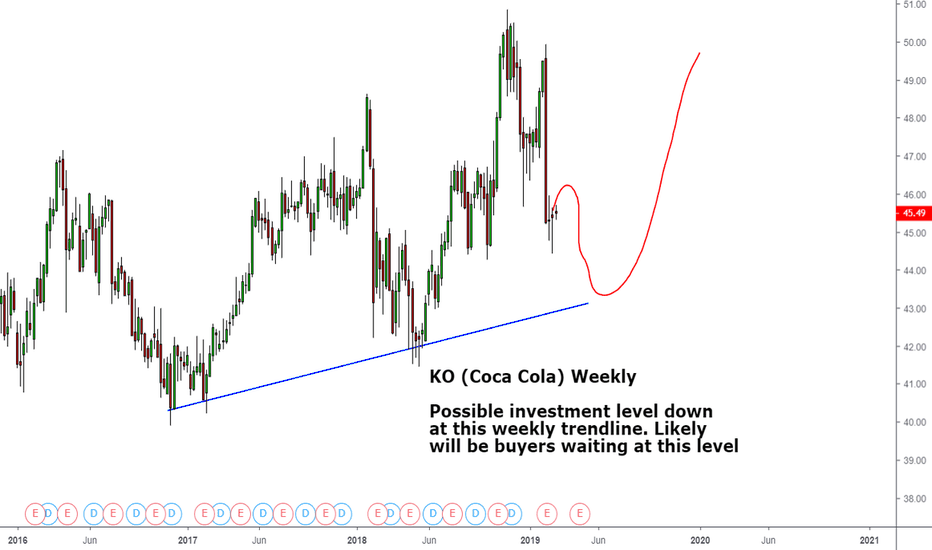

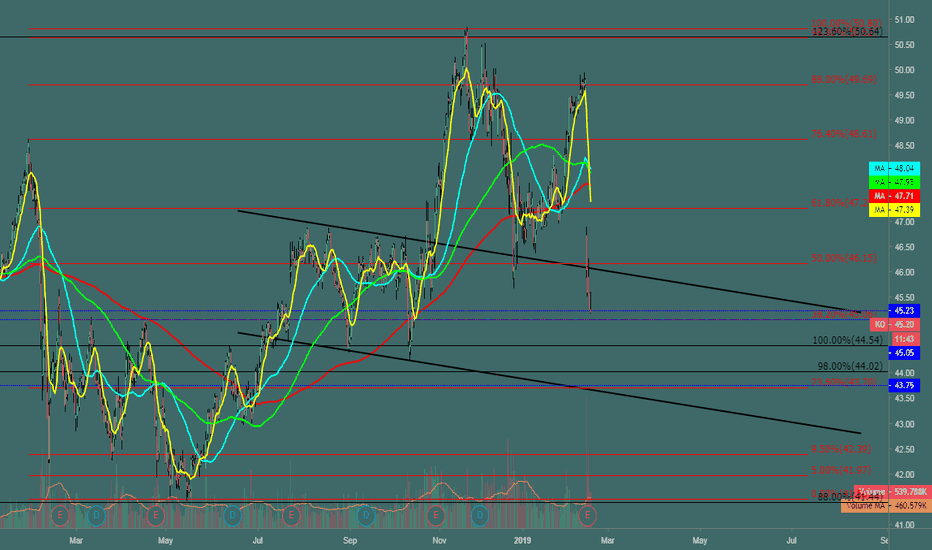

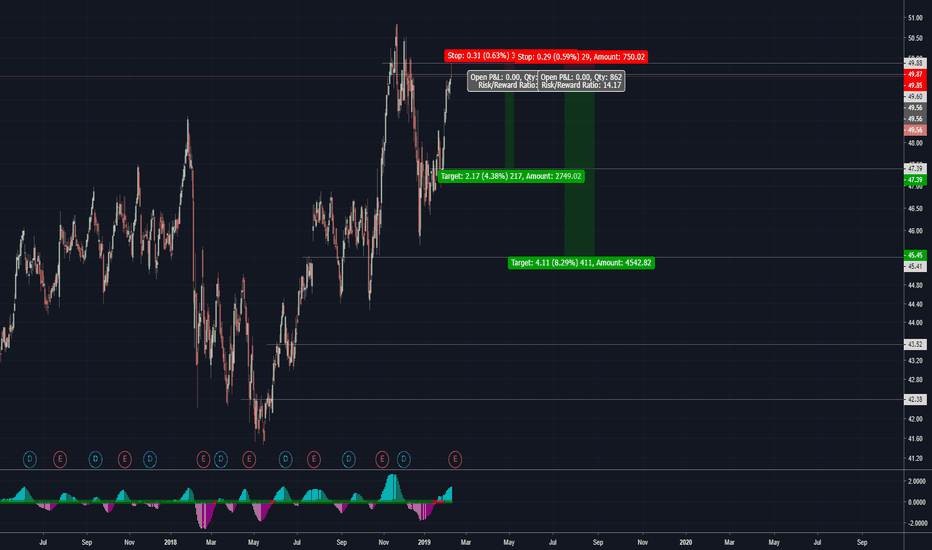

Building KO long position (hedged) with 2nd entry at $42.xxHedging/spreading with a 50% short on MSFT (short 118.70)

and 40% short on WFC (short 49.12) , which I see as relatively overvalued.

