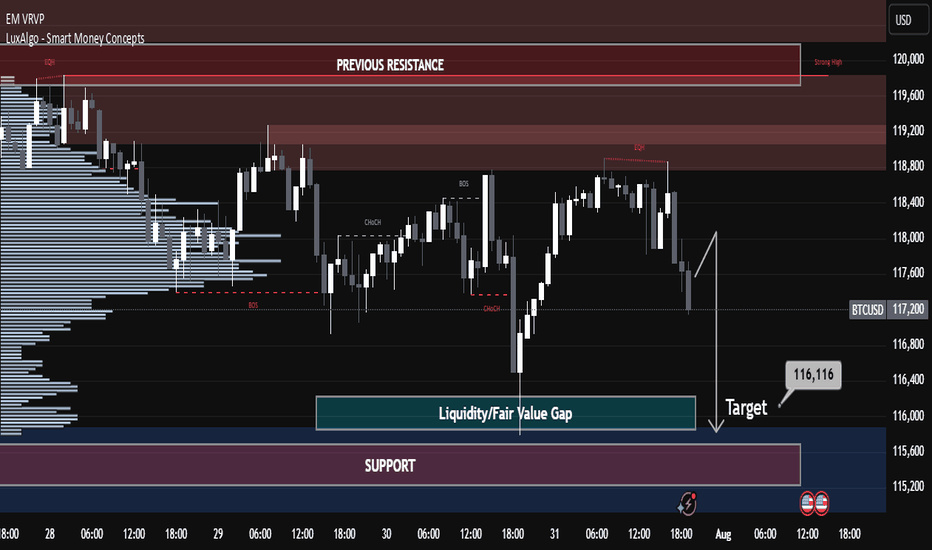

BTCUSD Technical Analysis – Bearish Momentum Towards Fair Value BTCUSD Technical Analysis – Bearish Momentum Towards Fair Value Gap

