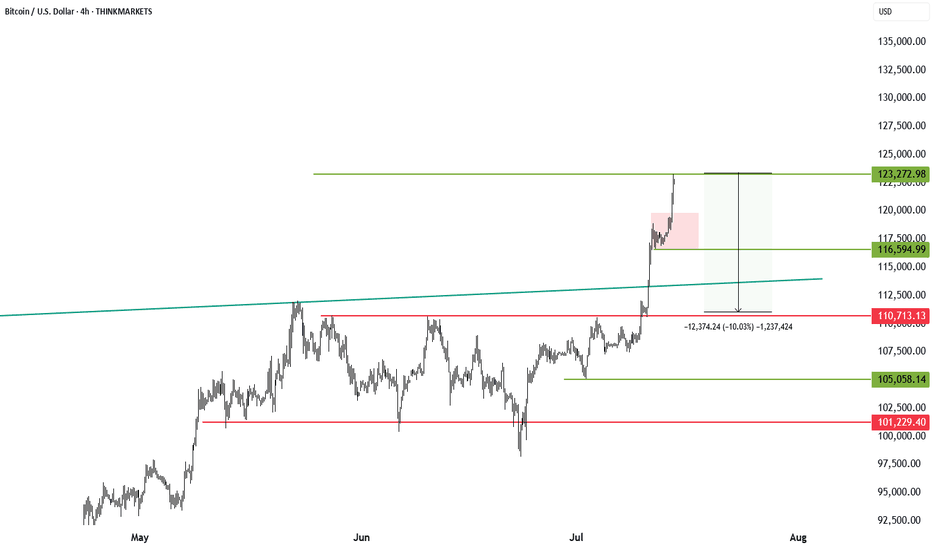

Bitcoin Hits First Target: What I Traded and What Comes NextBitcoin just hit my first target. I went long on BTC, XRP, Chainlink, and more. Booked profits and jumped into two new breakouts with better risk-reward. In this video, I break down my trades, the setup, and why I’m still bullish between 116K and 120K. I also explain how crypto deregulation and the Genius Act could fuel the next move.

Let me know in the comments how you traded this breakout.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

BTCUSD.P trade ideas

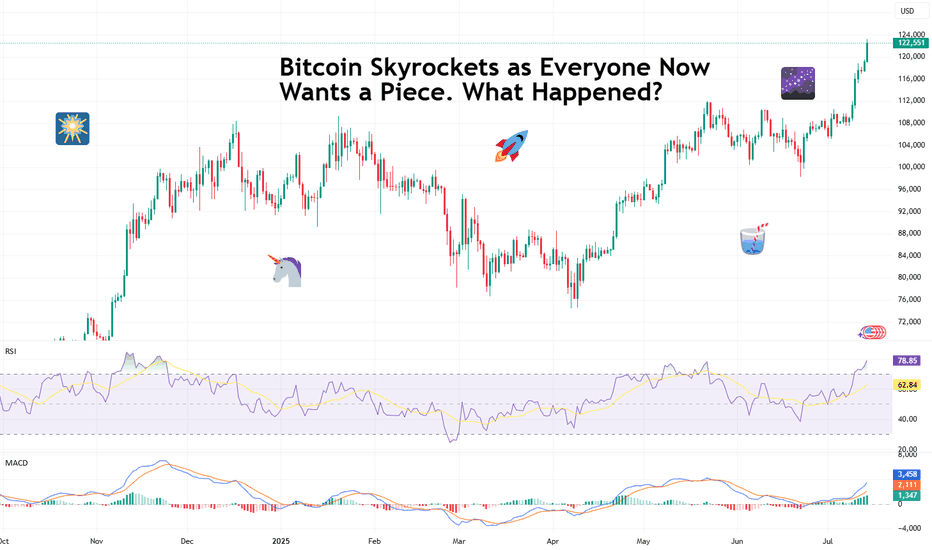

Bitcoin Skyrockets as Everyone Now Wants a Piece. What Happened?If you took a few days off last week and went to get coffee this morning, you likely missed Bitcoin torching its all-time high and soaring into the uncharted.

The world’s most popular digital asset took off in an unstoppable rocket ride, smashing records so fast that even the always-wired-in day traders couldn’t keep up.

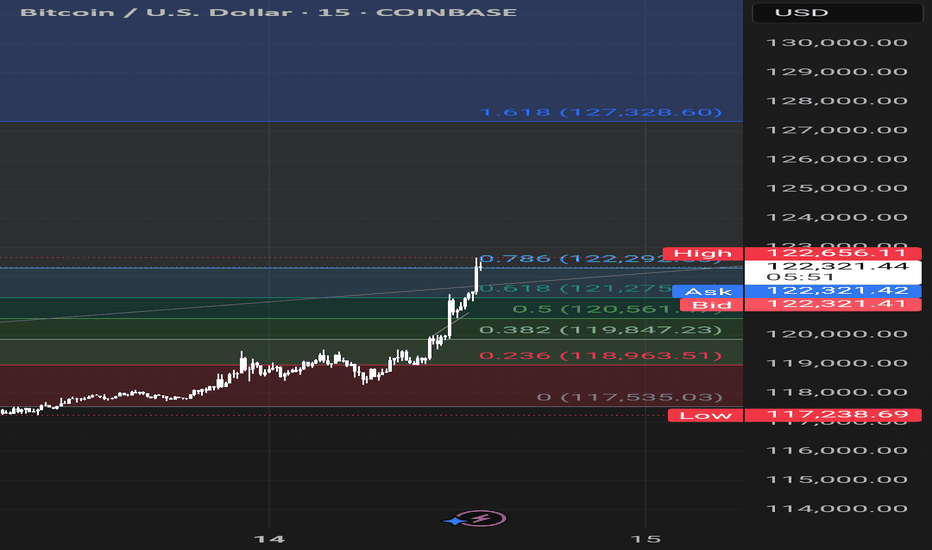

Bitcoin BITSTAMP:BTCUSD blasted through $122,000 Monday morning after gobbling up sell walls at $120,000 and $121,000 in less than one hour. That’s not a typo.

