BRENT3! trade ideas

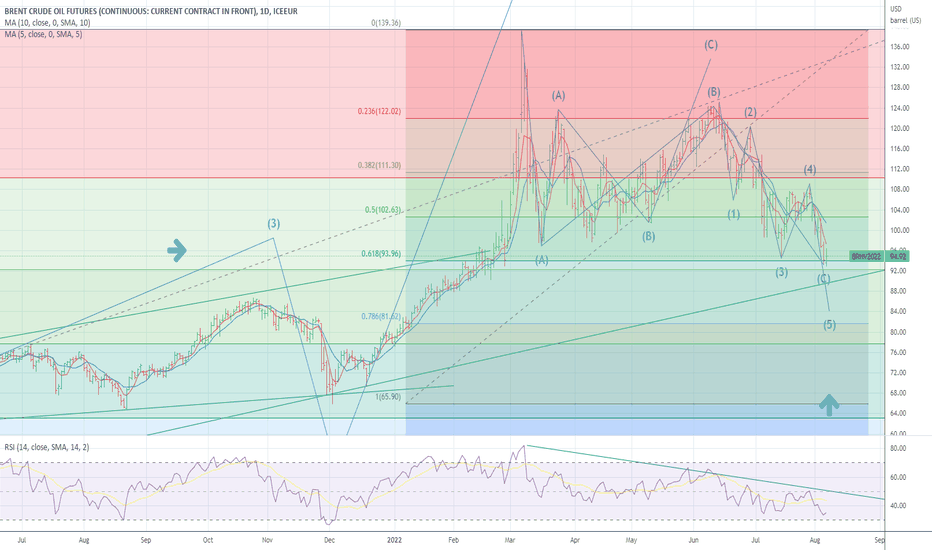

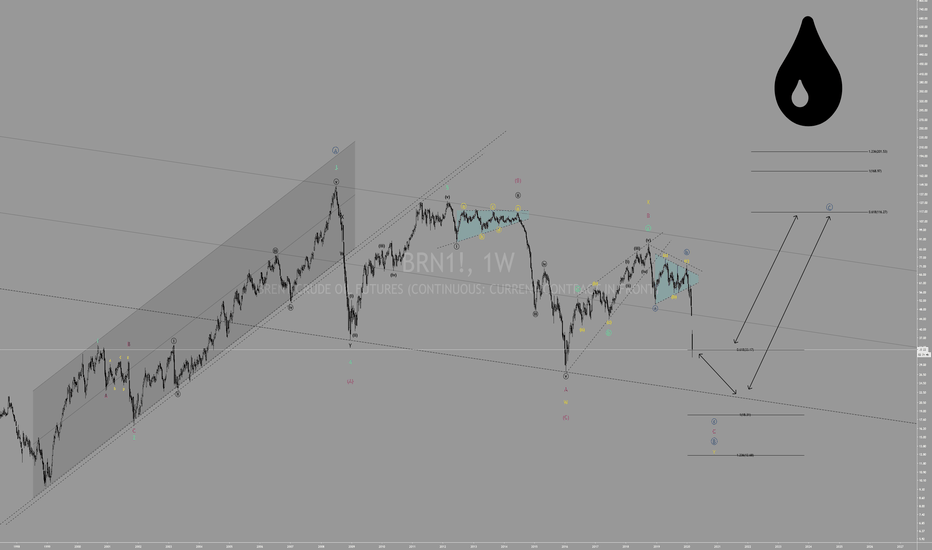

OIL B O T T O M E D fib .618 and .382 We have dropped to a max bearish on OIL we have now pulled back to .618 and .382 near perfect and wave structure reflect the massive view of trades from major bullish view at it peak to today . one of the max BEARISH view . watch for a very sharp move up as an event in the world unfolds rapid

What’s Hot: Is it all bears from here for oil prices?How have oil markets evaded the bearish sentiment in equities in the last six months? Have the fundamentals between the two risk markets really diverged or, as the OPEC1 claim, oil markets have simply been panicking? Is the discrepancy now getting corrected?

Might the cure for high prices be high prices?

Commodity prices are ultimately a function of demand and supply. Energy consumption isn’t inelastic, i.e., when prices rise due to supply constraints, consumption isn’t unaffected. Discretionary spending on energy can be reduced by limiting non-essential car and plane journeys. Painful? Yes. But doable? Also, yes.

