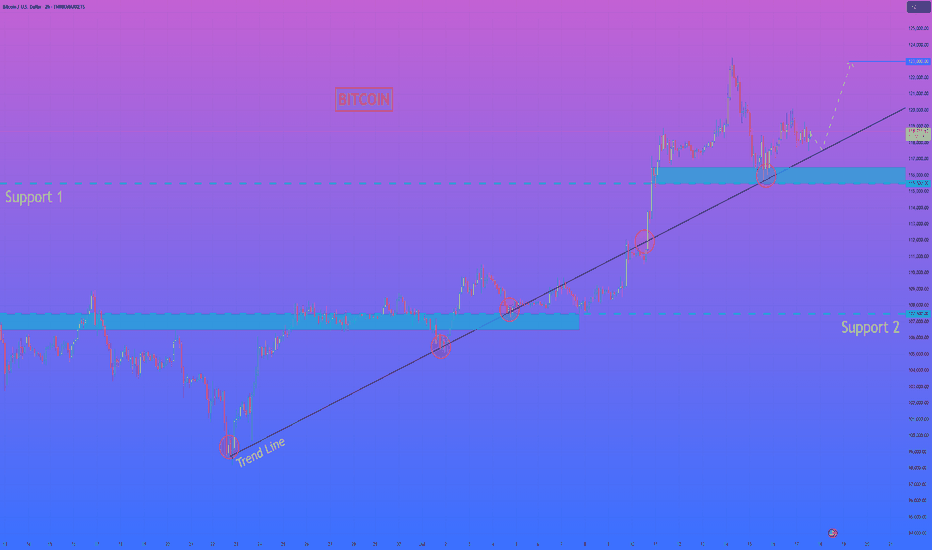

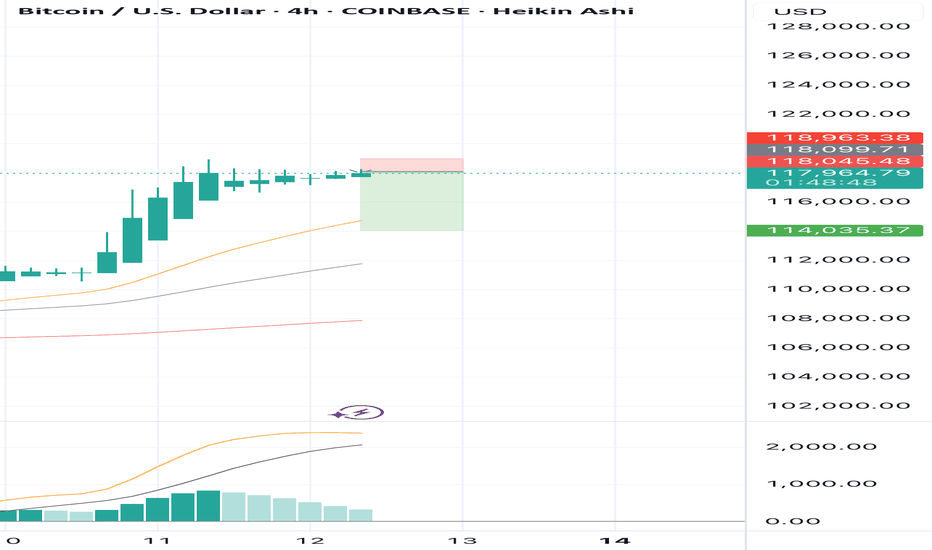

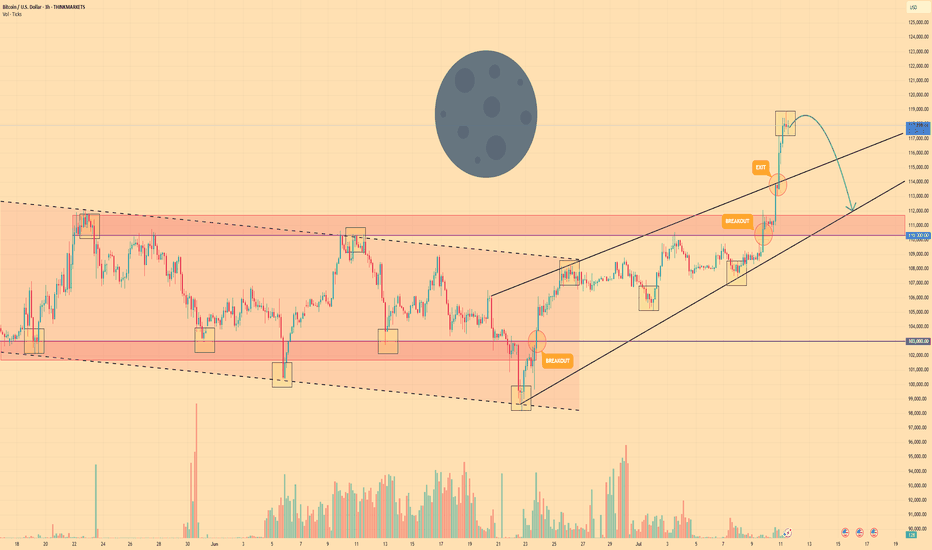

HelenP. I Bitcoin will correct to trend line and then start riseHi folks today I'm prepared for you Bitcoin analytics. The price has been trading in a strong bullish structure, clearly respecting the ascending trend line since the rebound from the 107500 level. Each time the price touched the trend line, it formed a higher low and continued the upward movement. After breaking through the important Support 1 zone (115500–116500), BTC made a strong impulse upward and reached a local high above 122000 points. Currently, the price is making a pullback and moving closer to the trend line again. This area has previously acted as a major point of interest for buyers, and now it's expected to play a key role once more. The support zone and trend line are converging, which makes this level critical for the next move. I believe BTCUSD will bounce from this area and continue its bullish momentum. My goal is set at 123000 points. Given the market structure, higher lows, and strong reaction from the support zones, I remain bullish and expect further growth from current levels. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BTCUSD.PM trade ideas

