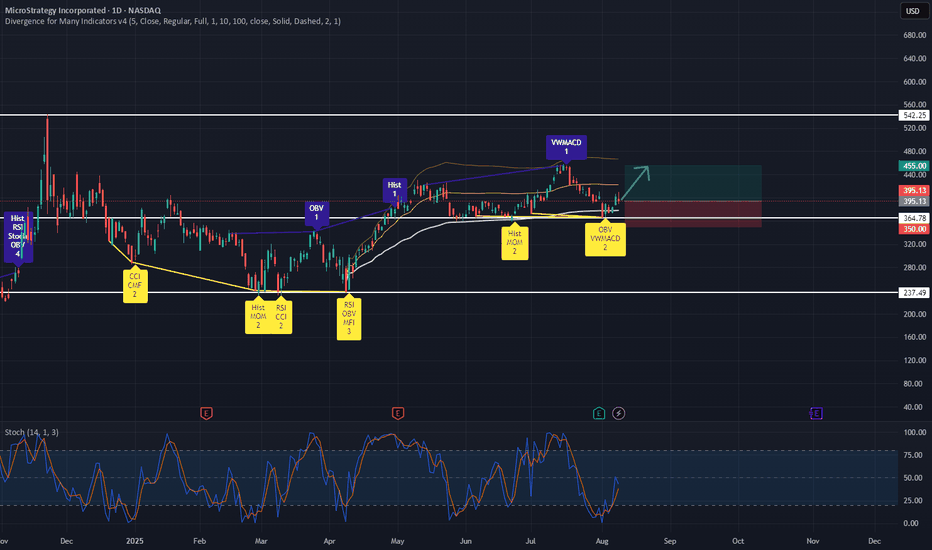

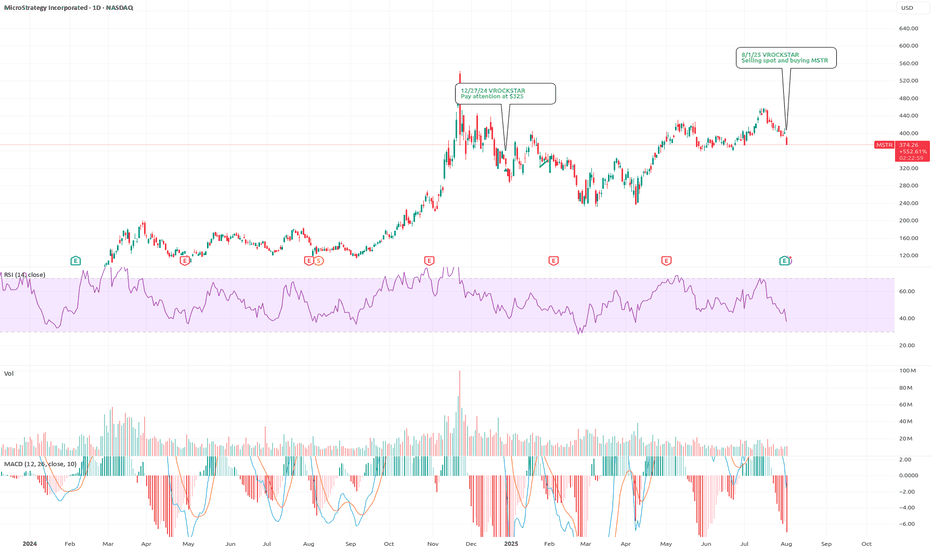

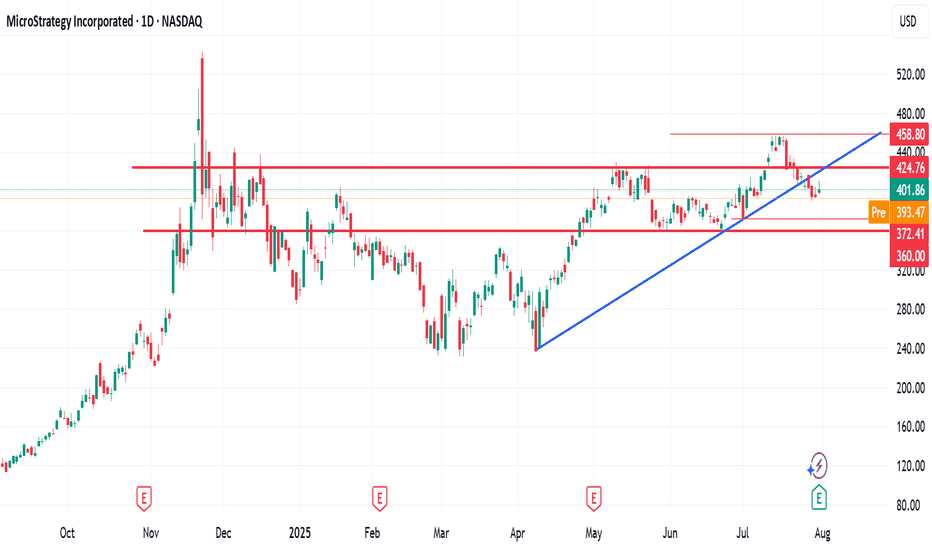

Buy MSTR - many indicators lead me to buy.Many, many indicators lead to a buy on mstr. Avwap, divergences, stochastic... strong buy for me. Stop loss at about 350$. Take profit could be set to 455$ (or adjust it while it's running). Of course it depends on the performance of btc, but I'm also bullish for btc (at least n short term).

MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.99 USD

−1.17 B USD

463.46 M USD

263.35 M

About MicroStrategy

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

FIGI

BBG01SX4QB45

Strategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

Why Pay $250K for a $115K Bitcoin? Welcome to Strategy (MSTR)This is already the third article I’ve written about Strategy (formerly MicroStrategy), and for good reason.

You don’t need to be a financial expert to ask: why buy a stock that simply mirrors Bitcoin’s price — but at a massive premium?

