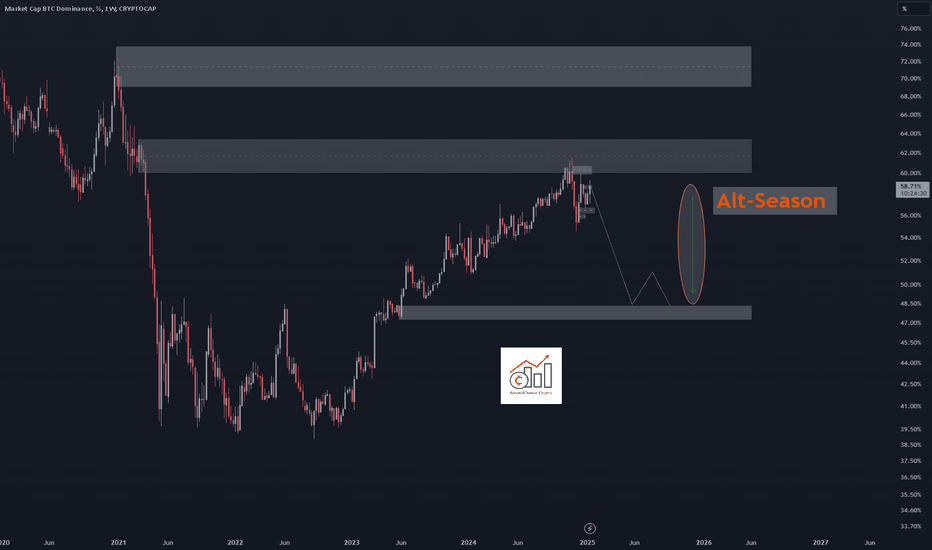

BTC.D : Alt -season 2025Hi friends,

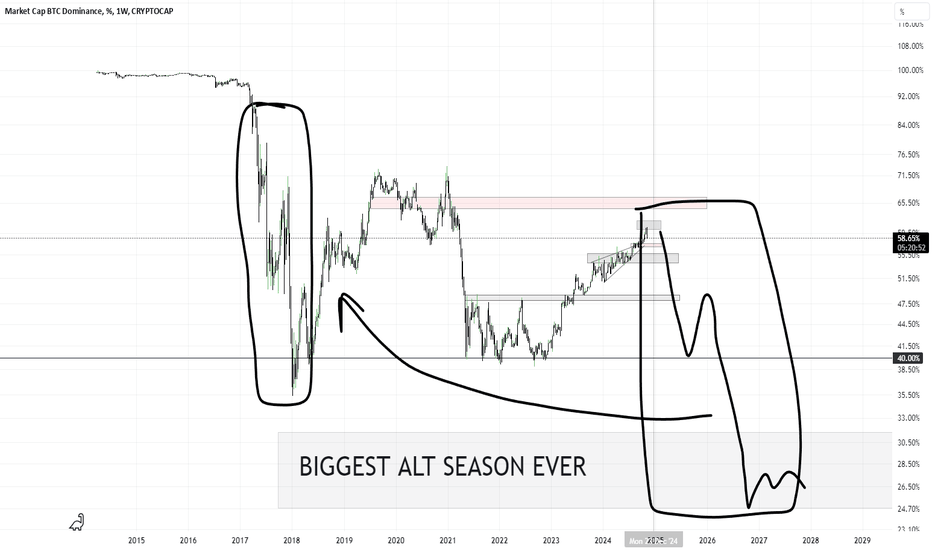

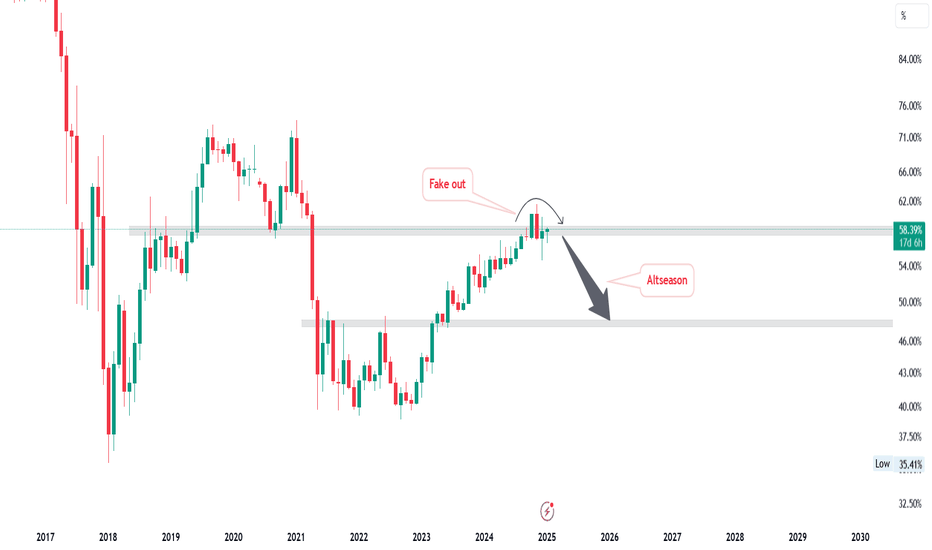

As you can see on the Bitcoin Dominance chart on the weekly time frame, I would like to remind you of the start of the 2025 Alt Season.

SecondChanceCrypto

⏰ 19/Jan /25

⛔️DYOR

Always do your research.

If you have any questions, you can write them in the comments below and I will answer them.

And please don't forget to support this idea with your likes and comments.

