Bajaj Finance

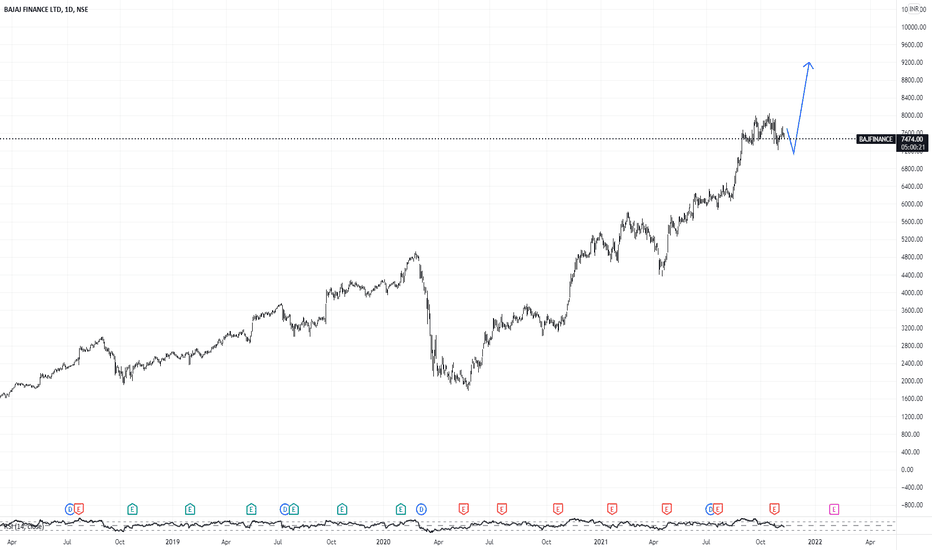

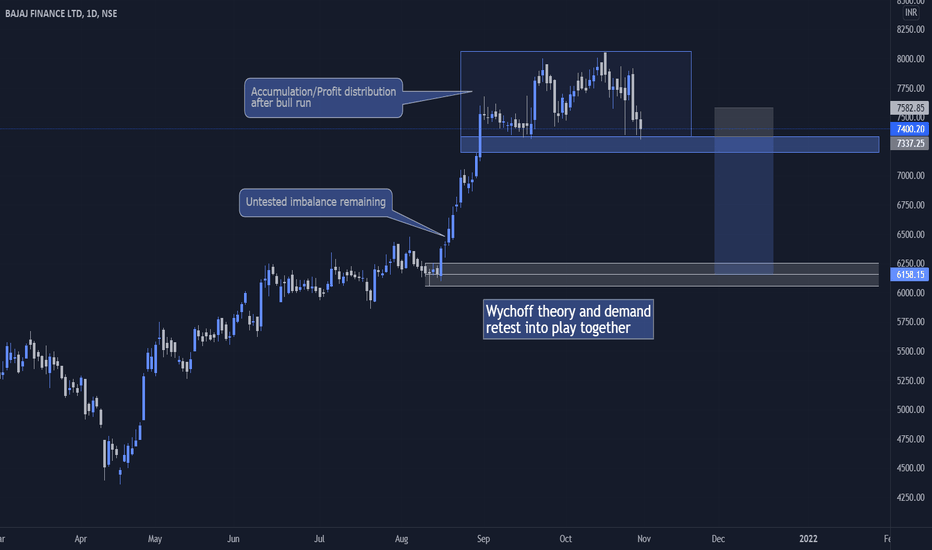

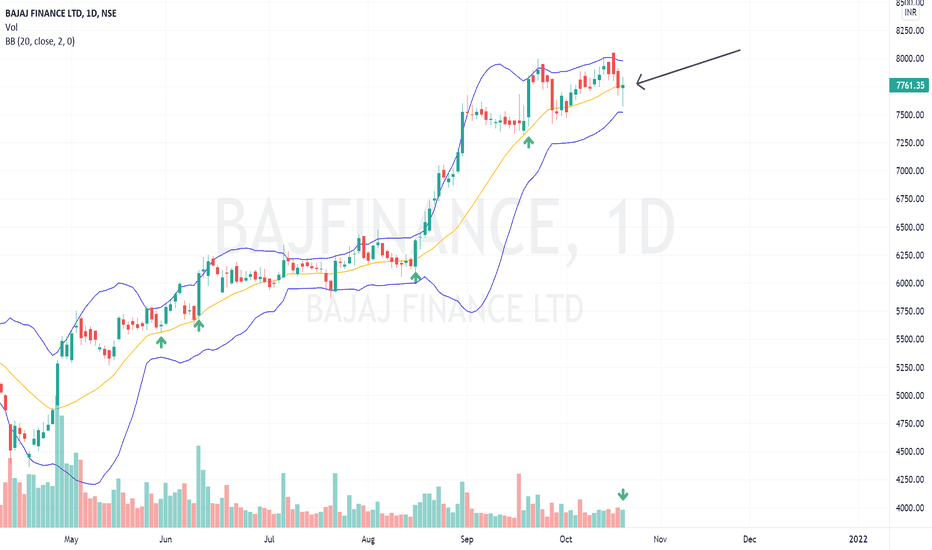

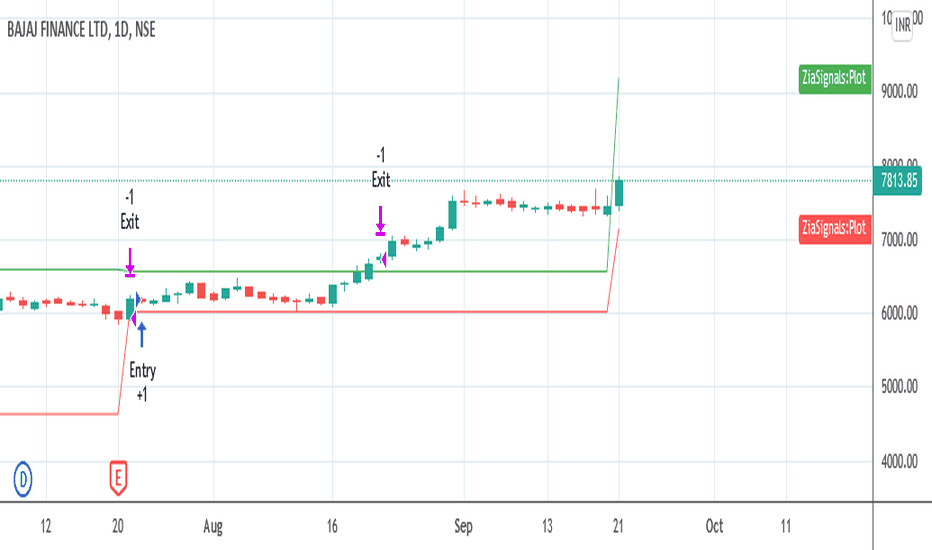

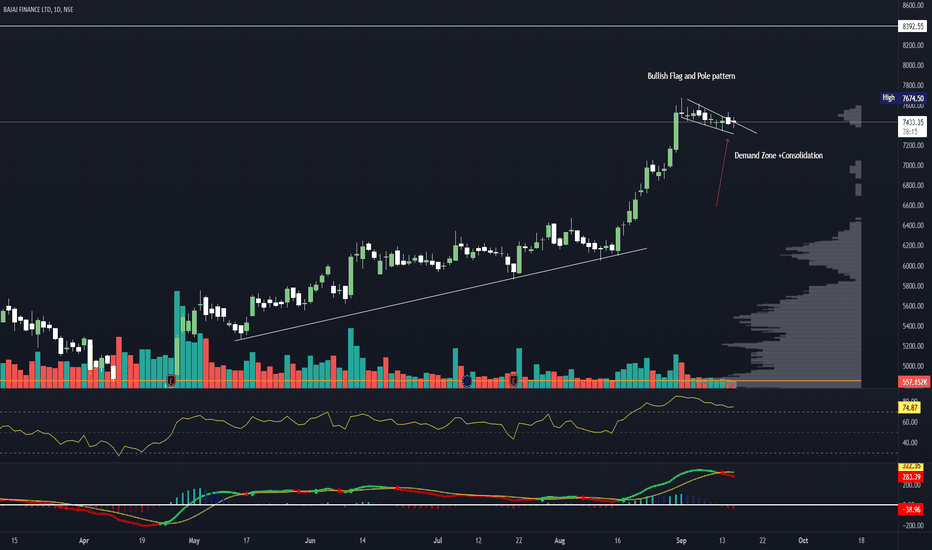

Trading at 7484.30 INR ----- The price is moving with un normal bull i can see very bullish for this share good to go long with target of 9000 INR and Above !

Bajaj Finance Limited, a subsidiary of Bajaj Finserv, is an Indian non-banking financial company (NBFC). The company deals in consumer finance, SME (small and medium-sized enterprises) and commercial lending, and wealth management.

