PEP - BULLISH SCENARIOPepsiCo reported revenues of $28 billion in the last reported quarter, representing a year-over-year change of +10.9%. EPS of $1.67 for the same period compares with $1.53 a year ago.

The strength centered on the Frito-Lay North America business grew by 25%.

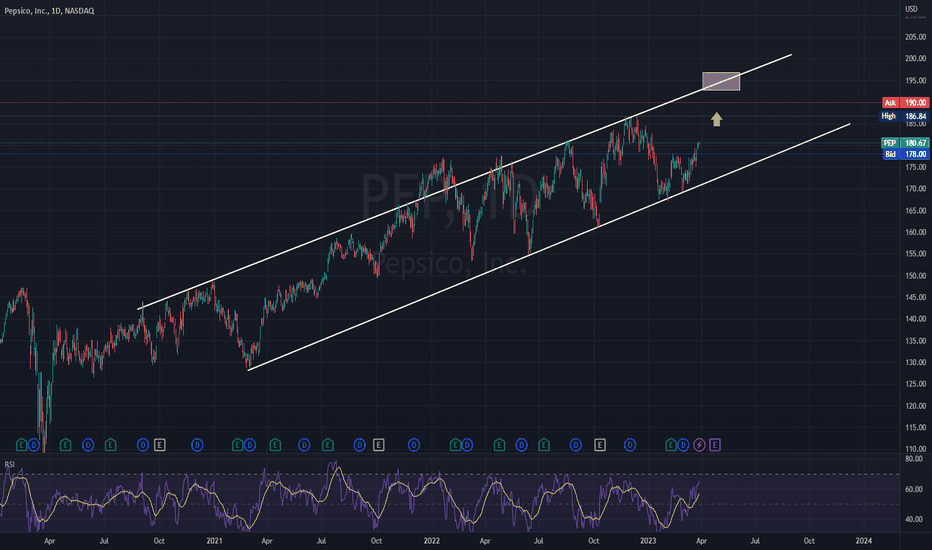

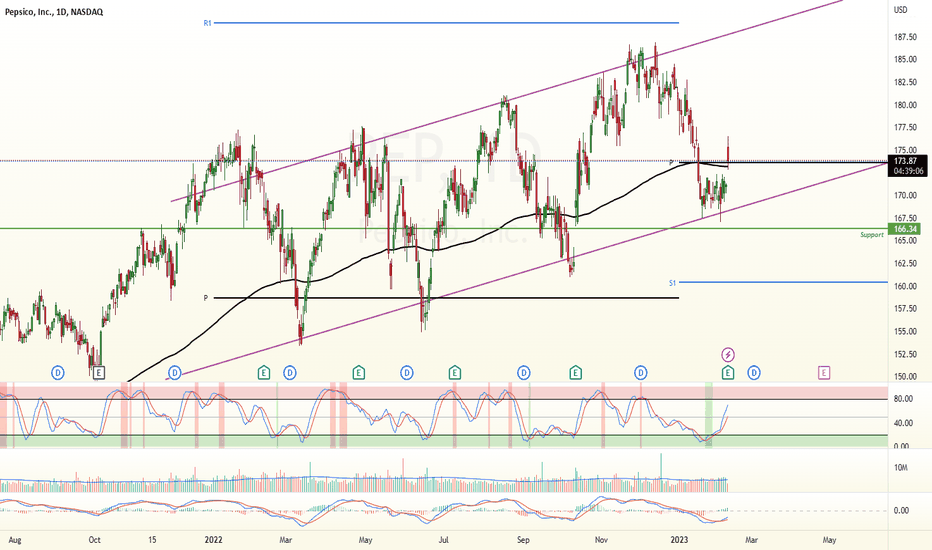

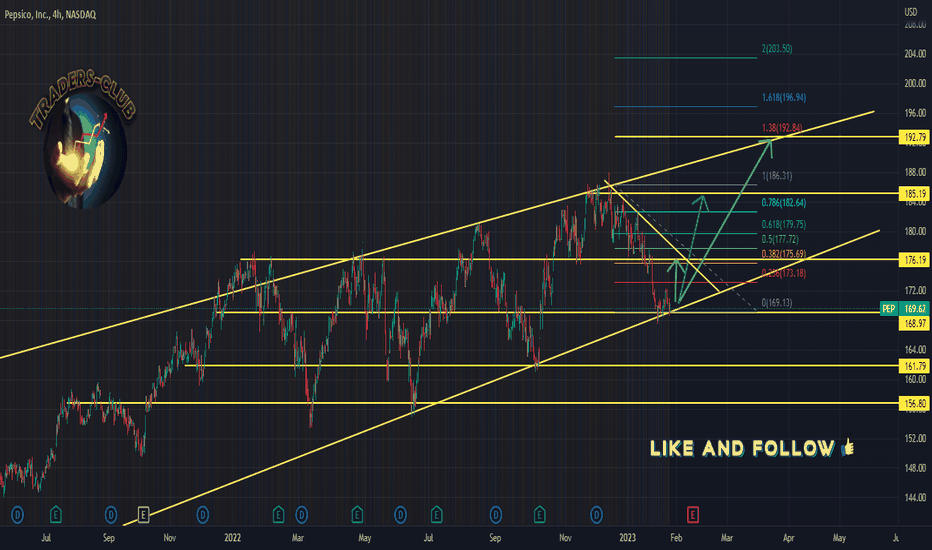

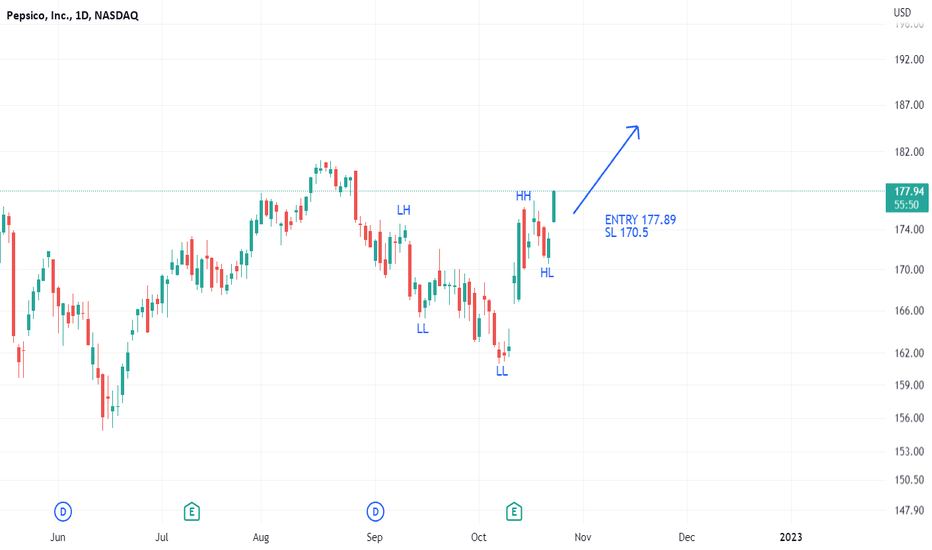

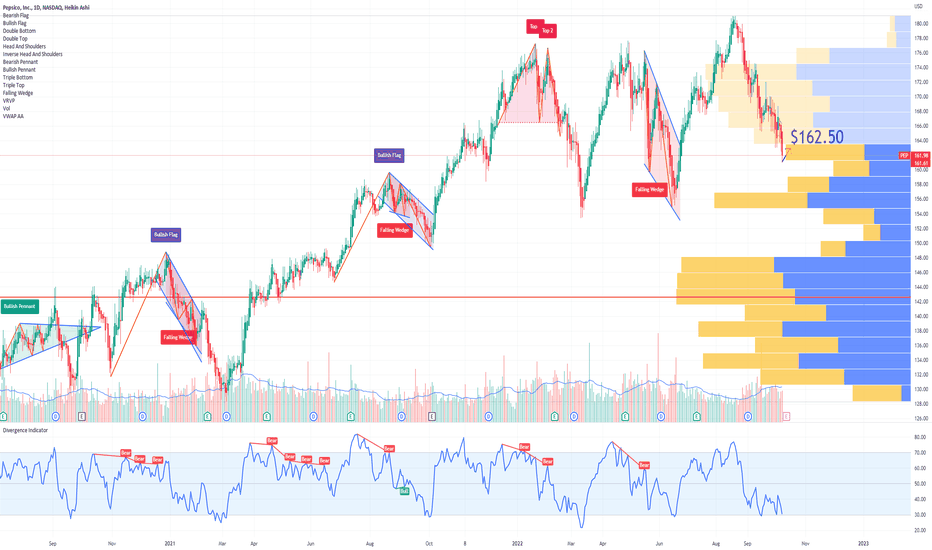

The uptrend remains strong, and the price is heading to the upper part of the channel, the $ 195 resistance level

