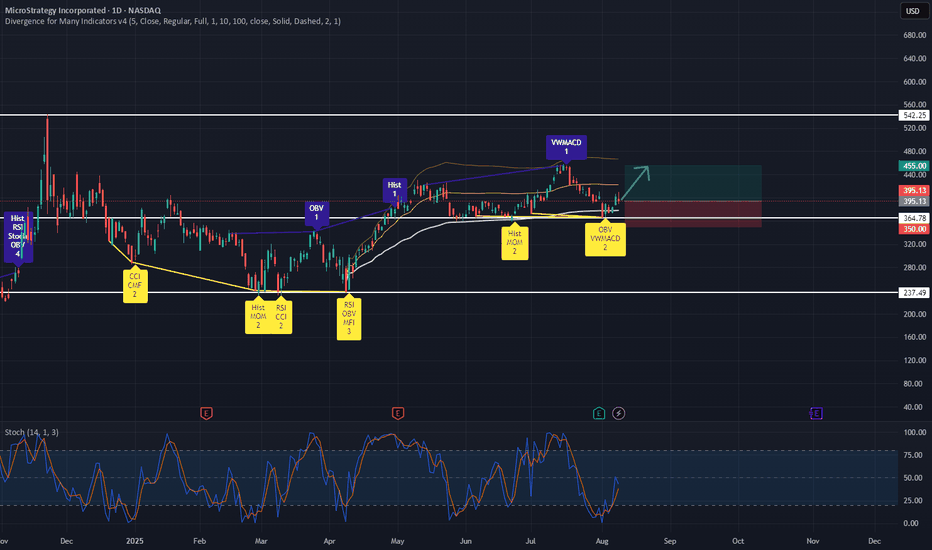

Buy MSTR - many indicators lead me to buy.Many, many indicators lead to a buy on mstr. Avwap, divergences, stochastic... strong buy for me. Stop loss at about 350$. Take profit could be set to 455$ (or adjust it while it's running). Of course it depends on the performance of btc, but I'm also bullish for btc (at least n short term).

STRK trade ideas

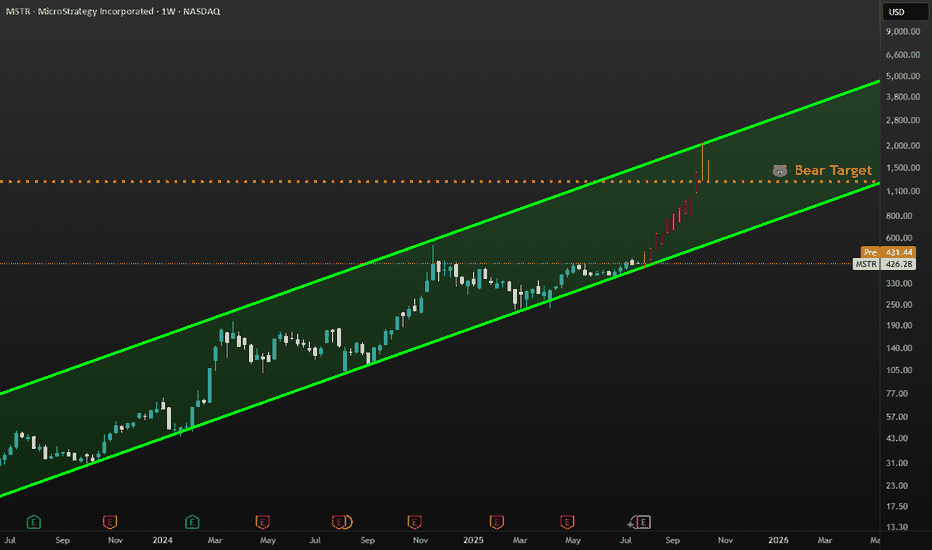

MSTR Holding the Line: Support Tested AgainMSTR (MicroStrategy) continues to respect its ascending trendline, a bullish sign showing buyers remain in control.

Technical Points:

Price tapped the trendline support for the fourth time and bounced, confirming its strength.

Volume remains stable during pullbacks, suggesting these dips are being absorbed by buyers rather than panic selling.

As long as MSTR holds above $1,400 (trendline + previous support zone), the bullish structure remains intact.

Next targets: $1,600, then $1,750, with potential for new highs if Bitcoin strength continues.

Bottom line:

Repeated successful tests of the trendline show strong market confidence. Unless this trendline breaks with conviction, the path of least resistance is still up.

Strategy: The Convertible Trap

The Convertible Trap

Part One: The Architecture

December 2024

Marcus Chen stood before the floor-to-ceiling windows of his corner office on the 47th floor of One Manhattan West, watching the city blur into twilight. The Bloomberg terminal on his desk glowed with a constellation of green numbers—Bitcoin had just crossed $110,000, and MicroStrategy's stock was up another 15% for the day. As Chief Investment Officer at Sovereign Capital Management, overseeing $480 billion in assets, he'd seen every financial instrument imaginable. But what Michael Saylor and MicroStrategy were building was something else entirely.

"Marcus, you need to see this." Sarah Kozlowski, his senior analyst, burst through his door without knocking—a breach of protocol that meant something significant. She spread a series of charts across his Italian marble desk, her usually steady hands trembling slightly with excitement. "I've been modeling MSTR's convertible bond strategy for three weeks. It's not just clever—it's architecturally perfect."

Marcus studied the papers. MicroStrategy had issued another $2 billion in convertible bonds at 0.875% interest, due 2029. The bonds could convert to MSTR shares if the stock hit $1,000—currently trading at $450. The company would use every dollar to buy more Bitcoin.

"Explain it to me like I'm a client," Marcus said, though he understood perfectly well. He wanted to hear her reasoning.

Sarah pulled up a chair, her Princeton MBA and MIT engineering background evident in how she structured her explanation. "Think of it as a three-layer cake. Layer one: Institutions like us, State Street, Vanguard—we're legally restricted from holding Bitcoin directly. Our charters, our compliance departments, our insurance policies—they all prohibit direct cryptocurrency exposure."

"But they don't prohibit holding equities or corporate bonds," Marcus interjected.

"Exactly. Layer two: MicroStrategy becomes our proxy. They hold Bitcoin, we hold them. But here's where it gets beautiful—they've promised publicly, legally, repeatedly, that they will never sell a single Bitcoin. It's their core value proposition. They're a Bitcoin black hole."

Marcus walked to his window, processing. Twenty-three floors below, he could see the evening rush beginning on the Hudson River Greenway. Cyclists and joggers, oblivious to the financial architecture being constructed above them.

"Layer three?" he asked.

"The convertible bonds. We're calling them STRK internally—Saylor's Trap, Really, Kid—" Sarah smiled at the trader slang. "These aren't normal corporate bonds. They're a bet on MSTR reaching specific price targets. If MSTR hits $1,000, bondholders convert to equity. If not, they get their money back plus interest."

"And MicroStrategy uses the bond proceeds to buy more Bitcoin," Marcus said slowly, "which drives up their stock price because they're leveraged to Bitcoin's movement, which makes the conversion more likely, which attracts more institutional money to the bonds..."

"Which they use to buy more Bitcoin," Sarah finished. "It's a perpetual motion machine powered by institutional FOMO and regulatory arbitrage."

Part Two: The Believers

March 2025

The Sovereign Capital Management quarterly board meeting took place in the firm's pristine boardroom, with its Rothko paintings and panoramic views of the Hudson. Marcus presented to twelve board members, each representing different institutional stakeholders—pension funds, sovereign wealth funds, university endowments.

"We're recommending a $3 billion position," Marcus said, clicking through his presentation. "Split between MSTR equity and the convertible bonds."

Board member Patricia Thornton, former Federal Reserve governor, raised a manicured hand. "What's our downside protection?"

"The bonds provide a floor," Marcus explained. "Even if Bitcoin crashes, MicroStrategy owes us the principal plus interest. They have Bitcoin reserves worth $30 billion against $8 billion in convertible debt."

"Unless Bitcoin falls more than 70%," Patricia noted.

"Which has happened before," added James Park, representing the California State Teachers' Retirement System. "2022, Bitcoin fell from $69,000 to $16,000."

Marcus nodded. "True. But MicroStrategy's strategy has evolved. They're not just holding Bitcoin—they're the primary institutional gateway to Bitcoin. Every major fund that wants crypto exposure but can't hold it directly comes through them. They've become systemically important."

"Too big to fail?" Patricia's tone was skeptical.

"Too interconnected to fail," Marcus corrected. "State Street has $2 billion in MSTR. Vanguard has $3 billion. BlackRock, $4 billion. If MSTR fails, it takes down every institution's crypto allocation."

The board voted 10-2 to approve the investment.

That evening, Marcus met his old friend David Kim for drinks at The Campbell, a cocktail bar in Grand Central Terminal. David ran crypto strategy for Bridgewater Associates, the world's largest hedge fund.

"You're buying MSTR?" David asked, swirling his $30 Old Fashioned.

"Everyone is," Marcus replied. "You?"

"Ray Dalio thinks it's the greatest example of reflexivity he's ever seen. George Soros's theory made real—market participants' biased views shape market fundamentals, which shape views, which shape fundamentals..."

"Until?" Marcus prompted.

David was quiet for a moment, watching commuters rush past the bar's entrance. "Until the only way to maintain the reflexivity is to never sell. Ever. Saylor's created a roach motel for capital. Money checks in, but it can't check out."

Part Three: The Prophets

June 2025

The "Bitcoin Miami 2025" conference was a spectacle of excess. Marcus attended reluctantly, sent by his board to "understand the ecosystem." The Miami Beach Convention Center pulsed with electronic music, laser lights, and the energy of 50,000 true believers.

Michael Saylor's keynote was scheduled for prime time. Marcus found himself in the VIP section, surrounded by institutional investors trying to look casual in their business-casual interpretation of Miami wear—khakis and polo shirts that still screamed "Wall Street."

Saylor took the stage to thunderous applause. At 60, he looked energized, evangelical. Behind him, a giant screen showed MicroStrategy's Bitcoin holdings: 423,000 BTC, worth $52 billion at current prices.

"We are not a company," Saylor declared. "We are a Bitcoin bank for the institutional world. Every corporation, every pension fund, every sovereign wealth fund that cannot or will not hold Bitcoin directly—we are their bridge to the future."

The crowd roared. Marcus noticed Sarah in the row ahead, frantically taking notes.

