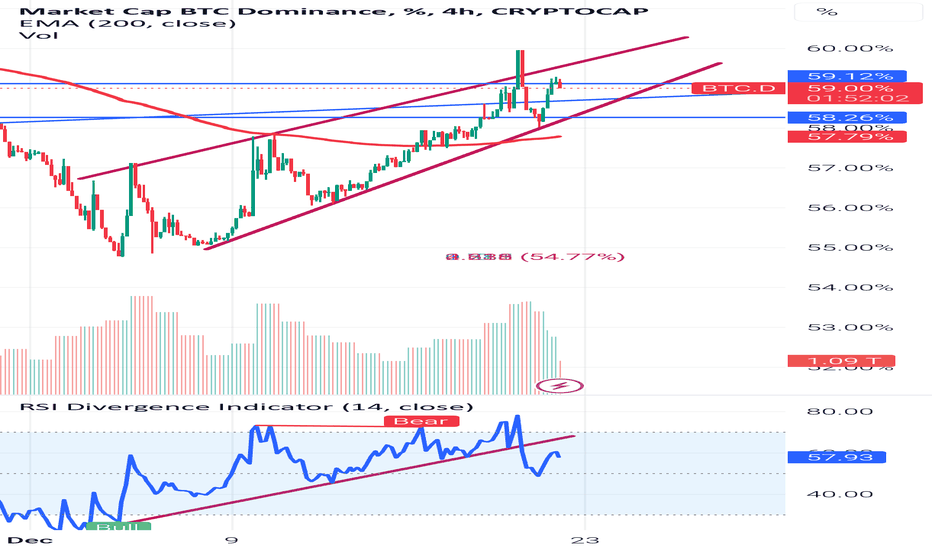

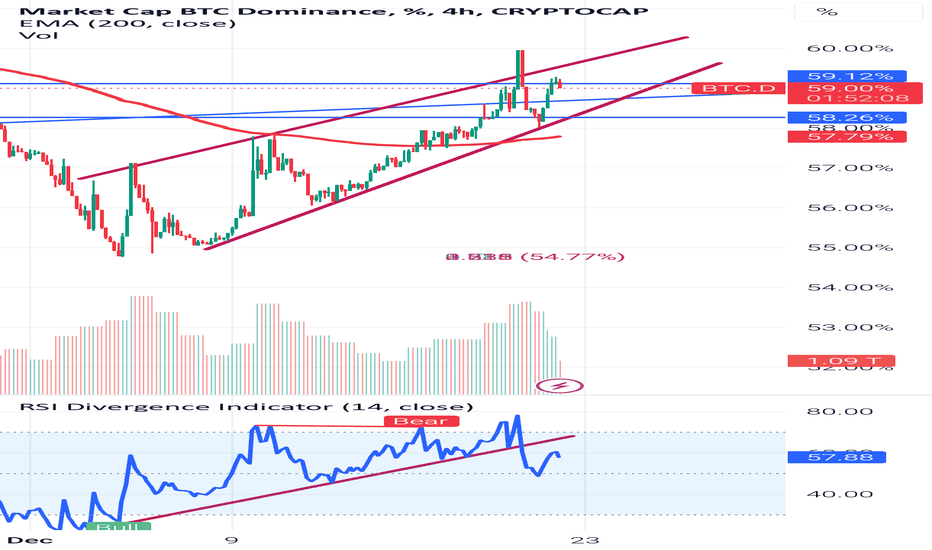

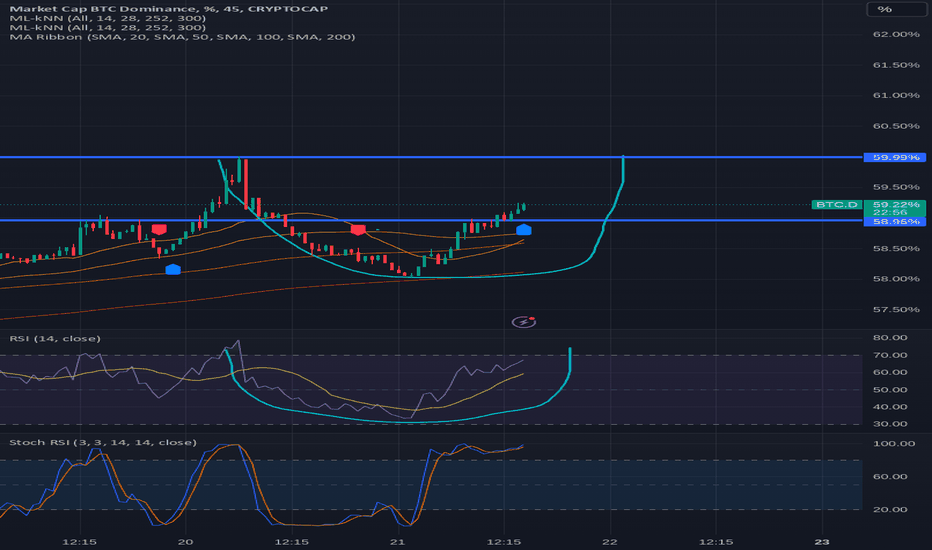

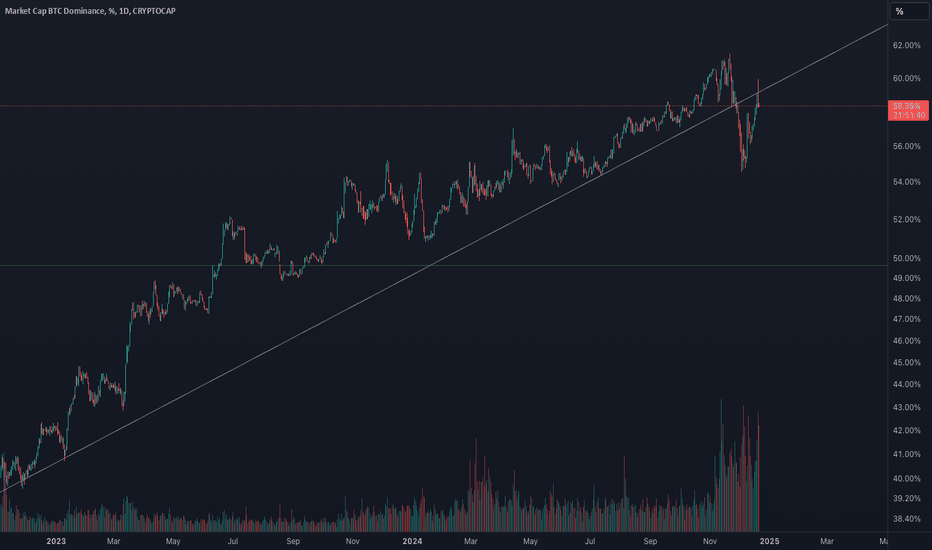

BTC Dominance ThoughtsBTC Dominance is moving in the pattern from last few days break this pattern can lead to fall. RSI support is broken below and on retest now. BTC.D is test 0.61 fib level and show weakness also we have seen outflow in BTC ETF but adoption of BTC is a big question here this bull run will be different than before will see.

BTC.D trade ideas

BTC Dominance ThoughtsBTC Dominance is moving in the pattern from last few days break this pattern can lead to fall. RSI support is broken below and on retest now. BTC.D is test 0.61 fib level and show weakness also we have seen outflow in BTC ETF but adoption of BTC is a big question here this bull run will be different than before will see.

$BTC Dominance is keyYou must watch this metric to understand #ALTSEASON

