IDBI trade ideas

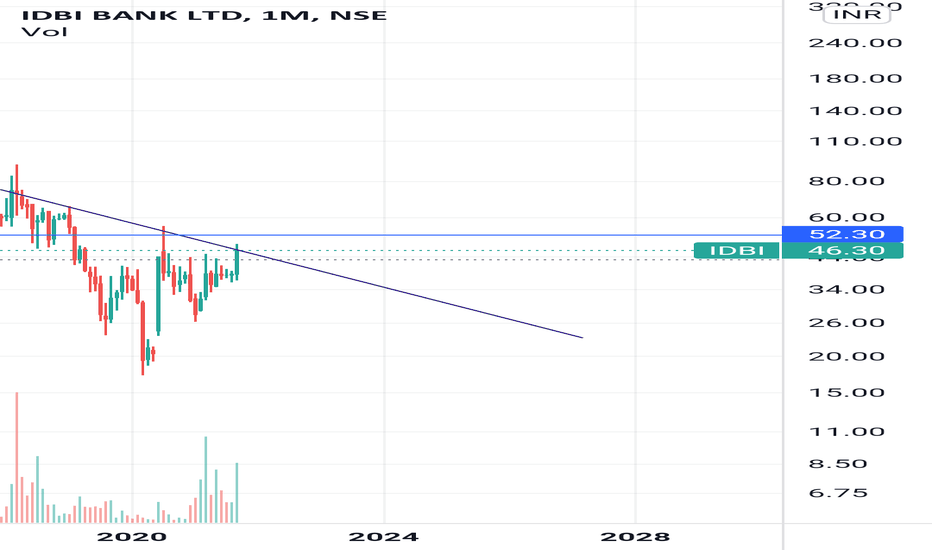

IDBI STOCK ANALYSIS FOR SHORT TERM INVESTMENT IDBI ANALYSIS For 15-NOVEMBER-2021 Short Term Investment, Live Intraday Calls, Predictions, And Market Analysis

