BTC.D trade ideas

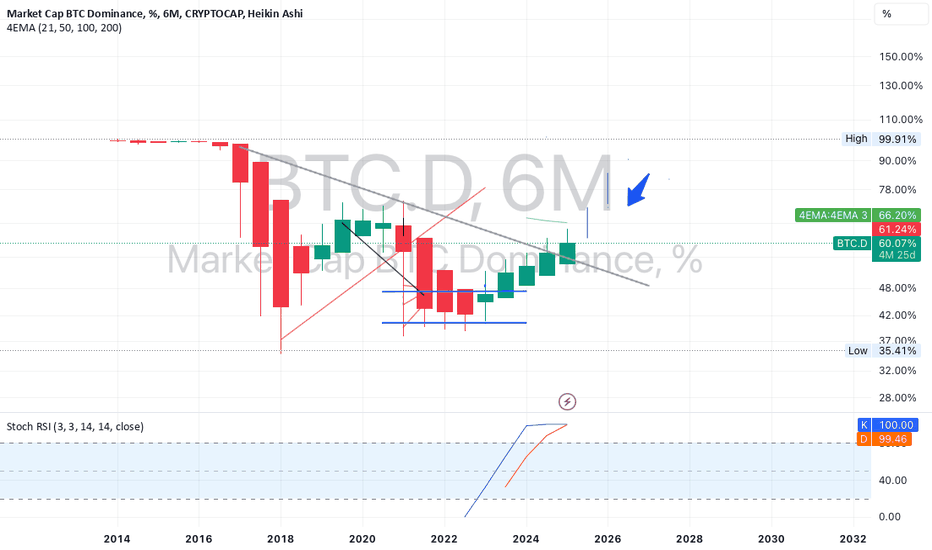

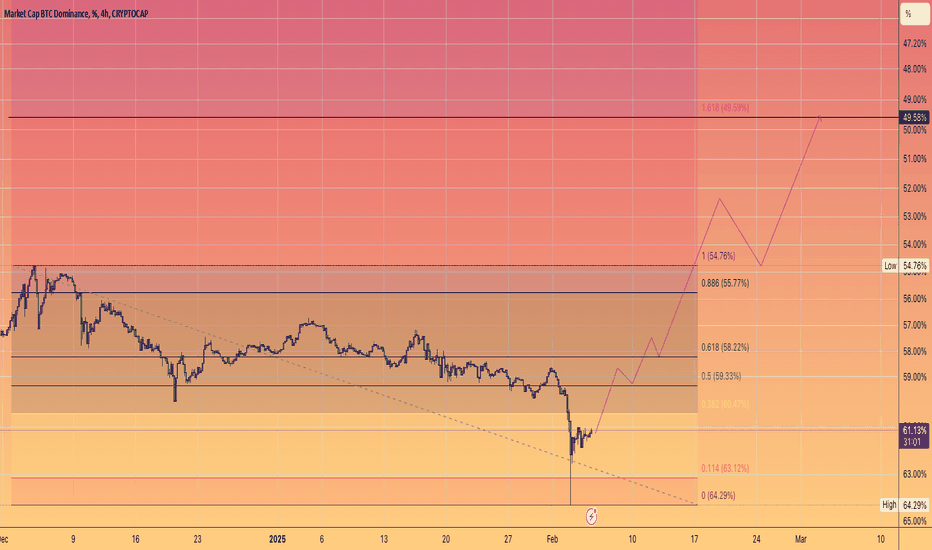

BTC Dominance: Correction or Final Impulse? Key Levels to Watch!Base Scenario:

The development of an expanded flat correction is expected. However, confirmation is required:

A 3D and weekly candle close below the 61.53 pivot.

Formation of a downward impulse structure, signaling the start of a full correction.

At this point, no aggressive drop in CRYPTOCAP:BTC.D below 50% is observed. Within this type of correction, the maximum target range for a decline is 51-52%.

Alternative Scenario:

Continuation of impulse growth within the 5th wave of BTC dominance. In this case, BTC will continue strengthening against the market, invalidating the corrective structure.

A key confirmation signal would be a 3D/weekly candle close below 61.53 and the formation of a downward impulse. For now, the correction scenario remains speculative, while BTC Dominance holds strong levels.

