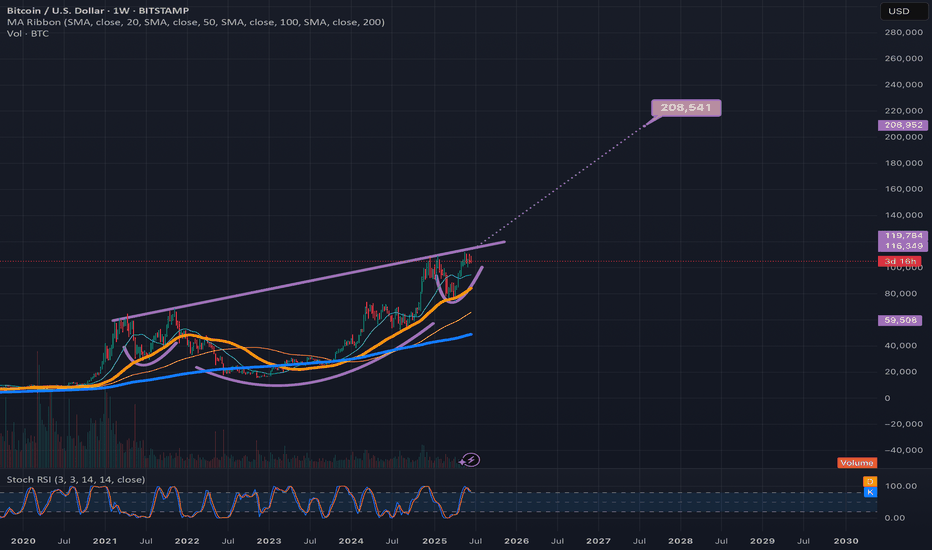

Ascending Inverse H&S on the BTC weekly chartThe longer it takes to break above this neckline the higher the breakout target will be. I have arbitrarily placed the measured move line at July 18th 2025. If the breakout were to happen on that day the measured move target is around 208k, which could take quite awhile to reach or if we entered a truly hyperparabolic blow off top we could reach such a target way quicker than when the dotted measured move line reaches it. *not financial advice*

BTCUSD.PM trade ideas

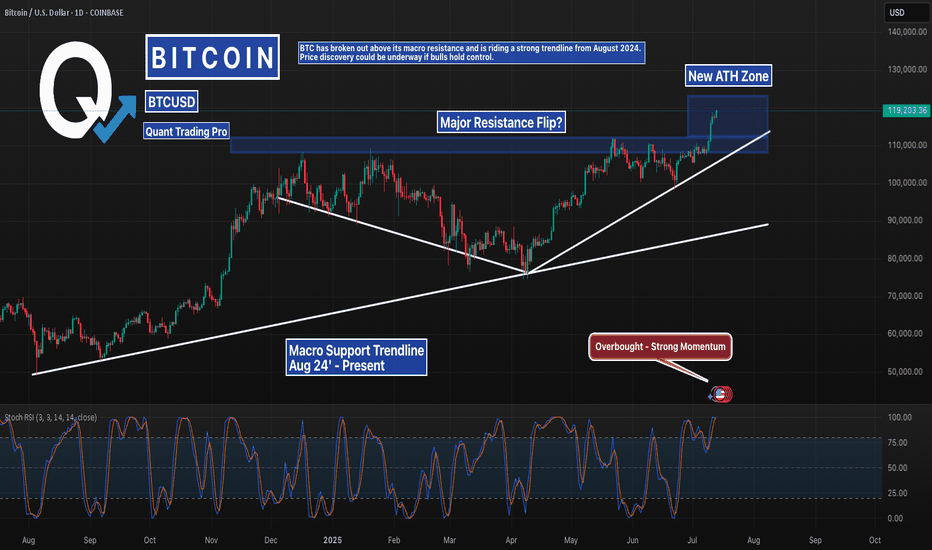

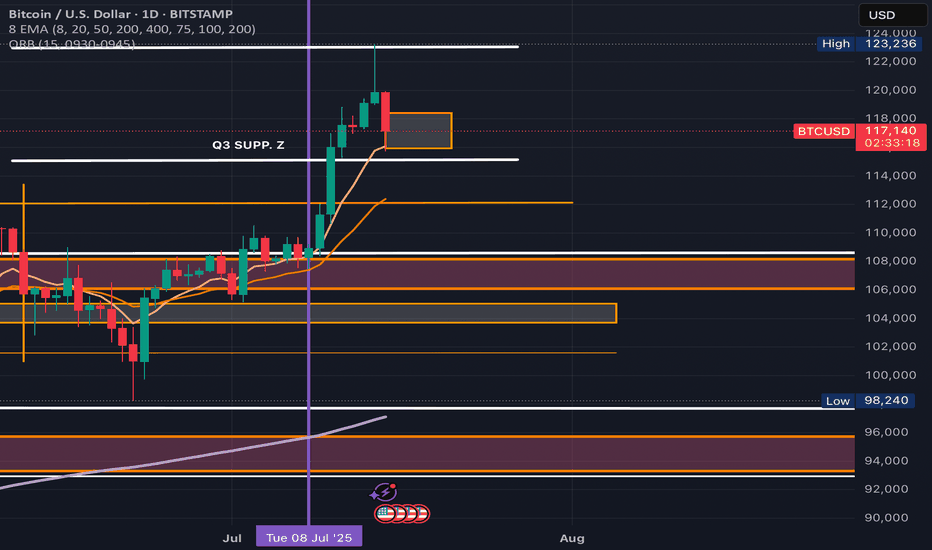

Bitcoin Breakout Confirmed – Eyes on Price DiscoveryBitcoin has officially flipped its macro resistance zone into support, continuing to follow a clean ascending structure from August 2024. With Stoch RSI pushing into overbought and no clear ceiling above, BTC may be entering a price discovery phase.

Stay alert for continuation or potential retest around $111K.

