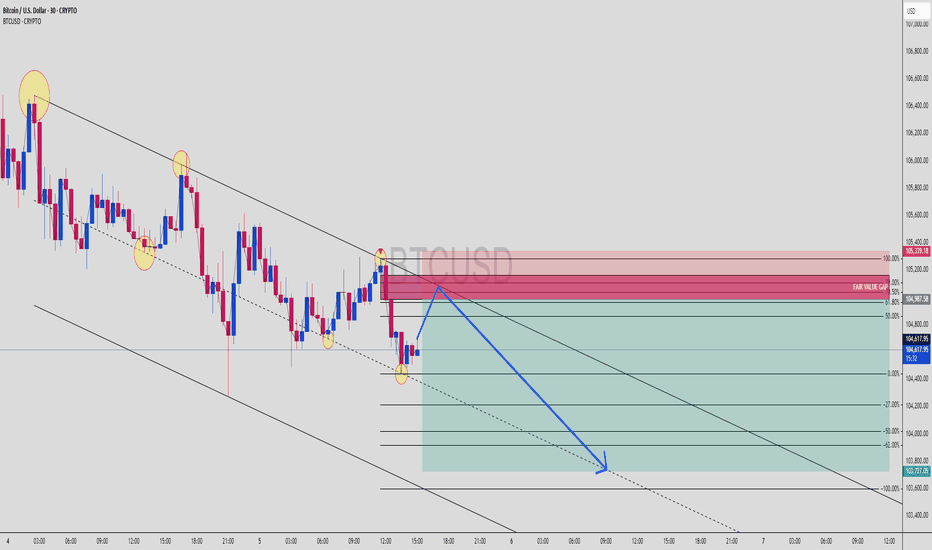

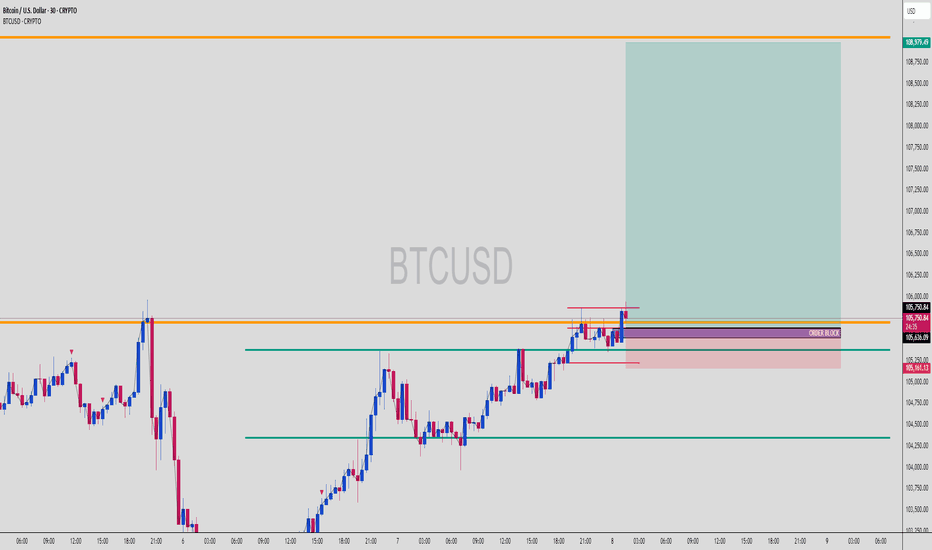

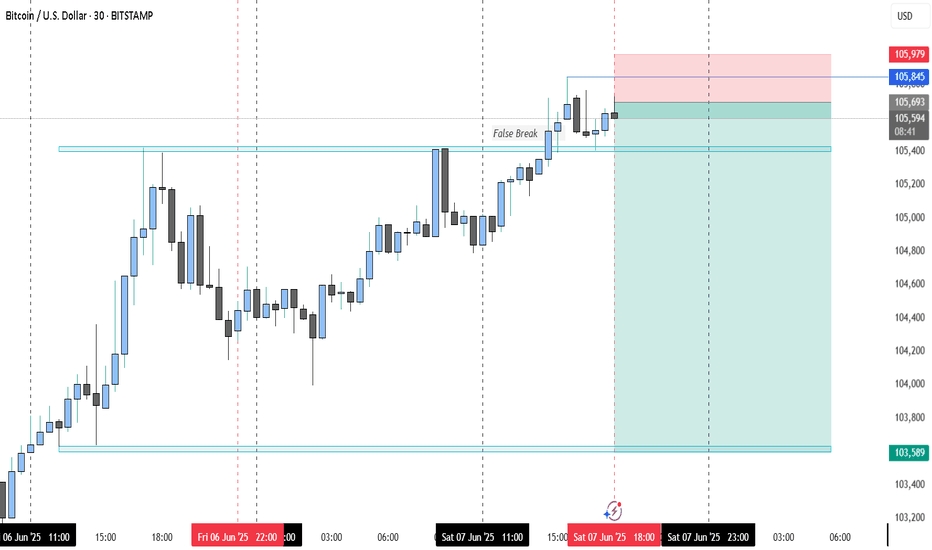

BTC Short Setup! OB + Fair Value Gap + Trend Channel ConfluenceBitcoin (BTCUSD) | 30-Min Chart – High Probability Sell Setup

Bitcoin continues to respect bearish structure inside a descending trend channel, creating prime opportunities for Smart Money traders to strike at optimal levels.

