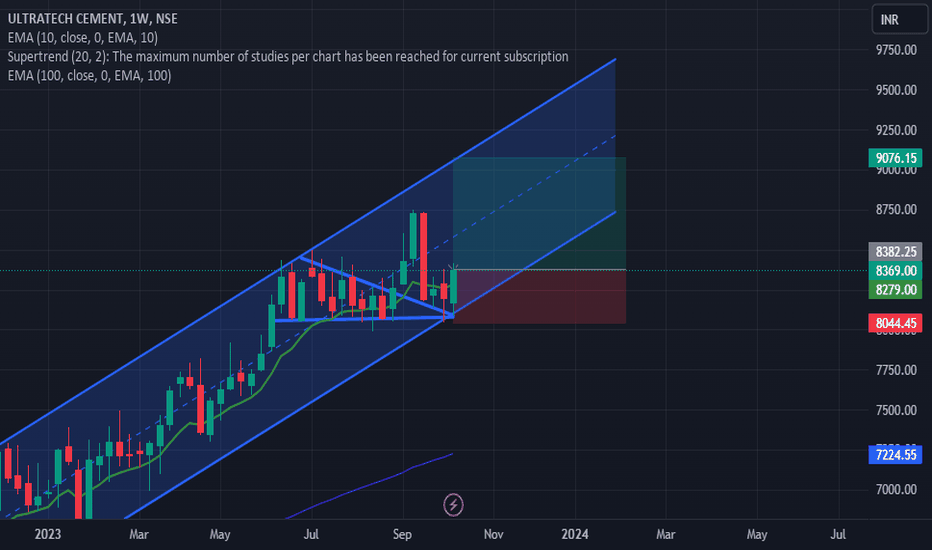

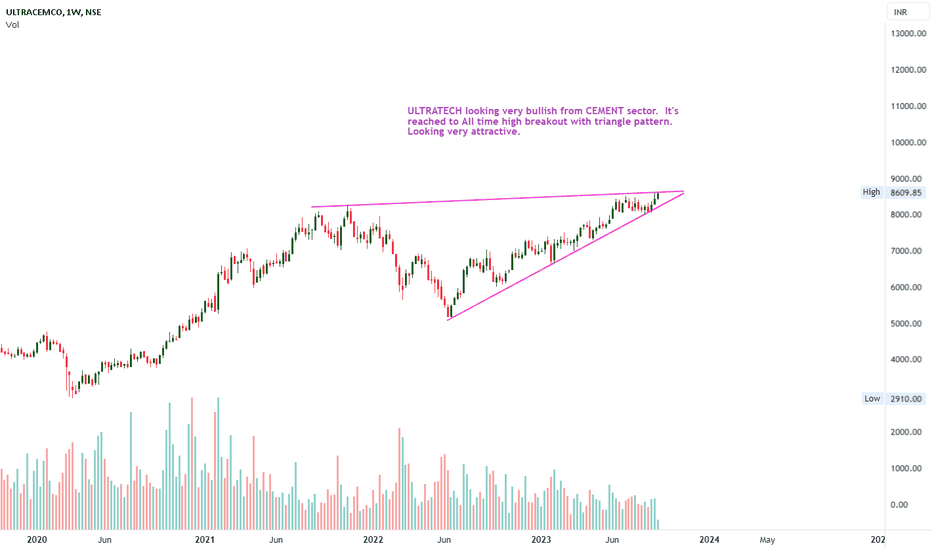

ULTRACEMCO trade ideas

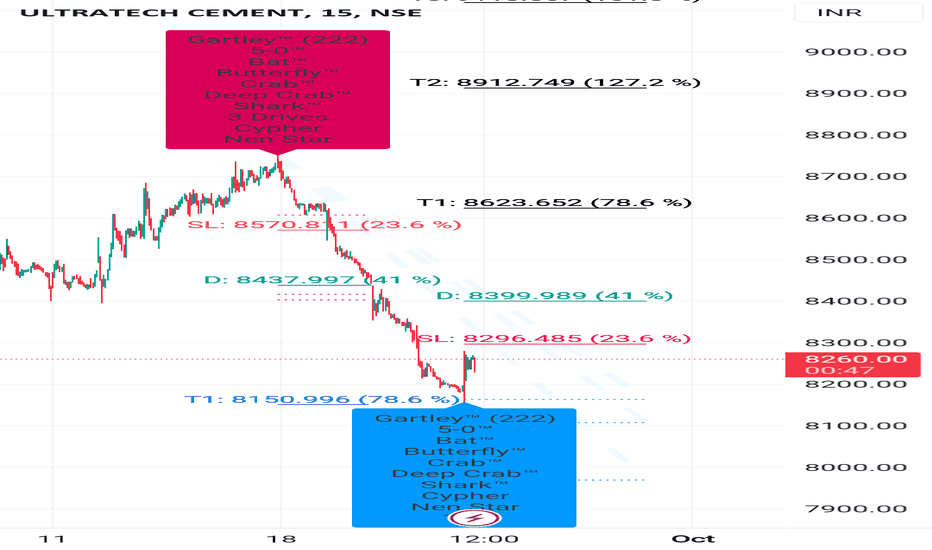

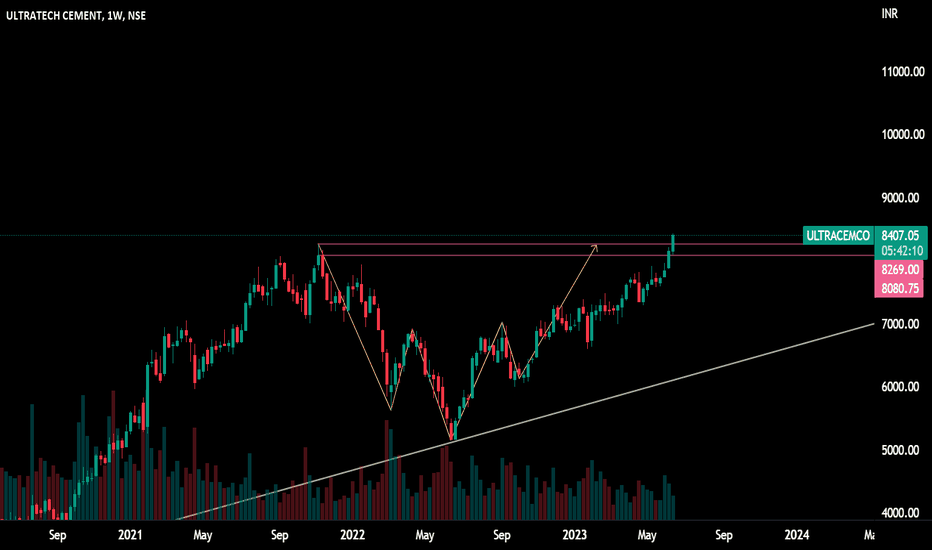

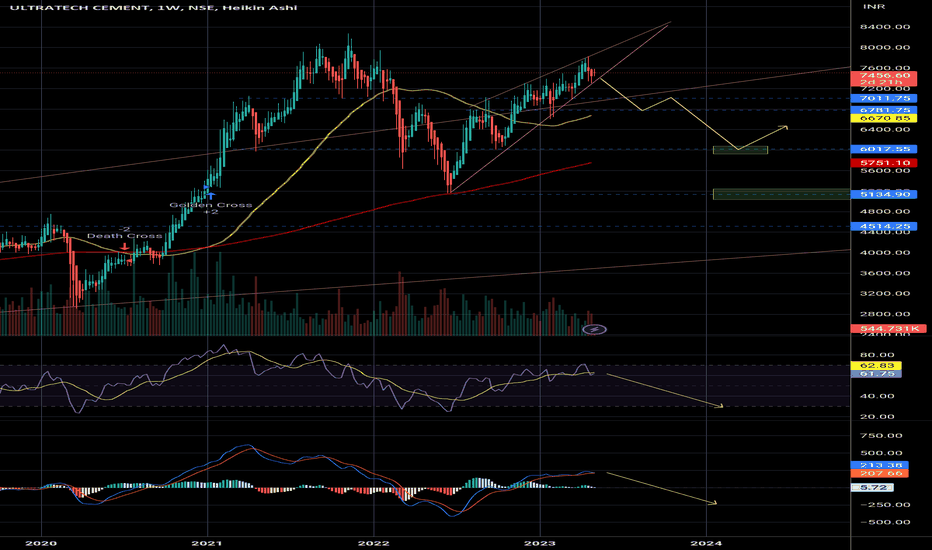

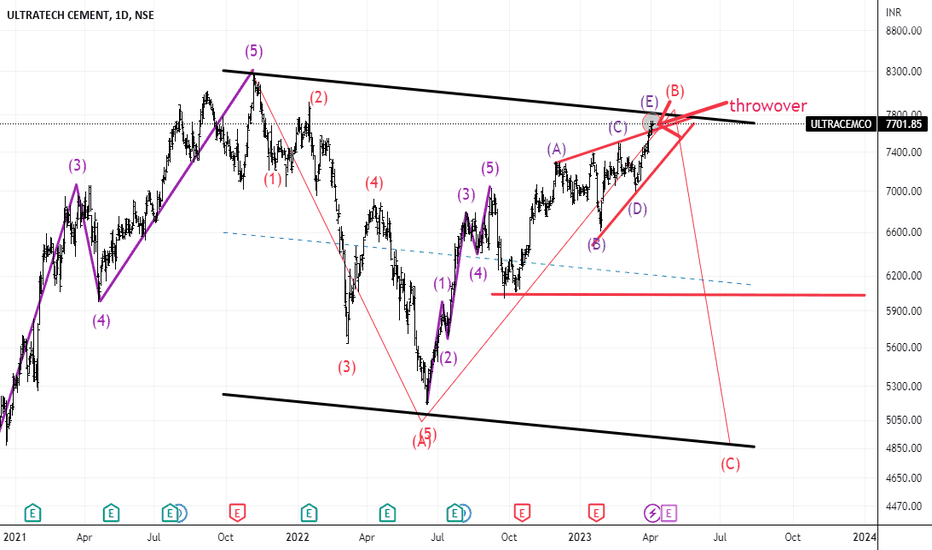