"We will never sell," Saylor continued, his voice rising. "Not at $100,000. Not at $1 million. Not at $10 million per Bitcoin. MicroStrategy is where Bitcoin goes to live forever. We are the event horizon—once Bitcoin enters our treasury, it never leaves."

After the speech, Marcus found himself at an exclusive rooftop party, hosted by Galaxy Digital. The Miami skyline glittered around them, Biscayne Bay stretching to the dark Atlantic beyond.

"It's a cult," said a familiar voice. Marcus turned to find Christine Walsh, chief economist at the Federal Reserve Bank of New York, holding a mojito and looking deeply uncomfortable.

"Christine? What brings the Fed to Bitcoin Miami?"

"Systemic risk assessment," she said quietly. "We're tracking institutional exposure to crypto through MSTR. It's... significant."

"How significant?"

She glanced around, ensuring they weren't being overheard. "If you aggregate all the convertible bonds, equity holdings, and derivative exposure, the street has about $200 billion tied to MicroStrategy. That's not a company anymore, Marcus. It's a synthetic crypto ETF with no exit door."

"The SEC approved actual Bitcoin ETFs last year," Marcus pointed out.

"Which hold actual Bitcoin they can sell," Christine countered.

"MicroStrategy holds Bitcoin it claims it will never sell. What happens when bondholders want their money back, but selling Bitcoin would break the company's core promise?"

Before Marcus could answer, fireworks erupted over the bay, spelling out "BITCOIN" in golden sparks. The crowd cheered. Christine shook her head and disappeared into the party.

Part Four: The Mechanics

September 2025

Sarah's desk had become a command center for tracking the MSTR phenomenon. Six monitors displayed real-time data: Bitcoin price, MSTR stock, convertible bond prices, institutional holdings, social media sentiment, and blockchain analytics.

"Look at this," she called Marcus over one morning. "MSTR's beta to Bitcoin is now 2.8x. When Bitcoin moves 1%, MSTR moves 2.8%."

"That's the leverage," Marcus said. "They've borrowed to buy Bitcoin, so they're magnifying the moves."

"But watch this," Sarah pulled up a correlation chart. "The convertible bonds are creating a feedback loop. When Bitcoin rises, MSTR rises faster, making conversion more likely, so bond prices rise, so MicroStrategy can issue more bonds at better terms—"

"So they buy more Bitcoin," Marcus finished. "Show me the sensitivity analysis."

Sarah clicked through her models. "If Bitcoin hits $200,000, MSTR goes to approximately $2,000 per share. Every convertible bondholder converts to equity. MicroStrategy can issue new bonds against the higher equity value."

"And if Bitcoin falls to $50,000?"

Sarah's expression darkened. "MSTR drops to around $150. They'd owe $15 billion in bond principal against Bitcoin holdings worth $20 billion. Still solvent, but barely."

"What about $30,000?"

"Then they're underwater. They'd have to sell Bitcoin to pay bondholders, but—"

"But they've promised never to sell," Marcus said. "So they can't. They'd default instead?"

Sarah nodded. "Or find another way. Issue equity at crushed prices. Negotiate with bondholders. But once they break the 'never sell' promise, the entire thesis collapses."

Marcus studied the screens. Something felt familiar—dangerously familiar. He'd seen this kind of financial engineering before, in 2008, when mortgage-backed securities created similar feedback loops.

"Sarah, model one more scenario for me. What happens if several major institutions try to exit simultaneously?"

Her fingers flew across the keyboard. The model ran for several minutes, then displayed results that made them both step back.

"Cascade failure," Sarah whispered.

"If institutions holding 20% of MSTR try to exit, the selling pressure drops MSTR by 60%, triggering bond covenants, forcing Bitcoin sales, creating more selling pressure..."

"Print that out," Marcus ordered. "And schedule a meeting with risk management. Today."

Part Five: The Momentum

December 2025

Bitcoin crossed $200,000 on December 15th, 2025. The financial media called it the "Saylor Singularity"—MicroStrategy's holdings were worth $100 billion, making it one of the most valuable companies in the S&P 500 despite having only 2,000 employees and minimal revenue outside of Bitcoin appreciation.

Marcus watched the celebration from his office. On CNBC, analysts debated whether MSTR could reach $5,000 per share. On Bloomberg, Michael Saylor announced another $10 billion convertible bond offering—the largest in corporate history.

"The institutional demand is insatiable," Saylor told the interviewer. "We're giving the world's largest financial institutions what they want—Bitcoin exposure with a corporate wrapper. We're the bridge between the old financial system and the new."

Marcus's phone buzzed. David Kim from Bridgewater.

"You seeing this?" David asked without preamble.

"Watching Saylor on Bloomberg right now."

"No, check the blockchain. Someone just moved 50,000 Bitcoin from a wallet dormant since 2010."

Marcus pulled up the blockchain explorer. Sure enough, an ancient wallet—one of the original Bitcoin miners—had awakened. Fifty thousand Bitcoin, worth $10 billion at current prices, on the move.

"Satoshi?" Marcus asked, referring to Bitcoin's pseudonymous creator.

"Or someone from that era. Marcus, if original holders start selling into this rally..."

"They sell into MSTR's buying," Marcus said. "MicroStrategy is the buyer of last resort. They have to be—they've promised to buy Bitcoin with every dollar they raise."

"What if that's the point?" David's voice was strange. "What if the early Bitcoin holders have been waiting for someone like Saylor? Someone who would create a mechanism to buy their coins at any price, no questions asked?"

Marcus felt a chill despite his office's warmth. "You're suggesting this was planned?"

"I'm suggesting that anyone smart enough to create Bitcoin was smart enough to anticipate how institutions would eventually need to access it. And what better way to cash out tens of billions in Bitcoin than to create a buyer who publicly promises to never stop buying?"

Part Six: The Warning Signs

February 2026

The first crack appeared, as they often do, in an unexpected place. Turkey's central bank, facing a currency crisis, announced it would sell its Bitcoin reserves—50,000 coins accumulated since 2024. The market absorbed the selling initially, but then Iran announced similar plans, followed by Argentina.

Marcus convened an emergency meeting with his team.

"Sovereign sellers," he said, addressing the twelve analysts and traders gathered in the conference room. "We didn't model for this."

"MicroStrategy is buying," one trader reported. "They're deploying their latest bond proceeds. Taking everything the sovereigns are selling."

"At what price?" Marcus asked.

"Bitcoin's down to $180,000. MSTR is at $1,400, off 30% from the peak."

Sarah pulled up her models. "The February 2027 convertibles are now at risk. Strike price is $1,500. If MSTR doesn't recover, those bondholders will want cash, not equity."

"How much?"

"$4 billion in principal due."

Marcus did quick math.

"MicroStrategy would need to sell 22,000 Bitcoin to raise that cash."

"Which they won't do," Sarah said. "Can't do. The moment they sell a single Bitcoin, their stock goes to zero. Every institutional holder exits. The thesis breaks."

Patricia Thornton from the board called Marcus directly. "Are we hedged?"

"We've bought put options on MSTR," Marcus confirmed. "But Patricia, if MSTR fails, those puts might not pay. The counterparties are the same institutions that own MSTR. It's all interconnected."

"Systemic risk," Patricia said quietly.

"Like 2008."

"Worse," Marcus replied. "In 2008, the bad assets were mortgages on real houses. Here, the asset is Bitcoin—purely digital, purely psychological. If confidence breaks..."

He didn't need to finish.

Part Seven: The Unraveling

May 2026

The Bloomberg headline was stark: "MicroStrategy Bonds Trading at 70 Cents on Dollar as Bitcoin Slides."

Bitcoin had fallen to $120,000, down 40% from its peak. MSTR was at $800, down 60%. The mathematics were brutal and simple—leverage that magnified gains also magnified losses.

Marcus attended an emergency meeting at the Federal Reserve Bank of New York. The room was filled with the who's who of American finance—CEOs of major banks, heads of regulatory agencies, senior government officials.

Christine Walsh from the Fed led the meeting. "Total institutional exposure to MicroStrategy: $380 billion. That's direct holdings. Indirect exposure through derivatives and linked products: another $200 billion."

"They can just hold the bonds to maturity," suggested the CEO of JPMorgan. "Get paid back in cash."

"With what cash?" Christine asked. "MicroStrategy's business generates $500 million in annual revenue. They have $20 billion in convertible bonds outstanding. The only way they can pay is—"

"Selling Bitcoin," finished the Treasury Secretary. "Which they've promised never to do."

Michael Saylor appeared on the conference room screen via secure video link. Even through the pixelated connection, Marcus could see the strain on his face.

"Gentlemen, ladies," Saylor began, "MicroStrategy remains committed to our strategy. We will not sell Bitcoin. We have alternative financing options—"

"What options?" the JPMorgan CEO interrupted. "Your stock is down 60%. You can't issue equity at these levels. No one will lend to you."

"We're in discussions with sovereign wealth funds—"

"Who are selling Bitcoin themselves," the Treasury Secretary said. "Michael, the music has stopped. You need to sell Bitcoin to meet your obligations."

Saylor's jaw clenched. "The moment we sell, we destroy $380 billion in institutional value. Every fund that bought MSTR as a Bitcoin proxy loses everything. Is that what you want?"

The room fell silent. It was the ultimate prisoner's dilemma—everyone would be better off if MicroStrategy held, but MicroStrategy would be better off if it sold.

Part Eight: The Cascade

June 2026

The end came not with a bang, but with a spreadsheet.

MicroStrategy's CFO, under pressure from bondholders and facing personal liability, leaked an internal document showing the company's true financial position. Without Bitcoin sales, they could operate for three more months. The convertible bonds due in August couldn't be paid without liquidating Bitcoin.

The leak hit Reddit first, then Twitter, then the financial press. Within hours, MSTR was down 40%. Bitcoin, sensing weakness, fell 20%.

Marcus watched from his office as the cascade began. Funds that had bought MSTR on leverage faced margin calls. To meet them, they sold MSTR, pushing it down further, triggering more margin calls.

"It's 1987, 2008, and 2020 combined," Sarah said, standing beside him. "But faster. Everything's algorithmic now. The selling is automated."

By noon, MSTR was down 70% for the day. Trading was halted seventeen times. Each halt only increased the panic—buyers disappeared, knowing more selling was coming.

Then, at 2:47 PM Eastern Time, the announcement came:

"MicroStrategy Announces Strategic Bitcoin Sales to Ensure Financial Stability."

The press release was corporate speak for capitulation. They would sell 100,000 Bitcoin—roughly 20% of their holdings—to pay off near-term debt and establish a cash cushion.

