Key facts today

Bank of America noted Shell's strong position amid low oil prices. Despite a weak Q2 update, Shell's LNG growth and acquisitions may aid recovery, with over $1 billion in net proceeds expected.

On July 8, 2025, Shell plc launched a share buy-back program for cancellation, managed by BNP PARIBAS SA until July 25, 2025, following UK Listing Rules and Market Abuse Regulations.

Shell has partnered with Libya's National Oil Corporation to evaluate hydrocarbon opportunities and conduct feasibility studies for the al-Atshan field and other NOC-owned fields.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

335.55 B MXN

5.71 T MXN

2.94 B

About SHELL PLC ORD EUR0.07

Sector

Industry

CEO

Wael Sawan

Website

Headquarters

London

Founded

2002

FIGI

BBG0151V35L9

Shell Plc engages in the business of producing oil and natural gas. It operates through the following segments: Integrated Gas, Upstream, Marketing, Chemicals and Products, Renewables and Energy Solutions, and Corporate. The Integrated Gas segment includes liquefied natural gas, and conversion of natural gas into gas-to-liquids fuels. The Upstream segment focuses on exploration and extraction of crude oil, natural gas, and natural gas liquids. The Marketing segment is involved in mobility, lubricants, and sectors and decarbonization businesses. The Chemicals and Products segment consists of chemicals manufacturing plants with marketing network and refineries, which turn crude oil and other feedstocks into a range of oil products. The Renewables and Energy Solutions segment provides renewable power generation, marketing, trading, and optimizing power and pipeline gas, as well as carbon credits and digitally enabled customer solutions. The Corporate segment covers non-operating activities supporting Shell such as holdings, treasury organization, self-insurance activities, and headquarters and central functions. The company was founded in February 1907 and is headquartered in London, the United Kingdom.

