BTCUSD.PI trade ideas

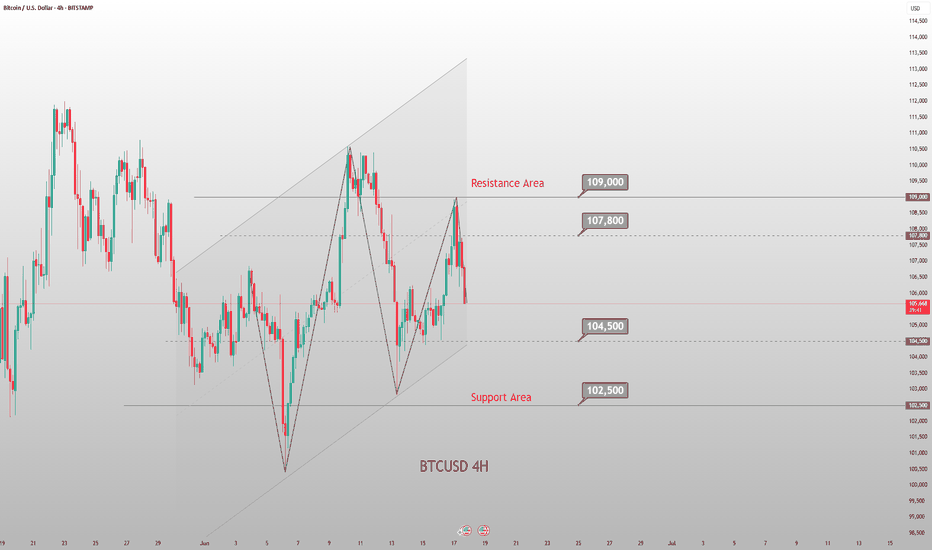

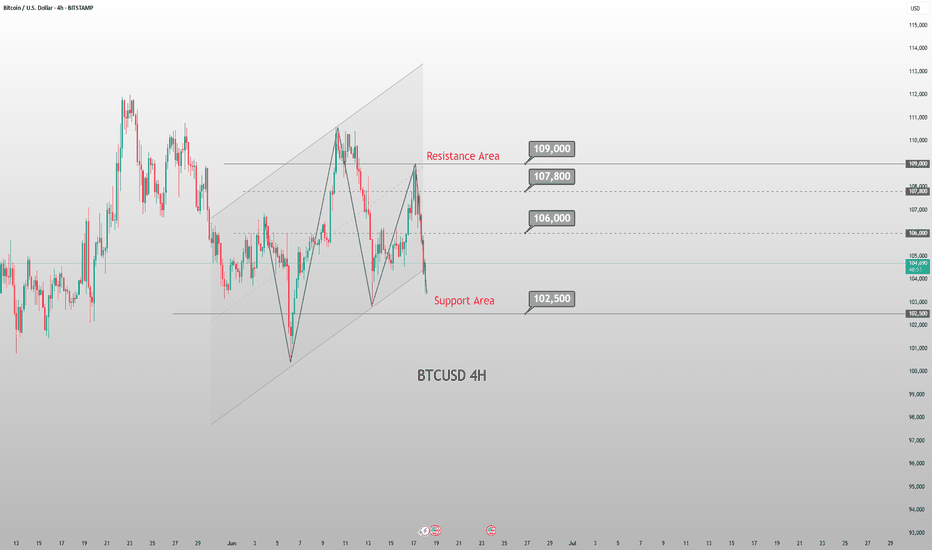

107.6-107.8 and 109-110KMorning folks,

So, position taking stage is done, now let's take a look at targets. In general we have a sequence of a few targets, starting from 107.6-107.8, 109-110, 113 and 116K. But in current situation I would watch for only first two.

Daily overbought is around 114, so 116K target seems too far. 113K is possible, but with rather extended downside action last week, it seems as very optimistic. That's why, more or less base case seems around 109-110K, while the easiest target is 107.6-107.8K.

So, once the first target will be reached - think about partial profit booking, if you want to continue trading. Say, take off 30-40% and move stops to the breakeven on the rest.