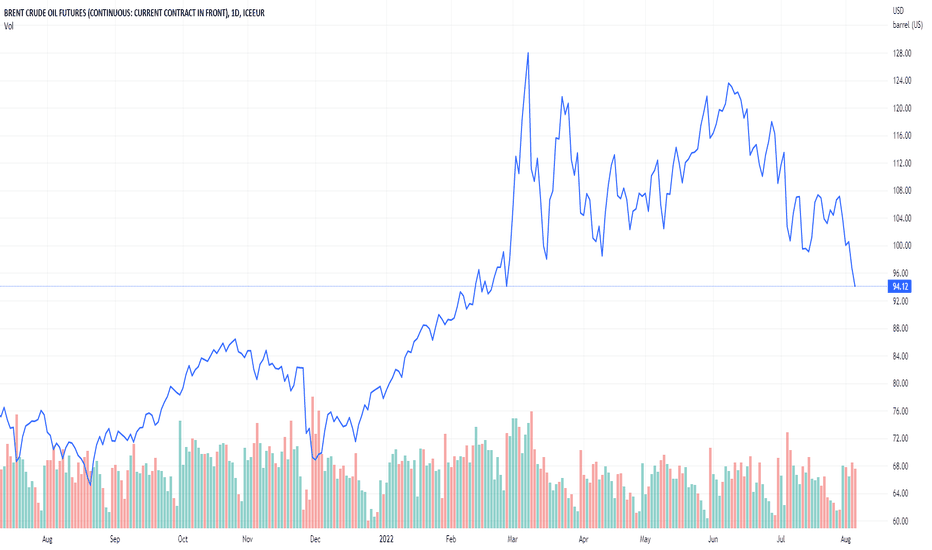

Even where things stand now, global demand and supply figures do not necessarily support the bull run in oil markets in recent months. According to the International Energy Agency, global oil demand was 99.2 million barrels per day (mb/d) in June while supply stood at 99.5 mb/d. Moreover, global oil supply is expected to average 100.1 mb/d in 2022 before hitting an annual record of 101.1 mb/d in 20232.

So, Brent oil prices exceeding $123/barrel in June, up from under $78/barrel at the start of the year3, doesn’t seem like a function of on the ground demand and supply dynamics.

Further demand destruction on the cards?

China is still pursuing a zero-Covid policy, and forty-one Chinese cities are under full or partial lockdowns or district-based controls, covering 264mn people in regions that account for about 18.7 per cent of the country’s economic activity4. China is the second largest oil consuming country in the world and further lockdowns could dent demand again, as they have in recent months (see figure 02).

What does OPEC say?

Saudi Arabia and the United Arab Emirates (UAE), the two countries where most of OPEC’s spare capacity sits, have both resisted pressure until now from the West to increase supply in the wake of rising prices. While some have seen this as the group’s inability to increase output, the US Energy Information Administration (EIA) state that OPEC’s spare capacity in the second quarter of this year was 2.85 mb/d and will remain above 2.5 mb/d through 2023. This is much higher than the 2003-2008 period when price rallied sharply, and spare capacity was below 2.5 mb/d5.

The OPEC have repeatedly asserted that the case for increasing supply at a faster rate is not strong enough as prices have rallied due to markets panicking over the Russia-Ukraine conflict.

Oil bulls can easily argue that OPEC could cut production if demand slows down meaningfully and this could cause prices to rise. Admittedly, this is possible. But it seems like the group is taking a more measured approach in view of the medium term demand outlook rather than making hasty decisions, in raising supply now and cutting later.

Is tackling oil prices the solution to inflation?

Probably yes. Consumer spending in the US has exceeded pre-pandemic trend levels. This is certainly not the case in Europe. But inflation is equally rampant in both regions. Energy prices are arguably playing a larger role in driving inflation than other components of aggregate demand. Perhaps governments can help their central banks avoid pushing their economies into a recession by rethinking energy policy and sanctions. While Russian oil exports fell slightly by 250 thousand barrels/day (kb/d) in June to 7.4 mb/d, export revenues increased by $700 million month on month to $20.4 billion due to higher prices, 40% above last year’s average6. So, the West’s plan to punish Russia via the oil market doesn’t seem to be working.

