BTCETH.P trade ideas

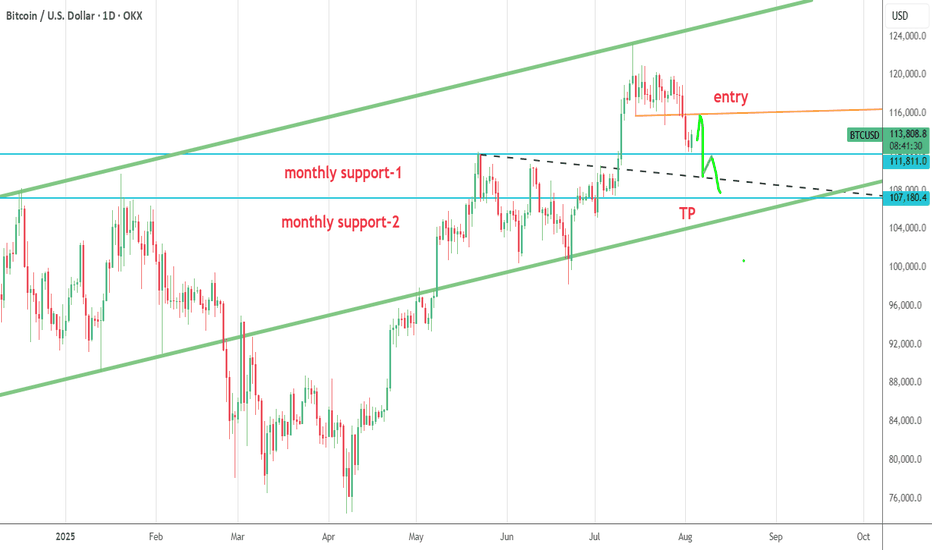

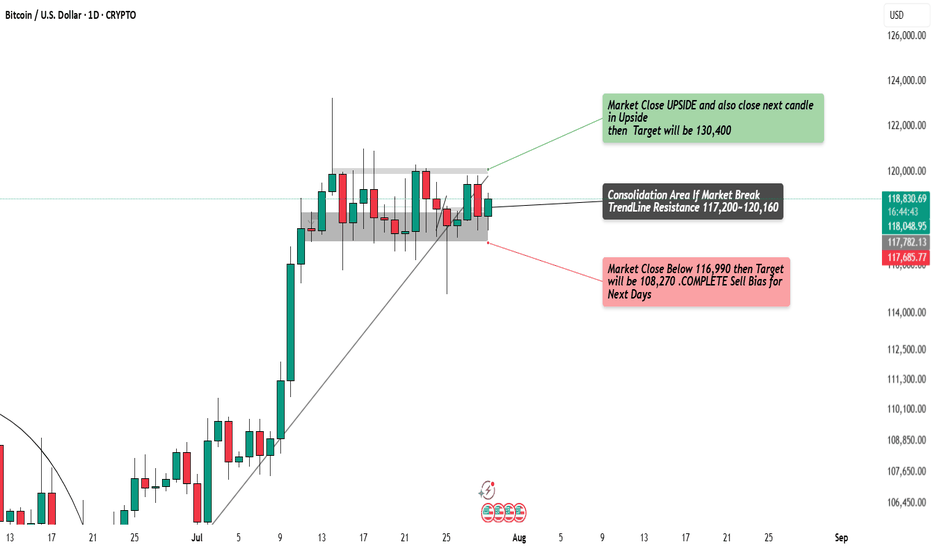

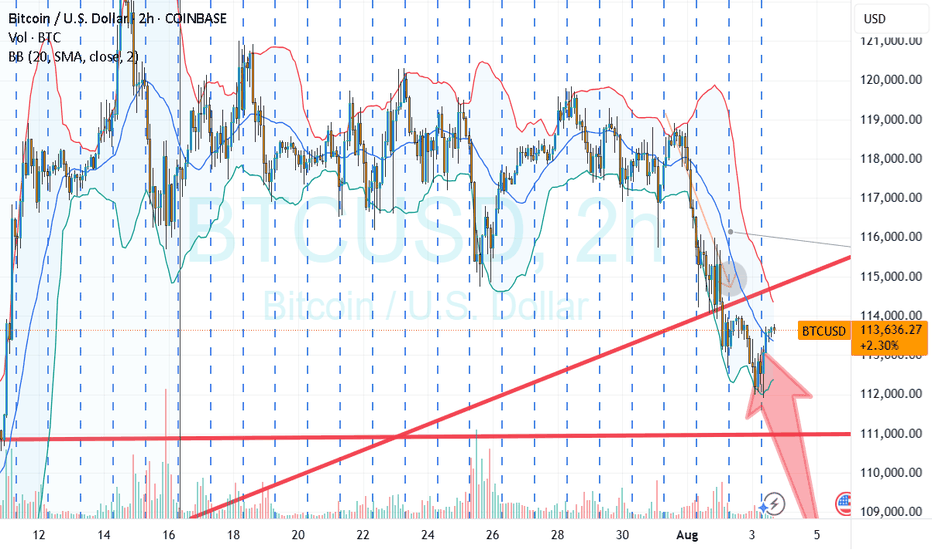

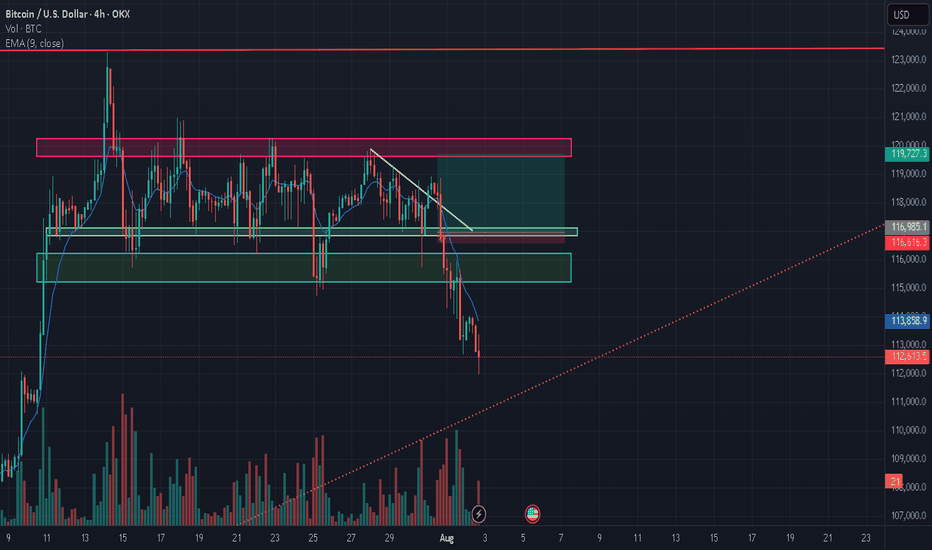

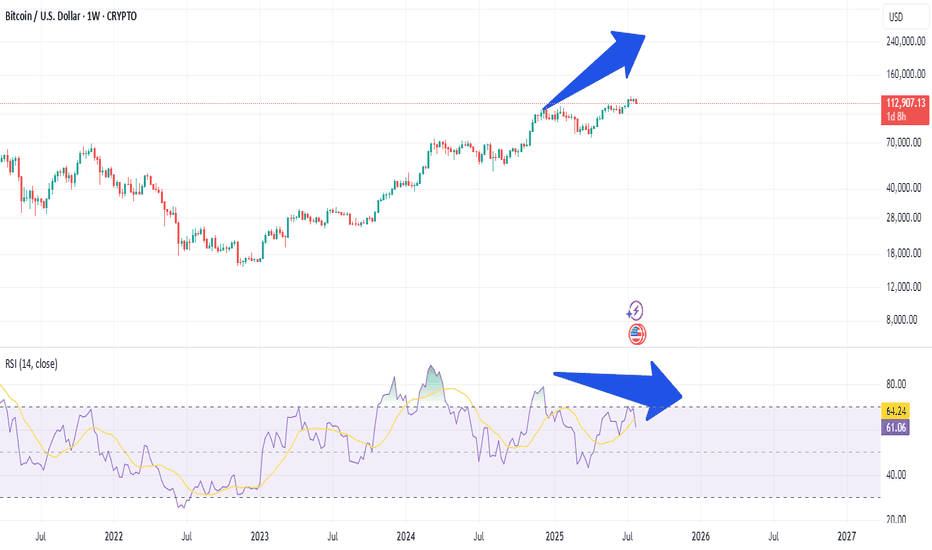

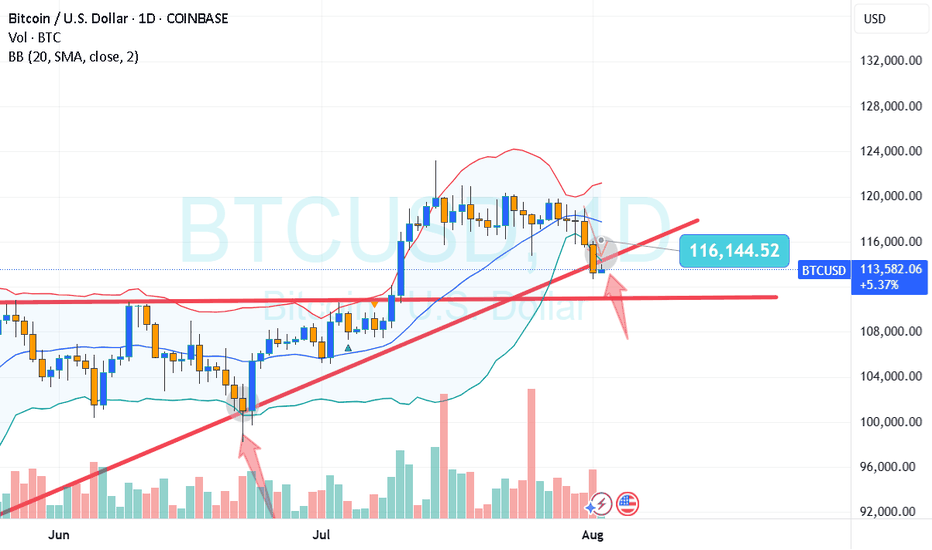

BTC/USD Ready to Explode?Watch 116,990 & 120,160 Breakout Zones!Massive move loading on BTC!

Price is trapped in a tight consolidation zone — breakout above 120,160 = 🚀 to 130,400, while a break below 116,990 = 💀 down to 108,270.

Waiting for 2 daily candle confirmations before entering . Stay sharp — this breakout could set the next major trend.