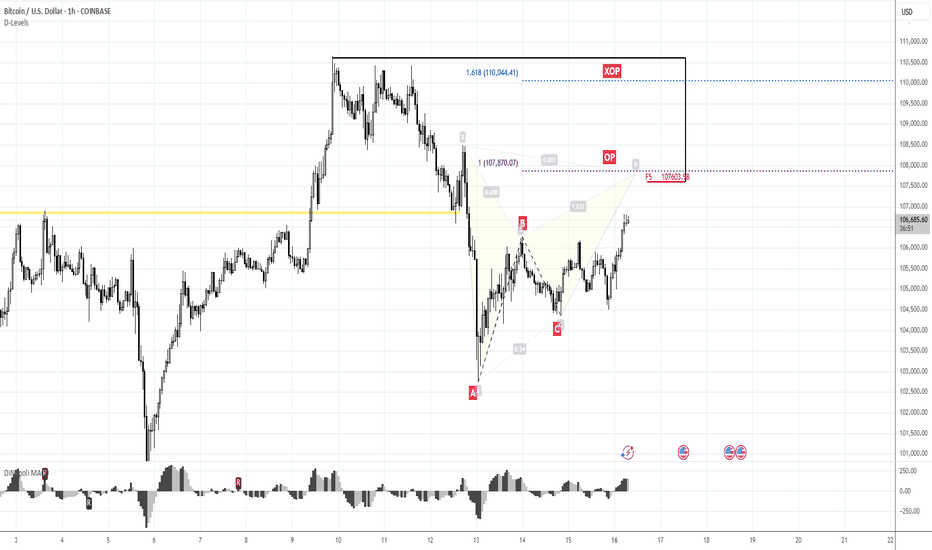

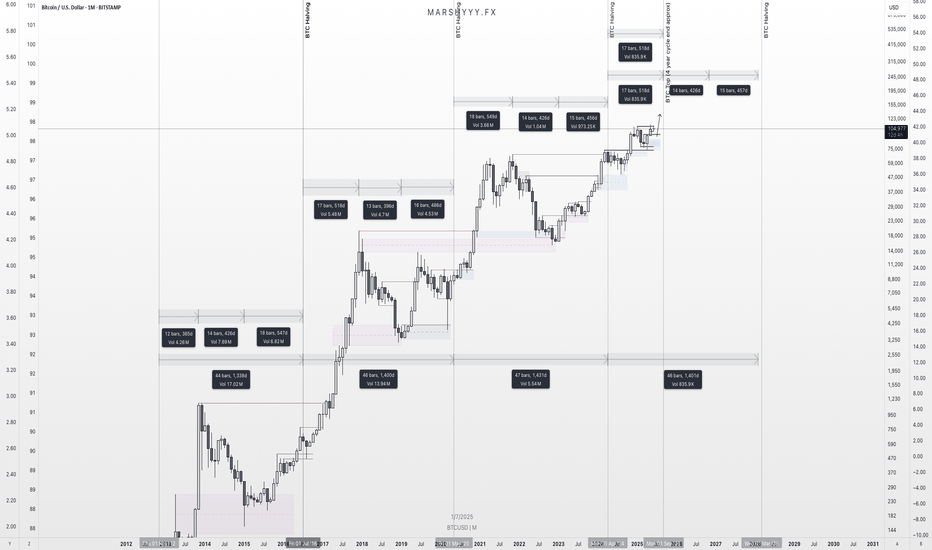

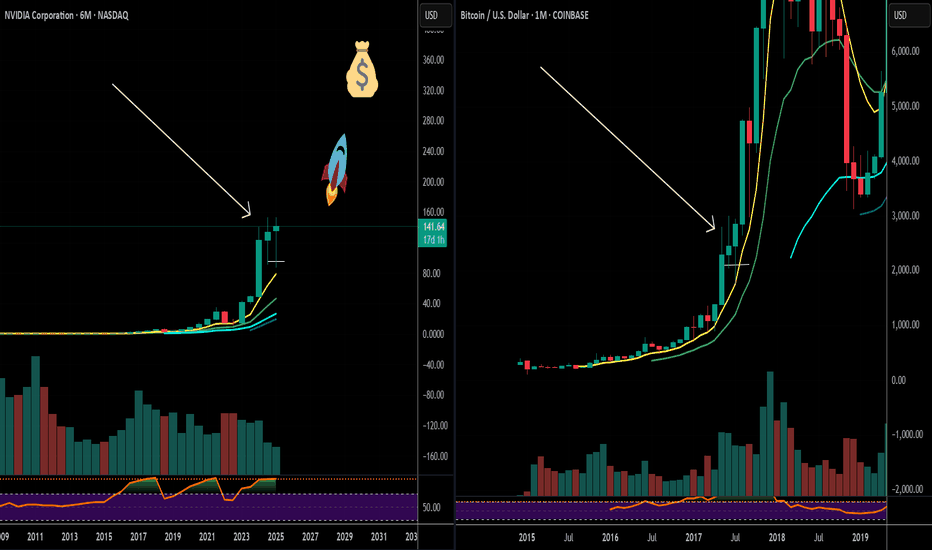

Bitcoin 4-Year Cycle Structure – Technical BreakdownBitcoin 4-Year Cycle Structure – Technical Breakdown

This chart examines Bitcoin’s historical 4-year cycle behaviour, focusing on the repeating market structure observed across the last three cycles: Bull Market → Bear Market → Accumulation/Recovery → Halving → Expansion.

Key Observations:

🔹 Cycle Timing Consistency

Each of the past three cycles has shown a consistent duration between the halving and the final bull market peak—typically between 500–550 days. Based on that timing, the current cycle suggests we are still ~100 days away from a potential macro top.

🔹 Post-Halving Correction is Expected

Corrections shortly after the halving have historically marked mid-cycle retracements, not macro tops. The current pullback is structurally aligned with the 2017 and 2021 expansions, where Bitcoin consolidated before pushing to final highs.

🔹 Altcoin Market Segments Lagging

TOTAL2 (Total Market Cap excluding BTC)

TOTAL3 (Excluding BTC & ETH)

OTHERS (Altcoins excluding top 10 by market cap)

All remain below their prior cycle all-time highs, which historically occurs before the full market cycle concludes. These segments often accelerate after BTC has established dominance, typically in the later stages of the bull market.

🔹 USDT Dominance Suggests More Upside

USDT.D is still trending down, which historically reflects increasing risk appetite and capital rotation into crypto assets. Prior cycle tops have aligned with much lower dominance levels, indicating further downside risk for USDT.D, and potential upside for crypto markets.

Conclusion:

Despite short-term volatility, the technical structure across Bitcoin and broader market indicators suggests the cycle remains in its expansion phase. Timing models, altcoin lag, and dominance signals all point to further upside potential before a full cycle peak is in.

1W:

1M:

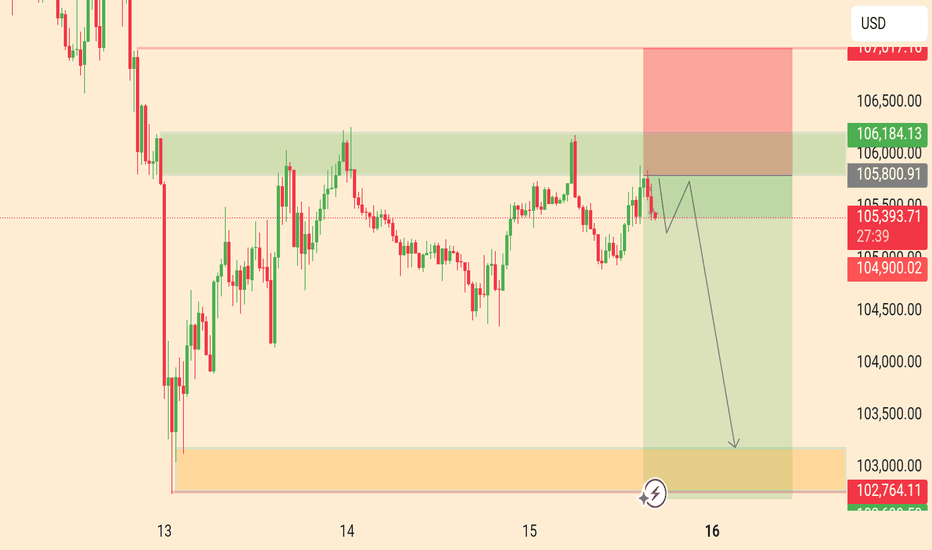

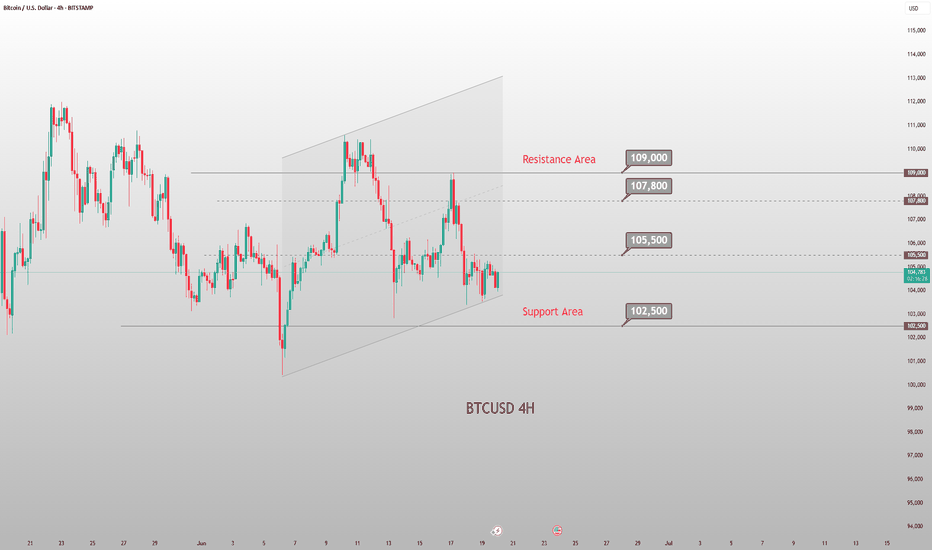

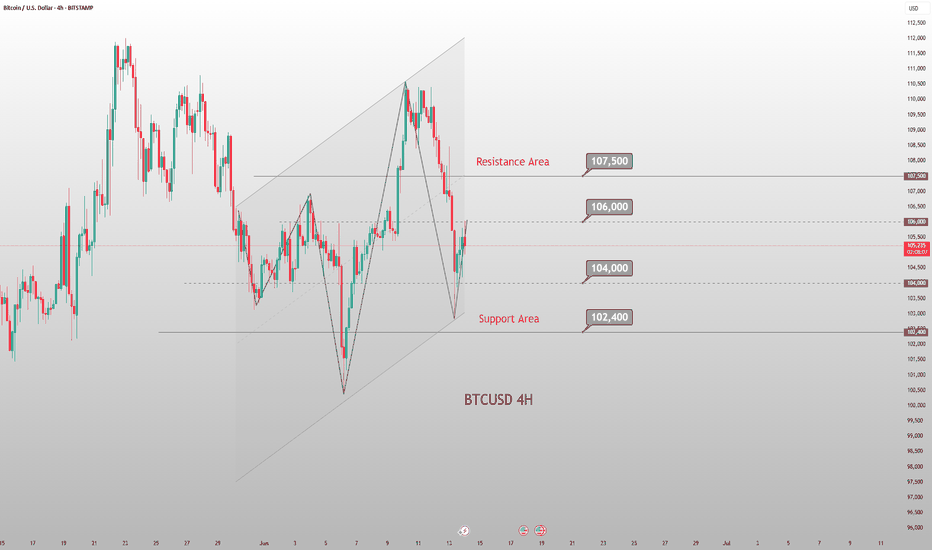

BTC Trend Analysis and Trading Recommendations for TodayThe BTC market continues its sideways-down trend, with notably insufficient rebound momentum during the session. Although there were brief signs of stabilization in the early trading, bearish forces continued to exert pressure during the European session, and the index showed a staircase decline.

From the 4-hour chart analysis, the price once fell to touch the middle Bollinger Band support during the Asian session, followed by a technical rebound. However, the rebound strength was obviously weak, encountering strong resistance near the middle band. The current candlestick pattern presents a typical Dark Cloud Cover, the MACD indicator continues to release volume below the zero axis, with fast and slow lines in bearish alignment.

Technically, the price remains significantly pressured near the middle band, and the US session is likely to extend the existing downtrend. Investors are advised to maintain a bearish stance. If the price effectively breaks below the middle band support, the next target is targeted at the lower Bollinger Band. Strategically, fading rallies remains the preferred approach.

BTCUSD

sell@106500-106000

tp:105000-104000

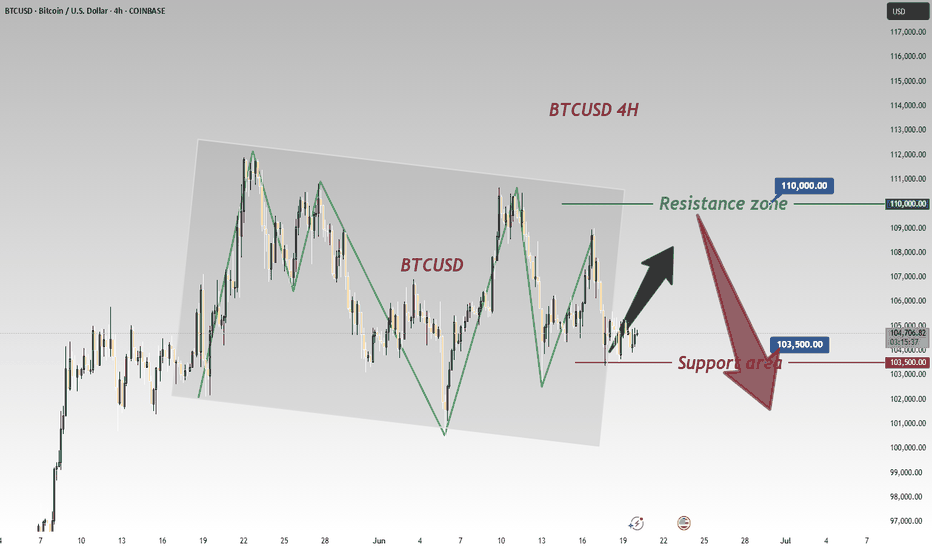

Current BTC Trend Analysis and Trading RecommendationsThe daily candlestick chart of BTC shows a three - day consecutive bearish retracement, having fallen back to the vicinity of the starting point of the previous pinbar rebound and currently remaining in a recent low - level sideways consolidation zone. However, the 4 - hour trend is pressured by the middle band of the Bollinger Bands, staying within a downward channel and forming a rebound - retracement wave pattern.

For short - term strategies, anticipate a further retracement first. Long positions should be initiated only after the support level is confirmed valid. This retracement represents a necessary consolidation phase before the bullish trend continues, and the current adjustment range does not pose a substantial threat of trend reversal to the overall uptrend. With the core upward trend intact and the direction remaining clear, BTC is expected to resume its upward momentum after a brief consolidation. The operational approach remains to go long on retracements.

BTCUSD

buy@103500-104000

tp:105500-106500

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

BTC Consolidates 104000-105000: Bearish Breakdown Looming?BTC Technical Update: Bitcoin has been consolidating within the 104000-105000 range for an extended period, with the overall trend showing a downward bias. With the overall trend tilting bearish, traders should watch for a break below 103500 to confirm the next leg down. 📉

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@ 105000 - 104500

🚀 TP 102500 - 101500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Bitcoin,when it’s all said and done.Bitcoin has no reason to revisit under 100k before a new high. Although markets are manipulated by large players often, it’s usually to change market sentiment for those who are over leveraged and ignorant of the whale games. If it were to wick down to below 100k, I strongly believe it will reverse violently to the upside surpassing ATH. There will be no WWIII. Believe in righteousness and give peace a chance.