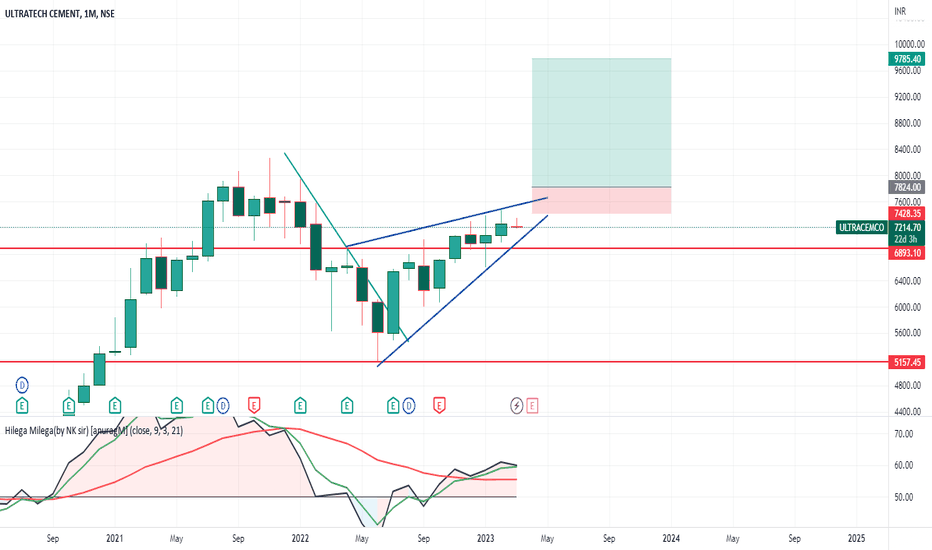

Ultratech cement again ready for 8600+ big moveFor all trade on my Auto Harmonic patterns indicator trade setup -

Risky trades can take trade after crossing 23.6% on either side and safe traders can take trade after 41% We can start buying when our Trailing SL hit at 23.6% with SL of recent low our Target will be 41%, 78.6% , 127.2% 161.8% and 223.6 % , when reversal pattern appears on chart we have to trail our SL if trailing SL hit exit from long trade and initiate sell trade ,

