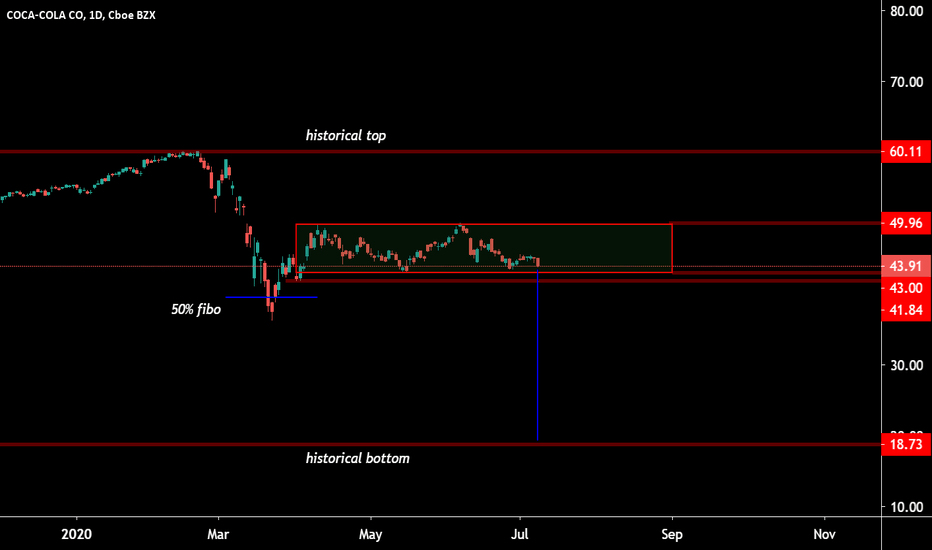

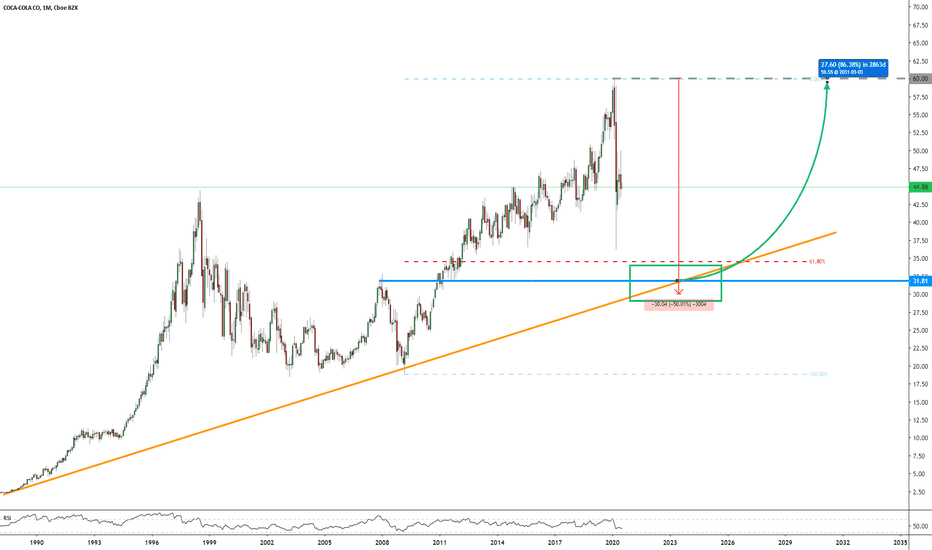

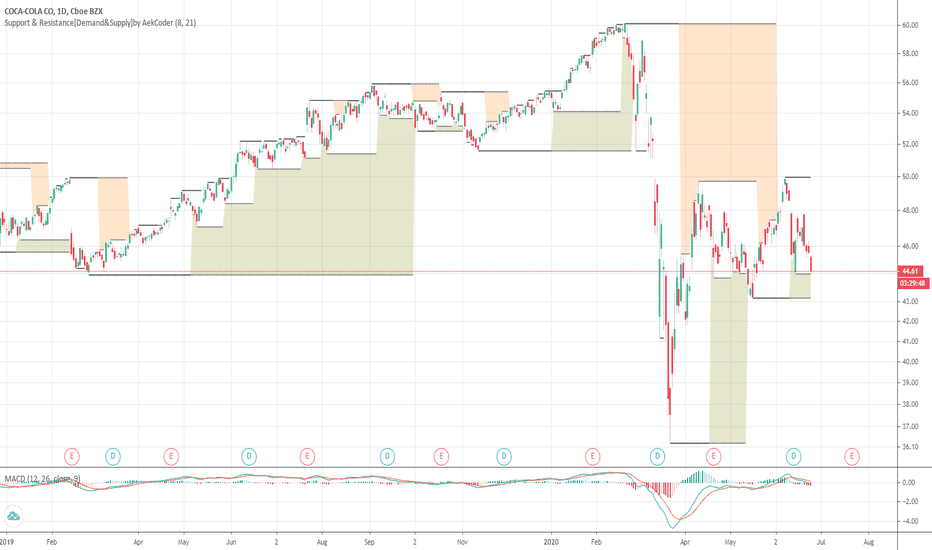

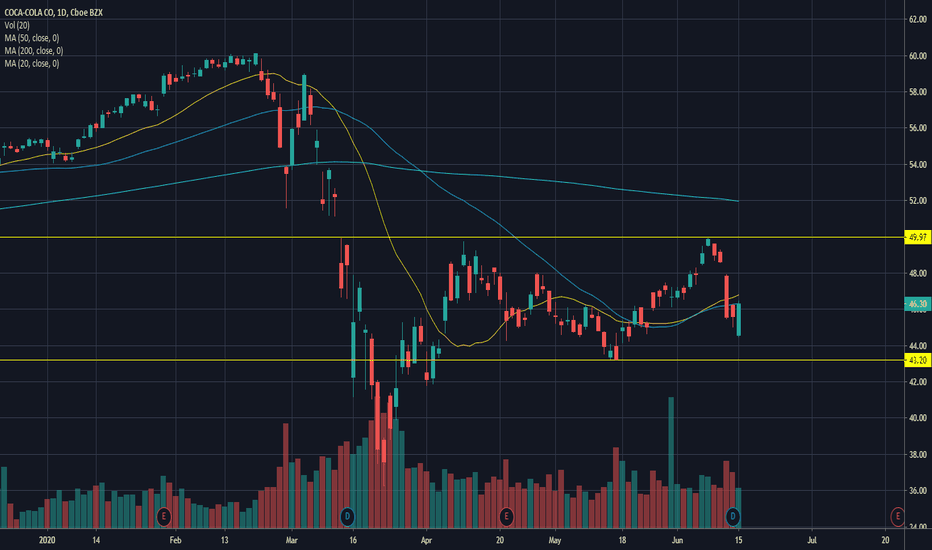

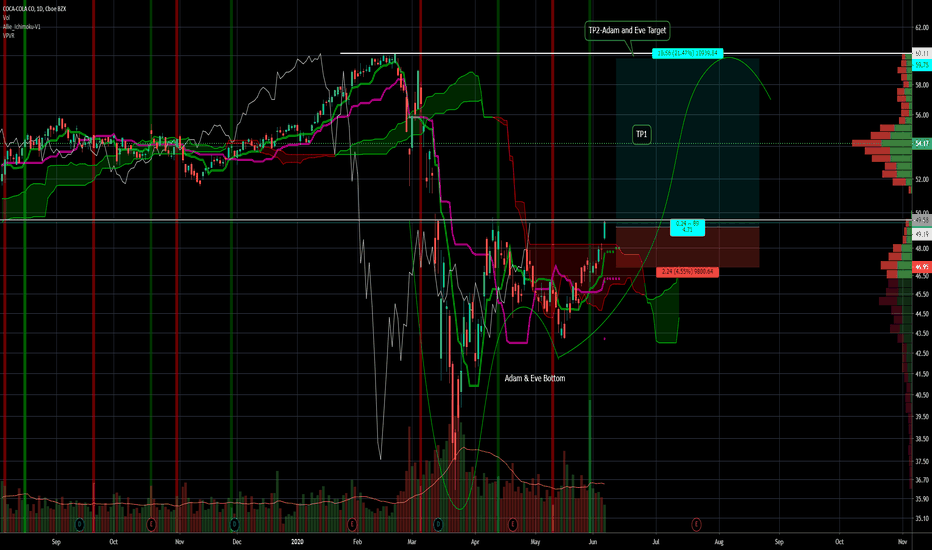

COCA-COLA CO: PRICE WILL STILL FALLING DOWN AFTER RANGE BREAK ??We observe in the chart a great correction of the upward trend of this asset just with the coinciding period of the covid during the month of March of this year, probably due to the global logistical problems derived from the situation.

