BTC.D trade ideas

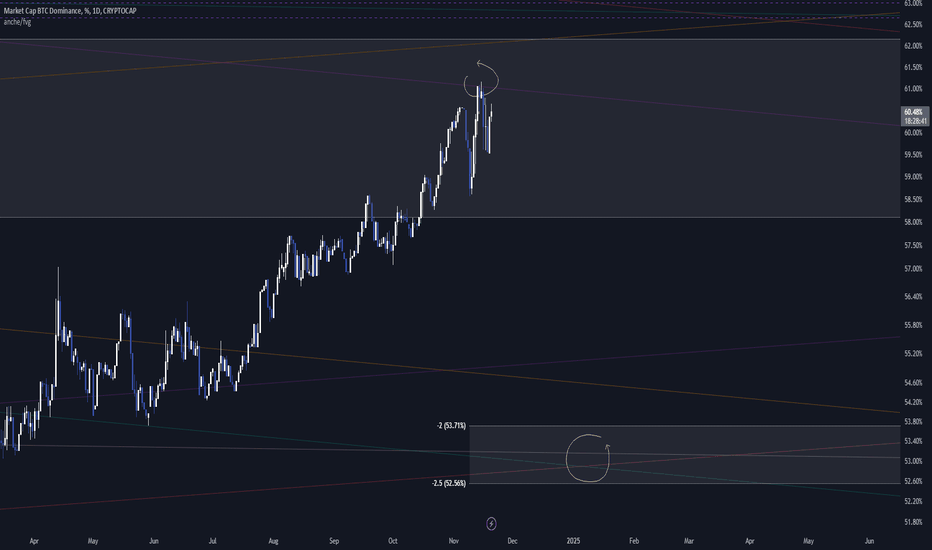

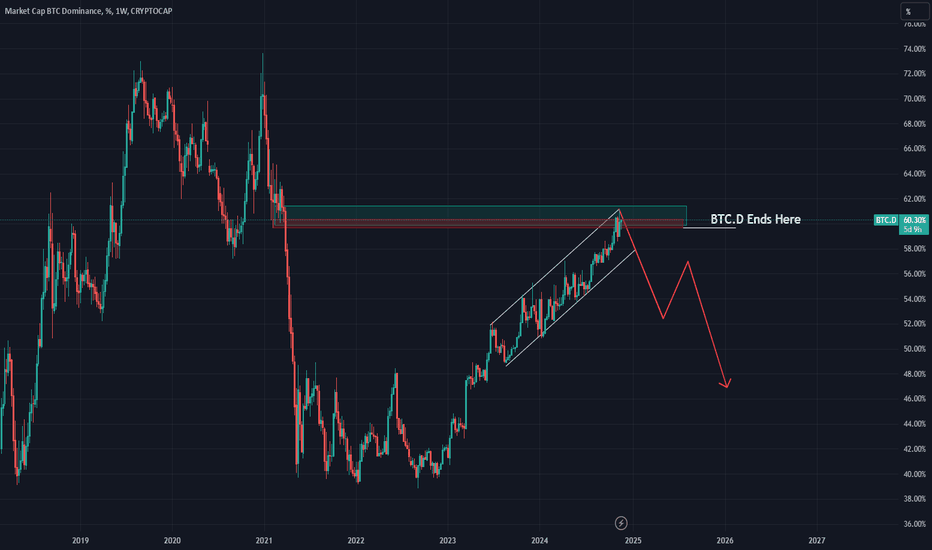

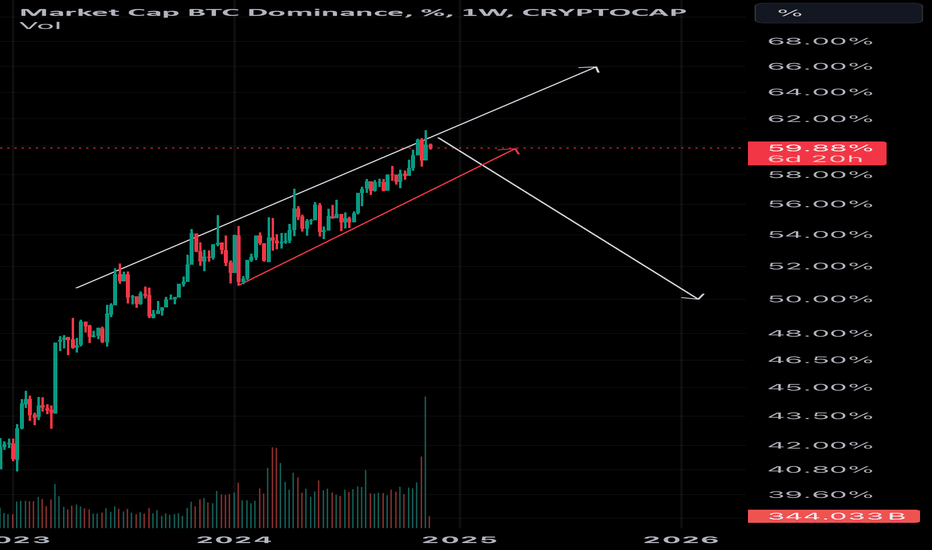

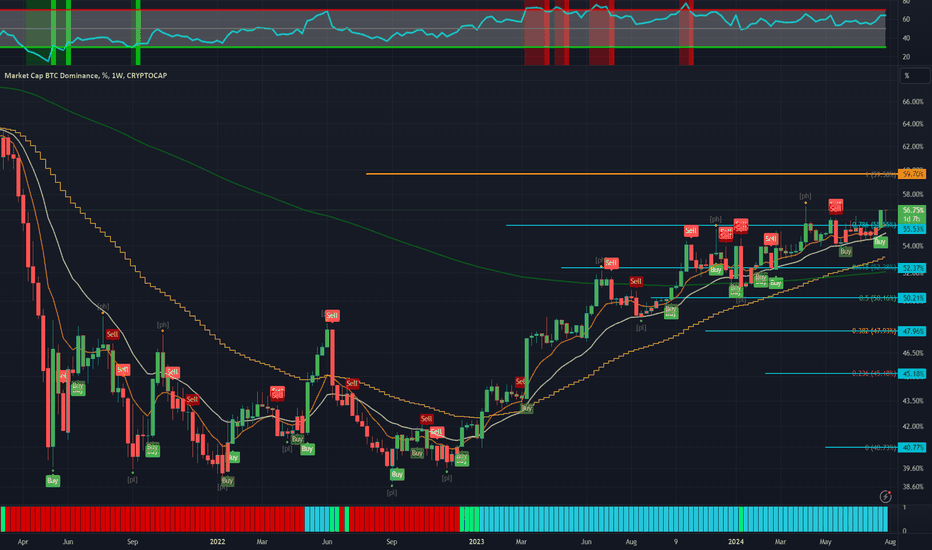

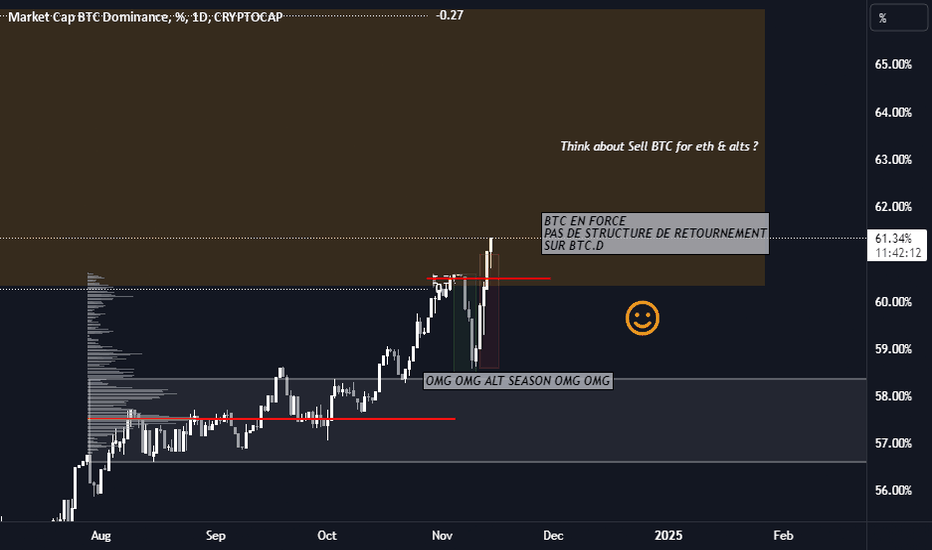

BTC.D Ends HereBitcoin dominance (BTC.D) is approaching a critical turning point at the 60% level, signaling a potential shift in market dynamics. A drop towards the 40% zone is anticipated in the coming days. If this scenario unfolds, it could ignite a powerful rally for altcoins, setting the stage for extraordinary growth leading