Key facts today

Norfolk Southern (NSC) is in talks with Union Pacific (UNP) for a possible merger, potentially creating a $200 billion coast-to-coast rail company.

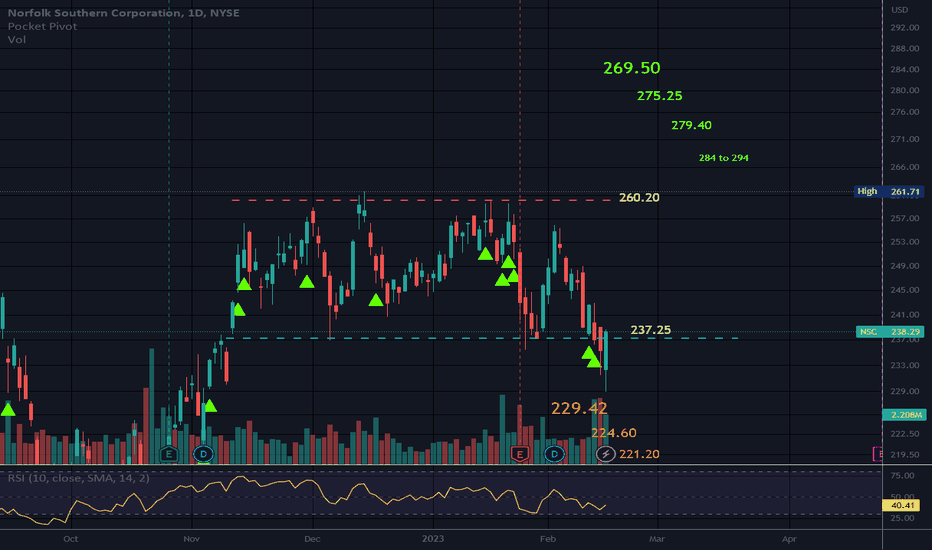

Jefferies has established a price target of $300.00 per share for Norfolk Southern (NSC).

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

300.39 MXN

54.60 B MXN

252.76 B MXN

225.33 M

About Norfolk Southern Corporation

Sector

Industry

CEO

Mark R. George

Website

Headquarters

Atlanta

Founded

1980

FIGI

BBG00N5917C4

Norfolk Southern Corp. is a transportation company, which engages in the rail transportation of raw materials, intermediate products, and finished goods. The company also transports overseas freight through several Atlantic and Gulf Coast ports. Its services include property leases and sales, wire line or pipeline and fiber optics projects, access property, managing private crossings, promoting businesses with signboards, and natural resource management. The company was founded on July 23, 1980, and is headquartered in Atlanta, GA.

Related stocks

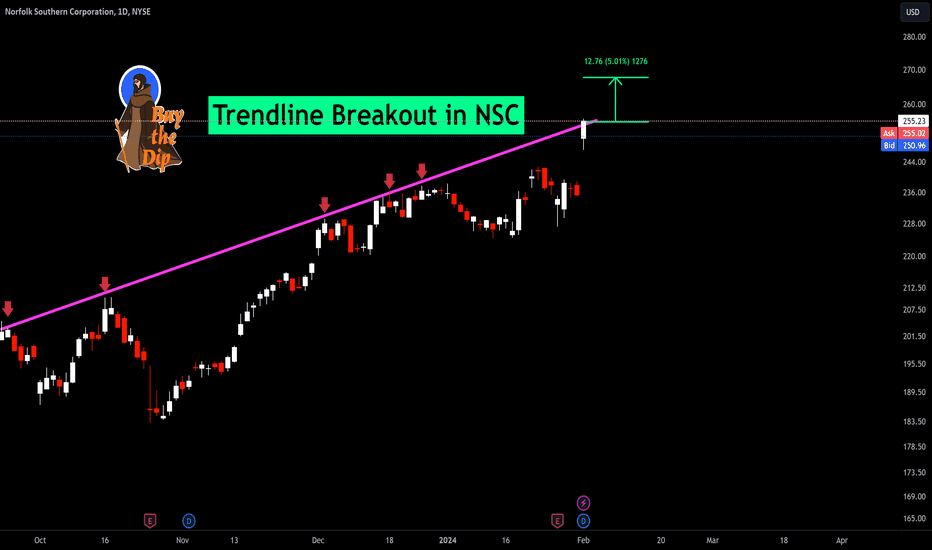

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

Norfolk Southern: Activist Investor Group Takes $1Billion Stake

Norfolk Southern (NYSE: NYSE:NSC ) finds itself at the center of a corporate upheaval as an Ancora Holdings-led investor group has taken a significant $1 billion stake in the company. The move, aimed at restructuring the railroad operator, includes a bold attempt to unseat CEO Alan Shaw. The activi

