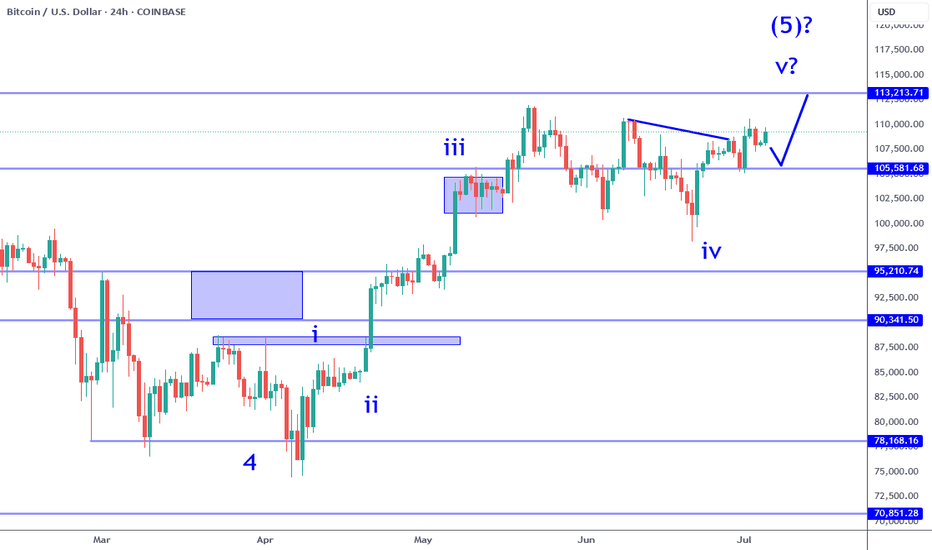

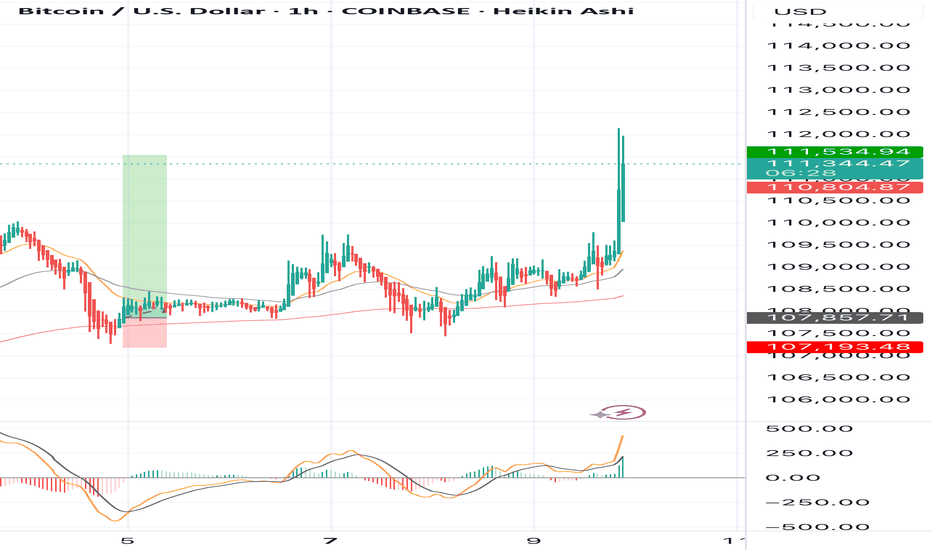

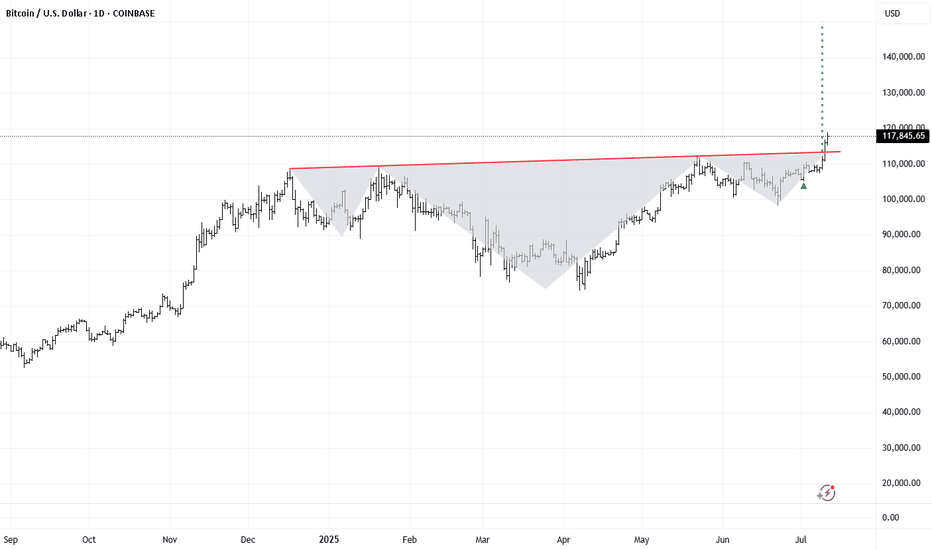

Bitcoin: Breakout To 113K Refuses To Pull Back.Bitcoin is poised to test the 113K resistance over the coming week. It has broken the upper trend line resistance and simply refuses to retrace in any meaningful way. With a continuously weakening dollar and other economic inflationary pressures, it will take a surprise negative catalyst to turn this around at least to the point of testing a high probability trend support on this time frame. Here is the way to play this environment:

Buying this breakout for time horizons longer than a swing trade requires a big risk tolerance. While this leg is likely to be the Wave 5 of 5 that I have been writing for some time and can see Bitcoin test some major new highs, investing here still puts you at the mercy of the market. The nearest support is around the 103 to 105K area at minimum and just not worth the risk in my opinion at current levels for INVESTING.

