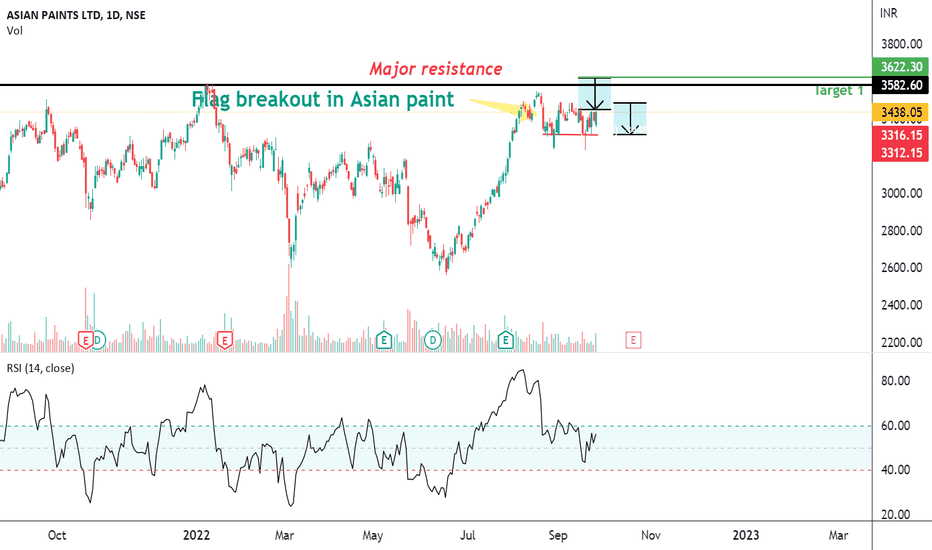

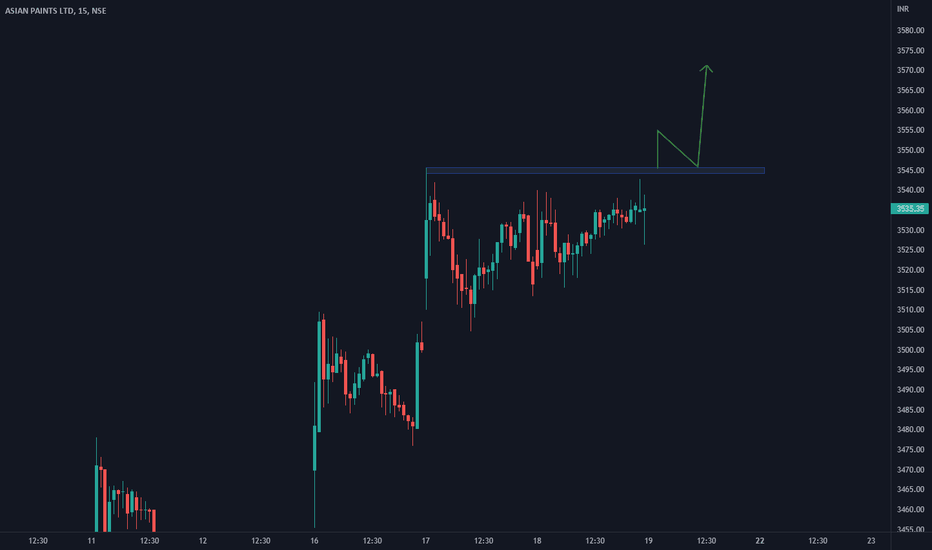

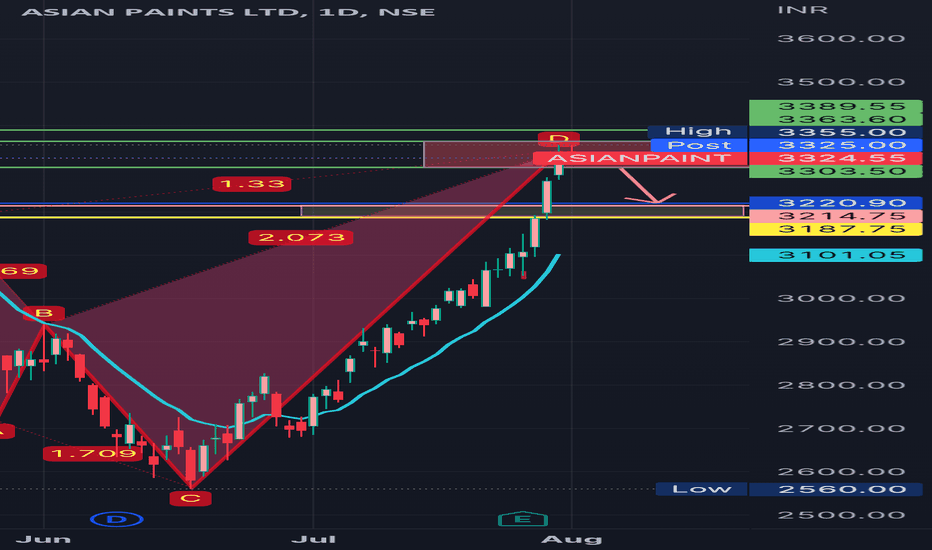

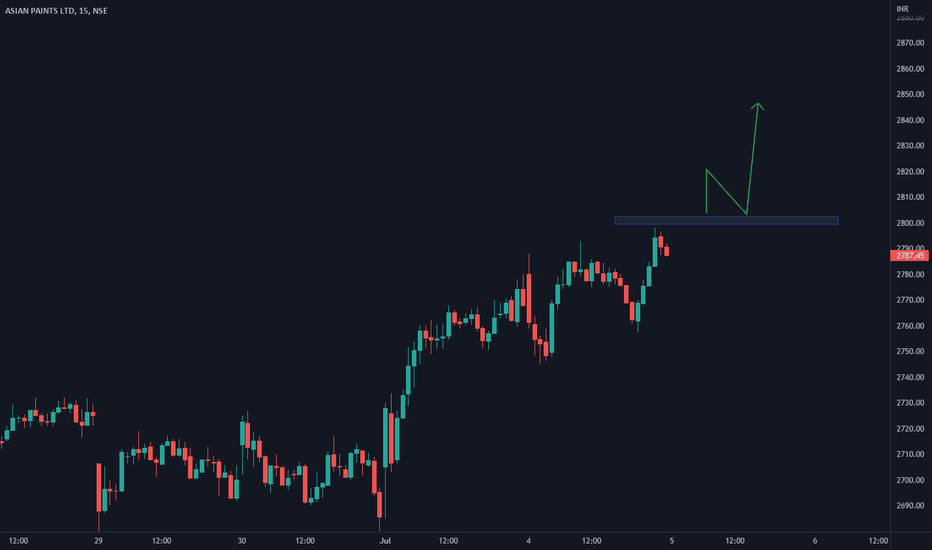

