Key facts today

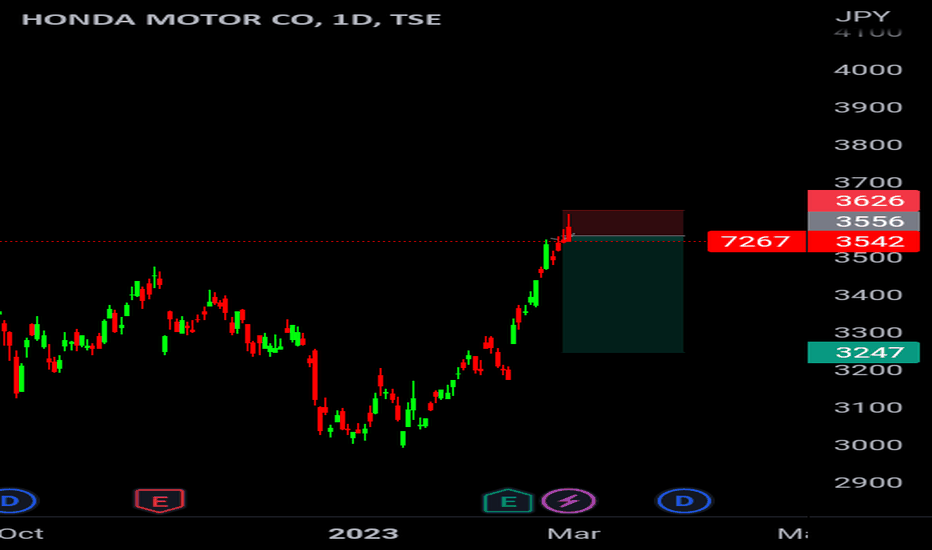

Honda Motor raised its fiscal 2026 profit forecast, now expecting an operating profit of 700 billion yen and a total profit of 420 billion yen, up by 200 billion yen.

Honda Motor's CFO announced plans to explore local production of hybrid vehicle parts in the U.S. to counter expected tariffs impacting the company's profits.

Honda Motor's Fastport eQuad, an all-electric delivery vehicle, won the Red Dot: Best of the Best 2025 award. Mass production starts summer 2026 at a U.S. facility.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

70.70 MXN

112.32 B MXN

2.91 T MXN

1.45 B

About HONDA MOTOR CO

Sector

Industry

CEO

Toshihiro Mibe

Website

Headquarters

Tokyo

Founded

1948

FIGI

BBG000L4Q213

Honda Motor Co., Ltd. engages in the manufacture and sale of automobiles, motorcycles, and power products. It operates through the following segments: Automobile, Motorcycle, Financial Services, and Power Product and Other Businesses. The Automobile segment manufactures and sells automobiles and related accessories. The Motorcycle segment handles all-terrain vehicles, motorcycle business, and related parts. The Financial Services segment provides financial and insurance services. The Power Product and Other Businesses segment offers power products and relevant parts. The company was founded by Soichiro Honda on September 24, 1948 and is headquartered in Tokyo, Japan.

