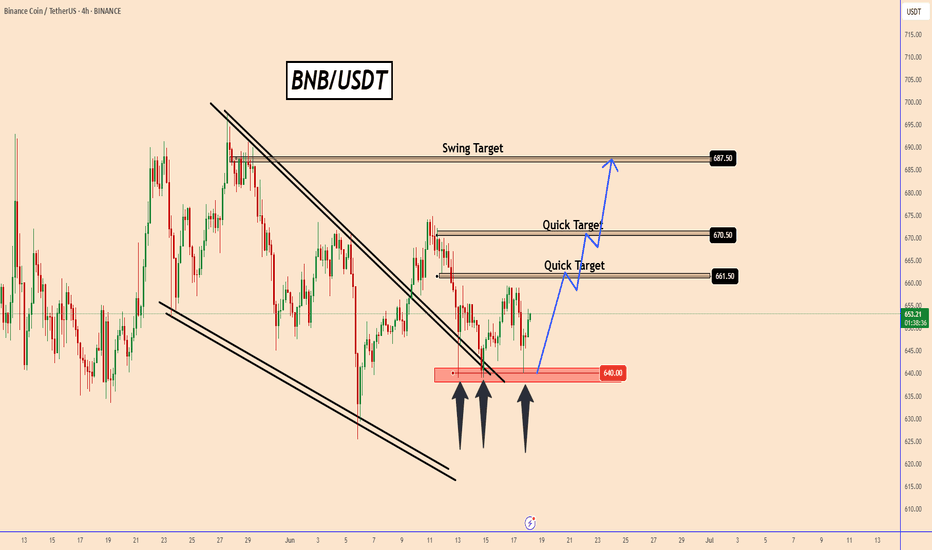

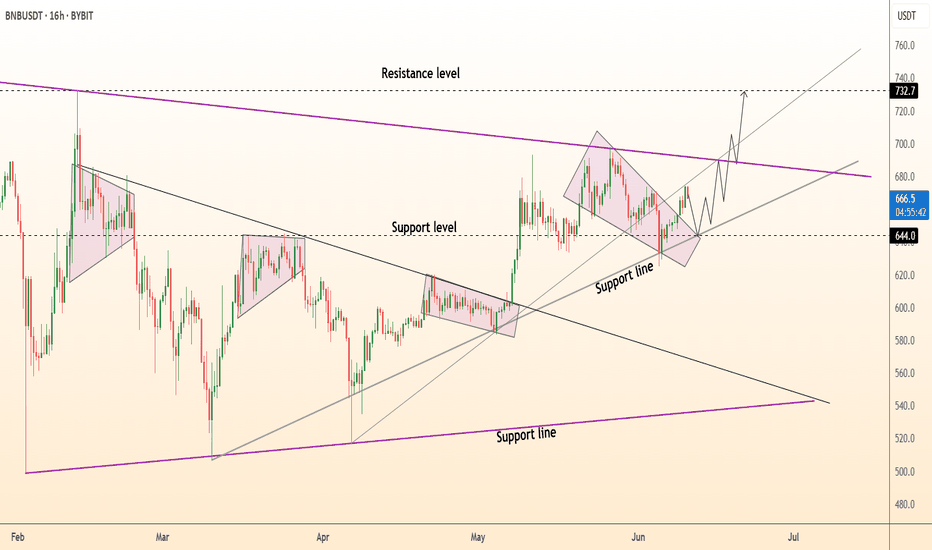

BNB/USDT: Poised for a Bullish Rebound?BNB/USDT: Poised for a Bullish Rebound?

BNB has tested the 640 support zone for the third time in recent days, signaling potential strength in this area.

