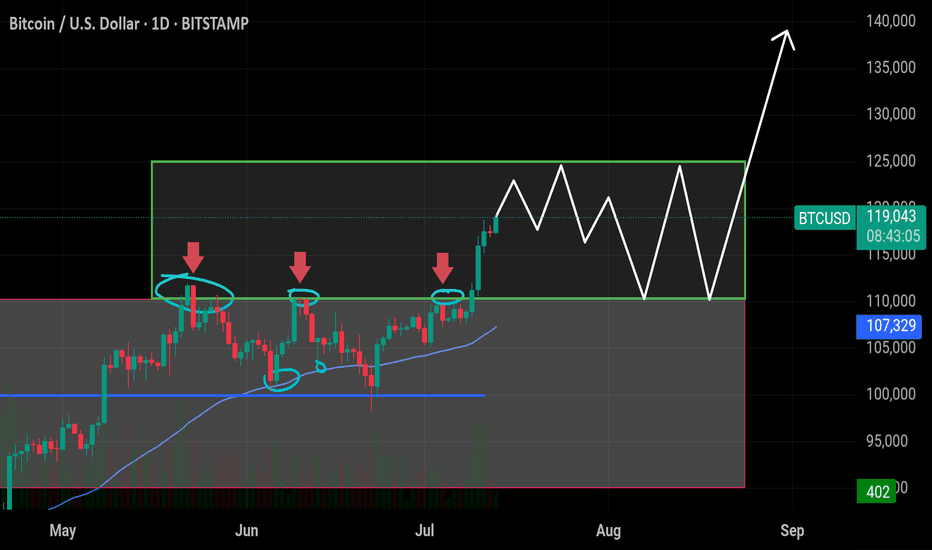

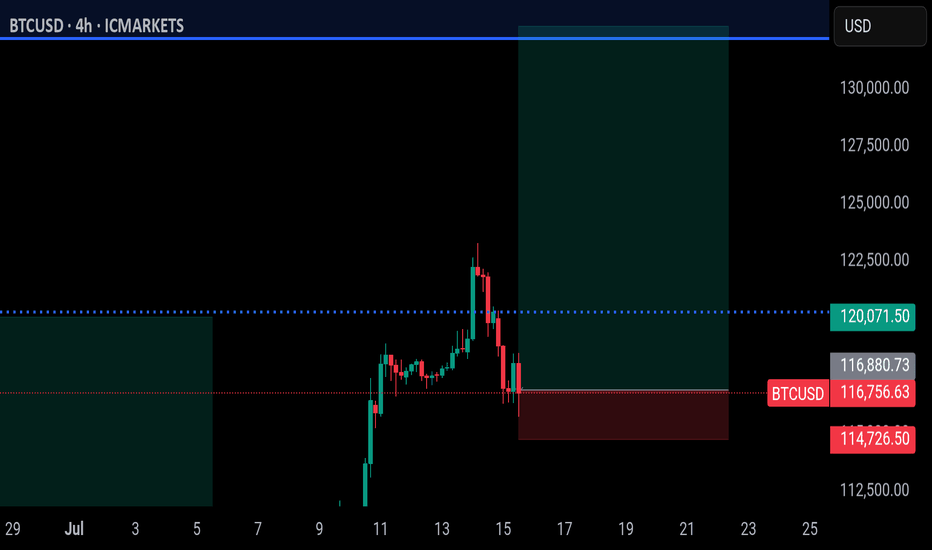

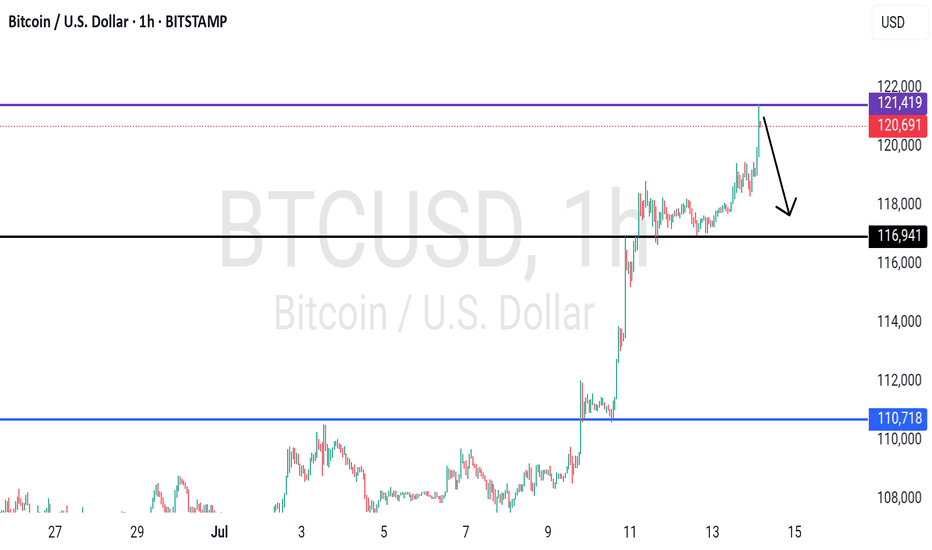

$BTC Ready to Explode – Targeting $125K+ Soon! Bitcoin has finaCRYPTOCAP:BTC Ready to Explode – Targeting $125K+ Soon!

Bitcoin has finally broken out of the previous resistance range (~$110K–$111K), where it was rejected multiple times in June. Now it's consolidating in a tight box, setting up for a big move.

🔸 Support $110k–$113k

This area was previous resistance and is now acting as strong support. Holding above this confirms bullish strength.

🔸 Upside Target: $125k

If BTC holds within the current range and breaks above, the next leg could push price toward $125K. A clean breakout could even extend toward $140K.

🔸 Short-Term Take Profits:

✅ TP1: $120,000

✅ TP2: $122,000

✅ TP3: $125,000

🔸 Risk Level at $110,000:

Break below this level would invalidate the bullish setup and increase downside risk.

