BNBUSD.P trade ideas

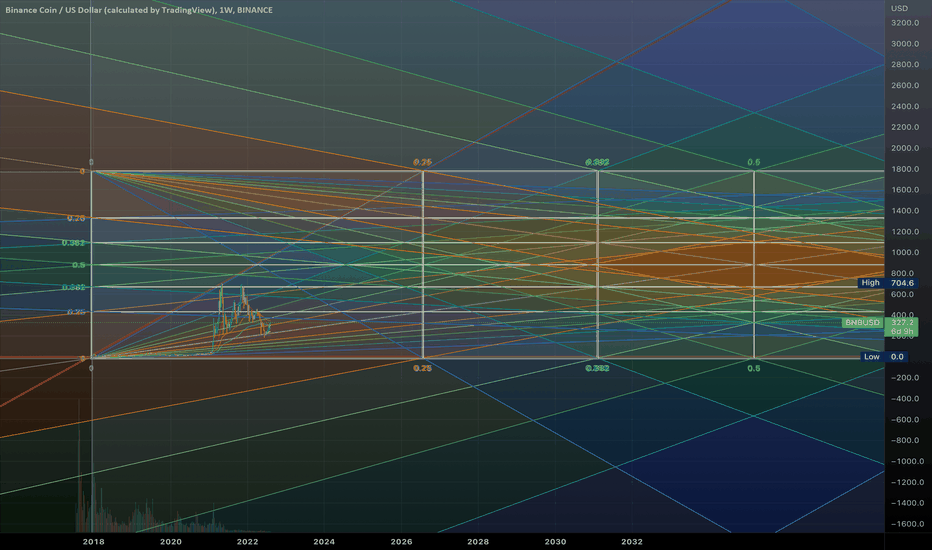

#btcstarburst The Crypto Giant, NOT BITCOIN?Its interesting what this Giant can and will do… they are constantly burning tokens quarterly… They will at least hit 2k at some point… pretty good return I guess They offer 5% on staking that compounds. HMMM… Not sure what to think about them BNB seems like a good bet. I always DCA into the just because, regardless of what I think of them…This is a Gann Study… DCA Safely.

