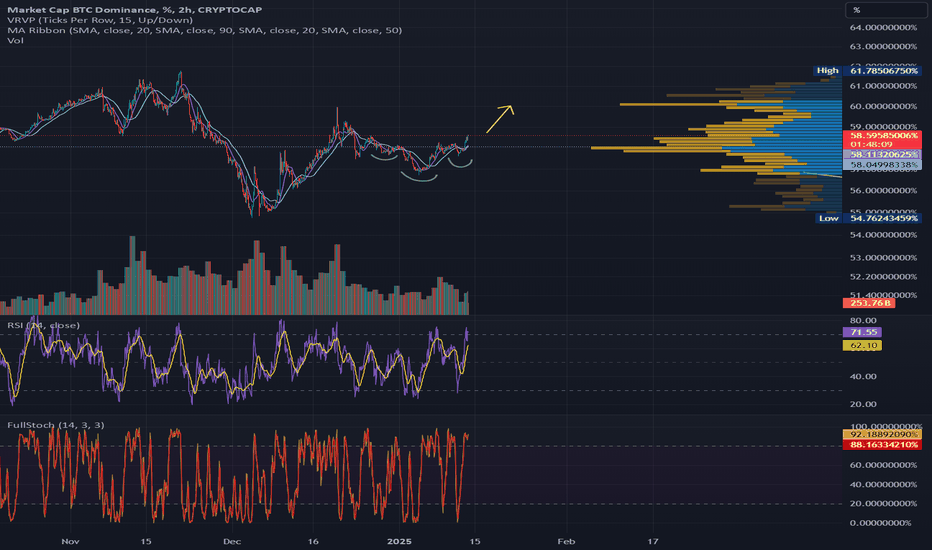

BTC - Dominance Rise puts ALT Season on IceThe CRYPTOCAP:BTC.D index has developed an Inverse Head & Shoulder pattern on the 2H timeframe, which points to further trouble ahead until we get some certainty and clarity with how the new administration decides to move.

The recent shakedown on ALTs has been driven by higher than expected inflation and repricing of FED reserve rate cut expectations, with no rate cut expected in the next FOMC. Wednesday is a key macro day as the CPI, a key gauge of inflation is due to be released. This data ultimately shapes policy and a hot print could spell more trouble for risk assets.

Having said that, we're only a week a way from the most crypto friendly White House administration taking office.

Will the crypto friendly policies turn the page to enable Risk Assets to surge higher despite inflation woes?