🤑🤑TRADE SETUP FOR IDBI FOR COMING WEEK🤑🤑

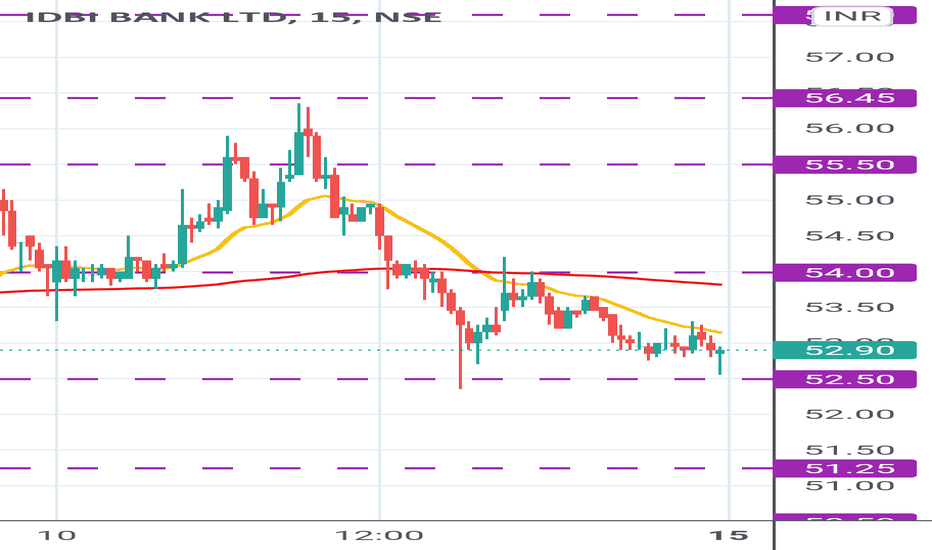

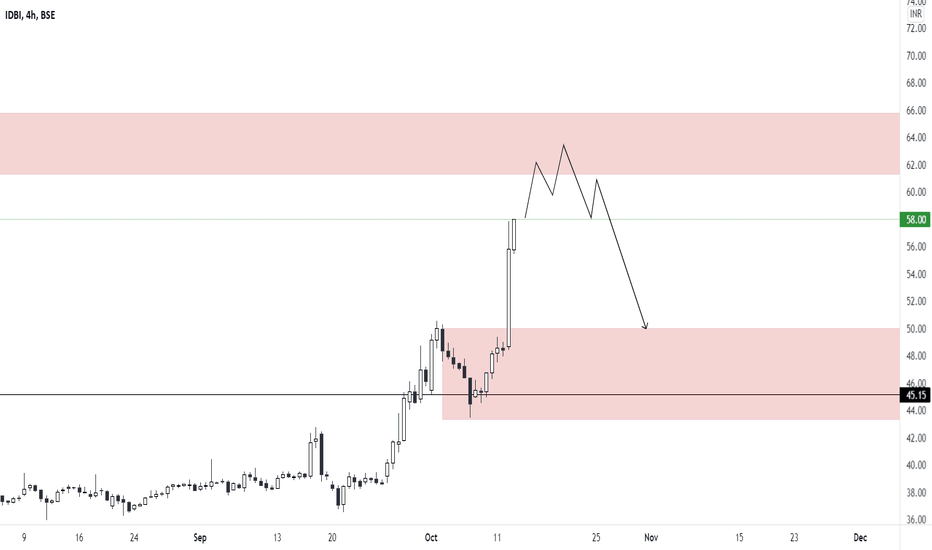

👉BUY IDBI ABOVE 54 WITH STOPLOSS OF 52 AND TARGET 55.50, 57.60,60.35

👉SELL IDBI BELOW 52 WITH STOPLOSS OF 53 WITH TARGET 51.25, 50.50 AND 49.59

✅ IDBI SUPPORT AND RESISTANCE LEVELS

SUPPORT 1 - 52.50

SUPPORT 2 - 51.25

SUPPORT 3 - 50.50

RESISTANCE 1 - 54

RESISTANCE 2 - 55.50

RESISTANCE 3 - 56.45

🔎 HASHTAGS 🔎

#tradenxt

#shotterminvestement

#investement

#bankniftyanalysis

#bankniftylivetrading

#livetrading

#stockmarketanalysis

#stockmarketanalysis15nov2021

#IntradayTrading

#IntradayCalls

#BankniftyPredictions

#StockMarketPredictions

#bankniftytomorrowprediction

#niftyanalysis

#niftypredictions

#bankniftyoptions

#niftyoptions

🔎 DISCLAIMER 🔎

NOTE: THIS VIDEO IS FOR EDUCATION PURPOSES ONLY KINDLY USE YOUR KNOWLEDGE AND STRATEGIES TO TAKE OR INITIATE A TRADE.

#trendanalysis #bankniftytrend #bankniftyview #bankniftytradesetup #bankniftytrading #bankniftyanalysis #bankniftyoptions #bankniftylevels #bankniftyfuture #bankniftytips #bankniftypredictions

