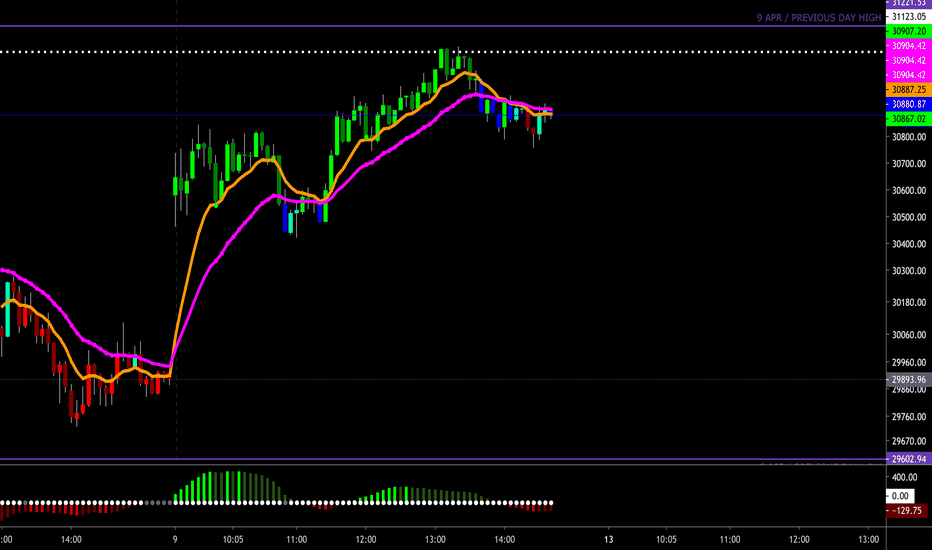

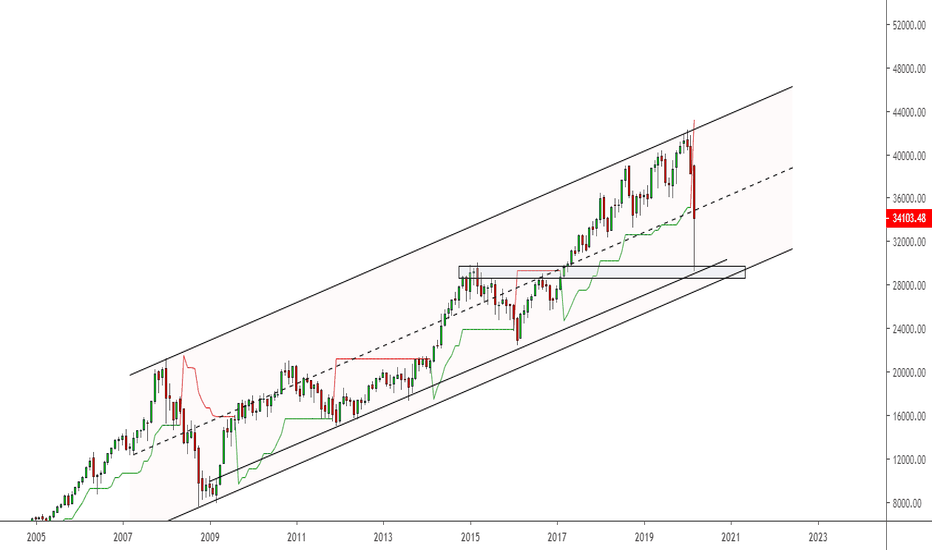

Third Time Lucky?We talked about this in our last update, if the BSE:SENSEX could actually pierce through the resistance at 31,123 to move higher.

That may not be the case. Well so far, let's wait till end of day to draw any conclusions.

There have been a number of holidays in April, so this sort of erratic behavior can only be expected. We close for Good Friday, and open for one day on Monday before the next public holiday on Tuesday. It's a long week, so stay home, stay safe.

May your longs go up, and your shorts go down!