No matter how sophisticated the explanations may sound, or how

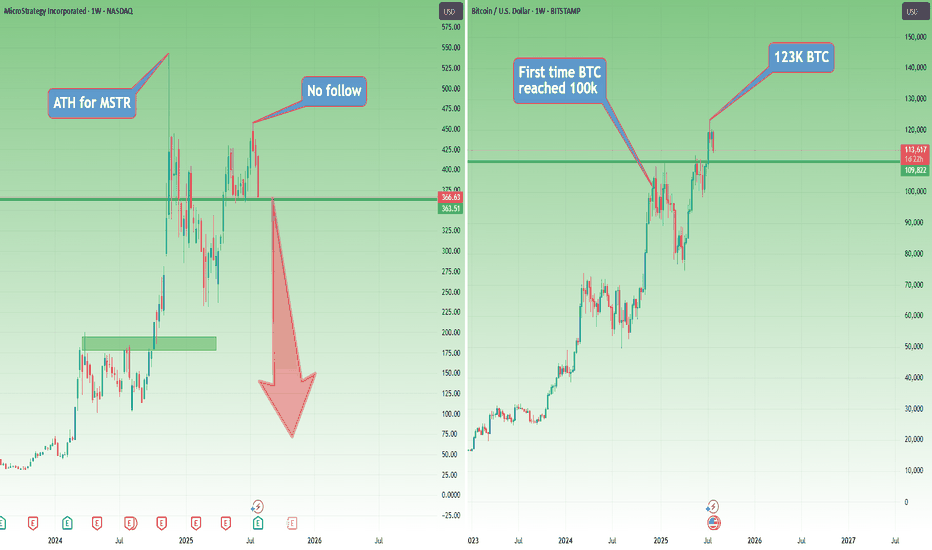

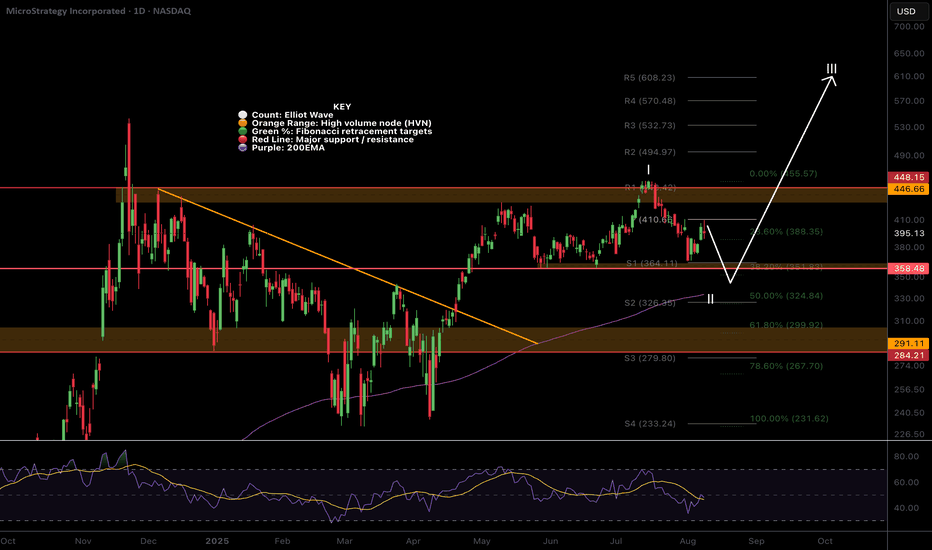

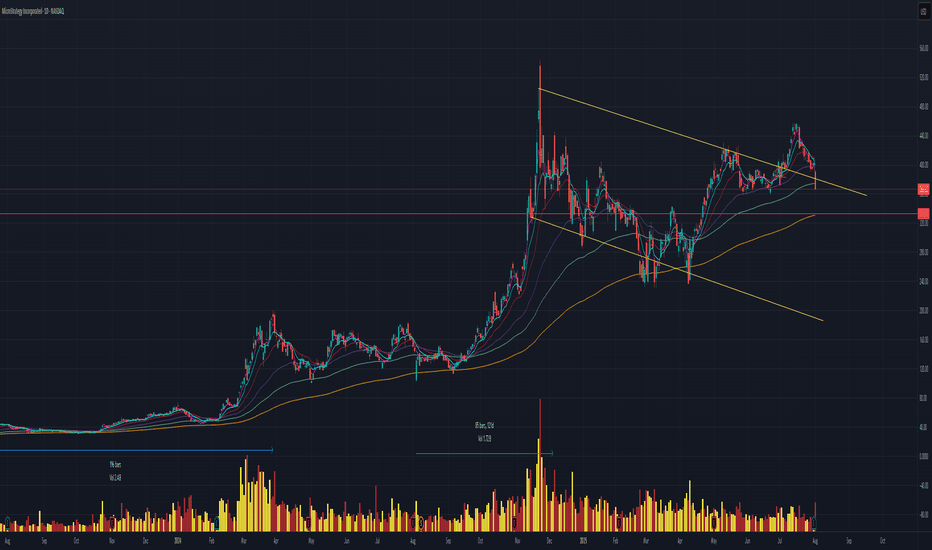

$MSTR shallow wave 2 underway before explosive move ?MicroStrategy has been caught in a range since Nov 2024 possibly building momentum for a large breakout into price discovery, continuing its huge rally from 2024.