That’s an actual snapshot of what happens when you mix onchain whale movements, fresh institutional FOMO, and traders rediscovering their appetite for risk. Billions upon billions swirled up and Bitcoin passed $2.3 trillion in market cap (ref: our Crypto Heatmap ).

🙌 Bow Down Before the King

Bitcoin has officially reminded every altcoin who wears the crown when markets go haywire. While some tiny tokens get to pump 100% on hype alone, Bitcoin does it with the weight of its market cap behind it — which now surpasses the GDP of entire countries.

Its dominance share has climbed back above 64%, a level we haven’t seen since the last time crypto Twitter argued whether “flippening” would happen by next Thursday (spoiler: it didn’t, and we mean 2021). And right now, all eyes are pinned on that round, meme-ready milestone: $125,000 or even $150,000.

Why these levels? Because traders love round numbers. They’re clean, symbolic, and if that next ceiling shatters, the chain reaction of liquidated shorts and new leveraged longs can turn an orderly bull run into pure market mayhem.

📈 Institutional Hoarding: The Secret Fuel

If you think this is just retail traders YOLO’ing in from their parents’ basement, think again. Onchain data showed earlier this month that this moon mission was being quietly underwritten by the big boys — institutional funds, overflowing Bitcoin ETFs , and corporate treasuries that once scoffed at Bitcoin as “magic internet money.”

Does this mean Bitcoin is becoming boring? Not quite. It means the foundation for this rally is sturdier than the TikTok-fueled moonshots of yesteryear. Think steady inflows, regulated vehicles, and balance sheets that no longer flinch when they see “digital assets” on a line item.

👀 So, Why Now?

Bitcoin doesn’t need much of a reason to get volatile — you know that. But a few more stars than usual aligned to give this surge its lift-off moment.

First, the macro backdrop: US inflation is at 2.4% (next ECONOMICS:USCPI report coming Wednesday, pay attention to the Economic Calendar ), which makes a Fed rate cut more likely later this year.

Lower rates mean cheaper dollars, weaker bond yields, and renewed appetite for risk assets. Oh, and don’t forget about gold OANDA:XAUUSD — the OG “no yield, no problem” hedge.

Second, corporate treasuries are all-in on Bitcoin again. If Michael Saylor’s Strategy NASDAQ:MSTR (formerly MicroStrategy — we all know what business they’re really in) keeps adding coins and onboarding new public companies like GameStop NYSE:GME , you know the institutions smell long-term value. Add Trump’s full-throated crypto endorsement and you’ve got a narrative tailwind no trader wants to miss.

🥂 Record Highs Everywhere — COINcidence?

Now let’s go back to those aligning stars. Bitcoin’s fresh all-time high didn’t happen in a vacuum. The S&P 500 SP:SPX , the Nasdaq Composite NASDAQ:IXIC , and Nvidia NASDAQ:NVDA — the world’s most expensive company — all clocked record closing highs last week.

So, is this a “rising tide lifts all boats” moment? Or are we partying on borrowed time? Equities are riding a wave of hope that the Fed will start easing soon, and any whiff of a rate cut is pure oxygen for risk assets.

But seasoned traders know that record highs can sometimes be the most dangerous places to FOMO in. Ask anyone who went all-in on dot-com stocks in 1999.

🏹 Eyes on the Big 120K — Will It Hold the Line?

Short-term, the $120,000 milestone is the line in the sand everyone’s watching. Break it decisively, see if it holds above it for a week or so, and the floodgates of speculative capital might open for another leg higher. Stall out below it? You could see a healthy round of profit-taking and some bruised egos during quiet dinners.

Macro factors will loom large: the Fed’s policy meeting, surprise tariff talks from the White House, or an unexpected bout of inflation could swing sentiment overnight. But for now, the mood is simple: bullish, frothy, and more than a little bit greedy.

💭 Final Take: From Moonshots to Maturity?

The shift from whales to suits means fewer wild swings but steadier institutional demand. The days of “Lambo tomorrow” might be giving way to “slow grind higher for the next 5 years.” For the retirement portfolio, that’s not the worst outcome.

For the traders who crave the adrenaline, there’s still plenty of room to catch the waves — just don’t expect them to come as easily or as frequently as they did in the wild west days.

📢 Your Turn: Moon or Swoon?

Over to you: is Bitcoin ready to break out above $125,000 and send shorts scrambling for cover? Or is this just another overbought stall before a healthy pullback?

Either way, grab your popcorn — and your stop-loss — because if there’s one thing crypto never does, it’s sit still for long. Drop your hot take below — and may your diamond hands be stronger than your coffee.

Key Insights: Financial Markets Transformation by 2030For years, this page has been my space to share in-depth market research and personal insights into key financial trends. This post reflects my perspective — a strategic outlook on where I believe the digital finance industry is heading.

The financial world is evolving at an unprecedented pace, and it's easy to overlook subtle shifts. But the undeniable fact is that we are now standing at the intersection of three powerful industries — financial markets, blockchain, and artificial intelligence. We are positioned at the cutting edge of technology, where innovation is not a future concept but a present reality.

This post serves as a reference point for future trends and a guide to understanding the transformative forces shaping financial markets by 2030. These are not just facts, but my vision of the opportunities and challenges ahead in this rapidly converging digital ecosystem. Staying ahead today means more than following the market — it means recognizing that we are part of a technological shift redefining the core of global finance.