🔍 Trade Breakdown:

Bearish Market Structure

Price is forming lower highs and lower lows

Channel structure is being respected with multiple taps on both the upper and lower bounds

Liquidity Sweeps & Internal Range

Multiple yellow-highlighted zones show liquidity engineering — both buy-side and sell-side have been swept

Recent sweep + demand failure confirms bearish intent

Premium Entry Zone Setup:

🔴 Order Block Zone (OB): 105,200 – 105,400

🟣 Fair Value Gap (FVG): Overlapping with OB – perfect imbalance correction

📐 Fib Levels:

61.8% = 104,987

70.5% = 105,298

79% = 105,388

🔺 This is the kill zone — premium retracement + inefficiency fill = high confluence

Bearish Continuation Expectation:

BTC likely to react at OB zone and continue bearish leg

Projection into discount fib levels:

-27% = 104,000

-62% = 103,800

-100% = 103,727

Channel Respect = Structure Confidence:

Every key swing is aligning with channel resistance/support

Blue arrow shows expected path: liquidity sweep ➝ OB/FVG tap ➝ drop to channel low

🧠 Chart Ninja Entry Plan:

🔹 Entry Zone 105,280 – 105,388 (OB + FVG + 70.5–79% Fib)

🔻 SL Above 105,400 (above OB)

📉 Target 103,727 (channel + -100% Fib extension)

⚖️ RRR Over 1:4 — sniper-grade RR setup

💬 Ninja Wisdom:

You're not chasing moves — you're waiting where liquidity pools.

Fair Value Gaps + OB + Trend Channels = institutional signature.

Trade like Smart Money. Let retail chase candles. 🥷💸

📍 Save this setup before the market plays out

🔁 Share your thoughts below – entry, TP, SL?