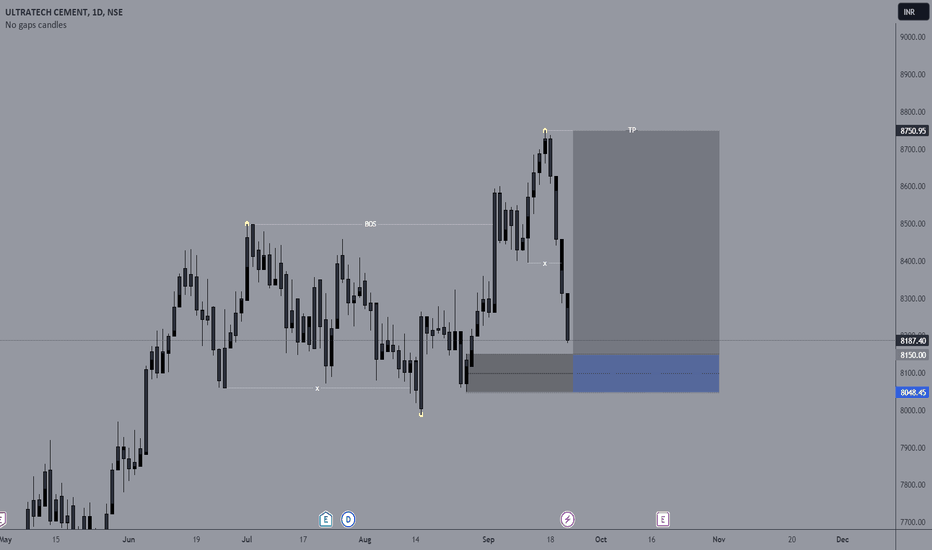

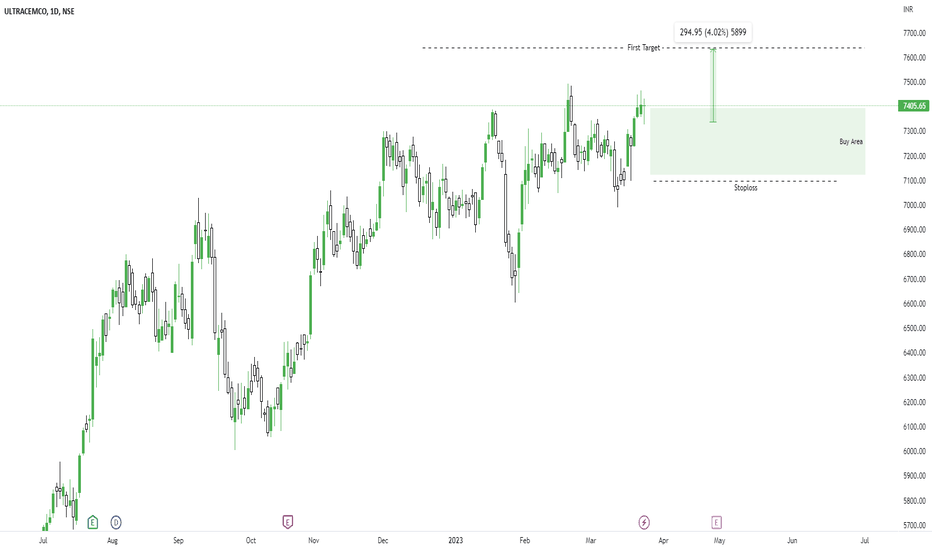

EXPECT 8% RETURN FROM INDIA's LARGEST CEMENT PRODUERSNSE:ULTRACEMCO , risking 1.5% in a stock is a good setup to trade, buying at the price of 8150 and making 8050 or 10 points below is the stop loss for the trade, expect the recent ATH to be the target. CHECKOUT SOME PREVIOUS ANALYSIS TO GAIN THE CONFIDENCE TO TRADE.

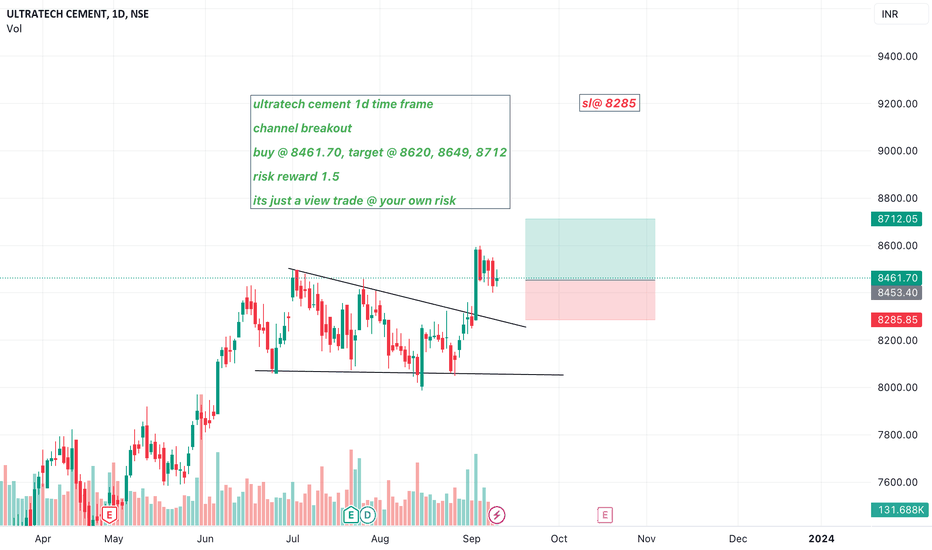

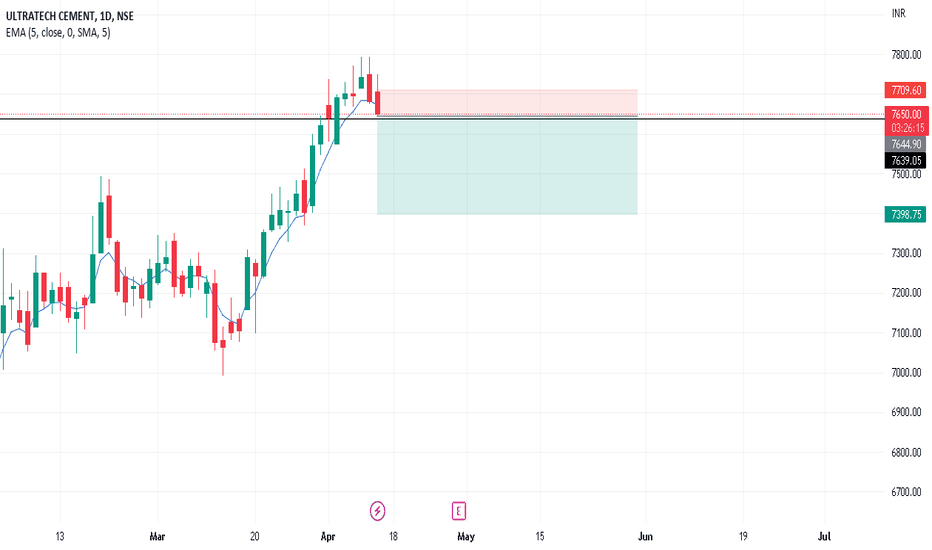

Bullish Breakout in UltraTech CementPrice was in solid uptrend from last few months and started consolidating in a range from past few days.