BTC.D trade ideas

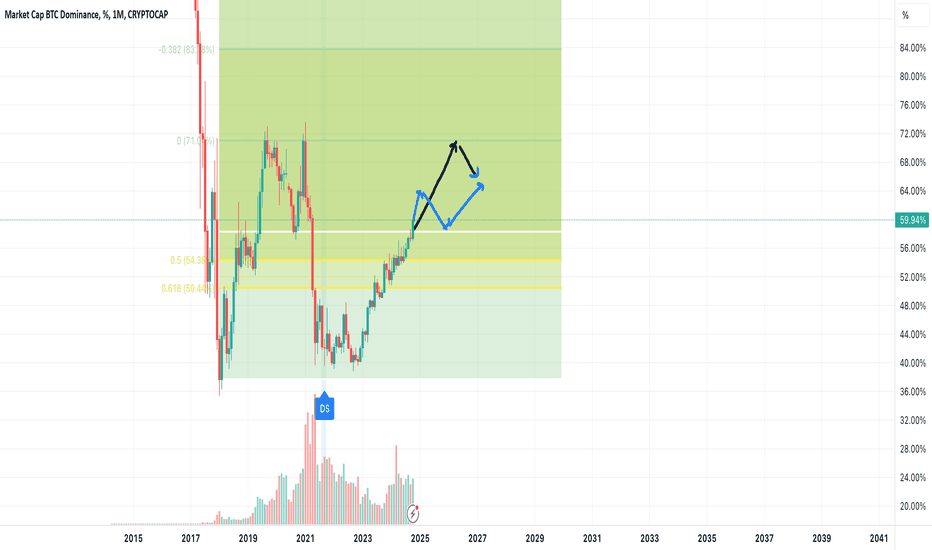

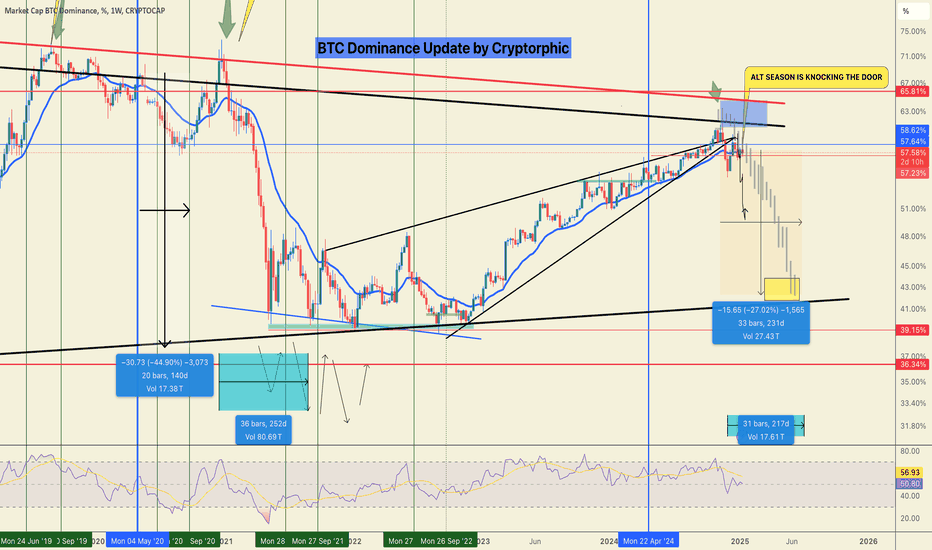

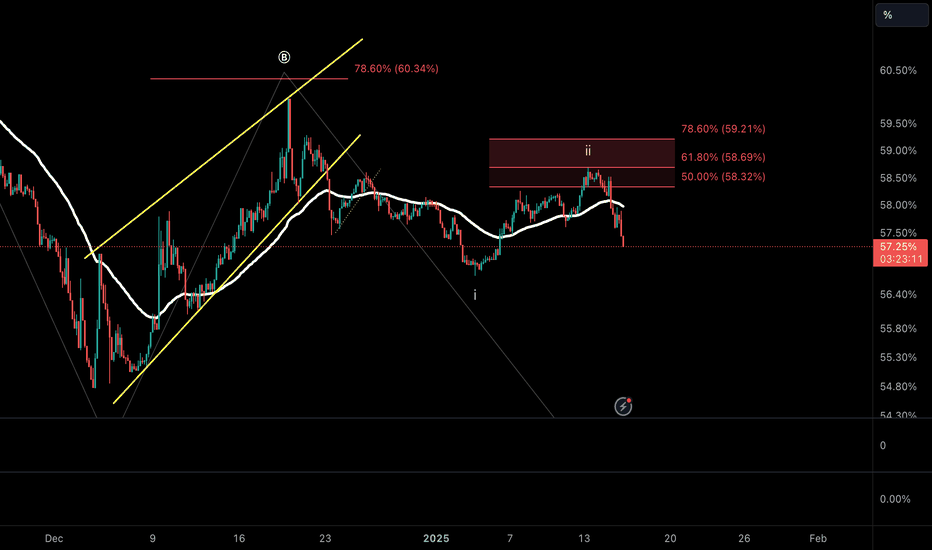

Alt season is not coming (yet)..Analyzing Fibonacci levels and trading volumes, it doesn’t look like an alt season is imminent. For now, a monthly close above resistance seems necessary, and as BINANCE:BTCUSDT rises, Bitcoin dominance will likely increase. While this might lead to some minor gains in altcoins, they’re unlikely to be substantial.

Two scenarios could unfold:

1. Short Alt Spring: Bitcoin sees a sharp rise followed by a short decline. This could bring a brief uptick for altcoins, but they would then experience a period of stagnation ("bleeding") before a full-scale alt season arrives.