SENSEX trade ideas

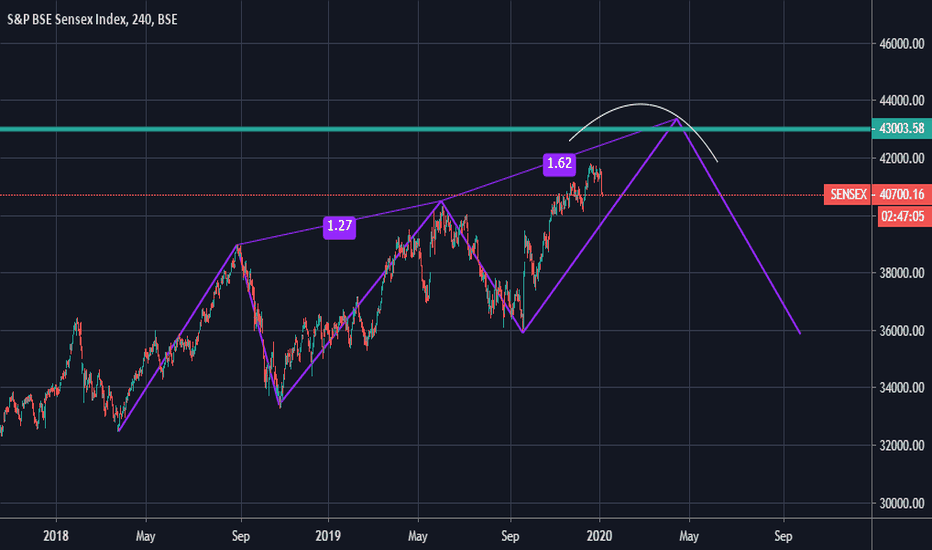

I was wrong, but I was never in doubt about the $SENSEX!Just after I published a recording on a dead cat bounce, immediately after the market started inching upwards, as if someone had switched a bot on. Was this a coincidence, or are there bigger conspiracies at play :D -- or was insider buying taking place?

I don't watch / listen to the news, because it brings very little value these days. And the markets factor everything before the reports can report. So what's going on? Take a look at the 5 minute chart to see unusual buying behavior.

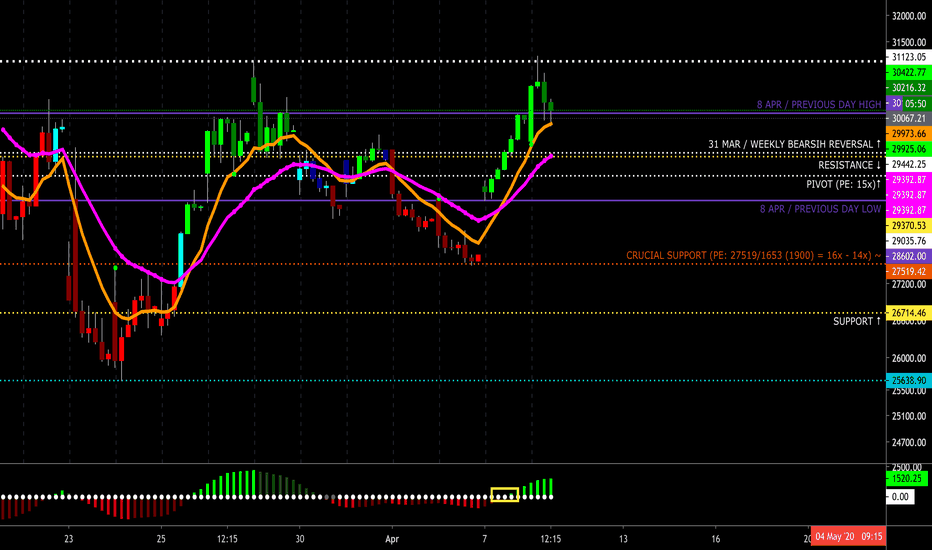

Could it be just pharma stocks rock and rolling or could it be MSCIs weightage adjustment for India. Let's have a relook and decide what needs to be done next.