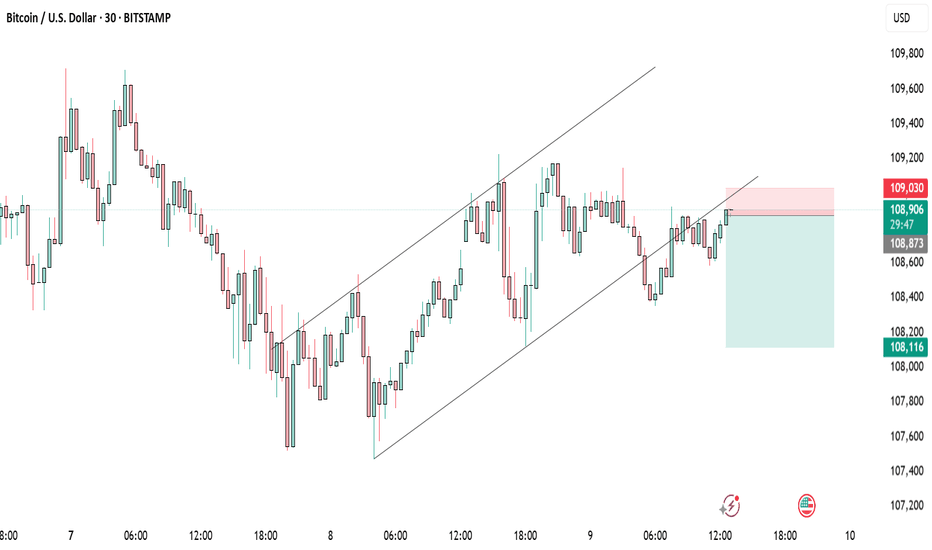

Swing trades are a great way to participate in the breakout continuation. Risk can best be defined by the current candle low or previous candle low. Profit objective now is 113K or 120K area. The Trade Scanner Pro actually called a long and offered numerous opportunities to enter over a week and a half ago. I have been reviewing this regularly on my live stream forecast every Monday at 3 PM ET. It helps immensely to have levels and risk defined for these type of situations in advance so that you know how to adjust your size.

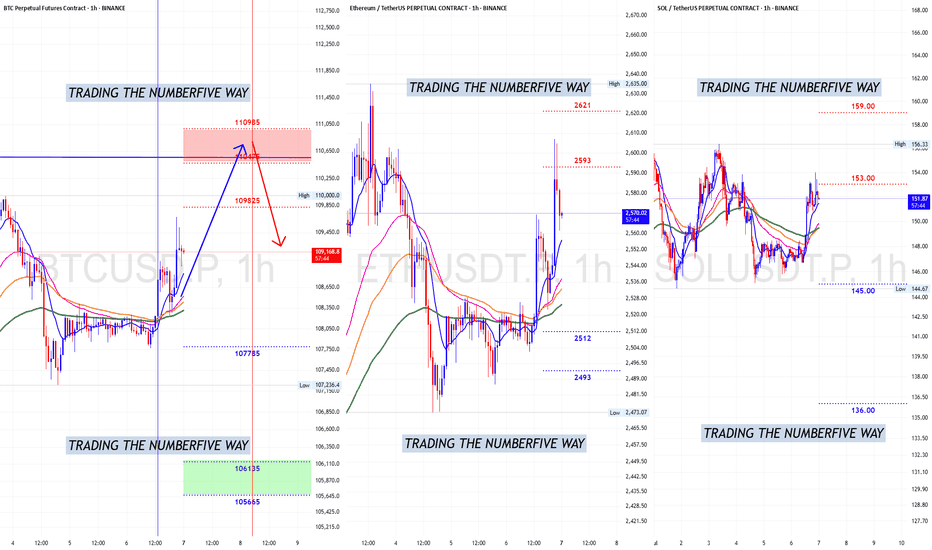

Otherwise the optimal way to go about this is trade the smaller time frames. I will always suggest this near highs and breakouts on larger time frames. The reason is simple: risk can be tightly controlled. This requires some kind of rules or guidelines to judge the market, along with a way to confirm. Using the Trade Scanner Pro for example, the analysis component is easy: trend is bullish on all small time frames. This means you wait for a trade suggestion on the time frame that you regularly trade (1 min or 5 min f or example).

No matter what type of trend following system or rules you use, by aligning with the bigger picture and confirming a setup in some way is what puts the probabilities on your side. The smaller the time frame you operate, the more precise your risk management can be.

Thank you for considering my analysis and perspective.

BTCUSD.PM trade ideas

BRIEFING Week #27-28 : Distancing from US MarketsHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