CRYPTOCAP:BTC Dominance is the most important metric now.

CRYPTOCAP:BTC Dominance rising or ranging is very bearish.

This means money is not flowing into altcoins yet.

When CRYPTOCAP:BTC Dominance falls altcoins will pump to ATHs.

The key is not to get shaken out while waiting.

Be patient and DIAMOND HANDS.

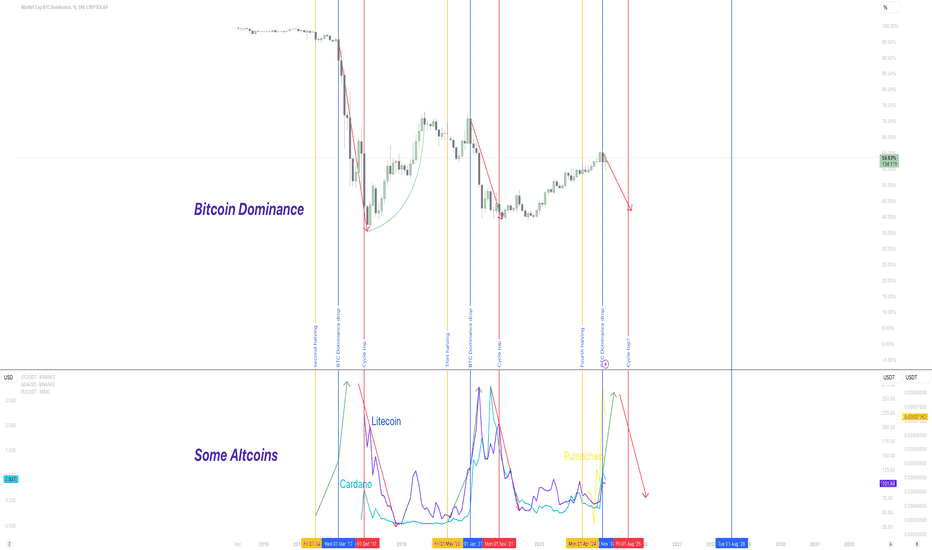

Bitcoin Dominance Cycles: Key Insights: Litecoin, Cardano, PLSDiscover the repeating cycles of Bitcoin dominance and how they correlate with altcoins like Litecoin, Cardano, and Pulsechain. This analysis reveals a potential peak in Bitcoin dominance by March, likely ahead of the broader market cycle top. Could this be the key to timing the market? Dive into the chart and uncover actionable insights for the coming months.

📈 Highlights:

Bitcoin dominance historical cycles

Altcoin trends aligned with dominance shifts

Potential implications for March 2024

🔗 Add your thoughts and share if you find this valuable!