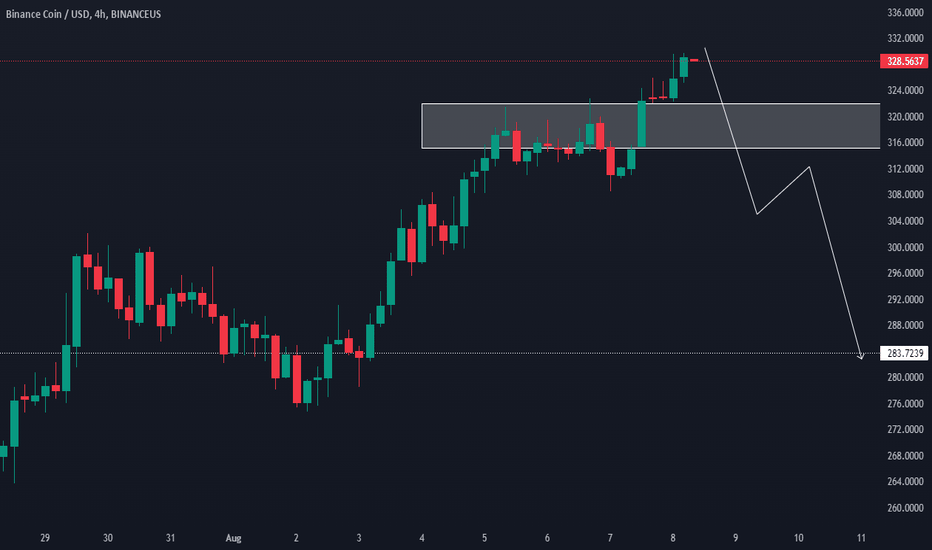

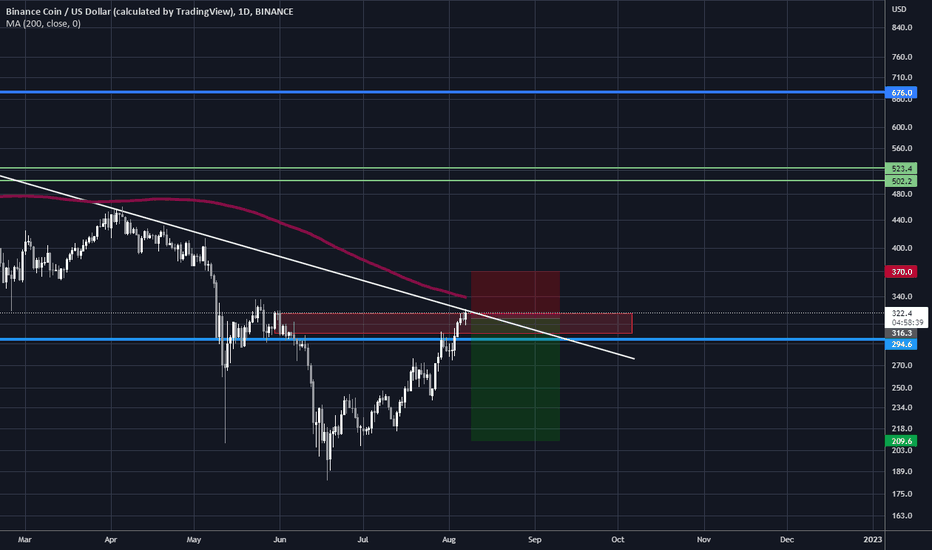

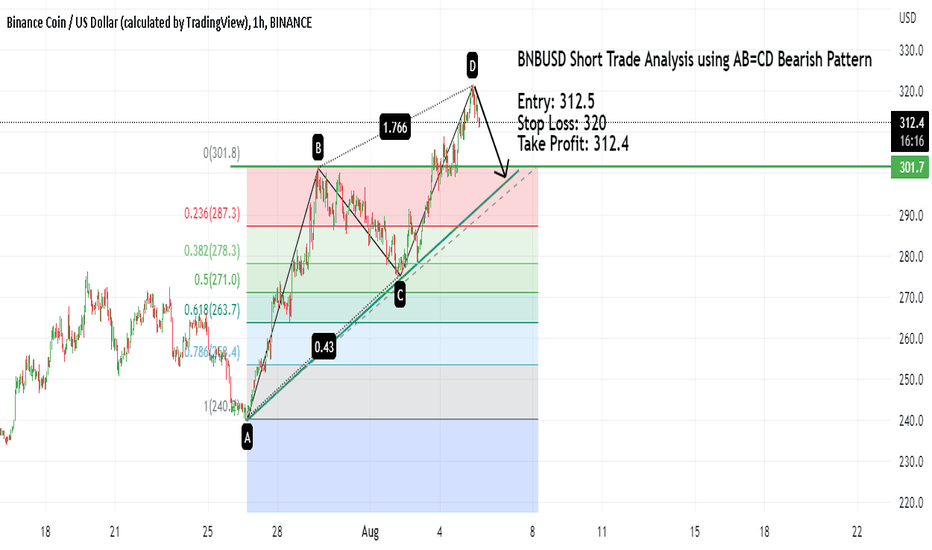

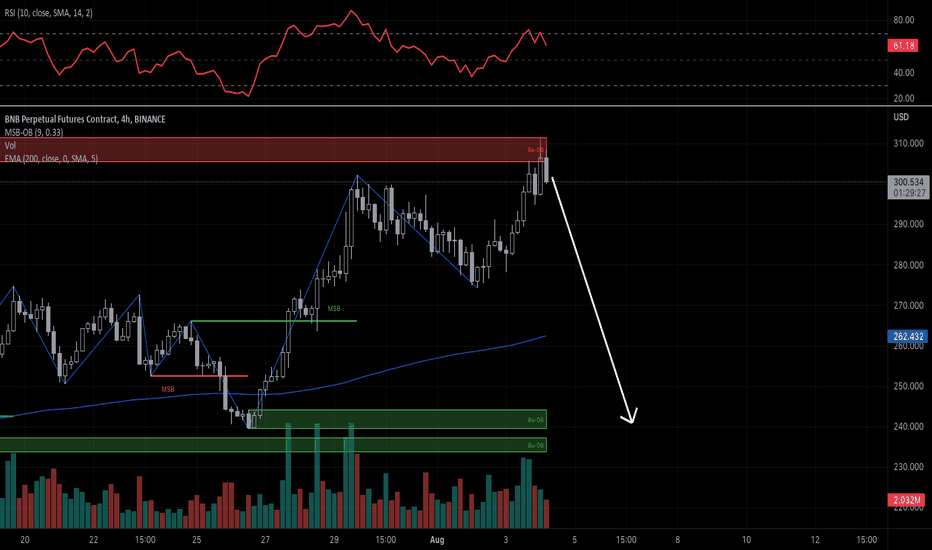

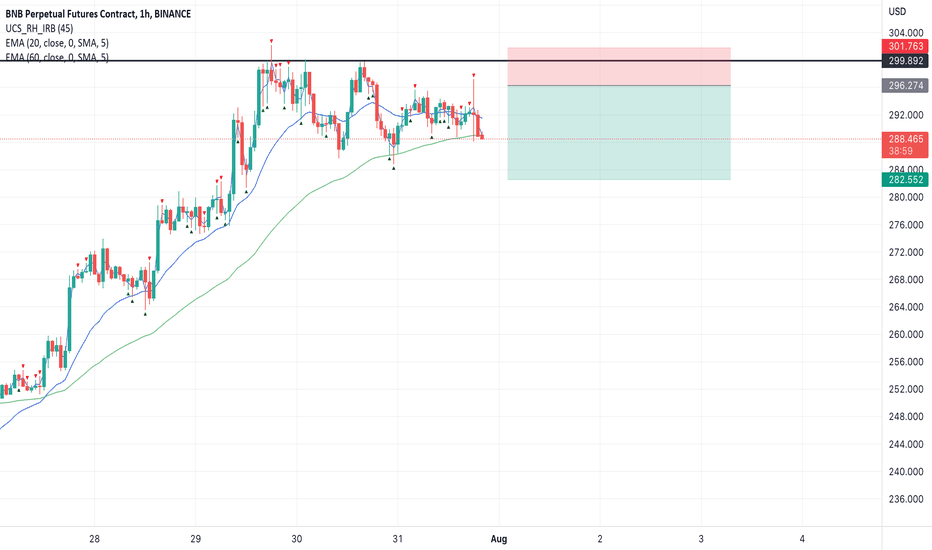

BNBUSD SHORT✔Our analysis is based on multi-timeframe top-down analysis & fundamental analysis

Based on our view the price will drop to the monthly level

DISCLAIMER: This analysis can change anytime without notice and it's only for the purpose of assisting traders to make independent investments decisions. Please this is a PREDICTION and I have no reason to acts on it and neither should you

