RELIANCE trade ideas

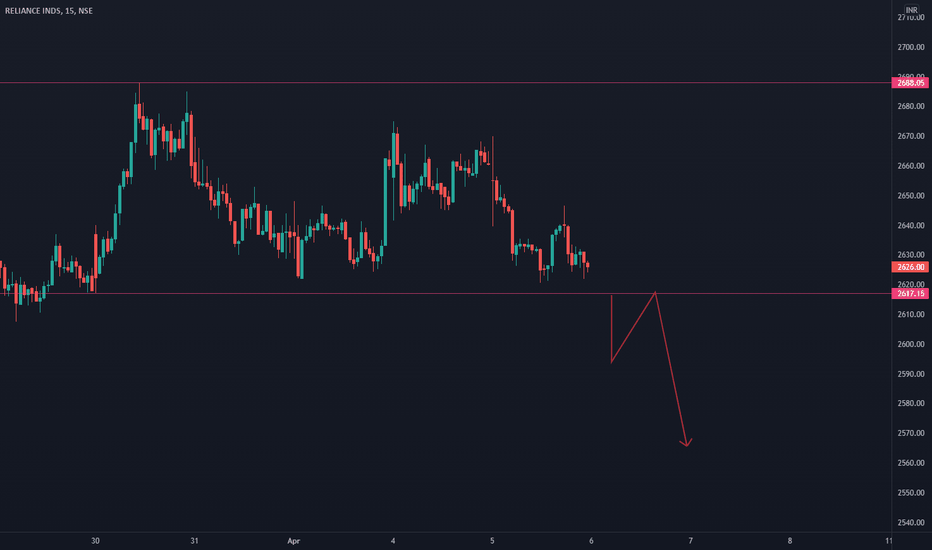

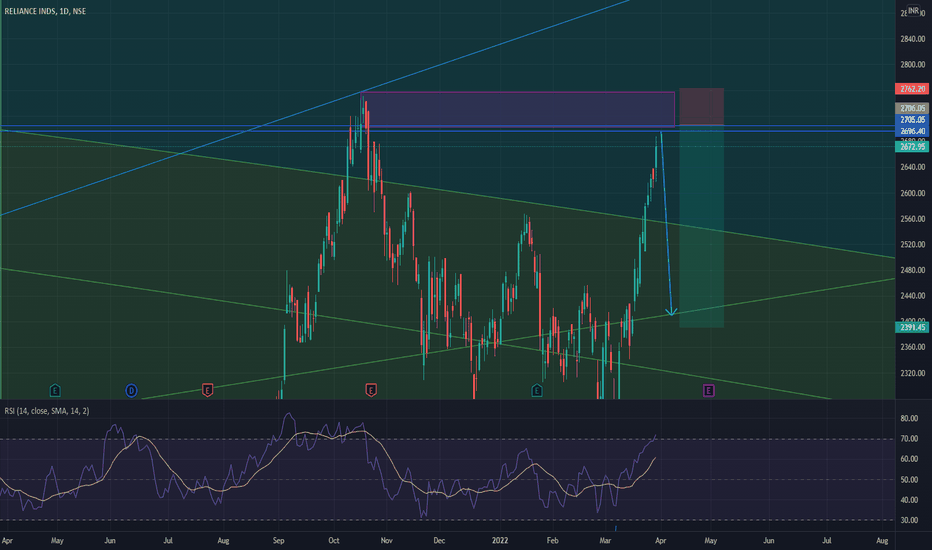

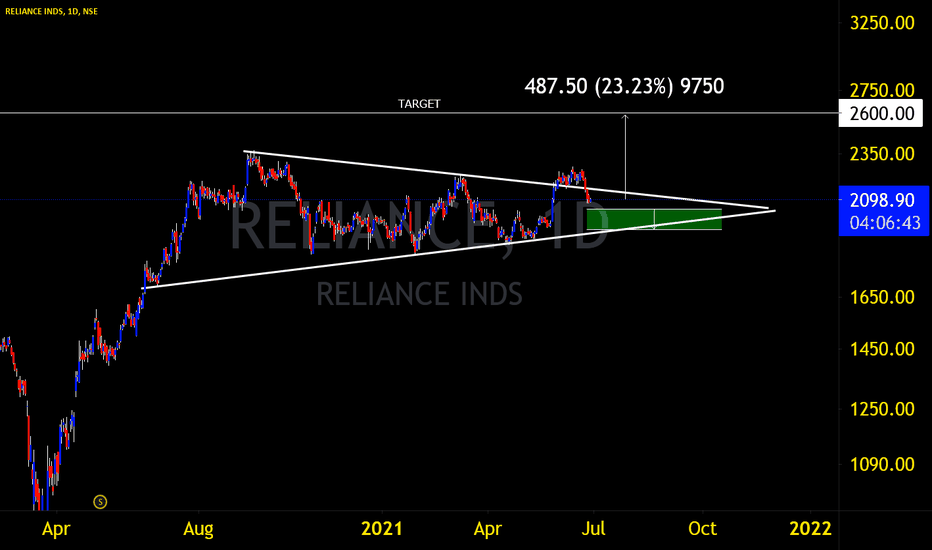

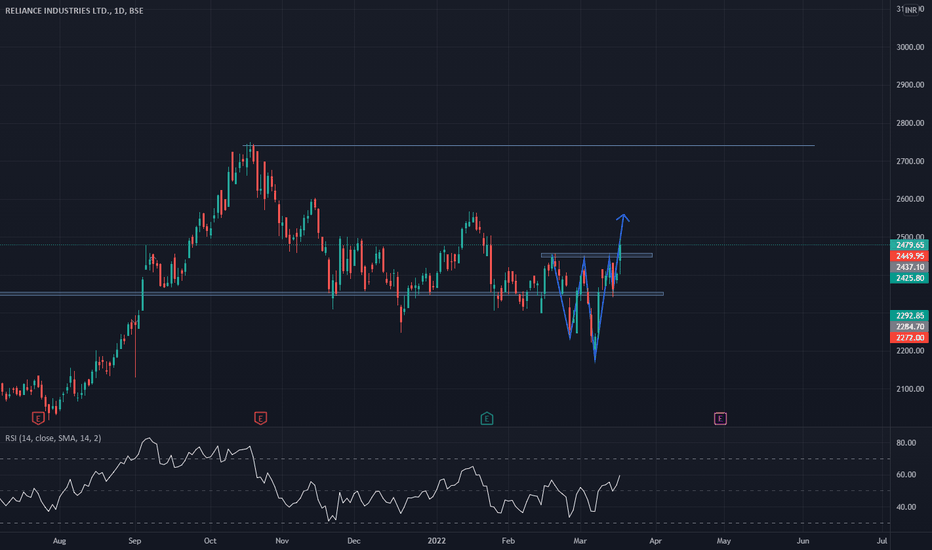

Reliance can be short for short Termafter making consecutive bullish upmove without any correction or pull back, Reliance has started to correct, the pullback may end taking support of Fibonacci Retracements or can take support on 5 EMA or 20 or any other EMA.try to observe this script for better understanding of price corrections , pullbacks and to learn Dynamic support and Resistances.

Disclaimer: Everything i post is for observation and Learning only, i am not a SEBI registered Analyst, consult your Financial Advisor Before Taking Position.

