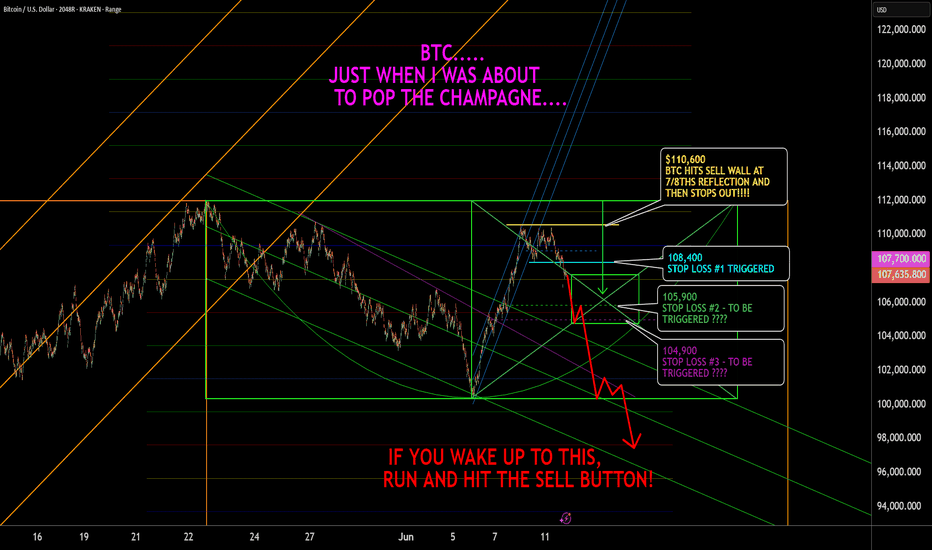

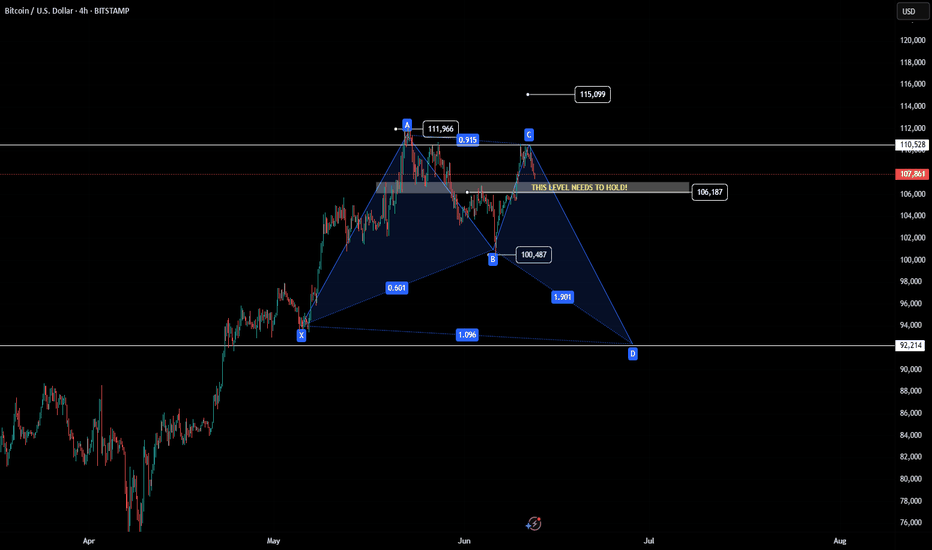

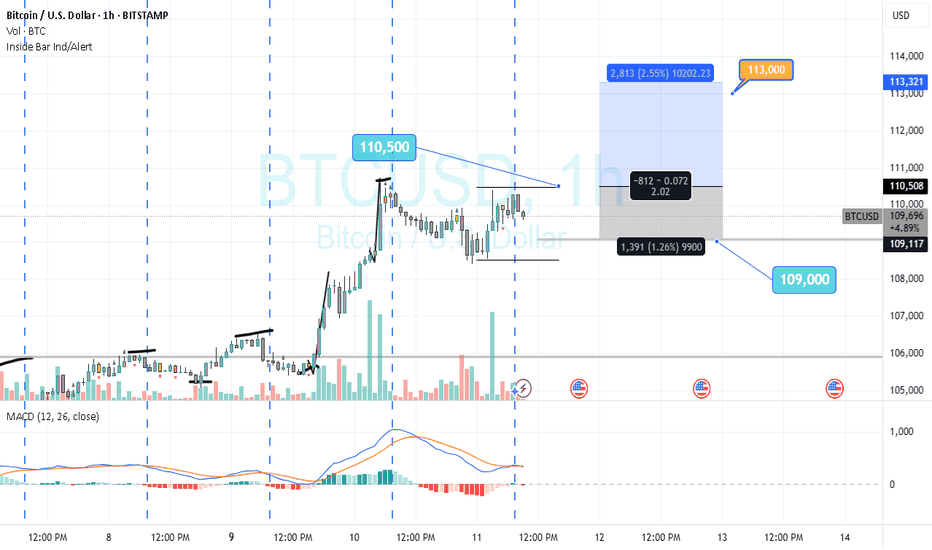

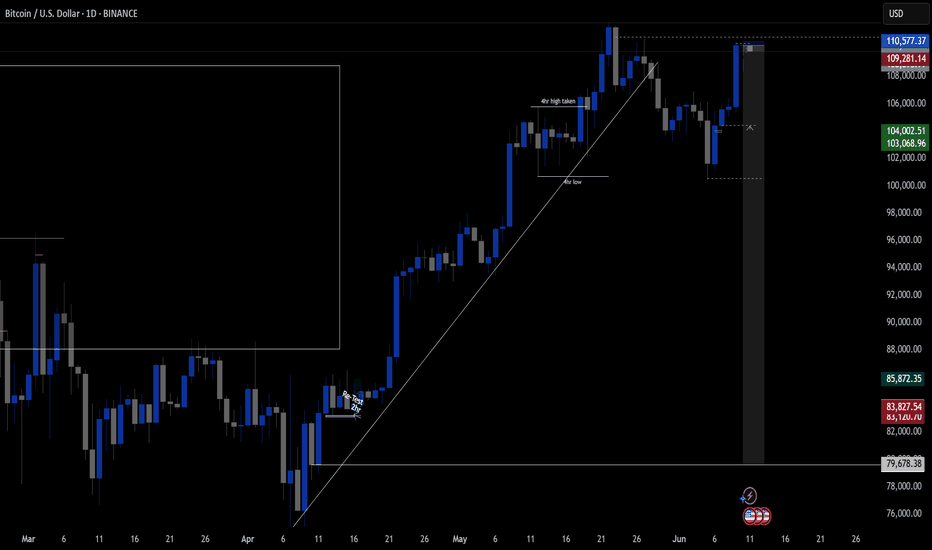

BTC - UH OH ? - RE CORK THE CHAMPAGNE ? Last night the momentum was so strong , and resistance levels where being taken out one after another. Today when we should have been making new highs, instead we hit a wall. Not good. That wall in yellow is the 7/8ths reflection line. The bounce backward from here could pick up massive steam downward. The 1st stop loss has already been hit, #2 and #3 look to be tested today, and from the way things look now, they look to yield. I am stopped out, and will not reenter long until a new high is made. Good Luck!

