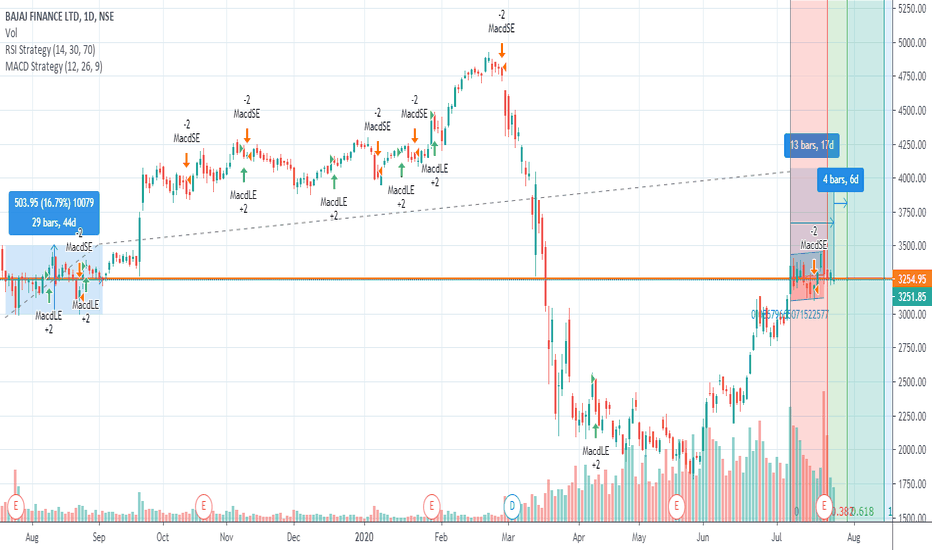

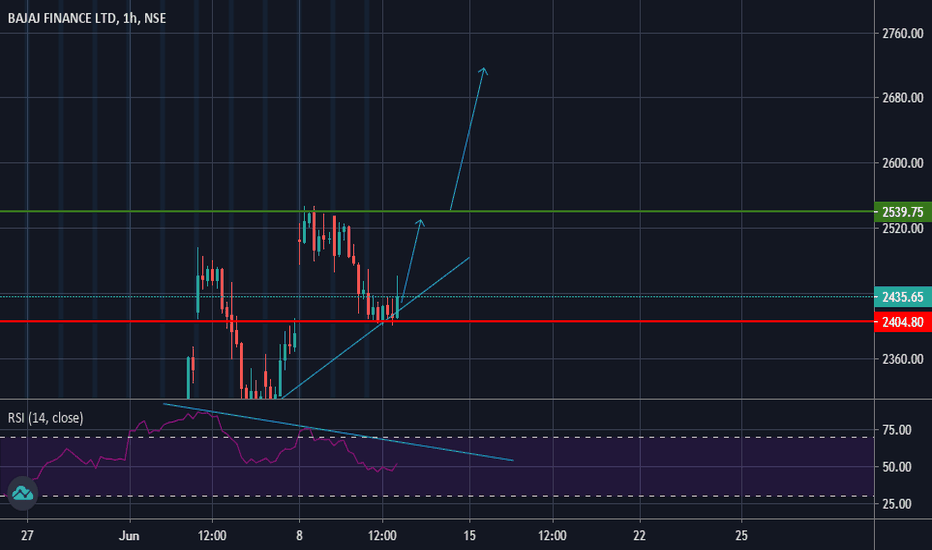

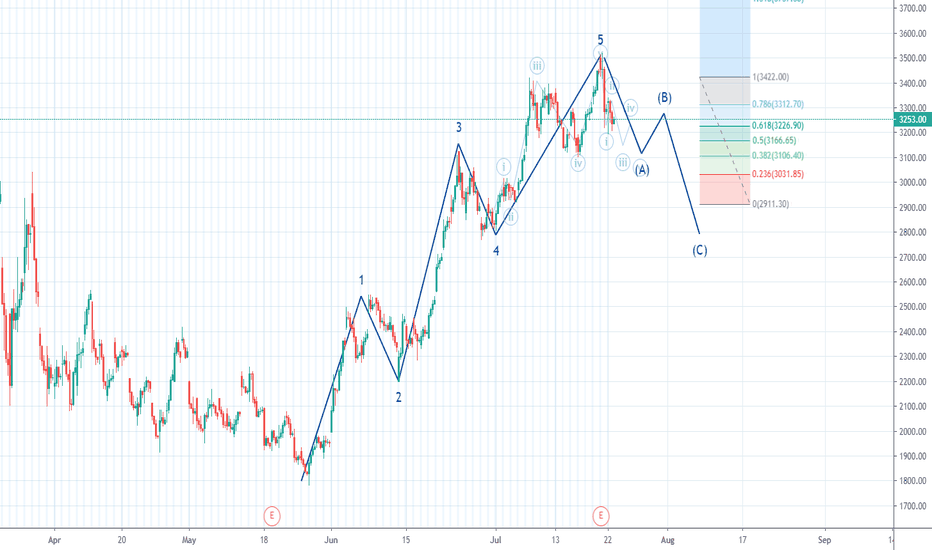

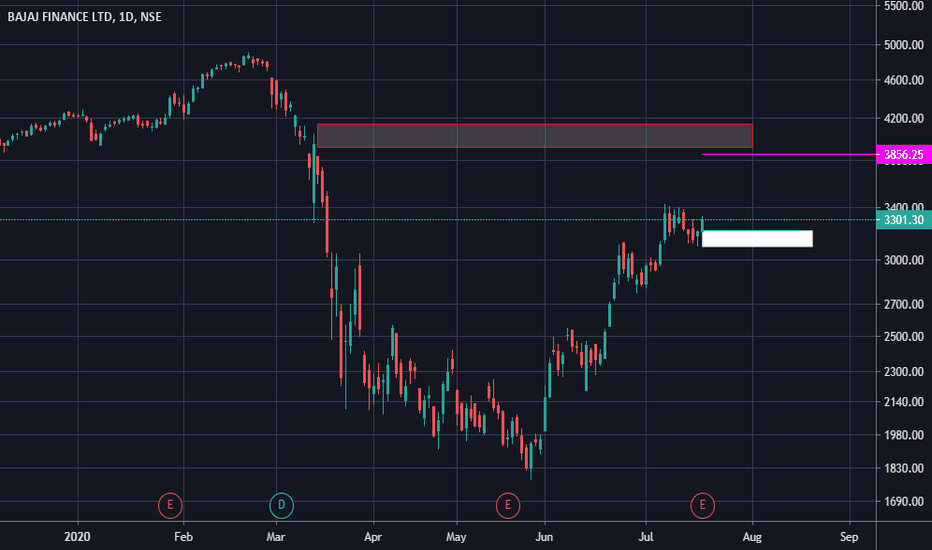

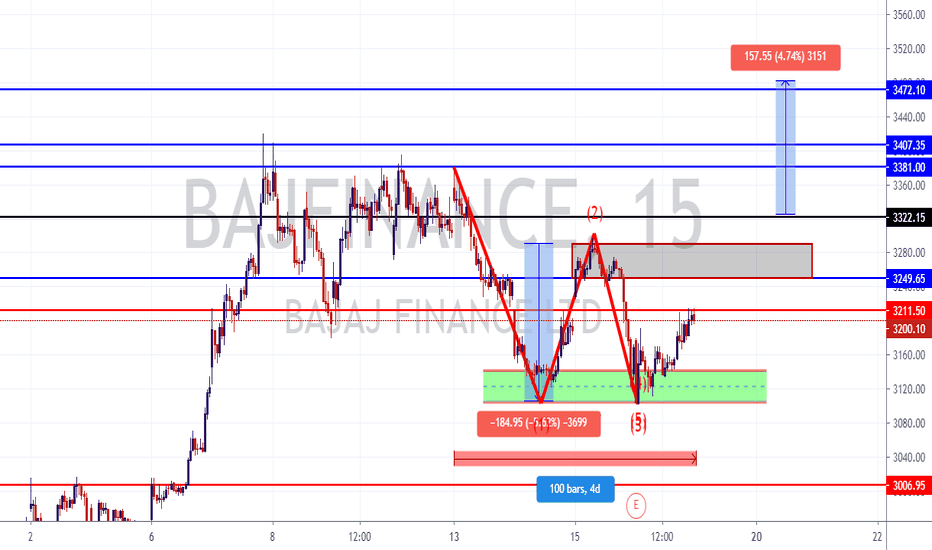

Bajaj Finance Ltd (Bajajfin - NSE) - stay short in bounce Bajaj Finance Ltd (Bajajfin - NSE) has completed ABC sequence down in 30 min time frame as W wave and now correcting up in X wave, where c wave will start soon. So it may be possible to make new high in X wave, so stay long with stops below 3183.50 for target of around 3430 or higher.