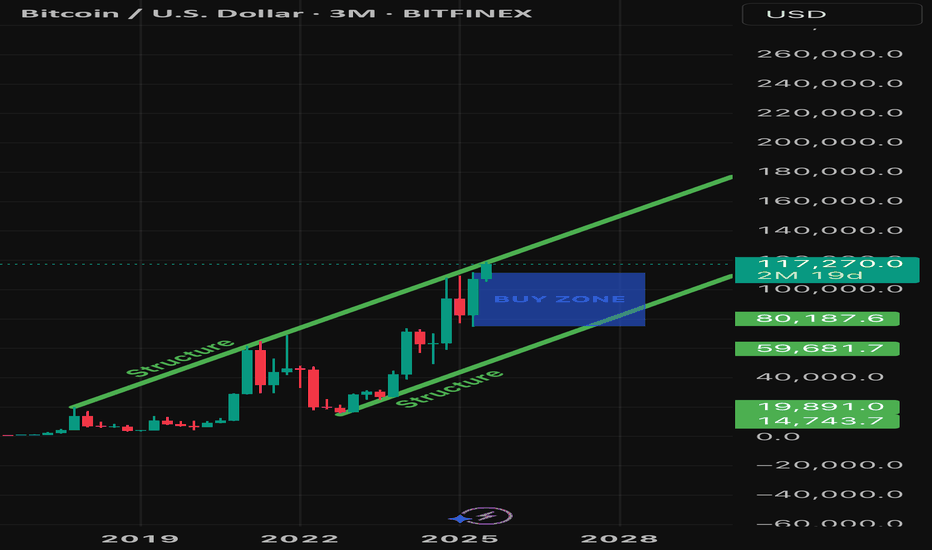

Bitcoin’s ForecastWho knows how high Bitcoin will go but my guess is between 300/350k. What I may know ahead of time is where price may fall, for the buy. I labeled the buy zone which I believe will trigger in January 2027 based off of the pattern Bitcoin has created. I’ve noticed a couple years ago that the best time to buy Bitcoin is in January, the year after being bearish. This is the pattern and you can check for yourselves: 3 years bullish, approximately 1 year bearish. January of 2027 may begin the next bull cycle that could last for 3 years. Stay tuned!

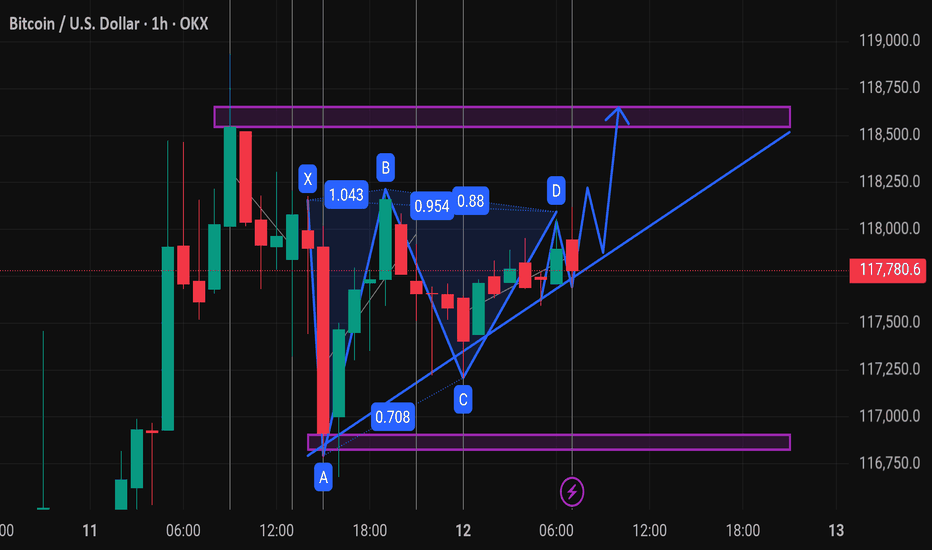

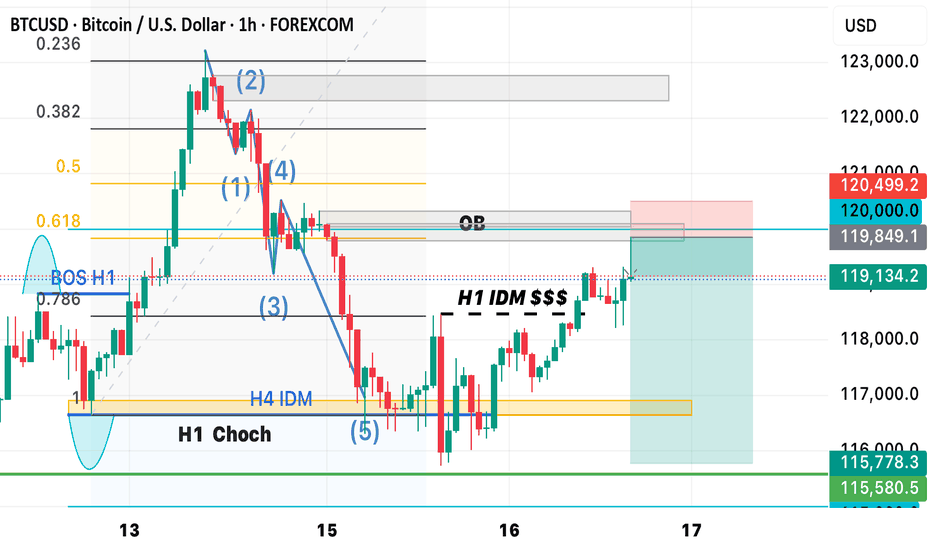

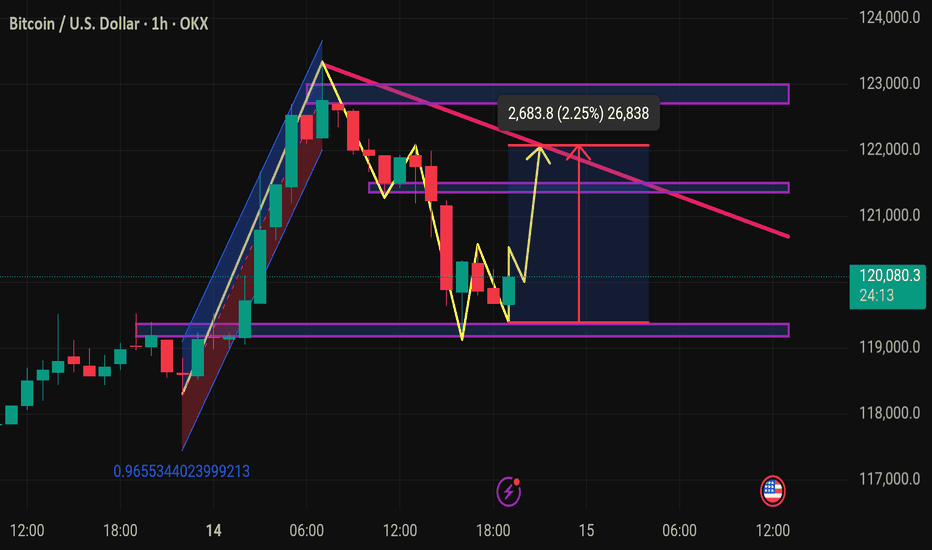

Btcusd techinical analysis.This chart displays a 1-hour candlestick analysis for Bitcoin (BTC/USD) on OKX, with a focus on harmonic pattern recognition and technical price projections.