BTCUSD.PI trade ideas

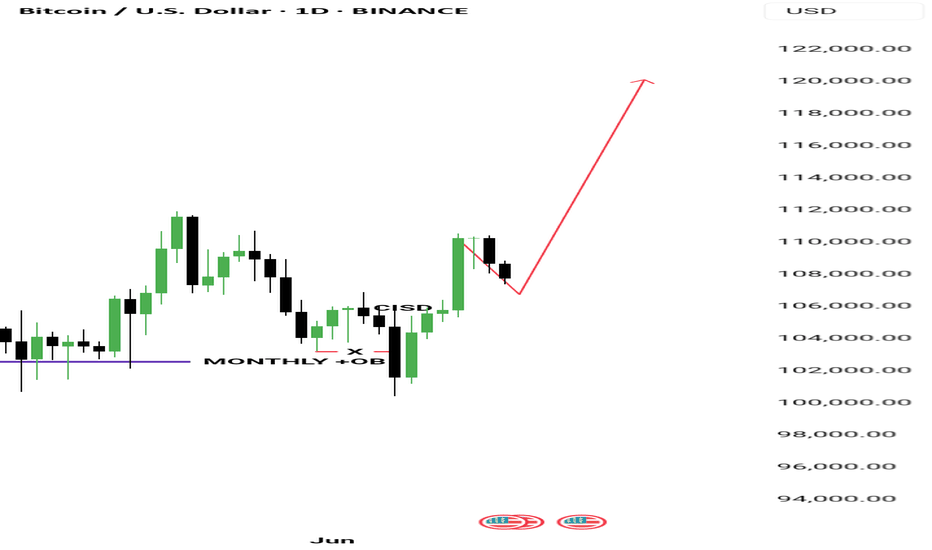

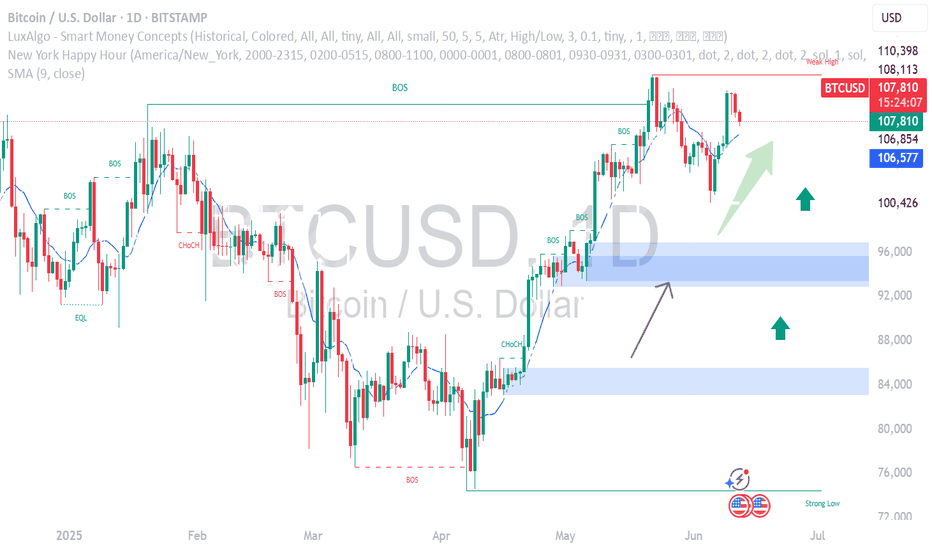

BTC NEXT TARGET BUY 110K MORE Bitcoin Alert! 🚨

BTC is showing strong momentum and the market is heating up! 🔥

Current levels present a strategic buy opportunity before the next big move.

📈 Targeting $110K–$115K in the coming wave — and the breakout could be explosive.

💰 Accumulate now before the FOMO kicks in.

📊 Smart traders are already positioning.

⏳ Time is limited — don’t watch from the sidelines.

This could be the move that defines the next phase of the bull run.

Stay ahead. Stay informed. Stay invested. 🧠🚀

#Bitcoin #BTC #CryptoAlert #BullRun #CryptoNews #BitcoinTarget #BTCNextMove #CryptoTradin