BTC.D trade ideas

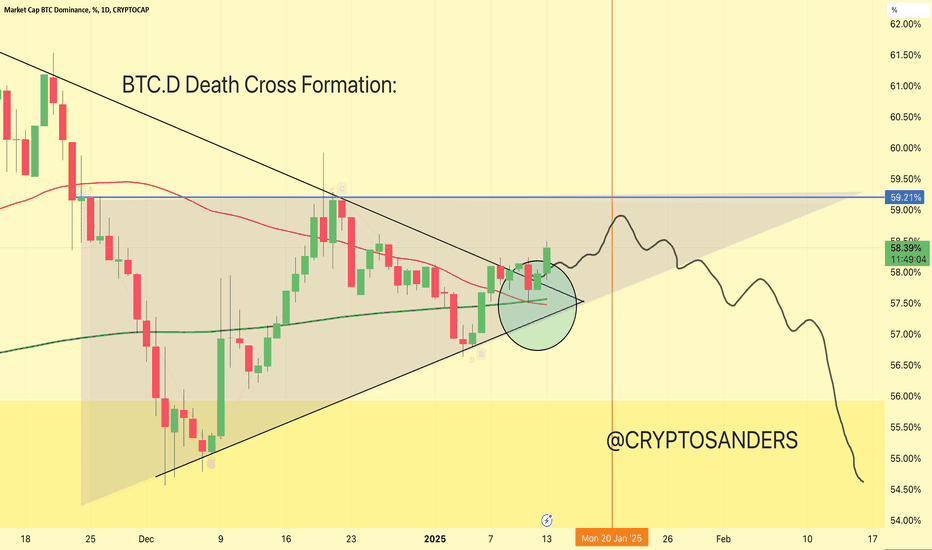

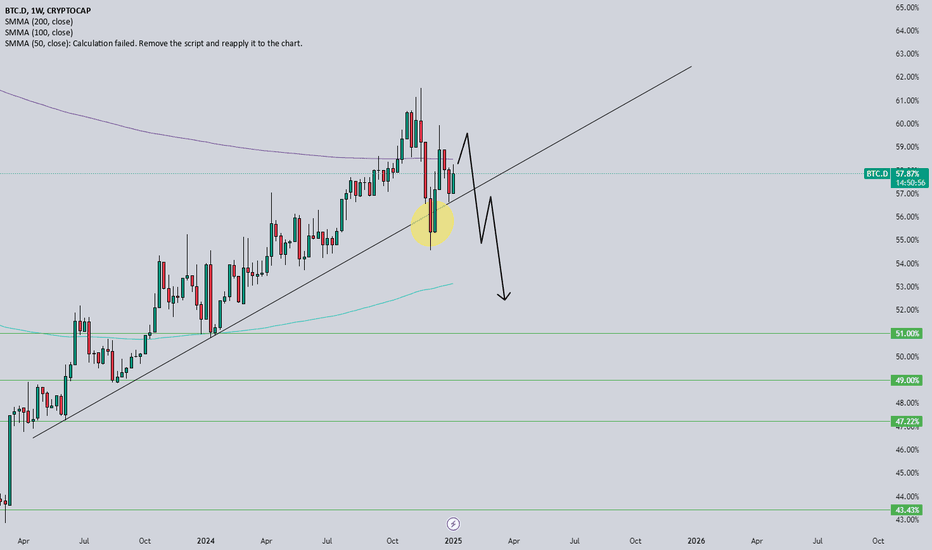

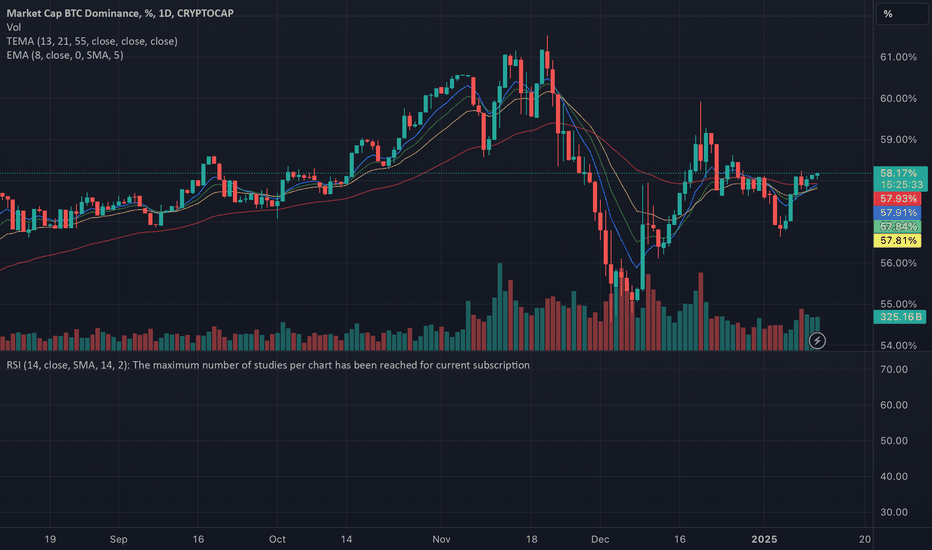

BTC.D Death Cross Formation:

The “death cross” occurs when the short-term moving average (50-day MA) crosses below the long-term moving average (200-day MA).

This is considered a bearish signal, often indicating a potential decline in the market.

In your chart, the highlighted circle represents this potential crossover or the situation after it.

The narrow trendline indicates a symmetrical triangle or wedge formation, where the price consolidates before the breakout.

The breakout direction appears to be initially upward, breaking above resistance but eventually moving downward.

The blue horizontal line at around 59.21% dominance is a key resistance area.

Bitcoin dominance has broken above the triangle for some time but may struggle to remain above resistance.

After initial upward movement, the chart suggests a downward trajectory, possibly retesting lower dominance levels (towards the 55.50% and 54% areas).

This implies a potential altcoin resurgence or broader market uncertainty if BTC.D declines.

The red and green moving averages are important in defining the current trend.

A bearish cross between these moving averages aligns with the death cross narrative and signals caution.

Let me know if you’d like further assistance or adjustments!