The market's reaction was swift and brutal. If MicroStrategy was selling, everyone would sell. Bitcoin fell from $100,000 to $70,000 in an hour. MSTR stock, briefly halted, reopened down 85% from the morning.

Part Nine: The Reckoning

July 2026

The congressional hearing was held in the Rayburn House Office Building, the same room where they'd grilled bank CEOs after 2008. Michael Saylor sat alone at the witness table, facing forty-three members of the House Financial Services Committee.

"Mr. Saylor," the committee chair began, "your company's failure has resulted in over $400 billion in losses to institutional investors, pension funds, and retirement accounts. How do you explain this?"

Saylor leaned into the microphone. "MicroStrategy didn't fail. We adapted to market conditions. We still hold 400,000 Bitcoin—"

"Worth $30 billion at current prices," the chair interrupted. "Down from $100 billion. Your stockholders have lost everything. Your bondholders are being paid back at 30 cents on the dollar."

"The strategy was sound," Saylor insisted. "We created a mechanism for institutions to gain Bitcoin exposure—"

"You created a trap," the ranking member interjected. "A financial weapon of mass destruction, as Warren Buffett might say. Institutions couldn't buy Bitcoin directly, so they bought your promises. And when those promises broke..."

Marcus watched the hearing from his office—one of the few he still had. Sovereign Capital had survived, barely, by selling their MSTR position in January before the worst of the collapse. They'd lost $800 million but avoided the complete wipeout that befell others.

State Street: $2 billion loss.

Vanguard: $3 billion loss.

Various pension funds: $50 billion combined.

The numbers were staggering, but the second-order effects were worse. The collapse in Bitcoin and MSTR had triggered a broader market selloff.

Crypto-correlated stocks crashed.

Tech stocks, seen as speculative, fell 30%. Credit markets froze as institutions faced massive losses.

Part Ten: The Revelation

September 2026

Marcus met David Kim at a coffee shop in Greenwich Village, far from their usual Wall Street haunts. Both men had left their firms—Marcus to start a small advisory business, David to teach at Columbia.

"I've been analyzing the blockchain," David said, sliding a tablet across the table. "Look at this."

The screen showed Bitcoin wallet analytics—flows, timing, amounts.

"Remember those early wallets that woke up during the boom? They sold perfectly into MicroStrategy's buying. Almost like they knew exactly when and how much MSTR would buy."

Marcus studied the data. "You're suggesting coordination?"

"I'm suggesting something more elegant. What if Satoshi—or whoever created Bitcoin—understood that institutional adoption would require an intermediary? A bridge between the anarchist vision of cryptocurrency and the regulatory reality of institutional finance?"

"MicroStrategy," Marcus said slowly.

"Not specifically MicroStrategy, but something like it. Some entity that would promise to never sell, becoming a one-way valve for institutional capital. The early holders could sell into institutional buying, cashing out billions, while institutions got exposure to an asset they couldn't directly hold."

Marcus sat back. "But that would mean—"

"That Bitcoin was designed from the beginning as history's greatest liquidity extraction mechanism. Not a conspiracy, exactly. More like... intelligent design. Create a scarce digital asset, wait for institutional FOMO, provide a mechanism for them to buy but never sell, then cash out into their buying."

"That's insane," Marcus said.

"Is it?" David pulled up another chart. "Look at the net flows. Early Bitcoin holders—the ones from 2009 to 2013—cashed out $500 billion during the MicroStrategy boom. That money came from institutions, pension funds, retirement accounts. It was the greatest wealth transfer in history, from institutional capital to anonymous early adopters."

Marcus stared at the data. The pattern was undeniable.

Part Eleven: The New Normal

December 2026

Bitcoin stabilized around $50,000. MicroStrategy, restructured through bankruptcy, emerged as a small software company again, its Bitcoin holdings liquidated to pay creditors. Michael Saylor stepped down, his fortune evaporated, his legacy complicated.

The congressional committee issued a 400-page report recommending new regulations on corporate cryptocurrency holdings and convertible bond issuances. The SEC implemented strict rules on institutional crypto exposure. The era of financial engineering through crypto proxies was over.

Marcus stood in his new office—smaller, simpler, with a view of the East River instead of the Hudson. He was writing a book about the MicroStrategy phenomenon, trying to capture the madness and brilliance of it all.

His phone buzzed. Sarah, now running her own research firm.

"You see the news?" she asked.

"What now?"

"Some company in Singapore is issuing Bitcoin-backed bonds. They promise to hold Bitcoin forever, never sell. Institutions are interested."

Marcus laughed, dark and knowing.

"Different verse, same song."

"You think it'll happen again?"

Marcus looked out at the river, watching a container ship navigate toward the Atlantic. "The names change, the instruments evolve, but the pattern remains. Someone creates a mechanism to concentrate wealth while appearing to democratize it. Investors, driven by greed and FOMO, pile in. The machine runs until it can't. Then it collapses, and we promise never again."

"Until the next time," Sarah said.

"Until the next time."

Epilogue: The Historian

2030

Professor Marcus Chen stood before his graduate finance class at Columbia Business School. On the screen behind him: a chart of Bitcoin's price from 2009 to 2030, with the MicroStrategy era highlighted in red.

"The MicroStrategy collapse of 2026," he began, "represents a unique moment in financial history. It wasn't fraud, exactly—everything was disclosed. It wasn't illegality—regulators had approved it all. It was something more subtle: a system designed to fail profitably."

A student raised her hand. "Professor, do you think it was intentional? The whole Bitcoin-to-institutional-capital pipeline?"

Marcus considered the question he'd been pondering for four years. "Intent is hard to prove. But consider this: Bitcoin was created by someone or some group brilliant enough to solve the double-spending problem that had plagued digital currency for decades. They created a system that survived every attack, scaled beyond anyone's imagination, and eventually attracted trillions in institutional capital."

He clicked to the next slide, showing fund flows from 2024 to 2026.

"Is it so hard to believe they also anticipated how institutions would need to access Bitcoin? That they understood regulatory constraints would require intermediaries? That those intermediaries would create the perfect exit liquidity for early holders?"

The class was silent, absorbing the implications.

"The MicroStrategy story isn't just about one company or one man's obsession with Bitcoin. It's about how financial innovation can become financial extraction. How complexity can hide simple wealth transfers. How the promise of democratization can enable unprecedented concentration."

He clicked to his final slide: a quote from Satoshi Nakamoto's original Bitcoin whitepaper: "The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party. The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous."

"Perhaps," Marcus said, "the real innovation wasn't the anonymity of transactions, but the anonymity of the architects. They built a machine that would inevitably create its own exit liquidity, then disappeared before anyone understood what they'd built."

A student in the back called out, "So it was all a scam?"

Marcus smiled, the same ambiguous smile he'd worn since 2026. "No, not a scam. Something more elegant and more troubling. A system working exactly as designed, just not as advertised. The greatest magic trick in financial history—making institutional wealth disappear into anonymous wallets, and making everyone applaud the innovation while it happened."

The bell rang. Students filed out, discussing the lecture in hushed tones. Marcus remained, staring at the Bitcoin price chart, still wondering if he was seeing patterns that weren't there or missing patterns that were.

His phone buzzed. A news alert: "New DeFi Protocol Promises Institutional Gateway to Cryptocurrency 2.0."

Marcus shook his head and smiled. The machine was starting up again, with new gears, new levers, but the same essential mechanism—a one-way valve for institutional capital, a promise of revolution that delivered extraction.

He gathered his papers and left the classroom. Outside, New York hummed with its eternal energy, fortunes being made and lost, the next financial innovation always just around the corner.

In his pocket, his phone buzzed again. He didn't check it. He knew what it would say—someone, somewhere, was building the next MicroStrategy, the next bridge between institutional capital and digital assets. The next trap.

The cycle continued.