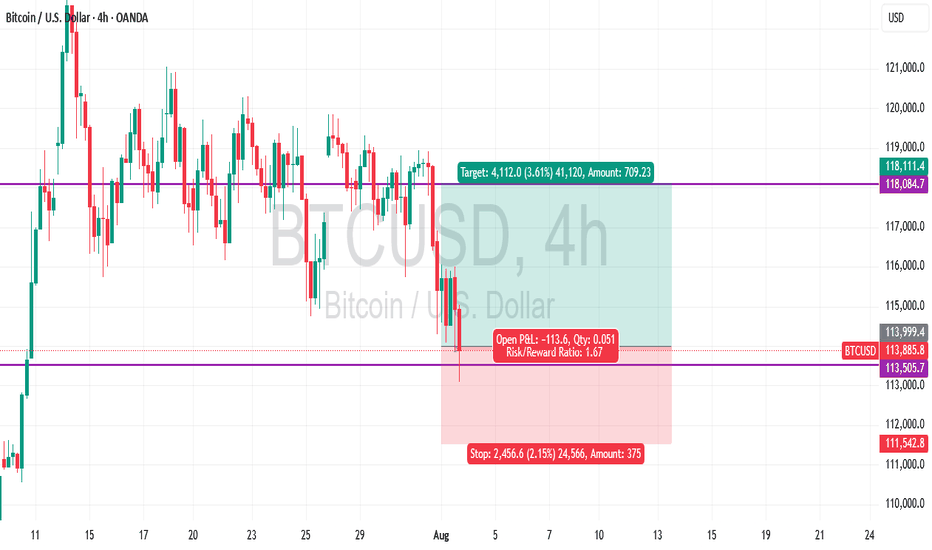

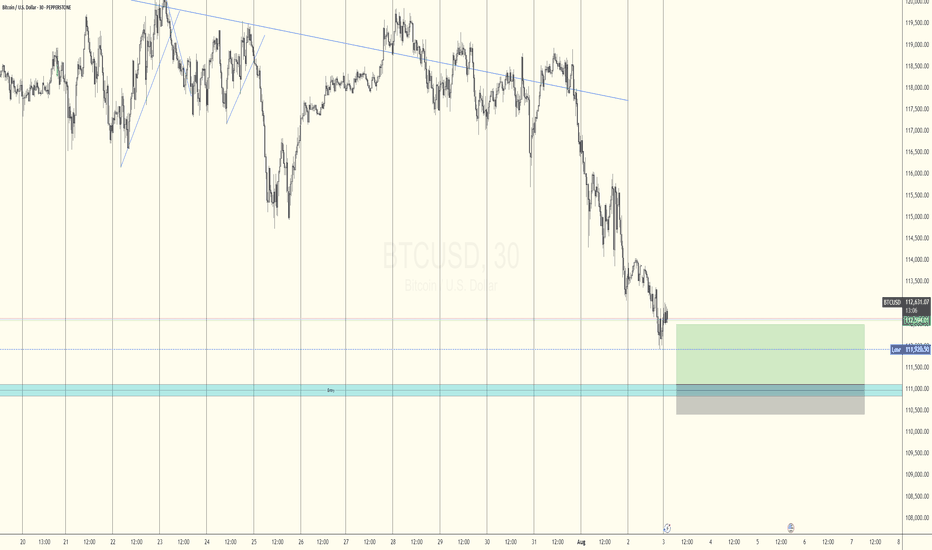

Bitcoin Price Analysis: Price headed to $118,100Bitcoin Price Analysis: Price headed to $118,100.