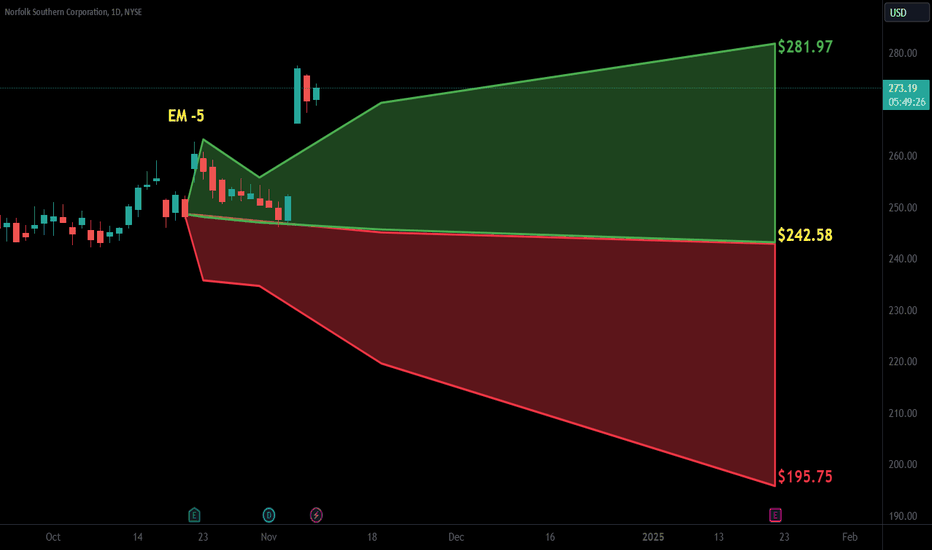

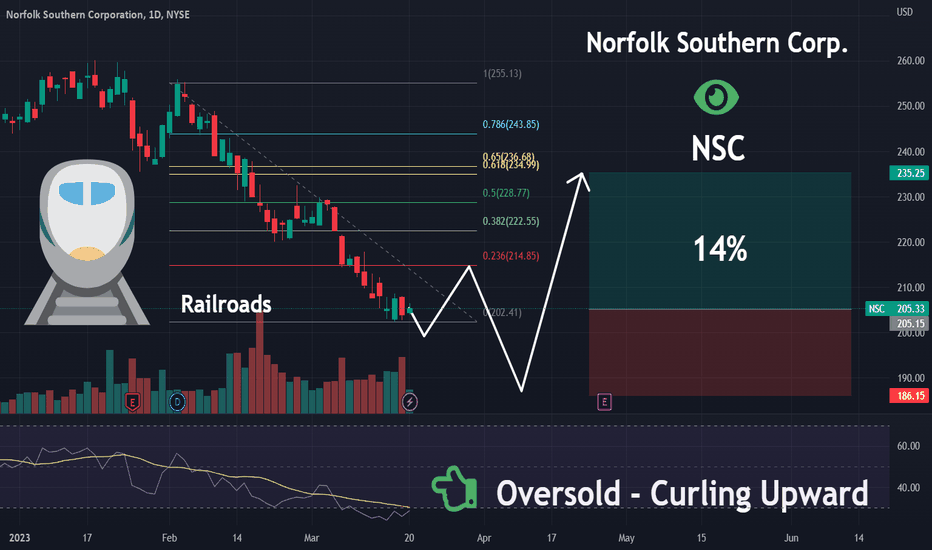

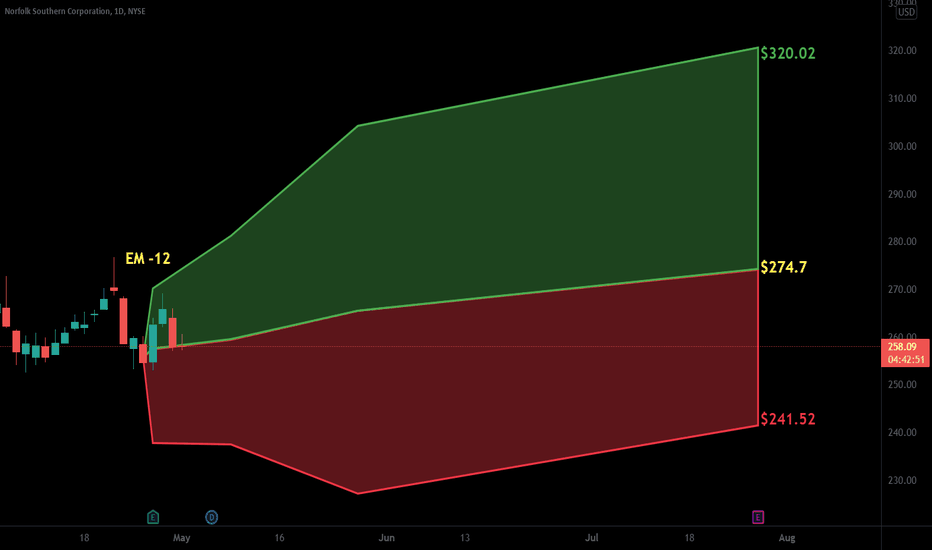

NSC | Come and ride the train | LONGNorfolk Southern Corporation, together with its subsidiaries, engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States. The company transports agriculture, forest, and consumer products comprising soybeans, wheat, corn, fertilizers, livestoc