2. Delayed Super Alt Season: A more robust alt season could happen directly, though with a slight delay.

Check the “golden pocket” (between the yellow Fibonacci levels) for crucial resistance and support zones.

Aside from technicals, consider the macroeconomic context: the Fed’s potential rate cuts and quantitative easing are expected to take time, meaning that a significant increase in money supply could be delayed.

Remember to do your own research (DYOR)! NFA.

BTC dominance 15 month trend has broken, Alt season startBTC dominance 15 month trend has broken, Alt season start?

With alt coins pumping and meme coin mania its a surefire sign. BTC is slowing its gains and the daily BTC dominance trend has broken. This is generally a good sign Alt season is about to start

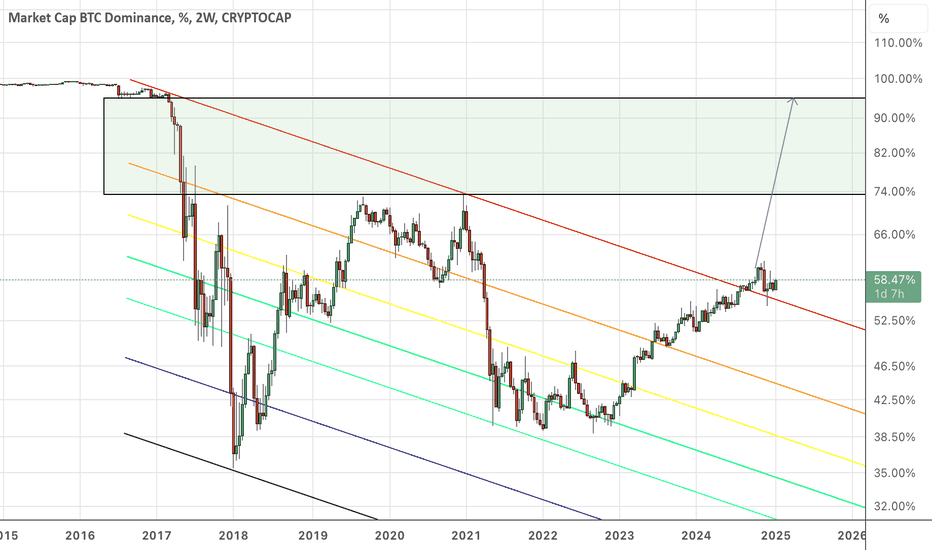

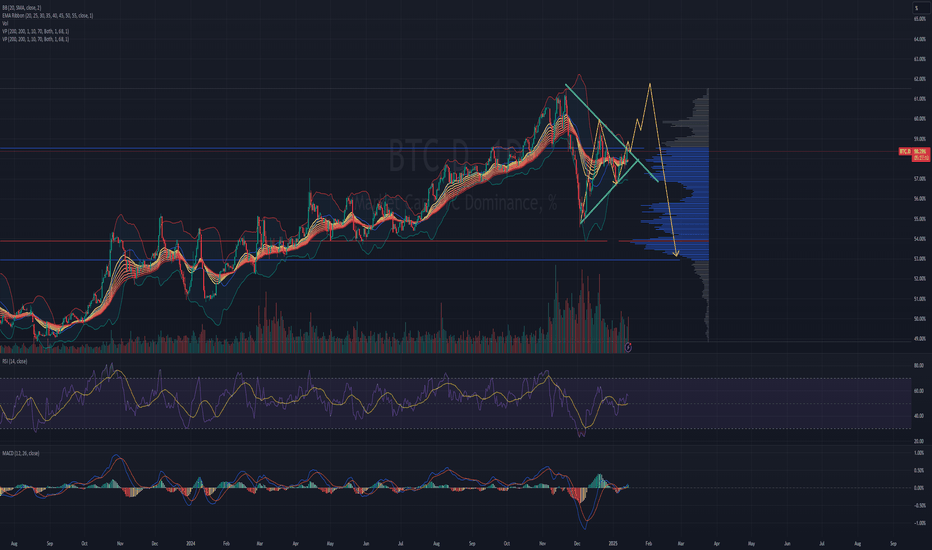

BTC Dominance logarithmic cycle105 days from the previous cycle top to low market dominance at 39%, should see BTC fall into the red zone around mid february and the end of the market.

Also a likely scenario that invalidates this, is a further purchasing in BTC to 150k following on the 3rd wave of the elliot wave pattern from it's previous low.

However in terms of both it's current dominance being lower than previous markets, and DOW, S&P and Russel 2000 being higher in fibonacci at their 4.236 from each market high to low, it's likely BTC hasn't got the strength left in it to perform, considering this is also the end of a 12 year debt cycle It's unlikely BTC has anything futher.

Additionally Pi cycle top indicators on both BTC Market cap and Price haven't triggered yet, so there is a potential it crosses soon. In which case Alt season runs adjacent with BTC price moving to 150 but Dominance slowly falls to 40% or lower over the next 2 months with no alt season continuing on BTC retracement. This essentially marks the retracement period has started, but will push for a higher price, which is similar to the 2021 market with a double top rather than 2012, or 2017 where BTC topped, and then retraced to 0.702 from a 20% correction.

#BTC Dominance is getting rejected, It's happening!!BTC Dominance has been rejected and is currently dropping on LTF and HTF.

This is good news for altcoins. It looks like the pain may be over, and now we have to wait for January 20th when Trump takes office, at least that’s my plan.

