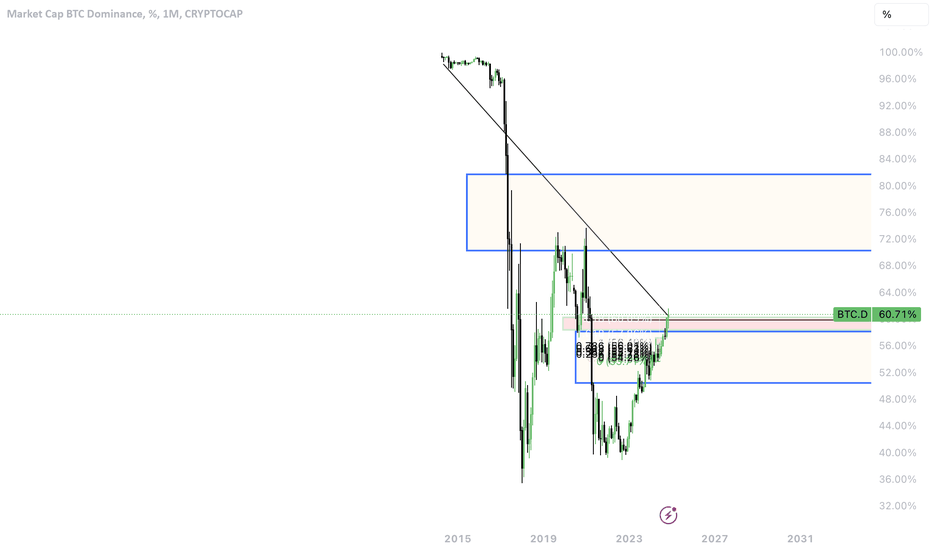

Bitcoin Dominance: Elliott Wave and Harmonics ComboBitcoin Dominance ( BTC.D) is giving a fantastic trading setup.

It's preparing a BIG Bullish Swing.

From an Elliott Wave point of view, a bullish Impulse Wave is about to start.

In this case I'm talking about Super-Cycle (C) (turquoise).

Moving on to Harmonic Patterns, there are two:

The smaller one is the Bullish Shark, which is preparing its completion.

The second one, and the bigger view, is the Cypher Pattern, which will commence one the Shark is done.

So, bottom line: BTC.D is gonna start flying, and will push the Crypto market into a fantastic Bull Cycle.

Bitcoin Dominance ( BTC.D ) Technical Analysis:

* Elliott Wave Impulse: Super-Cycle (C) (turquoise)

* Harmonic Pattern: Bullish Shark

* Harmonic Pattern: Bullish Cypher

* Double Bottom

* Bullish Divergence

* 88.6% Fibonacci Retracement

* 61.8% Fibonacci Extension

* Demand Zone

Conclusion: Bitcoin (BTCUSD) is and always will be the one and only driver of the Crypto Markets.