Today the price brokeout of that range and closed above it with a good volume as well.

I expect price to continue to rise further atleast till 8930.

Entry can be intiated at CMP.

Stop loss below the low of breakout candle.

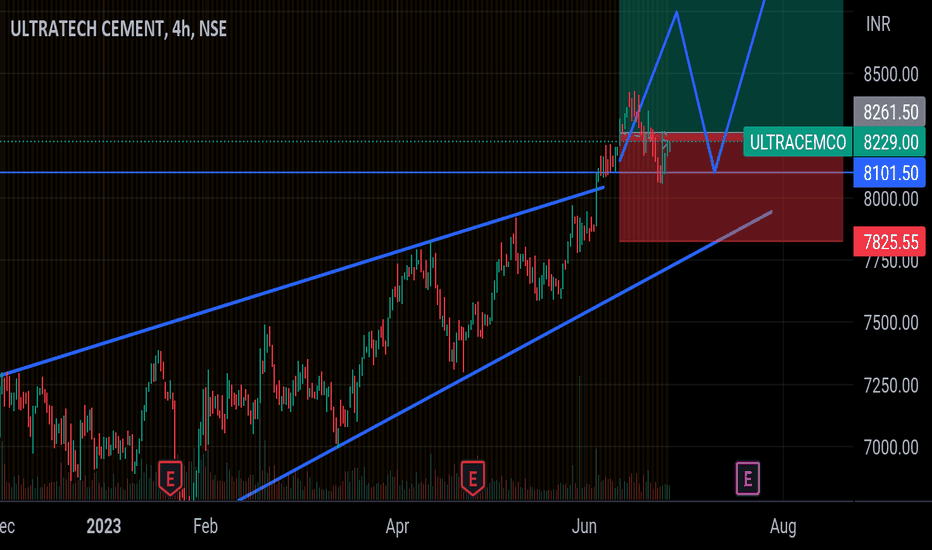

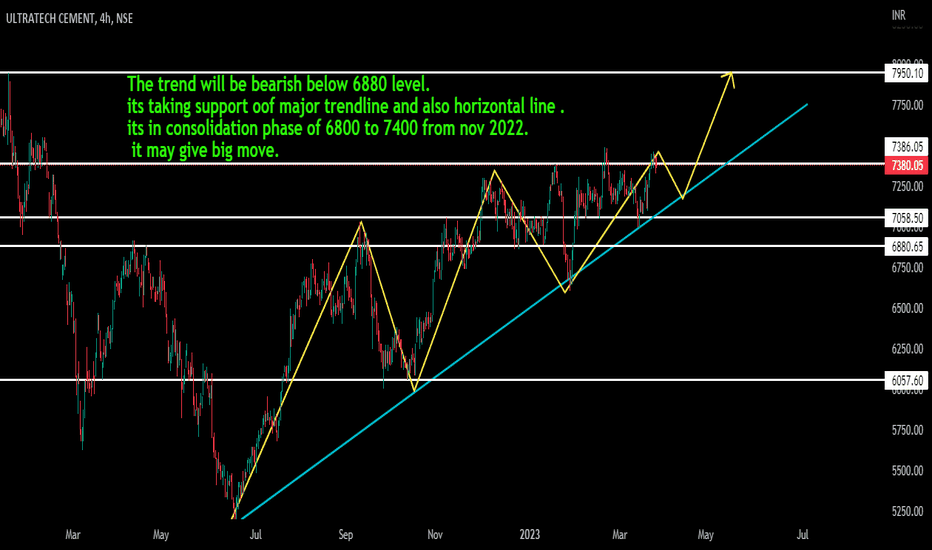

ULTRATECH CEMENTMake rising wedge chart pattern in 4 hour time fram , price is at 52 week high , take break out at resistance level and make retest at that level , take support of 50 EMA , MACD line and histogram also saw fair value for bullish way so first Target will be 9174.75 and stop loss will be 7825.55

This is for educational purpose not a trading advice so that's my view comment down your view 🤗