DYOR. NFA

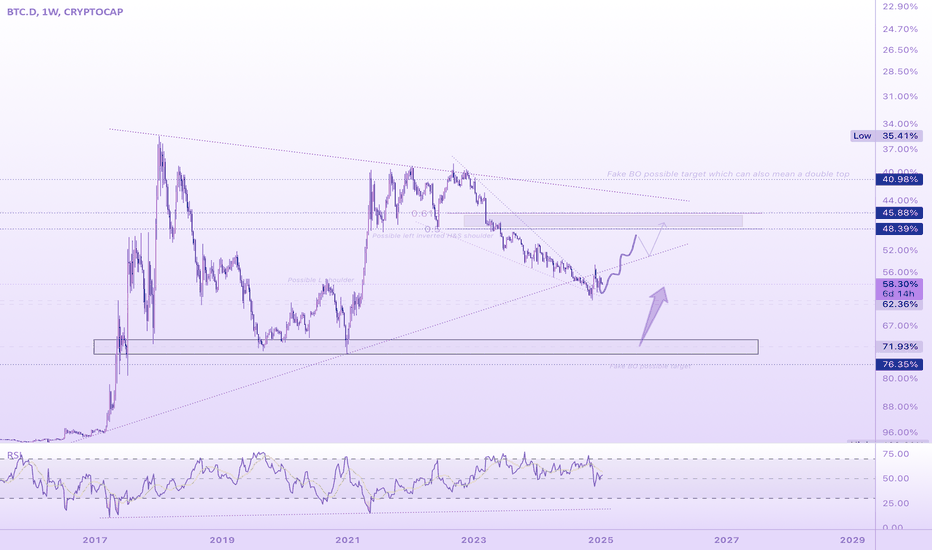

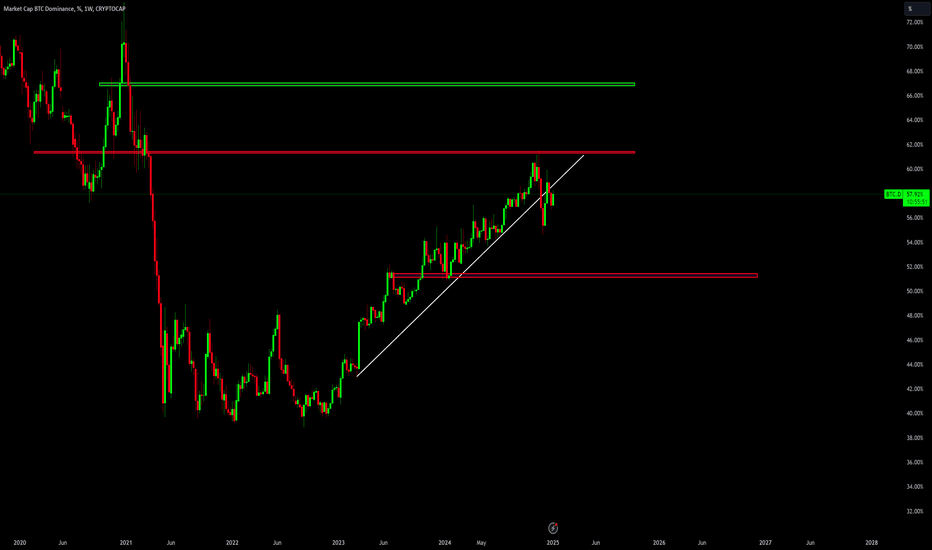

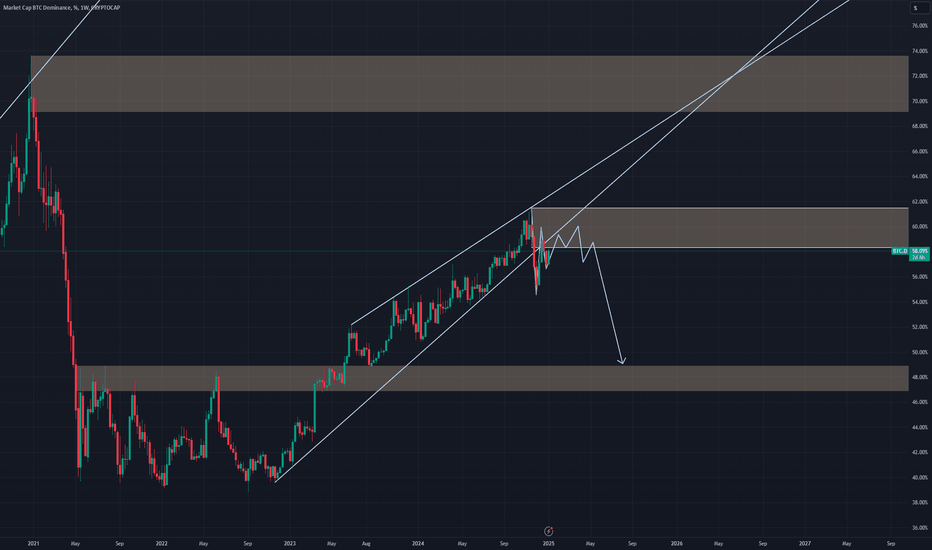

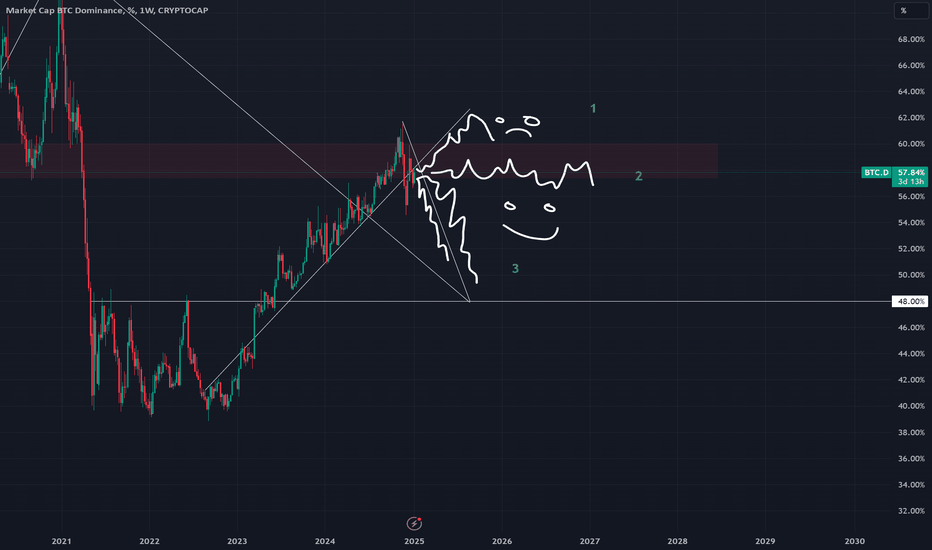

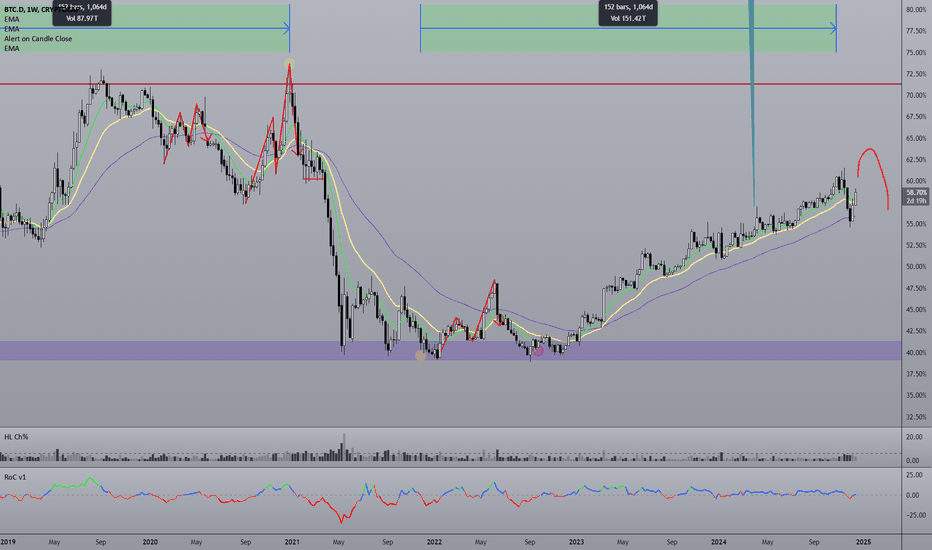

BTC.D; LONG TERM ANALYSIS (read the description)First of all sorry that my chart is not looking too messy and there are no weird indicators nor anything.

We have only two possible scenarios for bitcoin’s dominance.

1) The bearish pattern you can clearly see is broken after 2 years so two things might happen here: 1-1: BTC.D can have 60% touched in the coming days as a pullback to the broken resistance but what happens afterwards will be important.

1-1: if the pullback is confirmed ethereum will finally shine along with many altcoins.

the target for the dominance will be 45-48%.

What can happen afterwards: the price will keep moving in the pattern until a real breakout happens which will likely result in new lows for the dominance.

2) If the pullback is ruined and we see the support lost it will mean the pattern had a fake breakout & that would mean this current pattern is not a reversal one:

2-1: we can see new highs for the dominance if this is confirmed,

The target will be 70-72%. If bitcoin price falls too the market will bleed.🩸

But what can happen afterwards, two scenarios again:

1) Since the price will touch the top of the long-term trading range we can see the dominance moving towards the bottom again.

2) A double bottom will be confirmed, depending on the situation then, if dominance fails to break the shoulder at around 57% we can see even new highs but the chance of this happening is below 10% lol unless ethereum is destroyed lol.

So that’s all. I recommend yall to wait if you want to buy anything. And note that btc.d can go up and the price can still fall so beware and dyor.

Thanks for reading this.