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

PEP trade ideas

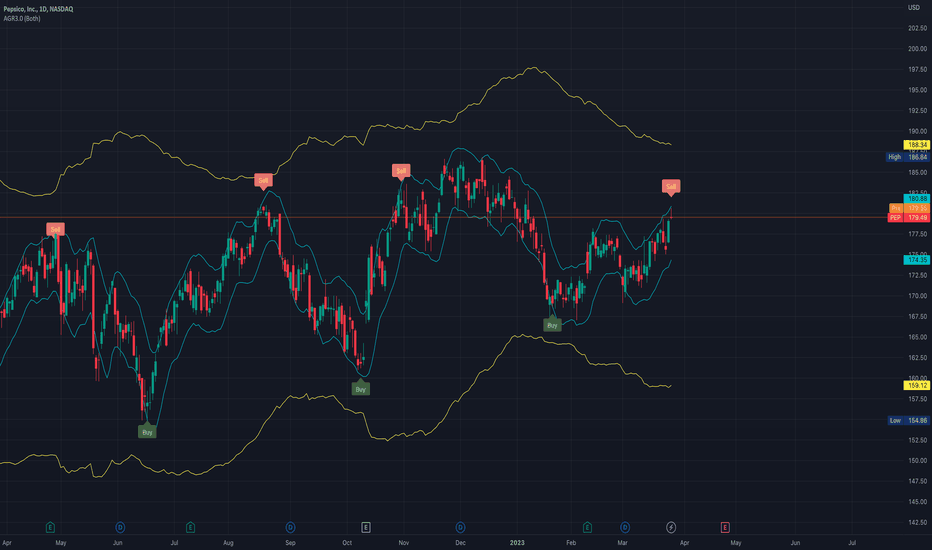

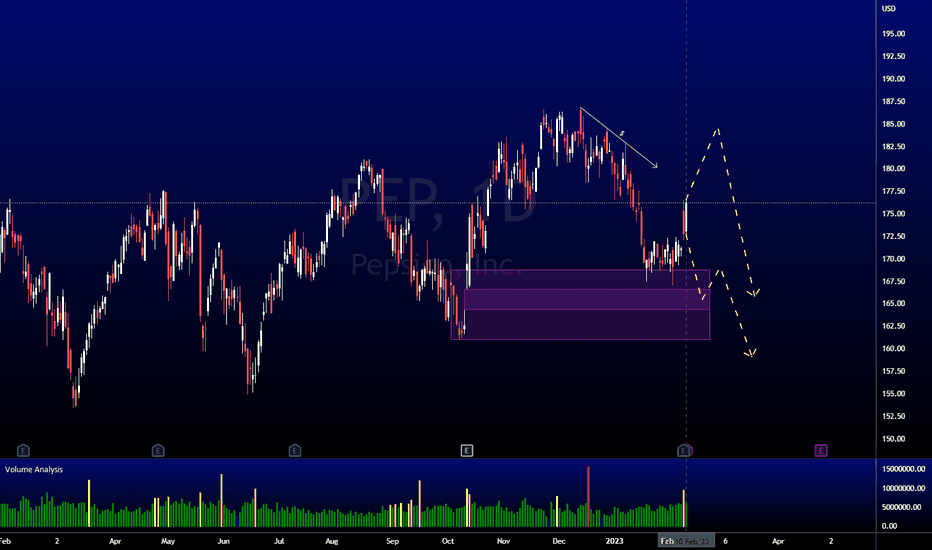

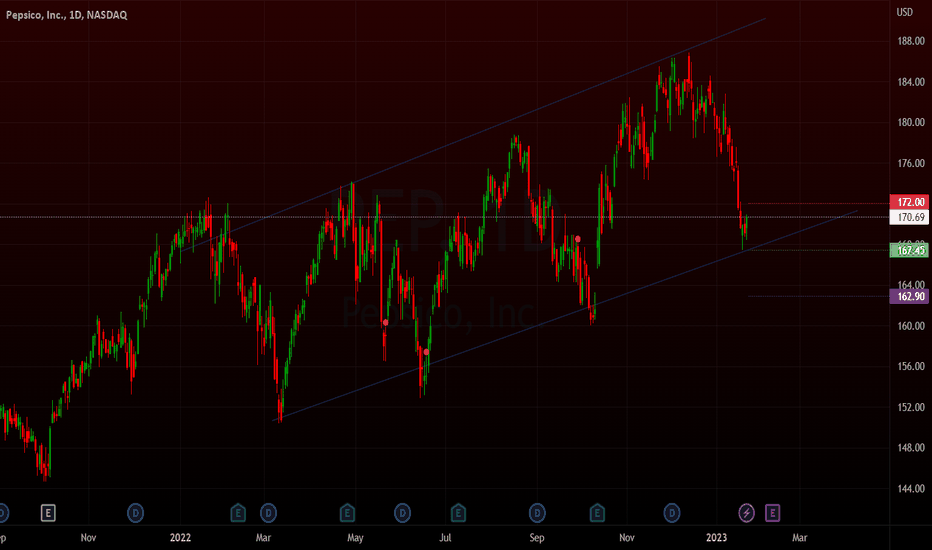

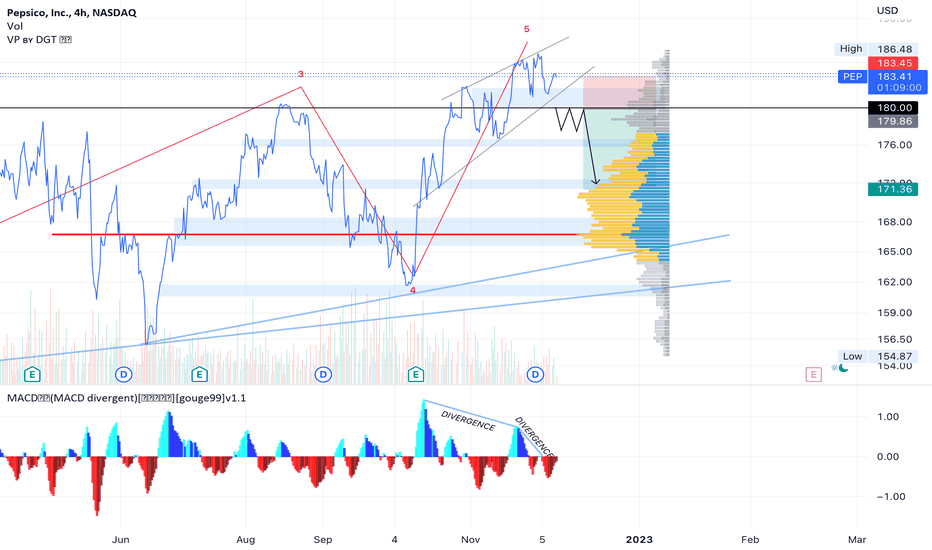

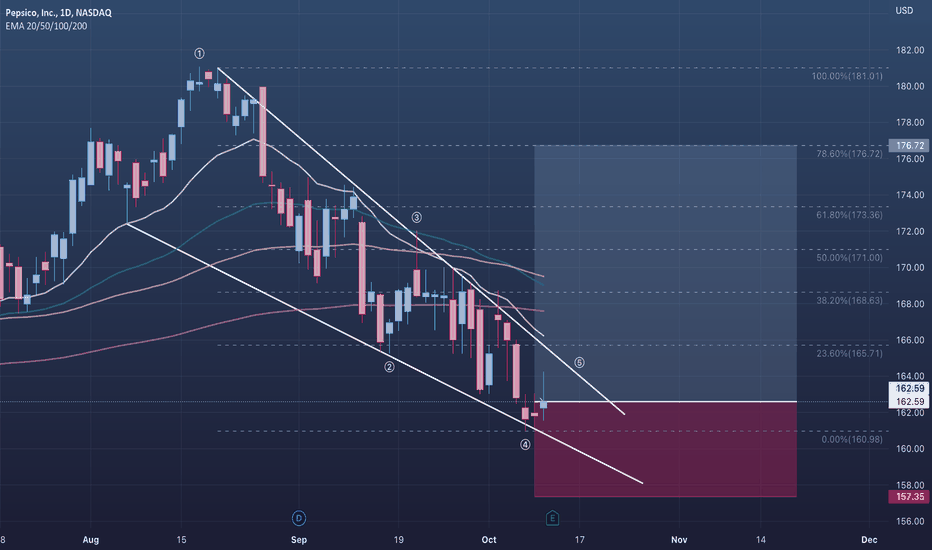

PEP AnalysisPrice has mitigated the bullish POI at 160.98 and broke minor market structure to the upside. Price has built buy-side liquidity from late December 2022 to early January 2023. 2 scenarios that could happen here. 1) Price could potentially going higher to take out the buy-side liquidity first then drop lower to fill the fair value gap at 166.60. 2) Price filling fair value gap below, continuing with the bearish order flow lower.

