HDFCAMC trade ideas

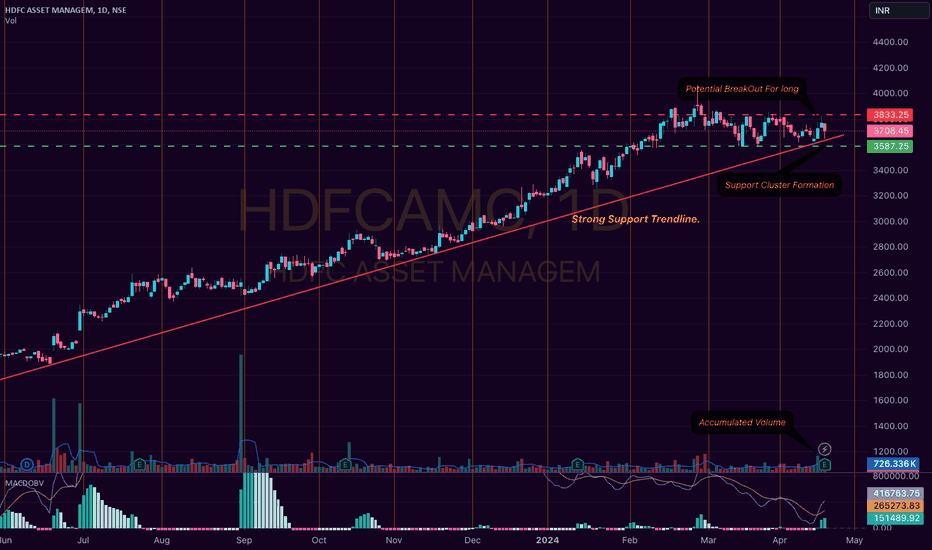

HDFCAMC: A Trading OpportunityAs a technical analyst, I'm excited to share my latest findings on HDFCAMC, a stock listed on the National Stock Exchange (NSE).

After conducting a thorough analysis, I've identified a unique trading opportunity that presents itself at the intersection of strong support and resistance lines.

The Setup

HDFCAMC has been trading within a well-defined range over the past three months, with a strong support line in place. This support line has been tested multiple times, and each time, the stock has bounced back, indicating a high degree of buying interest.

Furthermore, a one-week horizontal support line has also been established, providing additional confirmation of the stock's underlying strength.

The Resistance Line

The resistance line, on the other hand, appears to be a promising area of potential breakout. With a strong volume profile, this line has the potential to be broken out of, leading to a significant move upwards.

This presents a trading opportunity for both long and short positions, depending on the price action around the support and resistance lines.

Trading Opportunities

For traders looking to go long, the current setup presents a high-reward, low-risk opportunity. With the stock trading near the support line, a breakout above the resistance line could lead to a significant move upwards, potentially targeting the next resistance level.

For short sellers,

the setup is equally attractive, as a breakdown below the support line could lead to a decline, potentially targeting the next support level. Key Levels to Watch To take advantage of this trading opportunity, traders should focus on the following key levels:

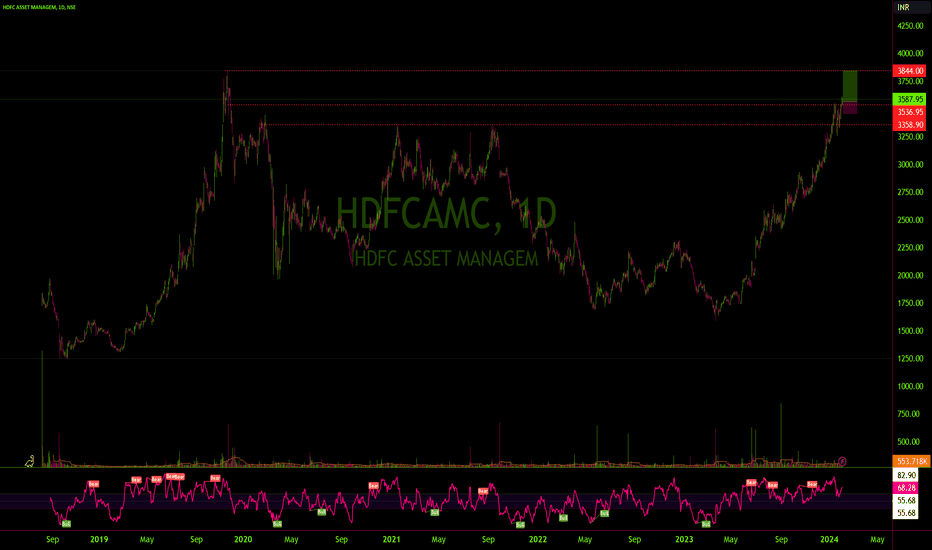

Support Line (3-month): 3,700

Horizontal Support Line (1-week): 3,580

Resistance Line: 3,800

Conclusion

HDFCAMC presents a unique trading opportunity at the intersection of strong support and resistance lines. With a well-defined range in place and a promising resistance line, traders can take advantage of this setup to go long or short, depending on their market view. As always, it's essential to monitor the price action closely and adjust trading strategies accordingly. For those looking to take advantage of this opportunity, I recommend setting stop-loss orders and adjusting position sizes based on market conditions.