Related stocks

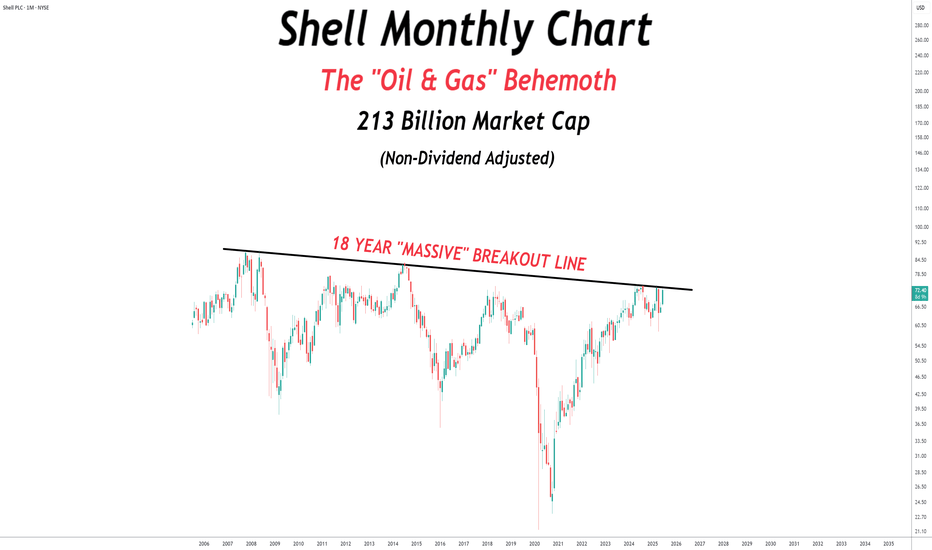

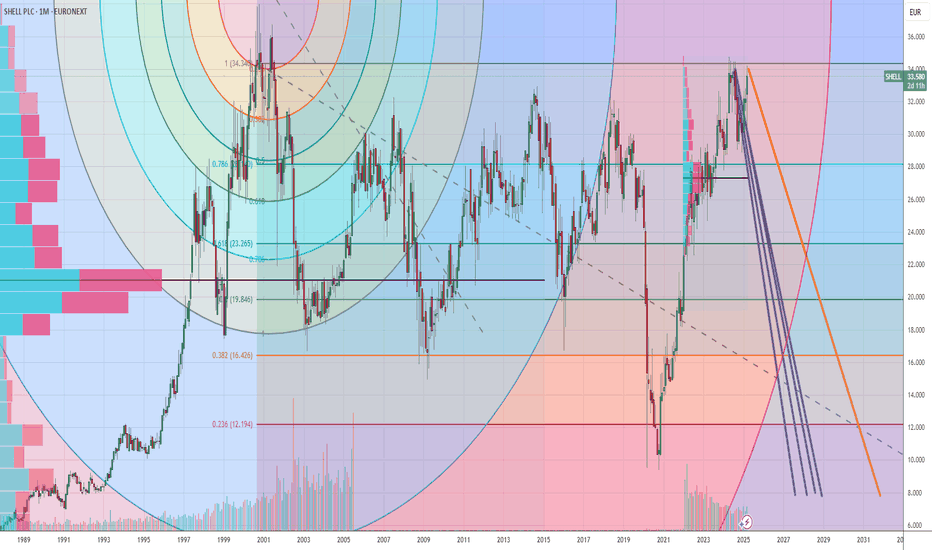

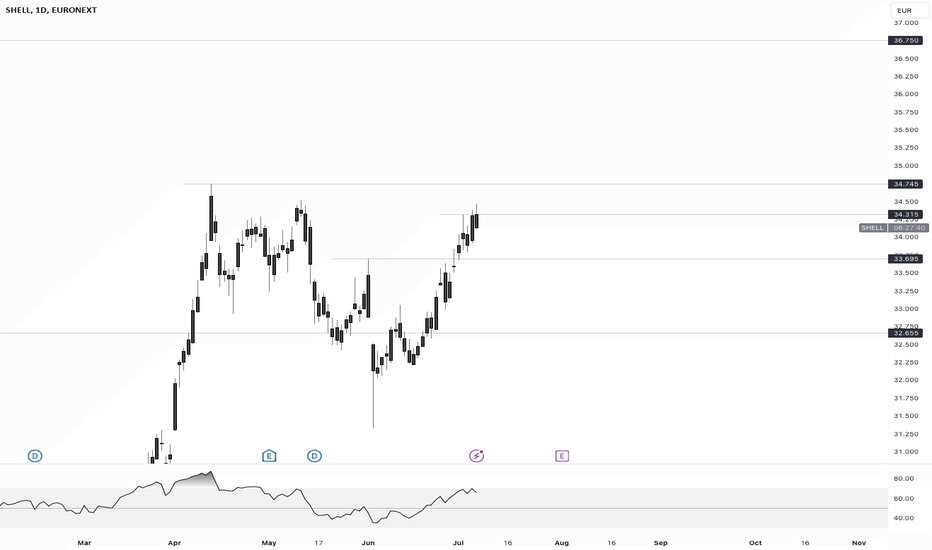

RDSA Shell Koninklijke Olie kan naar 7,5 terugvallen; Shell to 7De vraag naar olie droogt op zoals de vraag naar Haver terug liep toen paarden vervangen werden met brandstof autos. We vervangen nu de olie met electriciteit en dan is Koninklijke Olie klaar.

The demand for oil dries up like the demand for Horsefood fell back when horses were being replaced with f