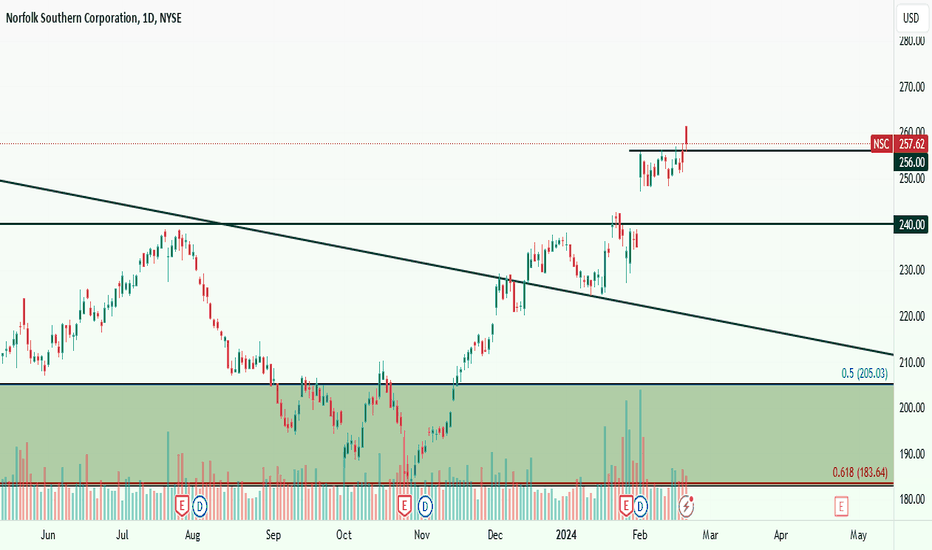

RectangleNeutral until broken with trend in that direction.

Horizontal trading ranges also know as a consolidation zone.

I am pretty sure this is the company who had a derailment in Ohio. Fish and animals are dying in unusual amounts in the area after a mushroom cloud of chemical debris was released in t