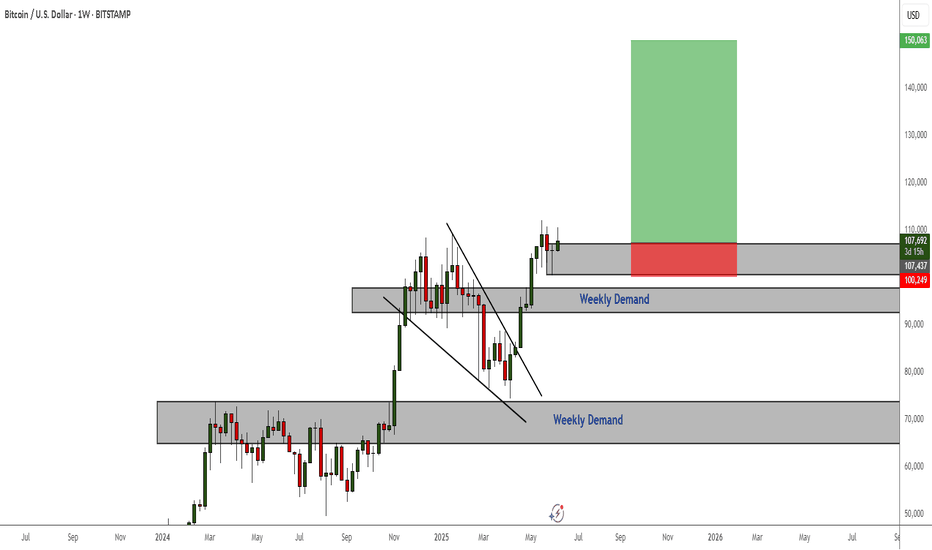

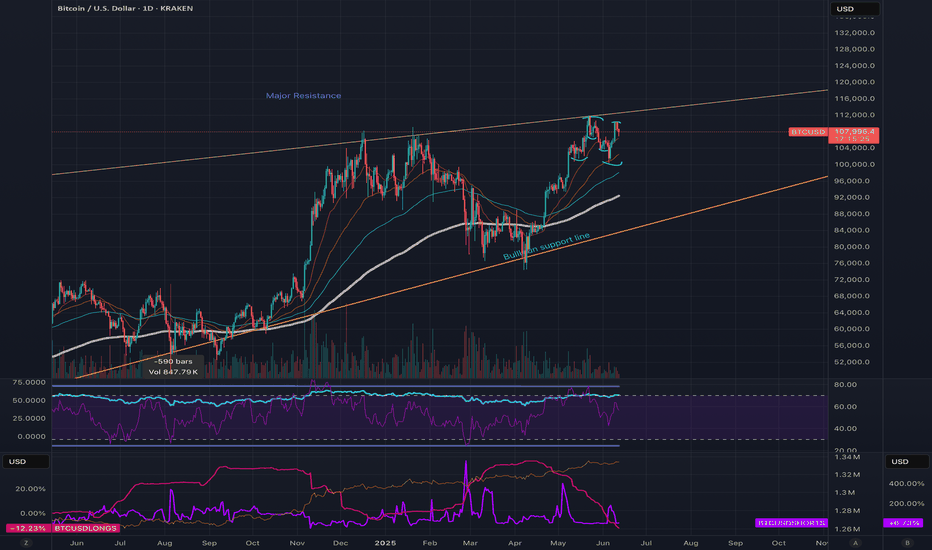

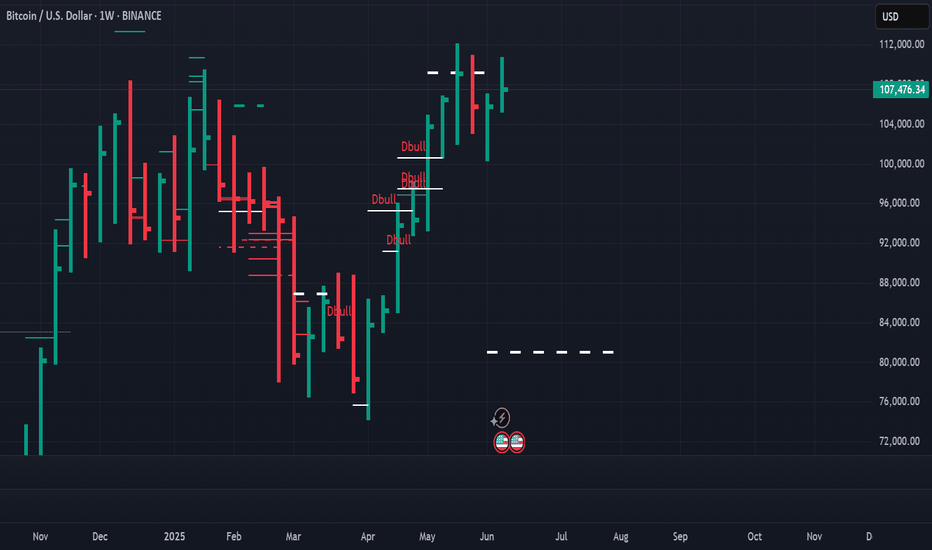

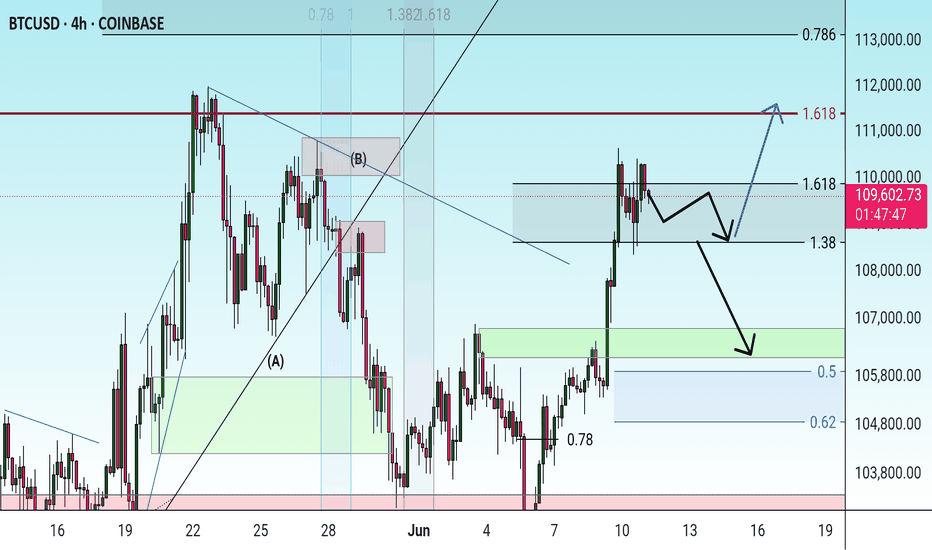

Bitcoin double top?It looks like we might be seeing a double top formation, and with lower lows and reduced trading volumes, the positive momentum is running out. The yellow line at the top represents my sell line and is based on a long-term trend dating back to 2015. This line accurately predicted the recent all-time high (ATH) within $50. Although Bitcoin can break through this line, it often doesn’t hold for long.

If the price does break through, the next ATH could be approximately 113700 USD. However, that could mean only small returns with the risk of a pullback to $40k. I’m a BTC bull, but you need to consider having more liquidity during the correction.

The news surrounding Bitcoin is very positive, yet it isn't reacting with enough momentum to reach the values suggested by bullish analysts. Many retail investors are currently focused on paying for living expenses rather than investing. In my opinion, the bull cycle may be nearing its end. The recent head and shoulders pattern that broke to the downside is concerning, although it was somewhat saved by institutions buying more.

This trend could continue, but it's important to note that miners are selling, which is another indicator of a market top, and the Net Unrealized Profit/Loss (NUPL) is high.