Disclaimer

This analysis is for informational purposes only and should not be considered as investment advice. Trading carries risk, and it's essential to do your own research and consult with a financial advisor before making any investment decisions.

HDFCAMC- Technical and Fundamental ( Concall summary)NSE:HDFCAMC

📈 #HDFCAMC Performance Update

1/🧵 AUM Growth 🌟: A strong year for HDFC AMC with a 20% YoY increase in quarterly average AUM, hitting a record INR 47 trillion. Equity-oriented funds grew by 26% YoY, reaching INR 23.1 trillion. #AUMGrowth #EquityFunds

2/🧵 Debt Funds Surge 💰: The quarter saw debt funds' AUM rise to INR 10.3 trillion. The B30 MAAUM category also showed significant growth, indicating rising mutual fund acceptance in these markets. #DebtFunds #MarketExpansion

3/🧵 Record-Breaking AUM 🚀: For the first time, the company's quarterly average AUM crossed INR 5 trillion, reaching INR 5.25 trillion - a 22% YoY growth. #RecordGrowth #FinancialMilestones

4/🧵 Market Share Momentum 📈: HDFC AMC’s market share continues to rise, with an overall QAAUM market share of 11.2% and 12.5% excluding ETFs. #MarketShare #InvestmentGrowth

5/🧵 Equity-Oriented Focus 🌐: The company's asset mix is now more equity-oriented, making up 58% of the total AUM. Also, its unique investor base expanded to 7.9 million by September 2023. #EquityFocus #InvestorBase

🆕 New Product Launches

6/🧵 Diverse Offerings 🛍️: HDFC AMC launched various new funds, including non-cyclical consumer, transportation & logistics, technology, and pharma & healthcare funds. #FundLaunch #Diversification

💹 Financial Performance Insights

7/🧵 Revenue and Profit Surge 💸: The company’s revenue from operations for Q2 grew by 18% YoY to INR 6.43 billion, while operating profit increased by 20% YoY to INR 4.67 billion. #RevenueGrowth #ProfitIncrease

8/🧵 Cost Dynamics 💼: Staff costs rose by 11% YoY, and other expenses grew by 22% YoY. #OperationalCosts #FinancialHealth

🔄 Marketing and Distribution Strategies

9/🧵 Long-term Investing Focus 🔄: HDFC AMC emphasizes SIP and systematic transactions for disciplined, long-term investing. #SIP #LongTermInvestment

10/🧵 Strengthening Partnerships 🤝: The company is enhancing its collaboration with HDFC Bank to leverage the bank’s distribution network, adding a dedicated vertical for this channel. #StrategicPartnerships #BankingNetwork

11/🧵 Market Share Gains 📊: A combination of performance, product range, and distribution efforts has led to market share gains, particularly in SIP flows and unique investors. #MarketShare #InvestorGrowth

12/🧵 Customer-Centric Approach 🧑💼: The company's focus on individual customers has resulted in increased folios and average AUM per folio, with higher flow market share in HDFC Bank. #CustomerFocus #GrowthStrategy

🔍 Other Key Highlights

13/🧵 Dividends and Future Plans 💼: HDFC AMC expects an upward trend in dividend payout ratios and plans to launch new funds, subject to regulatory approvals. #Dividends #FuturePlans

14/🧵 Passive Investment Strategy 🛠️: The company is expanding its product offerings in the passive space while maintaining a balance with active investment strategies. #ETFs #InvestmentApproach

15/🧵 Cost and Guidance Outlook 🔭: Expectations are for employee costs to increase annually by high-single-digit or low-double-digit percentages. No specific guidance provided for the upcoming financial year. #CostOutlook #FutureGuidance