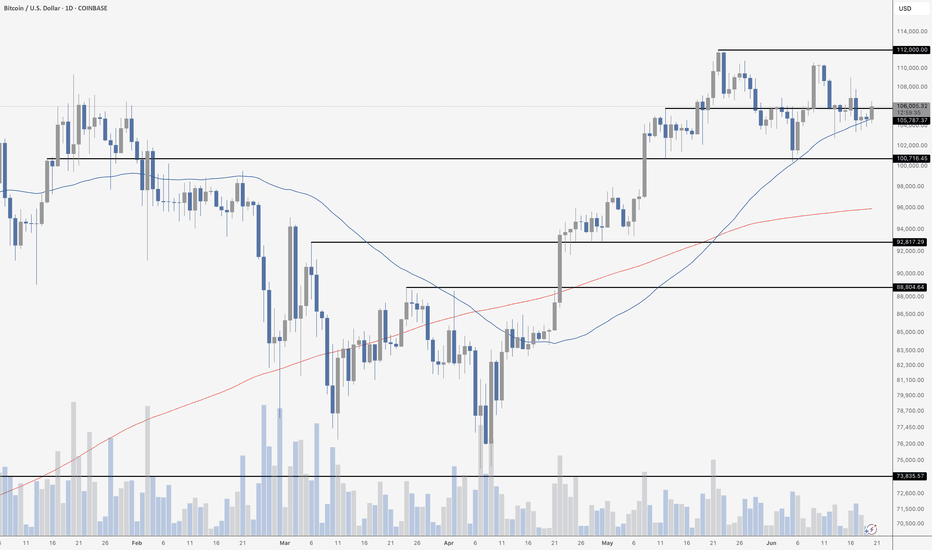

BITCOIN BOUNCES FROM 50 MA - AGAINBitcoin continues to treat the 50-day moving average like a sacred line in the sand. Once again, price dipped to test the level and found immediate support – bouncing right off the blue line with a solid daily candle and gaining over 1% in the process. That makes multiple successful defenses of the 50 MA in recent weeks – clearly, traders are watching it closely.

The key takeaway here isn’t just the bounce, but the fact that BTC remains in a tightening range between ~$112,000 resistance and ~$100,700 support. We’re seeing a clear battle between bulls and bears – with bulls still managing to defend higher lows while momentum tries to rebuild. As long as the 50 MA continues to hold, the structure remains bullish – but if it breaks, it could signal a retest of the $100K psychological level or even a deeper pullback toward the mid-$90Ks.

For now, the trend is still your friend. But keep one eye on the moving average – because the moment it fails, this range could resolve sharply. Until then, it’s a patient trader’s market.

Current BTC Trend Analysis and Trading RecommendationsToday, U.S. markets are closed, leading to light trading activity and relatively limited overall market volatility. From a technical analysis perspective, the 4-hour K-line chart currently shows prices trading below the middle band of the Bollinger Bands, exhibiting a classic range-bound consolidation pattern. Bulls and bears are locked in a tug-of-war between key support and resistance levels, with K-line formations alternating between bullish and bearish patterns.

In terms of chart structure, the lower support zone has demonstrated strong buying conviction, while the upper resistance level has exerted clear restrictive force. Multiple failed upward breakouts have formed a short-term top. This box consolidation—characterized by resistance above and support below—is expected to sustain sideways trading through Friday.

Against the backdrop of no major positive catalysts, bearish momentum may gradually dominate if no substantial bullish triggers emerge. Maintain a trading strategy of selling into strength.

BTCUSD

105000-105500

tp:104000-103000

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

BTC wait for Long

Bitcoin continues to struggle with its long-term weekly resistance.

In the short term, it’s likely that BTC will consolidate within the $100,000–$112,000 range.

Positioning heavily into altcoins during this phase may not be ideal. It’s more prudent to wait for either a confirmed breakout above weekly resistance or a pullback toward the $94,000–$92,000 support zone.

For now, the focus remains on short-term trading opportunities within this range. A potential long setup is outlined in the chart.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

BTCUSD Analysis | is 100k the Next Target?🔍 Chart Breakdown:

Price previously formed a range under key resistance at $108,800.

A Triangle Pattern emerged after a sharp rejection from the resistance zone.

The recent breakdown from this pattern signals bearish momentum.

Support Level: $100,513 — Key level to watch for a potential bounce or further breakdown.

📊 Scenarios to Watch:

🔴 Bearish Case (Preferred):

Breakdown continuation below $104,000 could trigger a move toward the $100,500 support.

Clean rejection from triangle breakdown area confirms the bearish structure.

🟢 Bullish Case (Less Likely):

If BTC holds above $104,000 and breaks above the mid-range zone (~$106,500), a retest of $108,800 is possible.

Watch for fakeouts at the top of the range.

💡Trade Ideas:

Short opportunities on breakdown retest or rejection from $106,000–106,500.

Potential long only if $108,800 is broken with strong volume confirmation.

🛑 Risk Management:

Always use stop-loss. Monitor BTC dominance and macro sentiment for confluence.

💬 What do you think? Bearish breakdown or fakeout trap? Let’s discuss below!

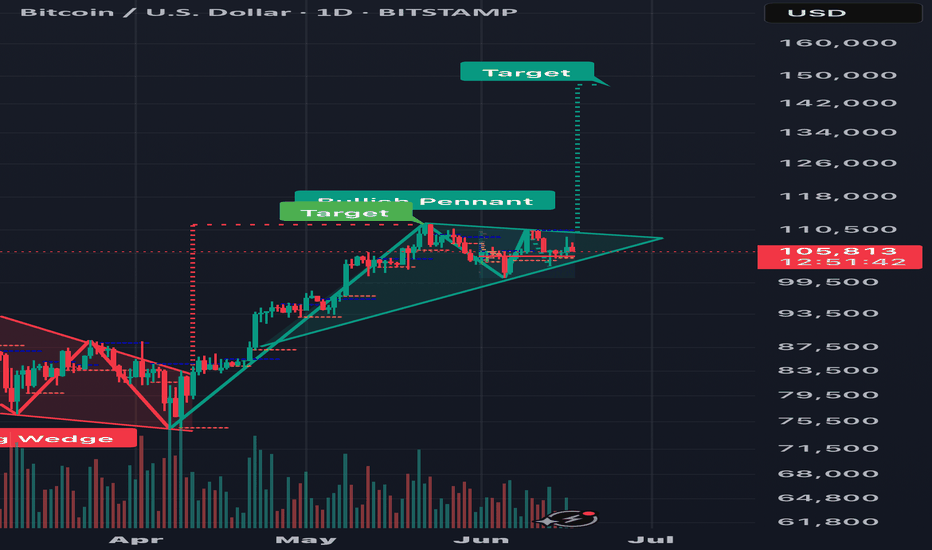

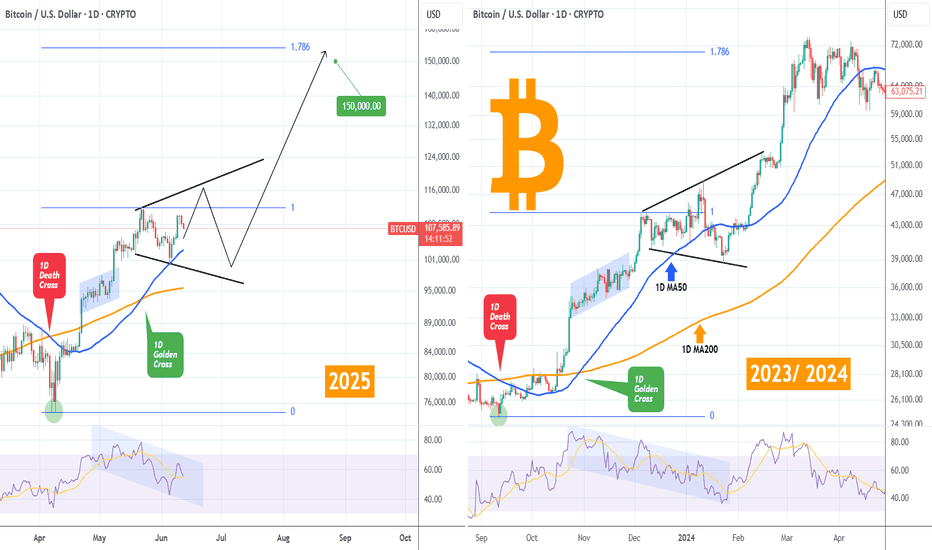

BITCOIN Megaphone is the last step before $150k.Bitcoin (BTCUSD) is repeating almost to the exact point the 2023/ 2024 uptrend, as right now it is in the process of forming a Megaphone pattern similar to the one during December 2023 - January 2024.

