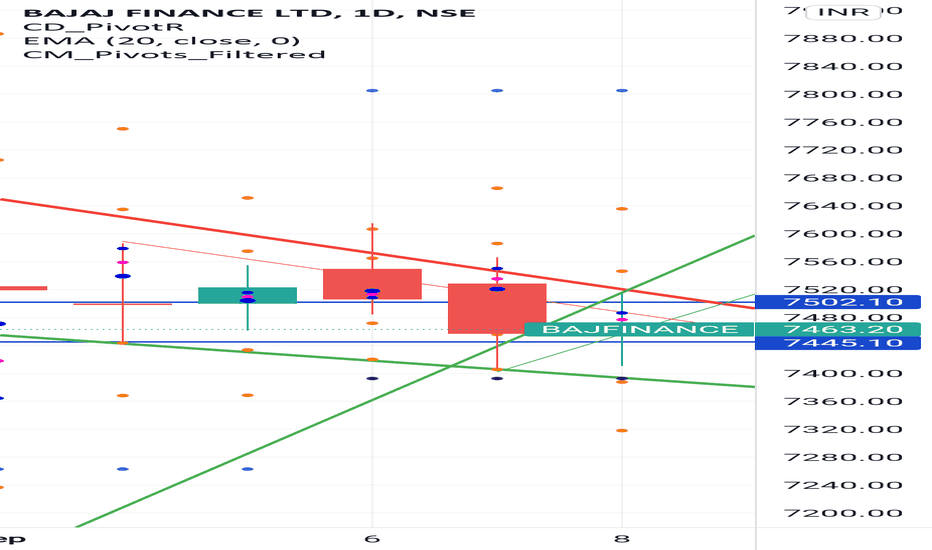

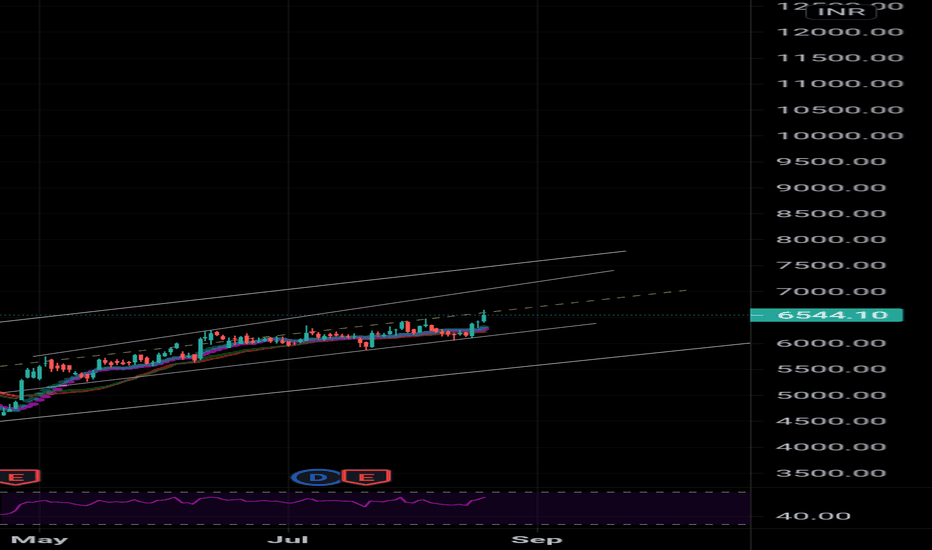

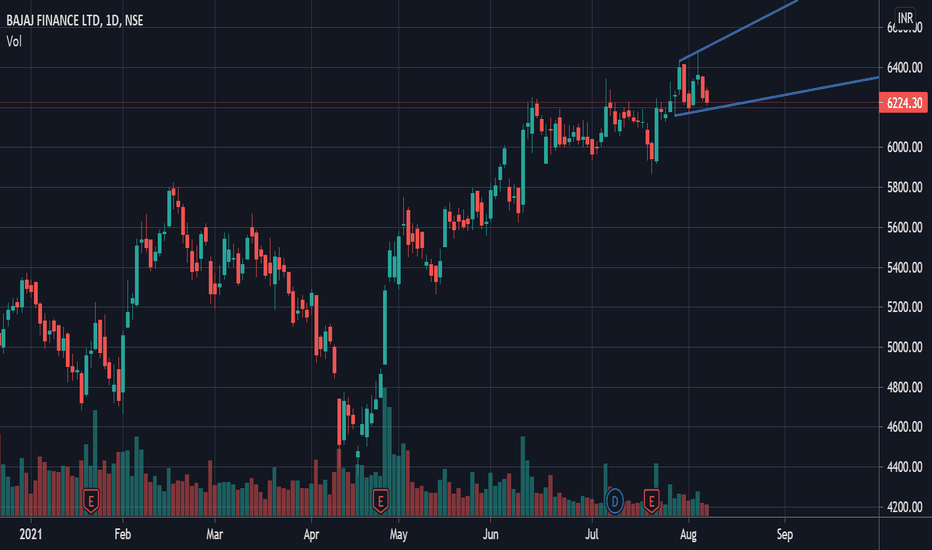

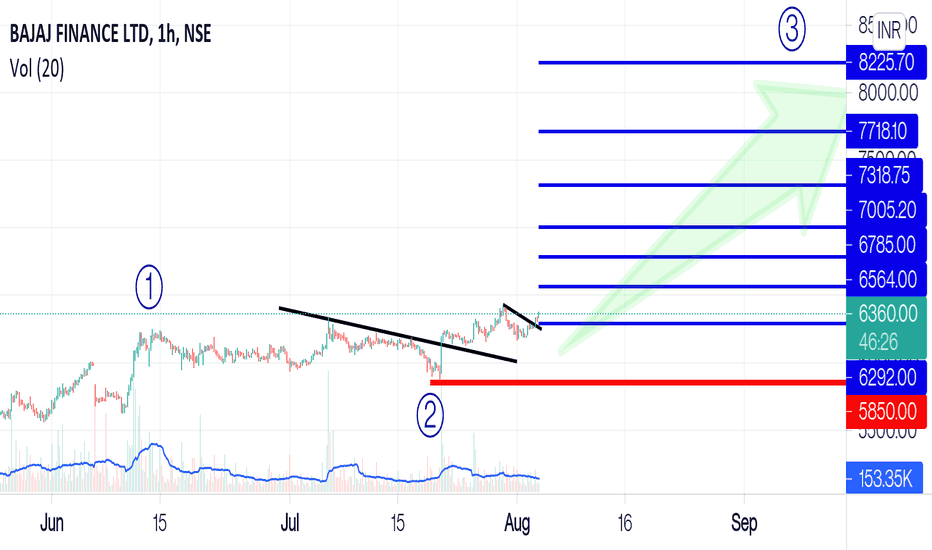

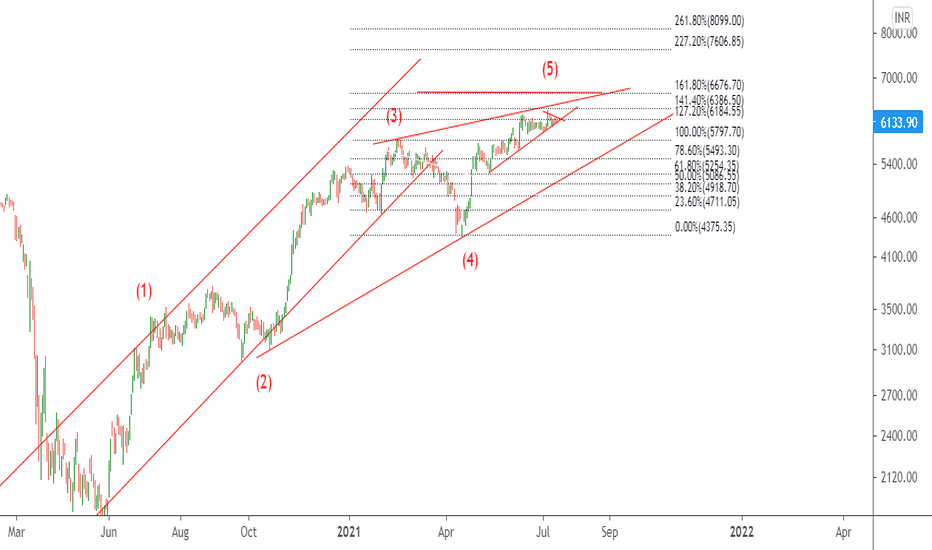

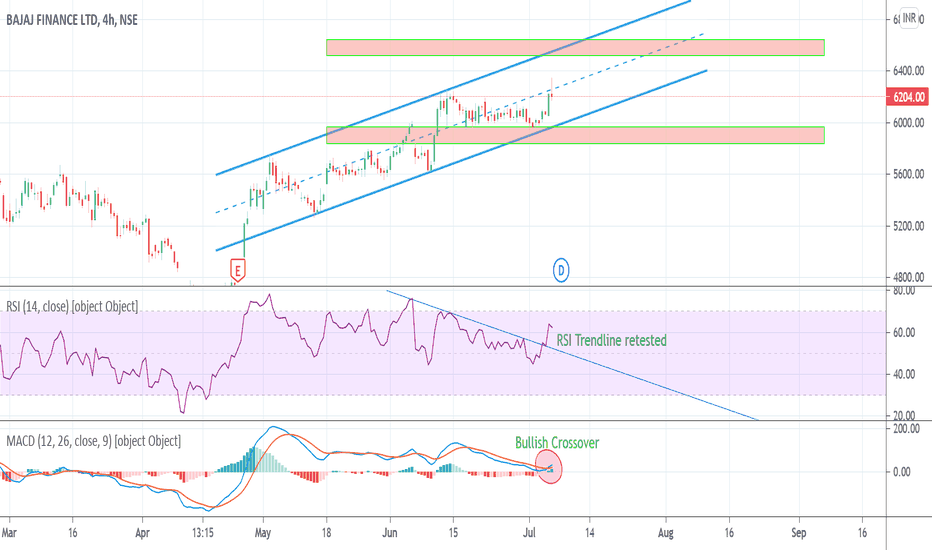

Bajaj Finance still upside can happenAs per chart analysis l'm expecting it can touch 8000 as a round level by the end of the September or 1st week of October but one things we should remember this stock is hugely out perform after COVID so book profit at 8000 level and it can do more of sustain above 8000. Trend line for you information and only education purpose.