📈 1. Electronic Trading Evolution

Full transition from traditional trading floors to AI-driven digital platforms.

Integration of blockchain and smart contracts ensures transparency, automation, and risk reduction.

Real-time data analytics democratizes market access and enhances strategic decision-making.

🤖 2. Algorithmic Trading Growth

Accelerated by AI, machine learning, and big data analytics.

High-frequency trading (HFT) boosts efficiency but introduces new volatility factors.

Adaptive algorithms dynamically adjust strategies in real time.

Strong focus on regulatory compliance and ethical standards.

🔗 3. Tokenization of Real World Assets (RWA)

Transforming asset management with projected growth to $18.9 trillion by 2033. (now 18.85B)

Enhances liquidity, accessibility, and transparency via blockchain.

Institutional adoption is driving mainstream acceptance.

Evolving regulations (DLT Act, MiCA) support secure tokenized ecosystems.

🏦 4. Institutional Adoption & Regulatory Frameworks

Digitalization of fixed income markets and exponential growth in institutional DeFi participation.

Key drivers: compliance, custody solutions, and advanced infrastructure.

Global regulatory harmonization and smart contract-based compliance automation are reshaping governance.

💳 5. Embedded Finance & Smart Connectivity

Embedded finance market to hit $7.2 trillion by 2030.

Seamless integration of financial services into everyday platforms (e-commerce, mobility, etc.).

AI, blockchain, and IoT power real-time, personalized financial ecosystems.

Smart contracts reduce operational friction and enhance user experience.

🛡 6. Financial Crime Risk Management

Market expected to reach $30.28 billion by 2030.

AI-driven threat detection and anomaly monitoring strengthen AML compliance.

Blockchain ensures data integrity and automates cross-border regulatory adherence.

Global collaboration (FATF, EU AML) fortifies defenses against evolving financial crimes.

🌍 7. Consumer Behavior & Financial Inclusion

Digital banking bridges the gap for underbanked populations, especially in emerging markets.

Mobile solutions like M-Pesa revolutionize access to financial services.

Biometrics, microfinance, and AI-powered engagement tools foster inclusive economic participation.

🚀 Conclusion

By 2030, financial markets will be defined by technology-driven efficiency, regulatory adaptability, and inclusive growth.

Success will favor those who embrace innovation, leverage automation, and engage in cross-sector collaboration.

The future belongs to agile stakeholders navigating a landscape shaped by AI, blockchain, tokenization, and smart finance connectivity.

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

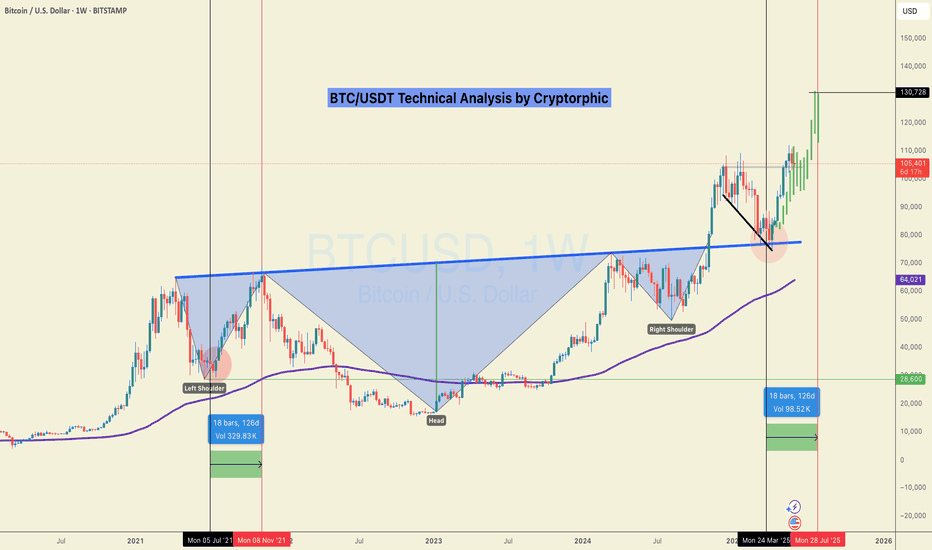

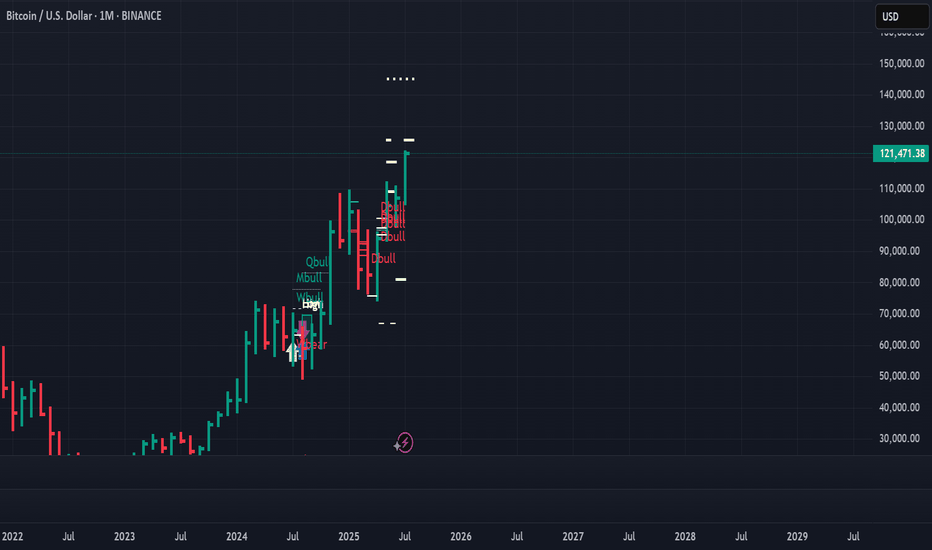

#BTC/USDT It's not over yet! Eying at 130K +ALTCOIN CHEAT SHEET!The last time I shared this chart was on April 14th, when Bitcoin was trading around $84,000 — right when panic was setting in across the market.

