IDFCFIRSTB trade ideas

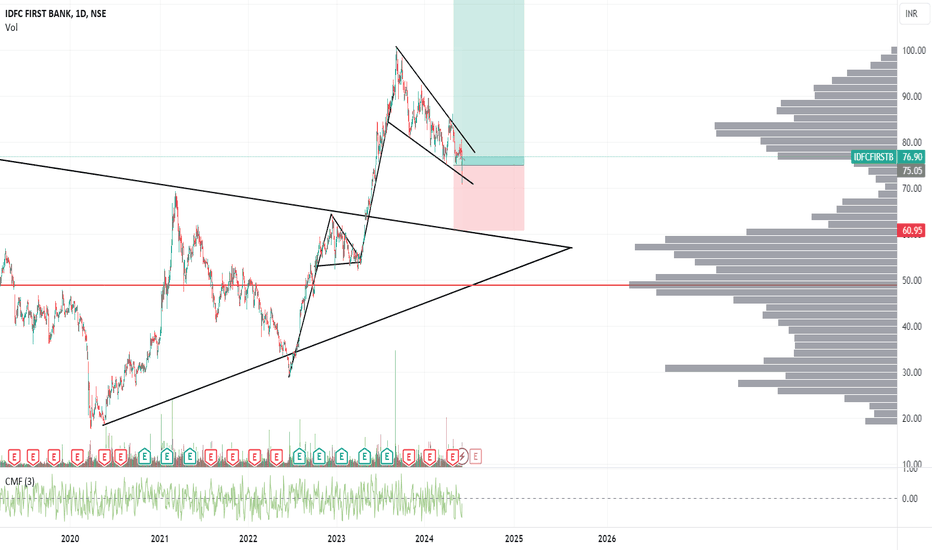

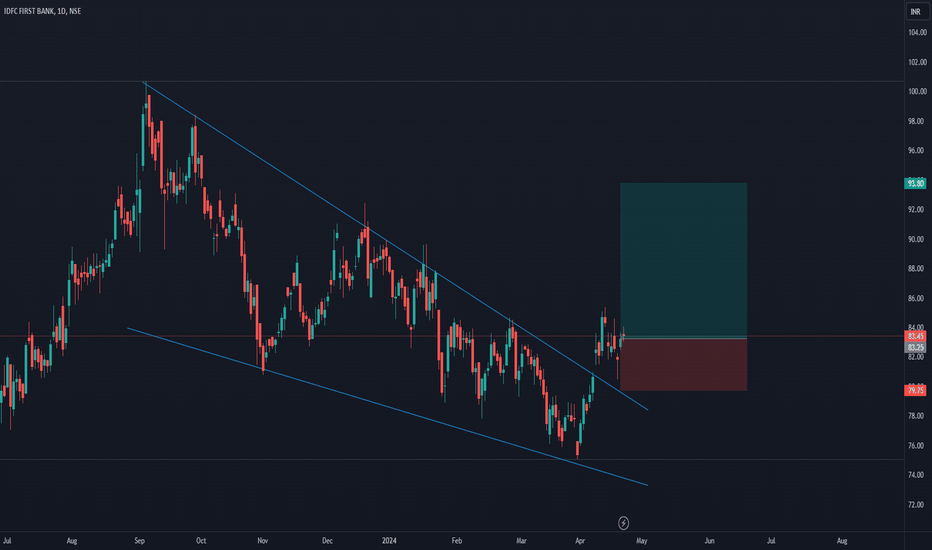

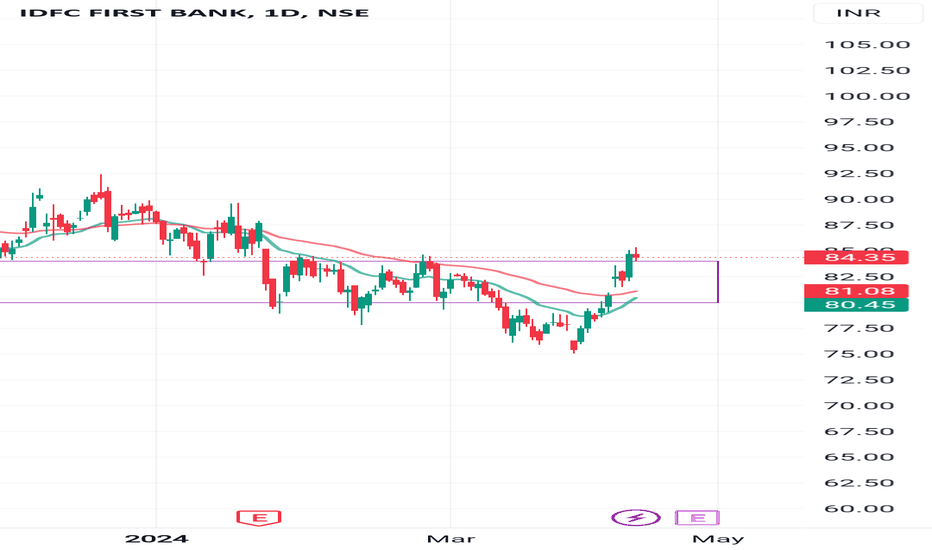

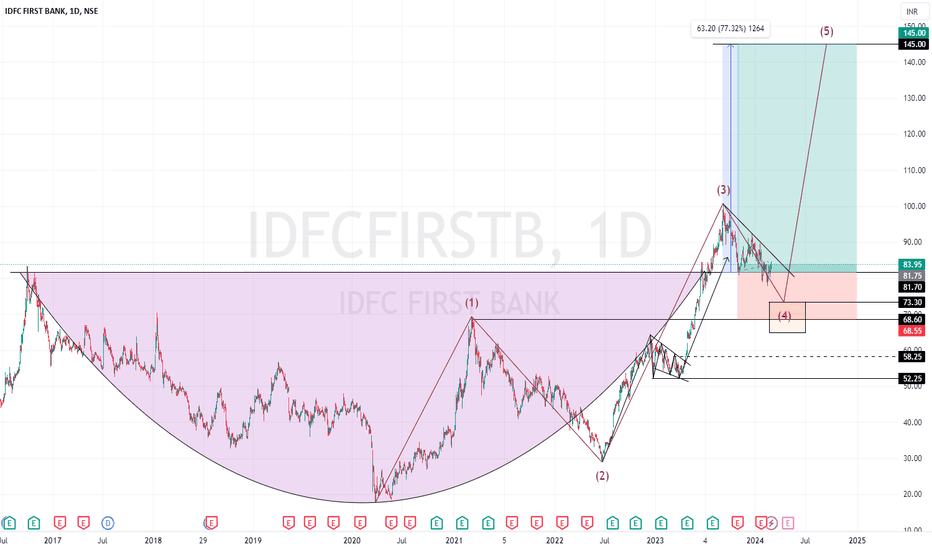

IDFCFIRSTBHi guys, In this chart i Found a Demand Zone in IDFCFIRSTB CHART for Positional entry,

Observed these Levels based on price action and Demand & Supply.

*Don't Take any trades based on this Picture.

... because this chart is for educational purpose only not for Buy or Sell Recommendation..