#Bitcoin #Crypto #TradingView #Altcoins #Litecoin #Cardano #Pulsechain #CryptoCycles #BTCdominance"

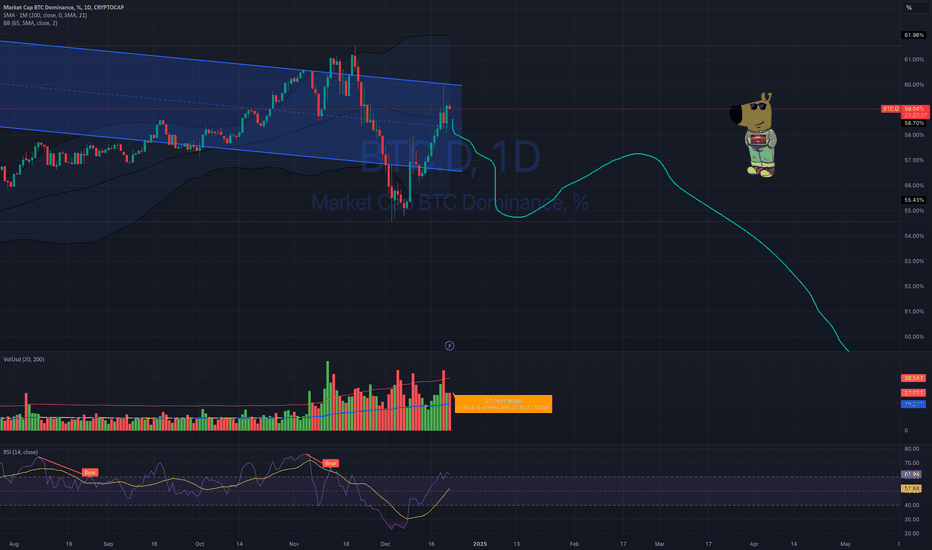

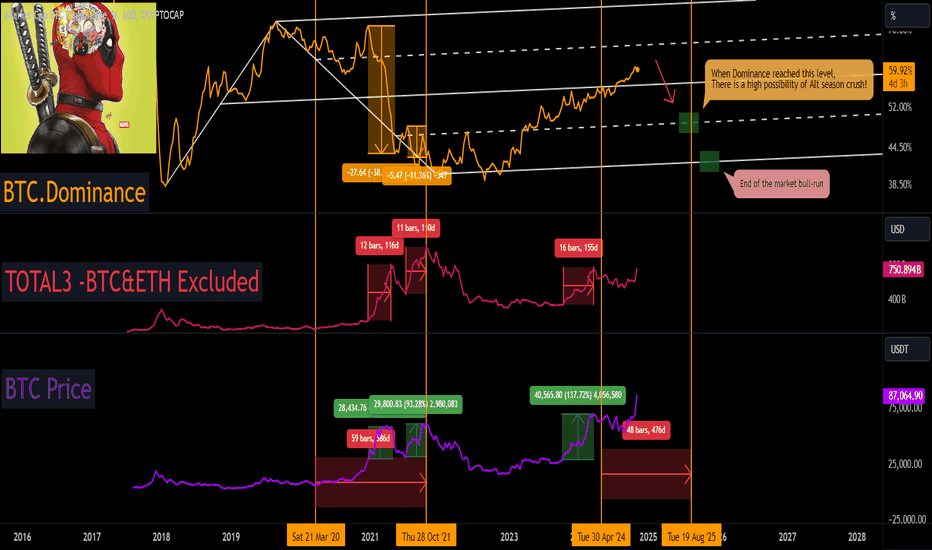

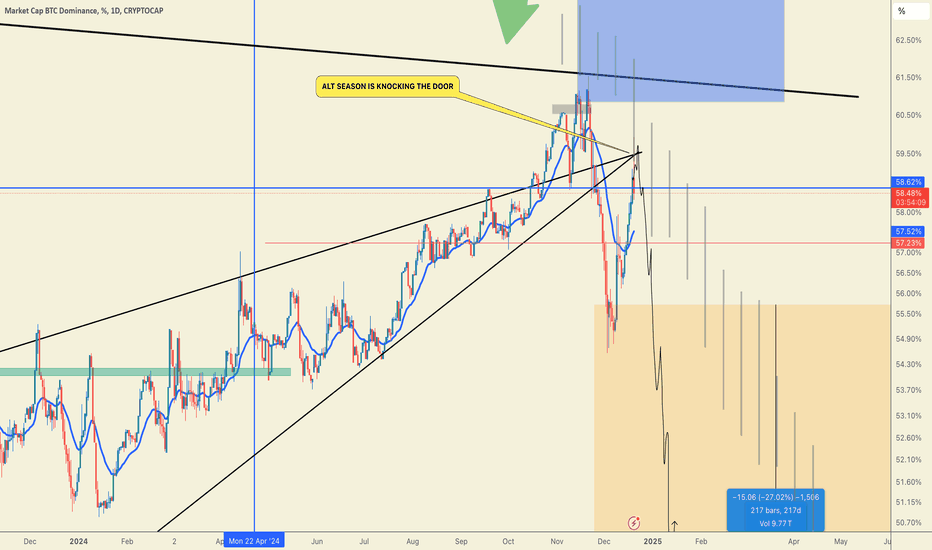

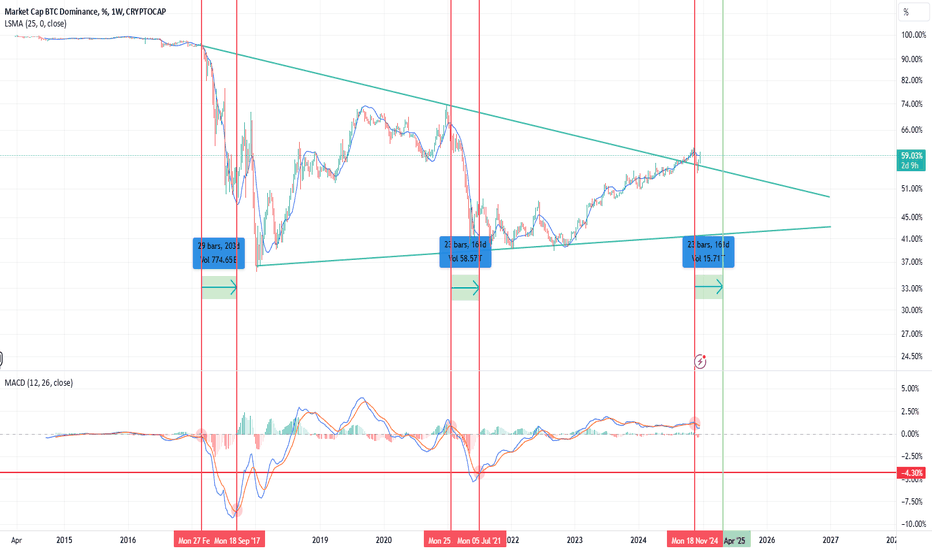

When and Where this Bull Market Ends / BTC.D and TOTAL3 BehaviorCRYPTOCAP:BTC.D

Bitcoin Dominance and Alt Season Trigger:

The chart indicates that when Bitcoin Dominance reaches around 59%-64%, there’s a high chance of an BTC dominance market correction. This level often signals the end of a Bitcoin rally and the start of funds flowing into altcoins.

You can use this dominance level as a timing signal to anticipate the start of the next alt season.

Historical Patterns and Timelines:

Key vertical markers show important dates from past cycles, such as 2018, 2021, and projected points for 2025. These points highlight recurring patterns that can help forecast the end of the current Bitcoin rally.

TOTAL3 Index Trends Relative to BTC:

The TOTAL3 index (all altcoins excluding BTC and ETH) shows that after Bitcoin Dominance declines, TOTAL3 often experiences a sharp rise. This pattern has repeated in previous cycles, hinting at a potential similar move in the upcoming alt season.

Bitcoin Price Rallies and Corrections:

The lower chart shows Bitcoin's bullish and bearish phases, typically lasting between 450 to 550 days. This timeframe can help estimate the remaining duration of the current Bitcoin rally.

Future Predictions:

Based on the chart, Bitcoin Dominance is expected to reach critical levels again in 2025, potentially marking the start of the next major alt season. While this timeline depends on market conditions and investor behavior, it offers a general framework.