👣 Follow @ChartNinjas88 for more sniper BTC setups daily

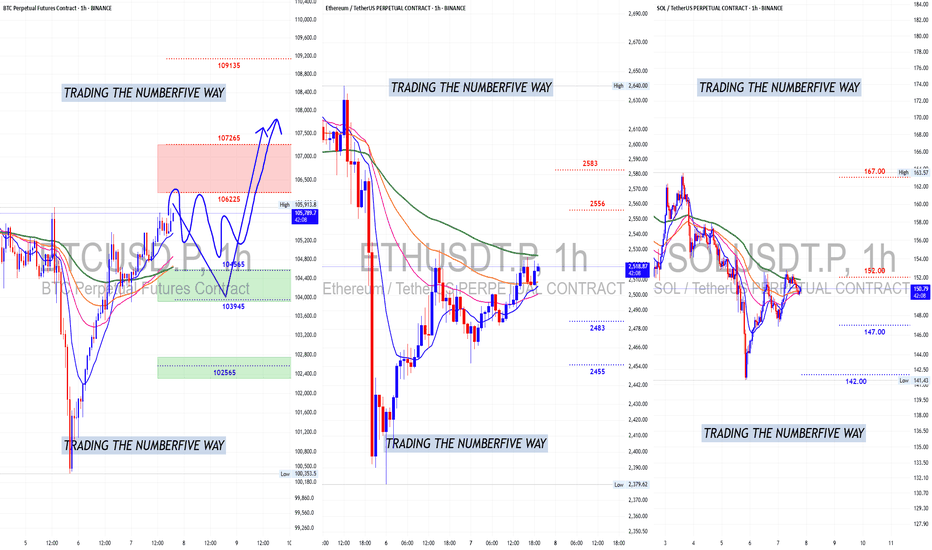

BTCUSD.P trade ideas

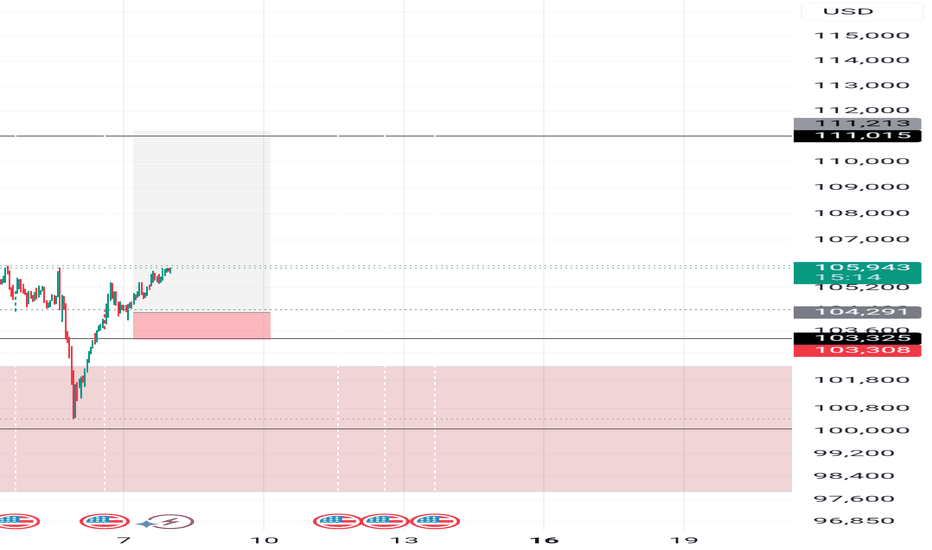

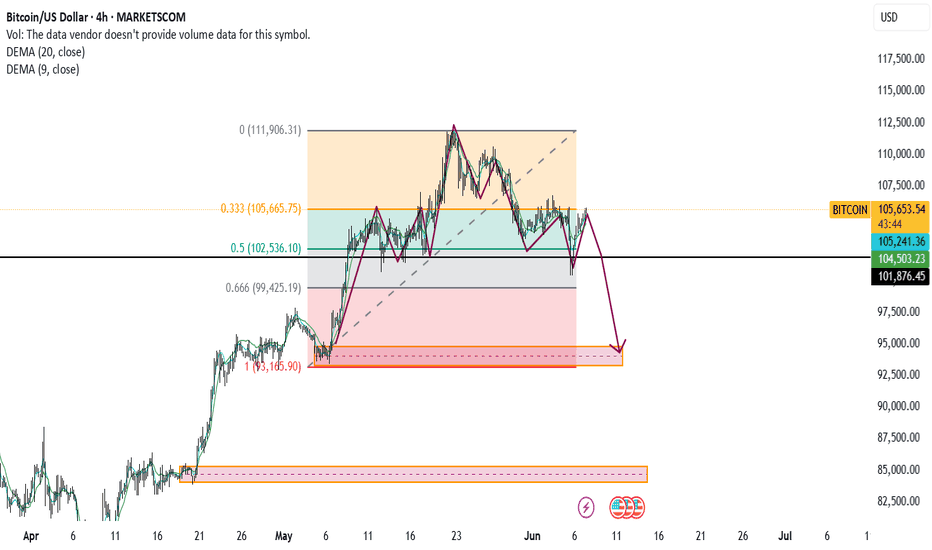

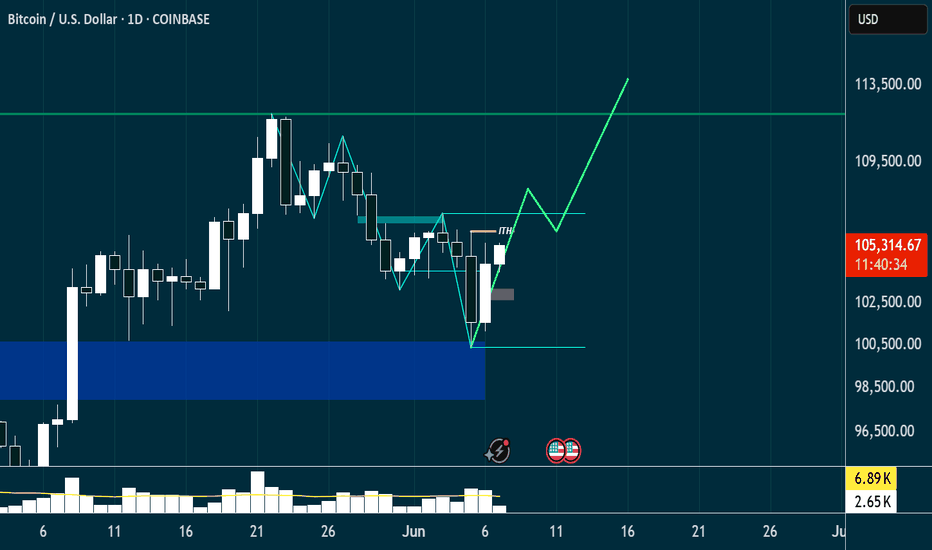

Long trade

1Hr TF overview

📘 Trade Journal Entry

BTCUSD (Buyside Trade)

Date: Saturday, 7th June 2025

⏰ Time: 5:00 AM (NY Time)

📍 Session: London AM

📈 Timeframe: 1Hr

📊 Market Structure Tool: Break of Structure + FVG Entry

🧠 Confirmation Tool: Clean Bullish Momentum

🔹 Trade Details:

Entry Price: 104,993.53

Take Profit: 106,180.50 (+1.13%)

Stop Loss: 104,687.73 (−0.29%)

Risk-Reward Ratio: 3.88

🔹 Technical Breakdown:

Market Structure:

Clean bullish market structure with higher highs and higher lows.

Break of previous structure and retrace into a bullish FVG confirmed intent.