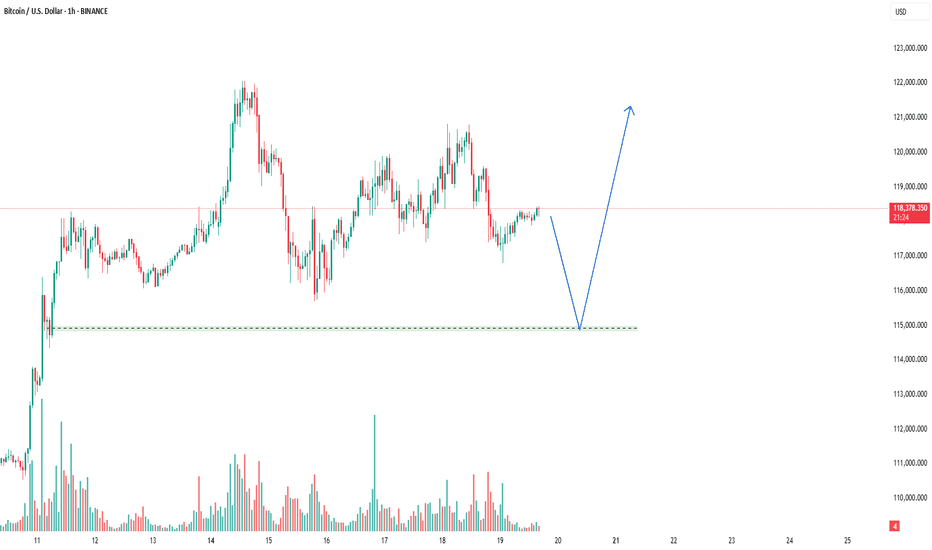

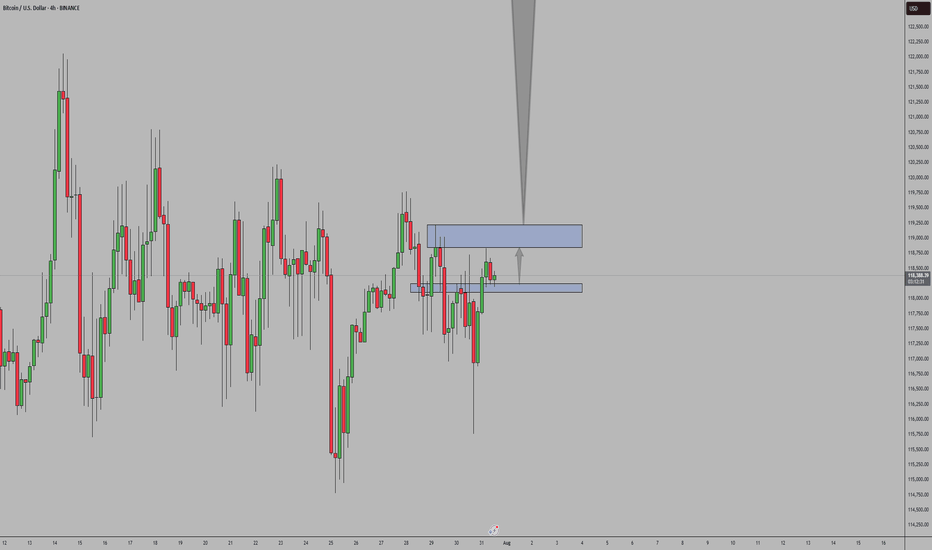

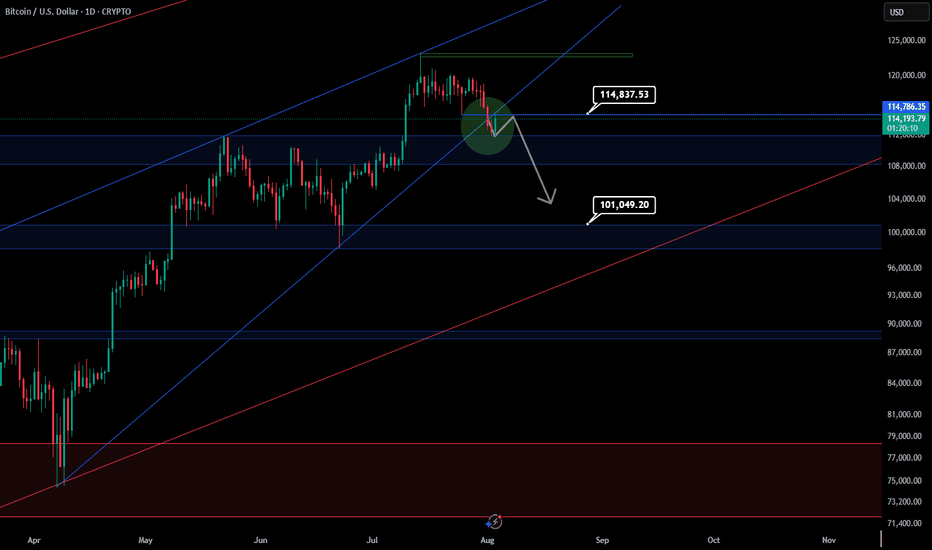

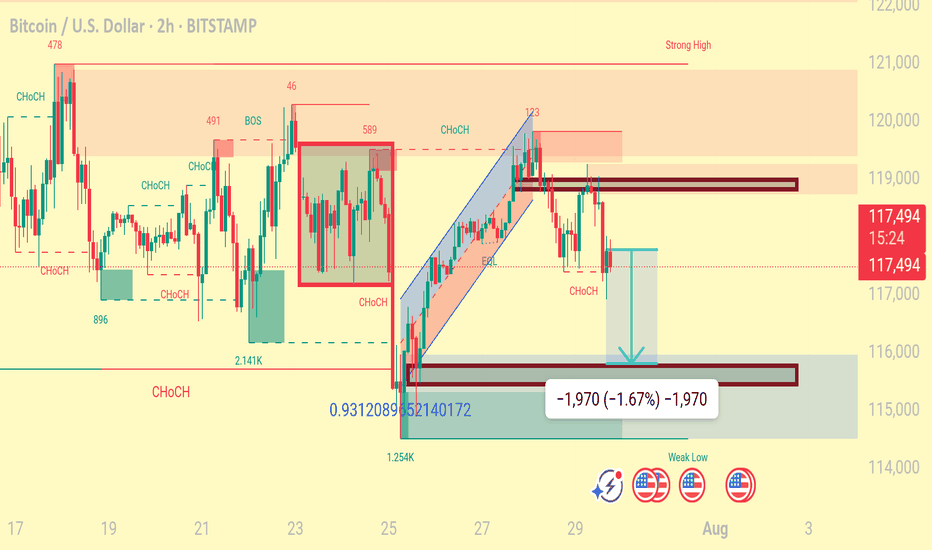

Bitcoin is showing clear bearish pressure after rejecting from the previous resistance zone around 118,800 – 120,000. The market structure and smart money concepts indicate potential for further downside.

🔍 Key Observations:

Previous Resistance Respected: Price failed to break through the strong resistance zone marked near the 119,200–120,000 level, showing strong institutional selling interest.

Market Structure Breaks:

BOS (Break of Structure) and CHoCH (Change of Character) confirmed bearish shift.

Price has maintained lower highs and lower lows, signaling a bearish trend.

Liquidity/Fair Value Gap Zone: The market is currently targeting the liquidity/FVG zone between 116,400 – 116,100, which aligns with price inefficiency and unfilled orders.

Support Zone Ahead: A strong support zone is visible near 115,600 – 115,200. Expect a potential reaction or consolidation here.

📌 Strategy & Bias:

Short Bias Active until price reaches 116,116 (target).

Watch for possible bullish reversal signs in the support/FVG zone.

Ideal for scalp-to-swing short trades, with tight SL above recent EQH.

📚 Educational Notes:

Fair Value Gaps (FVG) indicate institutional imbalances and are often revisited by price.

CHoCH and BOS are early signals of smart money moves – always monitor them in confluence with volume and zones.

BTCUSD.P trade ideas

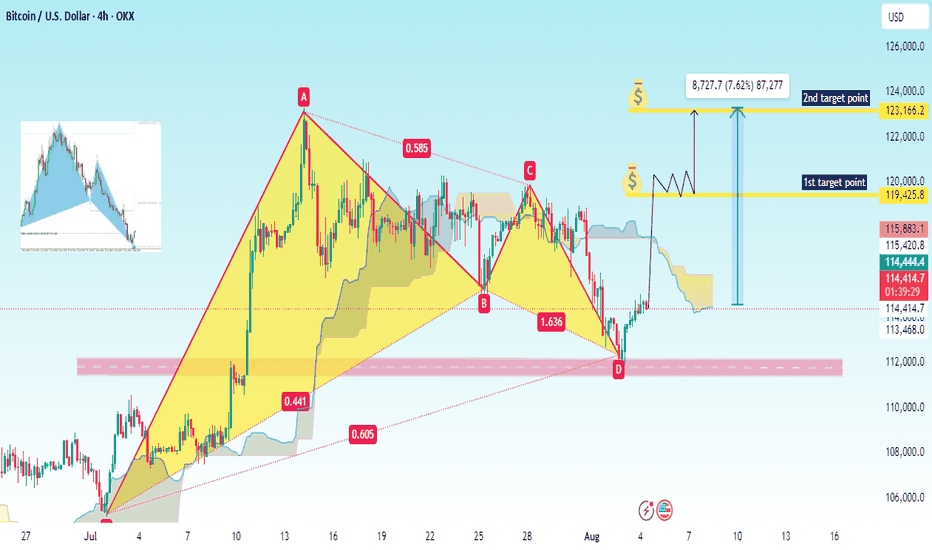

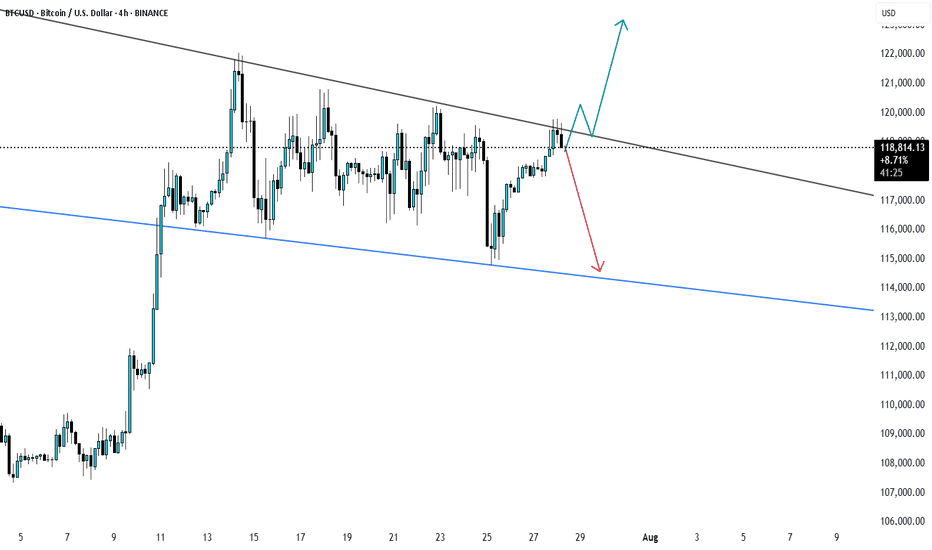

BTC/USD 4H – Bullish Harmonic Pattern Buy Setup from Support zonBTC/USD (Bitcoin vs US Dollar)