What’s the bottom line?

Oil prices were on the rise at the start of the year on expectations that demand might outpace supply as people start travelling again. But while chaos at airports around the world does confirm that travel activity has picked up, supply has been ample to meet the additional demand.

And then there has been the Russia-Ukraine conflict. Some might call it panic, other might call it a geopolitical risk premium. Either way, the perceived risk of supply shortages has helped sustain oil prices higher while equities, and other risk assets, have pulled back on recessionary fears. Markets may now be moving to address this discrepancy.

Sources

1 The Organization of the Petroleum Exporting Countries.

2 According to the International Energy Agency’s Oil Market Report July 2022.

3 Source: Bloomberg.

4 Source: Financial Times article from July 18 quoting a report from Nomura.

5 Source: US Energy Information Administration, data as of 12 July 2022.

6 According to the International Energy Agency’s Oil Market Report July 2022.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Brent Oil commodity Europe Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

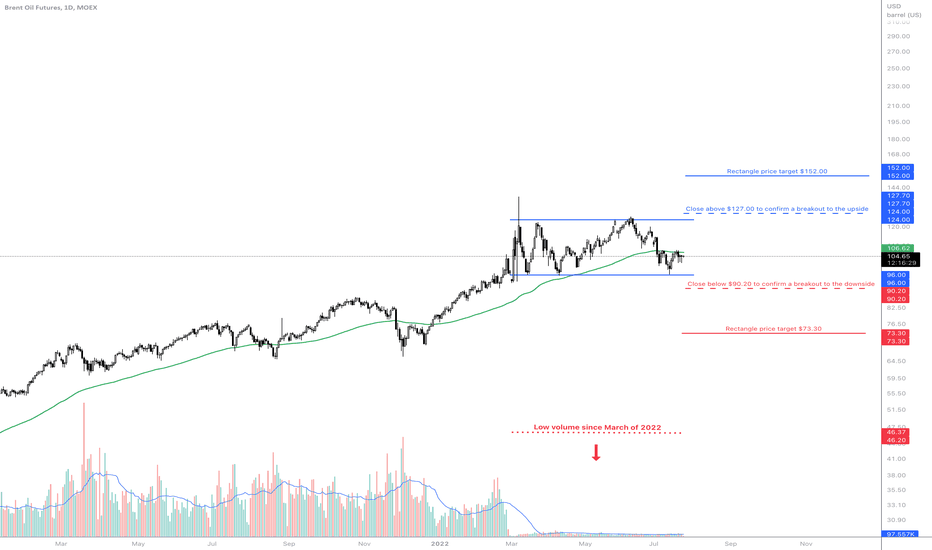

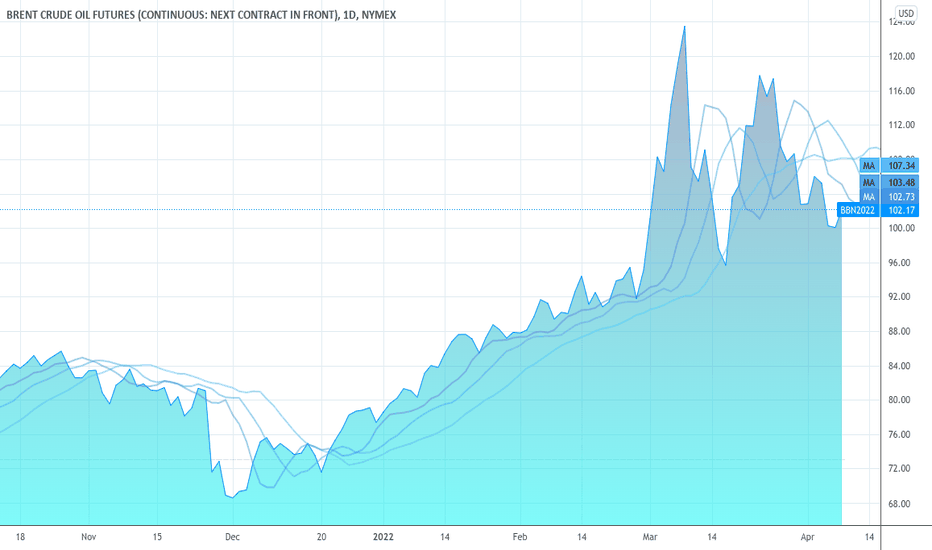

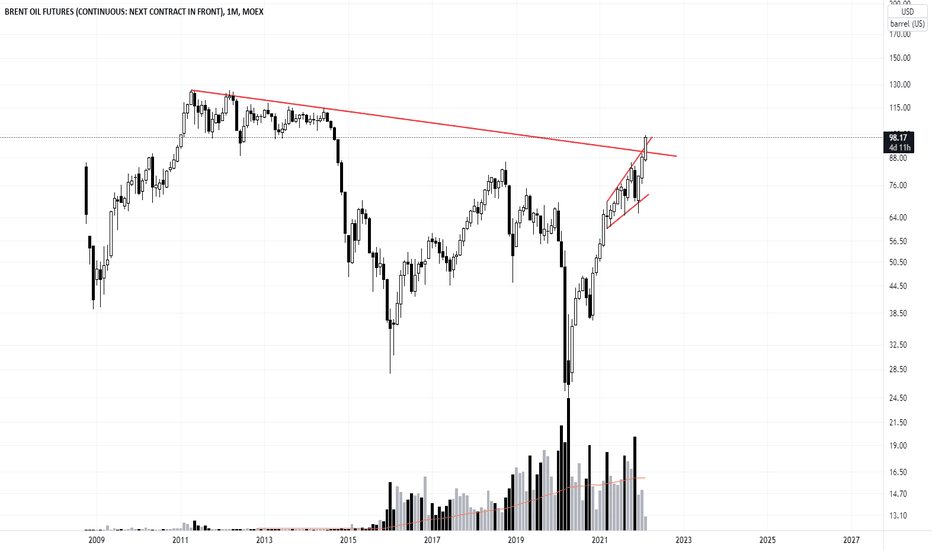

Brent Oil in trading range, low volumeMOEX:BR1! Brent Oil Futures has been in a trading range since March of 2022 on the daily chart forming a rectangle pattern. The support is found at $96.00 and the resistance at $124.00.

A close above $127.00 will confirm the pattern's breakout, with a target price of $152.00.

A close below $90.20 will confirm the pattern's breakout, with a price target of $73.30. Note that not every price target is met.

$BR1! has been trading below the 100 EMA since the first week of July of 2022.

It is essential to observe the low trading volume since the month of March. A low volume after an uptrend could indicate that the trend is ending, and a reversal might start.

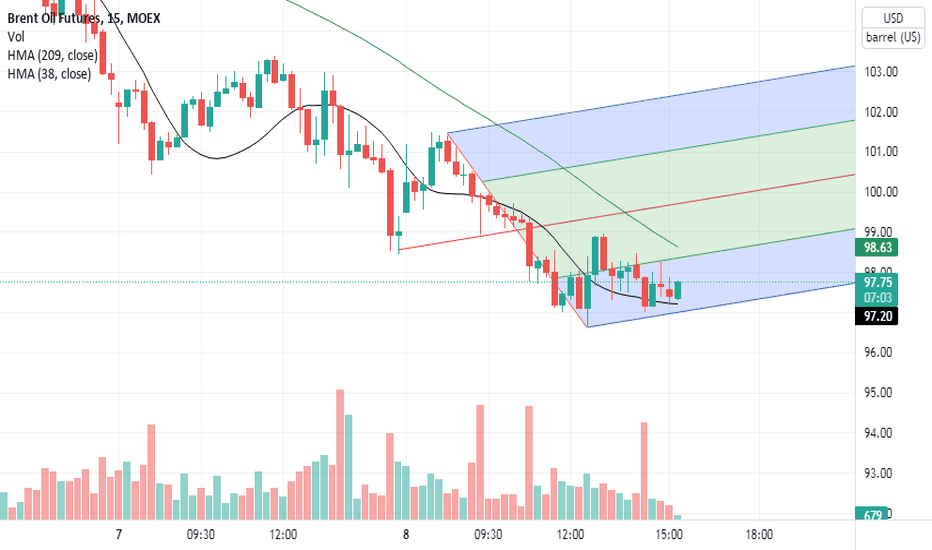

Is the oil market a correction pattern being completed ?Hello traders, it seems that the correction pattern of oil is being completed, but there is a possibility that the rise will continue if the ceiling of the third wave is broken, otherwise the correction structure will continue. Good luck and be patient in trading.

