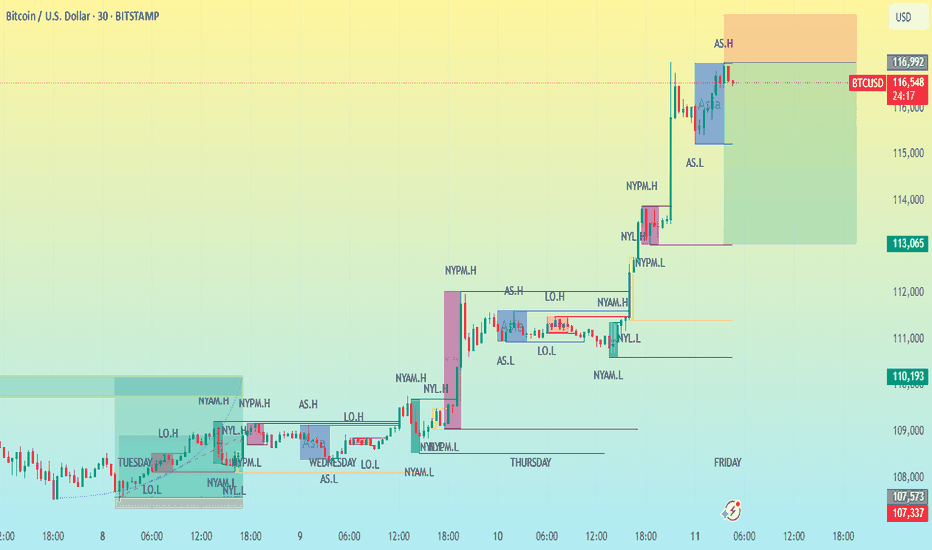

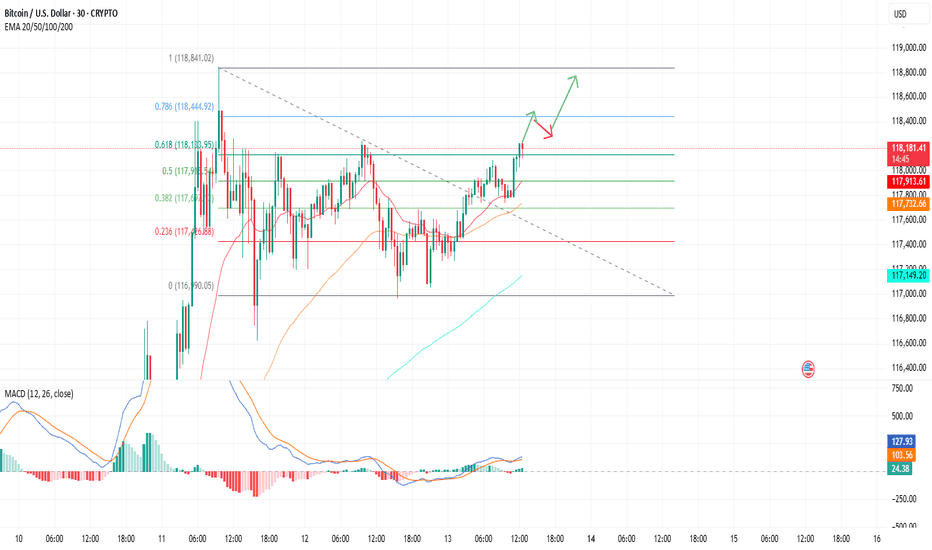

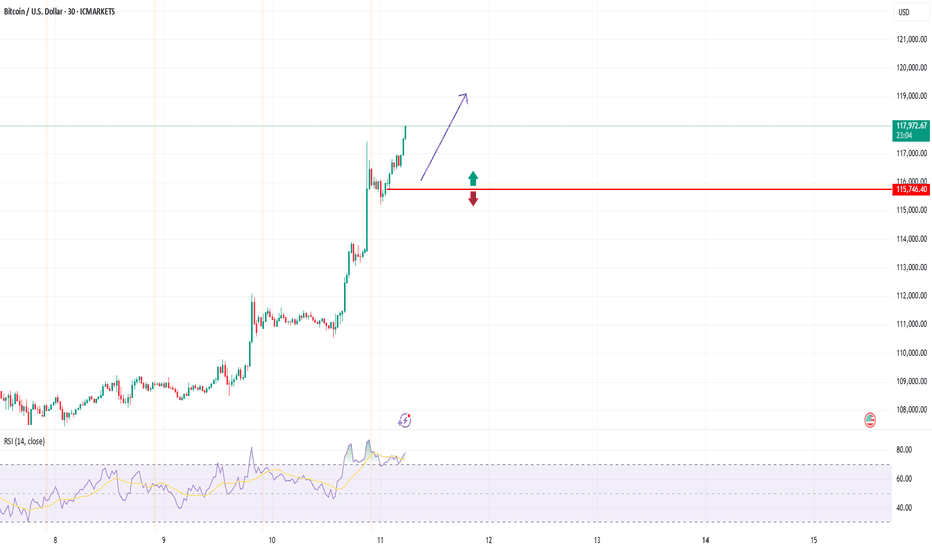

BTC/USD 30MCHART PATTERNThis chart shows the price action of Bitcoin (BTC/USD) on a 30-minute timeframe, with a variety of session-specific high and low labels and possible trade setup zones. Here's a breakdown of the key components and what they indicate:

---

1. Timeframe & Instrument

Instrument: Bitcoin vs. U.S. Dollar (BTC/USD)

Timeframe: 30-minute candles

Exchange: Bitstamp

Date Range: July 8–11, 2025

---

2. Session Labels

The chart includes key session high/low markers which are common in institutional trading analysis:

NYAM.H / NYAM.L: New York AM session High/Low

NYPM.H / NYPM.L: New York PM session High/Low

AS.H / AS.L: Asia session High/Low

LO.H / LO.L: London Open High/Low

NYL.H / NYL.L: New York Lunch High/Low

These session levels are often used to identify liquidity pools or areas where price might react due to prior institutional activity.

---

3. Trade Setup Zones

Orange box (top): Likely a sell-side liquidity or resistance zone, possibly a target for a long trade.

Green box (bottom): Likely a buy-side liquidity or support zone, possibly a stop loss or retracement target.

These zones often represent risk-reward blocks based on prior session data or imbalance fill areas.

---

4. Price

Current Price: ~$116,586

Recent High (AS.H): $116,992

Key Support Levels: $113,065 and $110,193 (from prior session lows)

---

5. Price Structure

The chart shows a clear uptrend, with higher highs and higher lows.

Breakouts followed by consolidations near session highs suggest bullish momentum.

Potential continuation of the uptrend unless the price breaks below the previous session low (marked NYPM.L or NYL.L).

---

Conclusion

This is a well-marked institutional-style price action chart, likely using ICT (Inner Circle Trader) or SMC (Smart Money Concepts) principles. It’s showing bullish strength with multiple liquidity grabs followed by expansions to the upside. Key levels for future movement include:

Break and close above AS.H → Potential continuation toward next liquidity zone.

Drop below NYPM.L or NYL.L → Potential reversal or retracement.

Let me know if you'd like help planning a trade based on this chart!