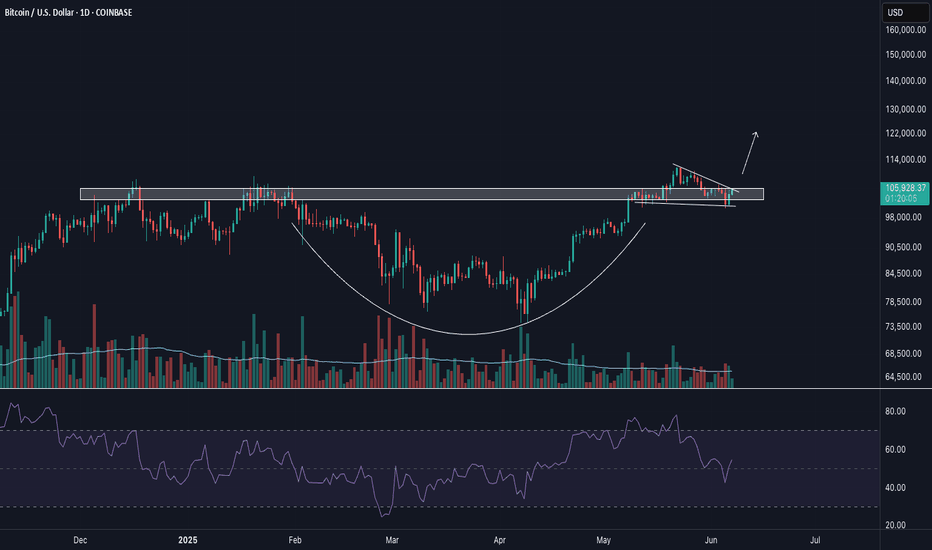

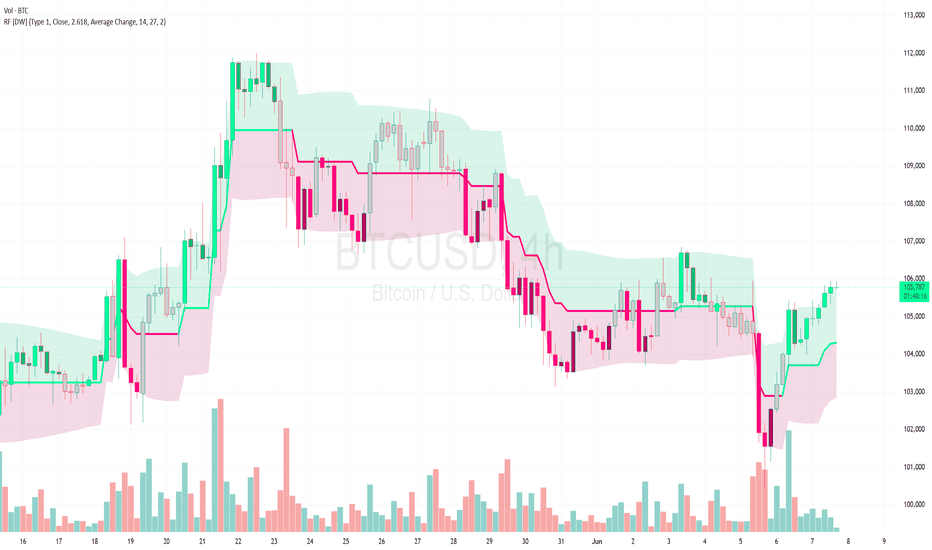

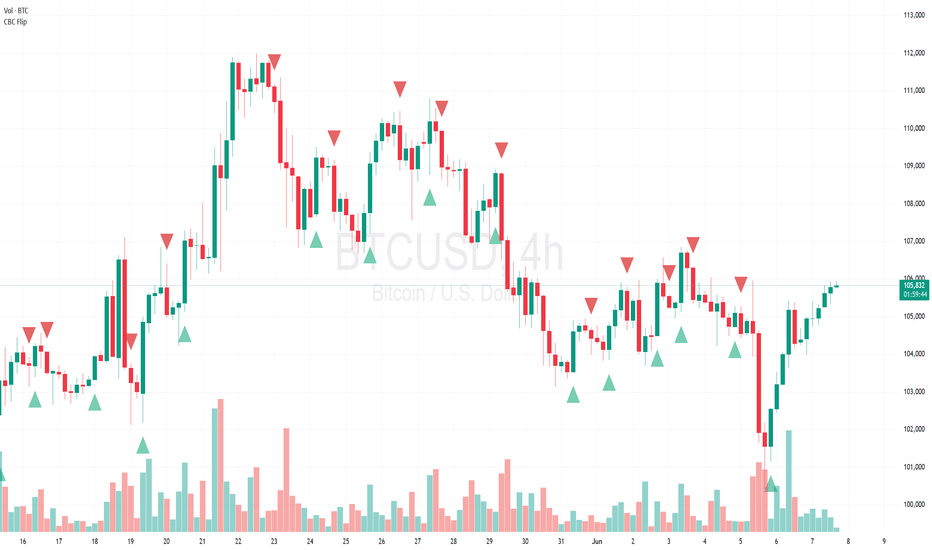

BTC/USD 4H Analysis: Range Filter StrategyThe following analysis is based on the BTC/USD 4-hour chart, utilizing the Range Filter Strategy indicator, as of June 7, 2025, 6:04 PM EDT. The chart reflects a recent trading range with notable price action and trading signals over the past few weeks.

Key observations:

The price has oscillated between a high of approximately 113,000 USD and a low of 104,000 USD, with the current level around 105,931 USD, showing a slight recovery from recent lows.

The Range Filter Strategy identifies long and short opportunities, with clear exit points. Notable long entries include a setup near 104,000 USD with an exit at 110,000 USD (marked as "Exit Long"), and another recent long signal around 105,000 USD with an ongoing upward move.

Short opportunities are indicated with exits at lower levels, such as the "Exit Short" near 107,000 USD, suggesting a profitable downward move.

The blue shaded areas represent the range filter, highlighting periods of consolidation and potential breakout zones. The recent drop from 110,000 USD to 105,000 USD was followed by a potential reversal, as indicated by the latest long signal.

Volume analysis at the bottom shows increased activity during breakout periods, supporting the validity of the signals.

Traders should watch for a sustained move above 107,000 USD to confirm bullish momentum, with resistance near 110,000 USD. A break below 104,000 USD could signal further downside.

Disclaimer: This analysis is for educational purposes only and not financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Conduct your own research and consult a financial advisor before making trading decisions.

BTC/USD 4H Analysis: CBC Flip Strategy Long OpportunitiesThe following analysis is based on the BTC/USD 4-hour chart, utilizing the CBC Flip Strategy indicator . As of the latest data, the price has experienced significant volatility, with a current level around 105,946 USD, reflecting a 0.94% increase over the observed period. Key pivot points are noted at 103,888 (H4), 104,304 (L3), 107,127 (C3), and 107,307 (Vol 104.09), providing critical support and resistance levels.

The chart highlights multiple long entry opportunities, with notable setups including:

A long entry at approximately 104,000 USD with a TP/SL at 104,319 and a target of 104,546.

Another long setup near 105,000 USD with TP/SL at 105,127 and a target of 105,307.

Recent price action shows a recovery from a low of 103,000 USD, with green candlesticks indicating bullish momentum as of June 7, 2025, 17:52 UTC-4.

The CBC Flip Strategy, set with a 2% risk parameter, suggests disciplined trade management. Volume analysis at the bottom indicates increased activity during upward movements, supporting the validity of these long signals. Traders should monitor for a potential retest of the 104,304 support level, with a break above 107,127 potentially confirming a stronger bullish trend.

Disclaimer: This analysis is for educational purposes only and not financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Conduct your own research and consult a financial advisor before making trading decisions.

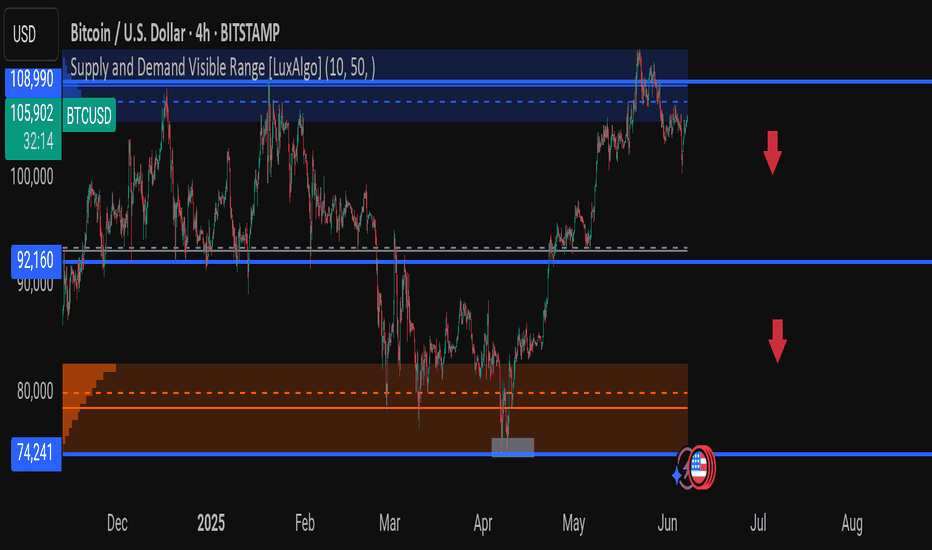

BTCUSD 4H Chart – Major Supply Zone Rejection! What’s Next Bitcoin is showing early signs of weakness after rejecting the key supply zone between $108,000 - $109,000. Price is currently trading at $105,868, and bulls are struggling to reclaim the highs.