The message back then was simple: don’t panic, it’s just a retest.

And here we are again, revisiting the same sentiment with a new chart!

There are a lot of “double top” charts circulating in the space right now, but let me be clear: it’s not over yet.

Before jumping to conclusions, go through this chart and analysis to understand the full picture.

Bitcoin closed the week at $105,705 — certainly higher than most expected just a few days ago.

This marks the first red weekly candle after seven consecutive green closes, which is normal in the context of a healthy uptrend. We're still midway toward the broader target, so there’s no reason to panic or shift into disbelief.

Yes, we may see further corrections in BTC over the coming days or week, potentially down to $98K, and in a less likely scenario, even $ 92K. But this time, Ethereum is showing signs of strength and is likely to outperform Bitcoin, creating high-quality entry opportunities across the altcoin market. In other words, this phase is not a threat, it's an opportunity. BTC is still destined to hit $130k+ as per charts and other important metrics.

Here’s a typical market structure and reaction flow to help put things in perspective:

1. Bitcoin rallies — Altcoins underperform or get suppressed due to capital rotation into BTC.

2. Bitcoin corrects — Altcoins correct further as fear increases and dominance rises.

3. Bitcoin stabilises — Ethereum begins to gain strength, often leading the altcoin recovery.

4. ETH/BTC ratio increases — Ethereum holds up better while many altcoins continue to lag.

5. Bitcoin breaks ATH — This triggers a gradual recovery in altcoins.

6. BTC dominance peaks — Altcoins start gaining serious momentum.

7. Capital rotates from BTC and ETH into altcoins — Sectors tied to the current narrative (like meme coins this cycle, and Metaverse/NFTs in the last one) begin to lead.

8. Altcoin season begins — Utility and mid-cap tokens follow, often delivering strong returns in the final phase.

This pattern has repeated across cycles. Currently, we appear to be in the transition between Bitcoin stabilising and Ethereum gaining dominance — typically the stage that precedes a strong altcoin rally.

Now is not the time to assume the move is over. Stay objective, monitor capital rotation closely, and prepare for what comes next.

If your views resonate with mine, or if this post adds any value to you, please boost with a like and share your views in the comments.

