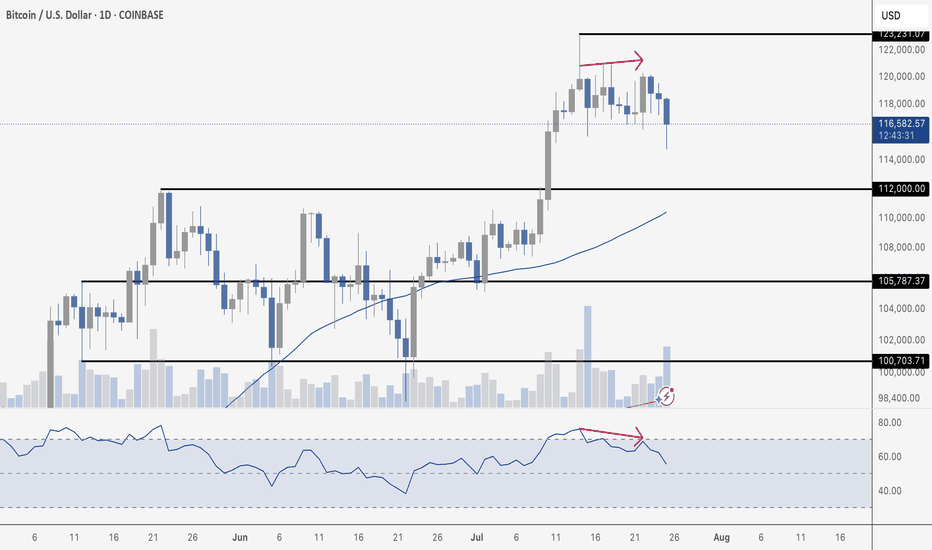

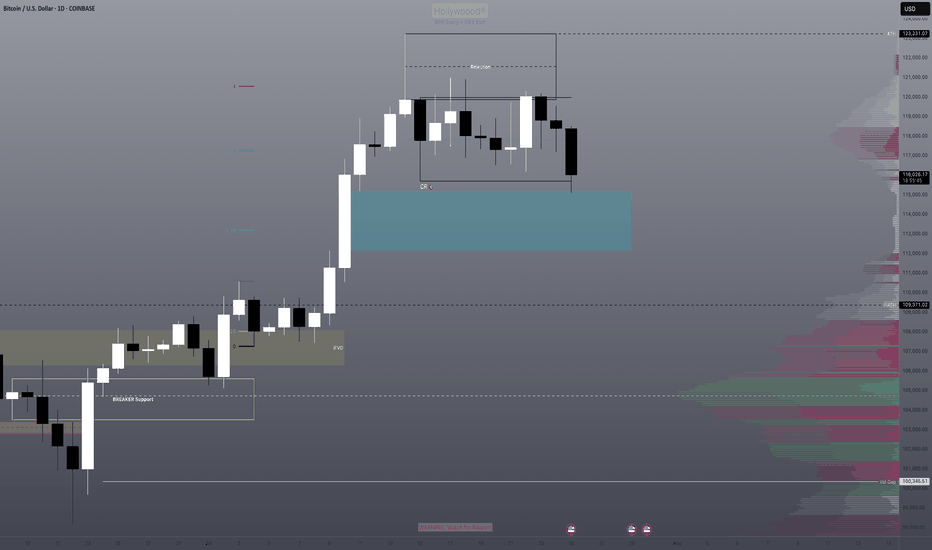

Bitcoin's Bearish DivergenceBitcoin has slipped to $116,605, down 1.5% on the day, and the daily chart is beginning to show signs of weakness following a period of sideways consolidation below key resistance.

The most notable development is a clear bearish divergence on the RSI. While price pushed to a higher high around $122K earlier this month, the Relative Strength Index (RSI) made a lower high, signaling that momentum was fading even as price climbed. This kind of divergence – particularly when it appears after an extended run – often foreshadows a correction or at least a short-term pullback.

Adding to the caution, RSI was deep in overbought territory before beginning its retreat, further supporting the case for a cooldown. Volume also looks unconvincing, and we’re seeing a potential drop in demand as Bitcoin tests support.

Immediate support sits near $112K, and a break below that would likely open the door for a move toward the $105,787 zone. On the upside, bulls would need to reclaim $122K with conviction to invalidate the bearish signal and reignite momentum.

Overall, the chart is tilting slightly bearish in the short term, and traders should watch closely for whether support holds or if this divergence marks the beginning of a deeper correction.

BTCETH.P trade ideas

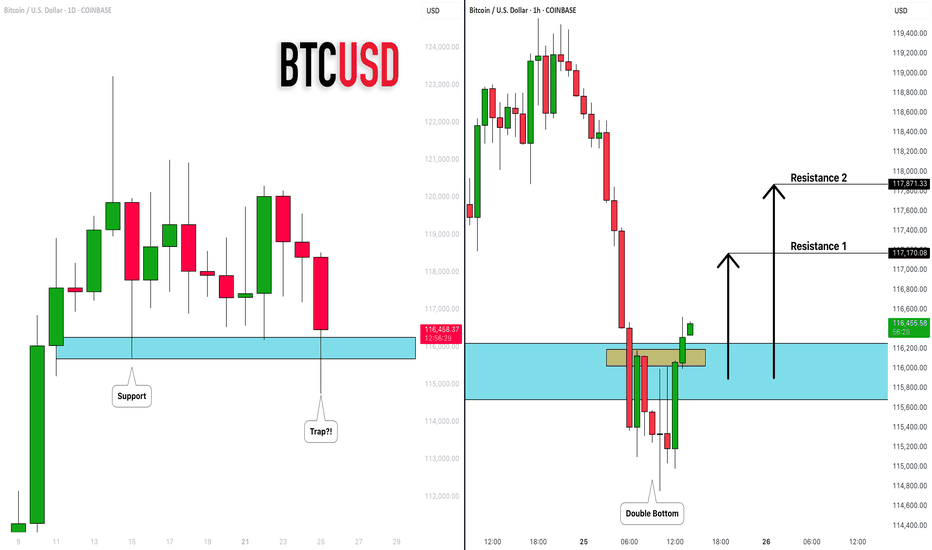

BITCOIN (BTCUSD): Recovery Starts

Bitcoin is going to rise from a key daily support.

After a liquidity grab, the market shows a clear strength,

forming a double bottom on an hourly time frame.