Thank you

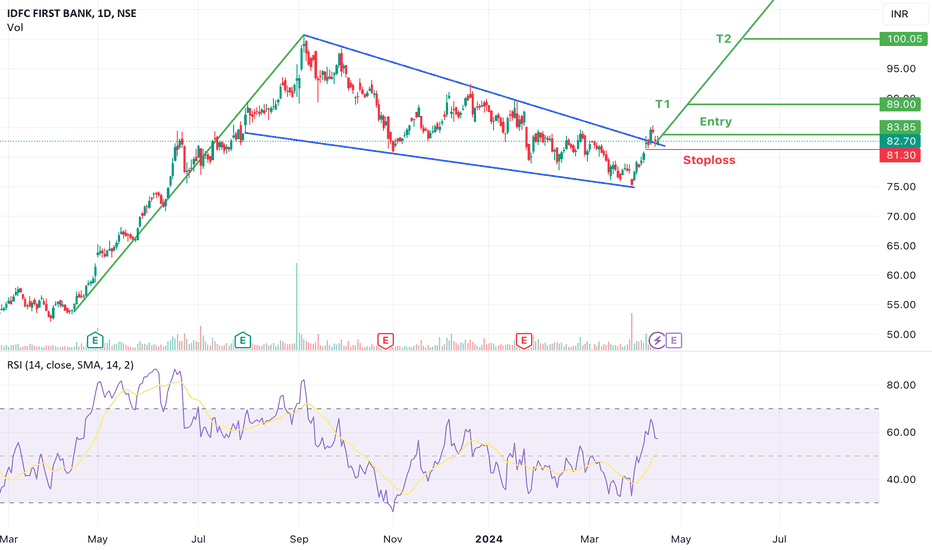

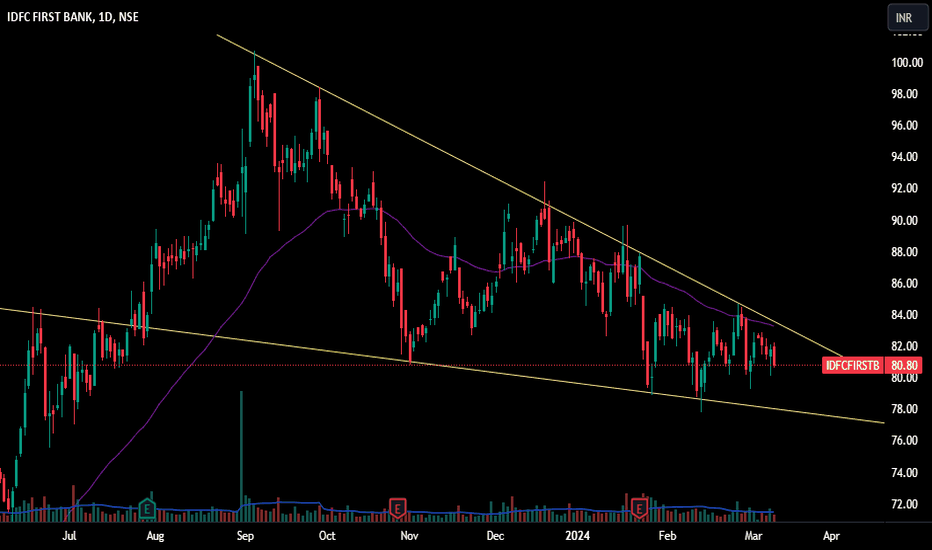

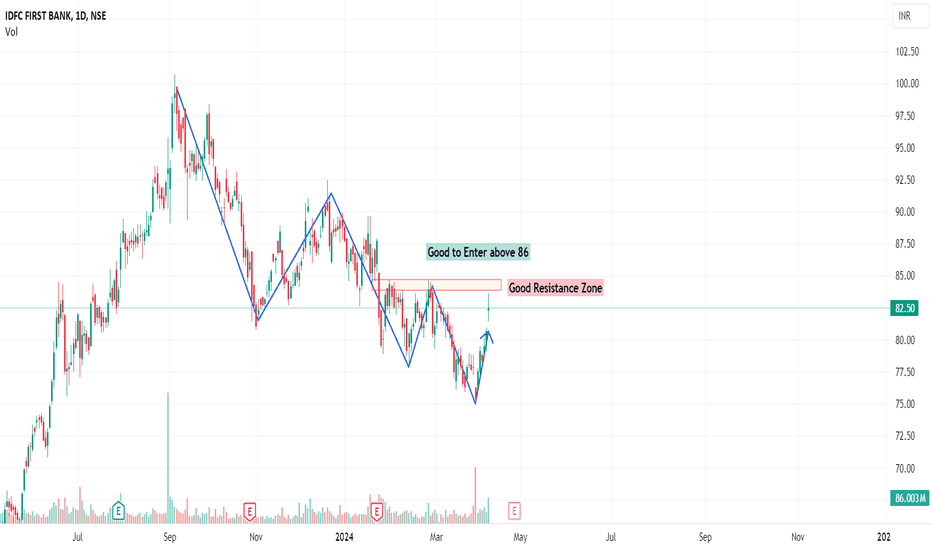

Falling wedges and Flag and Pole Breakout in #IDFCFIRSTBIDFC FIRST BANK has formed falling wedges and a bullish flag and pole pattern.

Today it has broken out again after the retest, taking support from the support trendline.

One can initiate a long position in this counter with mentioned:

Entry, stop loss & Targets.