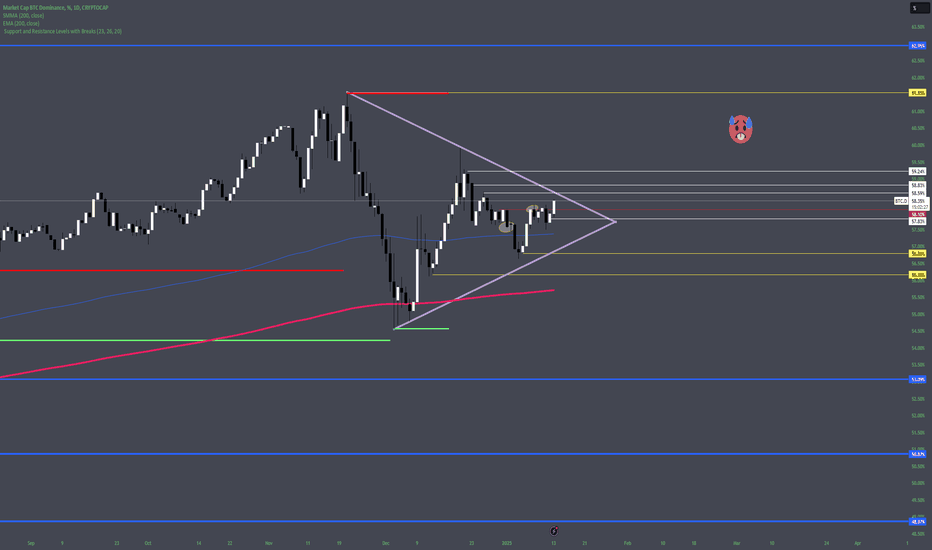

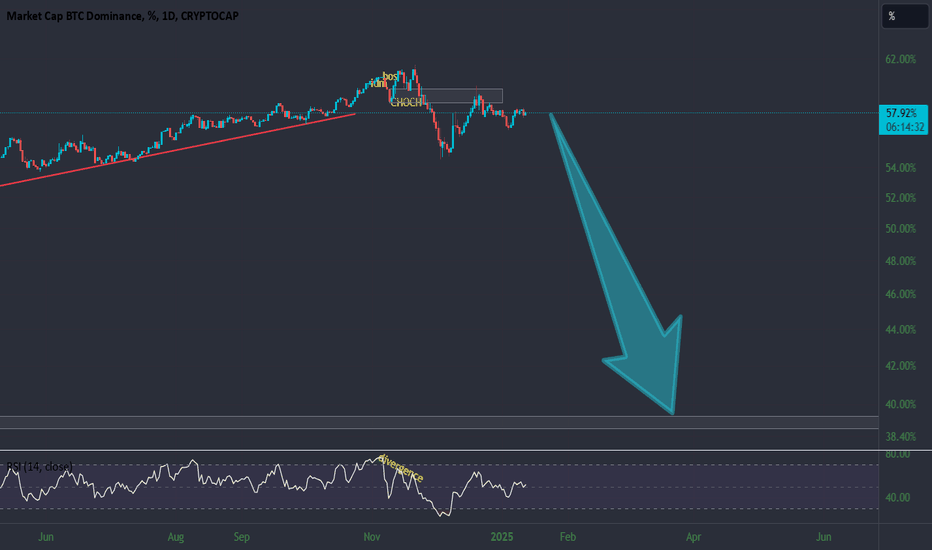

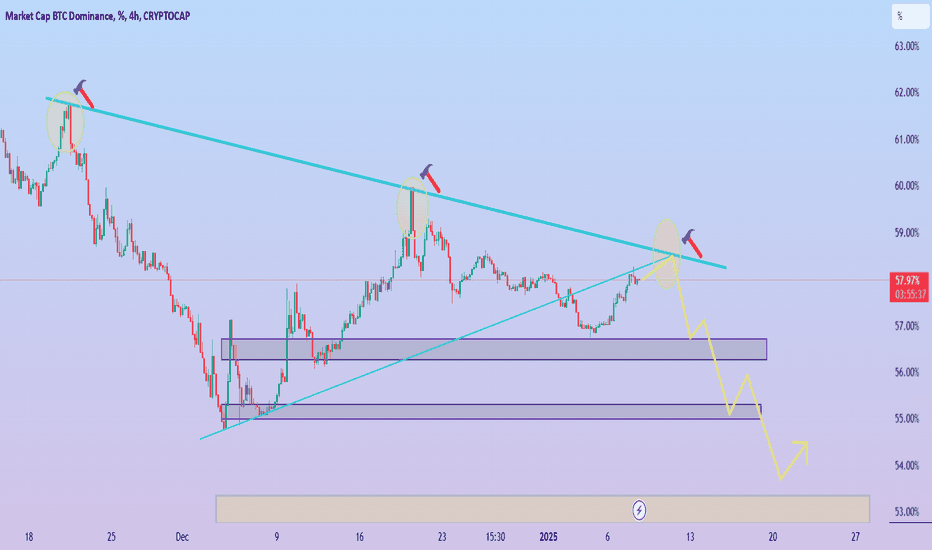

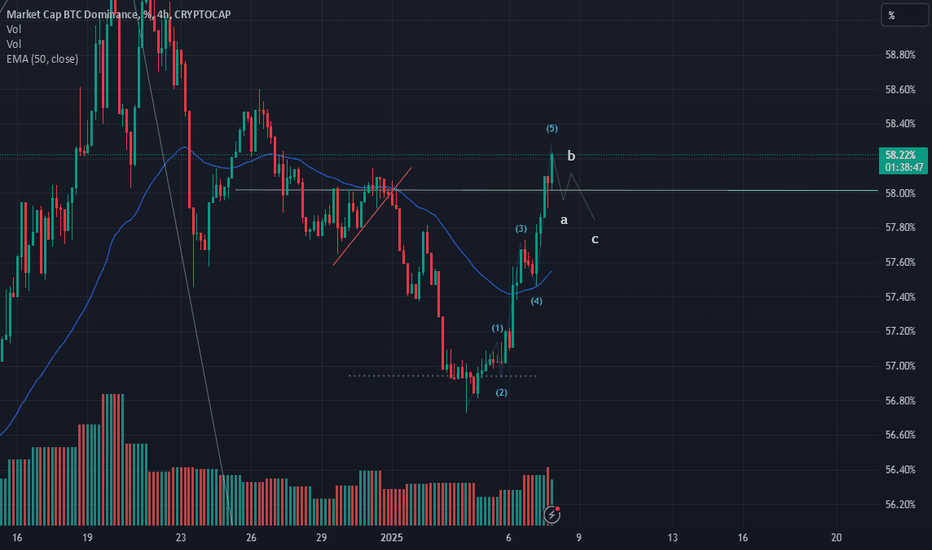

BTC.D Bitcoin Dominance Setting Up For A Sell Off!What's up cat DegenJake here, Welcome all to a new trading week were going to start zeroing in on crypto as things are really starting to heat up in the crypto scene. With much anticipation we wait for a bullish Run, but for now we definitely see bears in control of BTC.