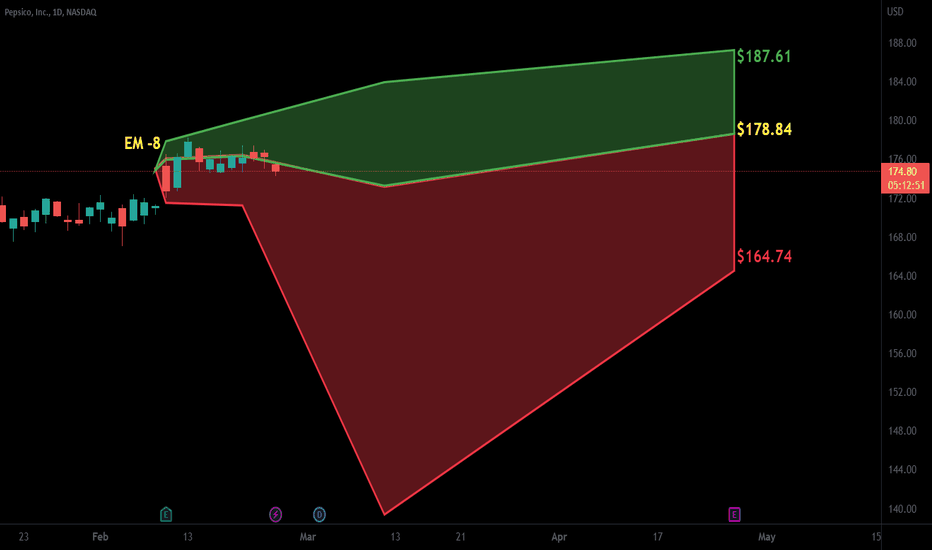

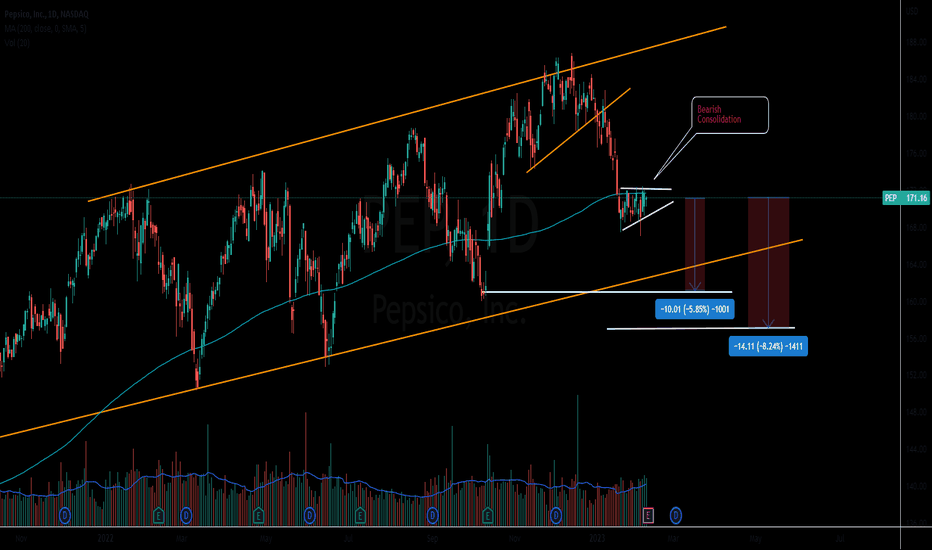

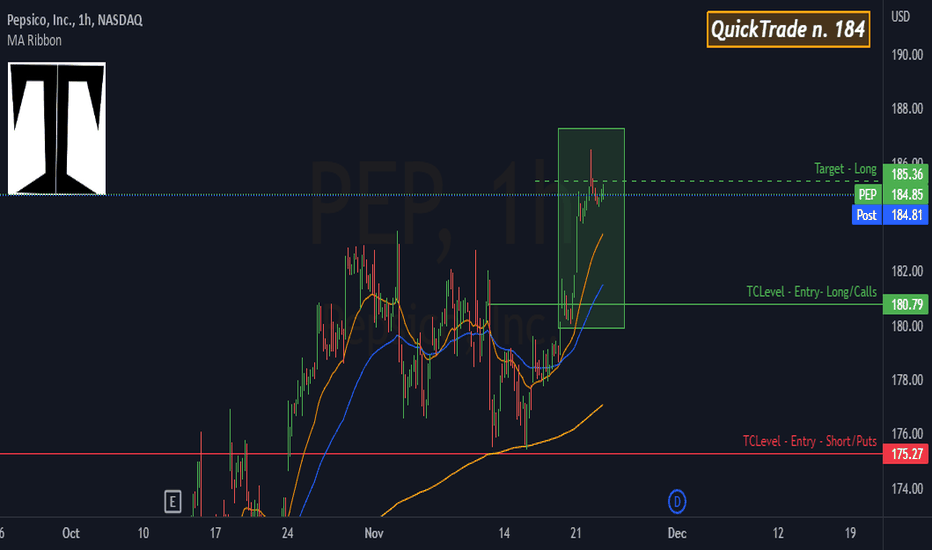

Pepsi Ahead of earningsPepsi reports earnings tomorrow morning.

Based off the bearish consolidation, its looking likely that Pepsi can fall lower on maybe a bad earnings or weak forward guidance.

The trading play that we are watching is a gap down into support and then buying Pepsi as a long. This will be a day trading level we will be looking for.