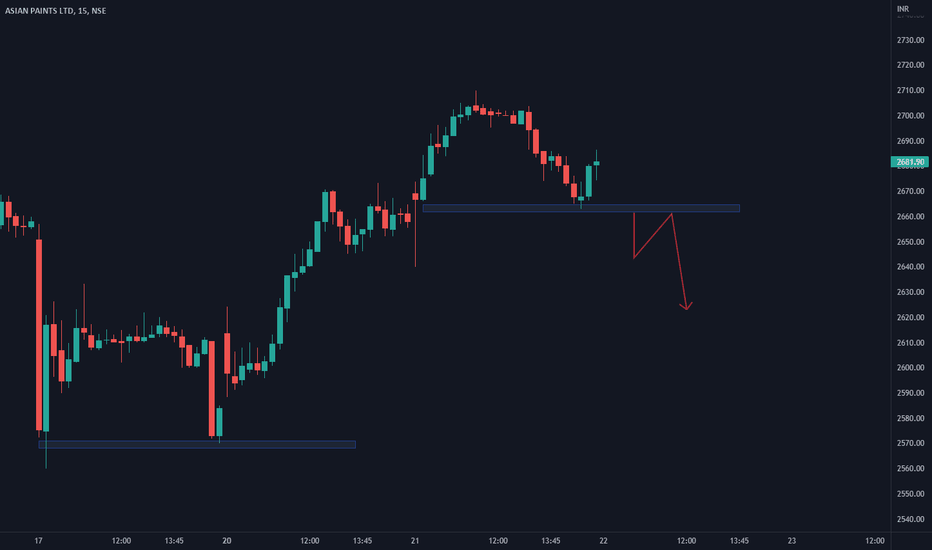

Asian Paint Flag BreakoutAsian Paint is Uptrending stock and outperforming nifty 50 index.