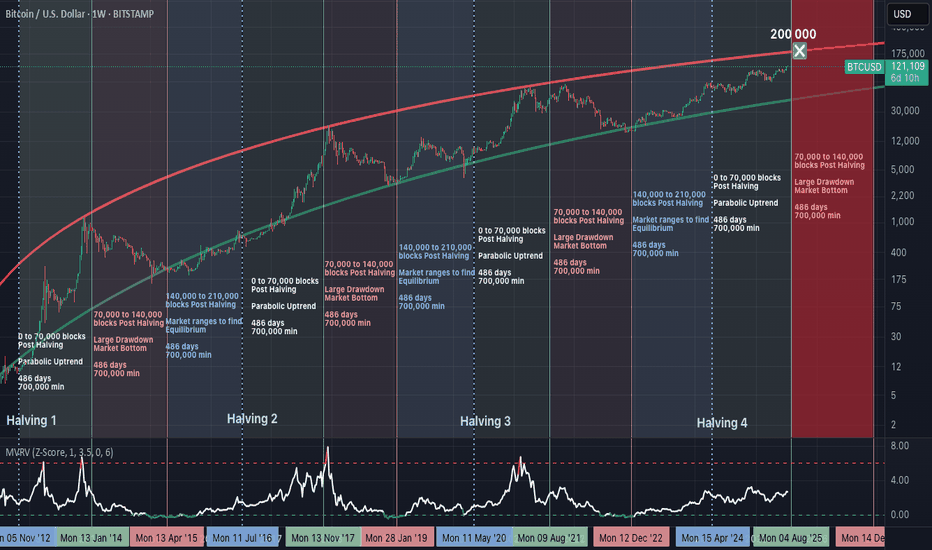

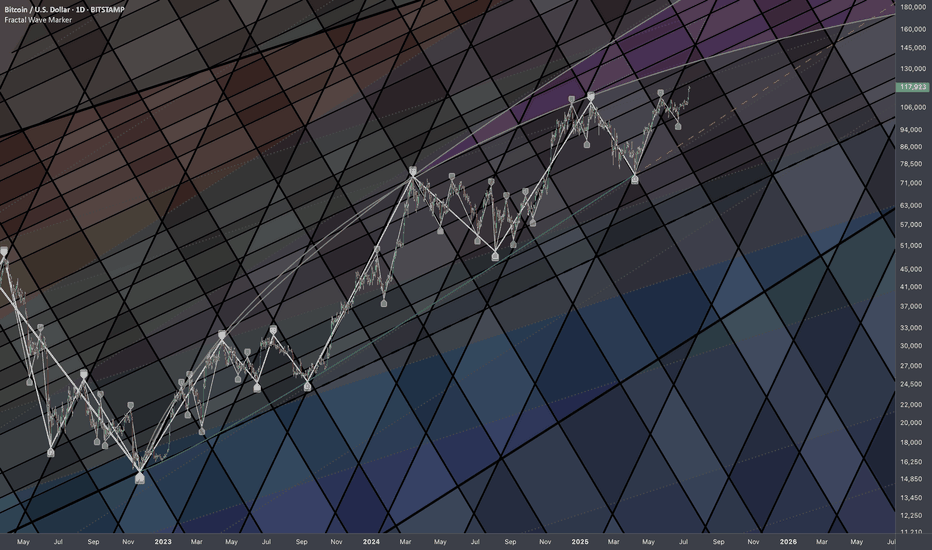

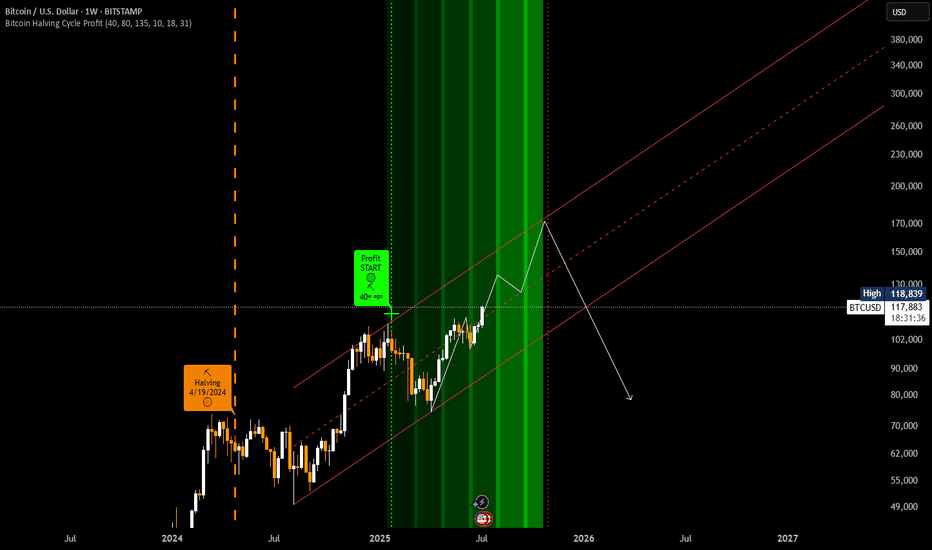

Bitcoin’s 486-Day Halving Blueprint: The $200,000 Blowoff?Summary

Bitcoin’s price consistently follows a 3-phase structure after each halving, with ~486 days per phase. If history repeats, we are nearing the end of the parabolic phase, with a potential peak around $200,000, before entering a structured drawdown.

Halving Cycles: The Real Clock Behind Bitcoin

Bitcoin’s monetary policy is pre-programmed.

A halving occurs approximately every 210,000 blocks (~4 years), and market behaviour after each halving follows this repeating pattern:

Phase 1: Parabolic Rally (0 to 70,000 blocks post-halving).

Phase 2: Major Drawdown (70,000 to 140,000 blocks).

Phase 3: Equilibrium Phase (140,000 to 210,000 blocks).

Each phase lasts approximately 486 days, and this structure has repeated reliably since 2012.

Phase 1: The Parabolic Rally (Current Phase)

We are currently in the growth segment of the cycle:

Price rising rapidly.

Miner profitability at highs.

Hashrate and network security increasing.

MVRV Z-Score steadily climbing, but not yet overextended.

Roughly 700,000 BTC are mined during this period, creating a supply shock as issuance is halved while demand accelerates.

Phase 2: The Drawdown (Expected Next)

Historically begins between block 70,000 to 140,000 post-halving.

Market peaks and begins to correct.

Miner margins compress.

Hashrate may plateau or decline.

Forced selling and miner capitulation drive volatility.

Price retraces significantly from the peak.

This phase resets the market and eliminates unsustainable excess.

Phase 3: The Equilibrium Phase

Occurs between block 140,000 to 210,000 post-halving.

Price enters consolidation.

Realized value and market price converge.

Ideal accumulation period for long-term investors.

Network fundamentals stabilize ahead of the next halving.

This phase is critical in building the base for the next cycle.

MVRV Z-Score: Market Thermometer

The chart includes the MVRV Z-Score, a key metric showing how far price deviates from realized value:

Readings above 6.0 have consistently marked cycle tops.

Readings near or below 0 have marked major bottoms.

Current value is around 2.67 — indicating a rising trend, but not overheated.

This metric reflects market-wide profitability and speculative pressure.

Why $200,000 Is in Sight

The projected resistance curve on the chart suggests that:

$200,000 aligns with the top of the long-term parabolic channel.

It corresponds with the expected end of the parabolic phase (Q1–Q2 2026).

It fits prior extension patterns following each halving.

It is a strong psychological target, likely to trigger heavy profit-taking.

This price level is not arbitrary—it is derived from the same structure that defined previous peaks.

What Comes After

If the historical cycle structure remains intact:

The peak should occur before mid-2026.

A deep correction phase follows, likely into 2027.

