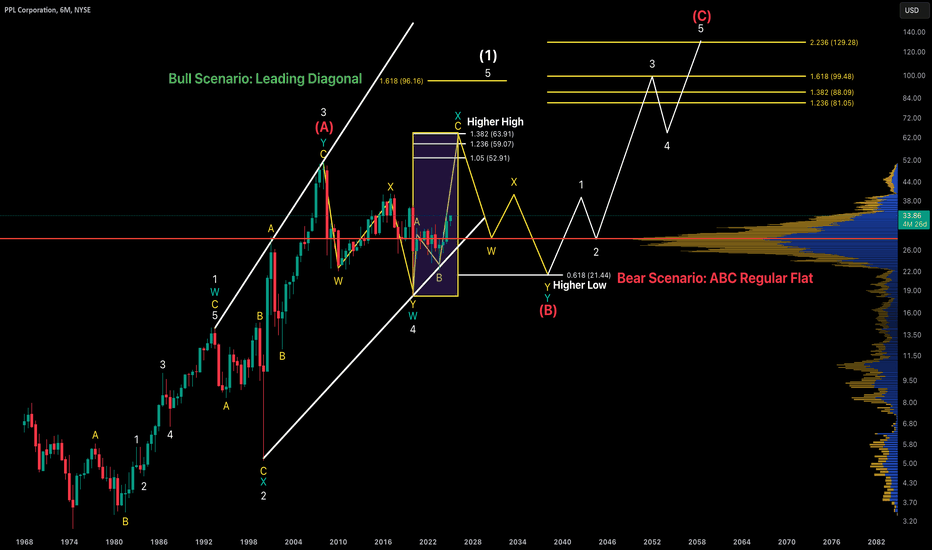

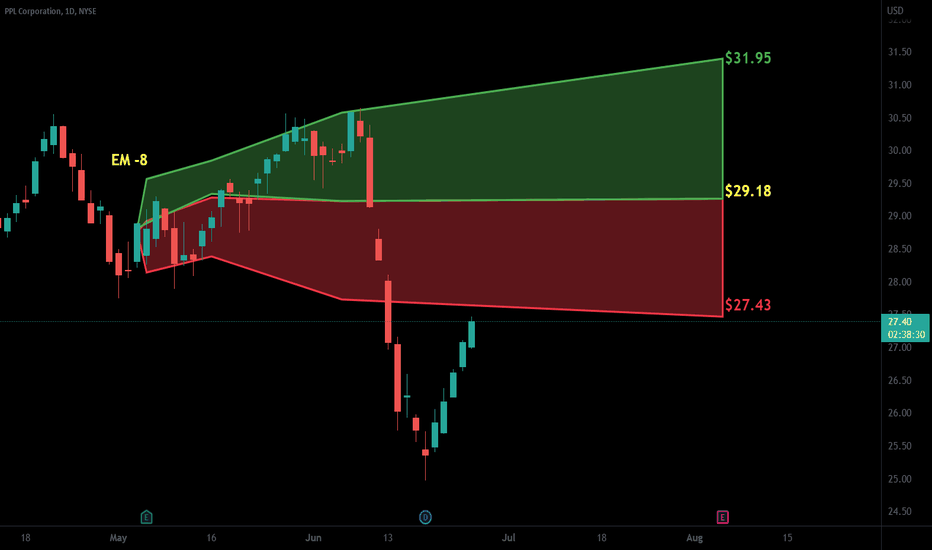

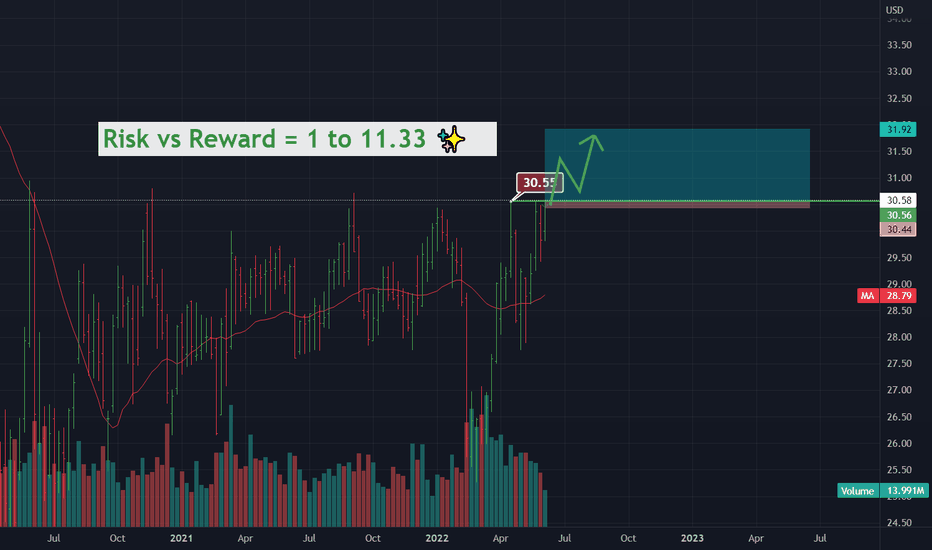

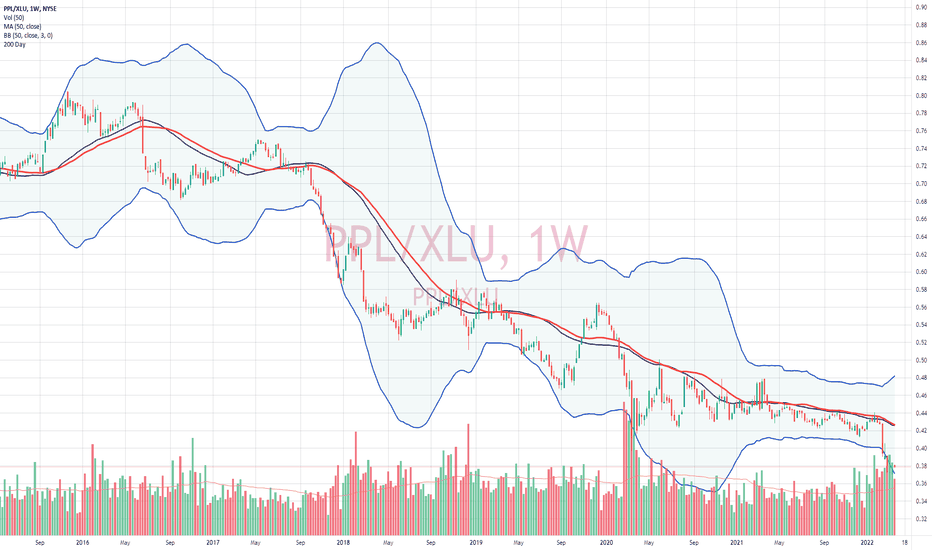

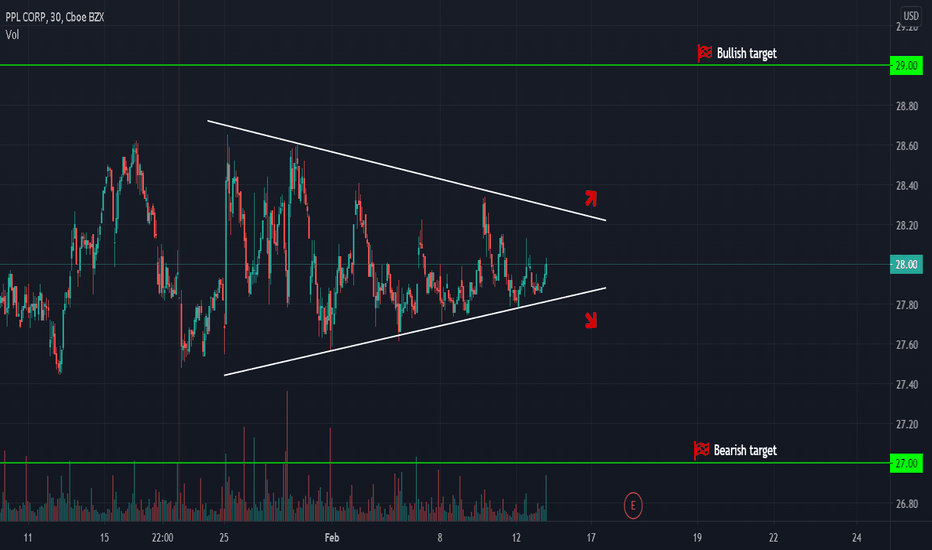

PPL Corp Elliott Wave Analysis: Bull & Bear OptionsTwo Potential Scenarios for PPL

BULLISH OPTION

Since the 1974 low, price has been advancing in a leading diagonal, forming a higher-degree wave (1). The projected target for the 5th wave is the yellow 1.618 extension at $96.16. If this scenario unfolds, PPL will enter a multi-year bear market as w