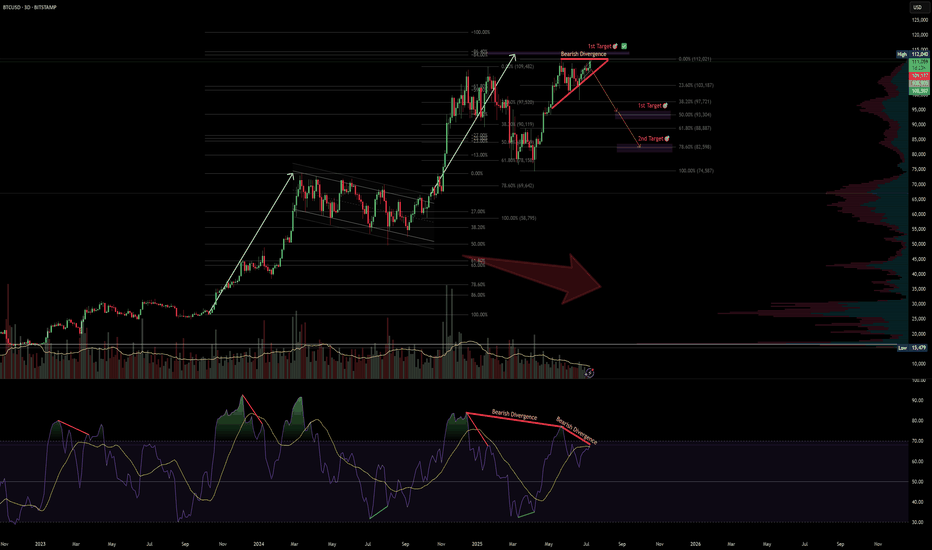

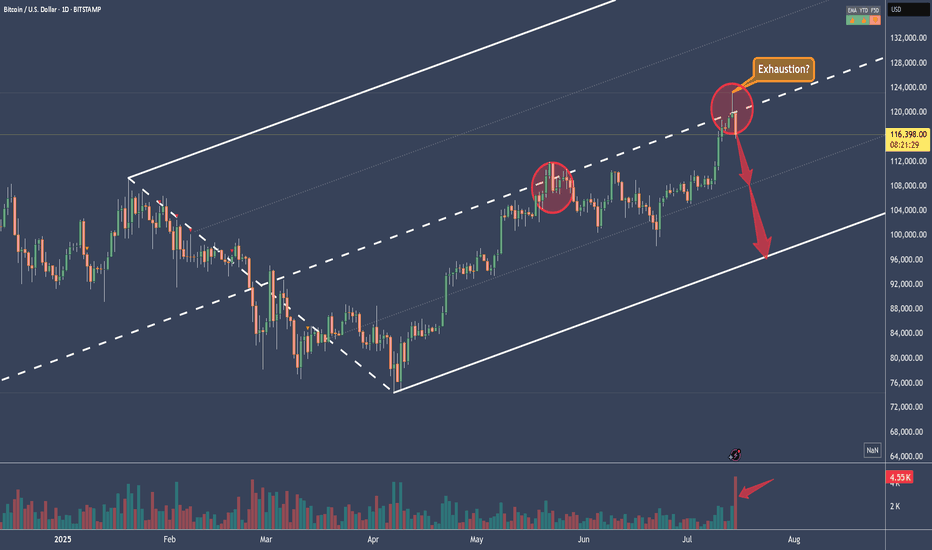

BTCUSD · 3D — Bearish Divergence + Volume Drop Suggest Pullback

🧠 Setup Overview

Bitcoin is showing signs of exhaustion after a parabolic rally:

Bearish divergence is visible on the 3D RSI — price made higher highs while RSI made lower highs.

Volume is shrinking with each push up, suggesting buyer momentum is fading.

Price is pressing into all-time highs without conviction, signaling potential for a pullback.

🔻 Downside Targets

Target 🎯 Level Why It Matters

Target 1 $92,300 (50% Fib) Midpoint of last impulse + first strong demand area.

Target 2 $82,500 (61.8% Fib) Volume-profile support + key confluence zone.

🔎 What Confirms the Setup?

Breakdown below $108K structure

Daily close below $105K with increasing volume

RSI losing midline support = momentum shift confirmed

❌ Invalidation

Daily close > $112K with strong volume = idea invalid

Would suggest continuation toward blue-sky breakout

✅ Summary

Bearish divergence + volume drop = classic topping signals

Risk is well-defined, with Fib-backed targets offering clean R:R

Trade cautiously — momentum is fading, not gone yet

📛 Disclaimer: This is not financial advice. Do your own research and manage risk according to your plan.

#Bitcoin #BTC #CryptoAnalysis #BearishDivergence #RSI #VolumeProfile #Fibonacci #TradingView

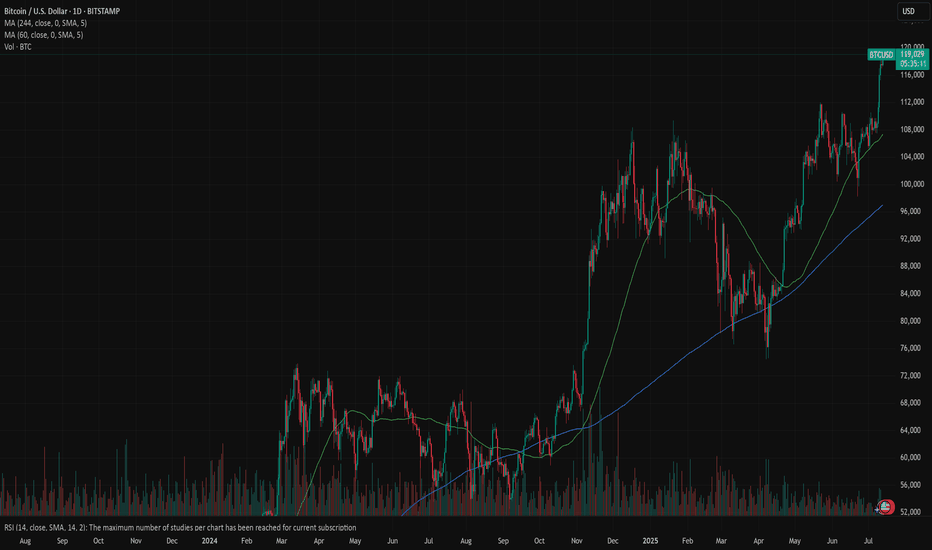

Bitcoin: celebrating new ATHCrypto enthusiasts are celebrating the latest achievement of BTC. The coin managed to reach another all time highest level during the previous week, at the level of $118,5K. Although BTC was struggling during the previous period to sustain the higher grounds, testing on several occasions the resistance level at $108K, the buying orders prevailed on Wednesday, bringing the skyrocket levels on Thursday and Friday. Crypto market significantly gained from the BTC move, as majority of other crypto coins gained in value, surging significantly total crypto market capitalization.

With the latest strong moves, the RSI reached a clear overbought market side, touching the level of 73. The indicator is closing the week at the level of 70, still continuing to move within the overbought market side. The MA50 is turning again toward the upside, leaving the MA200 aside. There is no indication of a potential cross in the coming period.

Charts are pointing to a potential for a short reversal of BTC price in the coming week. Such a move could be treated as “normal” in terms of how the market is functioning. A strong push toward the upside will make traders close their positions in order to take profits, which will shortly push the price toward downside. Where that level could be, at this moment, is hard to predict based on technical analysis, because BTC is currently moving in an uncharted territory.