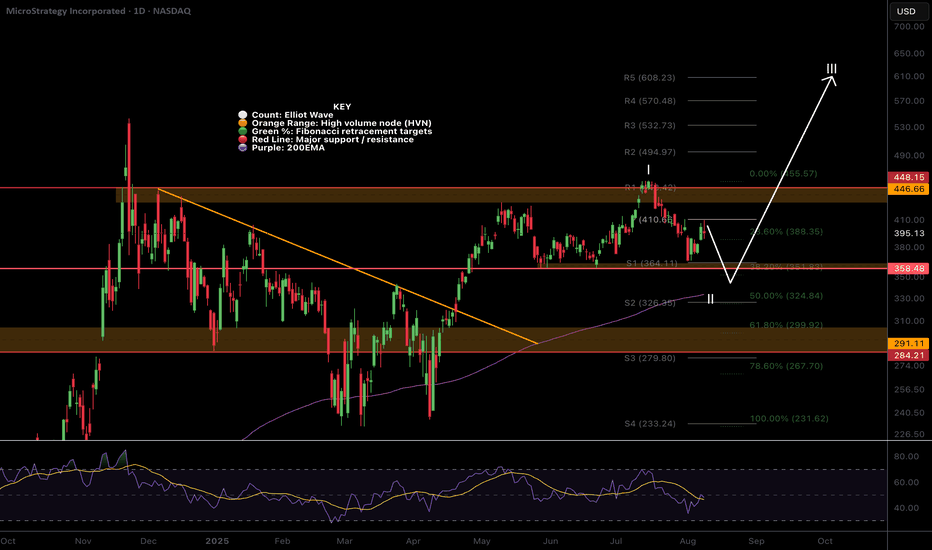

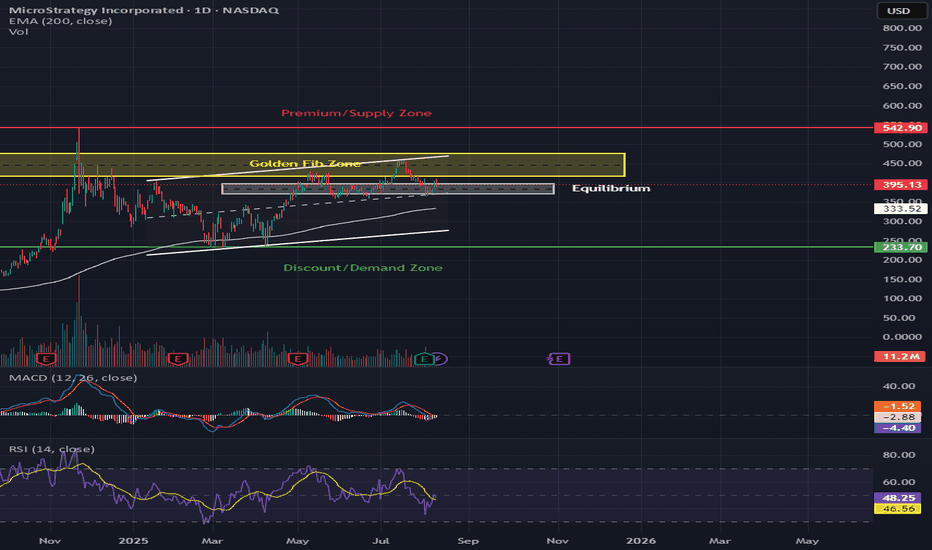

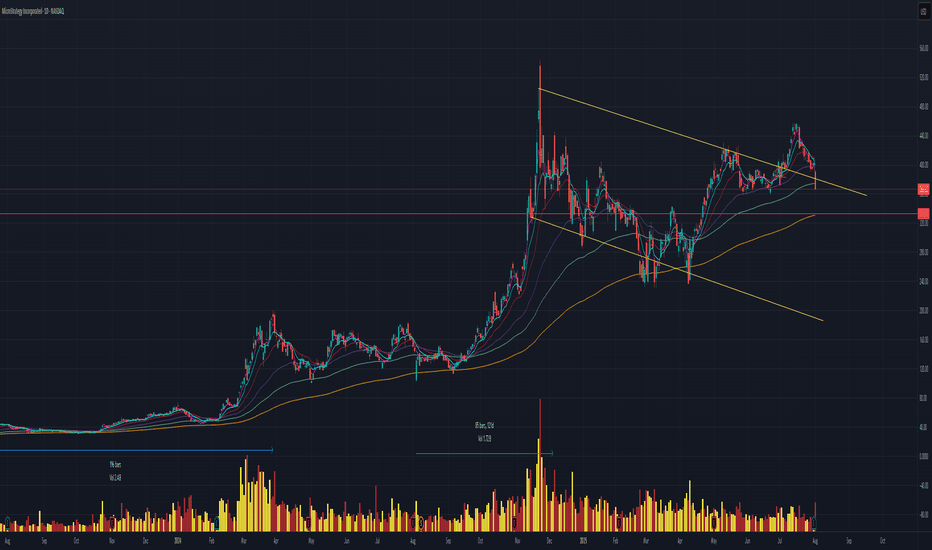

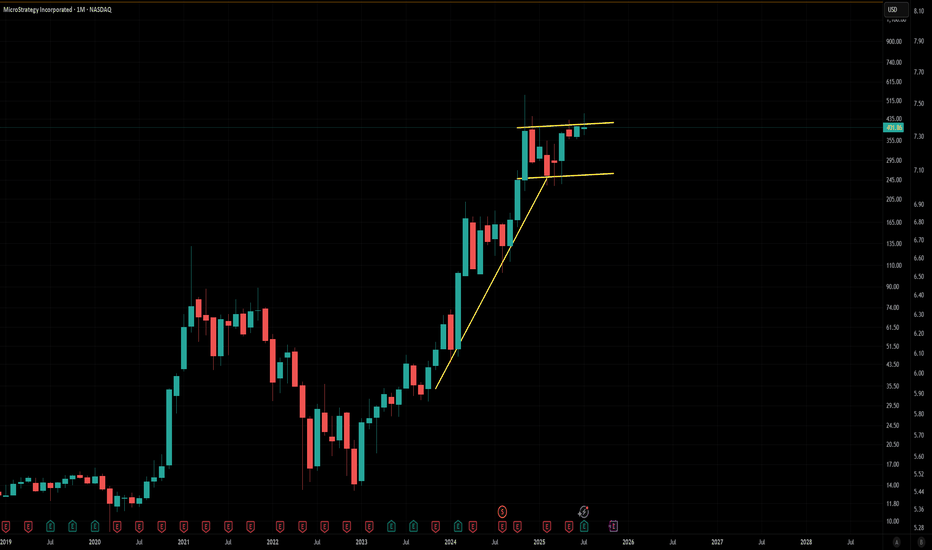

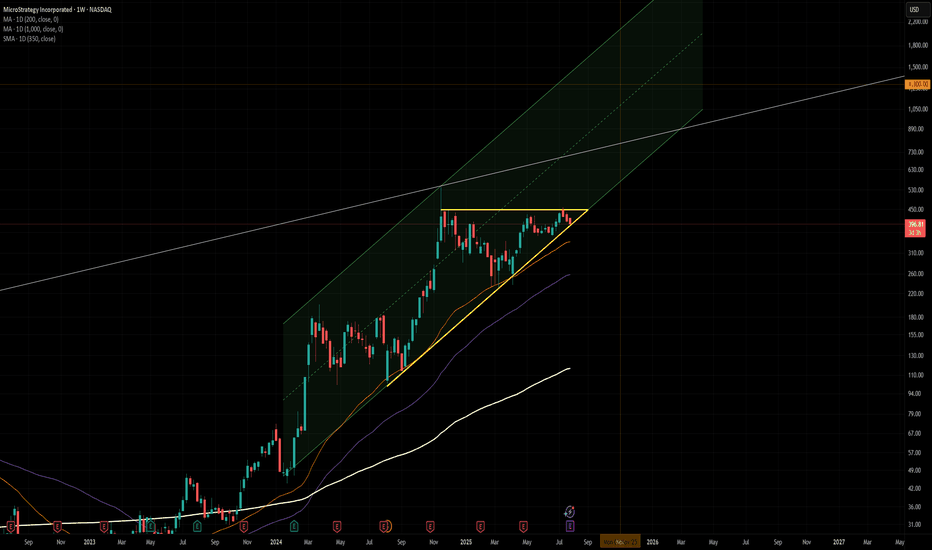

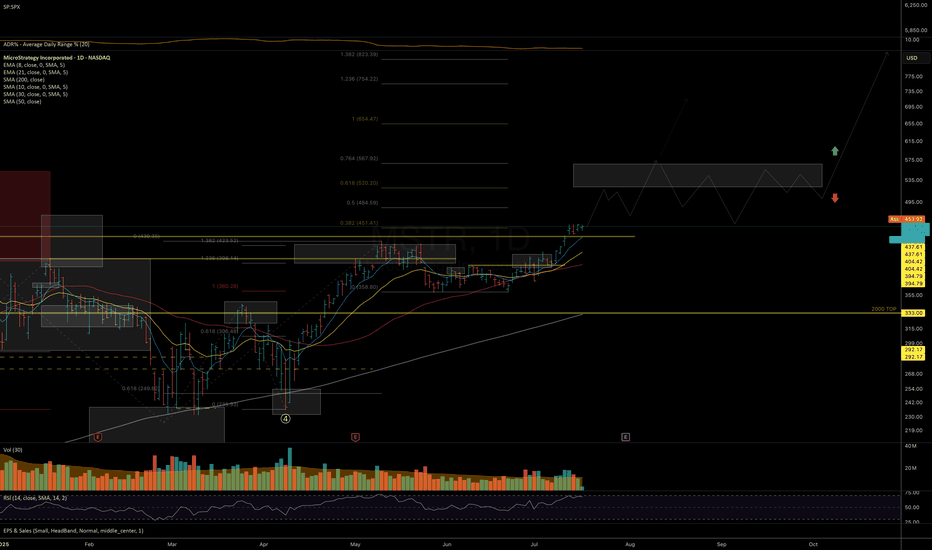

$MSTR shallow wave 2 underway before explosive move ?MicroStrategy has been caught in a range since Nov 2024 possibly building momentum for a large breakout into price discovery, continuing its huge rally from 2024.

Price appears to ave completed an Elliot wave 1 with wave 2 now underway with a target of the ascending daily 200EMA $340, the 0.382 Fibonacci retracement.

Weekly RSI is currently showing bullish divergence but daily suggests we have one push lower to get to oversold!

Bitcoin stocks have all had a decent retracement causing me to upgrade my Elliot Wave count to a completed macro wave 1 with wave 2 now underway, suggesting the best returns are still to come over the next months for this category asset class in wave 3!

Analysis is invalidated if we go to new highs above $457 or lose $229

New long signals are certainly building in the DEMA PBR and Price Action strategies so keep an eye out on the Trade Signals Substack as we have made very food profits lately in these markets!

Safe trading

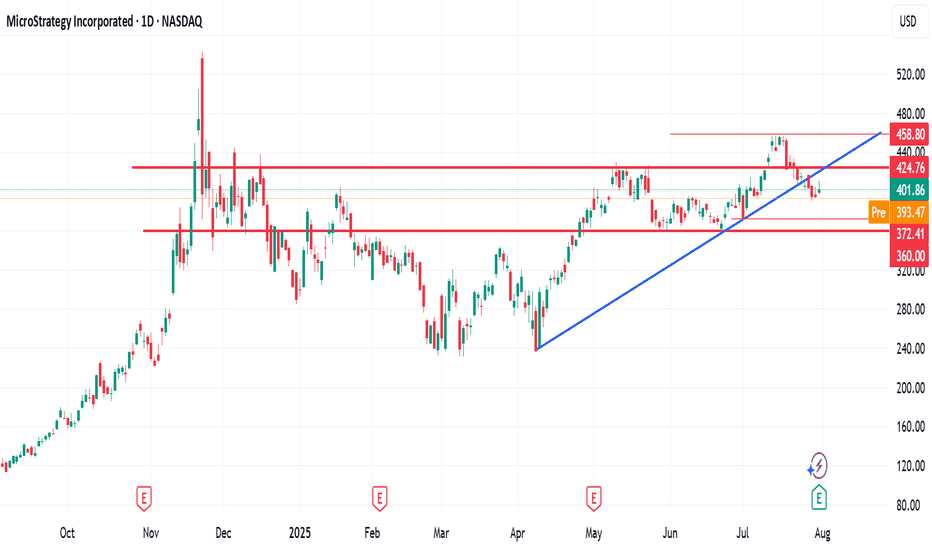

MSTR Testing Golden Fib Support – Bounce Back or Break Lower? 📊 Market Breakdown

MSTR is trading at $395.13, sitting right on the edge of the Golden Fib Zone ($395–$460) after recently failing to push through resistance. Price is holding above the equilibrium (~$333) for now, but with RSI cooling from overbought 74.41 and MACD momentum turning down, the next few sessions will decide if we bounce or break.

Trend: Strong bullish trend from 2024 lows, but recent price action shows consolidation near the top.