BTCUSD.PM trade ideas

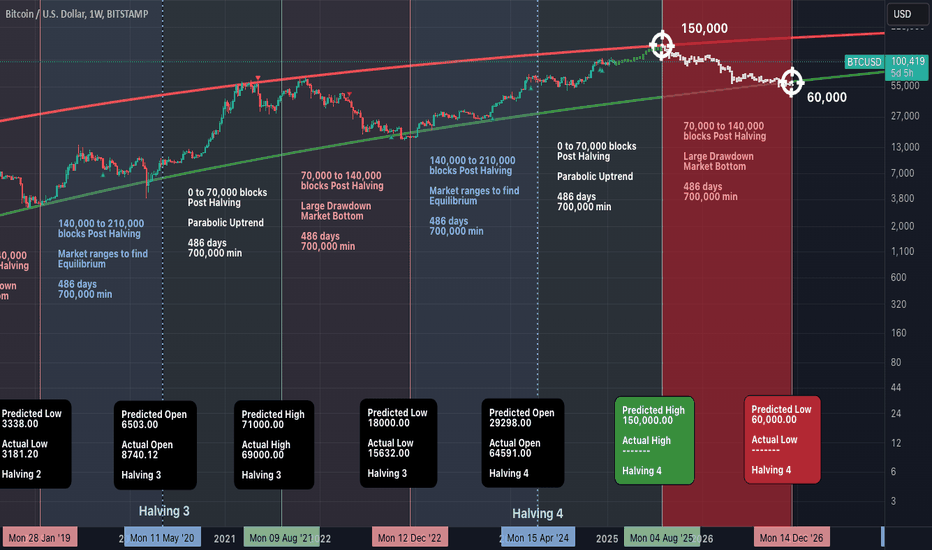

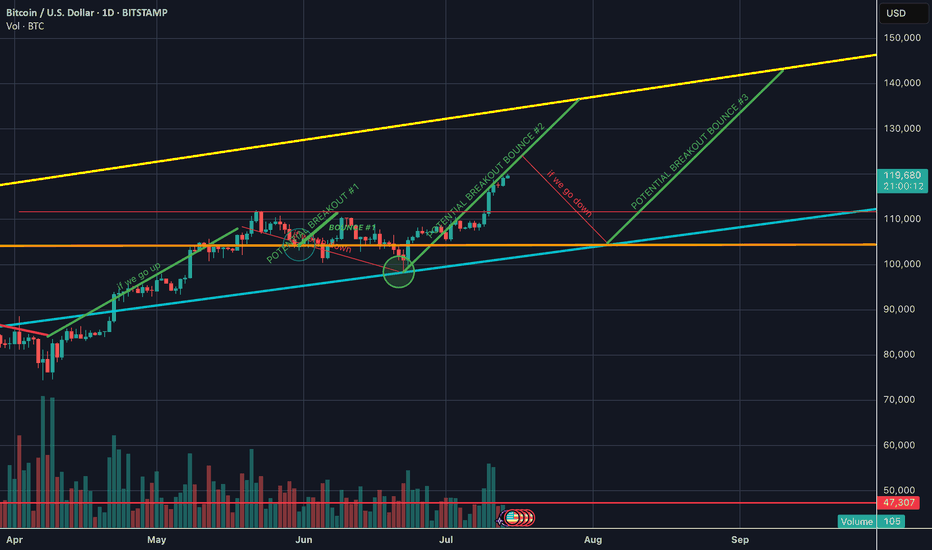

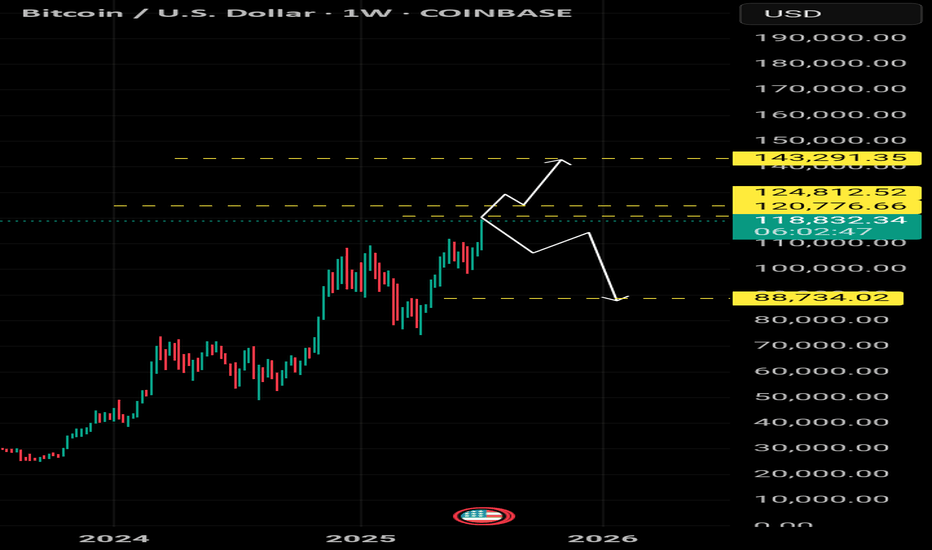

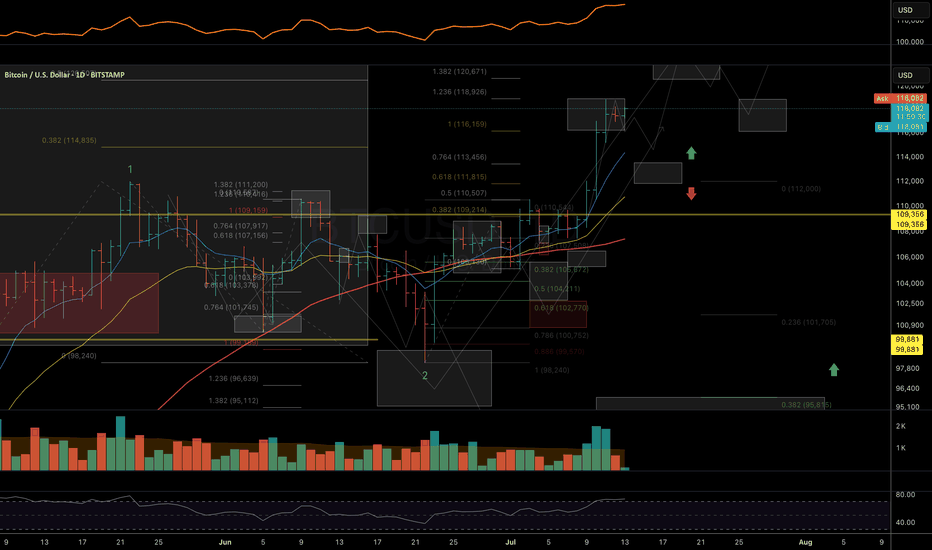

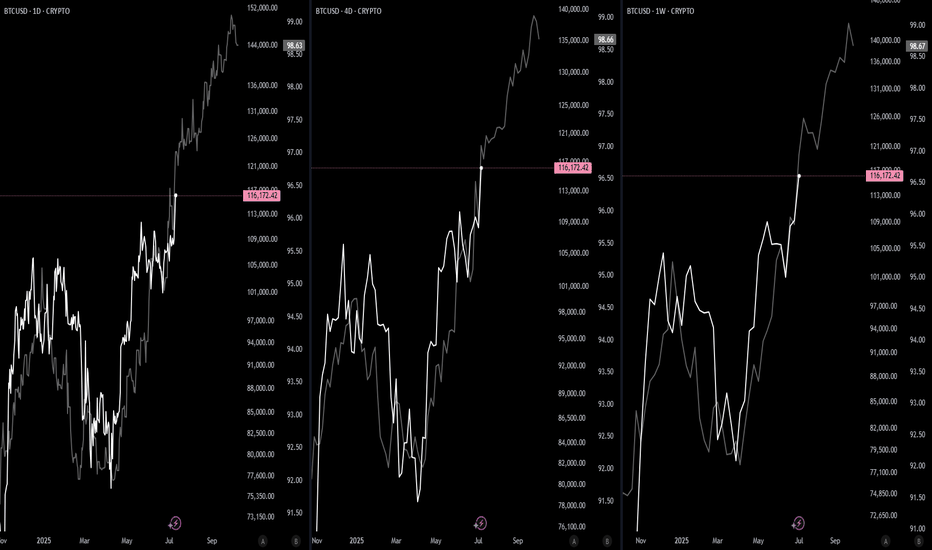

Bitcoin’s Incoming Bear Market!🚀 Bitcoin’s Bullish Phase: The Final Push Before the Fall?

Bitcoin is currently in the parabolic uptrend phase of its halving cycle, with price action closely following historical patterns. Since the last halving on April 15, 2024, Bitcoin has mined approximately 42,480 blocks, pushing the market closer to the 70,000-block threshold where the trend historically reverses into a deep bear market.

Based on historical patterns, Bitcoin’s next major bull market peak is expected around 150,000 USD, approximately 70,000 blocks post-halving (projected for August 2025). However, investors must prepare for what follows—a severe bear market fuelled by miner capitulation.

🔥The 70,000-Block Bearish Reversal: Why It Happens Every Cycle

1. The Mining Difficulty Trap & Rising Costs

Bitcoin’s mining difficulty adjusts every 2,016 blocks (~2 weeks) to maintain the 10-minute block interval.

As BTC price surges in the bull market, more miners join the network, driving competition and difficulty higher.

This raises mining costs and squeezes profit margins, making it harder for smaller miners to stay afloat.

✅ Bull Market (~0-70,000 Blocks Post-Halving)

High BTC prices offset increased difficulty, allowing miners to hold rather than sell.

Low sell pressure from miners keeps Bitcoin in an uptrend.

❌ Bear Market (~70,000 Blocks Post-Halving)

After BTC peaks, prices decline but difficulty remains high.

Mining costs remain constant, while block rewards drop.

Weaker miners can’t afford to mine at a loss and are forced to sell their BTC holdings to cover operational expenses.

2. The Snowball Effect: How Miner Capitulation Triggers a Crash

Once inefficient miners begin selling, a chain reaction unfolds:

1️⃣ Bitcoin price starts declining after the cycle peak (~12-18 months post-halving).

2️⃣ Miners struggle to remain profitable due to high difficulty and lower block rewards.

3️⃣ Miners begin offloading BTC to cover expenses, increasing supply in the market.

4️⃣ More BTC supply leads to further price drops, triggering panic selling.

5️⃣ Additional miners shut down operations, selling off reserves, further flooding the market.

6️⃣ Capitulation accelerates, causing a cascading effect similar to leveraged liquidations seen in past bear markets.

🔄 This cycle repeats until enough miners exit, difficulty adjusts downward, and BTC stabilizes.

3. Historical Proof: How Miner Capitulation Has Marked Every Bear Market

Each Bitcoin bear market aligns with major miner capitulation events. Here’s how past cycles have played out:

📌 2012 Halving: Bull top in late 2013, miner capitulation in 2014, BTC fell -80%.

