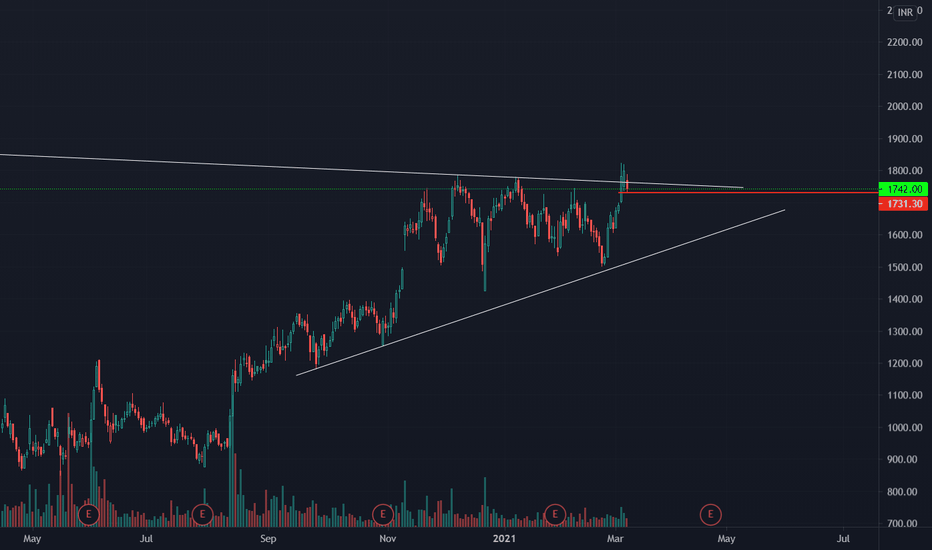

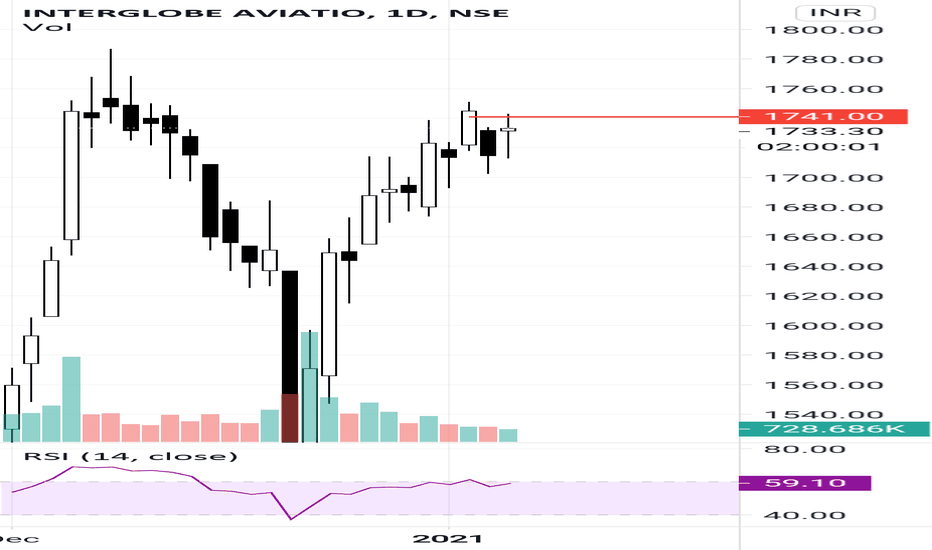

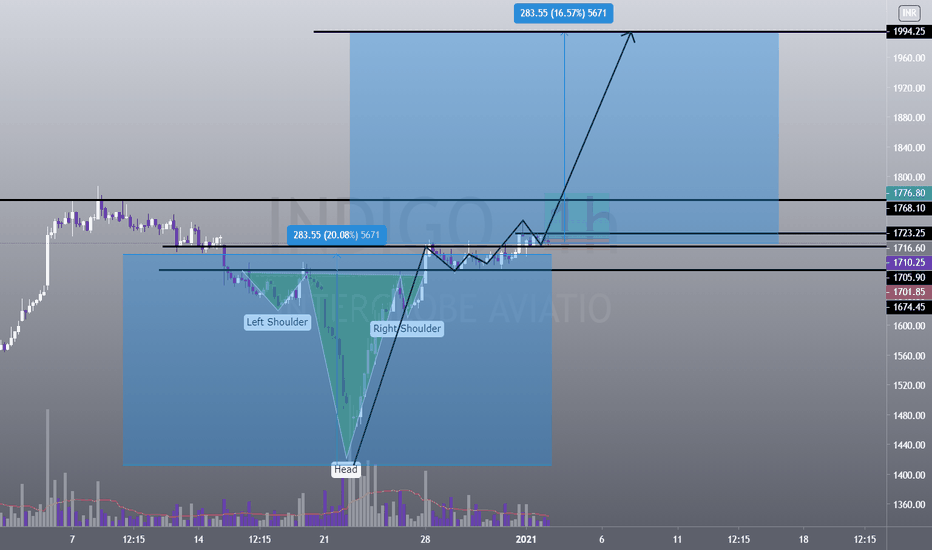

INDIGOHello friends

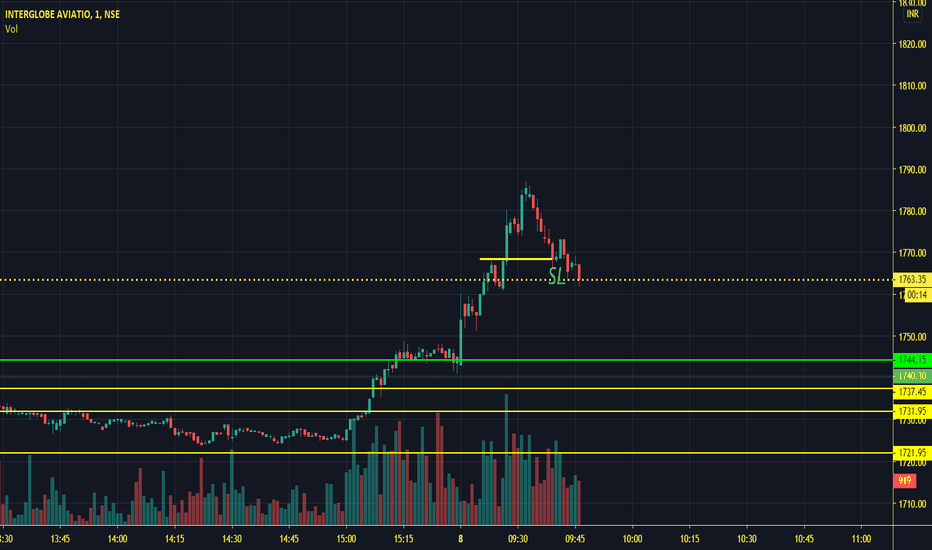

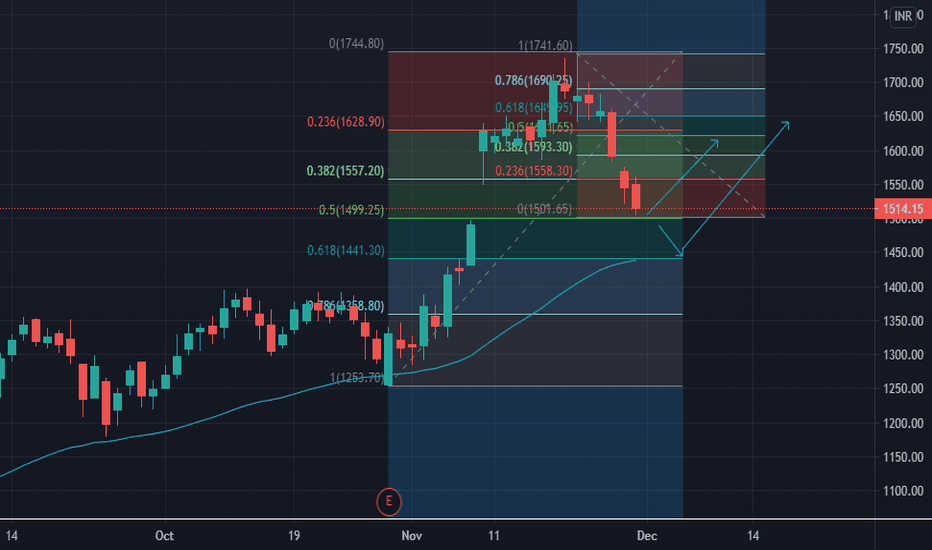

Today i am sharing this INDIGO analysis which is very important. This stock has given daily timeframe breakout and retested its breakout level but it could not able to sustain breakout level. This stock has good potential for upside if stock hold 1732.5 level then stock will continue there journey toward uptrend. If stock breaks 1732.5 level then we can go for short sell.

