtech space. But what fuels its su

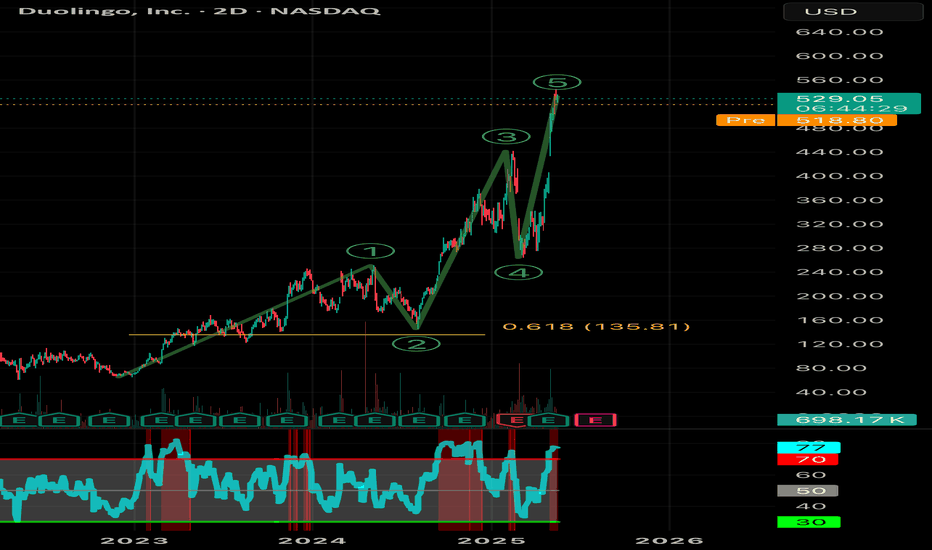

DUOL probable continues bearish for CCSDUOL 1D: at mid DDZ which coincides with FibR- 0.382. Just below price gap.

There is no sign of a reversal yet. Early next week , expect to confirm this to determine potential CCS.

Just covered a price gap with Fib-R 0.382 and likely bo would test 0.5 FibR, just before lower price-gap. BO here