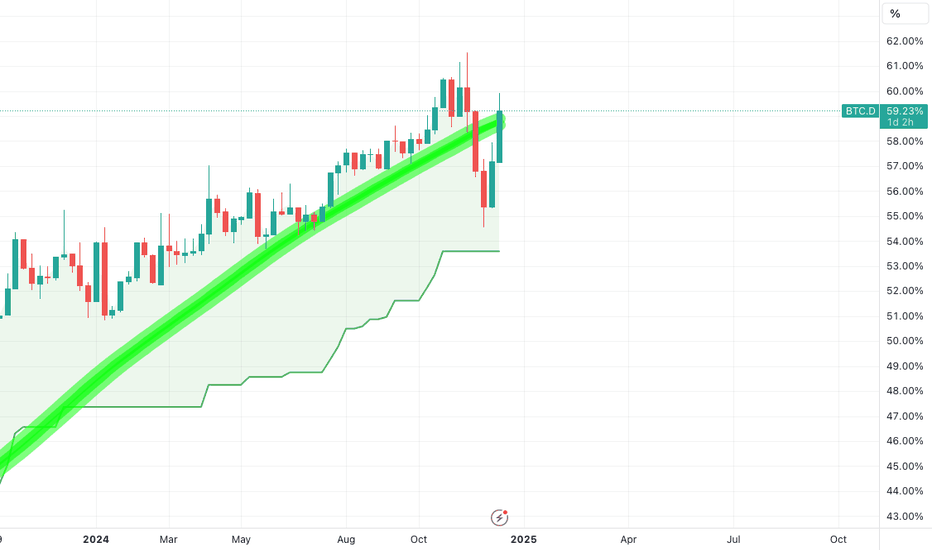

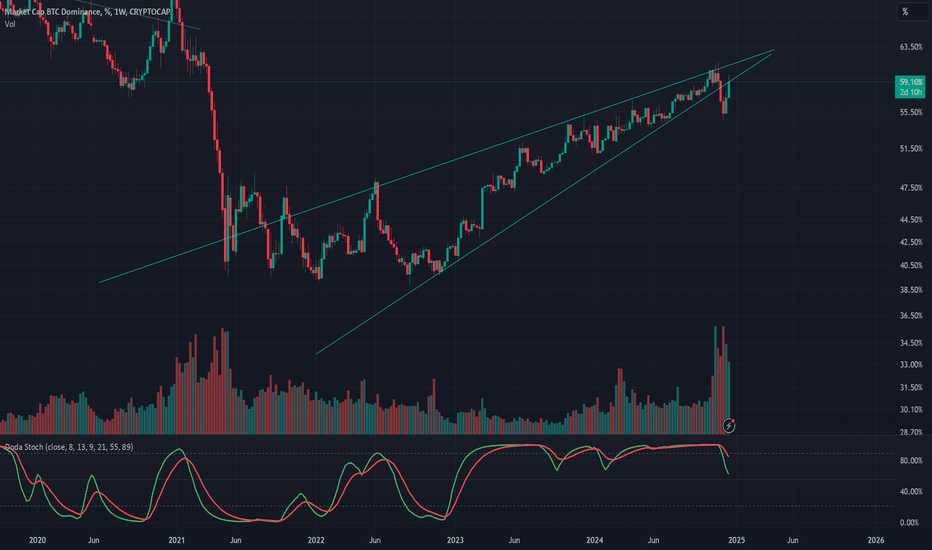

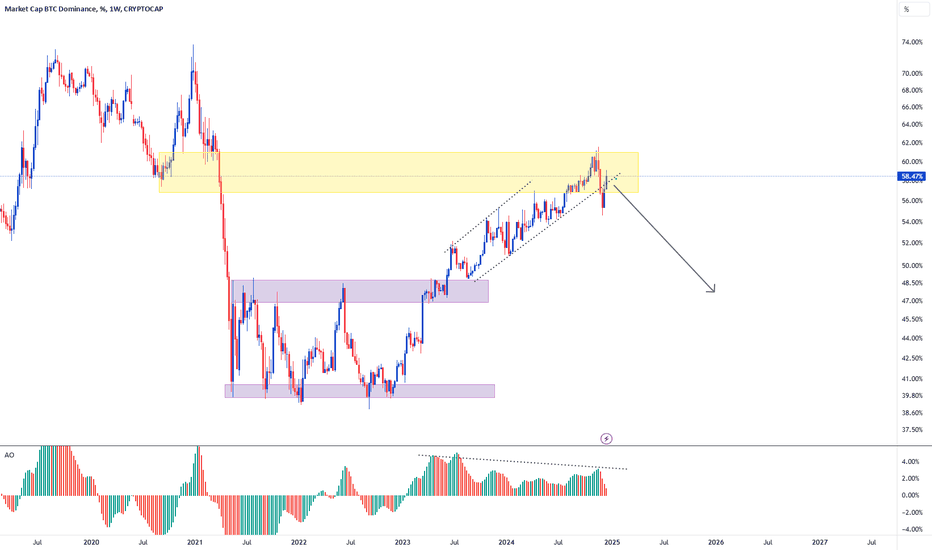

BTC.D Getting Rejected at the Trend Line Gives ALTS Hope After the Trump Pump delivered massive gains on a lot of coins since election day, it's not surprising to see some huge retracements. In fact the vast majority of ALTS have given back more than 40% with many in the 50% - 60% range. That capitulation means opportunities are coming. The question is whether or not we will get a legit Alt Season or if the Trump Pump was it.

Due to institutional demand and the ever changing dynamics in the crypto market we may not see BTC.D fall to the 40% - 45% levels, but failure to reclaim the 60% range after a rejection from the trend line may be an indication that we could get another crack at a legit Alt Season.

Keeping an eye on BTC.D and a select group of Alts to see how things develop from here.

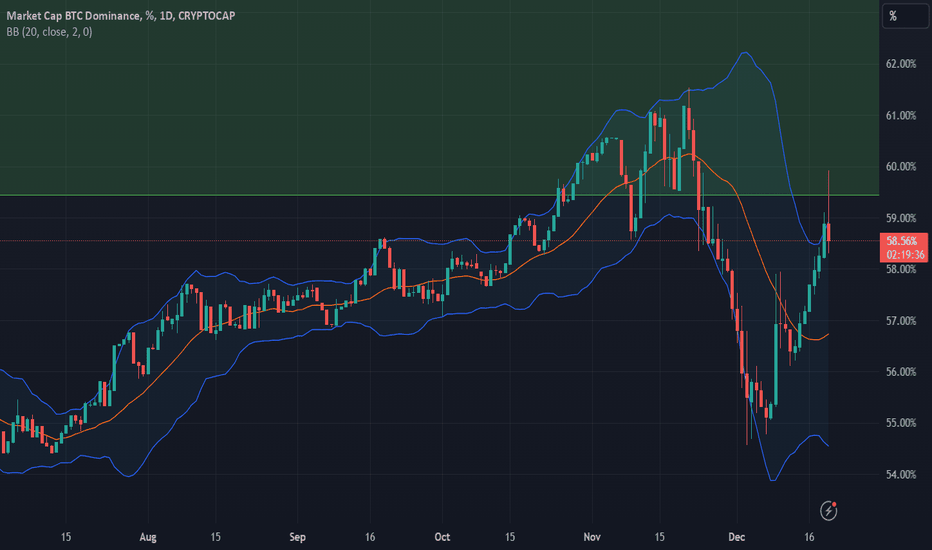

#CHRISTMAS RALLY INCOMING OR JUST A TRAP?CRYPTOCAP:BTC Dominance is Finally Seeing a Rejection!

The upcoming weekly close will be critical for ALTCOINS.

The rejection looks good and it's important for BTC to stay stable for the altcoins to pump.

The weekend is here and you don't decide on a trend on the weekend, you must wait for a weekly close and how traditional markets open.

So more clarity will be seen on Monday.

Is this the start of the altcoin rally you've been waiting for?

Or is there more pain ahead?

The answers will reveal themselves soon.

So make sure you follow me on all socials.

More updates will be posted on confirmation!