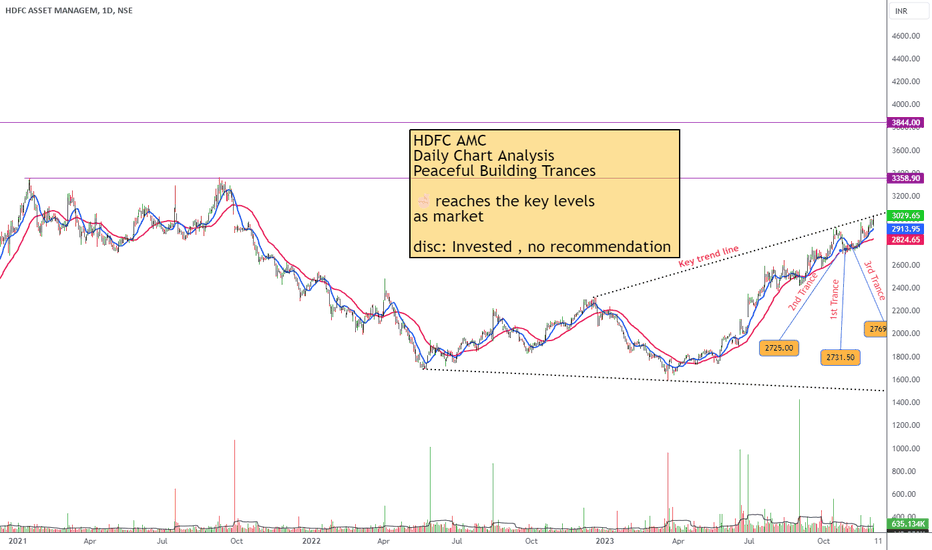

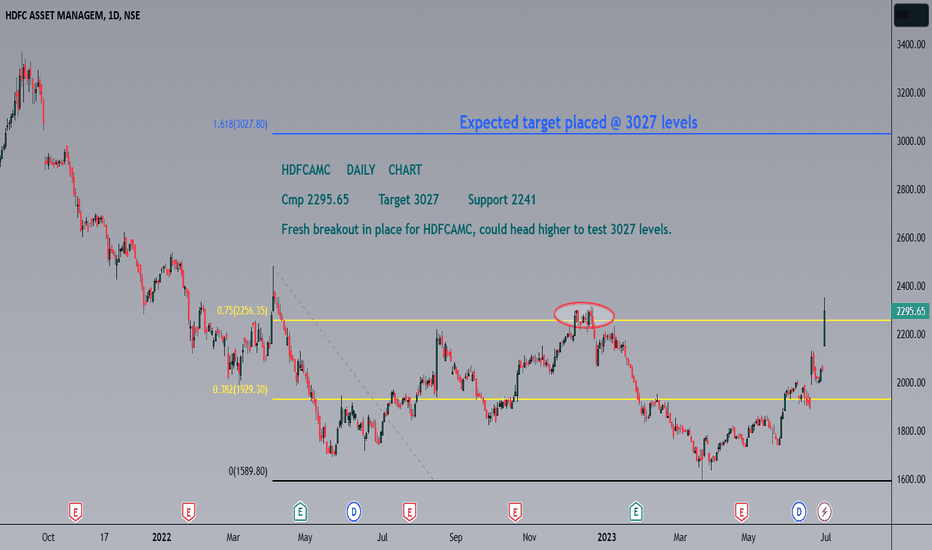

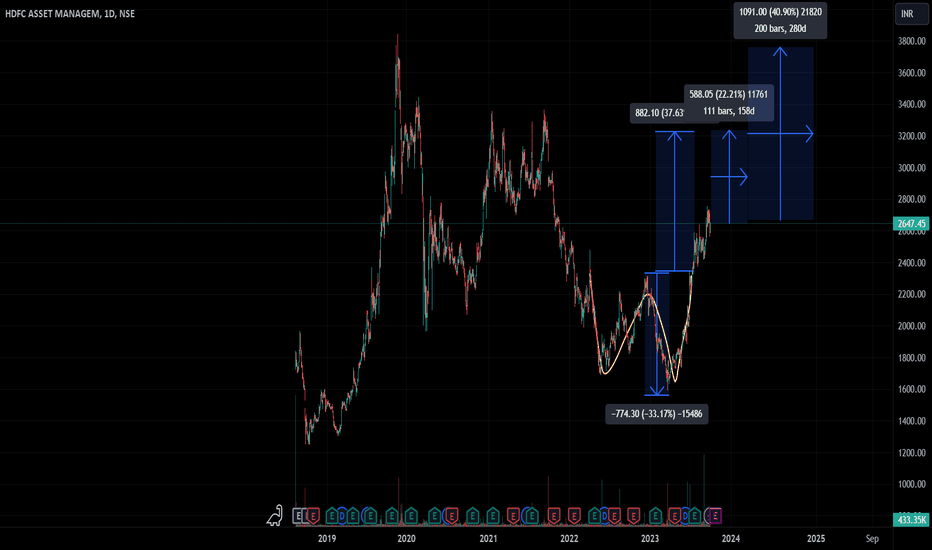

📈 Chart analysis

16/🧵Sharing my trances, and hopefully, the stock move towards the key levels with some strong financial performance in coming weeks and months