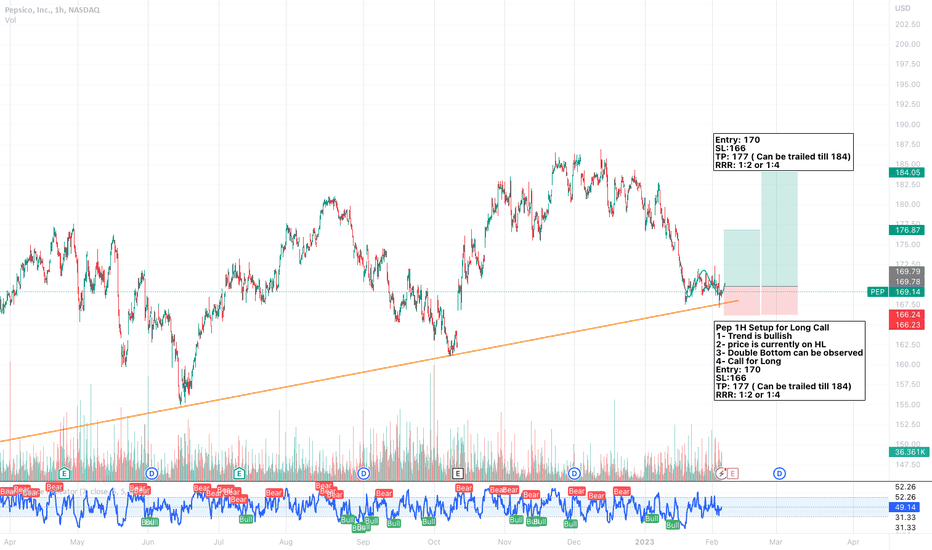

PEP PepsiCo Options Ahead Of EarningsIf you haven`t bought PEP after my last call:

Then you should know that looking at the PEP PepsiCo options chain ahead of earnings , I would buy the $165 strike price Puts with

