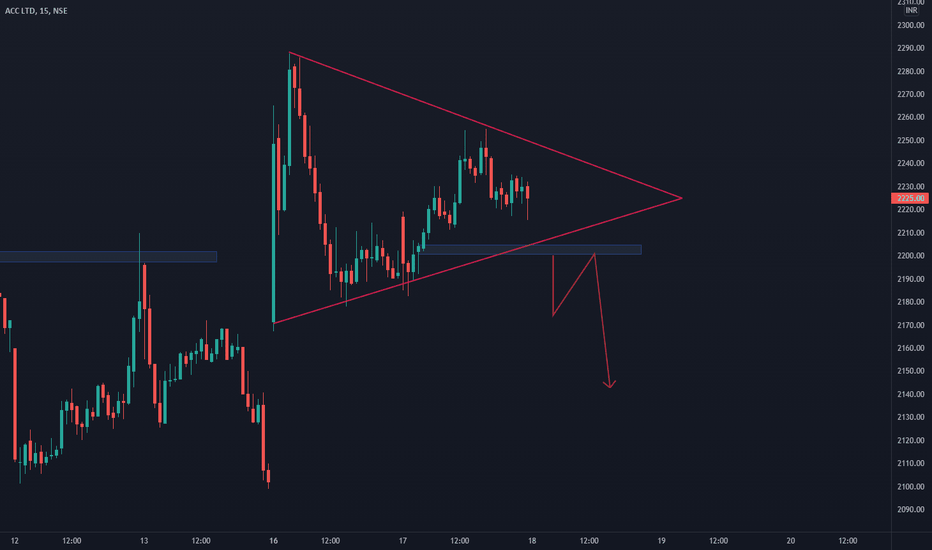

ACC trade ideas

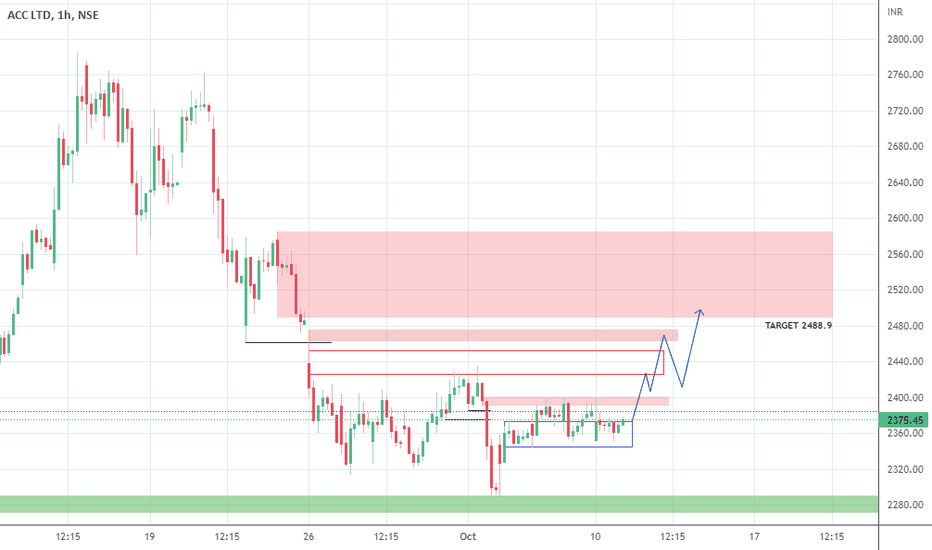

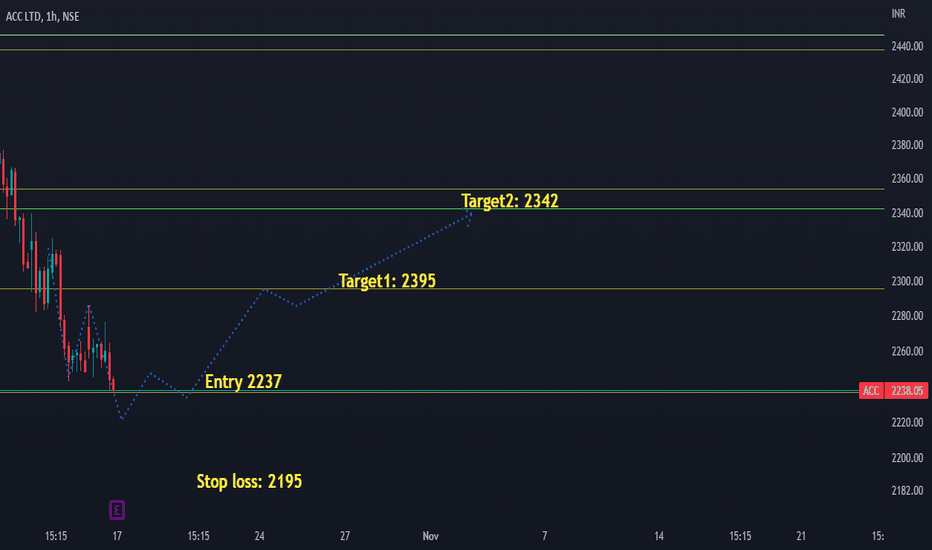