Price appears to ave completed an Elliot wave 1 with wave 2 now underway with a target of the ascending daily 200EMA $340, the 0.382 Fib

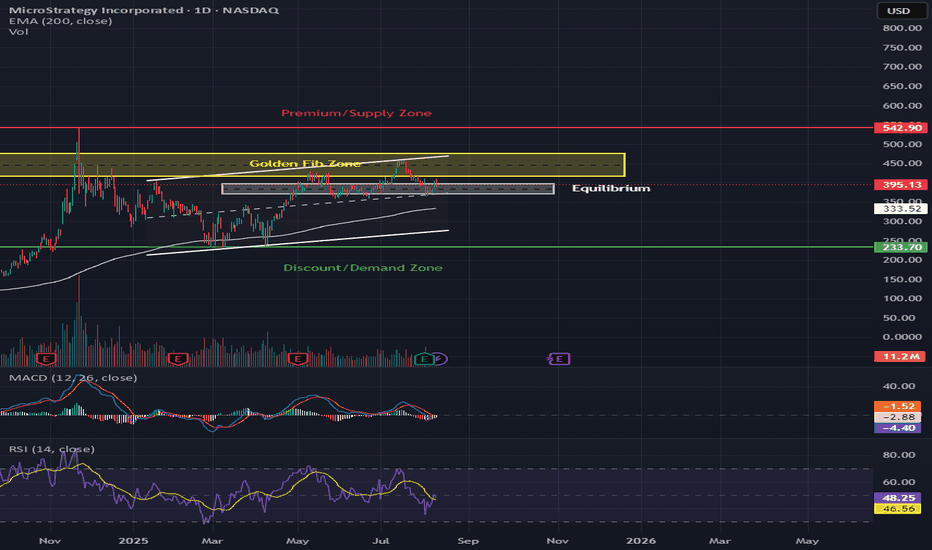

MSTR Testing Golden Fib Support – Bounce Back or Break Lower? 📊 Market Breakdown

MSTR is trading at $395.13, sitting right on the edge of the Golden Fib Zone ($395–$460) after recently failing to push through resistance. Price is holding above the equilibrium (~$333) for now, but with RSI cooling from overbought 74.41 and MACD momentum turning down, the next f