Related stocks

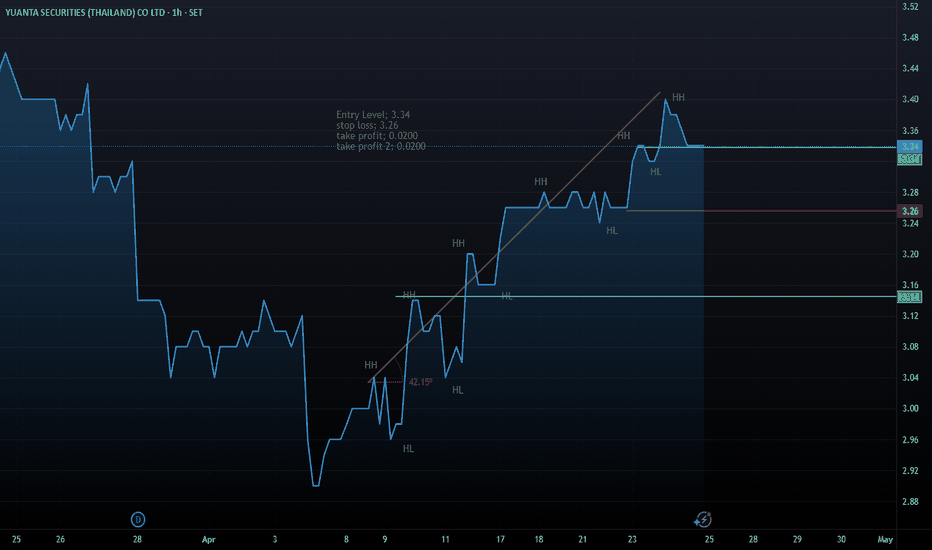

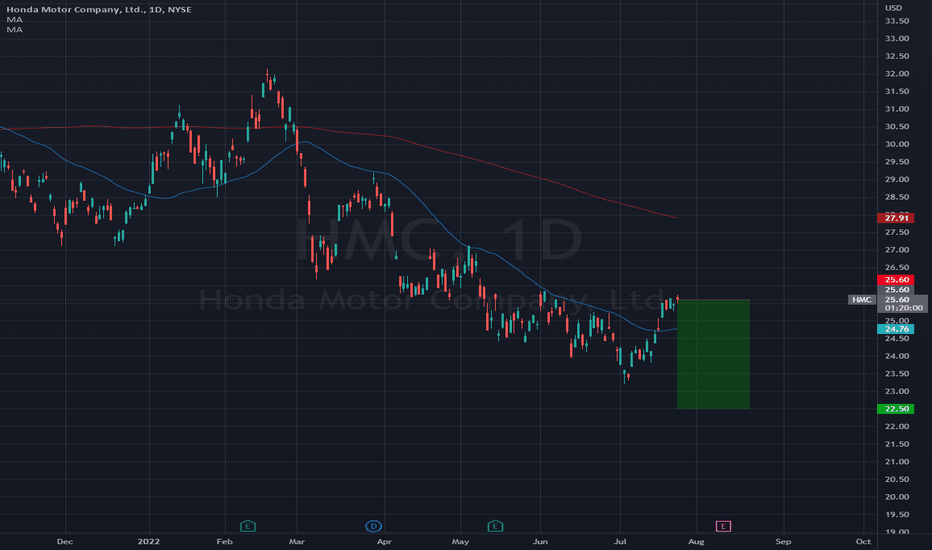

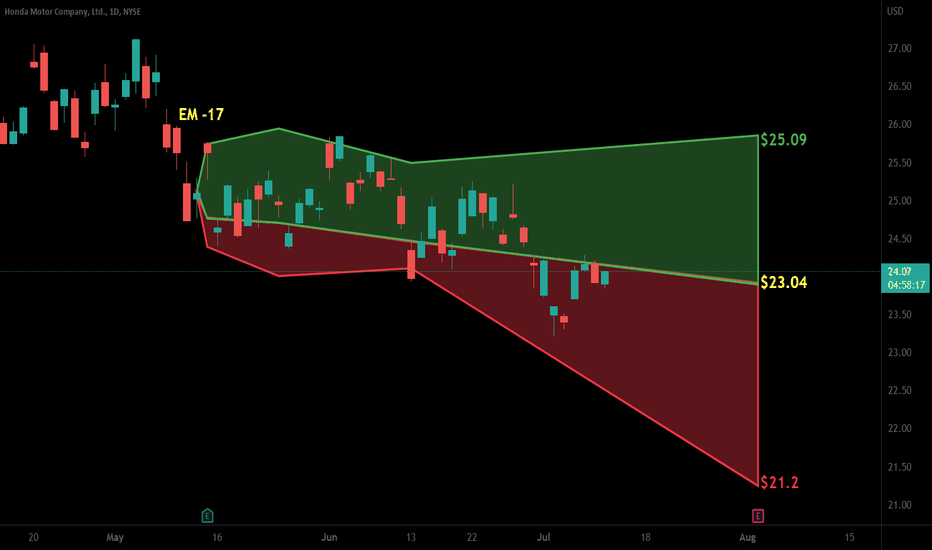

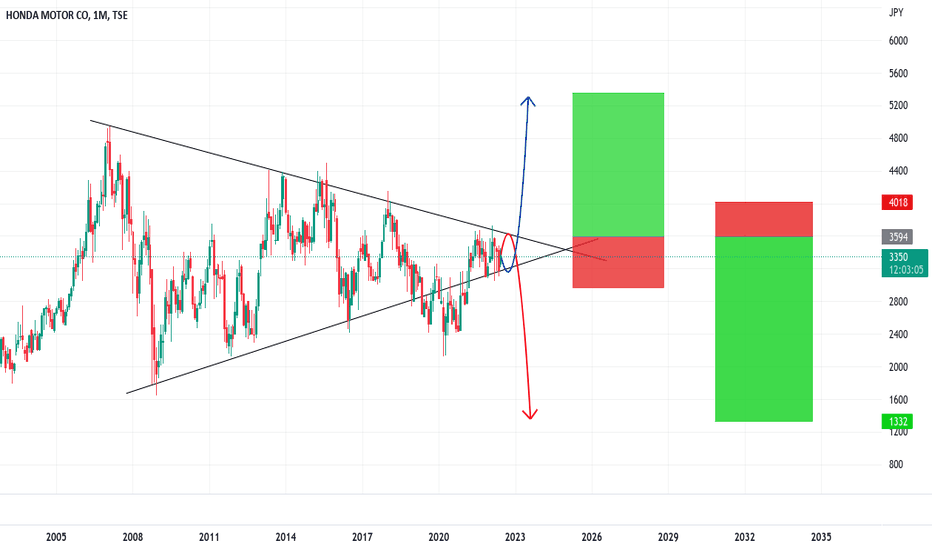

Honda motor company is setting up for a fall.Hello,

Introduction:

In recent market developments, Honda Motor Company, a renowned player in the automotive industry, finds itself navigating through a challenging phase. The company's stock is currently on a downward trend, signaling potential obstacles ahead. Investors and industry analysts a