This level may mark the bottom of the ongoing bearish correction, with signs pointing to a possible upward movement in the coming days, as ref

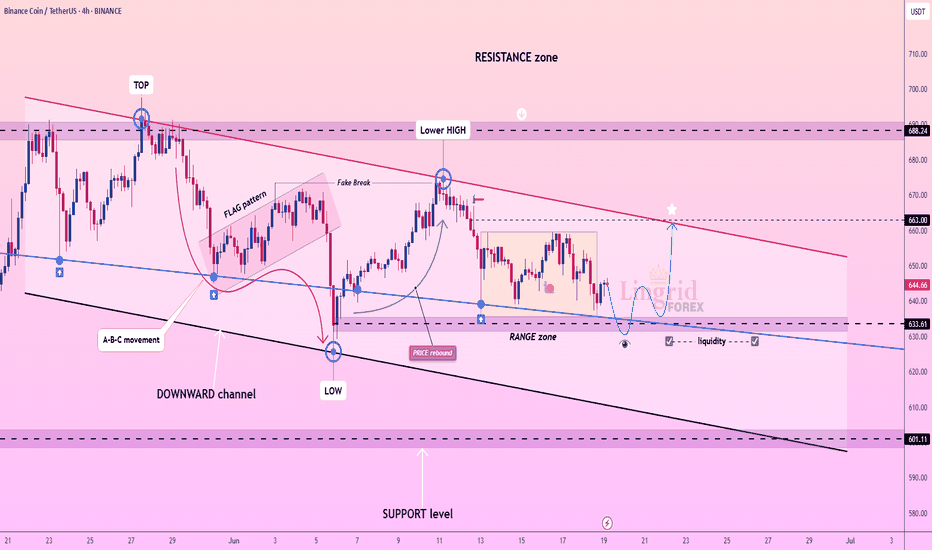

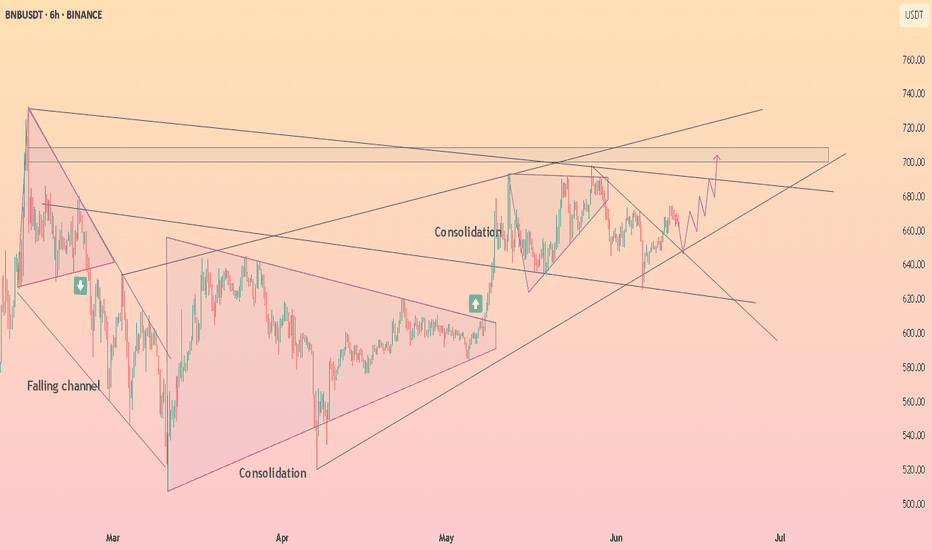

Lingrid | BNBUSDT buying Opportunity in Consolidation PhaseBINANCE:BNBUSDT is forming a reactive base inside the lower boundary of its descending channel, just above the 633 support zone. The current range structure suggests consolidation, with a potential for a false breakdown before an upward move. A breakout through the red descending trendline could t