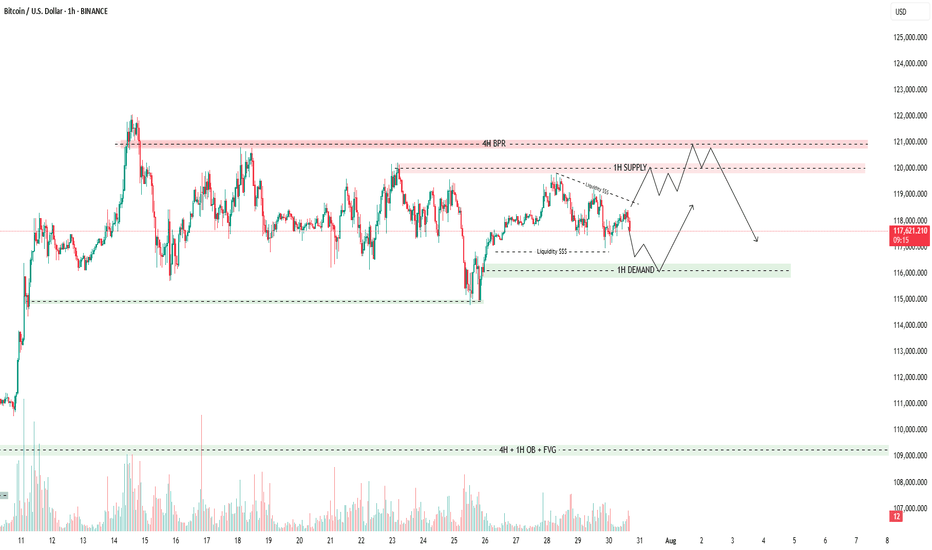

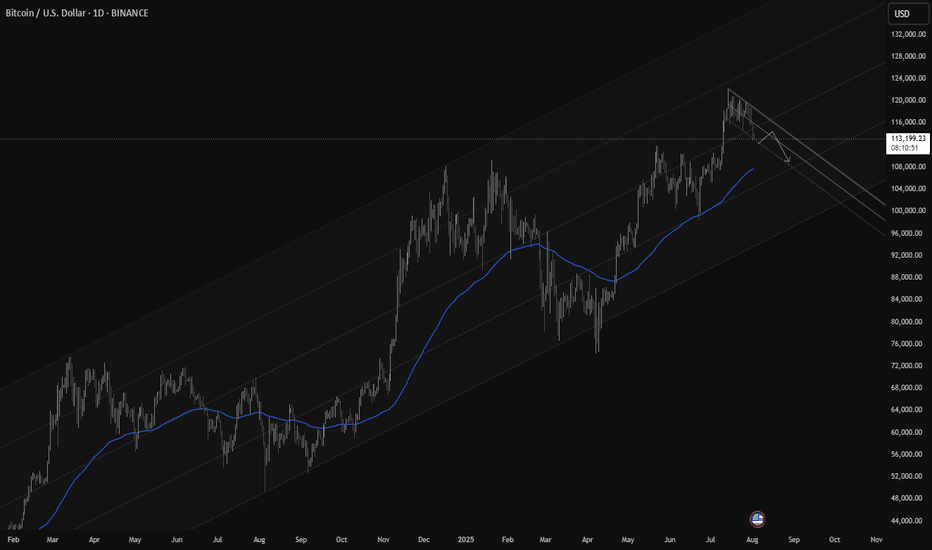

The Bitcoin price chart reveals a clear picture of the asset’s recent behavior. After consolidating within a trading range between $116,000 and $120,000 for over two weeks, Bitcoin broke below the southern boundary of this range on Wednesday evening. This correction began shortly after the US Federal Reserve announced its decision to maintain interest rates, ignoring calls from former President Donald Trump for a rate reduction. The Bitcoin live price dipped to $112,700, a three-week low, signaling a shift in market sentiment.

From a technical perspective, Bitcoin’s chart shows it has been moving within a descending channel since March 2024. The recent break below the $116,000 support level indicates a potential for further downside if momentum remains weak. Key support levels to monitor include $110,000, which aligns with historical price action, and a deeper support at $84,500, as suggested by technical analyst Katie Stockton. Conversely, resistance levels are observed at $118,100, where Bitcoin is expected to recover in the near term, and $120,000, a psychological barrier that could signal a bullish breakout if breached.