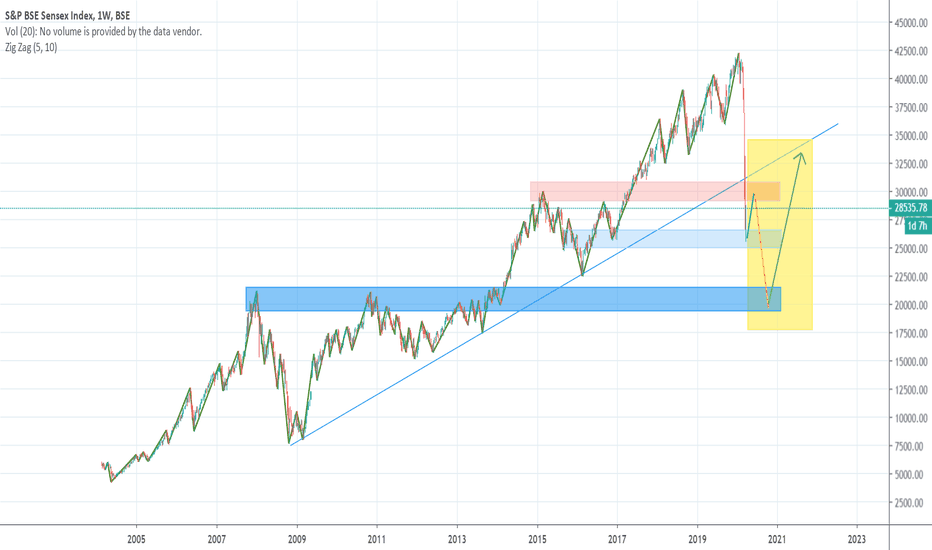

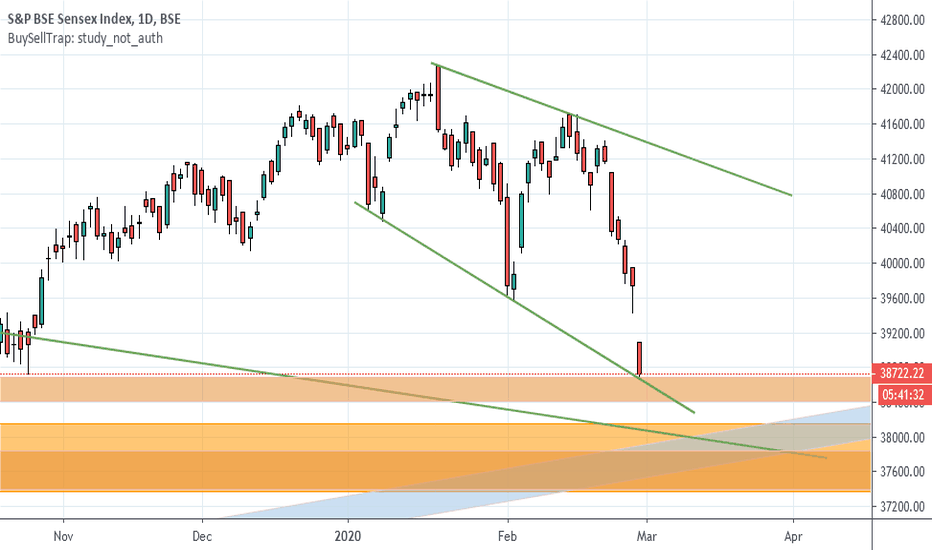

Could we be looking at a dead cat bounce in BSE?While the BSE:SENSEX index is showing some strength today, are we out of the woods? India is still in just the first week of a 21 day / 3 week lock down.

I'm sure many traders don't have anything better to do at home, so trading might be their stress buster!

Just wait until their wives ask them to buy 'subji' instead of 'stocks' :D

I may be saying this like a broken record, but lock downs are not the solution. I could elaborate on this, but it won't be worth the time and effort. In the meanwhile, watch the charts to see how the price action is.

Whether this is a dead cat bounce or a dead horse bounce, we'll find out in a few days/weeks. Till then hang on... may your longs go up, and your shorts go down!