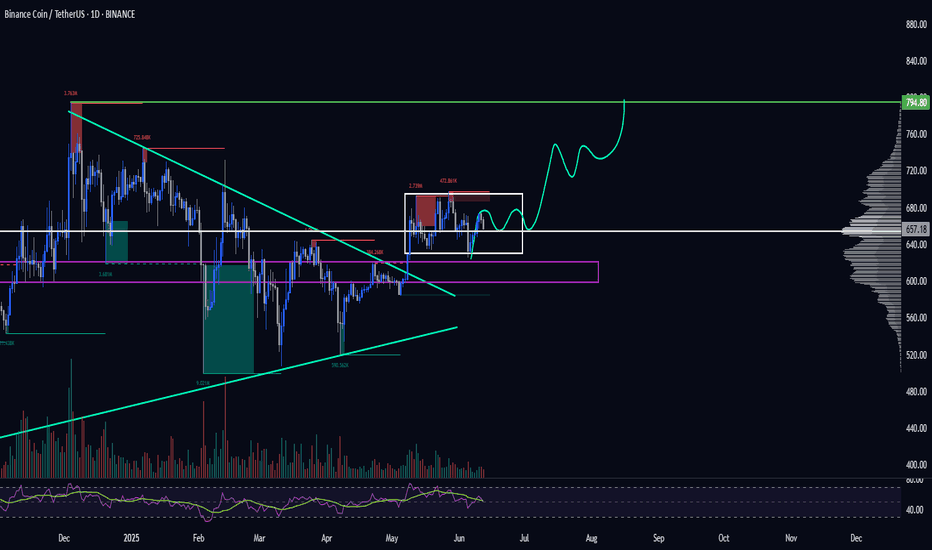

BNB 1D Ready to Explode? This Chart Says YES. 06/12/25BINANCE:BNBUSDT is forming a tight consolidation right below key resistance at $710, inside a triangle structure. Every dip into the $655–$625 support zone gets quickly bought up — showing strong buyer interest and accumulation.

Price is compressing inside the triangle with higher lows, indicating

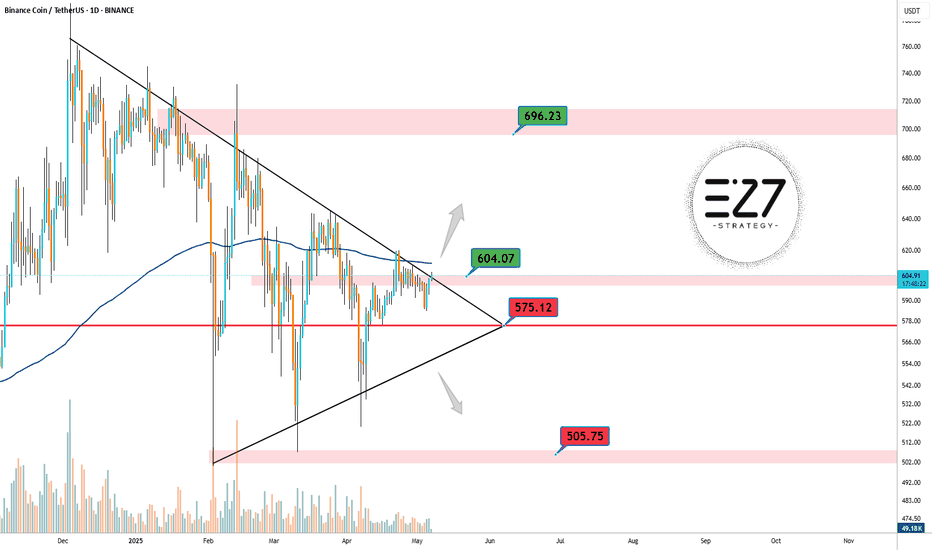

BNB Pump???On the daily chart of BNB, a symmetrical triangle has formed, and the price is approaching a breakout point. The $600–$604 zone, aligned with the 200-day moving average and the descending trendline, acts as a key resistance. A bullish breakout could push the price toward the $696 area. On the downsi