Of course, you’re free to make your own decisions. I’ve already shared a few altcoins earlier, and I’m still holding onto them, including RENDER, ENA, AAVE, XRP, ATH, MANTA, VVAIFU, and a few others.

More updates are coming soon, stay tuned!

Please support us with your likes and comments.

Thank you

#PEACE

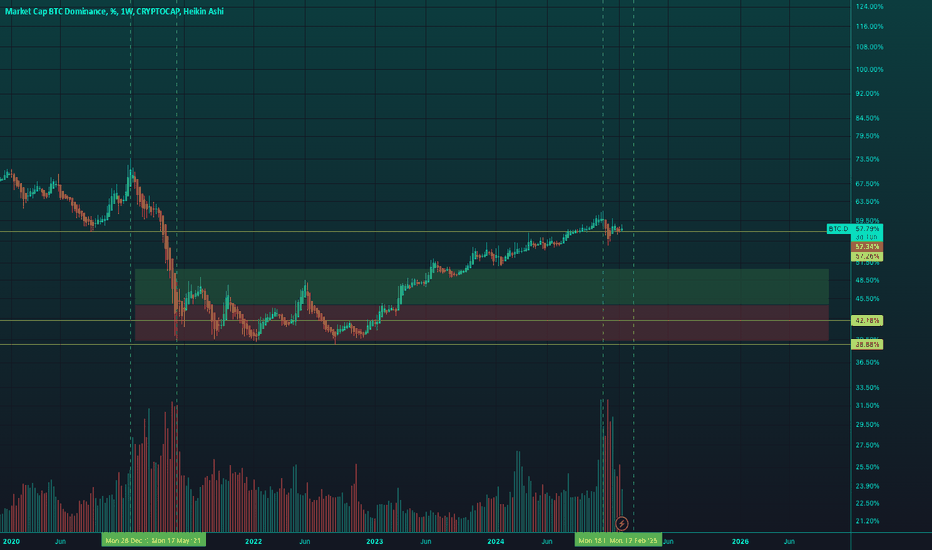

My thoughts are giving me no peace with this idea 2 I've updated my expectations regarding the altseason after reviewing the statistics. I believe the growth of altcoins will happen in two phases: first, a drop in Bitcoin dominance to 40%, followed by a recovery to 45-50%, and then a crash below 30%. I'll share any updates if I make any fixes. The scenario is invalidated if dominance rises to 65-70%