📌 2016 Halving: Bull top in late 2017, miner capitulation in 2018, BTC fell -84%.

📌 2020 Halving: Bull top in late 2021, miner capitulation in 2022, BTC fell -78%.

📌 2024 Halving: Expected bull top in late 2025, miner capitulation likely in 2026?, BTC decline TBD but estimated to be around -60%.

🔹 In all cases, BTC topped ~70,000 blocks after the halving, followed by a deep drawdown driven by miner capitulation.

🔹 The selling pressure from miners perfectly aligns with the start of major market crashes.

4. The Accumulation Phase: What Follows the Crash?

After miners capitulate and difficulty adjusts downward, Bitcoin enters a sideways accumulation phase (~140,000-210,000 blocks post-halving).

Weaker miners have already exited, reducing sell pressure.

Surviving miners adjust to lower rewards and stop mass selling BTC.

Smart money (whales & institutions) begin accumulating at undervalued prices.

The MVRV ratio drops below 1, signalling a market bottom.

Bitcoin stabilizes, setting the stage for the next bull cycle.

This predictable recovery cycle lays the groundwork for Bitcoin’s next exponential rally into the next halving period.

The Bitcoin Bear Market Prediction for 2025-2026

✅ Bitcoin is currently on track to peak near ~$150,000 around 70,000 blocks post-halving (August 2025).

✅ Following this, BTC is expected to enter its bear market, with prices potentially falling to ~$60,000 (by December 2026).

✅ The primary catalyst for this crash will be miner capitulation, just as it has been in every prior cycle.

Final Thoughts

If history repeats, the Bitcoin market is set to follow a sharp parabolic rise to ~$150,000 before undergoing a 70,000-block miner-driven selloff into a multi-month bear market. Investors should be aware of this pattern and plan accordingly.

Sources & Data Validation

The insights presented in this article are based on historical Bitcoin price cycles, on-chain analytics, and mining difficulty trends from various sources, including:

Blockchain Data (Glassnode, CoinMetrics)

Historical BTC Halving Data (Bitcoin Whitepaper, Blockchain Explorers)

Market Analysis Reports (Messari, Arcane Research)

Macroeconomic Influences (Federal Reserve Reports, Global Liquidity Cycles)

Disclaimer: Not an Investment Recommendation

This article is for informational purposes only and should not be considered financial or investment advice. Bitcoin and cryptocurrency markets are highly volatile, and past performance is not indicative of future results. Conduct your own research and consult with a financial professional before making any investment decisions.

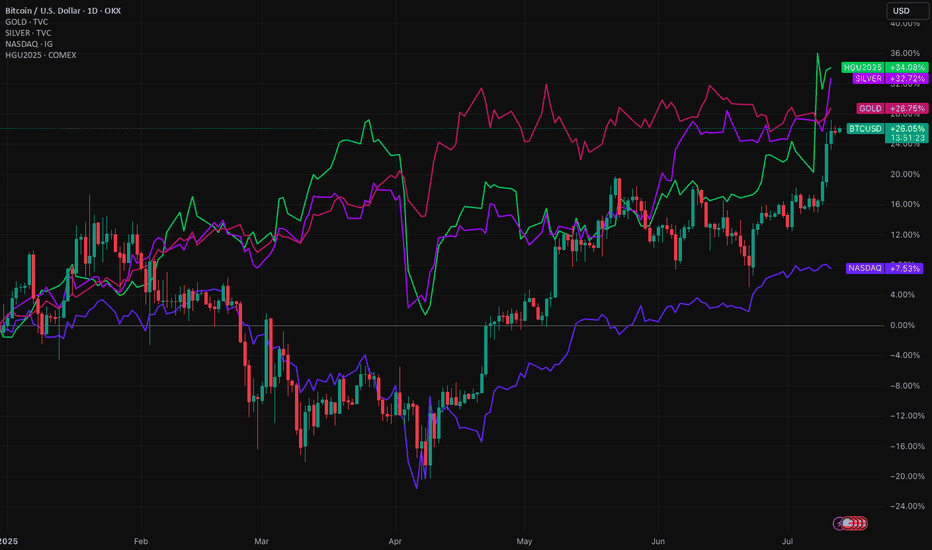

Bitcoin pushes higher, but its not the only game in townBitcoin is up around 26% this year. A strong gain. But it’s not alone. The higher Bitcoin rises, the less the gains become in percentage terms. It's now in a different league, so a $1,000 or $10,000 move its necessarily what it used to be.

