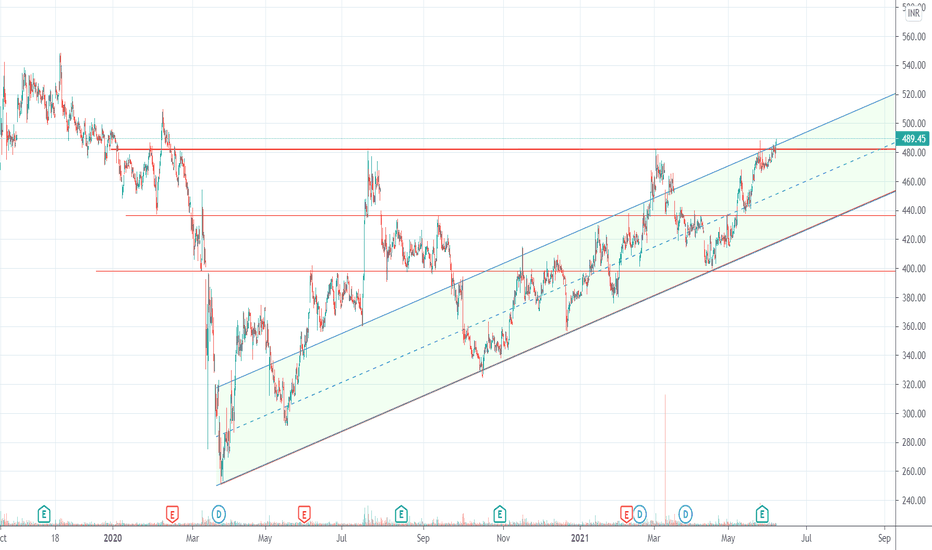

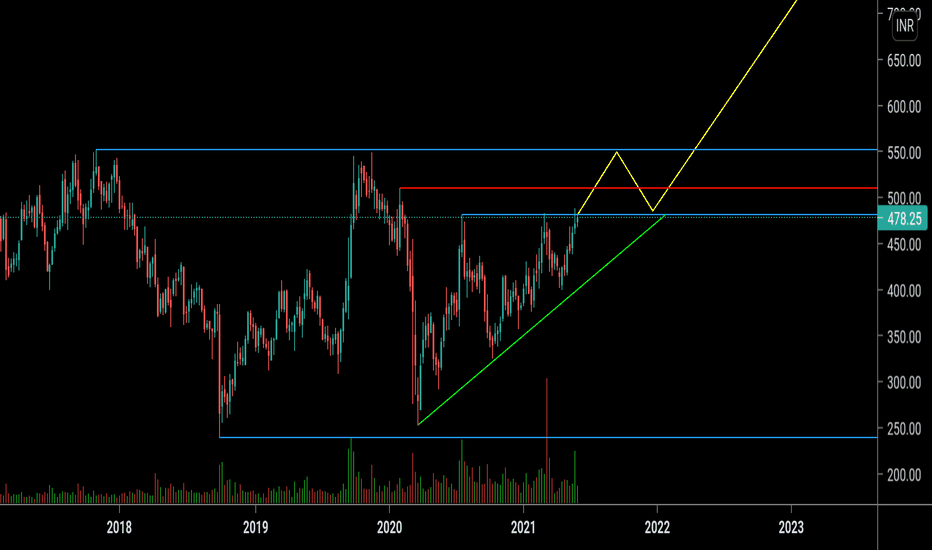

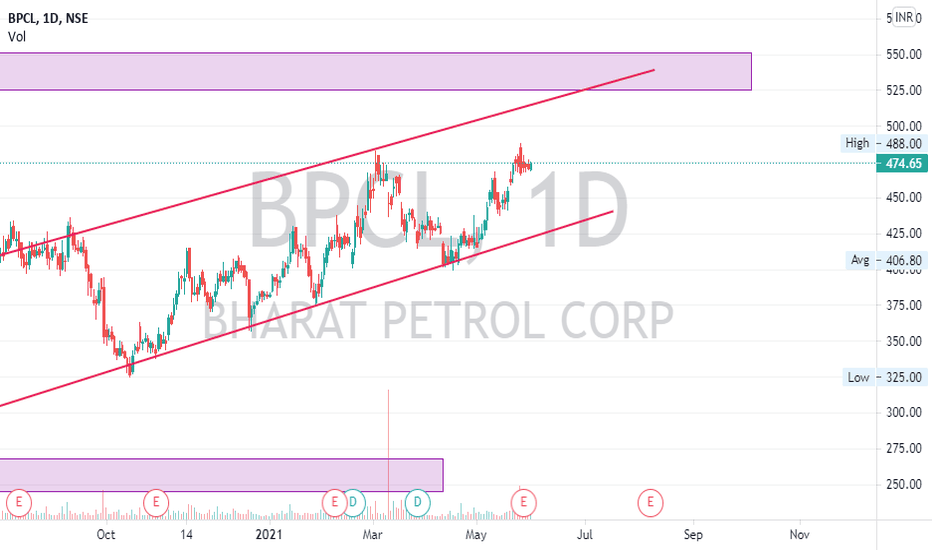

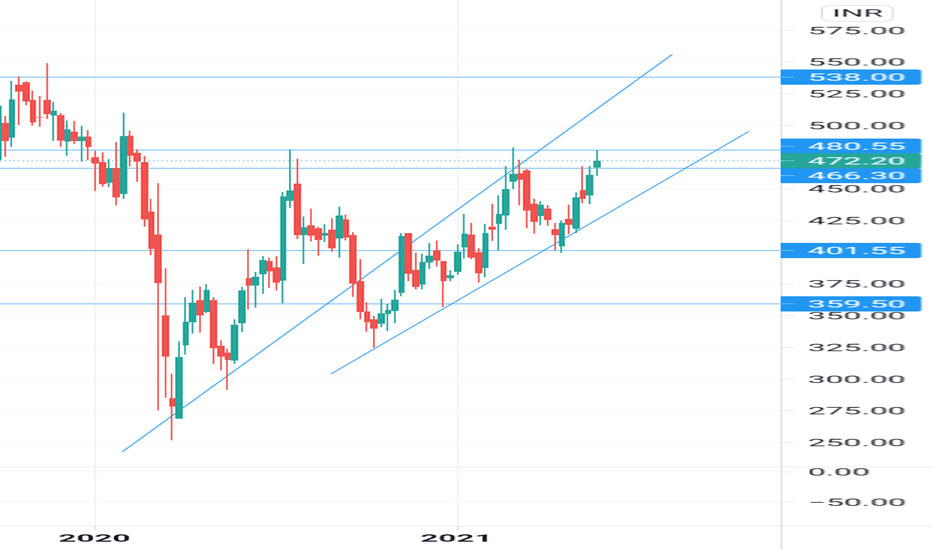

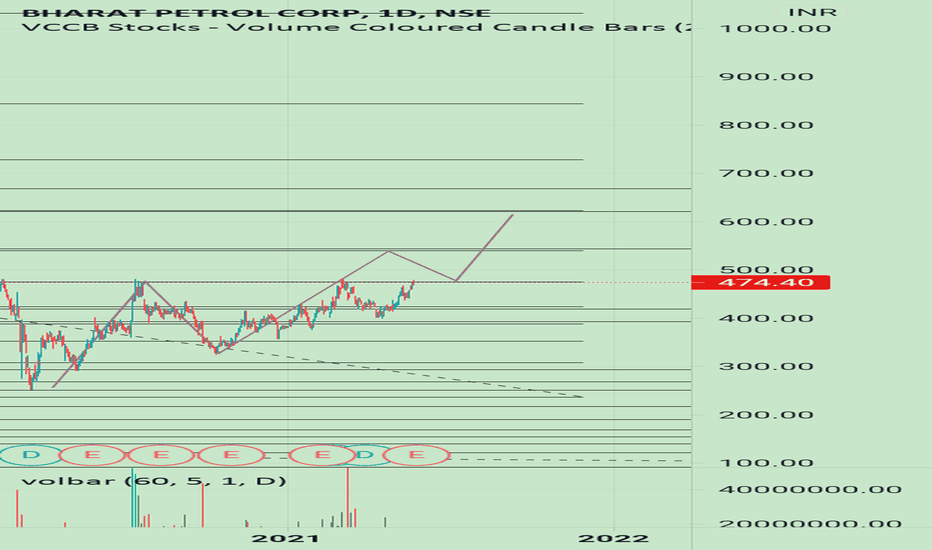

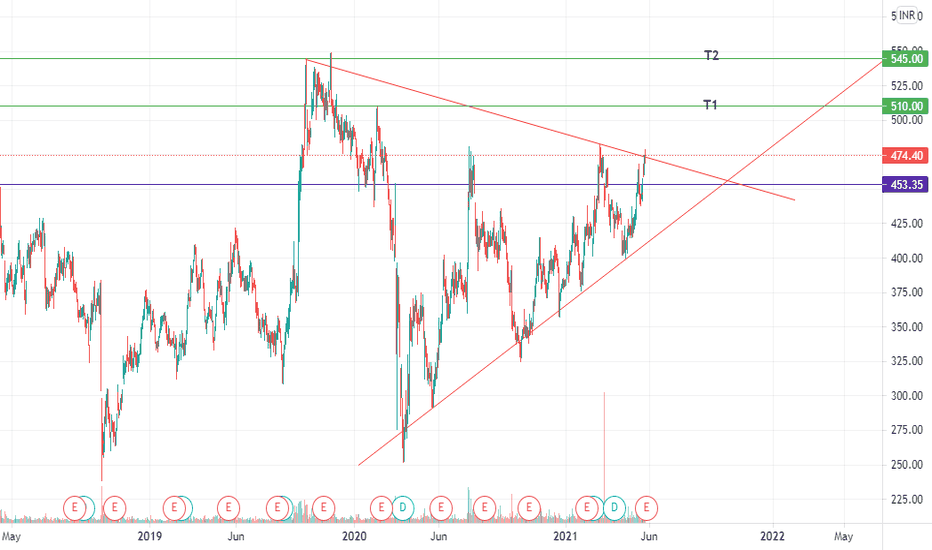