🔵 Key Levels to Watch:

🔹 Resistance: $108,990 (Strong Supply Zone – Multiple Rejections)

🔹 Support 1: $92,160 (Previous Consolidation Range)

🔹 Support 2: $74,241 (High-Volume Demand Zone from March/April Dip)

📉 Bearish Signs:

Price sharply rejected from major supply (marked in blue).

Two red arrows highlight potential downside targets if current support breaks.

A break below $92,160 could accelerate a fall to the $74K demand zone (orange area).

📊 Volume Profile Insight:

Notice how volume thins out between $92K and $80K, suggesting a vacuum that could lead to rapid price movement if BTC loses structure.

⚠️ Outlook:

Bulls need to reclaim and close above $108,000 to resume the uptrend. Until then, any rally may just be a lower high in a potential reversal pattern.

---

💬 What’s your outlook for BTC in June and July? Are you buying the dip or waiting for lower levels? Drop your thoughts and let's chart this together! 👇

#Bitcoin #BTCUSD #Crypto #TradingView #PriceAction #SupplyDemand #LuxAlgo

BTC, ETH and SOL UPDATEWell....well.....well, look at that, damn bears trying to set a trap but I know their game very well and one of two things it will take place and fortunately at the end both scenarios will have the same outcome (UP).

We can see that price didn't drop last nigh when it should so next price move during the next 2 or 3 days(if not sooner) either will move sideways and then breakout or it will drop to grab liquidity bounce and then breakout to go for the $107k in either case scenario it will end up going for the $107k. Now if you are Long with high lev and your liquidation point is above $103500 you gonna get rekt. Know the rules of the game ...Play it safe. Take care everyone.

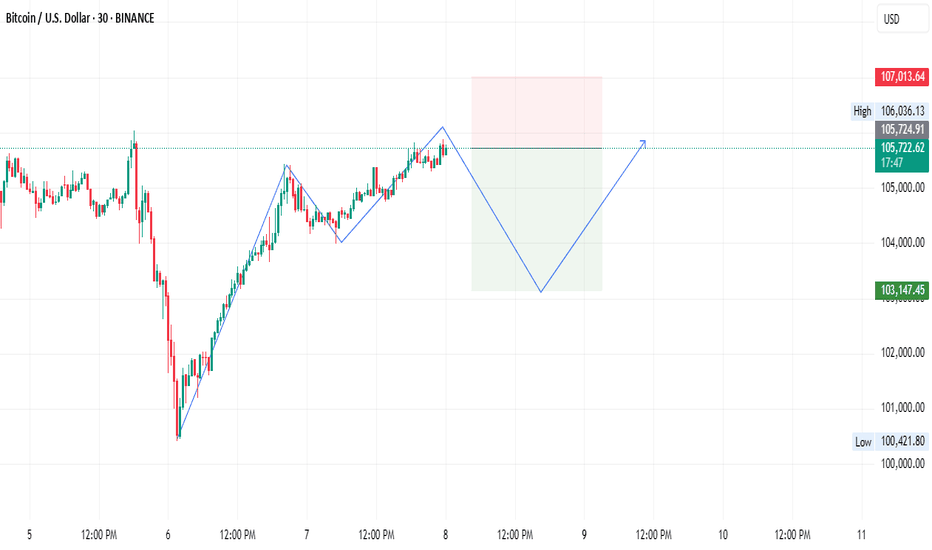

Short Bitcoin Setup – June 8, 2025 🔹 Entry: 105,800

🔹 Target: 103,200

🔹 Stop Loss: 107,000

Initiating a short position on Bitcoin at the current resistance zone around 105,800. Price is showing signs of exhaustion with potential for a short-term pullback. Targeting the support area near 103,200, with a well-defined stop loss at 107,000 to manage risk.

⚠️ Always apply proper risk management. This setup is based on technical analysis and market conditions at the time of posting.

Disclaimer: This post is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any financial instrument. Trading cryptocurrencies involves significant risk, and you should conduct your own research or consult with a licensed financial advisor before making any trading decisions.