Meanwhile, Gold, silver and copper have also pushed higher in 2025. The Nasdaq 100 is up too. All signs point to a weakening US dollar.

When risk assets and commodities rally together, it's a signal. Investors are shifting. Not out of fear, but to diversify away from the dollar. This is a theme that’s building strength.

Gold is up nearly over 25% YTD. Silver even more. Copper, the industrial bellwether, has joined the rally. These aren’t just trades. They’re strategic moves. A hedge against dollar debasement, inflation, and long-term fiscal risks in the US.

The Nasdaq’s rise tells a similar story. Tech stocks benefit when yields fall and the dollar softens. Big tech also has global revenue exposure. A weaker dollar inflates their earnings in foreign currencies.

What ties all this together? Loss of confidence in the dollar as the sole reserve hedge. Too much debt, too much printing. Central banks know it. They’ve been buying gold for years. Now, retail and institutional investors are catching on.

Bitcoin, the digital alternative to gold, gets the headlines. But it’s part of a broader move. The USD remains the world’s most important currency. That’s not changing tomorrow. But its dominance is being questioned in ways we haven’t seen in decades.

This isn’t just a crypto rally. It’s a dollar diversification play. And it’s gaining momentum.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

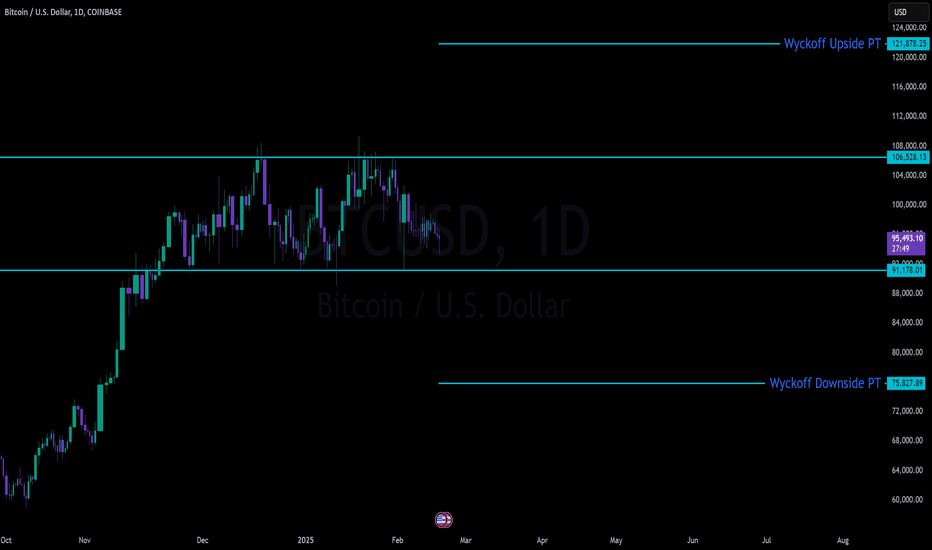

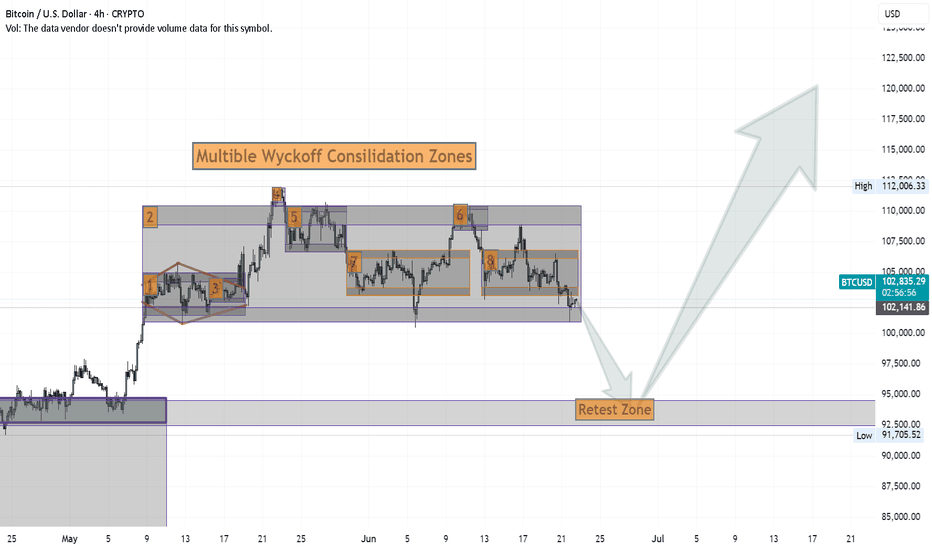

BTC Massive SetupConsolidation for months between 91k and 106k

- Classic Wyckoff setup as an accumulation/distribution

- Price targets of: 121.878 (122k is the popular target) to the upside with 75,827 on the down

- Saylor today put out news to be raising another $2 billion to buy BTC. Either he is going to be able to hold the floor or get washed out

- Trade can be taken with confirmation of breakout on either side pretty easily as momentum will be so strong that being on the wrong side will most likely be an immediate stop out

BTC: Buy idea: Bearish ChannelOn BTC we are in a bearish channel situation with a succession of numerous red candles. In such circumstances, we would have a high probability of seeing the market go up. This rise will be impressive if the resistance line is broken forcefully by a large green candle and followed by a large green volume. Good luck everyone!!!

[UPD] Trend analysis: BTC / ETH / SOL / XRP and other Just recorded a new video overview of the crypto market and the current trend developments in major coins: CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , CRYPTOCAP:LINK , GETTEX:HYPE , BSE:SUPER , $FLOKI.

Among the new assets on my radar I shared my view on the trend structure of $RENDER.

In my personal investment planning, I continue to treat any potential corrections into key support zones as opportunities to add or open new positions.