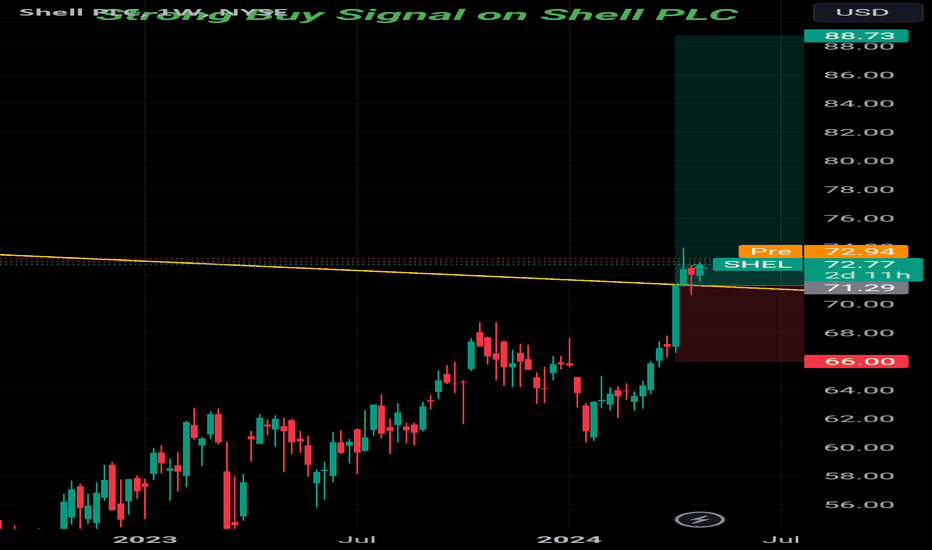

SHEL opened a short position✅SHEL #SHEL is an energy and petrochemical company in Europe, Asia, Oceania, Africa, the USA and other countries of America.

📊 FUNDAMENTAL ANALYSIS

🔴Impeccable balance sheet and good value.

🔴Traded 8.5% below our fair value estimate

🔴Earnings growth is projected at 4.72% per year.

🔴Analysts agr

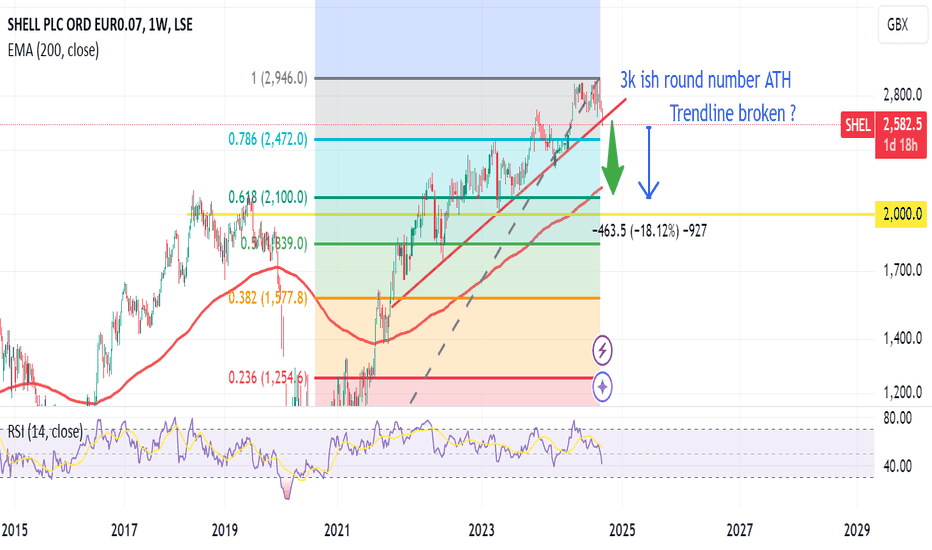

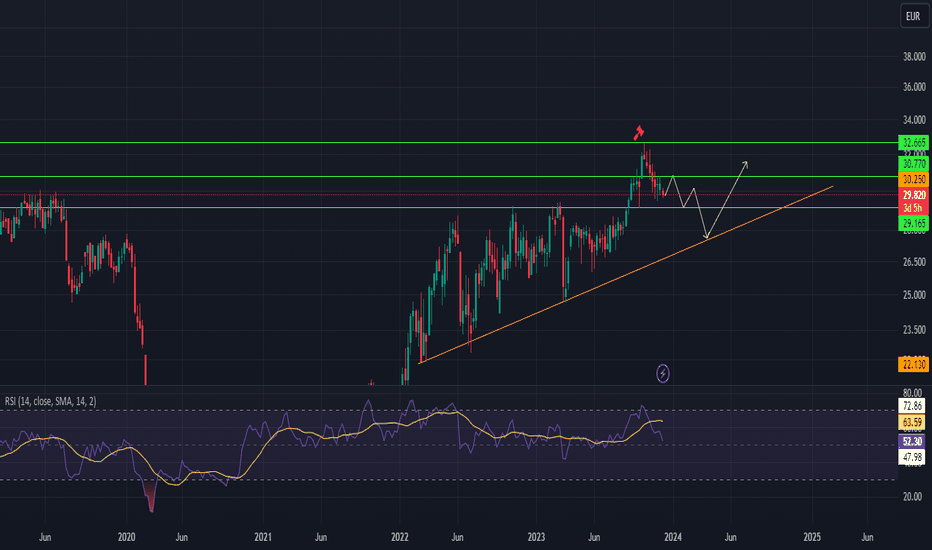

25% sell Shell and buy BPBP and Shell move together and BP has already lead the way lower