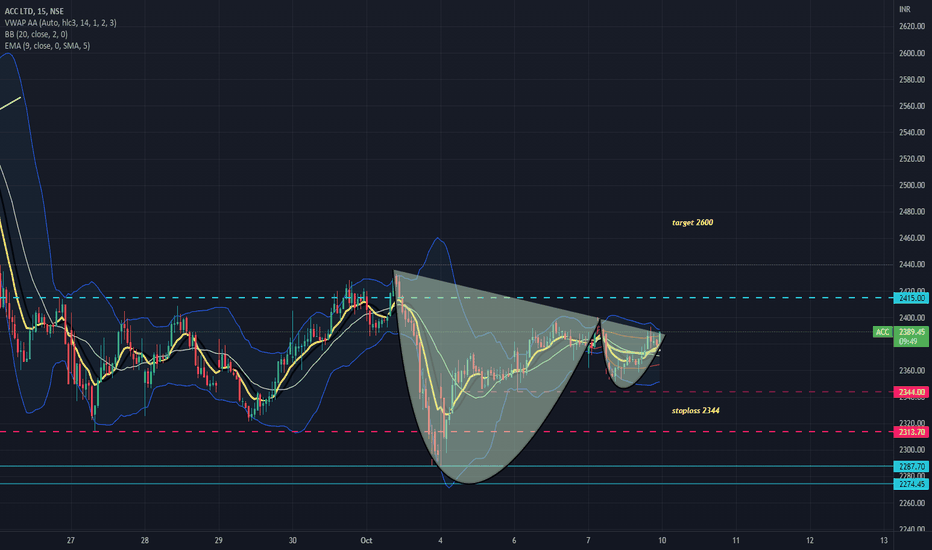

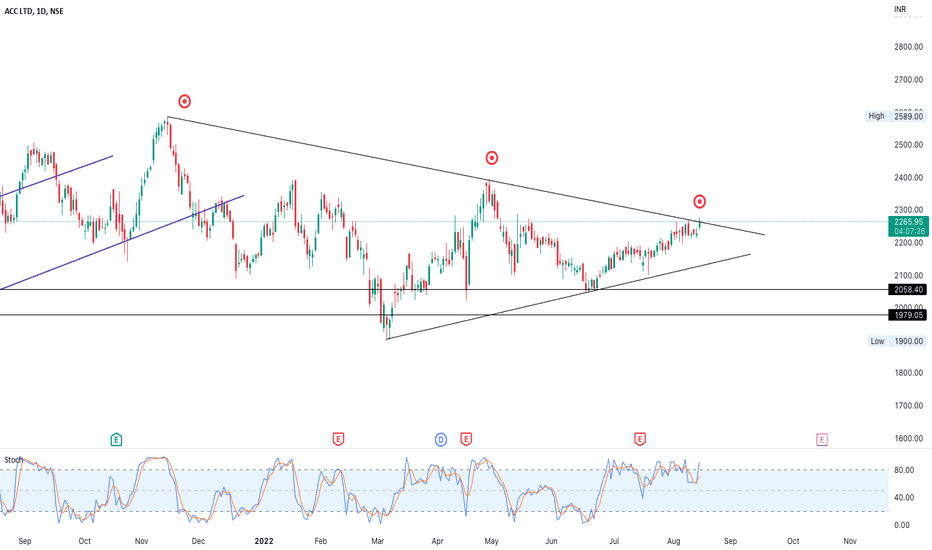

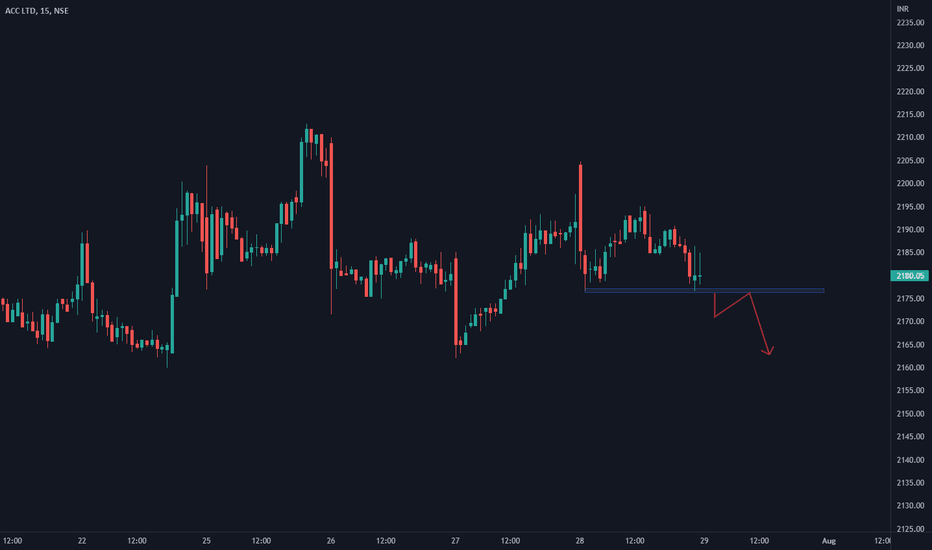

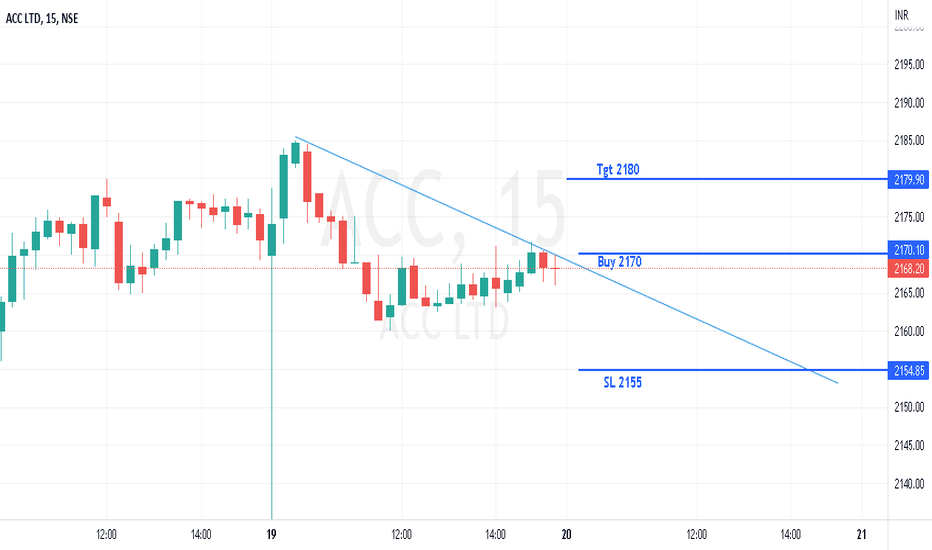

ACC ltd Long (Short Term Trade)PA made a good corrective move on a smaller time frame. RSI signaling bullishness for the same time frame.