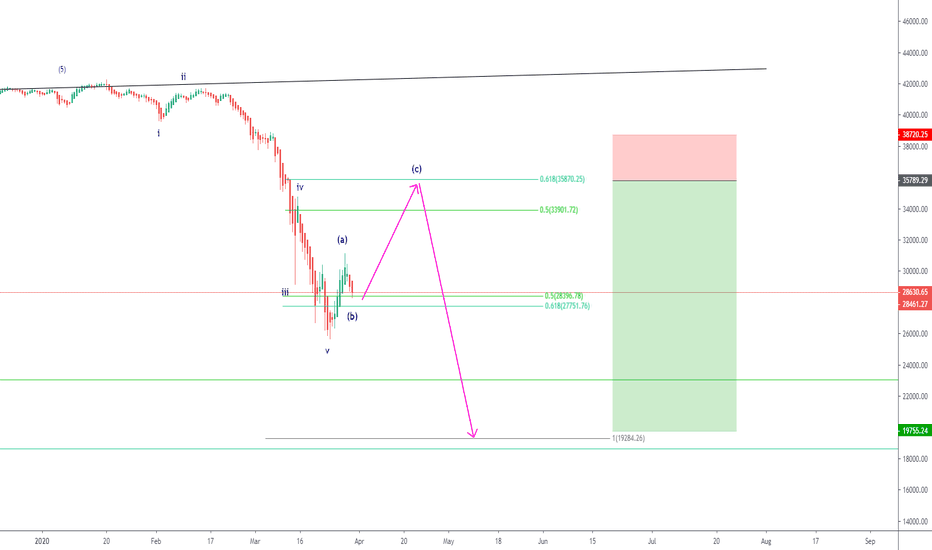

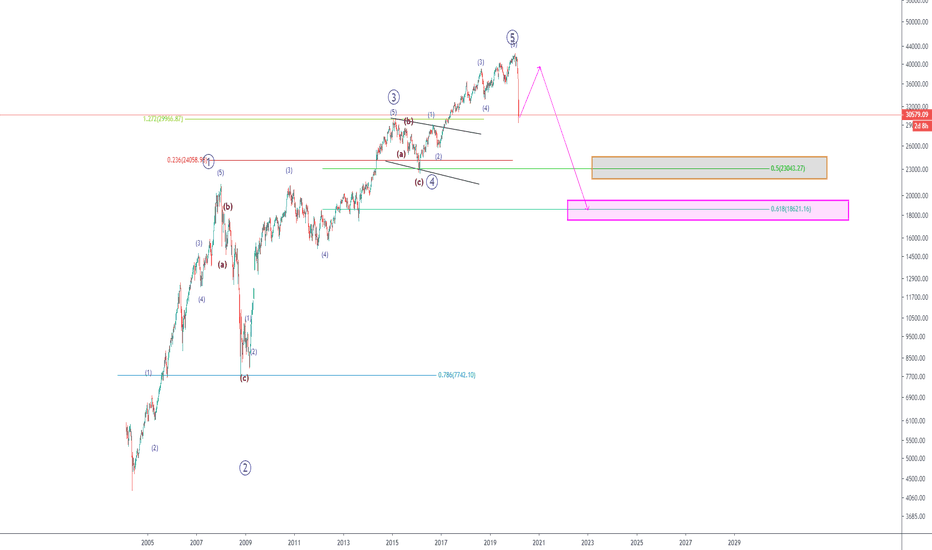

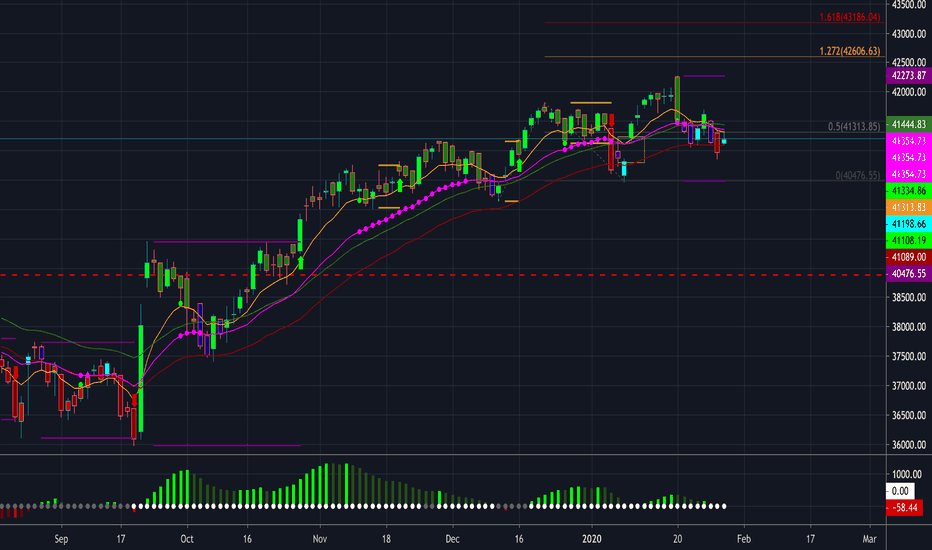

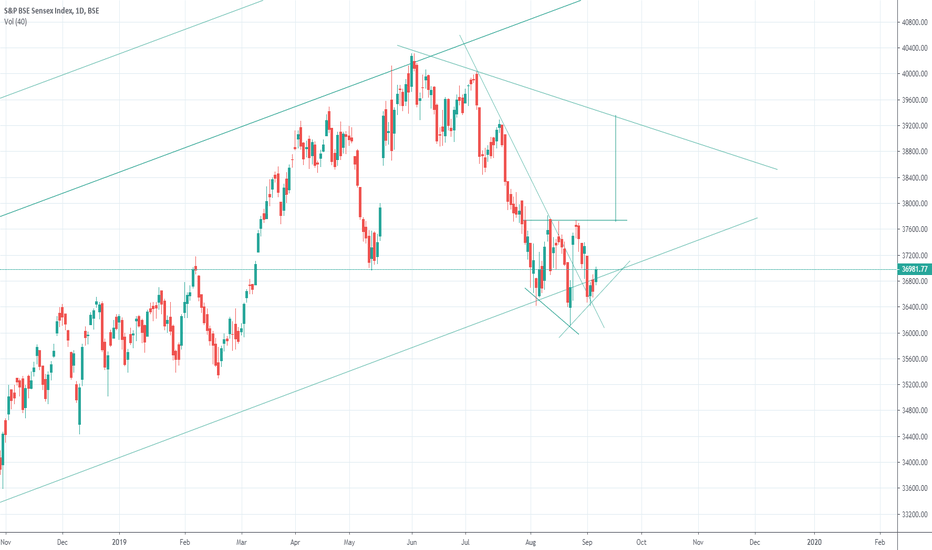

Sensex Index UP Coming Trend Analysis Hi

we believe that there exist a Three Drive Pattern for which it takes few days to complete and then we have a bearish retracement for which we may Short the Market.