Please support our analysis with a like or comment!

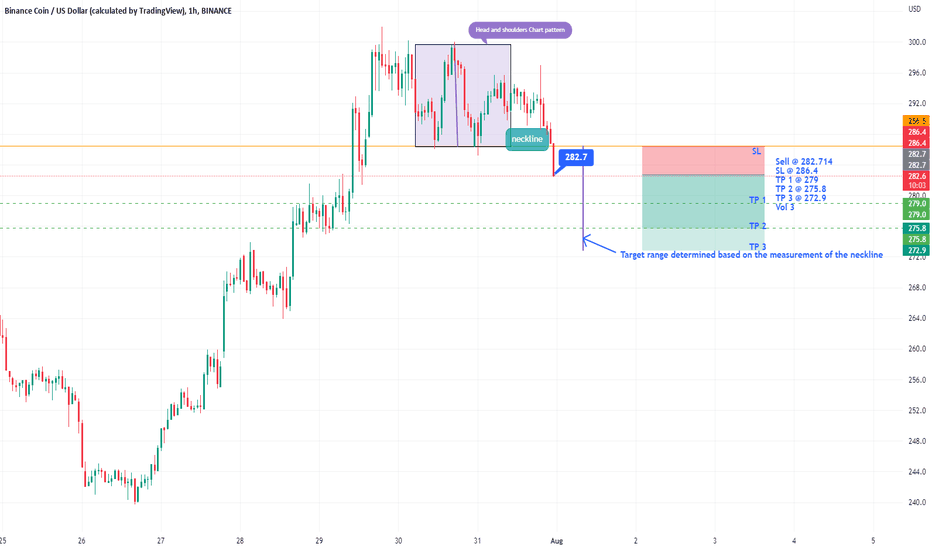

BNB.USDT Daily RR 1-2"If you can't beat the fear, do it scared!"

"Be fearful when others are greedy, and greedy when others are fearful!" - Warren Buffet.

"Markets are a device for transferring money from the impatient to the patient. - Warren Buffet

"Show me the charts, and I'll tell you the news." - Bernard Baruch

"The secret to investing/trading is figuring out how rich you want to be and how poor you're willing to become."

"If you want to live like the 5% of the population who are hugely successful, then don't act like the 95%!"