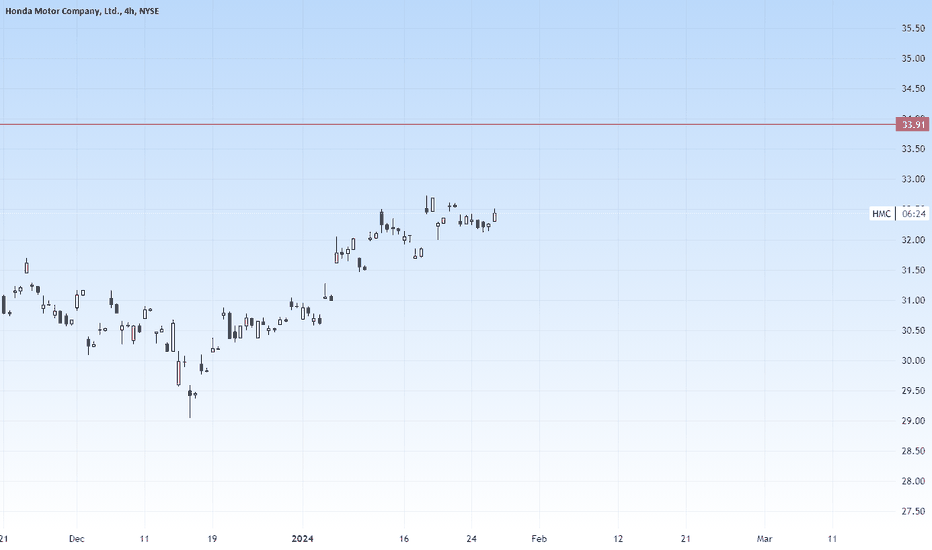

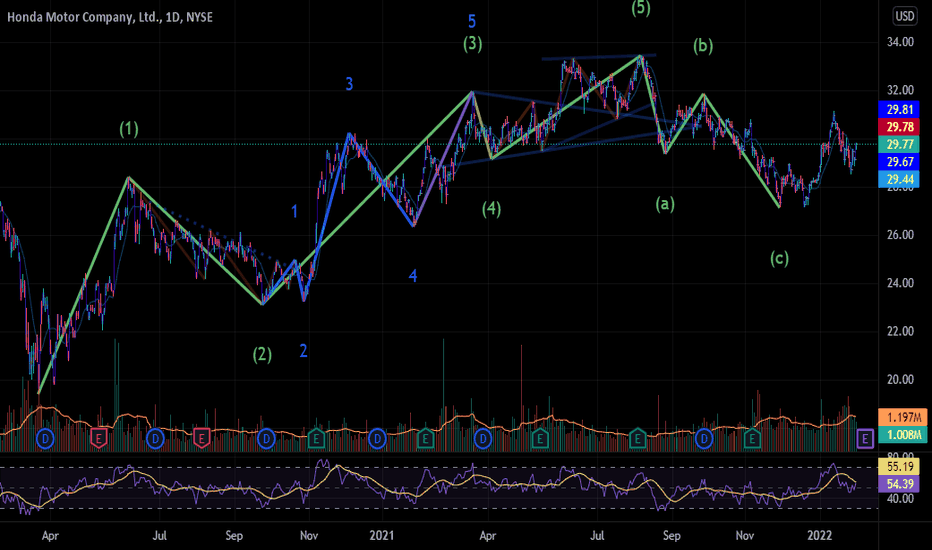

Honda Bull After earnings or before ? Strong Performance: Honda Motor shares have shown solid relative strength over the last month, tacking on nearly 6% and outperforming the S&P 5001.

Positive Earnings Estimate Revisions: The shares are looking to break out of a multi-year consolidation period, with positive earnings estimate revisio

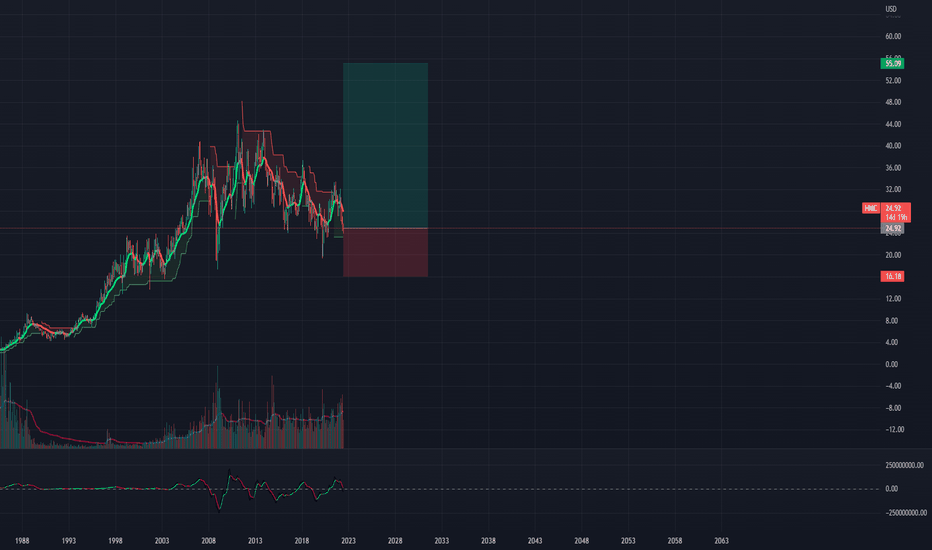

HMC Inflation adjustmentMusashi Seimitsu Industry Company, a supplier of transmission gears and suspension parts to Honda Motor Company, is negotiating with automakers to reflect the impact of higher shipping and material costs. Another Honda supplier, Yachiyo Industry Company, which manufactures fuel tanks and sunroofs, h

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

A

HMC5042814

American Honda Finance Corp. 1.0% 10-SEP-2025Yield to maturity

5.41%

Maturity date

Sep 10, 2025

A