The Fundamental analyses are base on the current Oil Price and problems in Middle East and as we have analysed the NIFTY, we can conclude there is a upcoming Bearish Trend as the Oil Pries may go Higher so the companies should face the Demand issues and their productivity comes down so their stock price...

Best of Luck

Trade Sensibly

please write your ideas for us so we can discus and develop our knowledge

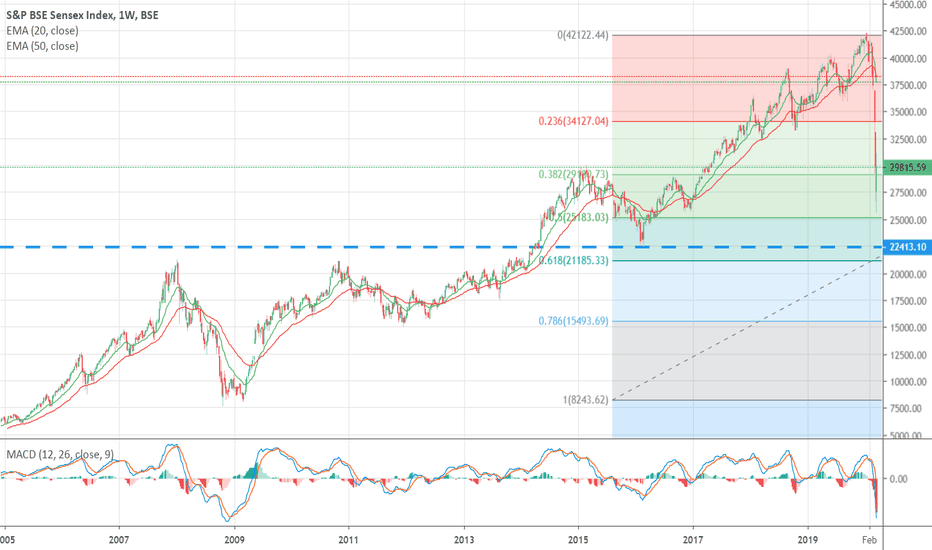

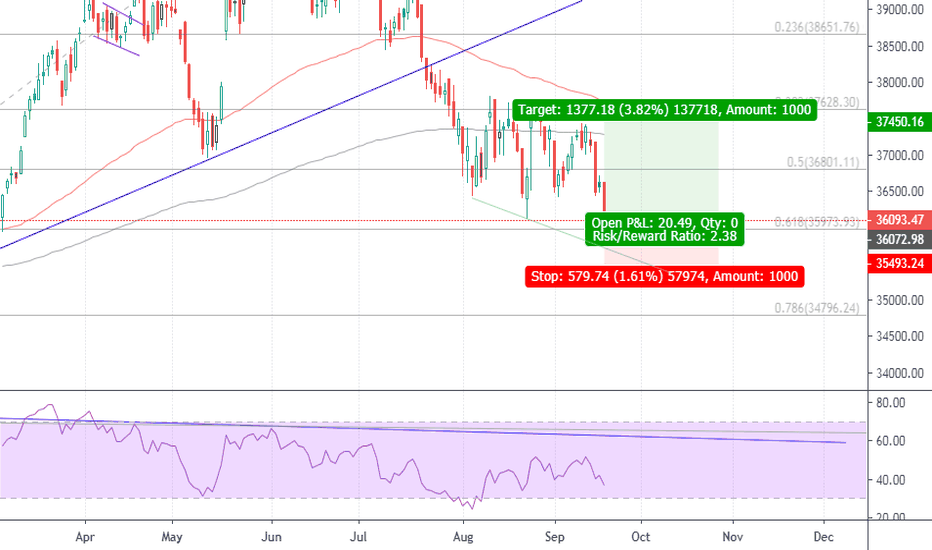

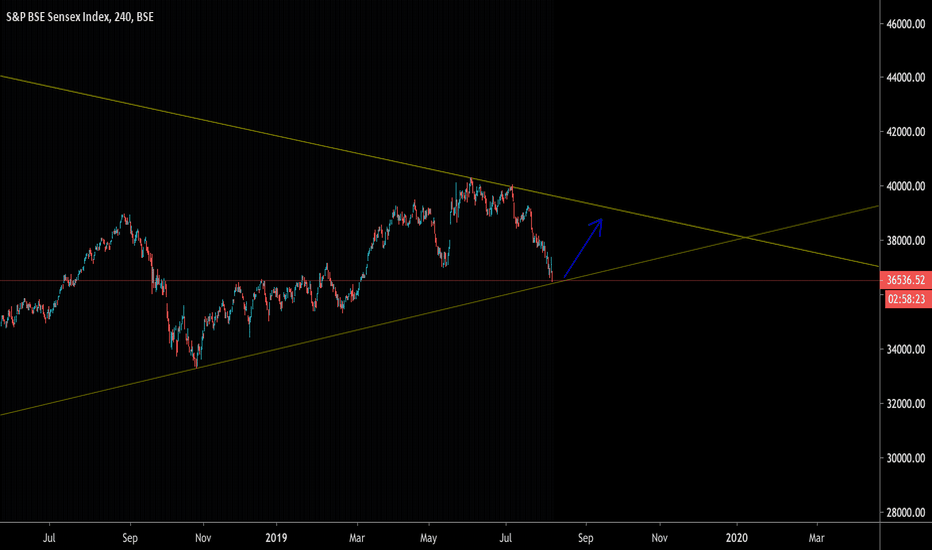

BSE:SENSEX is at ATH but got rejected by a year old trendlineBSE:SENSEX has recorded a All Time High today(26-Nov-19) but it was rejected by a trendline that extends from August 2018 till today. If this trendline is broken on a daily closing basis then I am expecting SENSEX to continue to the upside.