Timeframe: 4-Hour (4H)

Pattern: Bullish Harmonic Pattern

Most likely a Bullish Bat or Gartley Pattern

Marked points: X-A-B-C-D

Support Zone: Highlighted in pink, around $114,000 – $112,000

---

✅ Buy Setup:

Buy Entry Zone: Around $114,000 – $115,000

Entry is shown at point D, which is a bullish reversal zone

---

🎯 Target Points:

1. First Target: $119,428

2. Second Target: $123,166

These targets are clearly marked on the chart with horizontal lines and labeled as “1st target point” and “2nd target point”

---

🛑 Stop Loss (Suggested):

Below support zone: $111,800 – $112,000

---

🏷 Chart Title Suggestion:

"BTC/USD 4H – Bullish Harmonic Reversal from Key Support Zone"

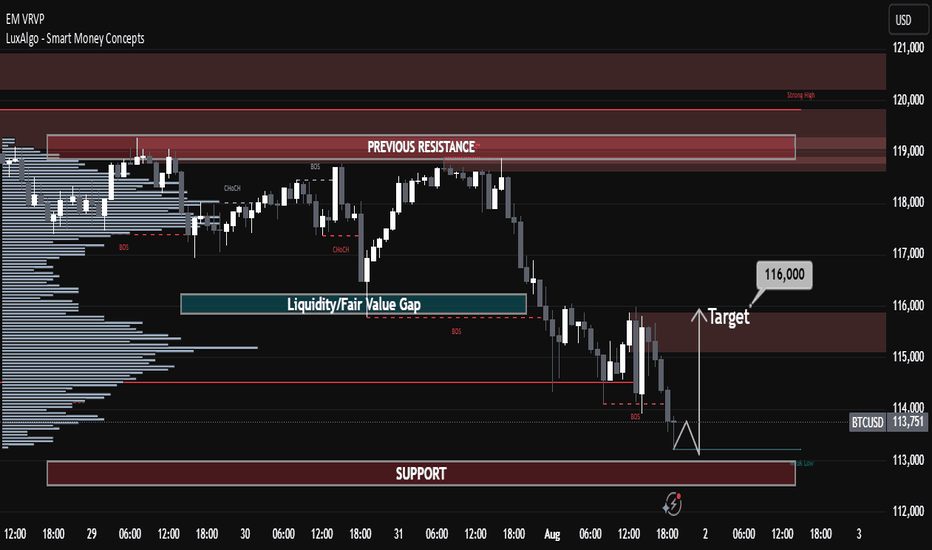

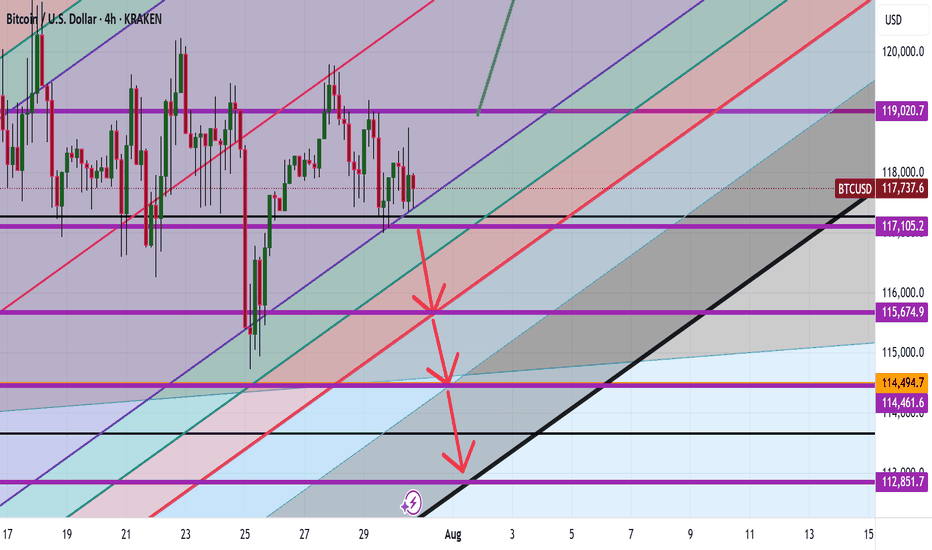

BTCUSD Technical Analysis (Smart Money Concepts) BTCUSD Technical Analysis (Smart Money Concepts)

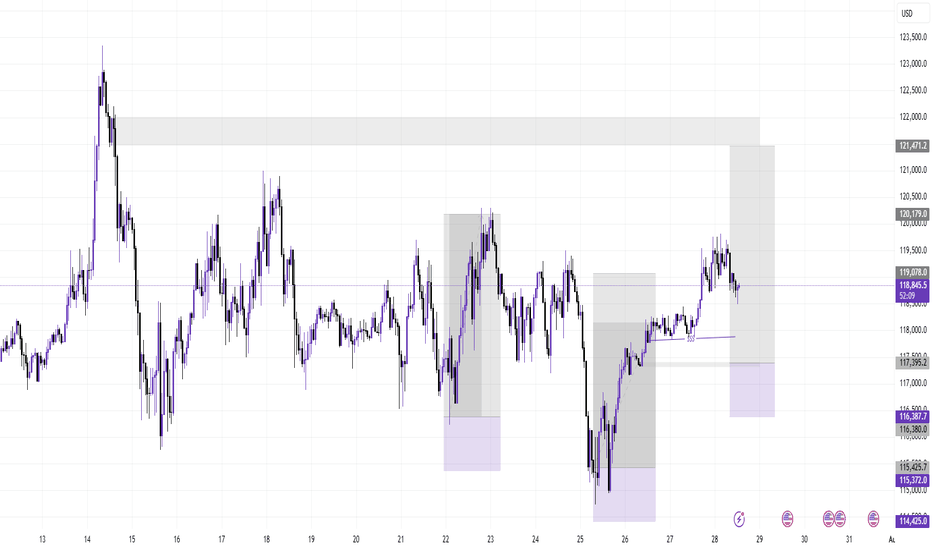

Market Structure Overview:

Break of Structure (BOS) observed multiple times confirms a strong bearish trend.

Change of Character (CHoCH) around 30th July indicated initial shift from bullish to bearish intent.

Price has been forming lower highs and lower lows, respecting the bearish structure.

Key Zones:

🔴 Previous Resistance Zone (119,000 - 120,500)

Strong supply area from where price sharply reversed.

Also aligned with a Strong High marked at ~$120,000 – key for any future bullish invalidation.