Coca cola is always a safe bet since one of its shareholders is called Warren Buffett, here is the portfolio of W. Buffett in percentage:

List %

AAPL Apple Inc 25.78

BAC Bank of America 11.69

WFC Wells Fargo 10.51

KO Coca-Cola Company 8.35

KHC Kraft Heinz 8.11

AXP American Express Company 7.30

USB U.S. Bancorp 2.98

MCO Moody's Corporation 1.86

GS Goldman Sachs 1.86

JPM JPMorgan Chase & Co 1.82

No Microsoft !!!??? i dont believe that...hahaha

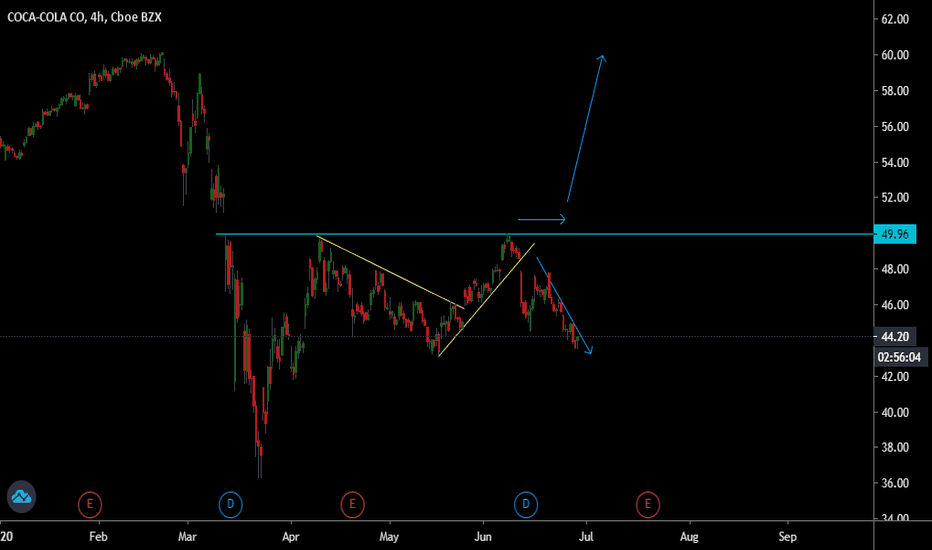

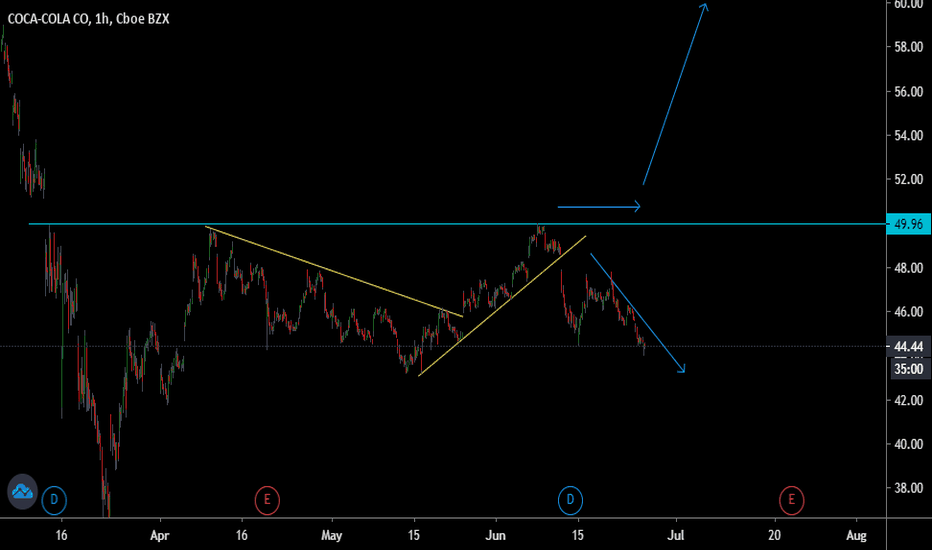

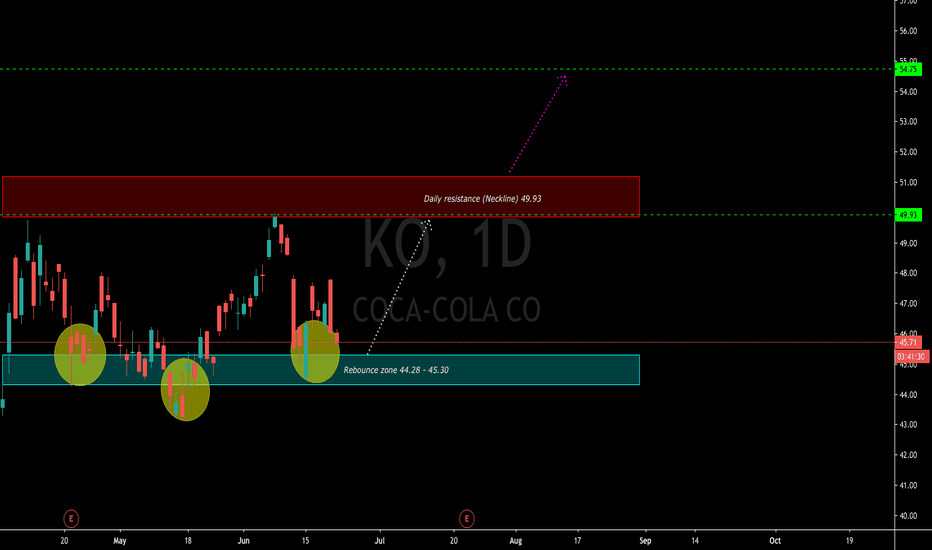

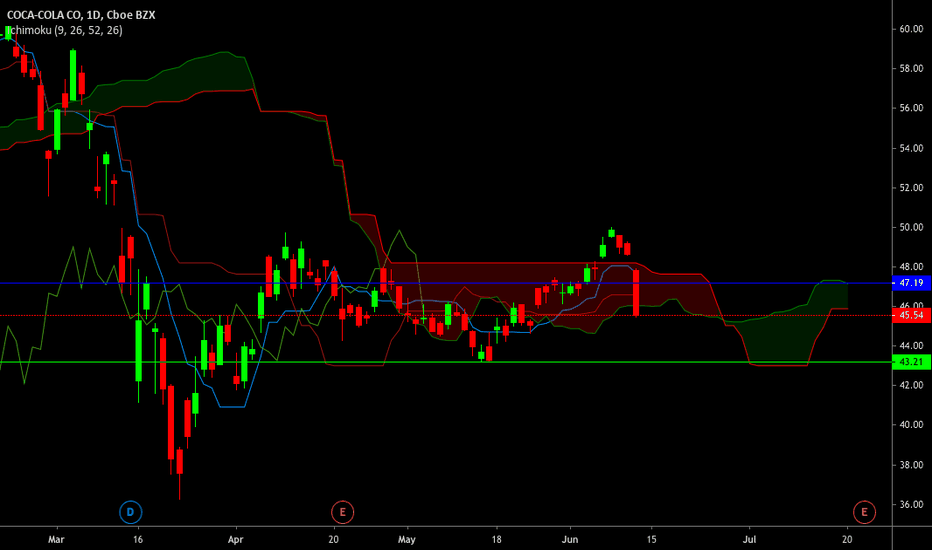

The price is boxed in a very narrow lateral range, it is as if you are waiting for some event to jump in one direction or another. In this scenario it is very difficult to determine what the price is going to do in the coming days, if it breaks the range downwards, things get complicated because there could be a 100% correction in AB = CD and see the price at historically low levels above 18.

If the price breaks the range by pushing up with strength and volume then he's likely to look for the historical top in a zig zag shape, if not and he do it in a V-shape then I very likely see a bearish bounce at that resistance level