Here's a breakdown of what the chart suggests:

---

🔷 Harmonic Pattern: Potential Bullish Bat or Gartley

The marked XABCD structure appears to form a harmonic pattern, likely a Bullish Gartley or Bat:

XA: Initial impulse leg.

AB: Retraces ~61.8–78.6% of XA.

BC: Retraces ~38.2–88.6% of AB.

CD: Extends to complete the pattern near the D point.

✅ Ratios like:

AB ≈ 0.618–0.786 of XA

BC ≈ 0.618–0.886 of AB

CD ≈ 1.272–1.618 of BC support this classification.

---

📈 **Ascending Triangle

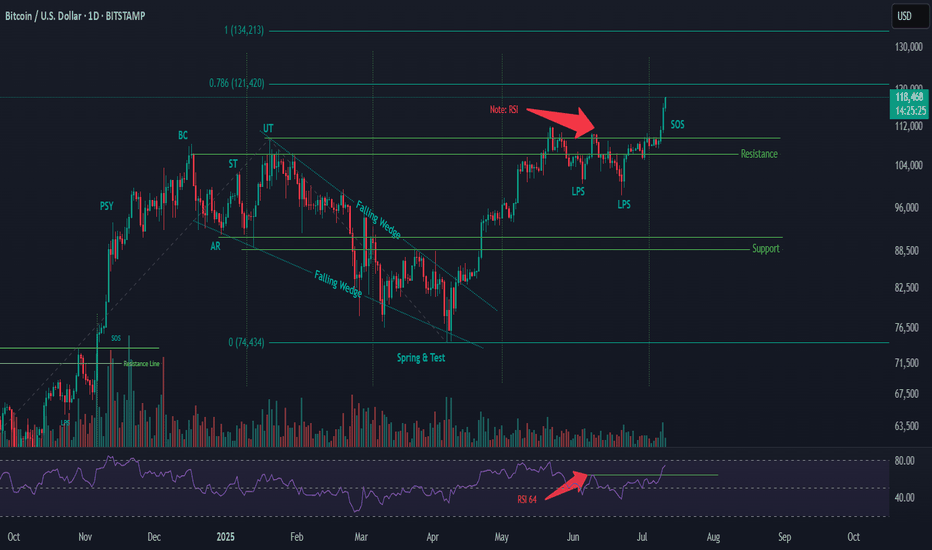

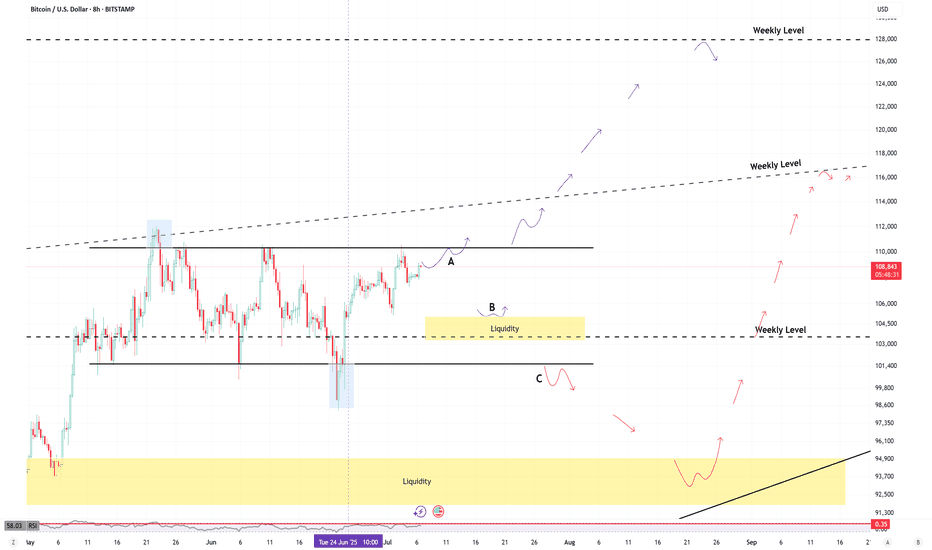

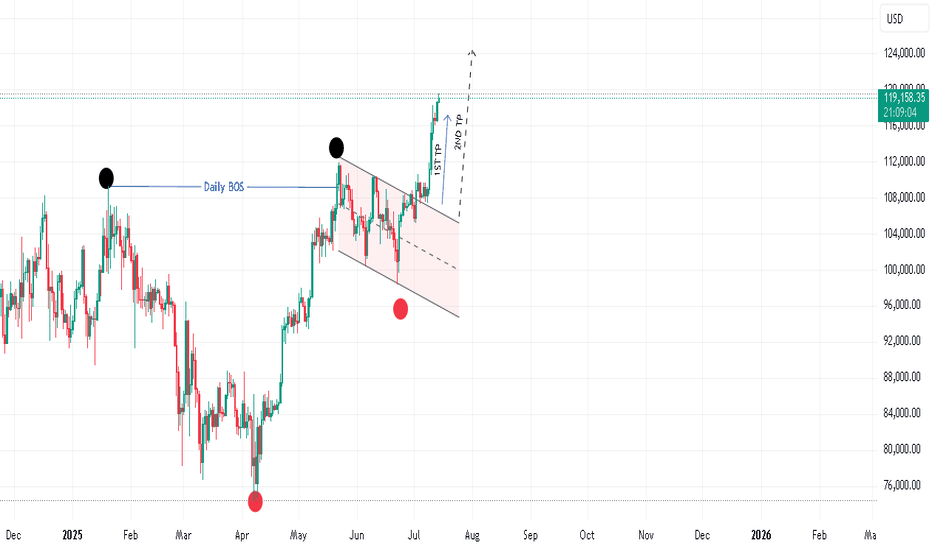

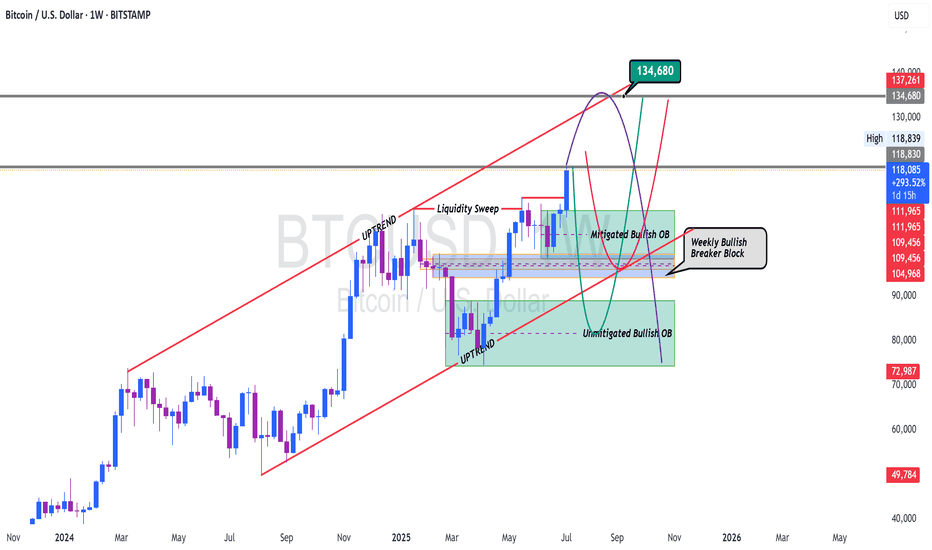

Wyckoff Re-Accumulation (Phase 2) – BTC Market Structure AnalysiThis is an updated outlook on BTC’s current price structure based on Wyckoff methodology.

🔹 Structure Overview:

BTC has broken out above its previous resistance and reached a new ATH. Based on current price action and volume behavior, I believe we are at the Sign of Strength (SOS) phase in a Wyckoff Re-Accumulation Phase 2.

Key Wyckoff Labels in this structure:

PSY – Preliminary Supply

BC – Buying Climax

AR – Automatic Rally

ST – Secondary Test

UT – Upthrust

LPS – Last Point of Support

SOS – Sign of Strength

(For those unfamiliar with the terms, I suggest looking up the Wyckoff Method for detailed definitions.)

The breakout is happening with volume support, and we’ll need to observe how sustained the demand is.

🔹 RSI Observation:

In June, RSI pivoted at 64, and has now reached 73

Both price and RSI are printing higher highs

Daily RSI has not yet reached overbought territory (80+)

If RSI crosses above 80 and then rolls over, it could signal a bearish divergence → followed by a retracement

🔹 Possible Scenarios (3 Outcomes I’m Watching):

📈 Another Re-Accumulation Phase forms after this move