If Shell moves back to relative parity there is a 25% poss move

Shell moves back to EMA 200

Shell moves back to 0.618 fib retracement of prior move

This could be start of much larger move lower

Most MSM are claiming inflation t

Shell quick 18% to sell off back to 200 EMA and to 61.8 FibAs Oil is weak bearish case for Shell to sell back to its 200 EMA and then just fake out below this level to reach the 61.8 Fib retracement of the recent move up

Shell looks like it just broke is support trendline

Other points Oil has broken out of a wedge and appears to be moving lower

BP and S

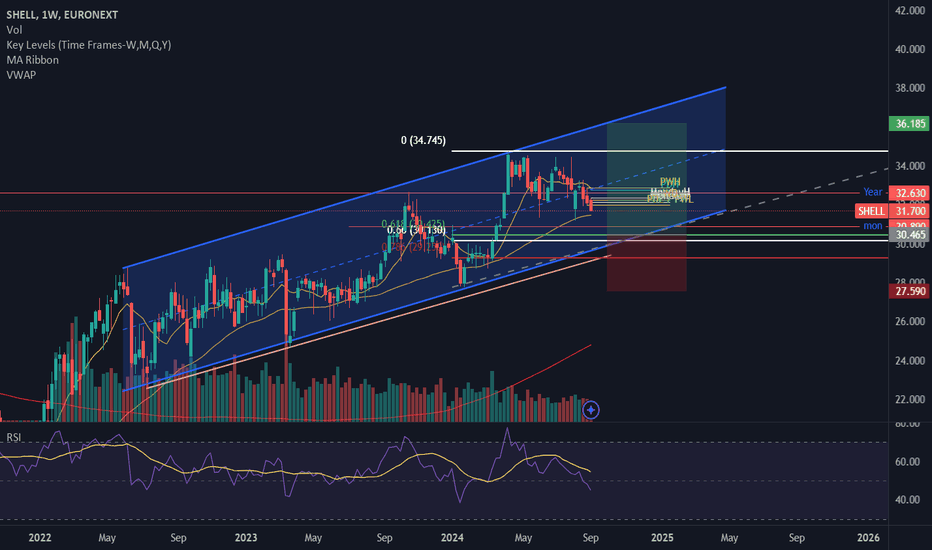

75: Key Levels Amidst Biofuel Plant Construction HaltShell (SHEL) is navigating significant financial and operational challenges. The company recently announced a delay in the construction of its biofuel plant in Rotterdam, which was initially expected to be operational this year but has now been postponed to 2030. This delay has resulted in a financi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS222838746

SHELL INTL F 20/52 MTNYield to maturity

8.80%

Maturity date

Sep 10, 2052

US822582CE0

SHELL INTL F 19/49Yield to maturity

7.03%

Maturity date

Nov 7, 2049

US822582CL4

SHELL INTL F 21/51Yield to maturity

7.02%

Maturity date

Nov 26, 2051

US822582CH3

SHELL INTL F 20/50Yield to maturity

6.97%

Maturity date

Apr 6, 2050

RDS5913231

Shell Finance US Inc. 3.25% 06-APR-2050Yield to maturity

6.72%

Maturity date

Apr 6, 2050

US822582BY7

SHELL INTL FIN. 16/46Yield to maturity

6.66%

Maturity date

Sep 12, 2046

US822582CK6

SHELL INTL F 21/41Yield to maturity

6.63%

Maturity date

Nov 26, 2041

RDS5913232

Shell Finance US Inc. 3.75% 12-SEP-2046Yield to maturity

6.48%

Maturity date

Sep 12, 2046

RDS5913229

Shell Finance US Inc. 4.0% 10-MAY-2046Yield to maturity

6.45%

Maturity date

May 10, 2046

US822582AT9

SHELL INTL FIN. 12/42Yield to maturity

6.42%

Maturity date

Aug 21, 2042

S0IC

SHELL INTL FIN. 13/43Yield to maturity

6.23%

Maturity date

Aug 12, 2043

See all SHEL1/N bonds

Curated watchlists where SHEL1/N is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

See all sparks