BTC.D trade ideas

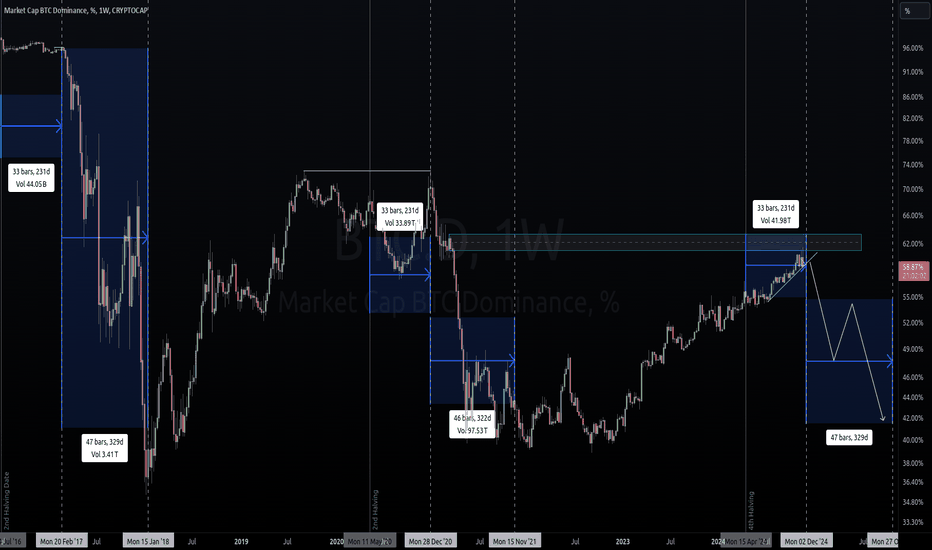

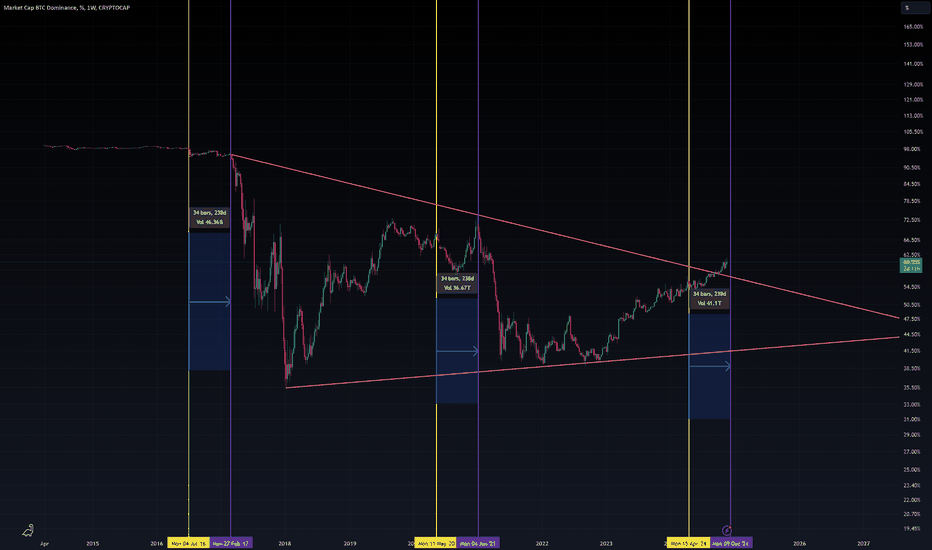

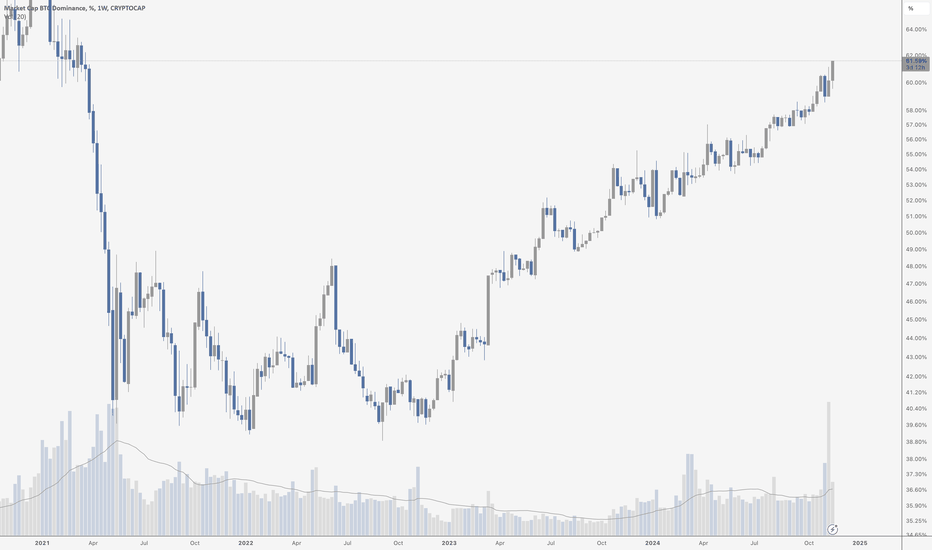

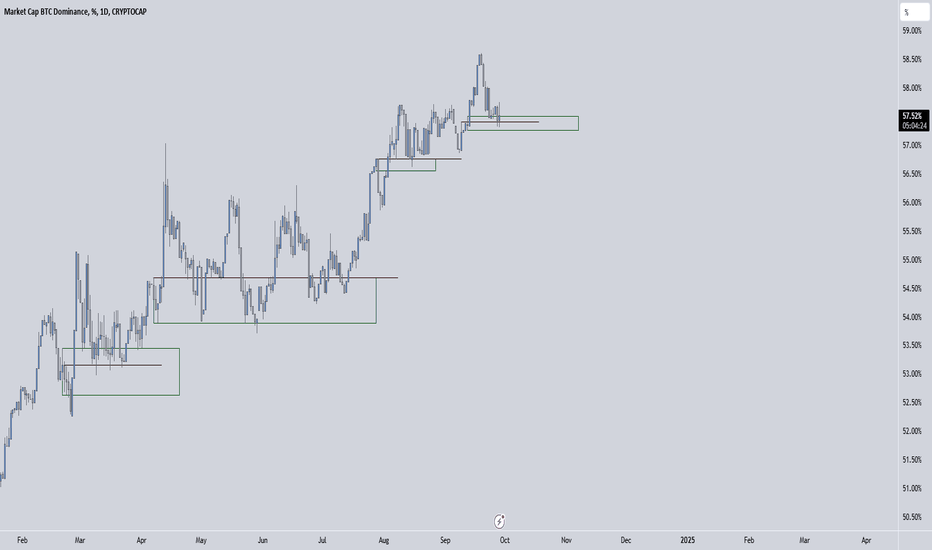

Altseason Starts SoonThe Chart above show Bitcoin Dominance (BTC.D) over time, with highlighted patterns and cycles that may be tied to Bitcoin halvings and market trends. Here’s my analysis based on the chart's structure:

Key Observations:

Repeated Patterns:

The chart highlights similar phases of Bitcoin dominance decline across three separate cycles, lasting roughly 231 days.

Each phase seems to correspond to a bearish period for Bitcoin dominance, where altcoins gain relative strength.

Halving Impact:

Vertical lines mark Bitcoin halving dates (green lines), which historically have a significant impact on the crypto market.

Following halvings, BTC dominance often rises as Bitcoin leads the market in initial rallies.

Projection:

The chart projects a decline in dominance after the current rally, extending into mid-to-late 2024.

A potential drop to ~44%-46% dominance is outlined, indicating a possible altcoin season or broader market rotation.

Support and Resistance:

The chart highlights a resistance zone around 62% dominance, which Bitcoin dominance seems to have tested recently.

A bearish breakout is suggested, aligning with a downward trend in the future.

Possible Interpretation:

Short-Term View: Bitcoin dominance might continue upward for a while but could face resistance near 60%-62%. If this area holds, a reversal could lead to dominance declining, benefiting altcoins.