KO trade ideas

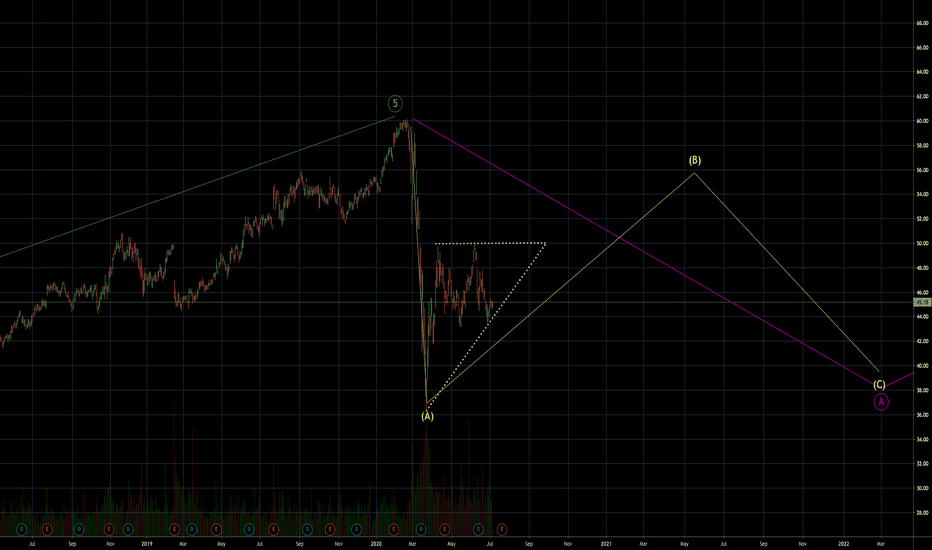

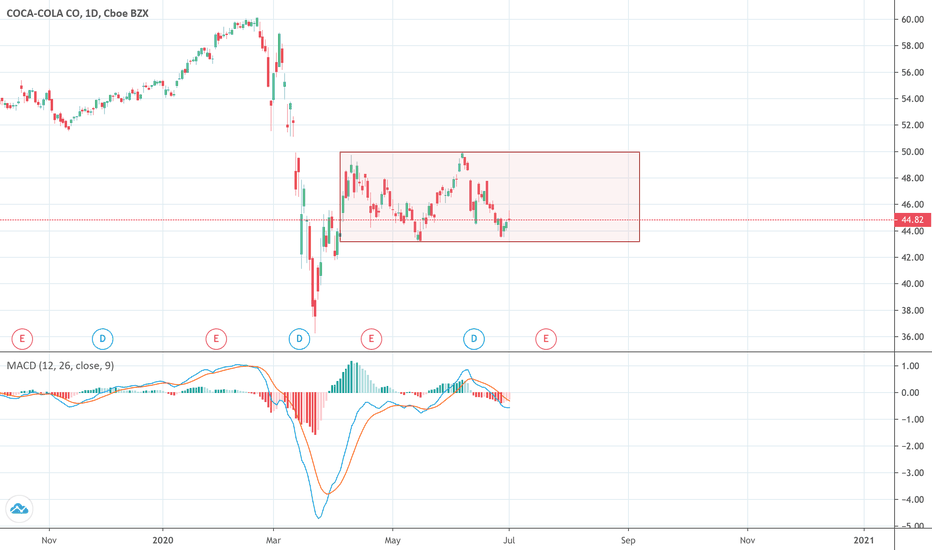

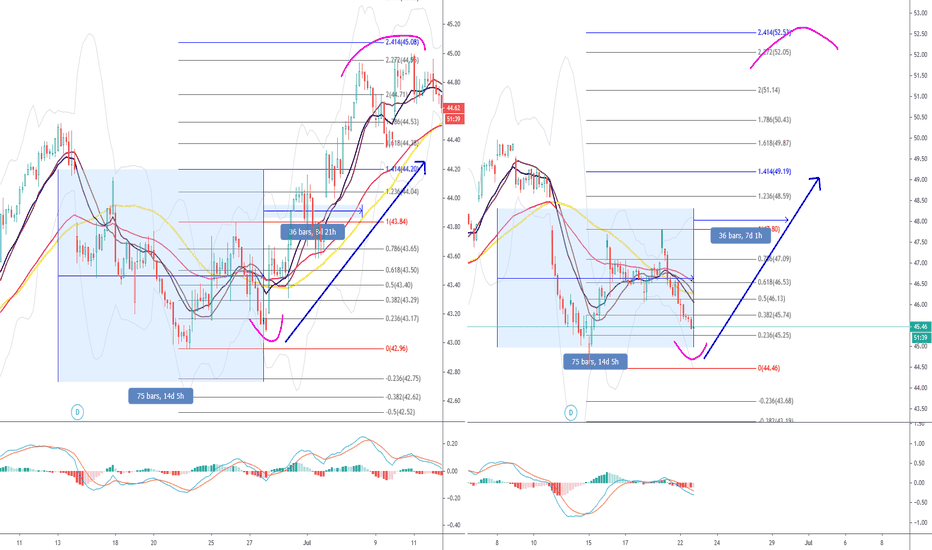

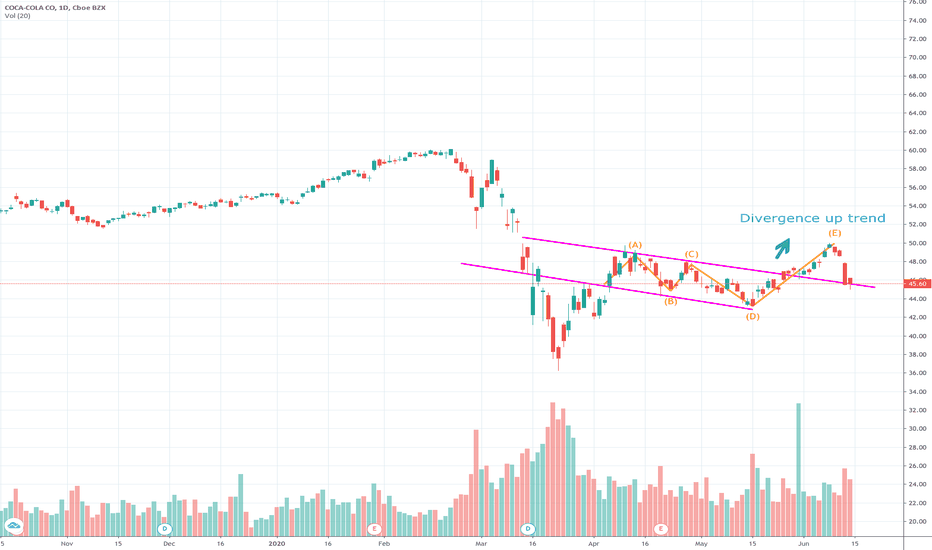

$KO in a higher degree correction completing Wave B of B

Disclaimer: I have been trading in the markets for about a year. After several months of charting various instruments, my eyes have gotten trained to recognize different candle formation patterns like Bear & Bull Flags, Head & Shoulders, and others. This was good. But, not enough for me to accurately forecast the next following moves and market structure after these patterns had been completed.

For me my next evolution as a Trader came with a more fine-tuned approach to Market Structure, The Elliott Wave Theory. There are two books that were recommended to me as I started this journey.

1. Elliott Wave Principle: Key to Market Behavior by Robert Prechter and A. J. Frost, www.elliottwave.com

2. Visual Guide to Elliott Wave Trading by Wayne Gorman and Jeffrey Kennedy, www.elliottwave.com

I am still learning. I accept the fact that my analysis may be wrong. But, these are my charts as I continue my journey. I am open to all feedback on my analysis as I continue to improve.