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

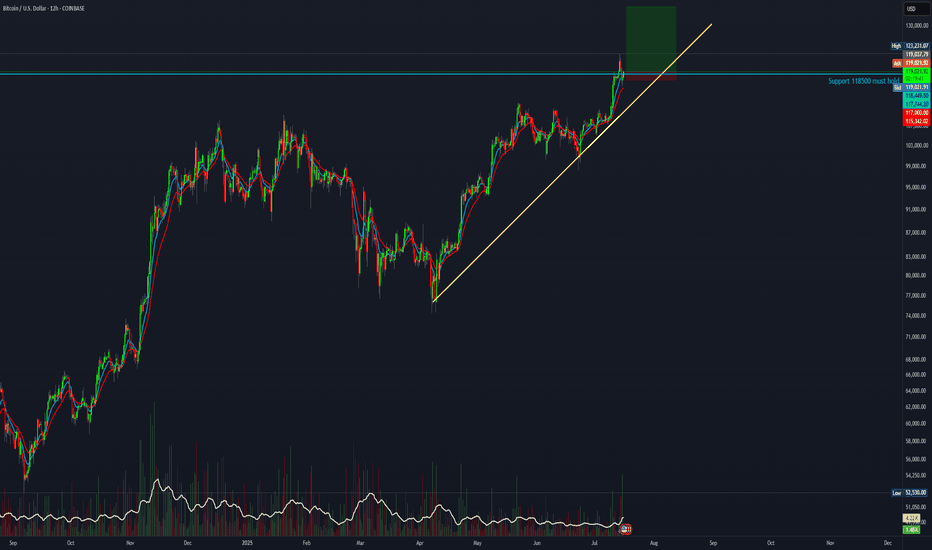

Wyckoff Structure Targets 92K–94K Retest Before Continuation!A rare and highly instructive market structure is currently unfolding, presenting a textbook case of Wyckoff pattern integration across multiple timeframes.

Over the past weeks, I’ve been tracking a series of smaller Wyckoff accumulation and distribution patterns nested within a larger overarching Wyckoff structure. Each of these smaller formations has now successfully completed its expected move — validating the precision of supply/demand mechanics and the theory’s predictive strength.

With these mini-cycles resolved, the spotlight now shifts to the final, dominant Wyckoff structure — a larger accumulation phase that encompasses the full breadth of recent market activity. According to the logic of Phase C transitioning into Phase D, price appears poised to revisit the key retest zone between 92,000 and 94,000, a critical area of prior resistance turned demand.

📉 Current Market Behavior:

📐 Multiple minor Wyckoff patterns (accumulations/distributions) have played out as expected, both upward and downward — lending high credibility to the current macro setup.

🧩 All formations are nested within a major accumulation structure, now in the final phase of testing support.

🔁 The expected move is a pullback toward the 92K–94K zone, before the markup phase resumes with higher conviction.

📊 Wyckoff Confidence Factors:

✅ All Phase C spring and upthrust actions respected

✅ Volume behavior aligns with Wyckoff principles (climactic action → absorption → trend continuation)

✅ Clean reaccumulation signs within current structure

✅ Institutional footprint visible through shakeouts and well-defined support/resistance rotations

💬 Observation / Call to Action:

This setup is a rare opportunity to witness multi-layered Wyckoff theory in motion, offering not only a high-probability trading setup but also an educational blueprint. I invite fellow traders and Wyckoff analysts to share their interpretations or challenge the current thesis.

➡️ Do you see the same structural roadmap?

Let’s discuss in the comments.

Price action is the vehicle—but these charts show the road aheadIn the world of trading, technical analysis often gets the spotlight—candlesticks, moving averages, and indicators. But beneath every price movement lies a deeper current: macroeconomic forces. These forces shape the environment in which all trades happen.

Great traders don’t just react to price—they understand the context behind it. That context is found in macro charts: the financial “weather maps” of markets. These charts reveal whether capital is flowing toward risk or safety, whether inflation is heating up or cooling down, and whether liquidity is expanding or shrinking.

In this post, we’ll explore 10 macro charts that can elevate your edge, backed by proven examples of how they’ve helped traders stay on the right side of the market. These aren't just charts—they’re market truths in visual form.

1️⃣ DXY – U.S. Dollar Index

Why it matters:

The U.S. dollar affects everything: commodities, stocks, global trade, and especially forex. The DXY measures its strength against major currencies.

📉 Chart Reference:

In 2022, DXY surged past 110 due to aggressive Fed rate hikes. This crushed EURUSD, pressured gold, and triggered a global risk-off move. Traders who tracked DXY rode USD strength across the board.

💡 Use it to: Confirm trends in FX and commodities. Strong DXY = bearish pressure on gold and risk assets.

2️⃣ US10Y – 10-Year Treasury Yield

Why it matters:

This is the benchmark for interest rates and inflation expectations. It guides borrowing costs, equity valuations, and safe-haven flows.

📉 Chart Reference:

In 2023, the 10Y spiked from 3.5% to nearly 5%, leading to weakness in growth stocks and boosting USD/JPY. Bond traders saw it first—equities followed.

💡 Use it to: Anticipate moves in growth vs. value stocks, and confirm macro themes like inflation or deflation.

3️⃣ Fed Dot Plot

Why it matters:

This is the Fed’s forward guidance in visual form. Each dot shows where a policymaker expects interest rates to be in the future.

📉 Chart Reference:

In Dec 2021, the dot plot signaled a faster pace of hikes than the market expected. Those who caught the shift front-ran the USD rally and equity correction in early 2022.

💡 Use it to: Predict future rate policy and align your macro bias with the Fed's path.

4️⃣ M2 Money Supply (US)

Why it matters:

This chart tracks the amount of money in the system. More liquidity = fuel for risk. Less = tightening conditions.

📉 Chart Reference:

After COVID hit, M2 exploded, leading to a major bull run in stocks and crypto. When M2 began contracting in 2022, asset prices peaked and reversed.

💡 Use it to: Gauge macro liquidity conditions. Expansion is bullish; contraction is dangerous.

5️⃣ Copper/Gold Ratio

Why it matters:

Copper is a growth metal; gold is a fear hedge. Their ratio acts as a risk-on/risk-off indicator.

📉 Chart Reference:

In 2021, the copper/gold ratio surged—signaling growth and optimism. This preceded strong gains in cyclical equities and commodity currencies like AUD and CAD.

💡 Use it to: Confirm risk sentiment and lead equity or FX trends.

6️⃣ VIX – Volatility Index

Why it matters:

VIX tracks expected volatility in the S&P 500. It's often called the "fear index."

📉Chart Reference :

In March 2020, VIX spiked to nearly 90 as COVID panic set in. This extreme fear was followed by one of the greatest buying opportunities of the decade.

💡 Use it to: Time entries and exits. High VIX = fear = possible reversal. Low VIX = complacency = caution.

7️⃣ Real Yields (10Y TIPS - CPI)

Why it matters:

Shows the inflation-adjusted return on bonds. Real yields affect gold, tech, and risk appetite.

📉Chart Reference :

In 2022, real yields went from deeply negative to positive—crushing gold and high-growth stocks.

💡 Use it to: Confirm direction in gold, NASDAQ, and broad macro trends.

8️⃣ Oil Prices (WTI or Brent)

Why it matters:

Oil is both a growth and inflation input. Rising prices mean higher costs and often precede policy tightening.

📉Chart Reference :

Oil’s rally in early 2022 foreshadowed CPI spikes and led central banks to turn hawkish. Traders who tracked it saw inflation risks building early.

💡 Use it to: Forecast inflation, assess energy-related equities, and understand global demand.

9️⃣ Global PMIs (Purchasing Managers’ Indexes)

Why it matters:

Leading indicator of economic health. PMIs above 50 = expansion. Below 50 = contraction.

📉 Chart Reference:

In 2023, China’s PMI consistently printed below 50—signaling manufacturing weakness and global demand concerns. This helped traders avoid overexposure to emerging markets.