BTCUSD.PM trade ideas

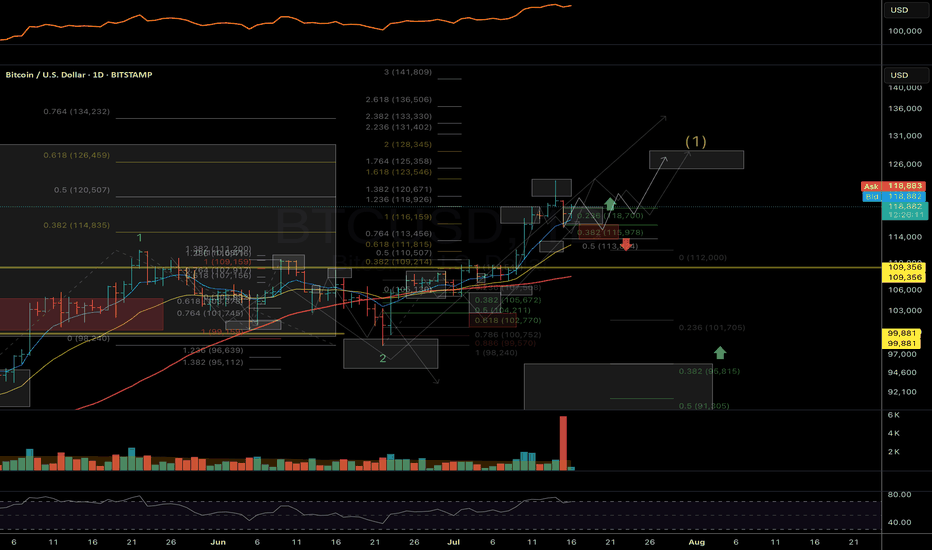

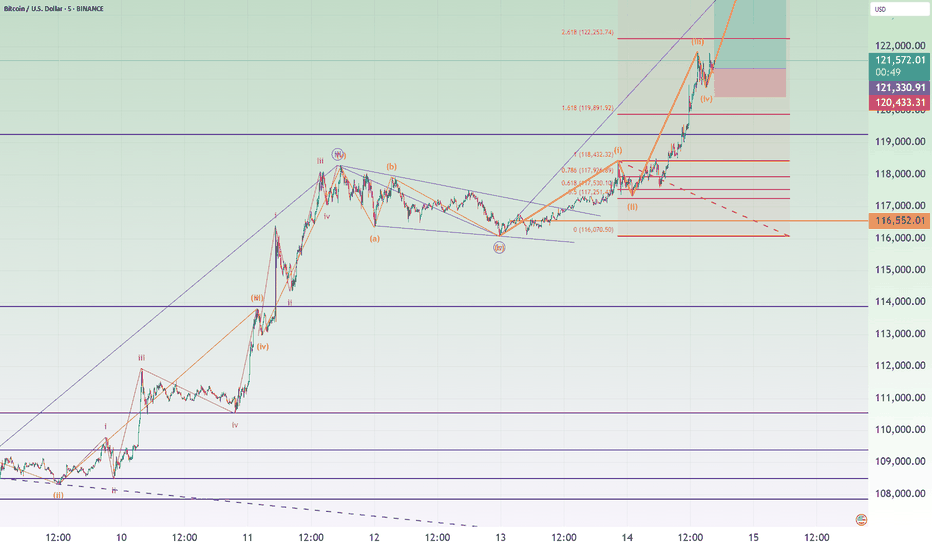

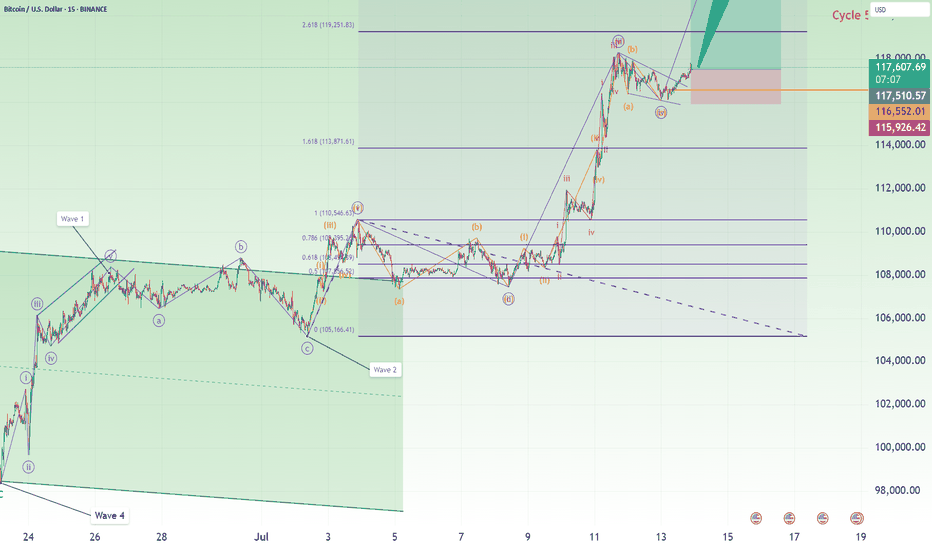

Bitcoin (BTCUSDT): Trade Wave 5—Next Stop $127,000?Bitcoin’s current structure is lining up for a classic Elliott Wave fifth wave scenario, and the setup could offer a high-reward trade as we look for a measured push toward the $127,000 area. Here’s what’s standing out in the recent price action:

What the Current Structure Shows (Primary Scenario)

Wave 4 Correction Complete: After peaking in wave iii near $124,000, BTC pulled back and has potentially completed a wave iv correction. Price respected the Fibonacci retracement zones bouncing near the 38.2% retracement at $117,116.

Preparing for Wave 5: With support confirmed, price action is stabilizing and looks primed for a final motive push—wave 5—to the upside. The target projection for wave 5 is around $127,000, in line with both the 61.8% extension of the previous swing and the common equality projection for wave 5 vs. wave 1 when wave 3 is extended.

Why the Count Is Labeled This Way

The advance from early July kicked off with impulsive movement, subdividing cleanly into smaller waves that align with classic Elliott structure.

Wave iii is the clear standout—steep, extended, and carrying most of the move’s energy, which checks the box for a strong third wave.