If you like my idea then please follow me on tradingview. Its give me motivation.

keep trading

Thank you

INDIGO trade ideas

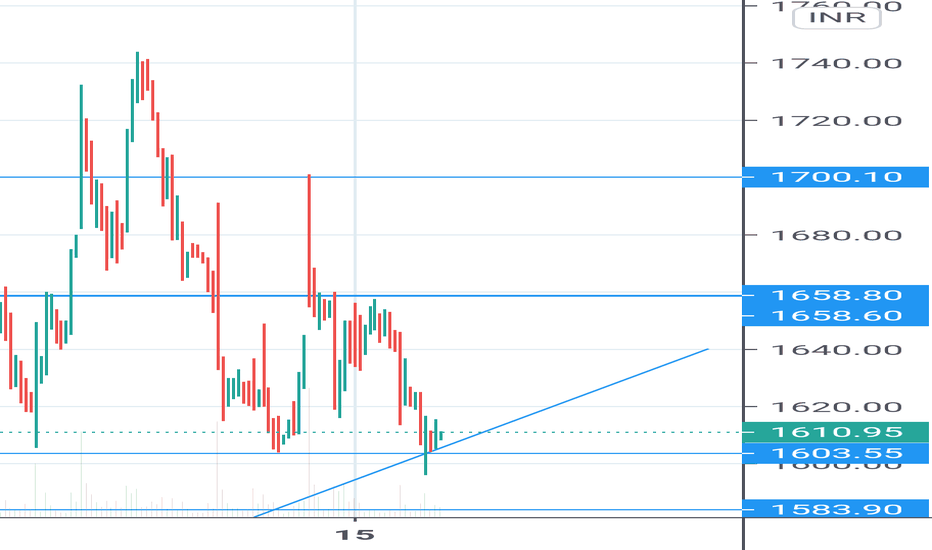

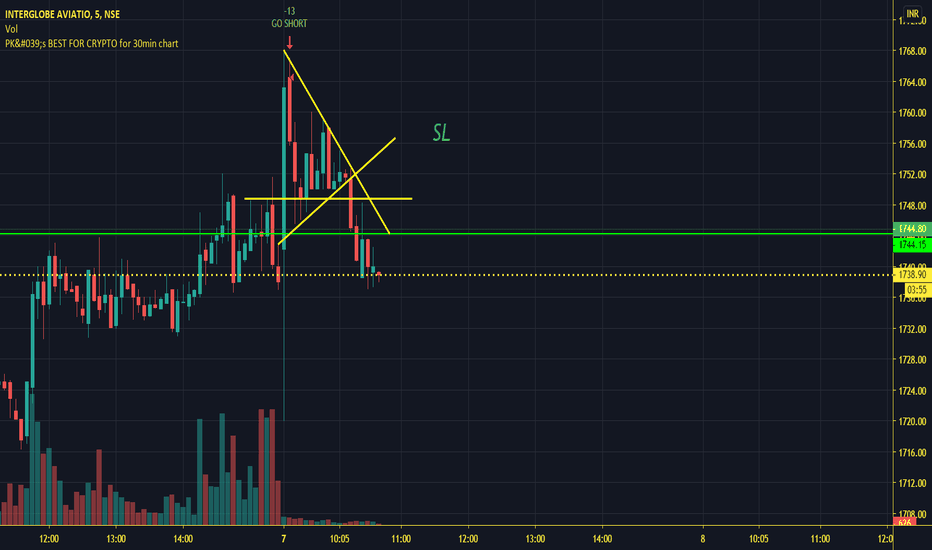

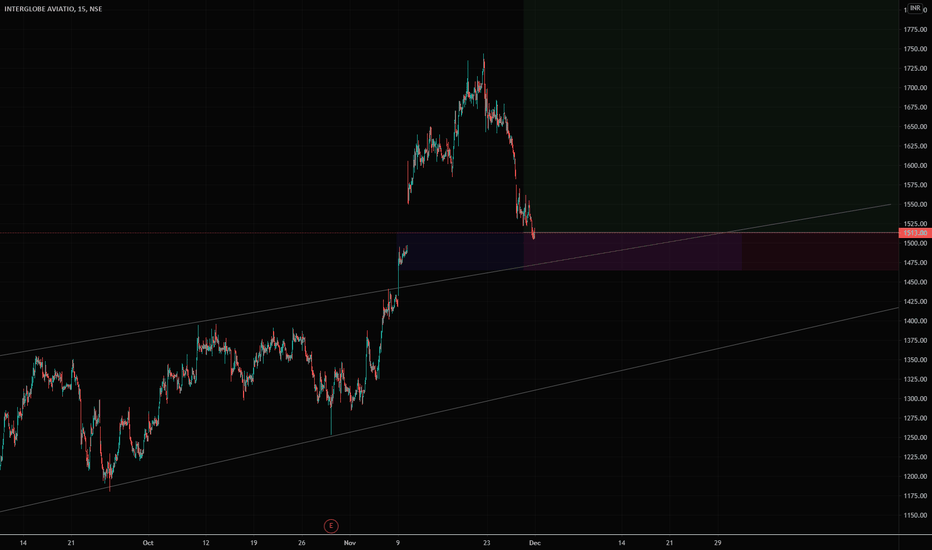

INDIGO { 15 M Short }Short Triggered in 15 M , giving chance to enter again

Rest is as per charts

Note :-

Entry - At the break of mentioned candle's low/high

Stop Loss -

In a Short Trade, I always use Previous Candle High ( PCH ) as a stop loss while entering the trade. Sometime I might use 15 M tf SL & trade in 30M tf which I'll mention. Vice Versa for long trades