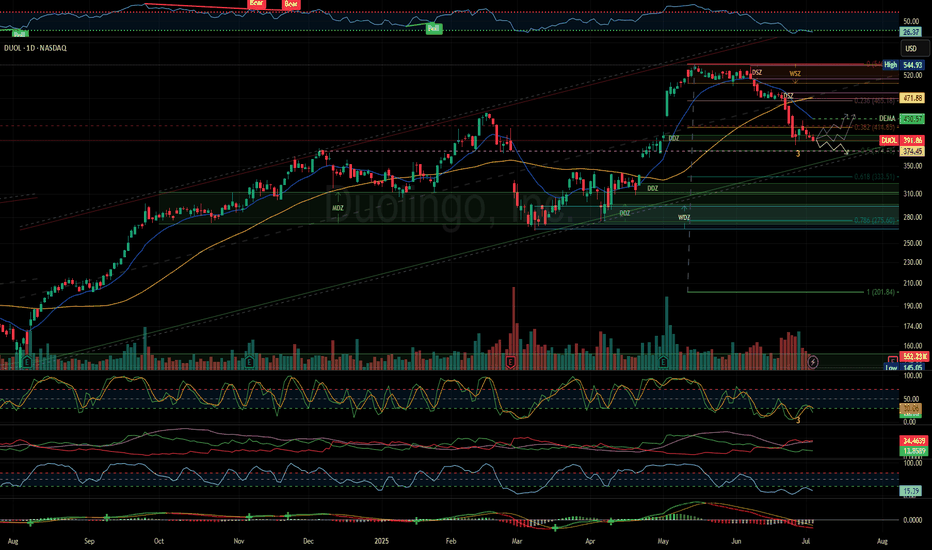

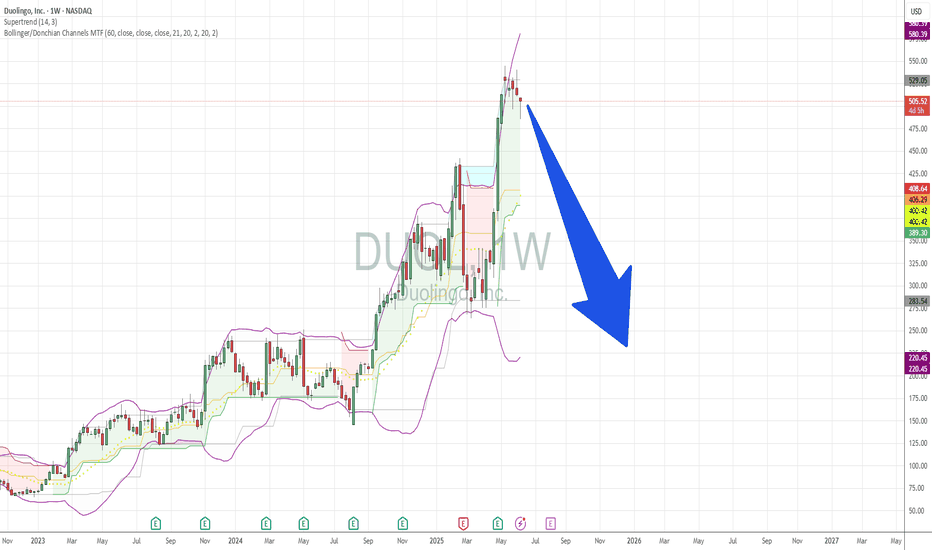

Its A Prime Set Up Guys, May 13th May 13th there will be a press conference with the CEO I think.

All techinals show a sharp fall will occur soon and I bet its the 13th.

Reached the top of the trend line and we are very over extended. Ying and a yang, time for the yang.

See my price path for a rough guess.