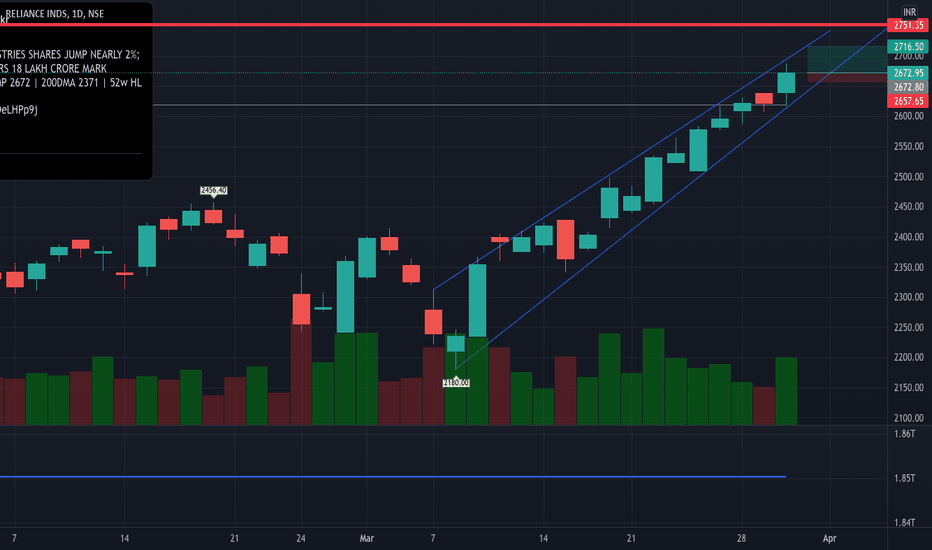

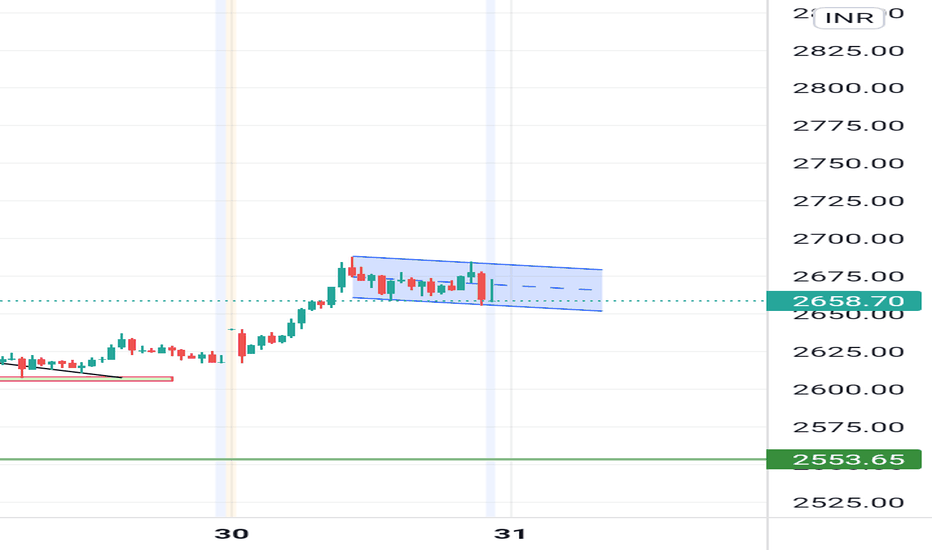

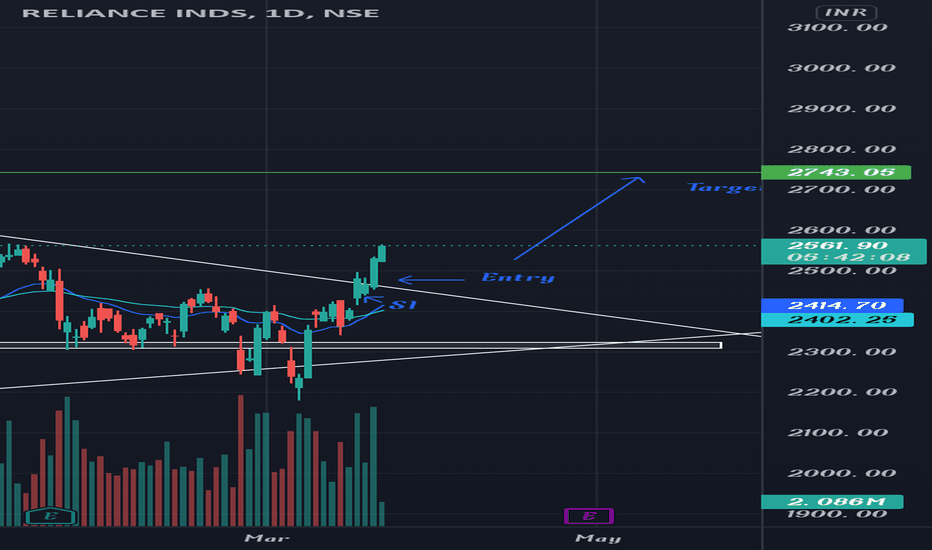

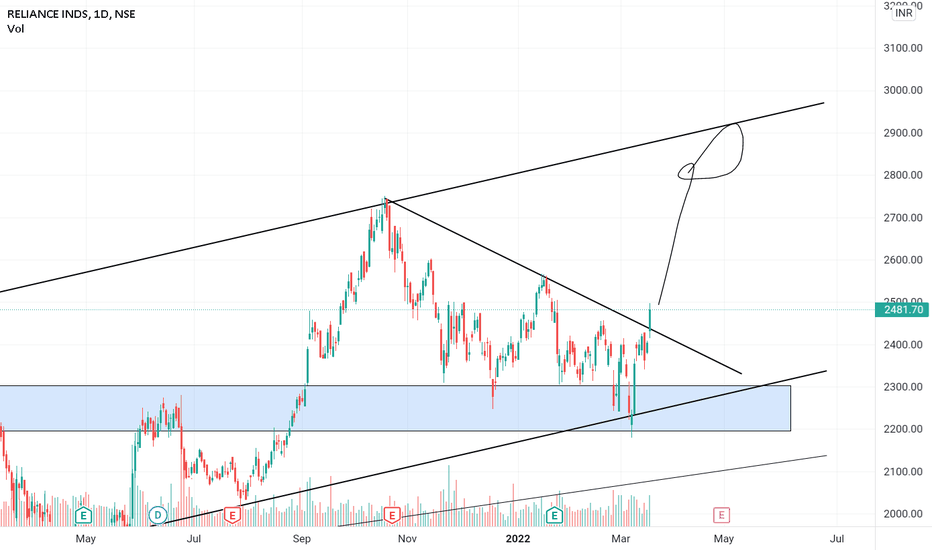

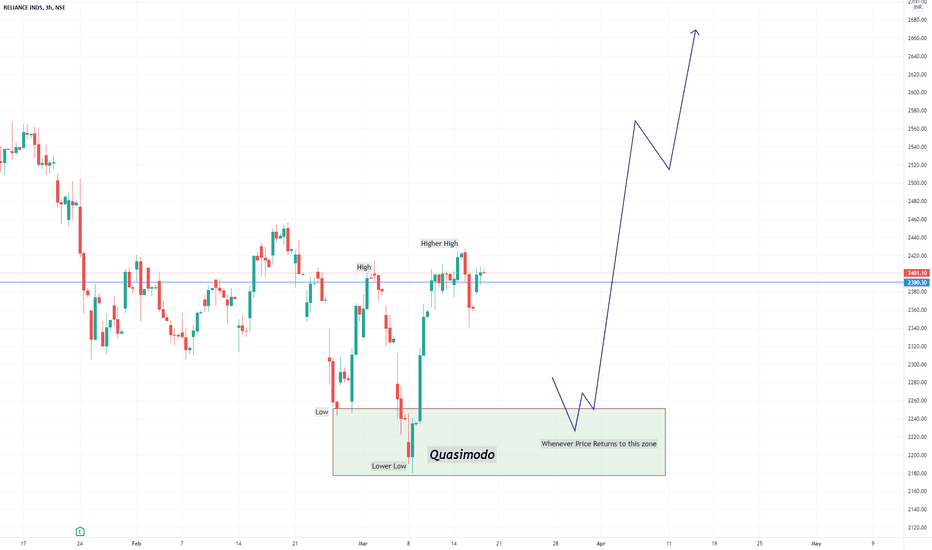

A Bullish position on ascending channel on Reliance Industries.Disclaimer: This is not a trade advice. This is an analysis for educational purpose. Kindly do your own research or consult your investment advisor before taking any positions in the capital markets.

The Indian mammoth has risen from the ashes of a descending triangle pattern to an ascending channel which presents us an opportunity of a 2.8:1 Risk reward trade on the basis of candle stick pattern and the channel boundary. On a technical analysis of the chart in a daily timeframe shows a Target upside of Rs. 43 with a slim stop loss of 15 Rs. . Trade setup is invalid if the stock opens below 2650. The stock closed on Wednesday at Rs 2672 Rs NSE:RELIANCE

RELIANCE - NSECo website

www.ril.com

39% Market share in telecom ( JIO ) with a possibility of only two telecom servicies to remain in India- Airtel and Jio.

Fast growing broadband presence

Oil bullish for $90 + to pump the bottomline of reliance

Front runner in bringing 5G to india, multiple investments from BIG names-- Facebook, Google, Silver Lake, Vista Equity Partners etc

Focus on renewable energy, control over mass media.

In short- An Elephant

Trivia- look JIO in a mirror and you get OIL, after all data is the new oil :)

RELIANCE INDUSTRIES LTD Up trend India's Reliance Industries Ltd (RELIANCE), operator of the world's biggest refining complex, may avoid buying Russian fuels for its plants following Western sanctions on Moscow over its invasion of Ukraine, a senior company official said.

"Even if we can source some of the feeds (from Russia), probably we will be out of it because of the sanctions," Rajesh Rawat, senior vice president and business head cracker, told an industry event on Wednesday.

Reliance buys Urals crude and straight run fuel oil for its refineries from Russia. The private refiner mostly buys its petrochemical feedstock from the Middle East and the United States.

Sanctions on Russia have prompted many companies and countries to shun its oil, depressing Russian crude to record discount levels.

Rawat said in India most of the oil supplies from Russia are going to the state-run companies.

"So probably, those feed streams will still continue, or may have a lesser impact compared to the private sector players. Because we deal with banks, and also even if we can source some of the feeds (from Russia), probably we will be out of it because of the sanctions," Rawat told the Asia Refining and Petrochemical Summit.