🧊 Market tops out at ATH and enters a Distribution Phase

🚀 A parabolic move (Blow-off Top) happens, followed by a sharp crash and Distribution

🔹 My Personal Trading Plan:

As price enters the next phase, I’ll be watching closely for signs of PSY and BC (Preliminary Supply & Buying Climax). If bearish divergence aligns with these, it may indicate an upcoming retracement.

Once BC forms, I expect an AR (Automatic Reaction) to follow

I’ll look for short entries during the retracement

A Trading Range could form between the BC (resistance) and AR (support)

⚠️ Be cautious of fakeouts, especially during breakout attempts at the range boundaries.

🔹 Price Projection (Fibonacci Extension – For Reference Only):

Using Fibonacci Extension based on the following price coordinates:

Point A: 49,577

Point B: 109,356

Point C: 74,434

🎯 Target Zones:

0.786 extension → 121,420

1.000 extension → 134,213

Again, these are not predictions — just reference points based on market structure.

🔹 Final Note:

This analysis reflects my personal interpretation of the current market structure. Price action can change rapidly based on macro and technical factors. Patterns and phase transitions may take days or even weeks to fully develop.

Feel free to share your thoughts, criticisms, or alternate views — I’m open to feedback from fellow traders.

#Wyckoff #BTC #Bitcoin #CryptoTA #Reaccumulation #TradingPlan #TechnicalAnalysis #RSI #FibExtension #MarketStructure

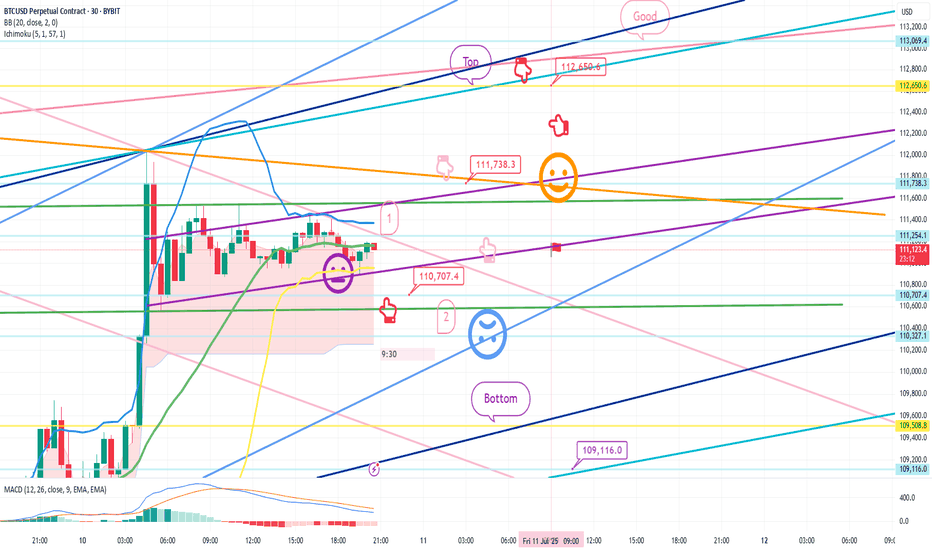

July 10 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here is the Bitcoin 30-minute chart.

There will be a Nasdaq indicator announcement at 9:30 in a little while.

There is a high possibility that Nasdaq will shake up and down significantly,

but Bitcoin still looks safe in terms of signal and pattern.