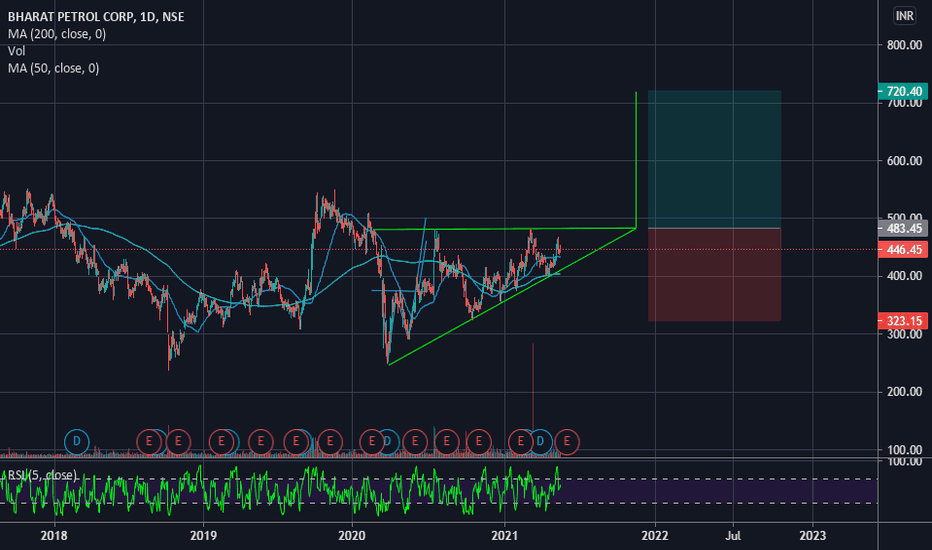

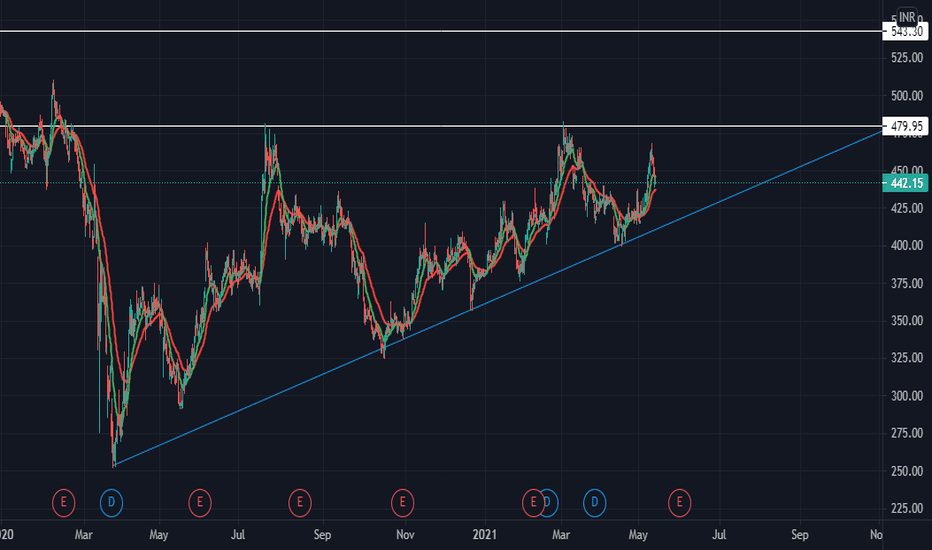

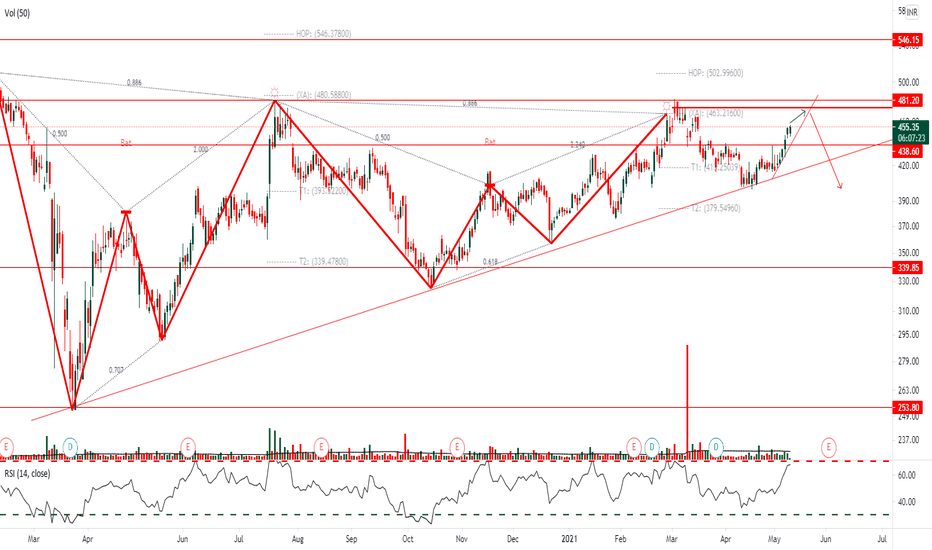

BPCL about to hit life time highsNSE:BPCL is coming out of an ascending triangle.

CMP 489 is just about right to buy, with a stoploss of around 482. If it hits, wait for another attempt to break the 480 mark.

Target of 542 above which the stock can make all time high.

Board has declared a dividend of 58 per share awaiting approval at the AGM.