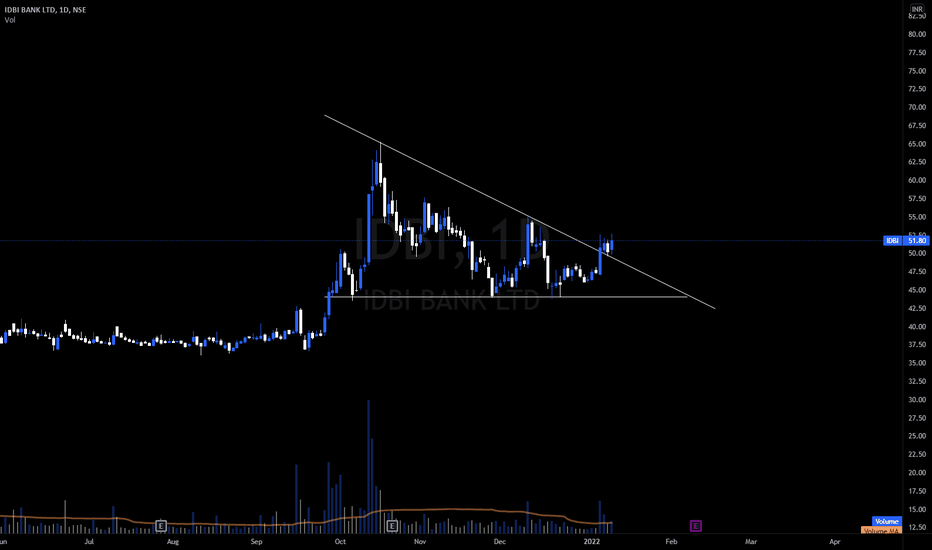

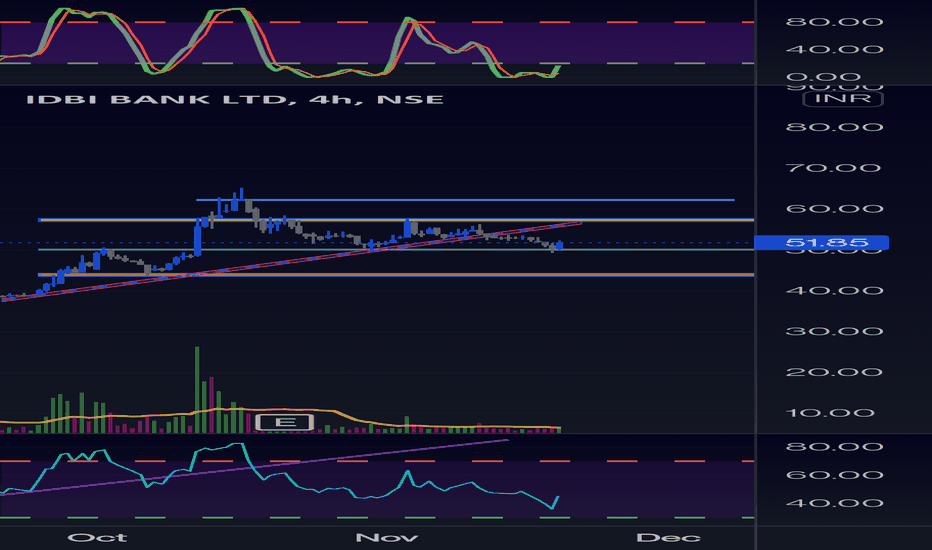

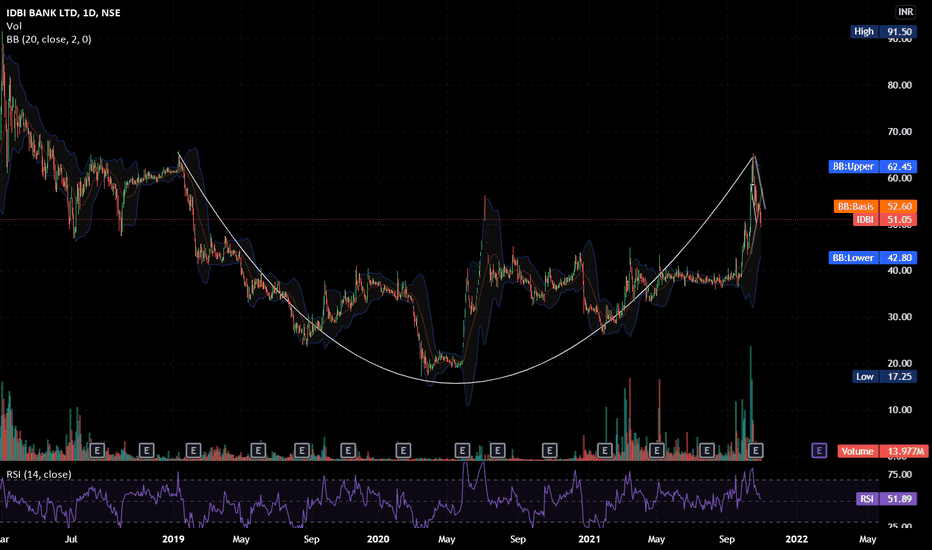

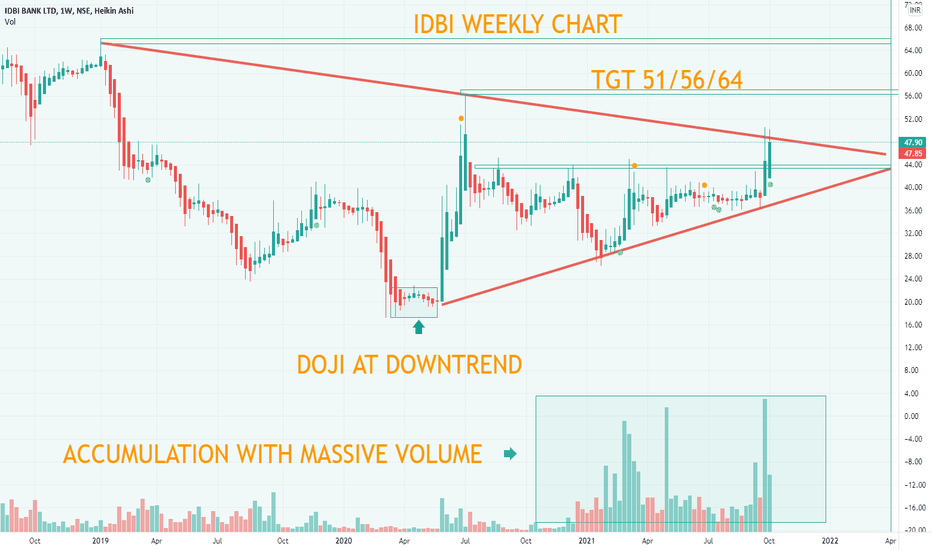

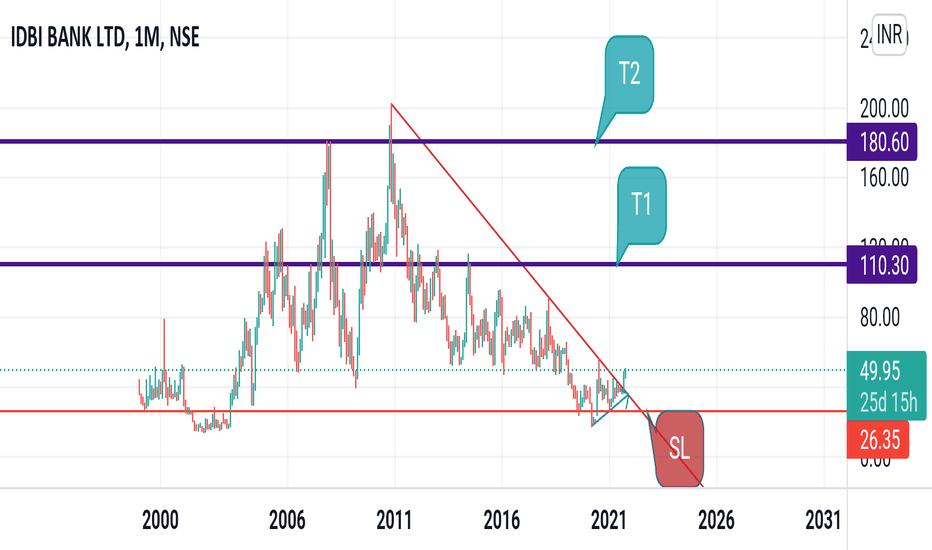