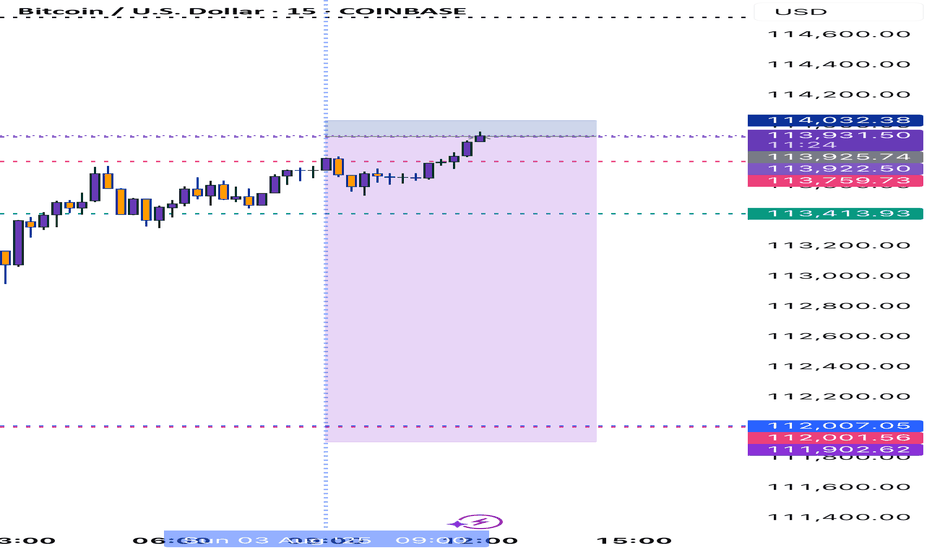

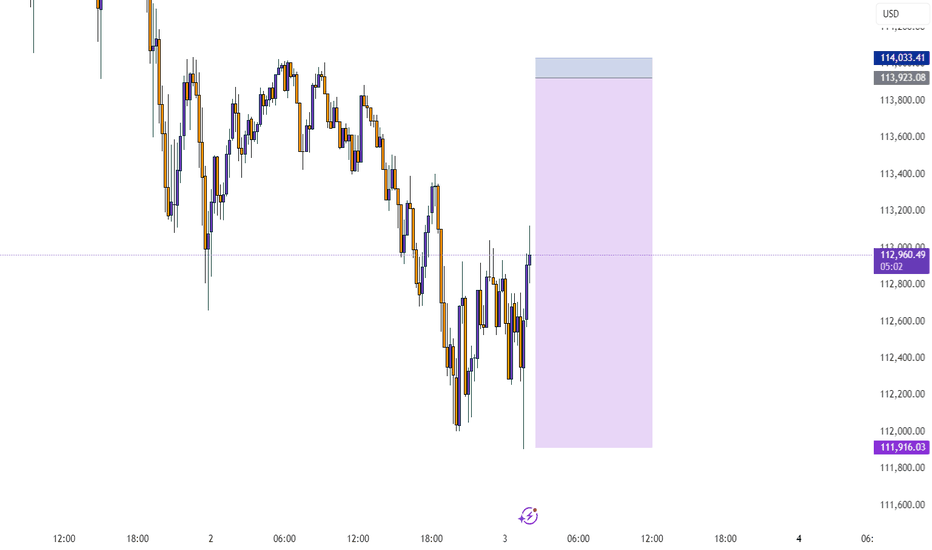

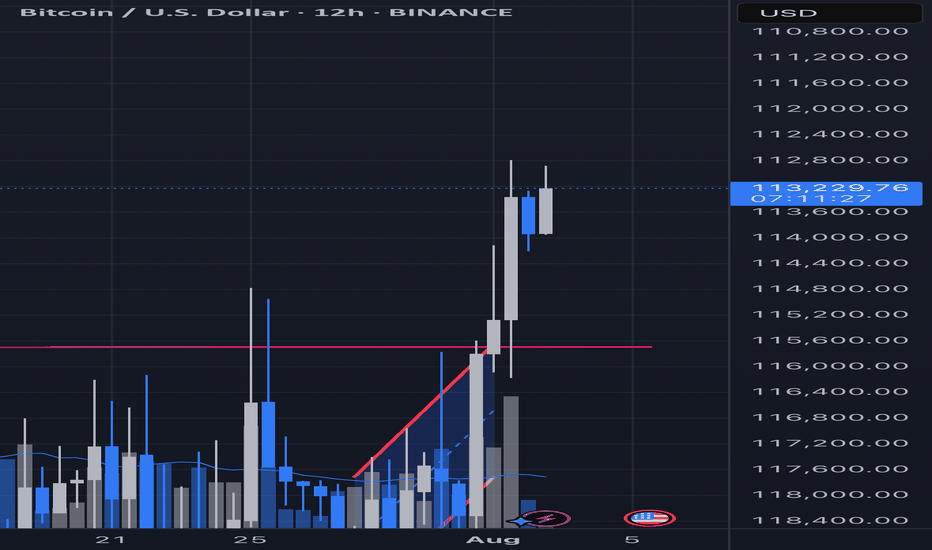

BTC Vs AI ? timing 115500

Hi,

I asked AI to give timing for a trade if momentum is the same

Now, time to travel 2,000 units = distance / rate = 2,000 units / 500 units per hour = 4 hours.

So, it would take 4 hours to travel from 113,500 to 115,500 assuming the same travel rate

Woow.. get ready guys

If it don't happen.. blame AI hahaha

Beach here we come.. :)