Key Structure: Holding above equilibrium keeps the bullish structure intact, but a close below $395 risks a drop toward $333 support.

Volume: Lighter compared to recent rallies, suggesting buying pressure is slowing.

Indicators:

MACD: Bearish crossover forming.

RSI: 66.85 – coming down from overbought, showing cooling momentum.

🛒 CALLS (Bullish Scenario)

Buy Zones:

🎯 Aggressive Entry: Hold above $395 with bullish daily candle

✅ Confirmation Entry: Break & close above $420

Take Profits:

1️⃣ $450 – Golden Fib Zone top

2️⃣ $490 – Minor resistance before supply

3️⃣ $542 – Premium/Supply Zone target

Stop-Loss: $385

Why This Works: Holding $395 and breaking $420 could spark a push back into the high $400s within 2–3 weeks.

🛑 PUTS (Bearish Scenario)

Sell Zones:

🚨 Aggressive Entry: Daily close below $395

📉 Breakdown Entry: Drop under $385 with momentum

Take Profits:

1️⃣ $333 – Equilibrium zone

2️⃣ $300 – Psychological support

3️⃣ $233 – Discount/Demand Zone

Stop-Loss: $410

Why This Works: Losing $395 puts MSTR at risk for a quick trip to $333, and possibly lower, as momentum shifts bearish.

🔍 Technical Highlights

Golden Fib Zone Test: This level is a decision point — bounce here is bullish, but a close below turns the chart bearish short-term.

Macro Watch: MSTR is heavily tied to Bitcoin’s price movement — BTC weakness = MSTR weakness.

⏳ Option Expiration Strategy:

1 Week: Short-term bounce or rejection plays around $395

2–3 Weeks: Swing toward either $450+ or $333 depending on breakout direction

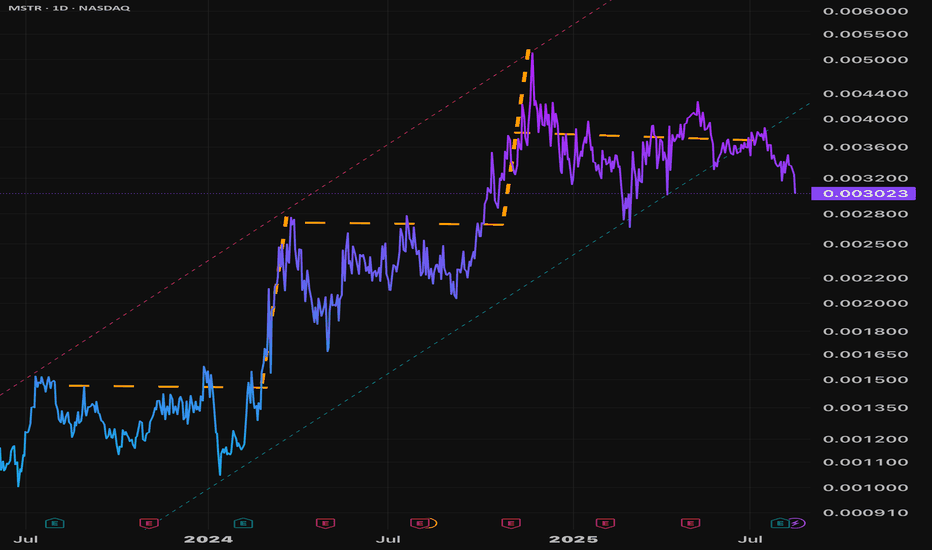

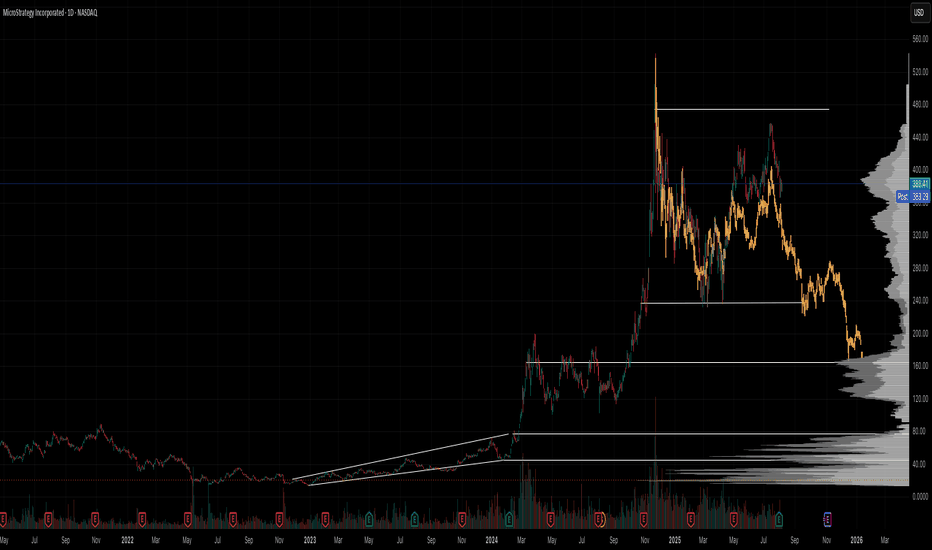

Why Pay $250K for a $115K Bitcoin? Welcome to Strategy (MSTR)This is already the third article I’ve written about Strategy (formerly MicroStrategy), and for good reason.

You don’t need to be a financial expert to ask: why buy a stock that simply mirrors Bitcoin’s price — but at a massive premium?

No matter how sophisticated the explanations may sound, or how many times you’re told that “if you don’t understand it, it must be brilliant,” the reality is much simpler — and much more absurd.

Buying Strategy today is like paying $250,000 for Bitcoin while the actual market price is $115,000.

It’s not about complexity. It’s about common sense.

I won’t dive too deep into it — no need to fight “financial sophistication” with even more sophisticated words.

The point is simple: buying Strategy is like paying me $10,000 just so I can hold your $10,000 and call it an “innovative capital deployment strategy.”

Sounds smart, right? Until you think about it for more than five seconds.

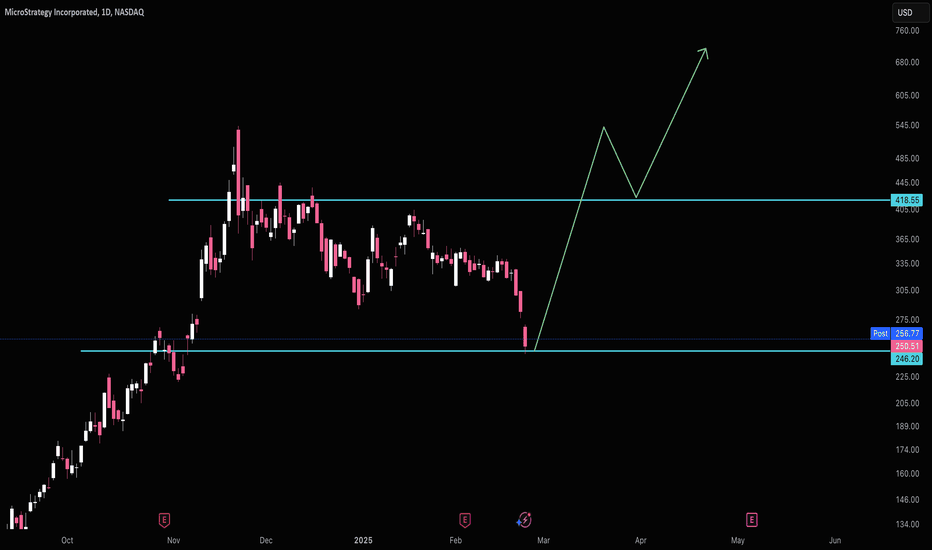

Now let’s look at the posted charts — simple and visual.

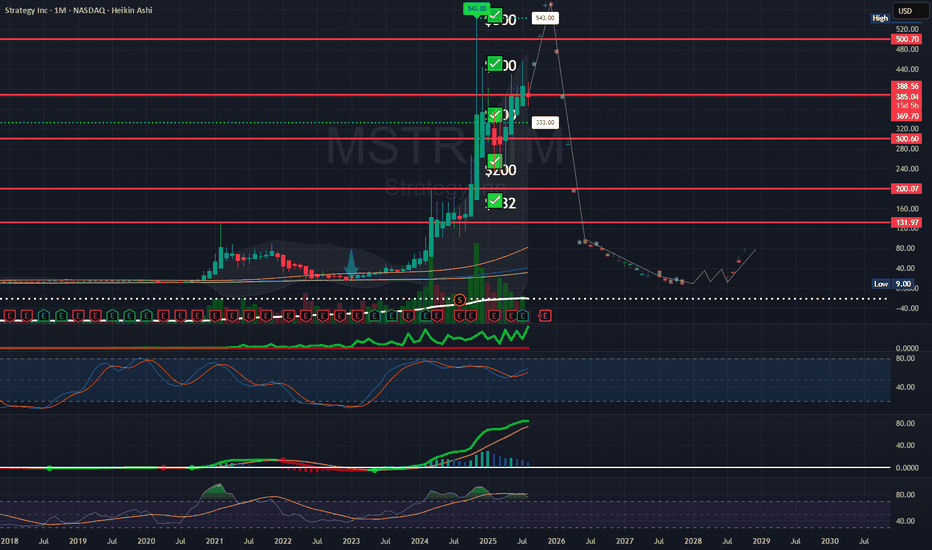

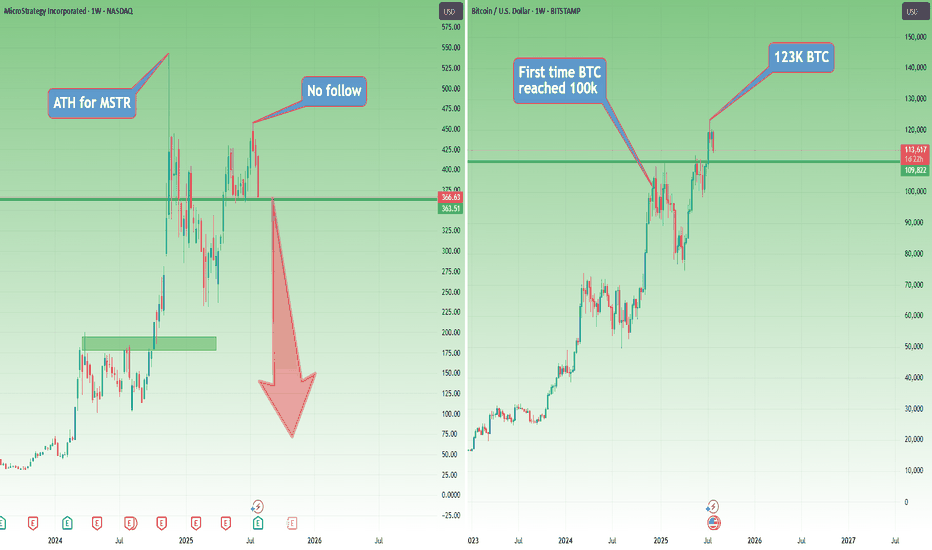

Strategy (MSTR) hit its all-time high in November 2024, right when Bitcoin first reached $100,000.