Cheers

Happy learning

BAJFINANCE trade ideas

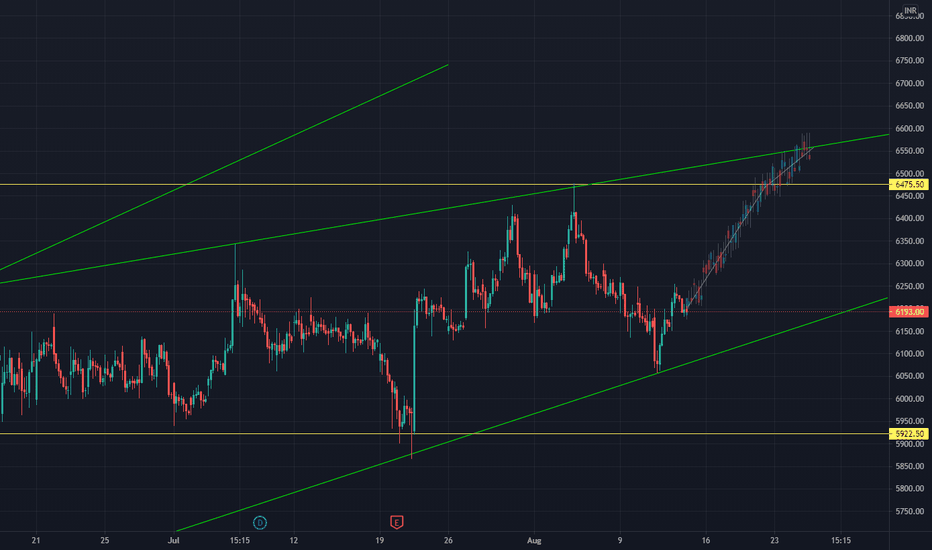

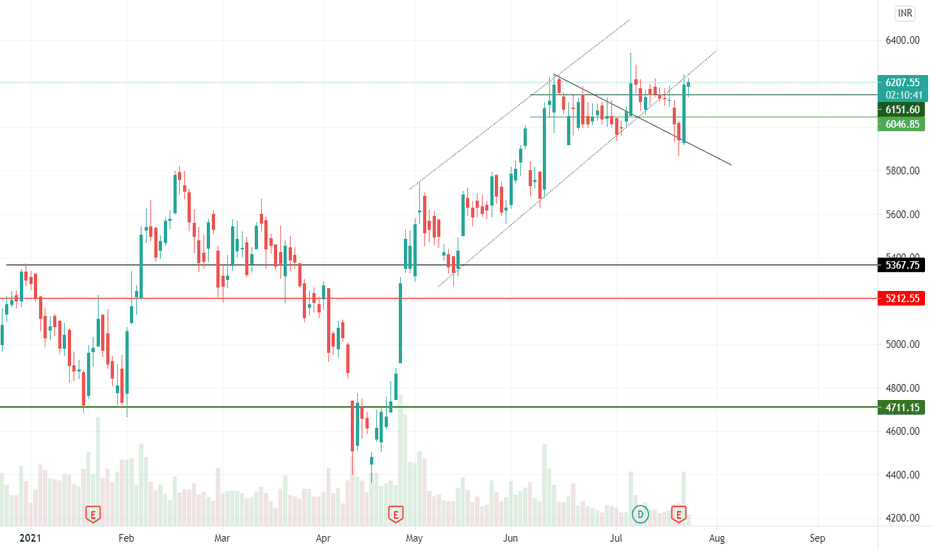

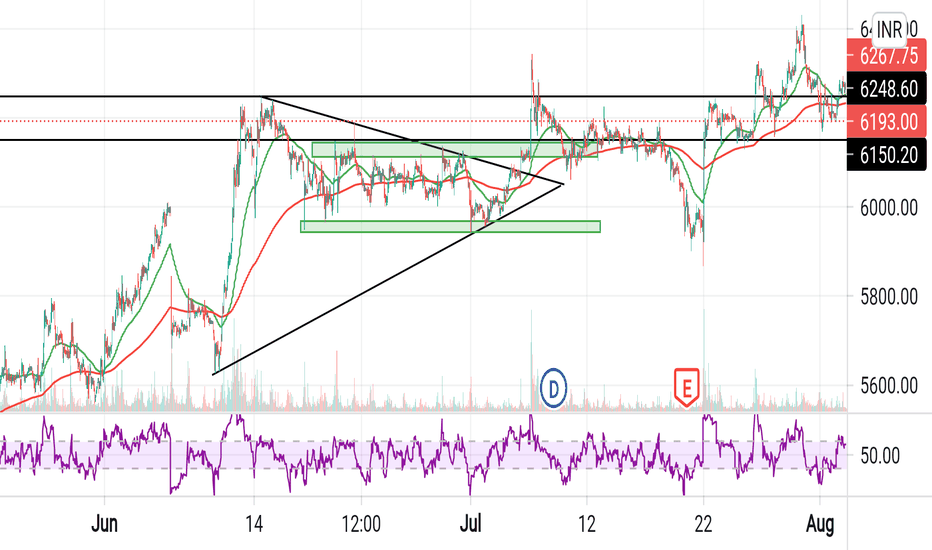

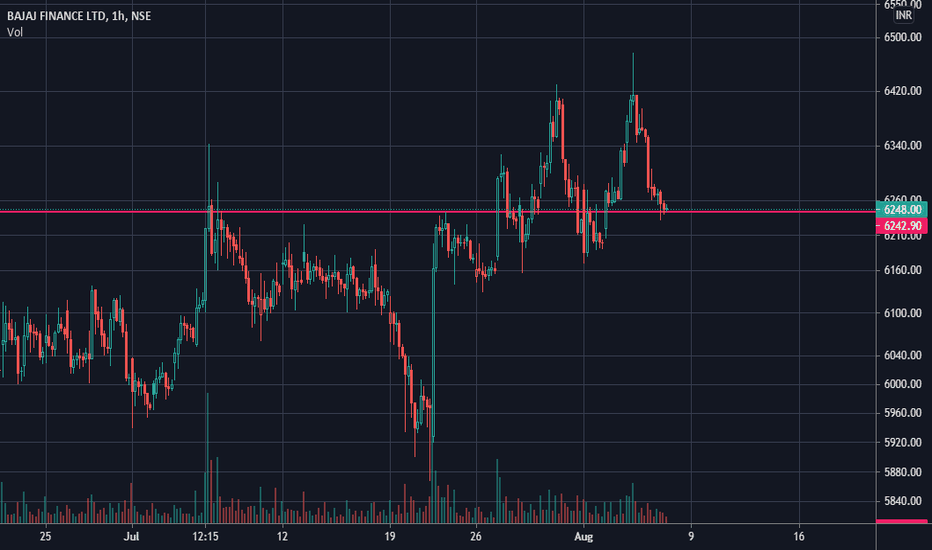