BAJFINANCE trade ideas

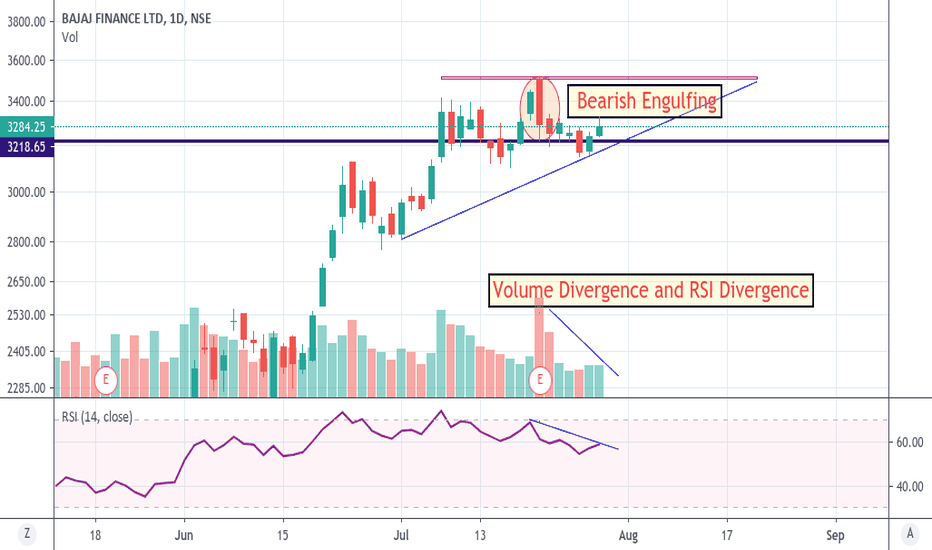

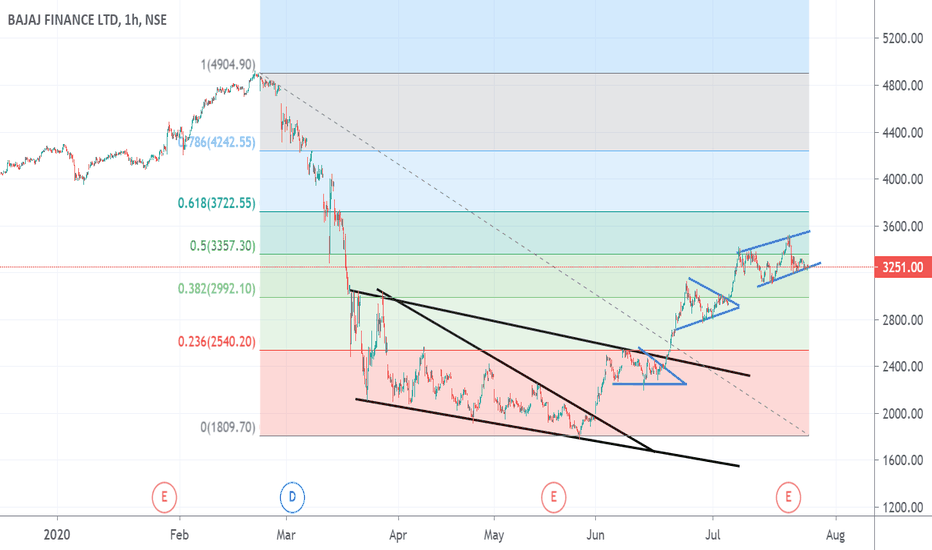

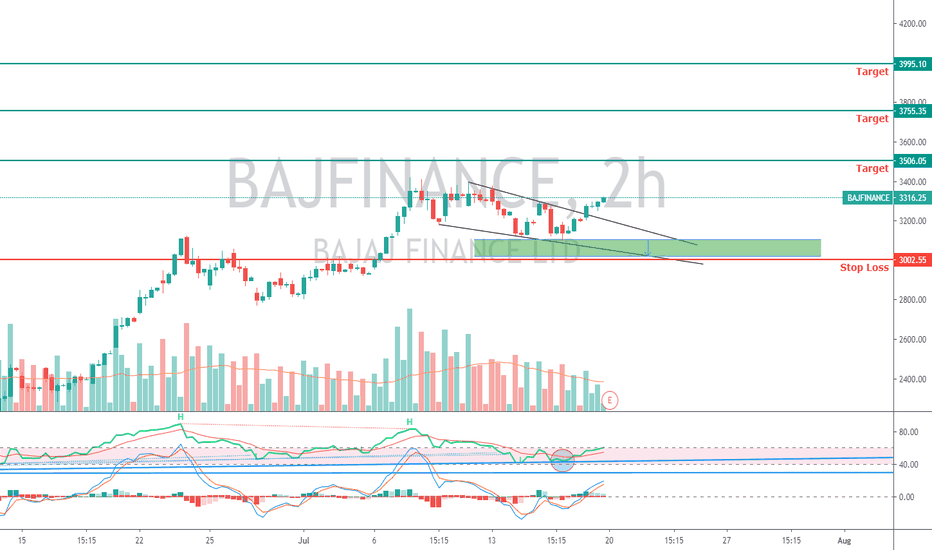

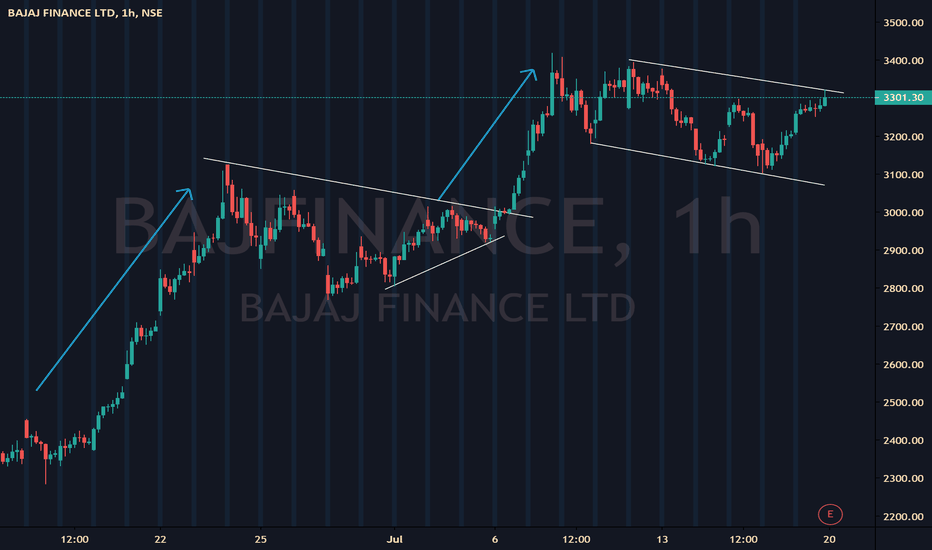

Triple Dhamaka is happening in Bajfinace #NiftyTriple Dhamaka is about to happen in Bajfinance be sure to Grab this opportunity, Check below :

1) Bearish Engulfing

2) Triangle Breakout

3) Volume & RSI Divergence

And moreover Option chain data also shows that writer is quite betting on CE side rather than PE side.

