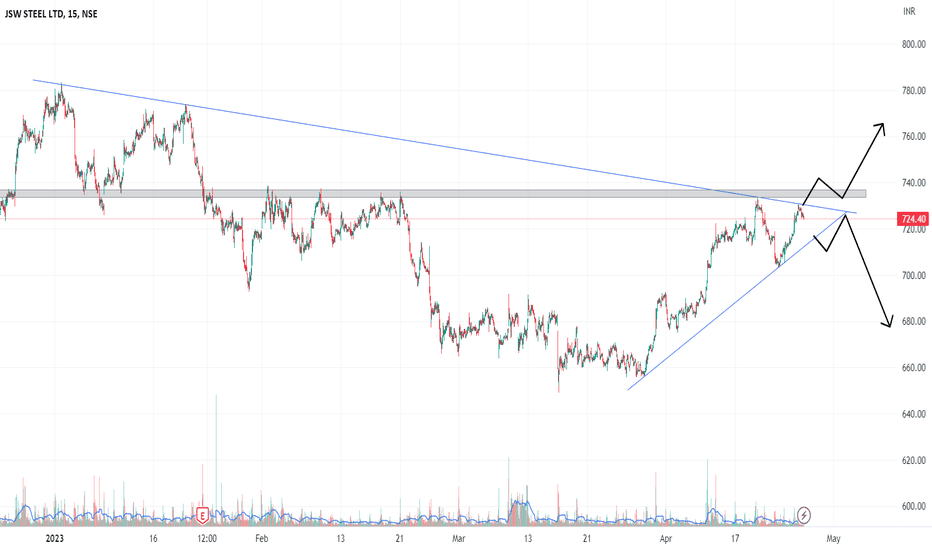

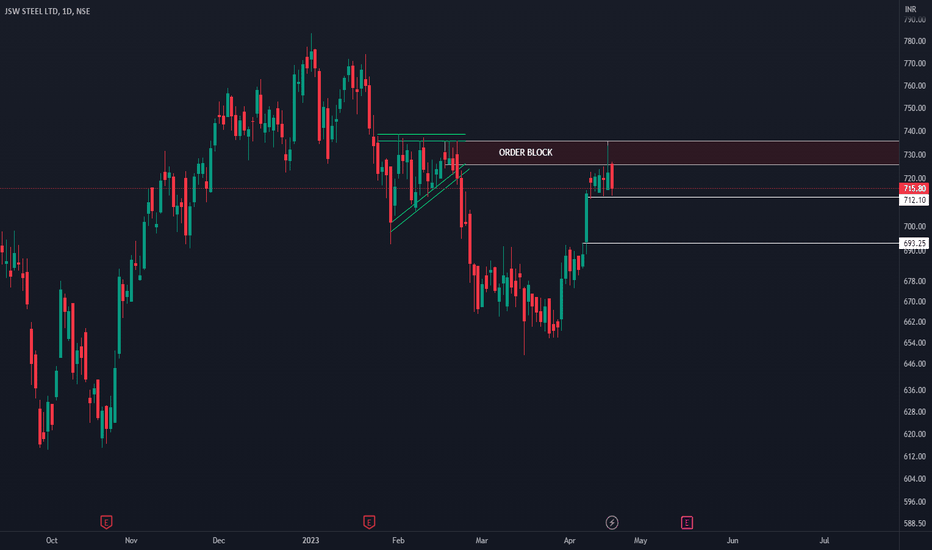

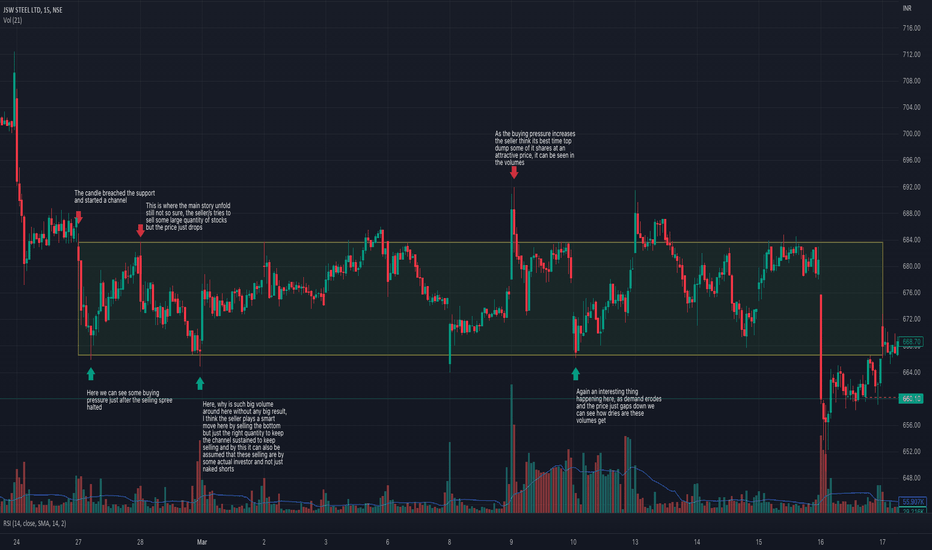

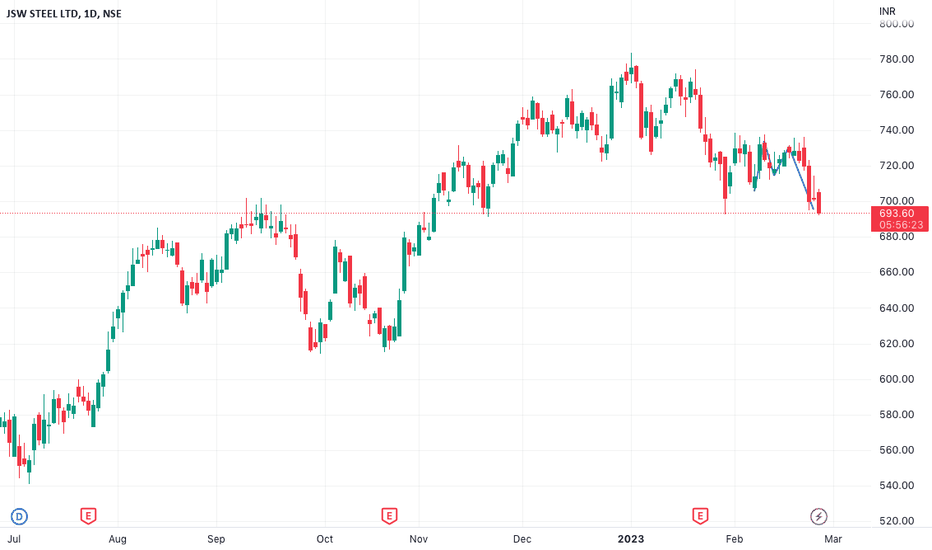

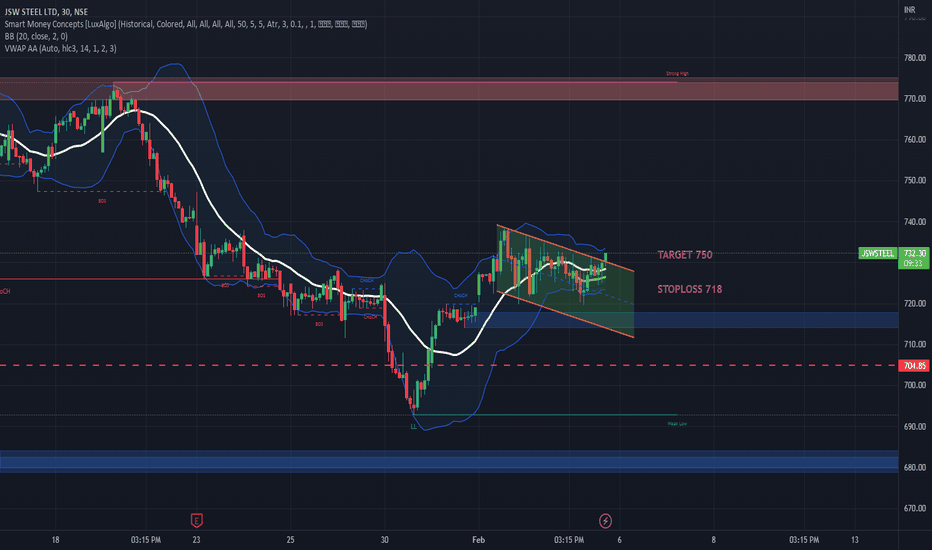

JSWSTEEL--Breakout Range??Observations::

clearly the stock is trending downwards,

previous support @710-718 level, broken strongly.the same support @710-718 range is acting as resistance.

now price is trading in a range, wait for the break of either side movement.

Keep track this levels. sharp movements will happen while breaking the resistance or support, when price is in range.