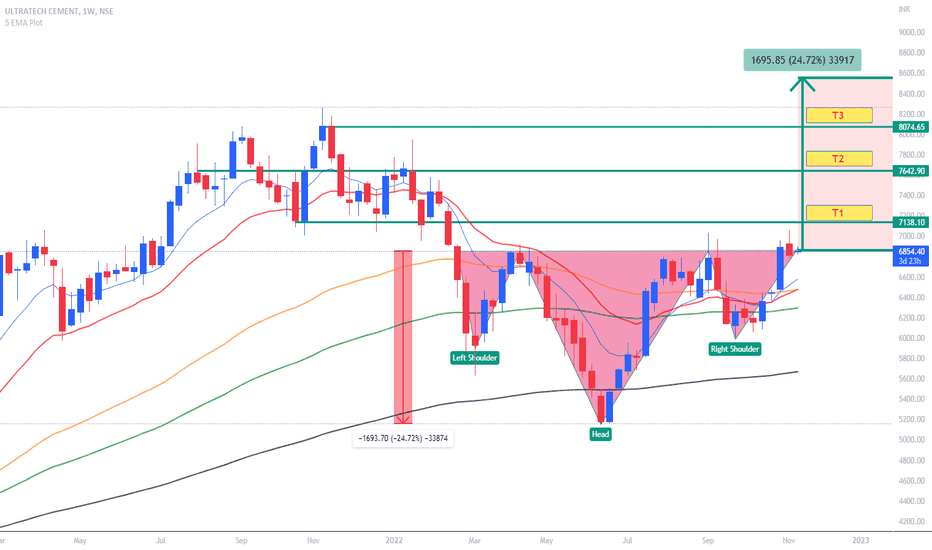

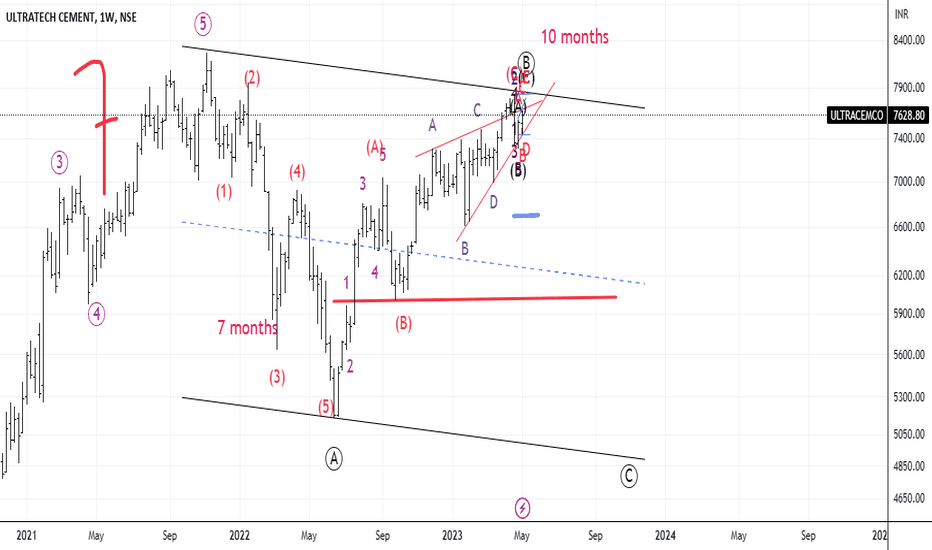

ULTRA TECH CEMENT Ultratech Cement is the largest cement company in India and 3rd largest cement company in the world (ex-china) and is the largest cement manufacturer in India It is also the only cement producer outside of China to have 100+ MnTPA of manufacturing capacity in a single country , formed inverse Head and shoulder pattern , above 10 , 21, 63 , 100 , 200 EMA , looking bullish.

Refer targets marked in the chart - recommended for longterm

Market Cap ₹ 197,633 Cr.

Current Price ₹ 6,845

Stock P/E 29.7

ROCE

14.3 %

ROE

15.2 %

Debt

₹ 12,876 Cr.

Pledged percentage

0.00 %

Debt to equity

0.25

Reserves

₹ 51,197 Cr.