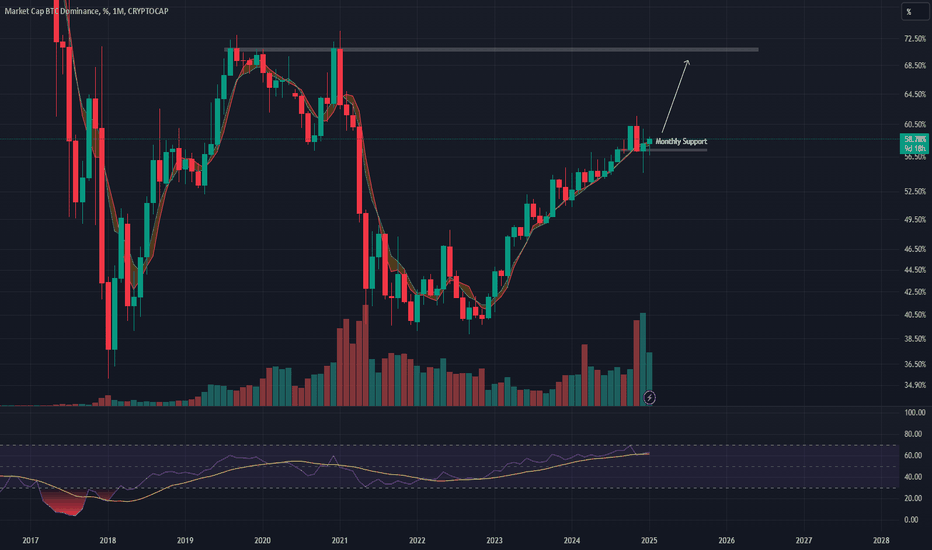

Timing the End of the Altcoin Bull MarketHello,

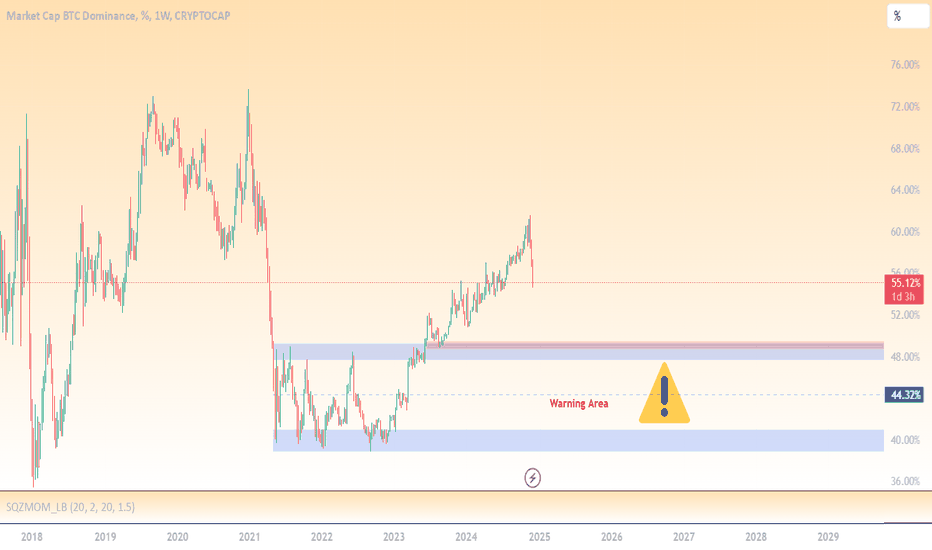

BTC dominance is currently around 55%. From my analysis, the altcoin bull market typically ends when BTC dominance drops to the 47%-40% range. At that point, it’s wise to prepare for selling altcoins, while also monitoring the total market cap for signs of a decline. For now, the bull market remains active.

As always, remember to stick to risk management.

BR,

BTC dominance .... Bitcoin: The King, But Not Everything!Crypto is More Than Just Bitcoin; Just Like Automobiles Are More Than One Brand!

In the world of digital currencies, many newcomers have only heard of "Bitcoin" and assume that the entire crypto market revolves around it. However, just as the automobile industry is not limited to a single brand, the crypto world is also filled with innovative projects and diverse digital assets, each with its own unique applications and features.

Bitcoin: The King, But Not Everything!

Bitcoin is the first and largest cryptocurrency by market capitalization. It is considered digital gold and serves as a store of value. But that's not the whole story! If we compare Bitcoin to brands like "Ferrari" or "Lamborghini," which are luxurious and powerful, other cryptocurrencies can be likened to different car brands, each with its own unique functionalities and purposes.

Altcoins: The Major Players in the Crypto World

Ethereum (ETH): If Bitcoin is Ferrari, Ethereum is like Tesla—a platform that has paved a new path in blockchain technology. Smart contracts and decentralized applications (DApps) run on its network.

Polkadot (DOT): Polkadot is like a versatile car, such as the BMW X5, allowing interoperability between different blockchain networks and enhancing cross-chain communication.

Chainlink (LINK): Chainlink is akin to a secure and smart car like Volvo, acting as an oracle in the blockchain space, connecting real-world data to smart contracts.

Solana (SOL): This cryptocurrency is like a sports car, such as Porsche—fast, scalable, and with low fees, making it highly popular among developers.

Cardano (ADA): Cardano can be compared to Toyota or Honda—stable, secure, and equipped with innovative technologies aiming to solve blockchain scalability issues.

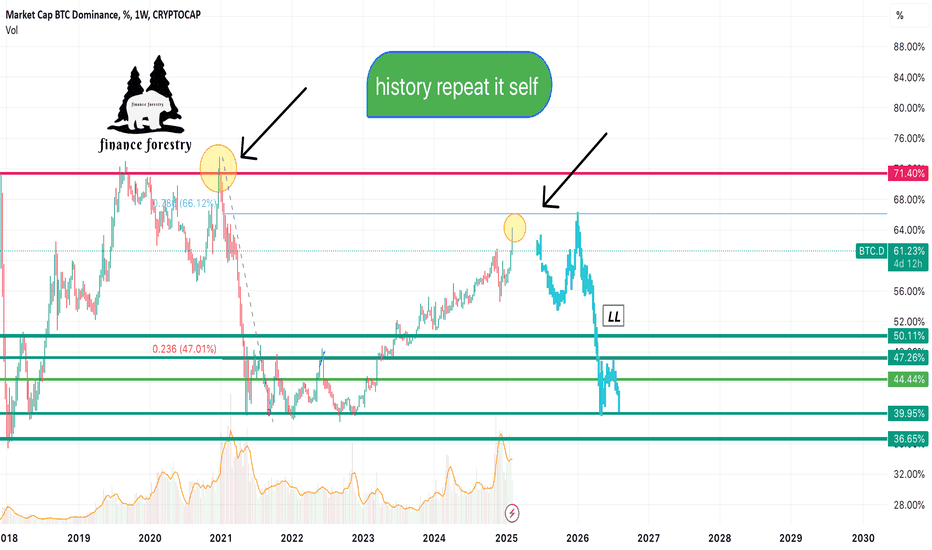

Is Altseason Coming?