Then came a sharp correction of more than 50% for the stock.

Fast forward: even though Bitcoin went on to make new all-time highs, Strategy didn’t follow, it seems like people were finally starting to wake up.

When BTC peaked again in mid-July 2025, Strategy only managed to reach $455 — well below its November ATH.

Since then, BTC has pulled back about 10%, while Strategy dropped around 20%.

So much for the “outperformance” argument.

And here’s where things get even harder to justify:

In the past, some institutions bought MicroStrategy because they couldn’t hold Bitcoin directly. Fair enough.

But now? Spot Bitcoin ETFs are live, regulated, widely available, and charge tiny fees — without the leverage, dilution risk, or premium baked into Strategy.

So what’s the excuse now?

Where are we now?

At this moment, even though I’m not too happy about this week’s Bitcoin weakness, I remain cautiously bullish — emphasis on cautiously.

But let’s entertain a scenario.

If Bitcoin continues to correct, Strategy is sitting right on support. And if BTC breaks lower, Strategy will almost certainly follow — breaking support and heading toward the next level.

That next support? Somewhere around $240–250, depending on how deep the Bitcoin pullback goes.

But here’s the real question:

What happens if Bitcoin enters a true bear market?

Will Strategy — which just recently rebranded from MicroStrategy — be forced to rebrand again as…

NanoStrategy?

Just a Saturday thought.

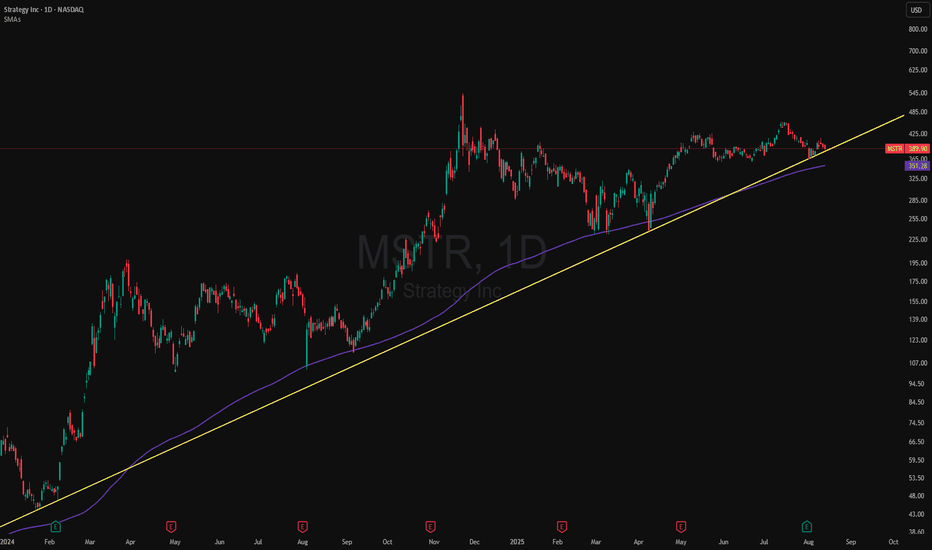

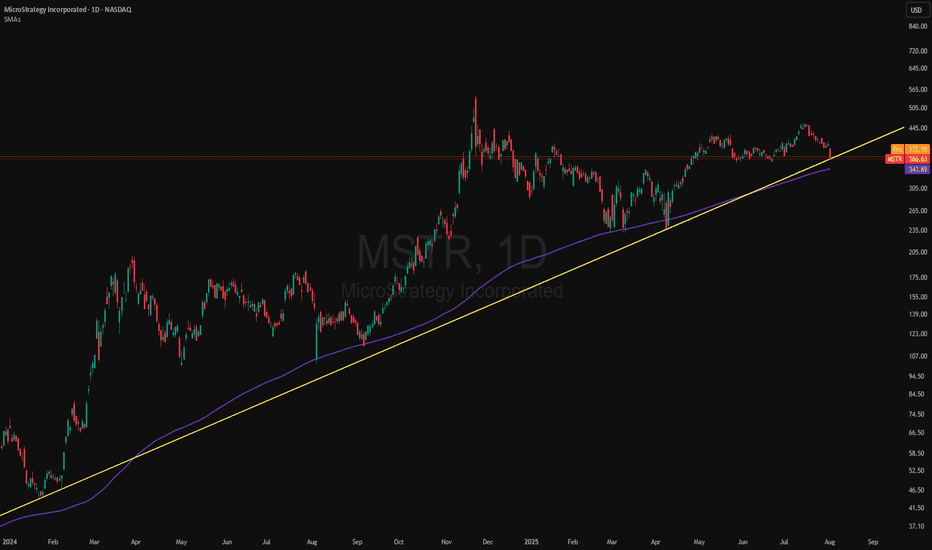

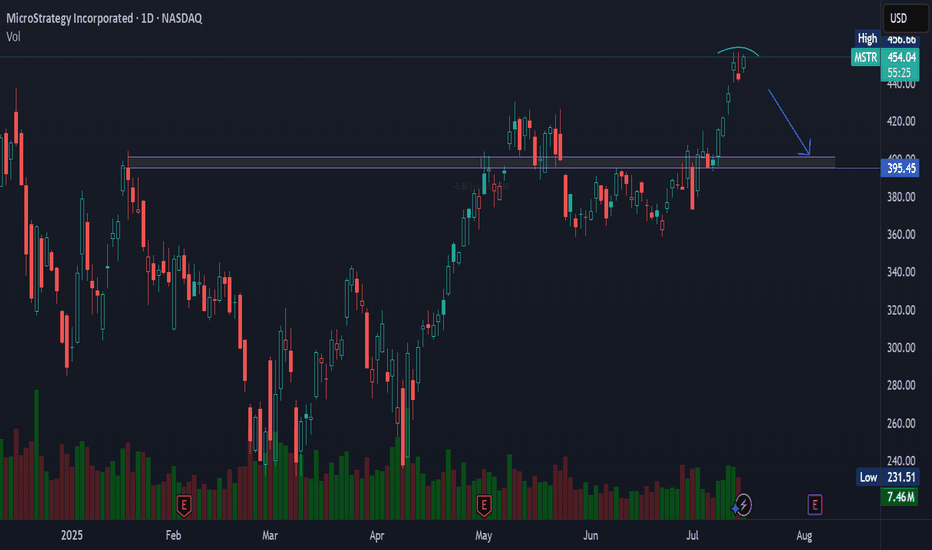

MSTR: Dual Support Test - 200 SMA & Trendline Hold… for NowMSTR (MicroStrategy) is now testing a key technical zone that combines dynamic trendline support and the widely-followed 200-day simple moving average (SMA). These two indicators have provided critical inflection points for the stock over the past year - and we’re back there again.

The current pullback may offer a pivotal bounce opportunity if buyers step in at this technical confluence.

Technical Highlights:

Long-term trendline (from early 2024) continues to hold as support.

200-day SMA has triggered rebounds multiple times, aligning closely with the trendline.

Price action is compressing into a narrowing zone - watch for resolution.

A clean break below may signal deeper correction; holding here keeps the bull case alive.

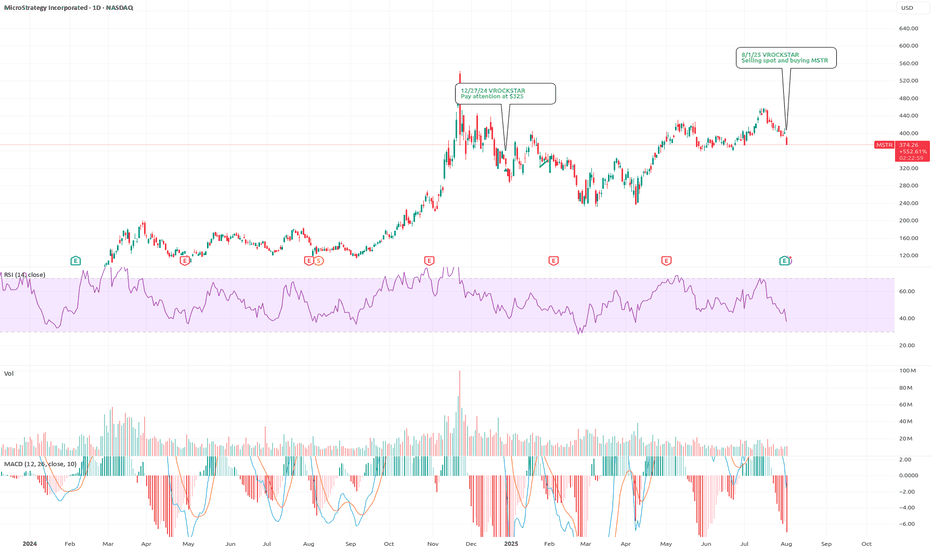

8/1/25 - $mstr - Selling spot and buying MSTR8/1/25 :: VROCKSTAR :: NASDAQ:MSTR

Selling spot and buying MSTR

- keeping it (purposefully) short today for everyone's benefit

- sold a bit of OTC:OBTC (which is nearly 15% off spot, e.g. $100k/BTC) to buy NASDAQ:MSTR MSD exposure here

- why?

- 1.6x mNAV is lowest it's been (nearly ever in current BTC move)

- Saylor not going to hit the ATM sub 2.5x, will run it hot

- Latest product further augments this runway to value accretion

- BTC still remains REALLY well bid in this current tape

- So math is like this

- ROE of BTC in "conservative" sense is 25%

- Kc (cost of capital) for Strategy is 10% again (conservative, it's really sub 10%)

- so ROE/Kc (without growth) = 2.5x book.

- A real ROE for BTC (remember this is permanent capital he's tapping, so no asset-liability mis-match) is 35%

- True Kc for this is sub 10%, but let's still say 10%. that's 3.5x book.