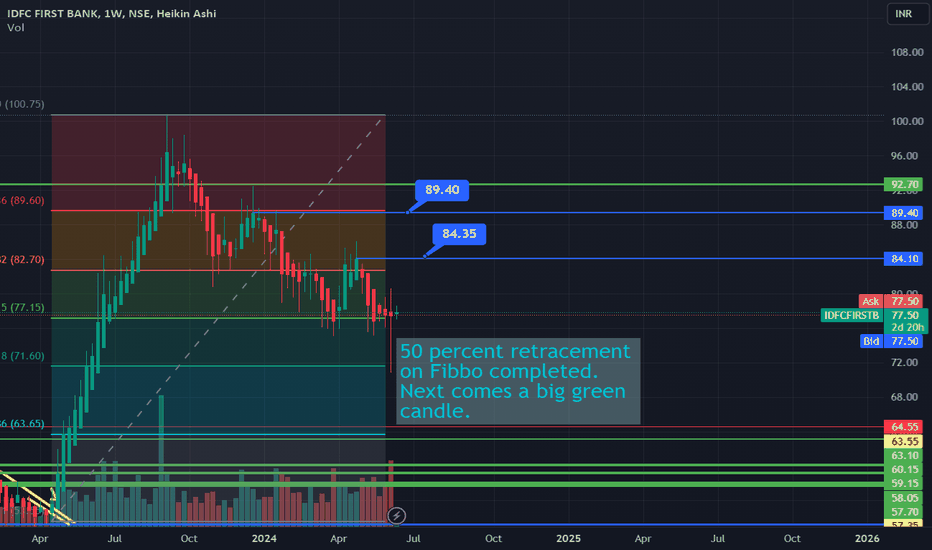

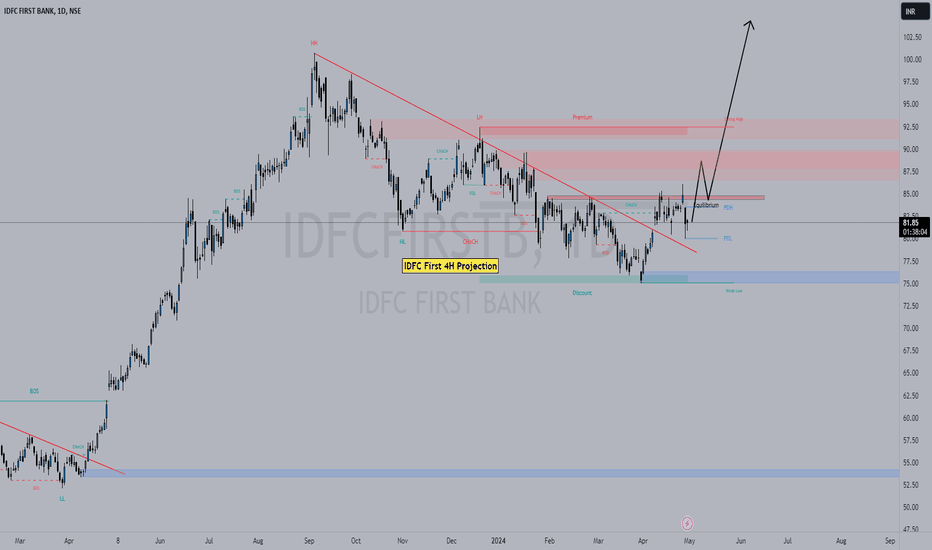

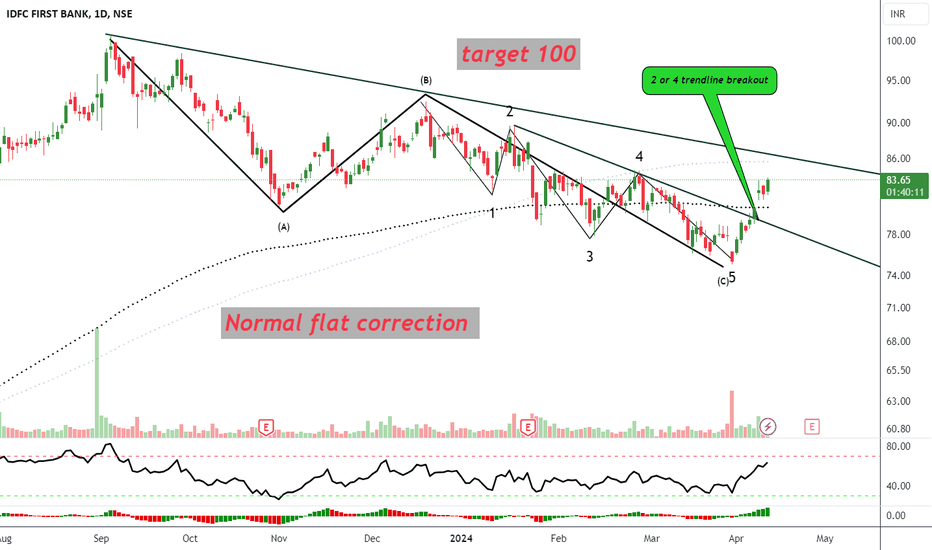

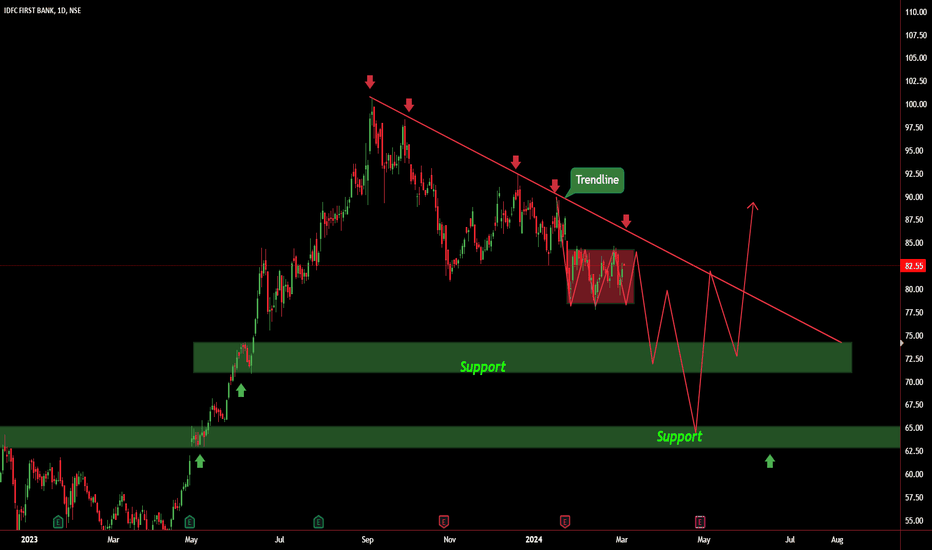

IDFC FIRST WILL HIT 100/SHARE?🤫Hi Guys, It looks like IDFC FIRST has given a breakout from a Falling wedge, everyone will thought that it will directly hit Rs 100, but it will be not like what others think. There is a resistance on 89-90 Which might become the reason that IDFC will again trade around Rs 80.

