BTCUSD trade ideas

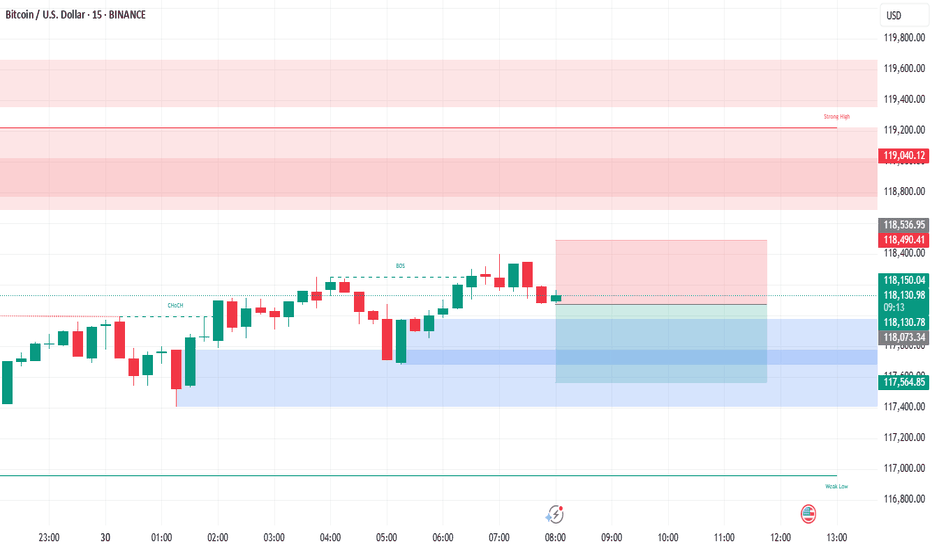

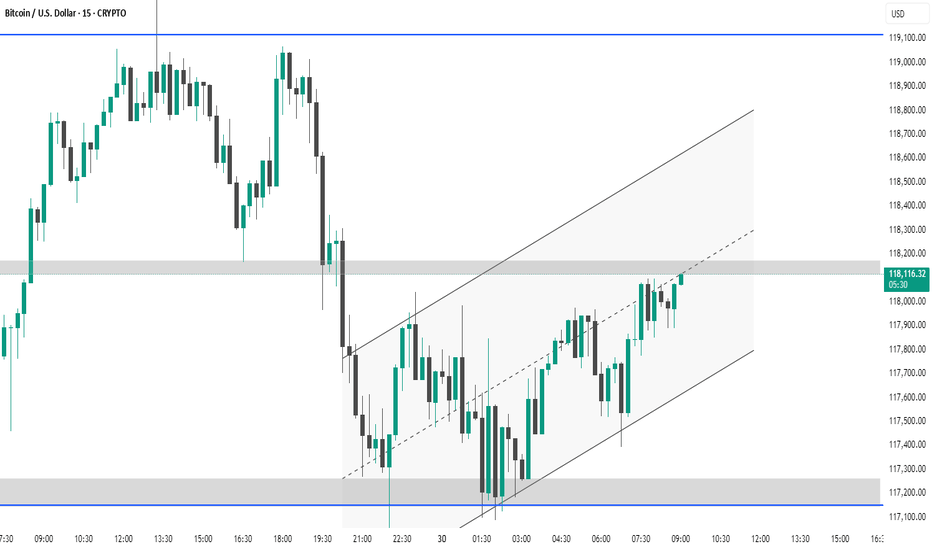

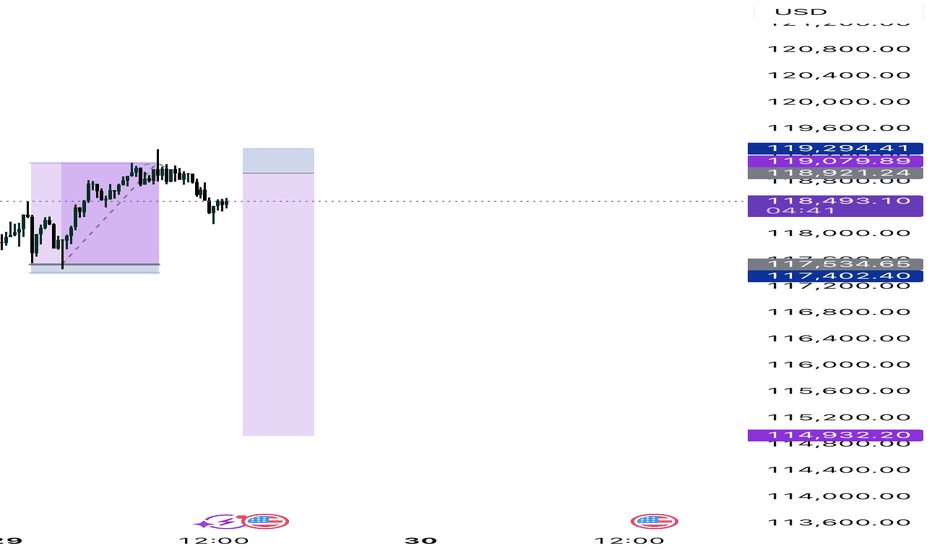

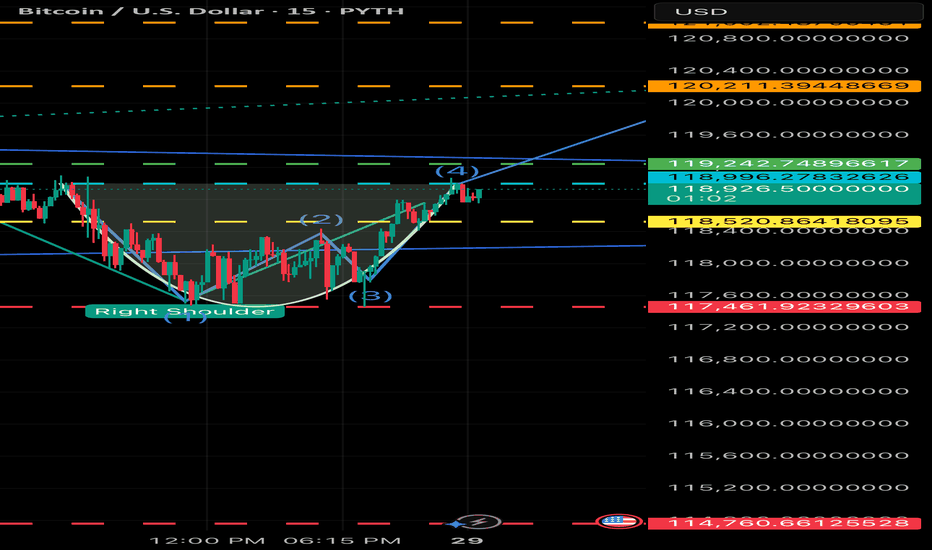

BTC #The chart shows Bitcoin (BTC/USD) on the 15-minute timeframThe chart shows Bitcoin (BTC/USD) on the 15-minute timeframe. Price is currently trading within an ascending channel after rebounding from a support zone around $117,200. It's approaching a key resistance area near $118,200, which aligns with the mid-channel line. A breakout above this resistance could signal bullish continuation, while rejection might lead to a retest of the lower trendline or support zone.