Medium-Term View: If the projection holds, BTC dominance could see a prolonged decline lasting nearly a year, dropping below 50%. This scenario typically coincides with altcoin seasons where altcoins outperform Bitcoin in relative gains.

Risk Factors:Bitcoin dominance does not always drop due to bullish altcoins; it can also decline during a market-wide sell-off where Bitcoin loses less than altcoins. Macroeconomic factors, regulatory changes, and adoption rates could alter the outcome.

BTC dominance and AltsznLet me preface everything with "NOT FINANCIAL ADVICE."

Right.

So, it’s been a crazy Uptober, hasn’t it?

When we thought CRYPTOCAP:BTC was going to continue its bear market trend from February 2024, the Trump trade happened.

Everyone was caught off guard—or maybe, like me, you were too.

So, I set out to find the next alphas. Presenting...

The Three Amigos: VeChain ( NYSE:VET ), Zilliqa ( GETTEX:ZIL ), and Helium ( FWB:HNT ).

Why these three? And why the 1986 comedy title?

Well, first...

VeChain ( NYSE:VET )

Targets and ROI if you bag them today..

Zilliqa ( GETTEX:ZIL )

Targets and ROI if you bag them today..

Helium ( FWB:HNT )

Targets and ROI if you bag them today..

(Side note: I love how TradingView has incorporated these subcharts into posts lately!)

In the 1986 comedy, a small Mexican village hired three out-of-work silent film actors to defend their community.

Initially, the trio thought they were performing a paid acting gig but soon realized the danger was real. Using humor, limited skills, and newfound courage, they rose to the occasion.

Similarly, today’s crypto markets have plenty of altcoins that have been underwater for ages—out of hype, out of demand, and far from a bull run.

It seemed Bitcoin’s dominance was going to climb even further, but then I spotted this resistance level. Digging through my list of coins from 2020, I found crypto’s Three Amigos.

Fundamentally, this trio has endured upheavals and enjoyed comebacks.

Technically, they’re either approaching or breaking their long-term down-sloping trendlines.

If I had to pick my top three to defend my portfolio against Bitcoin dominance, these would be my choices.

These are my Three Amigos. Perhaps you can share yours!

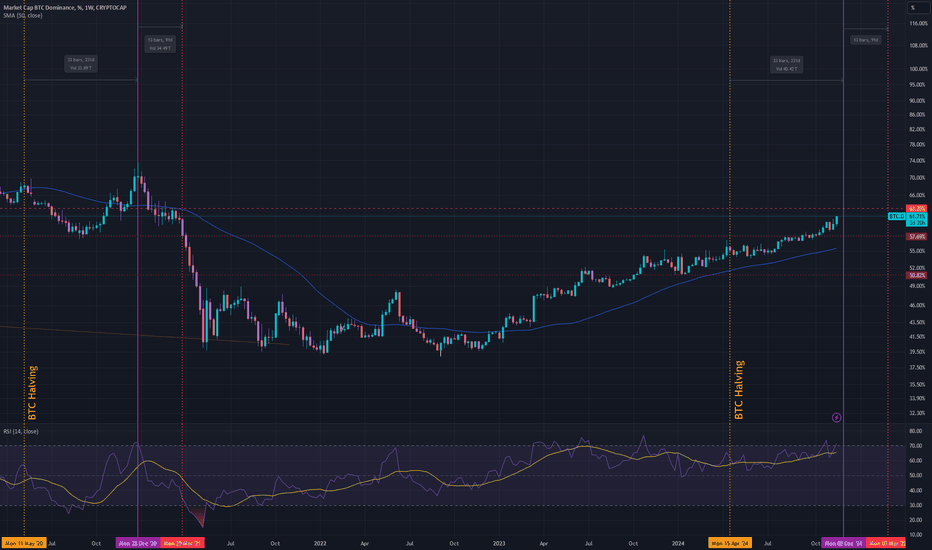

Alt Season closer than everAlt coins most likely will be having massive gains soon. There's Hidden bullish divergence on the monthly RSI with the Stoch crossing over bearish. Each percentage drop on btc.d will will push alts up a ton. When btc.d drops to around 40% is when you want to start scaling out of alts.

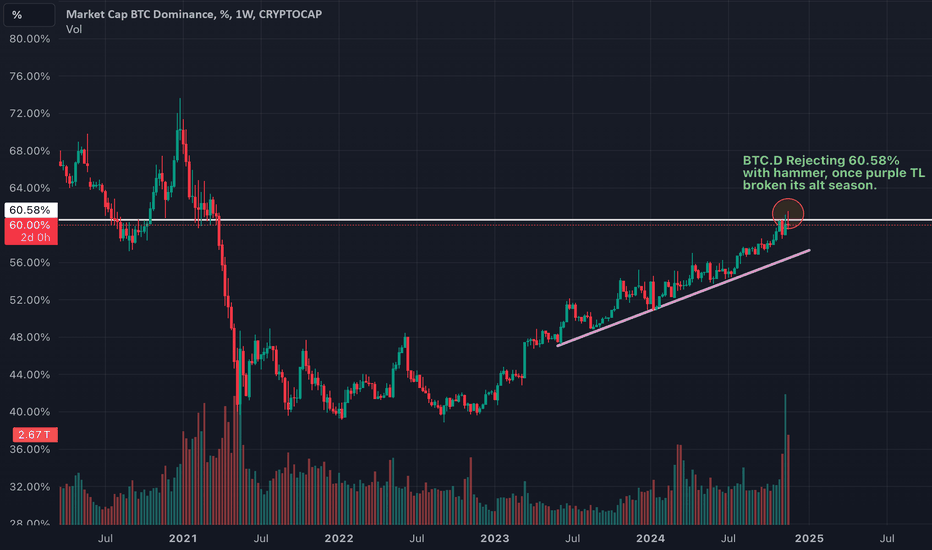

When ALT Coin season ? $BTC.D WEN MOON? Here's how to tellStep 1. Observation of rejection from key BTC.D levels 60.5% (Done)