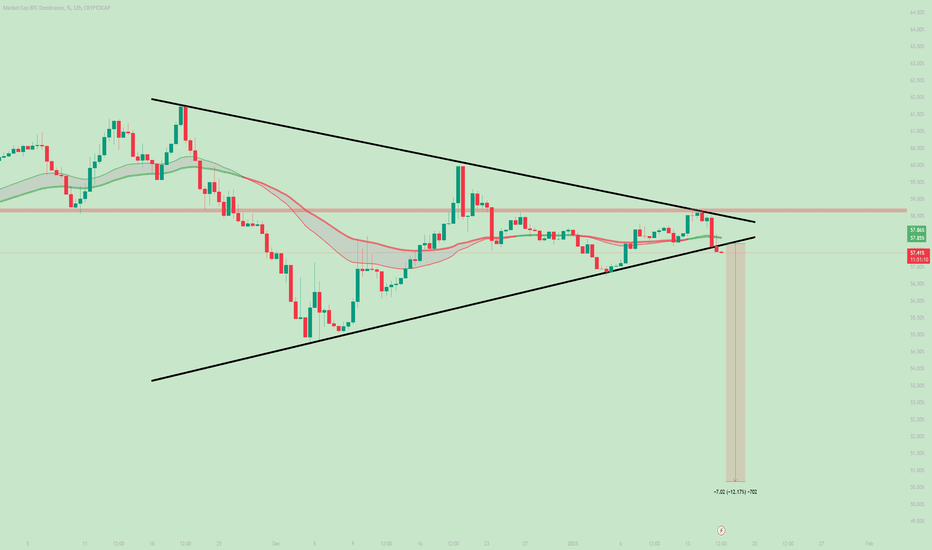

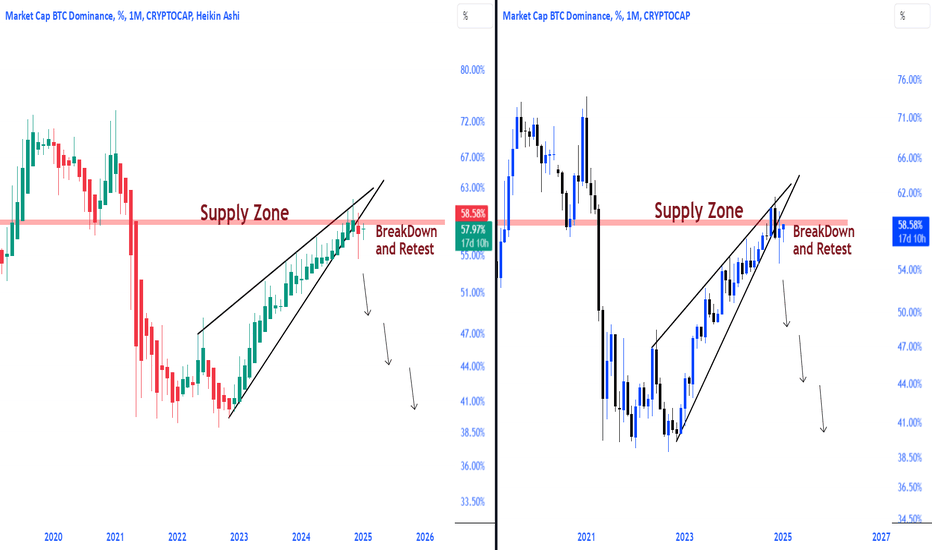

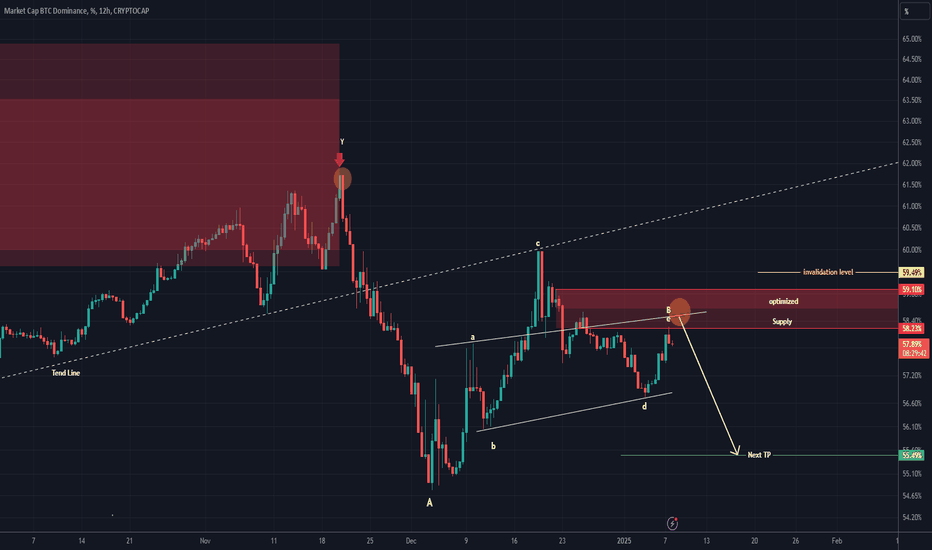

BTC Dominance UPDATE (12H)This analysis is an update of the analysis you see in the "Related publications" section

Market makers always do things to prevent retail traders from identifying the next direction. The support from the previous analysis has been engulfed, but this bounce is for order accumulation.

Based on the data available for this index, it seems we have a triangle instead of a diagonal wave B. The red zone is where candles could be rejected to the downside, and altcoins may perform better compared to Bitcoin.

A daily candle closing above the invalidation level would completely negate this outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

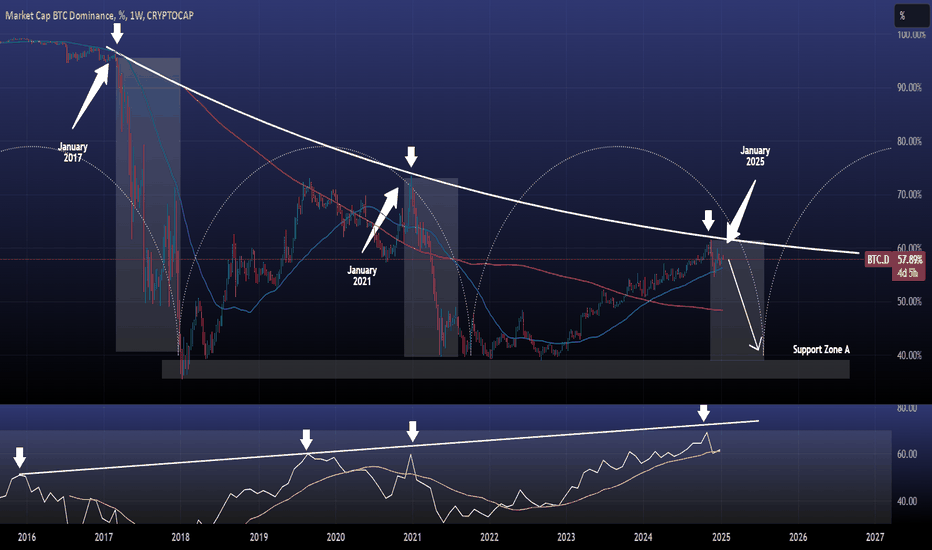

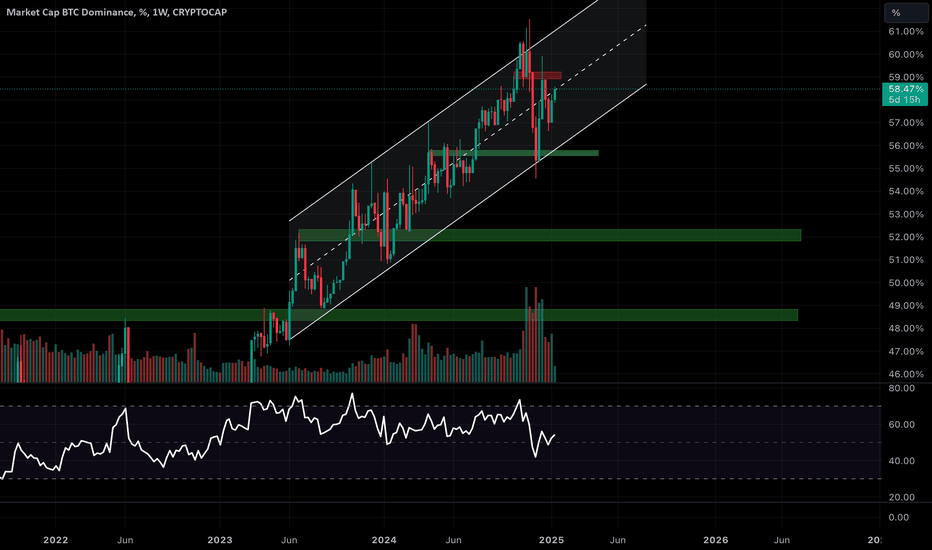

ALTSEASON There is nothing more bullish than Altcoins right now.Simple charting is always the best.