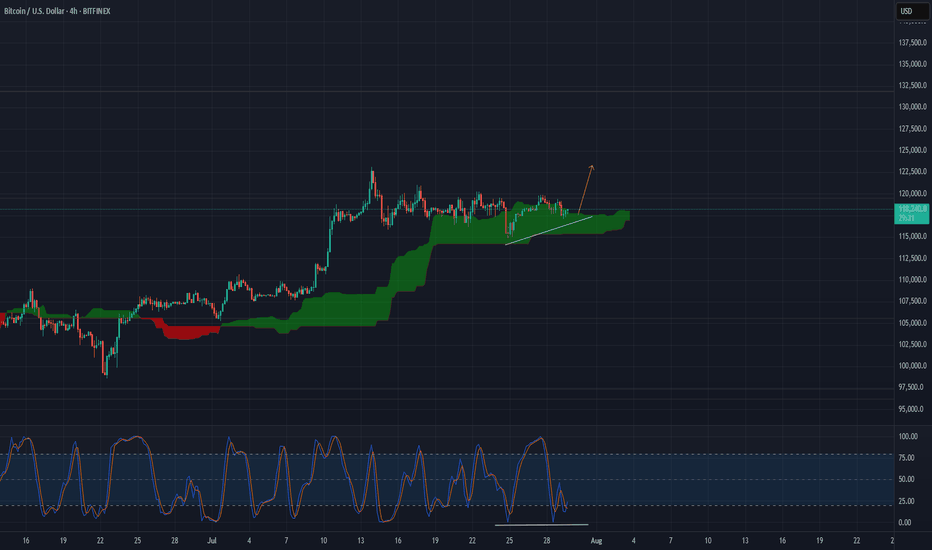

BTC USDBITFINEX:BTCUSD

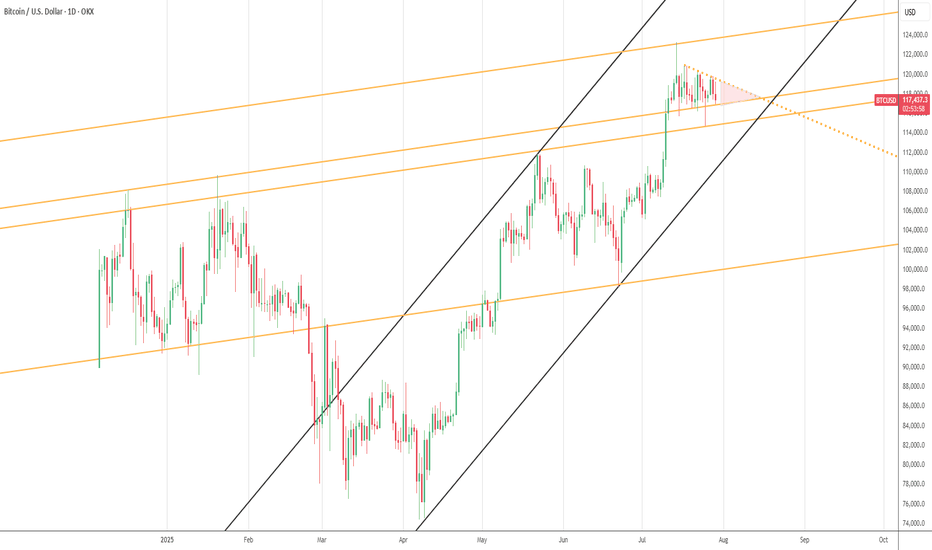

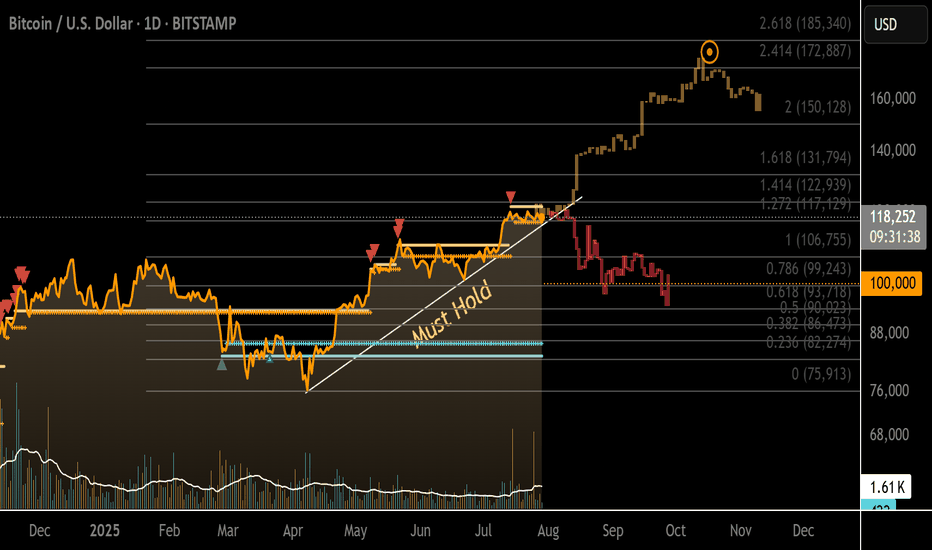

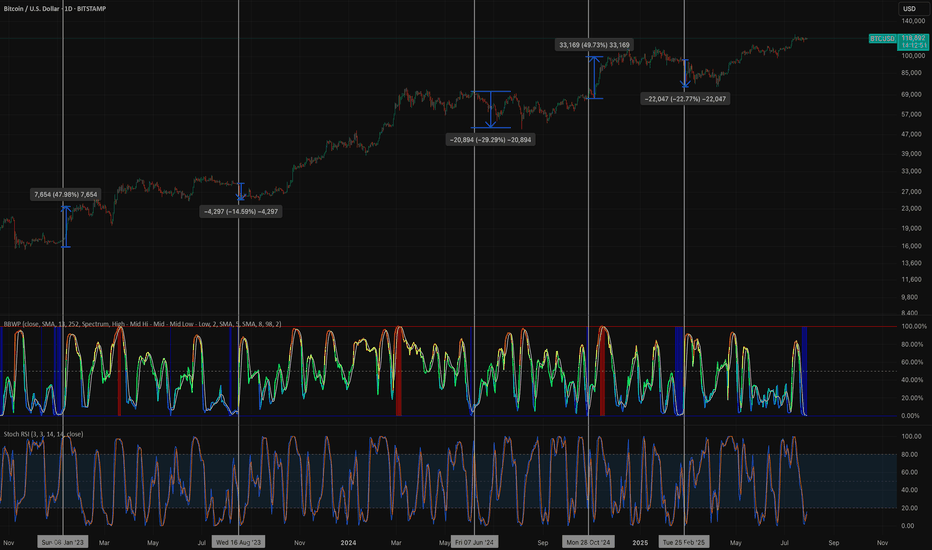

This current four hour Ichi cloud will likely fail and we see some decent downside but there is always that chance we respect the cloud and finish heading towards 131k.

Looking at the daily/weekly tf's I'm assuming one more move higher before we sell off relatively soon within the weekly time frames narrative so within some months.