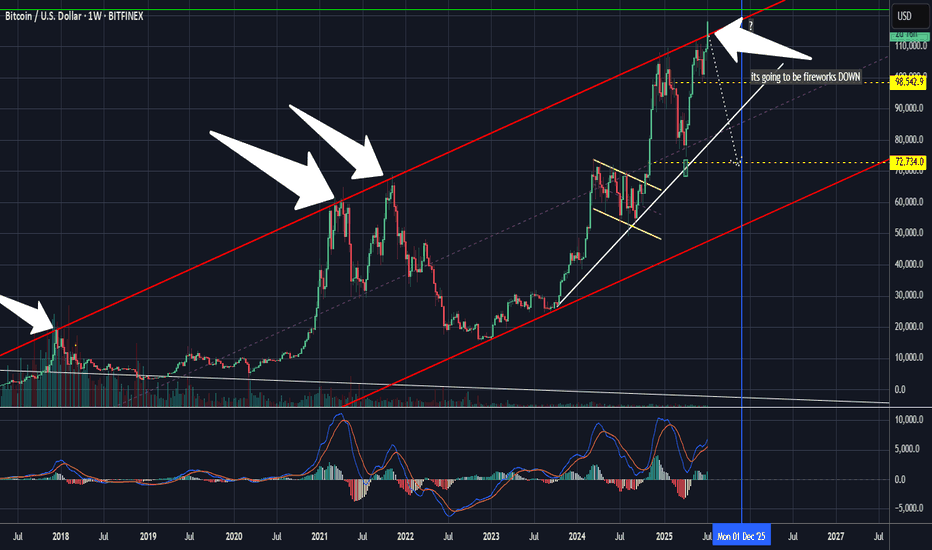

Bitcoin in dangerzoneAgainst all influencers online let me warn you that the current Bitcoin position is one to be very aware of. We re sitting above a multi year long strong trendline, the volume is low to moderate so no blow off top coming. DO NOT BUY or chase here, you can lose it all.

My next targets are below 90k. XRP 1.5usd still valid.

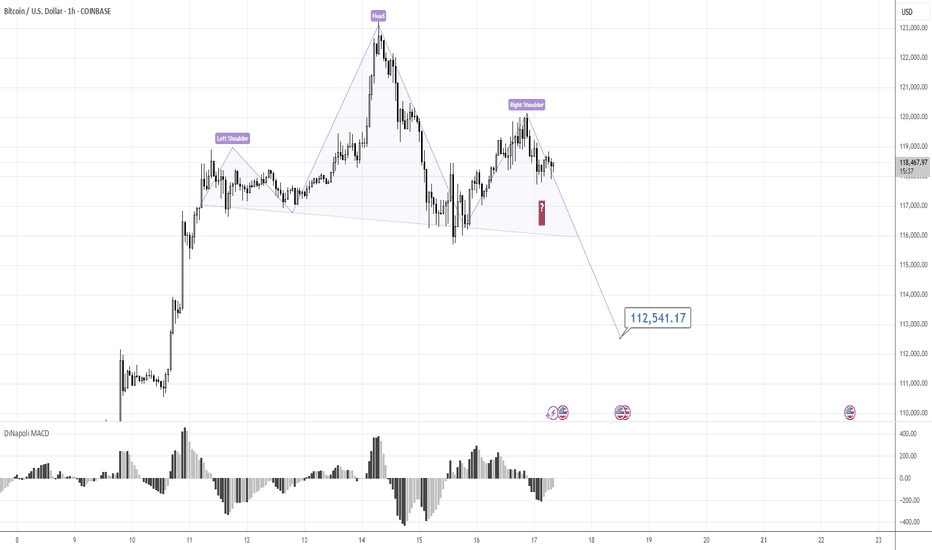

120K is the Key.Morning folks,

Our last plan worked perfect - market re-tested 117K support and jumped out. If you have longs - you could keep it.

We consider now two alternative scenarios, although we think that this one with triangle is more probable, we do not exclude the H&S shape on 1H chart that could lead BTC down to 112-113K support area.

So, if you do not know how to deal with this - keep an eye on the 120K area and top of the right arm. Upside breakout will confirm H&S failure and triangle scenario. Otherwise, until market stands under 120K - consider H&S as a basic scenario, just for safety.

Take care, S.

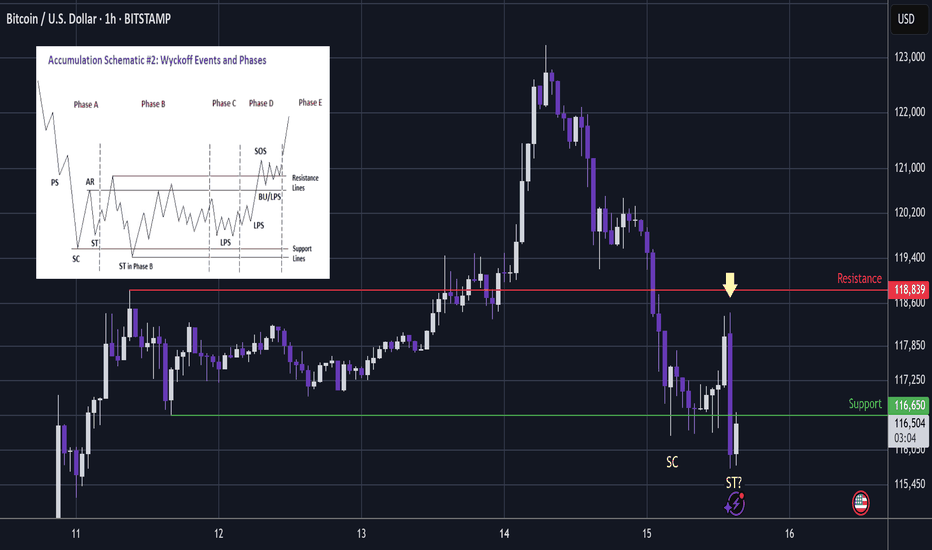

BTC - Capitulation. Now Time For A Bounce?Whenever there is a big impulsive rally, dumb money will come rushing in to buy.