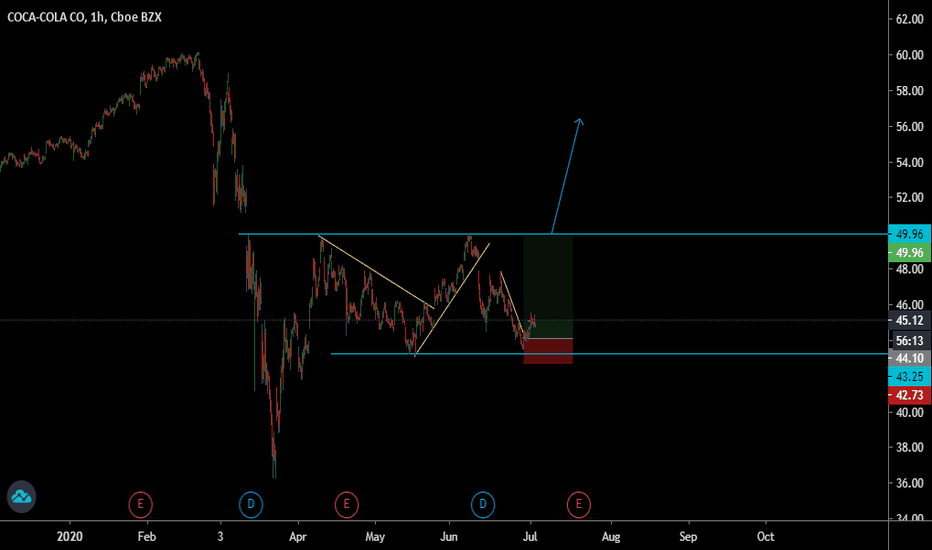

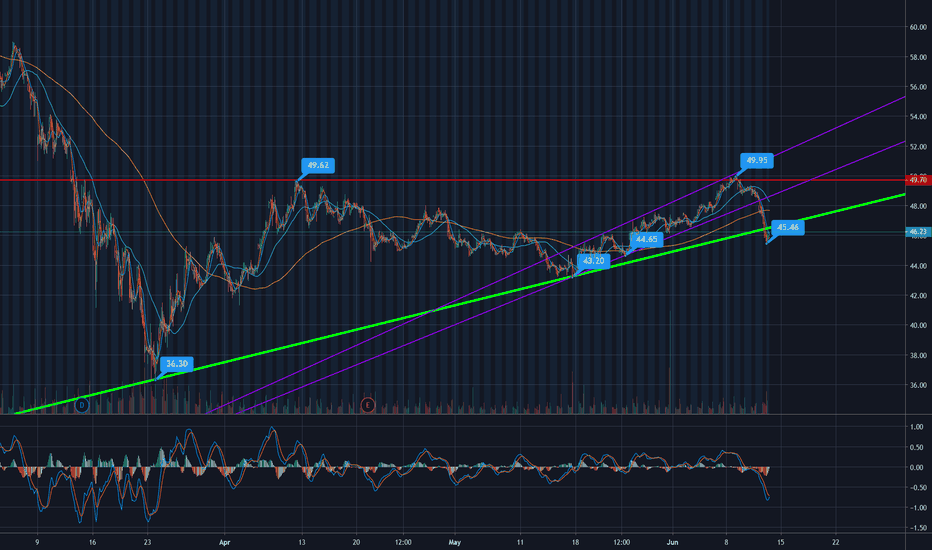

COCA COLA I am looking for buysHi traders:

KO is looking very good for mid/long term buy.

We see the price had a massive dropped from Covid, and strong bullish impulse up, forming a larger correction.

When we dropped down to lower time frame, we see a potential rejection off the bottom of the structure,

and forming a continuation correction.

I will wait for confirmation of a completion of the structure, and look for buy setups.

Traders, if you like my analysis, please like, follow, and comment. I welcome all kinds of feedback, suggestions and opinions, thank you.

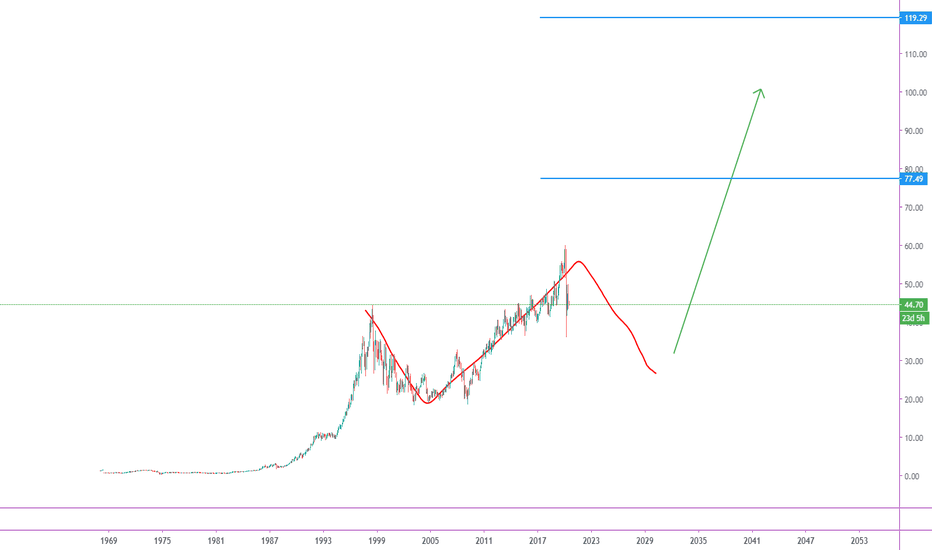

KO shown hidden moveWhile other monster stocks show parabolic uptrend. KO quietly started to it move in silent. Currently KO is waiting for the sharks to turn the key on. Inverted head & shoulder might soon complete it formation if support zone fail to break below. Entry from here will be a good chance as risk to cutlass not really big. Lets see the momentum.