Today's price action show power of bulls in asian paint as entire index was falling but asian paint made a breakout.

Asian paint is good buy with 1st target of Rs 3622 based on size of flag.

Traders are requested to do their own analysis and post it in comment section.

ASIANPAINT trade ideas

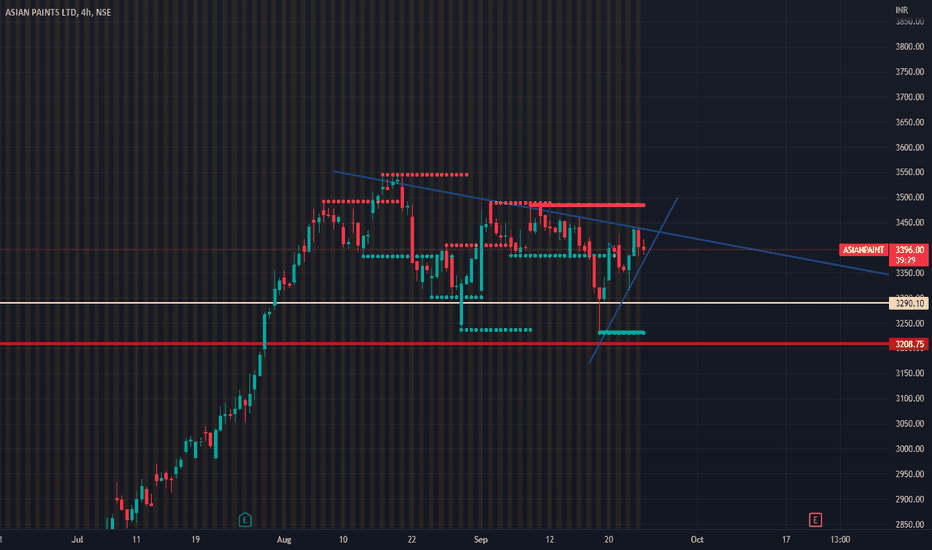