Step 2. Wait for purple Down trendline (DTL) to pop

Step 3. Look for alts that have broken down from DTL (Weekly), LSE:ARB CRYPTOCAP:DOT NYSE:VET

You can find those set ups in my posts and profile

#BTC.D Analysis – Key Insight for AltcoinsBTC dominance (BTC.D) is approaching a critical resistance level, and this is where we often see shifts in the market. Based on my 7 years of experience, if BTC.D reaches resistance and starts showing weakness, we could see money flowing into altcoins. However, the key to altcoin rallies is their BTC pairs, and this should be taken very seriously.

Why BTC Pairs Matter for Altcoins:

Strength in BTC Pairs = Altcoin Momentum:

For altcoins to pump, they must show strength against Bitcoin in their BTC pairs. It’s not just about USD price—BTC pairs reflect true capital flow into altcoins compared to Bitcoin.

BTC.D at Resistance = Opportunity for Altcoins:

If BTC.D gets rejected at its main resistance, it creates a chance for altcoins to shine. But this will only happen if their BTC pairs confirm strength. Without strong BTC pairs, an "alt party" will struggle to materialize.

Conclusion:

Altcoin rallies don’t happen randomly. They require BTC pairs to be strong, and BTC.D to show signs of reversal from resistance. Right now, the market is waiting for BTC.D to hit its key resistance zone. Be patient, and closely monitor BTC pairs—they are the key driver for any significant altcoin pump.