I expect a bullish movement at least to 117100

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

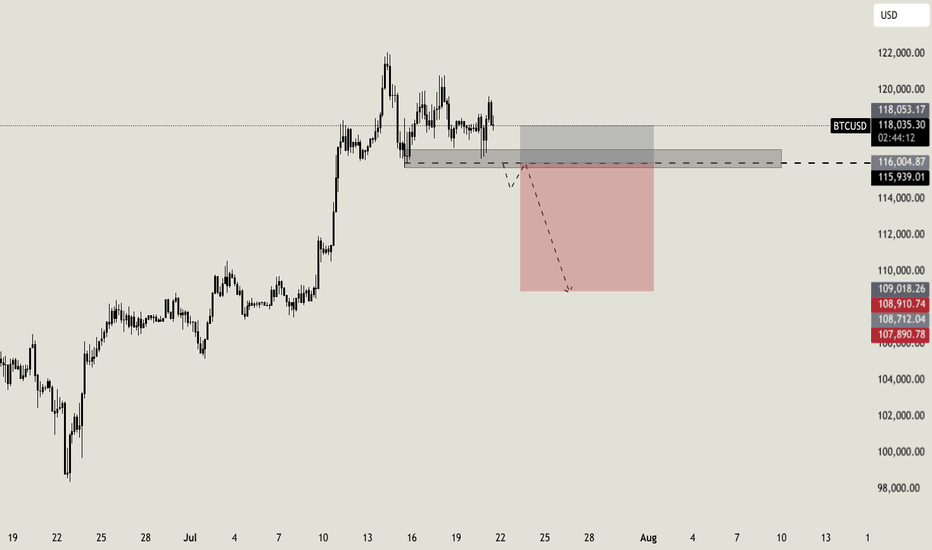

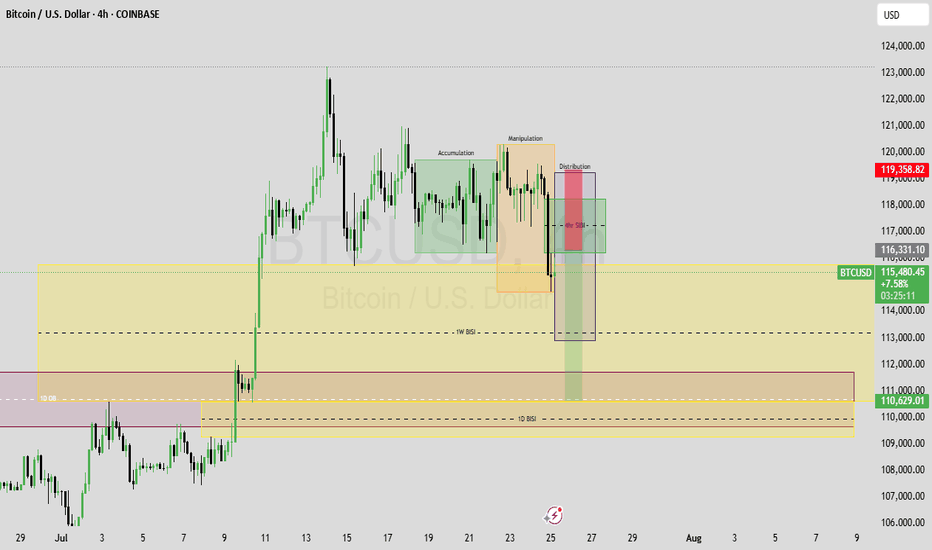

key area for bullsif bulls cant hold this we're going to test previous range VAH which is 110k

holding this will need to reclaim VAL

if it rejects Range VAL as a bearish retest we may lose this area.

if VAH (which is a CME gapfill) wont hold (imo if we go this far down it will nuke) theres a likelyhood to 103k

Im bullish i think we reclaim here but thought is not edge.

for now we have decent oscilator data.

SP will be king here, if it will pump btc will pump also.

i longed here

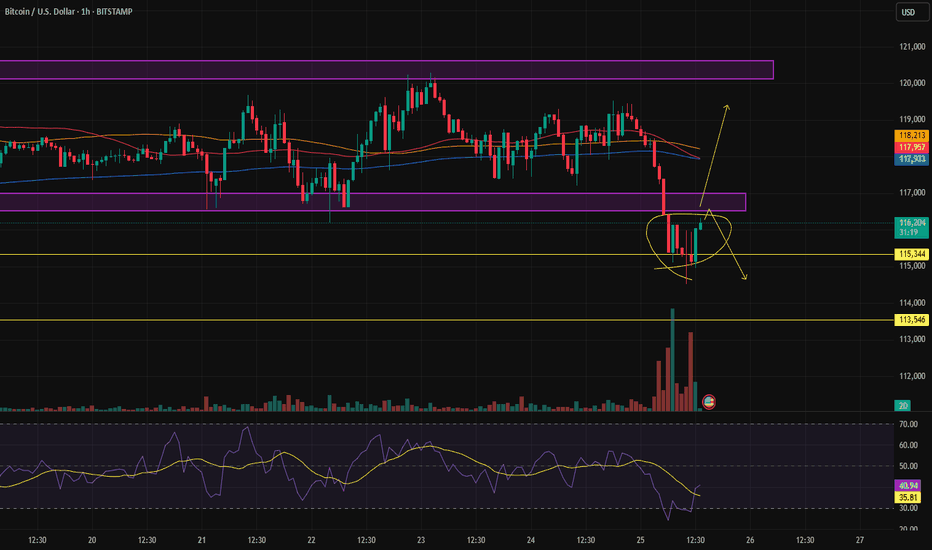

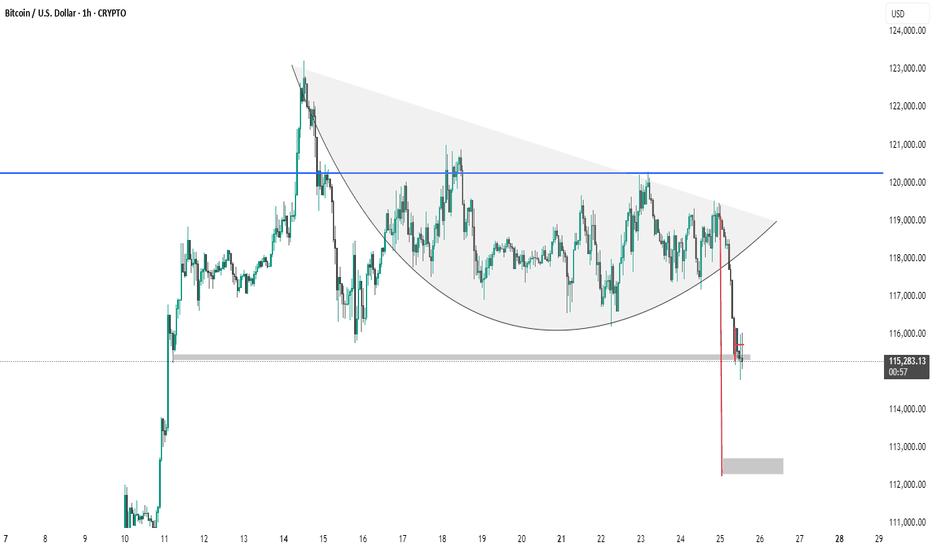

BTC #Bitcoin (BTC/USD) on the 1-hour timeframe.The chart shows a bearish breakdown from a rounded top formation, indicating a shift from an uptrend to a downtrend in Bitcoin (BTC/USD) on the 1-hour timeframe. Price broke below a key support zone ($116,000), confirmed by a sharp red candle. The shaded area below ($112,500) suggests the next potential support or target zone. This pattern reflects weakening bullish momentum and possible further downside.

