ASHOKLEY 4HNSE:ASHOKLEY

Please note that we are not a SEBI Registered Investor Adviser/PMS/ Broking House.

All the contents over here are for educational purposes only and are not investment advice or recommendations

offered to any person(s) with respect to the purchase or sale of the stocks / futures and options.

You are also requested to apply your prudence and consult your advisers in case you choose to act on

any such content available as WE claims no responsibilities for any of your actions or any outcome of

such action

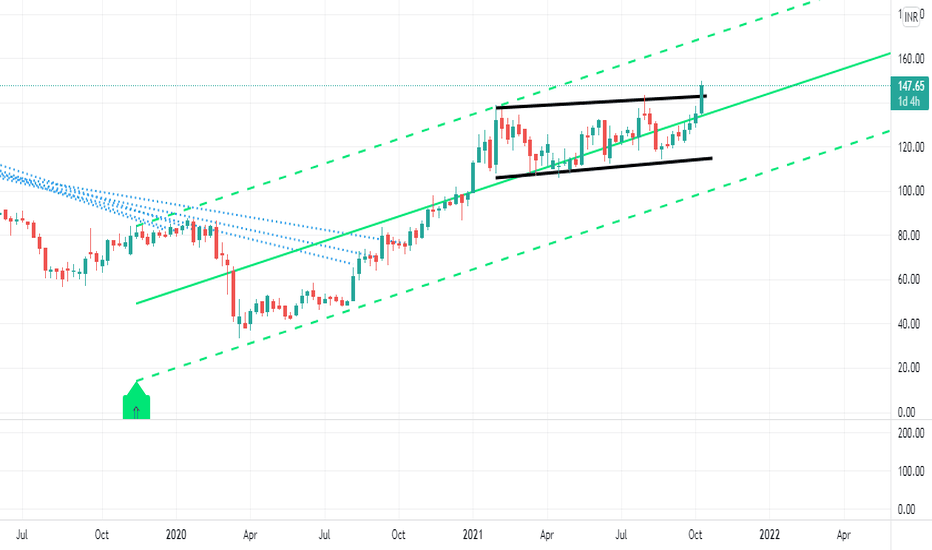

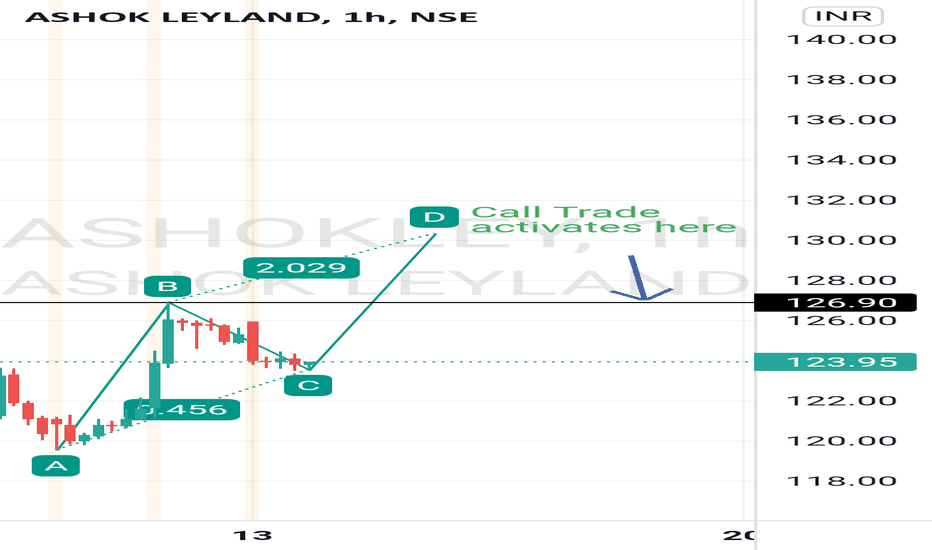

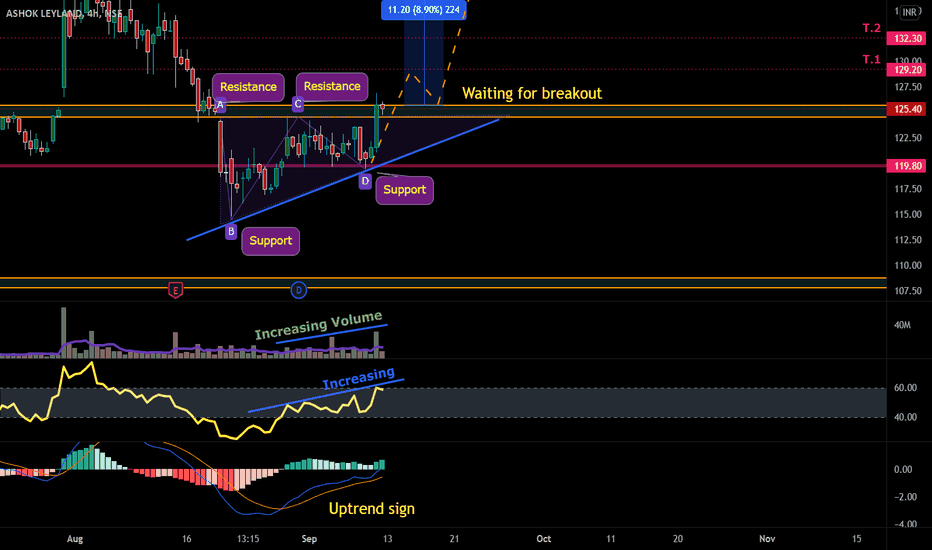