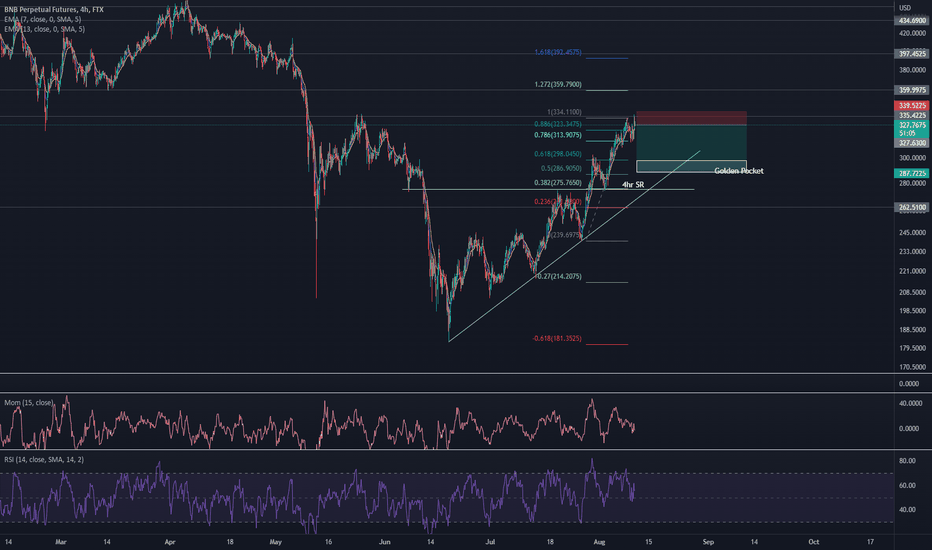

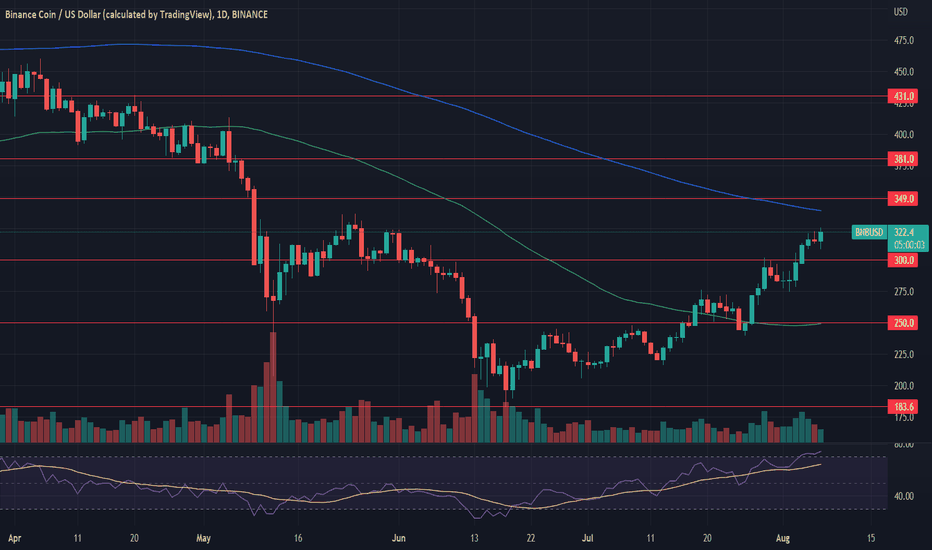

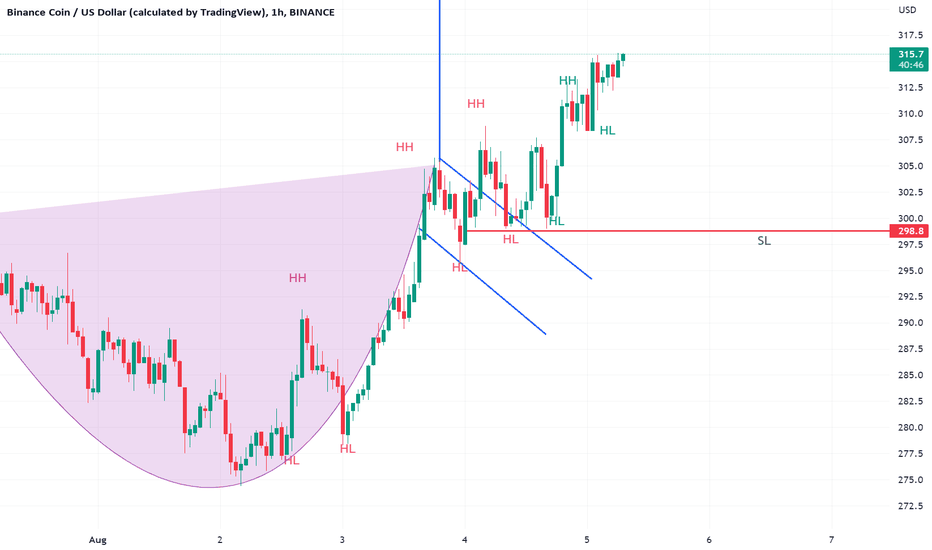

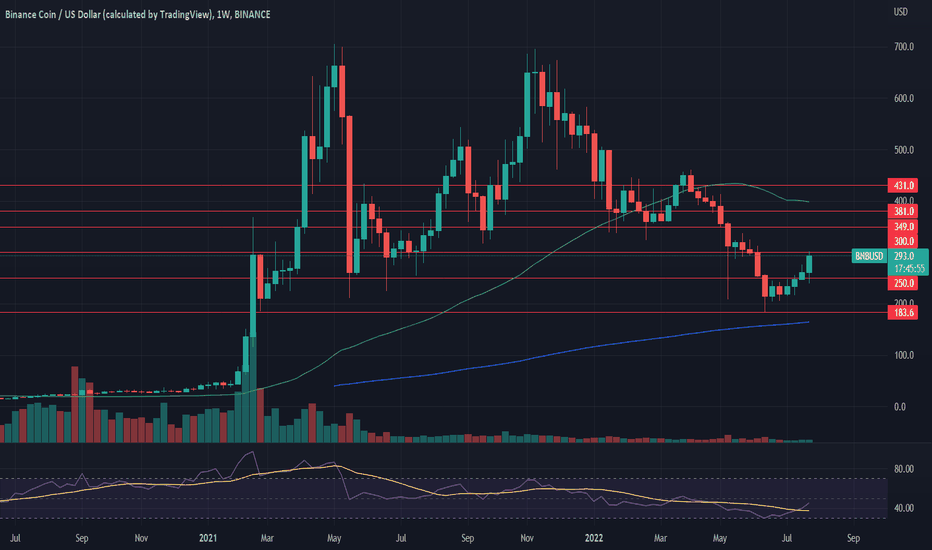

Binance Coin: overbought market reached Another positive week is behind BNB. The coin managed to reach another currently significant target of $300 resistance line to be clearly tested and breached as of the end of the week. Although BNB started the week around level of $275, dominant buying orders have pushed the price to the highest weekly level at $320. With this move the overbought market has been clearly reached, indicating that the future might bring some short term reversal for this coin.

As of the end of this week RSI was pushed to the level of 72, clearly indicating that the market is currently traded in the overbought zone. At the same time, the moving average of 50 days started its modest convergence toward its MA200 counterpart; however, it is still early to confirm this trend. The golden cross is still far away from this coin.

Considering that the coin reached the overbought side of the market, it might be expected that short term reversal is ahead. In this sense, the coin might revert back to $300 support line to test it once again, with decreased probability that $250 support might be reached again. On the opposite side, the next target for BNB might be $350 resistance, after a short stop at $330.