Banks in general are likely to be the weakest sector. Microsoft isn't fundamentally weak but is relatively overvalued (on a 1-3 week basis)

Total position size (short side 5% each stock and long side is 10%) is 20% of NAV. But hedged so low risk.

KO trade ideas

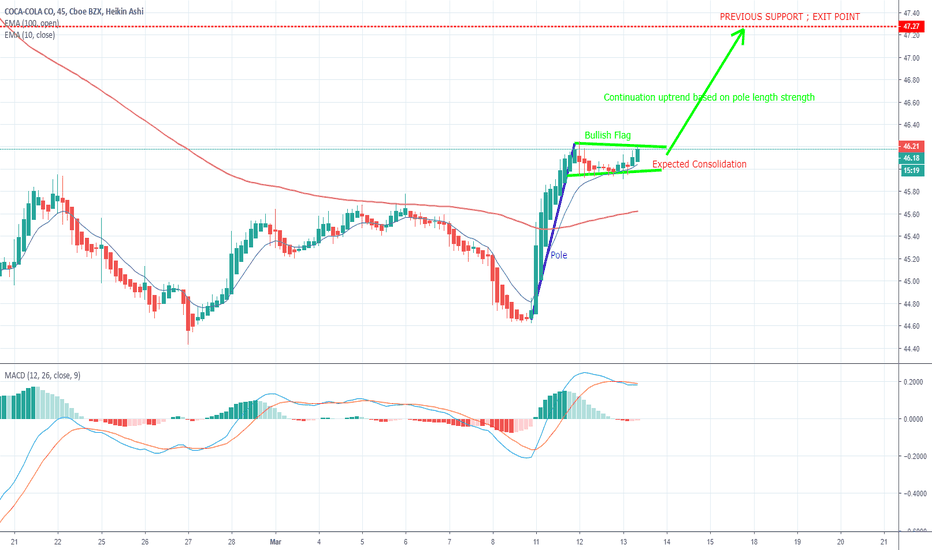

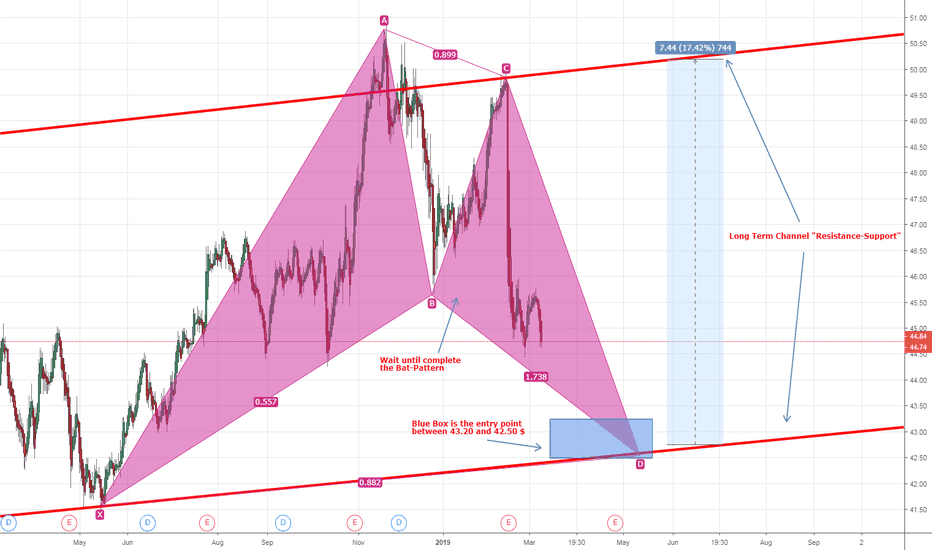

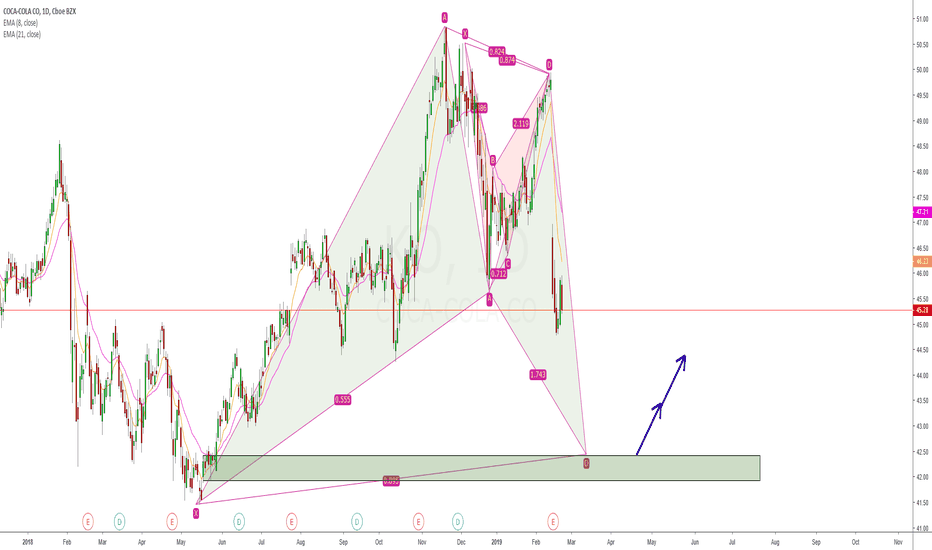

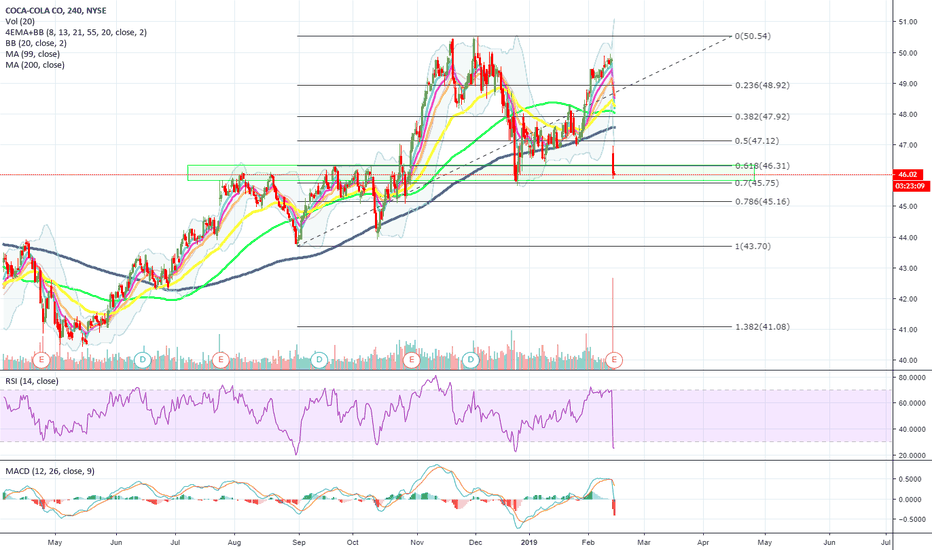

BUY OPPORTUNITY COCA COLA (KO)Strong projection of bullish flag, an expected consolidation will occur followed by a uptrend supported by pole strength (PIPS), my guess is the continuation will drop at previous support which has been quite strong.

Bullish flag formations are found in stocks with strong uptrends. They are called bull flags because the pattern resembles a flag on a pole. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. The flag can be a horizontal rectangle, but is also often angled down away from the prevailing trend. Another variant is called a bullish pennant, in which the consolidation takes the form of a symmetrical triangle. The shape of the flag is not as important as the underlying psychology behind the pattern. Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can get. The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole

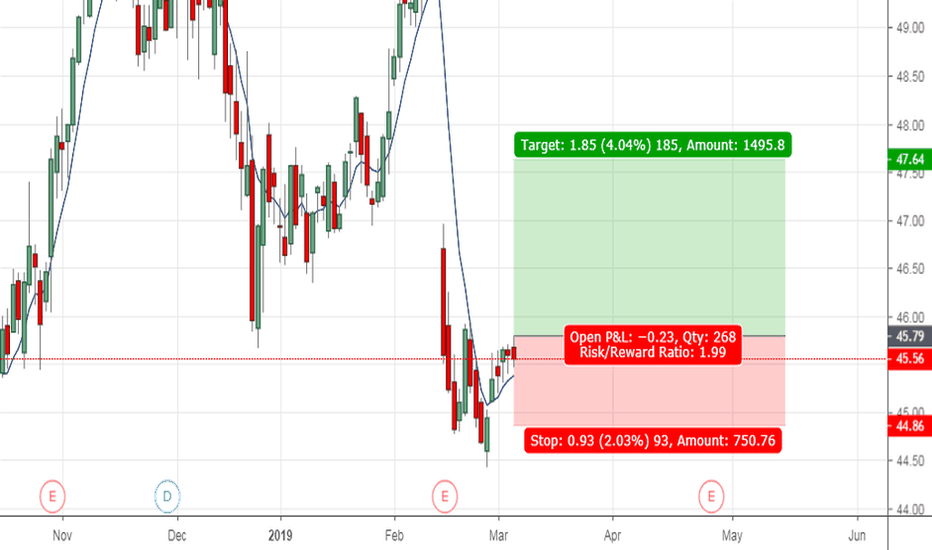

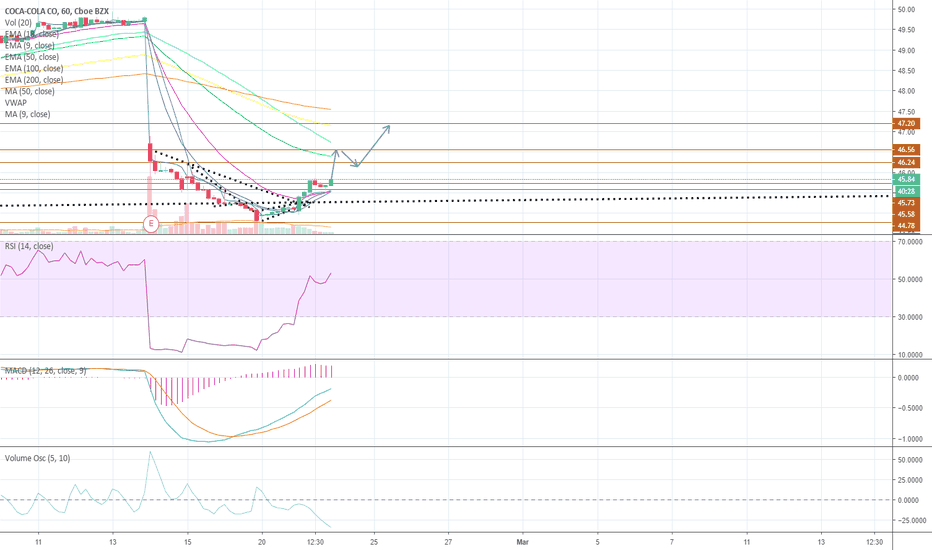

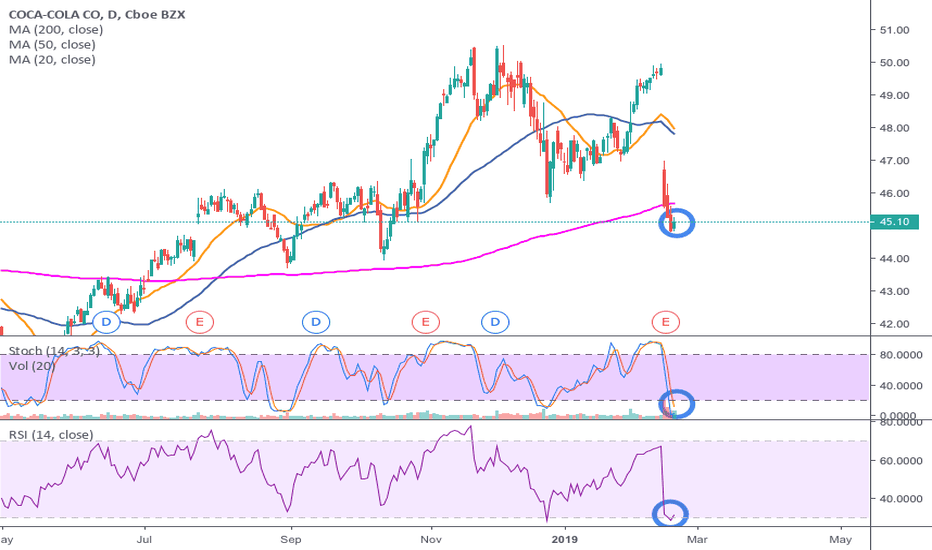

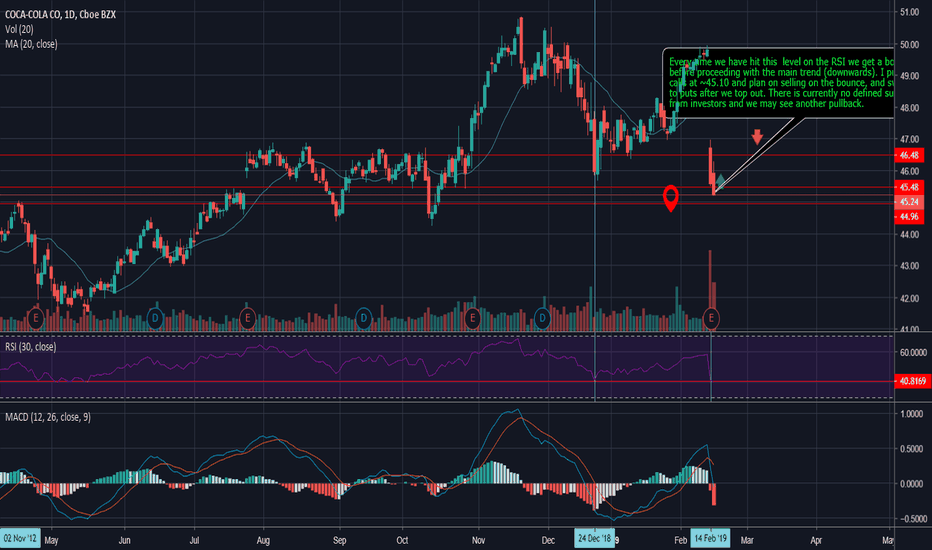

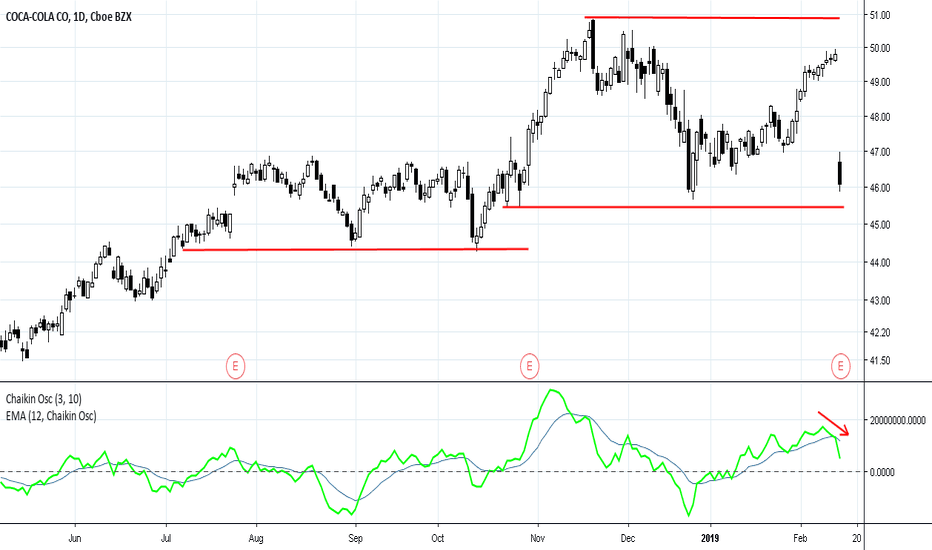

Coca-Cola - Buy OpportunityThe price bounced from the 44.50 support level. RSI and MACD histogram confirmed the price reversal. MACD lines support the upward movement. DMI is bearish with the falling ADX line. It tells us that we should not expect strong bearish movements. At the same time, the price breaks the local swing high - it's an additional confirmation that the market is going to move upward.