Here on BTC.D we definitely see it wanting to go upwards and take out some white horizontal lines of 4hr liquidity zones. & in another case scenario even be able to take liquidity

on the daily Yellow horizontal line.

Theres no denying that this chart has so much more liquidity to grab to the downside than it does to the upside anymore, But the market markers seem to be loving to shake out the retail investors and newcomers to crypto that aren't adapted to such rad volatility.

Personally i see these opportunities as further buy entries for ALT's and BTC.

Based off this chart we can see ALT's correcting about 16% in the incoming days then pumping to VALLHALLA.

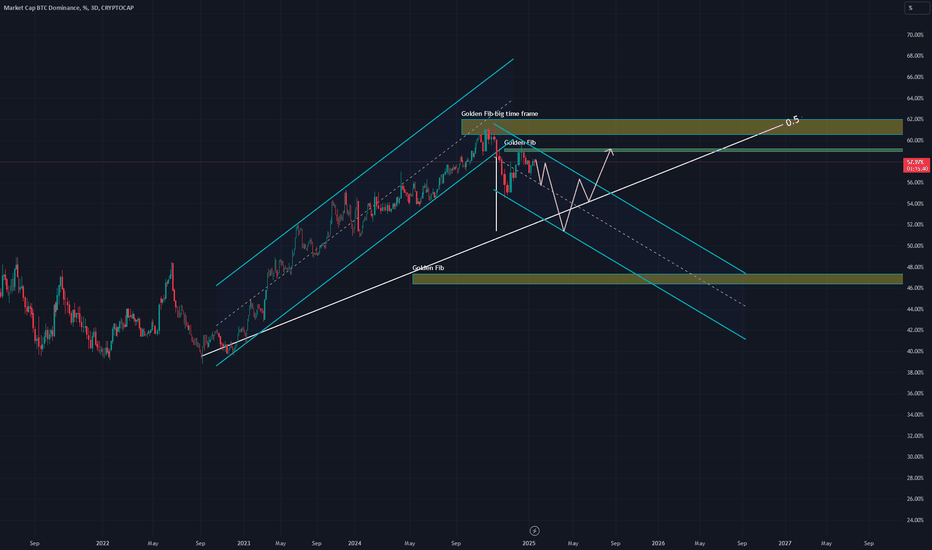

Bitcoin dominance (decreasing = Altcoin season)We are currently in an uptrend for Bitcoin, targeting approximately 250k.

For altcoins to grow in dominance, Bitcoin's dominance needs to decrease.

The price of altcoins is mostly related to Bitcoin. When Bitcoin decreases, altcoins tend to follow. However, when Bitcoin consolidates or slightly increases, altcoins often experience massive upward movements.

The best-case scenario for altcoin dominance would be a golden Fibonacci level around 45%, or alternatively, a bounce at the Gann Fan 0.5 level.

BITCOIN DOMINANCE ANALYSISBitcoin (BTC) dominance is a metric used to measure the relative market share or dominance of Bitcoin in the overall cryptocurrency market. It represents the percentage of Bitcoin's total market capitalization compared to the total market capitalization of all cryptocurrencies combined. Since Bitcoin was the first asset, it has remained the largest by market cap, which is why its dominance in the market is a number that many people follow. We describe the assets tracked in this chart as crypto assets because it includes tokens and stable coins, not just cryptocurrencies.

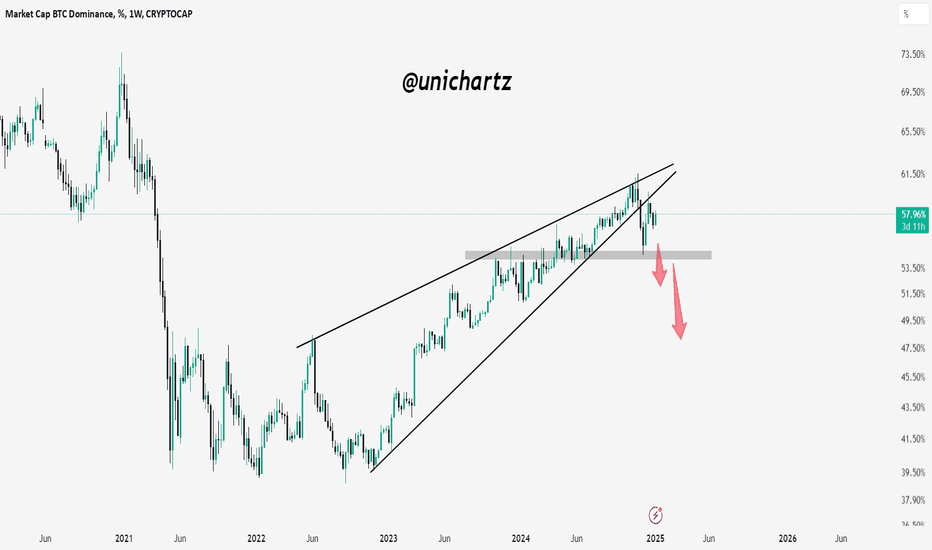

Get ready for ALT-SEASON!We got confirmation on breaking uptrend channel downwards in last few weeks and we all know what that means. More CRYPTOCAP:BTC.D goes down better for alt-coins. 47-51% is the range I am looking for. There are few alt-coins haven't made major moves in last year, I will post about it soon. Keep posted!

BTC.D READY FOR RALLY Bitcoin dominance has broken the rising wedge pattern to the downside, creating a large block order zone during the breakout.

Following this, it has retested both the created block order zone and the broken rising wedge.

The next expected move is to enter a distribution phase from this point and decline further towards the 48% level.