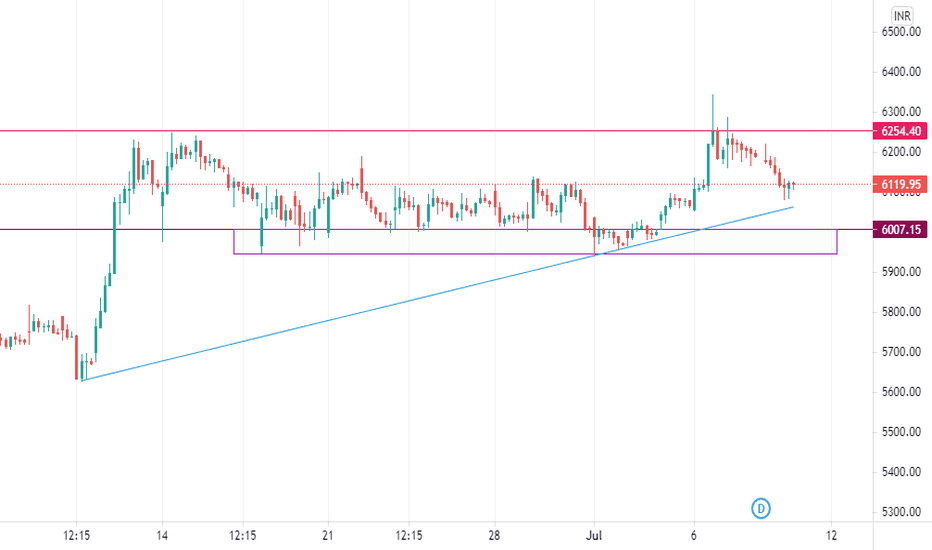

Analysis on Bajaj finance Break down from the channel and get to retest

6000 possible within 3days and will be in range bound 5950-6250 just 300 points range