The BTC Dominance just got rejected and once it crosses under the 1week MA50, it will confirm the start of the new altseason.

This is a pattern that we see every 4 years. The previous rejection and altseason took place in January 2021 and the one before in January 2017.

On top of that, the 1W RSI is getting rejected on its 10 year Resistance trendline.

This is the last call to invest in altcoins.

Follow us, like the idea and leave a comment below!!

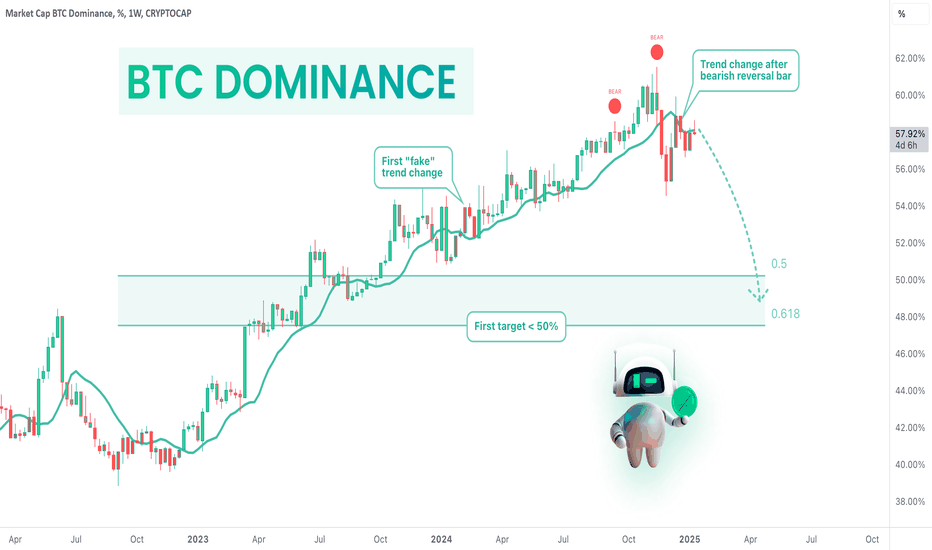

Bitcoin Dominance Is About Give a New Life To Altcoins!Hello, Skyrexians!

We have already mentioned the importance of different crypto assets dominance analysis. Today we are goin to update the main one CRYPTOCAP:BTC.D . Last month it makes us nervous with the potential intention to set the new high. Current formation looks like a triangle - trend continuation pattern and it scares many traders. Is this nightmare is going to be true, or altseason is coming?

Let's take a look at weekly time frame. Now we use the combination of our hand made indicators: Bullish/Bearish Reversal Bar Indicator and Fractal Trend Detector . Trend detector started printing the red candles, the bearish trend late in 2023, but those time this tendency shift failed. This time we have seen two red dot on other indicator and after that trend change. In our opinion this is much stronger confirmation that altseason is really coming.

You probably already know that predicted earlier the dominance drop to 27%, but today we are talking about short term forecast, 0.61 Fibonacci level below 50% is the target for February.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

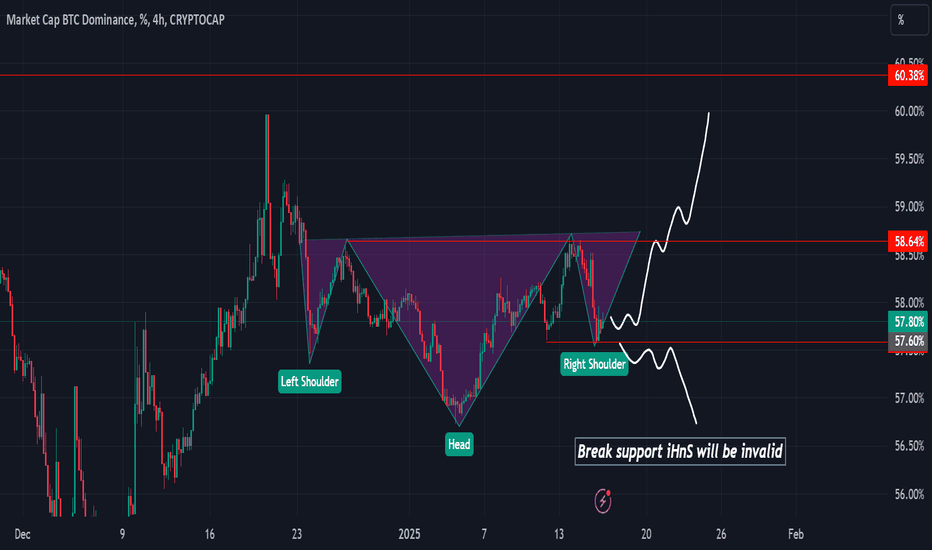

another IHS on BTC.D? Chop chop more?We have successfully completed an IHS on a lower time frame (see my other chart)

Now we seem to have the beginnings of what could be another IHS on a higher time-frame?

Another scary pump of Bitcoin dominance incoming?