The cluster of Fibonacci and previous resistance/support near $127,000 offers strong technical confluence for the next objective.

Trade Setup: Riding Wave 5 to $127,000

Entry Zone: Consider longs on breakouts above the current consolidation, ideally after confirmation of support holding near $117,100–$116,000.

Stop Loss: Place stops just below $113,300 (the 61.8% retracement), or tighter for risk management depending on your position size and timeframe.

Target: $127,000—where wave 5 projects to equal the length of wave 1 and aligns with multiple Fibonacci targets.

What to Watch Next (Confirmation or Invalidation)

Confirmation: An impulsive move above the interim high at $120,000–$121,000 with strong volume would confirm wave 5 is underway and that bulls have regained control.

Invalidation: A break below $110,500 would invalidate this setup and suggest a more complex correction is taking shape.

Final Steps: Monitor for impulsive character in the rally—wave 5s can sometimes truncate, so don’t get complacent at resistance.

Alternate Count

If price fails to hold support and breaks down, BTC could still be in an extended or complex fourth-wave correction—possibly a running flat or triangle—before wave 5 eventually resumes.

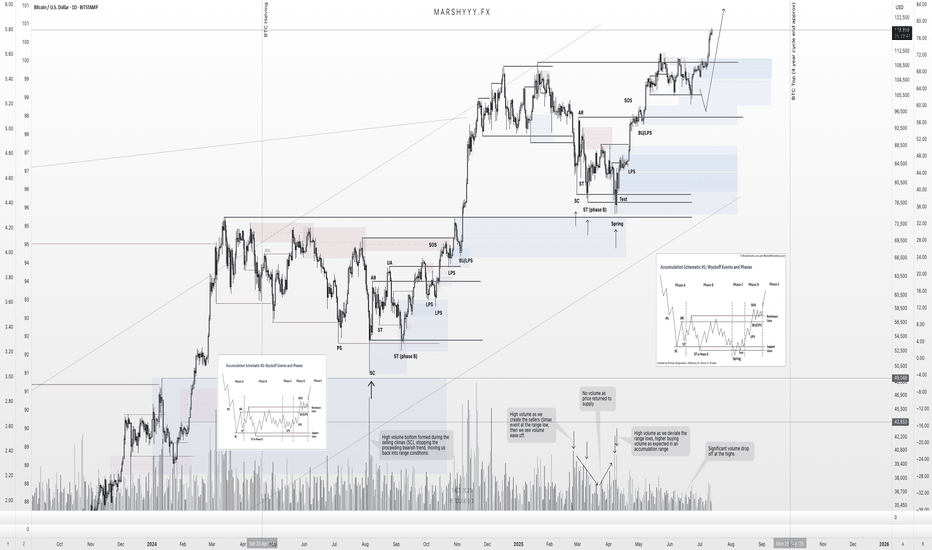

BTC – Textbook Pullback. New ATHs. What’s Next?Back in mid-June, I published a BTC update calling for a local correction into HTF demand while most were screaming bear market and waiting for deeper breakdowns.

Price action played out exactly as forecasted.

BTC swept the $100k swing low, front-ran my first demand zone by $400, and launched into a powerful reversal — just like it did back in April, where it also front-ran the key HTF demand before rallying.

That move took us straight into new all-time highs (ATHs) — now trading comfortably around $118k.

🧠 What Happened?

✅ Liquidity sweep of the prior low

✅ Front-run demand zone (perfect HTF structure)

✅ Strong bullish reaction and higher high

✅ Confluence from USDT.D rejection at 5.25%

✅ Alts showing signs of strength as BTC rallies

The entire setup aligned perfectly across BTC, USDT.D, TOTAL, and OTHERS.D — all of which I’ve been tracking in tandem.

🔮 What Now?

With BTC now in price discovery, I expect continuation higher — but not without the possibility of a short-term pullback.

📉 A potential retest of the $108k zone isn’t off the table. This level aligns with:

- Prior breakout structure

- Range high retest

- Local demand before continuation

But even if we go straight up — I remain HTF bullish into the final phase of this cycle, supported by:

- USDT.D structure still bearish

- BTC.D showing signs of distribution

- ETH.D and OTHERS.D gaining momentum

- Altseason rotation already starting to pick up

🧭 The Macro Outlook

The 4-year cycle projection still points to a Q3 2025 top — likely between August late and September based on historical cycle timing, but this could deviate.

That gives us a window of 2–3 months for this final leg to unfold — and it’s already in motion.

Stay focused. Stick to your plan. Ride the trend, don’t chase it.

Let me know what levels you're watching next, and whether you think we get that $108k retest — or we go vertical from here.

1D:

3D:

4D:

1W:

1M:

— Marshy 🔥

[UPD] BTC / ETH / XRP / SOL / HYPE and other alt and mem-coins A new video update with insights on the intermediate trend structure with key support and resistance zones to keep on radar in the coming sessions

Coins discussed in the video: CRYPTOCAP:BTC / CRYPTOCAP:ETH / CRYPTOCAP:XRP / GETTEX:HYPE / CRYPTOCAP:SOL / CRYPTOCAP:LINK / CRYPTOCAP:SUI / $BRETT / SEED_DONKEYDAN_MARKET_CAP:FLOKI and others

Hope this is helpful in guiding you through the crypto market. Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking - feel free to ask in the comments (just don’t forget to boost the idea first 😉).