I’ve shared 13 altcoins on request in my TG, and they’re already up 10%-25% in the last 4 hours.

Also, do not forget to hit that like button and share your views in the comment section.

Thank you

#PEACE

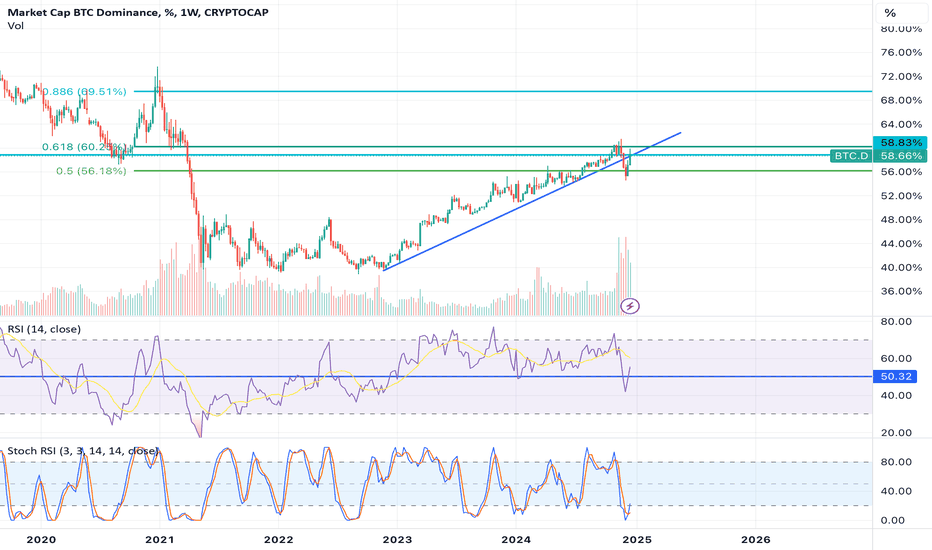

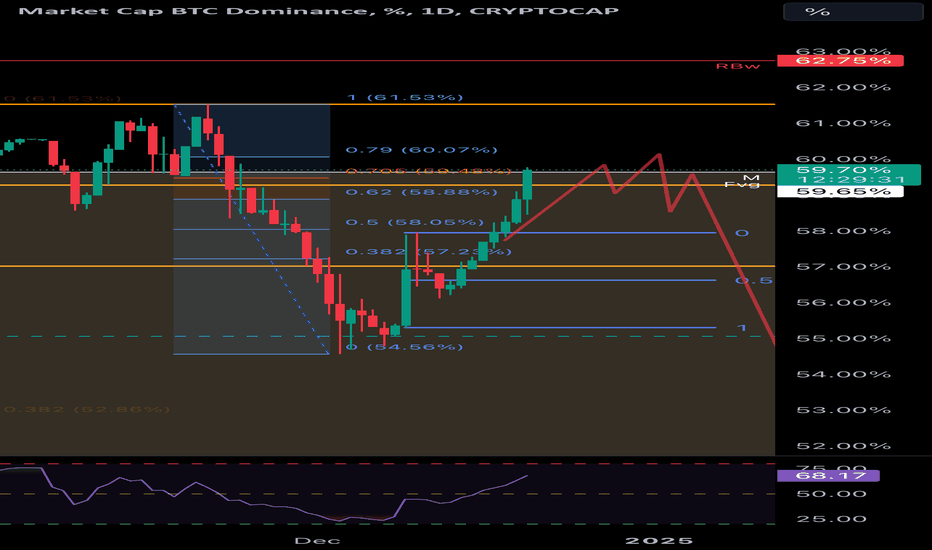

Bitcoin Dominance at Major Resistance: Alt Pump Incoming?

🚨 Bitcoin Dominance Update 🚨

Currently sitting at 58.69%, Bitcoin dominance has reached a critical confluence of horizontal and trendline resistance.

📉 Key Observations:

- Dominance retraced precisely to the Golden Ratio (0.618 Fibonacci) level.

- This area marks a potential reversal zone.

💡 What This Means:

A decline in Bitcoin dominance could signal the much-anticipated altcoin season as capital flows out of BTC into altcoins.

🗺️ Key Levels to Watch:

- A breakdown from this resistance could lead to massive altcoin pumps.

- On the flip side, a breakout above this resistance could invalidate this setup.

📊 Keep your eyes on this setup, and let’s prepare for potential opportunities in the altcoin market. 🚀

🔔 Follow for more trade ideas and market insights!