🟫 Current Target Zone – 116,000

Acts as an immediate imbalance fill/FVG retracement zone.

Target highlighted as potential retracement point before continuing lower.

🟦 Liquidity / Fair Value Gap (FVG) Zone

Located between ~115,800 and 114,500.

Price may aim to revisit this zone on pullback, filling inefficiencies.

🟩 Support Zone (~113,000)

Price currently reacting near this zone.

This area has acted as a demand zone in the past and is expected to provide short-term support.

Volume Profile & Order Flow:

Visible Range Volume Profile shows heavy activity near the resistance cluster, indicating strong distribution by institutional players.

Low volume in the FVG area further confirms inefficiency and potential for a retracement move.

Smart Money Perspective:

The current structure reflects distribution at highs, followed by markdown phase.

Price swept liquidity below local lows and may now seek to mitigate previous supply or FVG around 116,000 before resuming bearish trend.

📌 Conclusion:

Bias: Bearish until 116K is tested and rejected.

Next Move Expectation: Possible liquidity sweep → bounce to 116K → short continuation.

Invalidation Level: Break and close above 117K would signal strength returning.

✅ Educational Note:

This is a classic Smart Money trap setup — liquidity grab near lows, fakeout pump to FVG, and potential short continuation. Traders should be cautious of fake rallies into known supply zones.

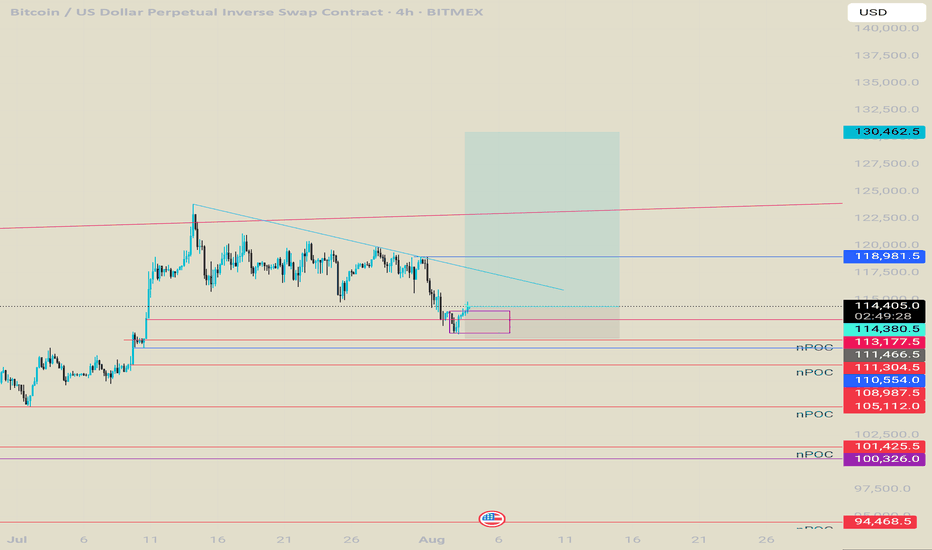

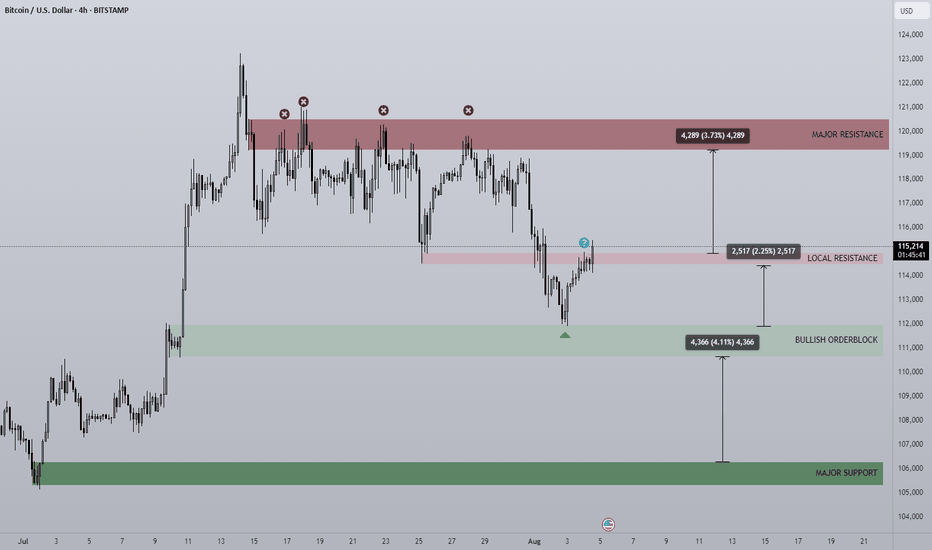

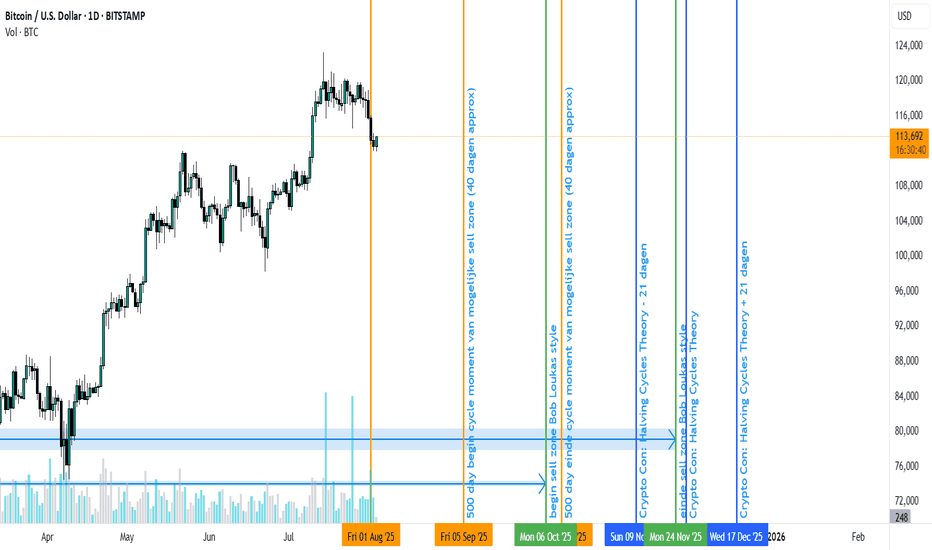

Bitcoin Range for August?Historically August has been a tough month for crypto in the past with mostly flat to negative returns. For that reason, although not a perfect science, I would not be surprised if we see a rangebound environment continuation for BTC.

So what would that look like? Structurally there are three thirds to the range, currently price is looking to break through into the upper third after bouncing off the bottom third bullish orderblock.