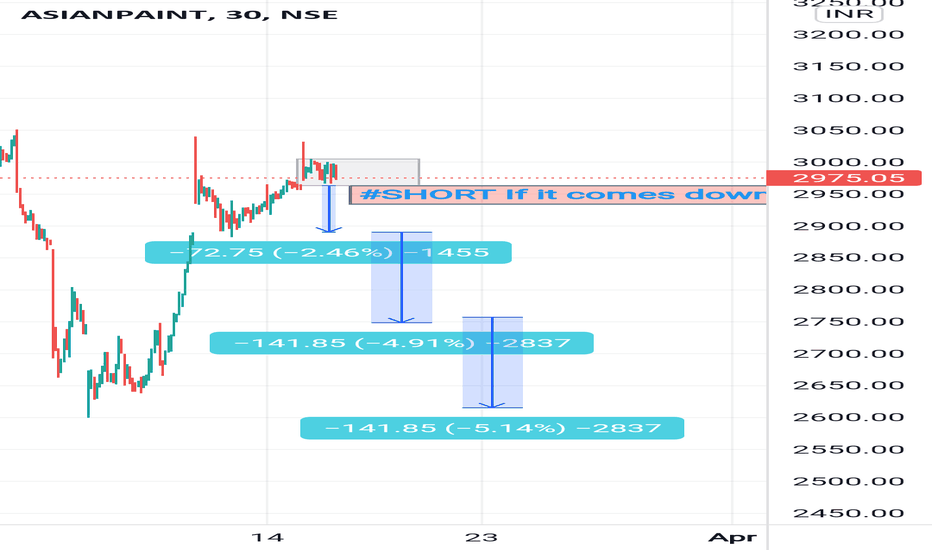

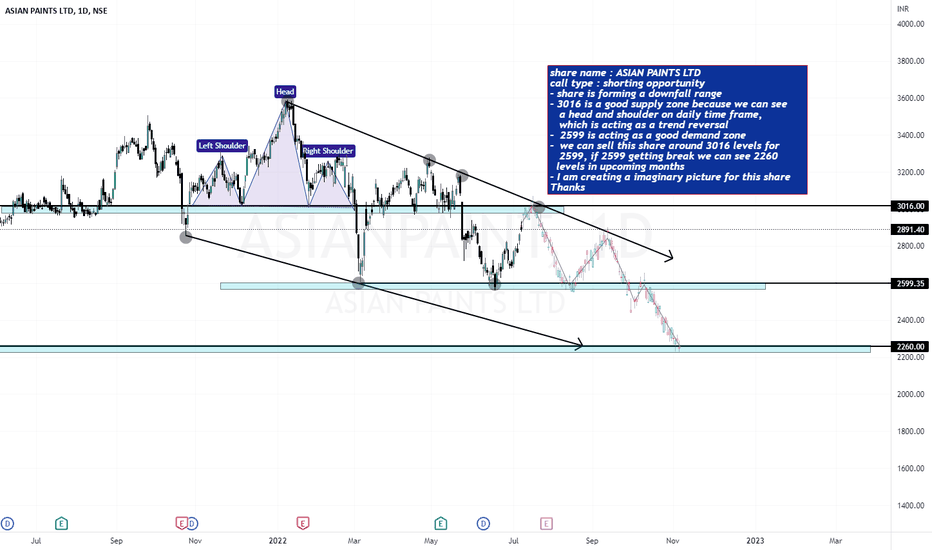

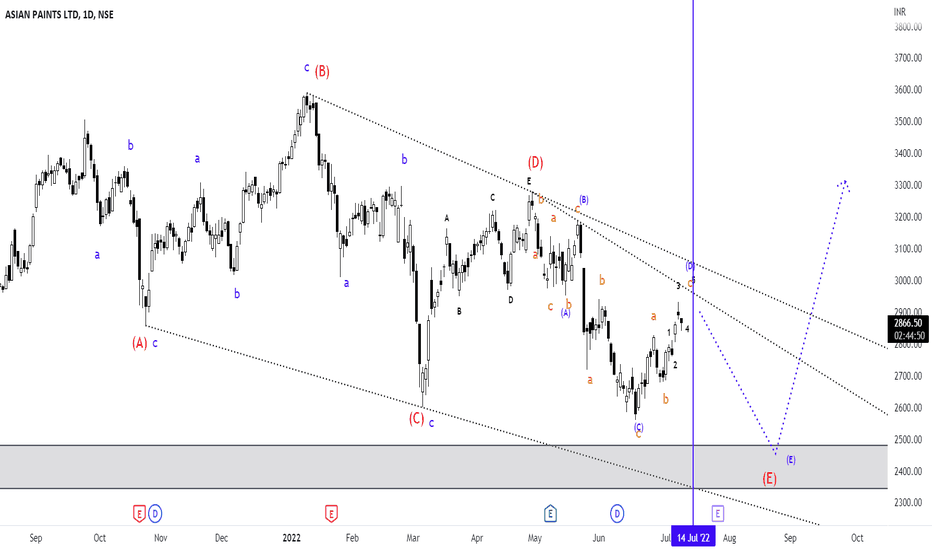

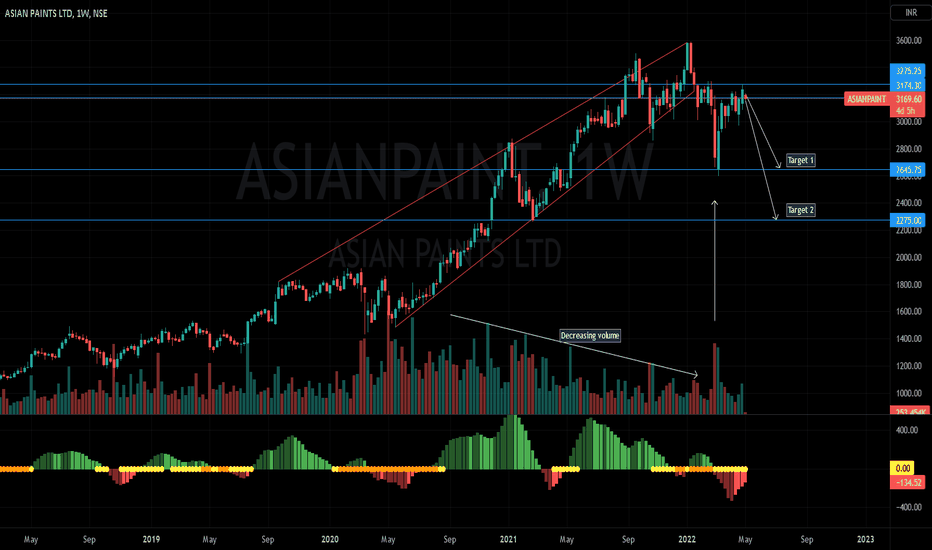

asian paints ltdshare name : asian paints ltd

call type : shorting opportunity

- share is forming a downfall range

- 3016 is a good supply zone because we can see