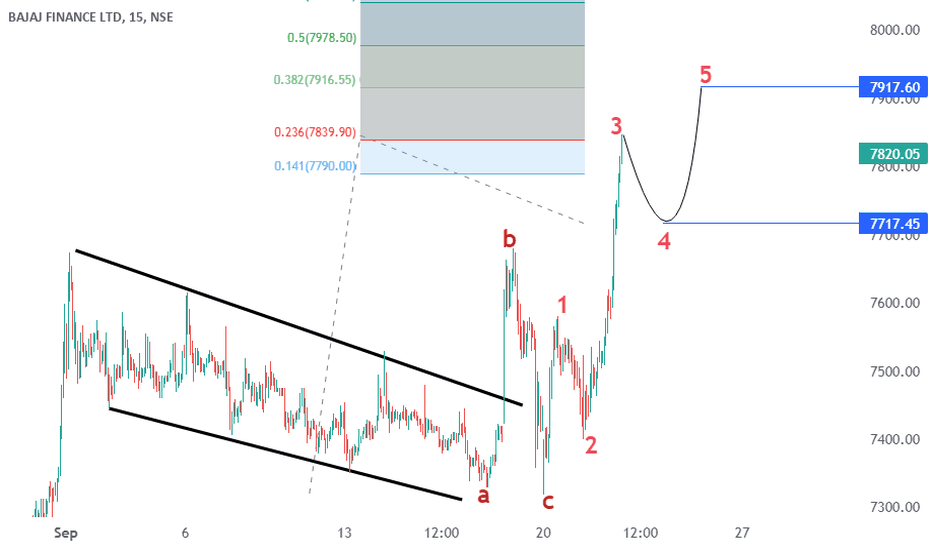

BAJFINANCE trade ideas

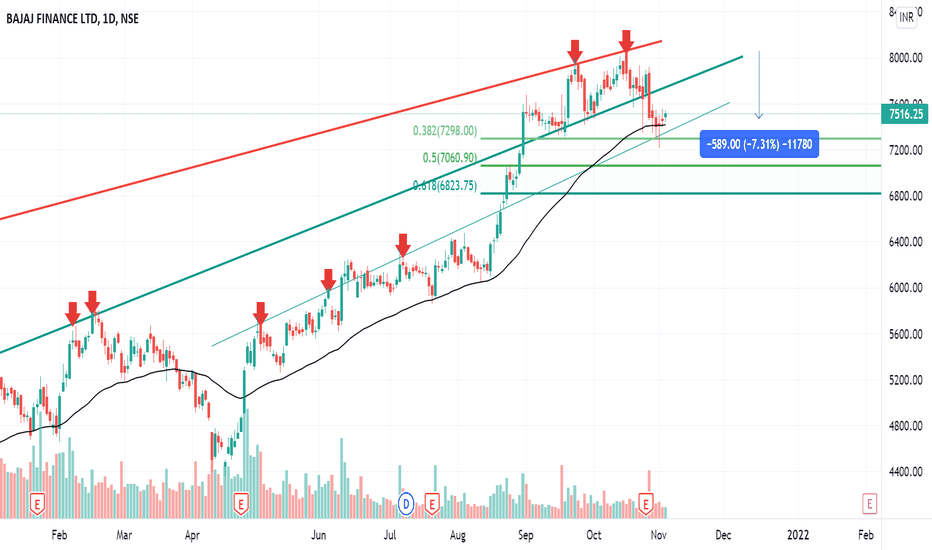

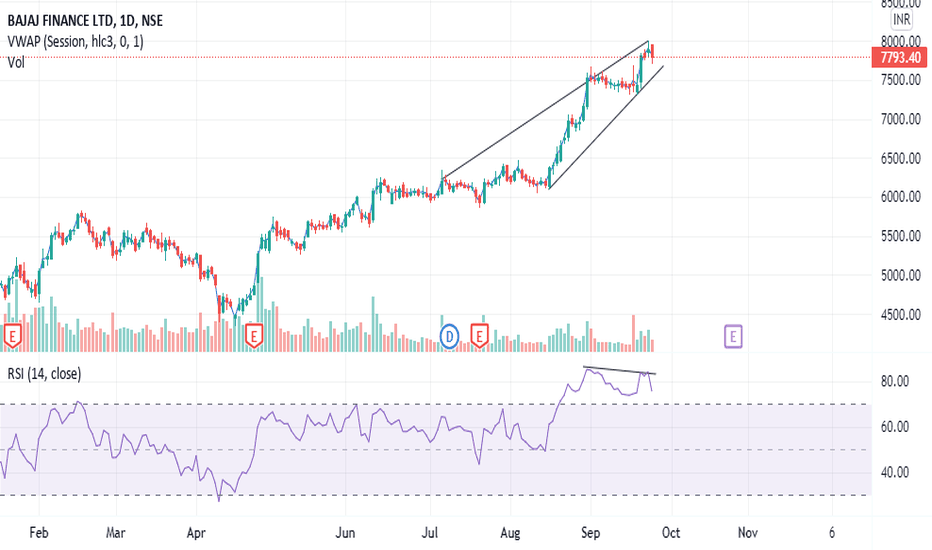

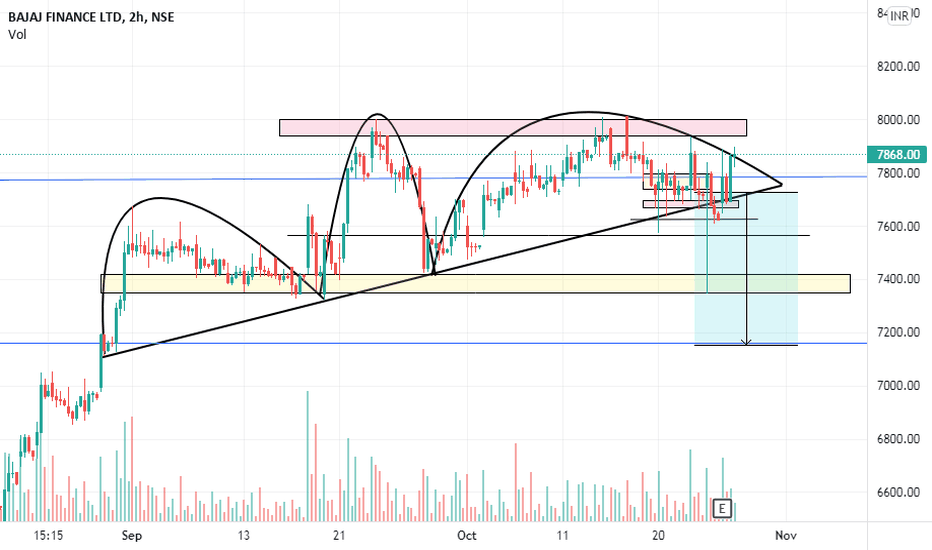

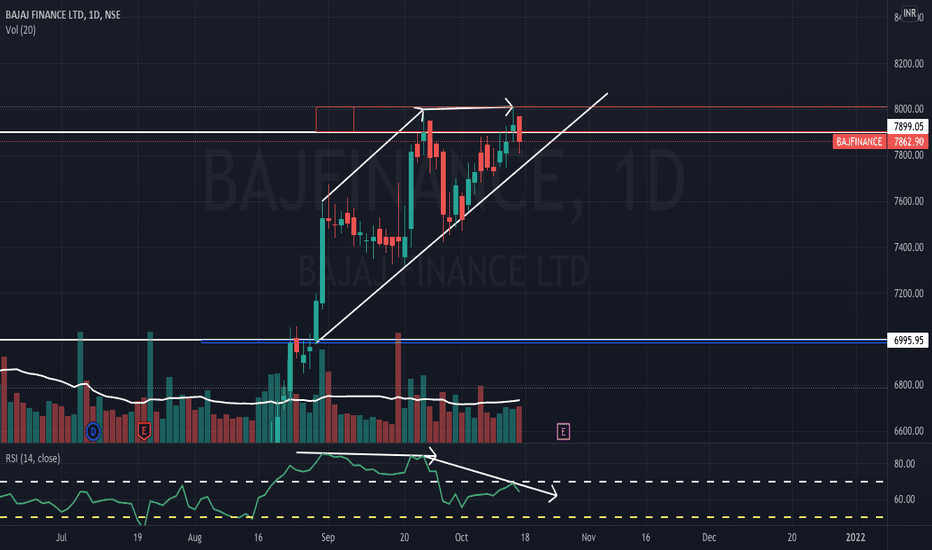

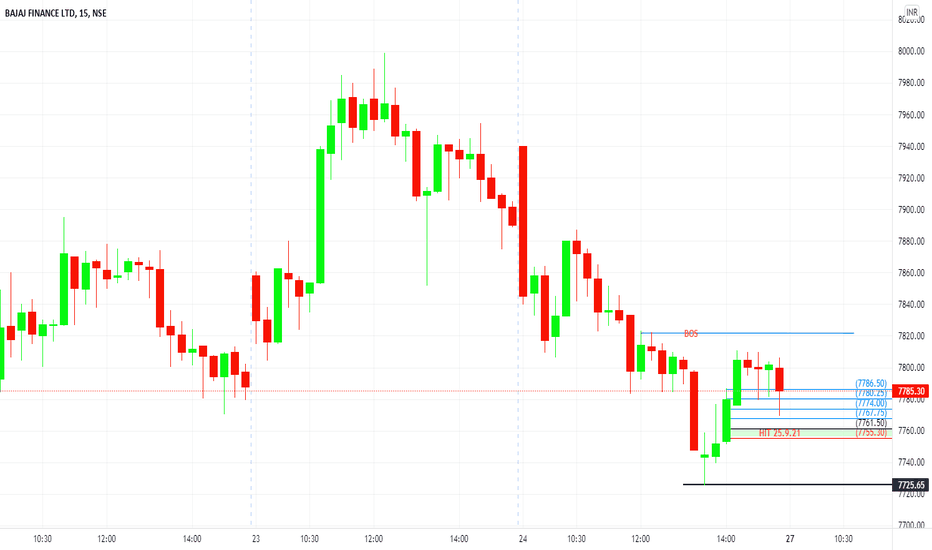

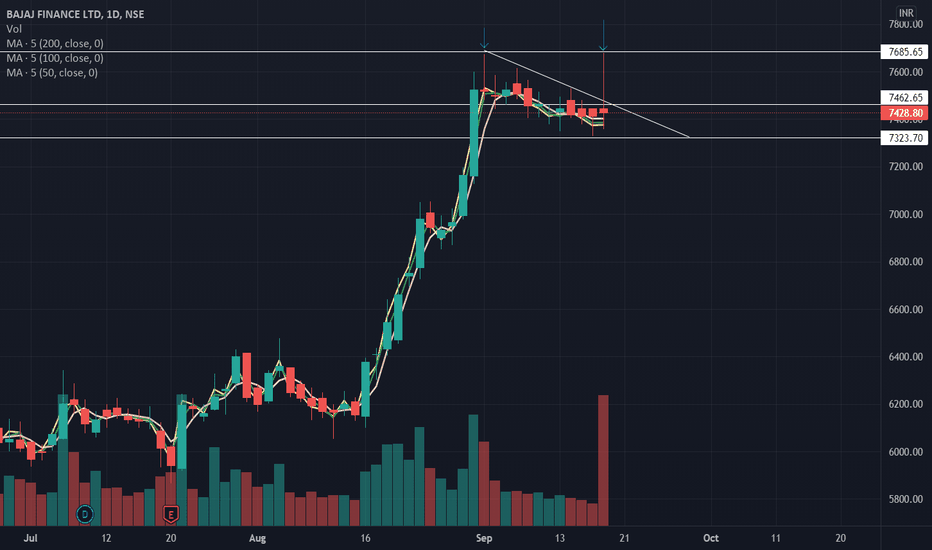

BAJAJ FINANCE DAY TIME FRAME ANALYSISDouble top structure with bearish rsi divergence. The view will negate if 8000-8010 crossed.

White arrows show that stock is making higher highs but the rsi indicator is making lower highs, hence the rsi divergence.

One more red candle on day time frame (breaking the trend line), one can go short with 8000-8010 as stop-loss or can sell call options above 8000 and hedge with an OTM call.

TARGET 1: 7650-7700 Range

TARGET 2: 7500-7550 Range

Disclaimer: consult your financial advisor before taking any trades or positions

Thank you!