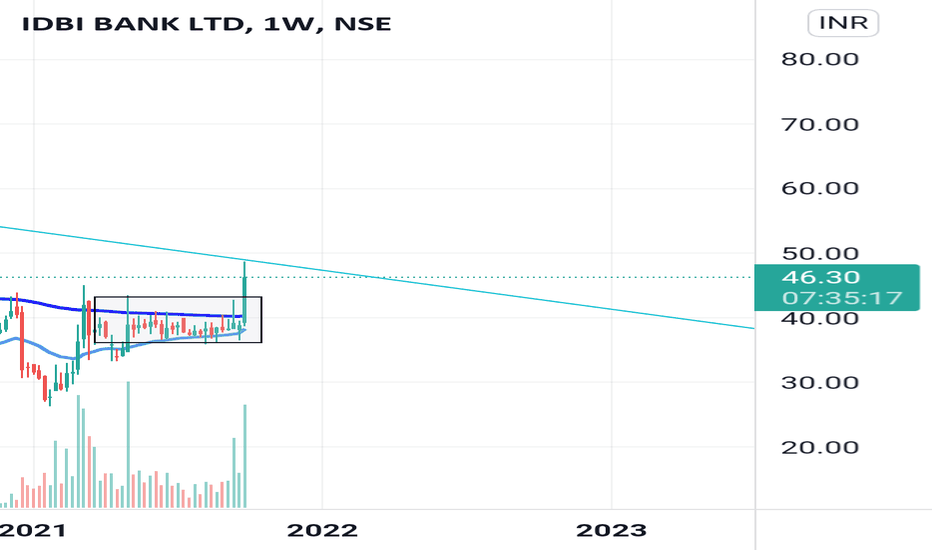

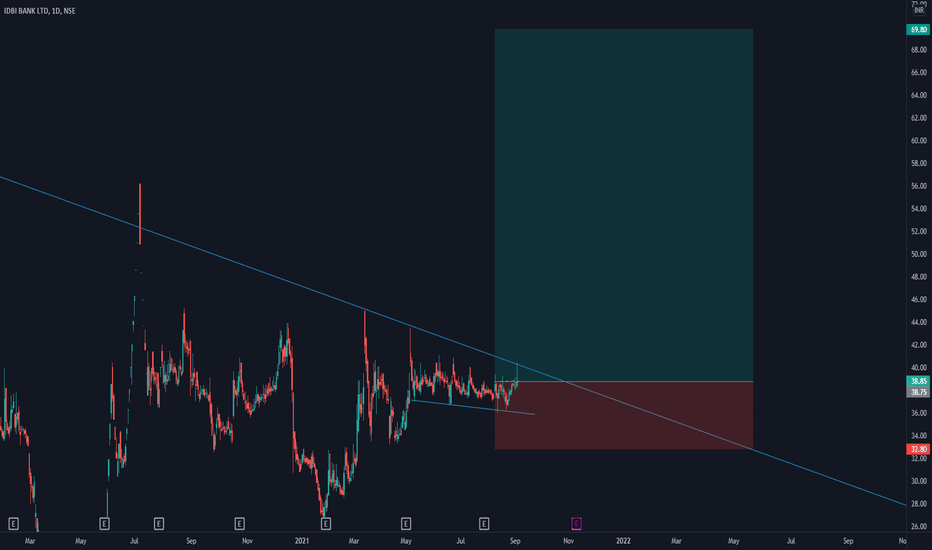

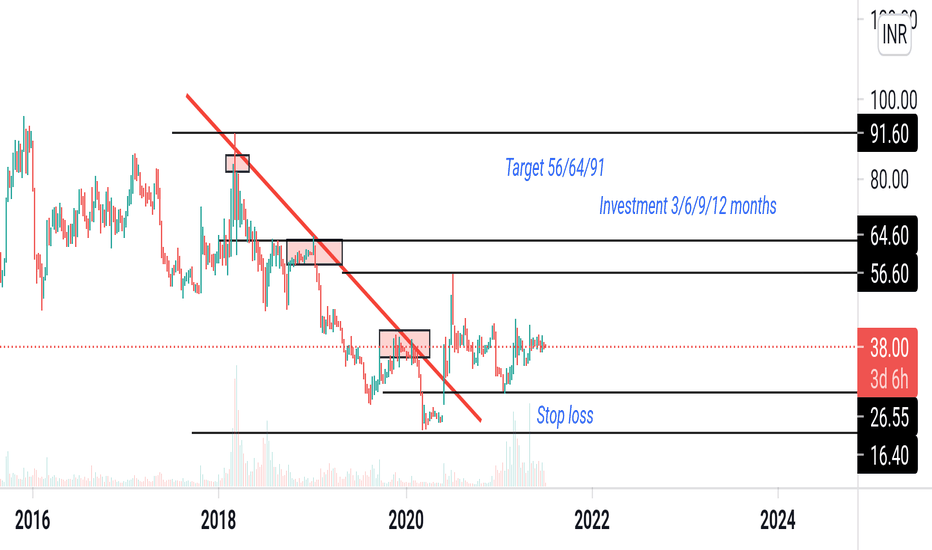

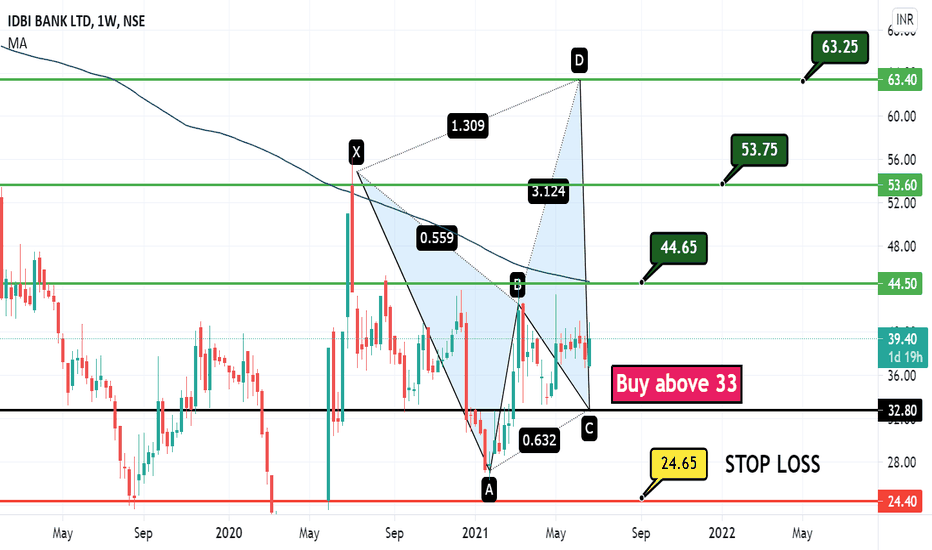

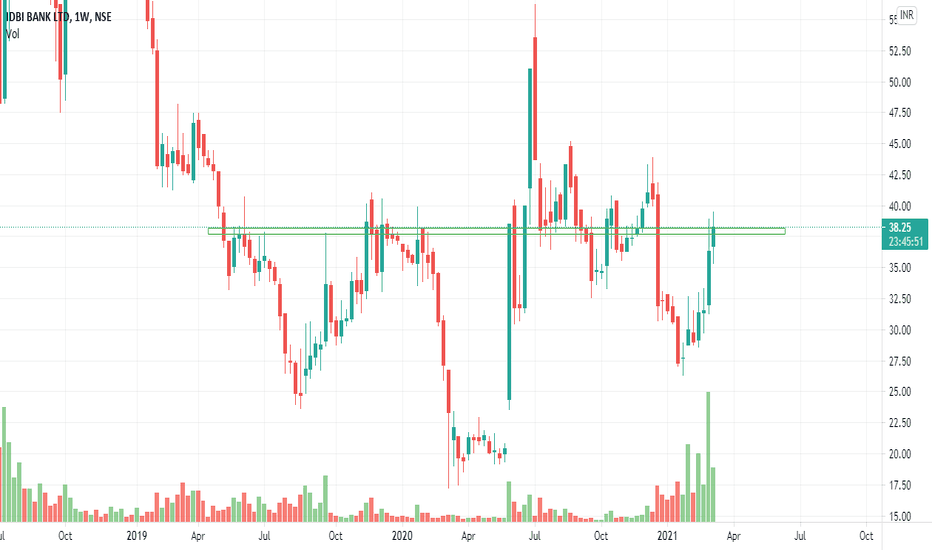

IDBIBANK - D-STREET BANKABLE BANKIDBI Bank printed yesterday huge upmove pushing through the long trendline break. This is encouraging for price move towards the 70 area with min move towards the 60. Strong buy here and dips to 43 (if any) with stop loss as a tad around the 38 handle. This is a. despite the stronger down move b. if the market moves up particularly bank nifty it would be out performer near to medium term.