ASHOKLEY trade ideas

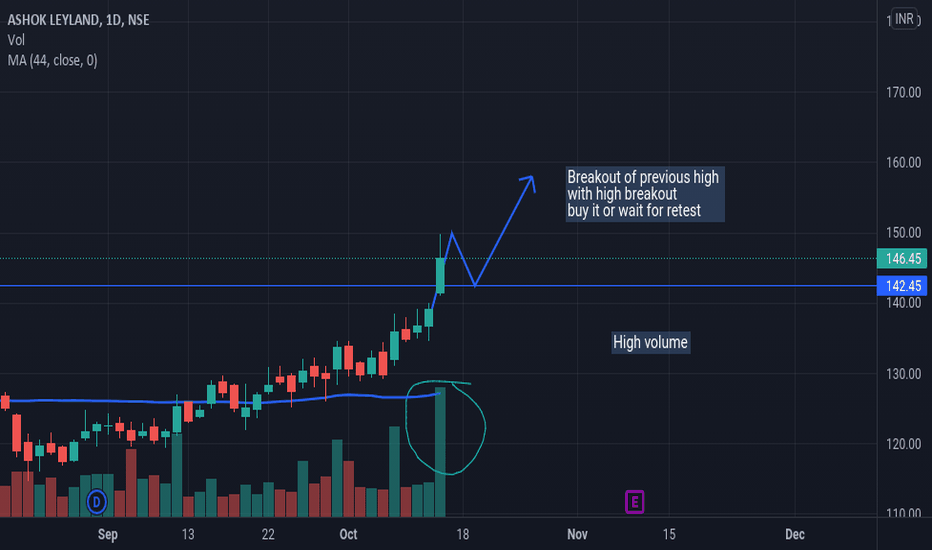

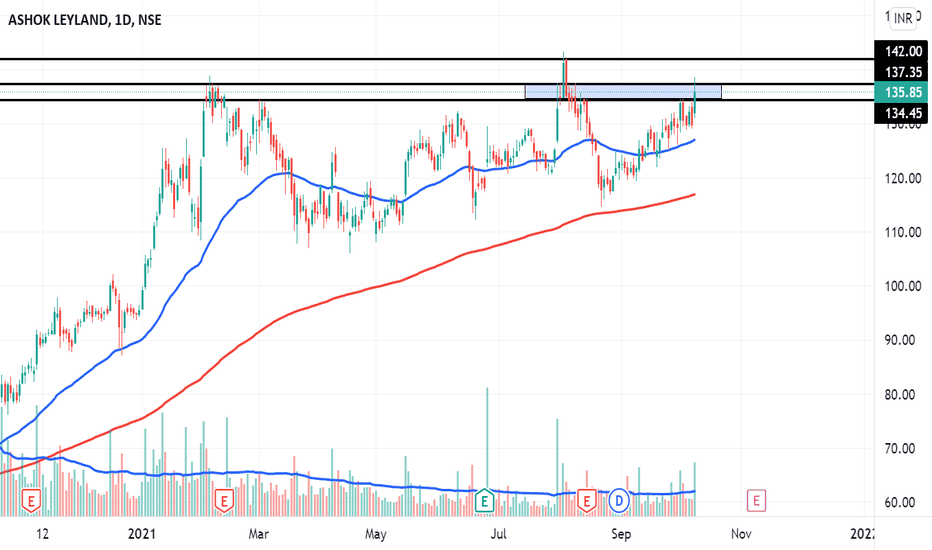

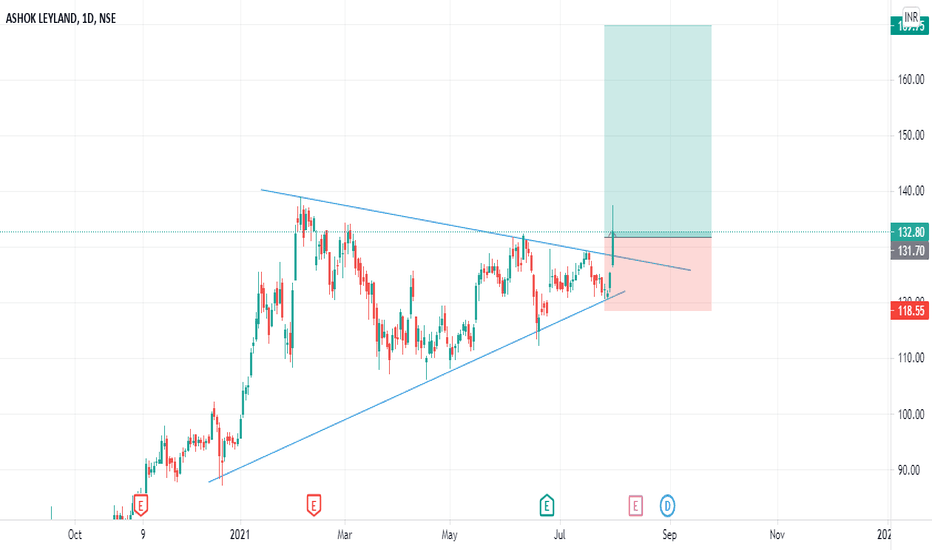

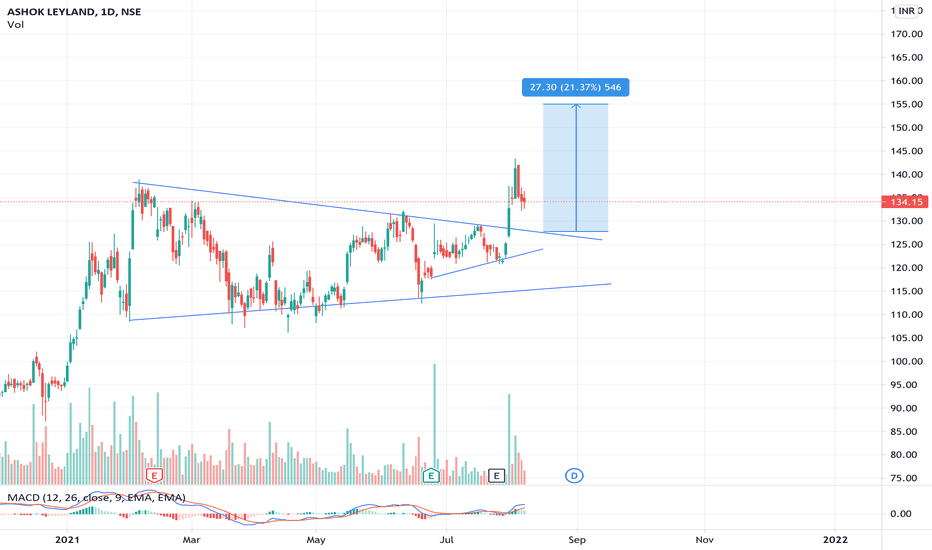

Ashok Leyland BreakoutThe stock has broken out and retested, so it may undergo a rally. Trade is supported by brokerage calls and Supports Nearby.