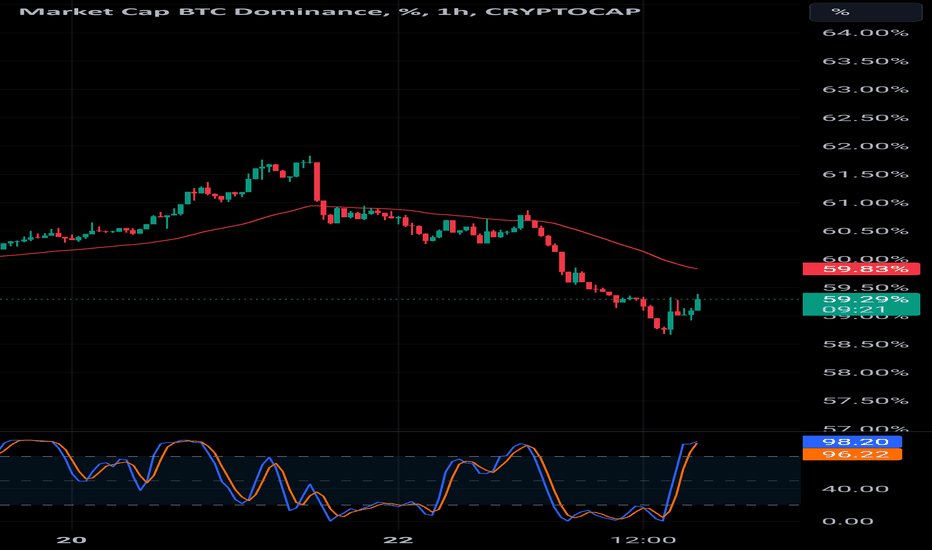

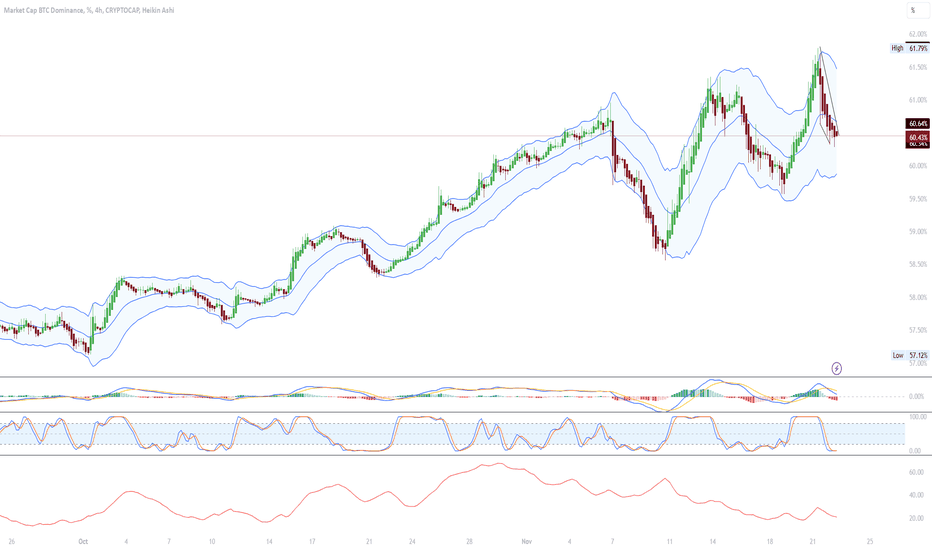

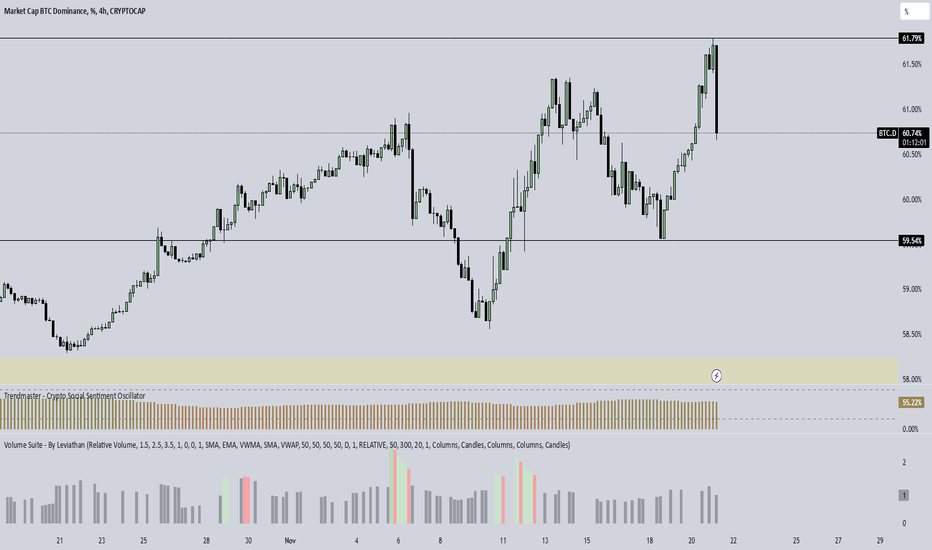

"Bitcoin Dominance : Will Altcoins Take the Lead?Bitcoin Dominance Analysis on 4-Hour Chart (BTC.D)

using StochRSI, ADX, Keltner Bands, MACD:

Dominance is currently at 60.47% after pulling back from the recent high at 61.79%. The price has broken the upper Bollinguer band and is now in the median band, indicating a potential support zone. If it breaks to the lower band, it could signal a decrease in BTC dominance, favoring altcoins.

The ADX at 25 indicates that the recent downtrend is not as strong but still valid. If the ADX drops below 20, it could indicate a period of sideways consolidation or an imminent reversal. A crossover of the MACD lines soon could confirm a continuation of the decline or the beginning of a recovery.

If StochRSI remains oversold and ADX loses strength, BTC.D could drop to support at 58%, indicating further movement in altcoins.

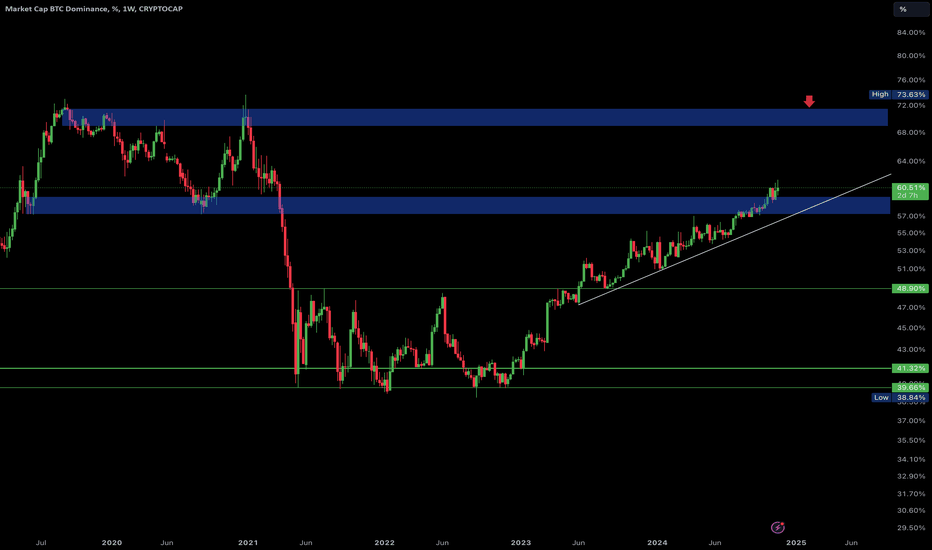

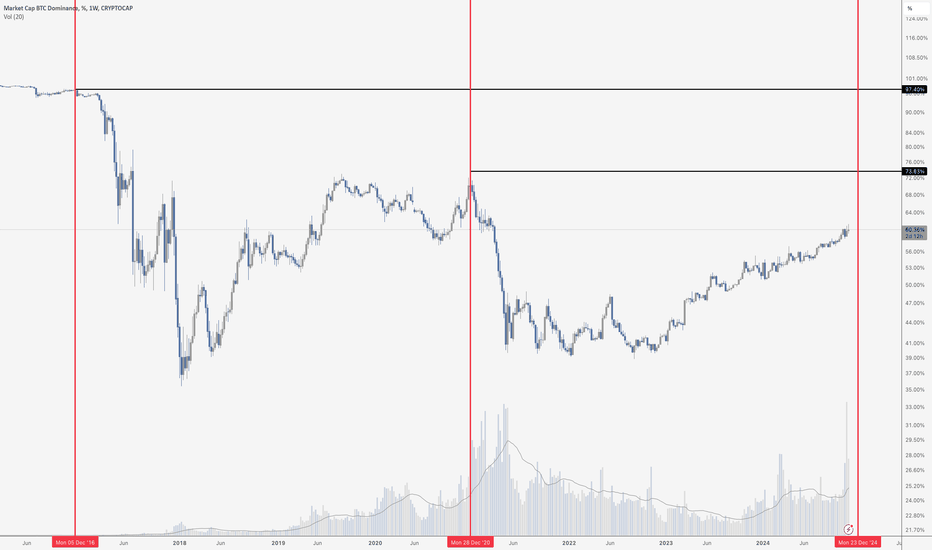

Is Bitcoin Dominance Nearing A Cycle Top?Do you see those huge red lines? Those are the “tops” for Bitcoin Dominance in the 4 year cycles, which came right before a MAJOR alt season.