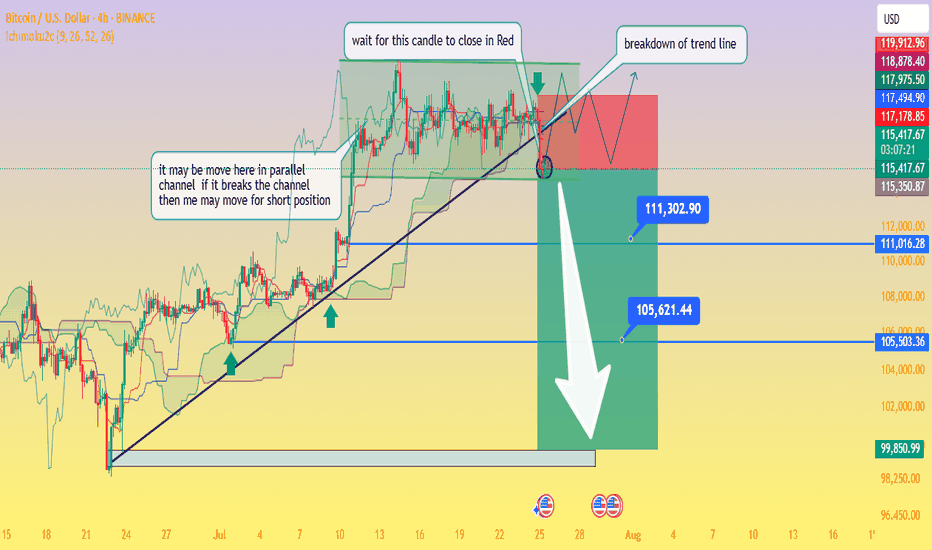

Critical Breakdown: BTC/USD Poised to Fall — Waiting on H4 CloseAnalysis of the BTC/USD 4‑Hour Chart

From the chart you provided, here's how the technical situation looks:

Ascending trendline support has been tested multiple times and was recently breached this afternoon, signaling a possible shift from the bullish setup to a bearish continuation.

The price is now trapped within a descending triangle formation beneath a well‑defined swing high resistance zone. This reflects indecision in the market, with neither buyers nor sellers in clear control

Business Insider

+15

Fxglory Ltd

+15

Bitcoin News

+15

.

Key levels to monitor:

Support zone: ~$115,500, extending down to ~$111,300 and ~$105,600 as deeper targets if bearish momentum strengthens.

Resistance zone: ~$119,000–120,000 area, forming strong overhead supply

Economies.com

DailyForex

Bitcoin News

.

The chart’s annotations align with a classic breakout strategy—with the caveat: wait for a confirmed close below the trendline before considering short positions (as noted in your “wait for this candle to close in red” comment).

Breakout confirmation would likely pave the way toward your indicated profit zones near ~$111k and ~$105k, with a larger potential down to ~$99.8k if further downside pressure builds.

🔍 What the Broader Market Signals

Technical sentiment from sources covering today’s analysis shows BTC/USD hovering just under $120,000, stuck within the defined range of $115.5k support to $120k resistance

Economies.com

.

While there’s still neutral momentum in indicators like RSI and MACD, the short-term direction leans bearish if the breakdown is confirmed on the H4 timeframe

Fxglory Ltd

.

Analysts emphasize that sustained movement above $116.5k could retarget resistance near $119–120k. A failure there and a move below $115.5k may thrust price deeper toward your downside zones

DailyForex

.

✅ Trading Strategy Overview

Scenario Trigger Target Levels

Bearish Breakdown H4 candle closes below trendline ~$115.5k $111.3k → $105.6k → possible $99.8k zone

Bullish Rejection Bounce back above ~$116.5k and trending above resistance $119k–120k retest, potential breakout if sustained

Neutral / Wait-and-see No decisive candle close yet Hold for confirmation

⛳ Final Thoughts

chart highlights a critical point: don’t act prematurely. Wait for a decisive H4 candle close below the trendline before committing to shorts. Confirmed bearish action around the breakout could open the path to the lower targets you identified. However, if price rebounds above support and climbs above $116.5k, a short-term retest of $119k–120k is still in range.

Traders should maintain prudent risk management—watching the unfolding price action around these pivot points without overreaching. Let me know if you'd like help crafting entry/exit zones or risk profiles for this setup!

