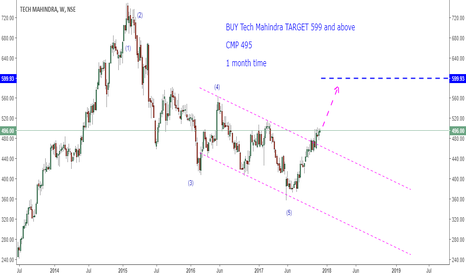

TECHM trade ideas

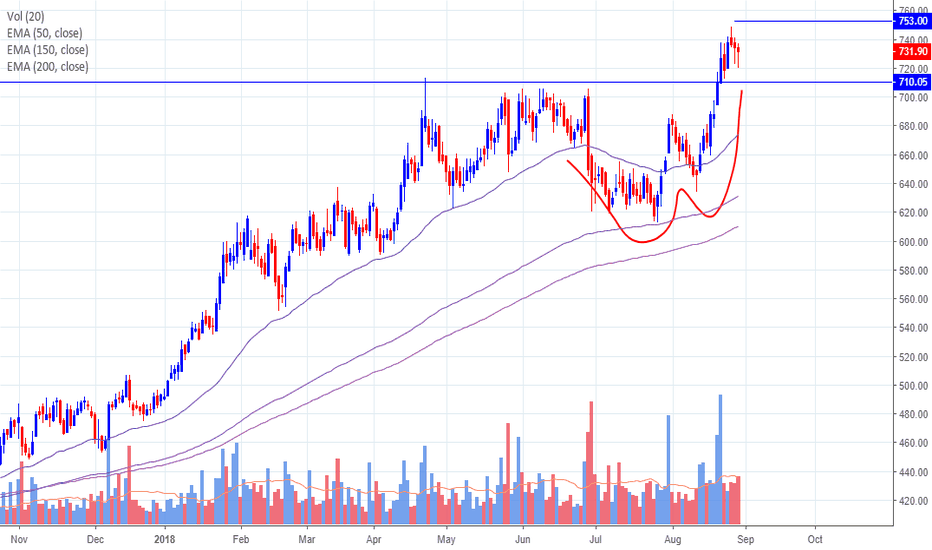

TechM, Ascending TriangleBullish stock and bullish industry segment. Price is constantly taking support at 50 DMA during correction/profit booking. An Ascending Triangle is visible. Bulls are closing in on the price in this formation of the classic pattern which means corrections are becoming smaller by day. On breakout target can be new highs beyond 755-760. SL is a must.

TechMThe stock is in Bulls control. Have a look at the candles. Red candles are indications of profit booking done by bulls. Then they enter long trades on small correction-- correction of just 4-5 sessions. I have drawn a probable Shark patter and the same has not been effective. This too points out to bullish stance in this counter.

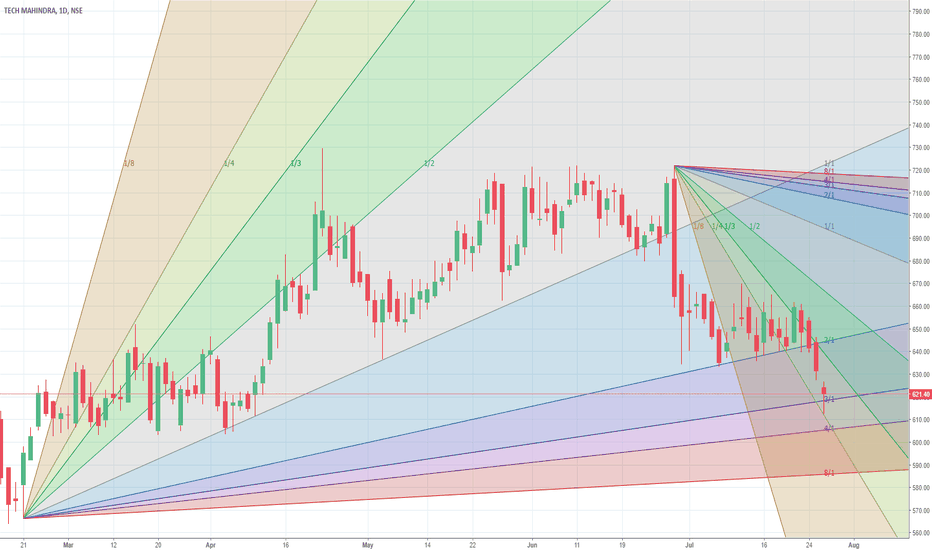

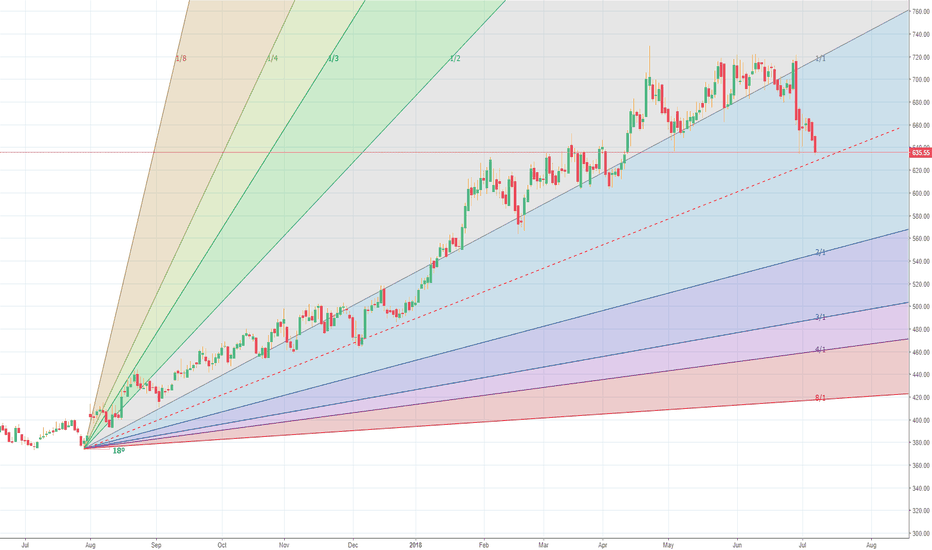

Tech Mahindra (NSE): Correction in uptrendThe long-term trend is completely intact and unchallenged. However, on the near term the outlook is a bit tiresome; bearish divergence and the lack of significant new highs suggests buyers are exhausted and a correction is around the corner. Tighten stops on existing longs or cover all together. New buying can be done if/once a deeper correction has occurred and prices set a new higher base. The area around 550<>570 would be ideal for such a base.

Primary trend: positive

Outlook: correction in uptrend, moderately negative

Strategy: cover/protect longs and re-enter after correction

Support: 571.70 / 537.50 / 506.10

Resistance: 532.10 / 665

Outlook cancelled/neutralized: n/a

NSE:TECHM