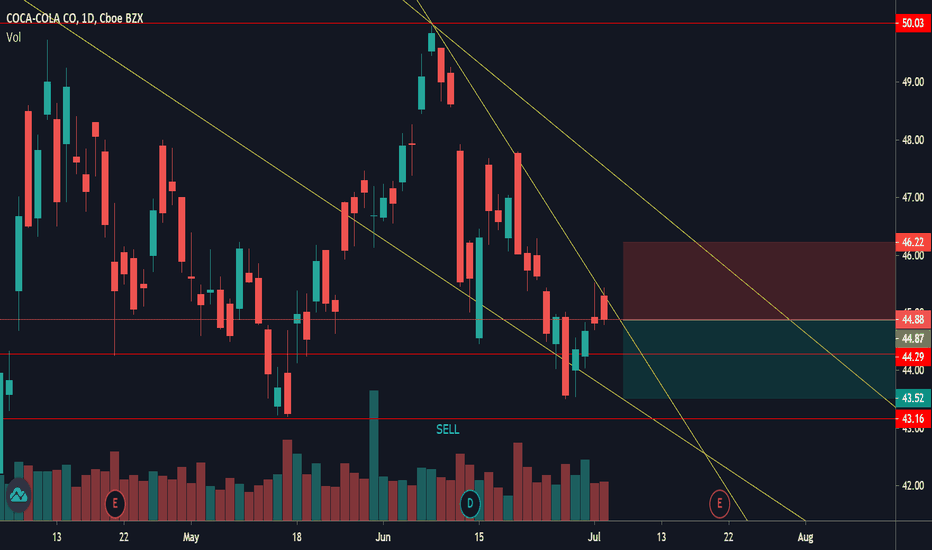

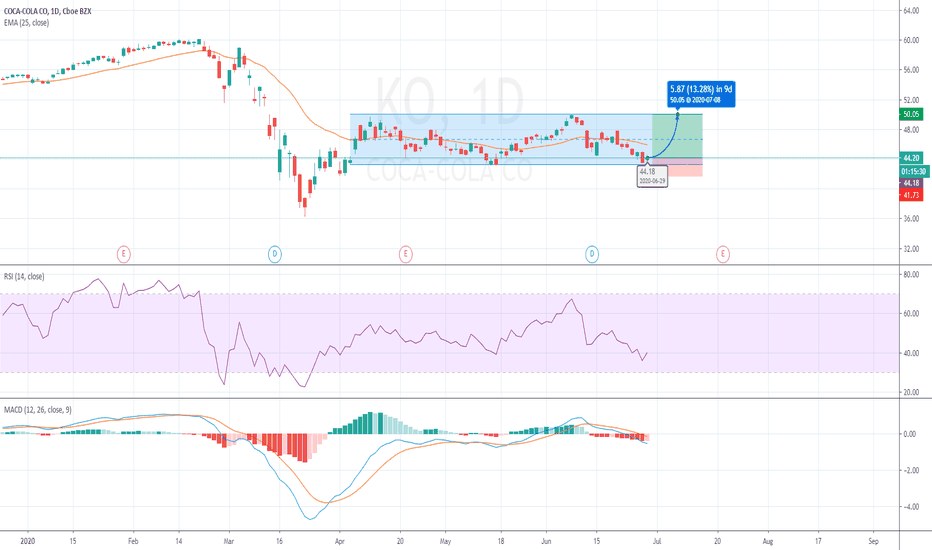

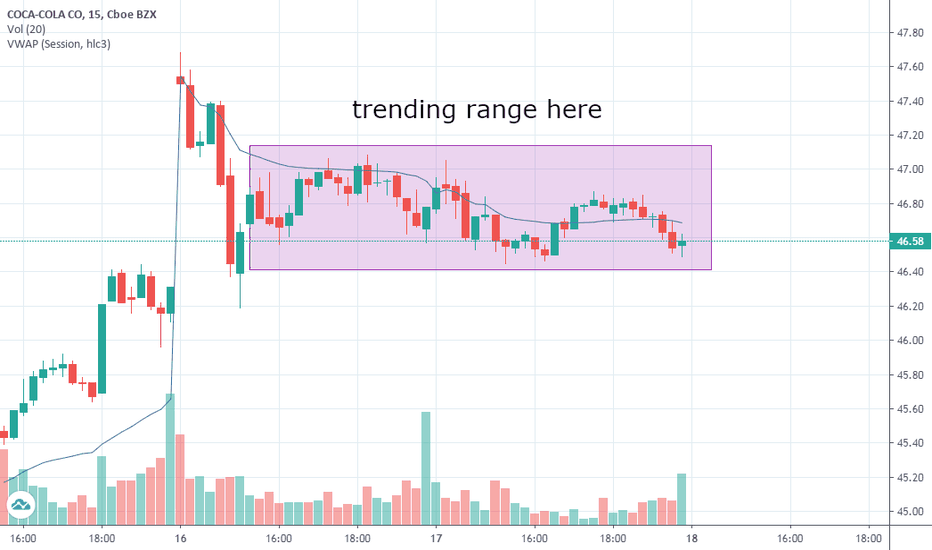

KO 07/17 $46pKO 07/17 $46p

1. MACD Flip Negative

2. Bearish Triangle Formation

3. 0.786 Fib Level Rejection

4. Buyer's Uncertainty Candle on 06/18

5. Retail Sector ETF strength is low - pandemic cases significantly hurts retail

6. Unemployment increased for week of 06/14 - significantly hurts retail