What a person who bought around 85 can do..? He can hold and wait till it breaks Rs 90 my personal view is to HOLD & ADD more shares on pull back.(not any recommendations). The reason is (1) Break out from falling wedge (2) the high chances of golden cross becoz price is above 50MA and about to break 200MA so 50MA will move upward and cut 200MA.

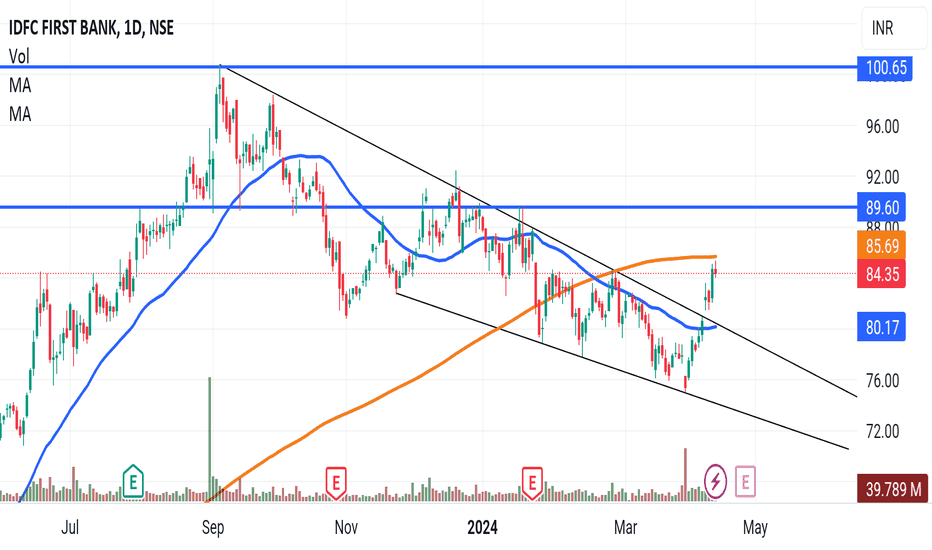

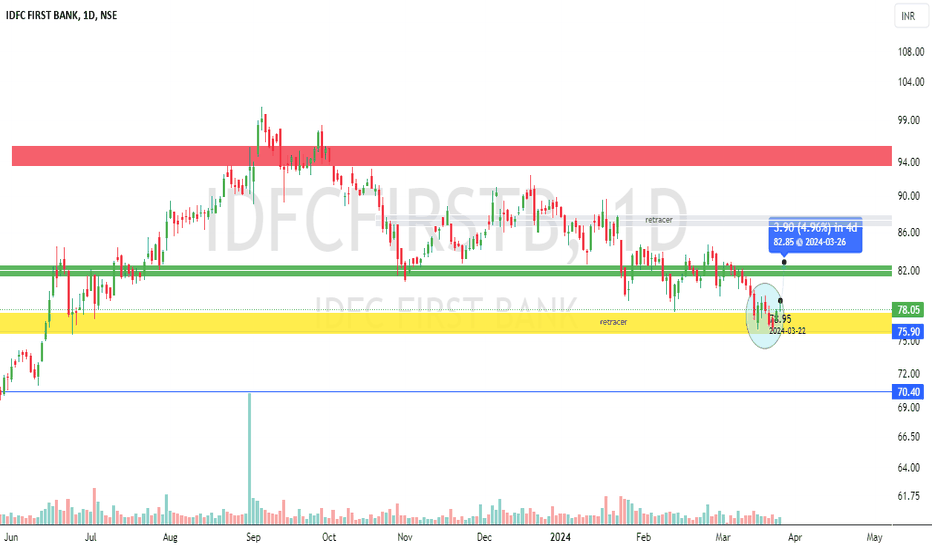

Hammer candle on weekly frame1) All time high @ 100.85

2) Range 93.55 to 96 seems to be strong selling zone with small support(acting resistance) range 86.65 to 87.95

3) Strong resistance range 81.42 to 82.55 since all time high in 2016 and breaks the level in 2023

4) Hammer of 4.5% forms in weekly frame taking long position with target of +3 points in coming week

Expectation : - If target of 3 points are achieved, we can expect further movement for range 86.65 to 87.95 range near (acting resistance)

** logic : with target being hit, price also breaks the current resistance, fi momentum persists we can see movement forming another swing so that trend can be formed **