💡 Use it to: Gauge growth momentum globally and regionally.

🔟 SPX vs. Equal-Weighted SPX (Breadth Divergence)

Why it matters:

Shows whether the S&P 500 rally is broad-based or just driven by a few megacaps.

📉Chart Reference :

In early 2024, the index made new highs—but the equal-weighted version lagged badly. That divergence warned traders of a fragile rally.

💡 Use it to: Detect weakness beneath the surface and avoid false confidence in rallies.

🧠 Nerdy Tip: Macro Is the Invisible Hand

These charts don’t give you trade entries—but they give you conviction, timing, and perspective.

When you combine macro context with technical setups, you trade in sync with the market’s deeper rhythm.

So before you place your next trade, ask yourself:

What are yields doing?

Is liquidity expanding or drying up?

Is risk appetite rising or falling?

put together by : @currencynerd as Pako Phutietsile

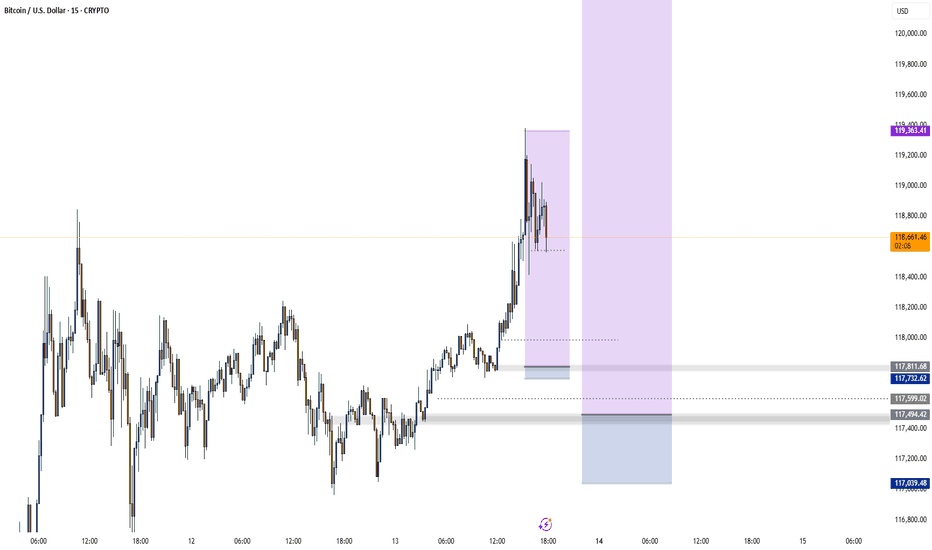

BTCUSD (Bitcoin): Forex Technical AnalysisDate: 11 July 2025

Momentum: Up

First Scenario : long positions above 115,706.14 with targets at 117,269.52, 117,904.51 and 118,513.05

Second Scenario : short positions below 115,706.14 with targets at 114,544.35, 113,774.89 and 113,053.39

Comment: RSI - Bullish.

Supports and resistances :

118,513.05 **

117,904.51 *

117,269.52

116,747.25 - Last price

114,544.35

113,774.89 *

113,053.39 **

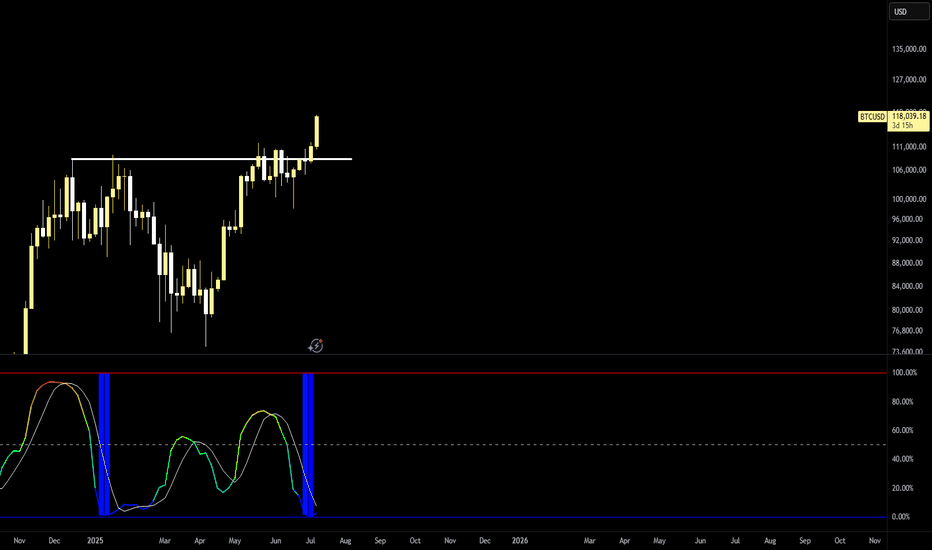

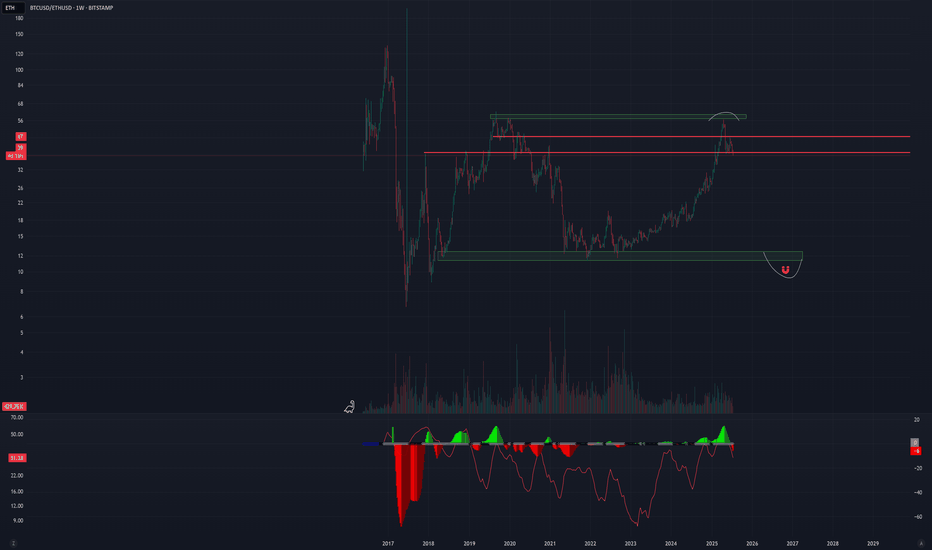

BTC-M2!Sooo much liquidity out there currently! I think everyone calling for 150 as the cycle pico top are being bearish. As I have said before, I predict that BTC will take the full cycle and max out its potential early to mid October.

My thesis for over a year...

Base -- 160

Norm -- 220

Bull -- 280

FYI, the M2 adjustments as shown...