True bottoms tend to occur as miner capitulation concludes and difficulty adjusts downward.

This is where conviction and preparation matter most.

Final Thoughts

Bitcoin cycles are not random. They are structured around block height, issuance, and miner economics.

Every cycle since 2012 has followed this 486-day framework, divided across parabola, crash, and reset. This model has outperformed calendar-based predictions and technical narratives.

Disclaimer

This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Past performance is not indicative of future results. Always do your own research and consult with a qualified financial advisor before making investment decisions. The author holds no responsibility for any losses incurred as a result of using the information presented herein.

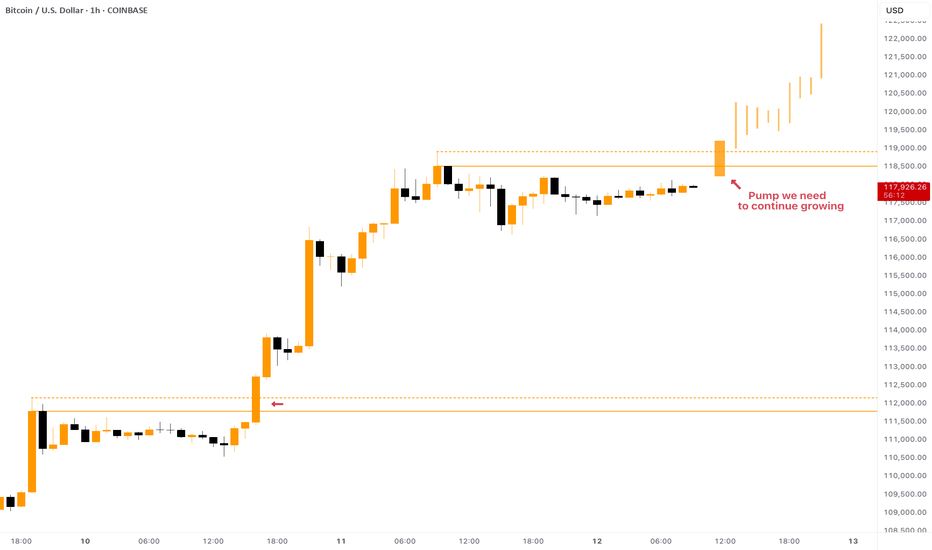

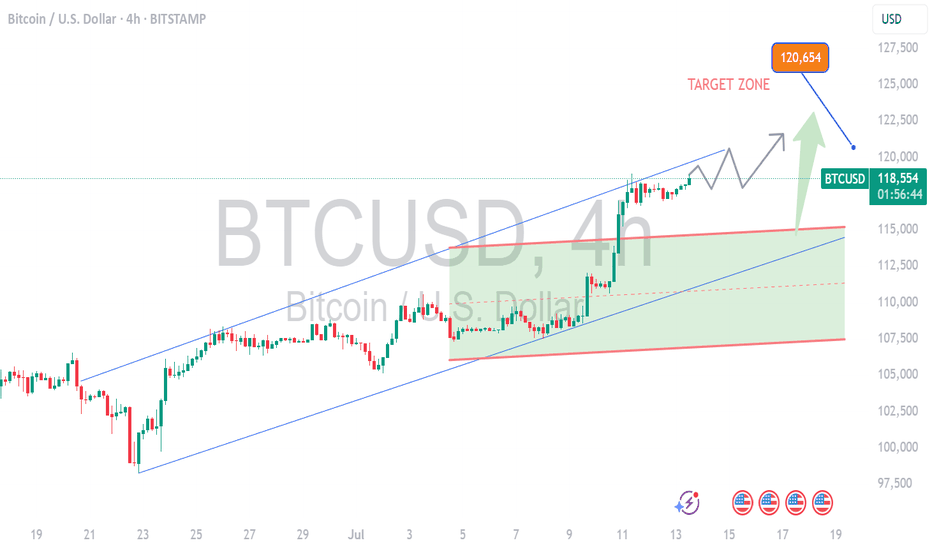

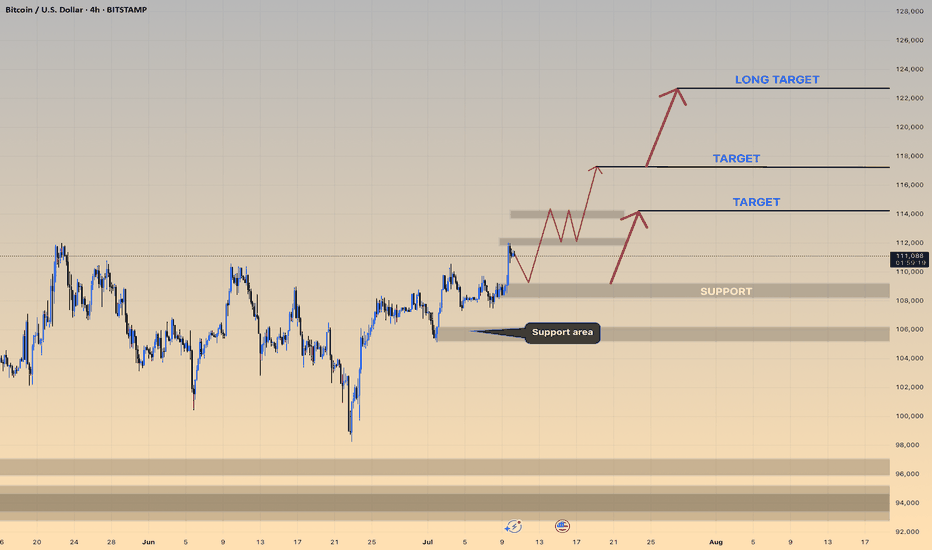

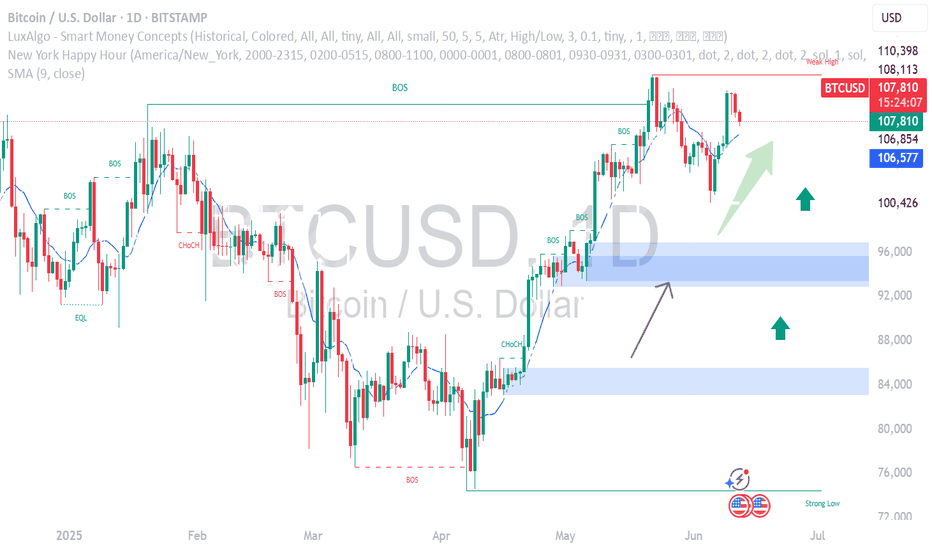

BITCOIN - Local Conditions for Growth ContinuationCRYPTOCAP:BTC showed us an astonishing growth from $108,000 to $118,000 in a few days! But what is next and where is the next target?