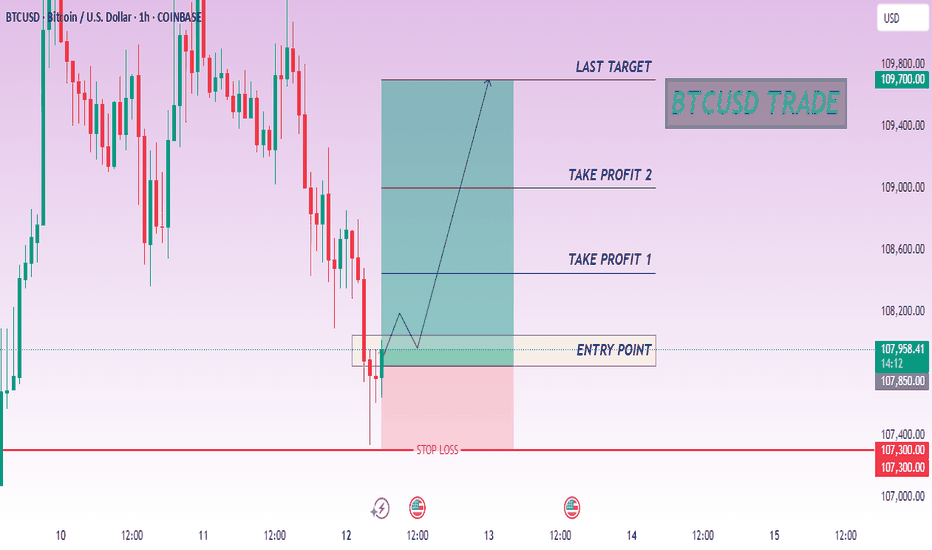

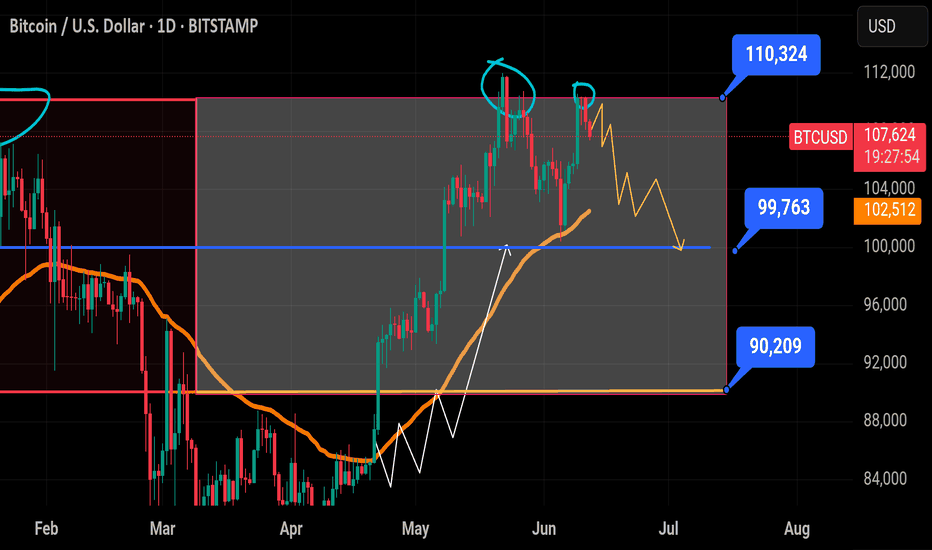

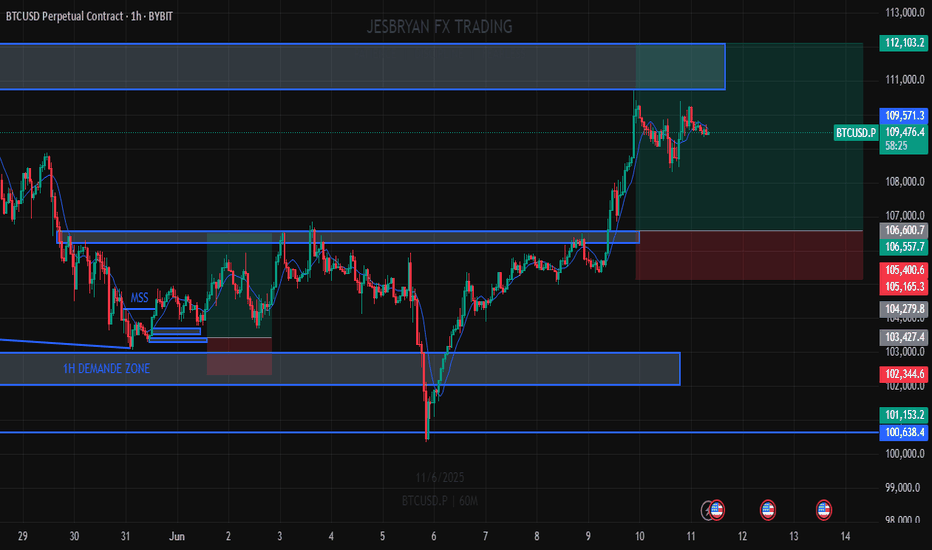

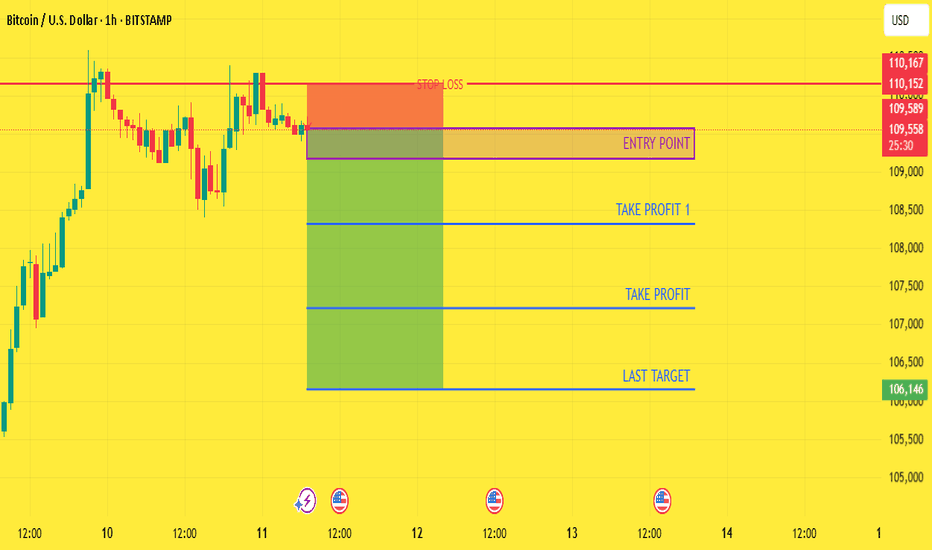

$BTC Rejected at Key Resistance – Global War Concerns Pressure P

Bitcoin failed to break above the $110K resistance, facing sharp rejection for the third time. Rising global war tensions have triggered risk-off sentiment across markets, and Bitcoin is now showing signs of a deeper pullback.

🔸 Key Support Zone at 99K – 100K:

This zone is the last strong support holding the bullish structure. A break below it could trigger a larger correction. Eyes on this zone for possible bounce or breakdown.

🔸 Upside Target: 110k+ (Invalidated)

Unless BTC reclaims $110K with strong momentum, upside targets are currently paused.

🔸 Risk Level at 99K:

A daily close below $99K would confirm bearish momentum and open room toward $90K next.

🔸 Outlooks:

Stay cautious due to macro instability (global war risk).

🔹 If price bounces near $99K → short-term long trades possible.

🔹 If it breaks below $99K → prepare for continuation to $90K.

Avoid heavy exposure until the trend clears.