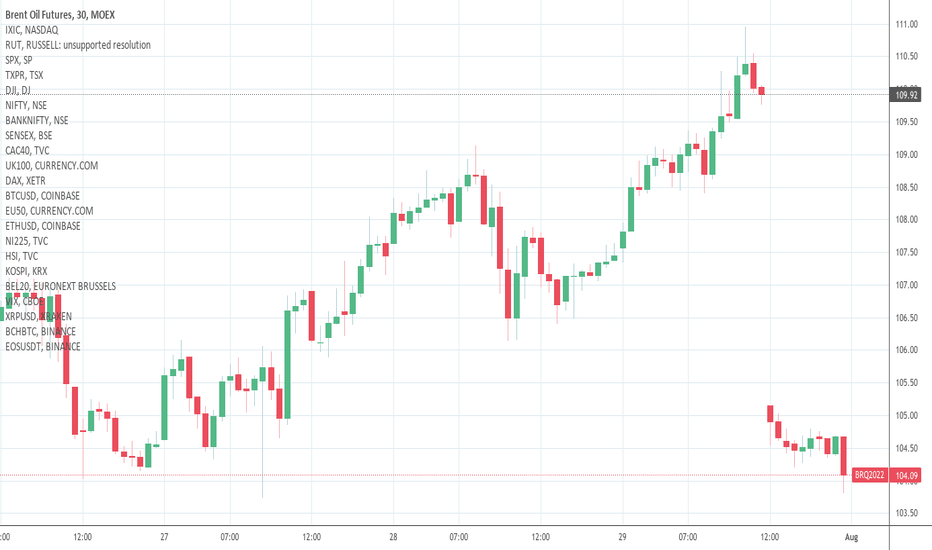

Growth of Brent crude oil, ceased?! HEY traders, what's going on today?!

Oil is down ahead of Biden's trip to Middle East , and it seems that want to be decreased more

Prices of crude oil futures decreased by over 2% on Tuesday as market participants assessed United States President Joe Biden's chances of negotiating an increase in oil production from OPEC countries during his trip to the Middle East later this week. so it seems the geopolitical situation shows the declining of the price of oil it the future.

Also the another coronavirus wave in Asia and global economic downturn concerns could threaten demand for crude.