Before that, both patterns started the uptrend when a 1D Death Cross formed the bottom. After the 1st Bullish Leg, a Channel Up on a 1D Golden Cross marked the transition to the 2nd Bullish Leg that eventually led to the Megaphone.

In 2024, when BTC broke above the Megaphone, it started the final Bullish Leg that peaked a little above the 1.786 Fibonacci extension from the bottom. During that process, the 1D RSI sequences among the two fractals have been similar.

As result, aiming for the $150000, which is marginally below the 1.786 Fib ext, is a solid target.

Do you think the pattern will continue to be repeated? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

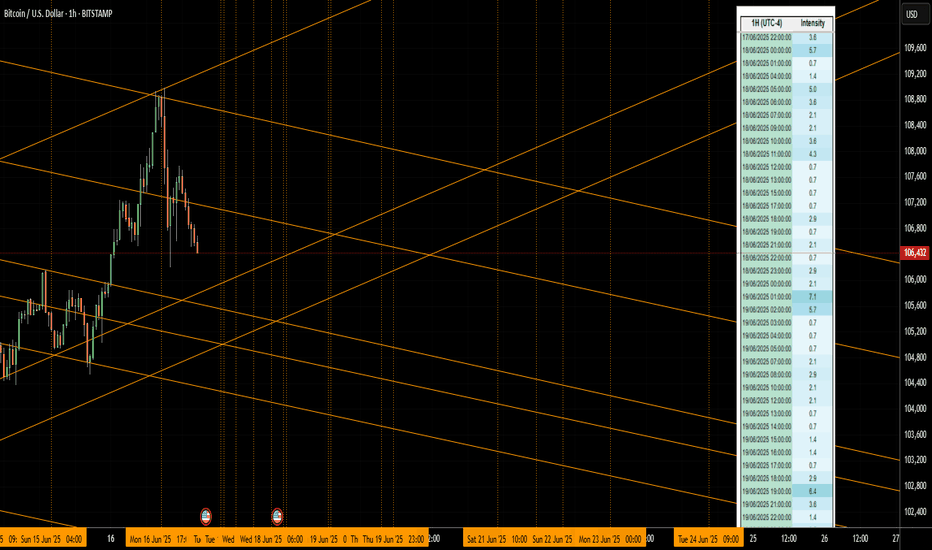

Current BTC Trend Analysis and Trading RecommendationsToday's overall BTC market rebounded after hitting a low of 102,614 in the early trading session, with Bitcoin's price maintaining a slow upward trend throughout the day. The intraday high reached 105,912 but encountered resistance. As the weekend approaches, historical market data shows limited volatility during weekends, so range-bound fluctuations are expected for the weekend.

From the current overall market rhythm, the price has rebounded slightly today after the previous decline. The hourly chart shows consecutive upward candles, though the price movement remains relatively slow. As time progresses, the price is expected to sustain an upward trend after pullbacks, and breaking through the short-term resistance level is only a matter of time. In terms of short-term structure and pattern, despite slight resistance and minor pullbacks, the downward momentum has weakened. We can still focus on long positions at lower levels, paying attention to the 106,000 resistance level.

BTCUSD

buy@104000-104500

tp:106000-107000

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

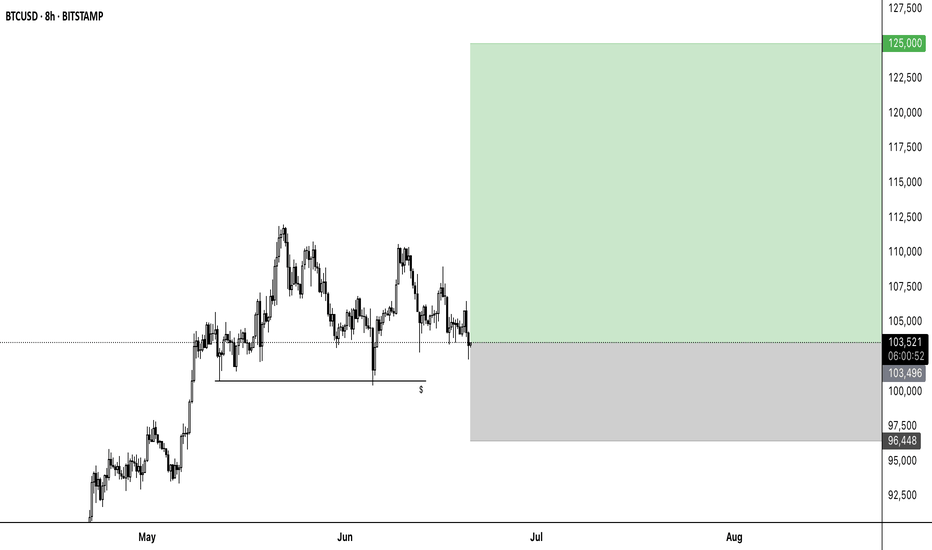

BTC to 125000📈 BTCUSD Long Setup – Maximum Fear Often Marks the Bottom

Timeframe: 8H

Entry: ~103,500

SL: 96,448

TP: 125,000

RR: ~3:1

🧠 Market Sentiment:

The current environment is dominated by extreme fear – sentiment is heavily bearish, and interest from retail investors is strikingly low. Most market participants appear to be short or sitting in hedged positions, which ironically sets the stage for a potential short squeeze if price breaks to the upside.

🔍 Technical Context:

BTC has been ranging for weeks – support has held repeatedly.

Liquidity has been swept below previous lows – possible spring formation.

A reclaim of the 104k–105k zone could act as a launchpad.