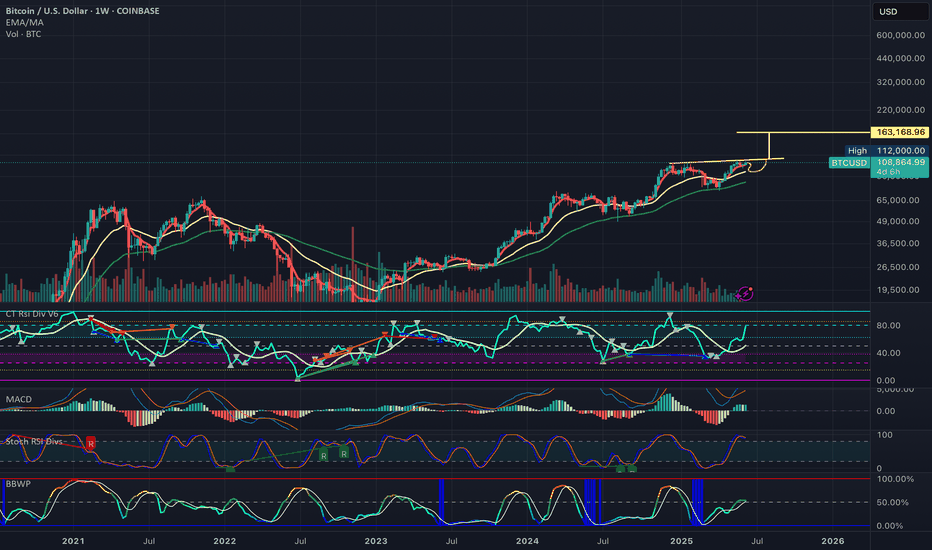

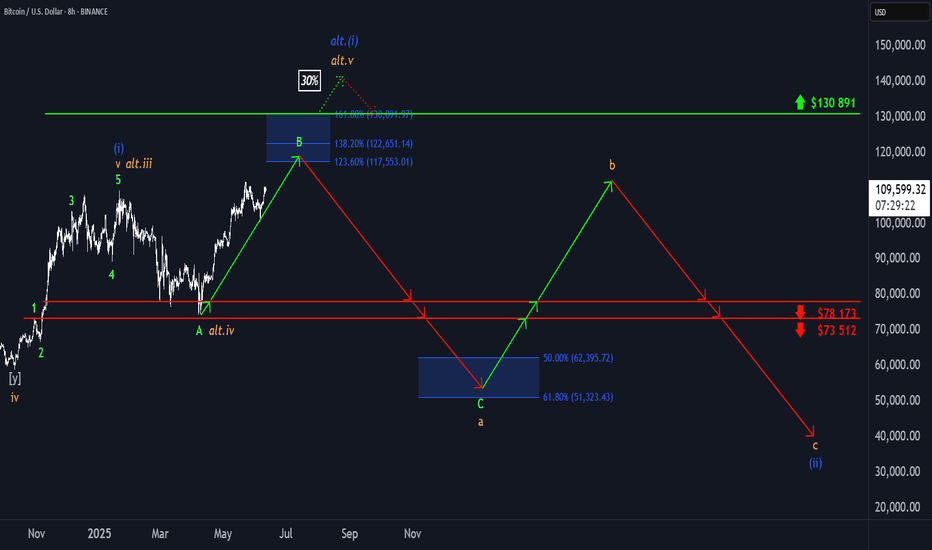

₿ Bitcoin: Further Upside ExpectedBitcoin (BTC) pulled back slightly in yesterday’s session but remains on track to continue its corrective rally within green wave B. In line with our primary scenario, this advance is expected to reach the blue Target Zone between $117,553 and $130,891. Afterward, we anticipate the onset of wave C, which should initiate a substantial decline—driving the price down into the lower blue zone between $62,395 and $51,323. This is also where we expect orange wave a to conclude. From there, wave b should provide a temporary rebound before wave c resumes the broader downtrend, ultimately completing blue wave (ii). That said, there’s still a 30% probability that blue wave alt.(i) has not yet topped. In this alternative scenario, BTC would extend higher, potentially breaking above resistance at $130,891 before the corrective phase resumes. The daily chart illustrates the entire five-wave blue sequence and shows our expected low for wave (ii) within the blue zone between $37,623 and $26,082.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