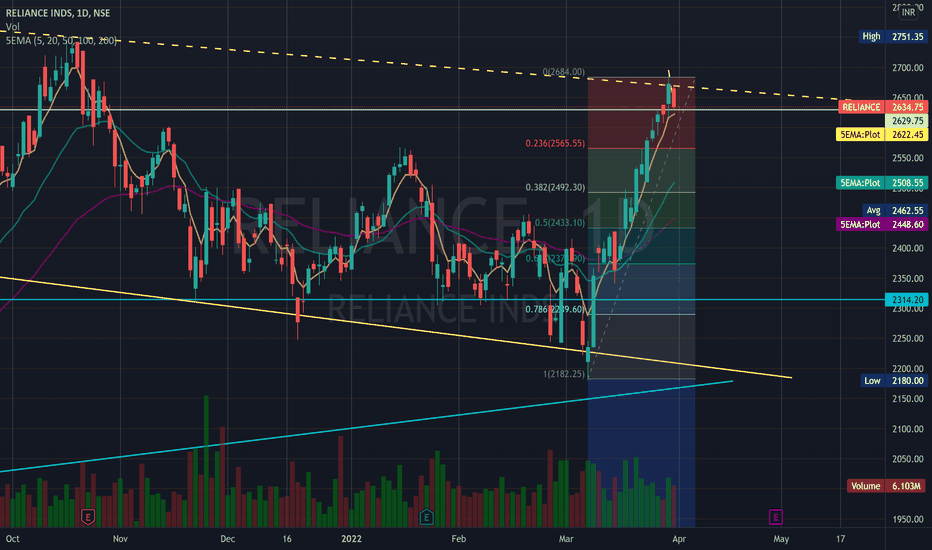

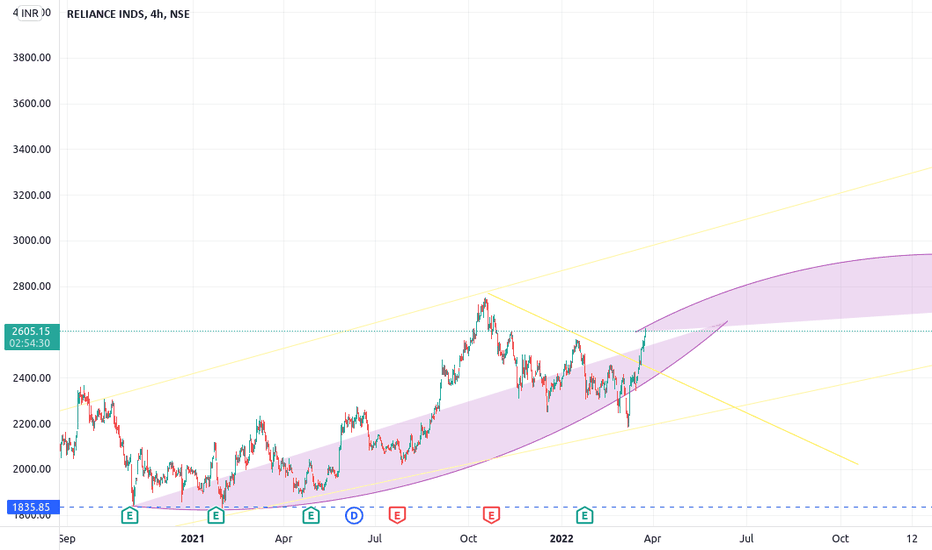

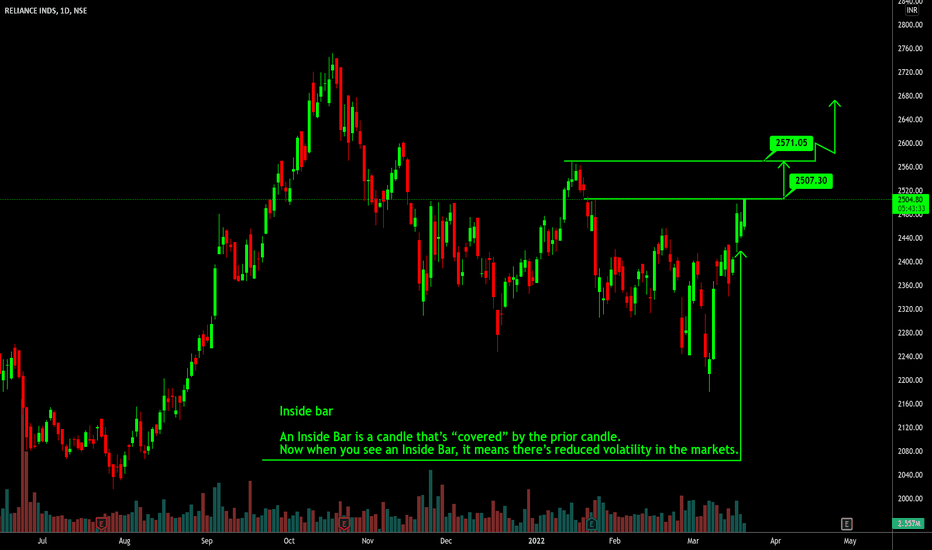

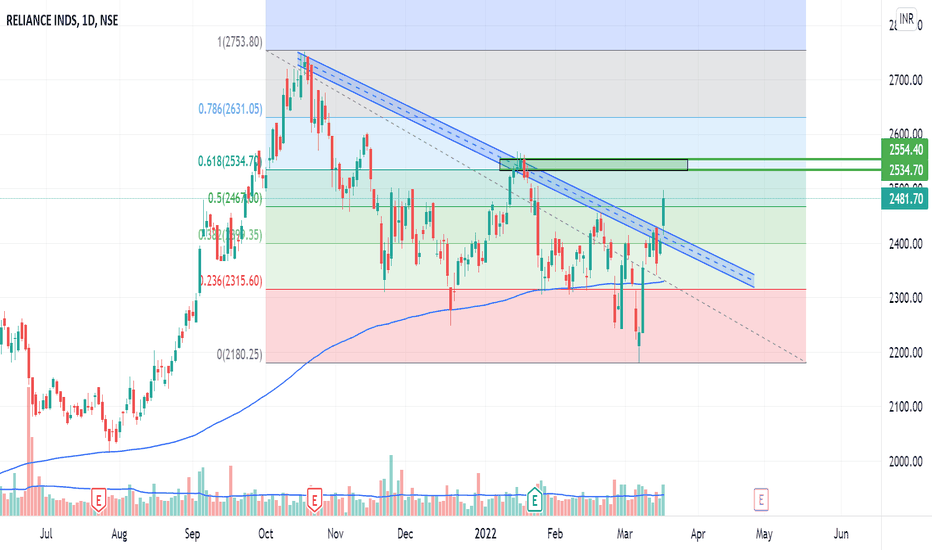

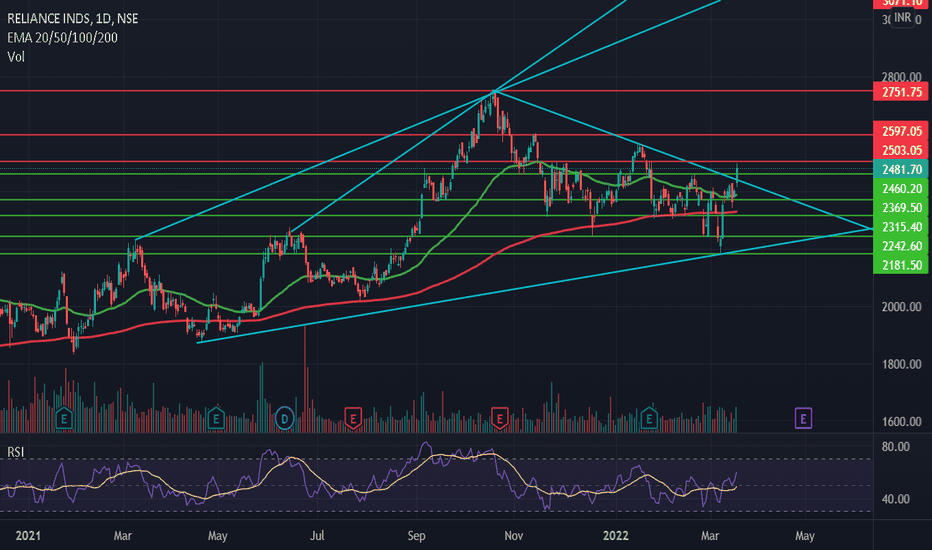

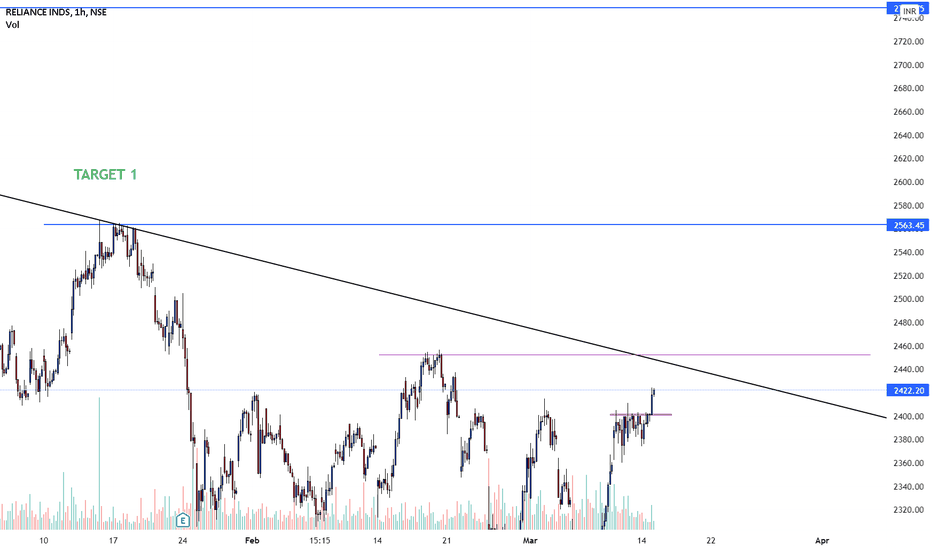

Reliance might be in the zone from where it go/grow stronger Reliance is trying to come out of the squeezing triangle and is making the case for fresh entry above 2503 closing. The medium term target will be 2597 and the long term target will be 2700+. Reliance is a buy on dip and bounce candidate and also a Portfolio stock being India’s one of the premier companies. However for trading purpose if someone wants to keep a stop loss they should keep it at closing below 2175. Reliance is into Oil and Gas, Retail, telecom, Green energy and textile all together. Scope of value unlocking in the share is huge owing to the diversity of segments the company caters to. By all means the stock has potential to become a long term asset creator. One down side of the stock is that it trades at a expensive valuations of 29.1 currently. For Paper trading. Educational view only.

RELIANCE LONGReliance crossing 2400.

One more hurdle in the stock 2450. Once this breaks, we can again expect it to give a good move till 2750 levels.

Trade safe. Manage risk. Be profitable.

Please follow us for more simple trading analysis and setups. Also let me know in the comment in case you have any queries.

Disclaimer :- This is just my view. Please analyze charts yourself and then decide to take any trades.