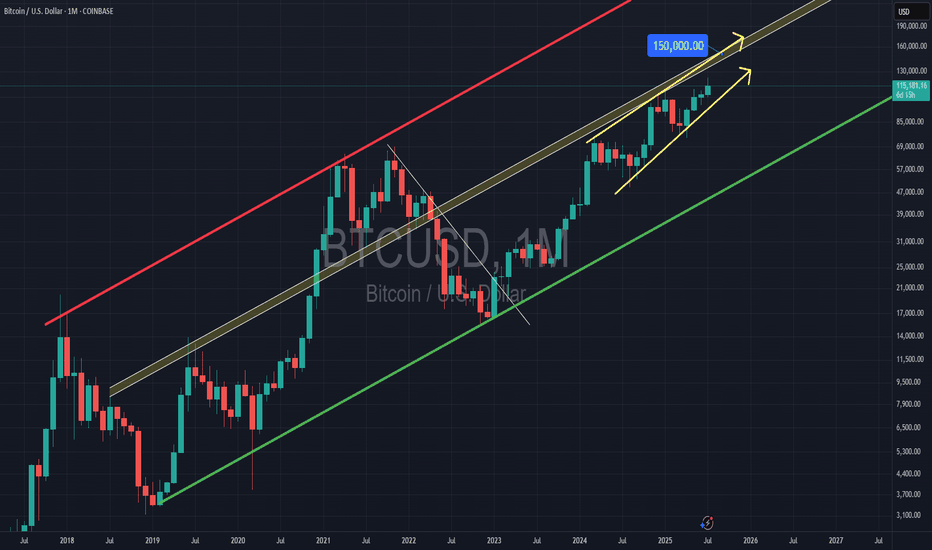

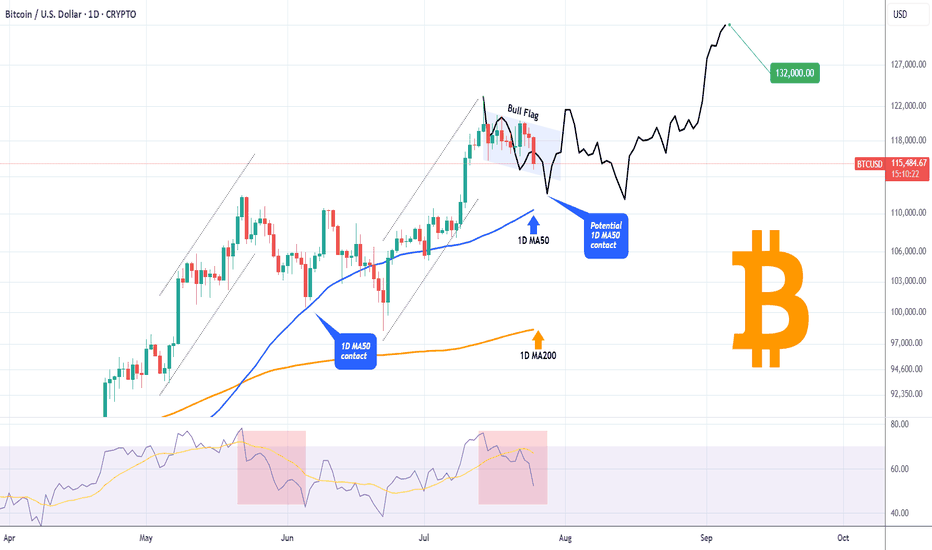

BITCOIN Is this just a giant Bull Flag?Bitcoin (BTCUSD) is basically on its first strong pull-back since the July 14 All Time High (ATH), as it is the 3rd straight red day going from roughly $120300 to below $115000 as of this moment.

Technically this Channel Down pull-back looks like a Bull Flag to the uptrend that started following the June 22 Low. The 1D RSI pattern is similar to the May 22 - 30 fractal, which was also a correction that started after a Channel Up and initially hit the 1D MA50 (blue trend-line), only to rebound a settle for a last dip lower closer to the 1D MA200 (orange trend-line).

If the 1D MA50 fails to contain the current correction, we may again be faced with a slightly more prolonged pull-back, which may be translated into an Accumulation Phase that could eventually lead to prices above $130000 by September.

Do you think that will be the case or we will see an instant rebound? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

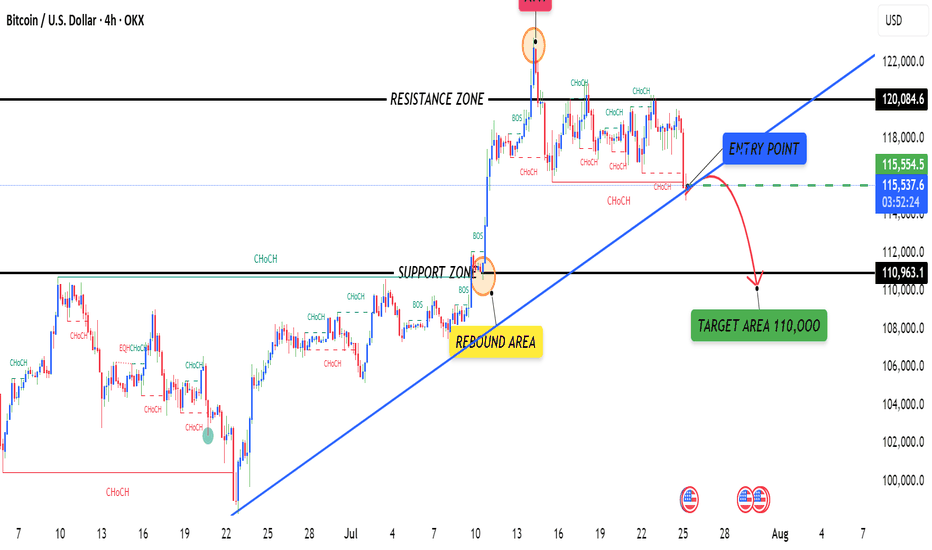

Bitcoin: The Key Buying Level Near $112K Liquidity ZoneFenzoFx—Bitcoin consolidation extended into the bullish FVG, trading near $115,470.0. The 4-hour chart shows an indecisive candle, while the 200-day MA points upward, signaling bullish control.

The bullish outlook remains intact if price holds above the critical $112,000.0 support. However, current bearish momentum may drag price toward this level, potentially filling nearby FVGs.

Traders should monitor $112,000.0 for bullish setups, including break of structure and long-wick bullish candles.

BTCUSD 4HOUR TIME FRAME ANALYSISCurrently bearish on the 4-hour chart with lower highs and lower lows forming consistently.

Price Action: BTCUSD recently broke below a key support zone around 116,000, turning it into a fresh resistance. The market shows bearish momentum as price fails to reclaim above that zone.

Candlestick Patterns: Multiple bearish engulfing candles confirm selling pressure near the 115,500–116,000 area.

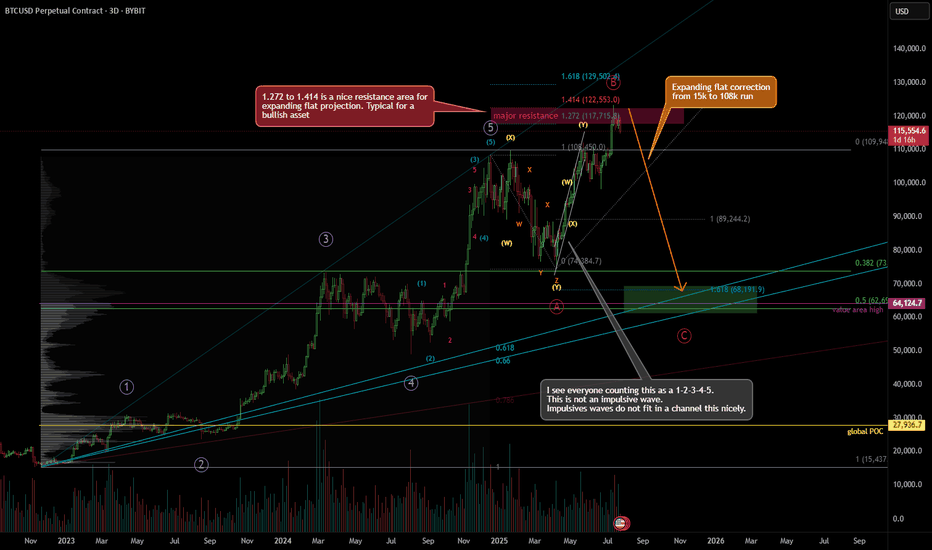

Looking for a correction, bearish Elliott Wave countThere's a probability that the Jan 25' high was the true 5-wave top, and not the Dec 24' top shown here, but because the price difference is barely 1%, the projections don't differ much.