Trailing Stop Loss ( TSL ) - Mostly I trail stop loss by PCH as price falls . I exit as PCH breaks & vice versa

Use of PSAR as TSL :- TSL get's hit in trend following due to noise, In such cases I use PSAR to be in trend & exit if PSAR direction change

You can use any one of above mentioned or your own way to manage risk

Time Frame :- I take ~ 90% of my intraday trades in 15m tf. Where my analysis might come from higher frames like W , D or 1hr chart pattern which will be mentioned.

Target :- I do set target line based on support / resistance slightly above/ below it . Please pay attention to it

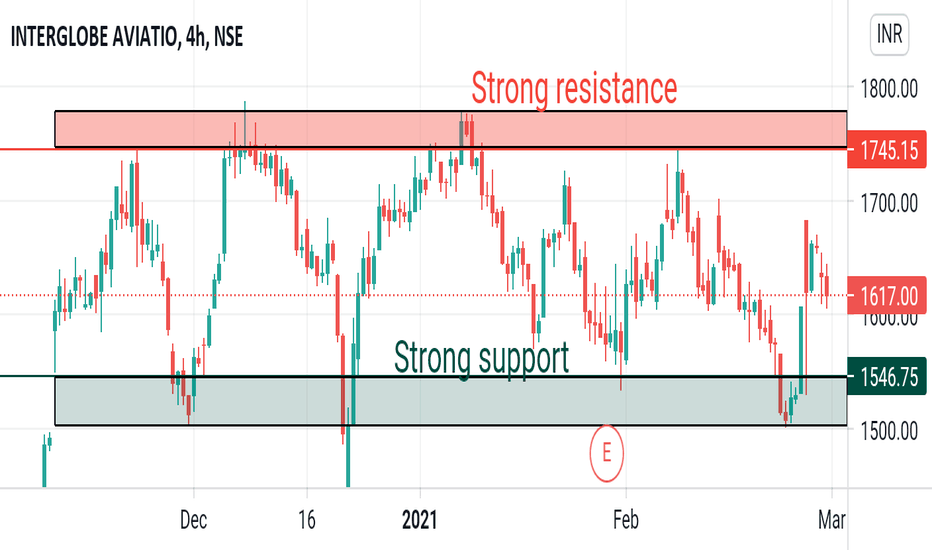

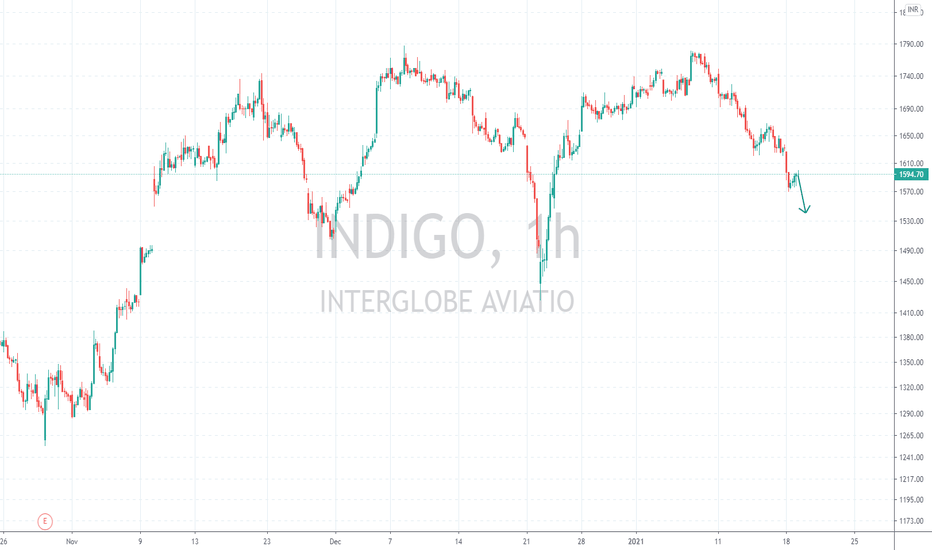

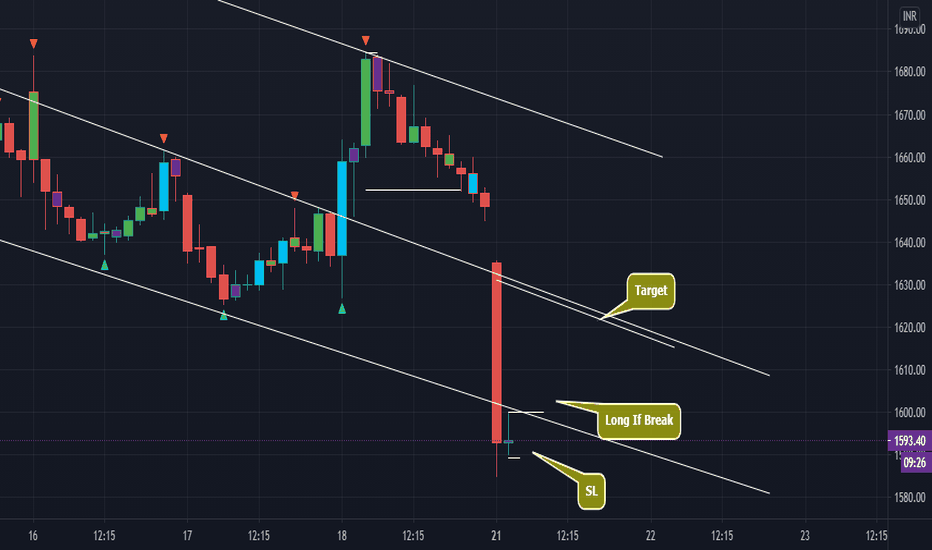

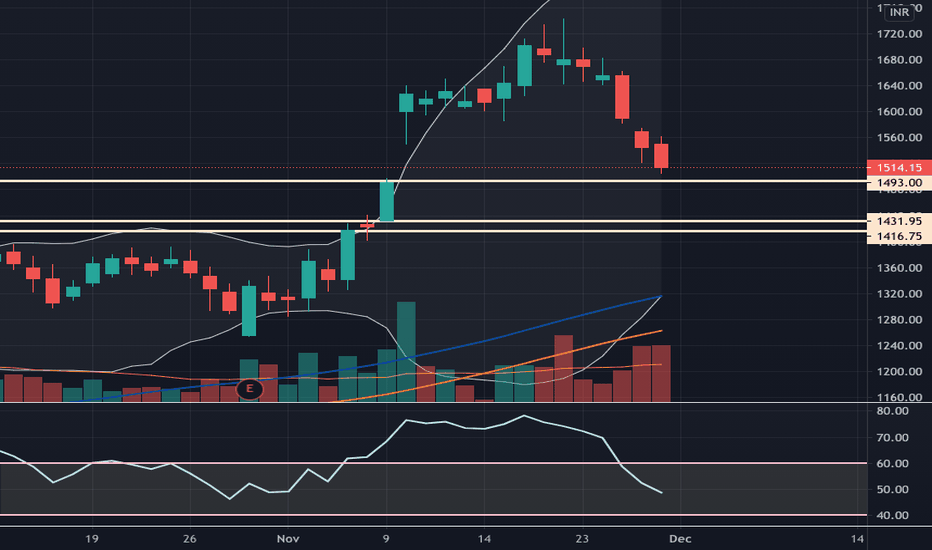

Indigo - Intraday / Swing Trade SetupIndigo CMP - 1594.05

Looking bearish in higher time frame. One can go for Intraday / Swing Trade Setup with the following entry, exit & targets

Sell at or Below 1590 ONLY / Stop Loss 1600

Target 1 - 1582

Target 2 - 1572

Target 3 - 1562 / 1540

Swing Target - 1505 / 1631

Disclaimer: This is my view and for educational purpose only.