Setup anticipates a contrarian move against the prevailing bearish bias

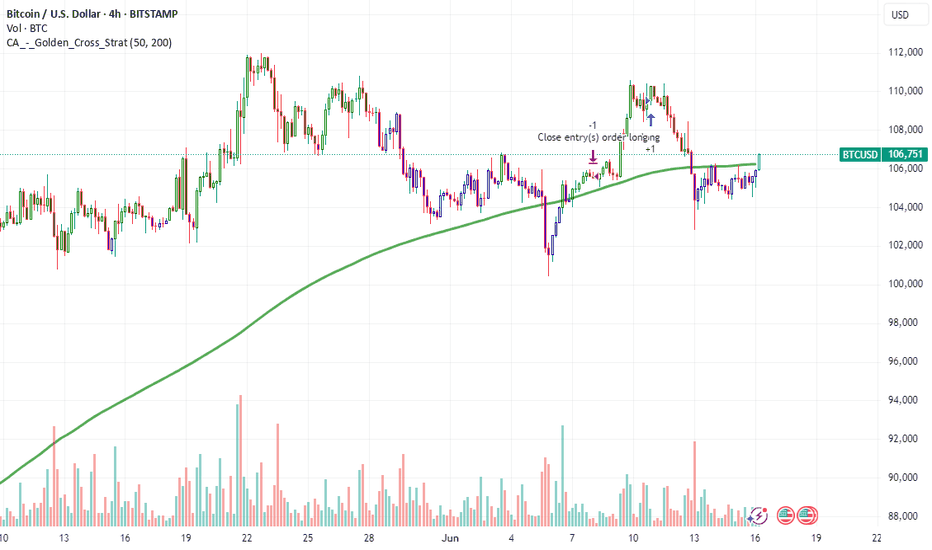

BTC “Golden Cross” Looms, but Geopolitics Could Delay ItBitcoin’s “Golden Cross” Looms, but Geopolitical Shocks Could Delay the Breakout

Deep dive into price action, derivatives, on-chain data, and the tug-of-war between Middle-East risk and crypto bull-run momentum

________________________________________

Table of Contents

1. Executive Summary

2. Scene-Setter: BTC at $105 K in a World on Edge

3. Technical Spark: What a Golden Cross Really Means

4. Price Action: From $103 K Dip to $106.8 K Hurdle

5. Options Market: A Sudden Lurch Toward Puts

6. Macro Overhang: Why Israel–Iran Turmoil Matters to Bitcoin

7. On-Chain Pulse: 656 % Cycle Gain, Yet Supply Is Tighter Than 2021

8. Mining Fundamentals: Difficulty Eases, Margins Improve

9. Corporate Treasuries: The Quiet, Sticky Bid

10. Targets & Scenarios: $97 K Downside vs. $229 K Upside

11. Strategy Playbook for Traders & Investors

12. Conclusion: Delayed, Not Derailed

13. Disclaimers

________________________________________

1. Executive Summary

• Bitcoin (BTC) is trading in a tight $103 K–$108 K band, unable to confirm a breakout as Middle-East tensions push investors into hedging mode.

• A Golden Cross—the 50-day SMA crossing above the 200-day—could flash within 10 trading sessions, historically adding +37 % median upside over the subsequent 90 days.

• Options flow has flipped decisively toward puts, with the 25-delta skew hitting –10 %, its most bearish since the FTX collapse, signaling short-term anxiety even as long-term bets remain bullish.

• On-chain metrics (exchange balances at six-year lows, HODLer supply at all-time highs) reveal structural demand; Glassnode notes a 656 % cycle advance despite a trillion-dollar market cap.

• Analysts’ upside targets range from $140 K (Q3) to $270 K (October) and even $229 K based on the Golden Cross fractal. Yet a clean break of $104 K support opens room to $97 K first.

________________________________________

2. Scene-Setter: BTC at $105 K in a World on Edge

Bitcoin entered 2025 with a blistering rally—spot ETFs hoovered nearly 200 K coins in four months, miners sold aggressively into strength, and macro tailwinds (Fed easing, USD weakness) fueled risk appetite. Then two macro curveballs hit:

1. Sticky U.S. core inflation revived “higher-for-longer” rate fears.

2. Israel–Iran hostilities spooked global markets, sending Brent crude to $76 and sparking a dash for USD liquidity.

BTC, once heralded as “digital gold,” behaved like a high-beta tech stock: it slipped 7 % in 48 hours, tagging $103,200 before bargain hunters stepped in. As of this writing, price sits near $105,800—right on the 100-hour SMA. Whether we escape the range depends on which force proves stronger: geopolitical dread or the long-term structural bid.

________________________________________

3. Technical Spark: What a Golden Cross Really Means

A Golden Cross occurs when the 50-day simple moving average (SMA-50) crosses above the 200-day (SMA-200). In Bitcoin’s 14-year history, we have logged nine such events:

Year Days to Cross 90-Day Return 180-Day Return

2013 51 +88 % +202 %

2015 73 +34 % +67 %

2019 46 +193 % +262 %

2020 38 +77 % +112 %

2023 59 +29 % +48 %

Median 90-day gain: +37 %

Median drawdown post-cross: –12 %

We are ~$700 shy of triggering the cross (SMA-50 at $97.9 K, SMA-200 at $98.1 K and rising). Assuming volatility stays muted, the lines converge within two weeks, potentially firing a widely watched buy signal. But remember: the cross is lagging; smart traders anticipate, not react.

________________________________________

4. Price Action: From $103 K Dip to $106.8 K Hurdle

Key intraday levels (Kraken feed):

• Support 1: $104,000 – prior weekly low + bullish order-block

• Support 2: $101,200 – 0.786 Fib retrace of the Feb–Mar impulse

• Bear Pivot: $97,000 – 200-day EMA + high-confluence volume node

• Resistance 1: $106,800 – last week’s swing high; three failed probes

• Resistance 2: $108,500 – May monthly open

• Bull Pivot: $113,000 – neckline of the March distribution range

Monday’s bounce broke a declining trend-line from $110 K, printing a higher low—constructive, yet bulls require a daily close >$106.8 K to invalidate the short-term bearish structure.

________________________________________

5. Options Market: A Sudden Lurch Toward Puts

Deribit data (largest BTC options venue):

• Put/Call Ratio: 0.62 last Friday → 0.91 today

• 25-Delta Skew (1-month): –10 %, lowest since Nov-2022

• Max-Pain for April 26 expiry: $104 K (huge open interest)

Translation: traders rushed to buy protective puts as Iran war headlines crossed. Market-makers, short those puts, delta-hedged by shorting spot or perpetual futures, adding downward pressure—classic gamma feedback loop.

Yet term structure remains contango; June and September IVs price higher topside. Institutions appear to sell near-dated panic, accumulate long-dated calls—a bullish medium-term stance.

________________________________________

6. Macro Overhang: Why Israel–Iran Turmoil Matters to Bitcoin

1. Risk-Off Correlation: Despite “digital gold” narratives, BTC’s 30-day correlation with the Nasdaq-100 sits at 0.64; equities slide → crypto follows.

2. USD Liquidity Drain: War premium lifts oil, stoking inflation and forcing the Fed to delay cuts; higher real yields pressure non-yielding assets.

3. Regulatory Optics: Heightened national-security chatter emboldens lawmakers keen to scrutinize crypto, a perceived sanctions-evasion channel.

4. Regional Flows: The Middle-East hosts some of the largest sovereign-wealth pools; risk aversion could pause their crypto allocations.