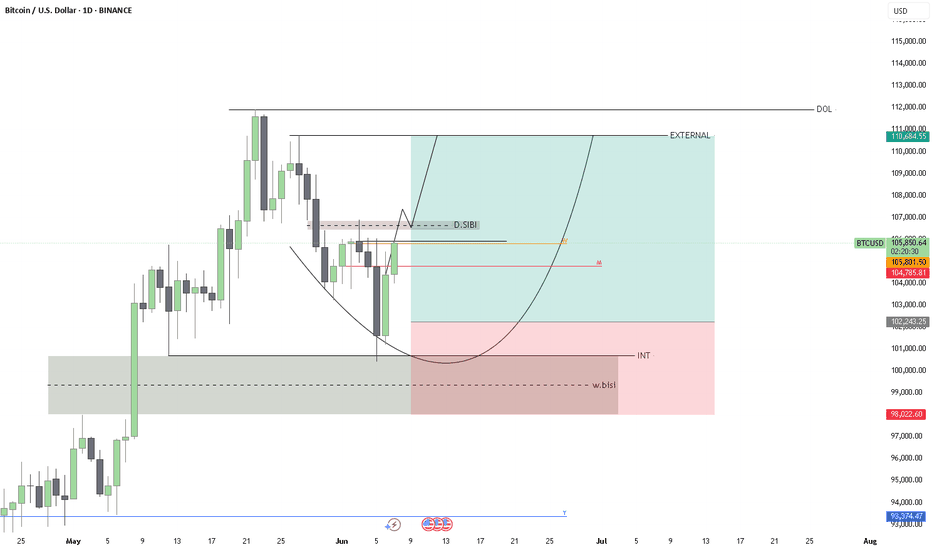

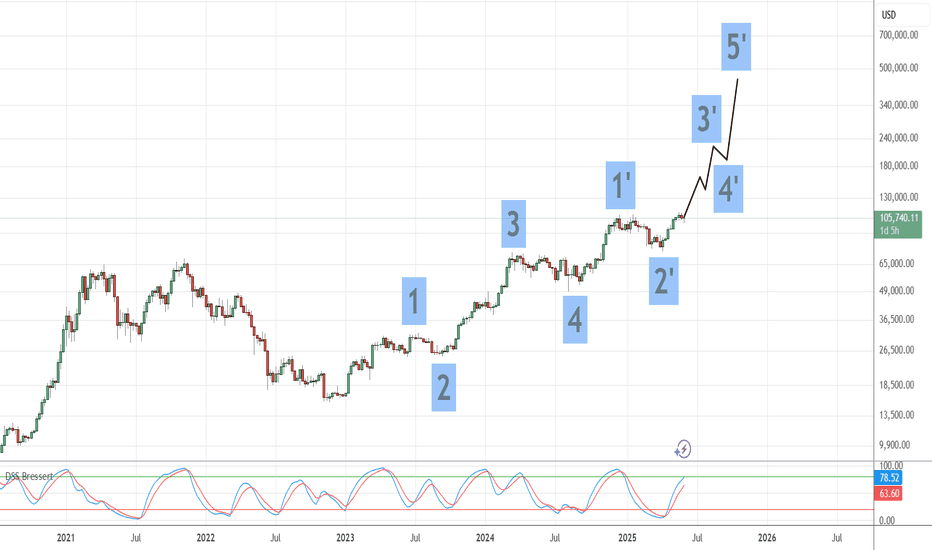

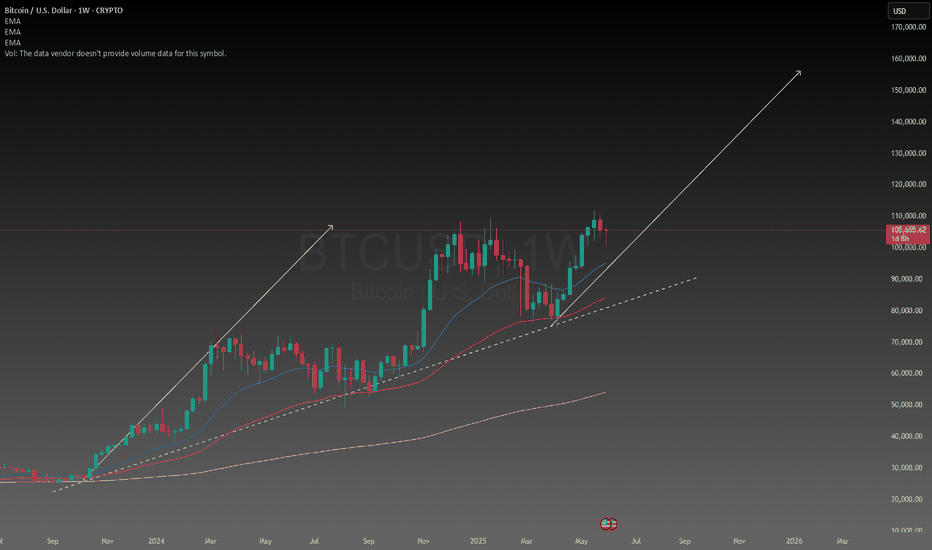

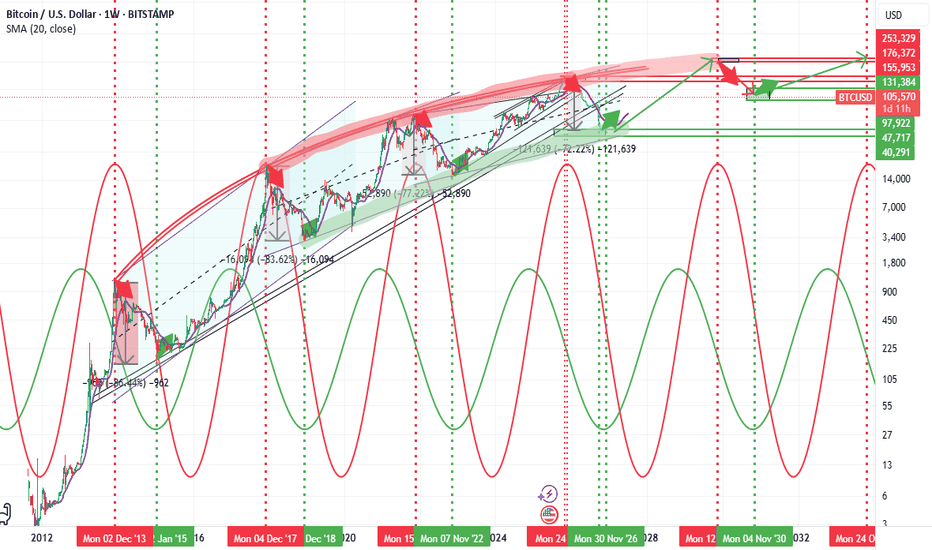

End of the present 4 year cycleApril 6 a new weekly cycle of about 5-6 months duration started.

Its first 60d daily cycle ended June 6.

The second and present daily cycle will target 160k USD mid July.

The third and last daily cycle of this weekly cycle will be left translated and tops at 210k USD around August 20 and ends around September 20.

Then the next weekly cycle will start with a blow off top of the entire 4 year cycle (since November 2022), which will be beyond 400k USD.