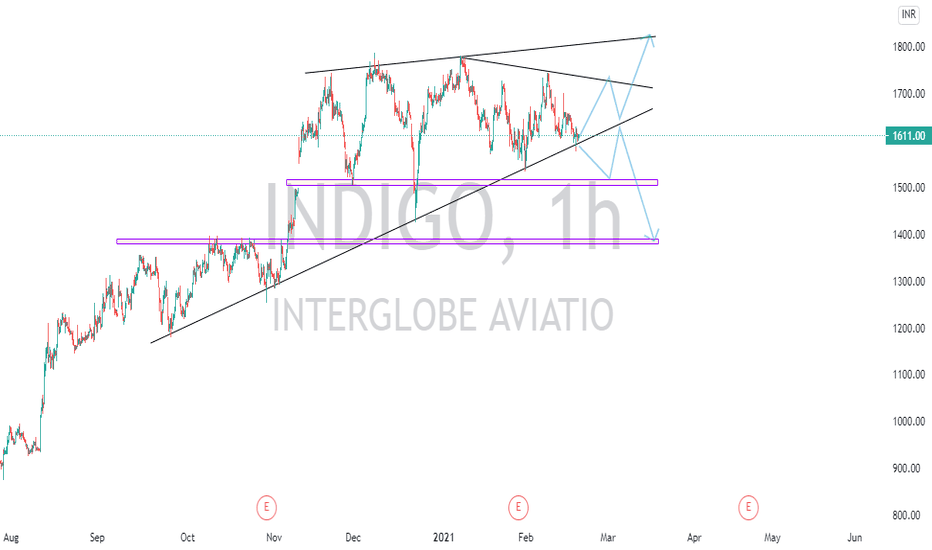

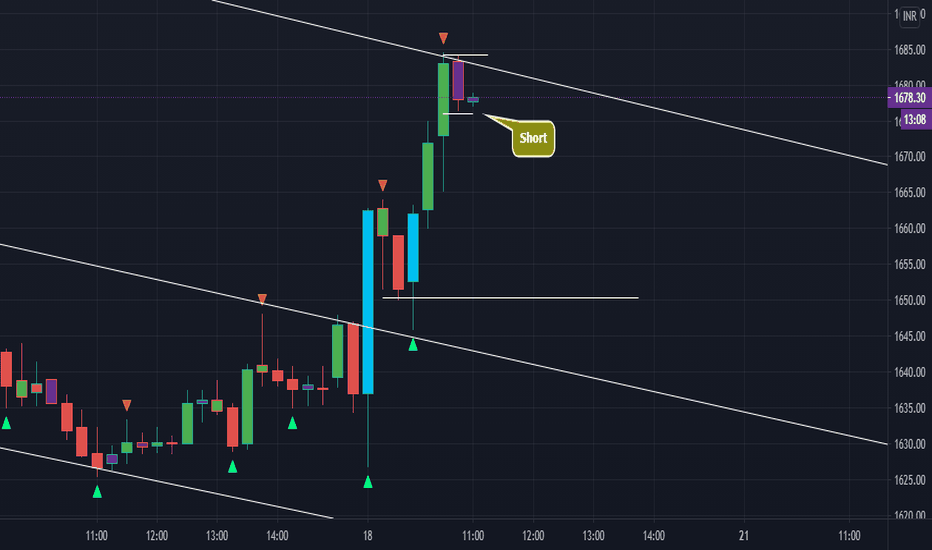

Indigo { 15 M Short }Stock slightly gapped down and broke the D- Frame support if you notice. Now it has formed a shooting star & IB in formation which is also good example of RETEST THEORY, as the previous support acting like resistance. Rest is as per charts

( You can take 1:2 risk reward ration for target here )

Note :-

Stop Loss -

In a Short Trade, I always use Previous Candle High ( PCH ) as a stop loss while entering the trade. Sometime I might use 15 M tf SL & trade in 30M tf which I'll mention. Vice Versa for long trades

Trailing Stop Loss ( TSL ) - Mostly I trail stop loss by PCH as price falls . I exit as PCH breaks & vice versa

Use of PSAR as TSL :- TSL get's hit in trend following due to noise, In such cases I use PSAR to be in trend & exit if PSAR direction change

You can use any one of above mentioned or your own way to manage risk

Time Frame :- I take ~ 90% of my intraday trades in 15m tf. Where my analysis might come from higher frames like W , D or 1hr chart pattern which will be mentioned.

Target :- I do set target line based on support / resistance slightly above/ below it . Please pay attention to it