Risk Reward Ratio - 2:1

SL is placed below support zone & the previously upper trendline. The target is placed based on fundamentals and near swing high.

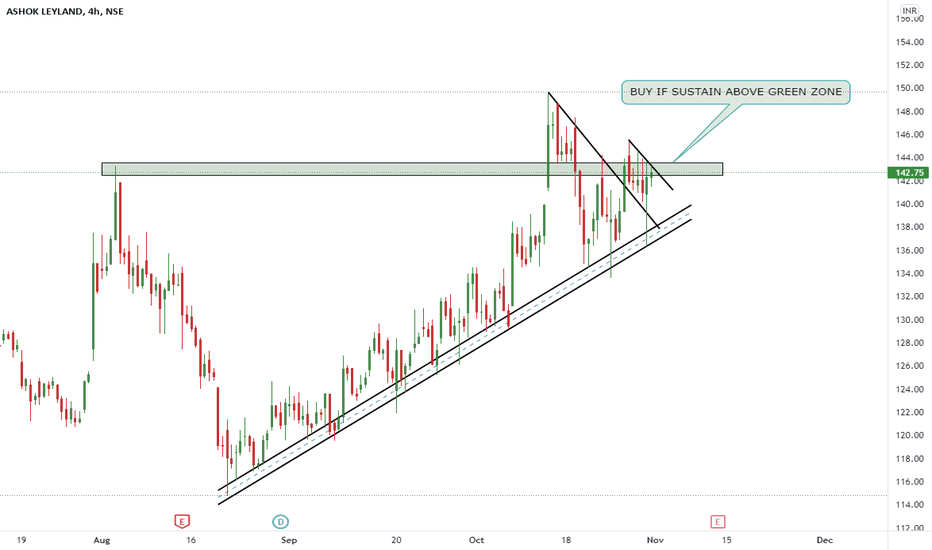

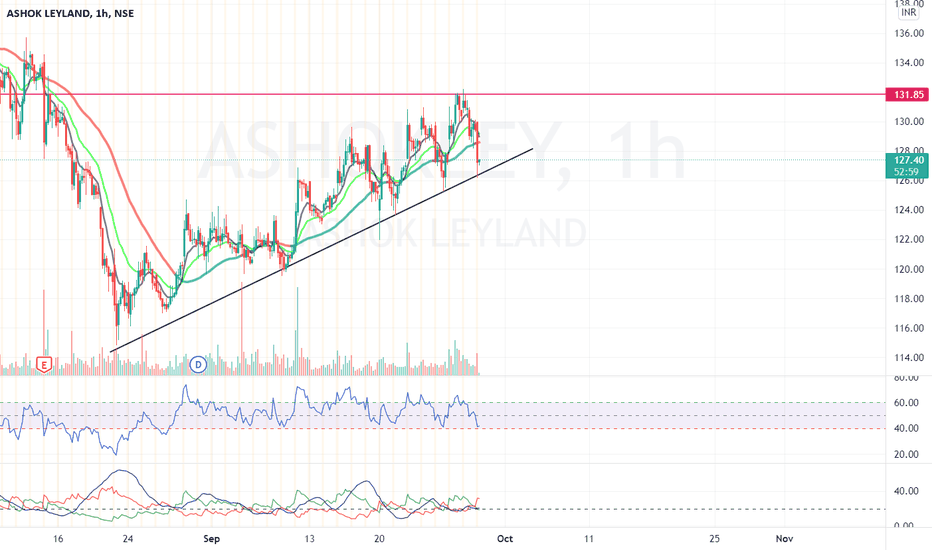

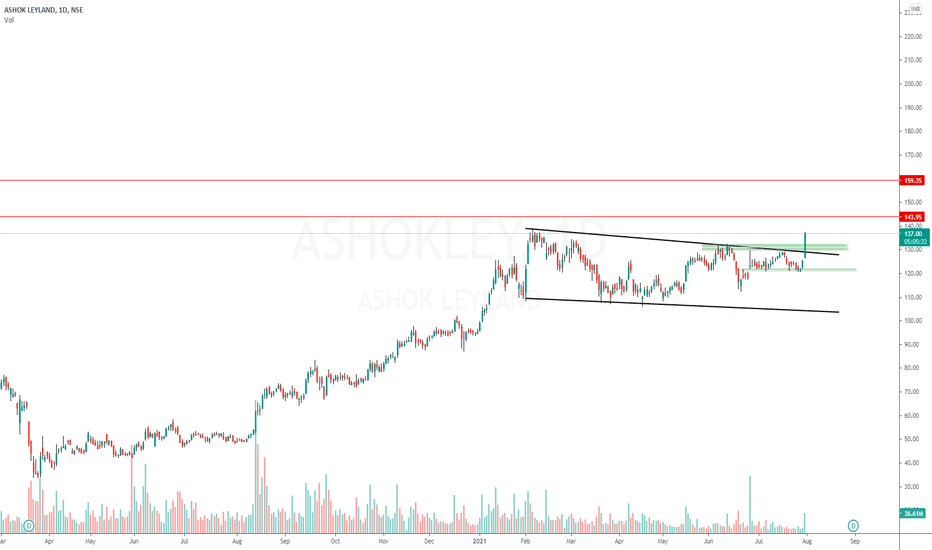

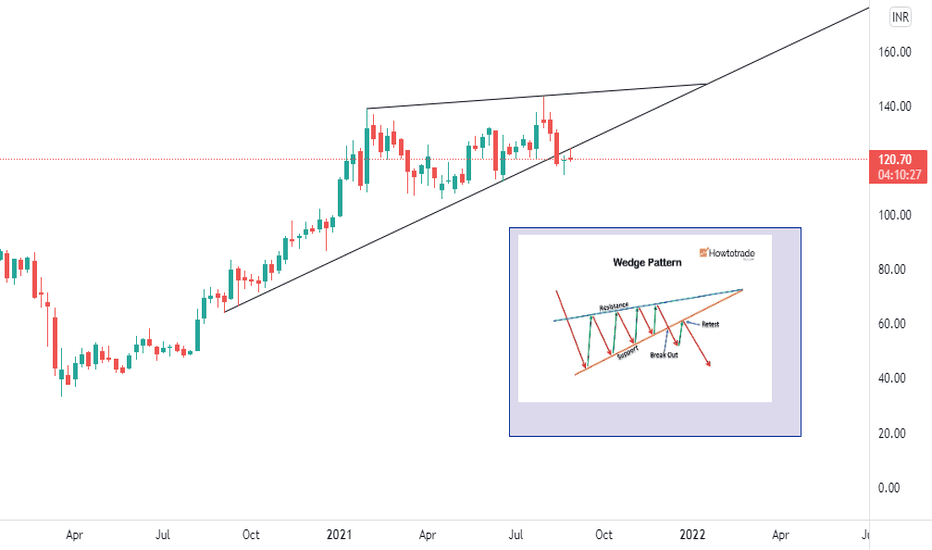

ASHOK LEYLAND WEDGE PATTERNHello

Welcome to this analysis about ASHOK LEYLAND , we are looking at daily timeframe perspectives. ASHOK LEYLAND is developing here that will be a decisive factor in the upcoming times. I discovered the main formation ASHOK LEYLAND is developing here that will be a decisive factor in the upcoming times. As when looking at my chart now we can watch there how ASHOK LEYLAND has emerged with this key WEDGE PATTERN marked in my chart with boundaries. which is an important resistance and also psychological resistance-mark together with the lower-boundary of the WEDGE PATTERN

In this manner, thank you for watching my update-analysis about ASHOK LEYLAND and its major WEDGE PATTERN with the determining factors we need to consider in upcoming times, support the analysis with a like and follow or comment for more market insight!