Altseason is a term referring to a period in the crypto market where altcoins (cryptocurrencies other than Bitcoin) experience significant growth. This typically happens after Bitcoin stabilizes or when investors feel that Bitcoin has reached a short-term price peak.

Some signs of an approaching altseason include:

Bitcoin dominance rising and then declining (indicating a shift of capital from Bitcoin to altcoins)

Explosive growth in certain altcoins, signaling increased investor interest in alternative projects

Improved macroeconomic conditions and increased liquidity in the market

Just as the automotive world is not dominated by a single brand, the crypto market extends beyond Bitcoin. Major projects like Ethereum, Cardano, Solana, Polkadot, Chainlink, and many others offer diverse use cases worth exploring and investing in. Given current market indicators, we may soon witness a powerful altseason where altcoins experience substantial growth. Therefore, it's essential to look beyond Bitcoin and view the market from a broader perspective!

good luck

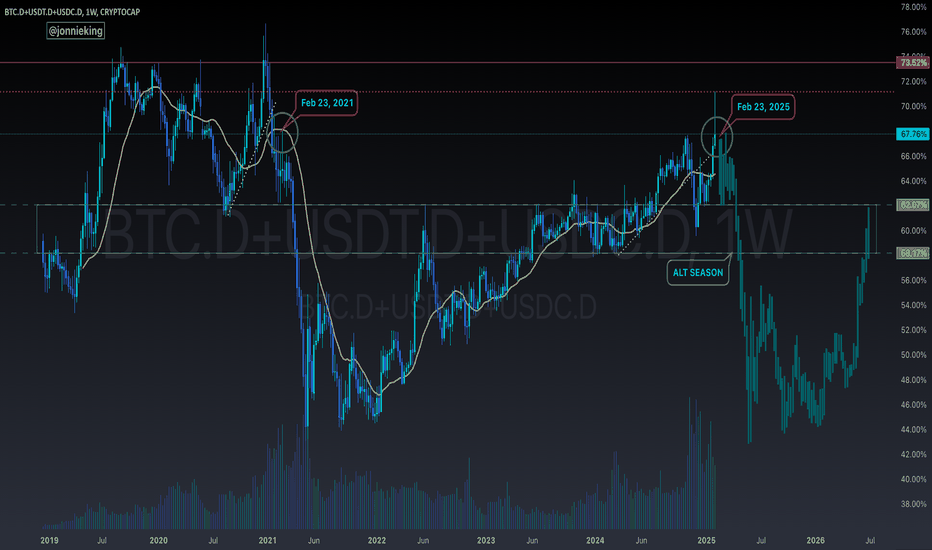

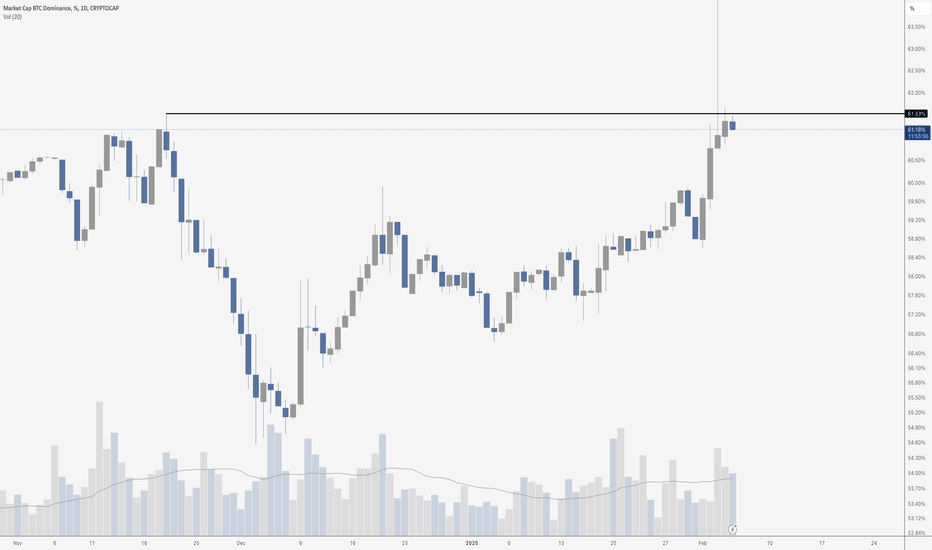

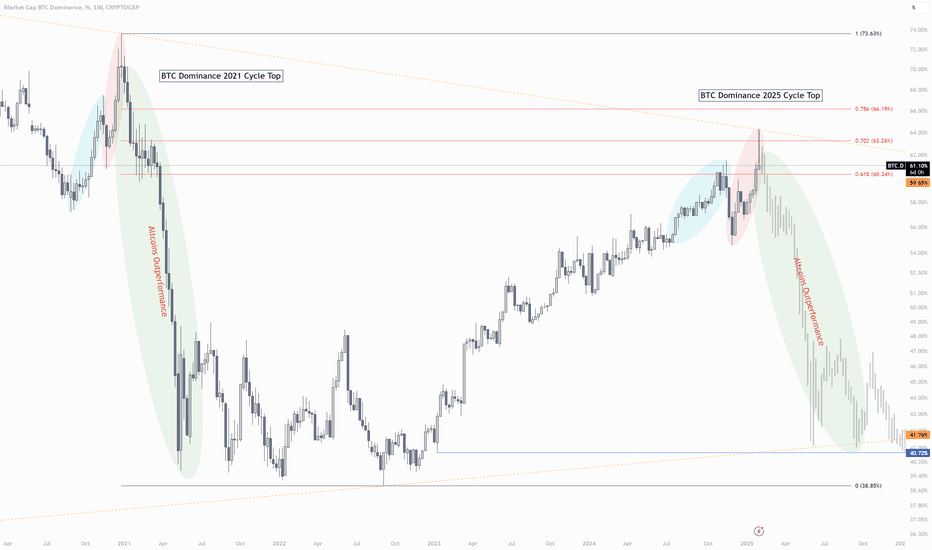

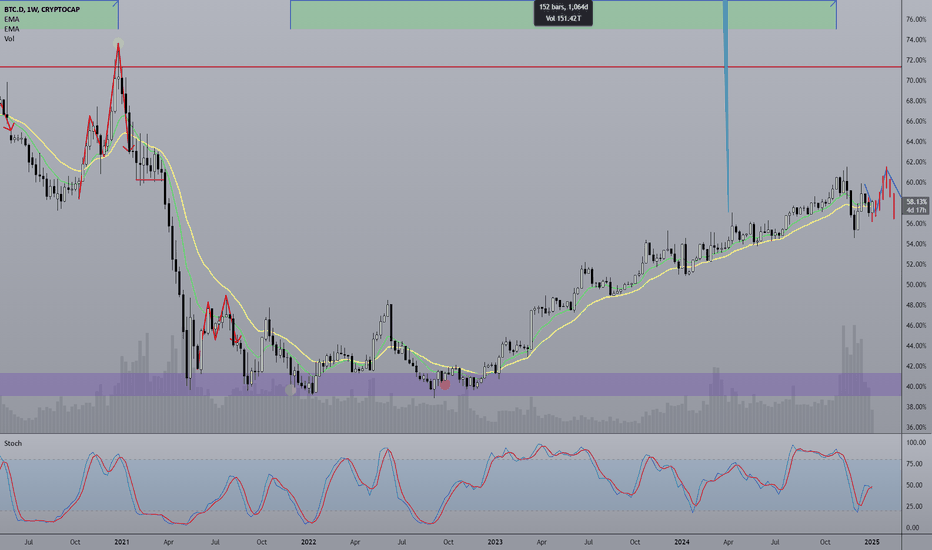

BITCOIN DOMINANCE AT RESISTANCEBitcoin dominance is currently testing a critical resistance level near 61.5%, with multiple wicks poking above but no decisive breakout as of yet. While it's worth noting that Bitcoin dominance isn't a tradeable metric—there are no orders on the books—it can still serve as a valuable sentiment indicator for the broader crypto market, particularly in gauging the relative strength of altcoins versus Bitcoin.