At the moment the price is consolidating below the ATH, in fact there are two resistances: $118,500 and $119,000. To continue pumping, Bitcoin has to break both of them with strong impulse.

To be honest , the current price development reminds me of what we've seen a couple days ago: breakout of the resistance -> consolidation below local highs -> strong breakout and growth continuation. Something similar can be expected now as well.

In the past couple of years CRYPTOCAP:BTC taught us a lesson of waiting no time to hop on the train . When it pumps - it does it quickly, just like it does it this time. So, waiting for the best entry near $109,000 - $110,000 might leave you behind while Bitcoin will be pumping towards $125,000.

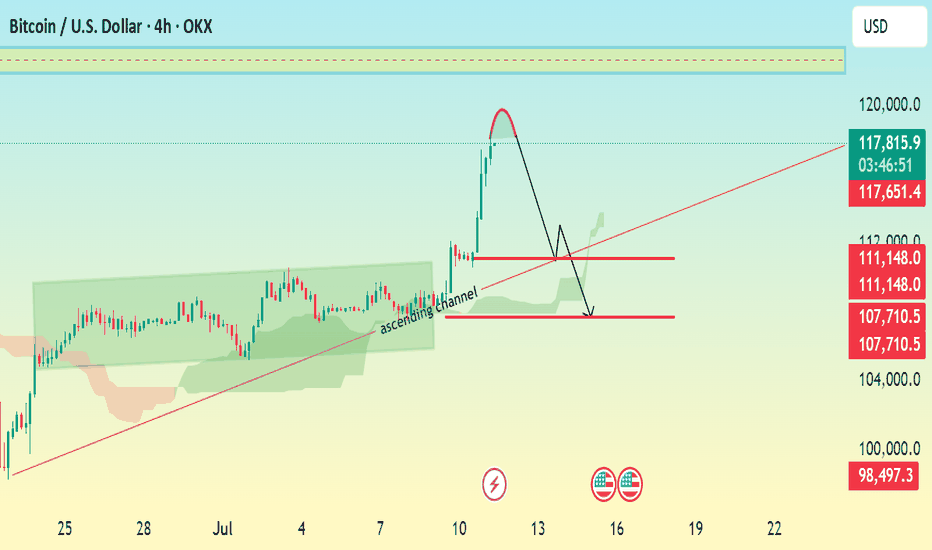

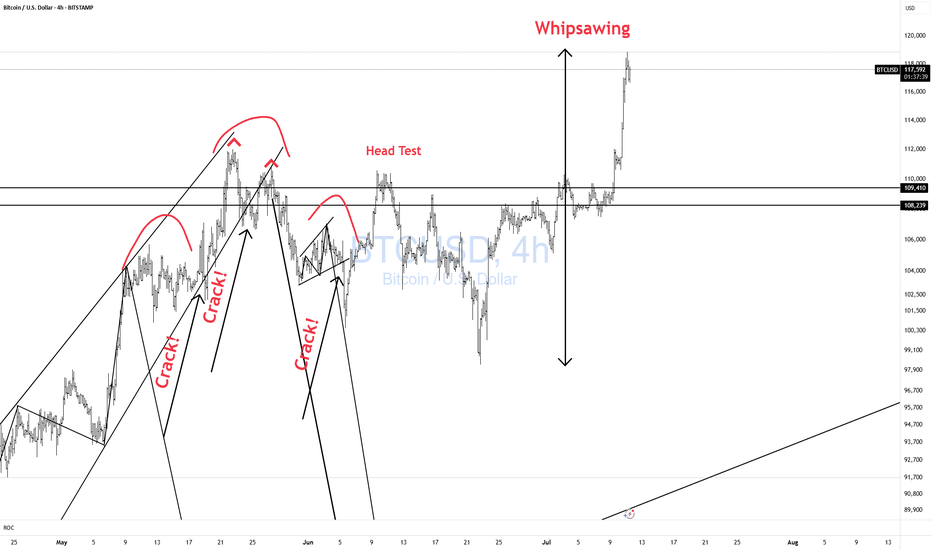

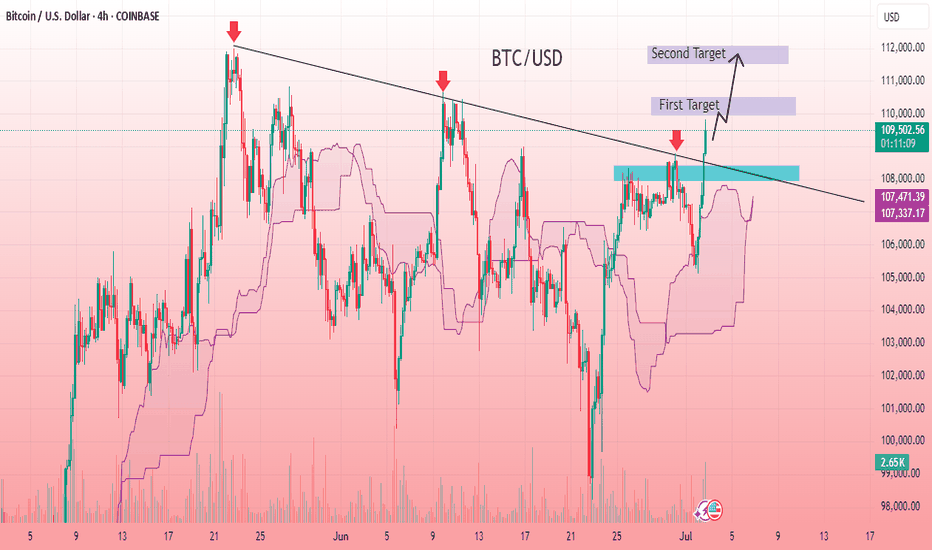

BTC/USD 4H CHART ANALYSIS \ BEARISH CORRECTION EXPECTED.Current Price: $117,755

Trend: Recently bullish, now facing a potential correction

Chart Pattern: Breakout above ascending channel, followed by a sharp projected correction.

🔍 Technical Breakdown:

> Ascending Channel:

Price was respecting an ascending channel (highlighted in green).

A bullish breakout occurred with strong momentum.

> Sharp Rejection & Correction Setup:

After the breakout, a steep rally seems to have peaked.