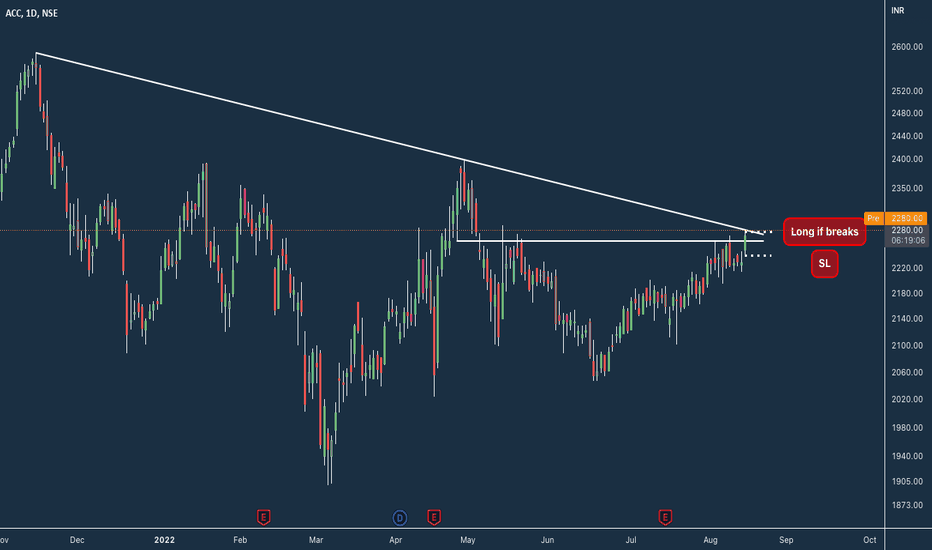

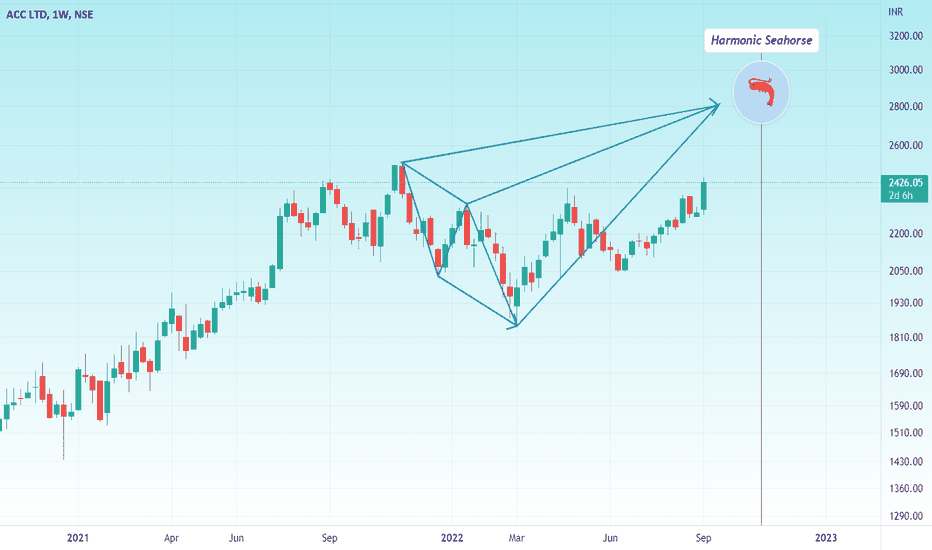

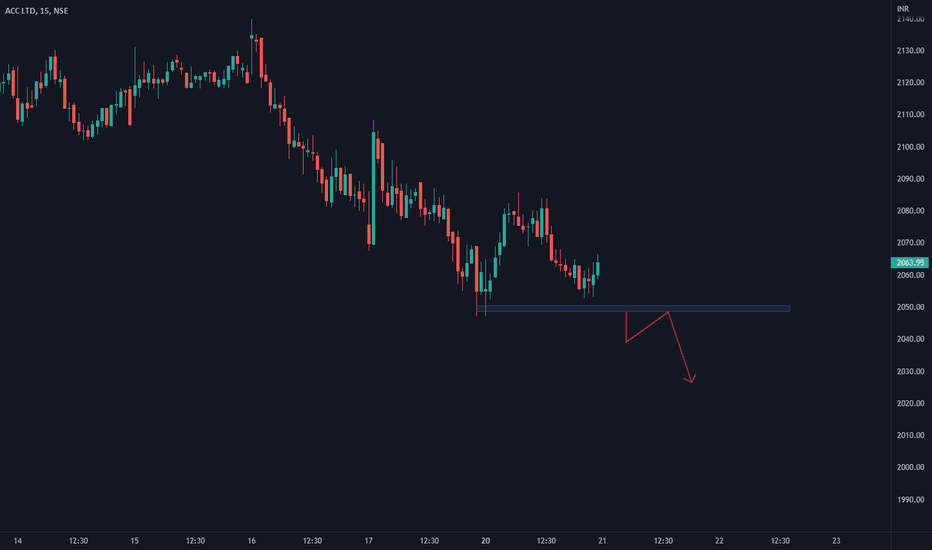

A Three drive pattern is about to emerge... Once the pattern emerges a good RR trade is formed.

#For the test purpose only. still, there is no clear breakout.