And thus we can somewhat expect the market maker to print a shakeout for them to exit at best price and dumb money to carry the bags at worst price.

...

In this area we have multiple charts providing the liquidity zones for the shakeouts:

The upside shakeout (long wick) printed on TOTAL through ATH:

...

Before I make the next point, lets see the design of the chart bots 10 years ago in 2015.

Notice that the high and low of the trading range is set by the impulsive high then initial slump:

That sets the trading range.

Once set; the chart bots then print a liquidity sweeping slightly higher high...

Which slumps back to liquidity sweep the lows of the trading range.

From there the next wave up begins.

...

Now notice in these charts from the last 2 days, that the trading range was similar to that of 2015.

But once the range was set; rather than printing a simple slightly higher high, the more evolved chart bots printed a wild impulsive move up to draw in buyers.

This then became a very impulsive smackdown.

...

Although going on a wild journey, the price is effectively similar to the pattern of 2015; liquidity sweep at the highs and now it is below the low.

Notice on these 2 charts from the last two days that the support that Bitcoin has hit today was the obvious trading range low - similar to 2015.

And so the question is now; whether it will also be a liquidity sweep at the lows and a bounce will follow?

Notice on the chart, there was a big smackdown and then we have had another fast smackdown (arrow) to take price beneath the lows.

This looks very much like a fear test - where the chart bots try to sell you another immediate capitulation, but yet the price holds in the zone of higher liquidity below support.

Wyckoff would call these 2 lows SC Selling CLimax and ST Secondary Test.

The selling climax completes the real bearish wave down.

Secondary Test is the probe into higher liquidity which is a fear test to scare longs away.

...

So if we consider that history may not repeat, but it does rhyme then there will likely be a bounce in this area - as the market maker gets best price for their short positions while dumb money panic sell their long positions at a loss.

Not advice

BRIEFING Week #29-30 : BTC stalling, ETH & then Alts ?Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

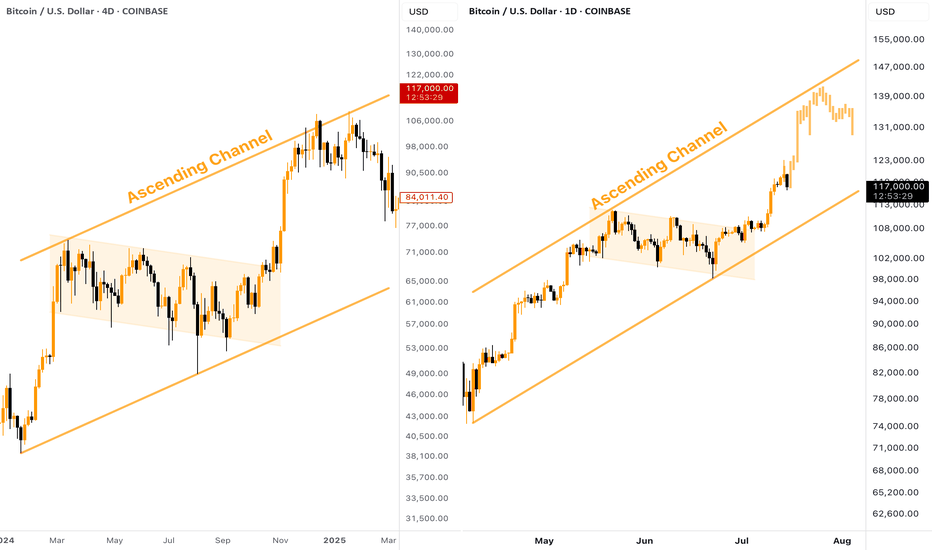

[BITCOIN] - Where is Potential TOP (ATH) of the Bull Cycle?Many people wondering where is the potential TOP of the current Bitcoin Bull Run? Besides setting a Fibo Retracement, we can take a look at the past. The current situation on CRYPTOCAP:BTC chart reminds me of what we've seen in the end of 2024, here is why:

Big ascending channel, price perfectly moves inside without breaking borders

Descending consolidation inside the bull flag

Strong breakout and pump towards the resistance of the channel

👉 According to this pattern, the target for the current Bitcoin upward move should be located in the $140,000 zone. Keep this in mind when planning your trades.