BitcoinDominance Altcoins CryptoTrading AltSeason BTC

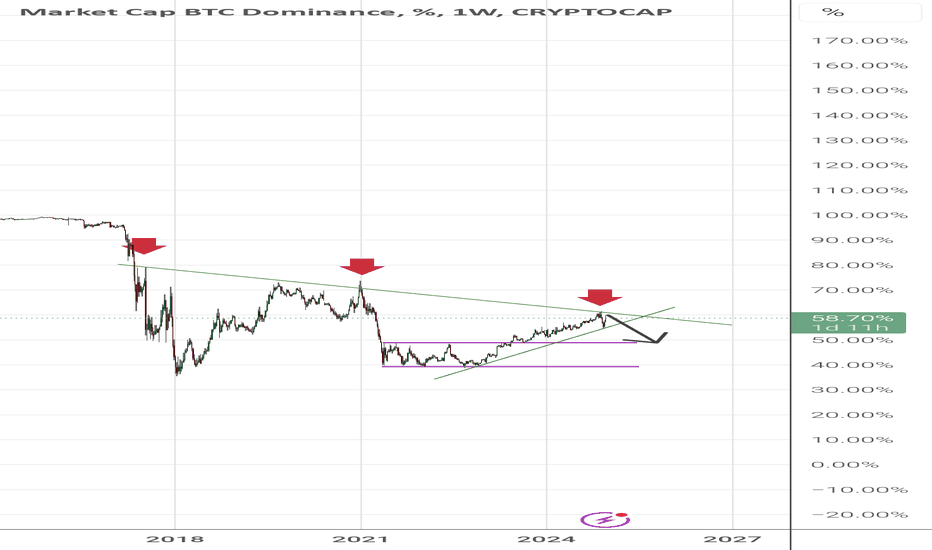

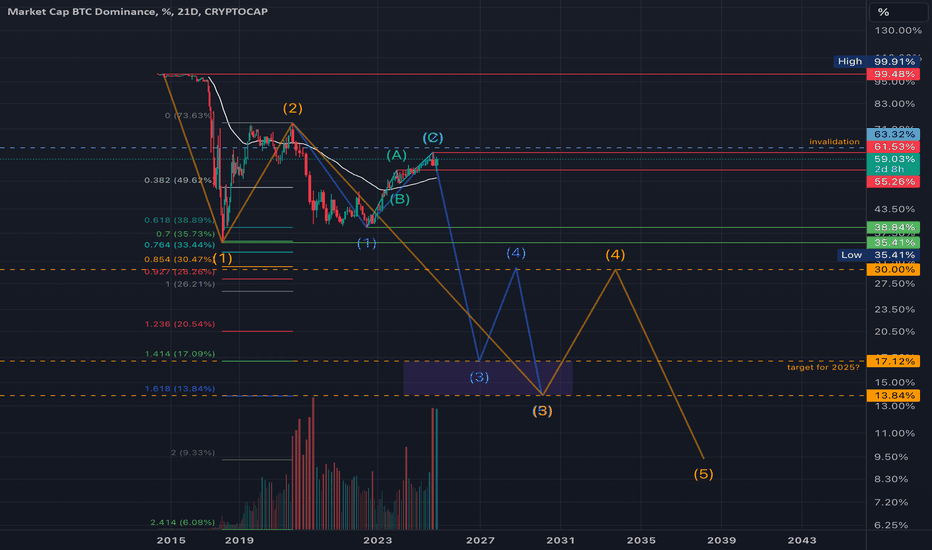

BTC.D Long-term SpeculationLooking at this chart objectively, it is currently in a lifelong downtrend and we should now expect a rapid and sustained decline to around 13-17% from where we are now in a wave 3 of 3. This changes if dominance exceeds 63.32% or if the next move down doesn't reach the 1.618 extension and starts to look like the C wave of an ABC correction of an uptrend...

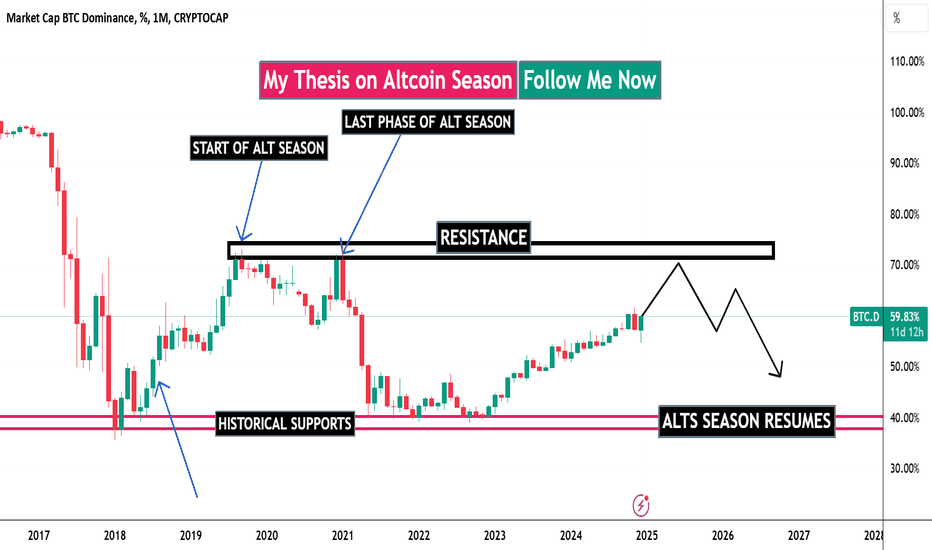

This My Thesis on Altcoin Season: When Alt Season???Yesterday, we had some scary dips in the crypto market, and many people switched to panic mode, they felt the bull season was over.

Well, the bull season is barely 1 year and 3 months old, and it is difficult to call the top when some historical patterns are yet to be seen in the market.

When Bitcoin is pumping, a couple of altcoins are yet to pump as much as BINANCE:BTCUSD , and when Bitcoin dips, they dump harder. This has left a lot of newbies in confusion lately.

They are beginning to lose hope in their altcoin bags. Suppose history is an important factor in investment. In that case, it is correct to say that BTC will soon lose its dominance at 68-70%, and there will be a capital rotation into viable altcoins that have strong communities, utilities, and better technologies.