5.

Hence, every missile headline becomes a volatility catalyst. Still, flash-risk events fade quickly if energy supply stays intact, offering windows for BTC to re-assert its secular trend.

________________________________________

7. On-Chain Pulse: 656 % Cycle Gain, Yet Supply Is Tighter Than 2021

Glassnode frames Bitcoin’s ongoing bull as “one of the most explosive relative to market cap gravity.” Highlights:

• Cycle Return: 656 % from the $14 K November-2022 bottom—impressive given the asset is now >$2 T in free-float value, dwarfing 2017’s sub-$100 B base.

• Exchange Balances: Just 2.02 M BTC on centralized venues—13-year low.

• Realized Price (short-term holders): $92,500—suggests marginal buyers remain well in profit.

• Entity-Adjusted Dormancy Flow: At 275 K BTC/day vs. 2021’s 550 K—implying HODLers are less willing to spend.

Put simply: even after a seven-fold rally, supply scarcity persists.

________________________________________

8. Mining Fundamentals: Difficulty Eases, Margins Improve

The April 20 adjustment saw difficulty dip 1.2 %, the first contraction since January. Why it matters:

• Post-Halving Breathing Room: Block subsidy fell to 1.5625 BTC; a difficulty rollback cushions miner profit margins, lowering forced selling risk.

• Hashrate Plateau: Network hashrate hovers at 640 EH/s, only 3 % off the ATH—miners remain confident.

• Transaction Fees: Average fee per block = 0.37 BTC, still elevated by historical standards thanks to BRC-20 activity.

Miners thus appear cash-flow stable, reducing downside pressure on spot markets compared to previous post-halving eras.

________________________________________

9. Corporate Treasuries: The Quiet, Sticky Bid

Since MicroStrategy cracked the dam, 68 public companies now hold BTC on balance sheets, totaling 412,000 coins (~$43 B). Recent newcomers:

Company Purchase Date BTC Added Avg Cost

SemiconX Feb-2025 2,500 $94,800

Nordic Logistics Mar-2025 800 $98,200

Atlantech Energy Apr-2025 1,200 $101,500

Traits of corporate treasuries:

• Long-Dated Liabilities: Align with Bitcoin’s four-year halving cadence.

• Low Turnover: None of the 68 have sold core holdings despite 80 % drawdowns in 2022.

• Regulatory Transparency: SEC filings broadcast purchases, inviting copycat demand.

This sticky bid stabilizes spot markets during macro squalls.

________________________________________

10. Targets & Scenarios: $97 K Downside vs. $229 K Upside

Bearish Path (30 % probability)

• Trigger: Israel–Iran broadens, Fed signals no cuts in 2025.

• Price Action: Break $104 K, bulls capitulate at $97 K (200-day).

• Depth: Could wick to $88–90 K (0.618 retrace) if macro gloom persists.

Base Case (50 % probability)

• Trigger: Skirmishes contained; oil cools, Fed cuts twice by December.

• Price Action: Golden Cross confirms, BTC grinds to $128 K by September.

• Highs: $140 K tap as ETF inflows resume.

Bullish Path (20 % probability)

• Trigger: Middle-East cease-fire + ETF FOMO round two + dovish Fed pivot.

• Fractals: Prior Golden-Cross extensions averaged +120 % at extreme.

• Price Action: $150 K by summer, $229 K (Fib 2.618 from 2022 low) by year-end.

• Blow-Off: $270 K October spike before the next cyclical bear begins.

________________________________________

11. Strategy Playbook for Traders & Investors

Horizon Bias Instruments Risk Management

Intraday (0–48 h) Range scalp $104–$107 K Perp futures (5× max), options gamma scalping Hard stop $103 K; position <1 % equity

Swing (2–8 wks) Buy pullbacks ahead of Golden Cross Spot, dated futures roll, 1-month $110 K calls Stop $97 K daily close; size 5–10 %

Position (3–6 mo) Accumulate for $140–150 K target Spot, June/Sept call spreads ($120/150) Hedge via 25 % put collar

Long-Term (1–4 yr) Maintain core stash; ignore noise Cold storage, DCA Re-balance only when price doubles

Optional hedge: Long Gold / Short BTC ratio spread as a geopolitical shock absorber; ratio 1.3 currently, mean-reverts to 1.1 post-crises.

________________________________________

12. Conclusion: Delayed, Not Derailed

Bitcoin stands at a crossroads: a textbook Golden Cross beckons, ETF inflows smolder, miners relax, and corporate treasuries drip-feed demand. Yet war headlines and a cautious options market act as sandbags on the balloon. History says macro shocks slow, not stop secular bull cycles. Unless Middle-East conflict strangles global liquidity or the Fed slams the brakes far harder than priced, BTC’s higher-time-frame structure remains bullish. Expect turbulence, embrace risk controls—but don’t mistake a weather delay for a busted engine.

________________________________________

13. Disclaimers

This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investing involves substantial risk; never invest more than you can afford to lose.

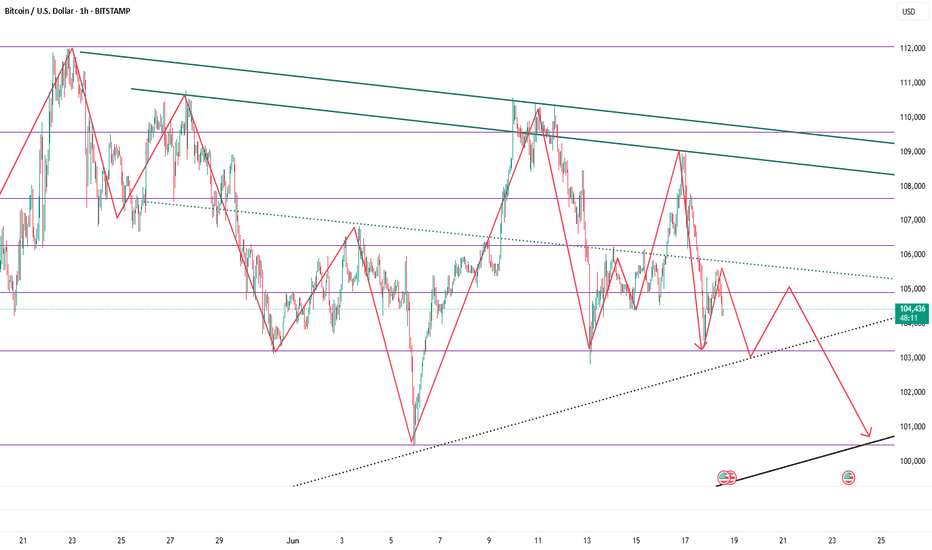

BTC is expected to continue its decline to 100,000BTC has encountered resistance and fallen back several times near 110,000, forming an absolute suppression in the short term. It is difficult for BTC to overcome this resistance area in the short term. As BTC has been unable to break through for a long time, some profit-taking and panic selling will cause BTC to gradually collapse. At present, BTC has fallen back to around 104,000. During the retracement, it has built a short-term resistance area of 105,500-106,000, which limits the rebound space in the short term and will further strengthen the bearish sentiment in the market. BTC will completely open up the downward space.