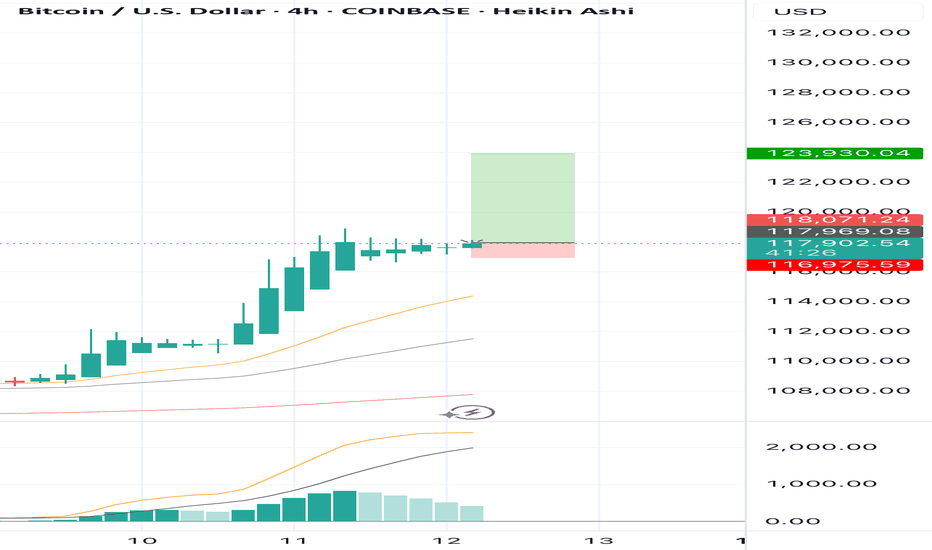

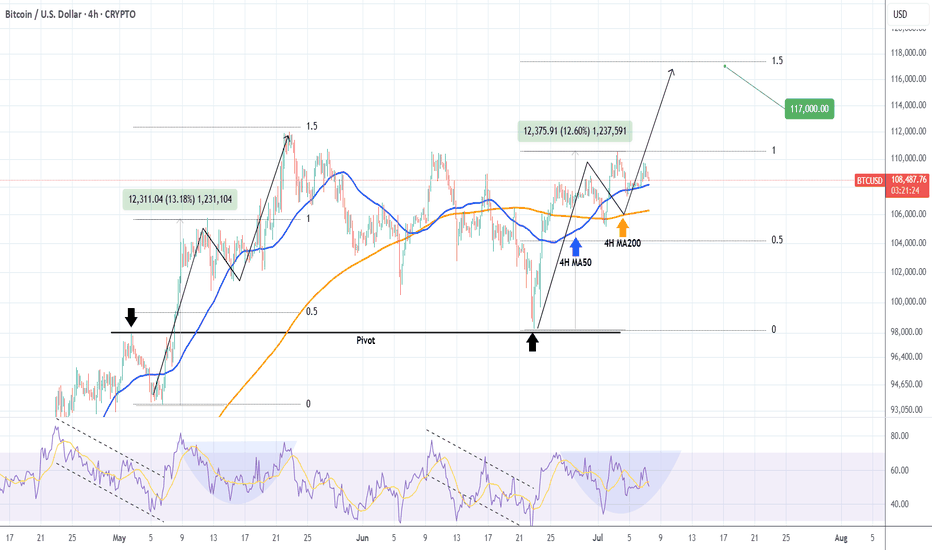

BITCOIN Short-term Target = $117kBitcoin (BTCUSD) is coming off a 4H Golden Cross, attempting to hold the 4H MA50 (blue trend-line) as its short-term Support. The early hours of the E.U. session today show that this might be a difficult task, however comparison with May's Bullish Leg, gives positive signs.

Almost the entire month of May sequence has been an uptrend, which looks very similar to today's. Almost identical rises from their bottoms (+13.60% against +12.60%) until the first top, with similar 4H RSI fractals also, we can expect the current uptrend to make a second top soon near the 1.5 Fibonacci extension at $117000.

Are you expecting such an outcome in the coming days? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

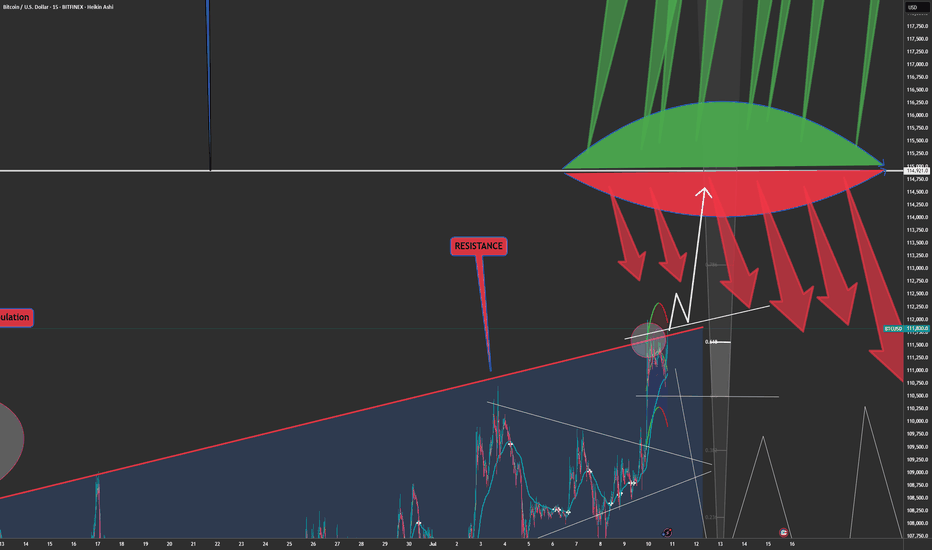

BTCUSD - Exhausted? Second time rejected, now down.BTCUSD got rejected at the Centerline the second time. This is super bearish. If it's closing below yesterdays low, that's a clear short signal to me.

Taking 50% gains off the table is never bad. Because then you still have 50% if it's going up further. Otherwise, you got 50% booked.

Don't let gree eat your brain §8-)

Bitcoin Breaks Out – The Final Test Has Begun 🚀🔥 Bitcoin Breaks Out – The Final Test Has Begun 💥📈

Boom! The breakout is here. After days of grinding under resistance, BTC has finally burst out of the channel — and all eyes are now on the monster level at $114,900.

📊 We spoke about this level again and again — the third macro test, the “HUGE-est Level EVER,” the battleground between Ultimate FOMO and End of Cycle.

⚠️ This breakout could lead to:

✔️ Acceleration to retest 114,900

✔️ A potential 3rd attempt to break the golden structure

✔️ Euphoria or exhaustion — no middle ground

🧠 Smart traders will remember:

– 8+ divergences still exist on higher timeframes

– The risk of failed breakout traps is high

– But this is what we’ve been waiting for: confirmation + continuation

🎯 If momentum holds, we may be on our way to test the upper macro structure. This is not the time to hesitate — it’s time to manage risk like a pro and track the flow.

💡 Catch up on the setup:

👉 Where Can Bitcoin Go? Part 8

👉 July 10th Market Outlook – Uncharted Waters

🗣️ It’s not about prediction — it’s about preparation.

We were ready. Are you?