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

27.53 MXN

18.47 B MXN

176.43 B MXN

738.27 M

About PPL Corporation

Sector

Industry

CEO

Vincent Sorgi

Website

Headquarters

Allentown

Founded

1920

FIGI

BBG01HQNPFN6

PPL Corp. engages in the generation, transmission and distribution of electricity. It operates through the following segments: Kentucky Regulated, Pennsylvania Regulated, and Rhode Island Regulated. The Kentucky Regulated segment consists of LKE's regulated electricity generation, transmission and distribution operations of Louisville Gas and Electric Company and Kentucky Utilities Company as well as regulated distribution and sale of natural gas of Louisville Gas and Electric Company. The Rhode Island Regulated segment primarily consists of regulated electricity transmission and distribution operations and regulated distribution and sale of natural gas conducted by RIE. The Pennsylvania Regulated segment consists of the regulated electricity transmission and distribution operations of PPL Electric Utilities Corporation. The company was founded on June 4, 1920 and is headquartered in Allentown, PA.

Related stocks

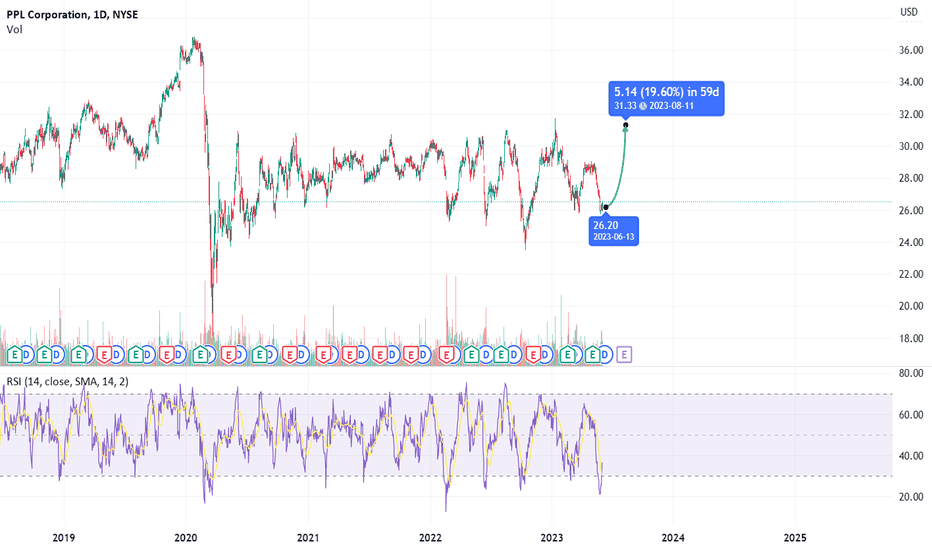

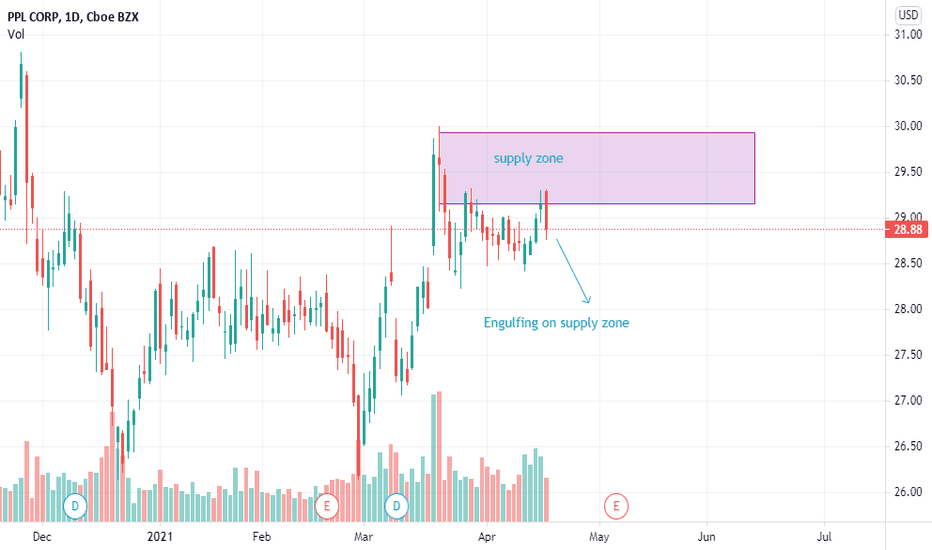

Pump or Dump#2One more stock, wolves🔥

Consolidation of the price after a strong bullish movement. There is a symmetrical triangle on small frame on PPL (PPL CORP).