Trade setups will naturally present themselves as rotational plays both bullish and bearish at the extremes of each of the thirds but much larger trades from the range top and bottom.

Altcoins are lagging behind BTC structurally so where BTC has been choppy for a few weeks, most large cap alts have hit their highs and are now looking to settle into a range before the next leg up.

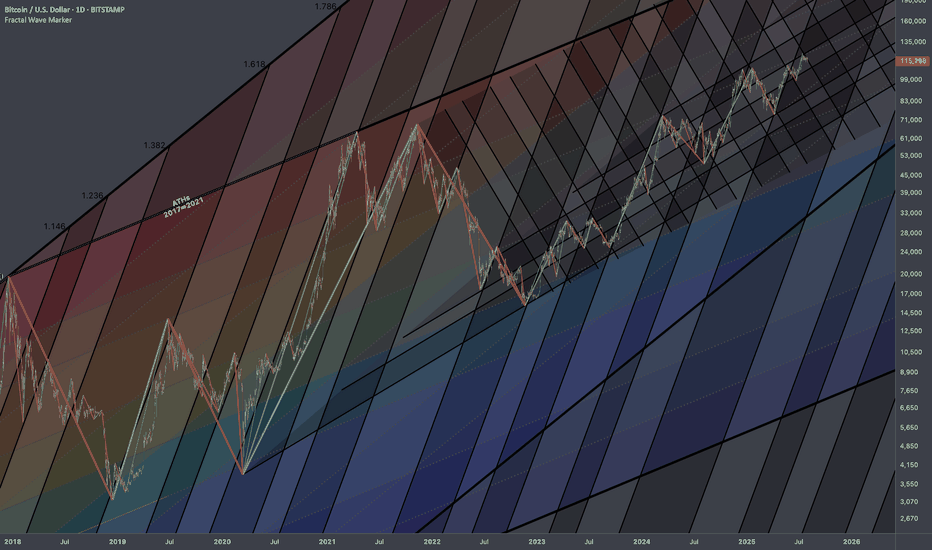

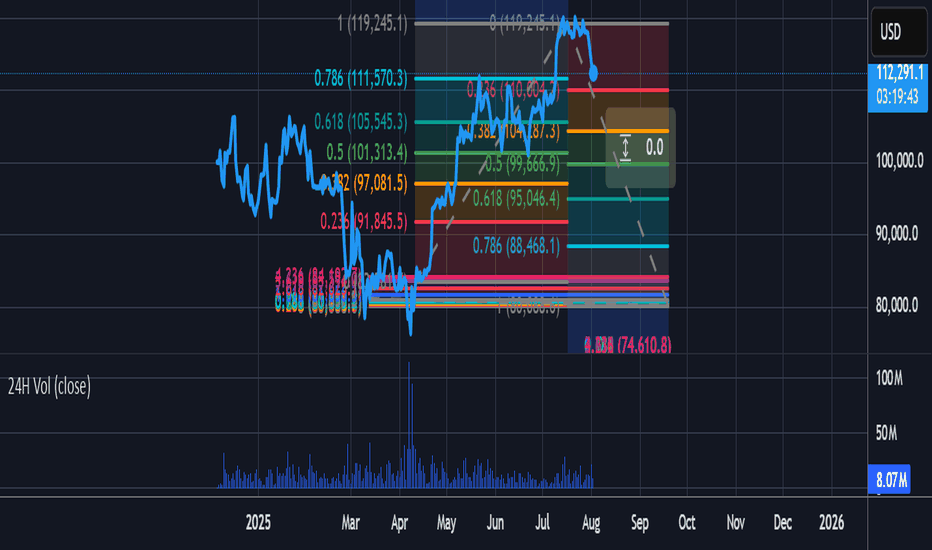

Bitcoin: Interconnections Rewired🏛️ Research Notes

Keeping fib channel of the rising trend angles as they've number of times covered well that aspect of cycle texture.

The other frame of reference would be with fib channel that covers drop from 2021 ATH to late 2022 bottom.

Last bit would be integrating fib channel discovered while ago that connects covid & late 2022 bottoms

Together they create a framework that addresses the complexity and makes even the most chaotic price movements seem to be a part of structural narrative.

Bitcoin to $116K in a Week? Here's the Case Everyone's IgnoringI know it sounds wild — but hear me out.

BTC is primed for something massive, and the ingredients are all on the table:

✅ ETF inflows are quietly stacking

✅ Supply shock post-halving is still underestimated

✅ DXY weakening = flight to hard assets

✅ Global uncertainty = Bitcoin safety bid

✅ Technicals pointing to a breakout above ATH with no resistance until $100K+

We're seeing the early signs of parabolic structure forming — and if volume confirms, this could move fast. Everyone thinks a 2x in a week is impossible... until it isn't.

Not saying it’s guaranteed — but if you've been around long enough, you know BTC doesn’t move linearly.

👀 Watch the $72K breakout zone closely. If it flips with conviction and volume, $116K is not out of the question.

Drop your charts. Agree or disagree?

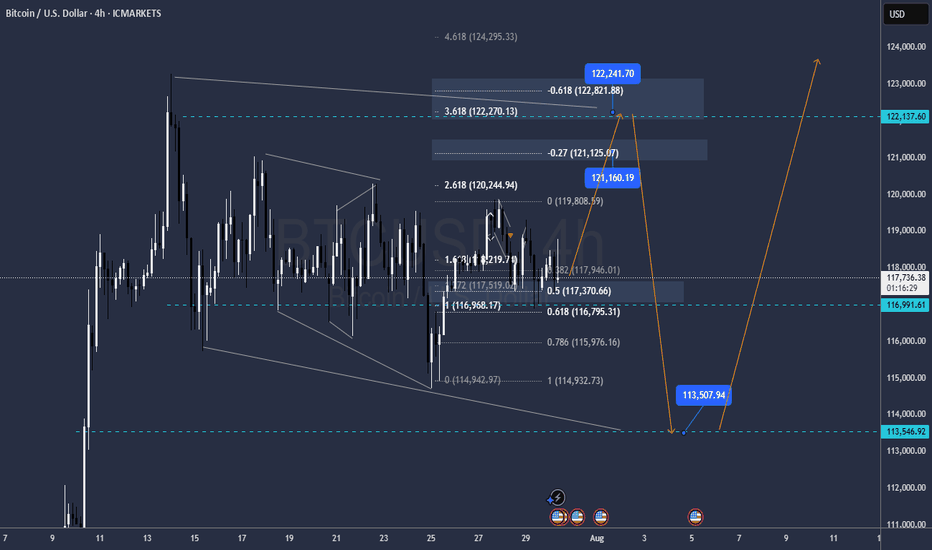

BTC FOMCOnce Again Ive the same view on BTC

There is a chance that it will go down now towards 113.500 straight so the internal buy towards 122.600 should be taken with low risk

if that level is reached the sell to 113.500 is prettyu much asured and also on 113.500 the buy to all time highs 127.500 and 133.000

GG

BTCUSDT BUYING SETUPBTCUSDT is showing a strong bullish setup as price holds above key support. A bounce from this zone could trigger the next upward move.