Thank you

#PEACE

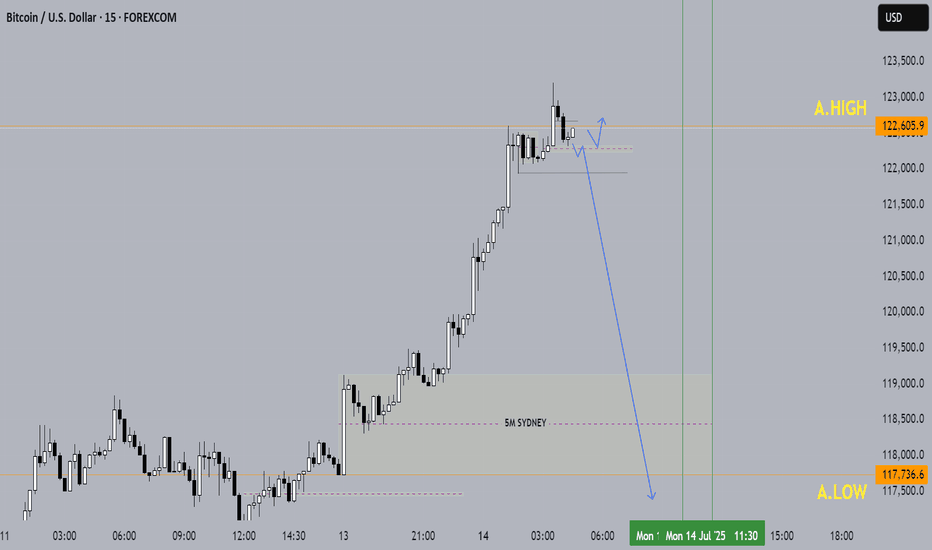

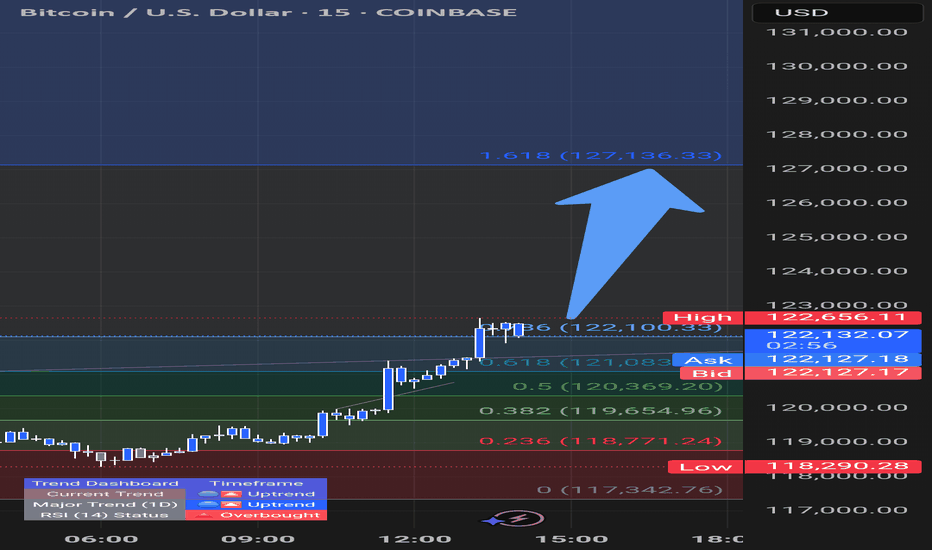

127KMorning folks,

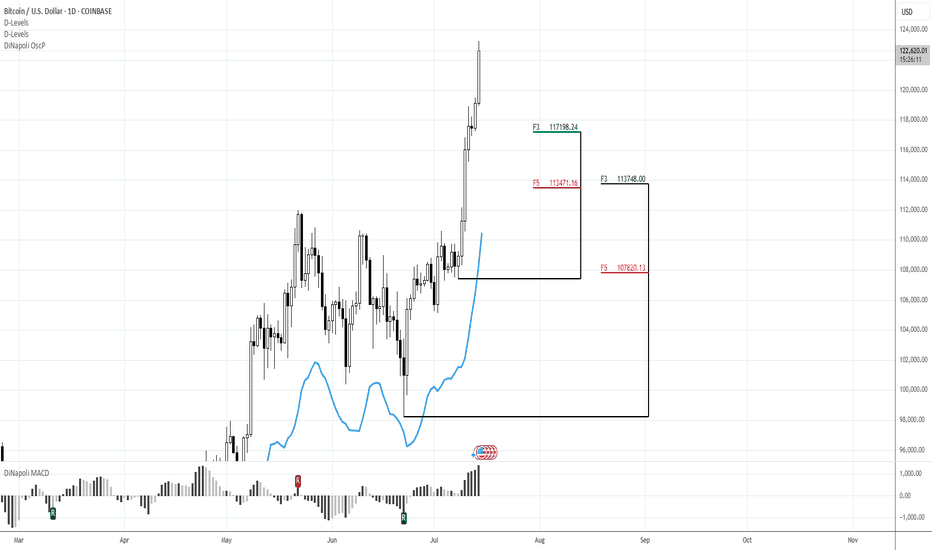

So, BTC shows even better performance that we thought, although it obviously something stands behind, this is not market-natural motion. Anyway, we consider 127K level as all-time nearest target that stands on monthly chart.

If any pullback starts (BTC now is at daily overbought and near Yearly Resistance Pivot), we keep an eye on 117.2K and 113.5K levels to decide on long entry

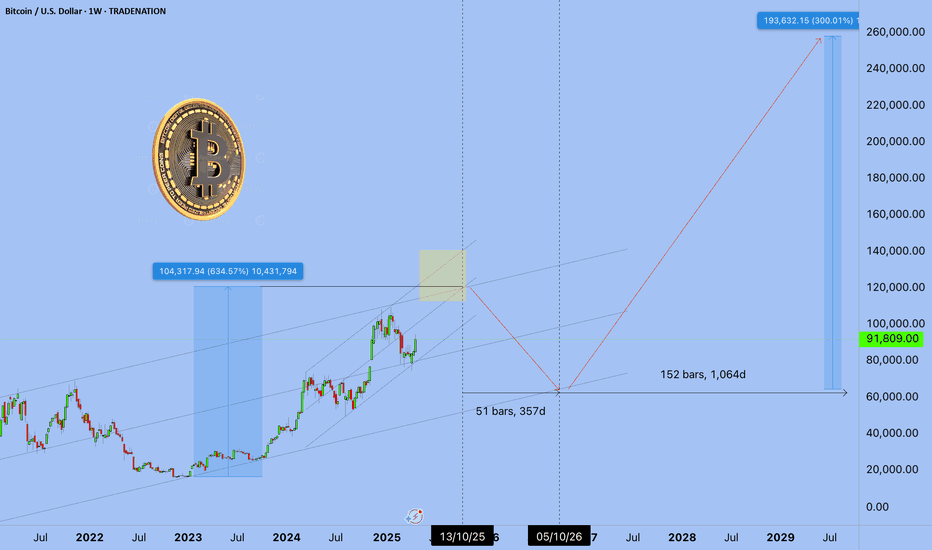

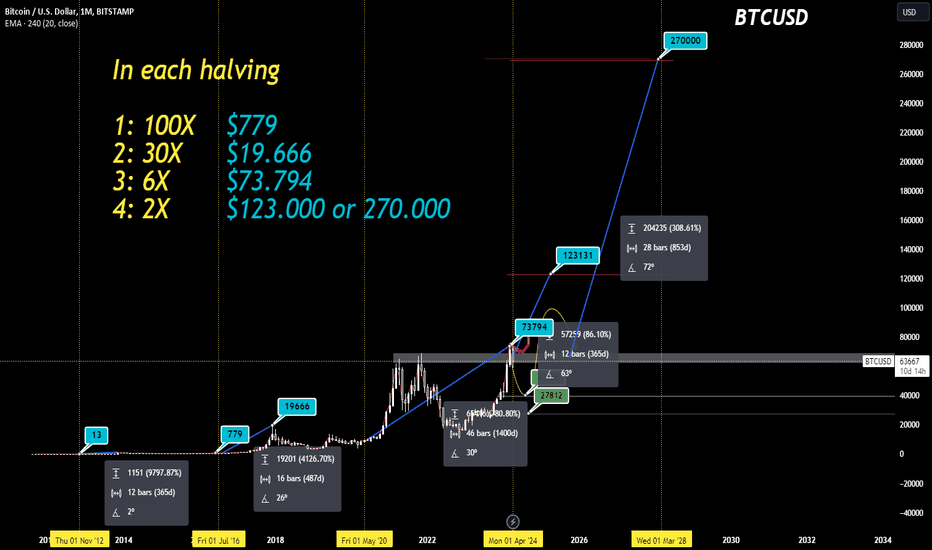

BTC: Next price Halving 📊Analysis by AhmadArz: #BTCUSD

By calculating the price growth in the 4-year halving time frame, we came to the conclusion that with the growth of the Bitcoin market cap, its growth will be halved and we can expect $120,000 from Bitcoin, and it is expected to grow up to 270,000 dollars in halvings.