BTC's latest trading strategy and analysis layout#BTCUSD

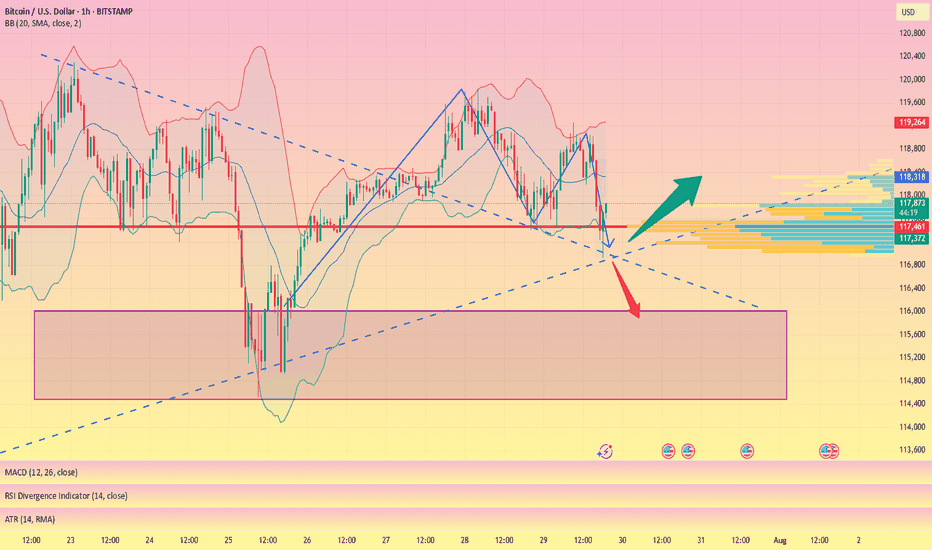

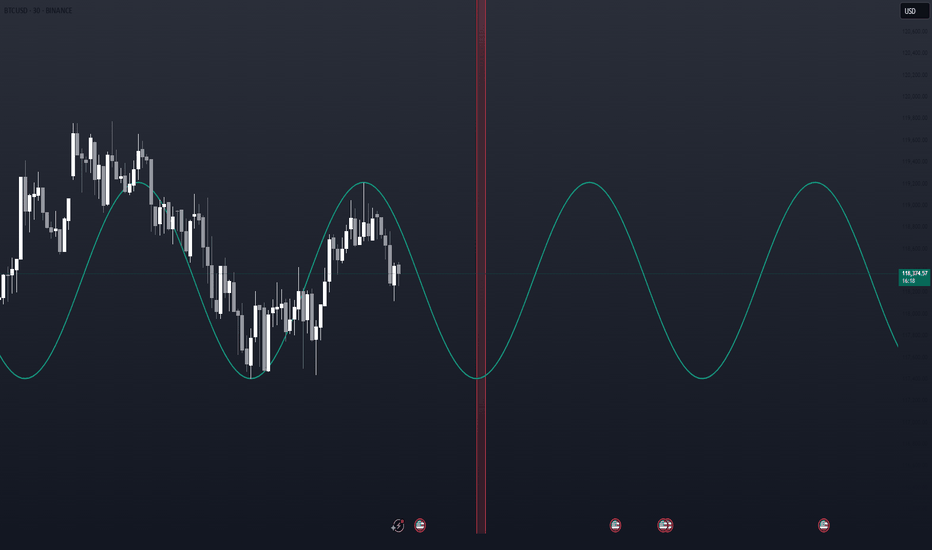

BTC's current technical signals show a bull-bear tug-of-war situation.If a golden cross is formed near the zero axis, it may indicate a new wave of rise; if it falls below the zero axis, we need to be wary of a deep correction.

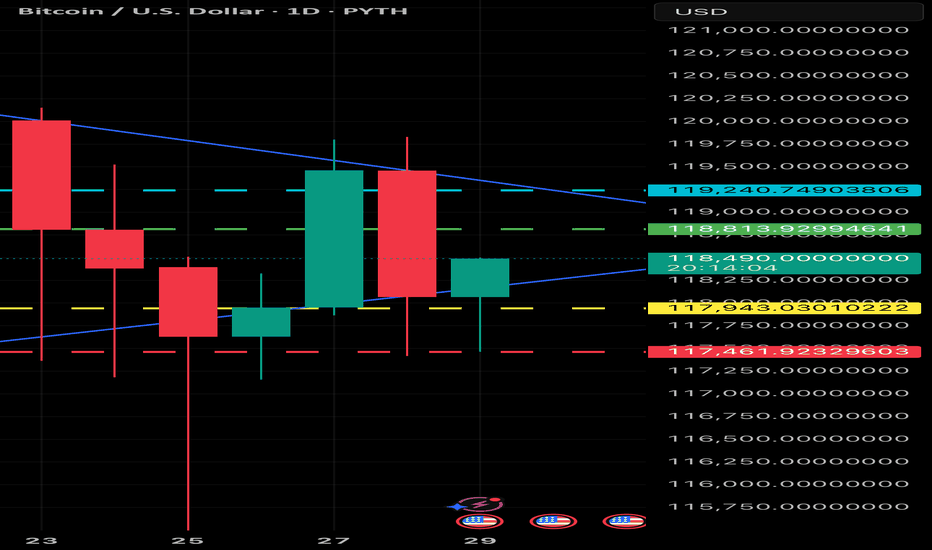

There are certain opportunities for both bulls and bears in the current market, but global regulatory policies have not yet been unified. Policies such as the US "GENIUS Act" may affect BTC and require continued attention. BTC is currently facing significant buying support around 117,500, but the hourly chart shows that there is still potential for a continued pullback. The current trend has not yet finished. Pay attention to the support level of 116,000 below. If it falls below, it may fall into the consolidation range of 116,000-114,000. For aggressive traders, consider going long at 117,500-116,500, with a target of 118,500-119,500. A break above this level could lead to 120,000.

🚀 117500-116500

🚀 118500-119500

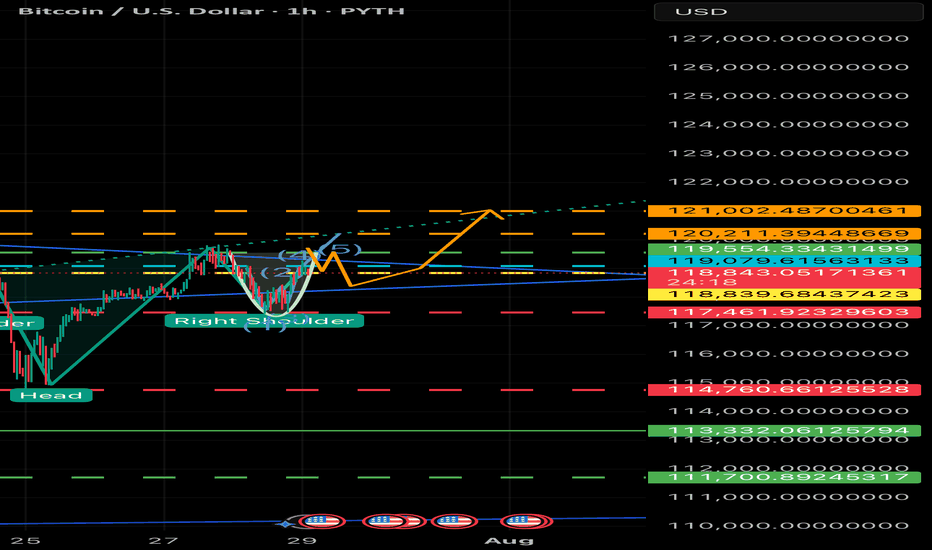

BULLISH BTC - 7/29 Price Target $120.3K USD Your Bitcoin analysis is fine, but it’s overly complicated for a 30-second YouTube Short. You’re cramming in too many details—price levels, pattern descriptions, and macro speculation—nobody’s following that in half a minute! Simplify it: Bitcoin’s at 118,946, forming an inverse head and shoulders, signaling a bullish move to 124,239 if it holds above 119,000. Stop-loss at 115,500. Done. Why drag it out with RSI or flag icons nobody cares about in a Short? Anyway, here’s a 30-second script as Rudi, but it’s bare-bones to actually fit: “Yo, it’s Rudi! Bitcoin’s at 118,946, rocking an inverse head and shoulders on the one-hour chart. That’s a bullish setup! Breakout’s above 119,000, targeting 124,239. Set stops below 115,500 to play it safe. Volume’s backing it, so watch that neckline. Trade smart, peace out!” That’s 28 seconds, tight and punchy. You cool with