I've long counted the April 25' to June 25' run as a very nice looking WXY. Almost perfect channel correction. A very bullish correction, sure, but still a correction.

And, we're forming an expanding flat from 109k region, down to 74k, then to 123k, and likely down to around 68k.

There's just too many confluences around 67-68k region.

(1) Huge volume node

(2) 1.618 fib projection

(3) 0.5 retracement from 15k to 109k run (2022-2025 run)

(4) Fib fan 0.618 to 0.66 (golden zone)

(5) Value area high of the 15k to 109k run

It's 7/25/25 as of posting this. Locally, in a 15min time-frame, I don't actually see this coming down right away. It's likely to spend few more weeks up here before it starts to make its movement.

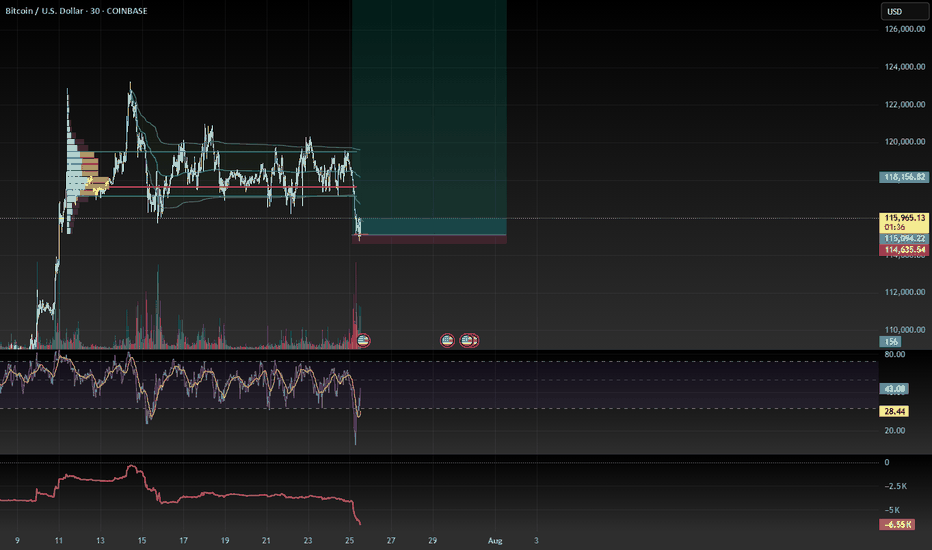

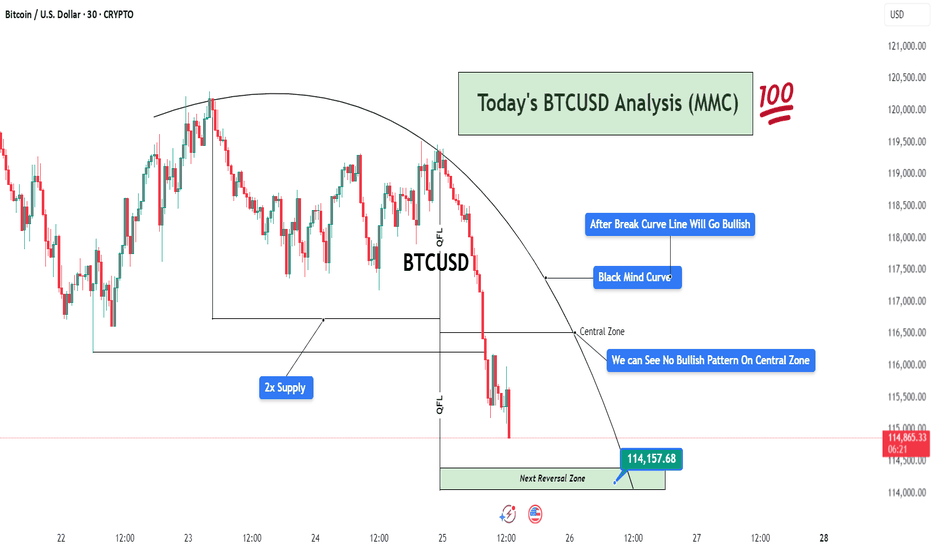

BTCUSD Analysis (MMC) – Bearish Flow Toward Reversal ZoneThis 30-minute BTCUSD chart highlights a well-structured bearish movement following the MMC (Mirror Market Concepts) framework. The analysis centers around the Black Mind Curve, multiple QFL drops, and supply/demand imbalances, presenting a professional outlook on current price action and potential reversals.

🧠 Black Mind Curve – Mapping Market Psychology

The Black Mind Curve is a visual representation of the market’s psychological behavior and serves as a dynamic resistance throughout this structure. Price respected the curvature, slowly losing bullish strength while forming lower highs.

This curve mirrors a distribution phase, where smart money unloads long positions before initiating a downside move.

Your annotation: “After Break Curve Line Will Go Bullish” implies that unless the curve is cleanly broken with strong bullish conviction, the bias remains bearish.

So far, the price is respecting the curve, reinforcing sellers’ control.

🔵 2x Supply Zone – Aggressive Selling Region

The supply zone is tested twice, confirming the presence of institutional-level sellers. This zone becomes critical because:

First touch: Minor reaction, but no follow-through.

Second touch: Strong rejection with extended downside move.

The double rejection clearly shows that buyers are trapped, fueling bearish momentum.

From an MMC view, this confirms the beginning of the “Mirror Market Shift” — where smart money rotates out of longs and traps retail longs near resistance.

📉 QFL (Quick Flip Liquidity) Events – Momentum Crashes

Two major QFL-based breakdowns appear in the chart after price consolidated within ranges. These drops are essential to understand:

QFL reflects market structure breaks where liquidity is engineered, and a sharp sell-off follows.

The first QFL drop occurs after the curve-resistance rejection, and the second confirms continuation.

These are liquidity runs, used to clear stop-losses and maintain bearish pressure.

This creates a domino effect — each QFL level becomes a signal of deeper imbalance.

⚠️ Central Zone – No Bullish Pattern Detected

The Central Zone marks a temporary support or midpoint level — a place where price might find footing if buyers show up.

However, as you noted:

“We Can See No Bullish Pattern On Central Zone”

No bullish engulfing candle.

No pin bar rejection.