2023-2-17 expiration date for about

$1.83 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

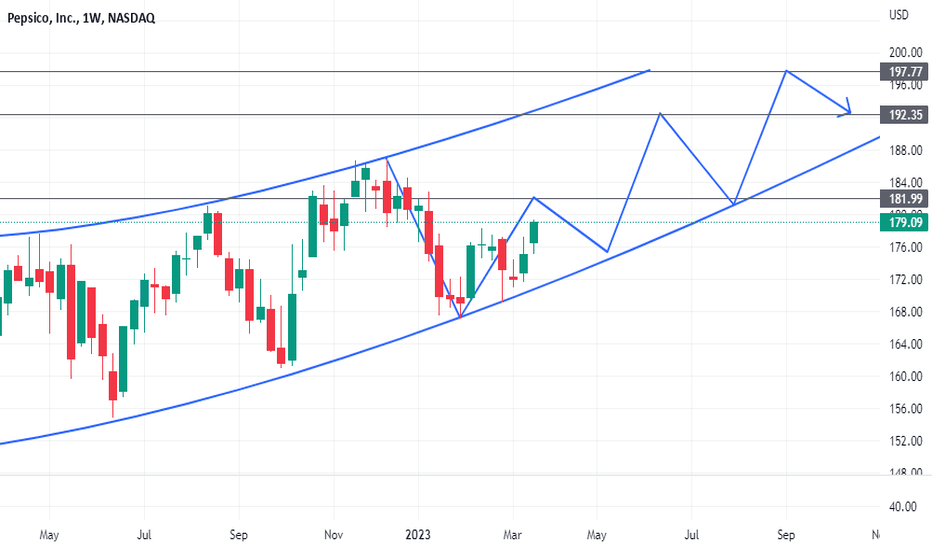

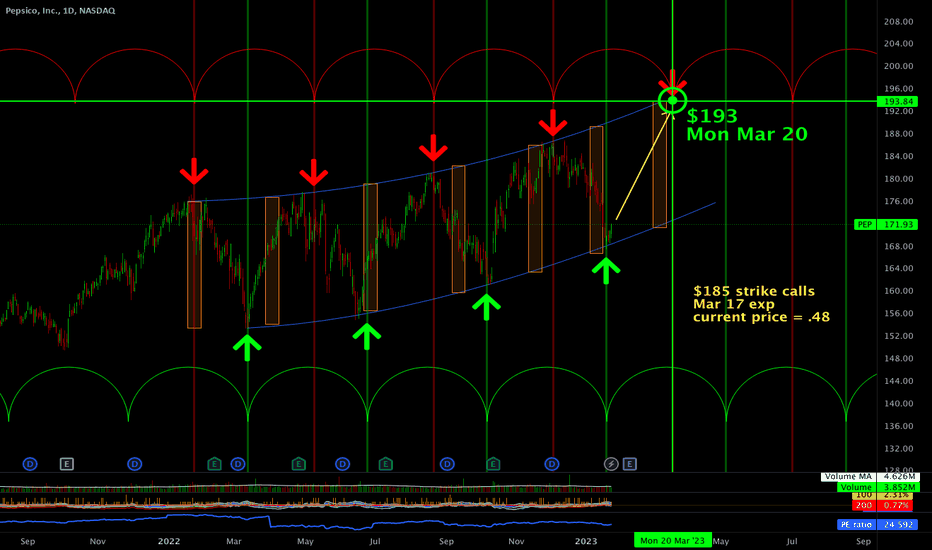

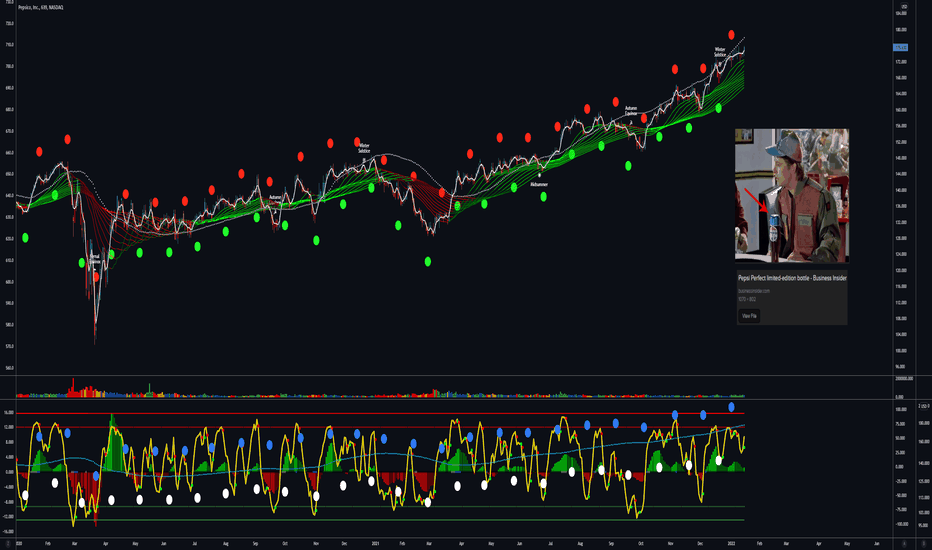

Pepsi Time CyclePrice is oscillating in a cyclical manner within a sweeping channel. If it continues to do so, it will be at $193 by March 20th. Keyword: if. It might make sense to pick up a couple calls just in case, they’re fairly cheap. Also, entering long here with a stop outside the channel might make sense as well.

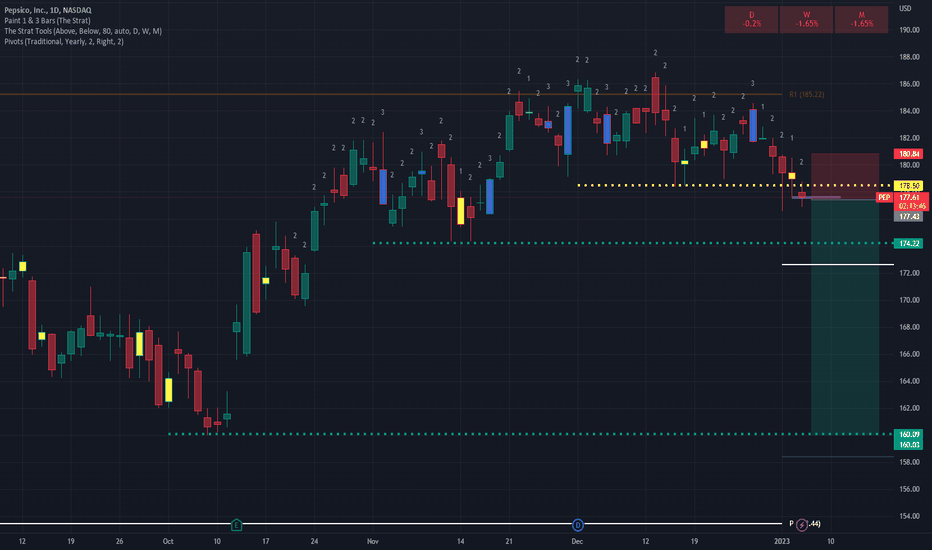

#PEP short ideaHello dear Traders,

Here is my idea for #PEP

Price closed below yellow line (previous month low)

Targets marked in the chart (green lines)

Invalidation level marked with red line

Good luck!

❤️Please feel free to ask any question in comments. I will try to answer all! Thank you.