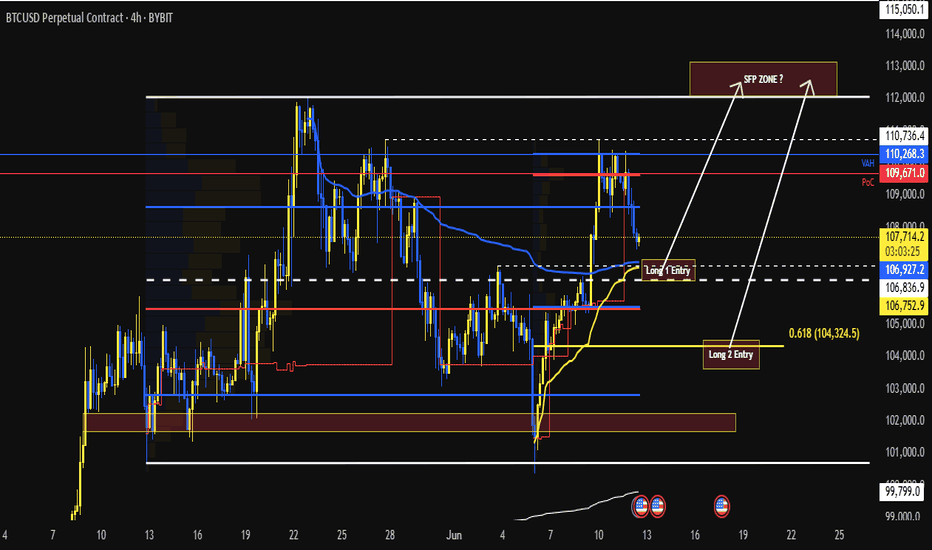

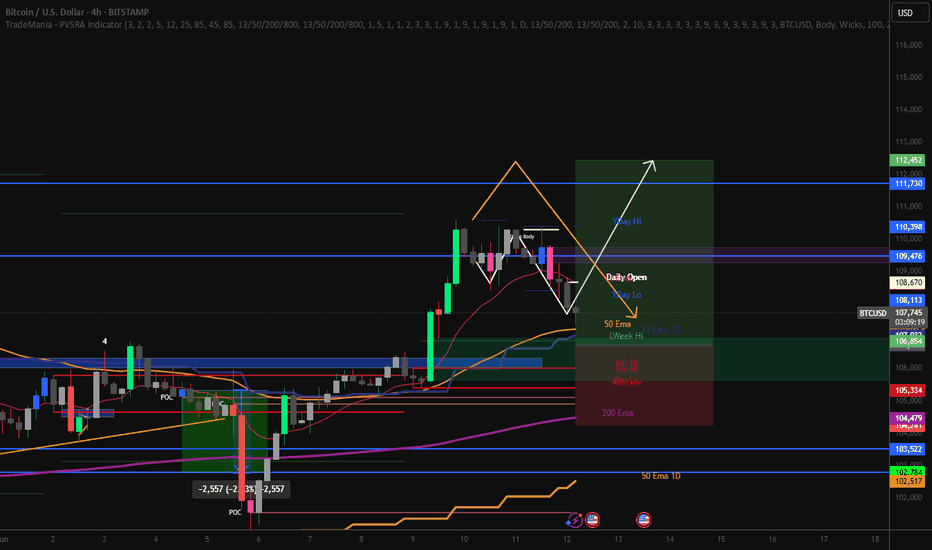

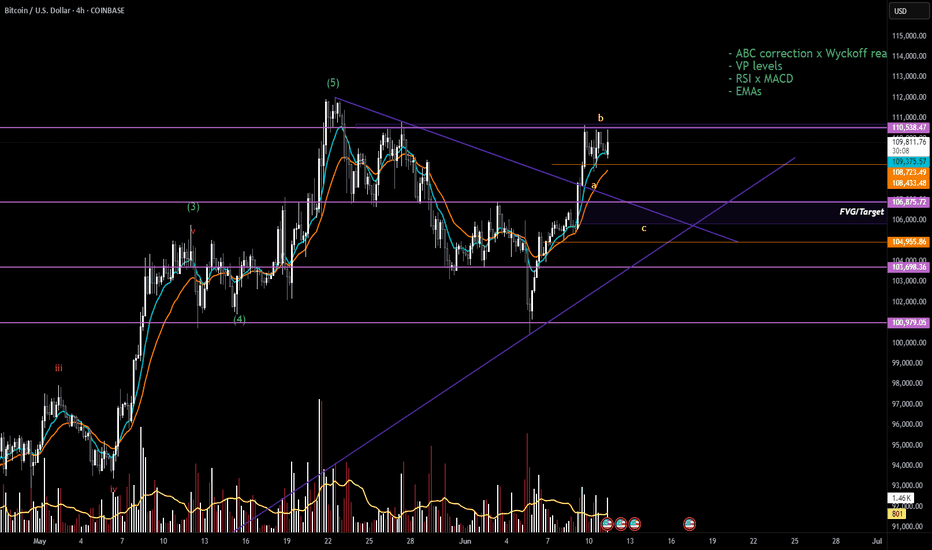

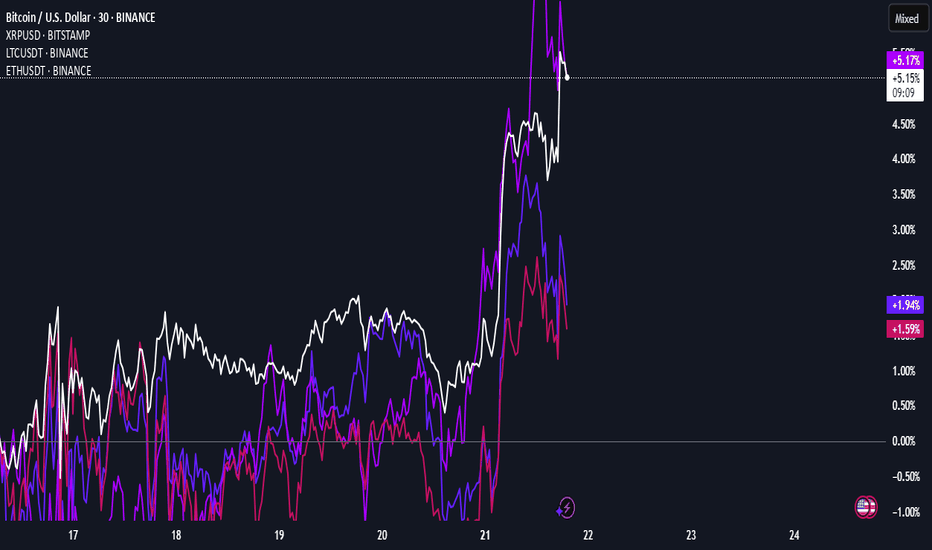

$BTC (Bitcoin) update - June 11, 2025In this video I go into our ABC correction theory for a W2 pull back on BTC. I also take a quick look at CRYPTOCAP:ETH , CRYPTOCAP:XRP and CRYPTOCAP:ADA just to see where the rest of the market is at.

- ABC correction theory is still at play, but I wouldn't recommend shorting as a possible accumulation could be happening.