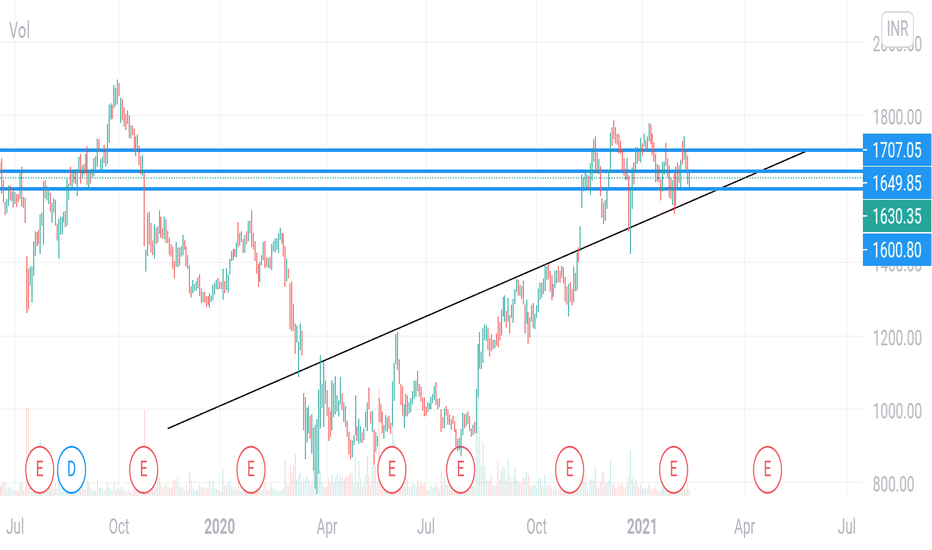

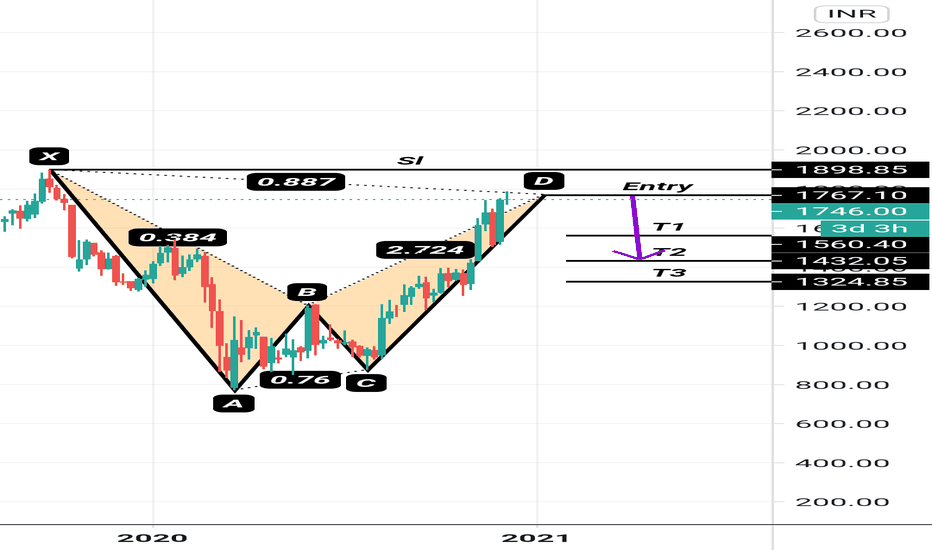

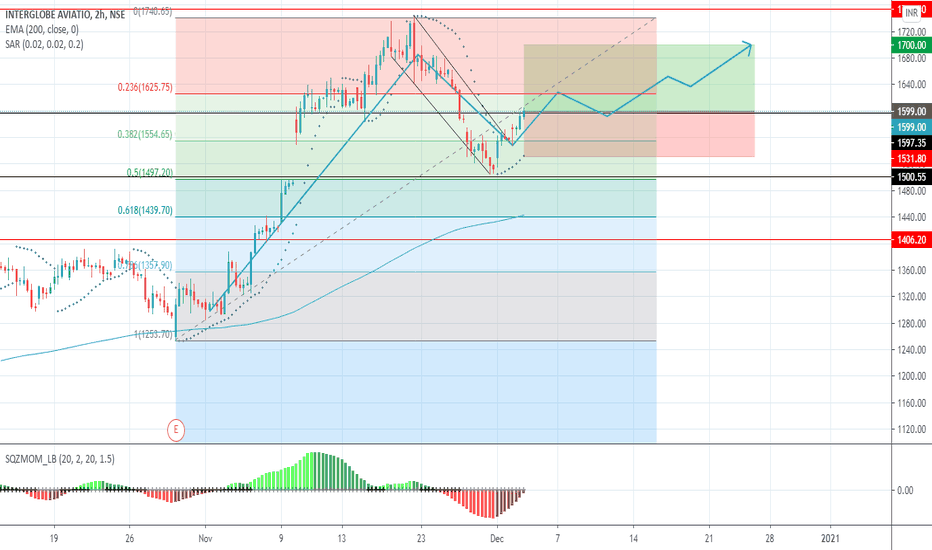

INDIGO { 30 M }This is a channel bet, in 30M tf you can see it's follwing a harmonic pattern. It's forming a IB now near support and showing high chances of reverse. Rest as per chart

Note :-

Stop Loss -

In a Short Trade, I always use Previous Candle High ( PCH ) as a stop loss while entering the trade. Sometime I might use 15 M tf SL & trade in 30M tf which I'll mention. Vice Versa for long trades

Trailing Stop Loss ( TSL ) - Mostly I trail stop loss by PCH as price falls . I exit as PCH breaks & vice versa

Use of PSAR as TSL :- TSL get's hit in trend following due to noise, In such cases I use PSAR to be in trend & exit if PSAR direction change

You can use any one of above mentioned or your own way to manage risk

Time Frame :- I take ~ 90% of my intraday trades in 15m tf. Where my analysis might come from higher frames like W , D or 1hr chart pattern which will be mentioned.