The red curved arrow suggests a completed bullish impulse, now setting up for a bearish correction.

> Key Levels:

Resistance Zone: $118,000 – $120,000

Immediate Support: $111,150

Next Major Support: $107,700

Bearish Target Support: $105,945

🎯 Trade Setup Suggestion:

Short Entry Zone: Around $111,150 if price gets rejected there.

Target: $105,945

Stop-Loss: Above $112,000 (tight risk control)

Weekly Close Watch: Bitcoin’s Key Level Could Shift the ChartsGood morning, Guys

There's only 1 day and 13 hours left until the weekly Bitcoin candle closes.

It's crucial that this candle closes above the 112,331 level with strong volume. Anyone experienced in economics and technical analysis knows just how significant this is.

If we get that close above the level, I’ll share a powerful analysis with a clear target.

I want to sincerely thank everyone who’s been supporting my analyses with likes—your support is

my biggest source of motivation when it comes to sharing content.

Much love to you all—we’re more than just a community, we’re a family. 💛

BITCOIN NEXT TARGET 1205001. Professional & Direct:

BTC Long in Play – Eyes on 120,500 🔥

Momentum building strong. Stay in the trend — next target: 120.5K.

---

2. TradingView Style (Engaging):

Bitcoin Bulls Gaining Strength 🚀

Long position active. Targeting next major level at $120,500 — hold tight!

---

3. VIP Signal Tone:

BTC BUY Signal Active ✅

We’re riding the wave to $120,500. Strong confirmation on higher timeframes.

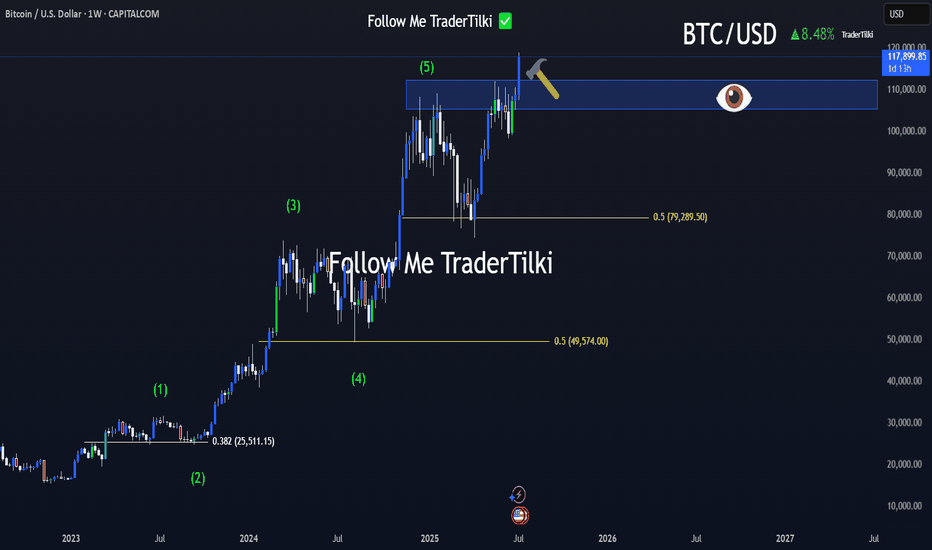

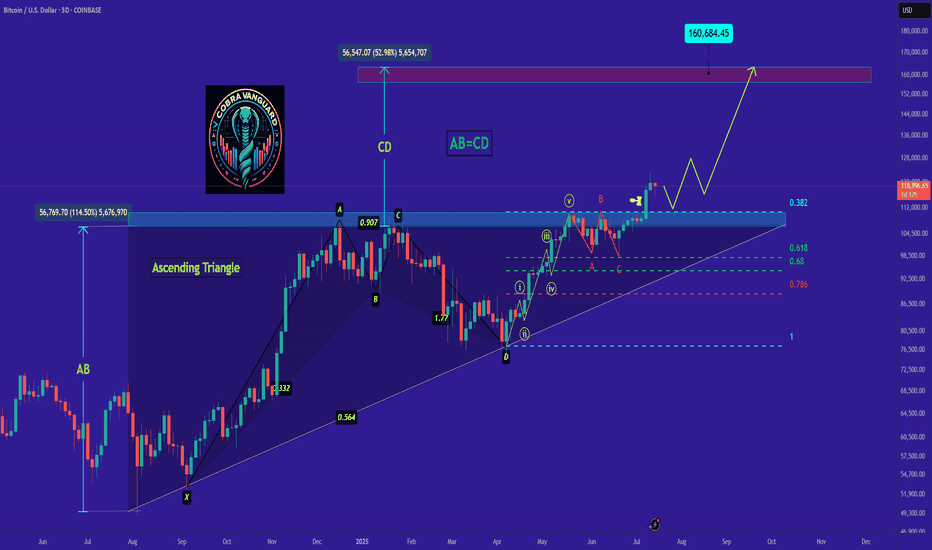

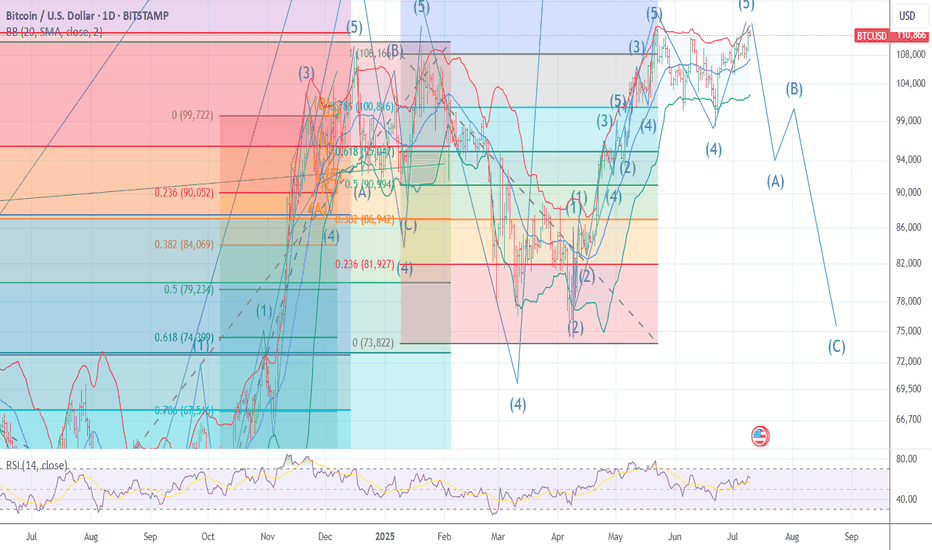

Are we on Super Bullish Express Highway ? Elliott Waves RoadmapHello friends,

Welcome to RK_Chaarts

Today we're attempting to analyze Bitcoin's chart, specifically the BTCUSD chart, from an Elliott Wave perspective. Looking at the monthly timeframe chart, which spans the entire lifetime of Bitcoin's data since 2011, we can see the overall structure. According to Elliott Wave theory, it appears that a large Super Cycle degree Wave (I) has completed, followed by a correction in the form of Super Cycle degree Wave (II), marked in blue.