In the analysis article on July 7,

I connected the strategy as it was at the last long position entry point of 107,484 dollars.

*When the red finger moves,

it is a one-way long position strategy.

1. 110,707.4 dollars long position entry point / stop loss price when the sky blue support line breaks

2. 111,783.3 dollars long position 1st target -> Top 2nd -> Good 3rd target price

The 1st section at the top is today's best short position entry point,

and the 2nd section at the bottom is a sideways market.

In the middle, with a pink finger,

I left a re-entry position after liquidating a long position, so

I think it would be good to use it.

From the breakout of the sky blue support line, it can be pushed to Bottom -> 109,116 dollars.

The report is not yet renewed,

but from now on, it will be very important, right?

This week, it seems like it will continue to shake up and down,

so I hope you operate safely with principle trading and stop loss prices.

Thank you.

BTC / ETH / SOL / XRP / HYPE: Potential Trend StructuresIn this video, I share my current daily and weekly analysis on the trend structures of BTC, ETH, SOL, XRP, and HYPE, highlighting key support and resistance zones to watch in the coming sessions.

Charts featured in the video:

BTC

ETH

SOL

XRP

HYPE

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking feel free to ask in the comments (just don’t forget to boost the idea first 😉).

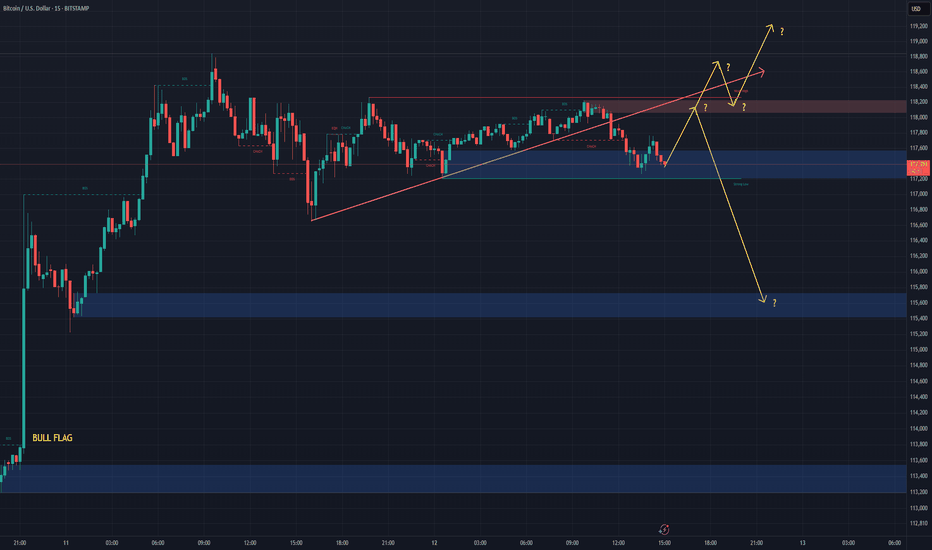

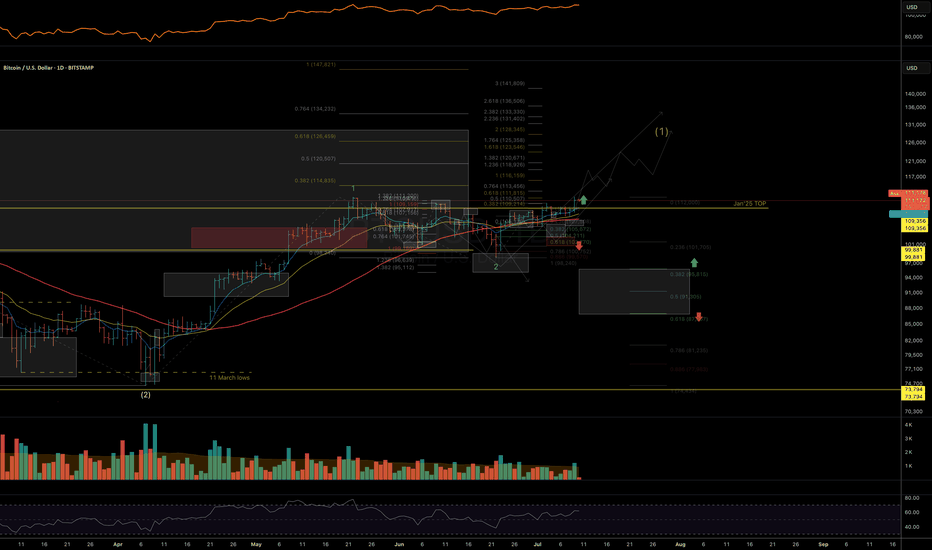

BTC Summer Roadmap: Key Levels & Breakout ScenariosBTC has retested the weekly resistance trendline (around $114K) that has been in place since February 2021. Over the past 4 years, this trendline has been tested four times, and a fifth retest appears imminent in the short term.

Historically, a fifth retest often leads to a breakout. If that breakout occurs, the next major target for BTC is around $128,000.

That said, the market rarely moves in a straight line.

As outlined in the chart, I’ve considered three potential scenarios for BTC to unfold this summer.

New trades will be based on these movements, with optimal entries either at the yellow-highlighted zones or upon a confirmed breakout above the current weekly resistance.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