🔚 Stay tuned for more updates and insights on HDFC Asset Management and follow Peaceful Weekend Investing and your friend Shivendra Bhatia

#HDFCAMC #InvestingJourney

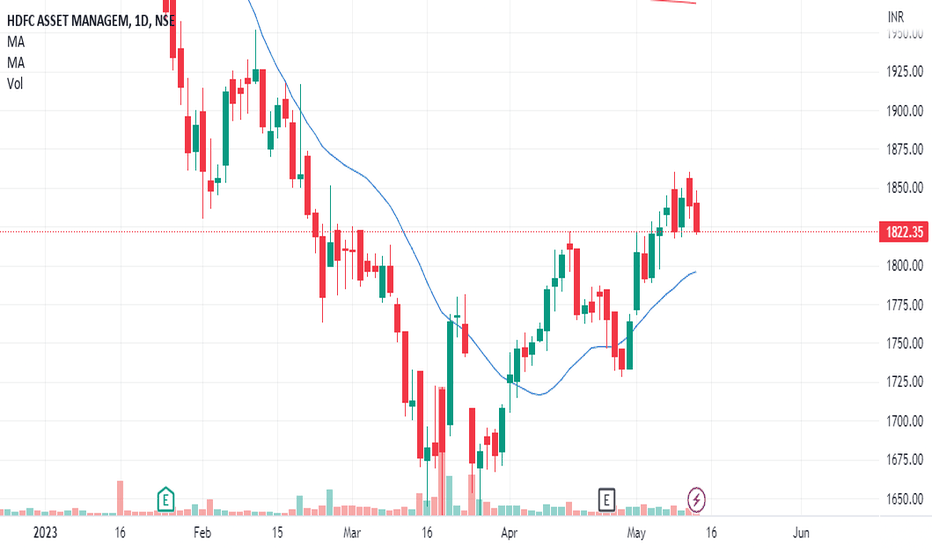

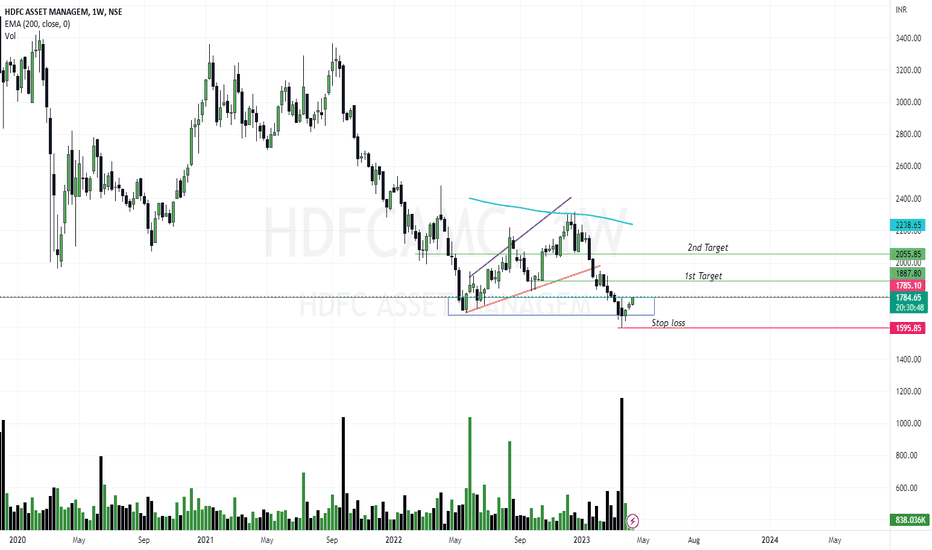

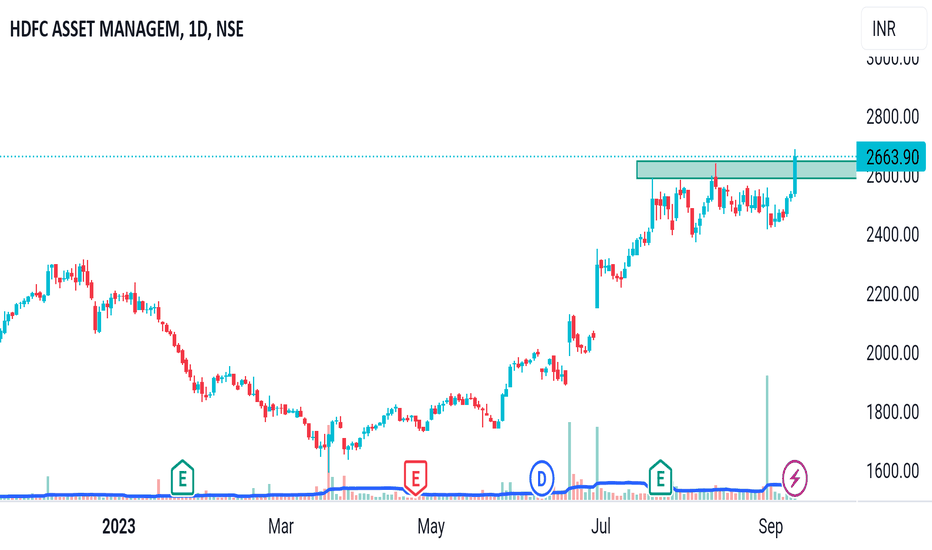

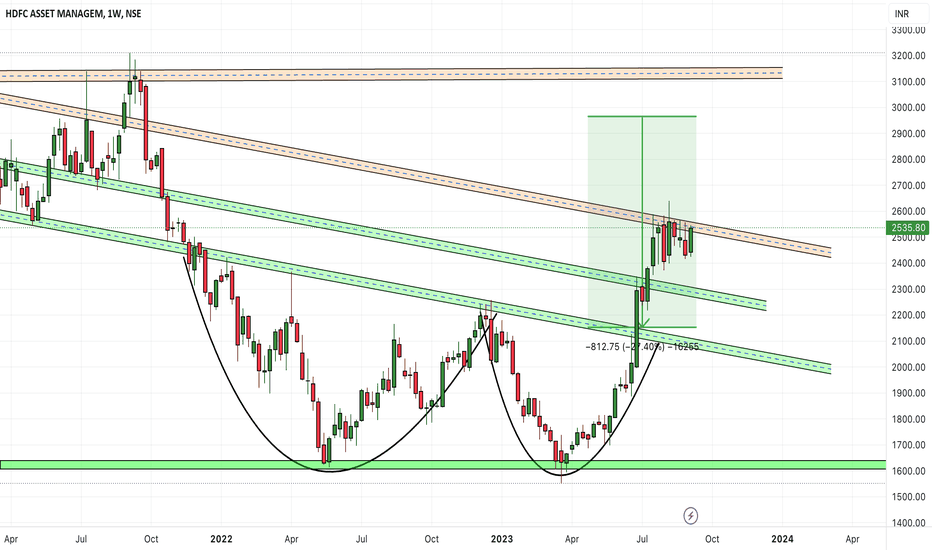

HDFC Asset Management (AMC) swing setup LongHDFCAMC has been trading in an uptrend for the past few months, forming a cup pattern. It has reached its all-time high. The monthly, weekly and daily RSI is above 60 and taking support at 60 levels in 75-minute time frame. You can see that the volume is also moderate. If it starts increasing as the price approaches its all-time high ( 3844), there would be a high probability trade for a small risk-to-reward ratio (1:2.5). One can also hold if it breaks the all-time high as there would be no resistance above 3844.