Now, friends, it's possible that we're unfolding Super Cycle degree Wave (III), which should have five sub-divisions - in red I, II, III, IV, & V. We can see that we've completed red I & II, and red III has just started. If the low we marked in red II doesn't get breached on the lower side, it can be considered our invalidation level.

Next, within red III, we should see five primary degree sub-divisions in black - ((1)), ((2)), ((3)), ((4)) & ((5)). We can see that we've completed black ((1)) & ((2)) and black ((3)) has just started. Within black ((3)), we should see five intermediate degree sub-divisions in blue - (1) to (5). Blue (1) has just started, and within blue one, we've already seen red 1 & 2 completed, and red 3 is in progress.

So, we're currently in a super bullish scenario, a third of a third of a third. Yes, the chart looks extremely bullish. We won't commit to any targets here as this is for educational purposes only. The analysis suggests potential targets could be very high, above $150,000 or $200,000, if the invalidation level of $98,240 isn't breached. But again, friends, this video is shared for educational purposes only.

Many people think that the market doesn't move according to Elliott Waves. But friends, here we've tried to analyze from the monthly time frame to the overly time frame. We've definitely aligned the multi-time frame and also aligned it with the principal rules of Elliott Waves, without violating any of its rules.

I agree that the Elliott Wave theory can be a bit difficult, and for those who don't practice it deeply, it can be challenging. But yes, the market moves according to this methodology, following this pattern. This is a significant achievement.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

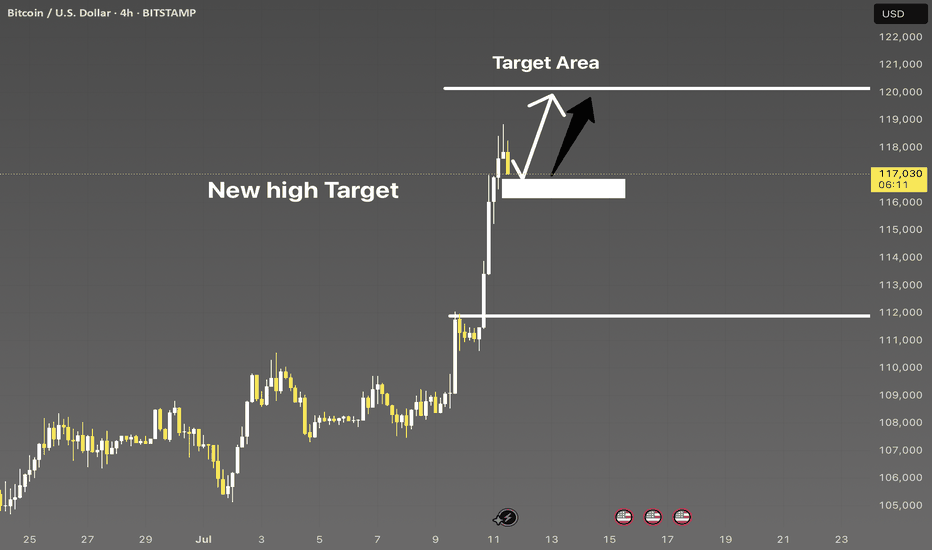

BITCOIN - Price can go into correction after reaching new ATHHi guys, this is my overview for BTCUSD, feel free to check it and write your feedback in comments👊

Bitcoin spent weeks confined to a tight falling channel, carving out a series of lower highs and lower lows as sellers maintained full control of the market.

The breakout above $110300 ignited a powerful rally, propelling BTC into an ascending wedge formation and driving price sharply higher toward a fresh all-time high at $118800.

Once the ATH was reached, selling pressure reasserted itself, halting further upside and triggering a loss of bullish momentum.

This lightning-fast climb to $118800 appears to have drained buyer enthusiasm.

Key support now resides around $110300 - $111700, backed by the wedge base.

Given the exhaustion of buyers and the clear wedge resistance, I anticipate BTC to retrace toward the $112000 area following its recent surge.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

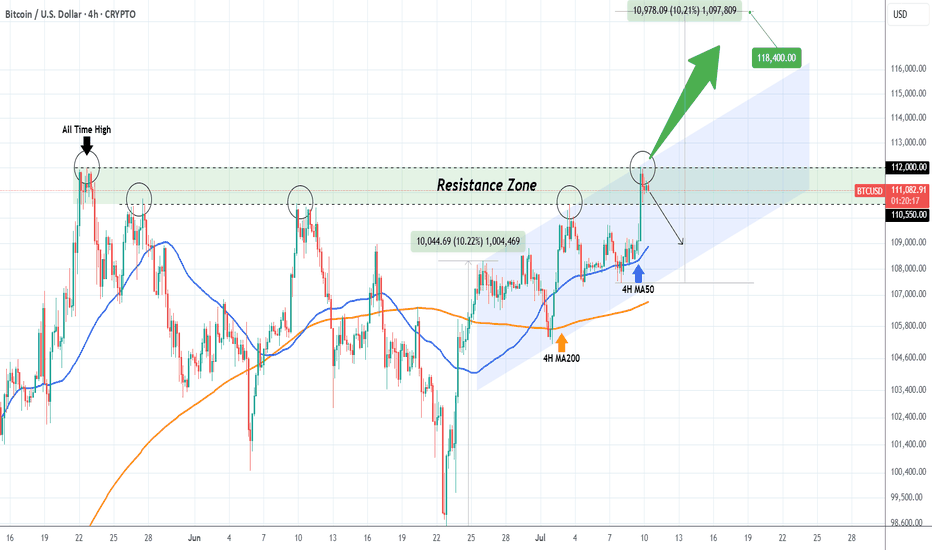

BITCOIN facing the most important Roadblock of the Cycle.Bitcoin (BTCUSD) reached $112000 yesterday, testing the May 22 2025 All Time High (ATH) and immediately got rejected. This ATH rejection is key to the continuation of the bullish trend as the entirety of the ATH Resistance Zone is perhaps the last (and most important) Roadblock before the final rally of the Cycle that could potentially price the new Top.

You can see that this Resistance Zone already had 3 rejections previous on its bottom and yesterday was the first one on its top.

A break above it can target $118400 at least within days, in anticipation of a +10.20% Bullish Leg, similar to the one following the June 22 Low.

If the rejection prevails however, we may see a pull-back that will test the bottom of the (blue) Channel Up.

Which scenario do you think will prevail? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC Breakout Alert: Ready for the Next Bullish Wave The BTC/USD 4-hour chart shows a clear breakout above a descending trendline that has acted as resistance since mid-May. After multiple rejections, the price has now broken above the structure, signaling bullish momentum. The Ichimoku cloud confirms support underneath, providing confluence for a potential rally. The bullish breakout is also accompanied by increasing volume and a bullish engulfing pattern near the breakout zone, which adds confirmation. Price is currently consolidating just above the breakout area, suggesting a retest may be forming before further upside continuation. If momentum sustains, higher levels could soon be tested in the coming sessions.