Historically, dominance at resistance often signals a potential pause or reversal, suggesting that Bitcoin's outperformance against altcoins may face some challenges here. However, a confirmed breakout above this level could indicate further liquidity flowing into Bitcoin at the expense of altcoins. Traders should watch for either a strong rejection or a sustained breakout to glean insights into the next potential trend for altcoins in relation to Bitcoin.

Bitcoin dominance soon about to dropBitcoin dominance and (eth/btc) have been playing with us for more than a year.

We have been chasing the altseason but it did not occur.

Soon this has to breakdown and reward those who are patient.

Starting from march we will see some gains in altcoins .

Most likely in next 3 months we will witness the altseason (march,april,may).

BTC.D Capitulation Liquidation candle. Bitcoin's price hovers around $97,000 on Wednesday, following a 3.5% drop the day before. David Sacks, President Trump’s crypto czar, has announced plans to assess a Bitcoin Reserve. Meanwhile, traders on the Bitcoin CME are adopting a cautious stance, advising investors to steer clear of leverage at all costs. As uncertainty and volatility rise in the wake of Trump’s supportive crypto regulations, the potential for a Bitcoin reserve is emerging, yet the market remains turbulent due to tariffs and broader economic challenges.

Additionally, Bitcoin is bracing for fluctuations as FTX prepares to start repaying creditors on February 18. The beleaguered exchange, which filed for bankruptcy in November 2022 with debts estimated at $11.2 billion, is set to disburse payouts that could reach up to $16.5 billion. To facilitate this, FTX is actively selling assets and investments in tech companies. This development is pivotal for those impacted by the FTX collapse, sparking significant interest within the cryptocurrency community.