Similar movements to the previous rally are being observed. BTC has broken the descending wedge, retested it, and we expect a downward move after the distribution phase.🚀🚀🚀🚀

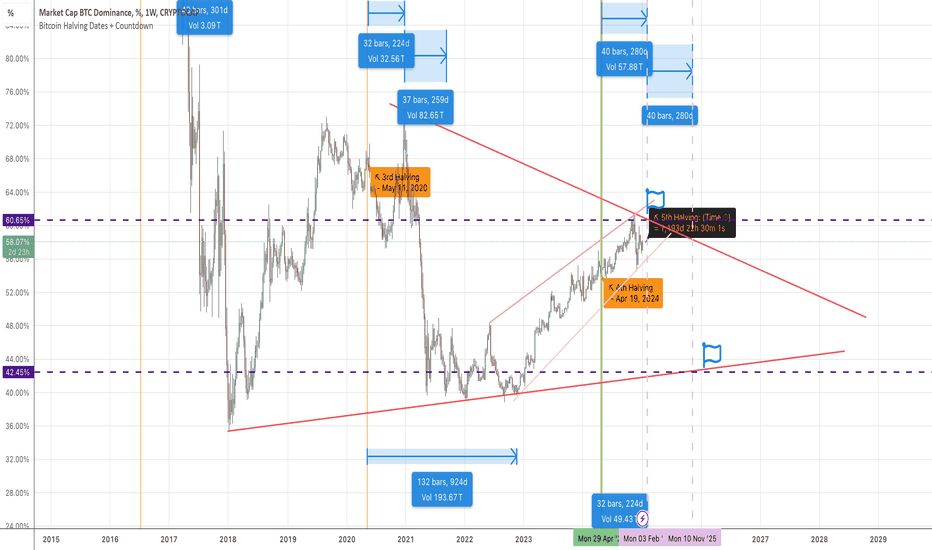

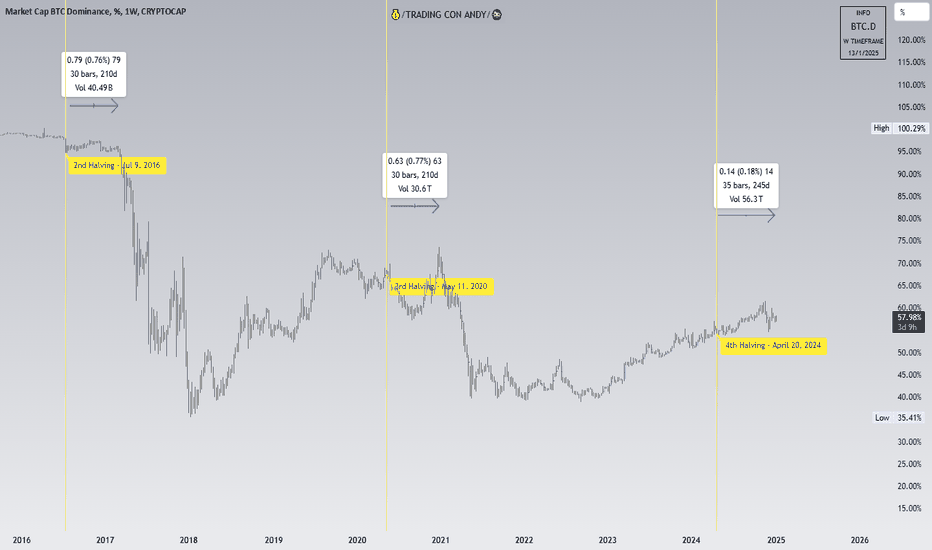

BTCD breaking downLooking at past halving events and how btc dominance moved, we either already have seen the btcd top or it will happen by end of January. Then if we follow the same patterns from the past, it will take a 4 to 6 month altseason.

The narrative that the altseason won't be like previous half seasons seems like BS. In the previous bull season the btcd bottom was at 40% and this time around it looks like it will bottom around 42% (maybe even lower due to FOMO).

So buckle your belts and hold on to your seats ladies and gents.

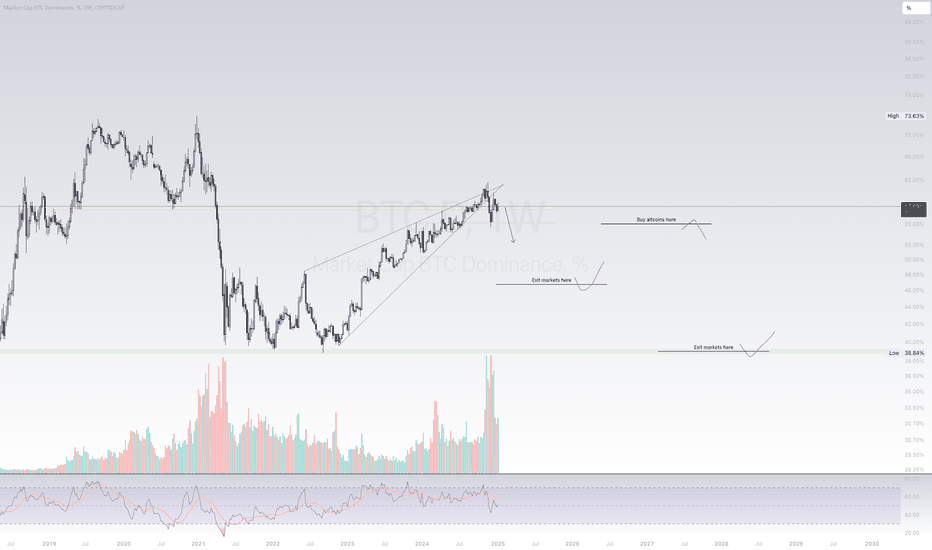

BTC Dominance Chart as an indicator(My first shot at really zooming out like this. Let me know what you think)

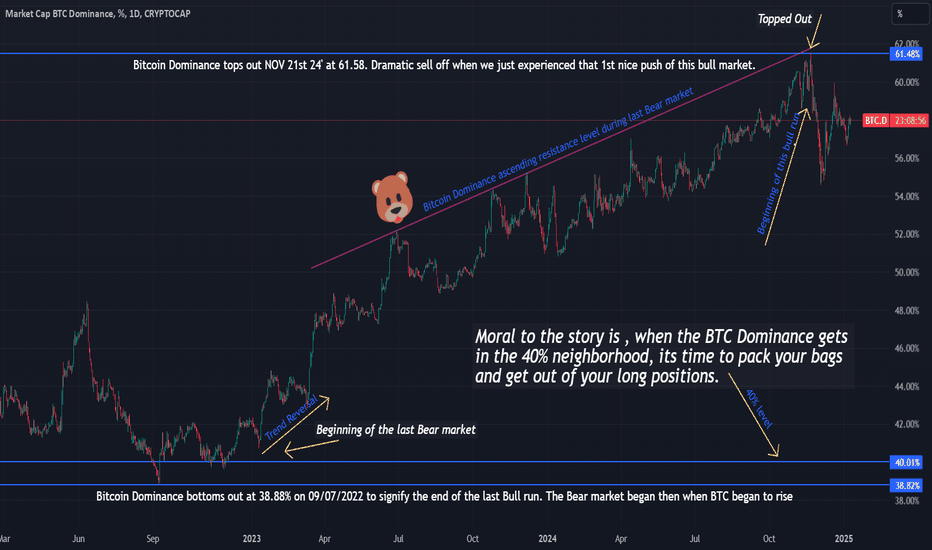

This is a BTC Dominance chart going all the way back to the end of the last Bull market cycle and then through the bear market to present day. This chart basically shows you how much of the entire crypto market is BTC. When the BTC dominance is on the rise, this suppresses the price of the other coins, but when the dominance drops its very bullish for the stables, alts, memes as well.