Traders should wait for confirmation signals such as bullish candlestick patterns or a break above short-term resistance before entering.

Stay patient, follow the trend, and manage risk properly! 📈🔥

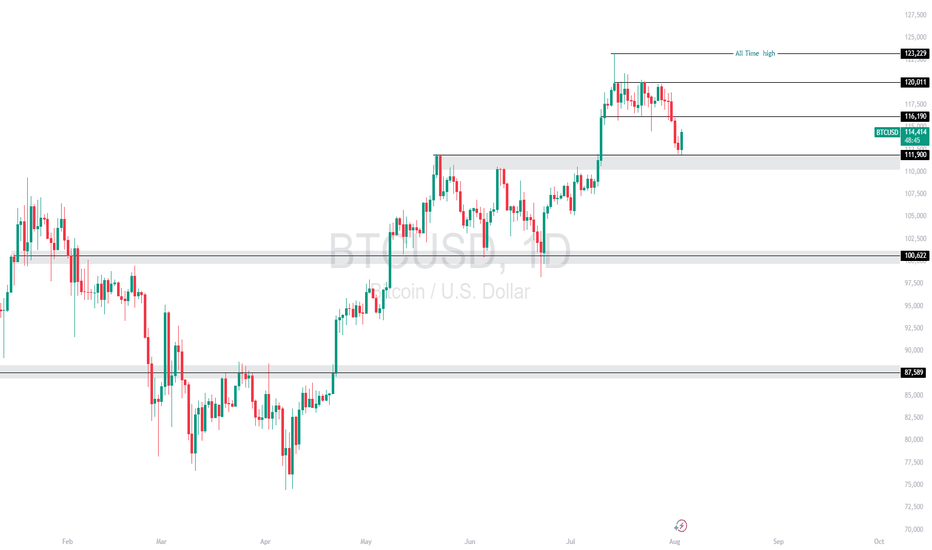

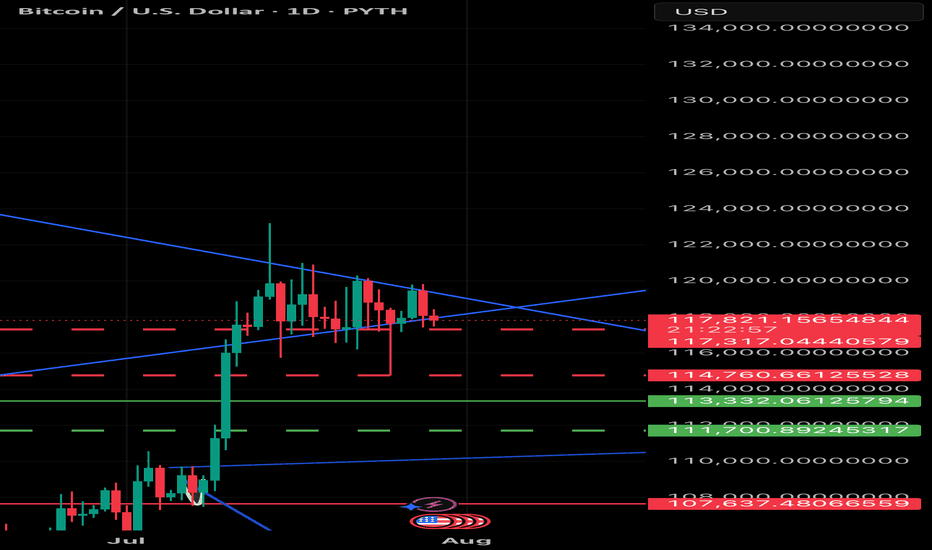

BTCUSD – Retest of Key Support at 111,900After setting a new all-time high at 123,229.00, BTCUSD has pulled back and is currently reacting to the 111,900.00 support area. This level aligns with prior structure and may provide a short-term floor if bullish momentum returns.

Support at: 111,900.00 🔽 | 100,622.00 | 87,589.00

Resistance at: 116,190.00 🔼 | 120,011.00 | 123,229.00

🔎 Bias:

🔼 Bullish: Price must hold above 111,900.00 and reclaim 116,190.00 to set up for a potential retest of the all-time high.

🔽 Bearish: A breakdown below 111,900.00 opens the door for deeper correction toward 100,622.00 and 87,589.00.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

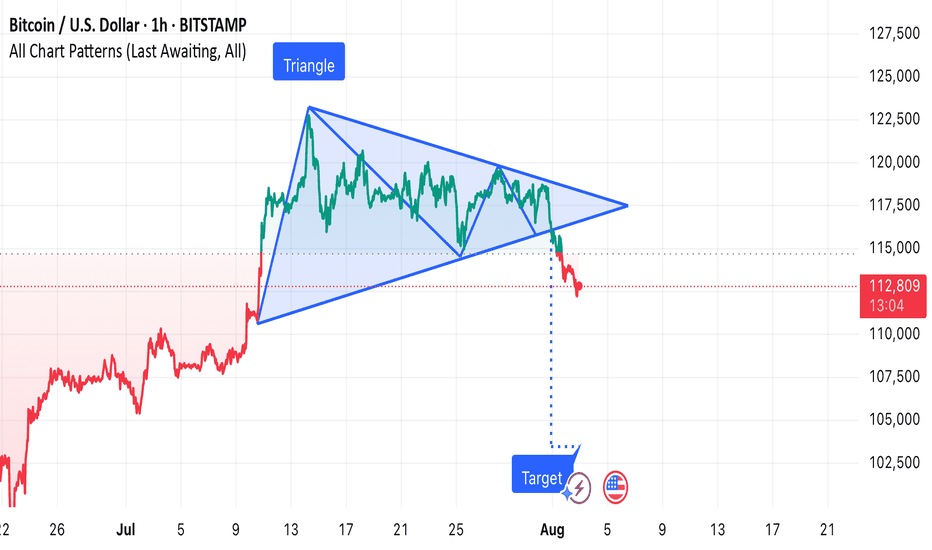

BTC/USD has formed a symmetrical triangle pattern on the 1-hour Price has broken downwards from the consolidation zone, signaling potential bearish momentum. If selling pressure continues, the projected target aligns with the measured move from the pattern’s height, indicating a possible decline toward the next major support zone. Traders should monitor volume for confirmation and manage risk accordingly.