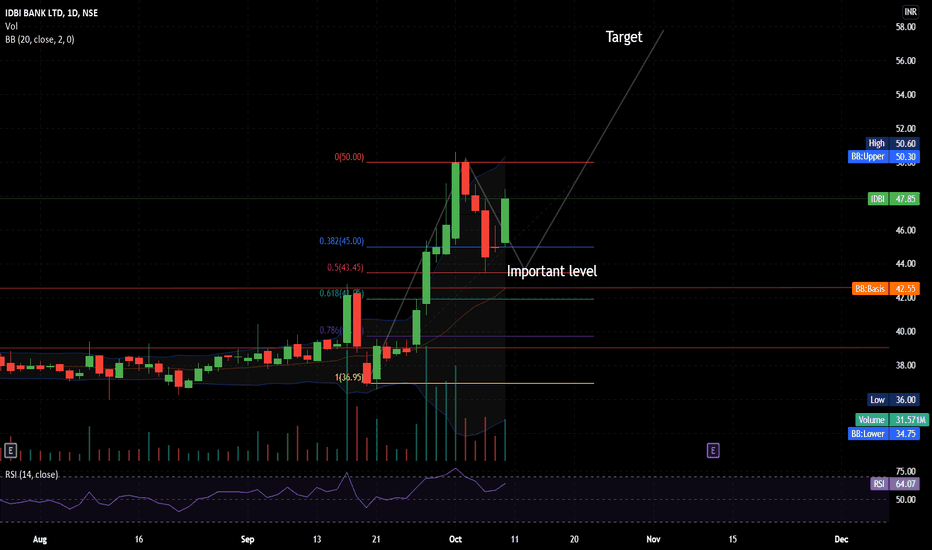

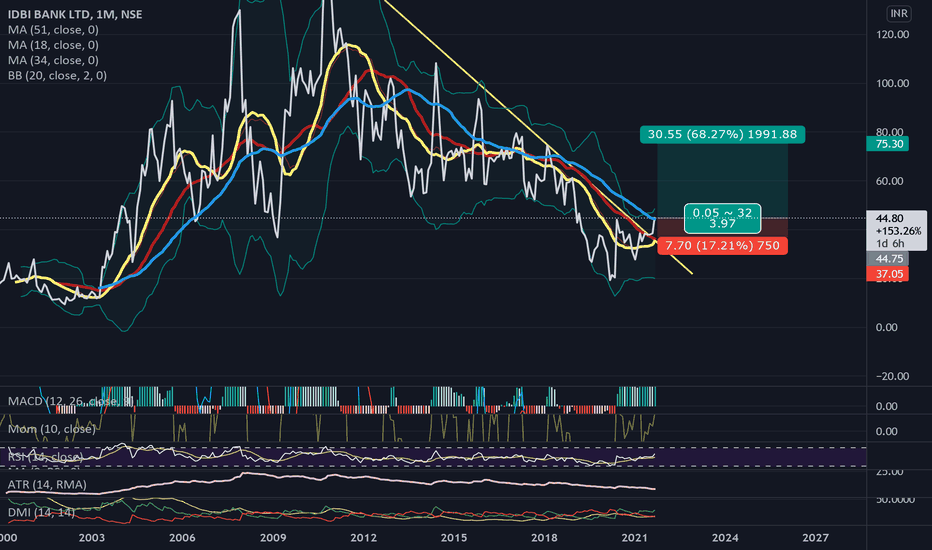

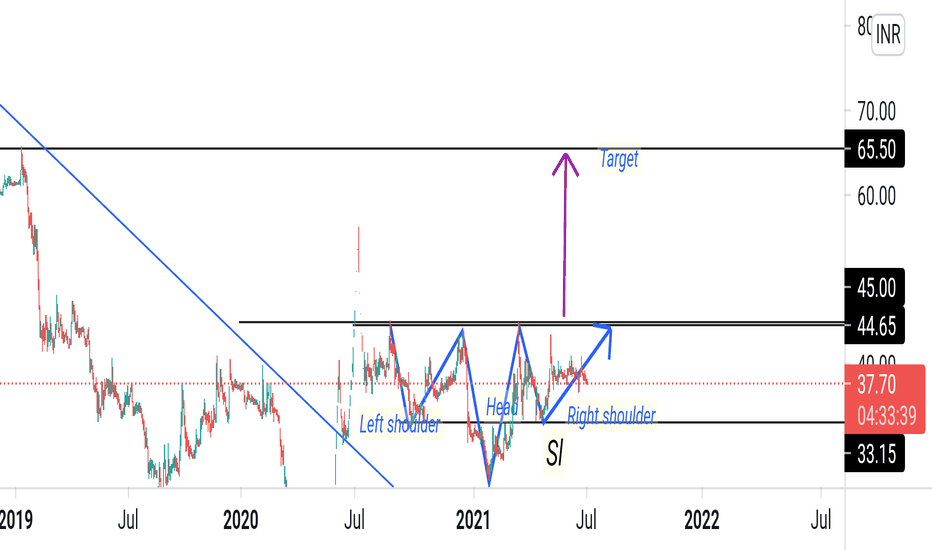

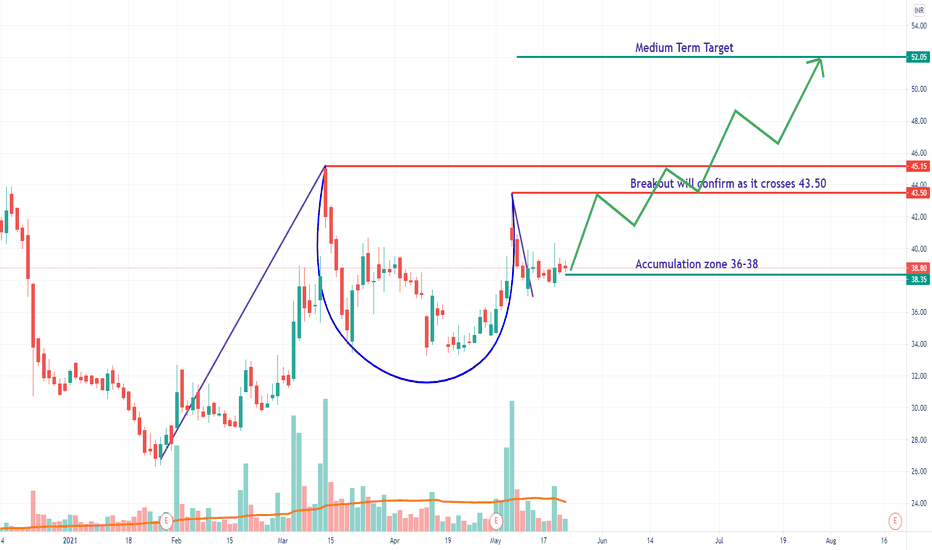

IDBI BankIDBI Banks firstly had a breakout of the cup and handle formation. It was immediately followed up by the flag breakout pattern. These breakouts have led the stock to rally for more than 33% in merely 7 trading sessions. The stock opened up with a circuit of 20% on NSE today but witnessed a strong sell off due to several factors such as rising US bond yields, imposing lockdown in several districts of India, global markets ending up in red etc. This cool off was seen in many stocks as the indexes ended up in red despite opening up with more than 1% gain.

The reasons for stock selection are as follows:

1. RBI has removed it from its PCA framework. It was placed under it in May 2017. Although this removal is subject to many clauses, however, it is expected to increase the business of the bank.