See all ideas

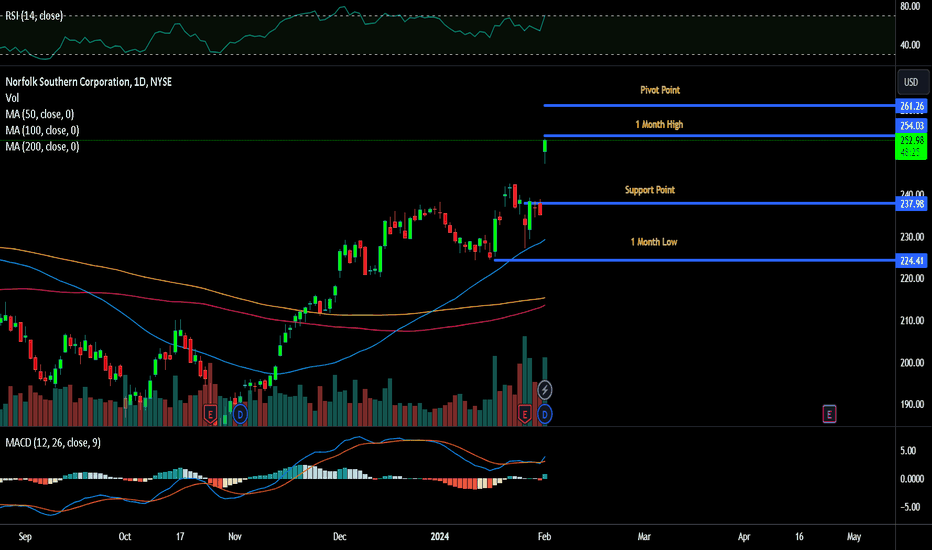

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NSC5241569

Norfolk Southern Corporation 2.9% 25-AUG-2051Yield to maturity

7.16%

Maturity date

Aug 25, 2051

NSC4661975

Norfolk Southern Corporation 3.65% 01-AUG-2025Yield to maturity

7.15%

Maturity date

Aug 1, 2025

NSC5033522

Norfolk Southern Corporation 3.155% 15-MAY-2055Yield to maturity

7.05%

Maturity date

May 15, 2055

NSC4983298

Norfolk Southern Corporation 3.05% 15-MAY-2050Yield to maturity

6.99%

Maturity date

May 15, 2050

NSC4902923

Norfolk Southern Corporation 3.4% 01-NOV-2049Yield to maturity

6.76%

Maturity date

Nov 1, 2049

NSC5362484

Norfolk Southern Corporation 3.7% 15-MAR-2053Yield to maturity

6.68%

Maturity date

Mar 15, 2053

US655844CJ5

NORFOLK STH. 21/2121Yield to maturity

6.64%

Maturity date

May 15, 2121

NSC4640823

Norfolk Southern Corporation 3.942% 01-NOV-2047Yield to maturity

6.51%

Maturity date

Nov 1, 2047

NSC4638220

Norfolk Southern Corporation 4.05% 15-AUG-2052Yield to maturity

6.51%

Maturity date

Aug 15, 2052

NSC4828054

Norfolk Southern Corporation 4.1% 15-MAY-2049Yield to maturity

6.44%

Maturity date

May 15, 2049

NSC4599457

Norfolk Southern Corporation 4.15% 28-FEB-2048Yield to maturity

6.39%

Maturity date

Feb 28, 2048

See all NSC bonds

Curated watchlists where NSC is featured.

Frequently Asked Questions

The current price of NSC is 5,194.67 MXN — it has increased by 10.57% in the past 24 hours. Watch NORFOLK SOUTHERN CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange NORFOLK SOUTHERN CORP stocks are traded under the ticker NSC.

NSC stock has risen by 10.57% compared to the previous week, the month change is a 10.57% rise, over the last year NORFOLK SOUTHERN CORP has showed a 31.12% increase.

We've gathered analysts' opinions on NORFOLK SOUTHERN CORP future price: according to them, NSC price has a max estimate of 5,994.80 MXN and a min estimate of 4,361.54 MXN. Watch NSC chart and read a more detailed NORFOLK SOUTHERN CORP stock forecast: see what analysts think of NORFOLK SOUTHERN CORP and suggest that you do with its stocks.

NSC stock is 9.56% volatile and has beta coefficient of 0.87. Track NORFOLK SOUTHERN CORP stock price on the chart and check out the list of the most volatile stocks — is NORFOLK SOUTHERN CORP there?

Today NORFOLK SOUTHERN CORP has the market capitalization of 1.16 T, it has increased by 1.96% over the last week.

Yes, you can track NORFOLK SOUTHERN CORP financials in yearly and quarterly reports right on TradingView.

NORFOLK SOUTHERN CORP is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

NSC earnings for the last quarter are 55.11 MXN per share, whereas the estimation was 54.55 MXN resulting in a 1.02% surprise. The estimated earnings for the next quarter are 62.01 MXN per share. See more details about NORFOLK SOUTHERN CORP earnings.

NORFOLK SOUTHERN CORP revenue for the last quarter amounts to 61.32 B MXN, despite the estimated figure of 60.86 B MXN. In the next quarter, revenue is expected to reach 58.68 B MXN.

NSC net income for the last quarter is 15.34 B MXN, while the quarter before that showed 15.26 B MXN of net income which accounts for 0.54% change. Track more NORFOLK SOUTHERN CORP financial stats to get the full picture.

Yes, NSC dividends are paid quarterly. The last dividend per share was 26.46 MXN. As of today, Dividend Yield (TTM)% is 1.94%. Tracking NORFOLK SOUTHERN CORP dividends might help you take more informed decisions.

NORFOLK SOUTHERN CORP dividend yield was 2.30% in 2024, and payout ratio reached 46.66%. The year before the numbers were 2.28% and 67.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 25, 2025, the company has 19.6 K employees. See our rating of the largest employees — is NORFOLK SOUTHERN CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NORFOLK SOUTHERN CORP EBITDA is 117.84 B MXN, and current EBITDA margin is 42.21%. See more stats in NORFOLK SOUTHERN CORP financial statements.

Like other stocks, NSC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NORFOLK SOUTHERN CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NORFOLK SOUTHERN CORP technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NORFOLK SOUTHERN CORP stock shows the strong buy signal. See more of NORFOLK SOUTHERN CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.