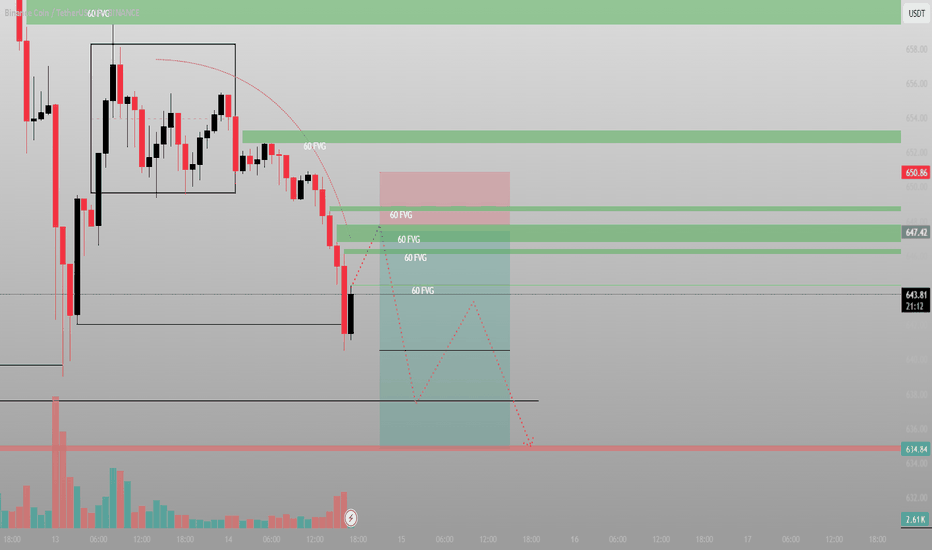

This isn’t a dump. It’s a delivery systemBNB sold off fast — but not irrationally. Look closer, and you’ll see the system at work: rejection from inefficiency, compression, and now a retest of where the last real buyers were found.

The structure:

Price swept short-term demand and wicked below local range lows with a high-volume rejection.

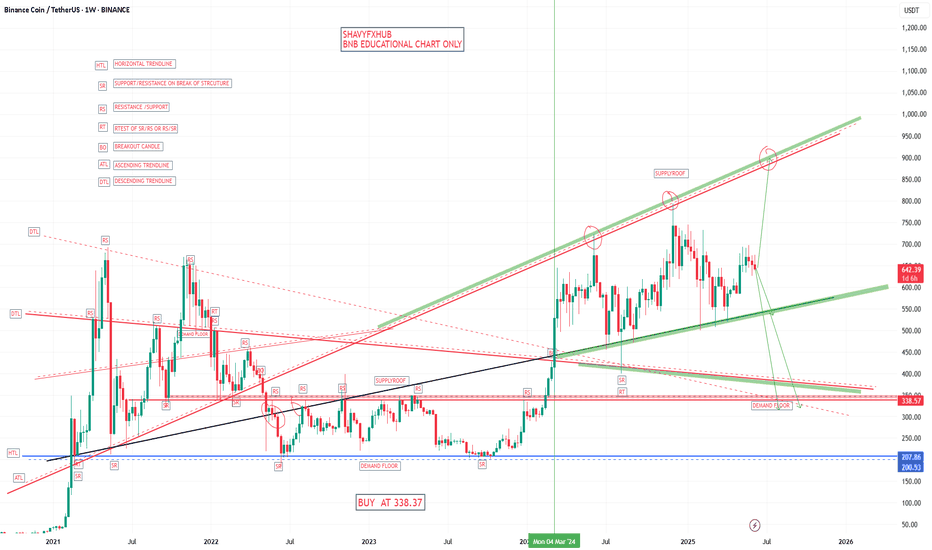

BNBthe BNB weekly chart shows lack of genuine directional bias ,its best to allow the market make clear direction .

On the the weekly demand floor ,price can make a surprise visit and activate a buy.

The green buy and sell zone will be watched for potential reaction especially on the ATL AND DTL LEVEL