1D -- 90

4D -- 22

1W -- 12

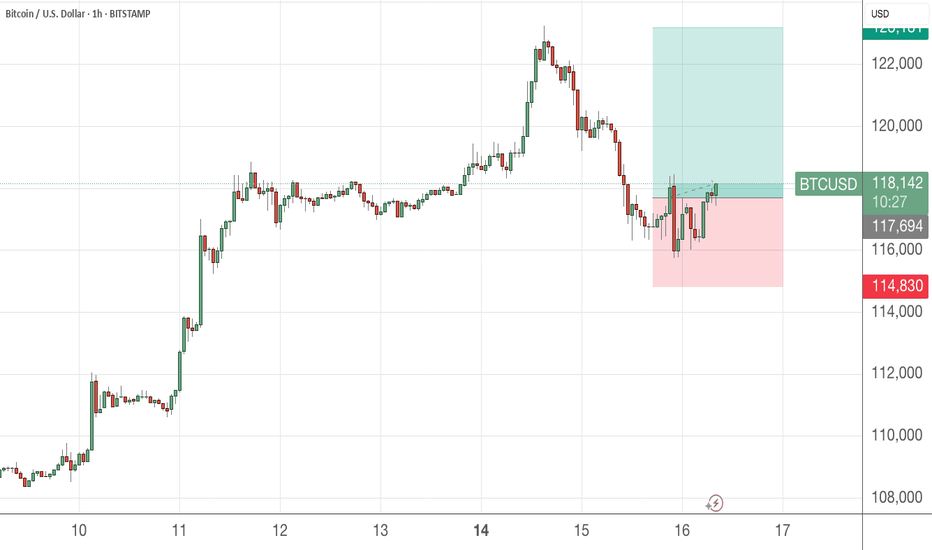

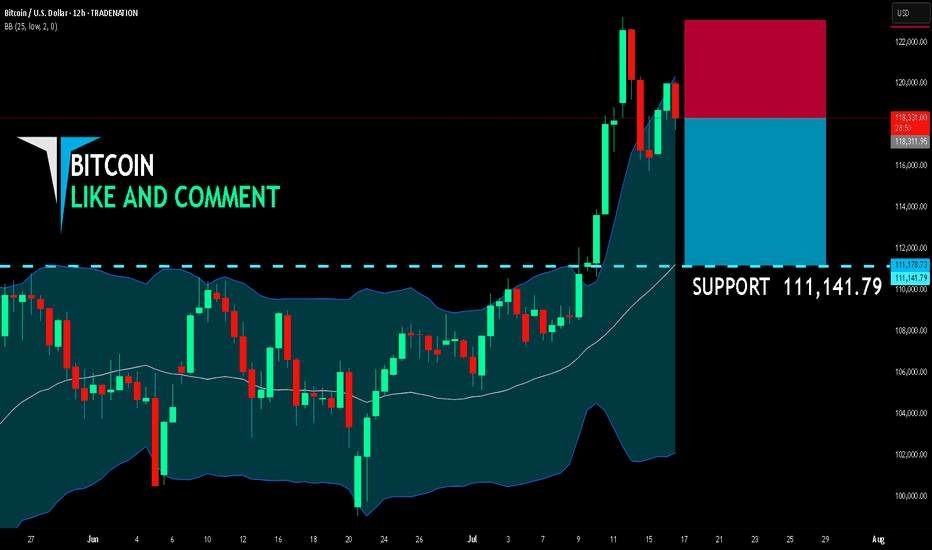

BITCOIN SHORT FROM RESISTANCE

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 118,311.95

Target Level: 111,141.79

Stop Loss: 123,054.98

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

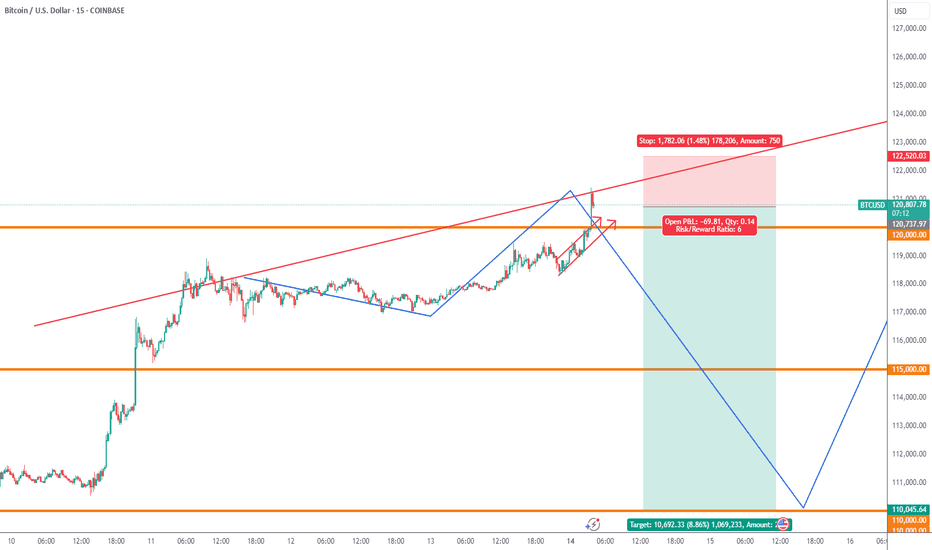

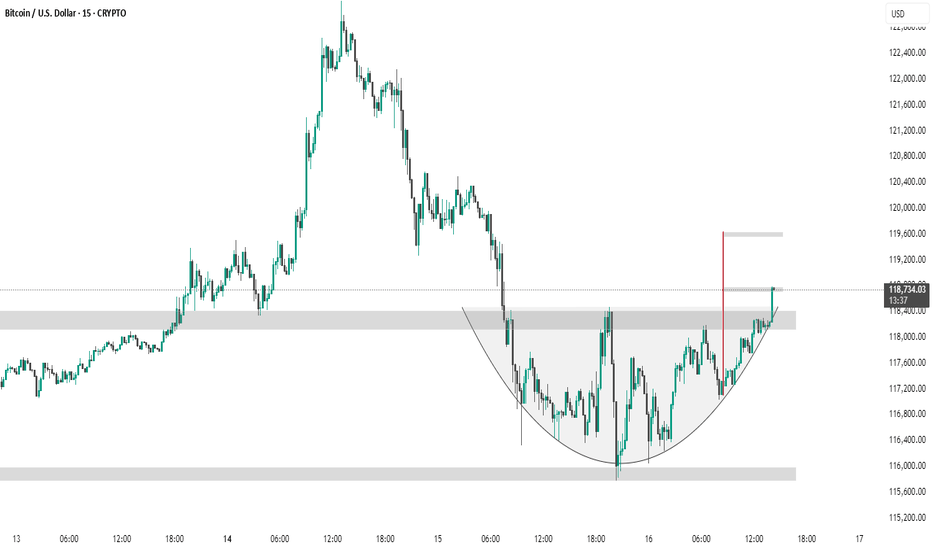

BTC #ARC Structure has breakout its levelThe chart shows a 15-minute BTC/USD timeframe forming a cup and handle pattern, a bullish continuation signal. Price has broken above the handle resistance zone (~$118,400), suggesting a potential breakout. The red vertical line marks the expected target, projecting a move toward the $119,600 level based on the pattern height.