HMC6020687

American Honda Finance Corp. FRN 03-MAR-2028Yield to maturity

5.13%

Maturity date

Mar 3, 2028

A

HMC6020580

American Honda Finance Corp. 5.2% 05-MAR-2035Yield to maturity

5.12%

Maturity date

Mar 5, 2035

A

HMC5770797

American Honda Finance Corp. FRN 12-MAR-2027Yield to maturity

5.10%

Maturity date

Mar 12, 2027

A

HMC5846700

American Honda Finance Corp. FRN 09-JUL-2027Yield to maturity

5.03%

Maturity date

Jul 9, 2027

A

HMC6119245

American Honda Finance Corp. FRN 09-JUL-2027Yield to maturity

5.02%

Maturity date

Jul 9, 2027

A

HMC5922333

American Honda Finance Corp. FRN 22-OCT-2027Yield to maturity

4.98%

Maturity date

Oct 22, 2027

A

HMC5731049

American Honda Finance Corp. FRN 09-JAN-2026Yield to maturity

4.95%

Maturity date

Jan 9, 2026

A

HMC5731051

American Honda Finance Corp. 4.9% 10-JAN-2034Yield to maturity

4.93%

Maturity date

Jan 10, 2034

See all HMC/N bonds

Curated watchlists where HMC/N is featured.