BPCL trade ideas

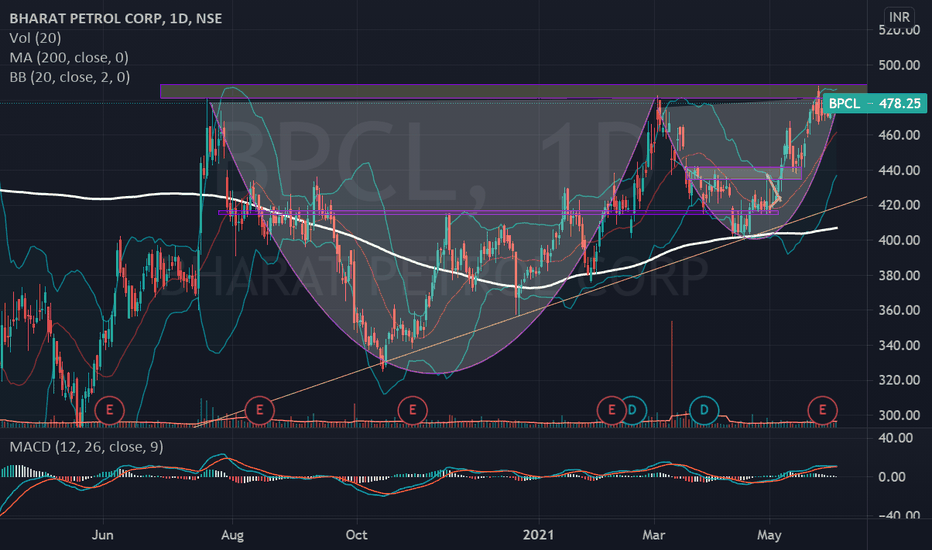

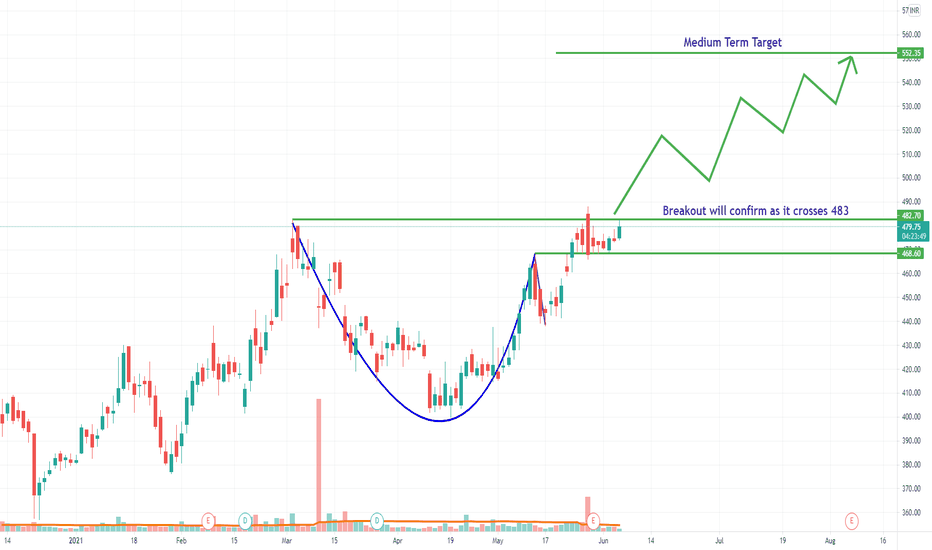

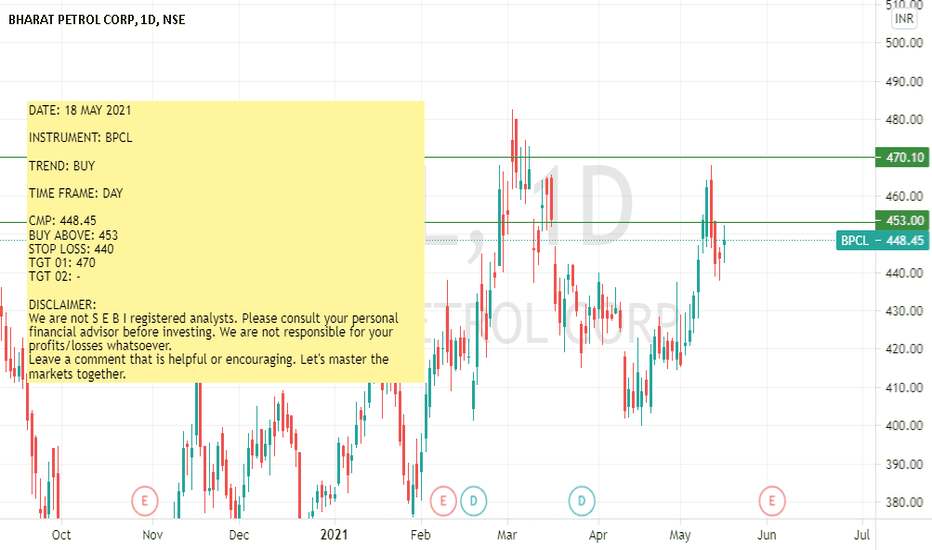

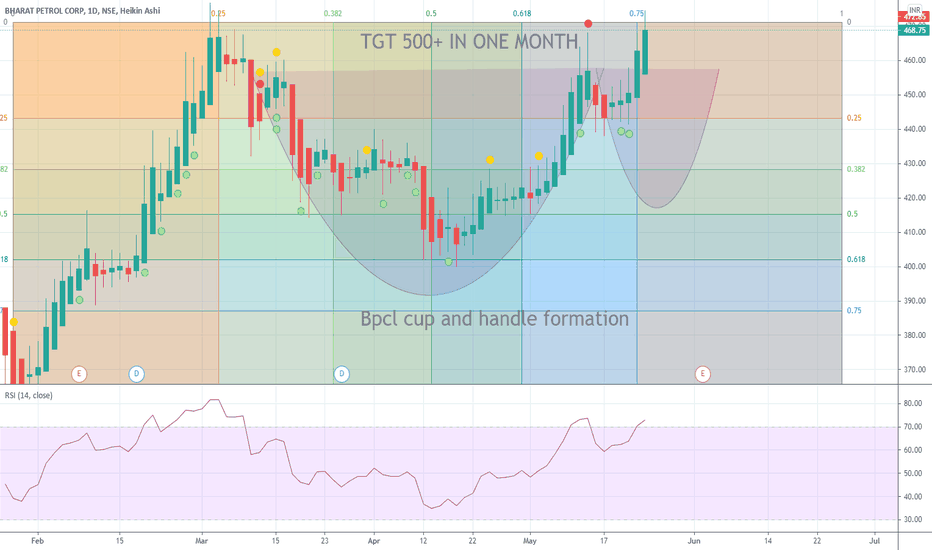

BPCL ::: BULLISHDATE: 18 MAY 2021

INSTRUMENT: BPCL

TREND: BUY

TIME FRAME: DAY

CMP: 448.45

BUY ABOVE: 453

STOP LOSS: 440

TGT 01: 470

TGT 02: -

DISCLAIMER:

We are not S E B I registered analysts. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.

Leave a comment that is helpful or encouraging. Let's master the markets together.