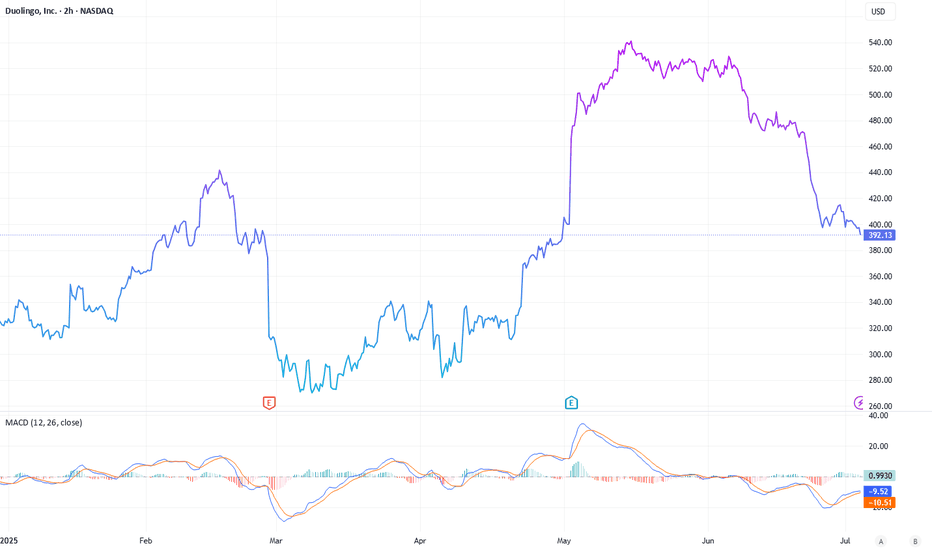

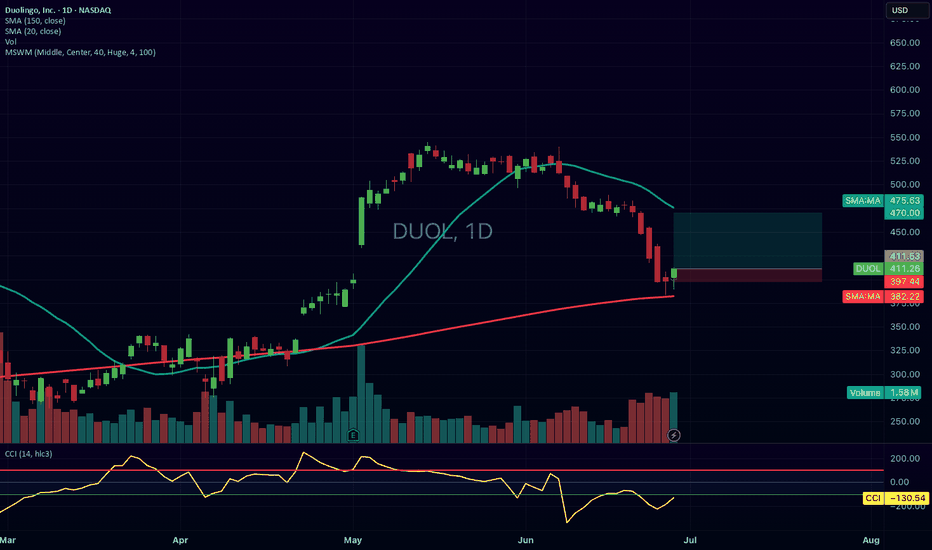

DUOL Long – High-Volume Hammer Bounce from 150 SMA with Bullish Entry: June 30, 2025

📉 Price: 411.53

✋ Stop: 397.44

🎯 Target: 470.00

⚖️ Risk-Reward: 1:4

✅ Status: Active

🧠 Trade Idea:

DUOL tested the 150-day simple moving average (SMA) as a strong support level, aligning with:

A green hammer daily candle with high volume, signaling a potential reversal.

The Comm

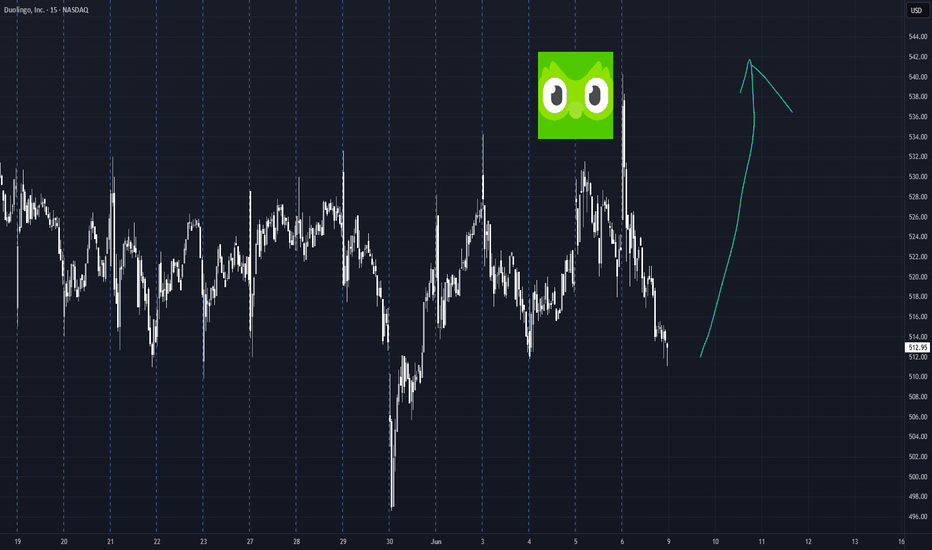

DUOL Swing Trade Plan – 2025-06-06🧠 DUOL Swing Trade Plan – 2025-06-06

Bias: Moderately Bullish

Holding Period: 3–4 weeks

Catalyst: Oversold short-term conditions inside strong weekly uptrend

Timeframe: Position trade based on weekly continuation

🔍 Multi-Model Consensus Summary

Model Direction Entry Stop Target(s) Confidence

DS Lon

Duolingo (DUOL) – Long Setup IdeaTicker: NASDAQ:DUOL

Entry level: $530.50

Stop: $502.00

📊 Setup Rationale

• Post earning consolidation on 10MA

• Tight consolidation between $500–530 with decreasing volume – signs of institutional accumulation