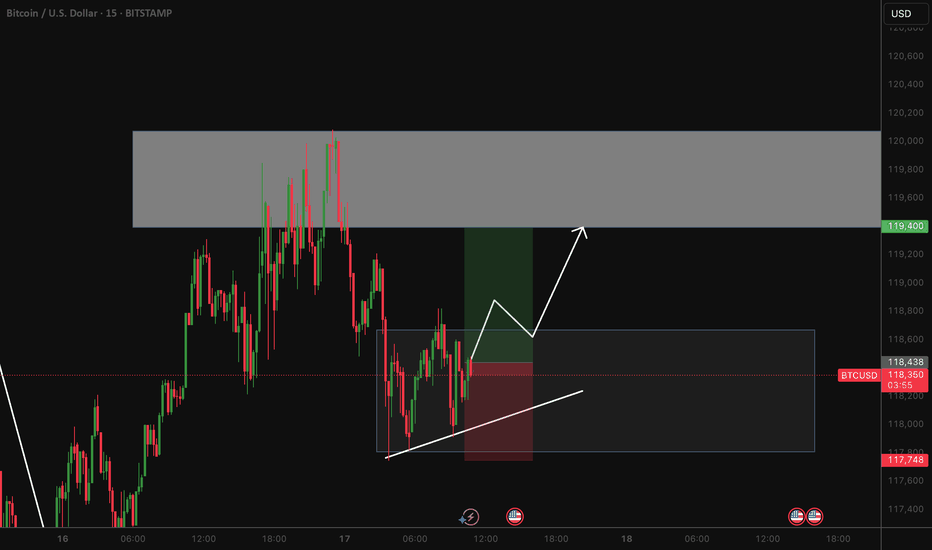

BTCUSD Analysis : Reversal Brewing from Volume Burst Demand Zone🧠 Overview:

Bitcoin is currently showing signs of a potential bullish reversal, following a classic Market Maker Cycle (MMC) pattern. The price action has been clean, respecting both volume dynamics and structural levels, setting the stage for a possible breakout above key areas of interest.

Let’s dive into the detailed breakdown:

🔍 Key Technical Elements:

1️⃣ Volume Contractions – Early Sign of Momentum Shift

At the top left of the chart, we observe a sharp upward move, followed by volume contraction within a rising wedge. This typically represents:

Absorption of orders

Reduced volatility

Market indecision

This kind of structure often precedes a reversal or aggressive breakout, depending on how price behaves near liquidity zones.

2️⃣ Fakeout/Trap Above – Classic MMC Manipulation Phase

After the rising wedge formed, BTC experienced a quick fakeout (stop hunt) just above the highs, then dropped sharply. This was the manipulation leg — a clear signal that liquidity above the wedge was taken and smart money is now repositioning.

🧠 Market makers love to trap breakout traders before moving the opposite way. The drop confirms manipulation is complete.

3️⃣ Reversal Zone + Demand Interchange into Supply

Price then entered a marked reversal zone which was previously an area of demand — now interchanging into supply. This zone is critical because:

It aligns with volume burst zones

It acted as support turned resistance

Multiple rejections confirm order flow shift

This tells us smart money is now testing this area to accumulate or trap sellers.

4️⃣ Volume Burst Area – Institutional Involvement Confirmed

We can clearly identify a Volume Burst Area, where price spiked with strong momentum — this is not retail trading. This zone is now being revisited for a potential bullish re-accumulation.

Expect reaction from this area, as it likely contains unmitigated buy orders from institutions.

5️⃣ Break of Structure (BOS) Mapping:

Minor BOS: Breaks short-term lower highs, showing early intent.

Major BOS: Breaks significant structure, confirming shift in trend direction.

A successful retest of demand and then break of both BOS levels will likely lead to a strong bullish continuation.

📈 Trade Plan & Potential Price Path:

There are two potential bullish entry strategies forming:

✅ Scenario 1: Clean Breakout Plan

Price holds the current reversal zone

Breaks Minor BOS, then Major BOS

Retest of BOS confirms continuation

📍 Target: $119,600+

✅ Scenario 2: Liquidity Sweep Entry

Price dips lower into Volume Burst Area

Sweeps liquidity below and prints a bullish reaction

Enters from discount zone

Same upside targets apply

🧠 This would be a smart money entry — entering from the lowest point of pain for retail traders.

🧵 Final Thoughts:

BTC is setting up beautifully for a reversal continuation pattern within the MMC framework. We’ve seen:

📉 Initial drop (accumulation phase)

🎭 Fake breakout (manipulation phase)

📈 Upcoming expansion (breakout phase)

All signs point to a high-probability move upward, especially if price confirms with BOS + retest. Be patient, wait for price action to align with structure and volume clues.

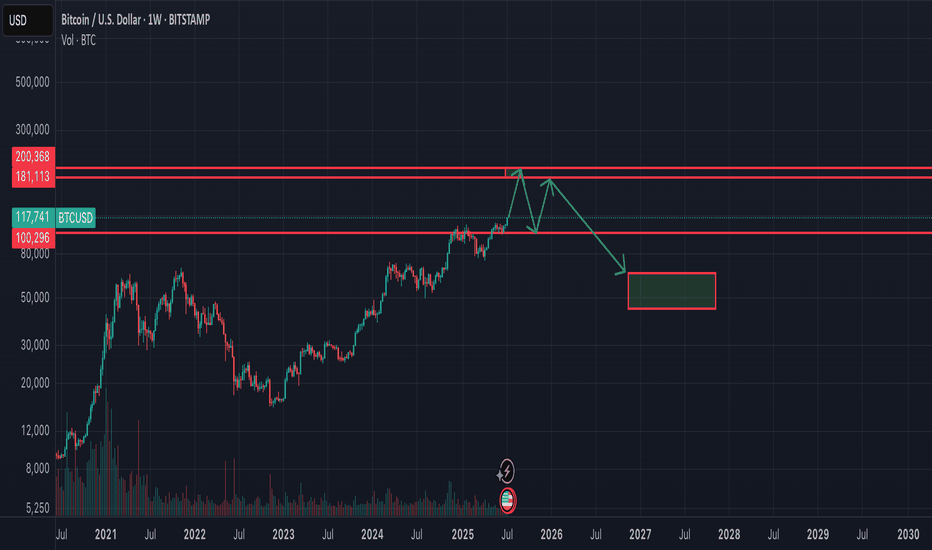

Final BTC target still remain above 130kBTC still has some push to do to reach my final target, 130k - 145k region. If you look at my BTC chart from January, that region has been highlighted. Till then, I'm still bullish. Now DXY is trying to turn bullish too, which will mean bearish BTC but it is that is s lagging indicator. It won't happen immediately, maybe next 2 or 3 months. Be prepared, for now, we still go up. Enjoyyy

Follow me as my trades are market order so you'll see the trades on time anand enter on time