All the best

Not a guru

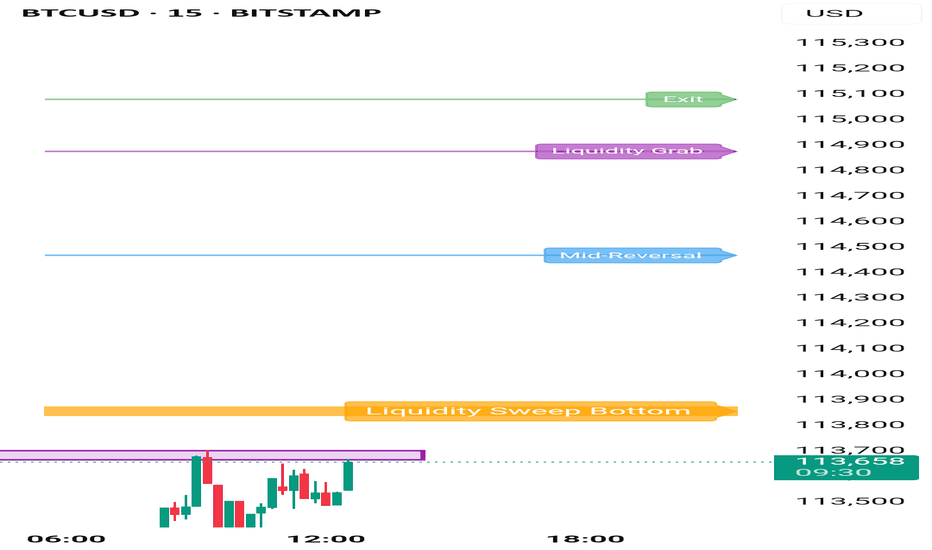

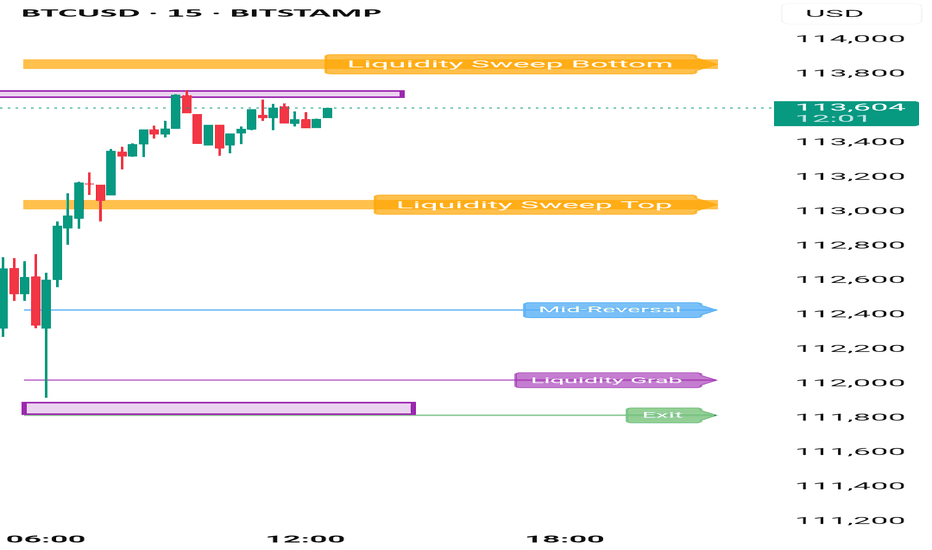

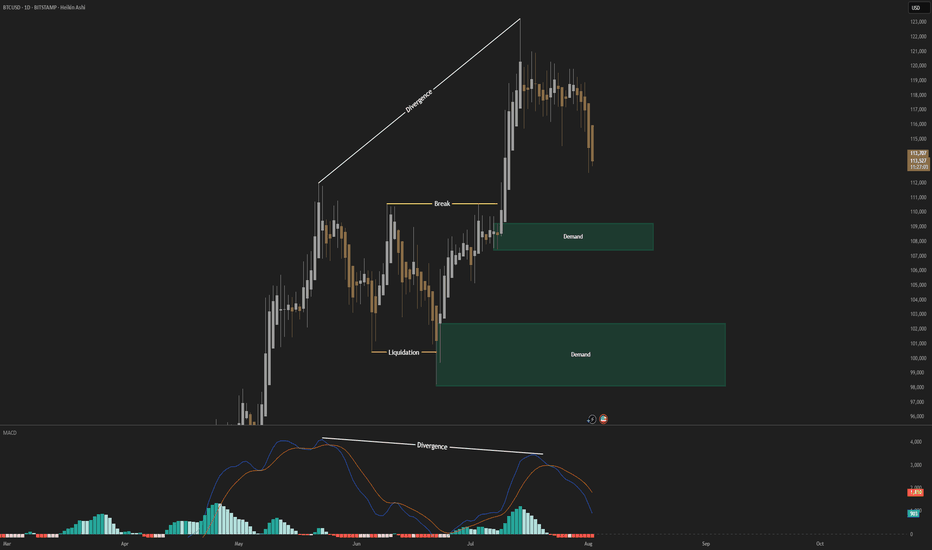

Targets for BitcoinIf we see break out of liquidity sweep . Liquidity Grab will be the target for bullish moment.

This charts and levels are plotted on the concept of liquidity sweep .

Once breakout of liquidity sweep, price should move till liquidity grab & after liquidity grab should take rejection and reverse for bottom liquidity sweep .

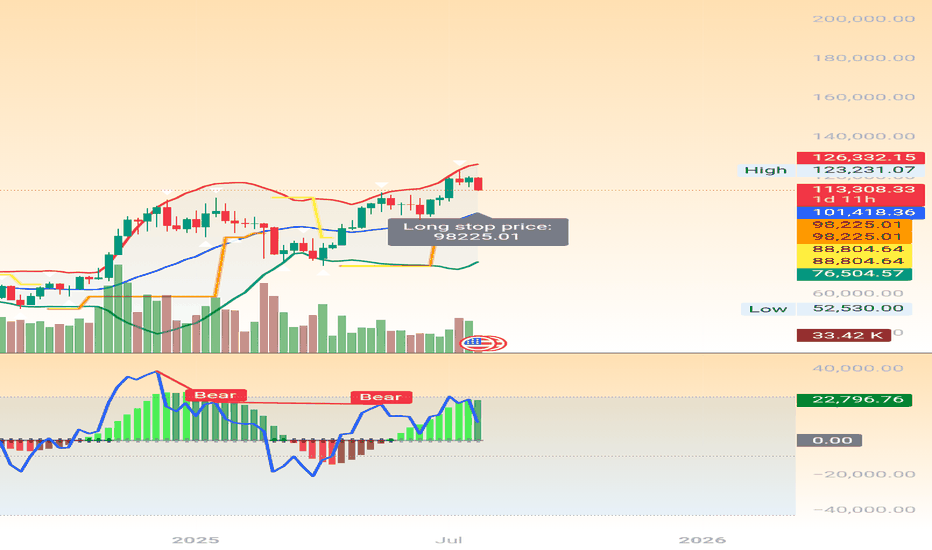

BTCUSDT BUYING AND SELLING SETUP !🔻 SELLING ZONE: 119,817 – 120,215

🔴 VERY STRONG SELLING ZONE: 120,700 – 121,122

🟢 BUYING ZONE: 115,823 – 116,392

✅ VERY STRONG BUYING ZONE (Buy Limit): 109,221

Watch these zones closely for potential entries. Wait for confirmation before executing trades and always follow proper risk management.