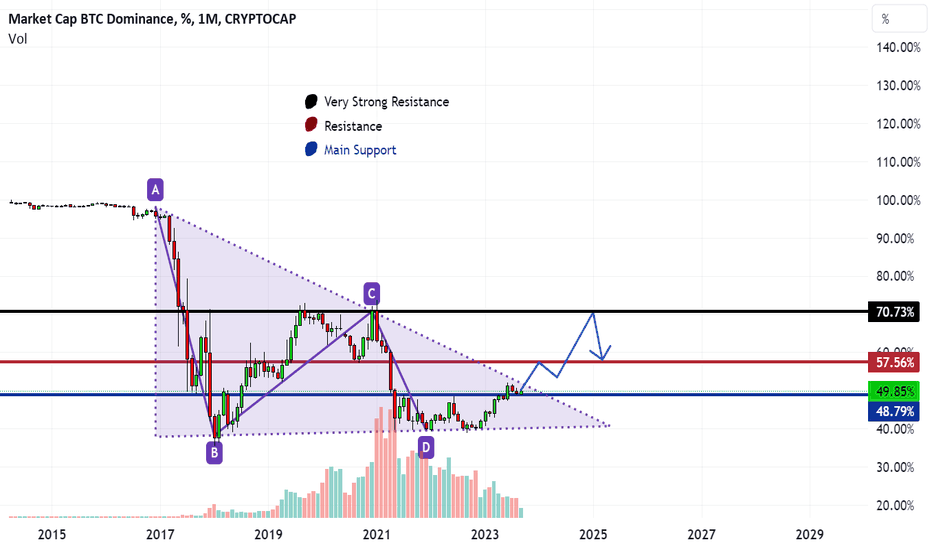

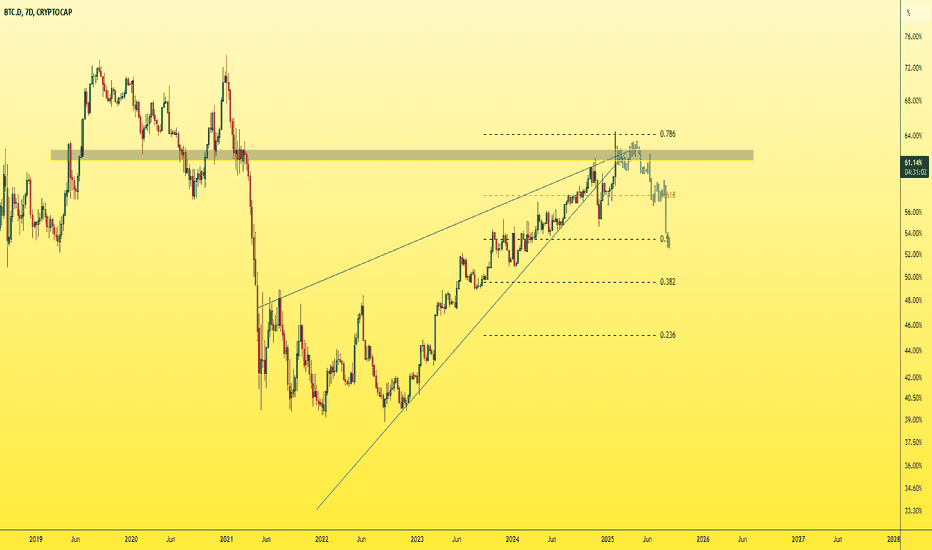

In 2018 and 2019, the BTC.D chart faced rejections from the 60% resistance zone during the bearish years that followed the explosive bull run of 2017.

Now, we find ourselves in a different scenario, with a retest happening in a bull run year post-halvening. While it’s too early to declare the end of the rally, the usual indicators for a BTC bull peak have yet to signal a positive trend.

From a technical standpoint, BTC.D has the potential to climb to 63.84% and possibly reach as high as 72.5%. This development could spell great news for Bitcoin while casting a shadow over the altcoin market.

This shift might be driven by consistent demand from ETFs and institutional investors for Bitcoin, leaving altcoins in the dust until later in the year.

However, some speculators believe that the recent liquidations over the weekend may have drained enough leverage, allowing altcoins to begin their recovery and, at long last, outshine Bitcoin. We await the unfolding drama with eager anticipation.