- Levels to watch: 110.8k, 108.5k, 106.8k, 104.9k.

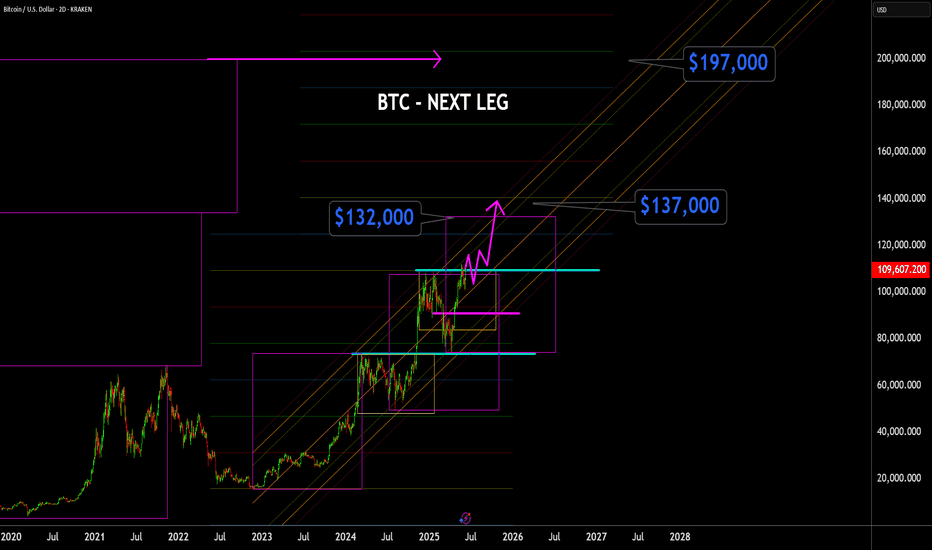

BTC - NEXT LEG COMING NOW - $132- $137KI was wrong about sideways action, then rally. BTC moved immeditely higher and looks to be picking up steam. I see a new high to $125 area, and then perhaps consolidation. But eventually to $132- $137 is in the next 2-3 months. Things are really looking bullish now. I was expecting it to take more time to develop, but that is not happening.