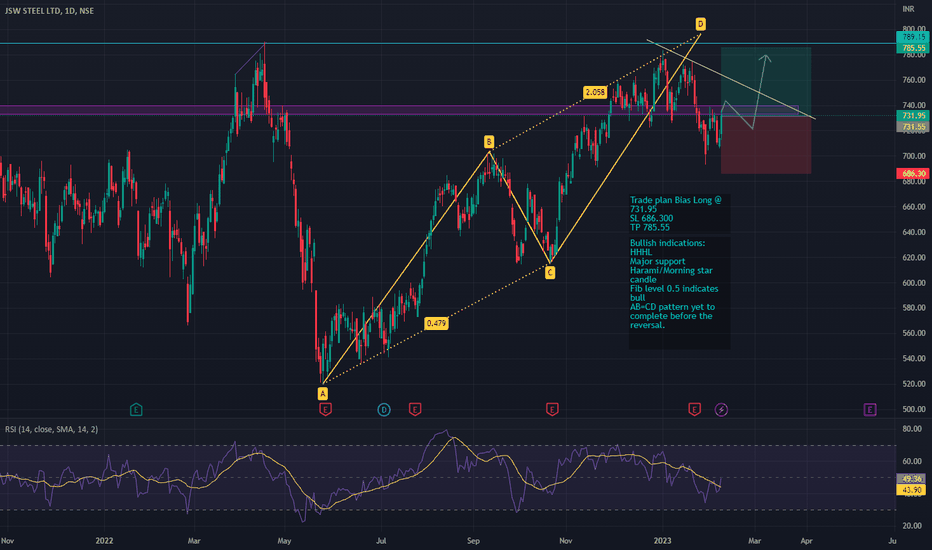

JSWSTEEL trade ideas

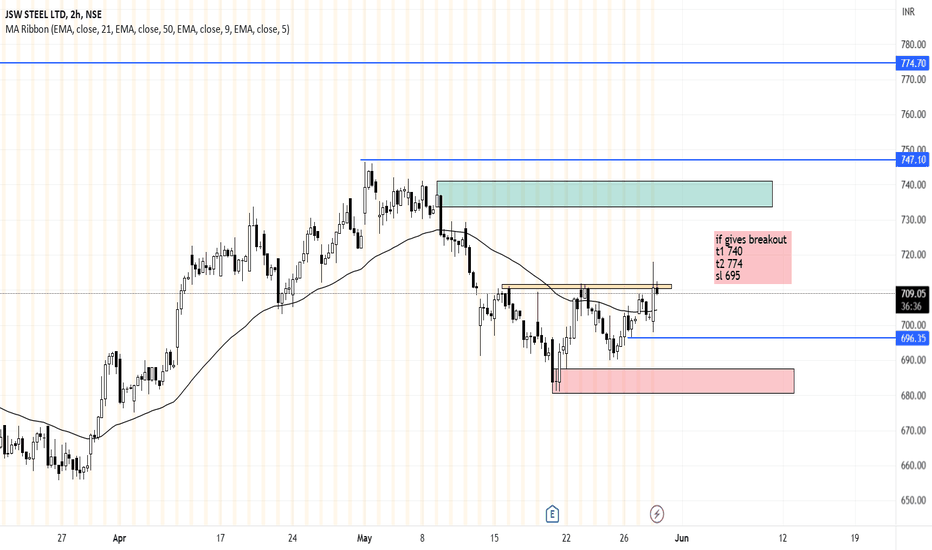

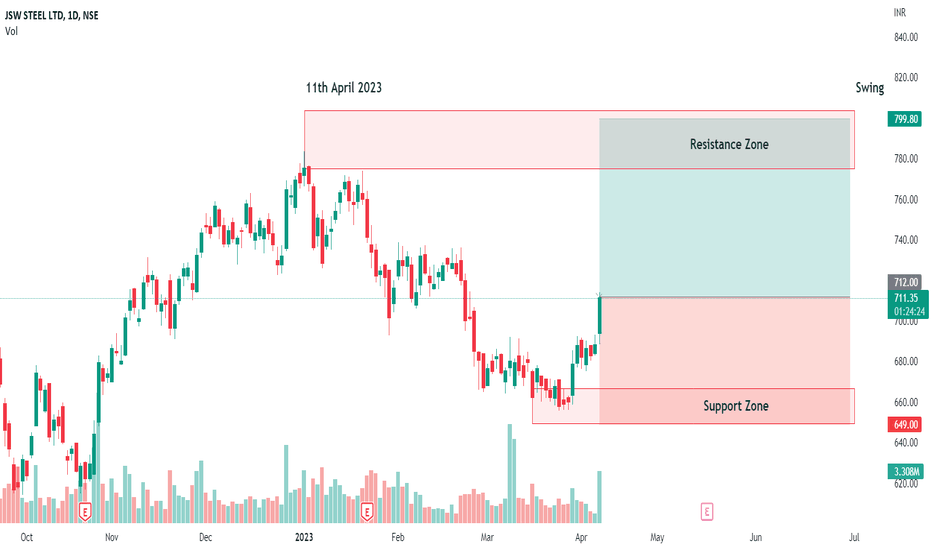

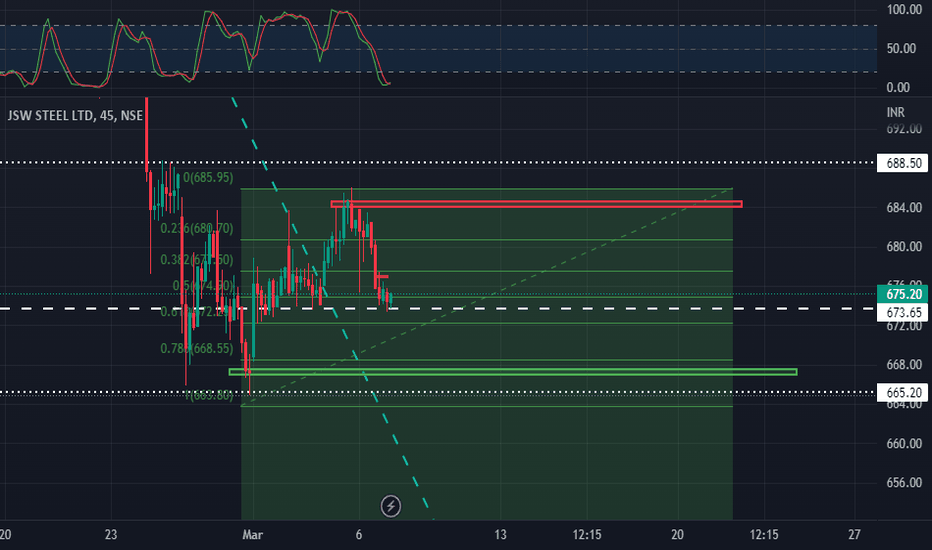

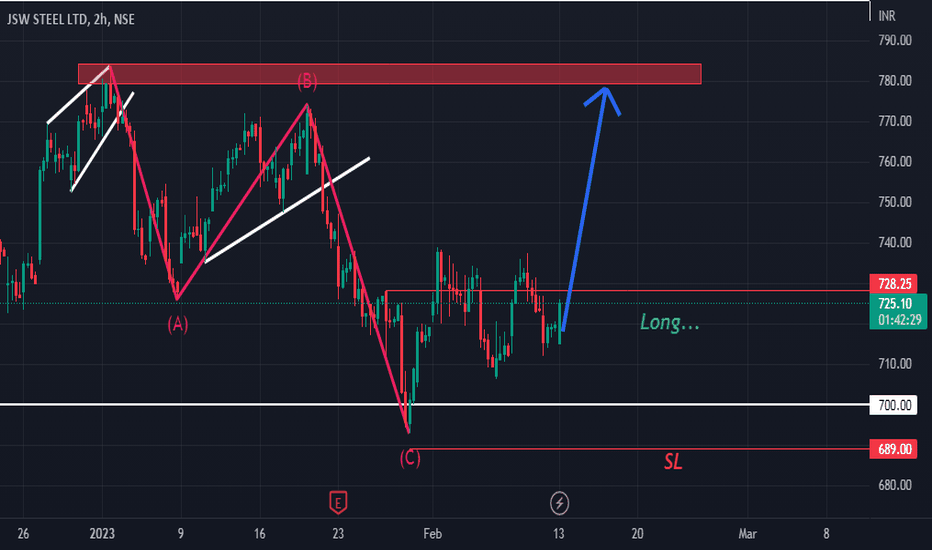

JSW STEEL FOR SWING TRADE IDEA This swing trade idea focuses on JSW Steel, a prominent player in the steel industry, and explores the potential for a breakout trade opportunity. By analyzing the 2-hour chart using technical analysis, particularly through the lens of supply and demand zones, this idea aims to identify a potential shift in market sentiment from a downtrend to a bullish trend.