The last bull run at the peak, the BTC dominance bottomed out at 38%

Any constructive criticisms, funny comments, advise, adjustments, tweaks, whatever let me know what ya think.

BTC Dominance: Volume Insight!As on the chart: I believe the volume suggests the big alt season will come soon, and that BTC dominance is correcting. And that, given the current scale of the move, the alt season will be less impressive than both of those before. Each alt season has effectively been less impressive than the last, with last cycle's alt season not even able to break the lows of the previous alt season dominance-wise!

The two sets of lines indicate a first corrective phase on dominance, consolidation where volume drops off, and then the really big dominance correction where once again rises. The pattern is very clear and visible to all!

This 'in a few months' view aligns with my EW analysis and time-cycle analysis, which is why volume as another confirming factor gives me additional confidence.

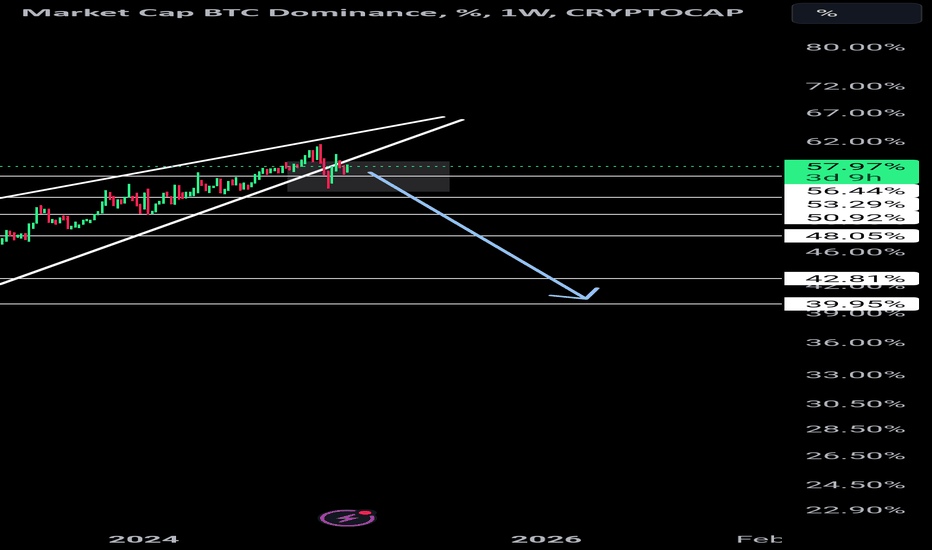

BTC.D Breakdown the Next Altcoin Bull Run Closer Than You Think?Bitcoin dominance (BTC.D) is a crucial metric that reflects Bitcoin's market share relative to the overall cryptocurrency market. A rising dominance often signifies Bitcoin outperforming altcoins, while a declining dominance suggests increased strength in altcoins or a broader altcoin rally. The current chart provides critical insights into the state of Bitcoin dominance, the potential implications for market dynamics, and the timeline for future movements.

Key Observations and Technical Insights

1. Breaking the Rising Wedge Pattern

The weekly chart shows a classic rising wedge pattern that Bitcoin dominance has adhered to for an extended period. A breakdown from this pattern is a bearish signal, indicating a potential shift in dominance from Bitcoin to altcoins.

The wedge breakdown was accompanied by significant bearish momentum, validated by a retest of the breakdown level.

This technical development is a strong indication that BTC.D has entered a new phase of its trend.

2. Current Consolidation Zone

Following the breakdown, BTC dominance has entered a consolidation phase within the highlighted rectangular box (approximately between 53.2% and 58%).

The consolidation suggests market indecision as Bitcoin retains relative strength but altcoin activity starts to increase.

Volume levels during this phase are moderate, reflecting a lack of aggressive participation, which is typical before a major directional move.

3.Key Levels to Watch

Resistance: The upper boundary of the box (58%) aligns with prior rejection levels. A move above this could indicate a temporary resurgence of Bitcoin dominance, potentially due to increased Bitcoin-led market rallies.

Support: The lower boundary of the box (53.2%) is a critical support zone. A sustained break below this level could confirm the next bearish leg.

4. Indicators Supporting the Bearish Bias

Ichimoku Cloud: The dominance has started interacting with the cloud's lower boundary, which acts as dynamic resistance. A clean break below the cloud would further confirm bearish momentum.

MACD Divergence: The MACD histogram is tilting bearish, signaling weakening upward momentum. A bearish crossover on the MACD line would solidify downside expectations.

RSI: The RSI is trending near the midline, showing no extreme conditions. This gives room for further downside before entering oversold territory.

Market Implications and Projections

1. Impact of a Breakdown Below the Box

If BTC dominance decisively breaks below the 53.2% level, it will likely lead to a significant shift in market dynamics.

A drop toward the marked lower levels (approximately 48%, 42.8%, and 39.9%) would indicate the onset of an altcoin season, characterized by robust performance in altcoins.

Historically, such breakdowns in BTC.D have coincided with increased speculation and capital rotation into altcoins, signaling the start of a bull run across the cryptocurrency market.

2. Bull Run Timeline

The estimated timeline for this critical move is Q1 2025, which aligns with broader market cycles and macroeconomic expectations. Institutional interest in crypto, combined with improved market sentiment, could amplify this trend.

3. Potential Scenarios

Bullish Case for BTC.D: A reversal above 58% would require significant Bitcoin-led rallies, possibly fueled by macroeconomic uncertainty or a Bitcoin ETF approval. This scenario delays the altcoin season but strengthens Bitcoin as the primary investment vehicle.