into Q1 2025. Stay tuned for what might be a game-changing period for the crypto market!

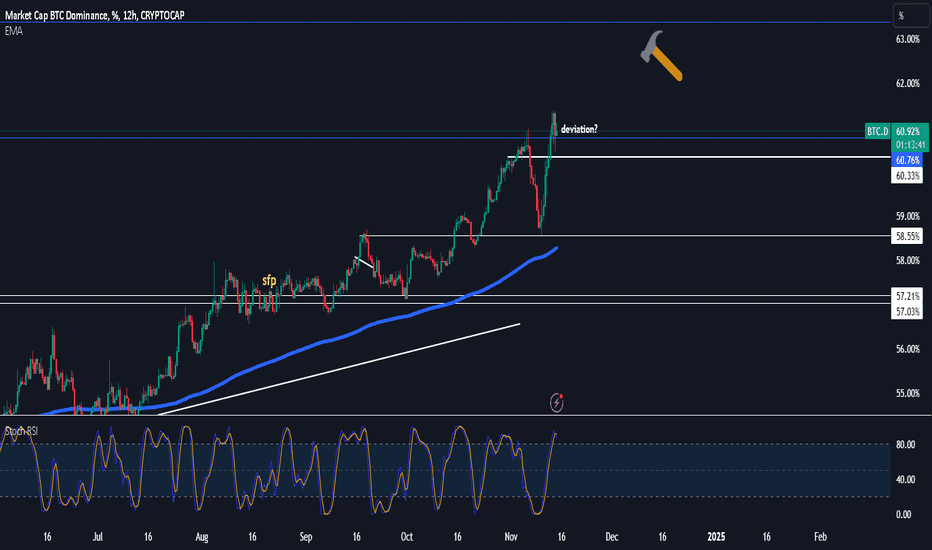

$BTC.D 60.33 ?not sure if this has topped yet but for now 60.3 is what i'd like to see us loose so the alts can all leg up while btc ranges

insane move up on dominance so a little retracement then we shall see

either way still got time to scale into alts once we break $3985 on ether everything will go loco

Fast and Furious mode soon for alts my plan is to risk off before Trump takes over and wait for some blood to long again