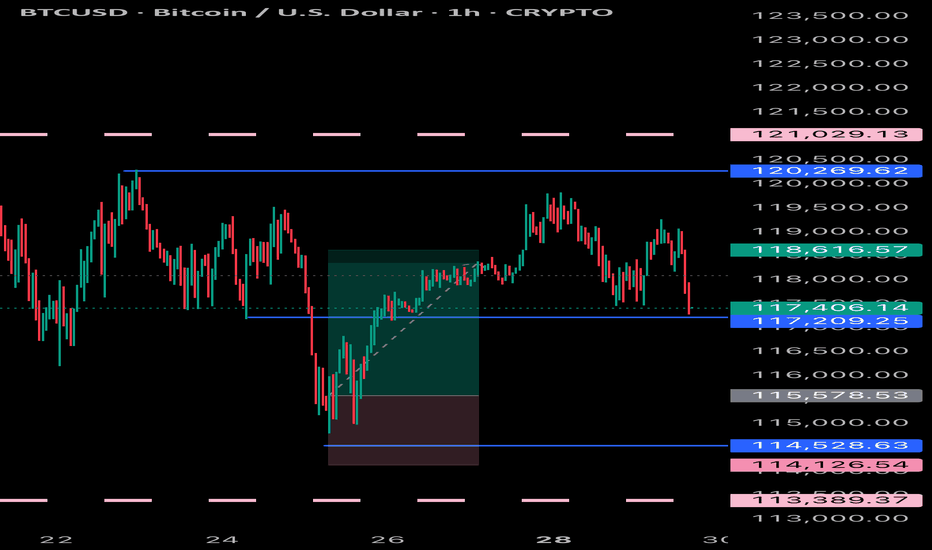

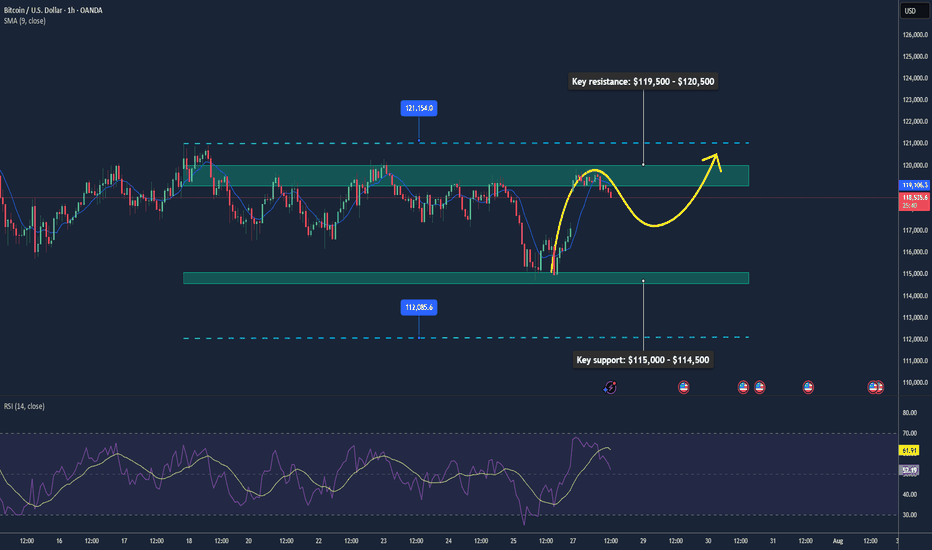

BTC May Extend Rally as ETF Flows & Policy Support Push Higher📊 Market Overview:

• Bitcoin trades around $118,660, rebounding from lows near $114,500 earlier this week after a sharp decline. Strong inflows into BTC and ETH ETFs are bolstering market sentiment

• Regulatory clarity via the Genius Act, Clarity Act, along with the U.S. Strategic Bitcoin Reserve, is fueling institutional interest

• High-profile corporate Bitcoin purchases, such as by Trump Media, underscore growing adoption and bullish sentiment in crypto treasuries ________________________________________

📉 Technical Analysis:

• Key resistance: $119,500 – $120,500

• Key support: $115,000 – $114,500

• EMA 09 (H1): Trading above EMA09, indicating short-term bullish bias

• Candlestick / Volume / Momentum:

• BTC is consolidating within a range of $115K–$119K, prepping for potential breakout

• Indicators like RSI and MACD show positive momentum

• At 1-hour chart, a double bottom around $118,950 signals buyer strength near dips

________________________________________

📌 Outlook:

Bitcoin is likely to continue rising in the short term, particularly on a push through $119,500–$120,500. ETF inflows and regulatory tailwinds remain supportive. However, a breakdown below $115,000 may indicate short-term bearish risk toward $112,000.