a head and shoulder on daily time frame,

which is acting as a trend reversal

- 2599 is acting as a good demand zone

- we can sell this share around 3016 levels for

2599, if 2599 getting break we can see 2260

levels in upcoming months

- i am creating a imaginary picture for this share

thanks

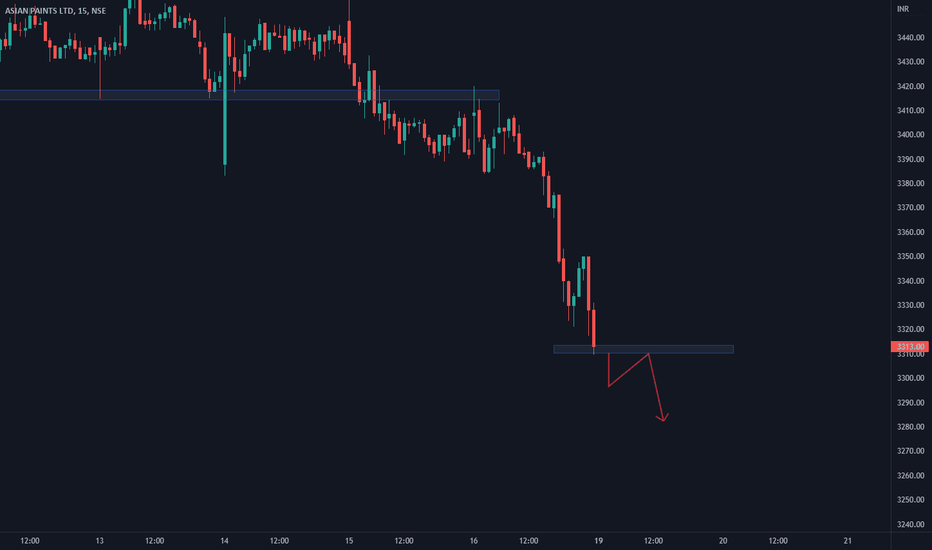

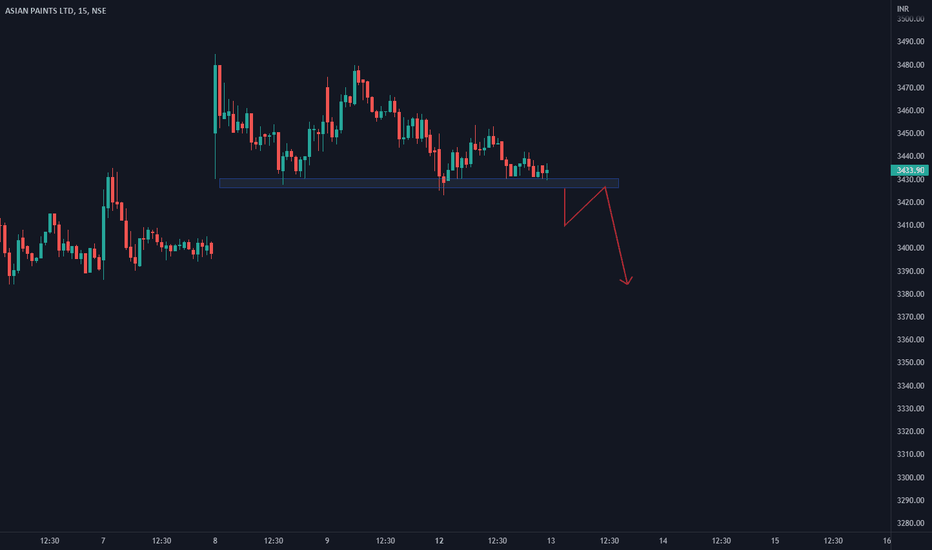

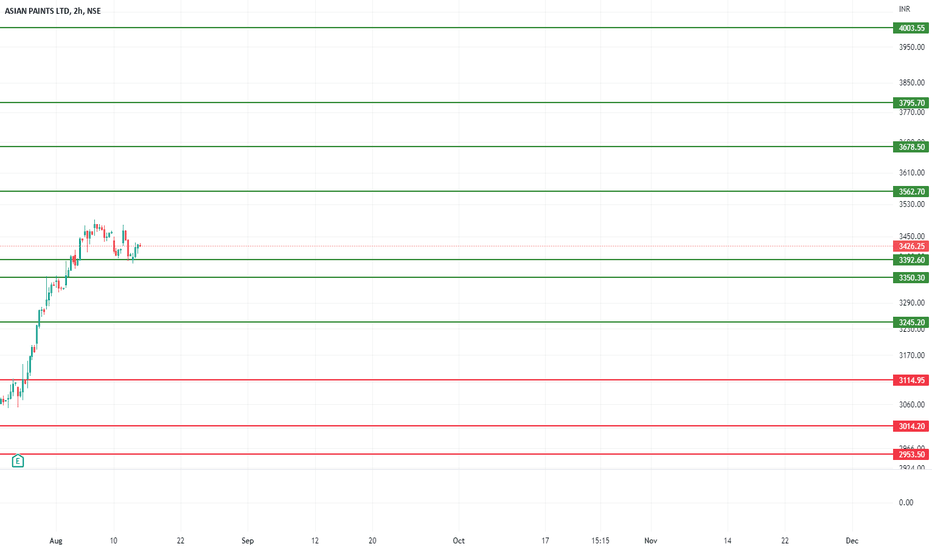

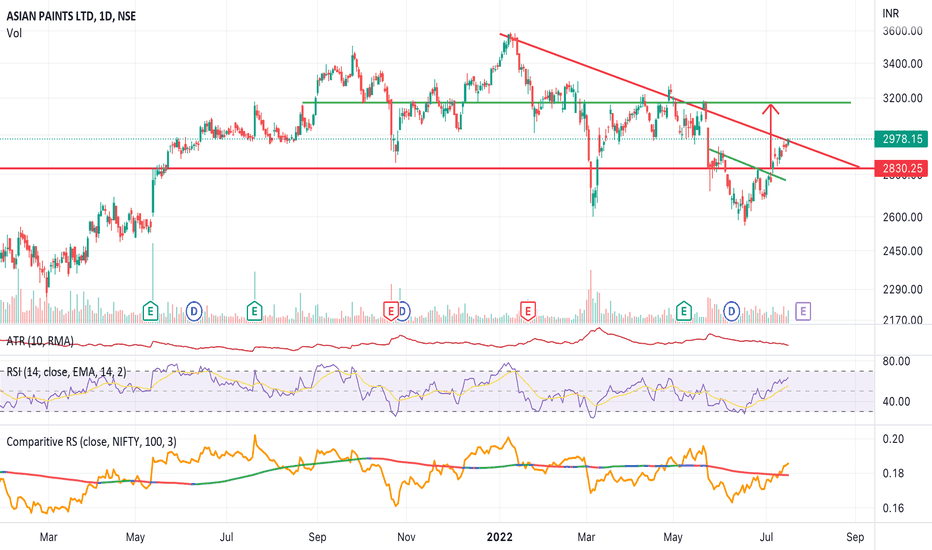

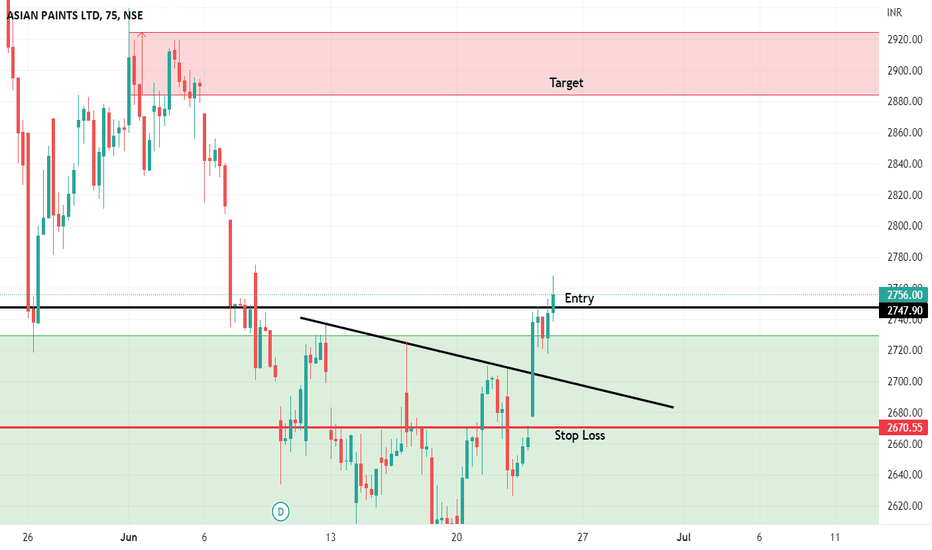

Asian paints - turning bullish againOne of my favourite stock turning bullish again.

Stock made an inverse head and shoulder chart pattern and gave a breakout from immediate resistance. Next resistance and target of inverse h&s is same, which is 3175. Short term traders can capture this opportunity. You can keep a small stop loss of candle low that decisively breaks the sloping trend line.

Existing investors like me can increase their positions.