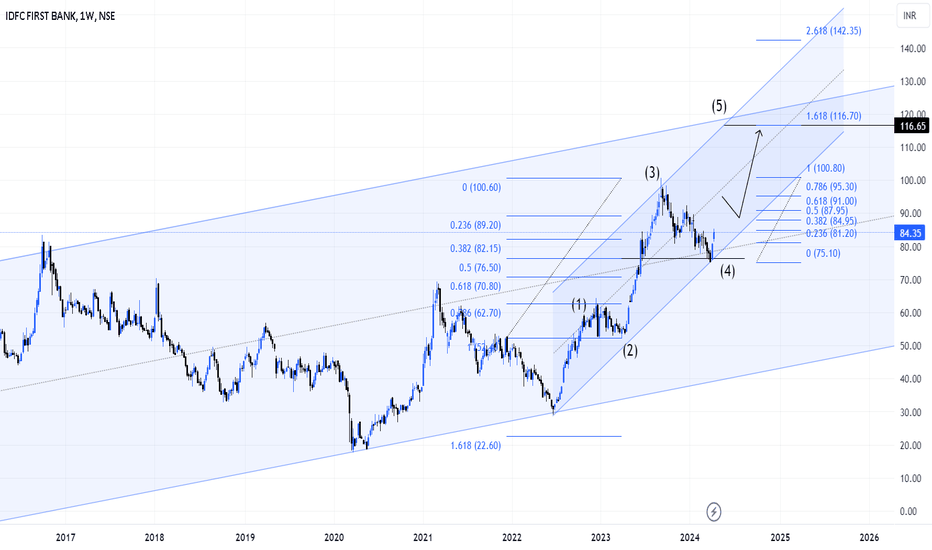

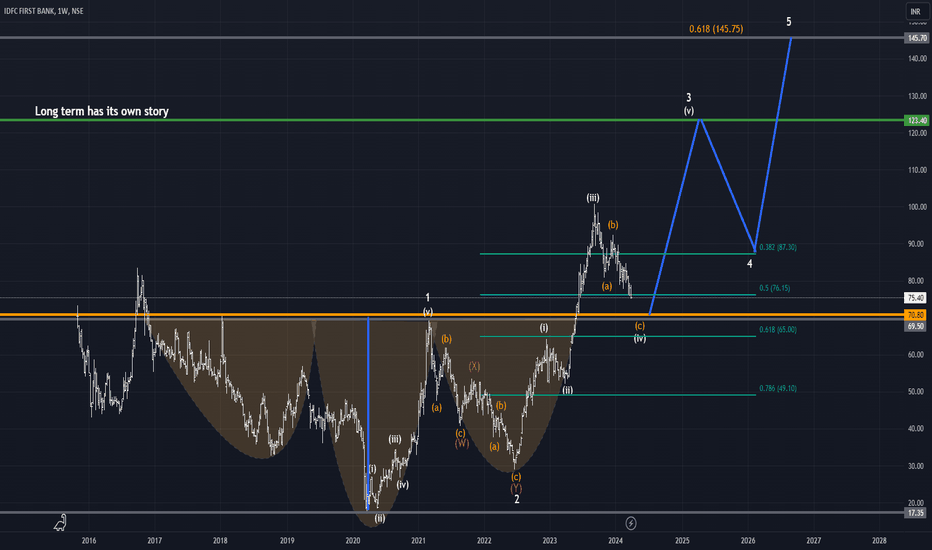

IDFC FIRST BANKIDFC FIRST BANK

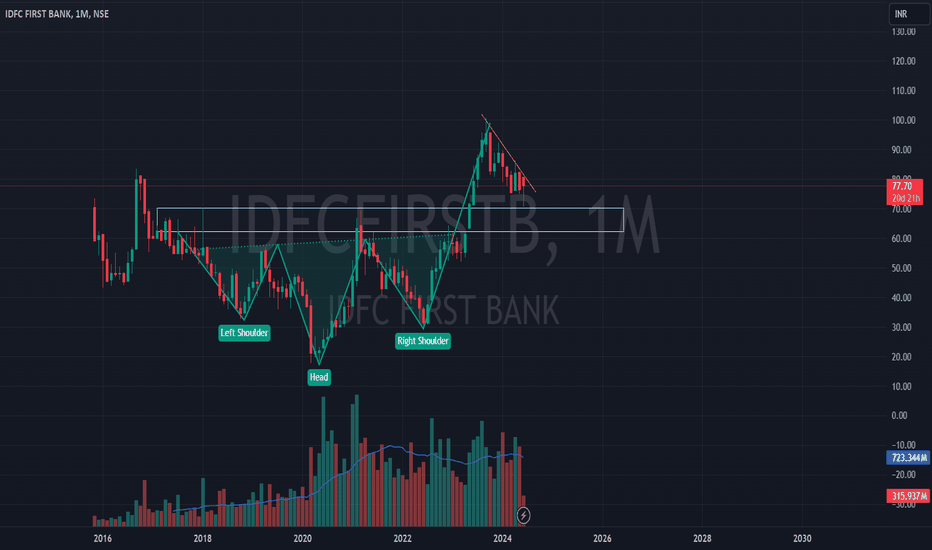

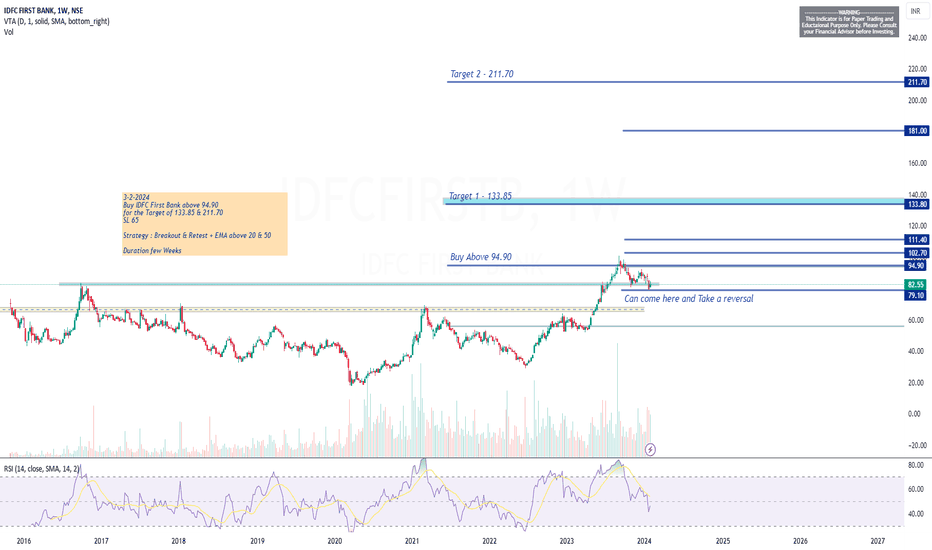

We are in retesting phase of the HEAD AND SHOULDER breakout and in my view we also are in 4th wave of the retracement. If all fundamental are intact then we can expect it to double your capital in medium to long term.