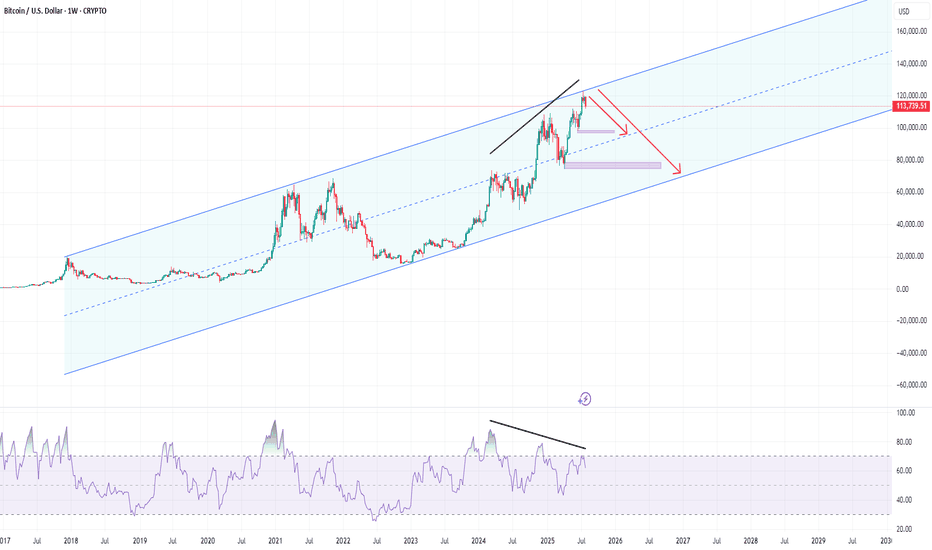

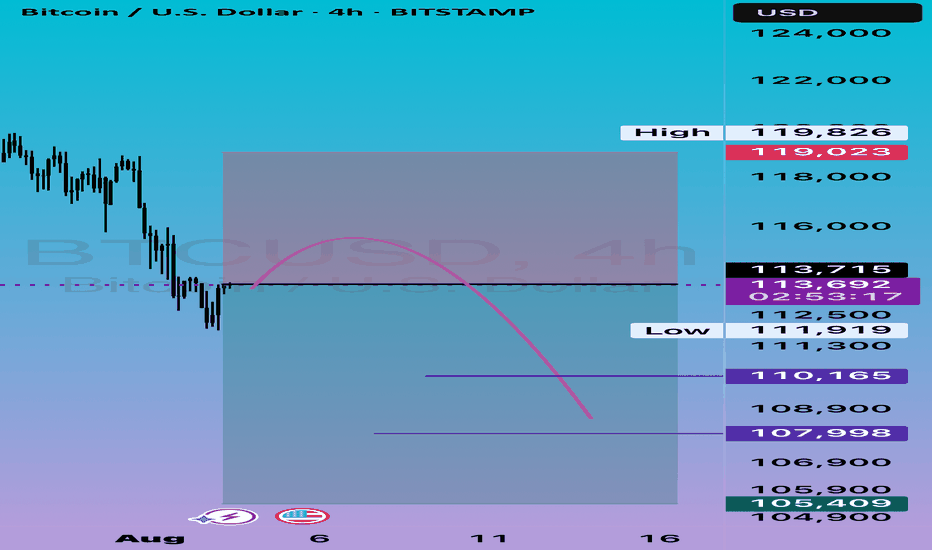

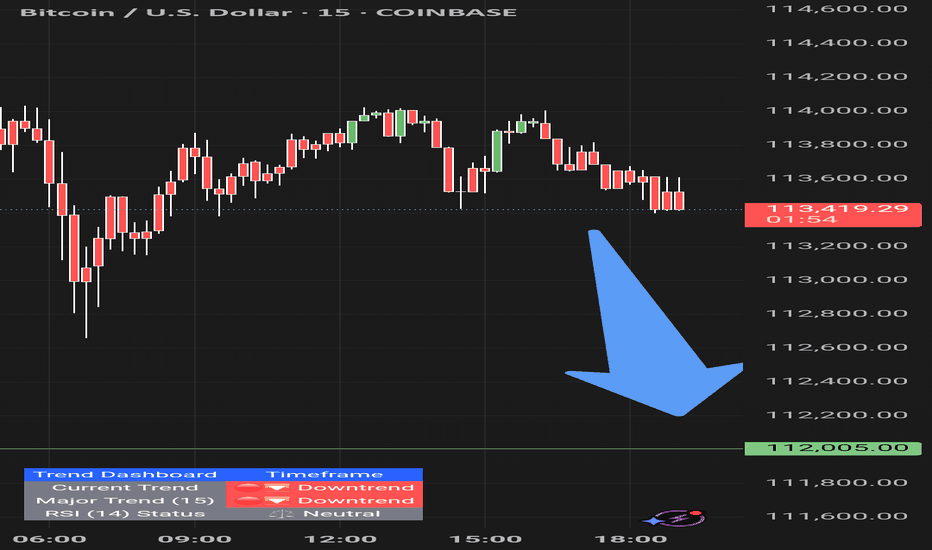

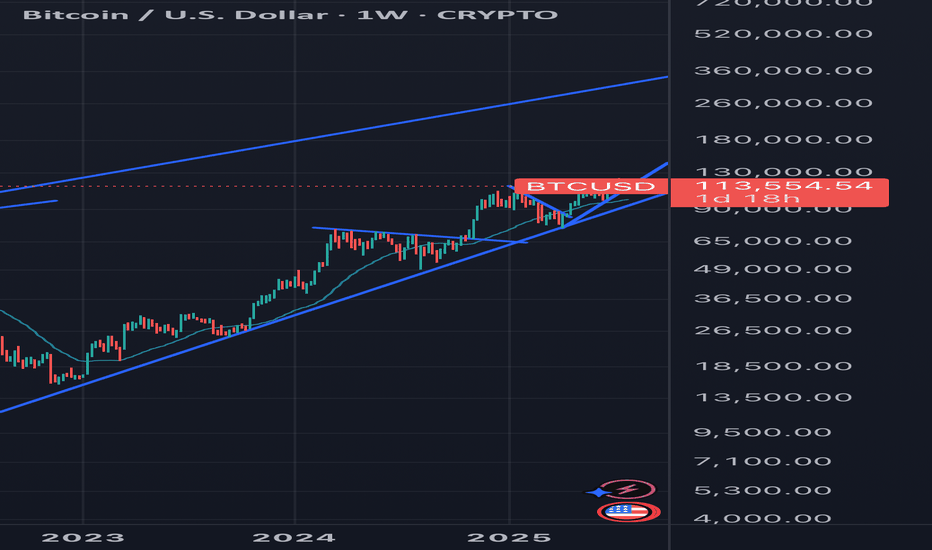

Downtrend to trendsupportHey guys, i this is my prediction for bitcoin. I believe it will drop to my trend support and become a resistance. If it goes below that it would turn into a ranged market and no longer be a trend anymore. Also, once the downtrend is over, it would hit my demand area. I do have some old analytics on this chart, i assumed it would be an uptrend a while ago, but as soon as it went beyond my buy area, i knew it might be a breakout.