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!

watch the laws, not just the charts.stablecoins were once the rebels of finance—anchored to fiat yet untethered from traditional banking laws, but the tides are turning. Across major economies, lawmakers are drawing up legal frameworks that place stablecoins inside the banking sector rather than outside of it. This shift could be the most pivotal regulatory development since Bitcoin was born.

But what does this really mean for traders, investors, and markets?

In this @TradingView blog we’ll unpack the new laws on stablecoins entering the banking realm, and what their ripple effect might look like, using past regulatory shifts as a lens to foresee market behavior.

🧾 Section 1: What the New Stablecoin Laws Say

Many regions—especially the EU, UK, Japan, and the US—are moving toward a model where stablecoin issuers must register as banks or hold full banking licenses, or at minimum, comply with banking-like oversight.

Key pillars of these laws include:

Full reserve requirements (1:1 backing in liquid assets)

Audited transparency on reserves and redemptions

KYC/AML compliance for users and issuers

Supervision by central banks or financial regulators

In the US, the House Financial Services Committee recently advanced a bill that would make the Fed the ultimate overseer of dollar-backed stablecoins.

In the EU, MiCA (Markets in Crypto-Assets) requires issuers of e-money tokens to be regulated financial institutions.

Japan now allows banks and trust companies to issue stablecoins under strict regulations.

💥 Section 2: Why This Is a Big Deal

Bringing stablecoins into the banking system could change how liquidity flows, how DeFi operates, and how capital moves across borders.

Potential market impacts:

Increased trust = more institutional money entering stablecoins and crypto markets.

DeFi restrictions = protocols may face scrutiny if they allow unverified stablecoin usage.

Flight from algorithmic or offshore stables to regulated, bank-issued stablecoins (e.g., USDC, PYUSD).

On-chain surveillance increases, potentially limiting pseudonymous finance.

Think of it as crypto’s "Too Big To Ignore" moment—where stablecoins become infrastructure, not outlaws.

📉 Section 3: Past Laws That Shaped Crypto Markets

Let’s examine how previous regulations have affected crypto markets—offering clues about what to expect.

🧱 1. China’s Crypto Ban (2017–2021)

Kicked off a massive market crash in 2018.

Pushed mining and trading activity overseas, especially to the US and Southeast Asia.

Resulted in more global decentralization, ironically strengthening Bitcoin’s resilience.

🪙 2. SEC Lawsuits Against XRP & ICO Projects

Ripple’s XRP lawsuit caused delistings and volatility.

Set a precedent for how tokens are treated under securities law.

Resulted in more structured token launches (via SAFEs, Reg D, etc.).

🧮 3. MiCA Regulation in Europe (2023 Onward)

Provided regulatory clarity, prompting institutions to engage more with regulated entities.

Boosted legitimacy of Euro-backed stablecoins like EURS and Circle’s Euro Coin.

Sparked a race among exchanges to gain EU registration (e.g., Binance France, Coinbase Ireland).

Each of these regulatory waves caused temporary volatility, followed by long-term growth—as clarity invited capital.

📊 Section 4: The Possible Scenarios for the Market

Here’s how things might play out as stablecoin laws become mainstream:

Golden Path-Regulated stablecoins coexist with DeFi; innovation meets compliance - Bullish for crypto adoption and capital inflows.

Walled Garden-Only bank-issued stablecoins are allowed; DeFi stifled -Neutral or bearish short-term, bullish long-term.

Backlash-Overregulation pushes stables offshore or into non-compliant zones - Bearish, liquidity fragmentation returns.

🔍 Nerdy Conclusion:

Stablecoins are no longer just tools for traders—they’re becoming the backbone of digital finance. Their formal entrance into banking law marks a turning point that traders must understand.

While regulation has historically caused short-term fear, it often leads to long-term maturity in crypto markets. The stablecoin laws now in motion could unlock the next chapter of institutional adoption, cross-border finance, and perhaps, the integration of crypto into the real-world economy at scale.

💡 Nerdy Thought:

When a technology becomes systemically important, it stops being ignored—it gets integrated. Stablecoins have reached that level.