Target :- I do set target line based on support / resistance slightly above/ below it . Please pay attention to it

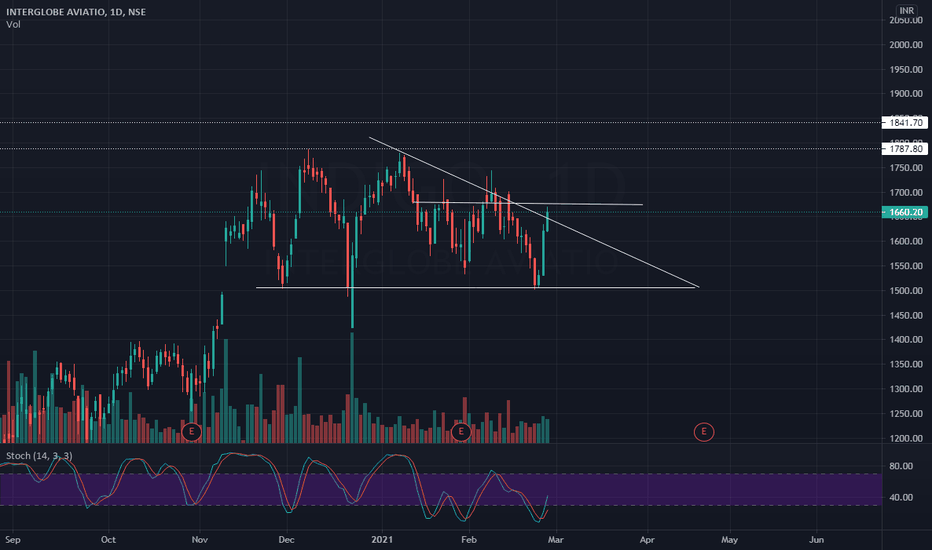

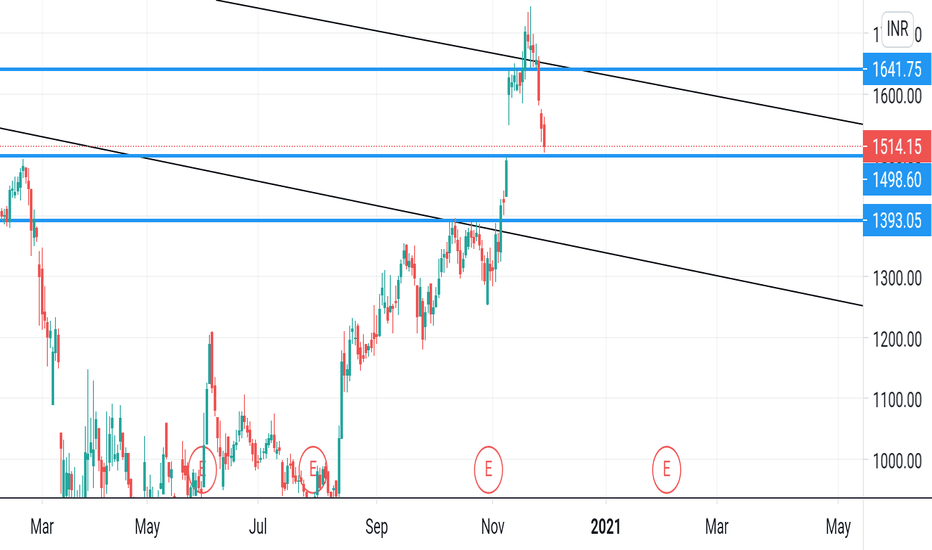

Indigo - ShortIndigo CMP - 1659.80

Looking bearish in higher time frame. One can go for Intraday Trade setup with the following entry, exit & targets

Sell at or Below 1650 / Stop Loss 1661

Target 1 - 1640

Target 2 - 1630

Target 3 - 1620 / 1610

Disclaimer: This is my view and for educational purpose only.

Live Intraday Trading - A confidence trade with easy setup !!When you want to go long in a stock which is opening gapped up , then forming a bull flag , breaking a resistance and finally with the market support where will that stock go . There is only answer to this and that is high . It was just a dream setup every trader needs for making money .

A full confidence trade with double size .