bounced from trendline support and psychological support

therefore, break out above 6300 target will 6700,6900 from fib A

at the same time, break down below 5900 target will be 5350

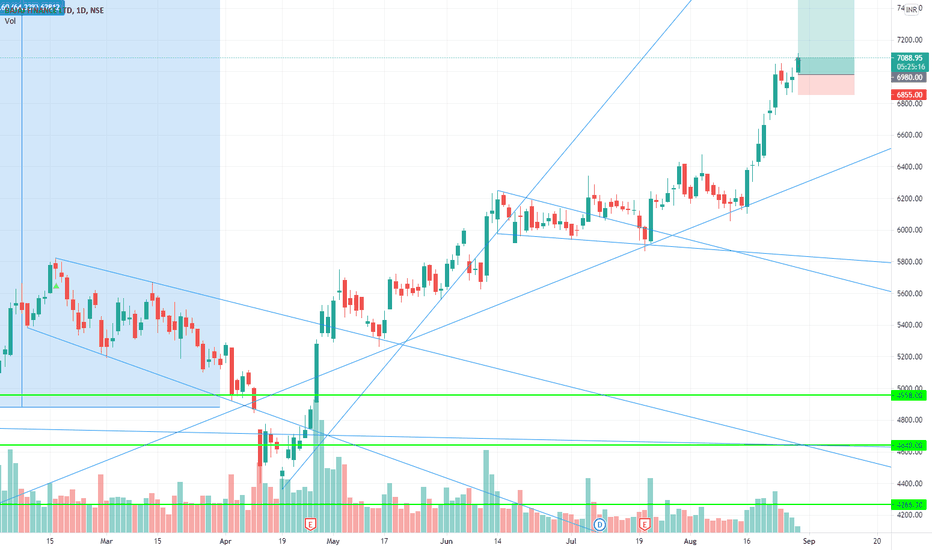

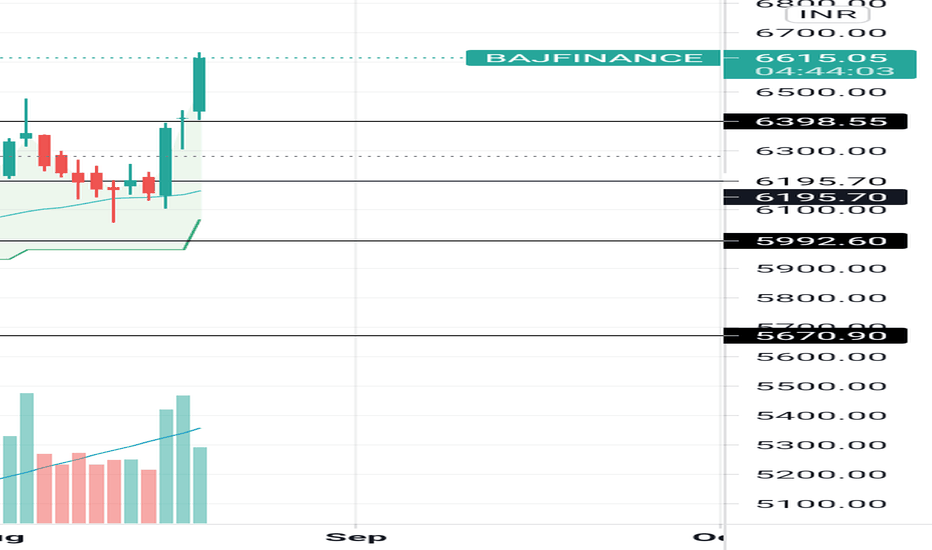

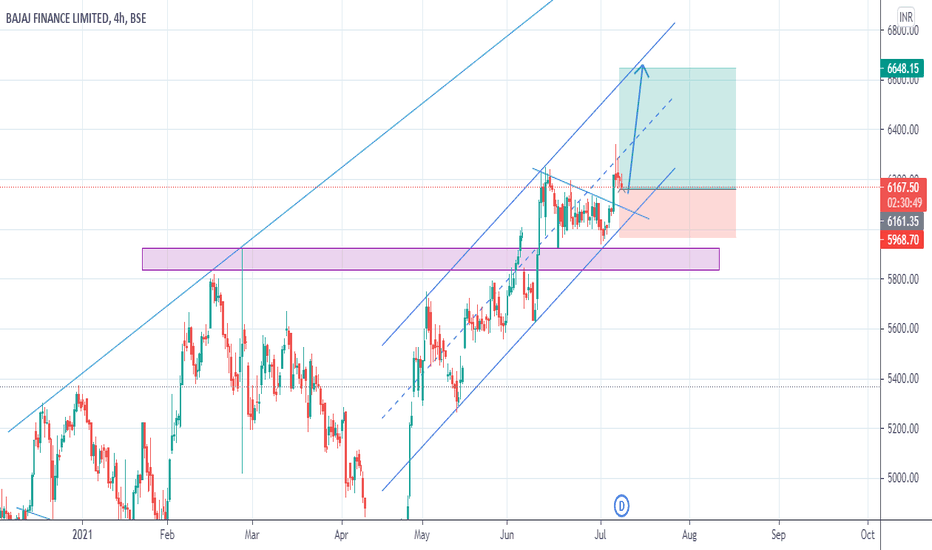

BAJAJ FINANCE LTDThis stock is near brackout

Stock related information-

- higher delivery quantity.

- stock outperforming benchmark index.

- increased relative strength benchmark index.

-SRS & ARS Abow zero.

-5 EMA crossing 20 EMA below zero.

-MACD crossing abow zero line.

Note: Long for 15 days to 1 month for tp1 and tp2.