**Setup is in the chart.

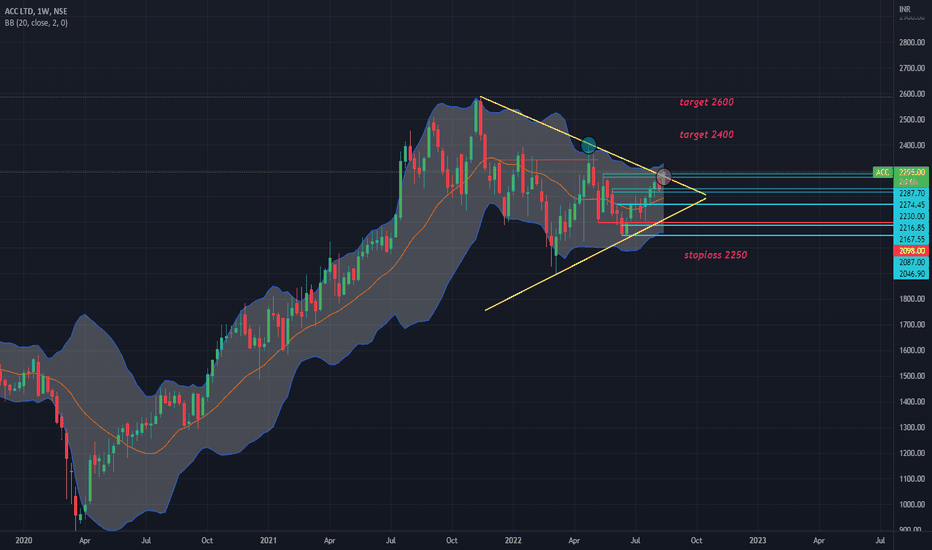

[POSITIONAL] ACC BUY IDEA risk: Reward ratio is 1: 2

Rest as per Charts

********

Note -

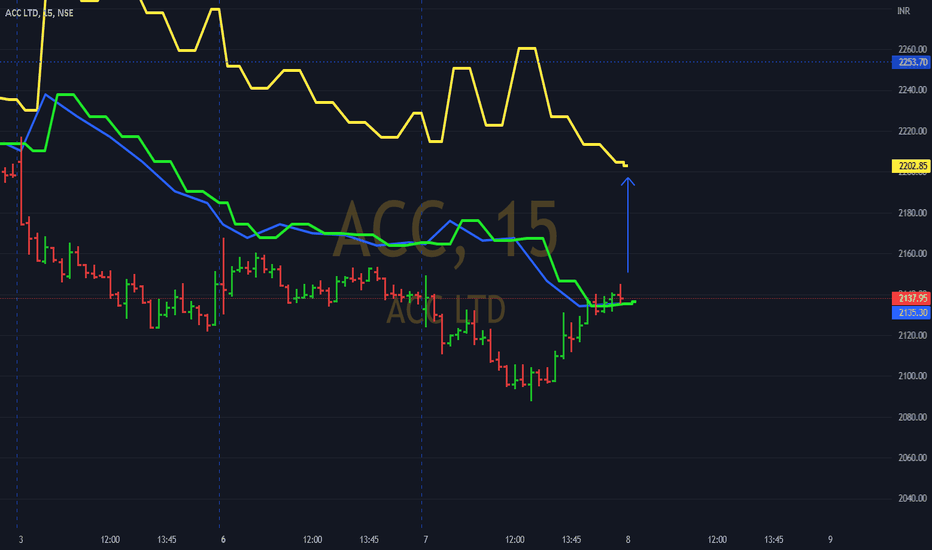

One of the best forms of Price Action is to not try to predict at all. Instead of that, ACT on the price. So, this chart tells “where” to act in “what direction. Unless it triggers, like, let’s say the candle doesn’t break the level which says “Buy/Sell if it breaks”, You should not buy/sell at all.

=======

I use shorthands for my trades.

“Positional” - means You can carry these positions and I do not see sharp volatility ahead.

“Intraday” -means You must close this position at any cost by the end of the day.

=======

Always follow a stop loss.

In the case of Intraday trades, it is mostly the “Low/High of the Candle”.