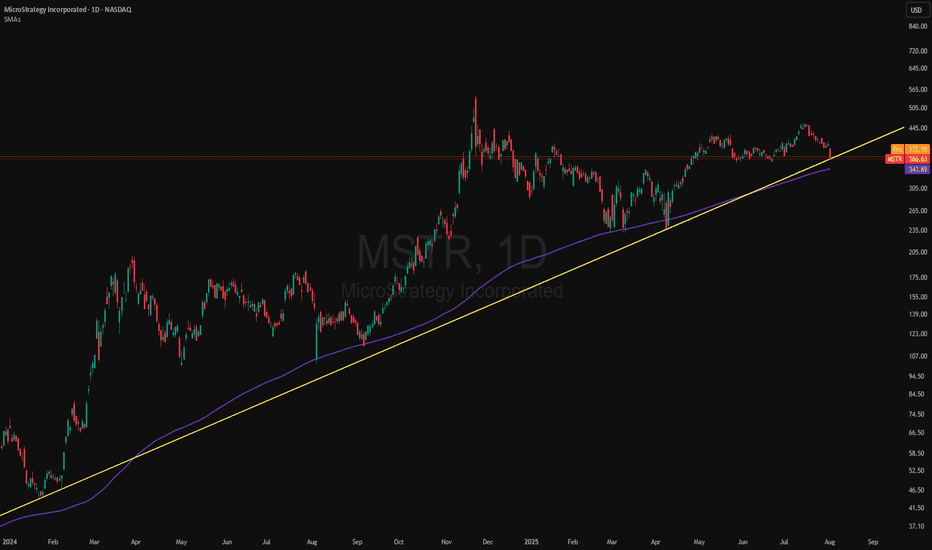

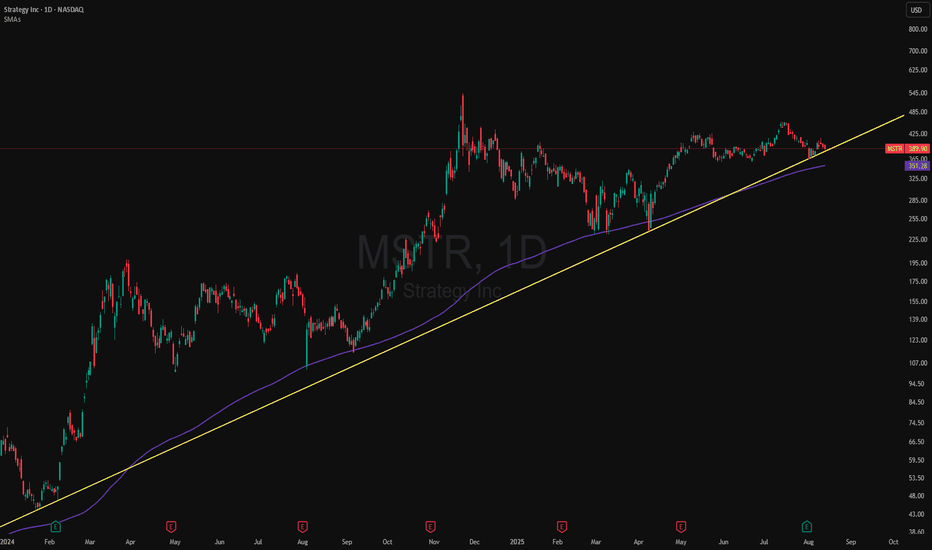

MSTR: Dual Support Test - 200 SMA & Trendline Hold… for NowMSTR (MicroStrategy) is now testing a key technical zone that combines dynamic trendline support and the widely-followed 200-day simple moving average (SMA). These two indicators have provided critical inflection points for the stock over the past year - and we’re back there again.

The current pull

MSTR Holding the Line: Support Tested AgainMSTR (MicroStrategy) continues to respect its ascending trendline, a bullish sign showing buyers remain in control.

Technical Points:

Price tapped the trendline support for the fourth time and bounced, confirming its strength.

Volume remains stable during pullbacks, suggesting these dips are bein

8/1/25 - $mstr - Selling spot and buying MSTR8/1/25 :: VROCKSTAR :: NASDAQ:MSTR

Selling spot and buying MSTR

- keeping it (purposefully) short today for everyone's benefit

- sold a bit of OTC:OBTC (which is nearly 15% off spot, e.g. $100k/BTC) to buy NASDAQ:MSTR MSD exposure here

- why?