The first red line is December, 2016. The second red line is December, 2020.

I’m not great at math, but in a few weeks it will be December 2024… I believe that is 4 years after the last dominance top… again.

Maybe alts have a bit more pain to come before dominance finally tops, Ethereum included. We will see.

Patience.

Btc.dCRYPTOCAP:BTC.D

🚨 Bitcoin Dominance Starts Dropping – Money Will Flow Into Altcoins 🚨

As Bitcoin dominance begins to decrease, it's a clear signal that the market is shifting. Historically, when Bitcoin’s market share declines, capital starts flowing into altcoins—offering traders and investors exciting opportunities for growth.

🔑 What does this mean?

Increased Altcoin Activity: Altcoins (such as Ethereum, Solana, and others) may experience significant price movement as investor attention shifts.

Possible Altcoin Season: With altcoins catching the spotlight, they could outperform Bitcoin in terms of percentage gains.

Diversification Opportunities: If you’re holding only Bitcoin, it might be time to consider diversifying into altcoins.

💡 Stay ahead of the market and watch for altcoin trends as they could offer substantial returns during this period. Be ready to take advantage of the opportunities that arise as money moves out of Bitcoin and into other projects!

Disclaimer : It's not Financial Advice

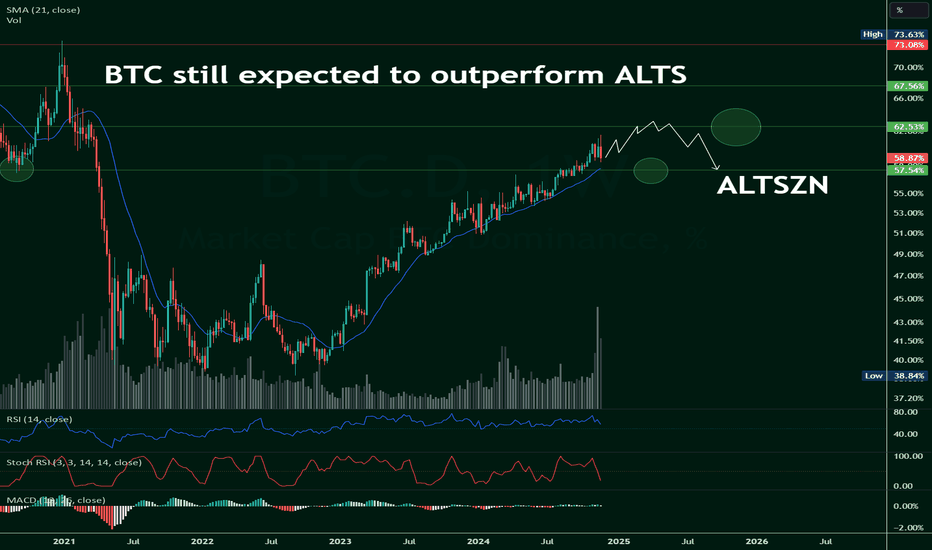

Bitcoin Dominance Makes New Cycle High... AgainThere is no reason to spend much time on altcoins while Bitcoin is in price discovery. When Bitcoin calms down, there should be plenty of opportunity in the altcoin space.

For now, altcoins are taking an epic beating vs. Bitcoin and are struggling to even advance on their dollar pairs.

61.6% is yet another new cycle high for Bitcoin Dominance.