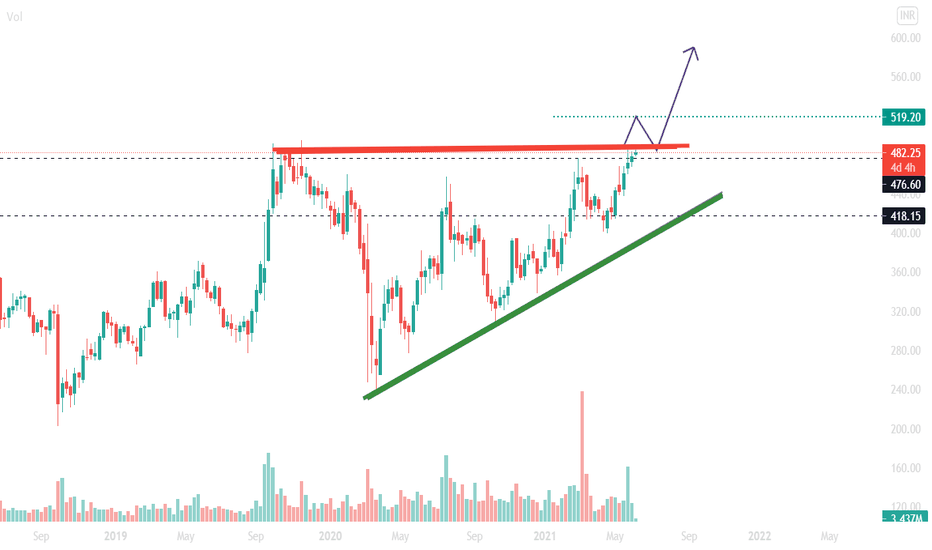

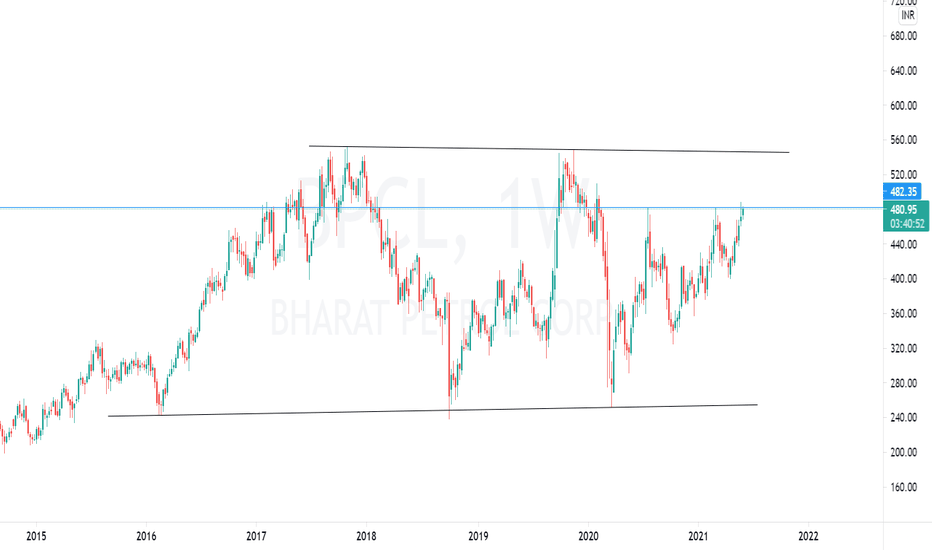

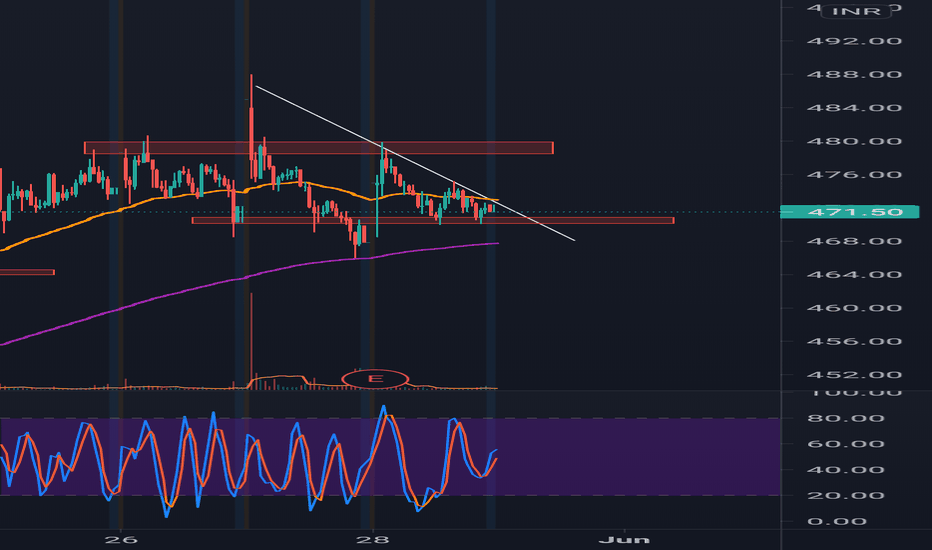

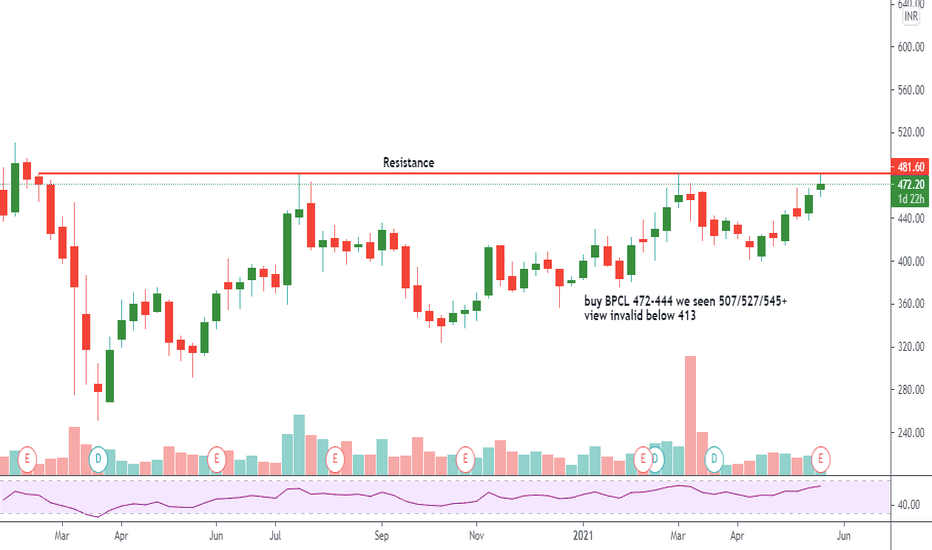

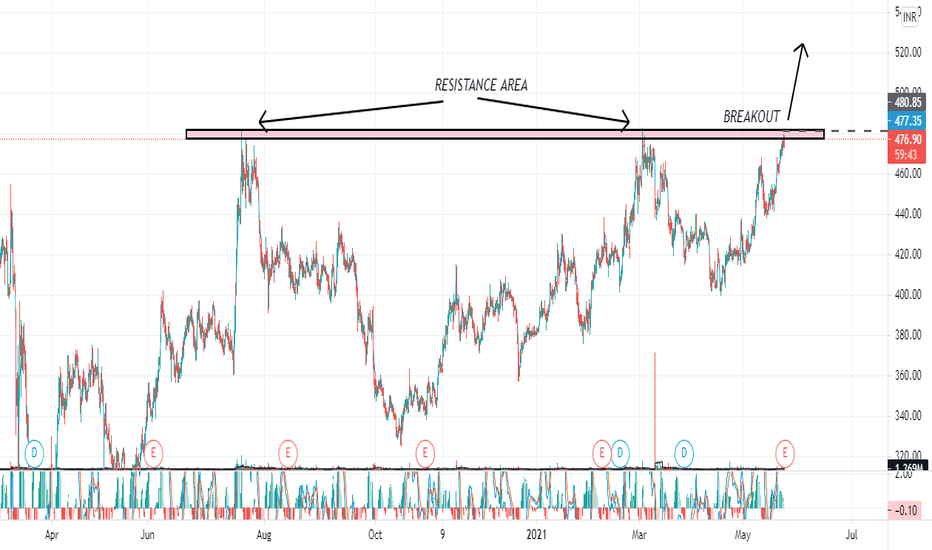

BPCL FUTURE LOOKOUTBpcl has been in somewhat of an uptrend as of late. But for the third time since last july 2020 today again it failed to cross the levels of 481-482. If tomorrow it crosses and closes above 481 we can most likely see an upside till 510 or higher. The same way if it closes again in red with a decent body below todays lows it can be shorted with 482 as a stoploss. Reason to short would be a triple top and a negative rsi divergence.