Observe the chart, I used a weekly timeframe so that you will have a better grasp of what is happening in the market.

BTC will likely squeeze out more capital from altcoins before it reaches the peak of its dominance.

Brace up, invest smartly, and most importantly take profit with wisdom and be patient with your moon bags.

Data don't lie, but if that is not the case this time, I will be glad to embrace my mistakes.

What mistake?

The mistake of depending too much on historical data and not admitting that history, sometimes, does not usually repeat itself.

For now, enjoy the flow of the market.

Cheers to 2025! It was an incredible year for us.

Do you like this analysis? Share with your friends, like the analysis, and follow me for more.

Do you have a contrary opinion? Leave a comment down below, you can present your case without insulting anyone.

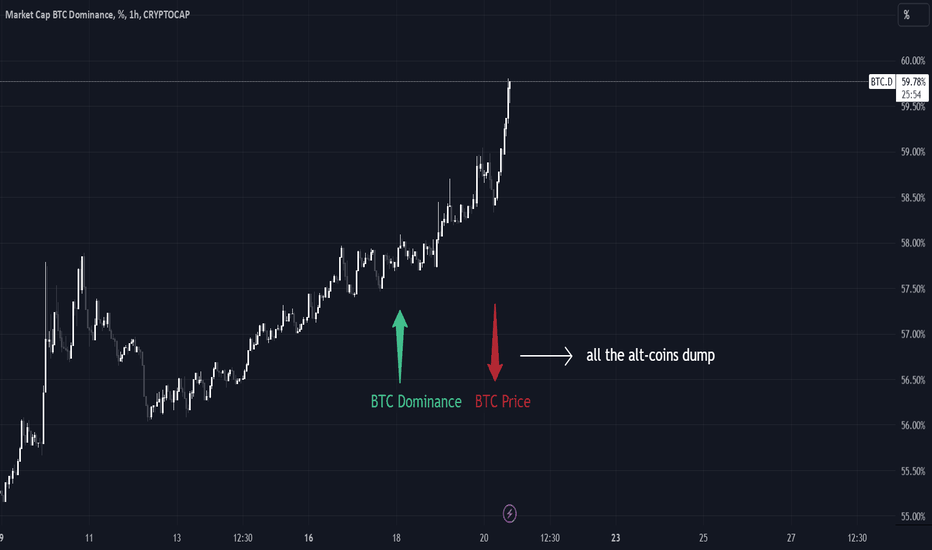

WHY ALT-COINS ARE DUMPING!!?hello to everybody and welcome back for another analysis.

today is kinda different and we are gonna talk about BTC dominance and the impact it can have on the alternate coins and it's very important.

the reason that the alt-coin market has been all red is actually because of the BTC dominance that is going towards the 60% market cap, and on the other side the BTC price itself is dropping significantly and this alone can cause a huge dump in alt-coin markets.

so be very careful these days for any long entry and manage your risks.

for all holders that want to buy any alt-coins, I suggest that they wait for the dominance to drop and maybe they can consider buying.

Remember, this is not financial advice; it is just my personal opinion that I wanted to share with you all.

THX for reading and have a great day.

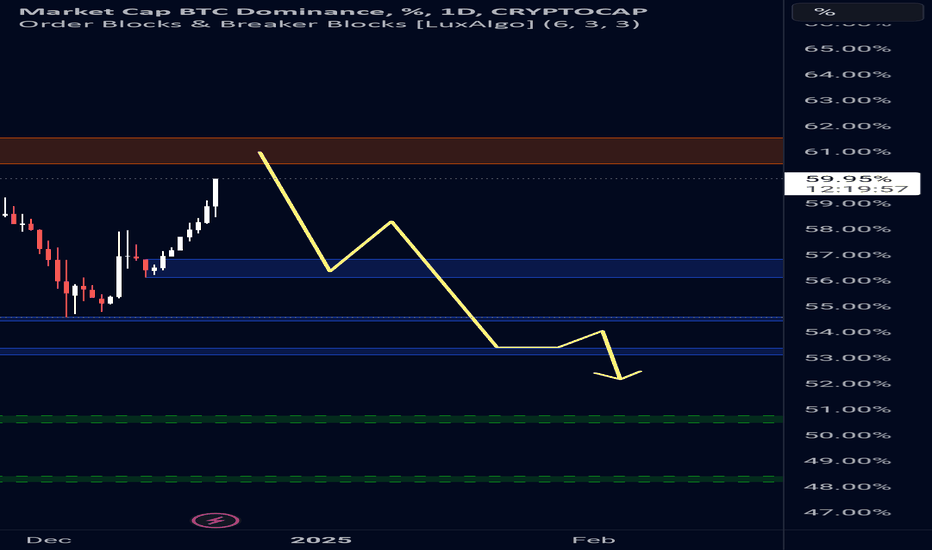

Btc.D Here is the plan:

Btc.d has much liquidity lying between 59.3-62

It reclaimed Nov bottom exactly on 15Dec. The daily close above 59.3 means moving towards 62ish.

For BTC; it needs to gather momentum exactly between 84-73; this will give our base towards 150k.

I started buying alts because majority are below 70% Fibs; where smart money starts to accumulate. Good luck to all; stay safe and stick your plan.

Closing 2 days below 59.30%, is the entry; hopefully last week of Dec or First week of Jan25.