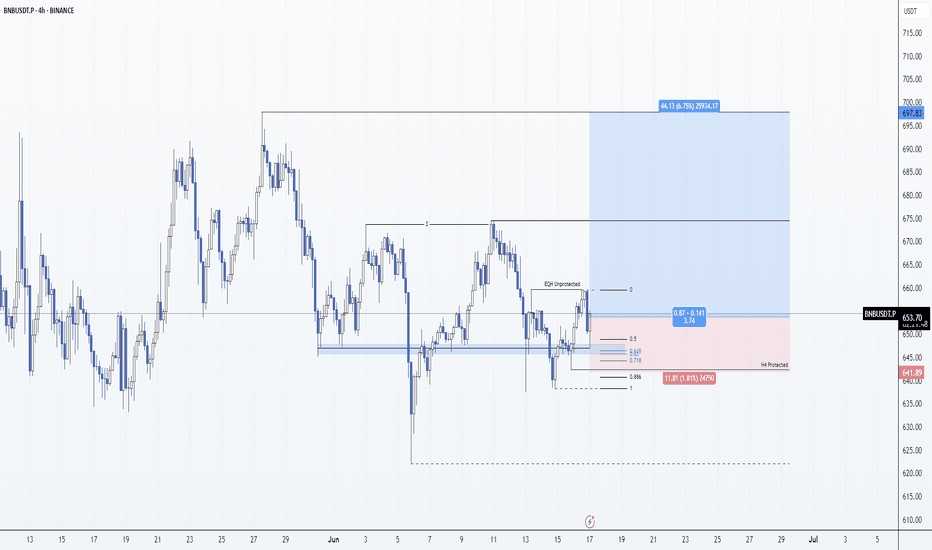

BNB: Long 17/06/25Trade Direction:

BNB Long BINANCE:BNBUSDT.P BINANCE:BNBUSDT

Risk Management:

- Risk set at approx 0.5%

Reason for Entry:

- Retrace into higher timeframe support marked

- Structure remains valid

- Unprotected equal highs DOL

- 0.5 retrace

- H1 and M30 oversold H4 Showing strength

- Banking on

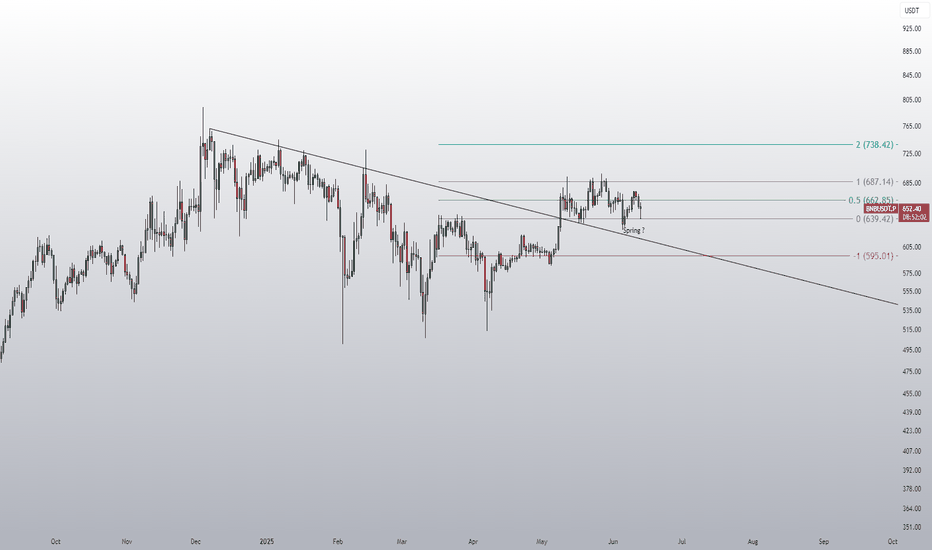

BNB as market indicator?Technically, BNB provides the perfect range setup. After forming a potential 'spring', the price went above the midband, but then retested the range low once more and has been bouncing ever since. Given that the price also broke the downtrend on the daily timeframe, the BNB chart could indicate that

DeGRAM | BNBUSD exited from the wedge📊 Technical Analysis

● Price is respecting a fresh up-sloping channel; the last pull-back halted exactly at $644 support & the inner grey trend-line, printing a higher low and confirming the former wedge top as demand.

● Inside the channel price is carving a bullish pennant whose 1.618 swing meets

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where BNBUSDT.P is featured.

Interest-earning crypto wallets: Put your digital money to work

12 No. of Symbols

Proof of Stake: Seeking validation?

26 No. of Symbols

See all sparks