The proposed trade setup suggests initiating a long position if JSW Steel breaks out above the crucial resistance level of 715. The suggested stop-loss is set at 695 to manage risk effectively. The trade targets are established at 740 and 775, reflecting the potential bullish momentum the stock could experience upon breaking out.

The technical analysis indicates that JSW Steel has been in a downtrend, but there are signs of a possible trend reversal. By considering the supply and demand zones on the 2-hour chart, this swing trade idea seeks to take advantage of a breakout scenario, where the stock's price action surpasses the resistance level.

Please note that swing trading involves a certain level of risk, and it's important to carefully evaluate your own risk tolerance and conduct thorough research before making any trading decisions. This trade idea serves as a starting point for further analysis and should be combined with your own judgment and market assessment before execution.

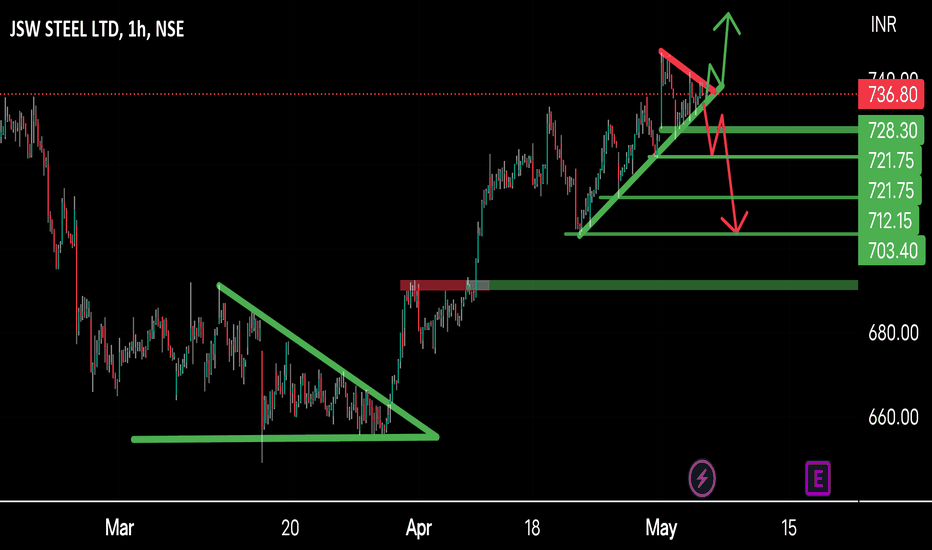

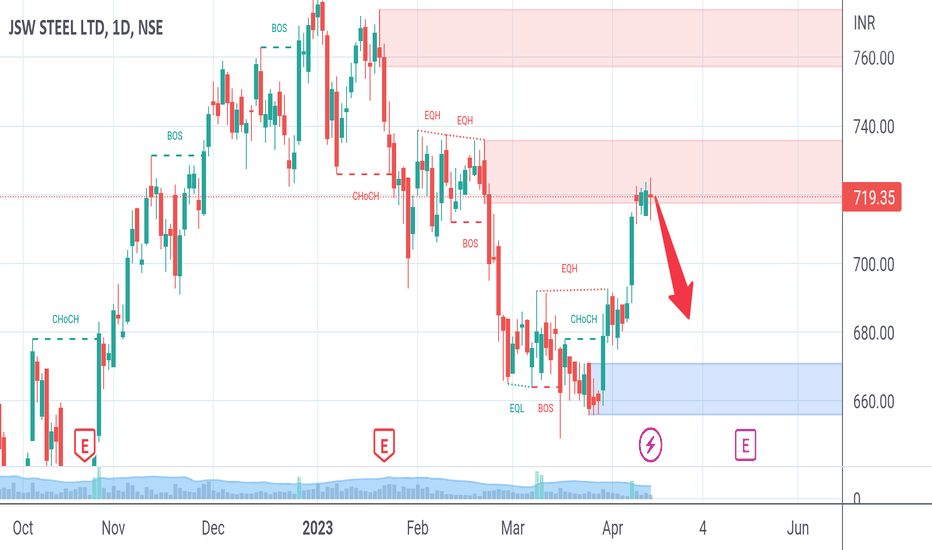

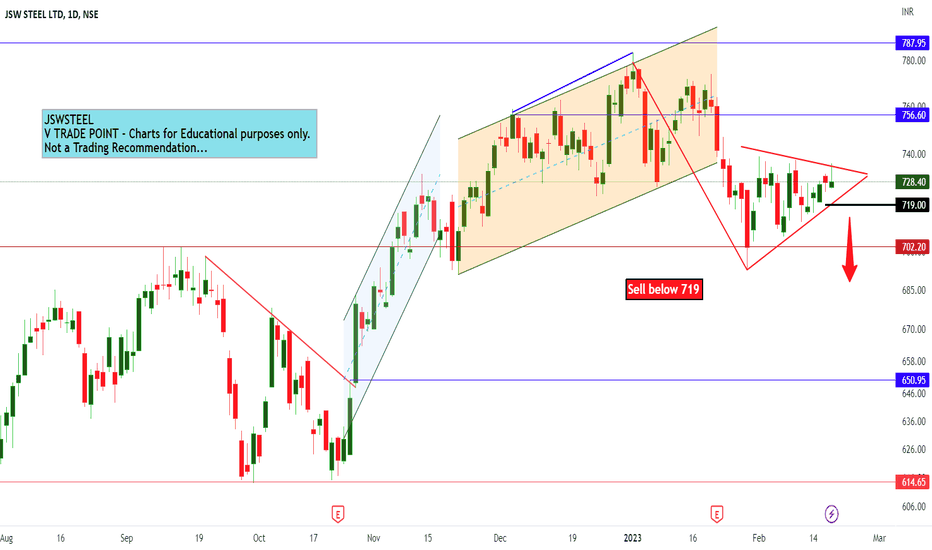

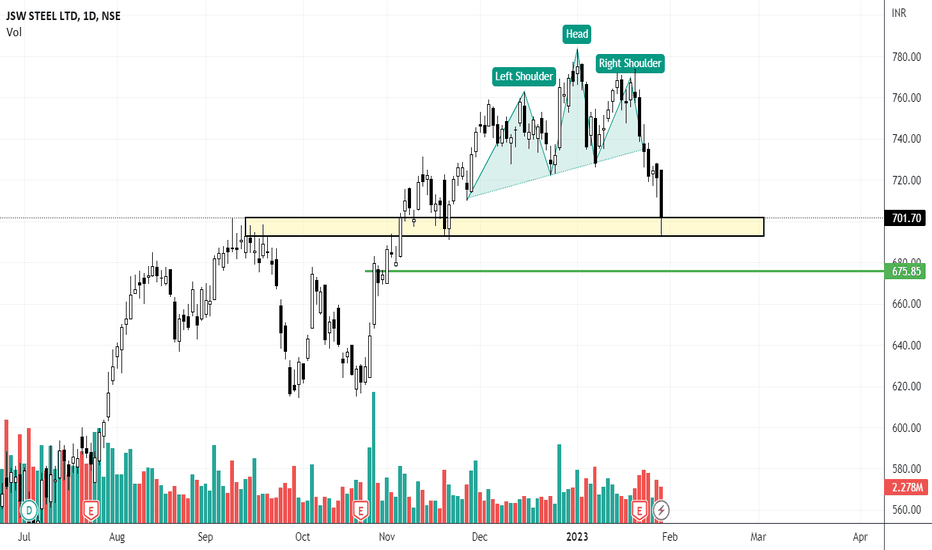

JSWSTEEL--Bullish or ReversalObservations:

Jswsteel is trending upwards.

After a strong break out to the upside price is not moving,price may again turned to be bearish from this level.

Previously after breaking trend line price is not retested to that level.

May price want to test this level of support again(655-660).