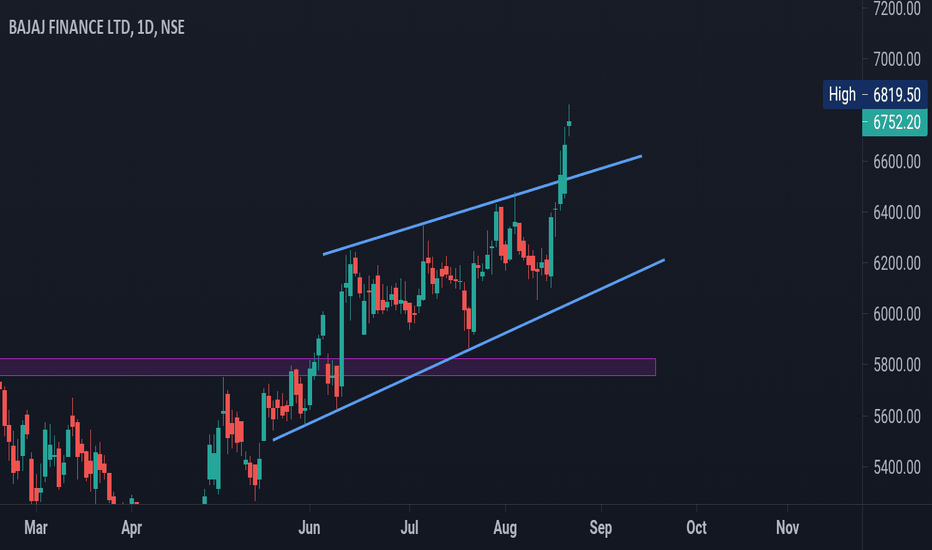

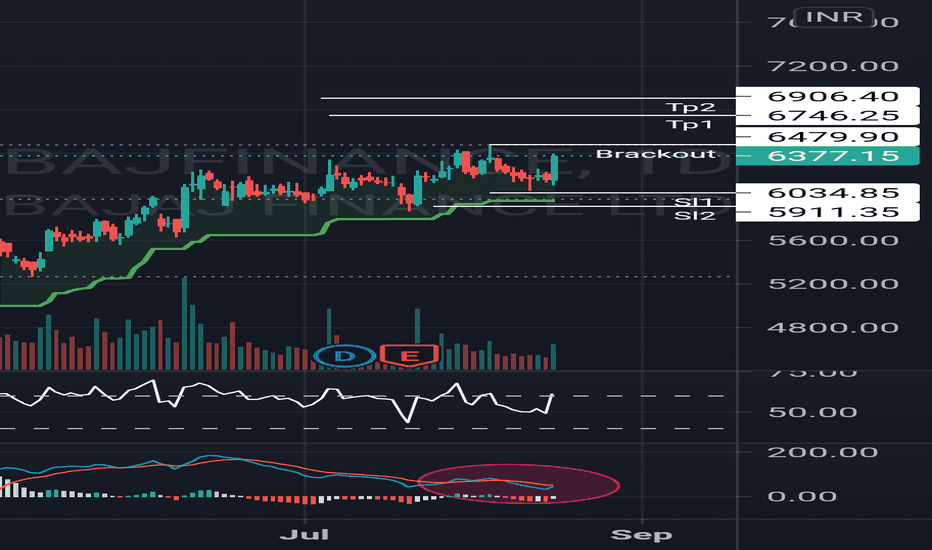

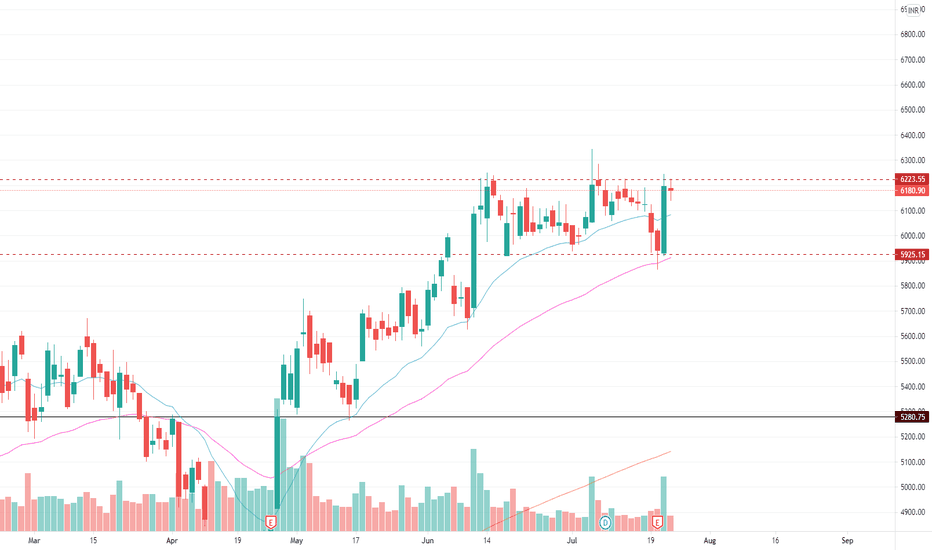

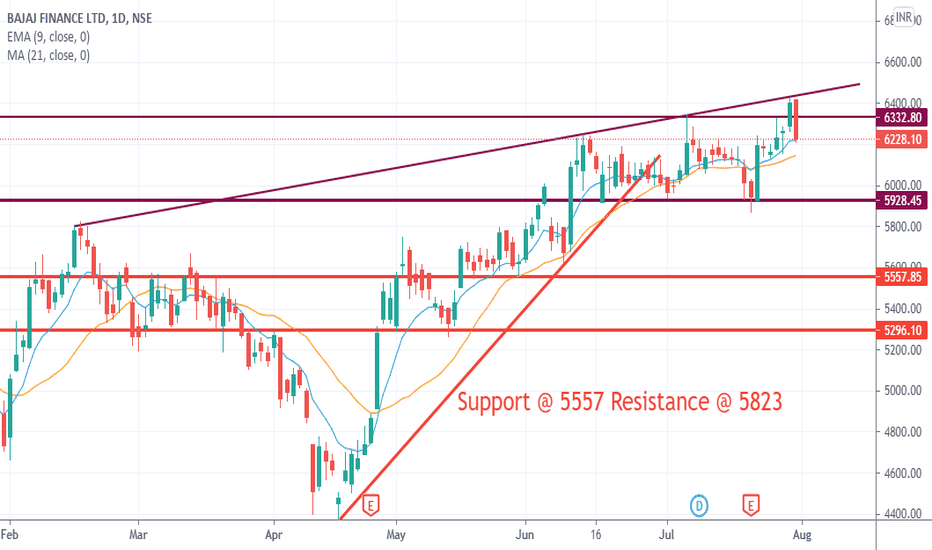

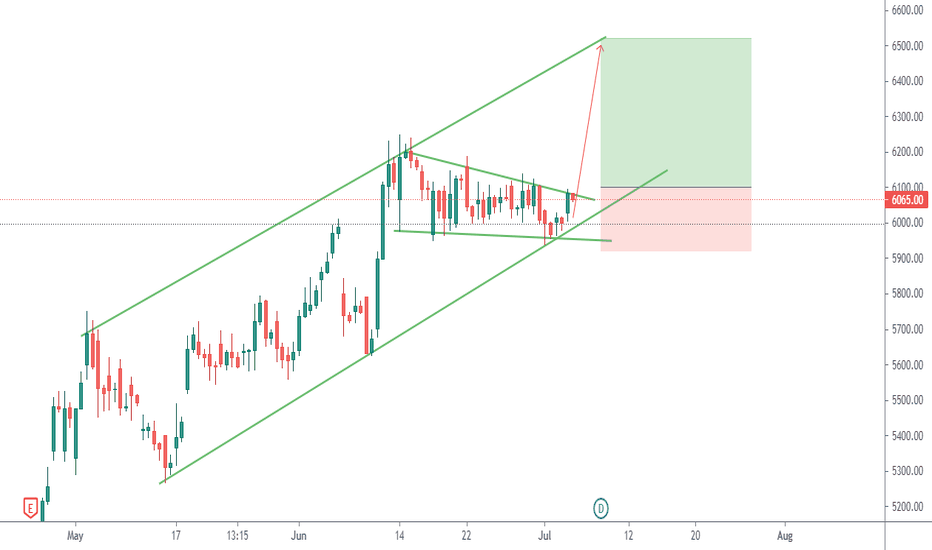

BAJFINANCE looks undecisive and could breakout either wayJust marking a couple of levels on the daily where the stock has been taking support(5925) and resistance(6223) multiple times now. We wait for a breakout on either side. A strong closing above or below these levels could trigger our entry but caution is advised as it's been stuck in this zone for a while now. Entry looks good with 1:3 being the minimum target. Lower SL Bigger Targets. Cheers and Happy Trading.