Entry: 109,400

1st Target: 110,000

2nd Target: 111,870

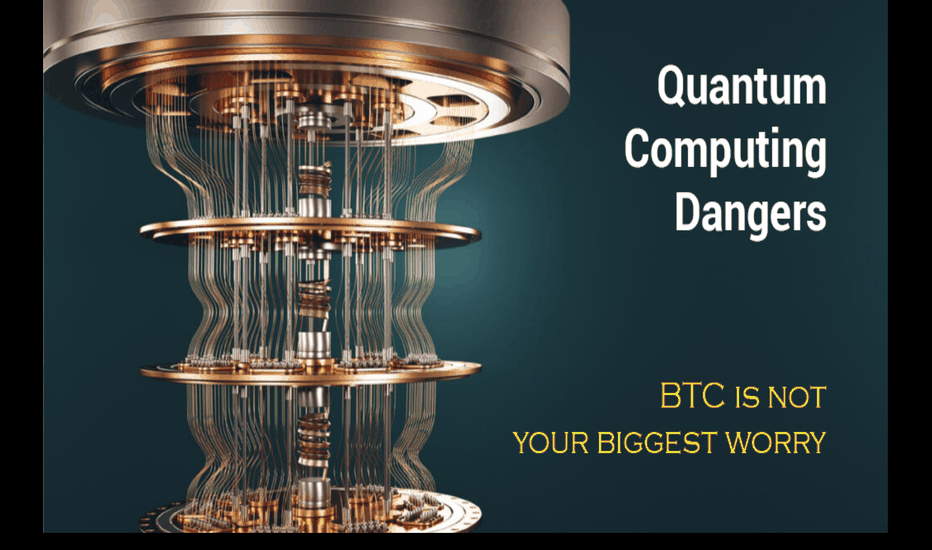

Quantum Computing - Why BTC isn't the biggest worryYou’ve probably heard that quantum computing could break Bitcoin’s encryption—and that’s true. But here’s the thing: Bitcoin might not even be the biggest target.

The real risks? Financial systems, national security, healthcare, and even the internet itself. These areas rely on the same encryption methods that quantum computers could crack, and the fallout could be far worse than a Bitcoin hack.

Let’s break it down.

1️⃣ Financial Systems: A Global Crisis Waiting to Happen

Imagine if hackers could:

Drain bank accounts at will.

Manipulate stock markets.

Fake trillion-dollar transactions.

This isn’t just about stolen crypto—it’s about economic chaos. Banks, stock exchanges, and payment systems all depend on encryption. If quantum computers break it, we’re looking at a meltdown way bigger than Bitcoin’s $3 trillion market.

2️⃣ National Security & Internet Privacy: A Hacker’s Dream

Governments and militaries use encryption to:

Protect classified intelligence.

Secure communications between leaders.

Guard critical infrastructure (power grids, water supplies).

If quantum computers crack these codes, entire nations could be exposed to cyberwarfare. Your private data? At risk too—email, messaging, even your online banking could be decrypted years later.

3️⃣ Healthcare, Supply Chains & IoT: The Hidden Vulnerabilities

Medical records could be leaked, exposing sensitive health data.

Smart devices (like home security systems) could be hacked.

Supply chains might collapse if logistics networks are breached.

These systems weren’t built with quantum threats in mind—and upgrading them won’t be easy.

🔴 The Bigger Picture: A "Civilizational Upgrade"

Switching to quantum-resistant encryption is like rebuilding the internet’s foundation. It’s necessary, but messy. Some experts compare it to the Y2K bug—but way harder.

🔷 So, Is Bitcoin Safe?

Not entirely—about 25% of all Bitcoin could be stolen if quantum computers advance fast enough. But compared to the risks facing banks, governments, and hospitals? Bitcoin might be the least of our worries.

🔷 What’s Next?

Governments & companies are already working on fixes (like NIST’s post-quantum cryptography standards).

The transition will take years—and hackers might exploit weak spots along the way.

Staying informed is key. If you’re in tech, finance, or security, this affects you.

ℹ️ Want to Dive Deeper?

Deloitte’s take on quantum computing & Bitcoin

Forbes on quantum risks beyond crypto

🤷♂️ Bottom line?

Quantum computing is coming—and while Bitcoin has risks, the real danger lies in the systems we all depend on every day.

❔What do you think? Will we be ready in time? Let me know in the comments! 🚀

BTCUSD BULLISH MORE all time high again The price may briefly break above the 113,000–114,000 level (first target) to trap long positions, then sharply reverse.

Support Break Warning:

If BTC fails to hold the 110,000–108,000 support zone, it could accelerate a drop to deeper supports:

Support Area 1: 106,000

Support Area 2: 102,000

Extreme Bearish Target: 96,000–94,000

What to Watch:

Bearish divergence on lower timeframes

Volume drop on new highs = possible fakeout

Candle rejection from 113,000–114,000 zone

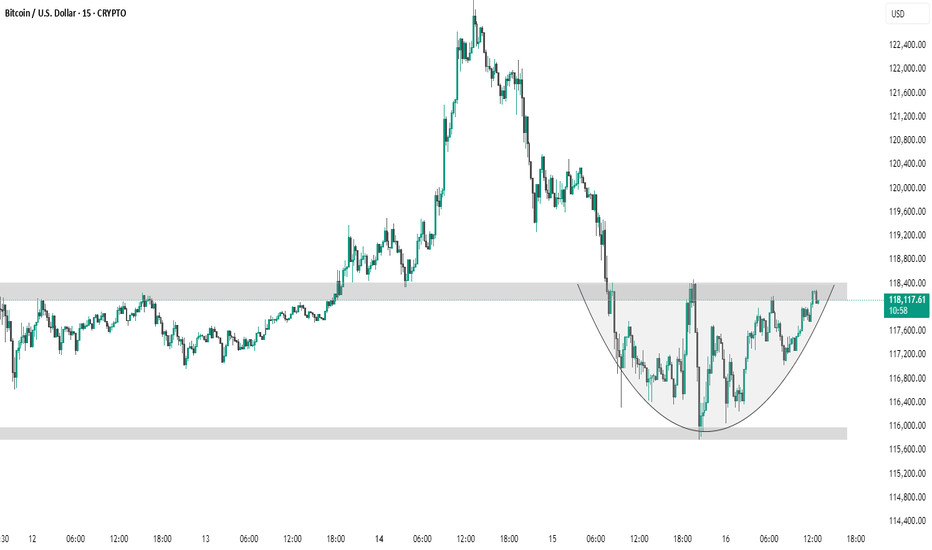

BTC #ARC FormationThe chart **15-minute Bitcoin (BTC/USD)** candlestick pattern with a clearly drawn **cup and handle** or **rounded bottom** formation. Let's identify key levels:

---

🔍 **Key Levels Identified:**

1. **Resistance Zone (Neckline of Cup)**

Level:** \~**118,400 USD**

Significance:** This is the upper gray zone where price has repeatedly been rejected. It's acting as a **resistance** and also forms the **neckline of the cup pattern**. A breakout above this level may indicate bullish continuation.