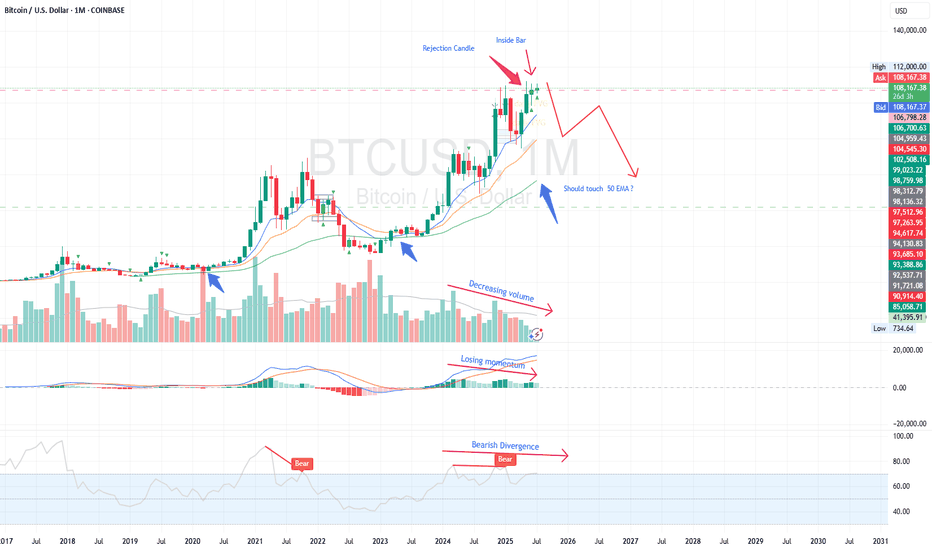

BTC monthly yelling at us for something interesting ?We read daily news about ETF, accumulation by institutes and scarcity in the exchanges, but I recognize something different in the chart based on multiple indicators. Historically, BTC boomed after touching 50 EMA and whenever it is extended it traces back to 50 EMA on monthly chart. As per current data, BTC is extended far from it. Also RSI and MACD indicating that it is losing momentum with -ve divergence. Volume as well descreasing since last leg, though price moved up. So, I expect price to retrace to 50 EMA which coincides with previous high at 60K. Let us see how it unfolds.

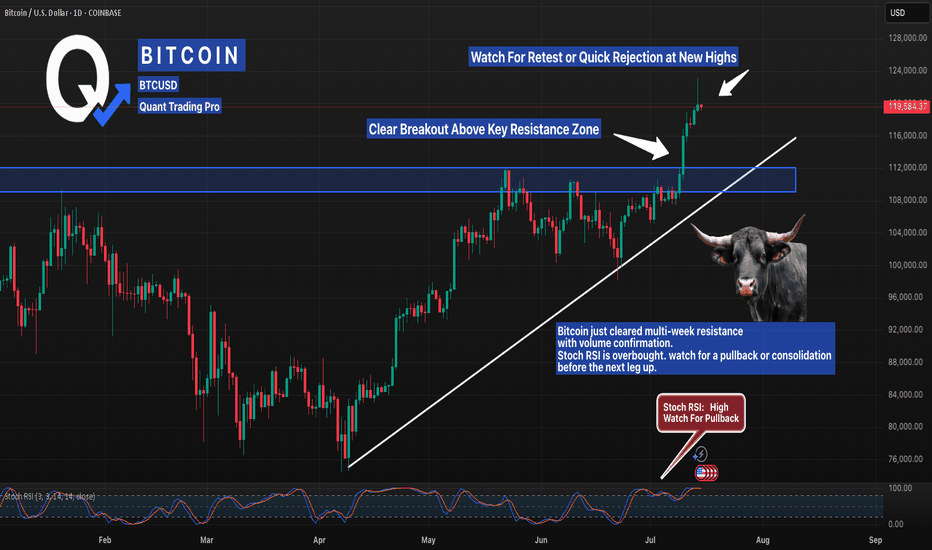

Bitcoin Just Shattered Resistance — Is a Pullback Coming Next? Bitcoin has exploded past a multi-month resistance zone with authority, confirming a breakout that’s been building for weeks. This move aligns perfectly with the rising trendline, signaling strong bullish structure. But here’s the catch — the Stochastic RSI is flashing overbought levels, a classic sign that momentum could be topping out short-term.

Smart traders are now watching two key scenarios: either we see a healthy pullback into the breakout zone (around $112K) for a textbook retest, or bulls keep control and push price into parabolic territory. If this level holds as new support, it could become the launchpad for the next major leg up.

Breakout traders, backtest your pullback strategies and manage risk — the next move could define the rest of the month.

BTC bullish scenario - short term bearishMapping out BTC sideways consolidation that could wreak havoc on ALTS.

Looking at the daily chart, this consolidation is still bullish as BTC price action is still likely respecting this ascending channel.

However, each move down on BTC could mean a significant dump on alt coins.

IMO, based on how the chart looks, BTC price still needs to come and test the bottom and coincidentally there is a huge FVG left when BTC rose impulsively. In all likelihood, I am expecting at the very least for a quick wick down to fill the gap before BTC can then start some bullish price action.