Interesting, let's see

(the chart is inverted)

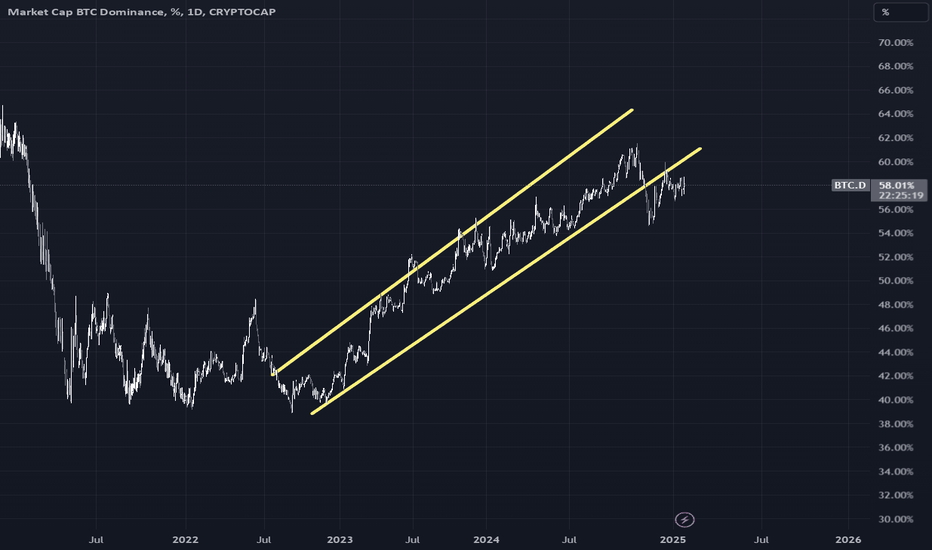

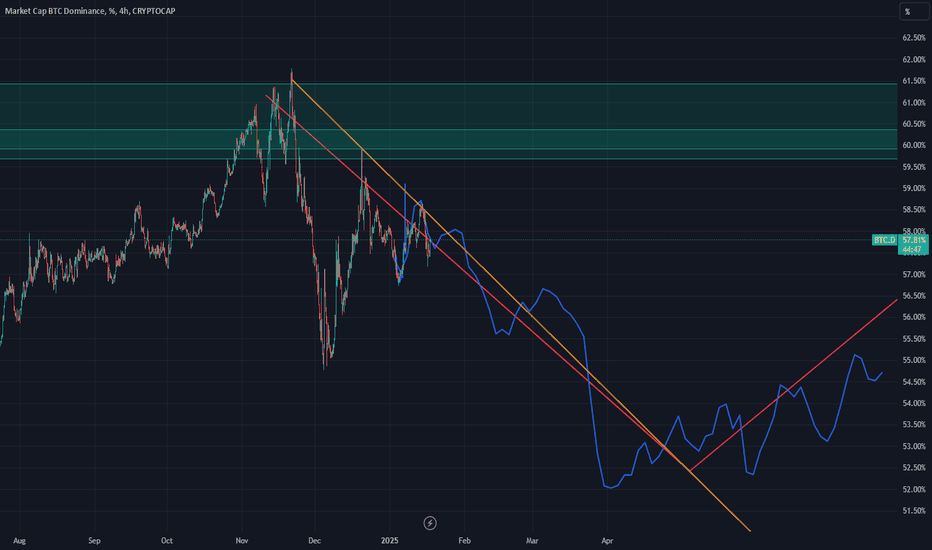

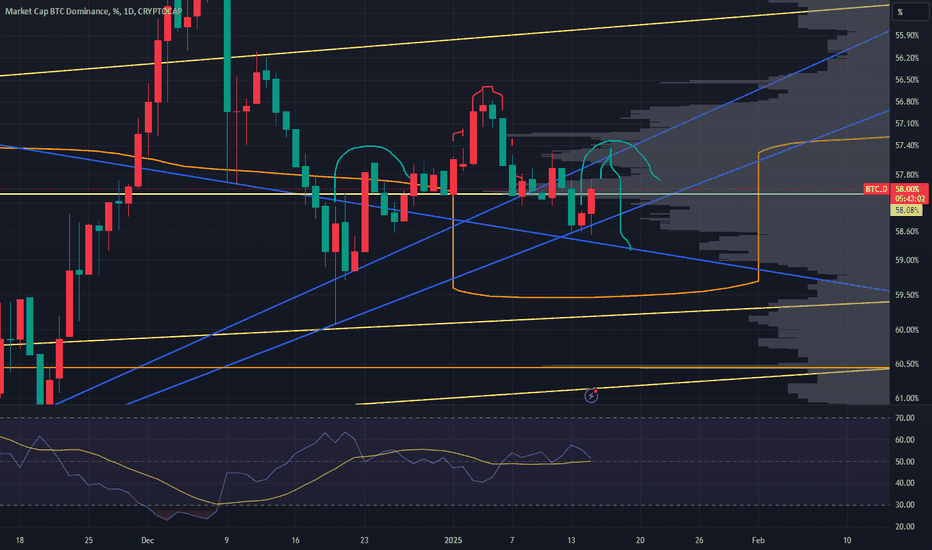

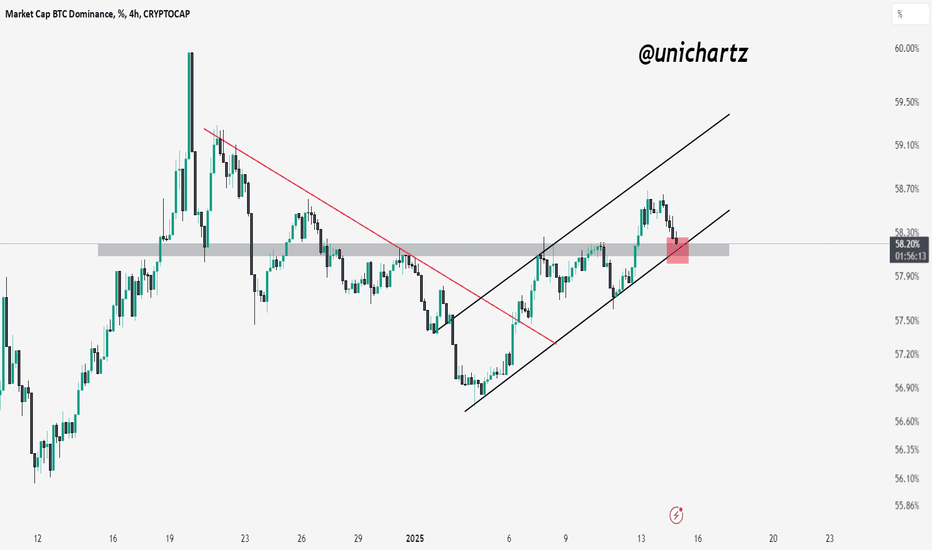

BTC.D Testing Confluence Zone: Will It Break Below?BTC dominance (BTC.D) is currently trading at a critical confluence zone, where the support of a rising channel intersects with a horizontal support level.

Many investors are closely watching this area for clarity on the next directional move. If the marked red zone (area of confluence) is broken, we could witness another leg of altseason as BTC.D trends lower.

btc dominance$CRYPTOCAP: BTC.D

Today, I will talk about BTC dominance. I think BTC dominance will pump hard, making BTC bullish or strong. I can see BTC dominance can go to the 61-62 level again, making BTC perform better than adults. When BTC dominance reaches the 61.5 level, I will sell my BTC position because BTC dominance will dump from the 61.5 level. That's why I will buy alts coins when BTC dominance is bearish.

Right now I am holding btc

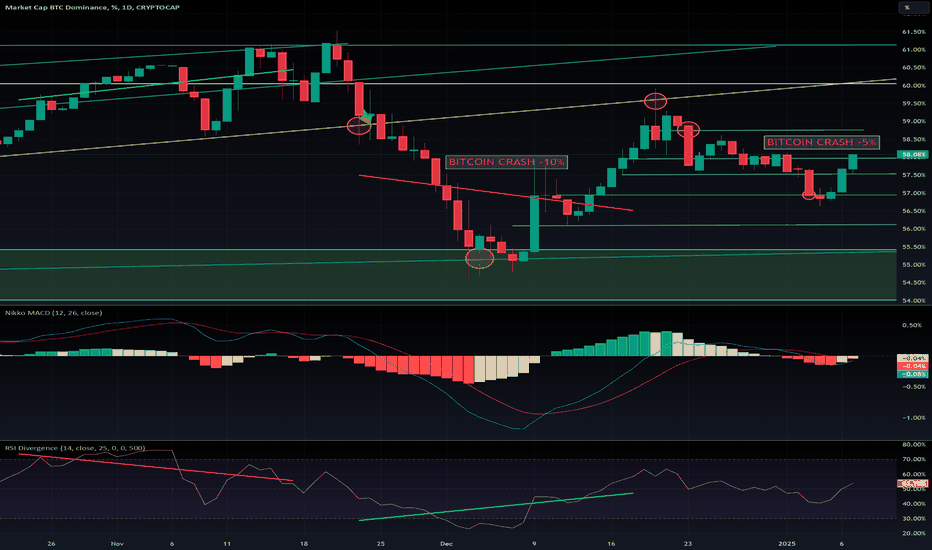

$BTC.D: this is how they are cancelling any attempt at altseaonsSomeone is canceling the altseasons.

Every time the altcoin market starts to gain momentum, a sudden CRYPTOCAP:BTC correction halts its progress.

Altcoins are inherently riskier assets, and when fear enters the market, investors sell alts first.