put together by : @currencynerd as Pako Phutietsile

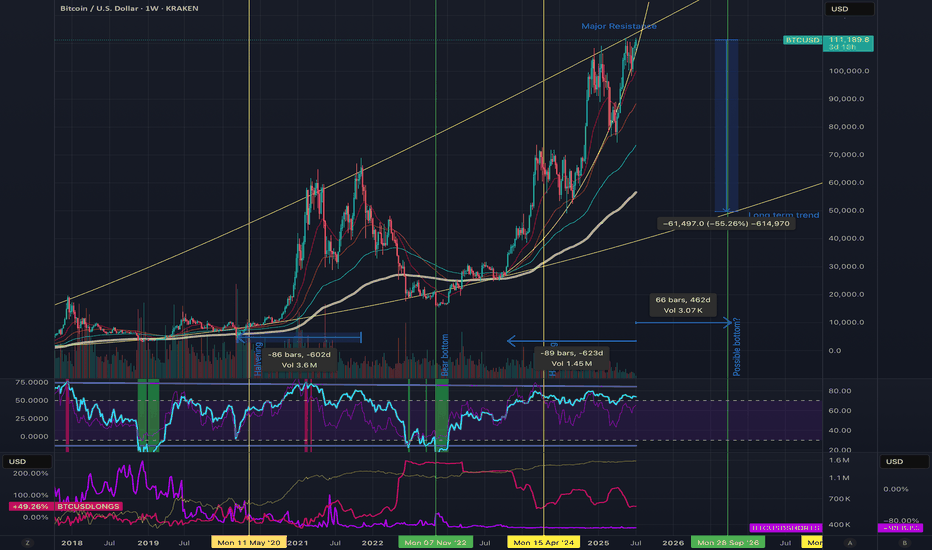

End in sight, Bull run near complete, don't be fooled. Bitcoin has experienced an incredible surge, rising from $15,000 to over $111,000 in this bull cycle so far. I expect the market peak to be around $114,000 to $115,000, with historical trends indicating strong resistance at these levels. As a long-term Bitcoin bull who has navigated through multiple cycles, I see several indicators suggesting we might be nearing a market top.

Firstly, this bull run has lasted 623 days, with only 462 days remaining until the predicted next cycle bottom. This could lead to a significant correction in the short term, potentially dropping prices by at least 50% down to below $40,000. Additionally, trading volume is declining; although exchange volume is decreasing, the number of trades per day is also dwindling. This means there’s less buying and selling pressure in the market. If this trend shifts to more selling pressure amidst such low volume, we could see a rapid decline. This scenario seems to align with what market whales may be anticipating.

MicroStrategy (MSTR) is certainly supporting the market, along with new institutional investors. However, we have yet to fully assess the impact of tariffs and other economic factors, which could result in fewer people willing to invest, especially in high-risk markets.

The Net Unrealized Profit/Loss (NUPL) has been high, remaining above 66 since March 2024, which also suggests that a correction is due, as many holders are currently in profit. Although institutional investment has been steadily increasing, we are now observing a plateau in the Accumulation/Ddistribution chart. The number of BTC long positions is decreasing, while shorts remain very low, indicating a lack of confidence that Bitcoin will rise significantly higher. This low interest in both longs and shorts suggests that market pressure could shift soon.

ETF inflows have remained stable, but profit-taking is likely to occur as investors seek to increase their positions in the bear market. While we all love Bitcoin and want the rally to continue, it's crucial to remember that a bear market will eventually happen, along with the next halving—it's just a matter of timing.

Looking at the charts, if anything signifies a market top more than “Laser Eyes,” it could very well be Trump coin. We might see another upward push, but history has shown that if everyone expects a massive rally in September or the fourth quarter, the opposite usually occurs; we end up buying the rumor and selling the news.

Safe trading, everyone! I remain a staunch Bitcoin bull, but I recognize that all good things must eventually come to an end and the next cycle will be so exciting, so make sure youe have the reserves to invest in the bear!

#Bitcoin - Pivot is $102915 | Target $125385 or $80445 ?Date: 24-06-2025

#Bitcoin

Current Price: 105375

Pivot Point: 102915.00 Support: 99206.48 Resistance: 106655.63

#Bitcoin Upside Targets:

Target 1: 111205.31

Target 2: 115755.00

Target 3: 120570.00

Target 4: 125385.00

#Bitcoin Downside Targets:

Target 1: 94640.74

Target 2: 90075

Target 3: 85260

Target 4: 80445.00

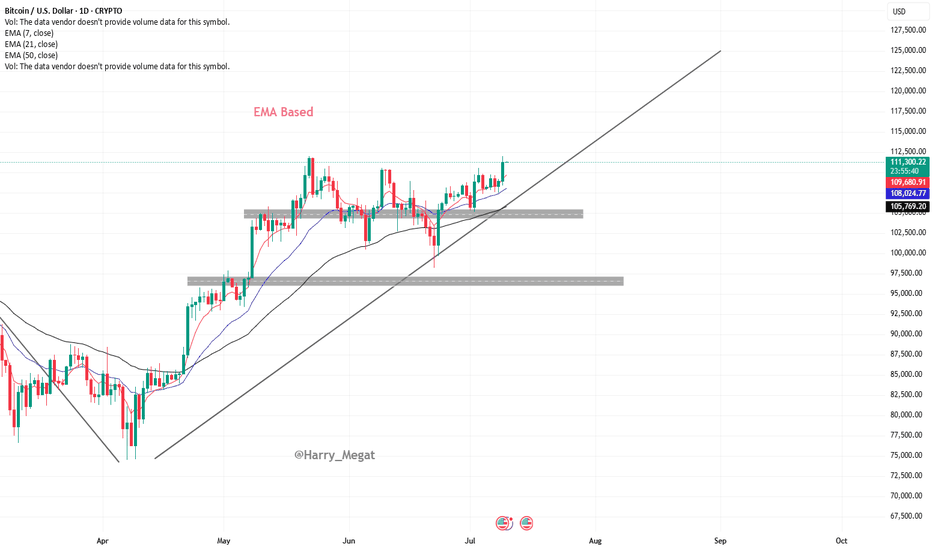

BTCUSD Chart Analysis (Daily Timeframe)Chart Analysis – BTC/USD (Daily Timeframe)

Trend Overview:

* The chart shows **Bitcoin (BTC/USD)** on the **daily timeframe**.

* Price is in a **clear uptrend**, making **higher highs and higher lows**.

* The recent breakout above **\$111,000** suggests a **bullish continuation**.

Moving Average Analysis (EMA 7, 21, 50):

* **EMA 7 > EMA 21 > EMA 50** — this alignment confirms **strong bullish momentum**.

* Price is **well above all EMAs**, especially the 50 EMA (\~\$105,546), showing trend strength and possible institutional support.