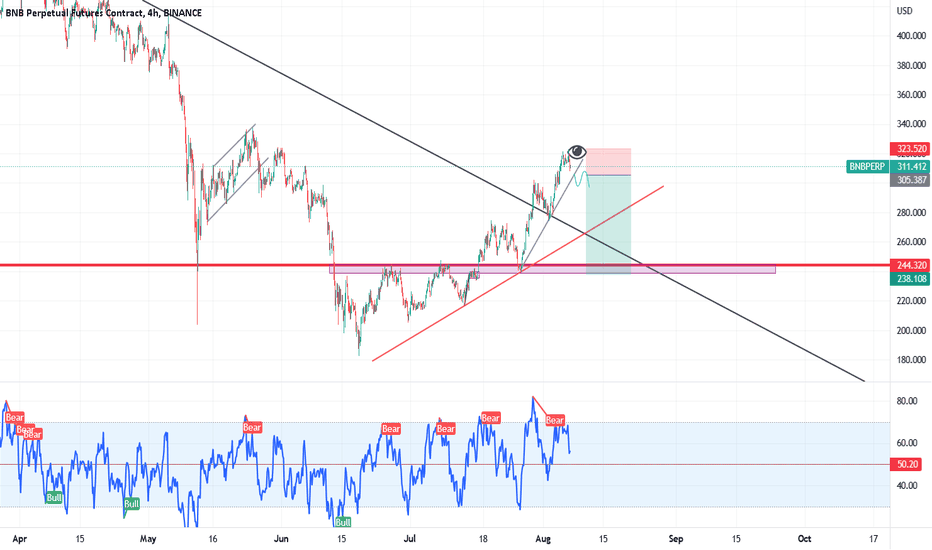

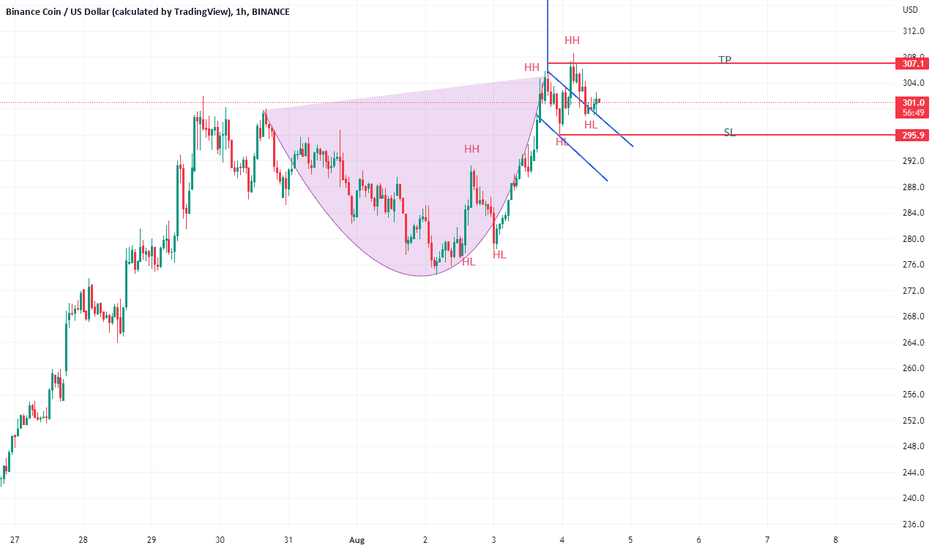

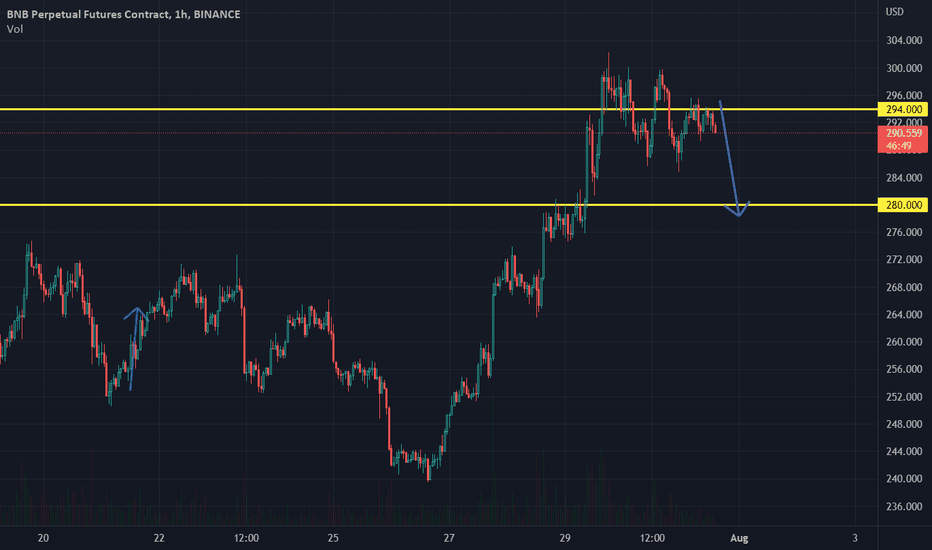

BNBUSD Short Week 08 Chart 02Taking a short position on BNBUSD based on the formation of a head and shoulders chart pattern. The neckline support has been broken.

Based on this analysis as well as the formation of 5 consecutive red candlesticks, it appears that the chart will continue its downward trend