Now that ETF providers hold significant amounts of CRYPTOCAP:BTC and CRYPTOCAP:ETH , they appear to be manipulating the market to maximize their Bitcoin profits. By triggering strategic crashes in CRYPTOCAP:BTC and CRYPTOCAP:ETH , they effectively prevent an altseason from taking off. Each crash leads to massive corrections in altcoins.

Today’s events are a smoking gun. The correlation with CRYPTOCAP:BTC allows ETF providers to instill fear and drive altcoin holders to sell, favoring Bitcoin.

Yesterday, all altcoins looked poised for a breakout. The MACD signaled a daily crossover, indicating sustained growth for the next two months. I even posted that CRYPTOCAP:ETH was likely to hit $3800 within a week—*unless* CRYPTOCAP:BTC crashed.

Guess what happened? CRYPTOCAP:ETH dropped 10% today—entirely due to manipulation.

There’s absolutely no reason for CRYPTOCAP:ETH to decline, except for psychological manipulation tied to its correlation with $BTC.

If altcoin holders don’t realize they’re being played by Bitcoin’s puppet masters, altcoins will continue to lose their appeal.

Investors hate losing money, right? ETF providers aim to redirect the crypto market’s wealth into their “new baby”—Bitcoin.

The result?

- BTC.D’s drop was reversed, driven by fear, as more altcoin investors panic-sell.

- USD.D increased as liquidated investors exited the market.

Where will that money go? Some will inevitably flow back into CRYPTOCAP:BTC because:

- Bitcoin has limited downside.

- Bitcoin is strong.

- Bitcoin is proven technology.

- Bitcoin isn’t a scam.

- Bitcoin is the most recognized and trusted crypto asset.

This marketing strategy is working. It’s been more than four years since we’ve seen a proper altseason.