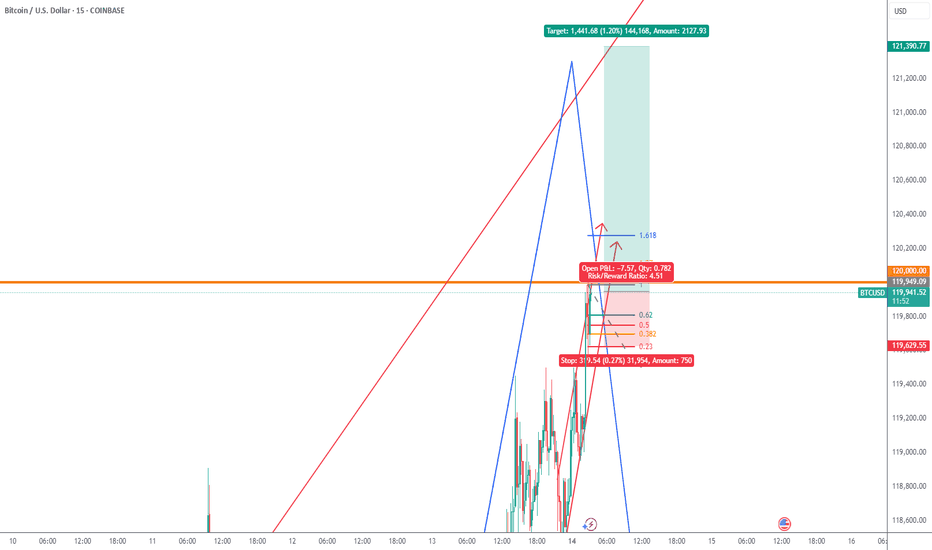

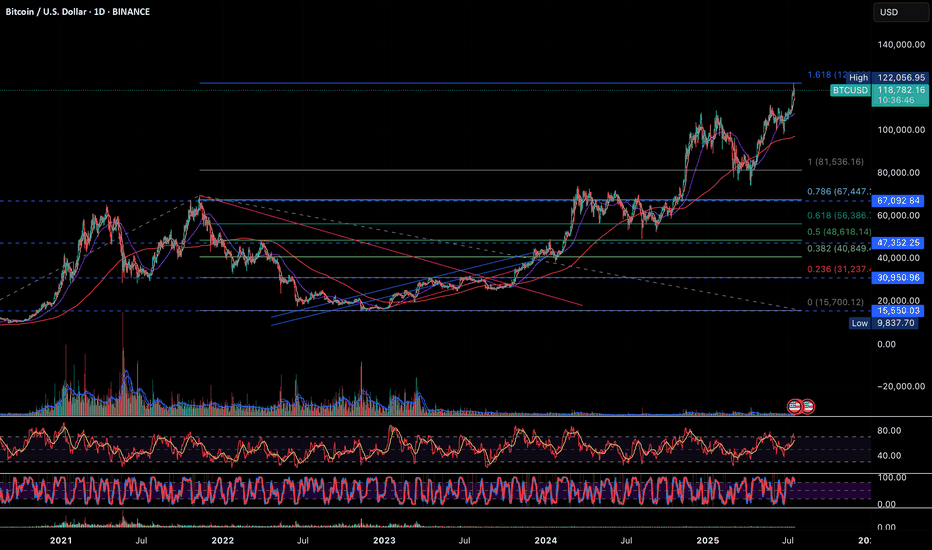

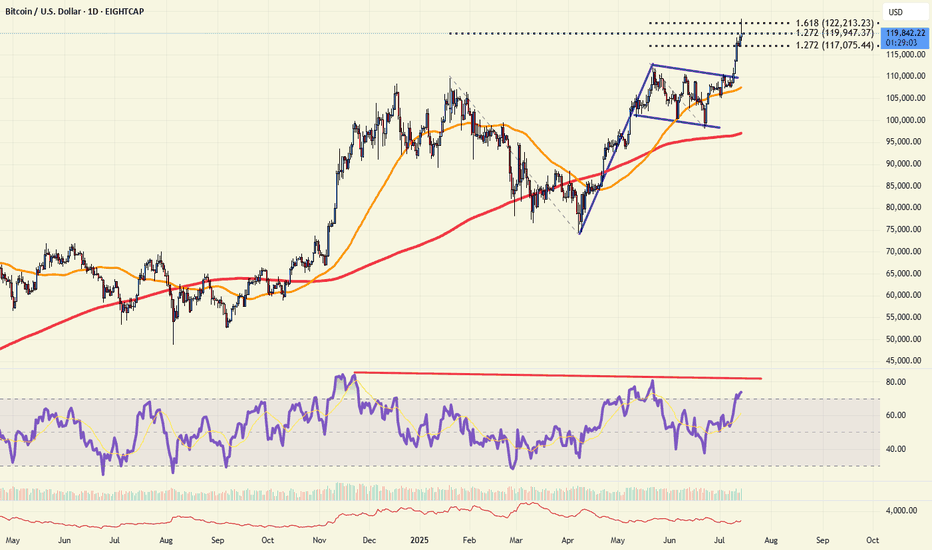

BTC Hits Predicted 1.618 Fibonacci Target at $122K — What’s Next🎯 BTC Hits Predicted 1.618 Fibonacci Target at $122K — What’s Next?

📅 Posted on: July 16, 2025

📍 Ticker: BTCUSD (BINANCE)

✍️ Author: @darwas121

⸻

🔹 Summary

In October 2023, I shared a long-term bullish projection for Bitcoin (BTC/USD) targeting the 1.618 Fibonacci extension level — projected around $122,000. As of today, BTC has successfully hit this target, validating the Fibonacci-based wave structure and bull market thesis. Now the key question is — what’s next?

⸻

🧠 Prediction Recap (Oct 2023)

• ✅ Projected rally continuation based on wave structure + Fibonacci expansion

• ✅ Long-term target: $122,056 (1.618 Fib level)

• ✅ Based on swing low near $15,550 and prior ATH structure

• ✅ Conditions: Confirmed breakout above $81,500

⸻

🔍 Current Technical Analysis (1D Chart)

💰 Price Action

• Current Price: $118,701

• Recent High: $122,056 (exact 1.618 Fib hit)

• Structure: Parabolic breakout from previous consolidation range

🔺 Fibonacci Levels

Level Price (USD)

0.236 31,237

0.382 40,849

0.5 48,618

0.618 56,386

0.786 67,092

1.0 (ATH Zone) 81,536

1.618 ✅ 122,056 (Hit)

📉 RSI & Momentum

• RSI is hovering in the overbought zone (>70), signaling potential cooling-off

• Stochastic RSI also indicates overextension — a pause or retracement could follow

• No bearish divergence yet, but watch closely

📊 Volume Trends

• Volume has tapered during this leg up — possible early sign of buyer exhaustion

• Previous volume clusters between $56k–$67k now act as strong support

⸻

⚠️ What to Watch Next

Risk Factors Notes

Overbought RSI Suggests short-term pullback risk

Weakening Volume Caution: Less conviction in highs

Parabolic Structure Vulnerability Break could mean fast correction

⸻

🧭 My View & Strategy

🔹 Short-Term: ⚠️ Cautious

• Book partial profits if holding from lower levels

• Watch for reversal candles near $122k zone

• RSI divergence or low-volume rally = yellow flag

🔹 Mid-Term: 🔼 Bullish

• Buy-the-dip zones: $67k (0.786) and $56k (0.618)

• Any correction into these zones may offer re-entry

🔹 Long-Term: 🔼 Strong Bullish

• BTC is in confirmed macro uptrend

• Sustained close above $122k opens price discovery zone

• Next logical Fib projection zones: $135k–$150k

⸻

📌 Key Levels

• Support: $81,536 / $67,092 / $56,386

• Resistance: $122,056 → Break = price discovery

• Invalidation Zone: Breakdown below $81,000 on volume

⸻

📣 Conclusion

The technical roadmap laid out in 2023 has now played out — Bitcoin has achieved its 1.618 Fibonacci extension target. We are now at a critical inflection point. If BTC consolidates well here and maintains volume, the next leg could launch us into new all-time highs beyond $135,000.