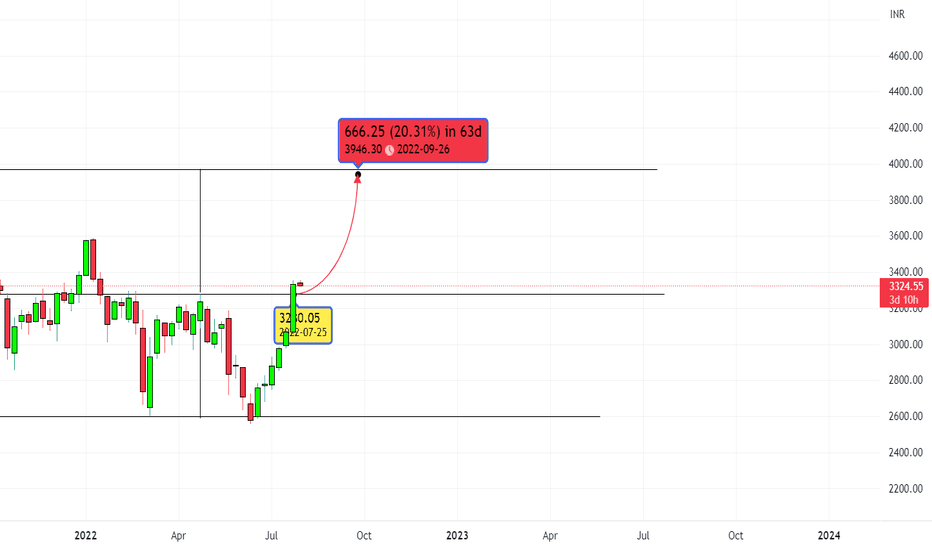

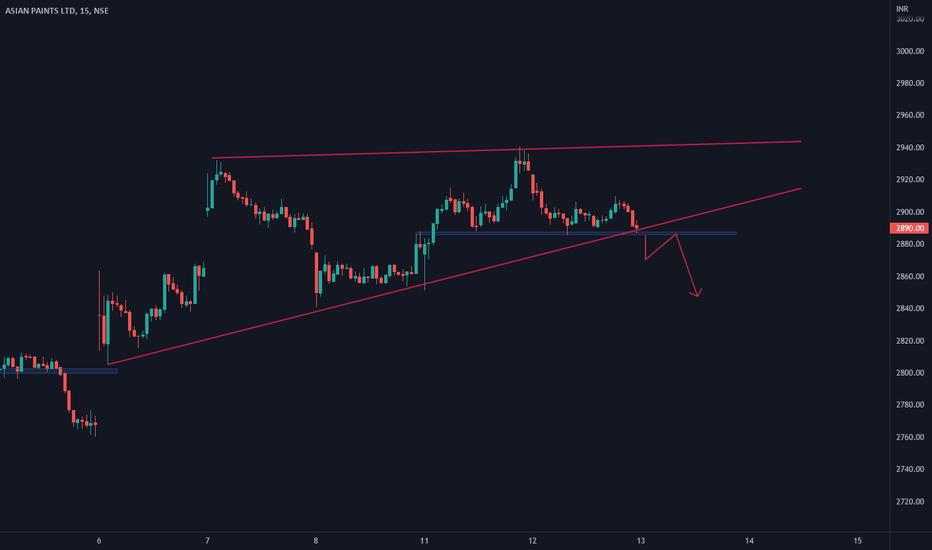

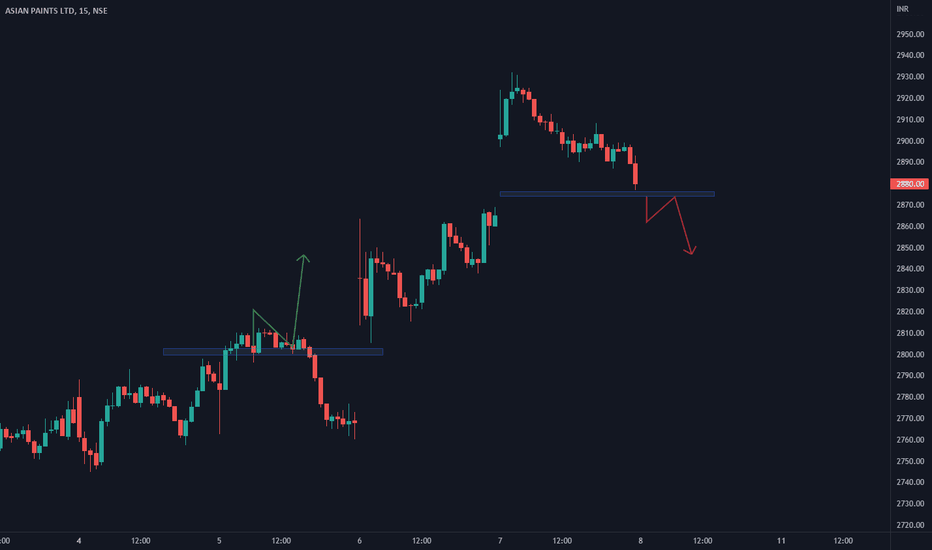

Price action analysis - ASIANPAINTNSE:ASIANPAINT had a good run up until recently and now it seems to have been topped out. In Weekly chart, rising wedge structure is formed and volume has declined with it. It suggests that buyers are losing the grip and sudden fall to 2625 with heavy volume confirms the reversal. Buyers stepped in from 2625 level and took the price higher but subsequent price action suggests that they have been exhausted and seem to be losing control. If price couldn't hold above 3100 level then it's going back to 2645. If it can't hold that one then it will go further down to 2275. Let's see what happens.