The market gives buy opportunity with an entry level above the local swing high. It's 46.00 level. Stop orders must be placed below the support level. Profit targets are at the resistance levels.

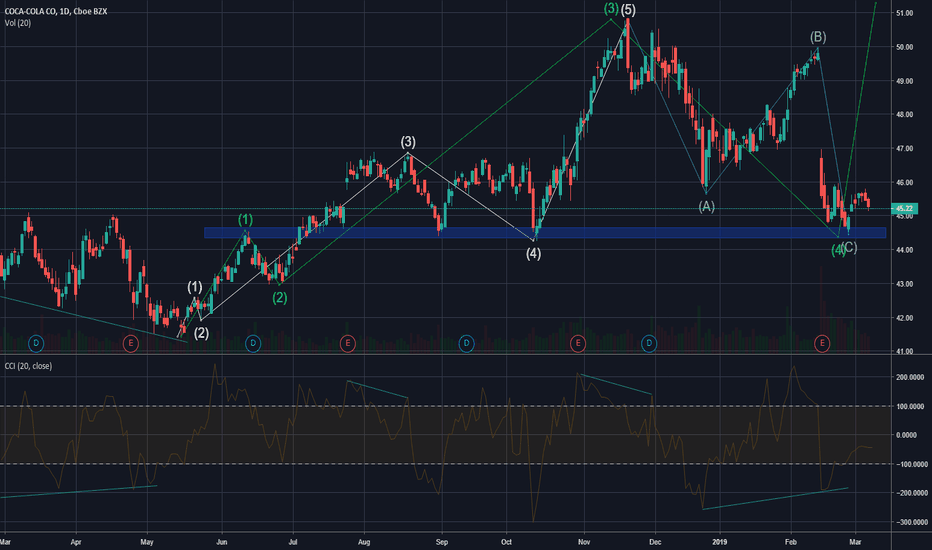

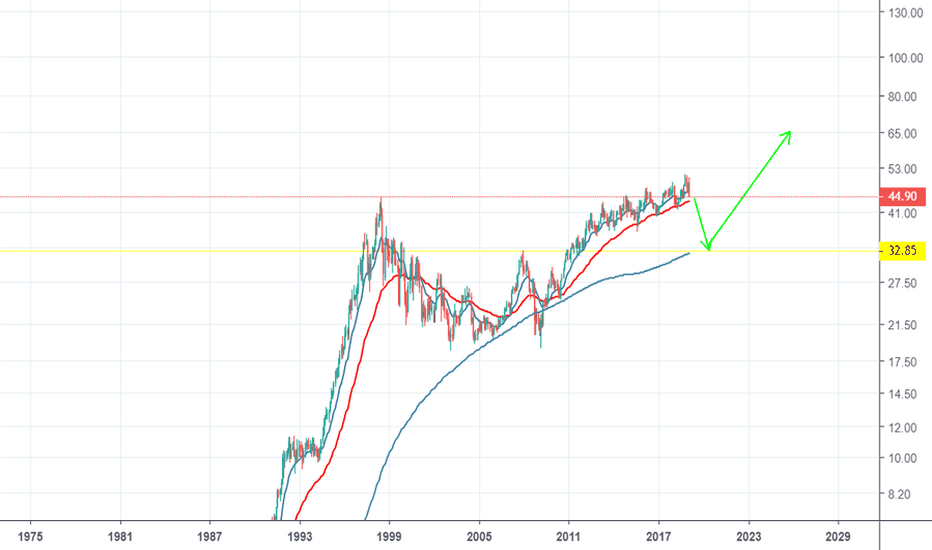

The Coca-Cola Company (KO)Despite fourth quarter earnings were lower than market expectations, we look for earnings to advance 7% this year, to 2.25 dollars per share. We still belive that the Costa Ltd. acquisition should halt the decline in the reveues; this high quality low Beta (0.70) company can provide some downside protection in the event of further volatility in equity prices. Very interesting dividend of 3.50%.