No spike in volume.

No market structure shift.

This confirms that buyers are either weak or absent in this zone. MMC traders use this info to stay with the dominant trend (bearish) until proven otherwise.

🟩 Next Reversal Zone – 114,157.68 (Critical Demand Zone)

The green zone marked as “Next Reversal Zone” is a key level to monitor:

This area aligns with historical demand, where BTC previously reversed or slowed down.

Price is likely to hunt liquidity below recent lows before a potential bullish reaction.

It’s a Smart Money zone — designed to trap breakout sellers and absorb volume for a reversal.

Traders should watch for:

Bullish engulfing patterns

Break of structure to the upside

Divergence with RSI/volume

Sweep and reclaim setup

Once the price enters this zone, MMC reversal tactics come into play — buyers may step in aggressively here.

📅 Fundamentals & Timing

At the bottom of the chart, we see upcoming U.S. economic news events, which can act as volatility catalysts. Price could reach the reversal zone just before or during high-impact news, which aligns perfectly with smart money manipulation.

Be cautious of fakeouts around news time.

Confirmation is key before entry.

🧭 Final Outlook & MMC Strategy

Trend Direction: Bearish until 114,157.68 zone is hit.

Momentum Drivers: QFL drops, strong rejection from 2x supply, absence of bullish signals.

Key Watch Level: 114,157.68 – wait for MMC reversal pattern here.

Invalidation: If price breaks and closes above the Black Mind Curve with volume.

📌 Trade Idea Summary (For Caption Use):

BTCUSD respecting MMC Black Mind Curve. 2x Supply Zone triggered QFL breakdowns. No bullish confirmation at Central Zone. Eyes on Next Reversal Block near 114,157.68. Watch for reaction and potential reversal setup. #SmartMoneyMoves

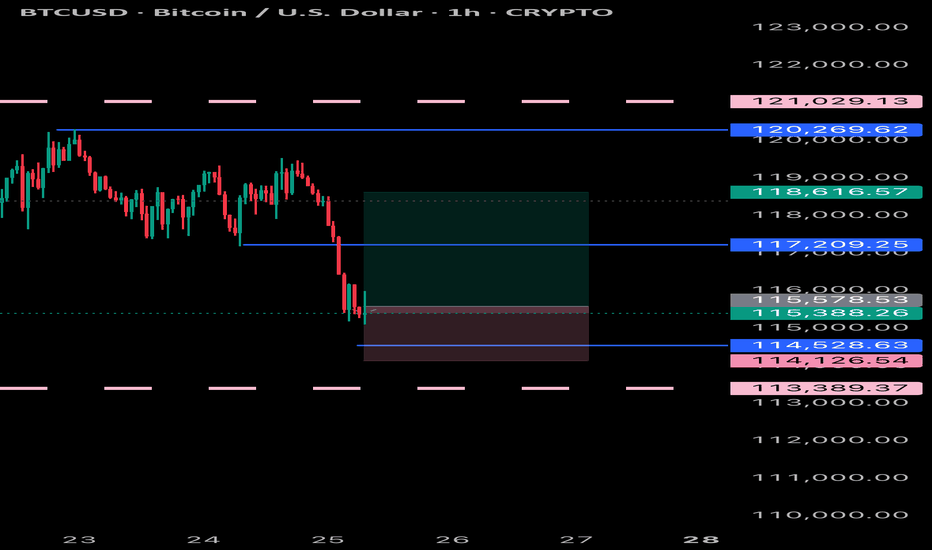

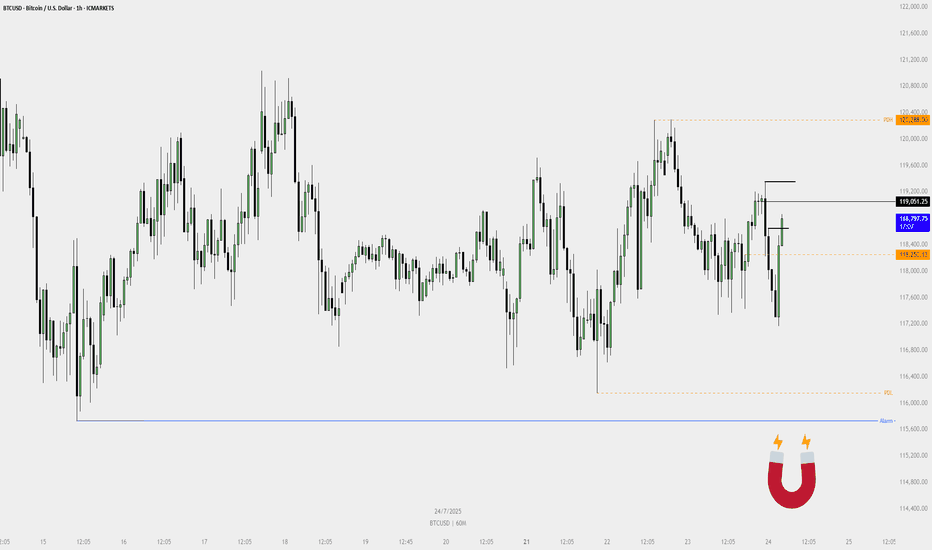

BTCUSD Sell Plan – 1H Chart📉 BTCUSD Sell Plan – 1H Chart

Previous Day High (PDH) has been swept.

A Bearish Fair Value Gap (FVG) has already formed on the H4 timeframe, signaling potential reversal.

Price has been struggling to push higher for several days, indicating exhaustion in bullish momentum.

A Weekly Bullish FVG lies below, acting as a strong magnet—drawing price toward it.

If a pullback occurs, there’s no need to panic. It’s just the market seeking fresh liquidity.

Liquidity is sitting below, making it a high-probability area for the next move down.

🧲 Let the magnet do its job.