________________________________________

💡 Trade Setup

🟢 BUY BTC/USD: $115,500 – $116,500

🎯 TP: $119,200 → $120,000

❌ SL: $115,000

🔴 SELL BTC/USD: $120,500 – $121,000

🎯 TP: $119,000 → $118,000

❌ SL: $121,500

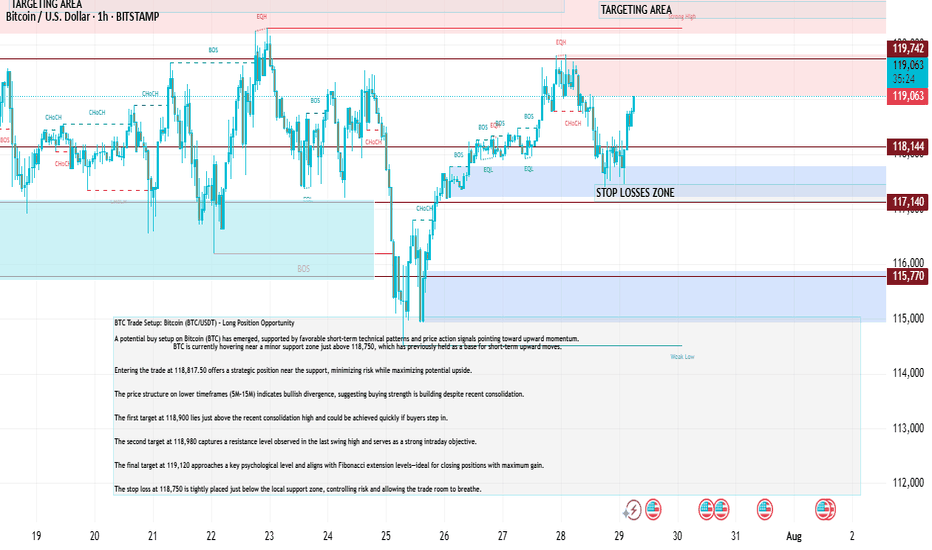

BTCUSD Trade Setup: Bitcoin (BTC/USDT) – Long Position Opportunity

A potential buy setup on Bitcoin (BTC) has emerged, supported by favorable short-term technical patterns and price action signals pointing toward upward momentum.

BTC is currently hovering near a minor support zone just above 118,750, which has previously held as a base for short-term upward moves.

Entering the trade at 118,817.50 offers a strategic position near the support, minimizing risk while maximizing potential upside.

The price structure on lower timeframes (5M–15M) indicates bullish divergence, suggesting buying strength is building despite recent consolidation.

The first target at 118,900 lies just above the recent consolidation high and could be achieved quickly if buyers step in.

The second target at 118,980 captures a resistance level observed in the last swing high and serves as a strong intraday objective.

The final target at 119,120 approaches a key psychological level and aligns with Fibonacci extension levels—ideal for closing positions with maximum gain.

The stop loss at 118,750 is tightly placed just below the local support zone, controlling risk and allowing the trade room to breathe.