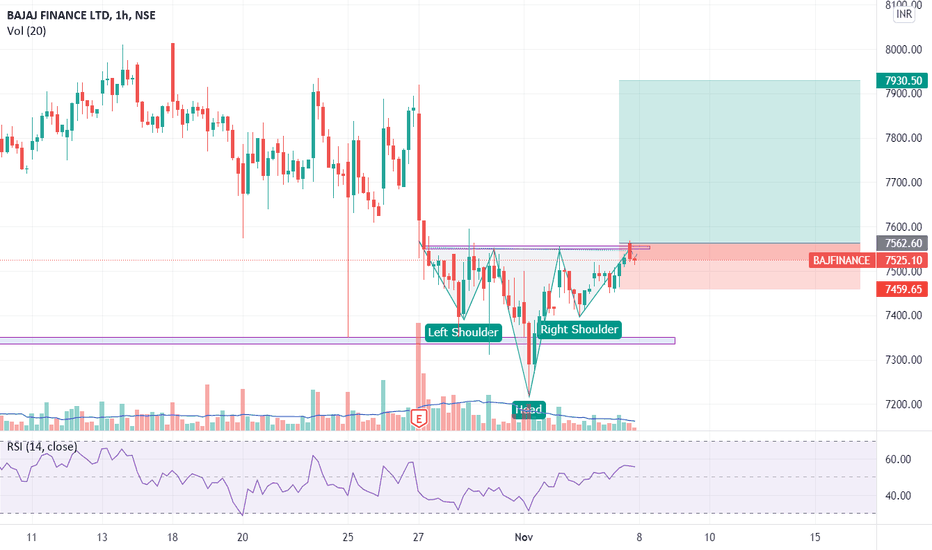

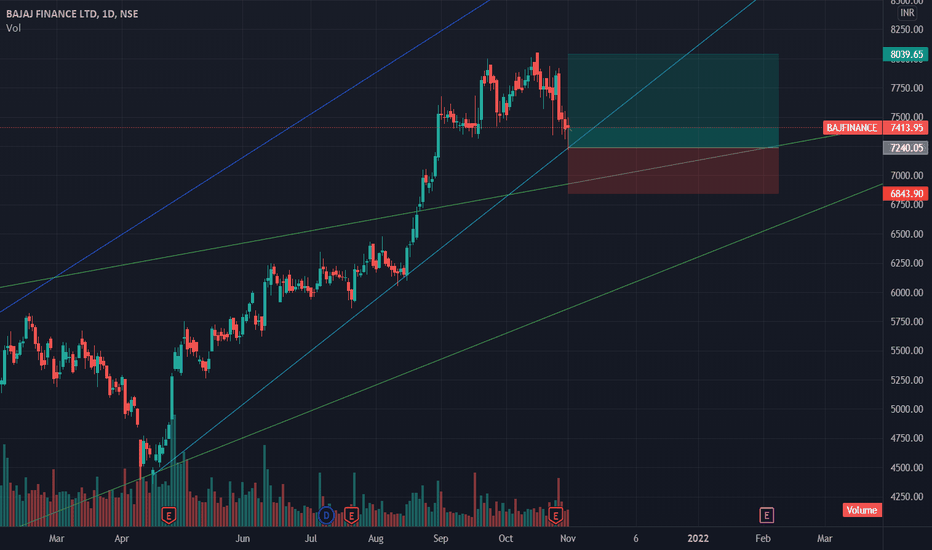

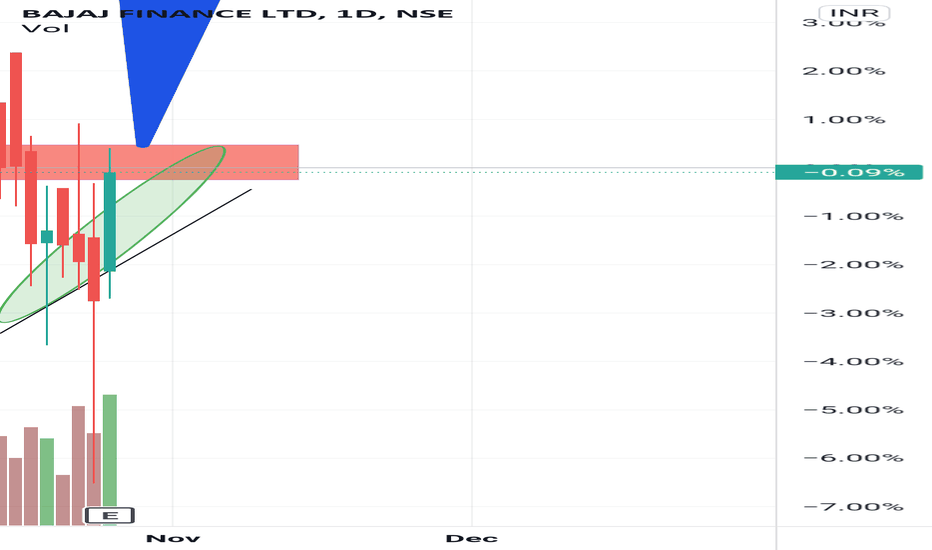

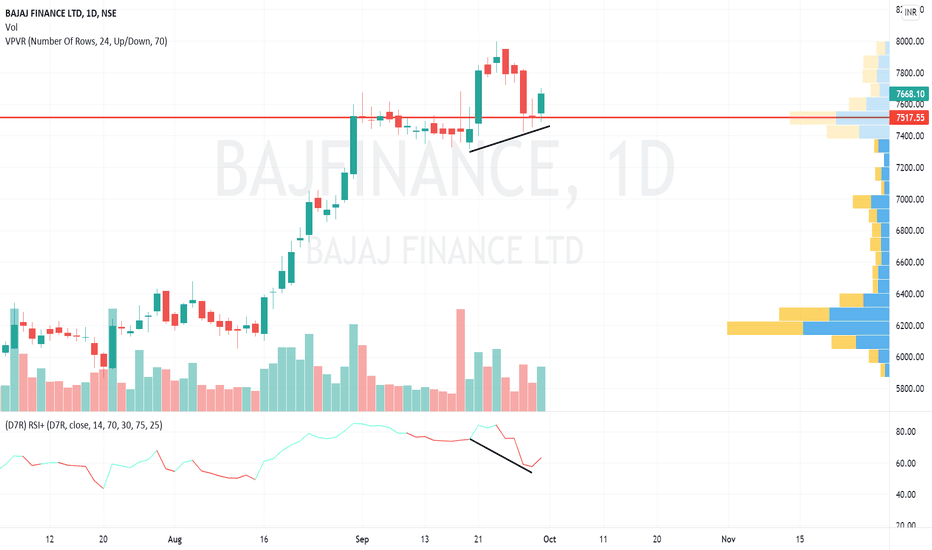

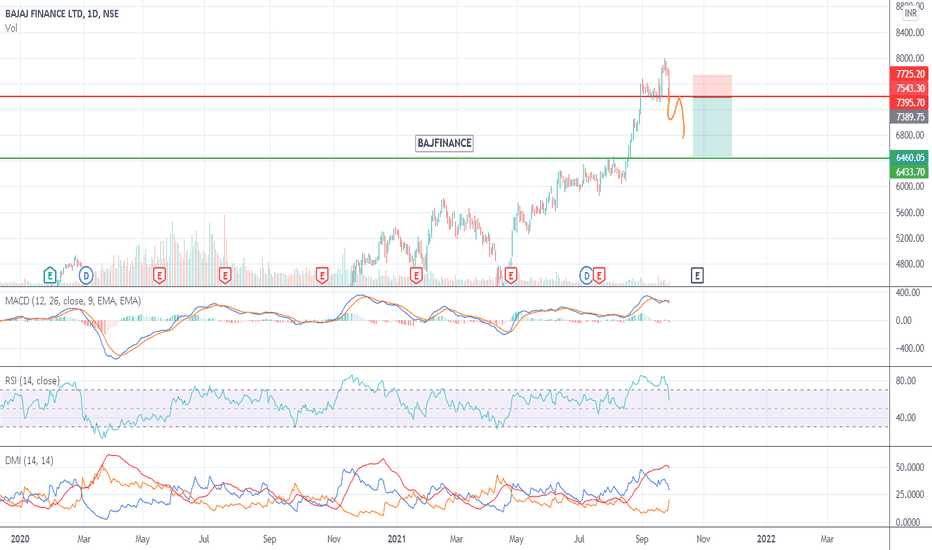

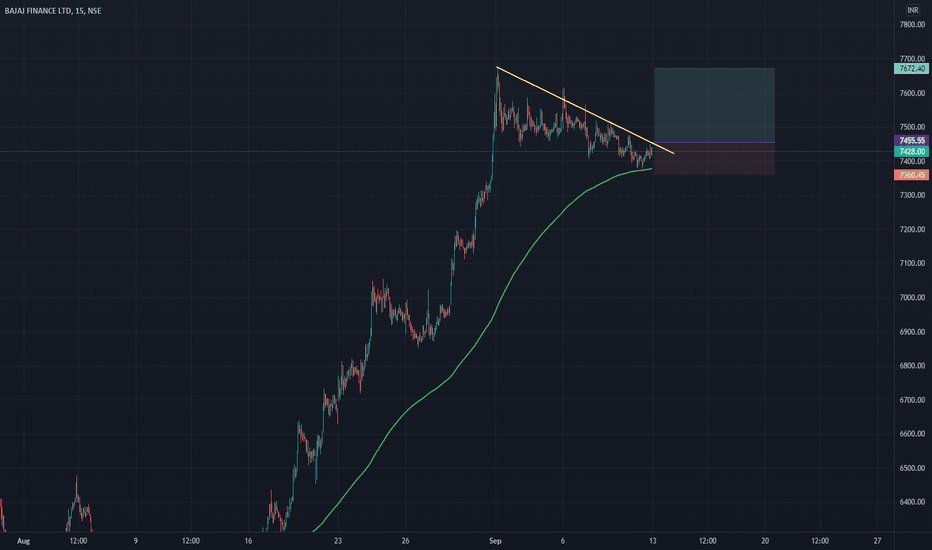

BAJFINANCE SHORT The indicators used to analyze this chart suggests that BAJFINANCE will probably reverse after a strong movement where the stock was overbought. As we can see, MACD line has just passed the signal line, indicating the presence of a bullish momentum. DMI indicator shows us that the uptrend is not strong anymore because +DM and -DM are closer than before now. And this indicate us that the uptrend is losing strength. RSI indicates that BAJAFINANCE may lose bullish momentum. Now we should wait for the price to break the support and retest it as a resistance.

Therefore rejection at the resistance will be our entry price.

P.S No financial advice