Please, support my work with like, thank you!❤️

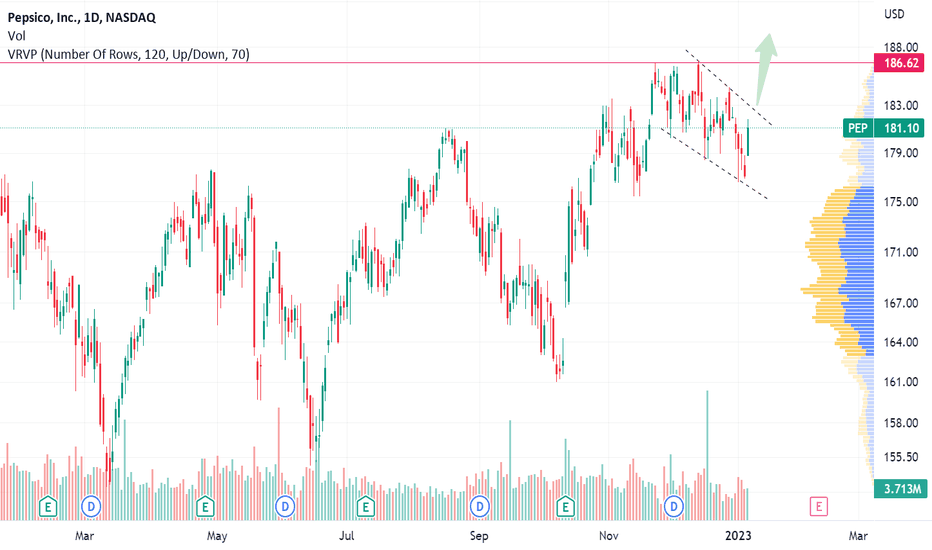

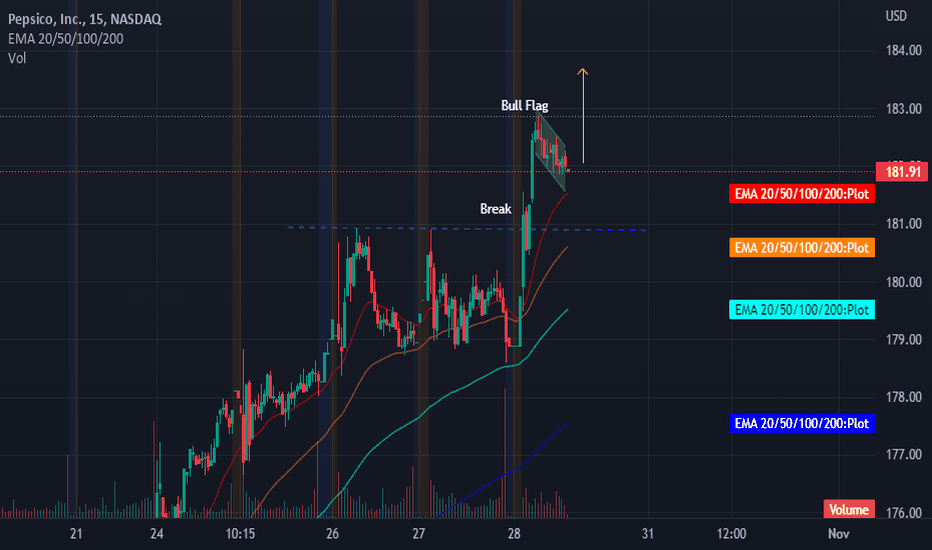

$PEP: Short, mid and long term potential...If $PEP crosses over $182.85 tomorrow, a short term signal will trigger which can cause a mid term signal to trigger which in turn could cause a long term signal to trigger catapulting the stock higher for many weeks if it holds up over the stop area in the coming 20 days.

Best of luck,

Ivan Labrie.

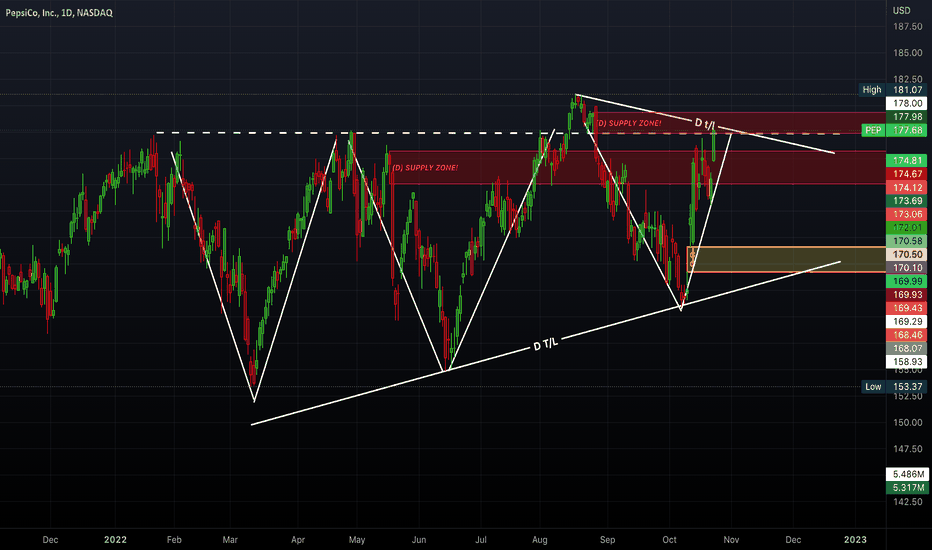

Does Pepsi Drinks Come With An Inverted Head & Shoulders?Does Pepsi Drinks Come With An Inverted Head & Shoulders?

No of course not! However, the daily chart for the global soft drink has an inverted head and shoulders on the daily chart.

PEP closed above the neckline of the pattern! Also, PEP has 4 touches at the daily trendline (immediately above the neckline). I set an alert on the neckline and at the daily t/l.

Pepsi closed in a daily supply zone on 24 October 2022.

Peace, Love & Abundance,

MrALtrades00