Price to book value

3.83

Int Coverage

10.2

PEG Ratio

1.35

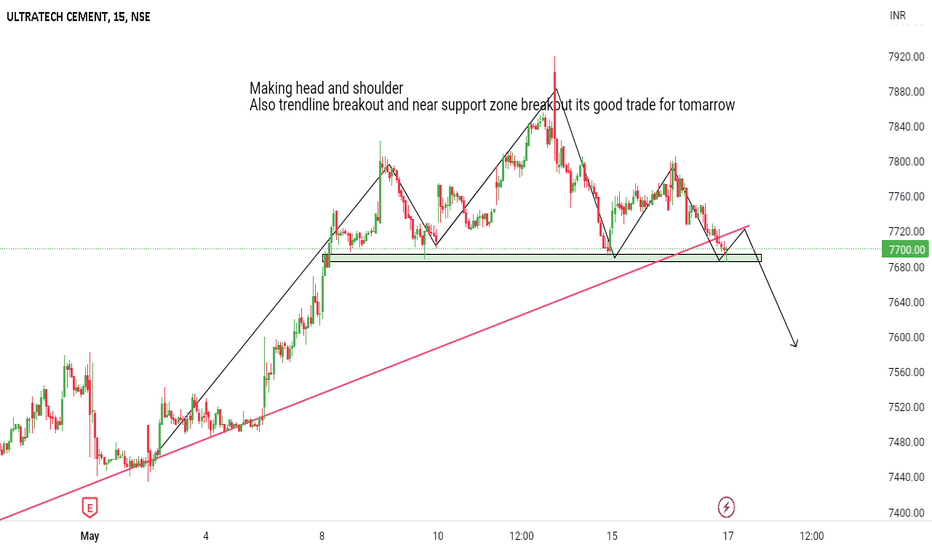

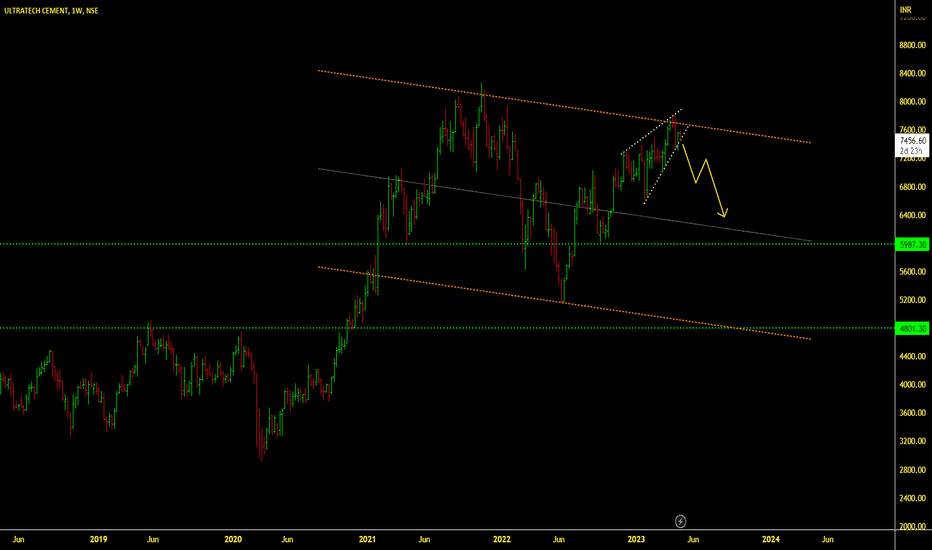

Ultratech Cement ShortNSE:ULTRACEMCO

Strategy: Short

The cement manufacturer saw a 36% dip in their consolidated net profit to Rs 1,666 crore for Q4 ended March.

Those who bought early, it's a perfect time to book profits.

For new entry wait till the price come to the green rectangular box i.e. the ideal buying zone.

Never trade a short without a stoploss.

*Not a financial advice to buy or sell. Only speculations.

My charts speaks louder than words.

I'm a chartist and I paint charts.