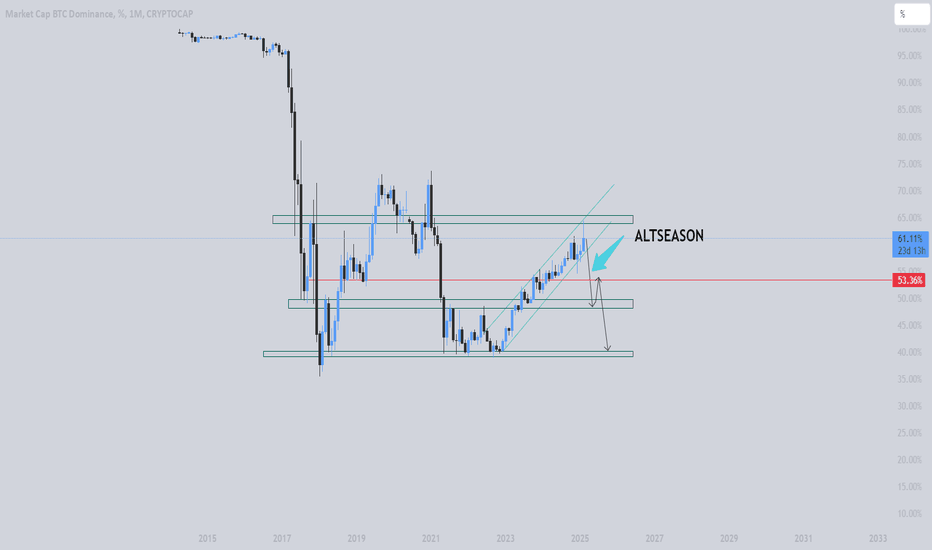

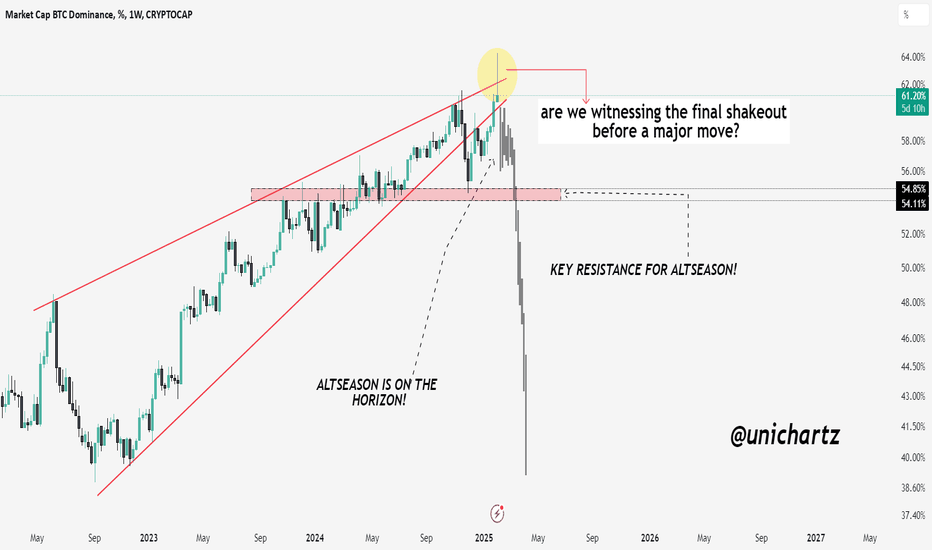

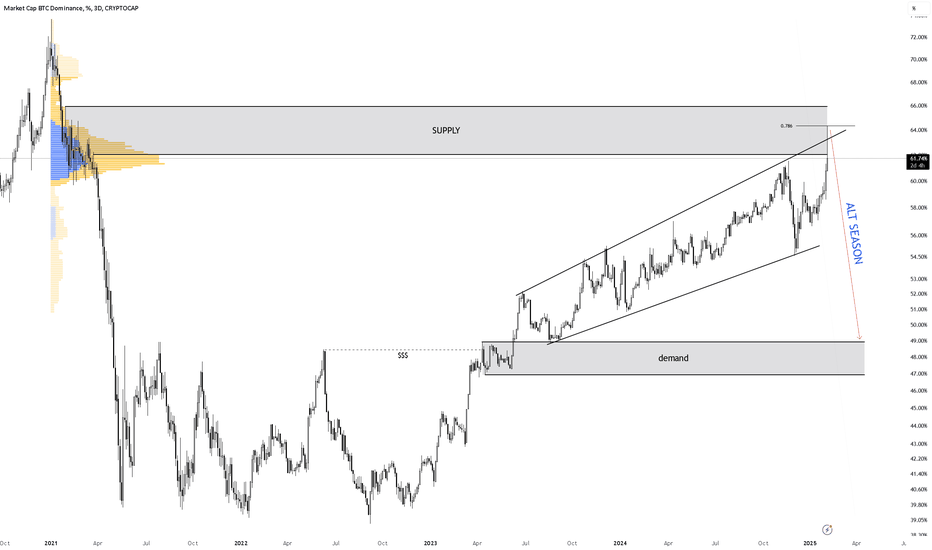

DOMINANCE - the manipulation!The weekly chart clearly shows a confirmed breakdown of the rising wedge pattern.

Everyone was waiting for a retest to buy in, expecting dominance to drop and altcoins to rally—but that never happened.

Why?

Because when everyone expects a move, the market does the opposite.

What actually happened?

-The market shocked everyone with a parabolic dominance surge to 64%.

-Over $182 billion was drained from the market in just two days.

-Altcoins suffered a brutal crash, with some dropping over 50%.

-Most assets hit extreme lows, forcing mass panic selling at heavy losses—which we predicted a week in advance.

-A sharp altcoin rebound happened the same day, while dominance dropped from 64% to 61%, stabilizing at this level.

What’s next?

The rising wedge pattern is still in play, but its targets won’t be hit without manipulation.

I expect heavy market manipulation in the coming days, with dominance fluctuating between 60% and 63%, designed to drain traders’ portfolios—especially futures traders.

The expected price action is outlined in this chart. Take a look, and you'll clearly see how manipulation operates in this market.

Best regards Ceciliones🎯

Final Shakeout? BTC Dominance Rejection Signals Market Shift!The Bitcoin Dominance Chart suggests a major shakeout, potentially signaling the beginning of a significant market shift.

After reaching the upper boundary of an ascending wedge, dominance has sharply rejected from key resistance, leading to a breakdown.