- 1.6x mNAV is lowest it's been (nearly ever in cu

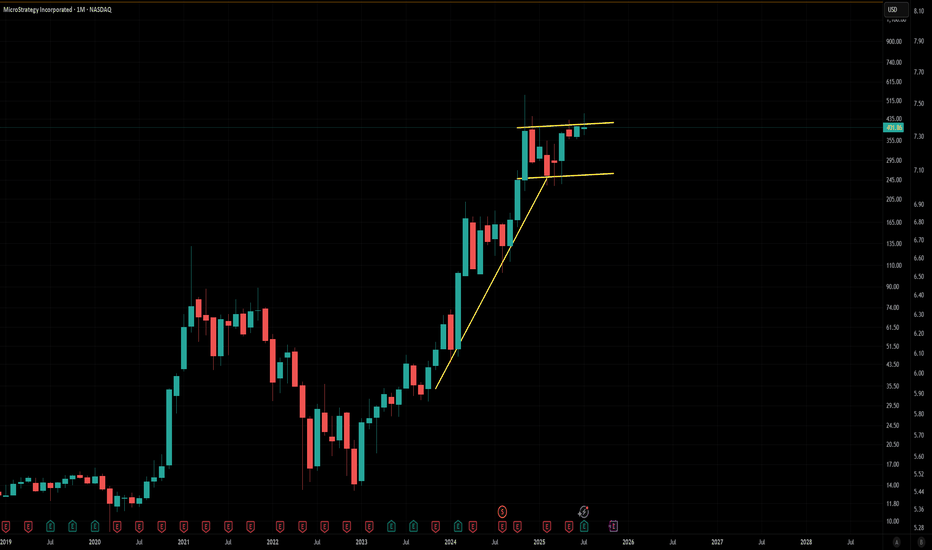

MSTR still bullish. MSTR bullishness is still intact but it should close above the upper yellow line for the bullishness confirmation intact. If that happens then there's a big possibility that we will see a big sharp last parabolic run to new ATH. Of course this is not financial advised.

If this failed then the la

Monthly $MSTR Bullflag MicroStrategy is forming a textbook bull flag on the monthly, right after a massive vertical leg from sub-$200 to over $500.

Strong pole ✅

Tight consolidation near the highs ✅

Monthly closes holding above prior resistance ✅

This thing is coiling under ~$455. Once it breaks, it could easily send

See all ideas

MSTR5946535

MicroStrategy Incorporated 0.0% 01-DEC-2029Yield to maturity

5.77%

Maturity date

Dec 1, 2029

US594972AR2

STRATEGY INC. 24/29 CV ZOYield to maturity

1.08%

Maturity date

Dec 1, 2029

US594972AT8

STRATEGY INC. 25/30 CV ZOYield to maturity

−3.03%

Maturity date

Mar 1, 2030

US594972AN1

STRATEGY INC. 25/32 CVYield to maturity

−6.57%

Maturity date

Jun 15, 2032

MSTR6034213

MicroStrategy Incorporated 0.875% 15-MAR-2031Yield to maturity

−7.51%

Maturity date

Mar 15, 2031

MSTR6032672

MicroStrategy Incorporated 0.625% 15-MAR-2030Yield to maturity

−13.32%

Maturity date

Mar 15, 2030

US594972AP6

STRATEGY 24/28 CV 144AYield to maturity

−17.66%

Maturity date

Sep 15, 2028

See all STRF bonds

Curated watchlists where STRF is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BOATS exchange MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock stocks are traded under the ticker STRF.

STRF reached its all-time high on Jul 22, 2025 with the price of 119.00 USD, and its all-time low was 119.00 USD and was reached on Jul 21, 2025. View more price dynamics on STRF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock financials in yearly and quarterly reports right on TradingView.

MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

STRF earnings for the last quarter are 32.60 USD per share, whereas the estimation was −0.10 USD resulting in a 33.25 K% surprise. The estimated earnings for the next quarter are −0.08 USD per share. See more details about MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock earnings.

MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock revenue for the last quarter amounts to 114.49 M USD, despite the estimated figure of 113.54 M USD. In the next quarter, revenue is expected to reach 118.11 M USD.

STRF net income for the last quarter is 10.02 B USD, while the quarter before that showed −4.22 B USD of net income which accounts for 337.61% change. Track more MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock financial stats to get the full picture.

Yes, STRF dividends are paid quarterly. The last dividend per share was 2.64 USD. As of today, Dividend Yield (TTM)% is 0.00%. Tracking MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock dividends might help you take more informed decisions.

As of Aug 14, 2025, the company has 1.53 K employees. See our rating of the largest employees — is MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock EBITDA is −26.12 M USD, and current EBITDA margin is −5.29%. See more stats in MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock financial statements.

Like other stocks, STRF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MicroStrategy Incorporated - 10.00% Series A Perpetual Strife Preferred Stock stock right from TradingView charts — choose your broker and connect to your account.