Total debt: 44.8 bilions

Total profit 2017: 8.24 bilions

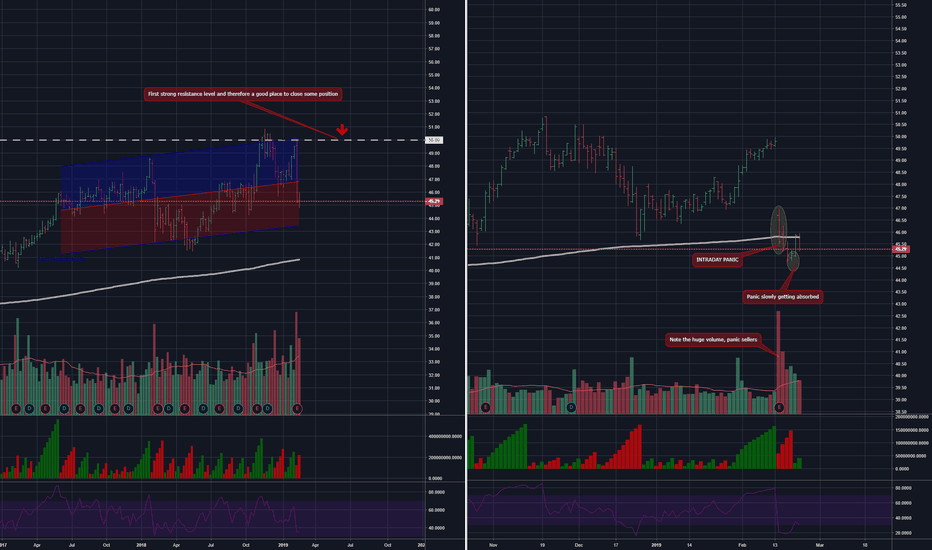

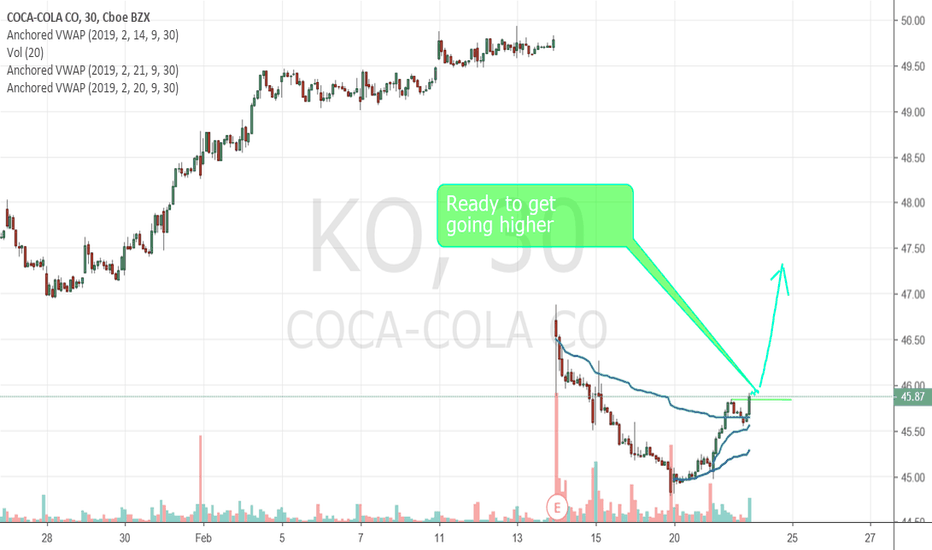

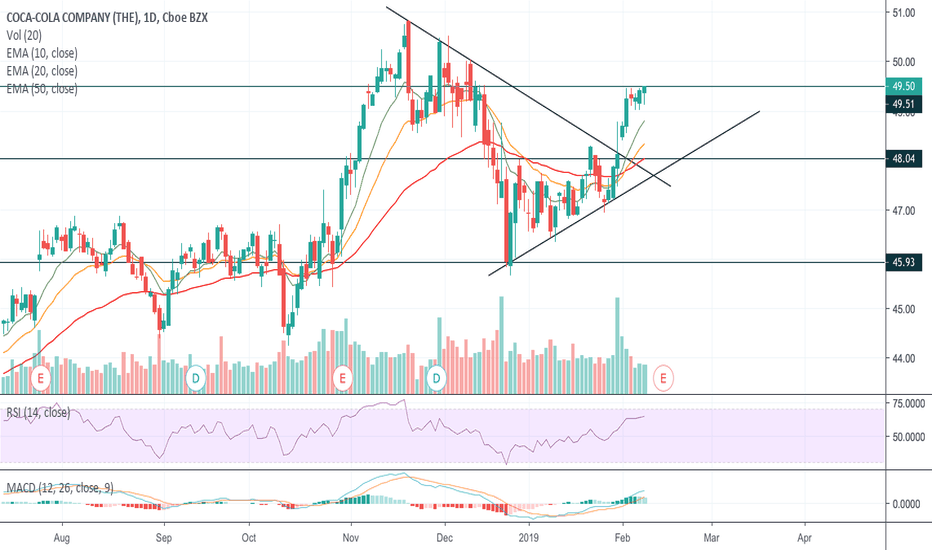

COCA COLA - Buy opportunityGood weekend everyone =)