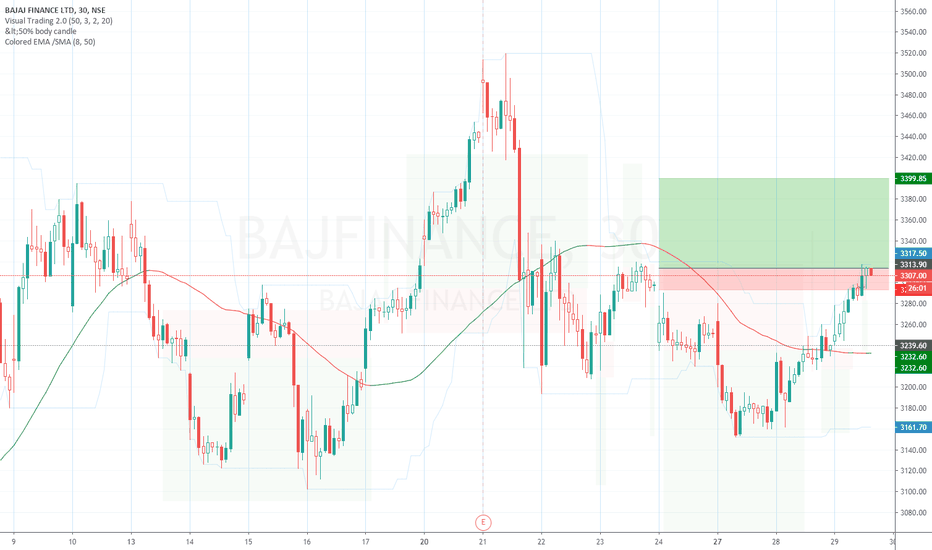

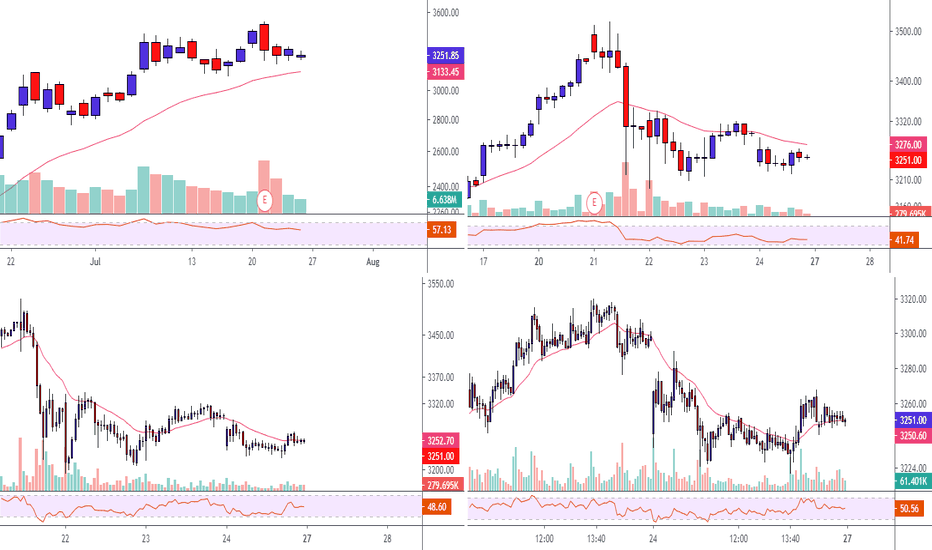

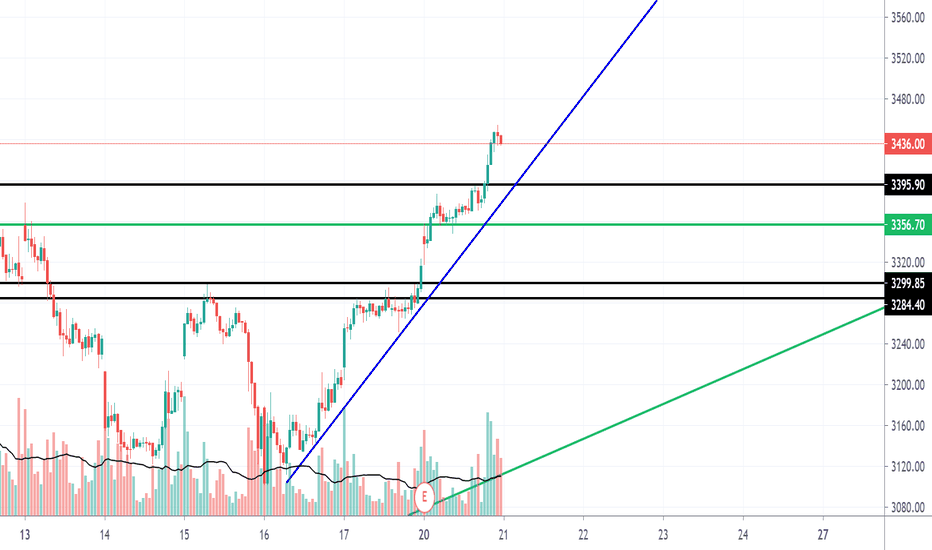

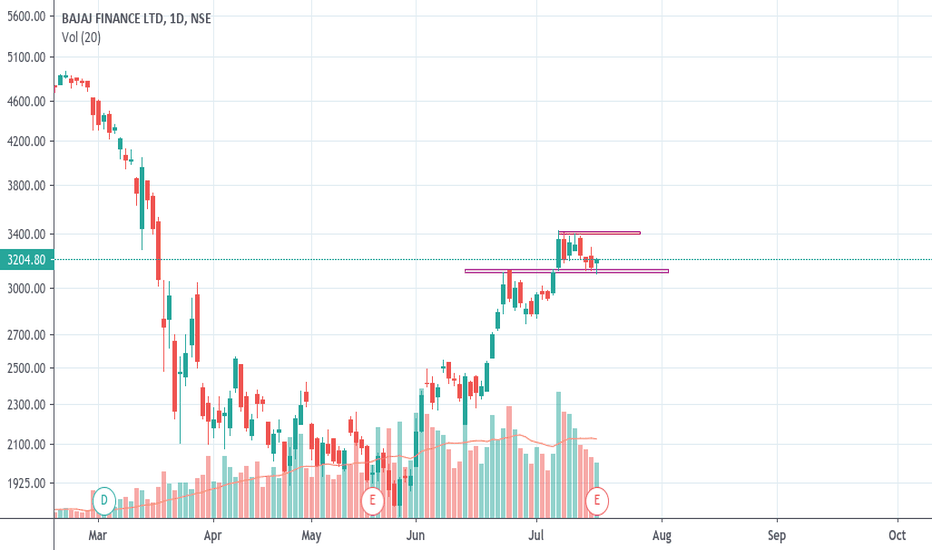

Bajaj finance Intraday for 23rd July Good Morning sir's

Today's first dish in our breakfast menu is Bajaj finance, Sitting on their Dynamic support daily and in a 4-hour time frame. Stock is damn bullish since June month but 1st Quarter Results has stopped the stock rally and stocks give a correction. but the news impact is always for a shorter time frame. anything can happen at this point. Support can break or stocks can give bounce from it.