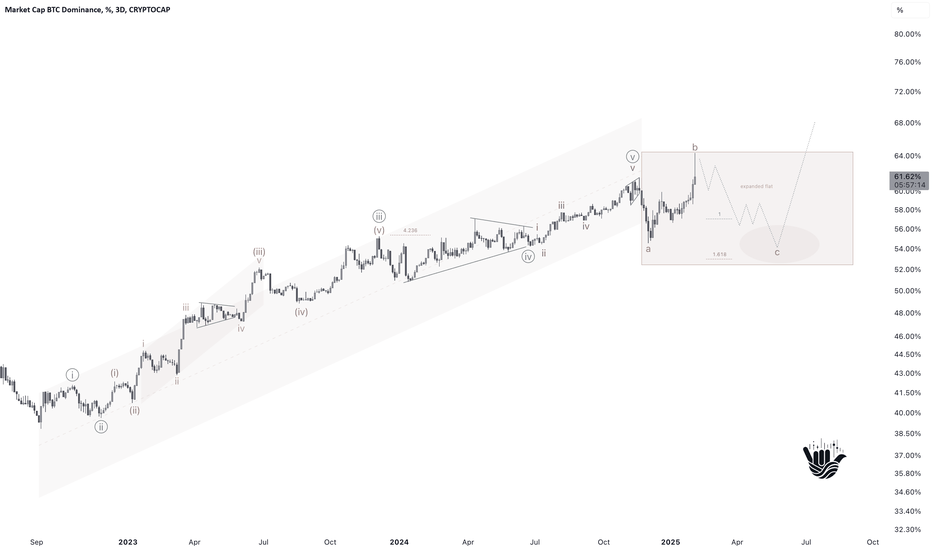

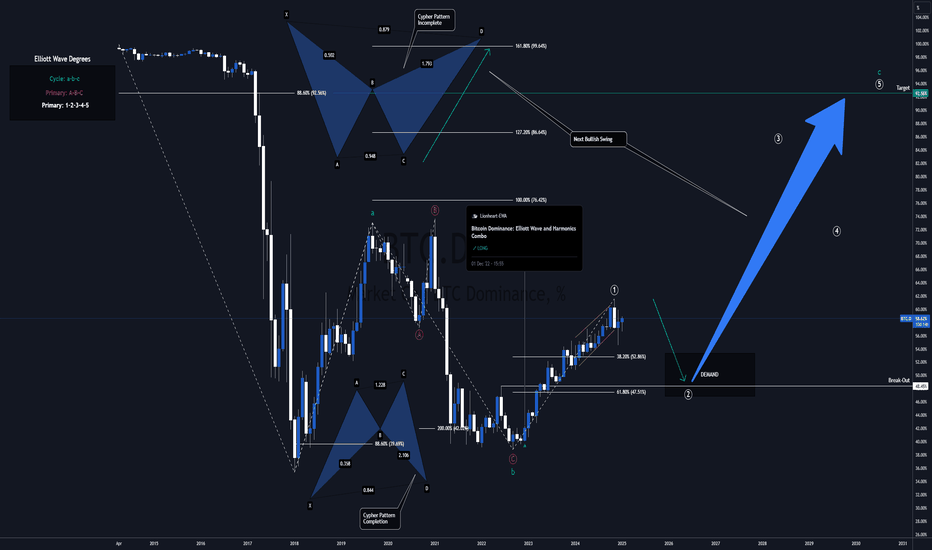

Bitcoin Dominance: Elliott Wave and Harmonics Combo (Part 2)MARKETSCOM:BITCOIN Dominance ( #BTC.D / CRYPTOCAP:BTC.D ) indeed started the rise I predicted back in late '22. CRYPTOCAP:BTC rose to the limits, exceeding the 100K Mark.

In #ElliottWave, this is Cycle Wave C (turquoise).

Primary Wave ① (white) completed, with the Corrective Primary Wave ②now in play.

The Correction will pave the way for Alt Season to commence, so the focus will shift to Alt Coins.

#Harmonics are showing #Cypher Patterns, a combo actually, on different degrees.

Bitcoin Dominance ( BTC.D ) Technical Analysis:

* Elliott Wave Impulse: Cycle C (turquoise)

* Harmonic Patterns: Bullish Cyphers

* 88.6% Fibonacci Retracement

* Break-Out with Divergence

* Leading Diagonal in Primary Wave ① (white)

Conclusion:

After a last rise, expecting MARKETSCOM:BITCOIN to top-out and start a Larger Correction.

Alt Season to start and deliver, based on #BTC losing ground.

After this, CRYPTOCAP:BTC to continue ruling, as the one and only #Cryptocurrency.