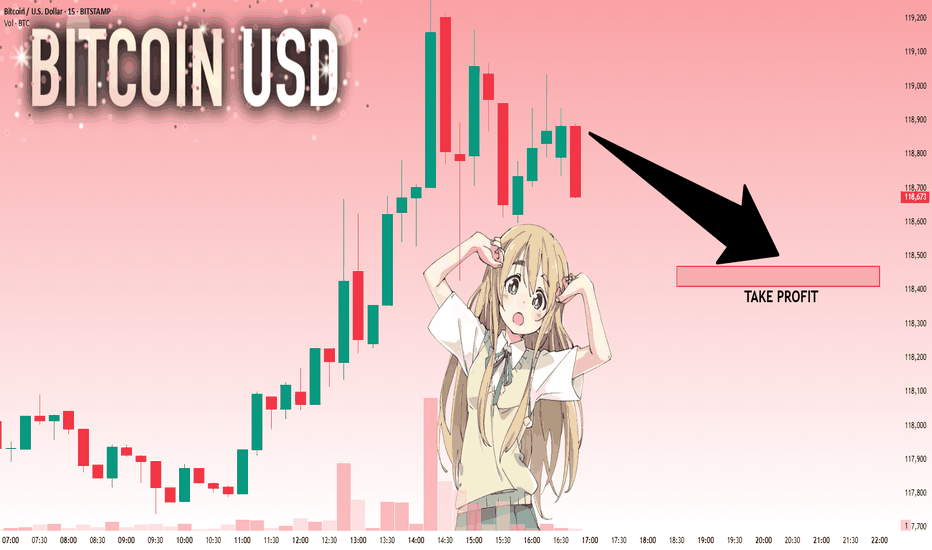

BTCUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse BTCUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 118.878 will confirm the new direction downwards with the target being the next key level of 118.470.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Bitcoin Long: Expects New High; Target 124,632Over in this video, I update on the Elliott Wave counts for Bitcoin and explain why I think that Bitcoin is going higher for a wave 5 of 3 of 5.

The stop loss will be below the wave 4 and given some leeway, will be around 115,900. There are 2 Take profit targets:

1. 119,251, and

2. 124,632

I made it known that my personal preference is $124,632 but note that once a new high is made, this wave counts will already be validated even if it then drops to our stop.

I talk about the possibility of trailing the stop once a new high is reached but commented that every trader must trade based on their own style and risk preference.

Finally, Good luck in your trading!

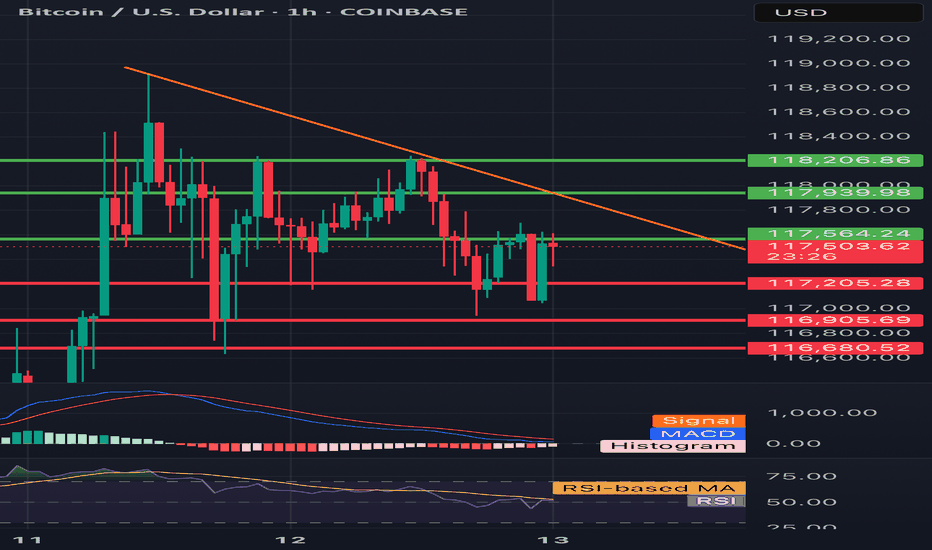

BTC/USD 1H chart short-term🔻 Trend:

• Currently visible inheritance channel - confirmed by the yellow inheritance trend (decreasing peaks).

• The price tests resistance in the area 117.564 - possible to break out, but requires confirmation of the volume.

⸻

📊 levels of support and resistance:

• resistance:

• 117,564 (here we are now - resistance test)

• 117,939

• 118,206 (key level - potential breaking from the channel)

• Support:

• 117,205 - a recent hole, valid short -term

• 116,905

• 116,680 - deeper support, possible target with further decline

⸻

📉 Macd:

• The histogram begins to decrease, but the MacD line and the signal line still below zero → still weakness.

• Possibility to build a base for reversing the trend, but there is no clear signal intersection.

⸻

📉 RSI (Relative Strength Index):

• RSI below 50, but it starts to reflect slightly.

• MA RSI is still falling → no strong growth dynamics.

⸻

🔍 Applications:

• The downward trend still dominates, but the price is trying to pierce local resistance (117.564).

• If it breaks above 117,939–118,206 and persists, a possible change in the direction at a short interval.

• If he rejects the resistance - a quick descend to 117.205 or lower (116,900-116,680).

⸻

⚠️ Signals for observation:

• Closing the candle 1h above 118.206 - Bullly Breakout.

• Rejection of level 117.564 and descent below 117,200 - confirmation of further decline.

• MacD and RSI - 50 - potential change of direction.

BITCOIN ABOUT TO BLOW UP OR TOP NEAR? Read my thoughts below Definitely Bitcoin looks strong compared to the rest of the crypto market.

we have been consolidating on top of the previous all time highs, and that is bullish, now price has broken out from its resistance and strong support remains around 108K area.

If momentum continues, 120K could be strong target, and if broken 135K is next by end of July.

BUT... Predictions is only in our minds, we need to look at Daily, Weekly and Monthly open and closes to determine bullishness or either momentum to the Upside, Distribution or Downside.

The fact that Bitcoin is making new ATH and the media is silent is a good thing.. But right now is trying to break the long top trendline that goes from 2017 top.

To me distribution and consolidation before the last leg makes sense. but nothing really does, markets can remain unpredictable and crazy more than you stay solvent. So if you are trading the move, use stop loss depending on your time horizon and timeframe.. AND DONT TRY TO PREDICT TOPS unless you are going for quick scalps or you might burn your money away.