• High ADR (~$17) confirms strong potential for sharp moves

• Earnings winner and s

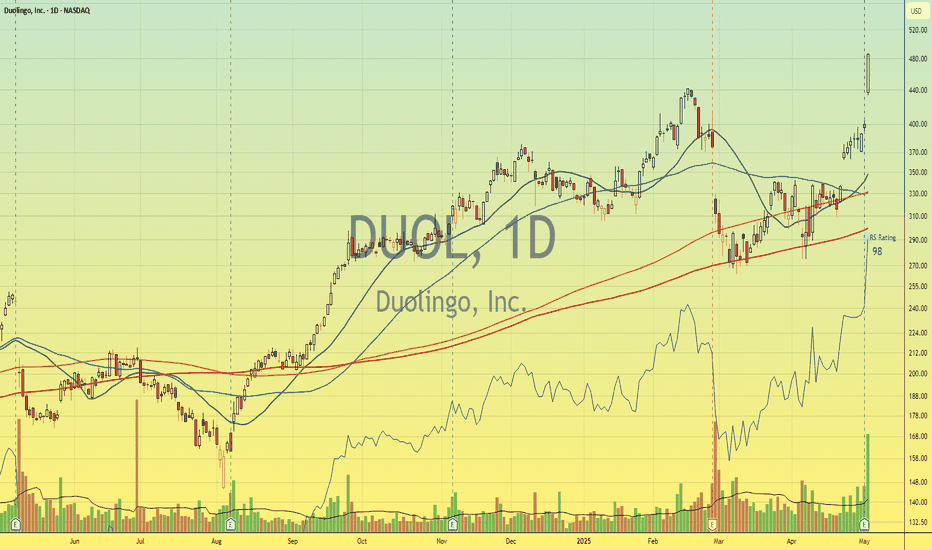

Super Performance Candidate NASDAQ:DUOL , leader in the digital language-learning market, rapid user and revenue growth and increasing profitability, cementing it in a well positioned long term growth model

Adding resilience in a downtrend market and a key breakout day, at a RS Rating of 98,

I have reasons to believe this secu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where DUOL is featured.

Frequently Asked Questions

The current price of DUOL is 7,180.00 MXN — it has increased by 1.27% in the past 24 hours. Watch DUOLINGO INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange DUOLINGO INC stocks are traded under the ticker DUOL.

DUOL stock has fallen by −4.71% compared to the previous week, the month change is a −28.13% fall, over the last year DUOLINGO INC has showed a 80.63% increase.

We've gathered analysts' opinions on DUOLINGO INC future price: according to them, DUOL price has a max estimate of 11,246.49 MXN and a min estimate of 6,747.89 MXN. Watch DUOL chart and read a more detailed DUOLINGO INC stock forecast: see what analysts think of DUOLINGO INC and suggest that you do with its stocks.

DUOL reached its all-time high on May 13, 2025 with the price of 10,160.00 MXN, and its all-time low was 1,918.69 MXN and was reached on Jun 23, 2022. View more price dynamics on DUOL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DUOL stock is 2.02% volatile and has beta coefficient of 1.68. Track DUOLINGO INC stock price on the chart and check out the list of the most volatile stocks — is DUOLINGO INC there?

Today DUOLINGO INC has the market capitalization of 320.73 B, it has decreased by −2.80% over the last week.

Yes, you can track DUOLINGO INC financials in yearly and quarterly reports right on TradingView.

DUOLINGO INC is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

DUOL earnings for the last quarter are 14.75 MXN per share, whereas the estimation was 10.55 MXN resulting in a 39.86% surprise. The estimated earnings for the next quarter are 10.85 MXN per share. See more details about DUOLINGO INC earnings.

DUOLINGO INC revenue for the last quarter amounts to 4.73 B MXN, despite the estimated figure of 4.57 B MXN. In the next quarter, revenue is expected to reach 4.52 B MXN.

DUOL net income for the last quarter is 719.82 M MXN, while the quarter before that showed 289.95 M MXN of net income which accounts for 148.25% change. Track more DUOLINGO INC financial stats to get the full picture.

No, DUOL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 15, 2025, the company has 830 employees. See our rating of the largest employees — is DUOLINGO INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DUOLINGO INC EBITDA is 1.70 B MXN, and current EBITDA margin is 9.95%. See more stats in DUOLINGO INC financial statements.

Like other stocks, DUOL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DUOLINGO INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So DUOLINGO INC technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating DUOLINGO INC stock shows the neutral signal. See more of DUOLINGO INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.