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

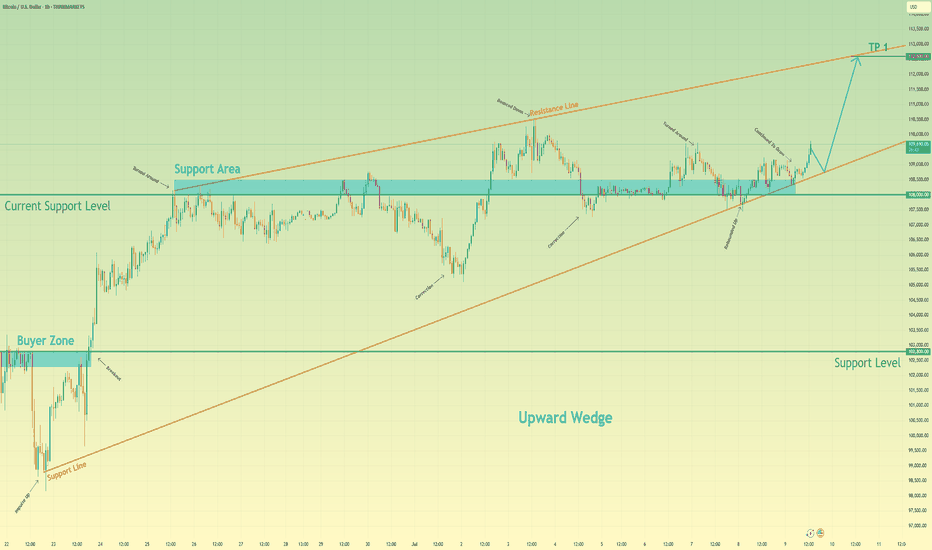

Bitcoin can rebound up from support line of upward wedgeHello traders, I want share with you my opinion about Bitcoin. In this chart, we can see how the price dropped from the 102800 support level, which coincided with the buyer zone, and later entered to wedge upward. In this pattern, price made an impulse up from the support line of the wedge pattern and broke the 102800 support level, after making a retest, and continued to move up. Bitcoin rose to the current support level, which coincided with a support area and even entered this area, but soon turned around and fell below. Next, price rose to this area again and then made a correction movement, after which it turned around and made an impulse up to the resistance line of the wedge, breaking the 108000 level. After this movement, the price bounced from this line and fell back to the current support level, where it some time traded in the support area. Later price rebounded and continued to move up. Now, I expect that BTC can correct to support line of the wedge and then rise to the resistance line of this pattern. That's why I set my TP at the 112600 points, which coincided with this line. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

127KMorning folks,

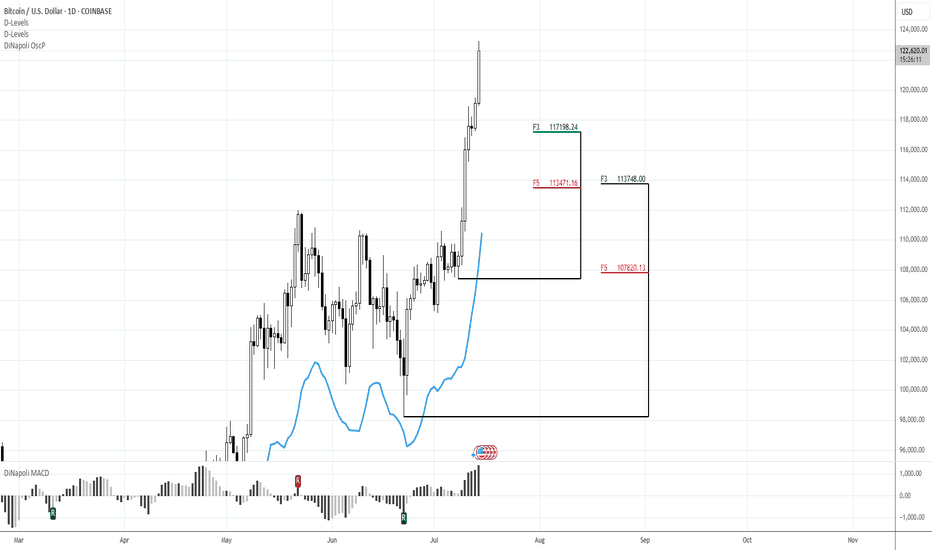

So, BTC shows even better performance that we thought, although it obviously something stands behind, this is not market-natural motion. Anyway, we consider 127K level as all-time nearest target that stands on monthly chart.

If any pullback starts (BTC now is at daily overbought and near Yearly Resistance Pivot), we keep an eye on 117.2K and 113.5K levels to decide on long entry

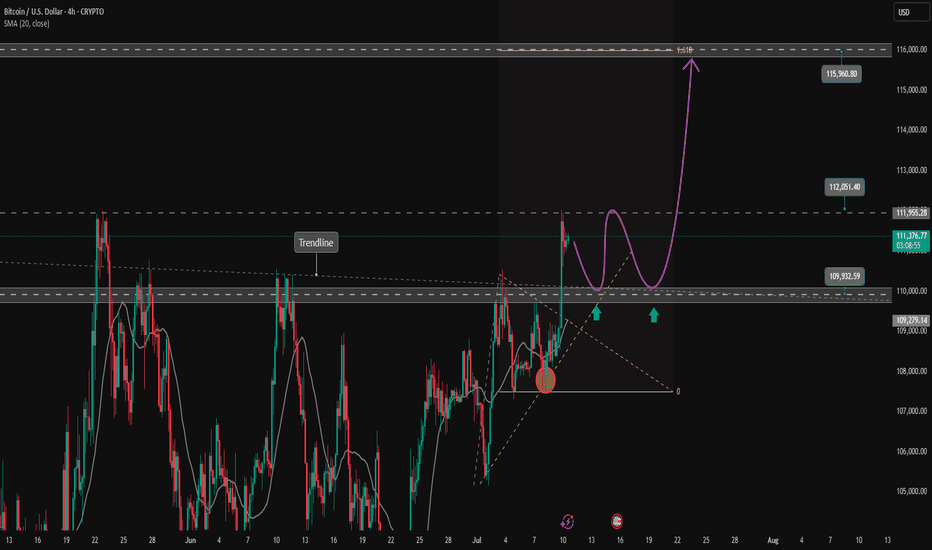

Bitcoin Running Out Of TIME.Bulls are doing a nice job at holding price in a tight range but are running out of TIME from the 1hr and 4hrs TF's pov while the Daily still needs a few days more to complete its setup for its next burst.