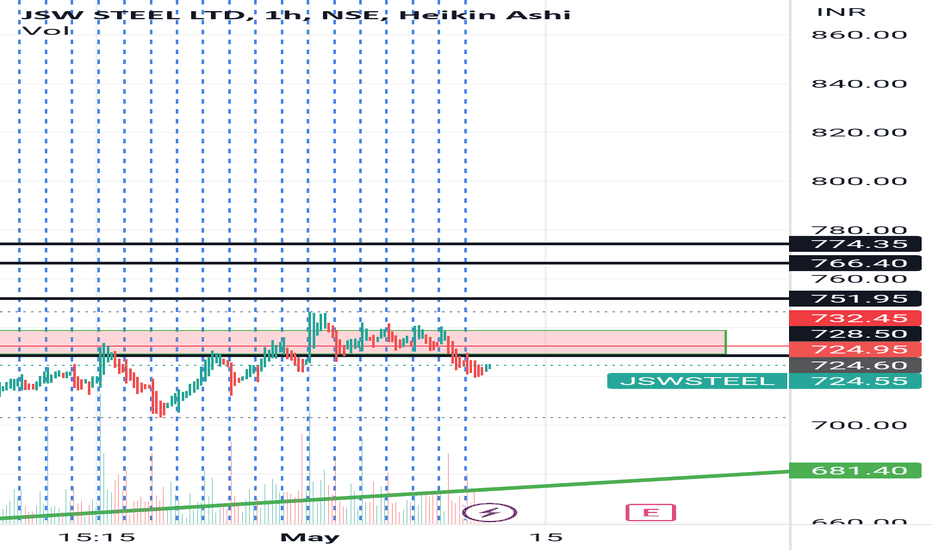

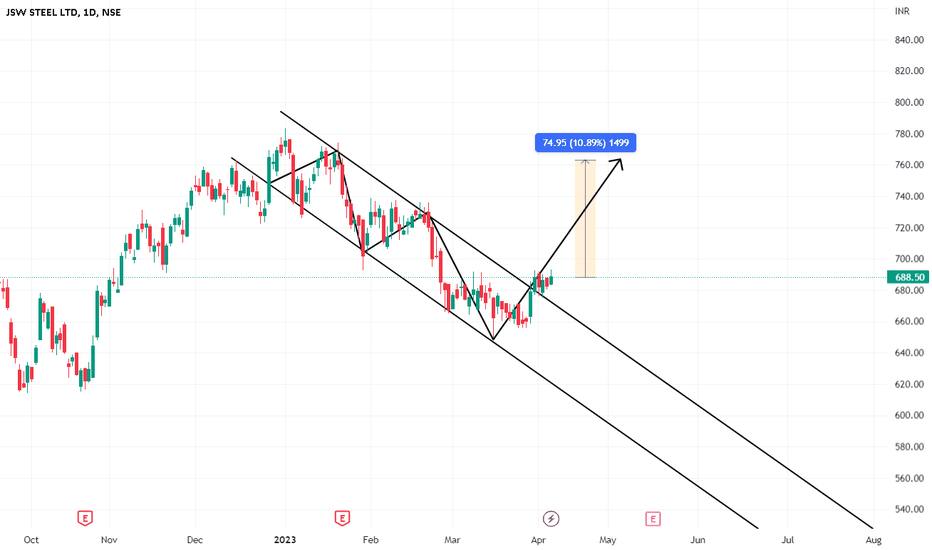

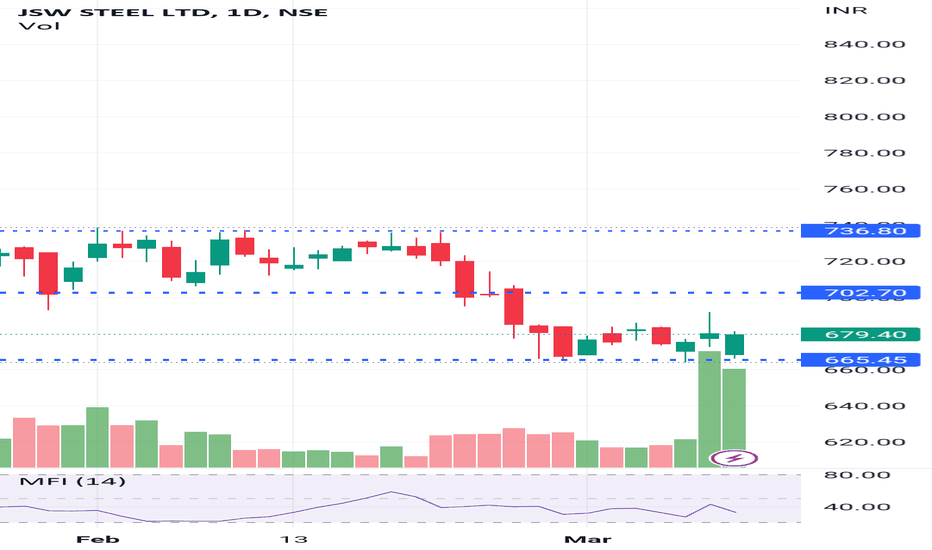

JSWSTEEL - Bullish Consolidation BreakoutNSE: JSWSTEEL is closing with a bullish consolidation breakout candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 12% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Disclaimer:

This is for educational purposes only.