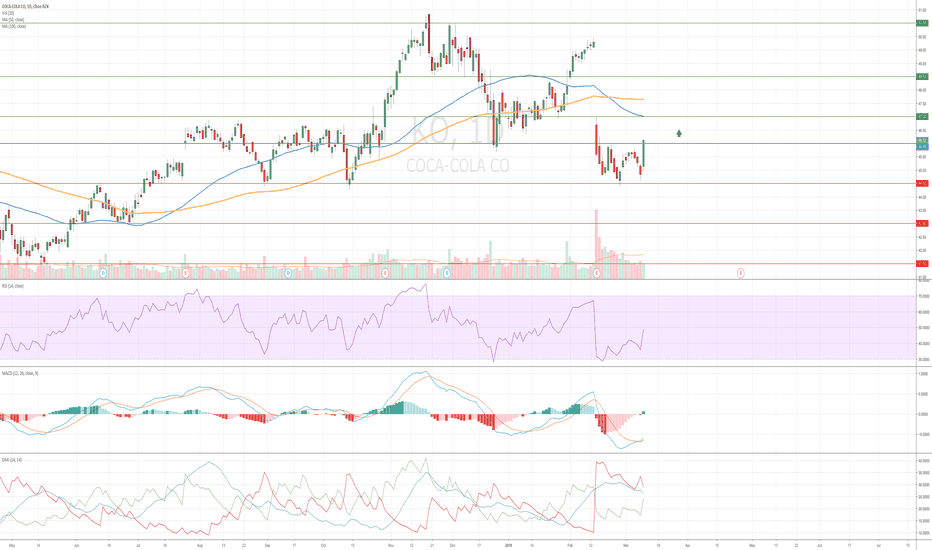

Coca Cola had a huge gap down after the bad news on the "earnings" event, we can see on the huge red bar and huge volume , what is that? Panic sell

We can see now that the panic is now being absorbed since the volume is decreasing and the stock is trading near a support zone .

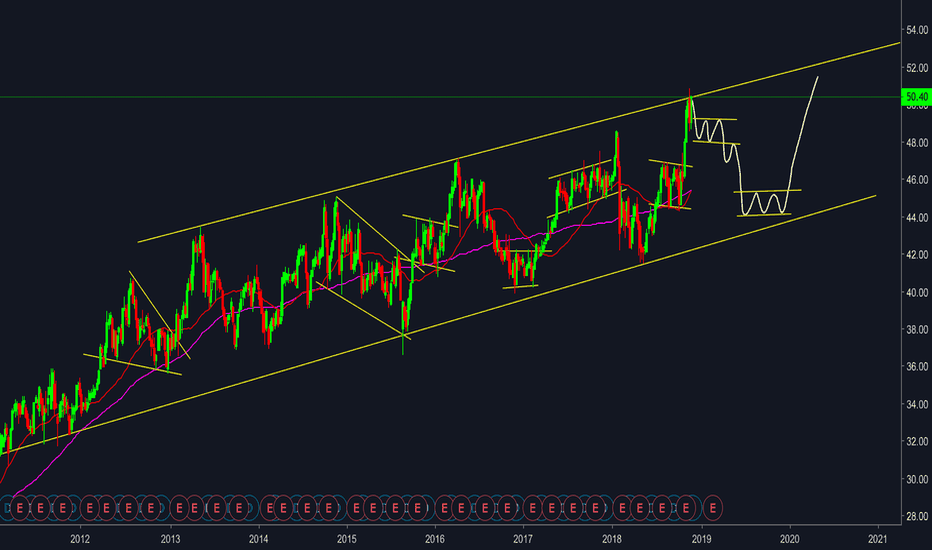

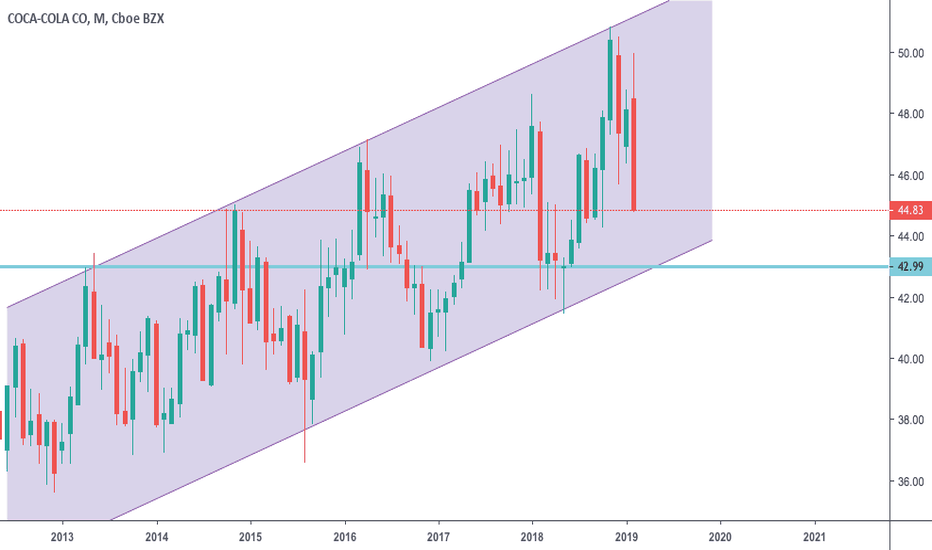

Overall the stock is still bullish as we can see on the weekly timeframe , we are now on the lower part of the big channel.