Don't forget to like share comment. please.

Regards

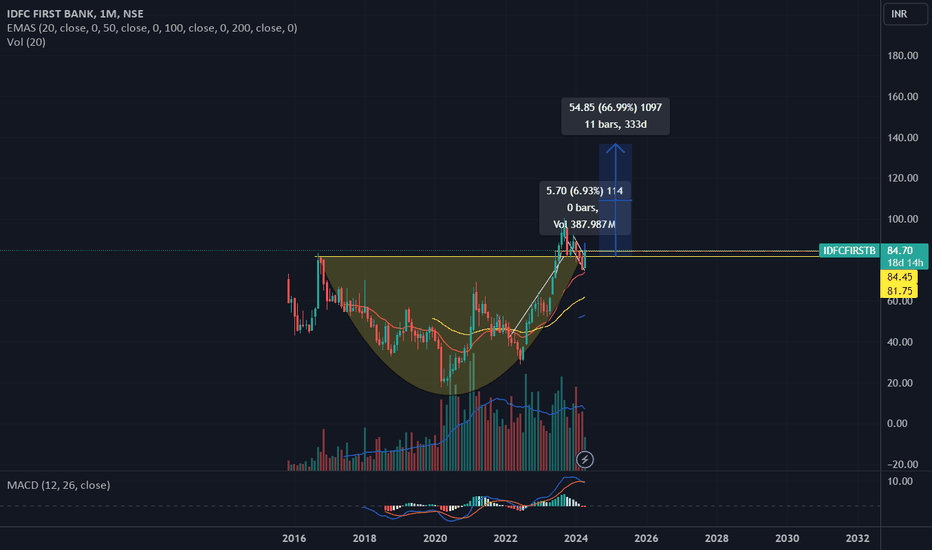

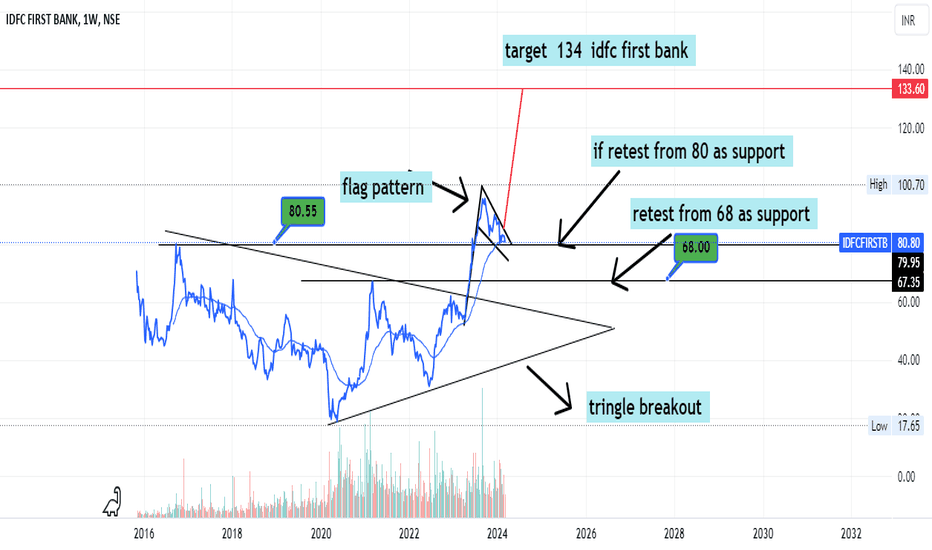

long term invest idfc bankbreakout has been done in idfc bank

now flag pattern making

The flag pattern occurs when a trending price pauses and goes back over slightly in a rectangular range.