Therefore let's even say 2x book (below both of the above) is 2/1.6 = 25% upside. If/do you think that BTC can go back to low 90s, ofc this might contract further (the 1.6x) but at the same time, you have EVEN higher implied ROE and R/R only improves.

So at a minimum, i'd guess your R/R is "balanced" here in the most conservative scenarios. And if we do get BTC bid, this will rocket at this stage thru YE and far exceed px appreciation of it's BTC pair.

Ok that was longer than I intended. Felt important to convey math and up/downside parameters.

Be well. Everyone loses money in correlation 1. Just make sure you find the betas that have the first bids. Right now that's BTC and some quality names doing 6-7% fcf yields and growing.

I like

OTC:OBTC (adding fuel w/ my NASDAQ:MSTR calls)

NASDAQ:NXT

NYSE:DECK

NASDAQ:LULU

NYSE:FI

<3

V

MSTR still bullish. MSTR bullishness is still intact but it should close above the upper yellow line for the bullishness confirmation intact. If that happens then there's a big possibility that we will see a big sharp last parabolic run to new ATH. Of course this is not financial advised.

If this failed then the last hope is on the Red Line.

Monthly $MSTR Bullflag MicroStrategy is forming a textbook bull flag on the monthly, right after a massive vertical leg from sub-$200 to over $500.

Strong pole ✅

Tight consolidation near the highs ✅

Monthly closes holding above prior resistance ✅

This thing is coiling under ~$455. Once it breaks, it could easily send toward $800–1000+, especially if CRYPTOCAP:BTC keeps surging. BTC already confirmed a major cup & handle — MSTR just lagging a bit.

High timeframe structure + BTC correlation = explosive potential.

Watching for volume + breakout confirmation. Let’s see if it rips.

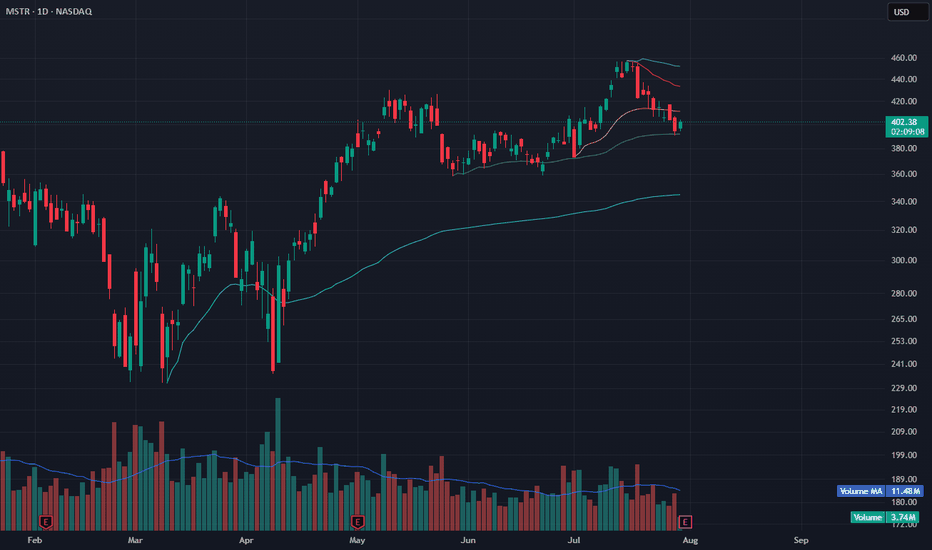

MSTR Holding VWAP Support – Reversal Attempt but Earnings AheadMSTR bounced nearly 2% today after testing anchored VWAP support near $390. This recovery comes after a steady pullback from the recent $460 high. Price is holding above the yellow VWAP and just above the green zone, signaling possible short-term support.

However, volume remains light (3.72M vs. 11.47M average), indicating cautious buying — and earnings are scheduled for tomorrow, which introduces added volatility risk. A close above $410 post-earnings would strengthen the bullish case.

Until then, this remains a speculative long setup with event risk.

Indicators used:

Anchored VWAP (support zone: $390–395)

Volume vs. Volume MA (light = indecision)

Earnings date = risk trigger

Entry idea: Only after earnings reaction; ideally above $410

Target: $430–440

Stop: Below $388 or earnings miss

$MSTR Weekly Ascending TriangleMicroStrategy has been consolidating within a textbook ascending triangle pattern, with a clear resistance around $520 and rising higher lows forming solid support. Price action remains inside a strong bullish channel, hugging the 50-week MA and riding above the 200/350 MAs.

A breakout above $520 could trigger a strong continuation toward the upper bounds of the channel, with potential long-term targets around $1300 if momentum aligns with Bitcoin strength.

Watching for volume confirmation and weekly close above resistance for validation. Breakdown below the yellow trendline would invalidate the setup.

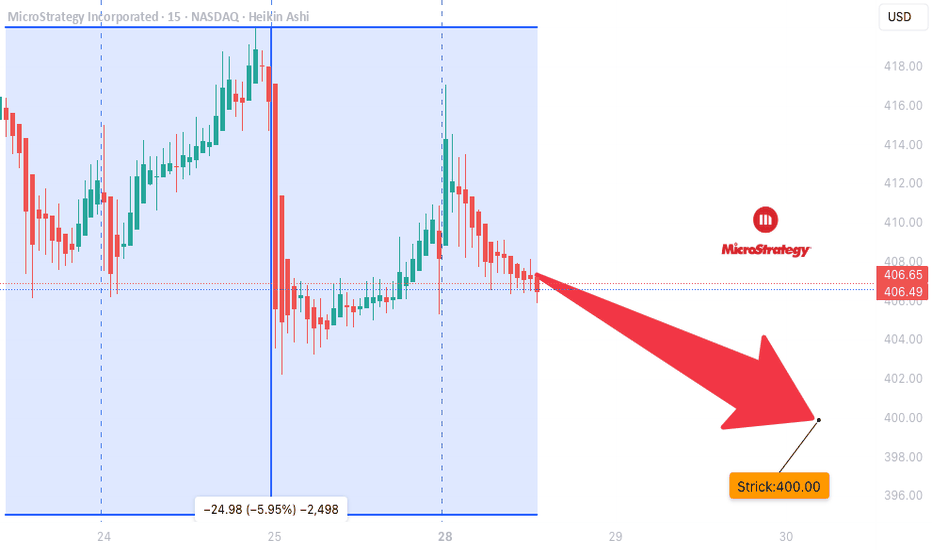

MSTR WEEKLY OPTIONS SETUP (2025-07-28)

### 🔻 MSTR WEEKLY OPTIONS SETUP (2025-07-28)

**Bearish Divergence with High Confidence — Time to Strike with a PUT?**

---

📊 **Momentum Recap:**

* **RSI:** Bearish 📉

* **Volume:** Weak (institutional exit risk)

* **Options Flow:** Mixed (calls > puts, but no alignment with price)

* **Sentiment Models:** Split 4:1 → **Only Claude/Anthropic** goes bearish with conviction

🧠 **Model Consensus:**

> “Momentum is weak, volume fading, and no upside confirmation = bearish edge.”

---

### ✅ SETUP OVERVIEW

* 🔍 **Trend:** Bearish (declining RSI)

* 📉 **Volume:** Weak = reduced institutional conviction

* 💬 **Options Flow:** Bullish bias, but **contradicts price trend**

* ⚙️ **Volatility:** Elevated, potential reward for directional plays

**Overall Bias:** 🔴 *Moderately Bearish*

---

### 💥 TRADE IDEA: MSTR \$400P

* 🎯 **Strategy:** Long Weekly Put

* 🔻 **Strike:** 400.00

* 📆 **Expiry:** Aug 1, 2025

* 💸 **Entry Price:** \$8.65

* ✅ **Profit Target:** \$12.50

* 🛑 **Stop Loss:** \$4.00

* 📈 **Confidence Level:** 72% (backed by Claude model)

* 📉 **Breakdown Trigger:** Below \$405 confirms bearish flow

* ⚠️ **Invalidation:** Break above \$415 → exit early

---

### 📦 TRADE\_DETAILS (Backtest/Algo Ready JSON)

```json

{

"instrument": "MSTR",

"direction": "put",

"strike": 400.0,

"expiry": "2025-08-01",

"confidence": 0.72,

"profit_target": 12.50,

"stop_loss": 4.00,

"size": 1,

"entry_price": 8.65,

"entry_timing": "open",

"signal_publish_time": "2025-07-31 09:30:00 UTC-04:00"

}

```

---

### 🧠 TRADE INSIGHTS

* 🟥 4/5 models say **no trade** due to signal divergence

* 🧠 **Claude’s bearish thesis = cleanest directional setup**

* 🚨 Volume + RSI combo = downside confirmation

* 🧭 Watch key price reaction zones: **\$400–\$405 (support)** / **\$415 (resistance cap)**

---

**#MSTR #PutOptions #WeeklyTrade #BearishSetup #OptionsFlow #QuantTrading #ClaudeModel #MarketMomentum**

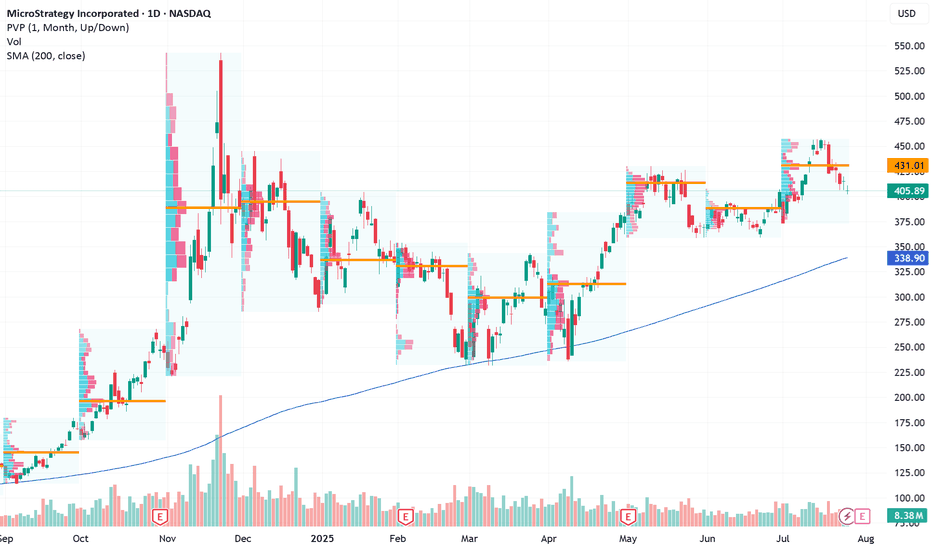

Long-Term Bitcoin Proxy Positioned for Next Upside RallyCurrent Price: $405.89

Direction: LONG

Targets:

- T1 = $418.50

- T2 = $425.99

Stop Levels:

- S1 = $399.50

- S2 = $386.20

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in MicroStrategy.