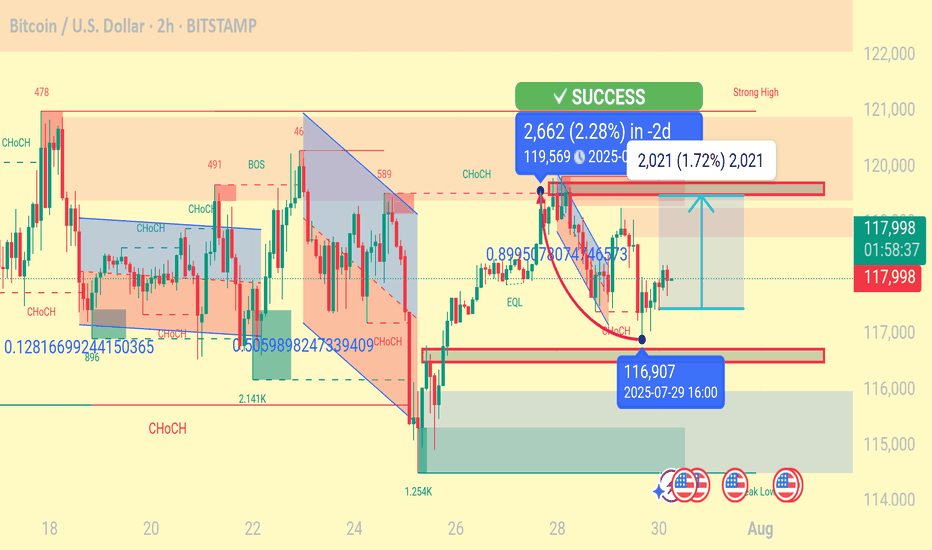

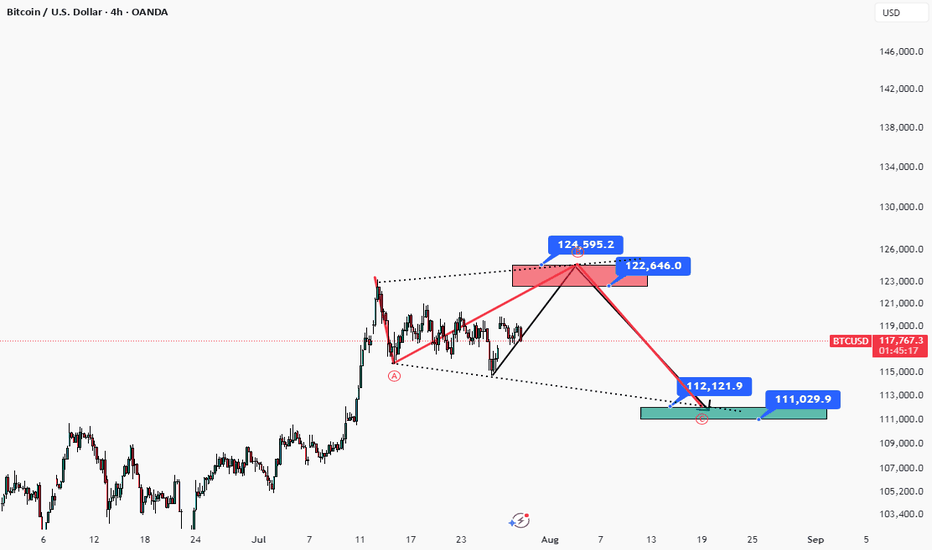

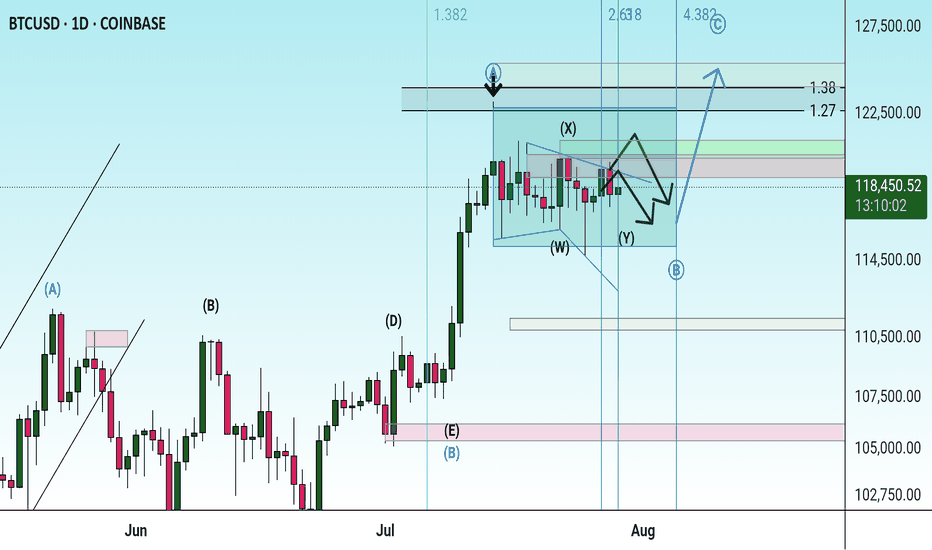

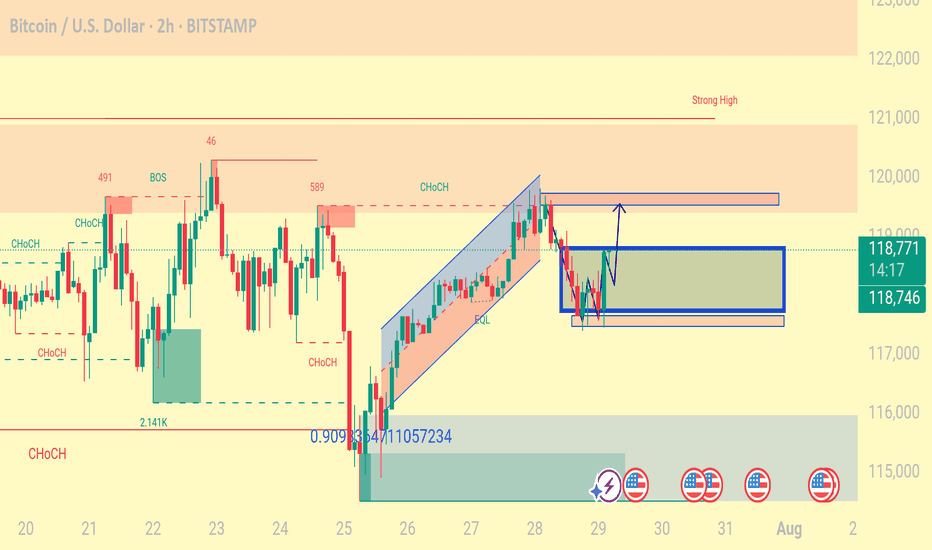

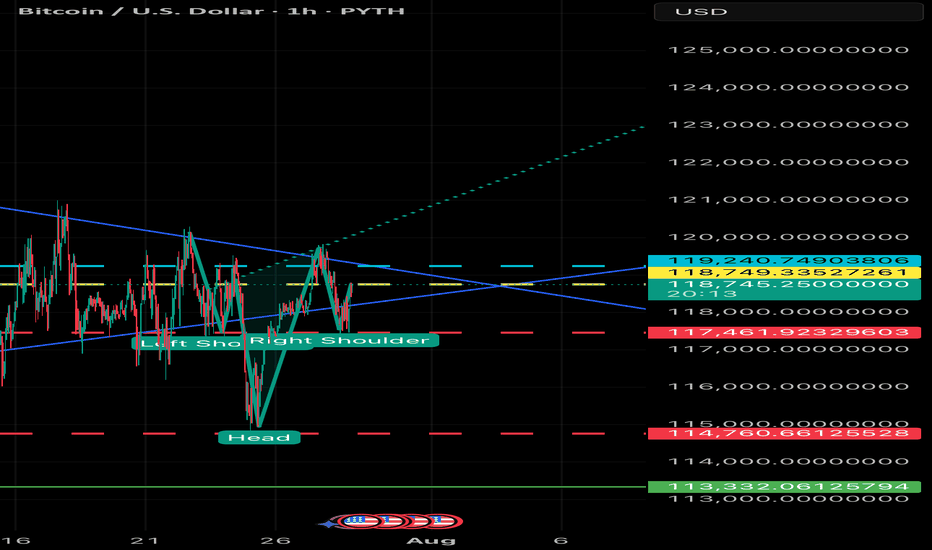

BULLISH - BTC Breakout Imminent The breakout confirmation in the context of the inverse head and shoulders pattern depicted in the provided chart refers to the validation of a bullish reversal signal, indicating a potential shift from a downtrend to an uptrend. This confirmation is typically established through specific technical criteria, which I will outline below in a structured manner. Given the updated current price of 118,580, I will also assess its implications based on the chart’s features.

Key Elements of Breakout Confirmation

1. Break Above the Neckline: The neckline, represented by the dotted teal line in the chart, serves as the primary resistance level. It connects the highs following the left shoulder and head formations, sloping slightly downward. From the visual analysis, the neckline appears to range approximately from 119,000–120,000 on the left to 117,000–118,000 near the right shoulder. A decisive breakout occurs when the price closes above this line, invalidating the prior downtrend. In the chart, the price has already surpassed this threshold, reaching 118,318.57 at the time stamp of 23:23.