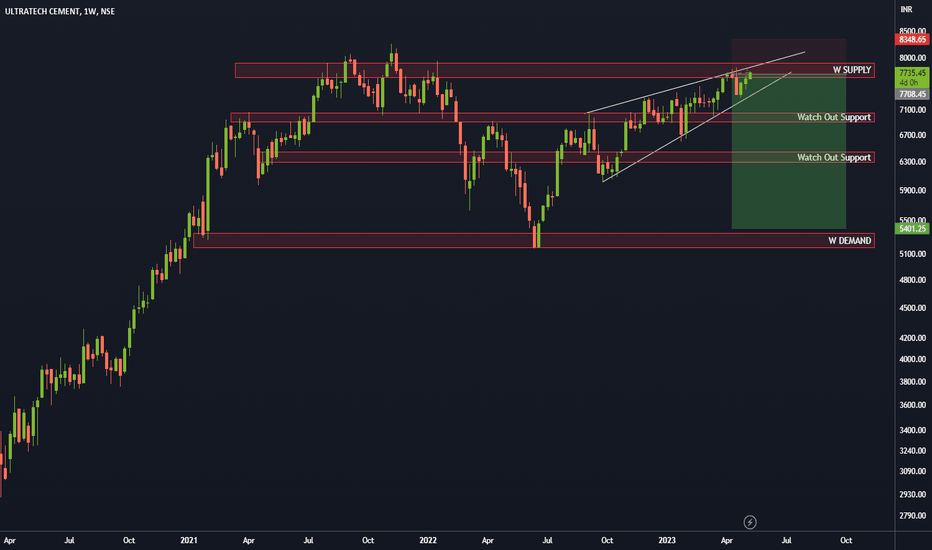

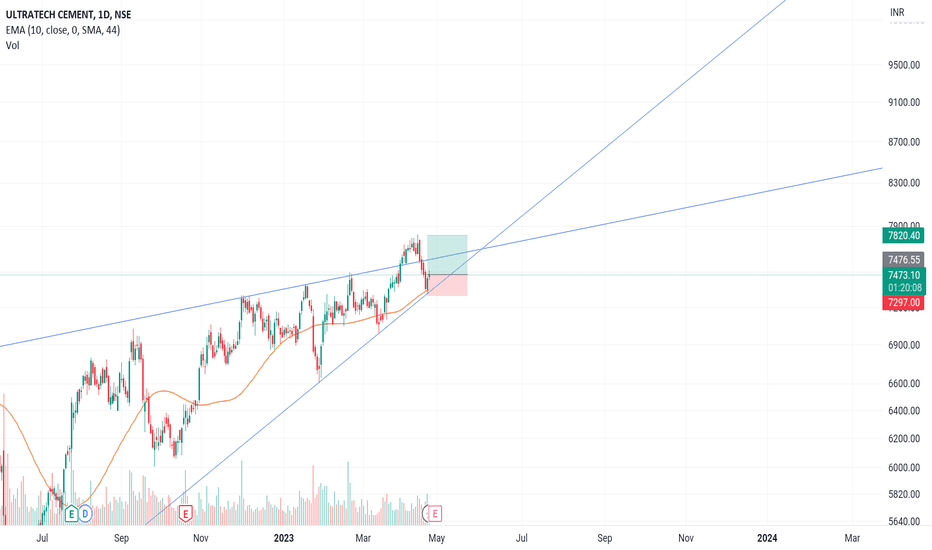

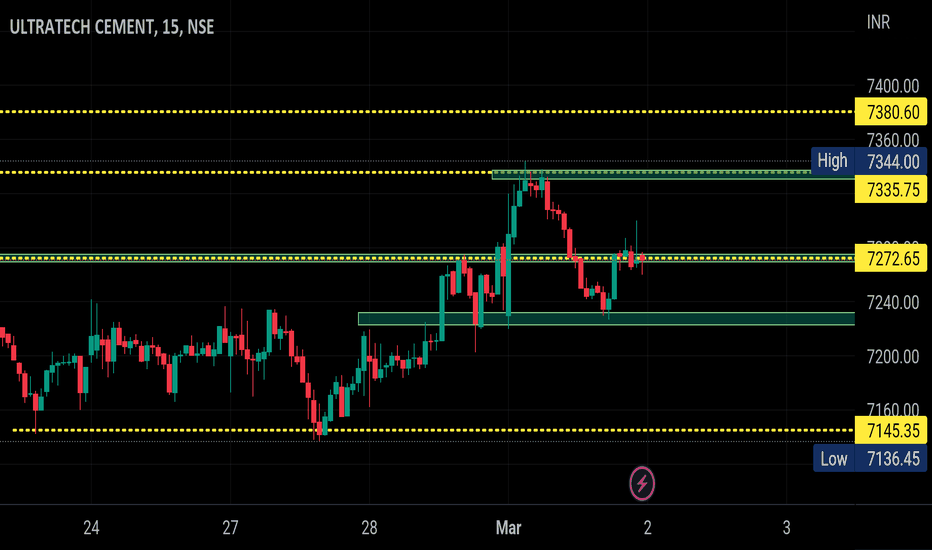

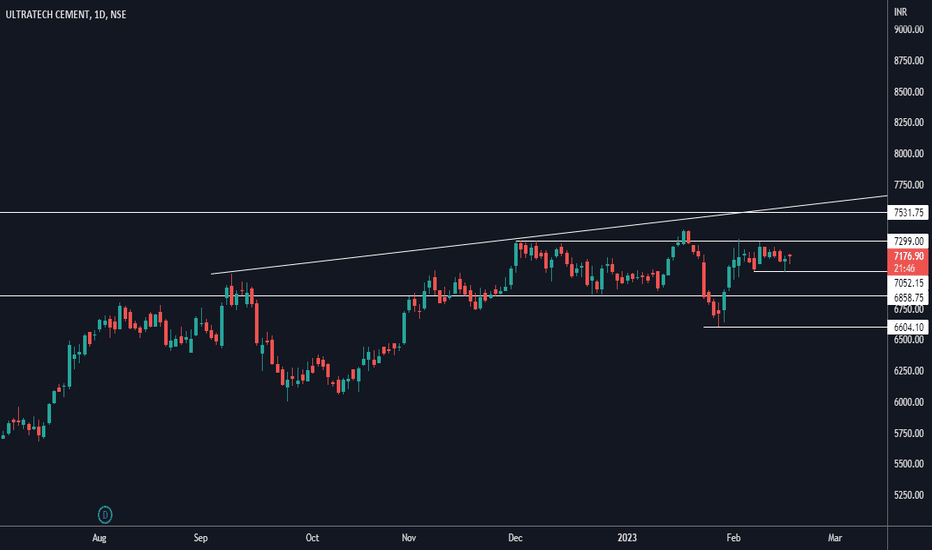

ULTRATECH in range can give breakout PREMPTINGultraech cmp 7175

sl 7040

target 7300 : 7530

price fall after result now retrace and consolidating in range. try to fall again but support strong at 7050 on closing basis

therfore can break upside

keep position sizing in control

market highly volatile

breakout has been tested very hard