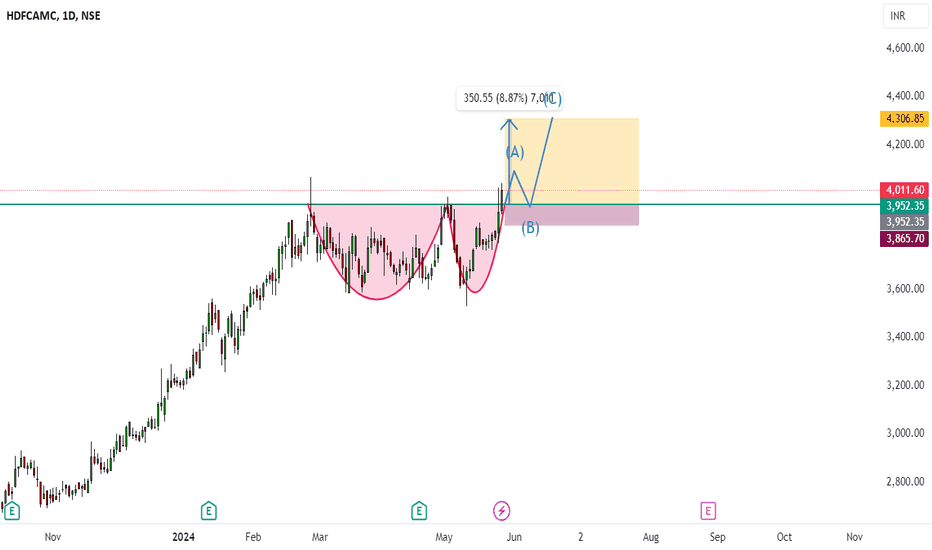

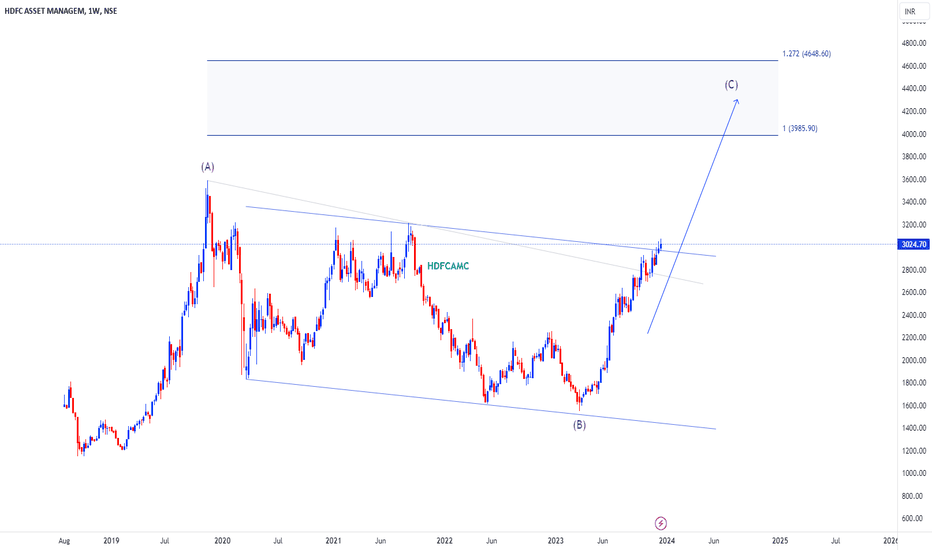

HDFCAMC - Bullish patternHDFCAMC - Elliott Wave count

the market is in wave C with the target of 4000 range. its better to wait for correction to take long position.

Please note that this information is for educational purposes only, and it is crucial to trade with caution.

NSE:HDFCAMC NSE:HDFCAMCZ2023 BSE:HDFCAMC

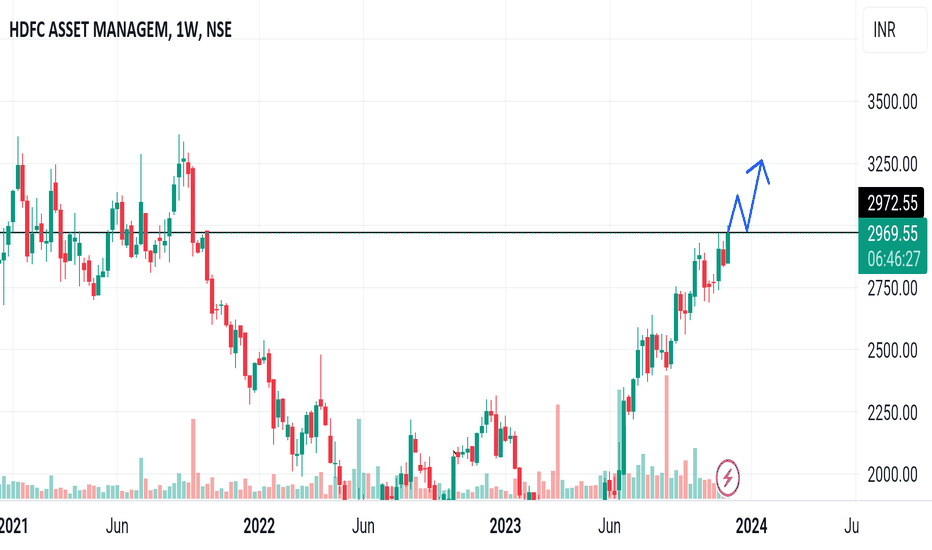

There is still chance to catch this move!

Still HDFC AMC is 300% down from it's peak and it is about to give breakout.

It is sitting at his highest ever profit and revenues so no doubt about it's fundamentals and profitability.

In the most near tern it is about to give you 11% return. Half rally is done but still most of the rally is left.

If you find this new and informative please boost this.

Best bet for short-term and long-term as well.

The stock is forming double bottom pattern and it is exactly rebound by forming it.

This is the chart pattern from this. We can define our target And also, it was rebounded from a strong support.

The target of the stock should Of the height of the double bottom pattern.

The main reason that I'm saying that this is short term and long term is in the short term it can surely achieve its Double Bottom pattern Target.

And in the long run it can go to its previous high so we can expect 20% minimum gain from this point And that too, in the short term.

If you find this valuable please do follow me and make sure you like this.