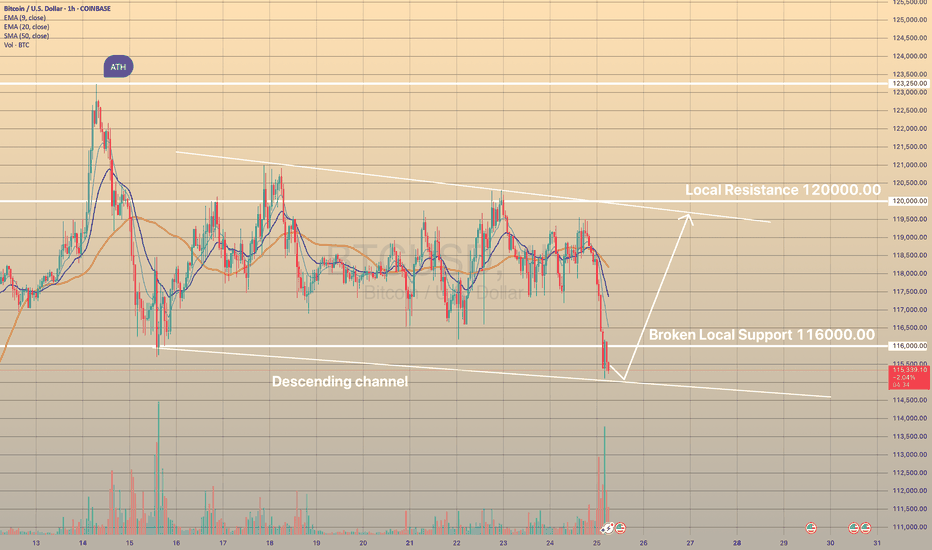

BTCUSD DROPPED BELOW LOCAL SUPPORTBTCUSD DROPPED BELOW LOCAL SUPPORT📉

Today bitcoin dropped below the level of 116,000.00 on high volume. However, the price didn't go somewhere far downwards and consolidates slightly below this level. Presumably, descending channel may be formed.

What is a descending channel?

A descending channel is a bearish chart pattern formed by two downward-sloping parallel trendlines connecting lower highs and lower lows in a pair’s price, indicating a consistent downtrend. It shows sellers are in control, with prices declining within a defined range.

Here I presume the price to rebound from lower border of the descending channel with possible movement towards upper border slightly below the 120,000.00 level.

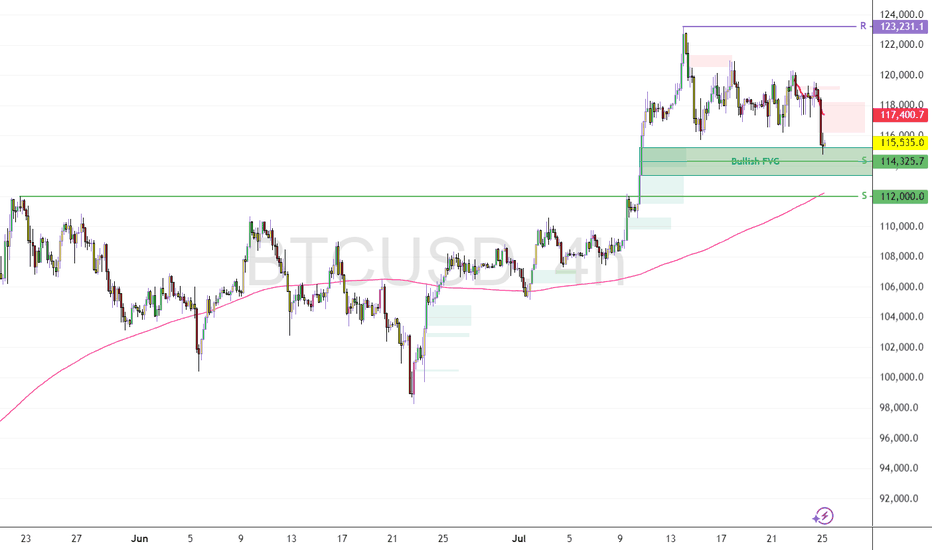

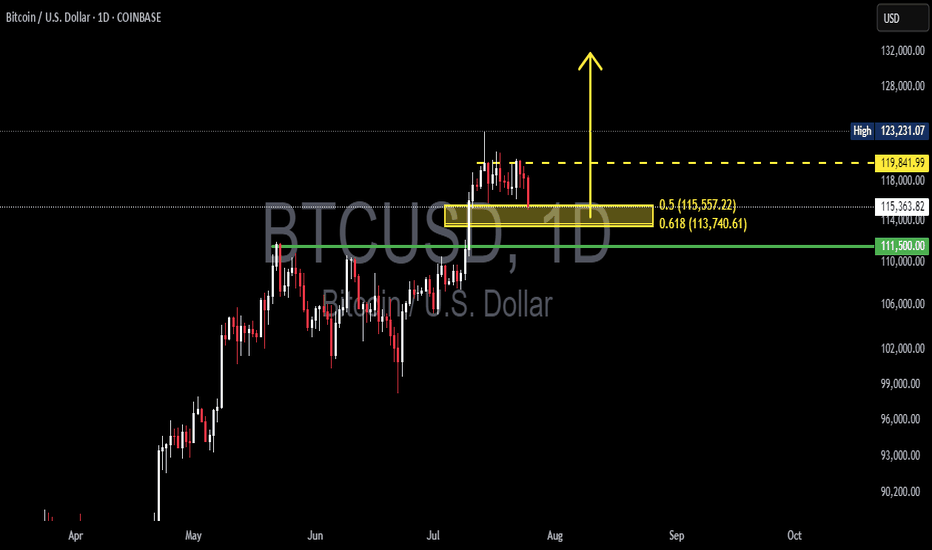

BTCUSD Daily Analysis – Golden Pocket Hold Before a Bullish?🧠 Chart Description & Market Structure:

The BTCUSD daily chart is showing a consolidation phase after forming a local high near $123,231. Currently, the price is retracing and approaching a key Fibonacci retracement zone between the 0.5 level ($115,557) and 0.618 level ($113,740) — also known as the Golden Pocket, which is often a strong reversal area.

---

📈 Bullish Scenario:

If the price holds within or just above the 0.5–0.618 Fibonacci zone (highlighted in yellow) and forms a bullish reversal candlestick (like a hammer, bullish engulfing, or pin bar), there’s a high probability for BTC to resume its uptrend.

Bullish upside targets include:

$119,842 as minor resistance.

$123,231 as the previous swing high and a key breakout confirmation.

A successful break above $123,231 could send BTC toward the next major targets around $128K–$132K.

---

📉 Bearish Scenario:

If the price fails to hold the 0.618 Fibonacci level ($113,740) and breaks down below the key psychological support at $111,500, a deeper correction may occur.

Downside targets:

$108K–$106K as the next major support zone.

A break below this could lead to the formation of a lower high structure and potentially trigger a bearish continuation.

---

📊 Pattern Observations:

Potential Bullish Flag or Rectangle Consolidation: The price action suggests horizontal consolidation after a strong rally — possibly a re-accumulation zone before a bullish continuation.

Golden Pocket Retest: Price is currently testing the Fibonacci 0.5–0.618 zone, often targeted by institutional buyers and technical traders as a potential entry point.

---

🧭 Key Levels to Watch:

Major Resistance: $123,231 (swing high)

Minor Resistance: $119,842

Fibonacci 0.5: $115,557

Fibonacci 0.618: $113,740

Key Support: $111,500

---

🔖 Conclusion:

BTC is currently in a decision zone. Price action within the $115,500–$113,700 range will be crucial. Will this be a healthy retracement before the next leg up — or the beginning of a deeper correction?