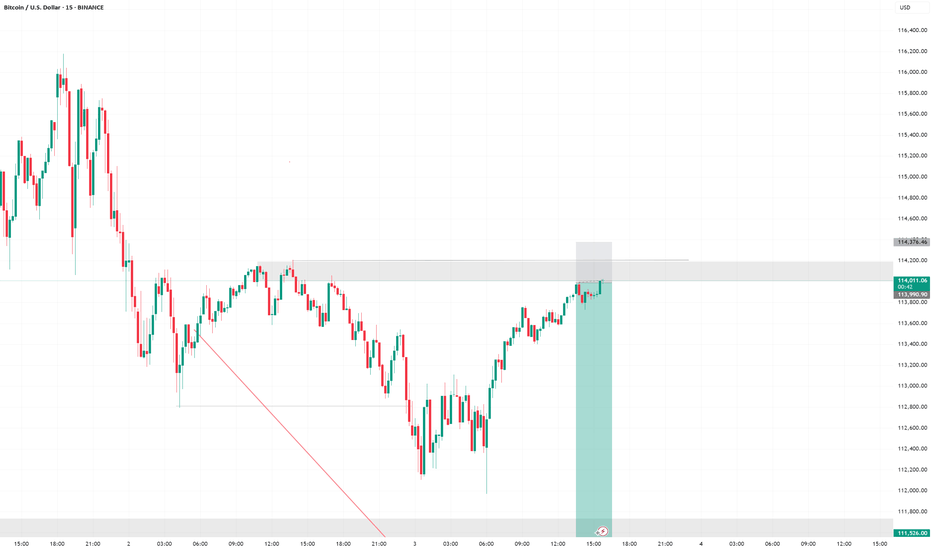

BTC VS AI ?Hi

I had asked AI the probabilities and projection from previous moves.

So here goes; as you know accuracy is vague and shall not be absorb as 100%

Just analysis and probabilities.

Need clearer confirmation when taking a trade .

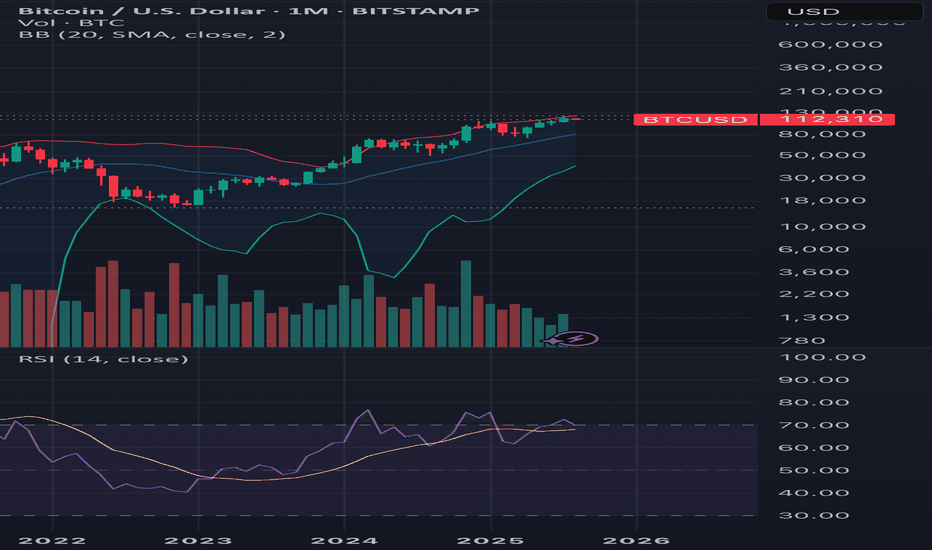

Given that the current price is 113,000, let's analyze whether the price has extended beyond previous retracement projections and then develop the next projection accordingly.

Recap from previous data:

Second move: price moved from 99,000 to 122,000

Projected retracement price (29.41%) was approximately 115,236

Current price at 113,000 is below 115,236 (projected retracement), meaning it has retraced more than expected before potentially continuing upward.

Interpretation:

Since 113,000 < 115,236, the price has actually retraced deeper than initially projected from the previous move.

This could suggest a stronger correction or weakness in the upward movement before continuation.

If the price started at 122,000 high and retraced below the anticipated retracement level, it may find support around current or slightly lower levels before attempting to move higher again.

Next projection based on current price of 113,000:

New retracement % on second move:

Move up: 122,000 - 99,000 = 23,000

Actual retracement: 122,000 - 113,000 = 9,000

Actual retracement % = (9,000 / 23,000) × 100 ≈ 39.13%

Updated retracement level is closer to a Fibonacci 38.2% retracement level, which is a common retracement level in markets.

Project next upward move:

Use the previous average upward move for projection: 28,500 (from prior analysis).

Starting point for next move projection: 113,000 (current price after retracement)

Next projected high = 113,000 + 28,500 = 141,500

Probabilities:

Retracement around 38.2% usually has a probability around 20-25%, slightly less frequent than 29-30%, but still common.

Uptrend continuation probability after retracement remains >60% if the trend is strong .

Summary Table with updated data:

Feature Value

Current Price 113,000

Previous High 122,000

Move Up Range 23,000

Actual Retracement Amount 9,000

Actual Retracement % 39.13%

Projection for Next High 141,500

Probability of 39% Retracement 20-25%

Probability of Uptrend Continuation >60%

Conclusion:

The price has retraced more than initially projected from previous data but still within reasonable common retracement levels (around 38%).

Assuming the uptrend holds, the next price move could push toward approximately 141,500.

It’s advisable to watch key support levels near 113,000 for signs of reversal or further retracement.

All the best

Lets see in we can trust it

Not a guru