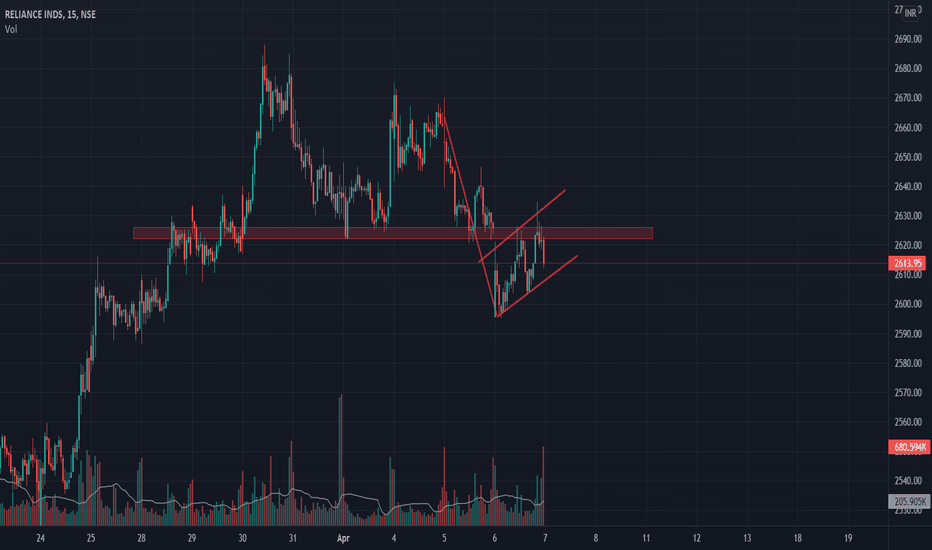

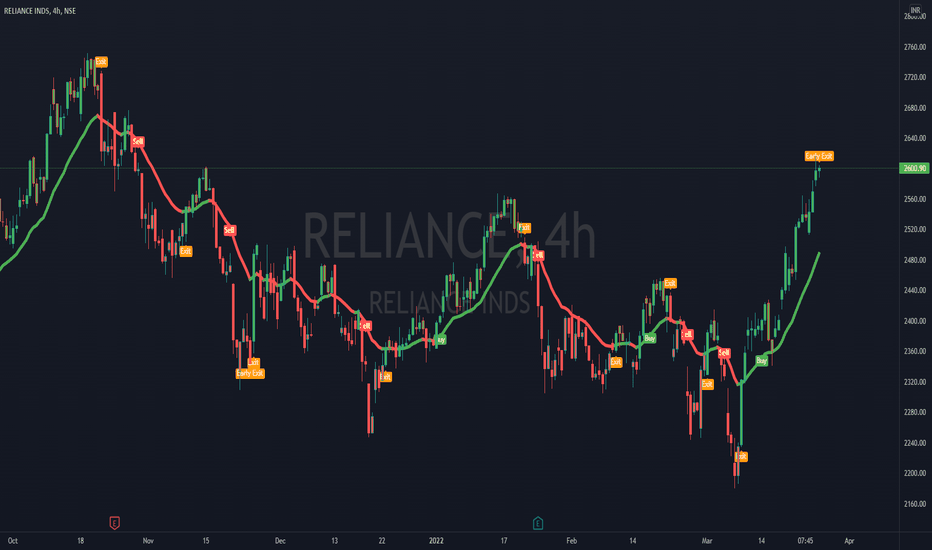

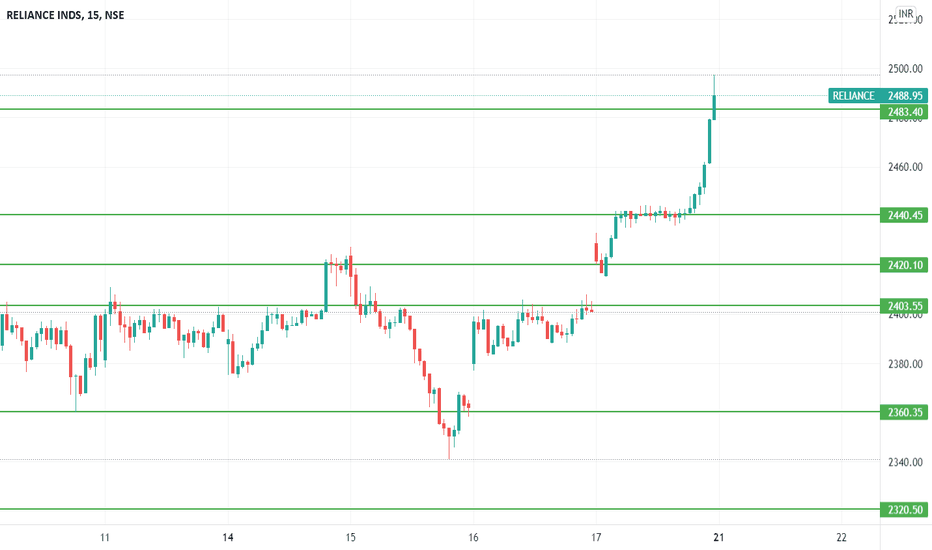

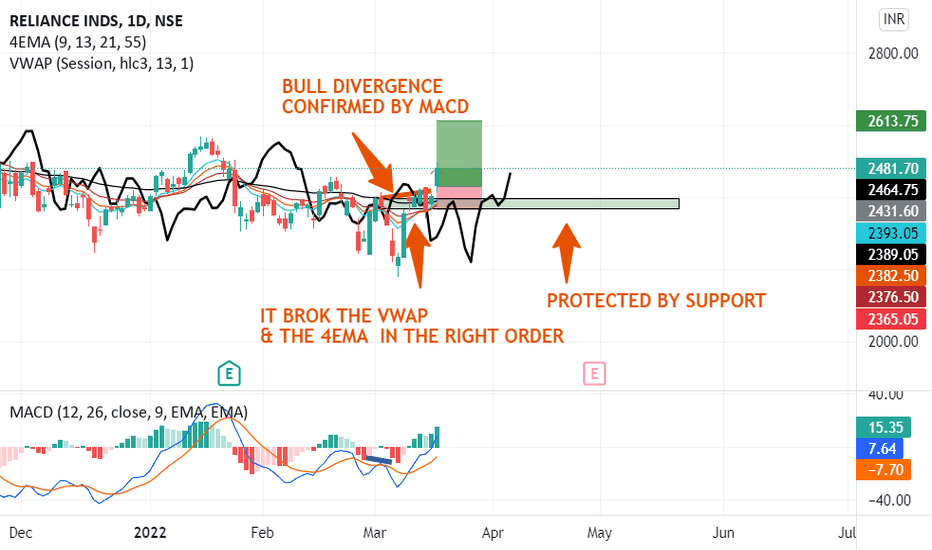

Is it a good idea to buy RELIANCE now ? Good morning,

Today there is an intersection of many strong indicators:

1)there is a bull divergence confirmed by MACD😎

2) we are above the VWAP❤

3) the 4EMA indicator is in the right order and well condensed👌

4) we are protected by support😎

👀 I didn't really study the profit so protected yourself from market reverses!!

Good luck 💖