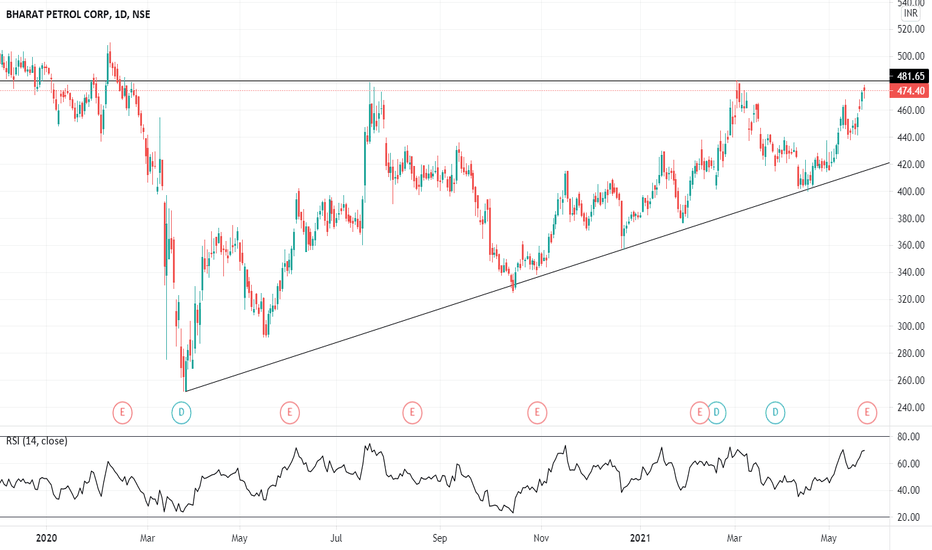

Bullish on BPCLBPCl is about to break the 480 trend line and looks Bullish, also the company is in good profits and is about to give a dividend of Rs 58/share. We can go for a buy now or once it crosses the 480 trend line and keep the stoploss somewhere below the trendline depending on your risk management. The first target is 510 and the next is close to 535. The target can be achieved in the next couple of weeks. Please verify with your analysis and think twice before investing. Happy Trading.

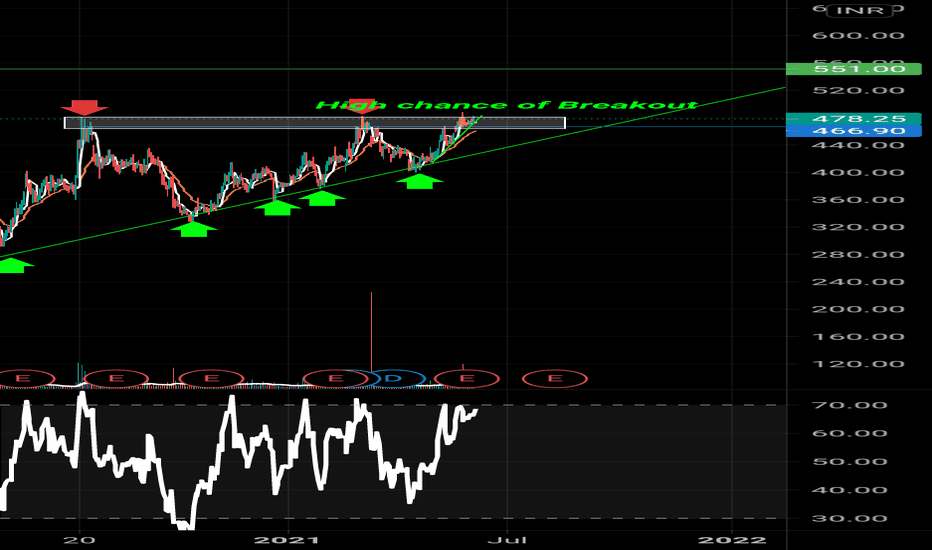

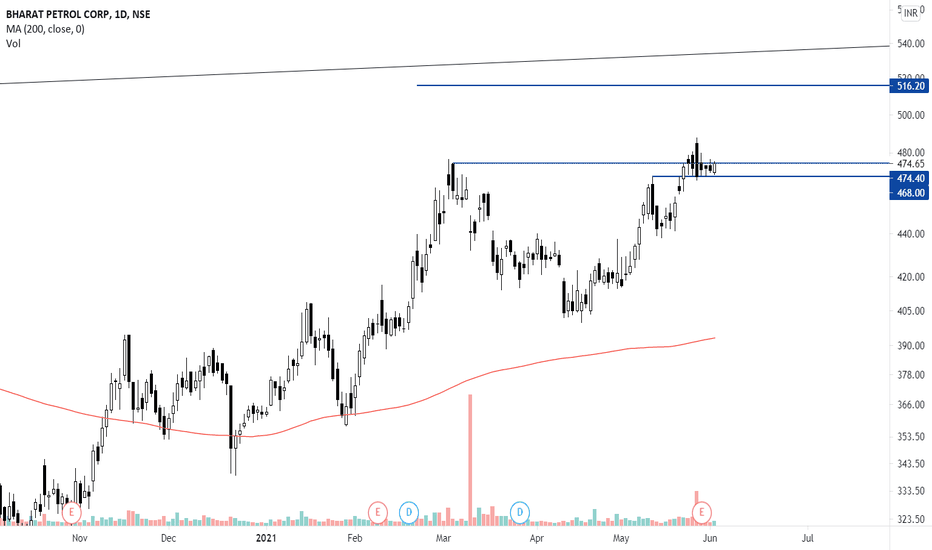

BPCL- BULLISHDATE: 18 MAY 2021

INSTRUMENT: WIPRO

TREND: BUY

TIME FRAME: 3 hrs

CMP: 448.45

BUY ABOVE: 453

STOP LOSS: 440

TGT 01: 470

DISCLAIMER:

We are not S E B I registered analysts. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.