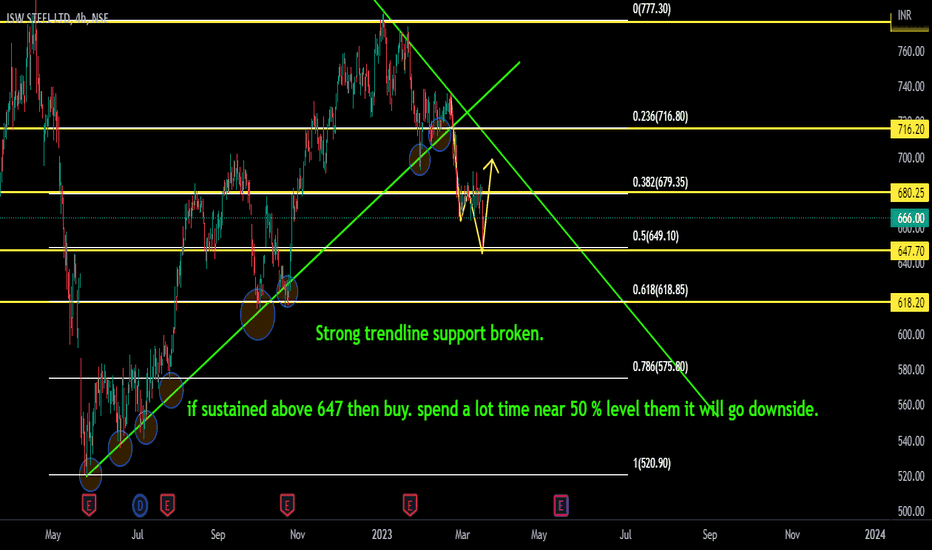

JSWSTEEL 4HRS NSE:JSWSTEEL

Hello traders this is the analysis of jswsteel of 4hrs. 647 is the most important level because of fib level 50%.if it bounced to upside from this level then it will touc 680 and next 716 target. by chance broke the level of 647 and consolidated more times then trend will change to downside.

THANK YOU.

i think jsw steel is set for longI can see that JSW chart is ready for long call in next few days.i am beginner i am not fully sure about this call but in my perspective,its all set for a long run. Because, candles are near to a demand zone and there will be a strong demand from that level. Moreover, the chart of this stock has already seen downfall. So,that is my reason behind this call.

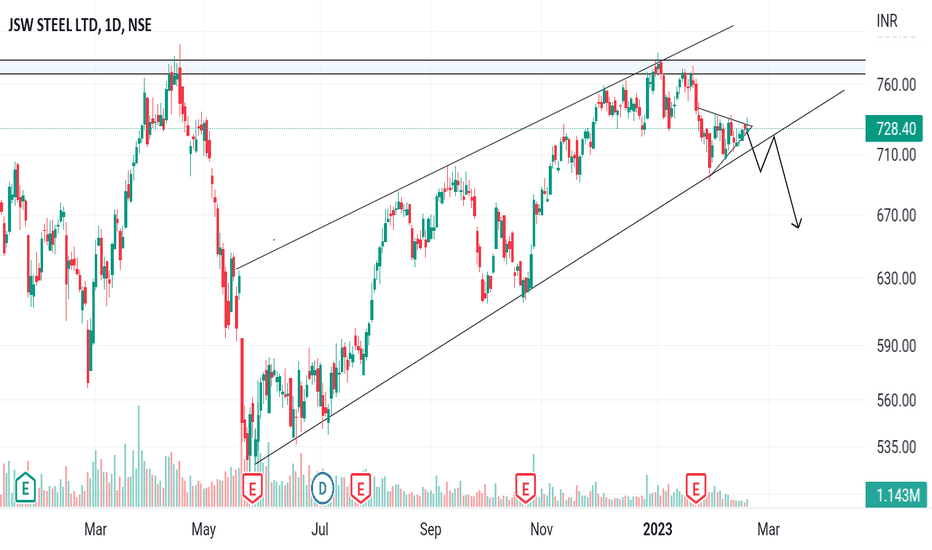

JSW STEEL IN A CHANNEL As seen,in the chart JSW STEEL is in a Bearish Channel in daily timeframe and in hourly timeframe it is forming a Symmetrical triangle chart pattern.We can plan a trade after the breakdown of channel. And Jsw Steel is coming down by taking resistance from its all time High.So it can be good trade after the breakdown and also there is also a possibility of going to upwards again to it's Upwards Channel resistance. If it gives the breakdown then our stoploss can be the high of breakdown candle and you can decide your traget as you want. Safe traders can enter after the retest.

DISCLAIMER: I am not SEBI registered it is only for educational purposes. Any risk involved in it is your responsibility.