This will happen around October 20 during the first daily cycle of the new weekly cycle.

This new weekly cycle and an additional one will bring BTCUSD to around 75k at the end of 2026 (around November).

Then a new 4 year cycle starts.

BTC Long Triggered from OB, Smart Money Played This Perfectly!BTCUSD | 30-Min Chart – Long Setup Execution

Bitcoin has just activated a clean long entry from a well-defined bullish Order Block at a key structural level. This move follows textbook Smart Money Concepts (SMC) — the kind of play institutional traders thrive on.

🔍 Setup Breakdown:

🔹 Order Block (OB):

Identified near 105,636 — aligned with previous support

Precise reaction zone after consolidation, showing institutional interest

OB respected after fakeout below short-term liquidity

🔸 Liquidity Sweep:

Quick wick below 105,250 acted as a stop hunt for early shorts

Price reclaimed the OB immediately after → classic Smart Money trap

🟩 Entry Zone (OB Zone):

105,636–105,250 range

Confluence with minor bullish imbalance and structure support

Price barely tapped the zone before launching higher

📈 Upside Target:

TP marked at 108,979 — prior liquidity pocket and untested highs

Large green zone shows ideal RR (approx. 1:6)

First obstacle: minor resistance at 106,750, but momentum looks strong

🟥 SL Placement:

Safely below OB at ~105,161

Below liquidity sweep zone = strong invalidation

🧠 Why This Setup Works:

✔ Price moved impulsively into the OB

✔ OB lines up with previous structure support

✔ Rejection + strong bullish candle = confirmation

✔ No significant resistance until higher liquidity zones (108K+)

This is classic SMC execution: trap, sweep, OB tap, and send. Let retail panic — we follow footprints.

💬 Ninja Wisdom:

"Smart Money doesn’t chase price — it traps and collects."

This was a clean confirmation of a bullish continuation after reclaiming control from liquidity grabs.

📍 Save this chart – this setup could explode into a full bullish swing

💬 Drop your thoughts: Are we headed to 109K or pausing at resistance?

👣 Follow @ChartNinjas88 for more sniper-level BTC/ETH/Gold plays

Bitcoin price prediction for the next 12 monthsMy simple analysis of Bitcoin, please don't hesitate to comment your feedback. Of course this is just drawings on a chart so don't take it too seriously. Hope everyone is having fun with Bitcoin it used to be harder to find assets like this but fintech has made it easier to build wealth.