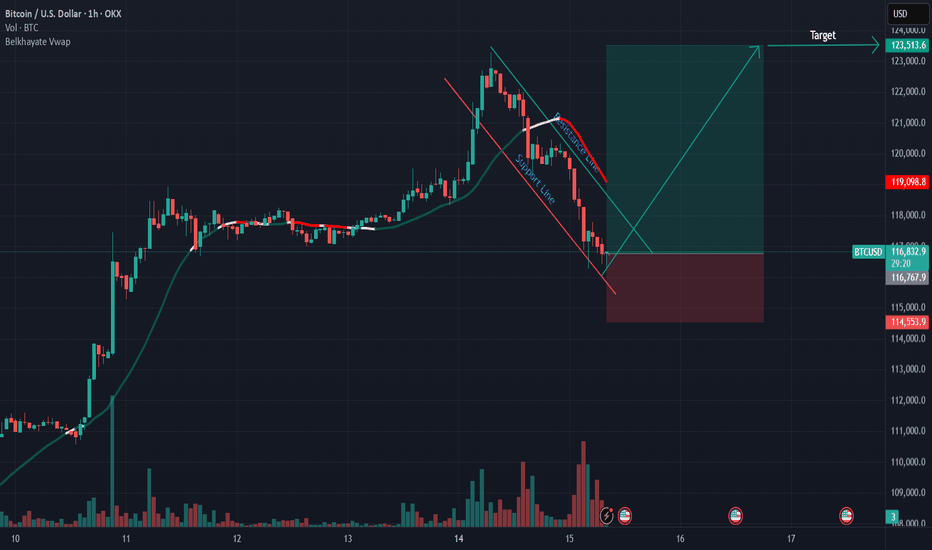

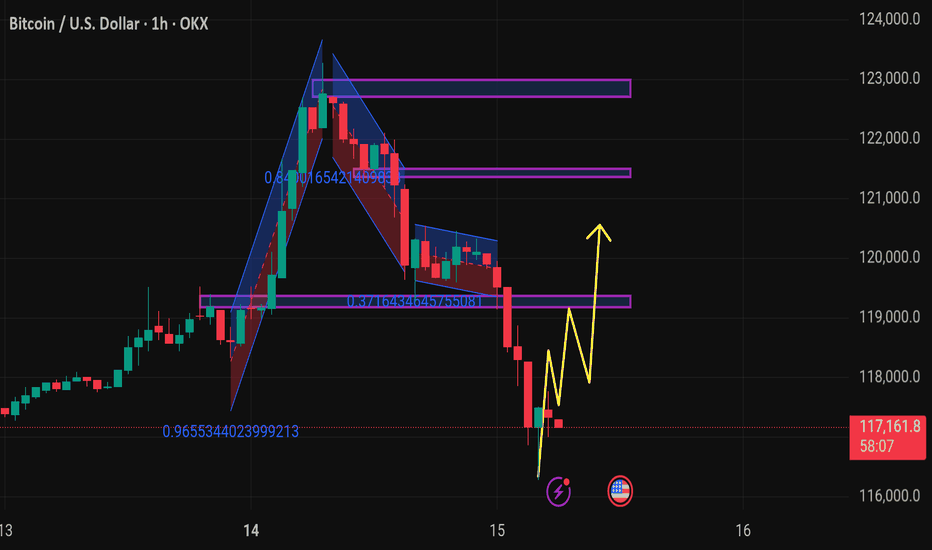

Btcusd techinical analysis.This chart shows the Bitcoin (BTC) / USD 1-hour timeframe on OKX, with several technical analysis elements:

Key Observations:

1. Price Action:

Current price: $117,334.1, showing a −2.14% decline.

Price has dropped from around $123,000 down to $117,000, indicating a sharp bearish movement.

2. Harmonic/Pattern Zones:

The chart contains harmonic pattern structures with Fibonacci ratios:

The large upswing has a retracement level of 0.9655, nearly a full retracement.

A downward channel/retracement touches 0.8416, indicating a deep pullback.

Another smaller retracement at 0.3716, a shallower correction.

3. Support and Resistance Zones:

Multiple horizontal purple zones mark areas of past price reactions:

Around 121,000, 119,000, and 117,000 levels.

Price is currently testing the 117,000 support zone.

4. Projected Price Path (Yellow Arrows):

The projected movement shows a potential bullish recovery:

Minor pullbacks are expected, followed by higher highs.

The target appears to aim back toward the 119,000 – 120,000 resistance zone.

5. Icons on Chart

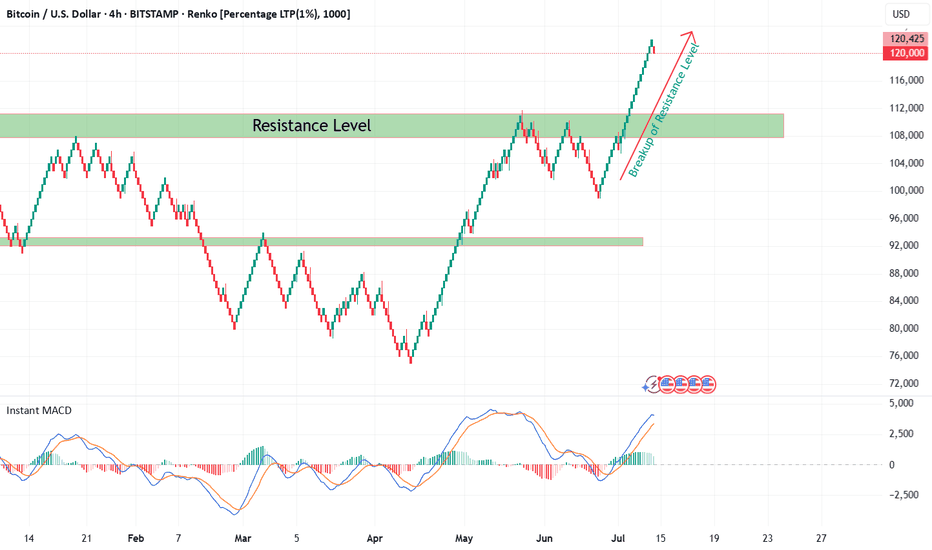

Bitcoin Renko Breakout Confirmation with CryptoQuant NetflowFrom late 2024 till now, Bitcoin (BTC/USD) was consolidating within a broad sideways range between well-defined support and resistance levels on the 4H Renko chart. During this time, market indecision was obvious as neither bulls nor bears could establish dominance.

Recently, BTC has decisively broken out above the major resistance zone at ~$108,000 — as seen with my custom Renko + Decision Tree + S/R Channel script ( ). This breakout above resistance technically suggests the end of range-bound price action and the potential start of a new bullish trend, especially when confirmed by on-chain data.

On-Chain Netflow Confirmation

As I originally highlighted in my CryptoQuant Netflow analysis (published under the username ‘cryptoonchain’ on CryptoQuant platform):

Total Exchange Netflow for Bitcoin has recently dropped to its lowest level since February 16, 2023 — at which point the last bullish cycle began.

Negative Netflow means more BTC is being withdrawn from exchanges than deposited, indicating reduced selling pressure and strong holder conviction.

Binance-specific Netflow also confirms massive outflows, a sign whales and large traders are accumulating and withdrawing funds from trading venues.

Historically, this combination — a technical breakout (Renko) and deep negative on-chain netflow (dataset: CryptoQuant) — has preceded major bull runs.

Summary

Based on both my Renko model and current on-chain flows:

The breakout above 108,000 resistance marks the start of a likely new uptrend for BTC (now 119,000).

On-chain data via CryptoQuant strongly supports the bullish scenario.

Invalidation

If BTC returns below $108,000 and consolidates there, this bullish outlook is invalidated and a reassessment is required.