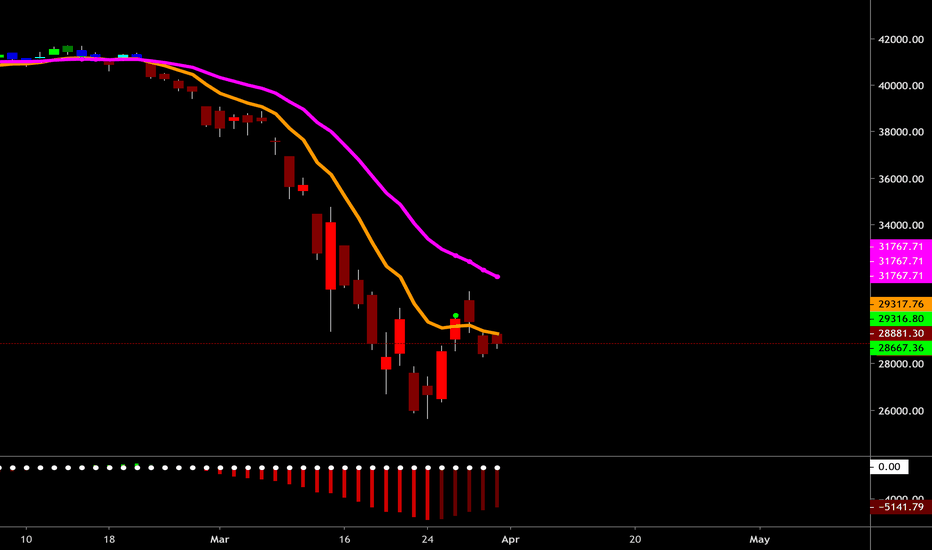

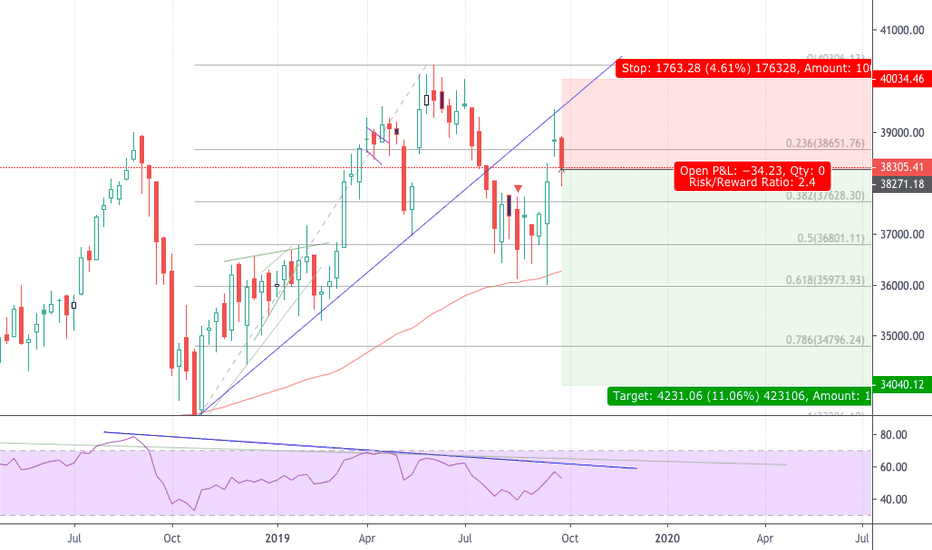

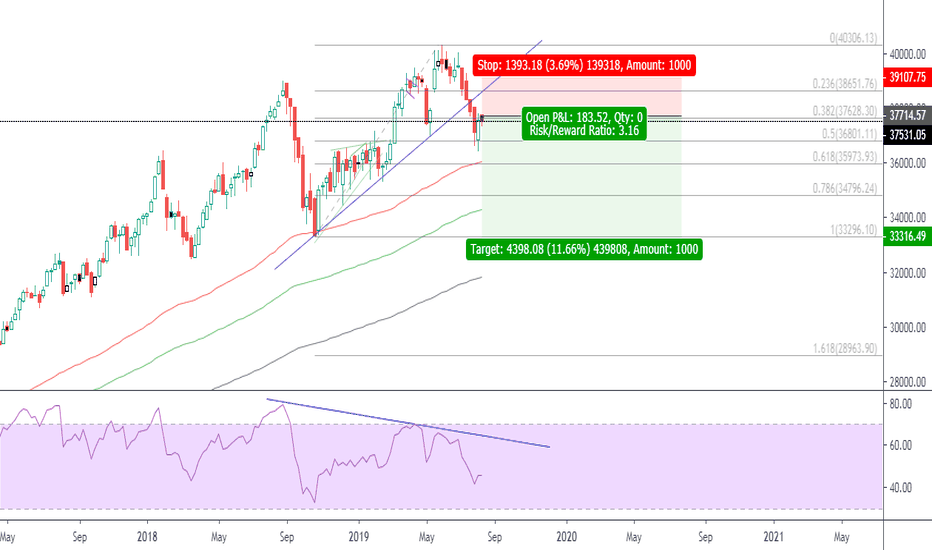

Drop in SENSEX is expected BSE:SENSEX

Price has broken down the trend line and is in a Pull back structure. May test 39000 (psychological level) which is also the base of trendline, previous support and near a FIB level.

If pullback is confirmed then price may test 33-34000 range.

Viewing at uncertainties globally, drop seems likely.