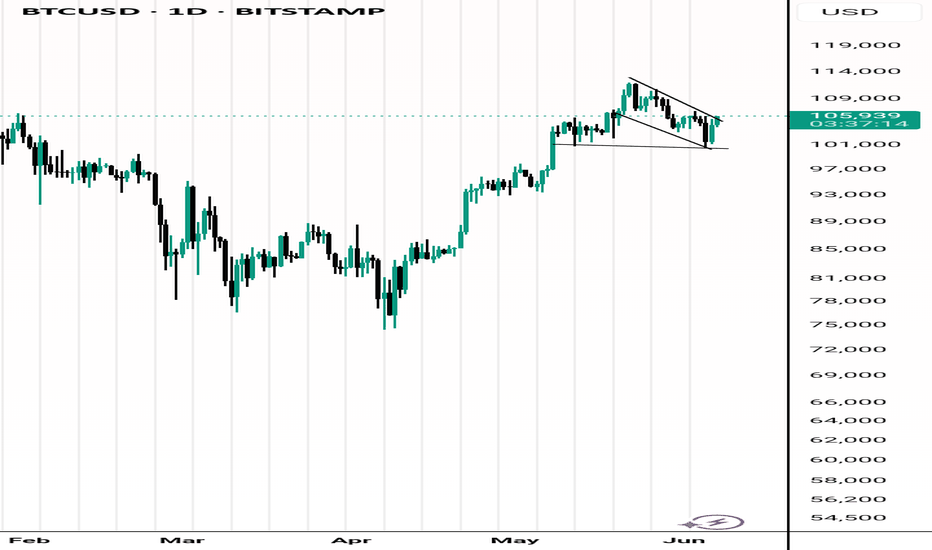

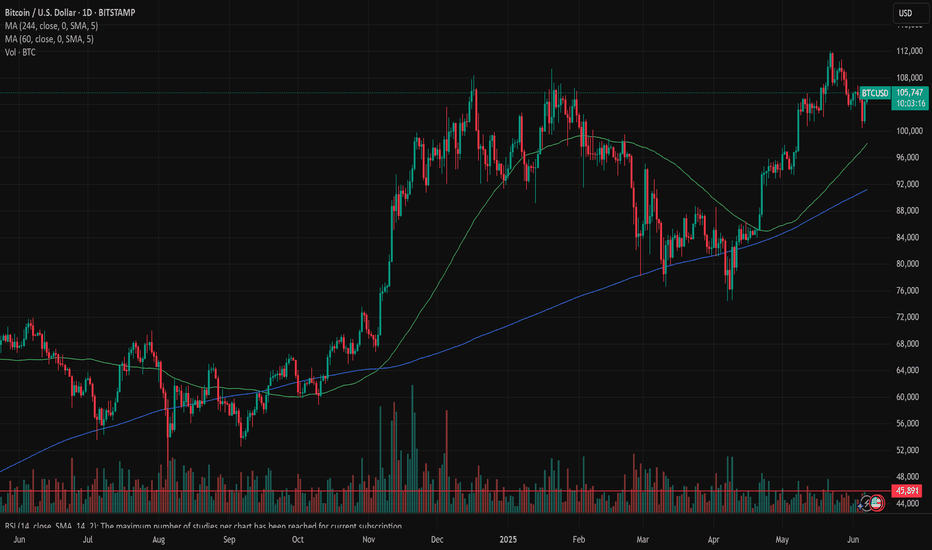

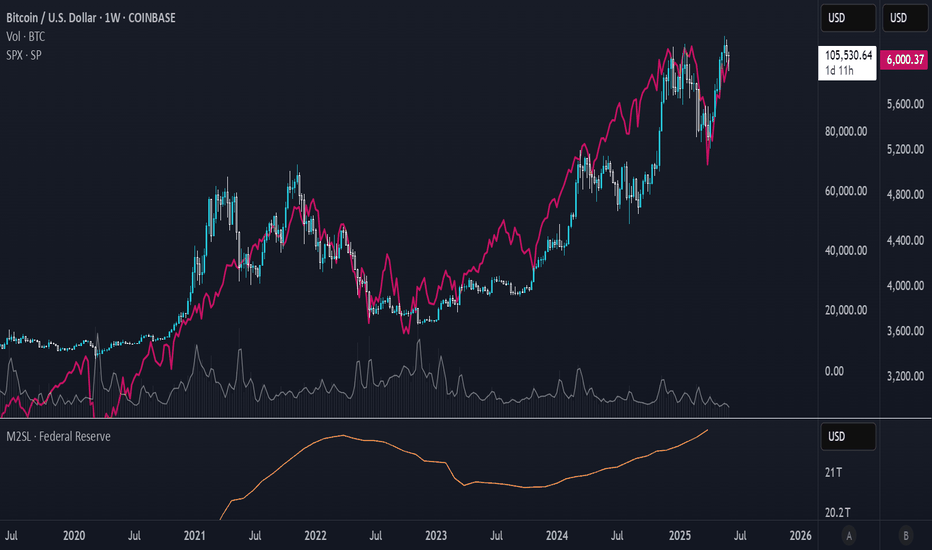

Bitcoin: will $105K prevail or not?After a spike in price on May 22-23rd, the price of BTC continued with a consolidation, moving the price toward the lower grounds. Fridays stronger than expected US jobs data returned the optimism among market participants, bringing back the price of BTC toward the levels around the $105K, where BTC is ending this week. The lowest weekly level reached was $100.754 on one occasion.

The RSI was pushed at levels below the 50 level, around 45, but is still ending the week at 52. This is an indication that market participants are slowly starting to eye the oversold market side. The MA 50 continues to strongly diverge from MA200, without an indication that the cross might come anytime soon.

Since the peak level was reached as of the end of May, the BTC was traded with lower highs and lower lows for the rest of the period. This is a clear indication that some short consolidation is ahead. In the technical analysis this formation is imposing the question, where this trend ends? One possibility is that BTC will again test the $100K, which was the lowest level reached during the previous week, on a short occasion. This level could also be treated as a psychological level for investors. The second option would be a break of the $105K level, which is currently tested, to the upside, where BTC will seek higher grounds, probably around $108K. Both scenarios currently have equal probabilities. Which one BTC will choose, it will be clearer at the start of the week ahead. Until then, the $105K is the level to watch closely, will it prevail or not?

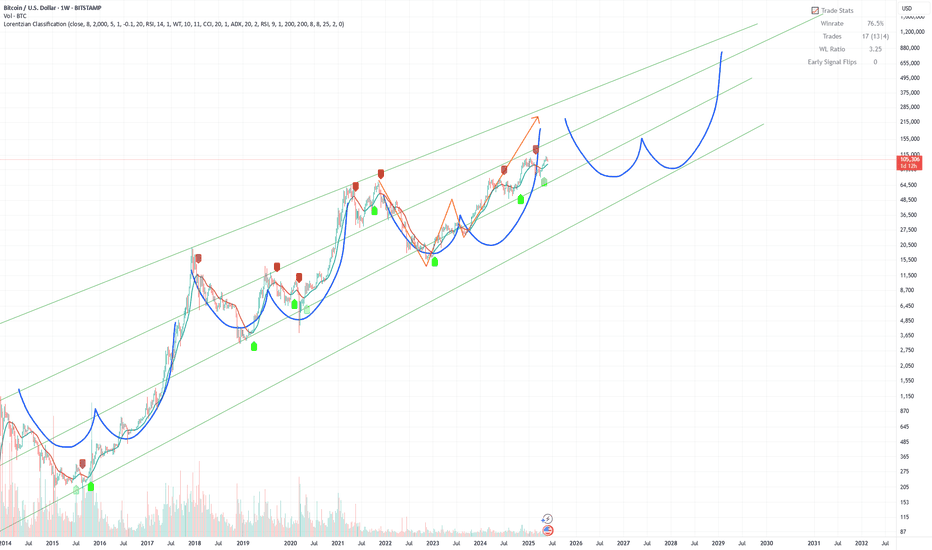

The magic fractal wave of BTCWell it is very interesting pulsation of BTC. ATH > Crash > New ath > Biger crash > recovery > Old ath > crash

I have pretty accurately predicted this cycle. I think we will see 150K this year and then crash to 77K in 2026 and then climb up to 0.5 Mil.

Tell me what you see.

BITCOIN - HTF.HTF analysis on Bitcoin:

Anyone with eyes can read the Monthly structure and bias as being bullish, April swept the prev ATH at 108K, tapping the 111K levels, before selling off sharply (to be expected, price must come down, to go up, after all!). - Monthly context shows we need to do just that, and this week, we did!

I had the target as the Weekly Bullish FVG residing at 100K, and expected the reaction we have seen, however, now is where it gets interesting - as we can see on the Daily (TF of the chart in this example), we can see that price ran a daily ITL as well as 4H liquidity levels, on its way into the W FVG (happened on Thurs, not Fri, which was interesting considering the RFN on friday), and has since shown bullish displacement back to the upside.

Current Daily targets are 105-108K levels, if Bulls can recapture this area, we can expect some form of consolidation before another leg up. The ETF's (in my opinion) were the institutions and their 'Trojan Horse's' - so the higher we go, the more we can expect sell offs in the form of profit taking via institutional profit taking.

Conclusion - BULLISH BIAS, WITH THE HTF TARGETS BEING DAILY HIGHS, AND THE OVERALL MONTHLY TARGET OF A NEW ATH - 125K is the next logical HTF target based off a trend-based Fib extension.