2. **Support Zone (Bottom of Cup)**

Level:** \~**115,800 – 116,000 USD**

Significance:** This is the **lowest point** in the recent pullback and serves as strong support**. The price rebounded from here to form the cup.

3. **Mid-Level / Breakout Point**

Current Price:** \~**118,067 USD**

Significance:** Price is testing the **resistance**. A candle close and confirmation above 118,400 could trigger a bullish move, possibly targeting previous highs near **121,600 USD** or more.

---

⚠️ Watch For:

Breakout confirmation above 118,400 USD** with volume for bullish continuation.

Rejection at 118,400 USD** could lead to a pullback or handle formation.

Support holding above 116,000 USD** is key to maintain bullish structure.

Let me know if you want price targets or entry/exit suggestions based on this setup.

thank u

BTC NEXT TARGET BUY 110K MORE Bitcoin Alert! 🚨

BTC is showing strong momentum and the market is heating up! 🔥

Current levels present a strategic buy opportunity before the next big move.

📈 Targeting $110K–$115K in the coming wave — and the breakout could be explosive.

💰 Accumulate now before the FOMO kicks in.

📊 Smart traders are already positioning.

⏳ Time is limited — don’t watch from the sidelines.

This could be the move that defines the next phase of the bull run.

Stay ahead. Stay informed. Stay invested. 🧠🚀

#Bitcoin #BTC #CryptoAlert #BullRun #CryptoNews #BitcoinTarget #BTCNextMove #CryptoTradin

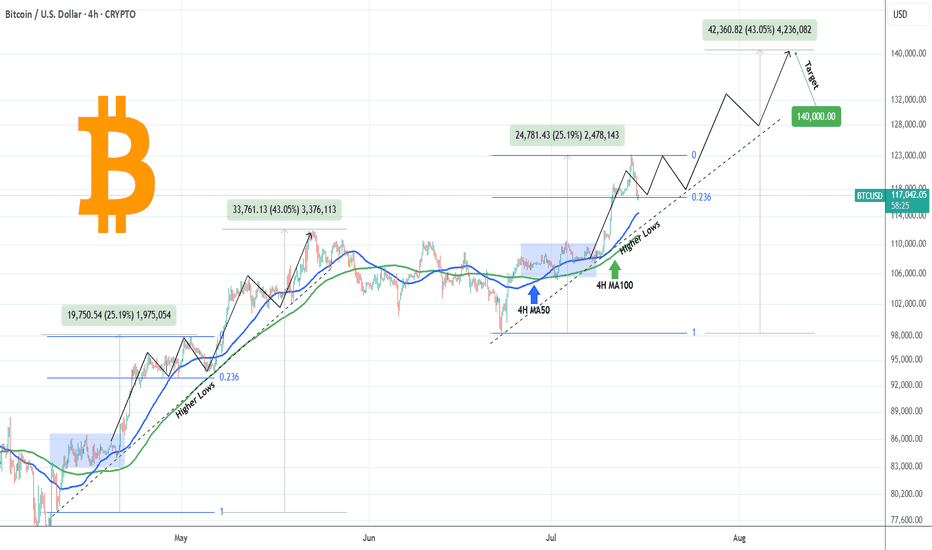

BITCOIN Will it go lower?Bitcoin (BTCUSD) pulled back rather aggressively yesterday after marginally breaking above $123000 and making a new All Time High (ATH).

We've mentioned before the similarities of this Bullish Leg to the April - May structure and so far the current pull-back having already touched the 0.236 Fibonacci retracement level, resembles the late April pull-back.

However, besides the 0.236 Fib, that pull-back also hit its 4H MA50 and rebounded, so that's a condition that hasn't been fulfilled. If it does, we are potentially looking for a Low around the $115k mark. Notice also how both fractals are supported by a Higher Lows trend-line exactly on their respective 4H MA100 (green trend-line) levels.

If BTC continues to replicate this pattern, we expect to see $140000 (+43.05% from the bottom) by early August.

Will the Support levels hold and push it that high? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

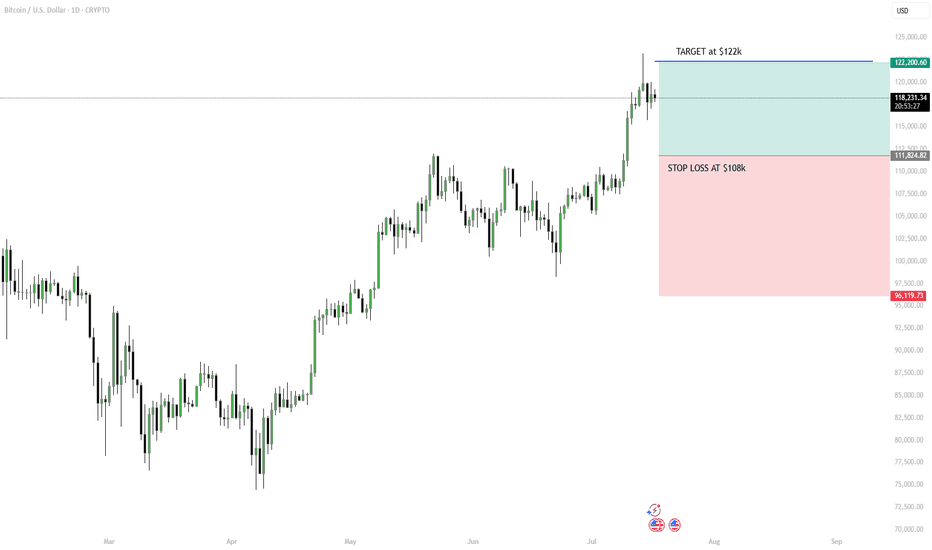

Strategy: “Breakout Bounce” – Buy the Retest, Ride the WaveHello Traders! BTC has broken out above $118K–$120K after a strong uptrend. Now it’s pausing, and a short-term pullback looks likely. Instead of buying the top, we wait for the price to retest previous resistance (around $112K–$114K), which could turn into support.

MY PLAN:

Wait for pullback to $112K–$114K zone.

Look for a bullish candle (daily or 4H) to confirm entry.

Target: $122K short-term or trail stop if trend continues.

Stop loss: Below $108K to manage risk.

Tip: Don’t chase. Be patient, follow the setup, and use proper risk management.

Please leave a comment and don't forget to support a fellow trader! Also, you can leave in the comments your target and plan ideas!

Have a great day y'all!

-Neo