🛑 But caution is warranted — overbought signals + weak volume could bring a healthy correction first. Stick to your risk plan. Let the market come to you.

⸻

💬 Feel free to share your views or ask for updates in the comments.

🔔 Follow me for more swing-to-position analysis using volume, fibs & structure.

📊 Chart shared below for reference.

#Bitcoin #BTCUSD #Crypto #TechnicalAnalysis #Fibonacci #PriceTargets #CryptoForecast #ParabolicMove #BTC

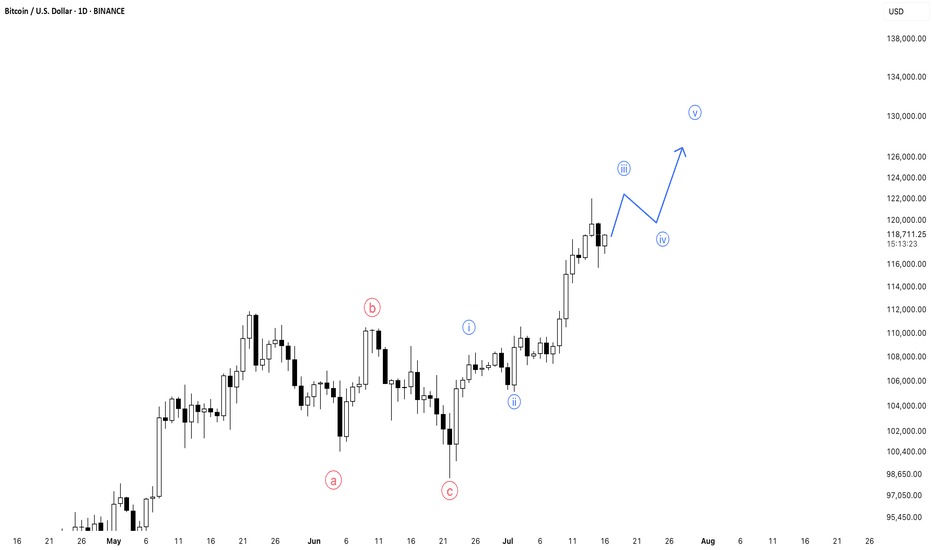

BTC Nearing Completion of Wave 3 – Correction Ahead?Bitcoin is approaching the end of its Wave 3 movement, which suggests a possible correction phase in the near future.

However, this is likely just a temporary pause before the next bullish wave continues the uptrend.

Stay patient and watch for key support levels to prepare for the next buying opportunity.

Bitcoin Buy Bias – On-Chain Confidence Still Has Room to RunThe On-chain Confidence indicator is showing signs of increasing sell pressure and profit-taking, but it still remains well below the historical peaks seen in previous bull market tops (2017 & 2021).

👉 This is a composite indicator combining several key on-chain metrics like RHODL Ratio, Puell Multiple, and MVRV, among others.

📊 The current level resembles early 2024 and early 2025, suggesting we are not yet at extreme sentiment levels.

If this indicator continues to climb toward its previous cycle highs, it may signal that we’re entering the final leg of this bull run. For now, there’s still room for upside momentum.

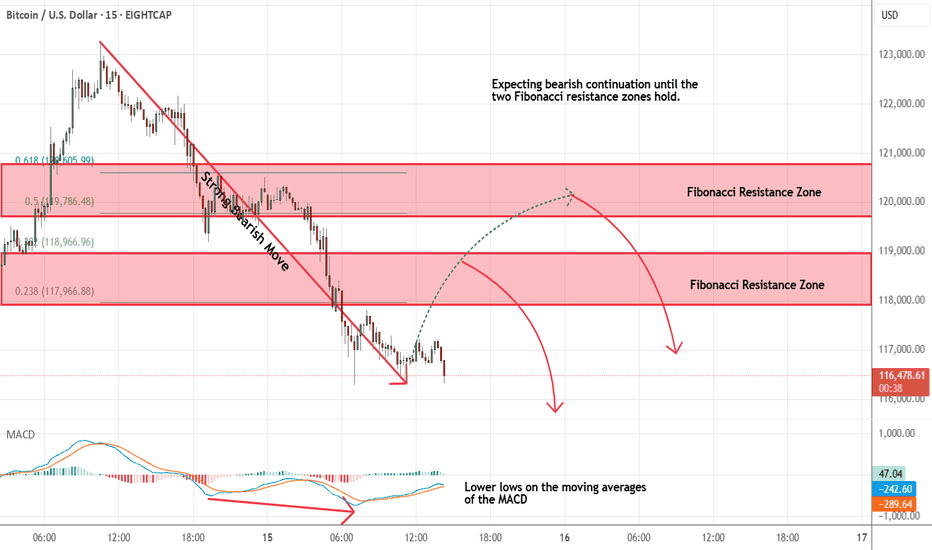

Bitcoin - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

Lower lows on the moving averages of the MACD.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