This pattern allows us to enter the market in the middle of a trend.

The break out in price continues its original strong trend, giving us the chance to enter that trend at a better price than before the flag's formation.

How To Identify Bullish Flag Patterns?

The chart below is an illustration of the bullish flag chart pattern.

Bullish Flag Chart Pattern

The price experiences a strong uptrend. Then it stabilizes into a rectangular range that slopes downwards.

Then there is a break out of that range, and the uptrend continues.

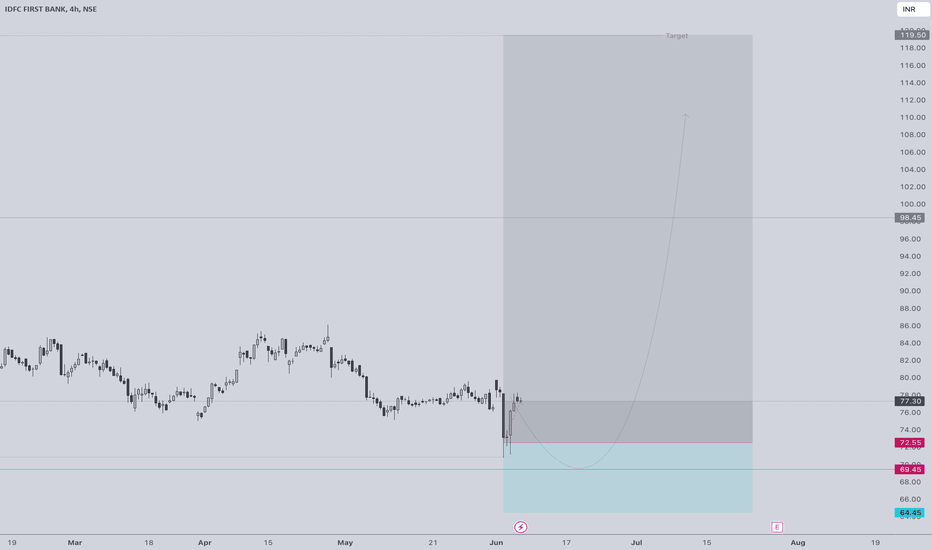

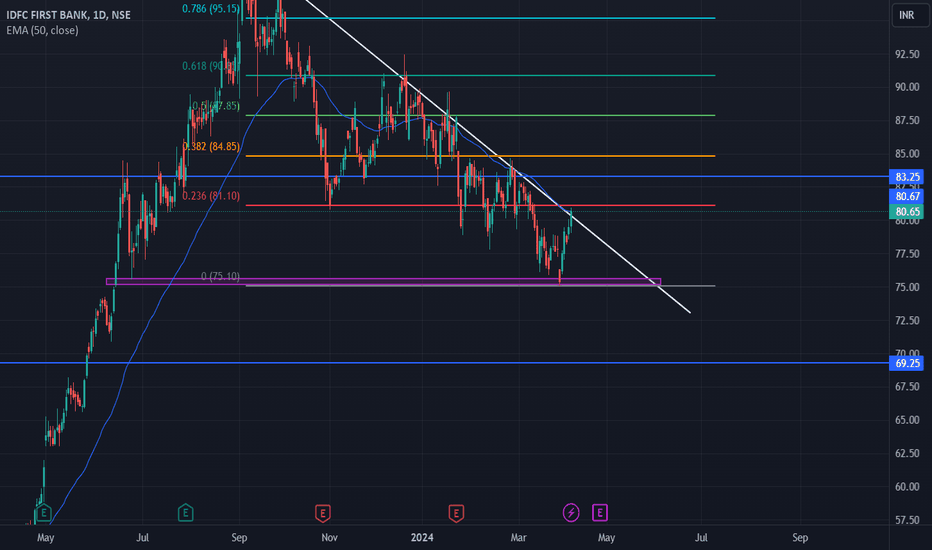

IDFCFIRSTBANK::Analysis Price is continuously falling,

facing the resistance from the trendline as well.

A drop is detected in the stock from 90 levels,

now price is in consolidation, we have a drop base drop indicating a potential bearishness in this stock.

Indicating a support at 75-72 levels zone.

back to back demand zones is lies below this support levels, keep in long side from this levels.