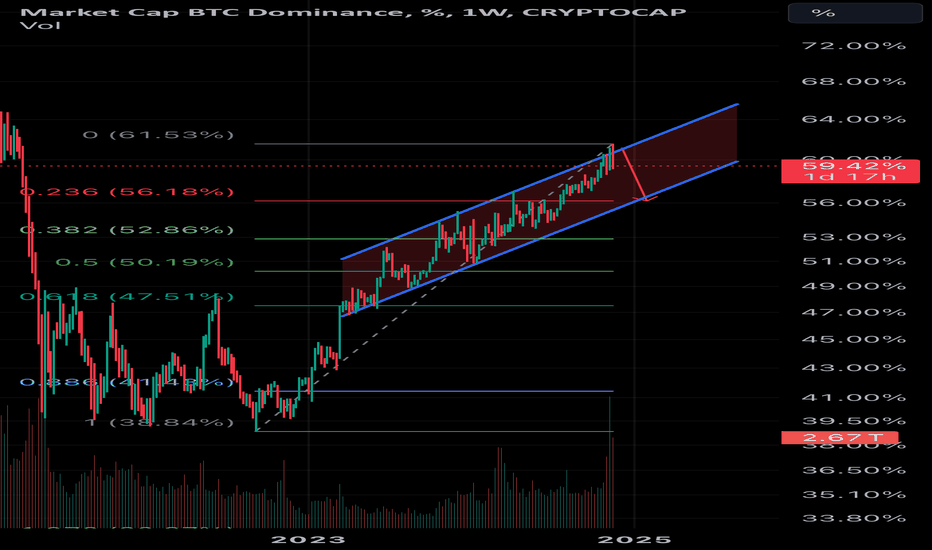

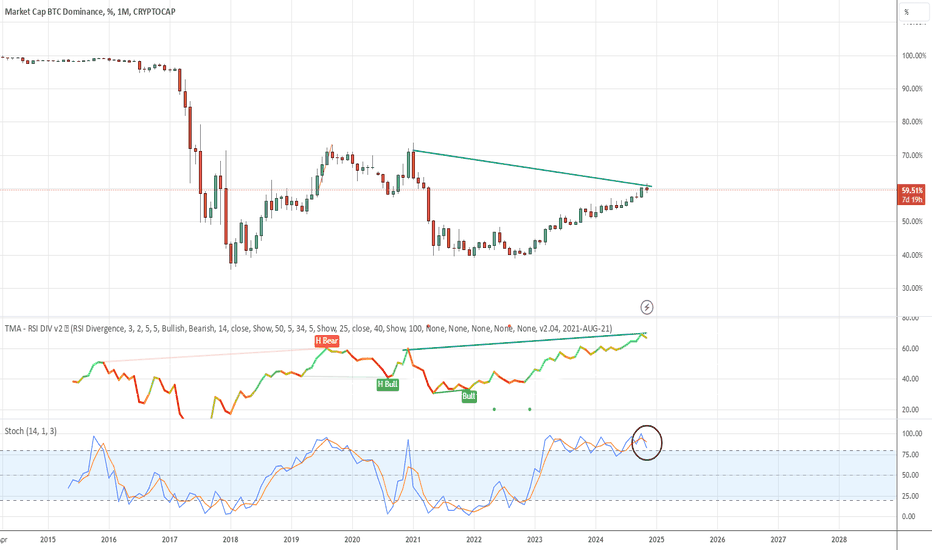

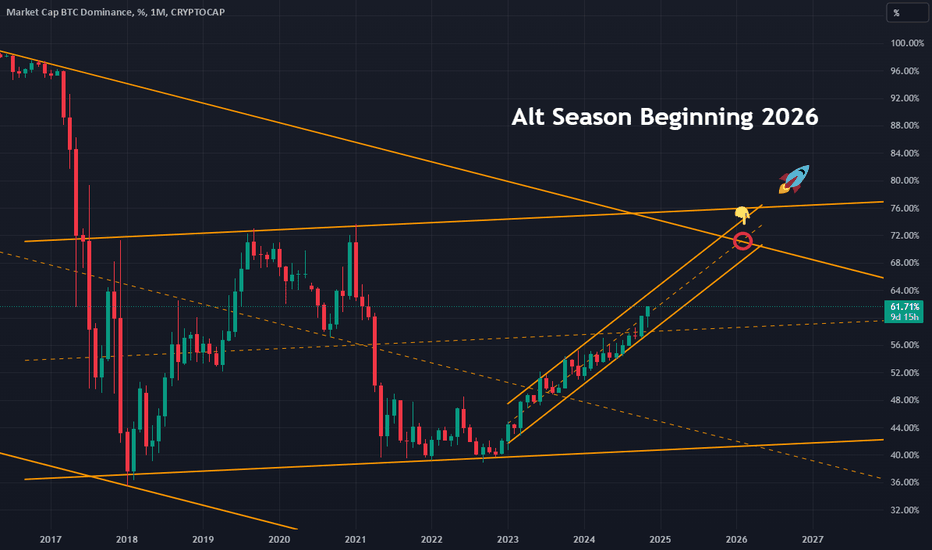

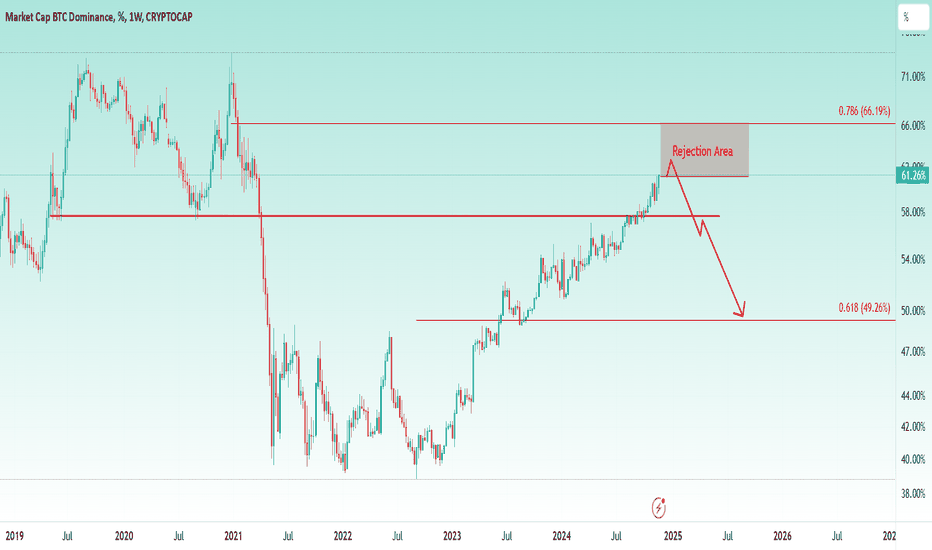

Bitcoin Dominance Trend Points to Alt Season 2026 Based on the long-term Bitcoin Dominance chart analysis, we're observing a critical pattern forming. The descending resistance line from 2015 intersects with the ascending support trend around early 2026, creating a potential convergence point at approximately 72-76% dominance level.