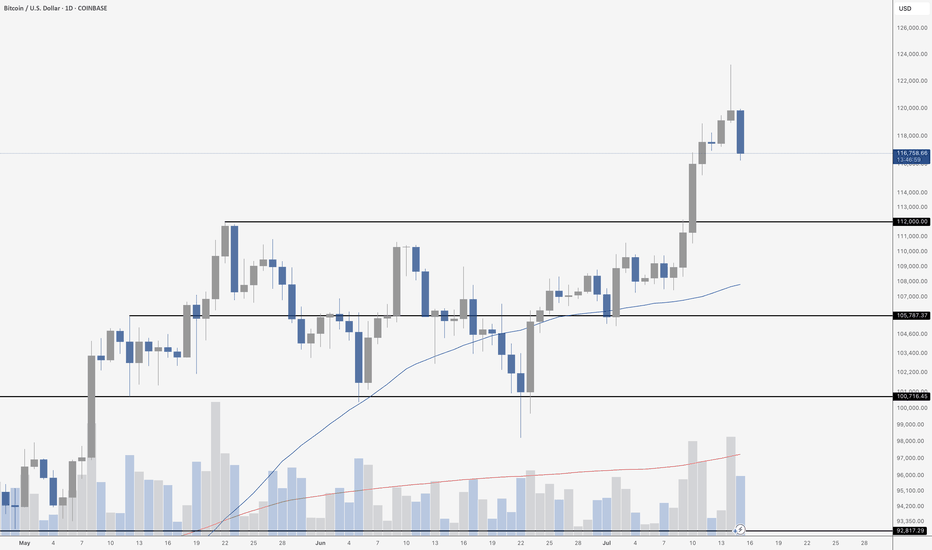

Bitcoin Blow-Off Top?Bitcoin’s daily chart is flashing caution after a sharp reversal candle on Monday was followed by downside continuation today. Yesterday’s session printed an unmistakably ugly candle – a long upper wick signaling rejection at the highs near $120K, with a close well off the top of the range. Crucially, that candle came on elevated volume, adding weight to the move and suggesting a possible blow-off top in the short term.

Today’s follow-through confirms that sellers are taking the reins, at least for now. Price is currently sitting around $116,800 after dropping over 2.5%, with the next major support zone near $112,000 – a level that previously capped price throughout early June before the breakout. If that fails, the 50-day MA and horizontal support around $105,800 should act as the next line of defense.

Volume has remained elevated, showing that this pullback has real participation – not just apathy or a lack of buyers. Bulls need to see price stabilize above $112K and reclaim lost ground quickly, or risk a deeper retrace after such an aggressive upside move.

For now, momentum has clearly stalled, and the risk of a more meaningful correction is on the table.

Btcusd techinical analysis.This chart is a 1-hour candlestick chart for Bitcoin/US Dollar (BTC/USD) from OKX, analyzed using TradingView. Here's a breakdown of the technical elements:

---

🔍 Key Observations:

1. Current Price

$120,054.6 with a +0.77% gain.

Price appears to be rebounding from recent support.

2. Chart Patterns & Annotations

Yellow Zigzag Lines: Indicate recent price action and a potential bullish reversal pattern forming.

Purple Zones: Likely represent key support and resistance levels.

Pink Downtrend Line: A descending trendline showing the bearish resistance.

Blue Box Area: Suggests a potential price movement range—either up or down.

---

📈 Technical Analysis Insights

✅ Bullish Case (Upside Scenario)

Break above descending trendline could lead BTC to:

Target: ~122,800 - 123,000

Potential

Retail in?After almost 3 decades as a trader, if there is one thing I have learned over the years, significant highs are made when sentiment is at extremes. Whether it is "mom and pop" or the "shoeshine guy" calling the top, it's when the buying (or selling) by retail is at a fever pitch. These days, you can't find a bear in Bitcoin, and the days on end of reports preaching "record inflows" is almost deafening.

Technically, Bitcoin is probing some key resistance today. It's stalled by the 161% Fibonacci extension of the recent early May highs to June lows. More importantly is the 127% extension of the January highs to April lows. RSI is very divergent as price hits new highs. And with sentiment at near extremes, bulls should be careful now. And a break back below the 112k level would be a very bearish "topping pattern" event.

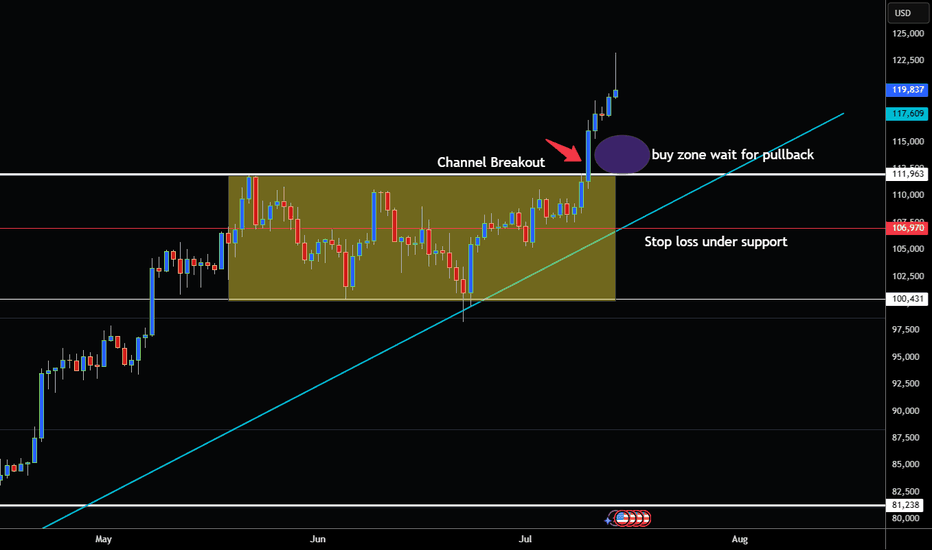

BITCOIN BREAKS OUT OF CHANNEL AND NOW AT ALL TIME HIGHS!Hey Traders wow just a few week ago I was watching to see if it was going to pullback instead smashes above all time high. Thats how quick these markets can change in the blink of an eye!

Lesson here (Always Expect the Unexpected in the Markets!) 😁

Ok so now we have channel breakout above resistance at 112,100. About 70% of the time market will retest this level before continuing the trend.

This could be a great place to buy on the pullback!

So if your bullish buy around $112,100-113,000 I would recommend a wide stop to give the market room to breath around 106,970.

However if bearish I would not consider selling unless market has complete reversal and has daily close below uptrendline at 106,000 .

Bears Be careful because this Bull looks like it has Horns!

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

BTC BREAKOUT VERY INSTRUCTIVE Weekly simply shows there are more rooms for BTC to continue the uptrend but lower time frame will let us know better as there may be pullbacks however, we need the weekly candle close above the most recent high of $118,900 to give us that immediate confirmation.

So as not to get trapped by the bears, the best way to trade the buy for BTC is to have a buy-stop Order at $118,900 with SL below $112,000 with very low Lot size depending on your account balance.

Proper risk management is strongly advised