2. The bank appears to be a perfect fit for the theme of privatisation of the Indian Government. Currently, GoI holds close to 45% of the stake in the bank and it is expected that the holding will either be diluted or sold off to the private players.

3. LIC which acted as a saviour for the bank and holds a 51% stake in the bank is also looking to sell its stake under the privatisation theme of GoI.

4. The stock has seen unusual volumes in the past 7 trading sessions.

** Point number 3 and 4 are speculations based upon several news articles or sources.

Levels (Considering the volatility in the market):

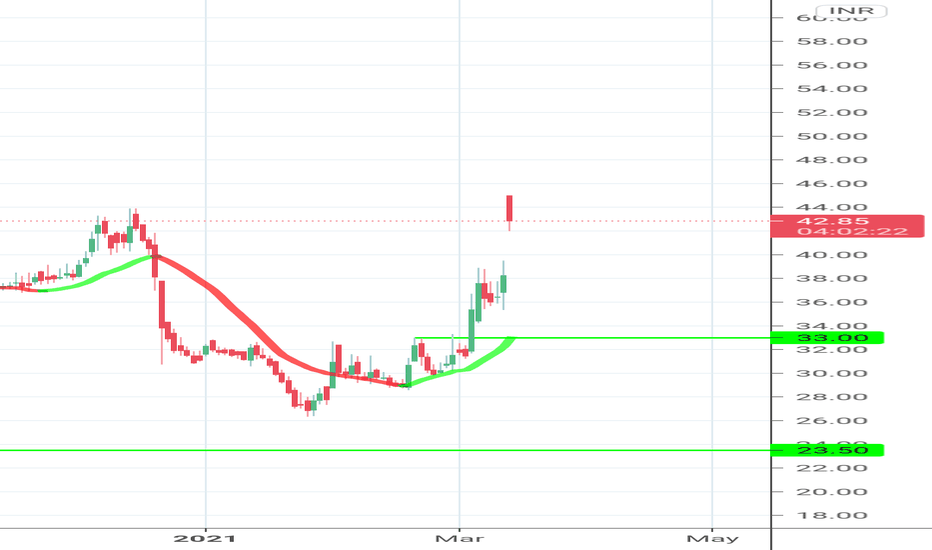

Buy - CMP (if sustains the level of 42) or 40 (if retraces)

Target - 49+

SL - 38

NOTE: These findings and levels are purely based upon the knowledge and understanding of the post publisher. The idea here is to predict the future price movements hence, please do not consider this as stock advice or recommendation.