As long as Bitcoin stays within that $106k - $110k range soon we will be testing the ATHs which it should it done by now but its playing a little bit lazy.

Bitcoin still has like 26 1hr bullish candles of TIME to go as high as it can before the next drop take place and that drop will be the one that can put and danger the uptrend direction again so the higher the drop starts the less damage to the trend bears will do.

Buckle up ladies and gentlemen cause Bitcoin will get wild again.

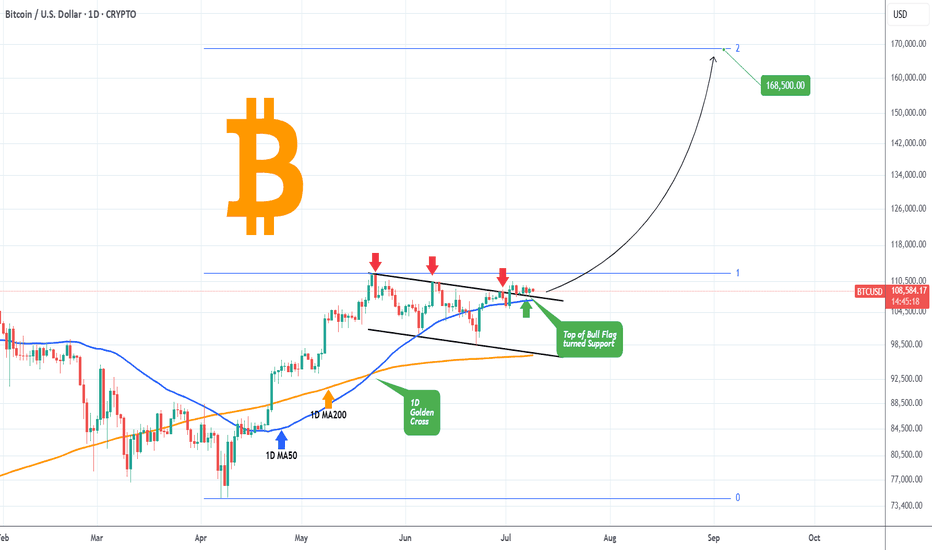

BITCOIN turning the Bull Flag into Support??Bitcoin (BTCUSD) has been trading sideways, almost flat, since the July 03 High, supported by the 1D MA50 (blue trend-line).

Perhaps the strongest development of the week though is the fact that this consolidation has been taking place at the top (Lower Highs) of what we previously identified as a Bull Flag pattern.

Together with the 1D MA50, this Lower Highs trend-line forms a formidable Support, which as long as it holds, can technically fulfil the technical expectations out of this pattern and target the 2.0 Fibonacci extension at $168500.

Is this one step closer to our 'fair valued' $150k Target for this Cycle? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC's increasing fomo force will push the price up furtherCRYPTO:BTCUSD just broke the important resistance zone and trendline around 110000. This price increase to create a new ATH will create a large amount of FOMO in the market pushing BTCUSD to increase more than half. 116,000 FIbonacci extension points are considered the immediate Target for the uptrend.

Waiting for retests to the support zone for the trend-following BUY strategy.

Support: 110000-107500

Resistance: 116000

Buy zone: 110000 ( support + trendline)

Buy Trigger: break above 112000

Leave your comments on the idea. I am happy to read your views.

$160K BTC by AUG 11thI think we are in the 2nd to last leg up to top of Bull run. 5 waves to this one should put us at $160k, then a 3 wave down before the last 5 waves up for top by end of year. this could all be done in Aug or sept. Will have to check then to see what happens. But I call for $160k within 30 days. Bold I know. Lets go Moon shot. Top of bull run. $190k ? thoughts?

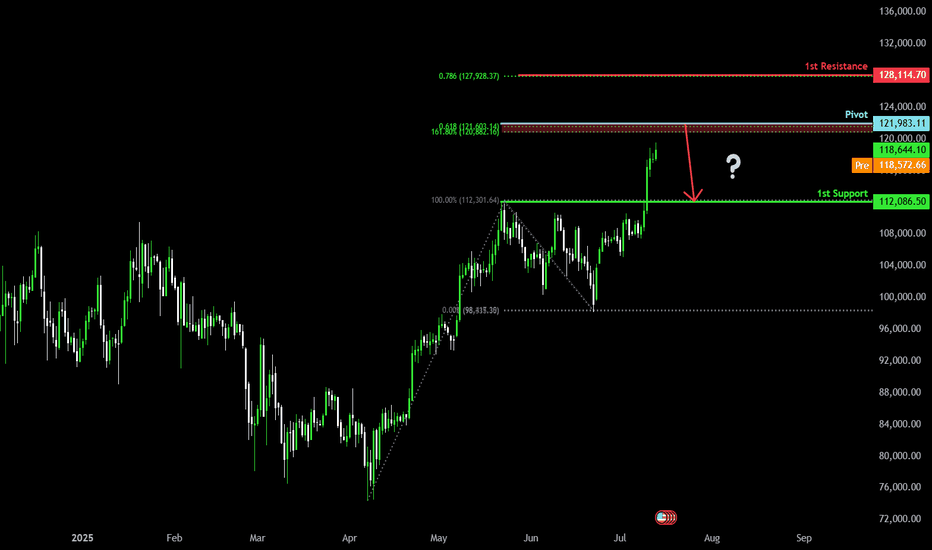

Bearish reversal off Fibonacci confluence?The Bitcoin (BTC/USD) is rising towards the pivot and could reverse to the 1st support which is a pullback support.

Pivot: 121,983.11

1st Support: 112,086.50

1st Resistance: 128,114.70

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.