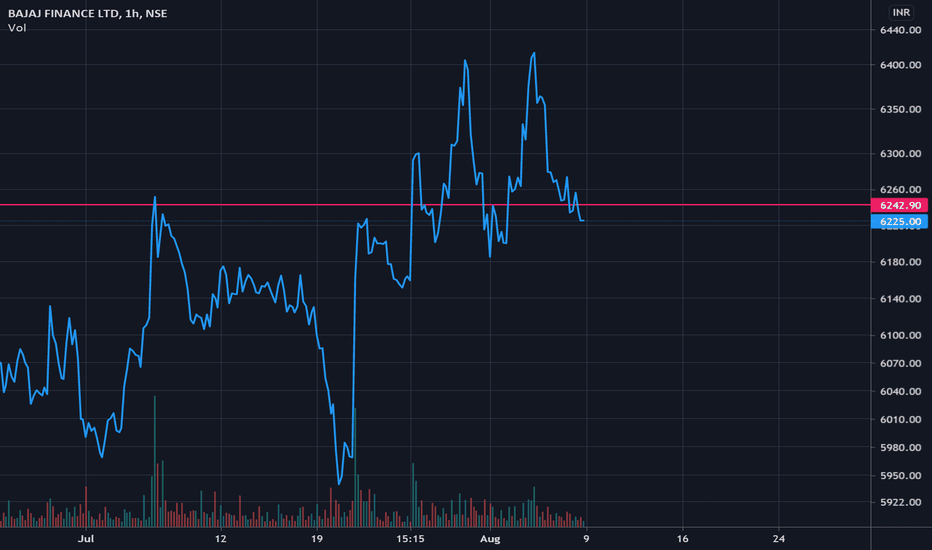

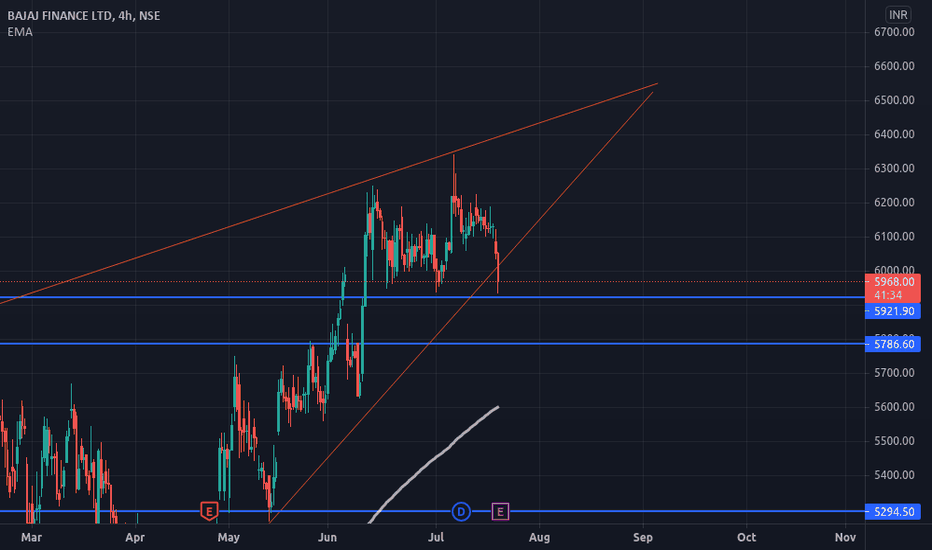

Bajaj finance Bajaj finance has given double breakout, one on daily basis and other on hourly basis, both breakouts are having good intensity of volume, as per wave structure it looks like 3rd of 3rd. all the indicators parameters are also aligned with positive situation, one can go long at these levels or in dips with key levels mentioned on chart

Key Levels are Mentioned on chart

Breakout with Good intensity of Volume in daily

Breakout with Good intensity of Volume in hourly

Macd in daily positive crossover and Uptick

Macd in hourly positive crossover and Uptick and also above zero line

Rsi in daily above 60 uptick

Rsi in hourly near 60

Dmi adx positive ungali setup in daily time frame

Dmi adx positive ungali setup in hourly time frame

Upper Bollinger Challenged in hourly

Disclaimer

I am not sebi registered analyst

My studies are Educational purpose only

Consult with your Financial advisor before trading or investing