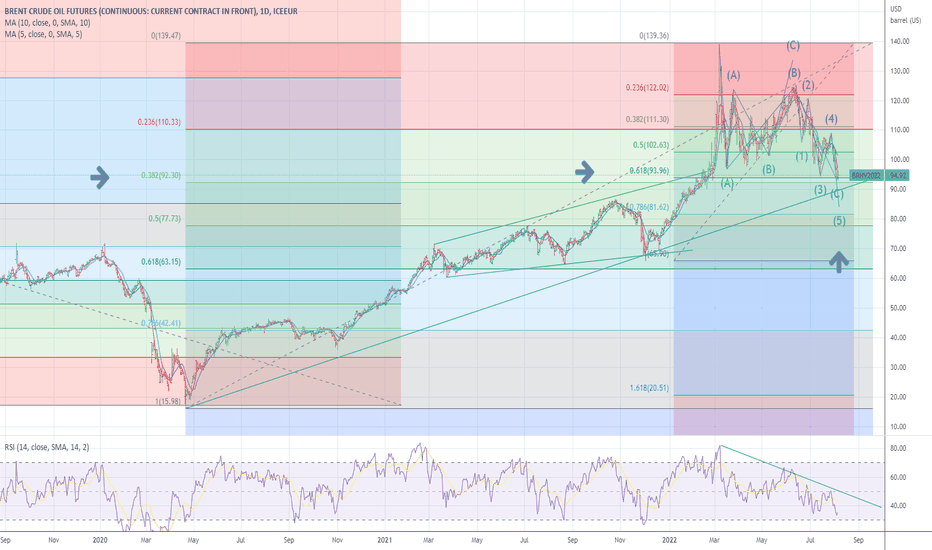

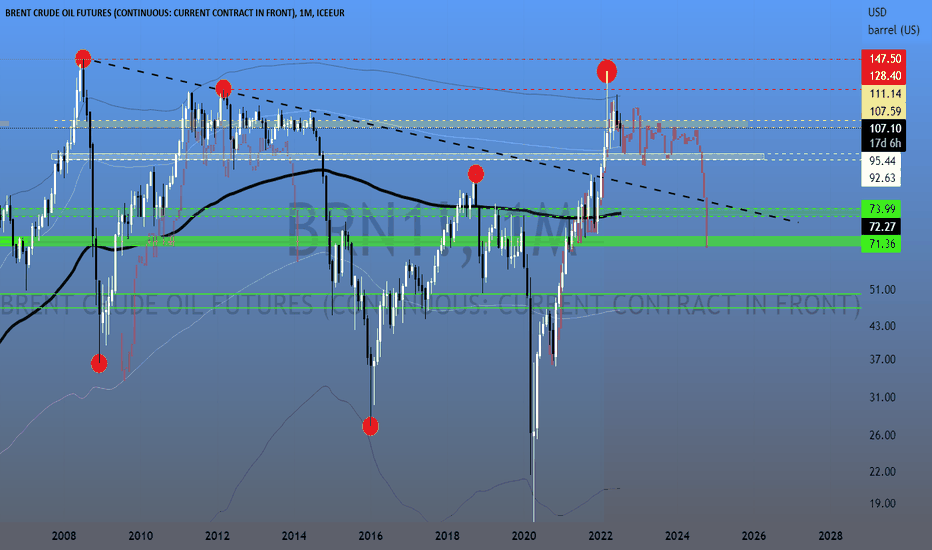

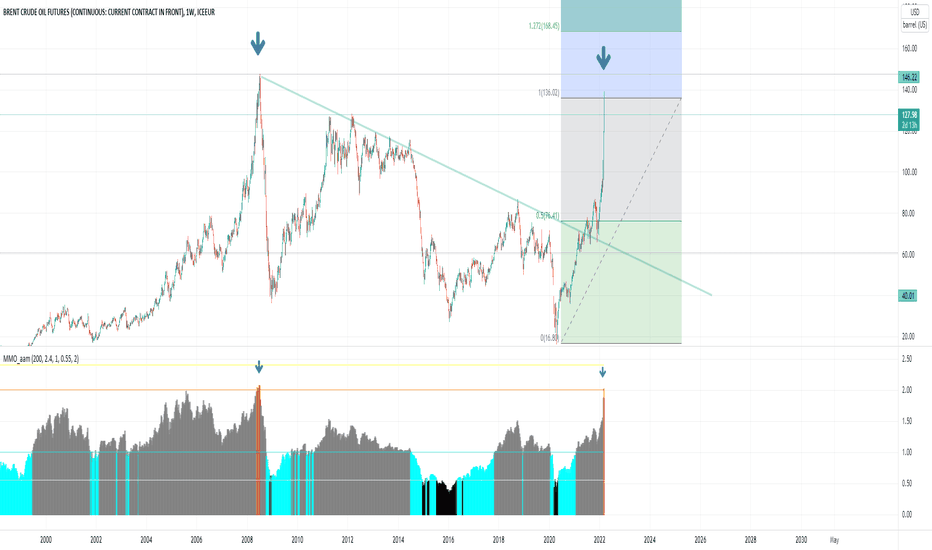

and as we can BRN1! has been going all the way up from 16$ to 139$ , So now I thing it can correct now on the lower support zone in the mid-term , or according to bars pattern can follow the the rest candles .

news sources :teletrader.com

✌️ Good luck with your trading and investing and remember: Trade smart…OR JUST DON’T TRADE!

--------------------------------------------------------------------------------------------------------------------

👉This analysis is my personal opinion ,not a financial advice ,so do your own research.