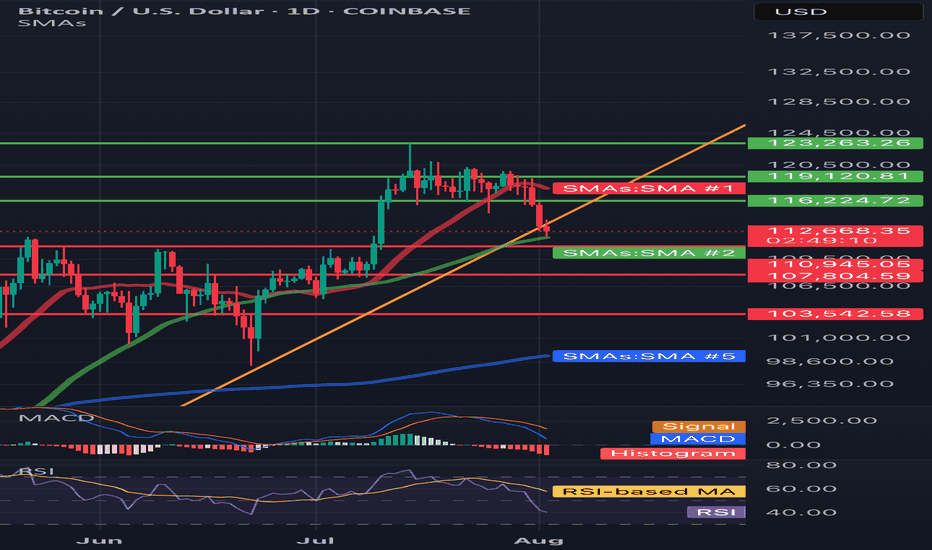

BTC/USD 1D Chart 🔼 Resistance:

• USD 123,263 - local peak, strong resistance (green line)

• USD 119,120 - level tested several times, recent reflection

• 116,224 USD - zone of previous consolidations

🔽 support:

• 110,945 USD - SMA #2 (movable average), tested in the past

• 107,804 USD - local hole

• USD 103,542 - strong support from the past (historical retention of declines)

⸻

📊 Technical indicators

📉 Trend:

• The yellow upward trend line has been broken - a potential bull weakness signal.

• The candle pierces the trend line from the bottom - it is possible to change the direction to a side or downward trend.

📈 Medium walking (SMA):

• The red SMA #1 line acted as dynamic resistance.

• The price is currently testing SMA #2 as support.

• SMA #5 (blue, approx. 98,600 USD) is very strong long -term support.

📉 Macd:

• The MacD line is below the signal line → Bear signal (Bearish).

• Red histogram - inheritance impetus is growing.

📉 RSI:

• RSI has fallen below the level of 50 → the advantage of supply.

• Currently, it is approaching the supply of supply overload (<30), which can herald the technical reflection.

⸻

🔮 Scenarios

✅ Scenario Bycza (Bullish):

• Maintenance of a price above 110.945 USD (SMA #2).

• Return above the trend line or testing USD 116,224 and piercing up.

❌ Bear scenario (Bearish):

• Loss of support to 110.945 USD → decrease to USD 107,800.

• If this does not keep the course, the next strong level is USD 103,500.

⸻

🧠 Applications:

• Short -term: the market looks weak, the candle breaks the upward trend.

• Medium -term: still in the game, but if it does not reflect from the current levels, a greater correction is possible.

• Commercial decisions: It is worth waiting for confirmation of the direction (reflection from support or continuation of declines).

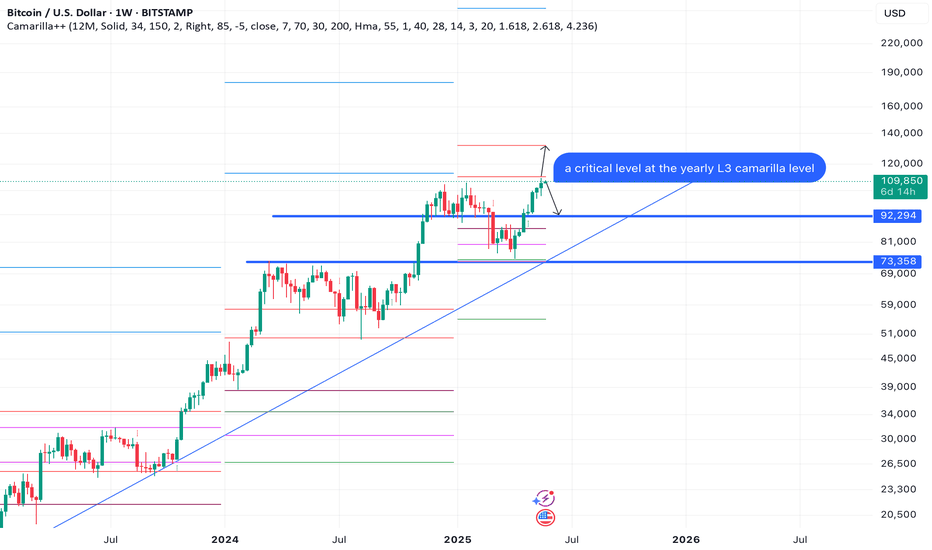

BTC at Make-or-Break: Rejection or Liftoff to $130K?

Bias/Summary

BTC is at a critical zone between 109K–112K. Price is currently showing hesitation after initial rejection at the Yearly L3 (112K), and I’m leaning short unless we see a strong breakout and hold above that level. However, if bulls reclaim it, we could see a fast move to 130K before many can react.

Technical Context:

Yearly L3 sits around the $112K zone – a historically significant level.

Price faced rejection at $112K and is now hovering near $109K.

Lower timeframe showing indecision, possible bearish bias.

Watching for:

Rejection + lower high below $112K = short setup.

Clean breakout + retest of $112K = shift to long bias.

Trade Idea / Setup:

🟥 Scenario A – Short Bias (Current Leaning):

Entry: 110K–111.5K (if rejection confirms)

Stop Loss: Above 112.5K

Targets:

TP1: 104K

TP2: 99K

TP3: 94K

R:R: Up to 3.5:1 depending on entry and target

🟩 Scenario B – Breakout Long (Contingent Setup):

Entry: 113K+ (after breakout and solid retest)

Stop Loss: Below 111K

Targets:

TP1: 120K

TP2: 130K

R:R: ~3:1 or more if momentum confirms

Risk & Patience Reminder:

⚠️Let price lead. No breakout = no long. No clear rejection = no short. Wait for confirmation, and don’t force entries in the chop.

Patience > Prediction.