Key Technical Observations:

Historical BTC dominance showing clear trending channels

Converging trendlines suggesting a major market shift

Support and resistance levels well-defined since 2015

Current uptrend channel indicating steady BTC dominance growth

Prediction:

The technical formation suggests that Bitcoin dominance may peak around 72-76% before experiencing a significant decline, potentially triggering the next Alt Season in early 2026. This timeline aligns with historical market cycles and post-halving effects.

Trading Implications:

Watch for BTC dominance reversal near the convergence point

Potential accumulation period for altcoins leading up to 2026

Major altcoin opportunities may emerge in Q1-Q2 2026

⚠️ Disclaimer: This is technical analysis based on historical patterns. Always DYOR and manage risk accordingly.

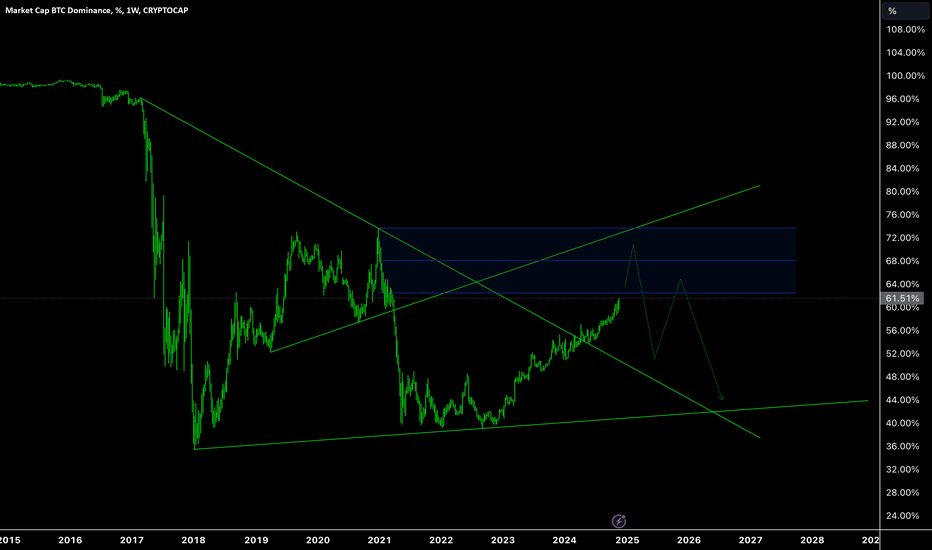

Forecasting Altseason: Why December Could Spark the Next RallyI expect that the altseason will start around December, following a similar pattern to the days after the Bitcoin halving event.

Based on historical market cycles, it seems likely that a potential altseason could begin in December, a few months after the anticipated Bitcoin halving event in April 2024. In the past, we have seen Bitcoin's price surge post-halving, typically leading to increased market interest in altcoins once Bitcoin enters a phase of consolidation. Given that Bitcoin often drives the market's overall sentiment, a sustained rally or stability in Bitcoin’s price could redirect attention toward alternative cryptocurrencies, sparking the onset of altseason.

This timing aligns with previous trends where after major Bitcoin price movements, altcoins often experience significant price action as capital shifts to other assets. Traders and investors tend to reassess their portfolios at the end of the year, adding further weight to the idea of a December rally for altcoins.

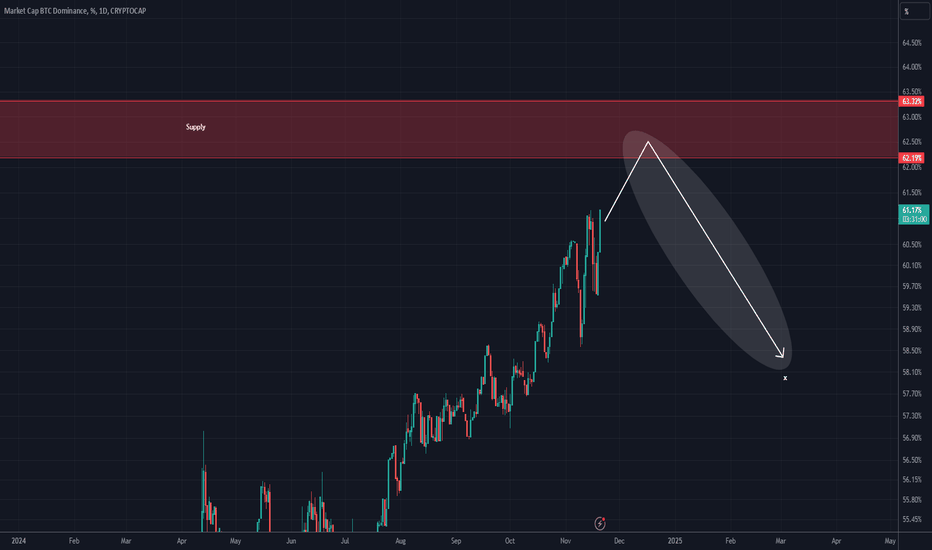

Bitcoin dominance is on a razor's edgeKeep an eye on the 62-63 Bitcoin dominance level; we will see a strong rejection from this range, which will lead to an altcoin pump. The duration of this drop is expected to be 60-90 days.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Alt Season Is Coming 📈 The BITCOIN Price Hit The 95k Area As a New ATH But Alt Coins Are Totally Red, The Reason Is Bitcoin Dominance Is Only Up And At This Update I Wanna Talk About My Plan About It

👉 The #BTC Dominance Break The Crucial 58% Level And Currently Playing Above It, In My Idea We Are Too Close To The Btc Dominance Pivot And Maximum High For It Could Be 66% Zone And After This High We Will Have a Nice Alt Party