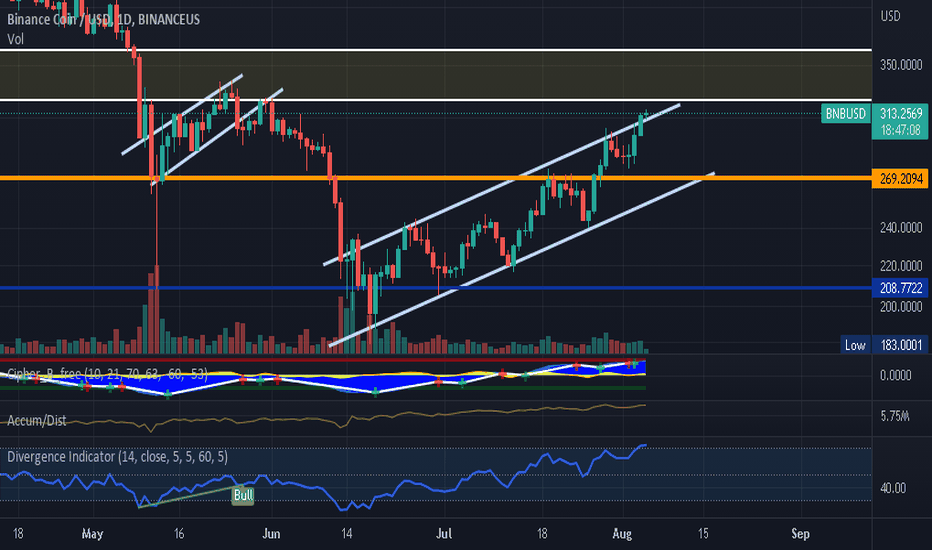

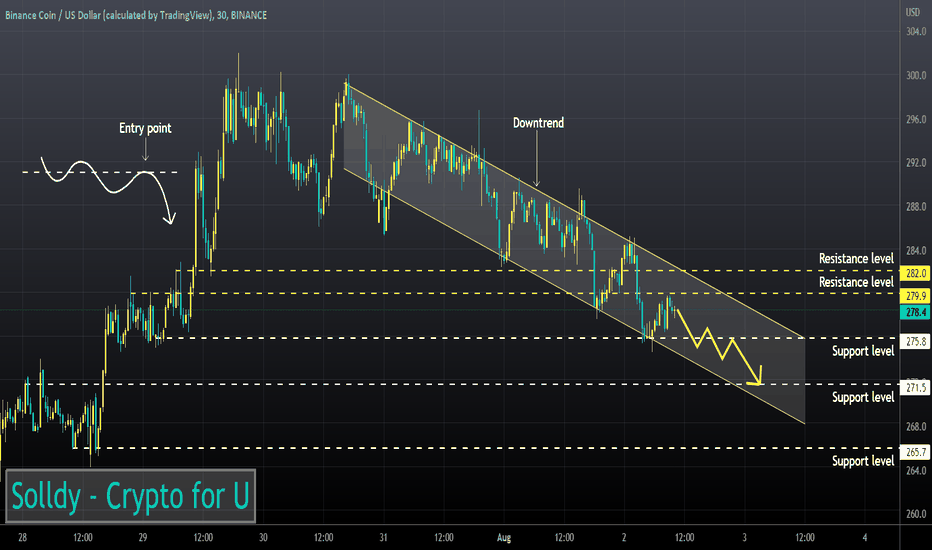

Binance Coin: overbought market is closeIt was a good week for BNB, as the coin managed to reach its short term target at the $300 resistance line. With the latest move, price was moved close to the overbought market, but it still has not been clearly reached, leaving some space for price`s further move to the upside.

BNB started the previous week by testing a $250 support line. Minimum price level has been reached at $240, when the coin reversed to the upside and clearly headed toward the resistance at $300. Such a move was clearly marked on the charts two weeks ago. At the same time, RSI was pushed to the level of 68, however, a clear overbought level has not been reached, which leaves some space for the price to test higher grounds. Moving averages of 50 and 200 days continue to move as two parallel lines, still without indication that convergence might soon start.

BNB reached its long awaited target at $300 resistance. In the coming days it might be expected for this level to be tested for potential for a move to the upper side. This might bring RSI to the clear overbought market, when the price might start its short term reversal. At this point, there is no clear indication on the charts that the price might go much higher from current levels, within the next few days. In case that price enters into short reversal, then it might head toward $250 support to test it once again.