Bearish Case for BTC.D: A sustained decline below 53.2% would confirm altcoin strength and could trigger rapid capital rotation into alternative assets, particularly in high-liquidity altcoins and DeFi protocols.

This chart provides a professional-grade analysis of Bitcoin dominance and its potential impact on market dynamics. The breakdown from the rising wedge, the ongoing consolidation, and the bearish indicators suggest that BTC.D is on the brink of a major directional move. Traders and investors should closely monitor the consolidation box boundaries and prepare for a shift in market structure as BTC dominance declines.

The Q1 2025 timeline for the next leg down aligns with historical patterns and macroeconomic projections. A break below 53.2% will likely usher in a new phase of the crypto market, driven by altcoin strength and increased retail participation. Stay vigilant, as this period could mark the beginning of the next crypto bull run.

Bitcoin Dominance Macro Vision#BTCDominance We have gone 245 days without any major drops, the first time it has taken so long to fall, it has been more than 35 days apart. However, after 210 days the dominance value dropped and it was a mini altseason, but nothing compared to the previous ones for the moment. An exit or sale of everything is projected with dominance at 45%. CRYPTOCAP:BTC.D

BTC.D1 . Increase in Bitcoin Dominance: This could happen if Bitcoin outperforms other cryptocurrencies, especially in times of market uncertainty, making it the preferred asset for investors.

2 . Stable Dominance: Bitcoin dominance might stabilize as the market matures, with Bitcoin maintaining a significant but steady share as other cryptocurrencies grow in value and adoption.

3 . Decline in Bitcoin Dominance: If altcoins continue to gain traction, particularly with technological innovations and use case developments, Bitcoin's dominance could decrease as more investors diversify into other digital assets.

BTC.D DOWNSell off pushing alts into support/lower area of their ranges, potential for more down, accumulation is picking up.

DOM has hit a wall, wicking away on the 4hr from the daily 50% signaling new capital rotation.

DT inauguration soon, sell off, sideways before pump?

Labor market data under Biden admin looks fake. Crypto likely to see the effects and rally soon as fed does fed things continuing QE without labeling it QE.

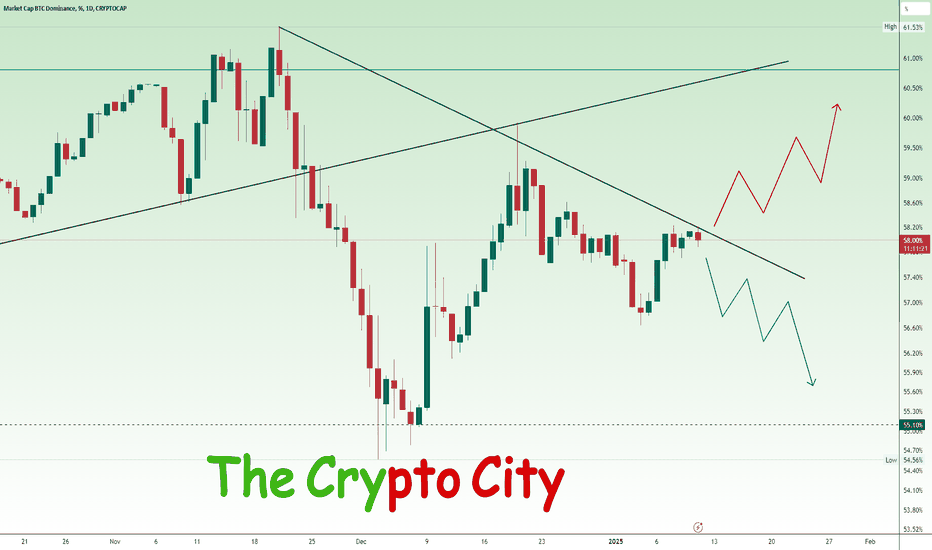

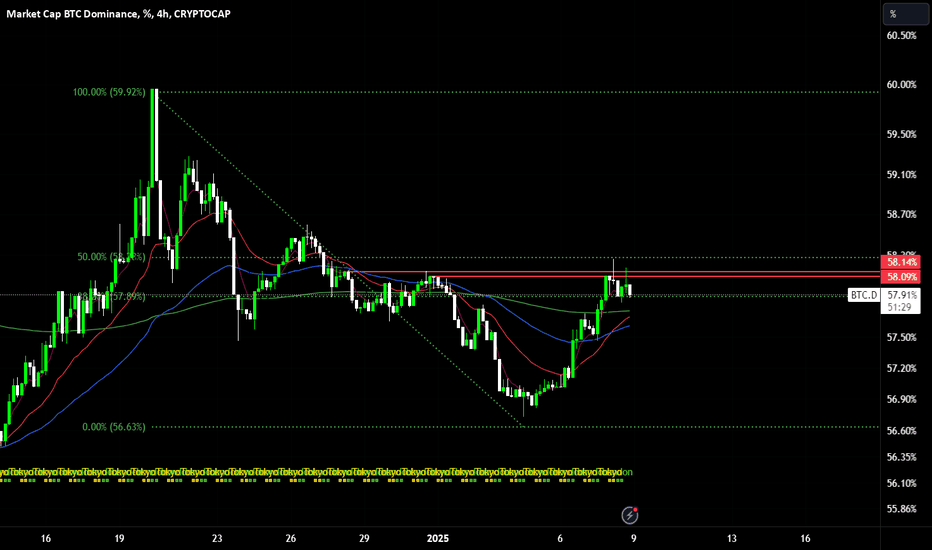

BTC.D: Critical Triangle Breakdown | Alt Season Signal?Current: 57.98% |

Pattern: Large descending triangle since November peak

Technical Analysis:

1. Macro Structure

- Multi-month descending trendline resistance

- Double rejection at 60% level

- Key support at 56% zone

- Volume profile decreasing in consolidation

2. Key Levels

- Major resistance: 60%

- Current resistance: 58%

- Critical support: 56%

- Target zone: 52-54%

3. Signals

- Triple rejection at descending line

- Volume decreasing in triangle

- Weak bounces from support

- Bearish RSI divergence forming

Trading Scenario:

- Targets:

T1: 56% (initial support)

T2: 55% (measured move)

T3: 54% (max target)

Market Implications:

- BTC.D drop typically signals alt season

- Monitor top 10 alts for rotation

- ETF approval could affect dominance

DYOR - Not financial advice. High-risk market period with ETF decisions approaching. Size positions accordingly.