Long

==========

Above: 3300

Sl: 3250

Target: 3360/3400/3430

Short

============

Lower : 3190

Sl: 3240

Target: 3140/3100/3070

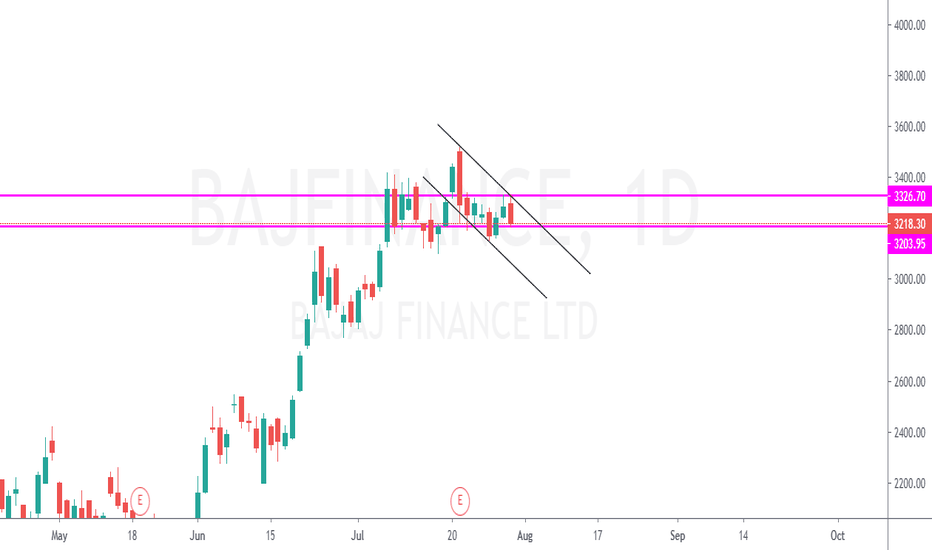

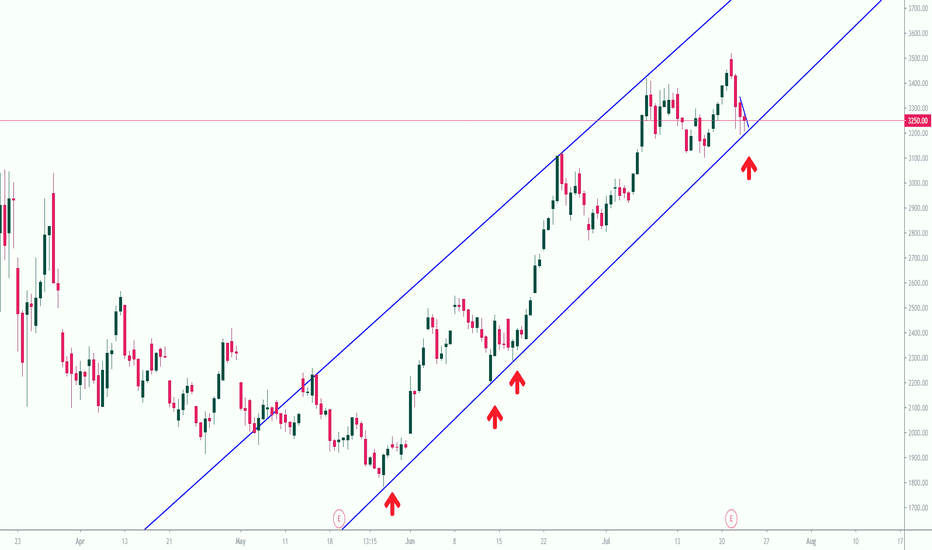

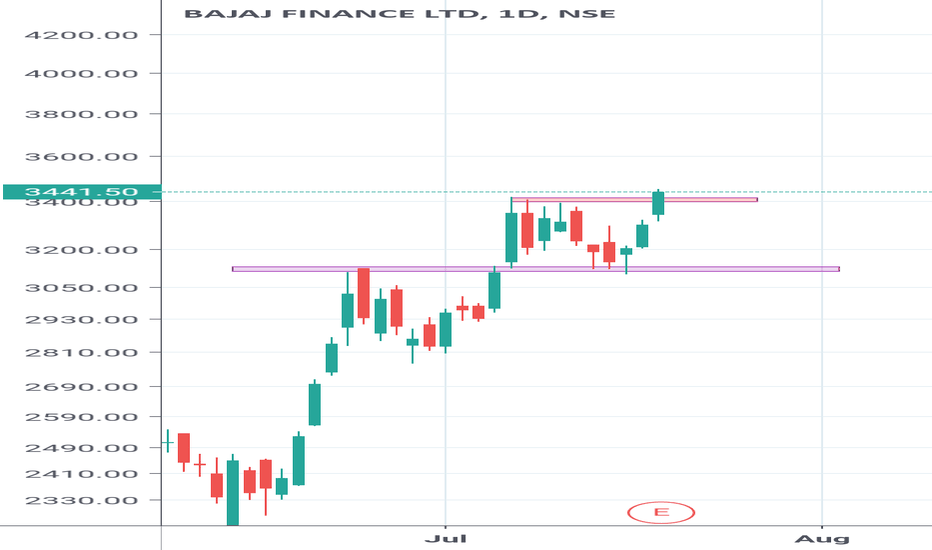

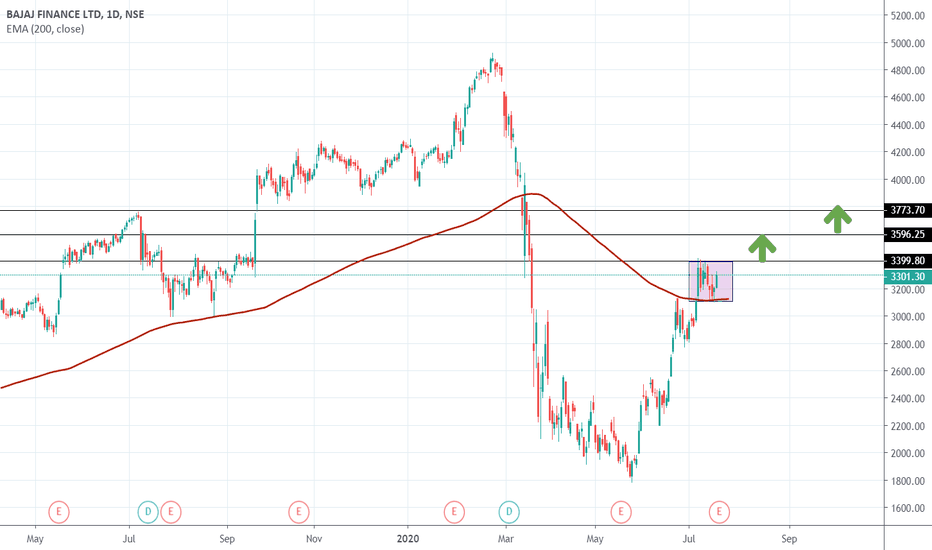

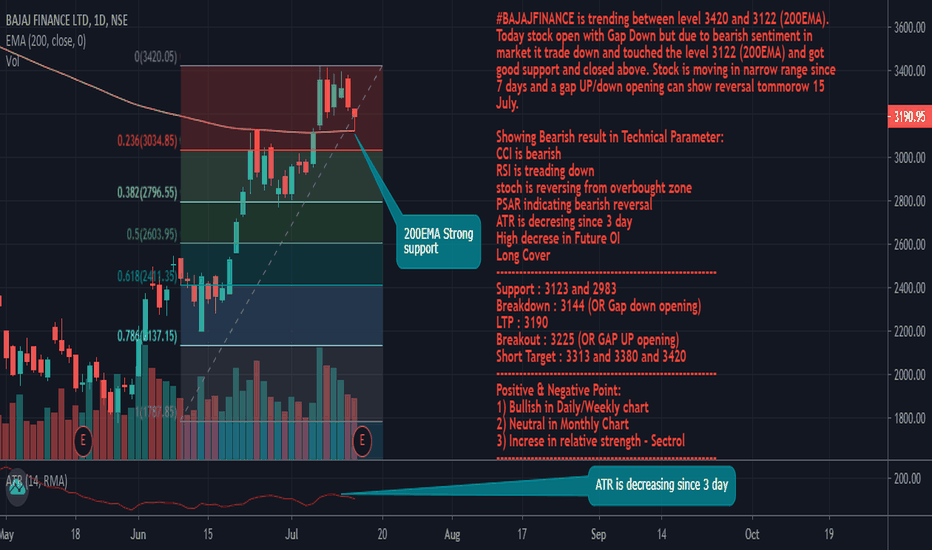

BAJAJ Finance - on Narrow range - showing bearish on Parameter#BAJAJFINANCE is trending between level 3420 and 3122 (200EMA). Today stock open with Gap Down but due to bearish sentiment in market it trade down and touched the level 3122 (200EMA) and got good support and closed above. Stock is moving in narrow range since 7 days and a gap UP/down opening can show reversal tomorrow 15 July.

Showing Bearish result in Technical Parameter:

CCI is bearish

RSI is treading down

stoch is reversing from overbought zone

PSAR indicating bearish reversal

ATR is decresing since 3 day

High decrese in Future OI

Long Cover

----------------------------------------------------------

Support : 3123 and 2983

Breakdown : 3144 (OR Gap down opening)

LTP : 3190

Breakout : 3225 (OR GAP UP opening)

Short Target : 3313 and 3380 and 3420

----------------------------------------------------------

Positive & Negative Point:

1) Bullish in Daily/Weekly chart

2) Neutral in Monthly Chart

3) Increase in relative strength - Sectrol

----------------------------------------------------------

(Disclaimer: This is only for educational purpose and paper treading.)