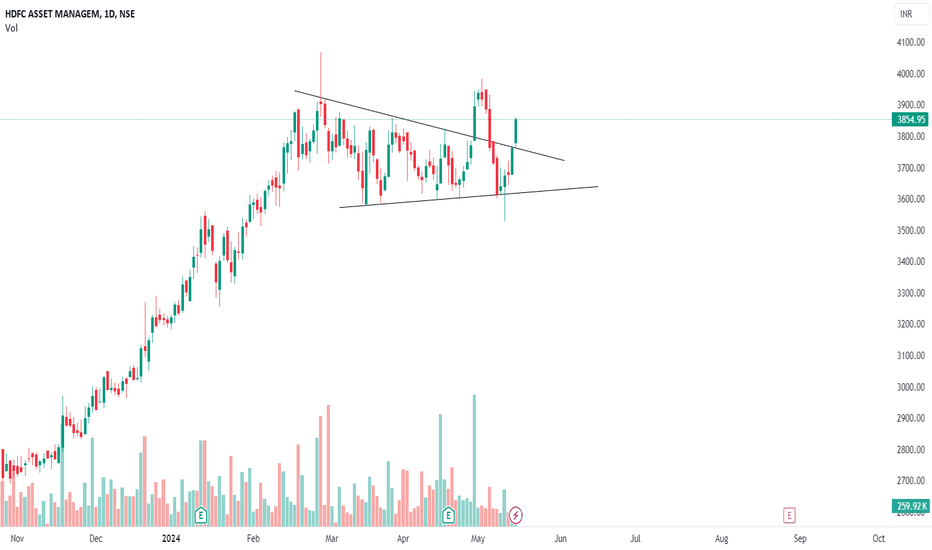

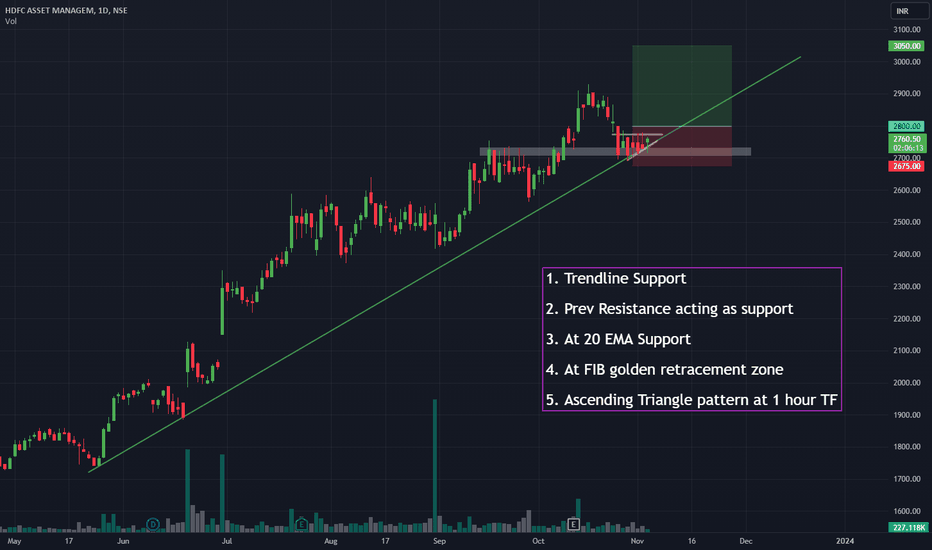

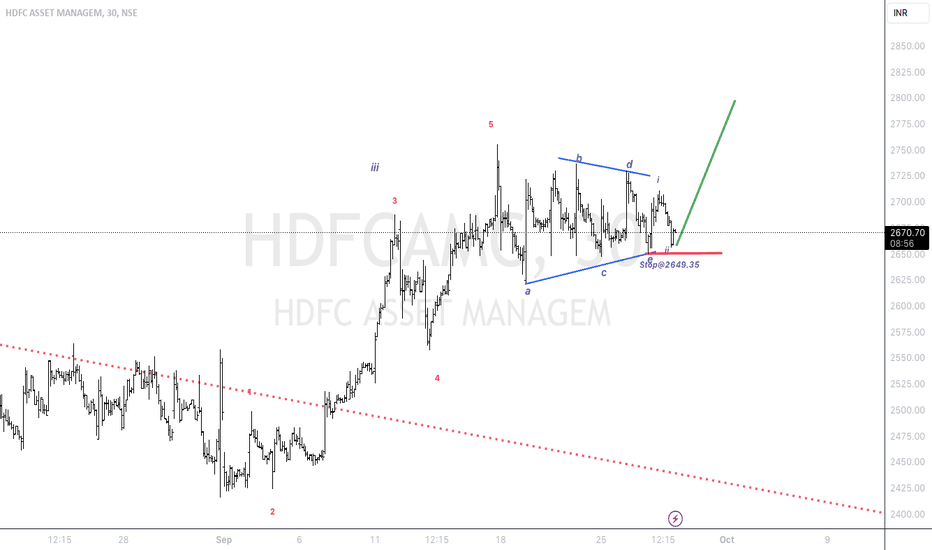

TRIANGLE breakout in HDFC AMCElliott Wave Analysis:-

Triangle breakout has happened and retracement is taking place.

with 2649.35 as stop loss we can get entry at current level.