#BTCUSD #BitcoinAnalysis #CryptoTA #FibonacciRetracement #CryptoChart #BitcoinDaily #BullishSetup #BearishSetup #CryptoMarket

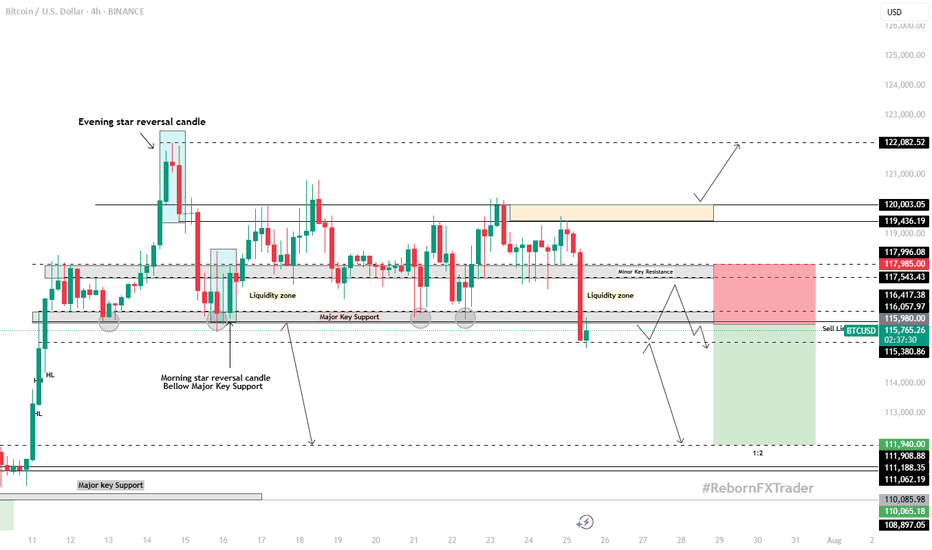

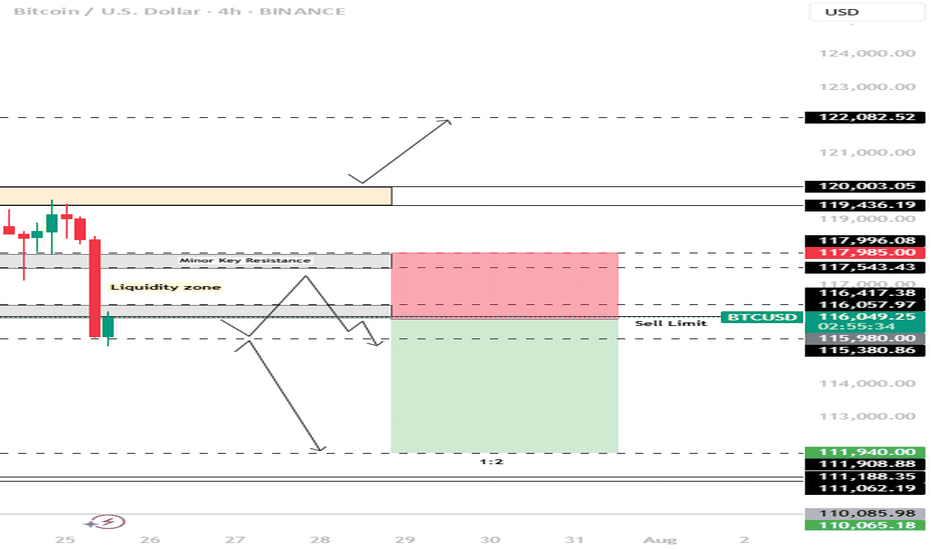

BTC/USD – 4H Technical and Fundamental AnalysisBTC/USD – 4H Technical and Fundamental Analysis

BTC/USD saw sharp downside pressure today, driven by a wave of long position liquidations—exceeding $800 million across the crypto market in the past 24 hours. The sudden shift triggered panic selling, dragging Bitcoin below its psychological and technical support near $116,000. Broader crypto market sentiment turned risk-off as large investors reduced exposure, accelerating the sell-off.

Fundamentally, the market remains cautious amid a lack of positive macroeconomic catalysts for risk assets. Speculation about stricter U.S. regulatory oversight and declining inflows into crypto ETFs also dampened sentiment. Combined with hawkish remarks from Fed officials, which keep interest rates elevated, appetite for high-risk assets like Bitcoin weakened further.

From a technical perspective, BTC/USD broke below the major support level of $116,000, confirming bearish pressure. This breakdown followed a period of consolidation, with price failing to maintain bullish momentum. A liquidity hunt appears to be underway, with price revisiting the zone to trap breakout traders before resuming its move.

We are now watching for a confirmed 4H candle close below the liquidity zone. Once confirmed, a short setup is validated, with targets aligned with the next key support zone.

📍 Sell Setup

Entry: Sell Limit at 115,980.00

Stop Loss: 117,985.00

Take Profit: 111,940.00

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

BTC/USD – 4H Technical and Fundamental AnalysisBTC/USD – 4H Technical and Fundamental Analysis

BTC/USD saw sharp downside pressure today, driven by a wave of long position liquidations—exceeding $800 million across the crypto market in the past 24 hours. The sudden shift triggered panic selling, dragging Bitcoin below its psychological and technical support near $116,000. Broader crypto market sentiment turned risk-off as large investors reduced exposure, accelerating the sell-off.

Fundamentally, the market remains cautious amid a lack of positive macroeconomic catalysts for risk assets. Speculation about stricter U.S. regulatory oversight and declining inflows into crypto ETFs also dampened sentiment. Combined with hawkish remarks from Fed officials, which keep interest rates elevated, appetite for high-risk assets like Bitcoin weakened further.

From a technical perspective, BTC/USD broke below the major support level of $116,000, confirming bearish pressure. This breakdown followed a period of consolidation, with price failing to maintain bullish momentum. A liquidity hunt appears to be underway, with price revisiting the zone to trap breakout traders before resuming its move.

We are now watching for a confirmed 4H candle close below the liquidity zone. Once confirmed, a short setup is validated, with targets aligned with the next key support zone.

📍 Sell Setup

Entry: Sell Limit at 115,980.00

Stop Loss: 117,985.00

Take Profit: 111,940.00

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

Will the low of this BTC zone be used as a buy point?We have an imbalance high being tested. We know that this also represents the consolidation range low where both TPs and long entries will be triggered.

Will this be enough to send us back bullish or will be need further correction of the imbalance? I think there's a high probability of this with DXY also running into it's daily bearish imbalance range.