May your choices reflect your hopes not fears!! carpe d

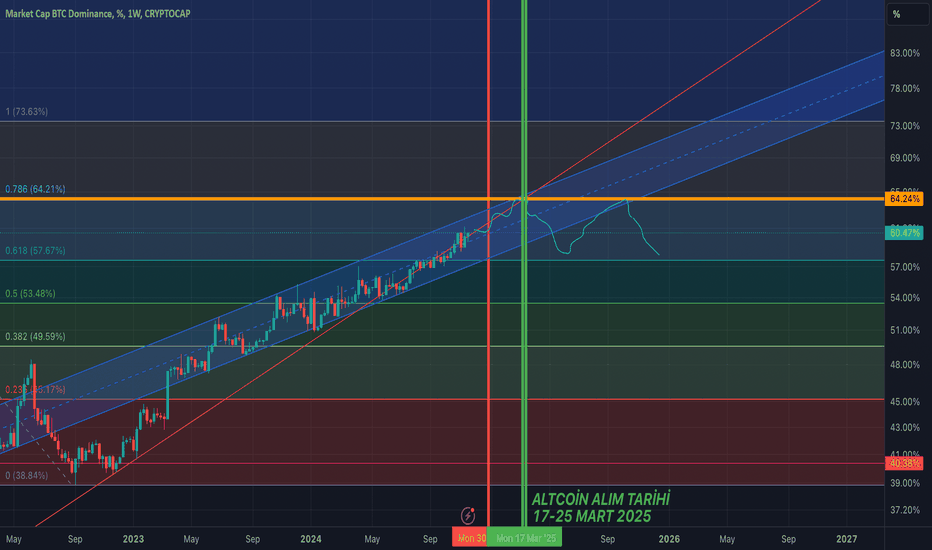

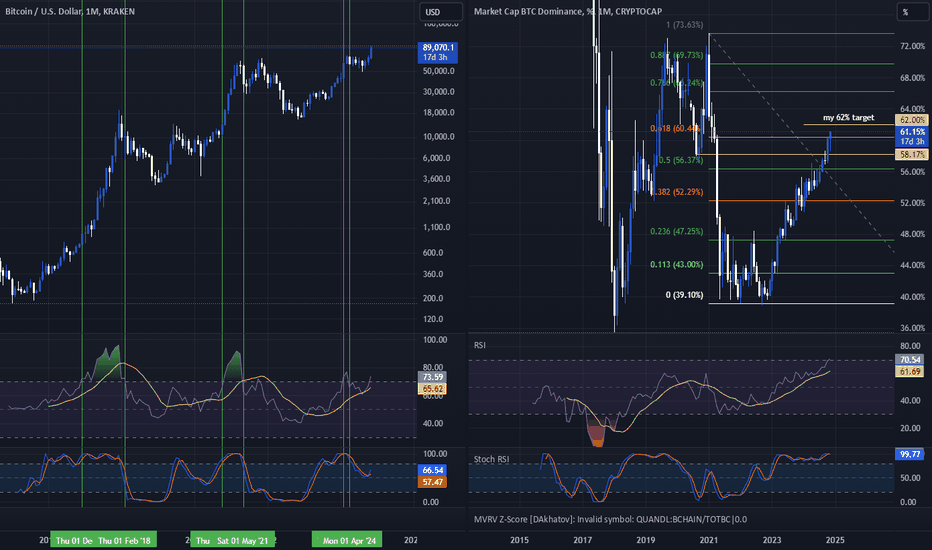

Altcoin Bullrun is cominglooking at the Bitcoin Dominance it looks like that in the next days and weeks we will go into the long requested Altcoin Bullrun, which will take aproximately 3-6 month. I took the fib retracement from the last bottom to the high and expected to turn arround in the golden pocket. And here we go, the chart exactly is turning arround in the golden pocket. Lets see if is going to happen. Kind regards and good luck to all, trade safe!!!

Christian Schoner

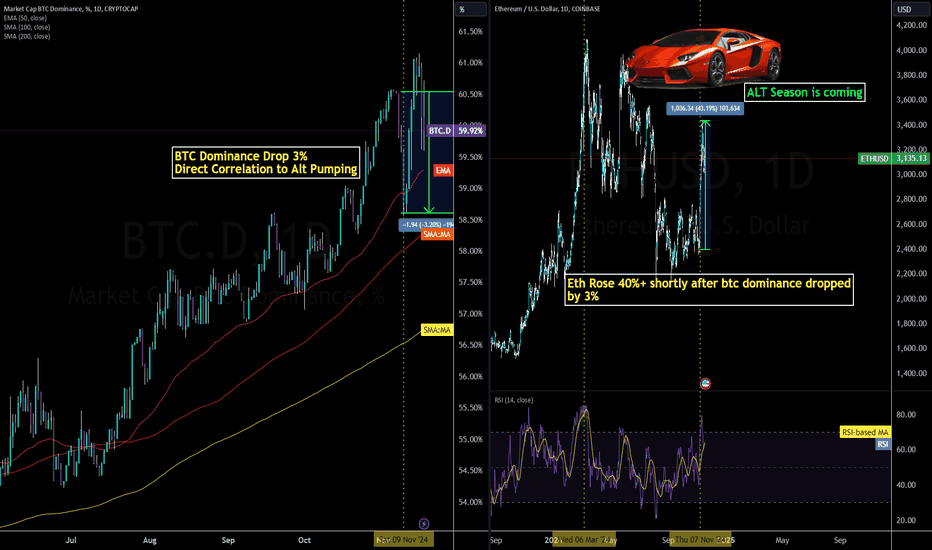

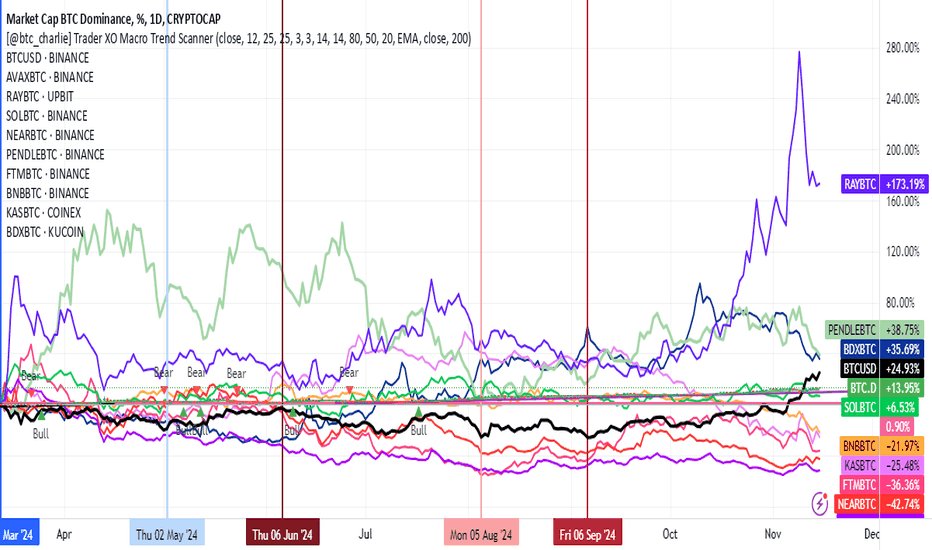

Alt Season is Coming!!! Event Overview

On November 9th, 2024, Bitcoin dominance in the cryptocurrency market experienced a significant drop of 3.2%, falling from to . This event coincided with a notable surge in Ethereum's price, which saw a dramatic increase of 43% over the same period. This pattern highlights the cyclical behavior within the cryptocurrency market, where liquidity flows from Bitcoin to alternative coins (altcoins) such as Ethereum and Solana during key shifts in market dynamics.

Key Observations

Bitcoin Dominance Drop:

Bitcoin dominance measures Bitcoin's share of the total cryptocurrency market capitalization. A decline in this metric typically indicates that investors are diversifying their holdings into altcoins. The 3.2% drop on November 9th suggests a significant shift in investor sentiment, with traders taking profits on Bitcoin's gains and reallocating capital into other cryptocurrencies.

Ethereum's Surge:

Ethereum, the second-largest cryptocurrency by market capitalization, responded to Bitcoin's dominance decrease with a sharp 43% price increase. This aligns with historical trends where Ethereum and other altcoins benefit from liquidity rotations as retail and institutional investors diversify into higher-risk, higher-reward assets once Bitcoin's momentum slows.

Market Behavior:

The behavior observed on November 9th exemplifies the "altseason" phenomenon. This term describes periods when altcoins outperform Bitcoin, often triggered by:

Profit-Taking in Bitcoin: Investors cash out after substantial BTC price gains, leading to reduced dominance.

Increased Risk Appetite: After Bitcoin stabilizes, retail investors and traders seek growth opportunities in altcoins, which often have higher upside potential during bullish phases.

Ethereum as a Gateway Asset: As the largest altcoin, Ethereum frequently acts as the initial beneficiary of liquidity flow, serving as a bridge between Bitcoin and smaller altcoins.

Solana and Other Altcoins:

While Ethereum saw the most significant surge, other altcoins such as Solana also experienced gains as the liquidity rotation expanded beyond Ethereum. This cascading effect reflects a typical pattern where capital initially flows into major altcoins (e.g., ETH) before moving into mid-cap and small-cap cryptocurrencies.

Implications

Correlation Analysis: The event underscores a direct correlation between Bitcoin dominance and altcoin performance. When Bitcoin dominance drops, liquidity often shifts into altcoins, driven by profit-taking and increased speculative interest.

Investor Strategies: For traders and investors, monitoring Bitcoin dominance can serve as an early indicator of altcoin market opportunities. A sharp decline in BTC dominance often signals the start of an altcoin rally.

Market Cycles: Understanding these market dynamics is critical for timing entries and exits. Investors who recognize the signs of a dominance shift can capitalize on altcoin price movements while managing risk effectively.

Conclusion

The 3.2% drop in Bitcoin dominance on November 9th, 2024, and the subsequent 43% rise in Ethereum illustrate the fluidity of capital within the cryptocurrency market. This event reaffirms the principle that liquidity flows from Bitcoin into altcoins during profit-taking phases, driven by retail and institutional behavior. Ethereum's performance during this period also highlights its pivotal role as a leading altcoin and a bellwether for broader market trends. As the market evolves, tracking Bitcoin dominance alongside altcoin performance will remain essential for understanding and predicting cryptocurrency price movements.

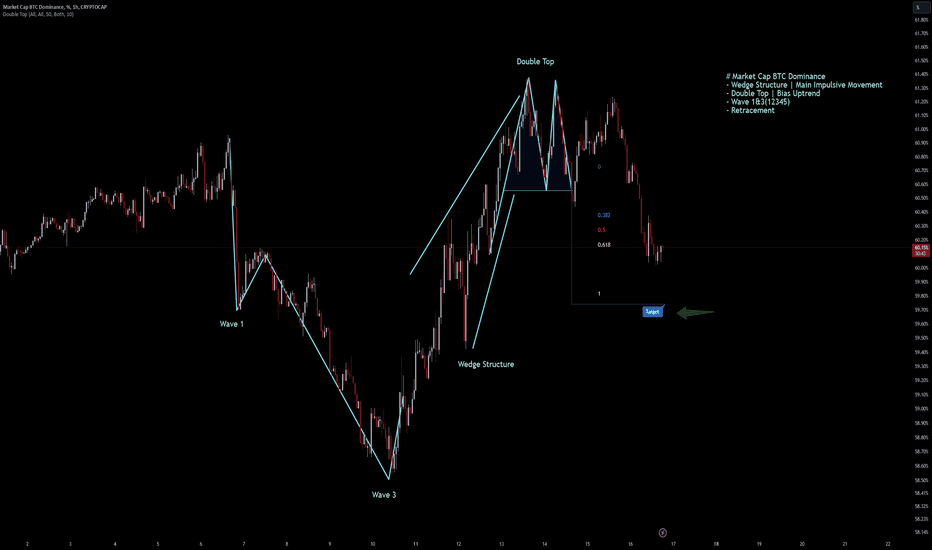

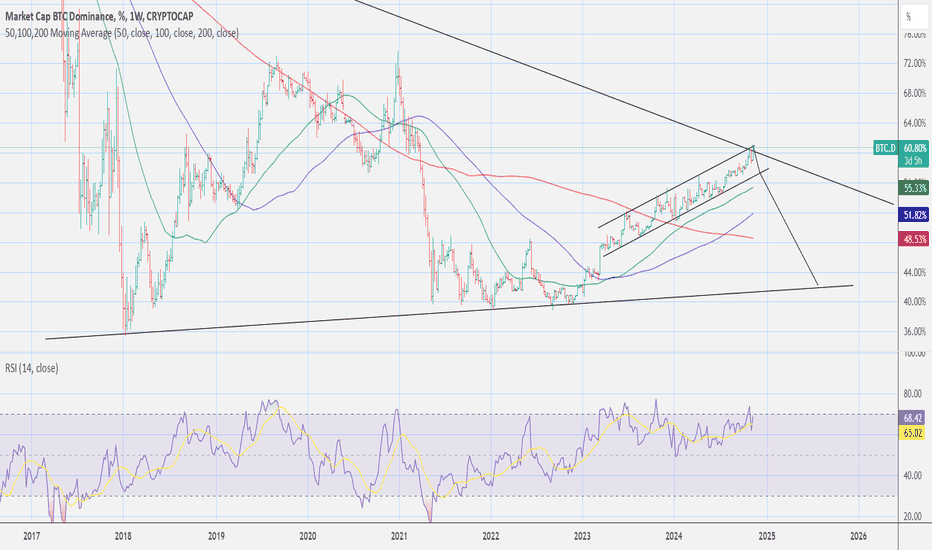

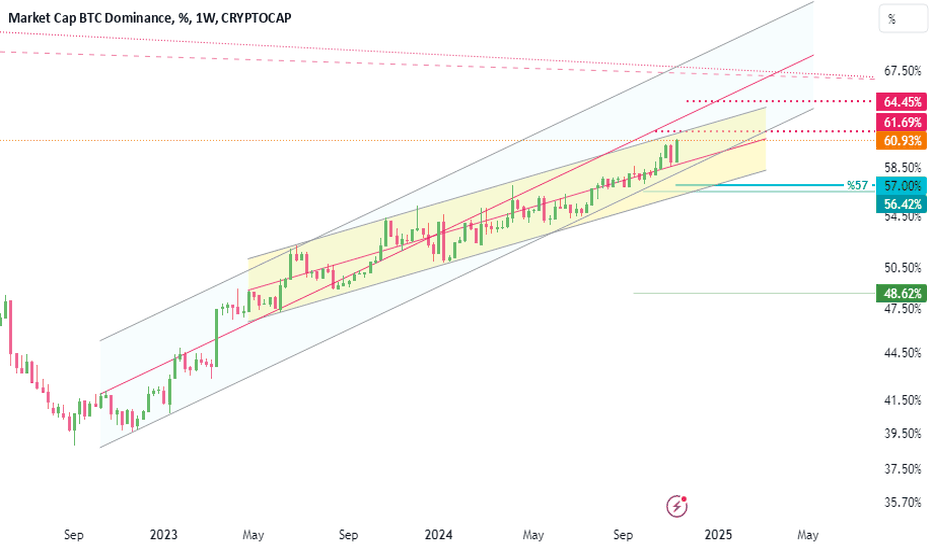

Market Cap BTC Dominance | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Market Cap BTC Dominance

- Wedge Structure | Main Impulsive Movement

- Double Top | Bias Uptrend

- Wave 1&3(12345)

- Retracement

- Scalp Intraday Set Up | Bearish

- Long Swing Trade Set Up | Bullish

Active Sessions on Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management on Demand;

Overall Consensus | Neutral | Long(Swing) & Short(Scalp Intraday Set Up)

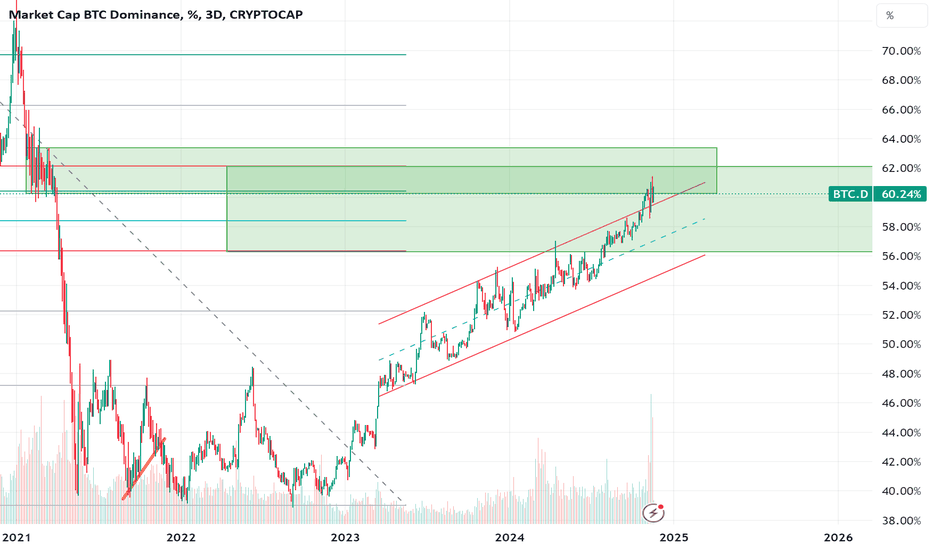

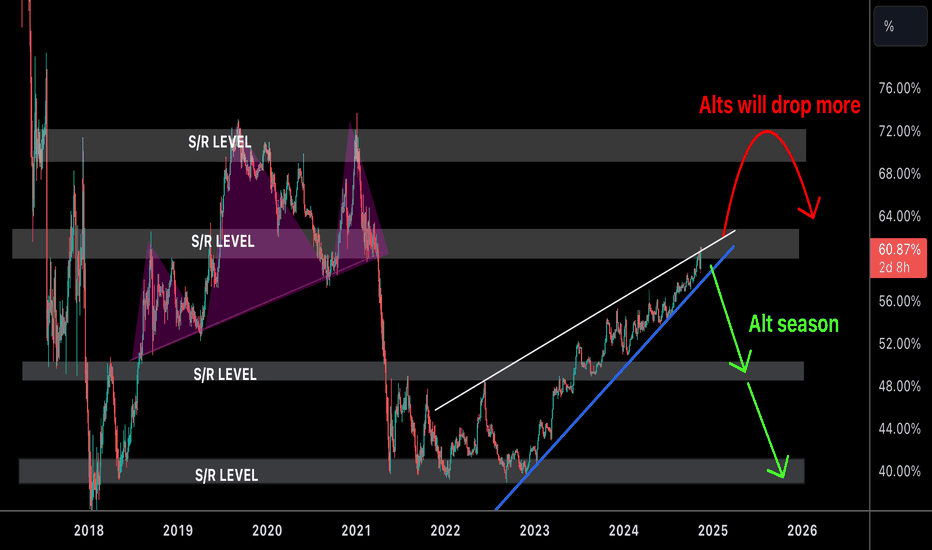

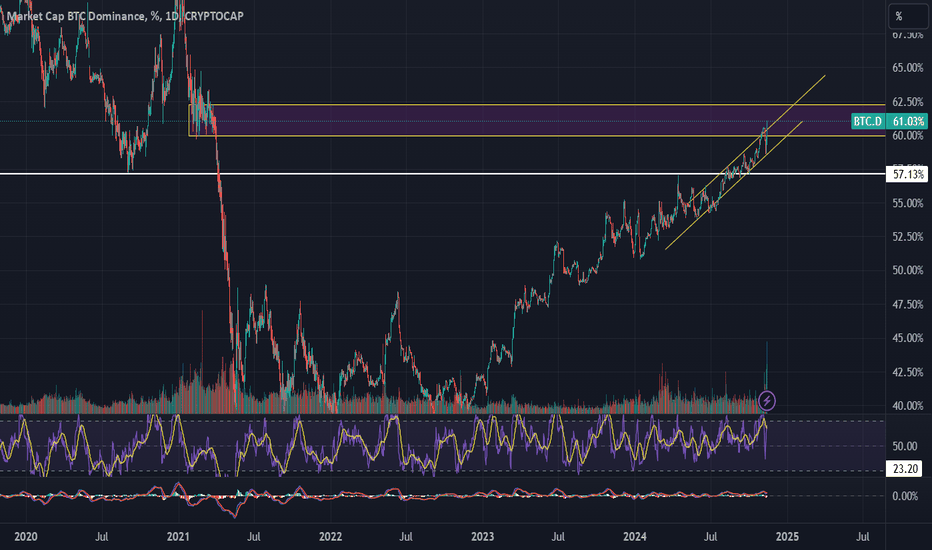

Put money on an altseason coming soonAlt season is likely approaching! We're currently hitting resistance on the intermediate-term trend line, making a correction in BTC dominance seem reasonable. If more institutional money starts shifting from BTC to ETH ETFs, it could trigger a surge in major altcoins, creating retail FOMO. Retail investors typically have a higher risk appetite than institutions, and they'll likely be drawn to the potential of altcoins. I'm loading up on alts right now. I would look to exit my alts positions around or below 45-50% btc dominance.

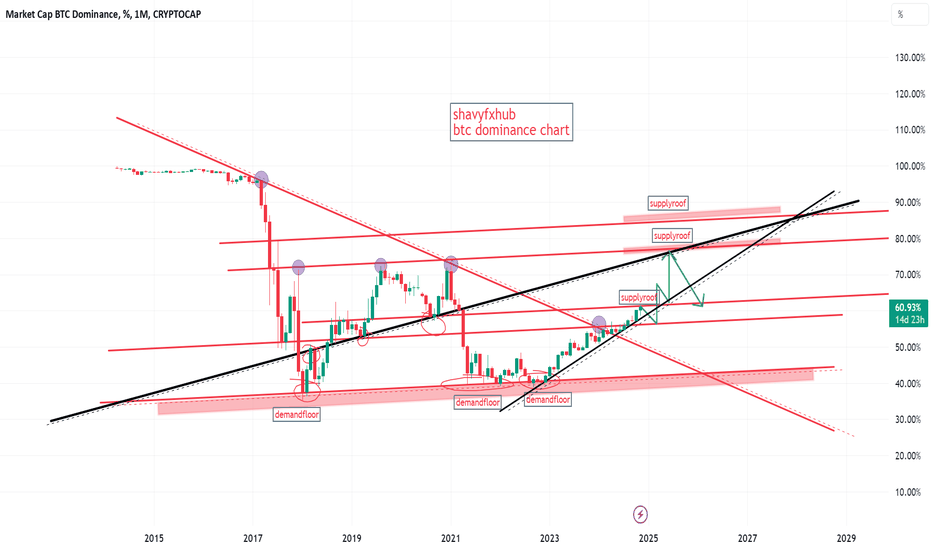

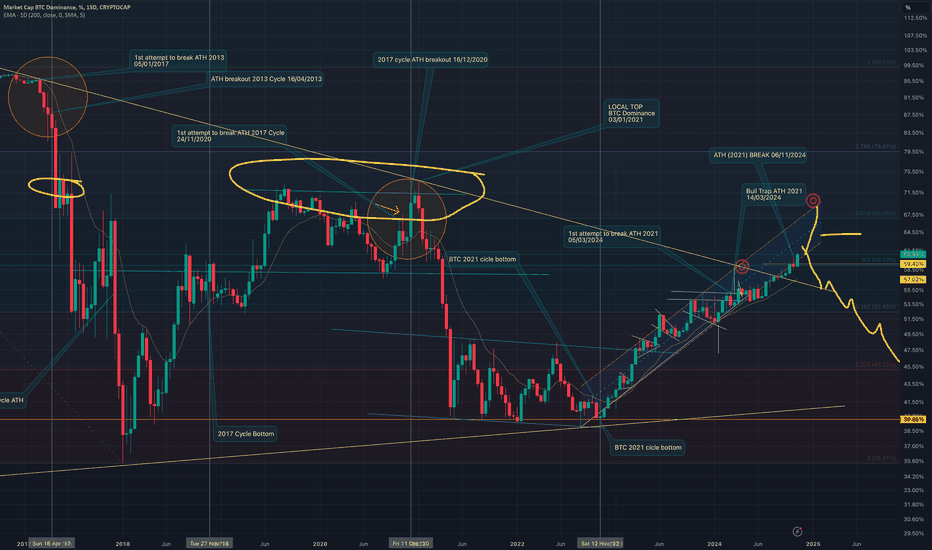

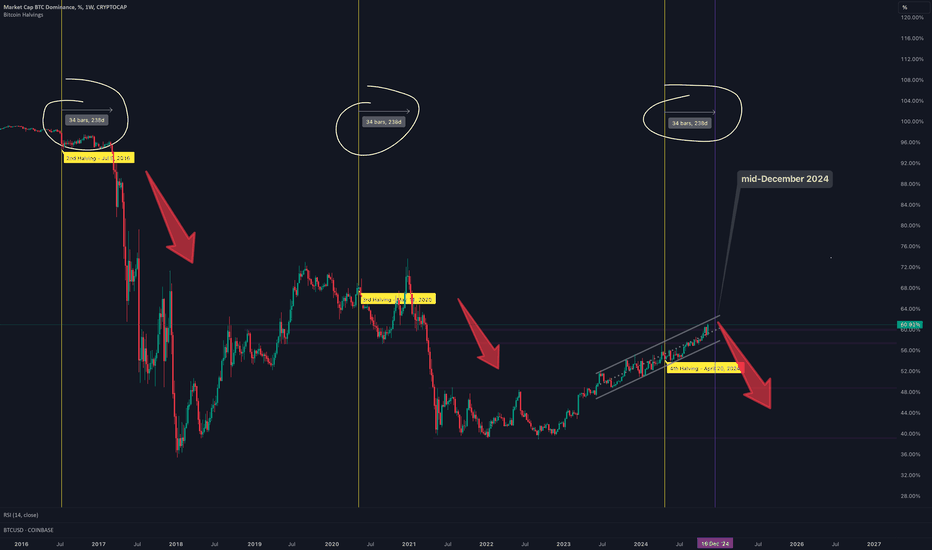

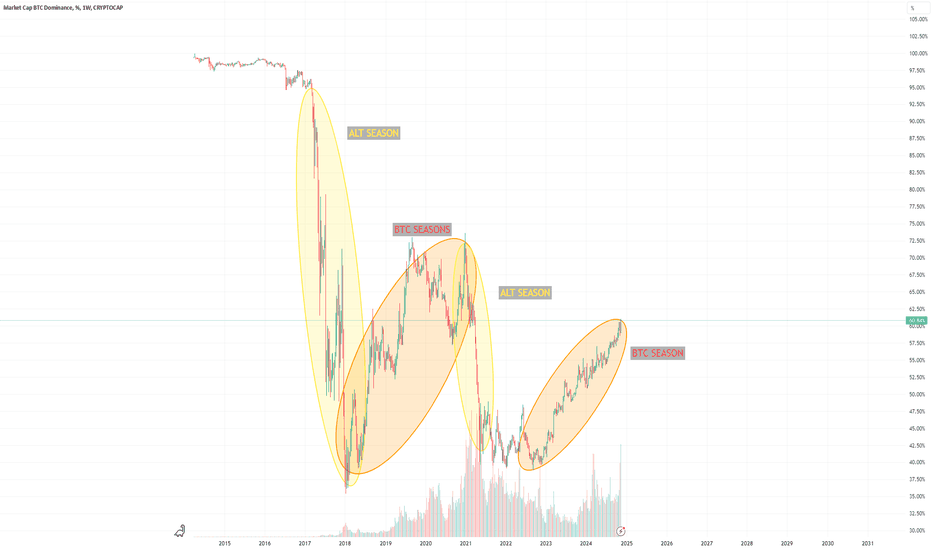

Alt-season? Bitcoin BTC Dominance past cycles behavior analysis The best way to spot an altseason is looking at the Bitcoin BTC Dominance graph.

On this analysis, of the behavior of the Bitcoin BTC Dominance, I spotted in the graph , what happened on the last two cycles, 2017 and 2021, looking back to the 2013 BTC price top.

In the analysis I spotted three types of events:

All Time High (ATH)

Cycle Bottom

Attempts to break the past cycle's ATH

This brought me some interesting "coincidences" that leads to some insightful predictions.

My conclusion, so far, is that an All Time High breakout is a very important moment to the possible alt season beginning. One thing that should be considered is that the current cycle has some different characteristics as, probably in detail, all of them have. This means that maybe it could take some more time to the alt season start, as it did for the ATH be finally broken.

One thing I did'n mention in the video is that the BTC dominance has broken a theoretical downtrend line. That said, considering the end of the year calendar change that is a mentally important moment, I wouldn't be surprised if the altseason waits till January to pick up.

To be continued...

BTC DOMINANCE UPDATEBTC DOMINANCE ANALYSIS :

In the past 7 months, Bitcoin has been ranging between 50k and 70k, then Bitcoin made a new all-time high, during this period, altcoins have struggled to rise …yes, some have seen significant growth but the majority are still at very deep lows. The main reason for this is rise the dominance of Bitcoin alongside Bitcoin!

We are looking at the current level, I hope there will be a rejection …If it rejected here, we could see a great altcoin season, but if it continues to rise, we could reach 70% (2020 high) before the alt-season.

Keep following this chart!

Best wishes

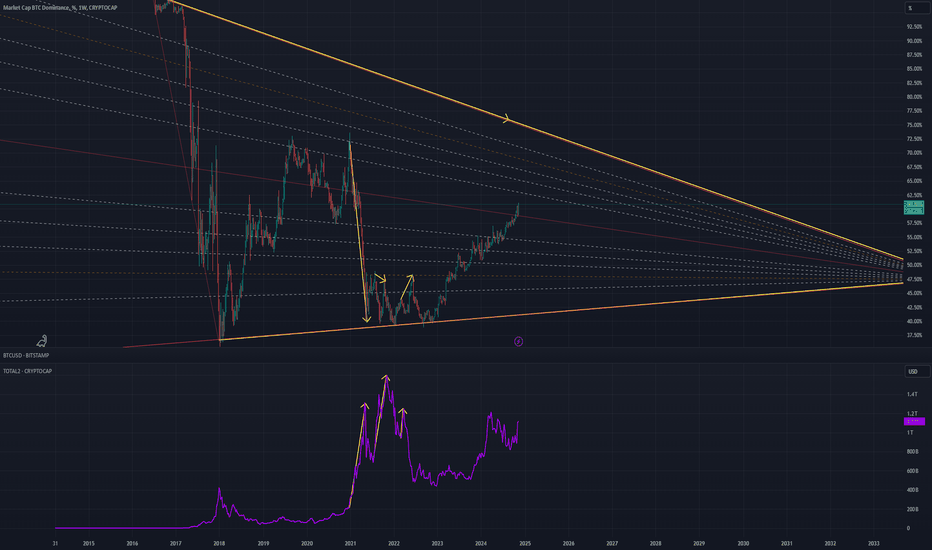

Alt season coming in?This chart shows Bitcoin (BTC) dominance percentage in the cryptocurrency market over the years, with highlighted BTC and Altcoin seasons.

BTC Season: Phases when BTC dominance is increasing, typically accompanied by growing investor attention and price rises. During these periods, investors tend to focus more on Bitcoin than on altcoins.

ALT Season: Phases when BTC dominance is declining, indicating a shift in investor interest toward altcoins. These seasons often lead to significant gains in altcoin values.

The chart illustrates the cyclical shifts between Bitcoin dominance and altcoin growth, which can help investors gauge when it might be advantageous to focus on BTC or altcoins, depending on the current market cycle.

BTC RSI > 70 and its parabolic runs... and BTC.DIf you look at the times where bitcoin has gone on its parabolic runs, the RSI has closed above the 70 and held there.

I know the charts are not related, but as BTC has just reached adoption from the USA it has entered the bullish control zone (>70k). Could this be the normal parabolic run for bitcoin, or something much greater

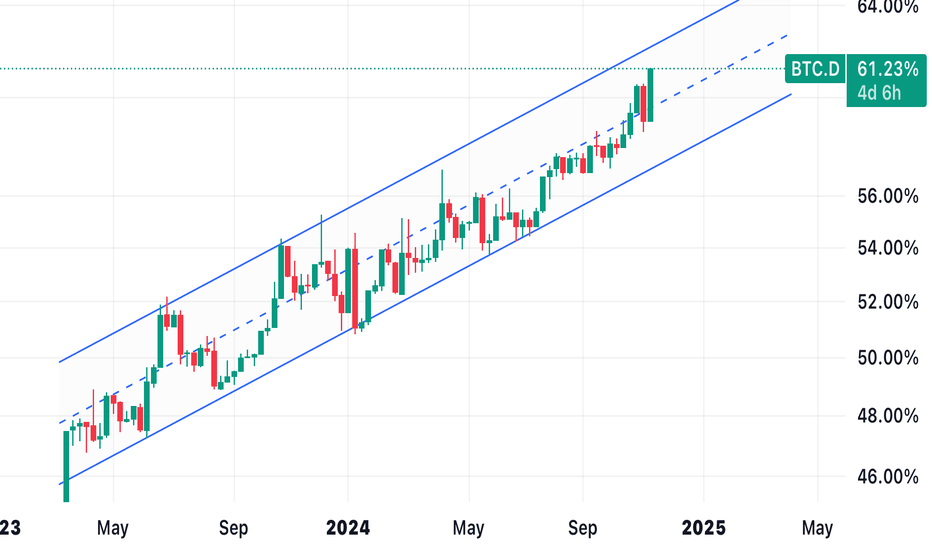

Ascending Channel Btc dominance is nearing the top of the ascending channel and for an alt season to occur dominance needs to get rejected at the top of this channel which is around 62%

BTC.D has been in an uptrend for 2 years, two months, and two weeks slaughtering Alt Season from left and right. I think the top of this channel will be crustal for Alts. I suggest people waiting for alt season to what out for this channel as it can be used as an indicator for at least a mini multi week alt season.