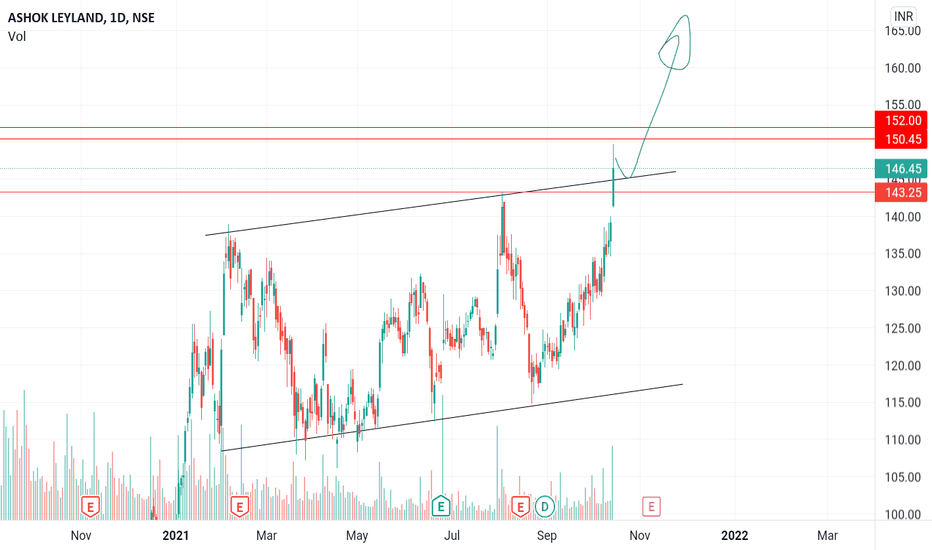

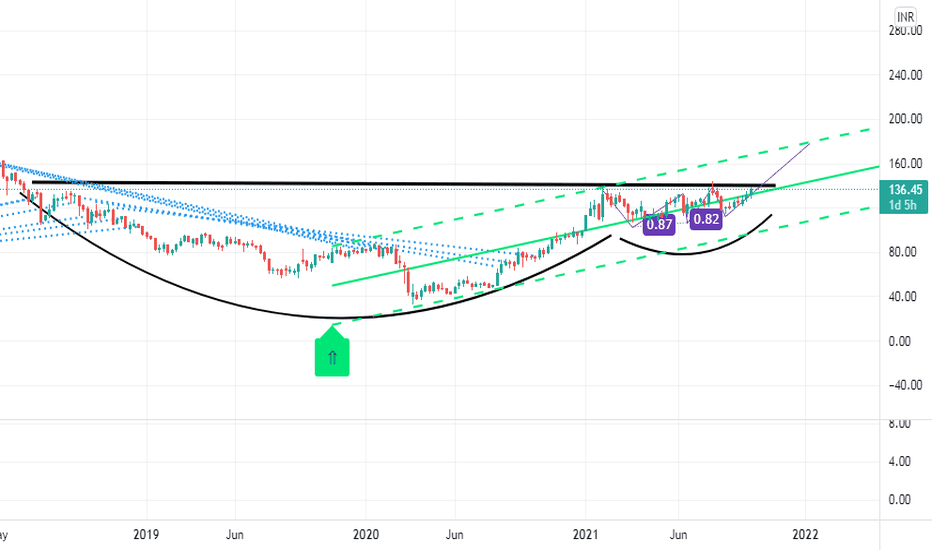

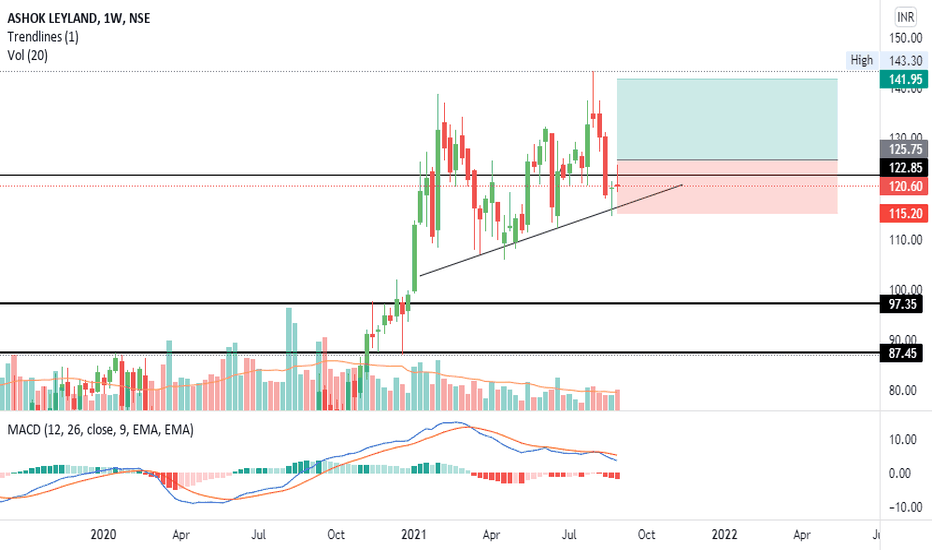

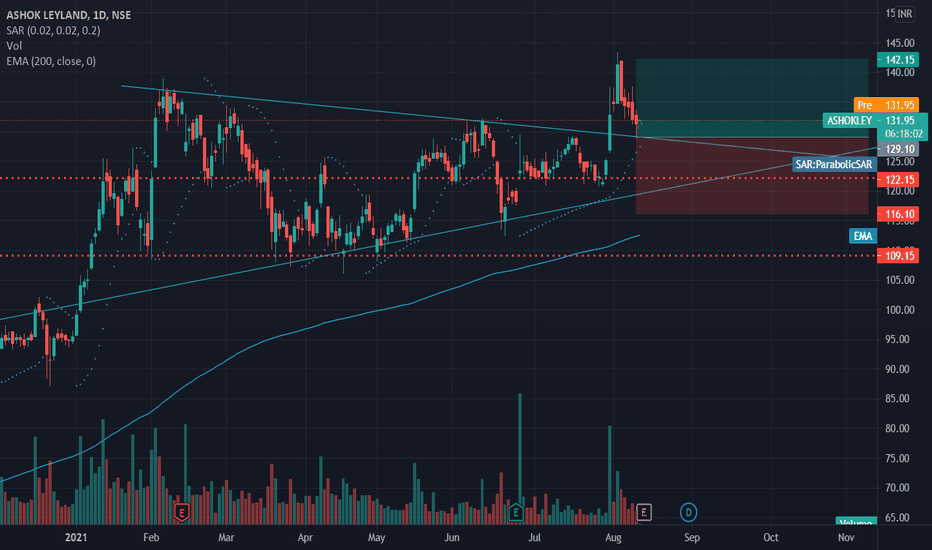

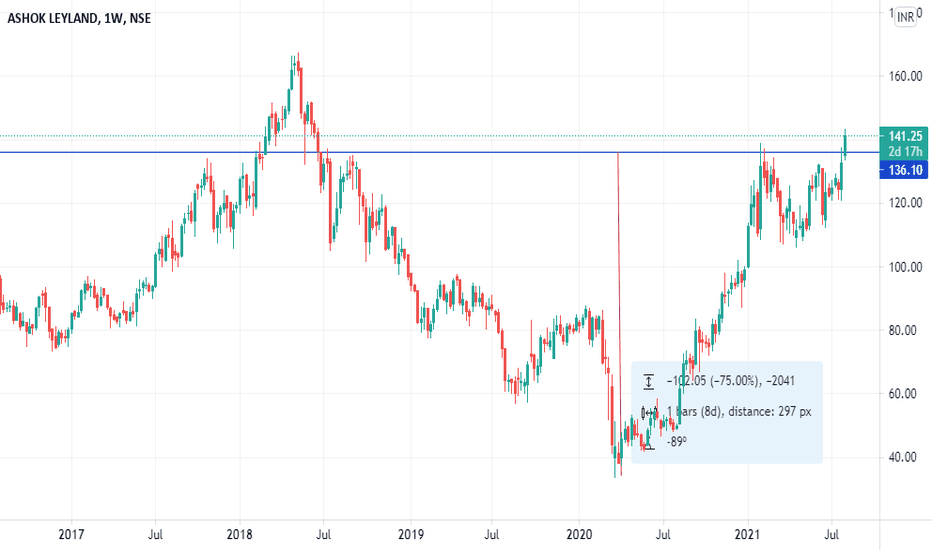

Breakout and formation of cup and handleThe stock has shown a breakout from its previous resistance level of around 136 with great volume. There is also a formation of the cup and handle formation on the weekly time frame chart. There is a buy call in the stock with a price target of 250 and a time target of 6 months. The stock has also seen a MACD crossover and breakout of RSI above 60 levels.