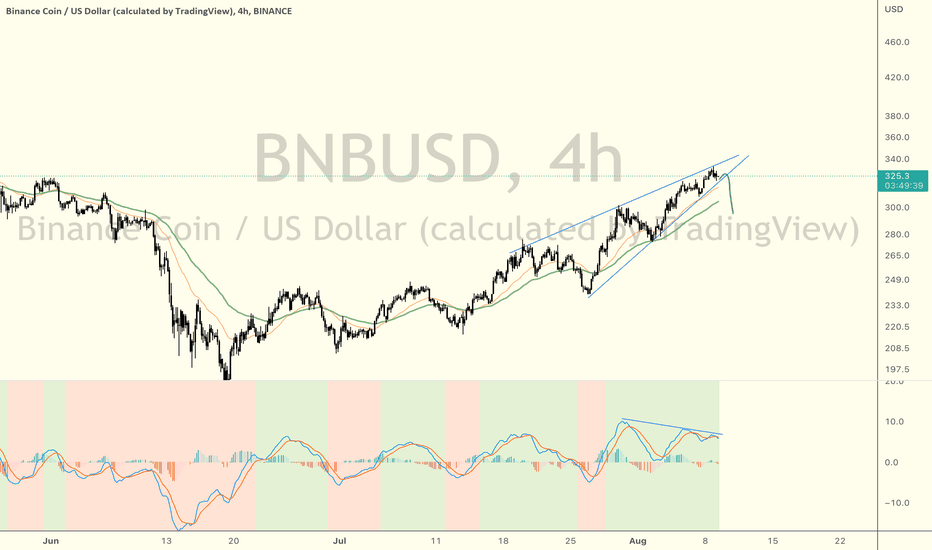

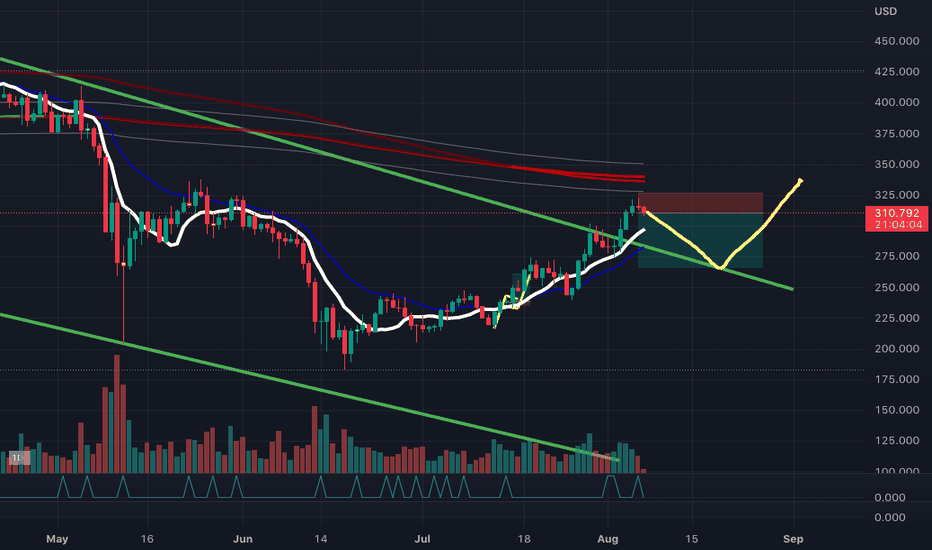

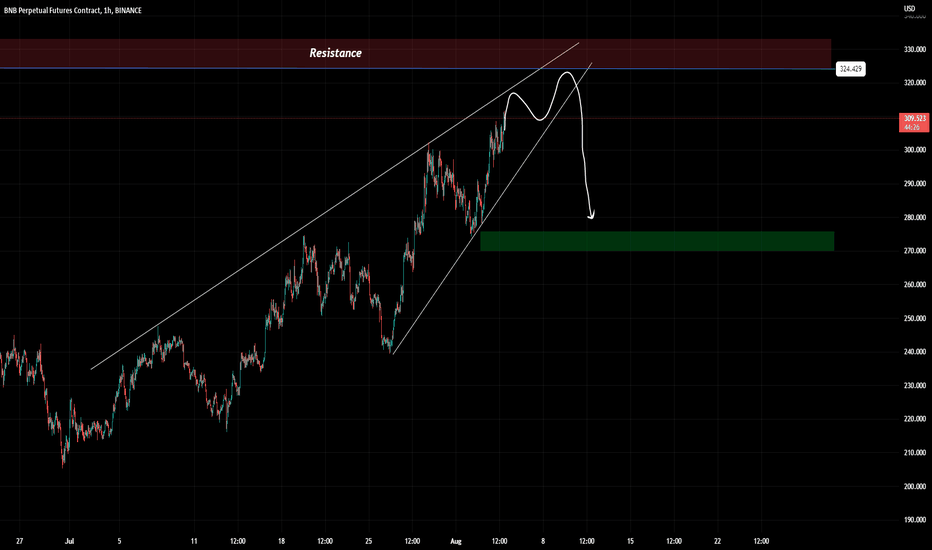

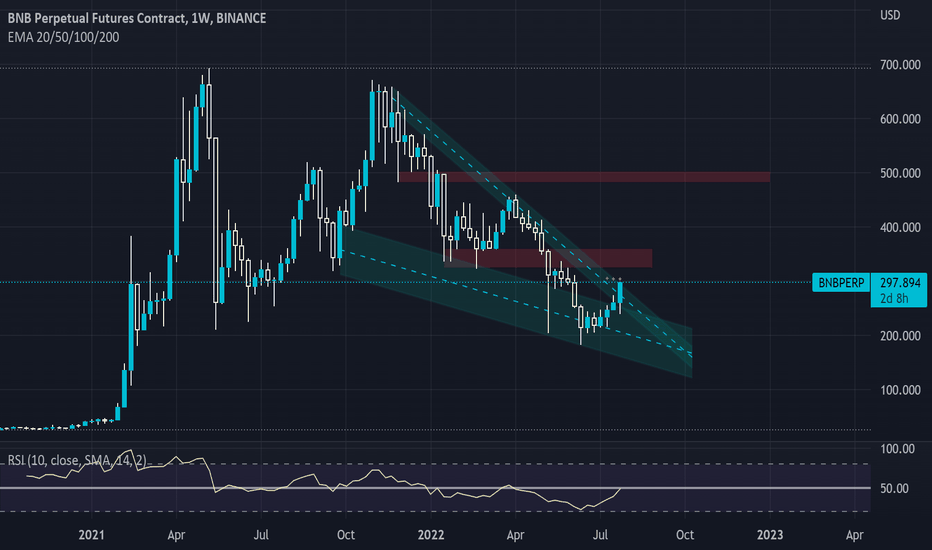

Binace Coin (BNB) is breaking out! BNB is breaking out of a large Falling Wedge, the 1-week average 100 (the yellow line) is $ 304 near the $ 325 and $ 365 resistance.

We are currently priced at $ 300 if the Wall Street market and Bitcoin turn up and put an end to this Bear Market we would have strong price growth.

Great investment and great crypto, the star of Binance.