In the case of Positional trades, it is mostly the previous swings

********

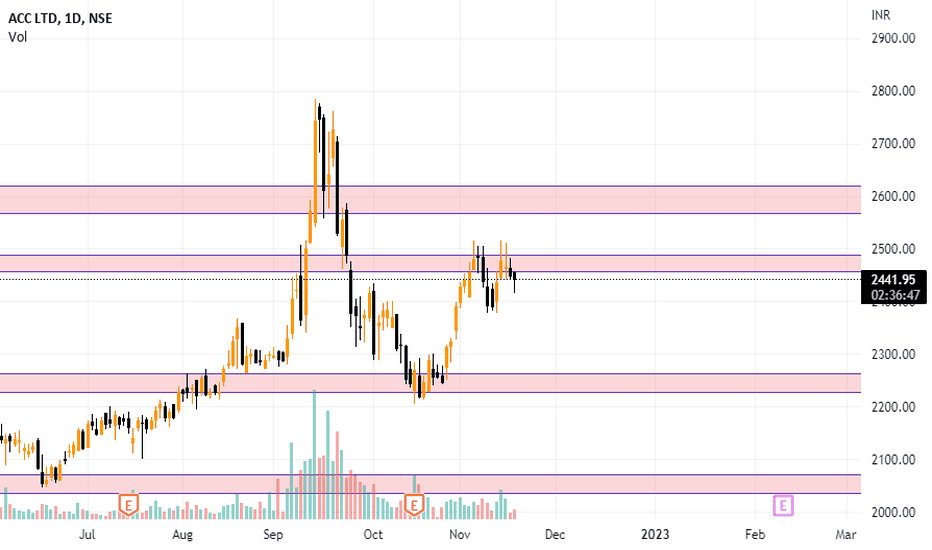

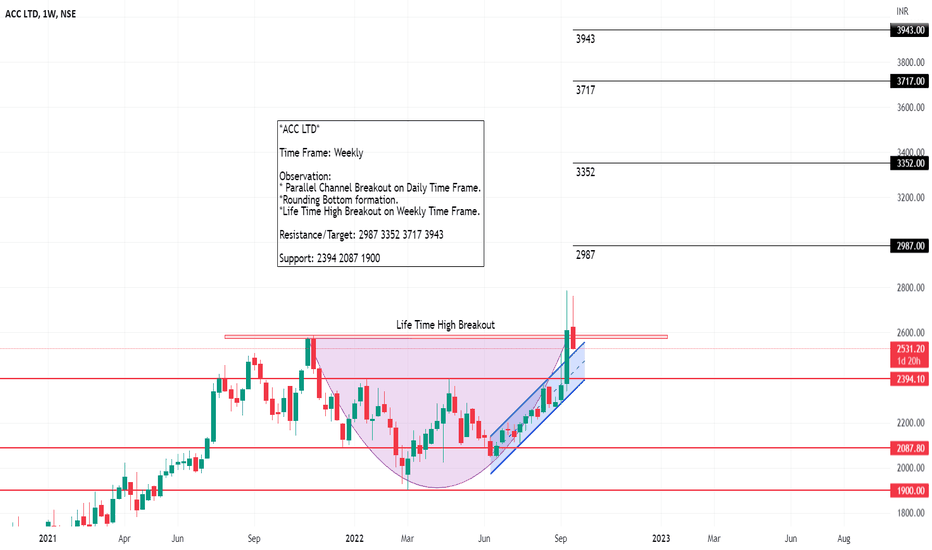

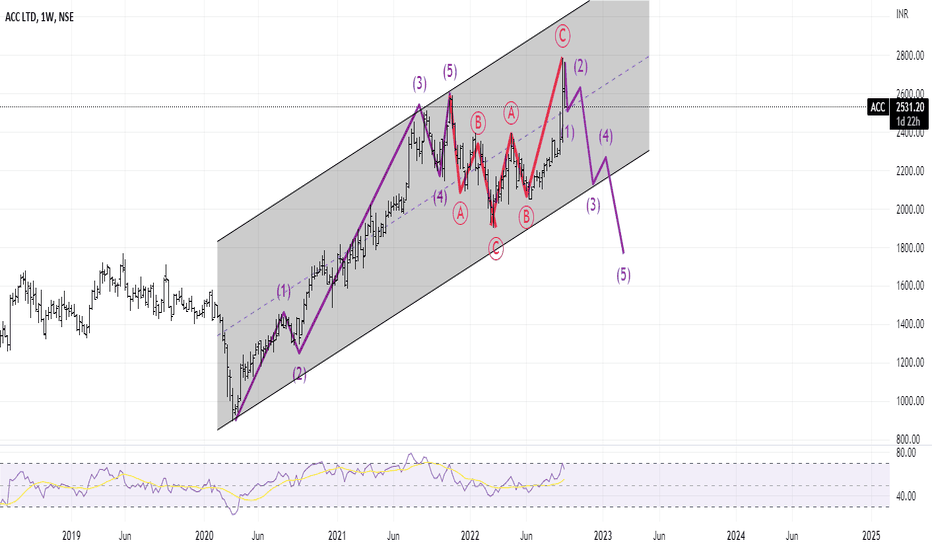

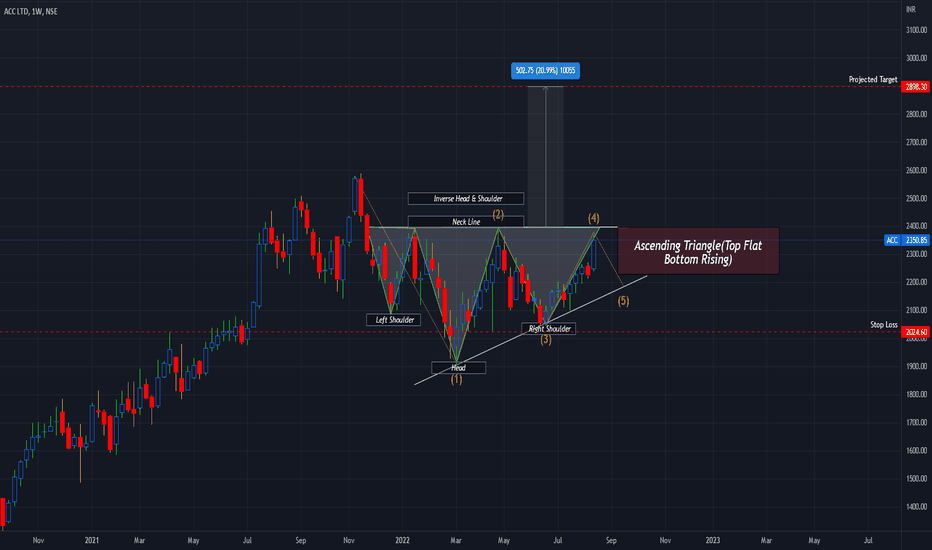

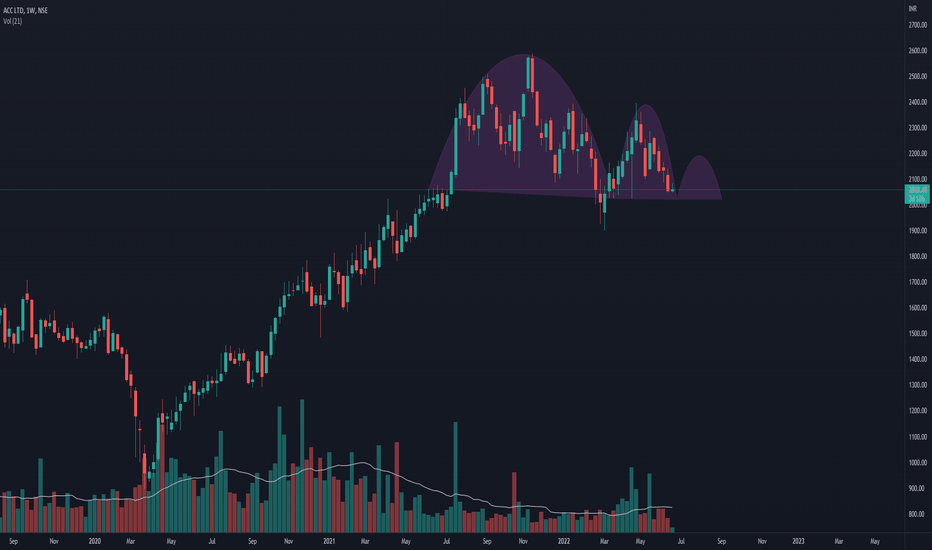

ACC LTD Wait for breakout & retest.The idea here is about ACC LTD.

mentioned below are the points to be considered

Points as per TA on a Weekly Chart:

1. Inverse Head & Shoulder Pattern almost complete.

2. Bullish Ascending triangle formation with top flat & bottom rising.

3. Trading way above 20 & 200 EMA on weekly chart.

4. Strong Kumo breakout on weekly chart (Ichimoku Cloud).

5. RSI is at 60.28 on a weekly Chart.

6. MACD way above signal line.

7. Hull Moving Average is a Buy Signal on a weekly chart.

8. Wait for breakout & retest @ 2400.00.

9. Stop loss just below lower low of right shoulder.

10. Projected target as per inverse Head & Shoulder on the chart.

Disclaimer: “The above is an idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas !!

Want to keep yourself updated with current market action, then please follow my profile for more analysis.

Cheers.