At present, the 103,000-102,500 area still has a certain support effect on BTC. As BTC shows a volatile downward trend, this support area will be broken again and continue to fall to the area near 100,000. Therefore, in short-term trading, we can consider shorting BTC in the 105,000-105,500 area.

BINANCE:BTCUSDT BITSTAMP:BTCUSD BINANCE:BTCUSDT COINBASE:BTCUSD

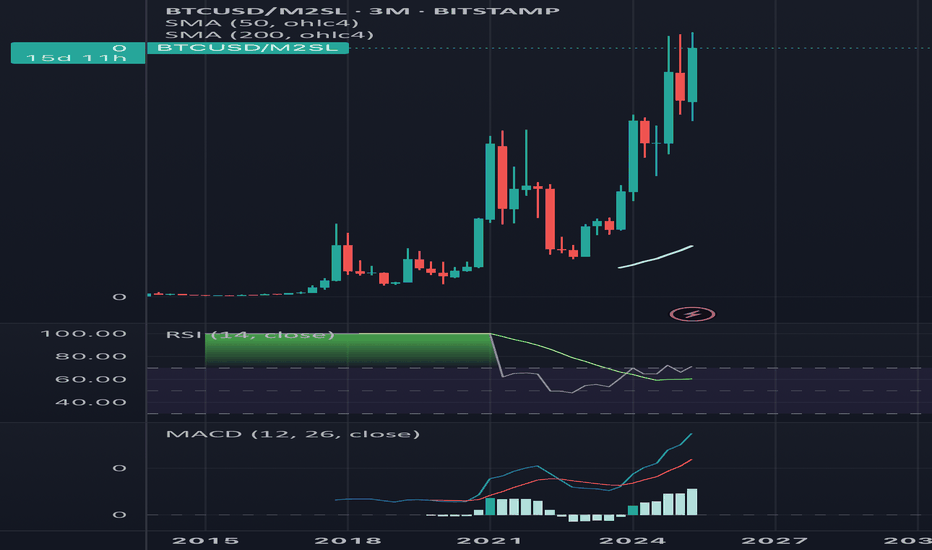

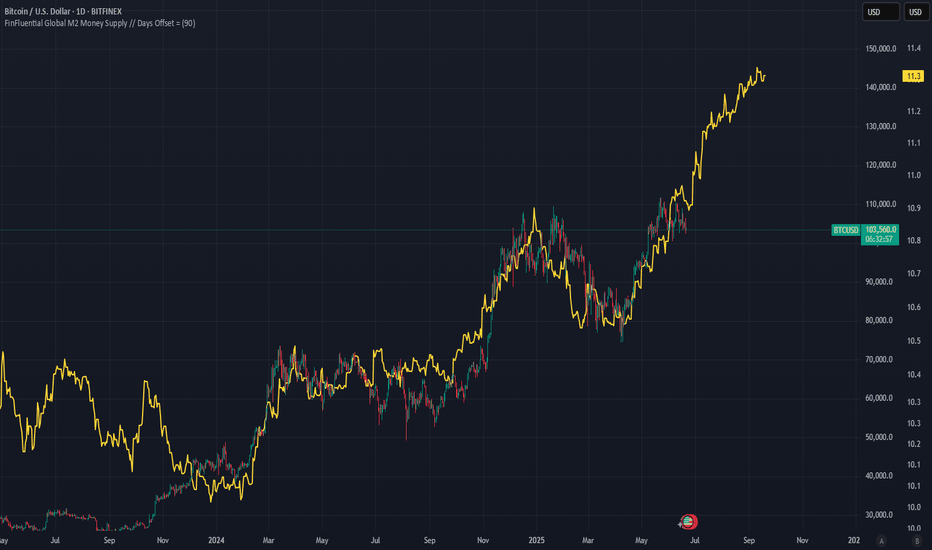

Bitcoin vs Global M2: The 90-Day Liquidity LagComparing Bitcoin’s price action to the Global M2 Money Supply with a 90-day offset reveals potential macro-driven trends. As liquidity expands or contracts globally, Bitcoin often reacts with a delay. This chart aims to visualize the relationship between monetary expansion and BTC price movement, helping spot broader cycle shifts and long-term momentum.

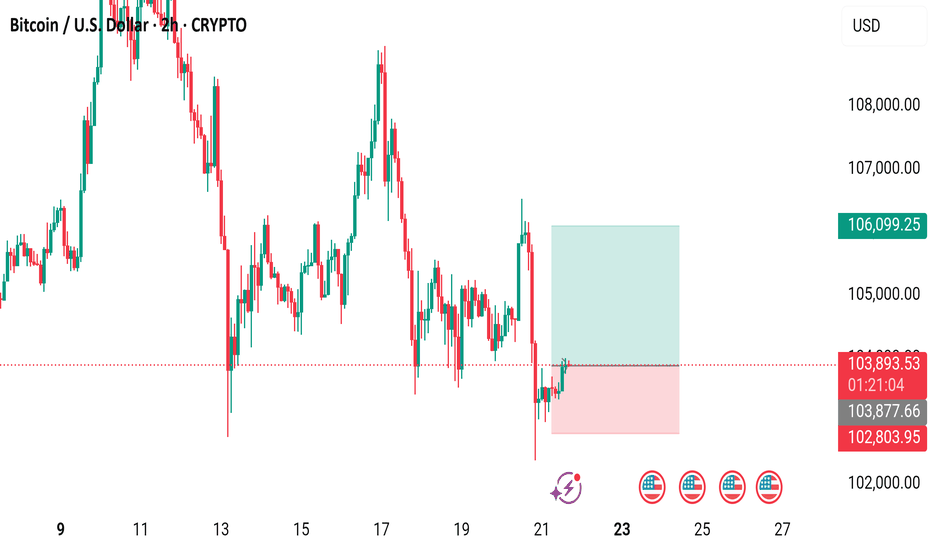

Bitcoin (BTC/USD) 2-Hour Candlestick Chart2-hour candlestick chart displays the recent price movement of Bitcoin (BTC) against the U.S. Dollar (USD), showing a current price of $103,904.89 with a gain of $595.12 (+0.58%) as of 01:22:41. The chart highlights a volatile period with significant price fluctuations, including a sharp drop followed by a recovery, and includes key price levels such as $106,099.25 and $102,803.95. The chart also features a highlighted support zone in pink and a resistance zone in light blue

#4162025 | BTCUSD Supply Zone 1:10BTCUSD Supply Zone Appears in D1 Time Frame Looking Price Action for Long Term Sell

Risk and Reward Ratio is 1:10

After 50 pips Profit Set SL Entry Level

"DISCLAIMER" Trading & investing business is "Very Profitable" as well as risky, so any trading or investment decision should be made after Consultation with Certified & Regulated Investment Advisors, by Carefully Considering your Financial Situation.