NSDL (INTRESTING STOCK )👉🏻 NSDL – Equity Snapshot 👈🏻

🕛 Conclusion ⏱️

NSDL stands at a strategic inflection point — evolving from an institutionally heavy, legacy infrastructure provider to a retail and digitally agile depository. With a zero-debt model, strong cash flows, and clear retail growth plans underway, NSDL shows potential for steady earnings expansion and margin improvement over the next few years. The foundation is strong; execution will now drive the delta.

🙋🏻 Introduction

India’s largest depository by value, with over ₹450 lakh crore in Assets Under Custody (AUC).

Founded in 1996, primarily serving institutional and corporate clients.

Known for stability, trust, and core infrastructure services in the capital market.

🌸 Financial Performance (FY25)🌸

Total Revenue: ₹1,535 crore.

Depository Business Revenue: ₹660 crore (Approx. 43% share).

Operating Margin (Core Business): ~50%.

Net Margin: 22% – 24%.

Net Profit: ₹330+ crore.

Free Cash Flow: ₹558 crore+.

Debt: Zero (Fully debt-free).

Capital Expenditure: ~₹74 crore only (Low capex model).

🌸 Market Position🌸

Dominates in value terms (highest AUC in India).

Client base includes mutual funds, banks, insurers, and corporates.

Retail demat accounts: ~4 crore (behind CDSL’s 15+ crore).

High average demat account size (~₹1,100 crore) vs CDSL’s retail-heavy base.

Gaining ground in retail via partnerships with Zerodha, Groww, Angel One, etc.

🌸 Future Growth Focus🌸

Aggressively entering retail segment through schemes like ‘YUVA Plan’.

Enabling paperless, digital onboarding for faster account growth.

Investing in blockchain, T+1 settlements, and smart compliance tools.

Actively participating in SEBI & RBI-led digitization (e-KYC, e-insurance, GIFT city).

Expanding subsidiaries (NDML, NPBL) to boost recurring income beyond core biz.

🌸 Key Positives🌸

Strong free cash flow, high annuity-based revenue visibility.

Lean, tech-driven operations with low employee cost base.

Well-positioned to benefit from India’s growing retail investor base.

Diversified, recurring revenue streams through subsidiaries.

Digital-first strategy ensures scalable, low-cost growth ahead.

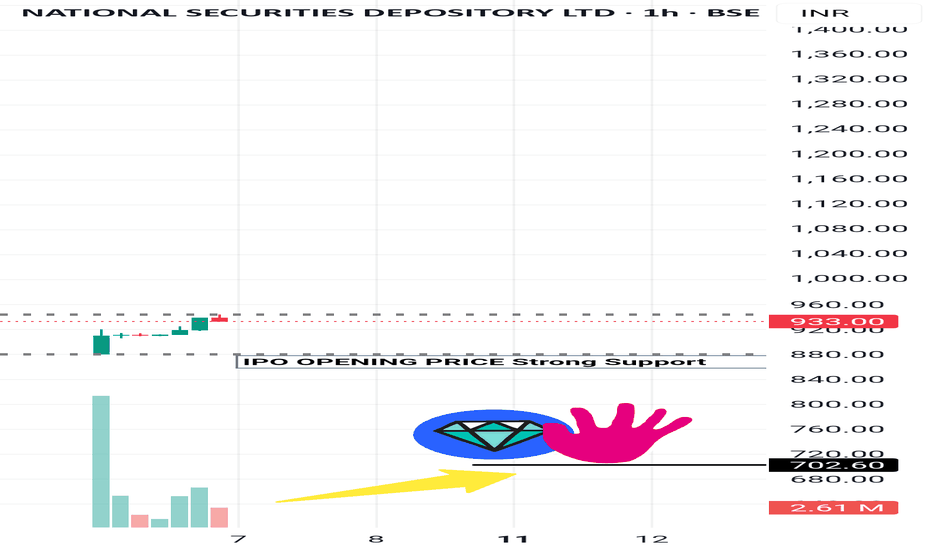

NSDL trade ideas

NSDL | Post‑Listing Surge Near ₹1,425Summary

After listing at ₹880 on Aug 6, NSDL rallied to ~₹1,425 within four sessions before profit‑taking; near‑term P/E ~77–79 vs peer CDSL ~66, so momentum may pause into the Aug 12 results.

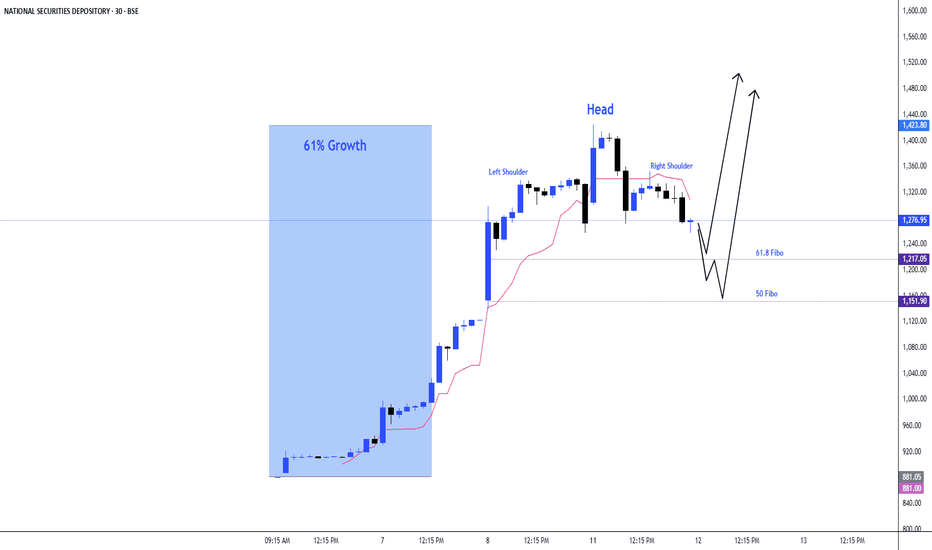

Chart Thesis

Structure: Parabolic advance from ₹880 to ₹1,425, followed by intraday rejection—first meaningful pullback likely to set a higher low above ₹1,200 if the trend is to continue.

Levels:

Long zone: ₹1,200–₹1,250

Invalidation: Close <₹1,160

Targets: ₹1,360 → ₹1,400–₹1,425

Note: Event risk—board meets Aug 12 to consider Q1 FY26; expect swings.

Fundamentals

FY25 revenue +~12% to ₹1,420–1,535cr; PAT ₹343cr (+~25% YoY); near‑duopoly advantages but valuation now full post‑rally.

Plan

Avoid chasing strength; buy dips only with tight risk and take partials near prior highs. Investors with IPO gains can book some profits and hold a core for the long term.

Disclaimer: Educational, not investment advice. Manage risk.