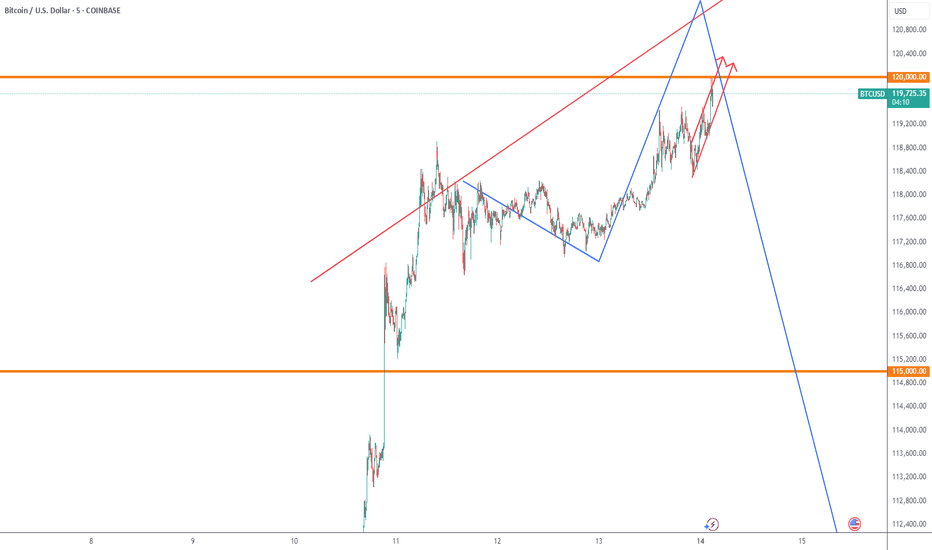

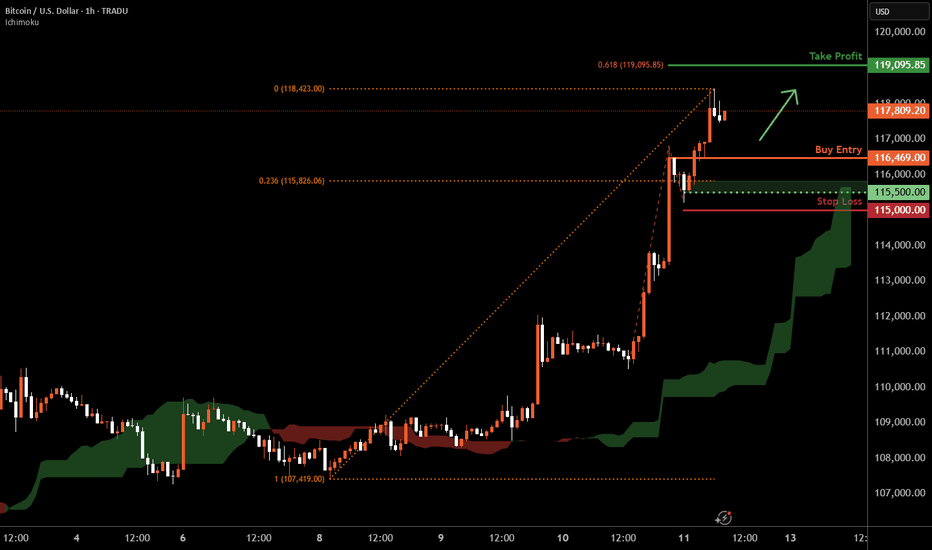

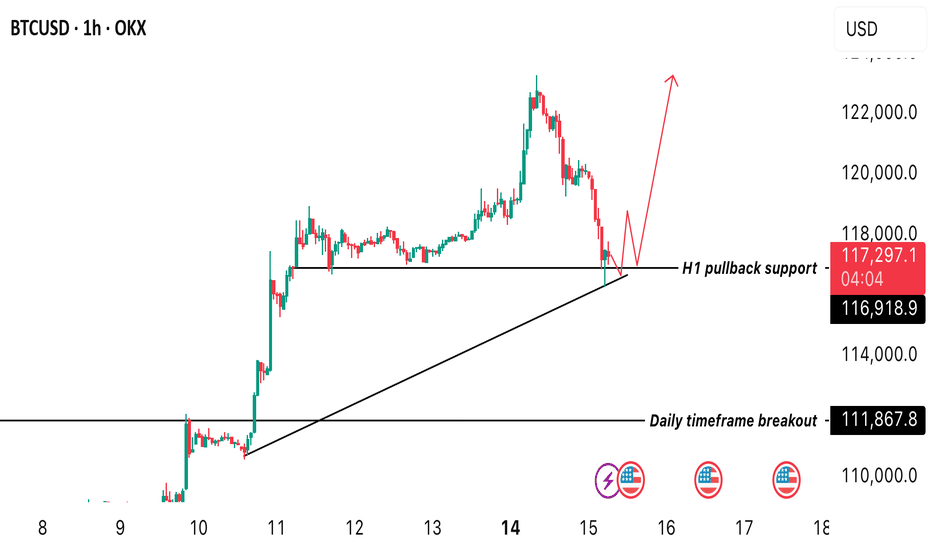

Bitcoin H1 | Bullish uptrend to extend higher?Bitcoin (BTC/USD) could fall towards a pullback support and potentially bounce off this level to climb higher.

Buy entry is at 116,469.00 which is a pullback support.

Stop loss is at 115,000.00 which is a level that lies underneath a swing-low support and the 23.6% Fibonacci retracement.

Take profit is at 119,095.85 which is a resistance that aligns with the 61.8% Fibonacci projection.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

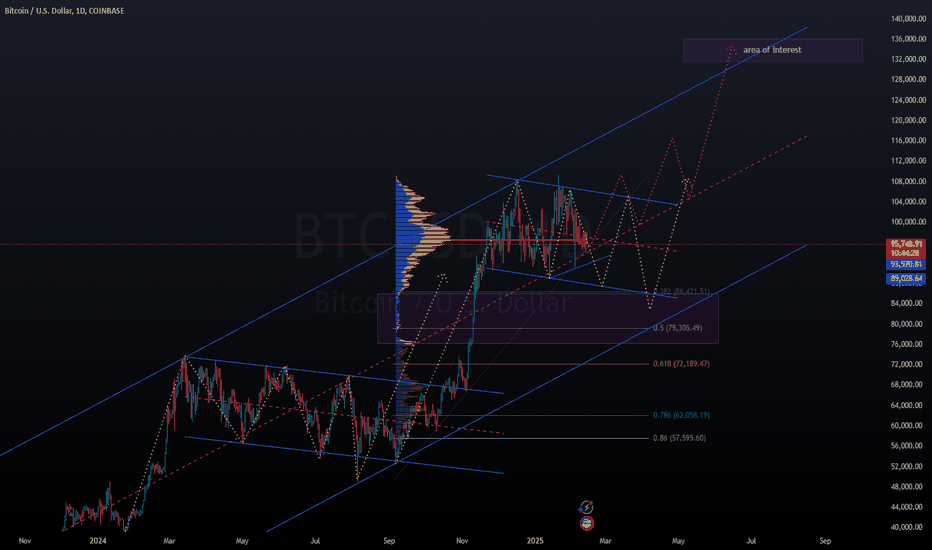

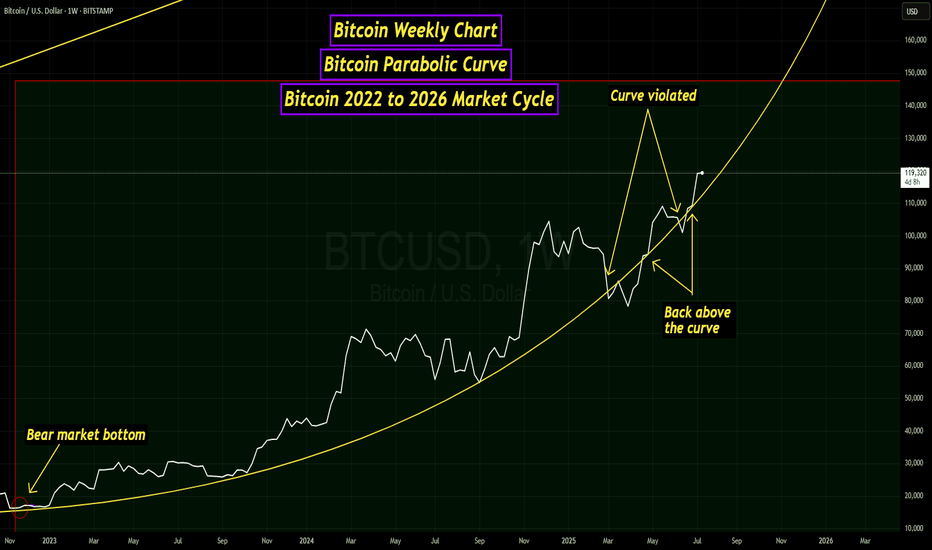

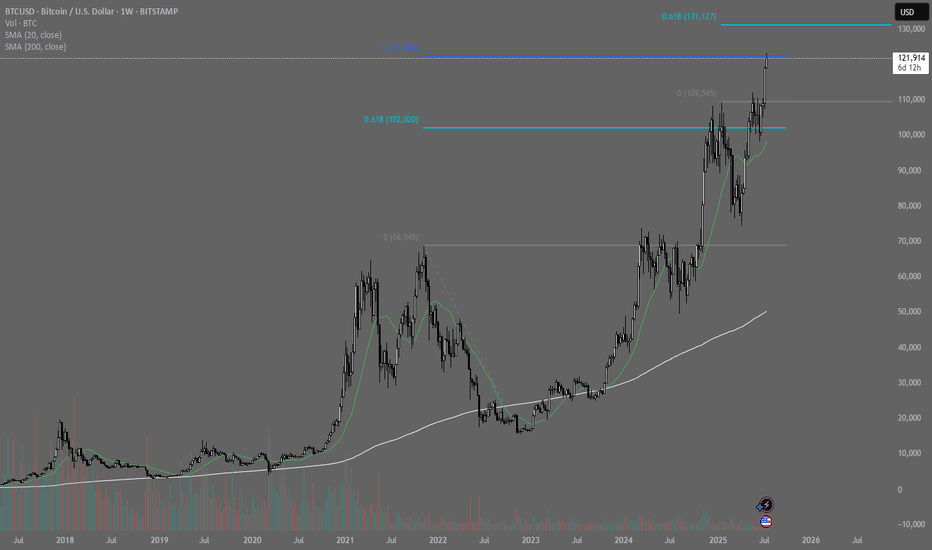

Bitcoin Parabolic Curve - 2022 to 2026 Market CycleThis line chart visualizes the current Bitcoin market cycle from the bear market bottom in November 2022. As you can see, the price has formed a parabolic curve, which was violated around the beginning of March. A couple of weeks later, a retest of the curve occurred, which was rejected. Later in April, the price of BTC was able to push back above the curve. There was another small dip below in June, but BTC was back above the curve by the end of June.

I am also watching the Bitcoin monthly chart and, more specifically, the monthly Stochastic RSI indicator. As you can see in the chart below, between the second and third months after the market cycle peak, the Stochastic RSI indicator has always dropped below the "20" level, and was near zero at the close of the third month.

Back in March and April, there was some speculation that the new all-time high set on January 20th at just over $109k was the peak for this market cycle. At the beginning of April, the Stochastic RSI dropped well below the 20 level but rebounded and was at 16.81 when the April candle closed. The May monthly candle closed with the Stochastic RSI at 31.45, and June closed at 50.17. This indicated to me that this market cycle was far from over.

On July 14th, BTC set a new all-time high at just over $123,000, ending the speculation that this current market cycle had peaked. My assumption for now is that Bitcoin is still following a 4-year market cycle. If this is true, I would expect a market cycle peak sometime in the final months of this year. Either way, it has been a very interesting market cycle with huge changes for the crypto asset class.

BTC at pullback support in H1 timeframe! Possible rebound?BTC reacted a pullback support of 117,140 this is a crucial point where we look forward to seeing a rebound. We anticipate a bullish rally from this week. Keep an eye at this level as the week progresses. A rebound indicates possible gains. A break below might take us back to 110k level.

End of Bitcoin cycle this Year nearly 180-200k$ The Great Depression 2.0 ahead and all politicians already know it and prepare to blame all their troubles on the crisis.. I think Bitcoin will reach 180-200k$ till the beginning or the end of september. Need to track the price of gold - Bitcoin ATH near the 55 oz of gold!

After reaching the peak - there will be dump -50%. September and October as the best months for bitcoin in 2025 would be the worst months. November and December maybe green - to close some nice year candle (giving to altcoins last chance for performing) and after that going into the bear market.