NFA. DYOR. Manage your risk.

Bitcoin Are We Heading to 140K or 80K ??? Here is the Analysis Based on what is happening here is what we currently see with Bitcoin

Idea 1: If we can break 119K then here are the following levels Bitcoin can go to :

122K

126K

135K

140K

Idea 2: If we continue and break further bearish here are the levels BTC can go to

115,600

114,500

112,800

If we go below this level then a larger correction thesis would point us with a deeper bearish level

Happy Trading

Trade Smarter Live Better

Mindbloome Exchange

Kris

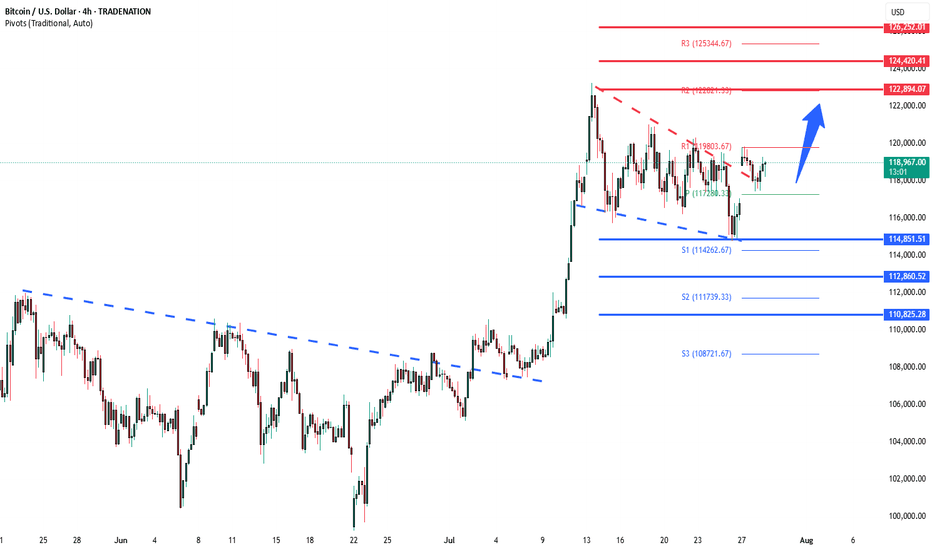

BTCUSD Bullish continuation breakoutThe BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at:

122,900 – initial resistance

124,420 – psychological and structural level

126,250 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 114,850 would weaken the bullish outlook and suggest deeper downside risk toward:

112,860 – minor support

110,825 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the BTCUSD holds above 114,850. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

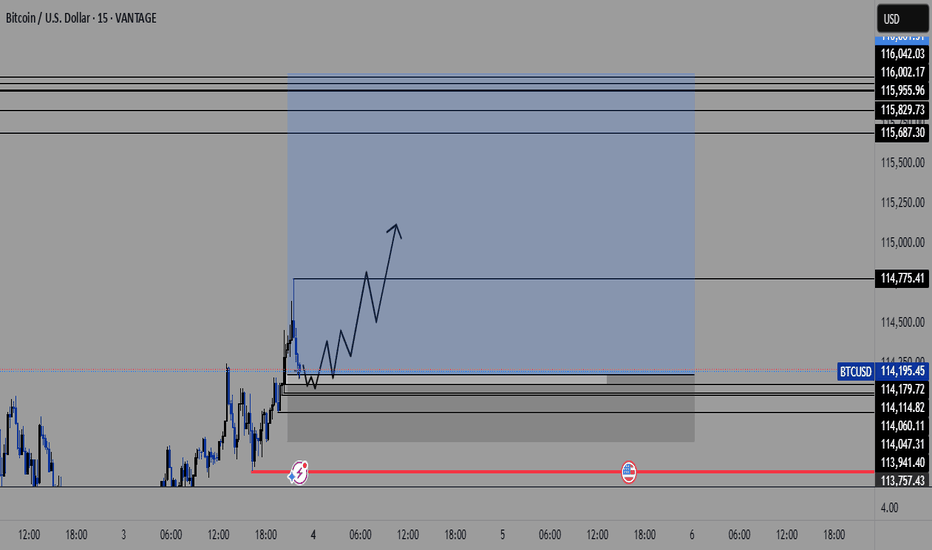

BTC Short Term - BULL FLAG - Aug 1st $121,300 Regarding the daily price forecast from July 28, 2025 (Monday), through August 1, 2025 (Friday), the projections are derived from the bull flag continuation pattern, cross-referenced with aggregated analyses from recent market data, technical indicators (such as RSI and MACD showing neutral-to-bullish momentum), on-chain metrics (indicating accumulation at $115,000–$117,000), and a distribution of expert predictions. These include short-term consolidation with a potential dip for liquidity clearance, followed by a breakout, aligning with historical post-halving cycles and institutional inflows. Note that cryptocurrency prices are inherently volatile and influenced by factors such as Federal Open Market Committee outcomes, ETF flows, and macroeconomic events; these forecasts are speculative and not financial advice.

• July 28, 2025 (Monday): Anticipated consolidation within the flag channel amid low weekend volume. Expected range: $116,800–$118,500. Key targets: Support at $116,700 (lower flag boundary, potential entry for accumulation); resistance at $118,500 (upper flag line, breakout watch level). Average closing prediction: $117,800, reflecting neutral sentiment with minor downside risk if global markets weaken.

• July 29, 2025 (Tuesday): Possible test of lower support amid early-week volatility, potentially sweeping liquidity before rebounding. Expected range: $116,000–$119,000. Key targets: Downside at $116,000 (critical on-chain accumulation zone); upside at $119,000 (initial breakout threshold). Average closing prediction: $117,500, with a 40% probability of a brief dip followed by stabilization.

• July 30, 2025 (Wednesday): Breakout attempt likely if support holds, driven by mid-week momentum and potential dovish policy signals. Expected range: $117,500–$120,500. Key targets: Support at $117,000 (mid-channel level); resistance at $120,000 (psychological barrier and prior high). Average closing prediction: $118,900, assuming bullish confirmation above $118,500.

• July 31, 2025 (Thursday): Extension of upward movement post-breakout, with volume potentially increasing. Expected range: $118,500–$122,000. Key targets: Support at $118,000 (retest of breakout level); resistance at $121,000 (flagpole projection start). Average closing prediction: $120,200, supported by technical alignment and ETF inflow trends.

• August 1, 2025 (Friday): Momentum continuation toward weekly close, with risk of profit-taking. Expected range: $119,500–$123,500. Key targets: Support at $119,000 (new floor post-breakout); resistance at $123,000 (extended target based on pattern measurement). Average closing prediction: $121,800, aligning with broader bullish forecasts for early August.