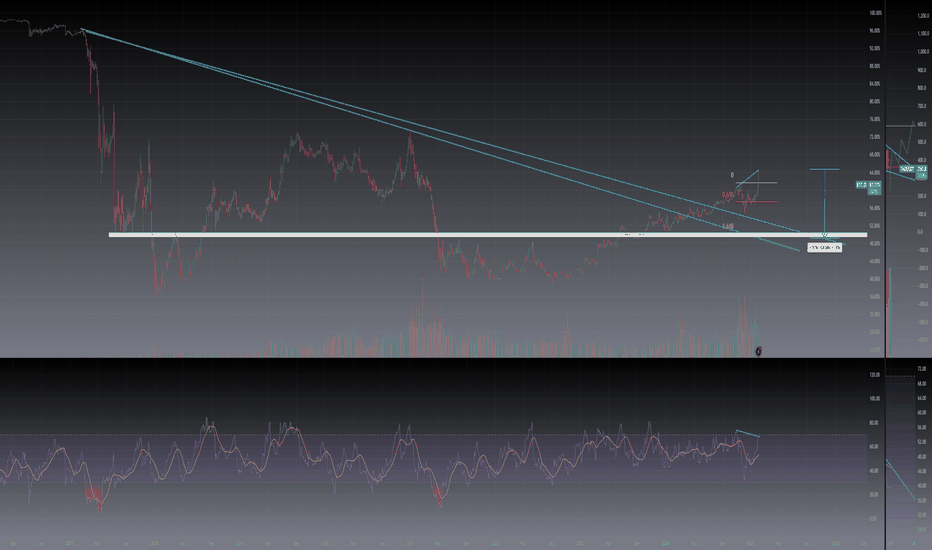

REGULAR FLAT WEEKLY ETHI've been watching Bitcoin dominance (BTC.D) for a while now. For those who follow wave trading, a continued rise in BTC.D seems likely. If Ethereum (ETH) loses the **$2,100** support level, it could confirm another bullish impulse in BTC.D, with a target between **73% and 74%**, validating a **regular flat**.

What concerns me about altcoin charts, especially ETH, is the **lack of long-term bullish structure**. A prolonged increase in BTC.D, combined with a BTC drop, could push ETH below **$900**. While this scenario might seem unlikely, it would be **technically clean** from a chartist perspective. It would represent a **wave C** of a **regular flat on the weekly timeframe**, setting up a potential **new all-time high (ATH)** afterward.

This reversal would correlate with a drop in BTC.D to **35% minimum**, which could trigger a strong altcoin rally.

**Summary:**

🔹 **As long as ETH holds $2,100 → No worries**

🔹 **Below $2,100 → High risk of deeper correction**

🔹 **BTC.D towards 73-74% → Regular flat confirmation**

🔹 **BTC.D dropping to 35% → Possible altcoin bull run**

Stay safe out there!

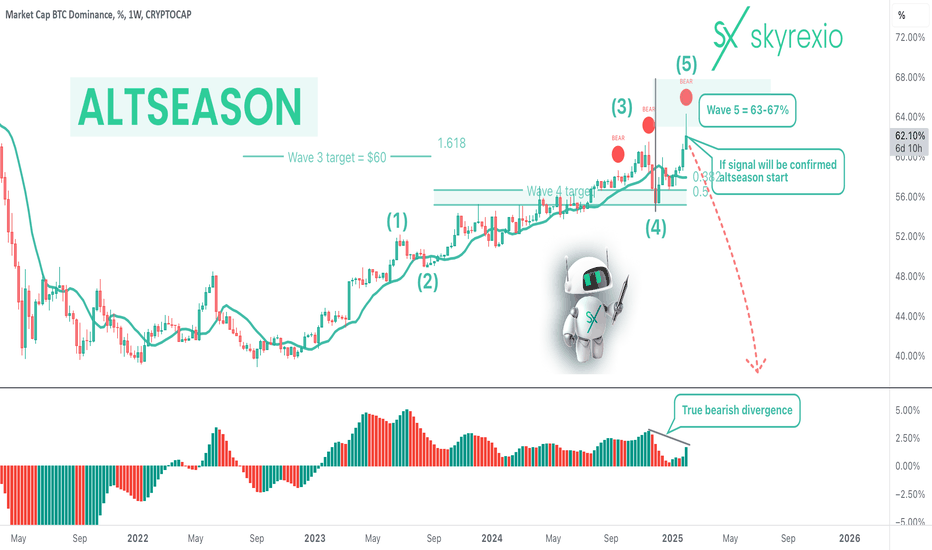

Skyrexio | Historical Moment - Retail Altcoins Capitulation!Hello, Skyrexians!

Hope your deposits are alive. We warned you yesterday that Altcoins Dominance is weak and today it dropped significantly. Most of traders have average deposit drawdown -50-70% and this is capitulation dump. If price will bounce now they will definitely sell. This is psychology of weak hands, it's useless to argue with this. I (Ivan) personally bought all last 3 days altcoins with extra 40% of USDT which I have after last purchases in August 2024. Now I have 30% of stables. I am ready to be out of position for these money, but if I will be lucky the bottom is going to be catched.

Let's go to analysis. Weekly CRYPTOCAP:BTC.D time frame is showing that this week can be closed with the third red dow on Bullish/Bearish Reversal Bar Indicator . If this will happen we will finally see altseason. I wanna show you beauty of Elliott Waves. You can see that wave 3 reached the 1.61 Fibonacci level. Then wave 4 reached 0.5 retracement. It gives us extra confidence.

Final target of wave 5 could be already reached inside the 63-67% green box. Here we need to see the lower time frame to get the precise target.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Update the scenario for BTC.Dom - When might Altseason actually?Currently, BTC.Dom CRYPTOCAP:BTC.D is following the second scenario I mentioned in my previous post. This is the only scenario I can think of right now.

According to this scenario, I predict that from now until Trump's inauguration, it will remain quite challenging for Altcoins.

To determine whether Altseason will occur, it’s best to wait until the beginning of February to make an informed decision about deploying capital.

The image below shows instances of the M-pattern , where the second peak is higher than the first, followed by significant **Altcoin growth** in previous seasons.

If this second scenario doesn’t play out, my concern is that BTC.Dom could return to the 70 region. In that case, Altcoins would be completely crushed, and I truly hope this worst-case scenario doesn’t happen. :(