Target

1. it has to cross 2737

2. 2772

3. 2800 - 2854

if the C wave was broken downside then the triangle may be in reverse and the fall will be the size of the A wave we marked.

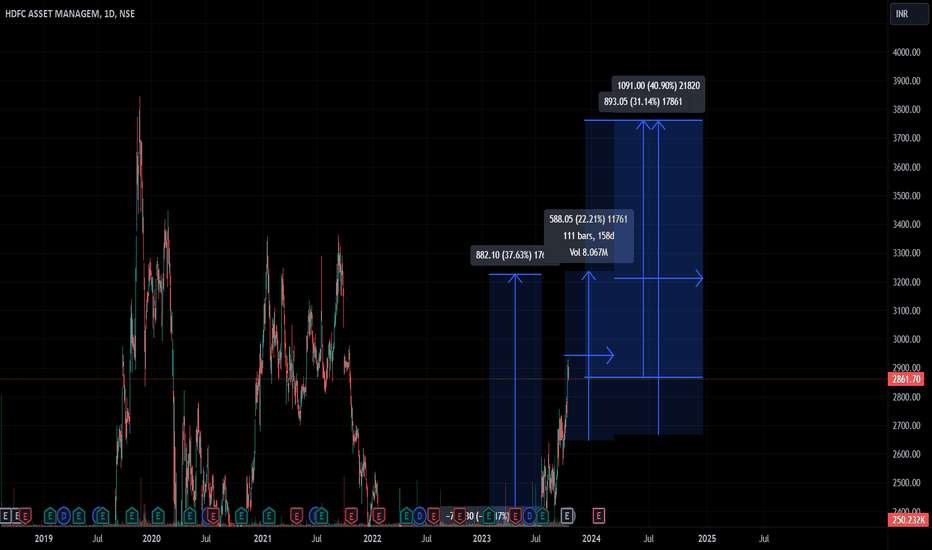

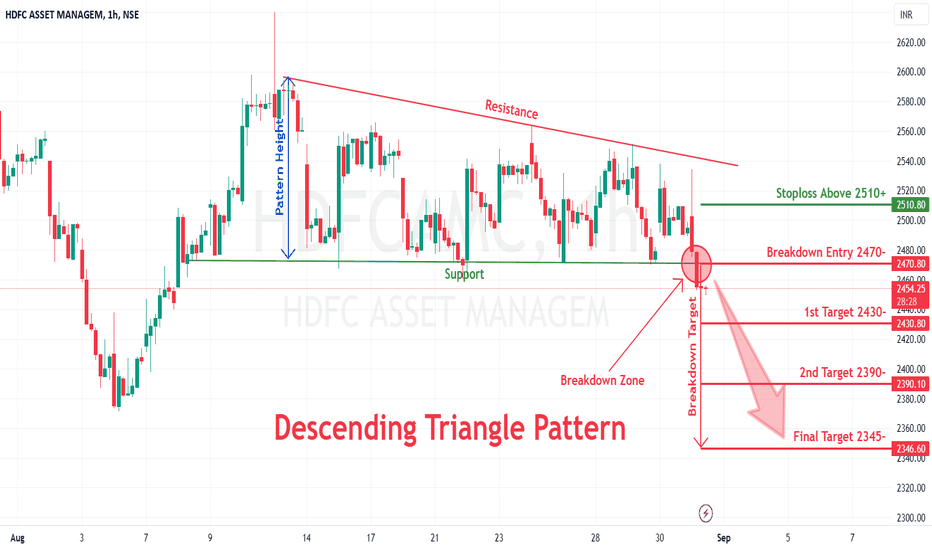

Descending Triangle breakdown in HDFCAMCHDFC ASSET MANAGMENT COMPANY LTD

Key highlights: 💡⚡

✅On1Hour Time Frame Stock Showing Breakdown of Descending Triangle Pattern .

✅ Strong bearish Candlestick Form on this timeframe.

✅It can give movement up to the Breakdown target of 2345-.

✅Can Go short in this stock by placing a stop loss above 2510+.