💜 if you're fan of my analyses please follow me , give a big thumbs 👍 OR drop a comment 🗯

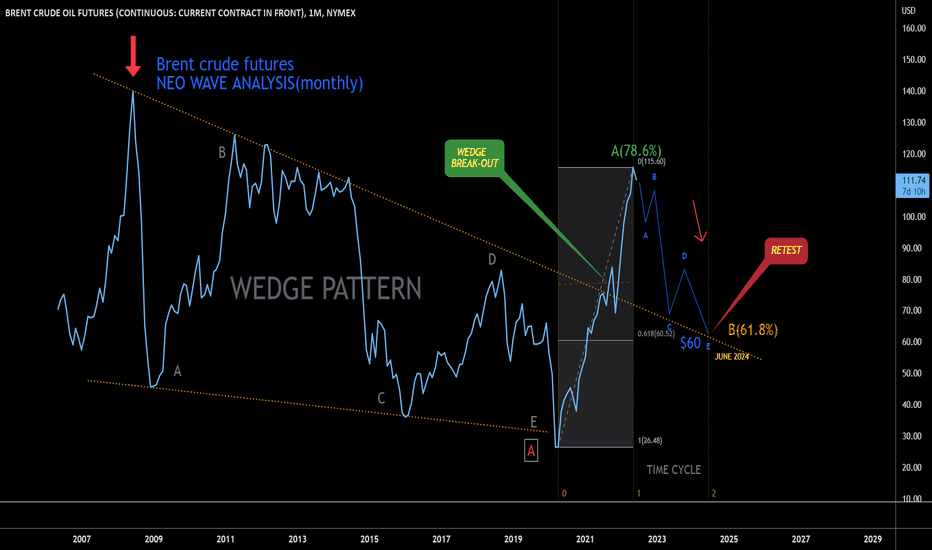

Don't worry crude will cool to $60Brent crude completed its 'A' wave after a WEDGE break-out.

It reached 76.8% of wave 'A'@$115.60, and started to fall

Economical slow down will not support its way up,

the result is formation of wave 'B' downwards until 61.8% of wave' A' ($60)

the maximum time as per Neo wave is june24

Brent Oil commodity USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Energy was the best trade short term, 125$ will be the topAnd energy will remain the best trade in long term. (going to 185$+ in next cycle).

Beautiful double top is forming.

However, because of the coming crash. Energy will follow indices even if less than during covid.

So I feel the objective to be around 43$

Brent Oil Commodity Europe Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

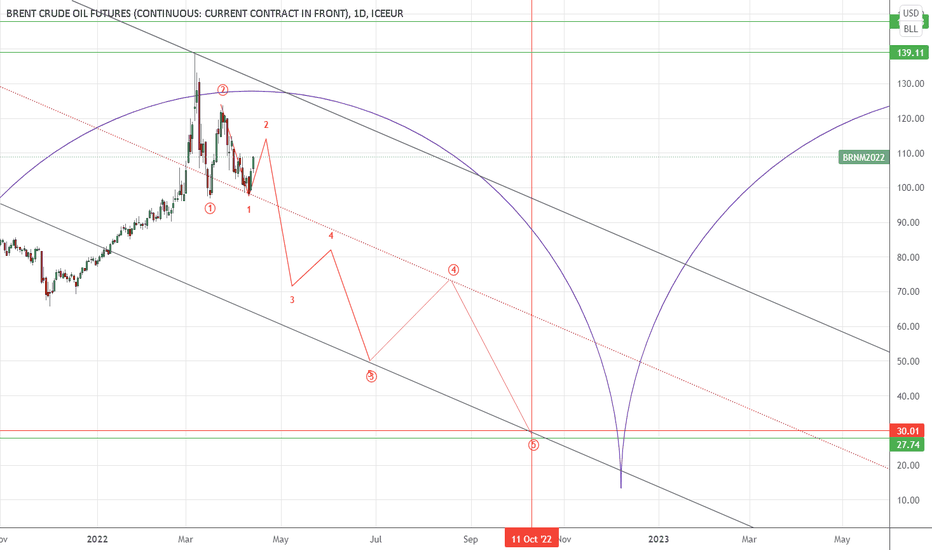

Oil short setup updateHere is how I see crude going down to 30+ zone into the end of this year. 1-2 / 1-2 set up is almost complete, we should see a strong move down starting end of April/early May. First support is 70+ zone, then 50, and 30 to complete the whole structure. I expect a long lasting (10+ years) bullish trend afterwards.

Brent Oil Commodity USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Brent UK USA Europe Commodity Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Brent Oil Commodity USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions