BTCETH.P trade ideas

Bitcoin Has Bearish DivergenceOverbought bearish divergence.

I pointed this out last week. In my mind, this is the most reliable signal for tops (bullish divergence for bottoms) that exists in technical analysis. We can see that this continues to play out, and know that it usually leads to RSI making the trip to oversold.

It looks like more correction is likely, standard fare in a bull market.

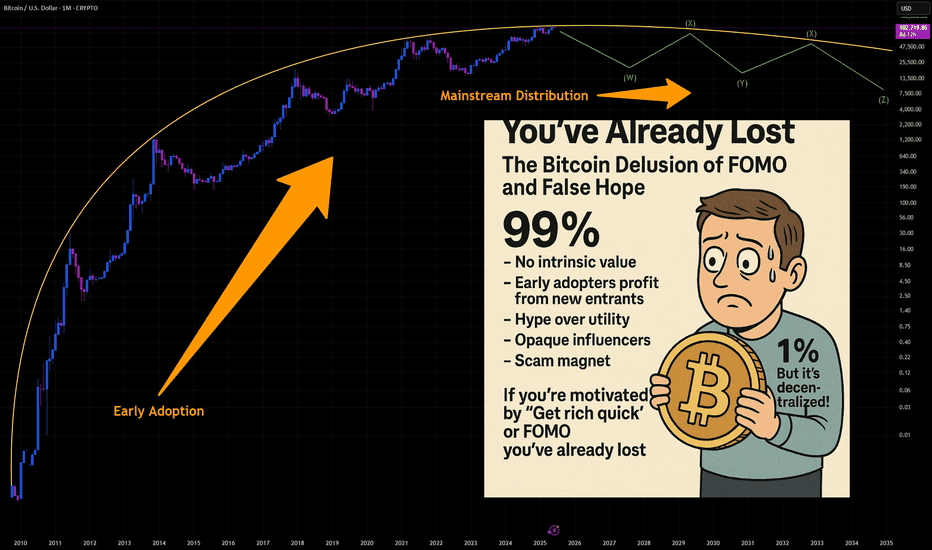

You've Already Lost: The Bitcoin Delusion of FOMO and False HopeLet’s get one thing straight: if you’re staring at Bitcoin, squinting past the red flags, and convincing yourself it’s not a Ponzi scheme because of that one shiny feature that screams “legit,” you’re not investing—you’re auditioning for the role of “next victim.” And if your motivation is the fear of missing out (FOMO) or the fantasy of getting rich quick, well... congratulations. You’ve already lost.

The 99%: Red Flags Waving Like It’s a Parade

Let’s talk about the indicators—the ones that make Bitcoin look suspiciously like a Ponzi scheme. No, it’s not technically one, but the resemblance is uncanny:

- No intrinsic value: Bitcoin isn’t backed by assets, cash flow, or a government. It’s worth what the next person is willing to pay. That’s not investing. That’s speculative hot potato.

- Early adopters profit from new entrants: The people who got in early? They’re cashing out while newcomers buy in at inflated prices. That’s the classic Ponzi dynamic: old money out, new money in.

- Hype over utility: Bitcoin’s actual use as a currency is minimal. It’s slow, expensive to transact, and volatile. But hey, who needs functionality when you’ve got memes and moon emojis?

- Opaque influencers: From anonymous creators (hello, Satoshi) to crypto bros promising Lambos, the ecosystem thrives on charisma, not accountability.

- Scam magnet: Bitcoin has been the currency of choice for over 1,700 Ponzi schemes and scams, according to a University of New Mexico study cs.unm.edu . That’s not a coincidence. That’s a pattern.

The 1%: The “But It’s Decentralized!” Defense

Ah yes, the one redeeming quality that Bitcoin evangelists cling to like a life raft: decentralization. No central authority! No government control! It’s the financial revolution!

Except… decentralization doesn’t magically make something a good investment. It just means no one’s in charge when things go wrong. And when the market crashes (again), you can’t call customer service. You can tweet into the void, though.

FOMO: The Real Engine Behind the Madness

Let’s be honest. Most people aren’t buying Bitcoin because they believe in the tech. They’re buying because they saw someone on TikTok turn $500 into a Tesla. FOMO is the fuel, and social media is the match.

Bitcoin’s meteoric rises are often driven by hype cycles, not fundamentals. Tesla buys in? Price spikes. El Salvador adopts it? Price spikes. Your cousin’s dog walker says it’s going to $1 million? Price spikes. Then it crashes. Rinse, repeat.

This isn’t investing. It’s gambling with a tech-savvy twist.

The Punchline: You’ve Already Lost

If you’re ignoring the overwhelming signs of speculative mania and clinging to the one feature that makes you feel better about your decision, you’re not ahead of the curve—you’re the mark. And if your motivation is “I don’t want to miss out,” you already have. You’ve missed out on rational thinking, due diligence, and the ability to distinguish between innovation and illusion.

Bitcoin might not be a Ponzi scheme in the legal sense. But if it walks like one, talks like one, and makes early adopters rich at the expense of latecomers… maybe it’s time to stop pretending it’s something else.

INDEX:BTCUSD NYSE:CRCL NASDAQ:HOOD TVC:DXY NASDAQ:MSTR TVC:SILVER TVC:GOLD NASDAQ:TSLA NASDAQ:COIN NASDAQ:MARA

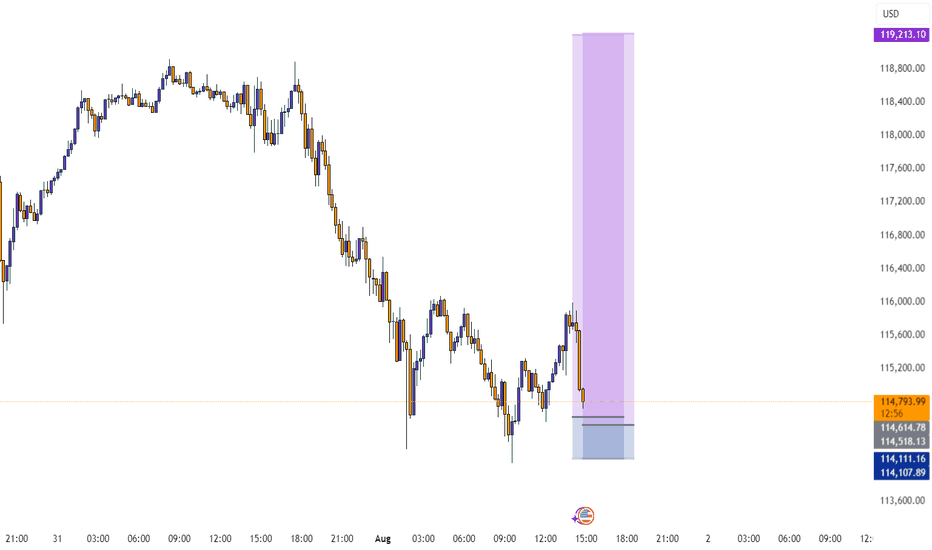

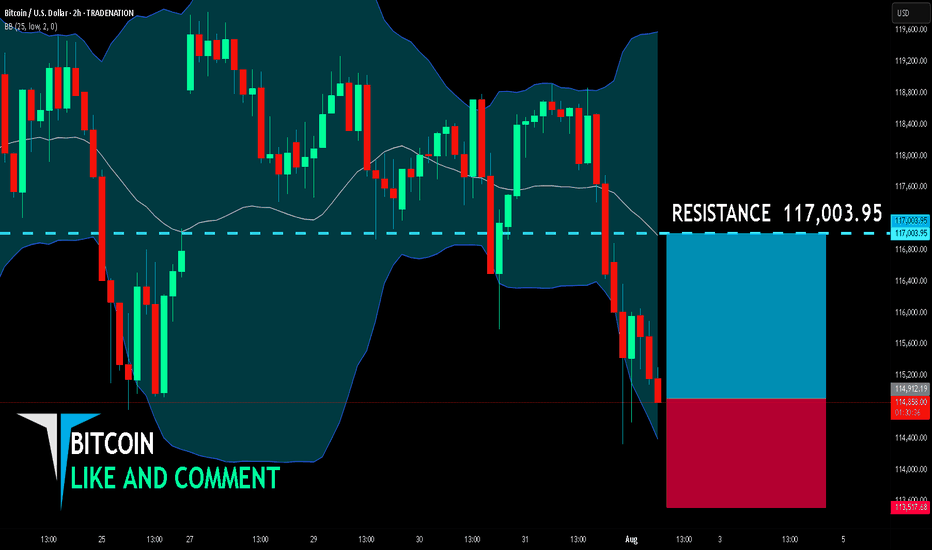

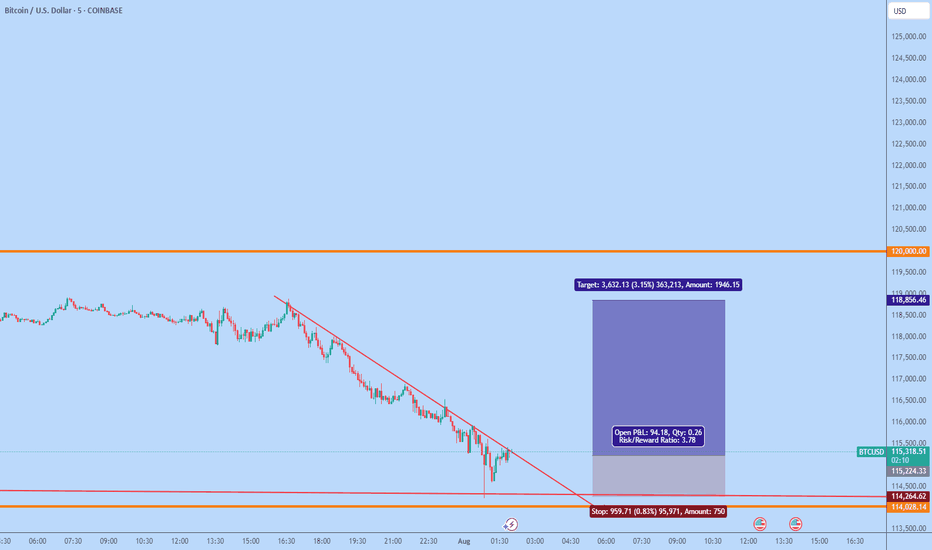

BITCOIN SENDS CLEAR BULLISH SIGNALS|LONG

BITCOIN SIGNAL

Trade Direction: long

Entry Level: 114,912.19

Target Level: 117,003.95

Stop Loss: 113,517.68

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

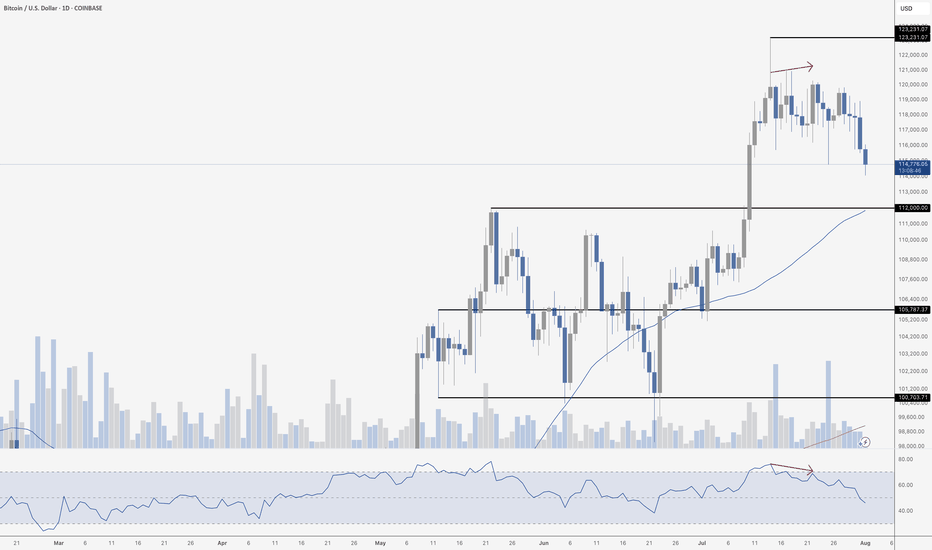

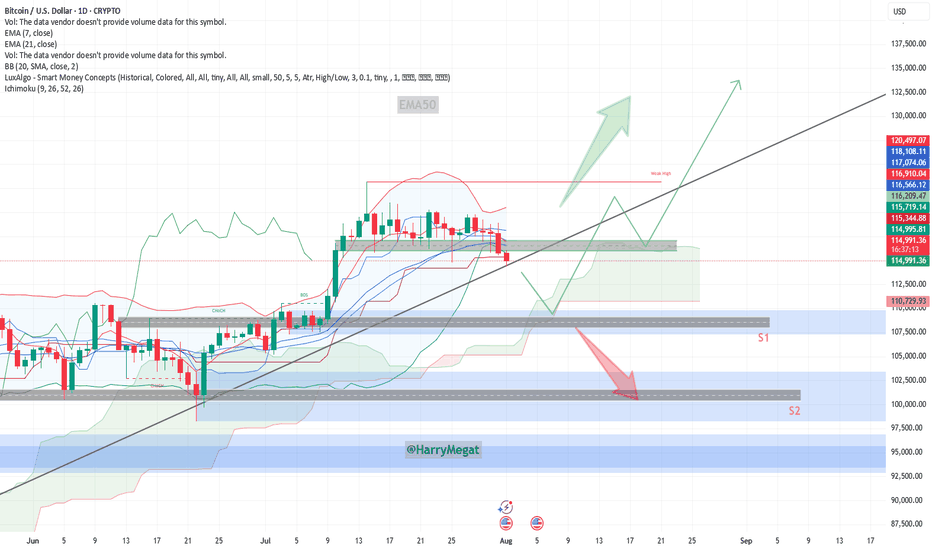

Analysis BTC/USD Daily ChartAnalysis BTC/USD Daily Chart

**Chart Overview (Daily Timeframe)**

**Current Price**: \~\$114,937

**EMA 7**: \$116,896 (short-term)

**EMA 21**: \$116,561 (medium-term)

**Trendline**: Price is testing the long-term ascending trendline

**Key Zones:**

* **Support 1 (S1)**: \~\$110,000

* **Support 2 (S2)**: \~\$102,000

* **Immediate Resistance Zone**: \~\$116,000–\$120,000

**Bullish Scenario**

**Conditions**:

* Price **holds above the ascending trendline**

* A strong **bounce from current level (\~\$115K)** or a reclaim above **\$116K**

**Buy Setup**:

* **Entry**: \$115,000–\$116,000 (if bounce confirmed)

* **Stop-loss**: Below \$114,000 or the ascending trendline

* **Targets**:

* TP1: \$120,000

* TP2: \$125,000

* TP3: \$132,000+

**Confirmation**:

* Bullish candle formation near the trendline

* Reclaim of EMAs (especially EMA 7)

**Bearish Scenario**

**Conditions**:

* Price **breaks below the ascending trendline** and **closes below \$114K**

* Rejection from \$116K zone with a strong red candle

**Sell Setup**:

* **Entry**: Below \$114,000 (on confirmed breakdown)

* **Stop-loss**: Above \$116,000

* **Targets**:

* TP1: \$110,000 (S1)

* TP2: \$105,000

* TP3: \$102,000 (S2)

**Invalidation**:

* Quick recovery above \$114.5K and trendline reclaim = possible fakeout

**Bias**

**Neutral to Bullish**, as price is **at trendline support**.

Watch closely for **price reaction at current levels** for the next directional trade.

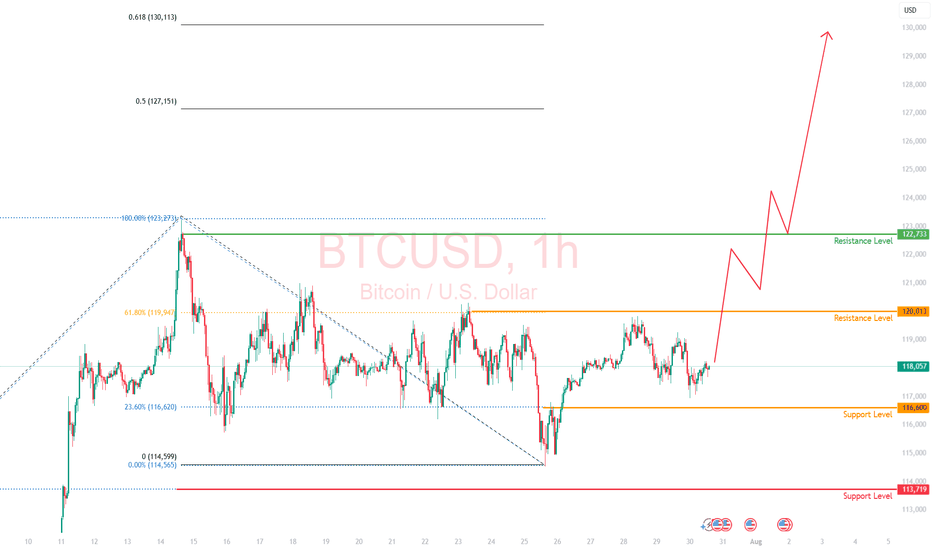

Bitcoin Passes Stress TestOn July 25, 2025, Galaxy Digital executed one of the largest Bitcoin sales ever recorded: 80,000 BTC, valued at approximately $9 billion , on behalf of a Satoshi-era investor.

Despite the size, the market absorbed the flow with minimal volatility—Bitcoin dipped from around $119,000 to $115,000, then rebounded above $119,000.

Liquidity Maturity in Motion

Analysts called the trade a significant demonstration of market maturity, noting that 80,000 BTC was absorbed in days with barely a market blip.

Crypto infrastructure has also evolved: algorithmic liquidity providers, institutional desks, and OTC channels handled the load without triggering cascading funding rate hikes or forced liquidations.

Ongoing Risks

Event-Driven Stress: During macro shocks or sharp sell-offs, liquidity may thin, and the same level of absorption might not persist.

OTC vs Exchange: This large sale was managed mostly off-exchange. A similar-sized on-exchange dump could still trigger stop-run cascades.

Retail Complacency Risk: The stability seen now can be deceptive, as retail may misinterpret low volatility as a safe leverage zone, only to be caught off-guard.

Projections:

Watching the 23.6% fib retracement level in line with the $116,600 price level. Anticipate the resistance level of $120,000 to be retested.

If price breaks above $120,000, we could see a significant move toward $130,000

The $9B BTC sale went through without materially impacting price is considered a milestone in crypto market evolution. It reflects institutional-grade liquidity and sentiment maturity.

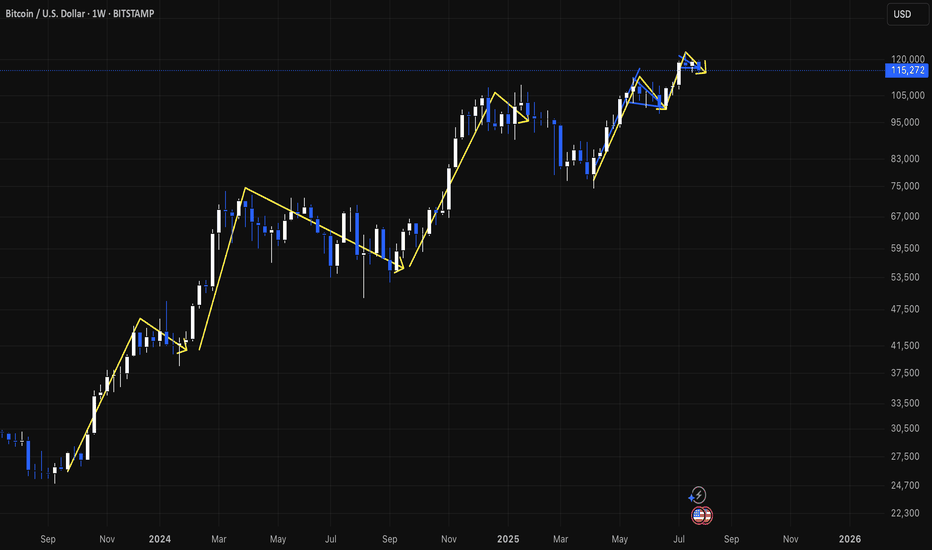

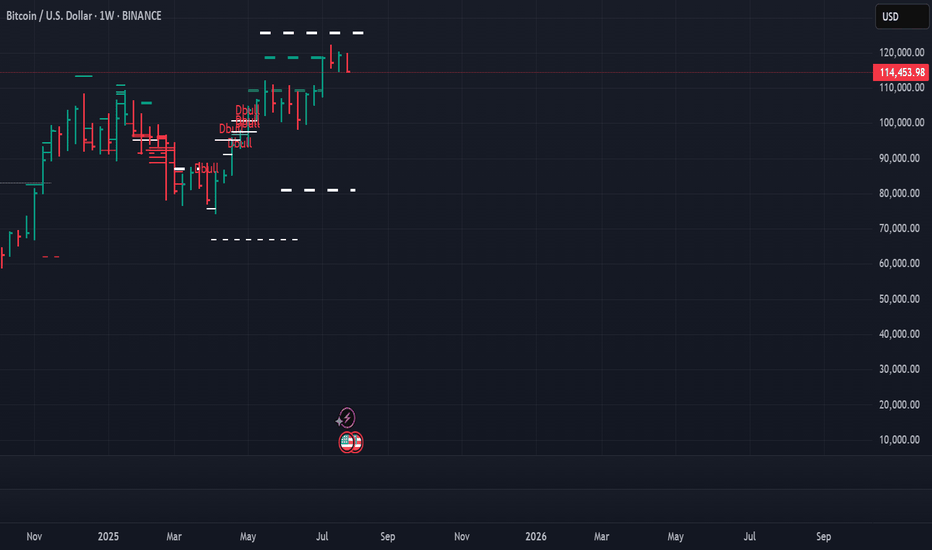

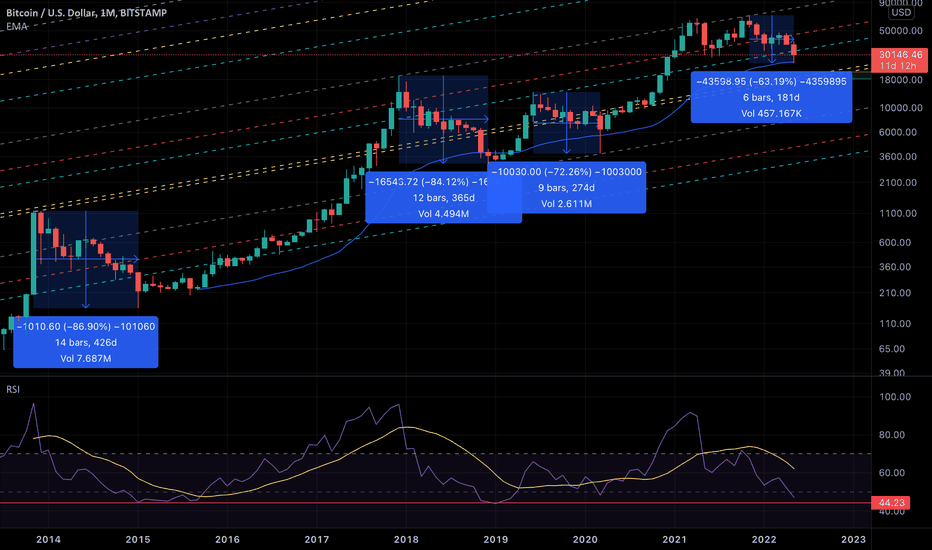

Where exactly is the most probable bottom of BTC for this cycle?This is the analysis based on the following data points

1. Monthly historical price action

2. Monthly Fibonacci Channel

3. Monthly Fibonacci Extension

4. EMA50 (Monthly)

5. RSI

We have been analyzing long term BTC price movements accurately since December 2021. Now that BTC is in sideway again, we are going to analyze the possible next moves. To be honest, current market is the hardest to analyze for us. There are mixed signals on the chart. We will try to provide as much information and perspectives as we can.

We will start with the Fibonacci extension which we have drawn based on monthly swing high/low. And zoomed in as a daily chart. Below you can see that the price bounced back exactly at 0.618 line of the fib extension. If you look at the Monthly chart above, it just touched monthly 50EMA line that day too. Coincidence? If we hit that golden pocket again and restart the bull run again, I won’t be surprised.

However, there is still a chance that we will go down further.

Let’s look at the monthly chart above for that assumption.

If we look at 2014/2015, 2017/2018, and 2019/2020 price actions, we are very near our maximum pain level. We are already in 6 months with -63% from the top. It also aligned with what we have suggested in our RSI based analysis here .

If we combine that two data points with the fib channel, we conclude that the area of fib channel golden pocket should be the bottom for this cycle. It will be -73% from the top. RSI monthly will also hit the bottom line.

One thing to note is that if we are going to break below that golden pocket, we will be looking at one of the worst bear market in the history.

Good luck.

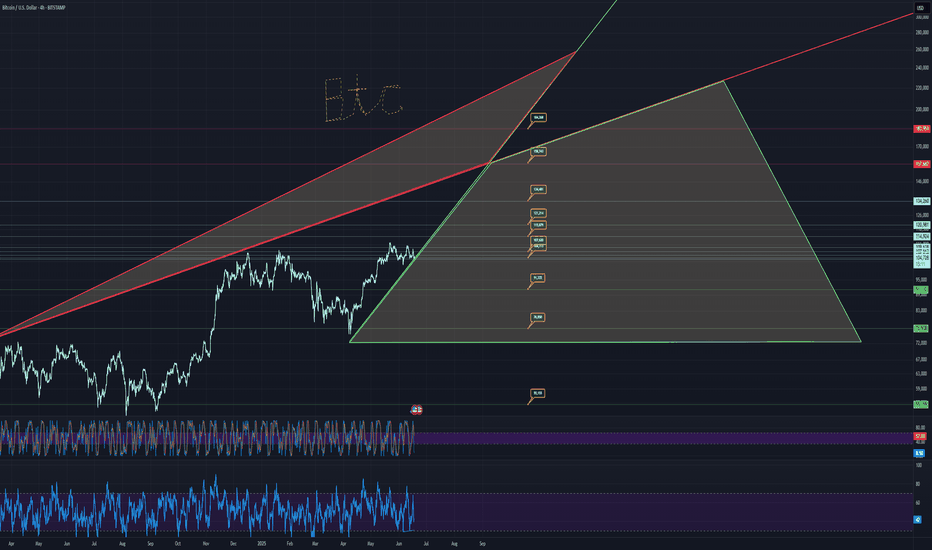

BTC USD 180K BIG HOW?Trends and price targets is how, but realistically, it looks like 134k in the short term.

Drop is wicked if it were to occur, takes price to literally 12k, which you want to go all in if that occurs.

55k is another drop zone.

Otherwise, it looks fairly bullish.

buy zone marked in green,

sell in red.

watch the trends

and price targets are pretty accurate usually.

good luck!!

Custom charts by request.

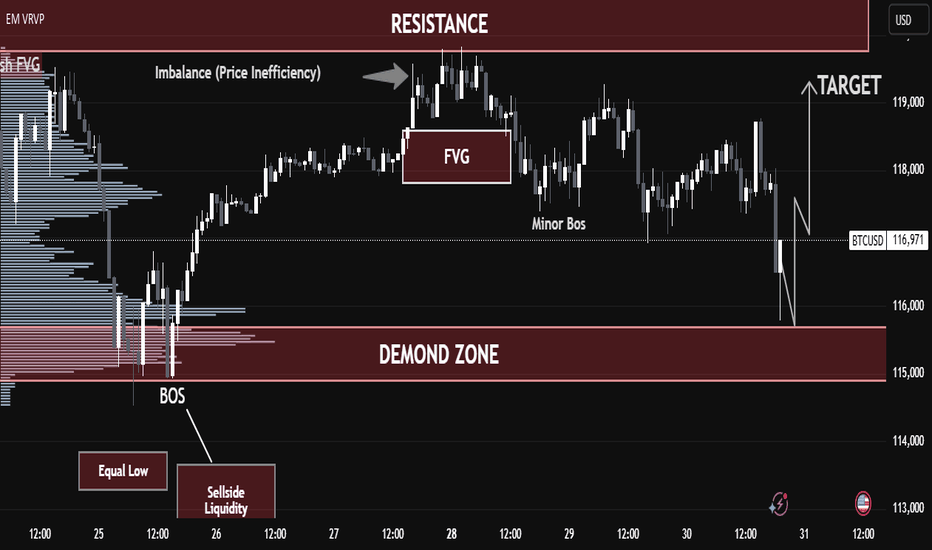

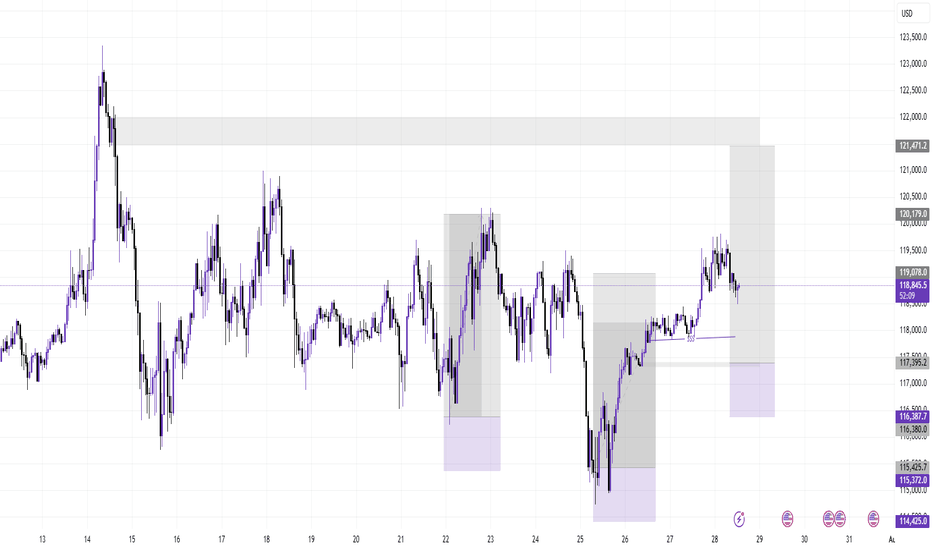

BTC/USD – Strong Buy Opportunity from Demand Zone BTC/USD – Strong Buy Opportunity from Demand Zone

🟢 Technical Outlook:

Bitcoin (BTC/USD) has tapped into a well-defined Demand Zone near 115,000–116,000, showing early signs of a potential bullish reversal. This level aligns with key liquidity zones, smart money concepts, and price inefficiencies — offering high-probability long setups.

🧠 Key Technical Highlights:

🔻 Equal Lows + Sell-Side Liquidity:

Market swept equal lows, grabbing liquidity below support — a common institutional setup before a bullish push.

✅ Break of Structure (BOS):

A prior BOS indicates a shift from bearish to bullish structure after liquidity collection.

📉 Fair Value Gap (FVG):

Price created and respected an FVG after the BOS, validating bullish intent.

📊 Imbalance Filled:

A prior price inefficiency has now been filled, completing a clean move from imbalance back into structure.

📈 Target Zone: 119,000 USD

Marked as the logical next stop — sitting near prior resistance and a liquidity zone.

🎓 Educational Insight:

This is a textbook Smart Money Concept scenario:

Sell-side liquidity sweep

Demand zone tap

Imbalance rebalancing

Shift in market structure

It shows how institutions often engineer liquidity grabs before a large directional move.

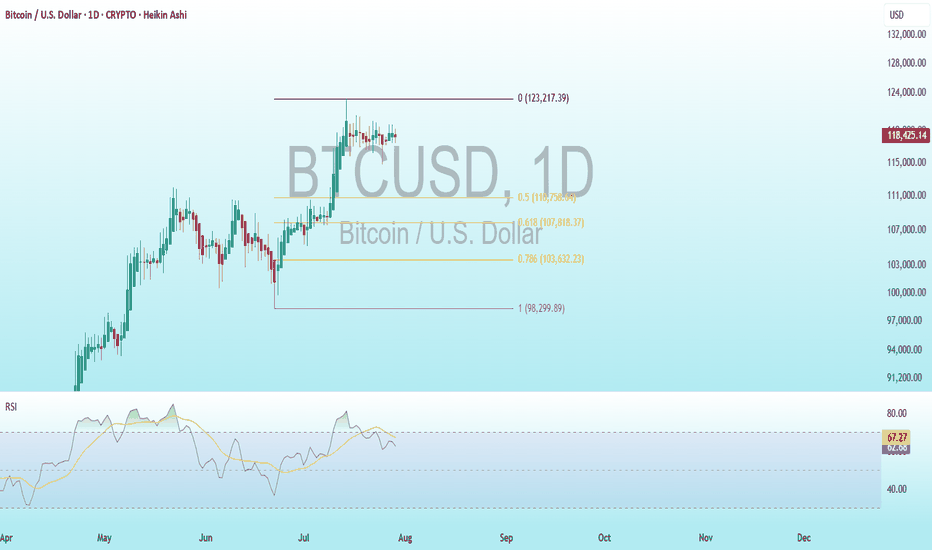

BTC Bearish DivergenceBINANCE:BTCUSDT

Rezistance Levels: 123,217.39.

Support: 98,299.89

Trade Setup:

Target 1: 110,758.64 (0.50 Fibonnaci Golden Zone).

Target 2: 107,818.37 (0.618 Fibonnaci Golden Zone).

Target 3: 103,632.23 (0.786 Fibonnaci Golden Zone).

Target 3: 98,299.89 (1 Fibonnaci).

Stop Loss: 123,217.39 (above recent high, ~25% above current price).

RSI Analysis: The RSI shows a bullish divergence (price making lower lows while RSI makes higher lows), suggesting potential upward momentum. Current RSI is around 62.80, nearing overbought territory (>70), so caution is advised.

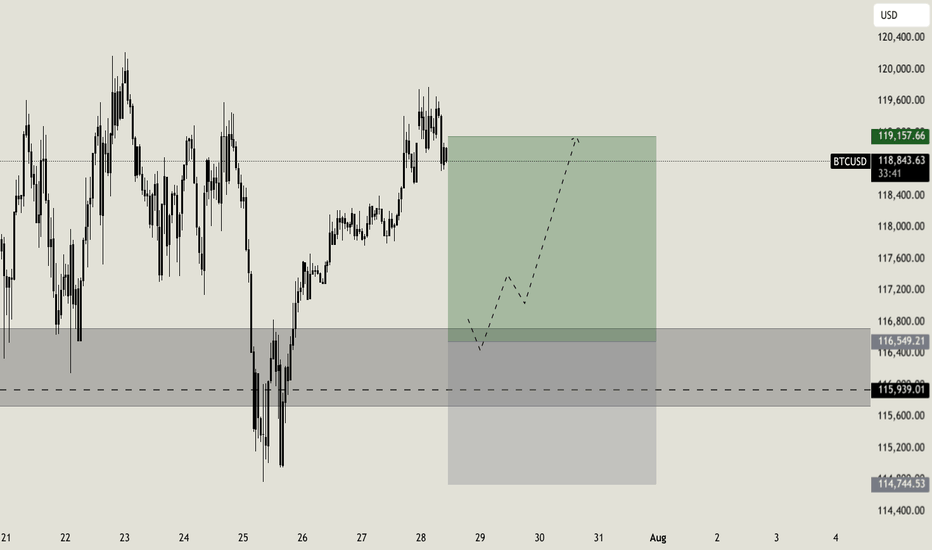

Weekly setup for BTCLast week i was waiting for a short confirmation on Bitcoin, a confirmation that has never arrived. But setups are made for this: we wait the right moment to join the market, based on a cold analysis. Considering that the support area looks still strong, i will now wait for a retracement till the key level at $116.550. Around this level i will look for a rejection to enter long, targeting the resistance zone at $119.000

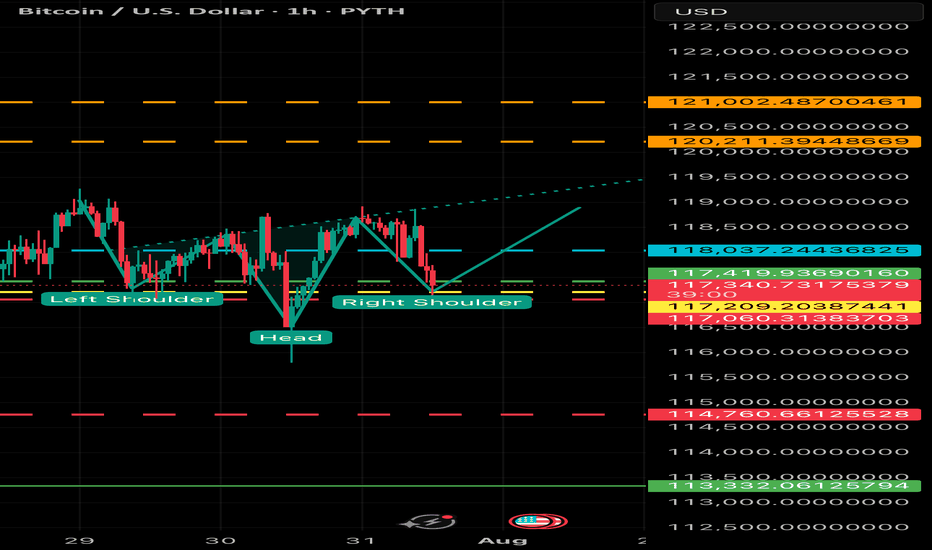

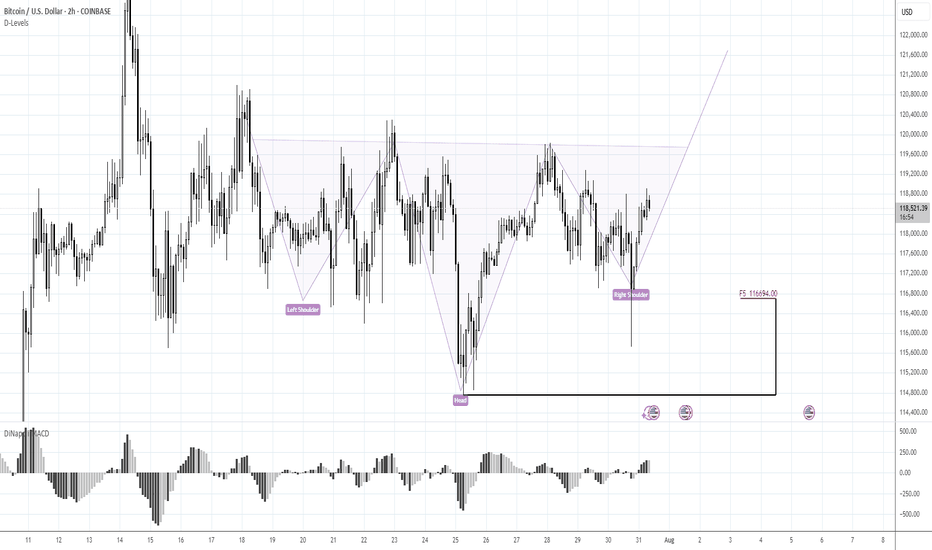

Keep following to the H&S PatternMorning folks,

To be honest, not too many things to talk about. We've prepared our scenario with H&S is still valid. Reaction to GDP numbers was quite welcome as it set the right arm's bottom. The only thing that we have to be busy with is to control its validity - reaching of the neckline and price standing above 116 lows and right arm.

At the first signs that market is start falling back - do not take any new longs. H&S failure is also the pattern and in this case we get deeper correction. But daily chart still makes me think that bullish context is here

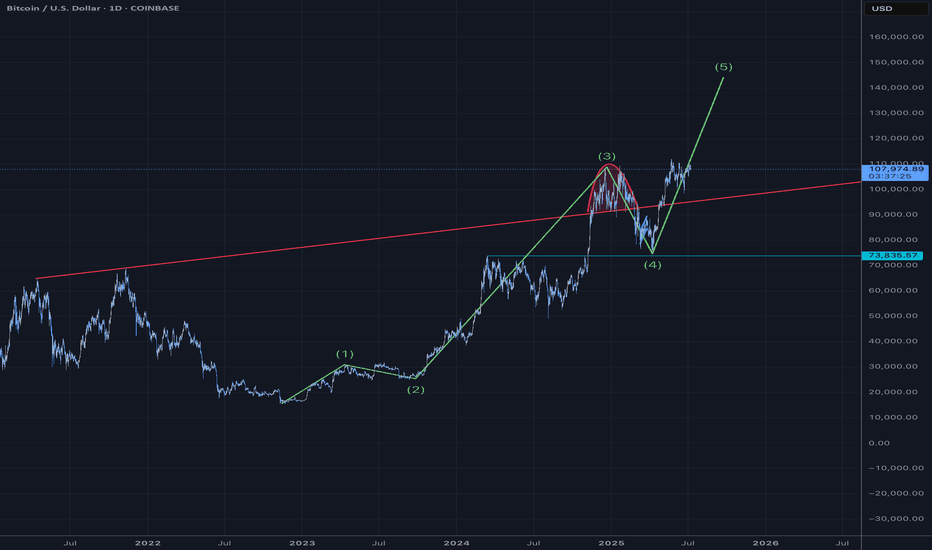

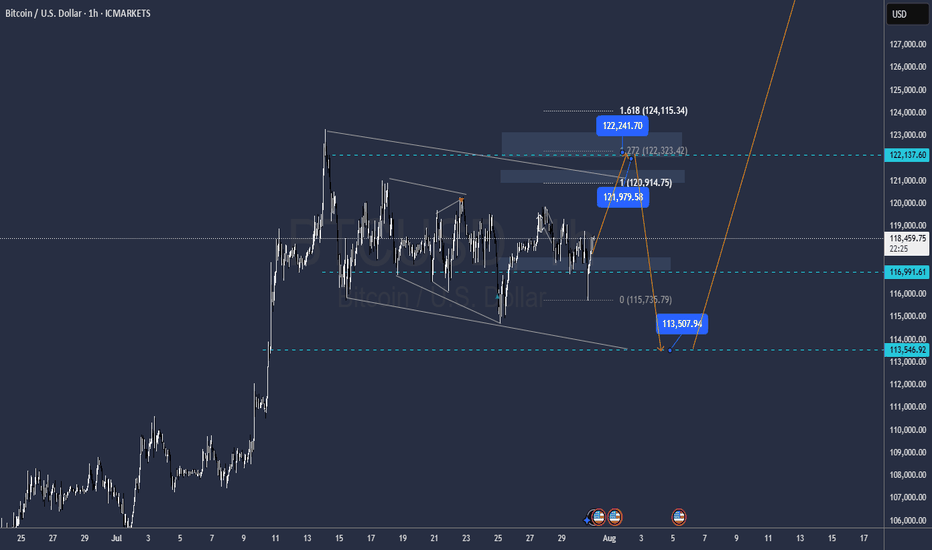

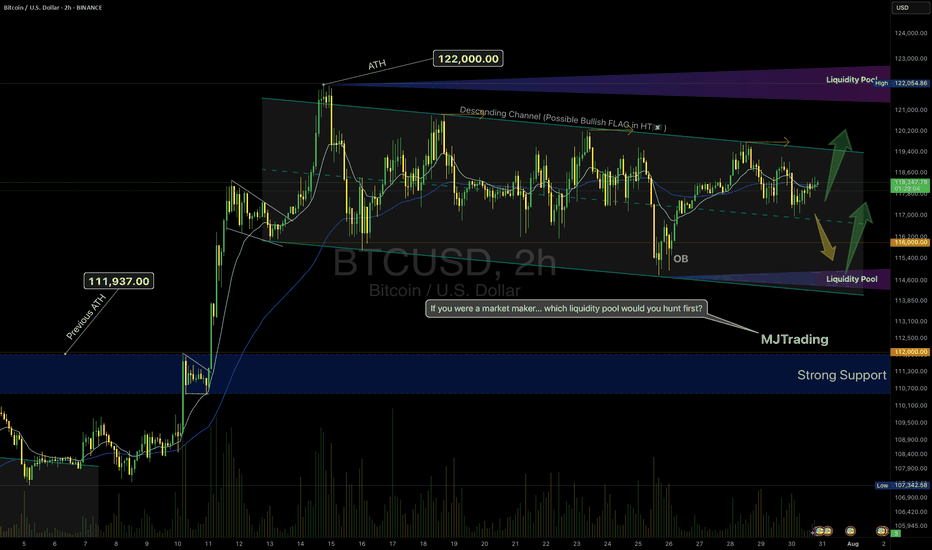

BTCUSD – Descending Channel or Bullish Flag?BINANCE:BTCUSDT – Market Maker’s Game Inside a Descending Channel

Timeframe: 2H | MJTrading View

Market Structure Overview:

Bitcoin recently printed a new ATH at $122,000 after a parabolic run from the previous ATH at $111,937.

Since then, price has been consolidating inside a descending channel, which could act as a bullish flag in higher timeframes.

Liquidity pools are clearly formed:

Above $122K – resting stops of late shorts.

Below $115K–$114K – weak long stops and untapped demand near the Order Block (OB).

Key Levels & Liquidity Zones:

Upside:

$122K Liquidity Pool → If swept, could trigger momentum towards $124K–$125K.

Downside:

$116K OB → First defensive zone for bulls.

$112K Strong Support → Aligns with previous ATH breakout base.

Market Maker’s Dilemma:

If you were a market maker… which liquidity pool would you hunt first?

Price is coiling tighter within the channel, and both scenarios are possible:

Upside Sweep → Rapid breakout above $122K to clear shorts, then potential continuation.

Downside Sweep → Sharp drop into $116K–$112K liquidity, flushing longs before any recovery.

⚡ MJTrading Insight:

This is the classic market maker compression – first sweep likely determines direction.

Patience here is key; let the liquidity tell the story.

#BTCUSD #Bitcoin #Liquidity #SmartMoney #PriceAction #MJTrading #ChartDesigner #CryptoAnalysis

Psychology Always Matters:

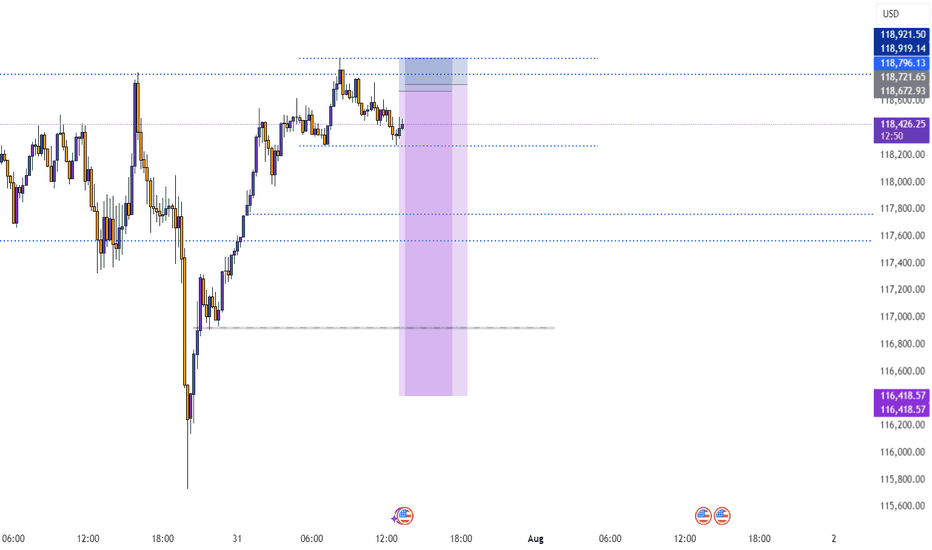

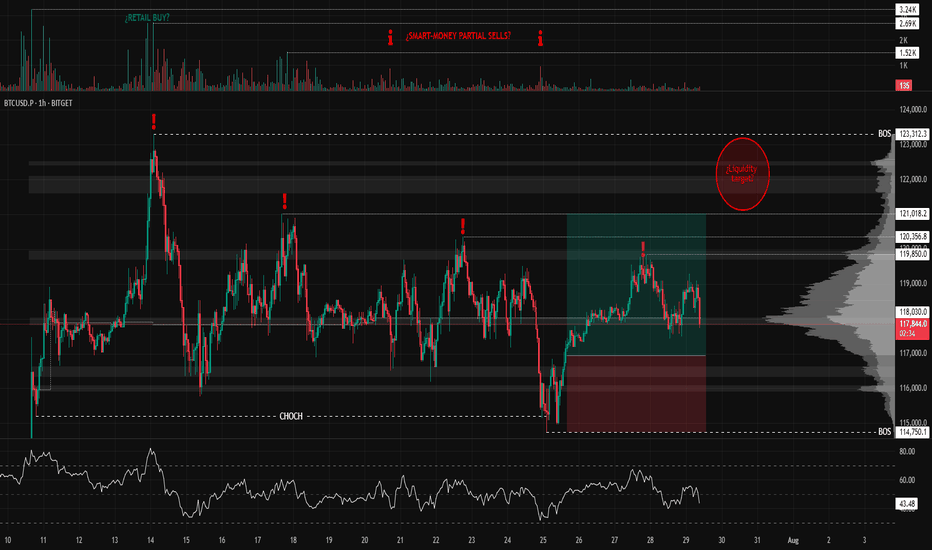

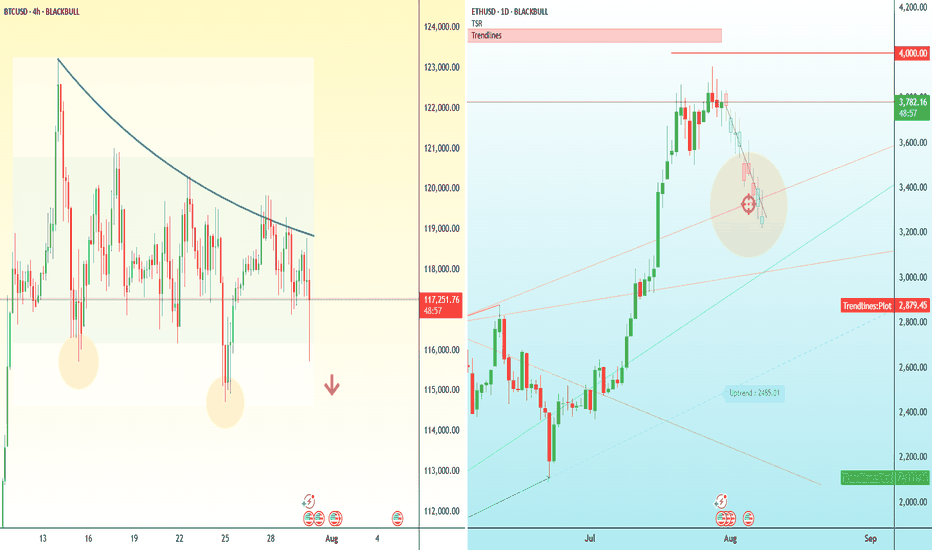

Major test for crypto bulls - BTC and ETH Bitcoin has dipped below $118,000, putting pressure on the bullish structure that’s held for the past two weeks.

The attempted breakout above $121,000 has failed, and price is now breaking down through the middle of the consolidation range, threatening short-term higher lows. On the 4H chart, this move resembles a failed breakout with a potential double-top near $121,000.

If Bitcoin can’t reclaim $116,000 quickly, the next downside levels to watch are $114,000 and $110,000.

Ethereum, meanwhile, has stalled just below $3,800 after a strong rally this month. Price action has flattened out over the past few days, with several failed attempts to push through that level. The key upside trigger remains $4,000.

But if $3,700 gives way, ETH may slide back to the $3,450–$3,300 region, where previous resistance and the rising trendline converge.