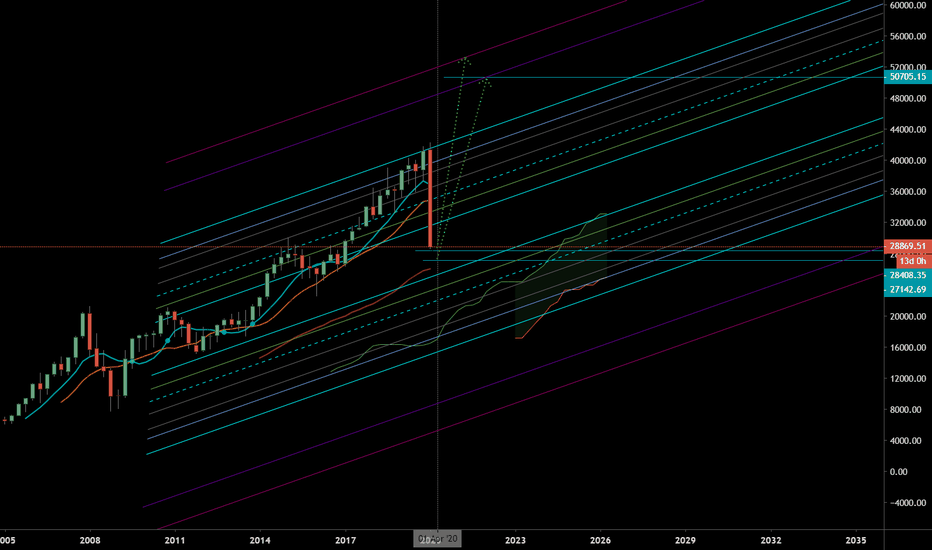

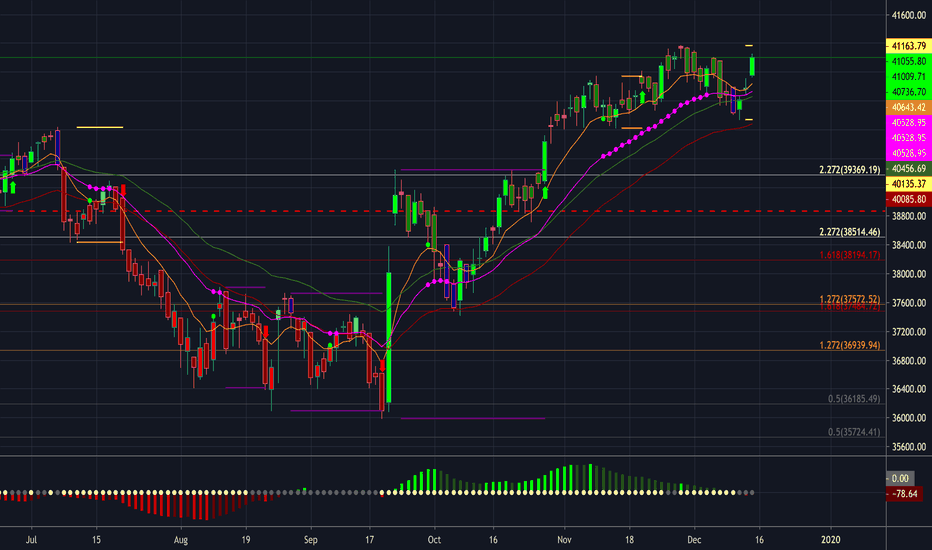

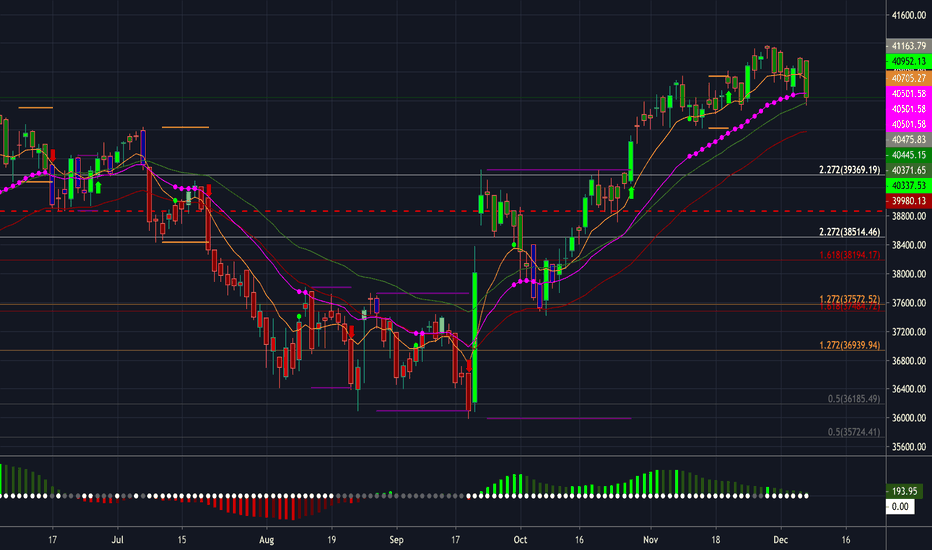

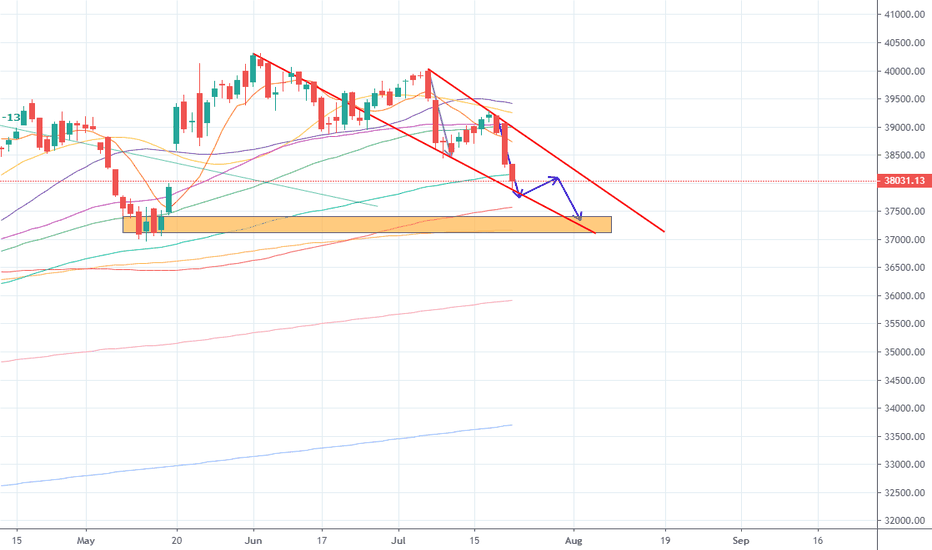

Daily India SENSEX stock market index forecast analysis22-Jul

Price trend forecast timing analysis based on pretiming algorithm of Supply-Demand(S&D) strength.

Investing position: In Falling section of high risk & low profit

S&D strength Trend: In the midst of a downward trend of strong downward momentum price flow marked by temporary rises and strong falls.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

View forecasts shape of candlestick 10 days in the future: www.pretiming.com

Forecast D+1 Candlestick Color : RED Candlestick

%D+1 Range forecast: 0.4% (HIGH) ~ -0.6% (LOW), -0.2% (CLOSE)

%AVG in case of rising: 0.9% (HIGH) ~ -0.2% (LOW), 0.6% (CLOSE)

%AVG in case of falling: 0.3% (HIGH) ~ -0.9% (LOW), -0.6% (CLOSE)