**Key Insights:**

MicroStrategy is uniquely positioned as the largest corporate Bitcoin holder, meaning its stock price is closely tied to Bitcoin's movements. The company holds over 68,000 BTC, making it a favored choice for investors aiming to benefit from Bitcoin's potential breakout. Recent bullish market sentiment and positive institutional positioning in cryptocurrency-related equities add strength to the Long scenario.

Short-term price metrics also confirm a bullish bias, with options flows targeting calls and aggressive price strikes above current levels. However, flexibility is required as Bitcoin remains highly volatile ahead of macroeconomic shifts and Bitcoin-specific technical resistance levels.

**Recent Performance:**

MicroStrategy's stock has gained momentum over the past month, trading in tandem with Bitcoin's recent stability in the $27,000-$28,000 range. Last week, MicroStrategy saw increased interest among institutional investors, as options targeting a sharp rally were opened at key resistance levels. This suggests confidence among professional traders about crypto recovery prospects.

**Expert Analysis:**

Analysts argue the stock could serve as a leveraged play on Bitcoin’s trajectory, especially during bullish setups like MicroStrategy’s upcoming quarterly reports. Some experts point to Bitcoin’s struggle to break above $30,000 as an immediate risk, yet highlight MicroStrategy’s firm association with Bitcoin as an advantage. Beyond crypto exposure, MicroStrategy’s operational restructuring and debt management efforts further bolster its appeal as a dual-tech and crypto equity.

**News Impact:**

MicroStrategy’s long-term strategy continues to blend Bitcoin maximization with tech-driven operational focus. Recent comments from management emphasize continued cryptocurrency accumulation despite market fluctuations, securing its place as a pro-Bitcoin institutional equity. The upcoming earnings report could provide deeper insights into strategic moves for 2024, driving a post-earnings rally.

**Trading Recommendation:**

MicroStrategy presents a compelling buy opportunity for investors betting on Bitcoin-led equity rallies. Technical setups align with improving sentiment and disruptive news catalysts around macroeconomic policies supporting crypto stability, triggering higher upside potential. Long setups above $405.89 show bullish targets to $418.50 and $425.99, while flexible stop placements provide downside protection amidst broader Bitcoin resistance risks.

MSTR - Where it goes only BTC knows📊 MSTR – MicroStrategy Technical & Bitcoin Correlation

Ticker: MSTR | Sector: Bitcoin Treasury Proxy / Enterprise Software

Date: July 26, 2025

Current MSTR Price: ~$405.89

Current Bitcoin Price: ~$118,127

🔍 Chart & Price Structure

Recent Action: MSTR declined from the ~$430–450 range and has consolidated around the $405 level, forming a tight base.

Support Zone: $395–$400 — prior volume cluster, recent dip buyers stepped in.

Weak Resistance: $415–$420 — a shallow supply zone; bigger resistance lies at ~$430.

Volume & Candles: Mixed volume, with small-bodied candles showing indecision near $405. Buyers are attempting to hold.

📈 Bitcoin Outlook & Influence

MicroStrategy remains tethered to Bitcoin’s trajectory. Recent BTC consolidation around $118K closely influences MSTR sentiment.

BTC Projections

From Citi (Jul 25):

Base Case: $135K by year-end

Bull Case: $199K

Bear Case: $64K if equities falter or ETF flows wane

Other Views:

Hashdex sees BTC reaching up to $140K in 2025

Omni Ekonomi

Global X ETF-based models anticipate $200K within 12 months

The Australian

Kiyosaki warns of potential crash despite optimism

These imply a possible 25–70% upside in BTC, which could drive MSTR toward $500–$600+ if holdings are stable.

⏱️ Short-Term Outlook (1–2 Weeks)

✅ Bullish Scenario

Trigger: Hold above support at $400, reclaim $415–$420

Immediate Upside Targets:

First: $430

Break above $430 → $450

Drivers: Bitcoin breaking back above recent highs, ETF inflows, favorable regulatory headlines

❌ Bearish Scenario

Trigger: Break below $395

Downside Targets:

$380 → $360 → $350

Drivers: BTC weakness → below $110K, altcoin rotation, broader equity weakness

🔭 Long-Term Outlook (H2 2025 / beyond)

🚀 Bull Case

If Bitcoin reaches $135K–$200K (Citi bull case, institutional demand, ETF momentum), MSTR could rally alongside to $550–$650.

MicroStrategy’s business fundamentals (data analytics/AI) may contribute optionality beyond BTC.

🐻 Bear Case

If Bitcoin retraces toward $64K or below due to risk-off sentiment or regulatory changes, MSTR could fall back toward $300–$350.

📊 Summary Table

View Trigger Level Targets Bitcoin Scenario Confidence

Short-Term Bull Above $405 and reclaim $415–420 $430 → $450 BTC > $118K and flat-to-up Moderate

Short-Term Bear Below $395 $380 → $360 → $350 BTC dips < $115K Moderate

Long-Term Bull BTC to $135K–$200K $550 → $600+ ETF inflows + adoption acceleration High (if BTC strength)

Long-Term Bear BTC drops below $110K $350 → $300 Sentiment collapse or regulation Moderate

🧠 Conclusion

MicroStrategy’s stock remains inherently tethered to Bitcoin performance. The $395–$405 zone acts as critical support, while a push above $415–$430 could signal renewed upside. Longer-term, BTC strength into the $135K–200K range would propel MSTR toward $600+ levels; a BTC pullback could drag it toward $300 or lower.

Watch Bitcoin flows, ETF updates, and pillar crypto adoption trends—these are likely to dictate MSTR’s next leg.

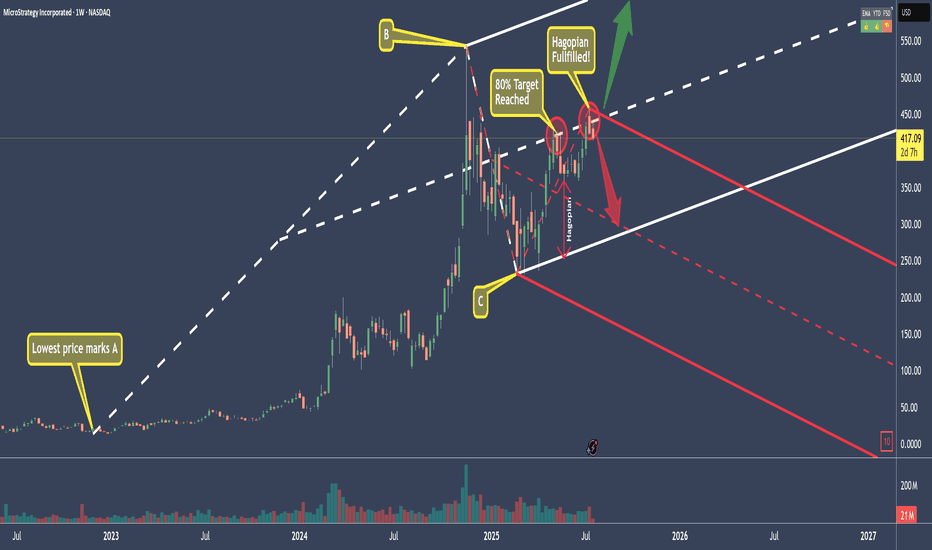

MSTR - Microstrategy Short...for now.The White Fork is created by choosing point A, which must be the lowest price before the swing.

B and C are the natural high and low of the swing we want to measure.

What this gives us is a Pitchfork that projects the most probable path of price.

Additionally, with the three lines that make the Fork, we have the natural extremes above, below, and the center—the mean.

We can see that price started to rise in March 2025.

The 80% rule states that price will reach the Centerline around 80% of the time.

And as we see, it did this time as well. Price reached the CL (Center Line), and immediately the big whales dumped positions.

Then price fell—only to be picked up before reaching the Lower Line, also called the L-MLH or Lower Median Line Parallel.

When price can't make it to this (or any of these) lines, we call this a 'Hagopian,' because it follows 'Hagopian's Rule.' This rule says that if price can't reach 'the line' (the L-MLH in this case), there is a high chance that price will reverse in the previous direction (up in this case), and even go further than where it came from (the Centerline).

And as we see, price indeed traded upwards—beyond where it came from—and overshot the Centerline (CL).

Unfortunately for long-positioned traders, the gas in the goose was empty, and price now starts to head south again, missing the target, which would have been the U-MLH (Upper Median Line Parallel).

So, the open happened below the CL!

If we also see a close this week, I'm ready to initiate a short trade.

Why?

Well, as before, Hagopian’s Rule applies—an indication that price will trade further down than where it came from, which is below $361.

And since we know that the natural target is the Centerline about 80% of the time, we have a heck of a good chance that we’ll be happy campers in a couple of weeks. :-)

With a risk/reward of about 2 to 3, and such a high chance of a profitable trade, I’ll sleep like a baby in the coming weeks.

The trade idea would be cancelled if price closes above the CL this Friday.

Let’s stalk it closely...

Possibility for MSTRIf bitcoin moves, Strategy moves.

I am no expert, so this is just for entertainment purposes.

But Strategy is acquiring bitcoin like there is no tomorrow and bitcoin inelastic supply tend to give a way to radical and fast grow in price.

Hence why I'd be keen to see MSTR move as much as I show in this chart.

MSTR – On the Path to New ATHI was initially skeptical about the recovery structure unfolding since the April lows — it looked like a possible macro lower-high before deeper correction (as outlined in my previous idea).

However, given the strength in underlying #BTC price action (covered in my recent video-idea on crypto trend structure) and clear signs of constructive consolidation and accumulation during the July breakout, Isee strong odds for follow-through toward the 520–570 resistance zone in the coming weeks.

This move may align with CRYPTOCAP:BTC testing its macro resistance near 130K (see my macro BTC analysis on the idea section).

If NASDAQ:MSTR can break above 570 and sustain a close above it, it opens the door to a potential immediate follow-through toward the 650–755 macro resistance zone. But a scenario for more prolonged consolidation around 570 would in fact serve as a solid base for more stable and prolonged next long-term leg higher.