Now, i'd not buy right now, i'd like to wait some extra signs of strenght or at least no signs of further weakness.

A break above the 46 level can mean that the stock is getting read to go up again.

Natural targets are 50.0 and 51.5 levels (new ath ).

This Trading Idea is to be used for educational purposes only. This idea does not represent financial advice and its NOT a signal. You should trade based only on your own technic and knowledge.

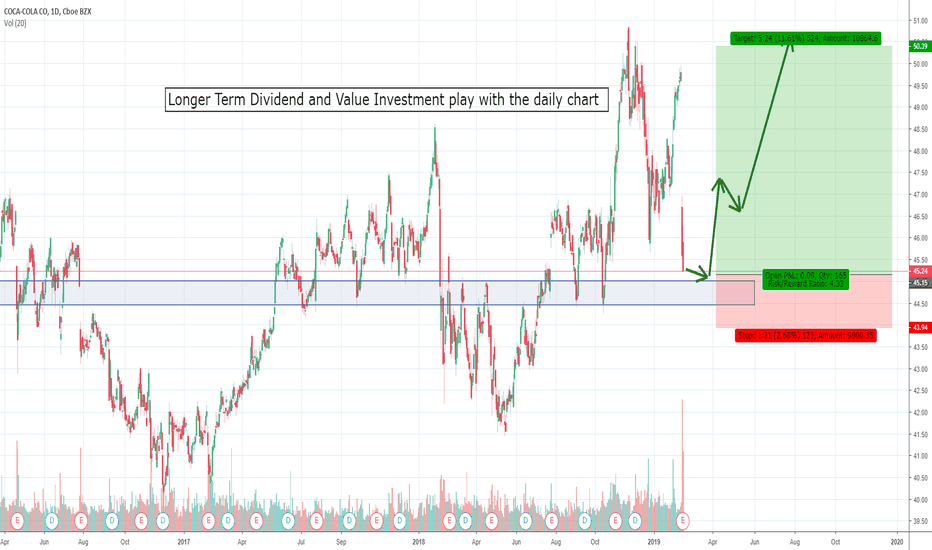

Longer Term Dividend and Value Investing on Coca Cola KORecent Earnings of $0.20 against the analyst consensuses of $0.43 is a big disappointment.

This is a "surprise" whopping 53.3% drop against expectations.

Coca Cola is a consumer staples stock and if you like them as much as Warren Buffett, this could be a high probability winning trade with dividend and capital appreciation on the longer term.

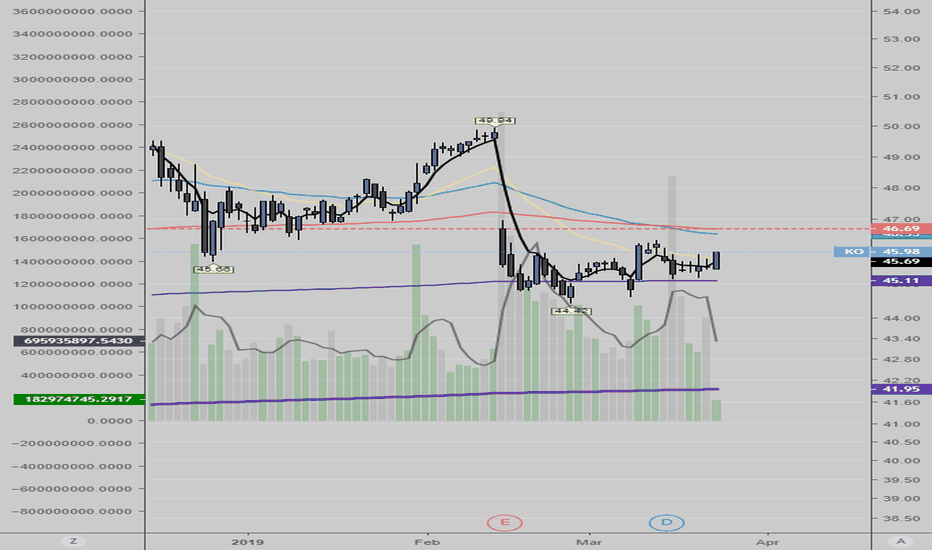

KO Earnings: Dark Pool Rotation vs. BuybacksCoca Cola has been in a major buyback mode for its stock in an attempt to move the price up. The buybacks have faced heavier than normal Dark Pool rotation (large lot selling) against the automated buyback orders. Recently the buybacks have increased, creating some interesting anomalies in the large lot indicators as well as in price patterns. Retail traders, who trade this stock heavily, are often fooled by buyback candlestick patterns. Institutional holdings has declined, which is unusual during a buyback mode.