* EMAs are **sloping upward**, which further confirms the upward momentum.

Recent Breakout:

* BTC broke out of a **short-term consolidation zone** between \~\$108,000–\$111,000.

* Today’s candle shows a **strong bullish close**, indicating fresh buying interest.

* If this breakout holds, price could extend toward the **next psychological level of \$115,000–\$117,500**.

Support Zones to Watch:

* **Minor support:** \~\$109,000 (EMA 7 + breakout retest area)

* **Stronger support:** \~\$105,500 (EMA 50 and previous swing low)

A break below **\$105,500** could signal a trend shift or deeper pullback.

Summary:

Bitcoin is showing **strong bullish structure** on the daily chart with EMAs aligned upward and a recent breakout above \$111,000. If momentum holds, next upside targets are around **\$115,000–\$117,500**. The bullish trend remains intact unless price breaks and closes below **\$105,500**.

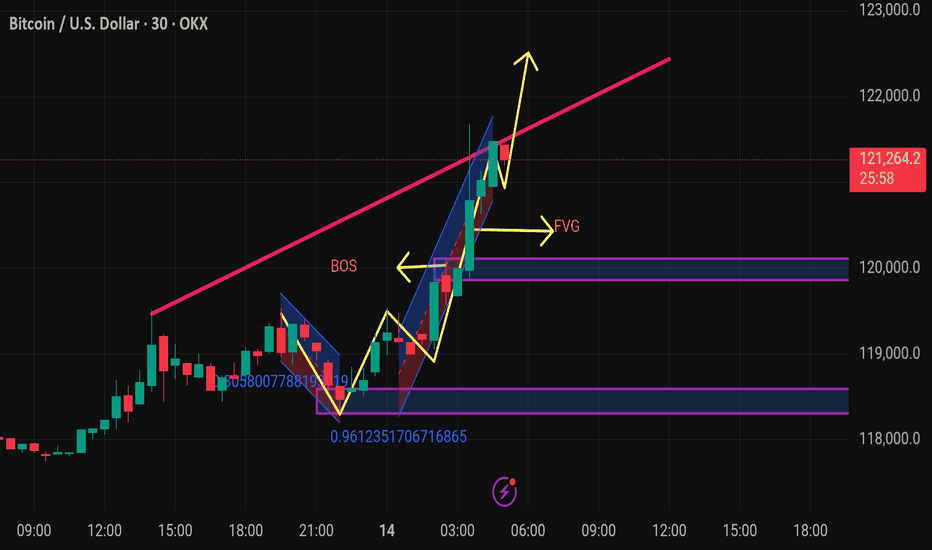

Btcusd techinical analysis.This Bitcoin (BTC/USD) 30-minute chart shows several key technical indicators and annotations, pointing to a bullish outlook. Here's a breakdown of the chart elements:

Key Elements:

1. Price Level:

Current price: $121,315.1

Change: +$2,178.0 (+1.83%)

2. Break of Structure (BOS):

Marked in yellow — indicates a shift in market structure from bearish to bullish.

It suggests a bullish trend continuation after this key resistance was broken.

3. FVG (Fair Value Gap):

The yellow "FVG" arrow points to an imbalance or gap between candle wicks that the market might return to for liquidity.

Often used as a potential entry point or pullback target.

4. Trendline:

The pink upward trendline shows current bullish momentum.

Price is currently testing or has broken above this trendline.

5. Bullish Flag/Channel:

Blue diagonal channel indicates a bullish flag or continuation pattern.

Price broke out upward from this flag — typically a bullish sign.

6. Fibonacci or Ratio Markers:

Numbers like 0.9612351706716865 and 0.305800778819... may

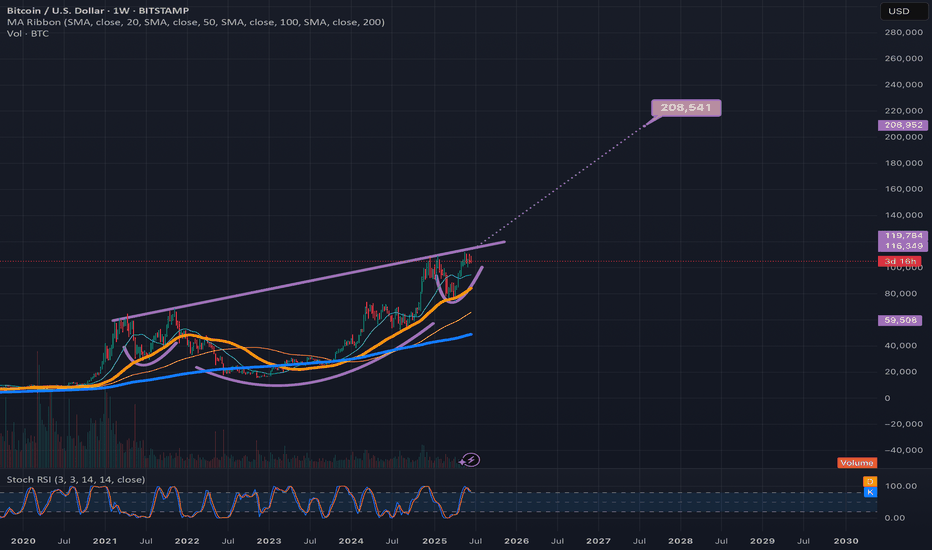

Ascending Inverse H&S on the BTC weekly chartThe longer it takes to break above this neckline the higher the breakout target will be. I have arbitrarily placed the measured move line at July 18th 2025. If the breakout were to happen on that day the measured move target is around 208k, which could take quite awhile to reach or if we entered a truly hyperparabolic blow off top we could reach such a target way quicker than when the dotted measured move line reaches it. *not financial advice*