Get ready to catch impulse because the price is close to breakout the level.

Follow the chart and look for the breakout carefully.

If you enjoy my

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PPL4539191

PPL Capital Funding, Inc. 4.0% 15-SEP-2047Yield to maturity

7.56%

Maturity date

Sep 15, 2047

PPL4989915

Kentucky Utilities Company 3.3% 01-JUN-2050Yield to maturity

6.96%

Maturity date

Jun 1, 2050

PPL4880163

PPL Electric Utilities Corporation 3.0% 01-OCT-2049Yield to maturity

6.76%

Maturity date

Oct 1, 2049

PPL4009132

PPL Capital Funding, Inc. 4.7% 01-JUN-2043Yield to maturity

6.76%

Maturity date

Jun 1, 2043

PPL4810003

Louisville Gas and Electric Company 4.25% 01-APR-2049Yield to maturity

6.57%

Maturity date

Apr 1, 2049

US69351UAU7

PPL ELECTRIC UT. 2047Yield to maturity

6.54%

Maturity date

Jun 1, 2047

PPL4068638

Kentucky Utilities Company 4.65% 15-NOV-2043Yield to maturity

6.32%

Maturity date

Nov 15, 2043

PPL4068637

Louisville Gas and Electric Company 4.65% 15-NOV-2043Yield to maturity

6.32%

Maturity date

Nov 15, 2043

PPL4291191

Kentucky Utilities Company 4.375% 01-OCT-2045Yield to maturity

6.21%

Maturity date

Oct 1, 2045

PPL4295287

PPL Electric Utilities Corporation 4.15% 01-OCT-2045Yield to maturity

6.10%

Maturity date

Oct 1, 2045

PPL4643970

PPL Electric Utilities Corporation 4.15% 15-JUN-2048Yield to maturity

6.10%

Maturity date

Jun 15, 2048

See all PPLC bonds

Frequently Asked Questions

The current price of PPLC is 629.97 MXN — it has decreased by −3.14% in the past 24 hours. Watch PPL CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange PPL CORP stocks are traded under the ticker PPLC.

PPLC stock has fallen by −3.14% compared to the previous week, the month change is a −3.14% fall, over the last year PPL CORP has showed a −3.44% decrease.

We've gathered analysts' opinions on PPL CORP future price: according to them, PPLC price has a max estimate of 746.27 MXN and a min estimate of 652.99 MXN. Watch PPLC chart and read a more detailed PPL CORP stock forecast: see what analysts think of PPL CORP and suggest that you do with its stocks.

PPLC reached its all-time high on Nov 1, 2024 with the price of 652.43 MXN, and its all-time low was 629.97 MXN and was reached on Jul 7, 2025. View more price dynamics on PPLC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PPLC stock is 3.24% volatile and has beta coefficient of 0.16. Track PPL CORP stock price on the chart and check out the list of the most volatile stocks — is PPL CORP there?

Today PPL CORP has the market capitalization of 472.66 B, it has decreased by −0.79% over the last week.

Yes, you can track PPL CORP financials in yearly and quarterly reports right on TradingView.

PPL CORP is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

PPLC earnings for the last quarter are 12.29 MXN per share, whereas the estimation was 11.33 MXN resulting in a 8.51% surprise. The estimated earnings for the next quarter are 7.24 MXN per share. See more details about PPL CORP earnings.

PPL CORP revenue for the last quarter amounts to 51.30 B MXN, despite the estimated figure of 44.06 B MXN. In the next quarter, revenue is expected to reach 37.26 B MXN.

PPLC net income for the last quarter is 8.46 B MXN, while the quarter before that showed 3.69 B MXN of net income which accounts for 129.28% change. Track more PPL CORP financial stats to get the full picture.

Yes, PPLC dividends are paid quarterly. The last dividend per share was 5.20 MXN. As of today, Dividend Yield (TTM)% is 3.09%. Tracking PPL CORP dividends might help you take more informed decisions.

PPL CORP dividend yield was 3.17% in 2024, and payout ratio reached 86.01%. The year before the numbers were 3.54% and 95.89% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 14, 2025, the company has 6.65 K employees. See our rating of the largest employees — is PPL CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PPL CORP EBITDA is 66.97 B MXN, and current EBITDA margin is 37.17%. See more stats in PPL CORP financial statements.

Like other stocks, PPLC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PPL CORP stock right from TradingView charts — choose your broker and connect to your account.