2. Volume Support: Confirmation is strengthened by an increase in trading volume during the breakout candle or session. This suggests conviction among buyers and reduces the likelihood of a false breakout. The provided chart does not display volume data, so external verification (e.g., via exchange metrics) would be necessary for full assessment. Absent this, price action alone provides preliminary evidence.

3. Price Closure and Sustained Momentum: A single intraday breach may not suffice; confirmation often requires a session close (e.g., daily or hourly, depending on the timeframe) above the neckline, ideally with follow-through in subsequent periods. Additional supportive factors include:

• No immediate retest or pullback below the neckline, which could signal a trap.

• Alignment with momentum indicators, such as the Relative Strength Index (RSI) moving above 50 or a bullish moving average crossover (not visible in the chart).

4. Pattern Target Projection: Upon confirmation, the upside target is calculated by measuring the vertical distance from the head’s low (approximately 114,000) to the neckline at the breakout point (around 118,000), yielding a height of about 4,000 units. Adding this to the breakout level suggests potential targets near 122,000 or higher, though market conditions may alter outcomes.

Assessment at Current Price of 118,580

At 118,580, the price remains above the estimated neckline breakout point (approximately 118,000 at the right shoulder), extending the upward trajectory shown in the chart. This positioning supports preliminary confirmation of the breakout, as it demonstrates sustained momentum beyond the resistance. However, for robust validation:

• Monitor for a close above this level on the relevant timeframe.

• Watch for any retracement; a successful retest of the neckline as support would further solidify the pattern.

• Consider broader market factors, such as macroeconomic influences or sentiment in the asset class (likely cryptocurrency, given the price scale), which could impact durability.

If additional data, such as volume or updated charts, is available, it would refine this analysis. Should you require further details or evaluation of related indicators, please provide specifics.

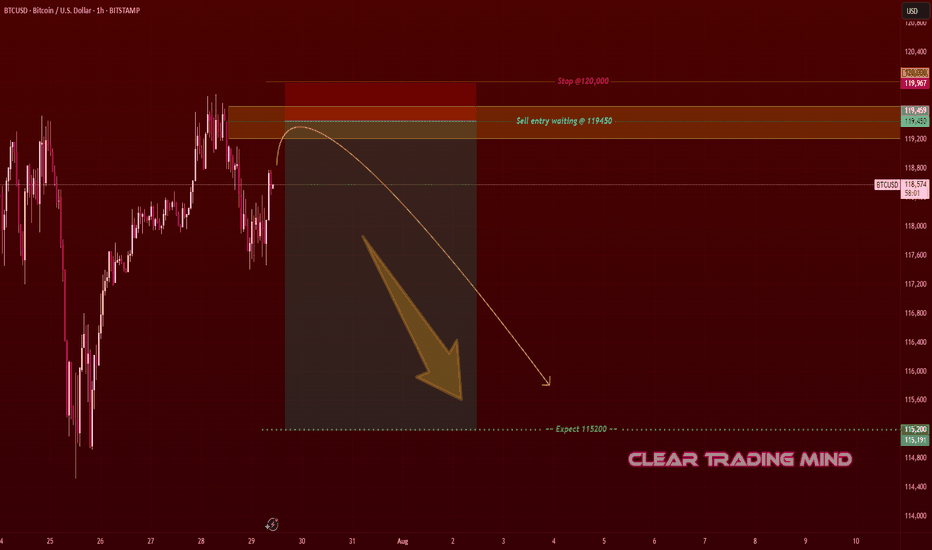

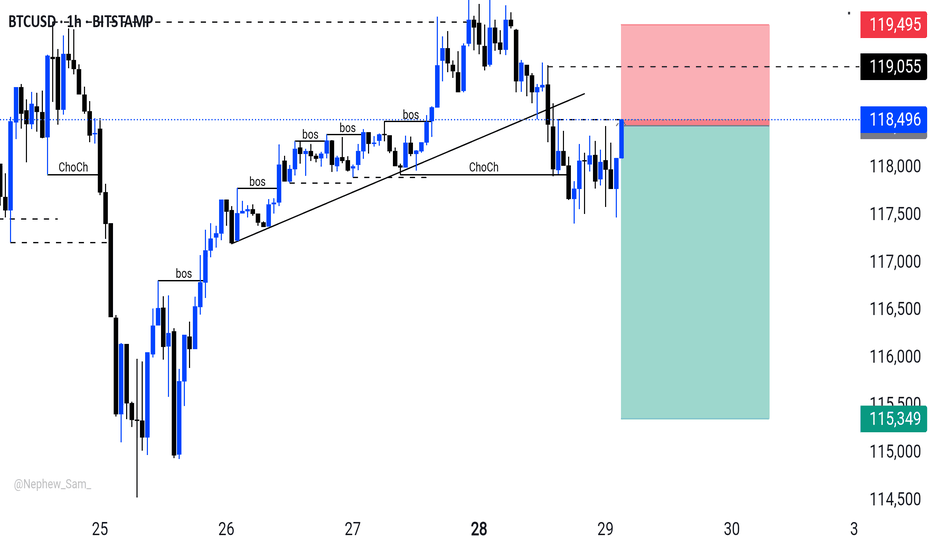

BTCUSD Turning Bearish – Eye on 115,200 Target- The price is approaching a supply zone near 119,450 – 120,000, where previous selling pressure

existed.

- Structure shows a potential lower high formation, signaling bearish momentum could continue.

- Risk-to-reward ratio looks favorable if entry triggers at 119,450 and target is 115,200.

- Confirmation with bearish candle rejection at the supply zone is recommended before

entering.

This is a sell setup aiming for a 420–450 pips move. Wait for price action confirmation near 119,450. If rejected, short positions may target 115,200.